Abstract

The contribution deals with the economic value added and its influence on credit absorption capacity. The aim was to determine the significance of the difference between the economic value added (EVA) entity and EVA equity indicators on credit absorption by the construction sector in the Czech Republic. The data came from the Albertina database of Bisnode Czech Republic for the period 2012–2018; small and medium-sized enterprises, in particular, were selected. The most important factor for calculating the amount of credit absorption depends on the EVA entity indicator and the weighted average cost of capital. The calculations produced negative values for credit absorption, which reflects an unattractive investment climate for business owners and their creditors. In other words, loans sought by enterprises in the Czech construction sector do not lead to a greater degree of realization of their goals, i.e., an increase in value for shareholders.

1. Introduction

How are a company’s profits developing? Are its capital costs adequate? Is it achieving the optimal level of investment capacity? These are crucial questions for the management, owners or potential investors of every business, including state enterprises [1]. To a large extent, these questions can be answered by the economic value added (EVA) indicator; it is used in a number of financial analyses for rating economic stability and sustainability. It goes without saying that this also applies to those businesses operating in the construction sector. A fundamental function of every business is to analyze, rate and control its finances. Where negative phenomena occur in a company’s financial management, it must take corrective action. Over the long term, failure to act accordingly is not sustainable and may result in the cessation of the organization as a unit. Businesses can fund their activities with their own capital or with the use of external capital from a creditor, who provides the credit at a predetermined rate of interest [2]. The effective management of such business resources is, therefore, key. Within this context, there are a number of financial instruments and indicators to deal with the issue. One of them is the EVA indicator, which is used to determine business management success and to monitor added value for owners. The EVA indicator is characterized as net income after taxation minus capital costs; it is used to measure the economic profit of a business [3]. Businesses that dispose of limited funds resort to external sources of finance because it enables the business to achieve optimal investment capacity [4]. Although the current trend is to merge financial and non-financial indicators, for instance, within the context of the integration of business management systems [5] or even in the event of integrated reporting [6], the EVA indicator, which is one of the main indicators of value generation for shareholders [7], is and will remain significant in terms of business reporting, as well as in terms of its impact on the decision-making of management and relevant stakeholders.

The aim of the contribution is to determine the amount of credit absorption in the construction sector of the Czech Republic on the basis of the calculation of economic value added or the difference between EVA entity and EVA equity, respectively. This calculation is especially focused on what its impact is on acquiring and absorbing credit, as well as on equity and external sources of finance. The purpose of the text is to explain that many businesses base their decisions about the involvement of borrowed capital on intuition or on the basis of incorrect parameters. It is true that there is a number of reasons for a business to take out a loan (bank credit, trade credit), e.g., solvency or overcoming cash flow shortage. However, the question remains what effect such credit will have on the creation of business value as its fundamental objective. Will the credit help in the value creation, or will it reduce the value of the business? The answer to this question is not easy. Most businesses do not even try to find it. The question is not answered simply even in the professional literature. It is this article that deals with looking for the answer to this question and finds it successfully. It uses the combination of two indicators that assess the performance in order to determine whether the use of borrowed capital will have a positive or negative impact on achieving the main objective of the business. This is addressed only sporadically in the professional literature. None of the resources available to us solves this issue in the way presented by the authors, that is, by including EVA entity and EVA equity. The calculation was carried out with the help of data for the period 2012–2018 for the construction sector in the Czech Republic. On the basis of the aim of the article, a hypothesis was established, specifically concerning the concept of sustainable development and corporate social responsibility, as illustrated by Rajesh and Rajendran in the example of Germany [8].

The difference in the values of EVA entity and EVA equity has a fundamental impact on the amount of the loan provided.

2. Literature Review

The EVA indicator, which was created in 1982 by J. Stern and G. Bennet Steward III, has become an analytical tool for measuring business performance [9]. The analysis of the creation of value and the application of such tools has been quite intensively examined. Lafont et al. [10] identified 213 scientific outcomes. The interest in Asian countries has dominated in the past few decades, however, Orazalin, Mahmood and Narbaev [11] showed a clear absence of research and the application of significant indicators in developing economies. EVA is effectively the financial performance rate that is closest to reflecting the true economic profit of a business [12]. It can be used as a management system based on business values or within businesses to compare the performance of individual units [13]. A business may decide to use equity if the rating is favorable or to use external capital if the costs are relatively low [14]. Debt financing enables a business to, among other things, consider and take advantage of investment opportunities that can help increase its value. In contrast, the excessive use of debt financing can cause a number of problems for a business [15]. The use of external capital for financing a business comes with the risk of bankruptcy [16]. Debt financing compared with capital financing generates certain advantages for a business, such as lower taxation and free cash flow [17]. The application of the EVA model for determining the allocation of capital is in line with the basic aims of an organization, i.e., to only undertake projects that are able to generate certain value for a business [18]. In other words, the indicator rates the change in the market value of a business as a result of their business activities in the market [19]. The real accounting earnings of a business should be used instead of modified operating income for the exact calculation of EVA [20]. The obtained information and indicator values are important factors for the decision-making on future business investments [21]. In the case of debt financing, high costs can disrupt the interest burden of a business, reduce financial limitations, thereby impacting business operations and investment activities [22]. The internationalization of a company matters; according to Mihov and Naranjo [23], international diversification significantly decreases the cost of capital. The EVA model informs us that profitability, size, ability to grow and intangible business activities are substantially and positively linked, whilst the opposite is true with regards to the capital structures of a business [24]. With an emphasis on integrated reporting, Salvi et al. [25] focused on the correlation of the costs of capital and the impact on the issuance of intangible assets. The correlation between the costs of capital and the liquidity of shares was revealed by Belkhir, Saad and Samet [26]. According to them, the unit standard deviation of liquidity index results in a rise in the costs of capital by 30 basis points. A specific model focused on the estimation of expected share yield on the basis of the capital costs of the growth of expected yields and profits was presented by Penman and Yhang [27]. The direct impact of the state’s economic policy on the level of uncertainty regarding the capital costs of businesses was proven by Xu [28]. The effects of idiosyncratic accounting information on the capital costs of businesses were examined by Gao [29], who explained the mixed empirical evidence concerning the relationship between the quality of information and capital costs. The static nature of the given models, especially in terms of the structure of assumed capital costs, was dealt with by Callen and Lyle [30] using a model based on forward option contracts. Tagliapietra, Zachman and Fredrikson [31] examined the highly topical issue of investments in sources of energy in the Czech Republic. They claimed that capital costs are crucial for possible investment decisions.

Research conducted into the values of banks suggests there is a direct correlation between indicators, including those in the EVA model, for the prediction of profit, and that it is appropriate to use them continuously as instrumental indicators [32]. The EVA model can be used by large companies, as well as by small ones, [33] or in the case of China, by state-controlled companies [34]. Prosperous businesses tend to employ the EVA methodology less than those in a defensive situation [35]. Under such circumstances and with the help of commercial processes, it adds value, which is, generally speaking, one of the main motivational factors for conducting business [36]. Where EVA is positive, a business has value added, whereas if EVA is negative, it does not. The reason for this may lie in expected high investment costs in the future [37]. There is a relationship with a leverage effect; if it does not function positively, it has a negative influence on business performance [38]. The EVA model is characterized by two indicators, namely EVA entity, which assesses an investment activity for the owner and the creditors, and EVA equity, which assesses what benefit is brought by a business to its owner; a value above zero is desirable for both indicators [39].

The use of EVA in managerial accounting and for the assessment of the state of a business is also subject to critical research. The main reason for this is the push toward changing the approach of businesses to the dominant goal of generating profit and creating value for owners and stakeholders, which, according to Khan [40], is losing ground to the growing importance attached to non-financial indicators of long-term profitability and sustainability [8]. According to Miralles-Quirós, Miralles-Quirós and Nogueira [41], the reason for the intense interest in integrating financial and non-financial indicators for assessing the state of a business is the fact that social responsibility has become a global phenomenon that directly influences investors’ decisions and profits. This is also pointed out in research conducted by Marin, Marino and Pellegrin [42], who documented the impact of businesses’ timely response to the European Emissions Trading Scheme, which, as they maintained, influenced the behavior of market participants but did not affect the economic performance of the selected group. The research by Bui, Moses and Houqe [43] into the impact of rights issues on the implicit costs of capital was directed in the same way. They stated that these costs can be reduced through adequate reporting, as Lemma et al. [44] also demonstrated in the example of South Africa. Likewise, Jankalová and Kurotová [45] combined the EVA indicator with non-financial indicators on the basis of a case study, with the aim of comprehensively evaluating the business, in particular with regards to the sustainability of its activities. This approach can be found relatively frequently in current research. The impact of sustainability and social responsibility indicators on financial performance in the form of a binary regression logistics model was investigated by Rodríguez-Fernádez et al. [46]. The combination of sustainability indicators and financial and risk indicators was also examined by Gangi, Daniele and Varrone [47]. Within this context, Cubilla-Montilla et al. [48] dealt with the area of corporate reporting and the incorporation of environmental indicators. The global reporting initiative (GRI) and the positive effect of reporting corporate social responsibility (CSR) indicators and their correlation with financial indicators were confirmed in the case of Ghana and Ethiopia by Oduro and Haylemariam [49]. Hou [50] drew attention to this in the example of Taiwanese companies, where he also distinguished between sectors and forms of business, as did Blasi, Caporin and Fontini in the form of Arellano–Bond technology in dynamic panels [51].

Compton, Kang and Zhu [52] focused directly on the correlation between gender stereotyping and the financial performance of businesses. They claimed that gender balance and the presence of women in corporate financial management have a positive effect on company performance, including its value added indicators.

Gan, Park and Suh [53] focused on the integration of financial performance measures, incl. EVA indicators and non-financial values, in the case of the construction of management bonuses. Omran et al. [54] did likewise in the case of the long-term monitoring of the performance of Australian manufacturing companies. According to them, there is a direct correlation between these indicators. Indicators for integrated reporting, aimed primarily at financial capital providers, were also addressed by Grassmann, Fuhrmann and Guenther [55]. According to them, their main purpose is to provide information on the interconnectivity of aspects of non-financial and financial value creation. According to Zhou, Simnett and Green [56], the uniform analytical approach by investors presents an opportunity to reduce the cost of capital. Vena, Sciascia and Cortesi [57] demonstrated this, based on 1445 observations from more than 30 countries between 2009 and 2017, in the form of a 1.4% reduction in the cost of capital. These results were also confirmed by Vitolla et al. [58], who claimed that integrated reporting, including both EVA and non-financial indicators, is an innovative way to reduce costs.

Lee, Glasscock and Park [59] pointed out the varying significance shareholders place on important financial indicators in relation to periods of economic growth or distress. Hong and Najmi [60] focused on their optimal selection and adjustment to assess the efficiency and financial sustainability of supply chains. Bolos, Brad and Delcea [61] searched for the form of a model for an optimal portfolio of financial assets, the evaluation of financial performance and the achievement of key indicators using the fuzzy neutrosophic method. Another area of research into the application of EVA is its use by regulatory authorities [62], for example, in connection with the deregulation of interest rates and the related effects on the reporting of the success rate of state-controlled companies in China [63].

However, there is a problem in the case of combined or integrated reporting models with the value of individual indicators and their significance. Krishnamoorthy [64] pointed this out within the presented hierarchical classification of financial sentiment. The use of unfavorable debt collection costs was addressed by Halov and Heider [65], who explained the degree and risk of uncertainty associated with the fact that companies are not required to issue their debt if they grow, which causes volatility, which is then interpreted as higher risk. This subsequently prevents a company from raising capital on favorable terms. The issue of the cost of capital in relation to innovations was examined by Hahn [66]. According to her in-depth qualitative analysis, the costs of capital security are, surprisingly, not significant, in particular, because market orientation is crucial for the management of German companies. A significant positive correlation between the financial performance and the long-term market value of Turkish banks was revealed through the multi-criteria evaluation conducted by Aras, Tezcan and Kutlufurtuna [67].

The EVA indicator is also a significant part of bankruptcy models or indicators. This was pointed out within the TreeNet machine learning method by Jones and Wang [68]. According to them, the predictive performance of financial variables increases significantly in combination with external risk factors, such as macroeconomic variables. The same model was used by Jiang and Jones [69], who again combined a number of variables, of which the main ones are key financial indicators. Bankruptcy models were also addressed by Serrano-Cinca, Gutiérerez-Nieto and Bernate-Valbuena [70], who selected those financial indicators that are best used for detecting unusual or threatening situations, including the cost of capital or value creation. Financial indicators within bankruptcy models were also dealt with by Scalzer et al. [71]. According to them, return on assets (ROA), immediate liquidity and current liquidity play a key role, whilst the EVA indicator mainly plays a role in the sustainability of corporate governance. Eling and Jia [72] used logistic regression, taking into account time factors, within bankruptcy models, which use the aforementioned financial indicators.

3. Materials and Methods

The data for the analysis came from the Albertina database of Bisnode Czech Republic, a.s. The dataset consisted of construction companies that operated in the market in 2012–2018 and were included in the classification of economic activities of the CZ-NACE in Category F (construction) sub-category 41 (construction of buildings), sub-category 42 (civil engineering) or sub-category 43 (specialized construction activities). The dataset contained a total of 88,242 data rows, whereby each column contained:

- Identification of business: company registration number, company name and period of financial statement.

- Financial statement report for a specific business period.

Small and medium-sized enterprises, as defined by the Ministry of Industry and Trade, i.e., company assets do not exceed the Czech crown equivalent of EUR 43 million [73], as determined according to the average annual EUR/CZK exchange rate for the years 2012 to 2018 according to the Czech National Bank (CNB), were kept in the dataset. Those businesses that met the following conditions were subsequently left in the dataset: assets greater than 0; liabilities greater than 0; equity greater than or equal to 0; external sources greater than or equal to 0; current assets greater than or equal to 0; bank loans greater than or equal to 0; interest expenses greater than or equal to 0; short-term liabilities greater than or equal to 0; and with return on equity (ROE) in the interval (−100%, +100%). Profit before tax was calculated by adding net profit to income taxes for extraordinary and ordinary activities. The modified dataset contained a total of 38,683 data rows (see Table 1).

Table 1.

Modified dataset according to year.

The economic value added (EVA) and its requisites are used for the calculation because economic value added and the calculation thereof fulfills a fundamental precondition for determining the individual components of the model itself. It is an important model that values the productivity of all relevant factors and is in many cases neglected by businesses. This contribution aims to demonstrate the importance of the model for businesses.

EVA entity is derived from the following equation [73]:

where

- EBIT = profit before taxation and interests;

- WACC = weighted average cost of capital;

- C = total invested capital (from an operational perspective).

This equation requires the precise calculation of the weighted average cost of capital (WACC) and total invested capital (C) [74]:

where

- = costs of external sources of finance (or interest);

- t = corporate income tax rate;

- D = external sources of finance;

- C = total invested capital;

- = cost of equity (expected profitability E; the calculation is in the form of a rating model (see EVA equity));

- E = equity.

EVA equity is derived from the following equation [74]:

where

- ROE = return on equity;

- = cost of equity.

The calculation of the form of rating model and the help of the weighted average cost of capital are required for this equation [74]:

where

- = cost of equity;

- WACC = weighted average cost of capital;

- UZ = payable sources (E + BL + B), i.e., equity that must be paid for;

- A = total assets;

- E = equity;

- BL = bank loans (or external sources of finance);

- B = bonds;

- = interest rate;

- d = corporate income tax rate (since 2010, the tax rate is 19%).

The weighted average cost of capital is required for the calculation of the rating model (). The calculation is obtained from the following equation [74]:

where

- = risk-free rate;

- = function of indicators describing the size of a business;

- = function of indicators describing the formation of production power;

- = function of indicators describing the relationships between assets and liabilities.

The calculation of the weighted average cost of capital [74] requires the following indicators () (see Table 2), (), () and ():

Table 2.

Summary of risk-free rates () according to year.

The indicator (), which characterizes the size of a business, is determined on the basis of the following equations [74]:

In case the payable sources (E + BL + B) are lower than CZK 3 million and greater than CZK 100 million, the following calculation is used [74]:

The indicator (), which characterizes the formation of production power, is determined on the basis of the following equations. If the return on assets (ROA) is greater than the XP indicator, () is determined at the 0% level. If the return on assets (ROA) is lower than zero, () is determined at the 0% level [74]:

In the case of different data, the following equation is used:

The indicator (), which characterizes the relationship between assets and liabilities, is determined on the basis of the following equations. If current liquidity is greater than , () is determined at the 0% level. If current liquidity is lower than , () is determined at the 10% level [73,74].

It is recommended to apply the methodology, in accordance with the Ministry of Industry and Trade [72], when the determined values are and .

If current liquidity is greater than and lower than , () is determined as follows [73]:

The resulting dataset was imported into Excel for the calculations of the EVA entity and EVA equity indicators, whereby the credit absorption of businesses was obtained from the difference in the resulting values (mathematically expressed as ). In this way, a tool for indicating credit absorption in the construction sector was created. The results are presented in tables and graphs.

4. Results and Discussion

Table 3 presents the average values for the balance sheet items of small and medium-sized enterprises in the construction sector of the Czech Republic. The values are presented in thousands of Czech crowns (TCZK).

Table 3.

Average values for balance sheet items of small and medium-sized enterprises in the monitored period. TCZK: thousands of Czech crowns.

It is clear from the data presented in Table 3 that among small and medium-sized construction companies in the Czech Republic, external sources of finance (bank loans and bonds) were more prevalent than equity during the monitored period.

EVA entity (in TCZK) was calculated for the individual years. The results are as follows:

A comprehensive overview of the data used for the above calculations of EVA entity is presented in Table 4.

Table 4.

Economic value added (EVA) entity (in TCZK).

Table 4 shows that the only year in the monitored period in which EVA entity has a positive value was 2016. This means that for the average small and medium-sized company in the construction sector of the Czech Republic, only TCZK 23.66 value added was generated in 2016. In the remaining years, no value added was generated. In other words, the original value of the businesses did not increase. The best EVA entity values were achieved in the period 2015–2017, a period in which the only positive value and the two lowest negative values of TCZK −3.42 (2015) and TCZK −23.02 (2017) were recorded. The decreasing nature of these values, or an improvement in the situation for shareholders and creditors, was recorded in 2018, whereby the value of the EVA entity indicator was calculated as TCZK −1214.99. This value was caused by the high weighted average cost of capital due to the low total level of invested capital and the high percentage cost of equity.

EVA equity (in TCZK) was calculated for the individual years. The results are as follows:

A comprehensive overview of the data used for the above calculations of EVA equity is presented in Table 5.

Table 5.

EVA equity (in TCZK).

The values for EVA equity are both negative and positive for the monitored years. The positive values were recorded in the period 2013–2017, which shows that, on average, small and medium-sized enterprises were a suitable investment for their owners, with a calculated level of risk. The contrary was true in 2012 and 2018 when the values were negative, i.e., the companies did not generate added value for their owners and creditors. In 2012, the negative value of the EVA equity indicator was due to the low earnings before interest and taxation and the higher costs of equity than the resulting returns. The best year in the monitored period was 2016. On average, the value added for small and medium-sized enterprises was TCZK 699.28. The progress of EVA equity during the monitored period was, on the whole, positive—growing from 2013 to 2016 and decreasing from 2017. The worst year in the construction sector was 2018, with a value of TCZK −676.33. This result was caused by the high cost of equity and the highest earnings before interest and taxation in the monitored period.

Table 6 shows the results of the calculation of credit absorption, which is represented by the difference between EVA entity and EVA equity.

Table 6.

Credit absorption according to year (in TCZK).

From the credit absorption data presented in Table 6, it is clear that the credit absorption of the average small and medium-sized enterprise in the construction sector of the Czech Republic during the monitored period is negative. The best credit absorption value was achieved in 2015, with a value of TCZK −430.40, and the worst year was 2017, with a value of TCZK −699.18. From 2012 to 2015, the credit absorption of the monitored businesses remained relatively stable, which was followed by a substantial rise in values from 2016 onwards. When taking into consideration the negative results, it can be stated that the credit absorption of the average small and medium-sized enterprise does not represent an attractive investment for the owner of the business and creditors. The reason is that both indicators should, ideally, be above 0. The actual results indicate that the credit absorption of the average small and medium-sized enterprise has a negative influence on the credit capacity of such businesses. The reason is that the values are negative and that the businesses do not generate value added for the owners and their creditors.

Table 7 shows the profitability/indebtedness indicators for the average small and medium-sized enterprise according to year.

Table 7.

Profitability/indebtedness indicators according to year [73].

The data presented in Table 7 reveals what the proportion of equity is to external sources of finance in the average small and medium-sized enterprise. From 2012 to 2015, the indebtedness of small and medium-sized enterprises grew, as did the return on equity. However, in 2016, return on equity decreased to 12.92%, while total indebtedness remained at a similar level to that in 2015, i.e., 50.15%. The highest return on equity achieved by the average business was in 2017 and the lowest in 2012. When taking the results into consideration, it can be stated that financial leverage works. The exceptions to this rule during the monitored period were in 2016 and 2018.

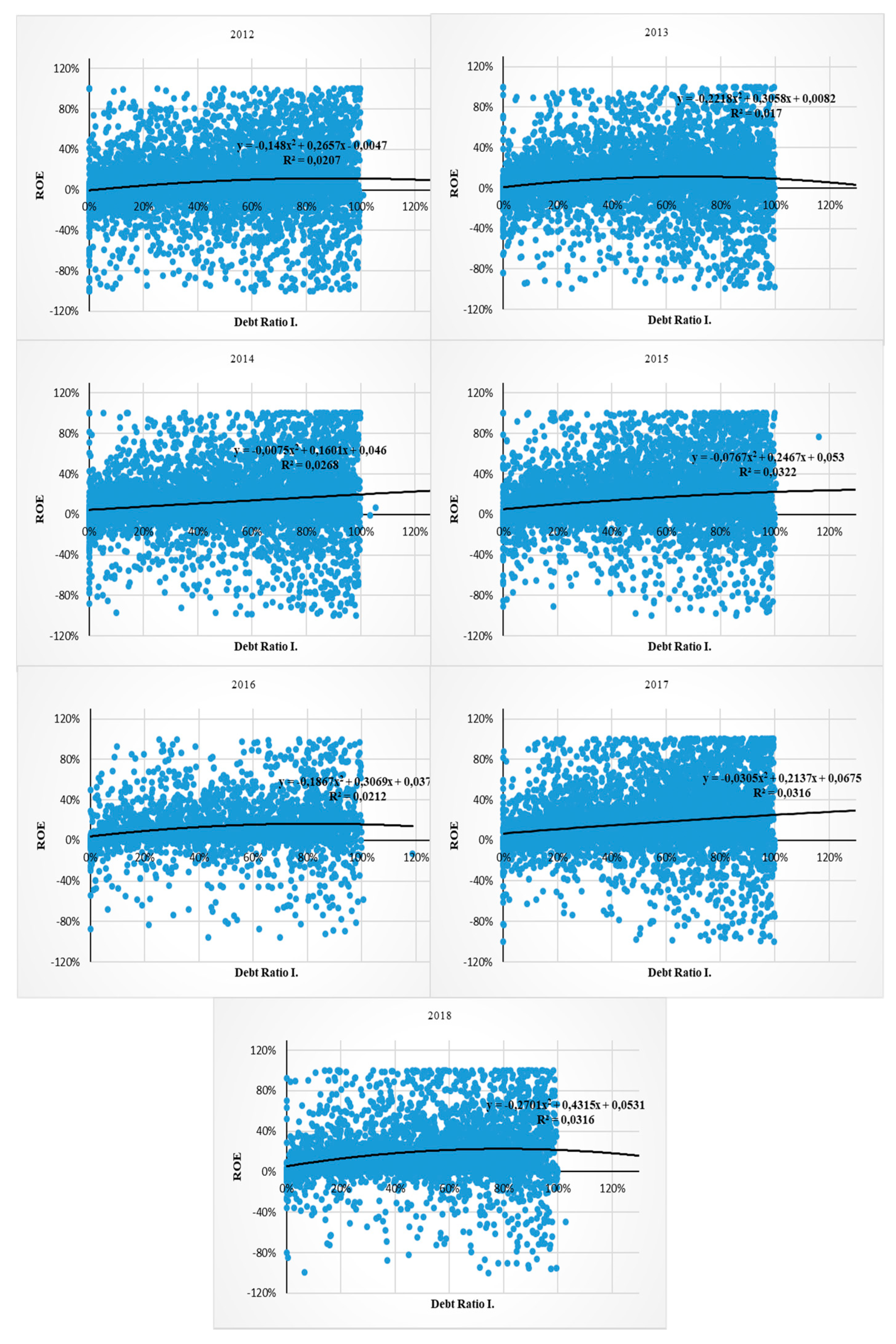

The graphs in Figure 1 show the return on equity and indebtedness of small and medium-sized enterprises in the construction sector of the Czech Republic during the period 2012–2018. In combination with the data presented in Table 7, it is possible to state that below-proportional growth occurred in 2016 and 2018. In contrast, above-proportional growth was recorded by the businesses from 2012 to 2015 and in 2017. This implies that, with the exception of the years 2016 and 2018, financial leverage worked, whereas in 2016 and 2018 it did not, i.e., the indebtedness of businesses reduced the rate of return on equity.

Figure 1.

Profitability/indebtedness indicators for the average small and medium-sized enterprise in the construction sector according to year.

Table 8 summarizes the interpreted results with regards to the credit absorption capacity of businesses in the construction sector of the Czech Republic.

Table 8.

Interpretation of results.

5. Conclusions

It is possible to summarize the results of the research presented in this contribution as follows: small and medium-sized enterprises are receiving credit, i.e., external sources of finance, which are not resulting in the greater fulfillment of their aims, namely to generate value added for their shareholders. This is not a complete surprise. Underestimating “hard” financial indicators, which subsequently results in higher costs of capital, is a frequent mistake made at the managerial level. The current intensification of interest in integrated reporting and the relativization of the aims of companies, i.e., away from generating profit and increasing value for shareholders, is not relevant here. As was suggested by Jones, Wright and Smith [75], although these concepts belong to the most often quoted in the field of corporate reporting, statistical testing of causality confirms that financial performance results in greater activity in the area of shared values. They directly refer to this as “managerial fashion”. Although this phenomenon cannot be underestimated, it is nevertheless clear that financial indicators remain the key to successful direct management or judgment. EVA entity and EVA equity undoubtedly belong to these indicators because successful company management is directly linked to the cost of equity [76]. The macroeconomic factors that affect the amount of economic value added by companies are numerous. In this case, the greatest influence on value added is exercised by those factors that affect labor productivity, i.e., employment. Within this context, and with regards to the Czech Republic, to which the data in this contribution relate, unemployment is low and at similar levels as in Western countries. In this case, the negative impact may be reflected in the current economic crisis, which will be reflected in an increase in unemployment and may result in reduced labor productivity, which will consequently be reflected in reduced value added.

The aim of this contribution was to determine the credit absorption capacity of businesses operating in the construction sector in the Czech Republic on the basis of the difference between EVA entity and EVA equity. The analysis produced negative results.

The recommendation for small and medium-sized enterprises is to increase their total invested capital, the value of which reached a low level in 2018. The reasons for this were the high values for short-term liabilities caused by the enormous increase in the weighted average cost of capital. This resulted in negative EVA entity values, which otherwise had a tendency toward growth (from 2013–2017) and were beginning to generate value added for business owners and creditors. Unfortunately, 2018 saw a decline due to the high cost of equity.

The importance of monitoring and calculating EVA entity and EVA equity lies in the possibility to provide companies with further insights into how well they are performing and where they stand with regards to the generation of economic value added. From a practical point of view, a company’s management can find out whether or not its investments create value, which is knowledge they can either turn into a competitive advantage or use to determine what their shortcomings are. The recommendation for small and medium-sized enterprises is to deal better with short-term liabilities in order to not impose a high burden on their businesses, which is reflected in the weighted average cost of capital.

On the basis of the research results presented in this contribution, it can be said that although the high values of external sources of finance acquired by small and medium-sized enterprises in the construction sector of the Czech Republic generate increases in return on equity, the difference between the values of the EVA entity and EVA equity indicators demonstrates that credit absorption is negative.

It is true that one of the reasons for a given small and medium enterprises (SMEs) result is and may be information asymmetry. There can be several other reasons, e.g., the preferences of the founders or managers, obstacles arising from the regulation of financial and capital markets, etc. This would, however, require separate research; in fact, this could be a great subject of further research on this topic. Nevertheless, this text aimed to inform that businesses (whatever reason it may have) do not behave only rationally in the issue of involving borrowed capital, either because they do not actually have a well-defined main goal, i.e., the growth of the value for the owner, or they do not have a tool that would provide a relatively simple answer to the question whether taking out a credit would have a positive or negative impact on the growth of the value for the owners.

With the conclusion that applies to the whole industry, the authors want to make SME managers think about and use the calculation methodology. Once the results are provided, it will be possible to compare them with the industry they operate in.

Author Contributions

Conceptualization, J.K. and J.H.; methodology, J.K. and J.M.; software, J.K.; validation, J.H., P.S. and J.M.; formal analysis, J.H. and P.S.; investigation, J.K. and J.M.; resources, J.H. and P.S.; data curation, J.K.; writing—original draft preparation, J.K. and J.M.; writing—review and editing, J.H. and P.S.; visualization, J.K.; supervision, J.M.; project administration, J.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Du, F.; Erkens, D.H.; Young, S.M.; Tang, G. How adopting new performance measures affects subjective performance evaluations: Evidence from EVA adoption by Chinese state-owned enterprises. Acc. Rev. 2017, 93, 161–185. [Google Scholar] [CrossRef]

- Belas, J.; Gavurova, B.; Toth, P. Impact of selected characteristics of SMEs on the capital structure. J. Bus. Econ. Manag. 2018, 19, 592–608. [Google Scholar] [CrossRef]

- Vrbka, J. The use of neural networks to determine value based drivers for SMEs operating in the rural areas of the Czech Republic. Oeconomia Copernic. 2020, 11, 325–346. [Google Scholar] [CrossRef]

- Vrbka, J.; Nica, E.; Podhorska, I. The application of Kohonen networks for identification of leaders in the trade sector in Czechia. Equilib. Q. J. Econ. Econ. Policy 2019, 14, 739–761. [Google Scholar] [CrossRef]

- Vochozka, M.; Rowland, Z.; Vrbka, J. Financial analysis of an average transport company in the Czech Republic. Nase More 2016, 63, 227–236. [Google Scholar] [CrossRef]

- Esch, M.; Schnellbächer, B.; Wald, A. Does integrated reporting information influence internal decision making? An experimental study of investment behavior. Bus. Strategy Environ. 2019, 28, 599–610. [Google Scholar] [CrossRef]

- Vochozka, M.; Machova, V. Determination of value drivers for transport companies in the Czech Republic. Nase More 2018, 65, 197–201. [Google Scholar] [CrossRef]

- Rajesh, R.; Rajendran, C. Relating environmental, social, and governance scores and sustainability performances of firms: An empirical analysis. Bus. Strategy Environ. 2019, 29, 1247–1267. [Google Scholar] [CrossRef]

- Machova, V.; Vrbka, J. Value generators for businesses in agriculture. In Proceedings of the 12th International Days of Statistics and Economics Conference Proceedings, Prague, Czech Republic, 6–8 September 2018; Loster, T., Pavelka, T., Eds.; Melandrium: Slany, Czech Republic, 2018; pp. 1123–1132. [Google Scholar]

- Lafont, J.; Ruiz, F.; Gil-Gómez, H.; Oltra-Badenes, R. Value creation in listed companies: A bibliometric approach. J. Bus. Res. 2020, 115, 428–434. [Google Scholar] [CrossRef]

- Orazalin, N.; Mahmood, M.; Narbaev, T. The impact of sustainability performance indicators on financial stability: Evidence from the Russian oil and gas industry. Environ. Sci. Pollut. Res. 2019, 26, 8157–8168. [Google Scholar] [CrossRef]

- Vochozka, M.; Machova, V. Enterprise value generators in the building industry. In Proceedings of the SHS Web of Conferences—Innovative Economic Symposium 2017: Strategic Partnership in International Trade, Ceske Budejovice, Czech Republic, 19 October 2017; Vachal, J., Vochozka, M., Horak, J., Eds.; EDP Sciences: Les Ulis, France, 2017. [Google Scholar] [CrossRef]

- Stehel, V.; Vochozka, M. The analysis of the economical value added in transport. Nase More 2016, 63, 185–188. [Google Scholar] [CrossRef]

- Alexandridis, G.; Antypas, N.; Gulnur, A.; Visvikis, I. Corporate financial leverage and M&As choices: Evidence from the shipping industry. Transp. Res. Part E Logist. Transp. Rev. 2020, 133. [Google Scholar] [CrossRef]

- Strýčková, L. Debt policy of companies in Czech Republic. J. Int. Stud. 2019, 12, 183–197. [Google Scholar] [CrossRef] [PubMed]

- Kliestik, T.; Vrbka, J.; Rowland, Z. Bankruptcy prediction in Visegrad group countries using multiple discriminant analysis. Equilib. Q. J. Econ. Econ. Policy 2018, 13, 569–593. [Google Scholar] [CrossRef]

- Wang, J.L. Joing effect of debt financing and credit rating on corporation´s performance. Int. Conf. Econ. Manag. Innov. (ICEMI) 2017, 1, 21–23. [Google Scholar]

- Pavelkova, D.; Homolka, L.; Knapkova, A.; Kolman, K.; Pham, H. EVA and key performance indicators: The case of automotive sector in pre-crisis, crisis and post-crisis periods. Econ. Sociol. 2018, 11, 78–95. [Google Scholar] [CrossRef] [PubMed]

- Limarev, P.V.; Limarev, Y.A.; Zinovyeva, E.G.; Usmanova, E.G. Methodical motivation of the using EVA (Economic value added) as instrument of cost-performance management in organizations. Mediterr. J. Soc. Sci. 2015, 6, 489–494. [Google Scholar] [CrossRef]

- Behera, S. Does the EVA valuation model explain the market value of equity better under changing required return than constant required return? Financ. Innov. 2020, 6, 1–23. [Google Scholar]

- Vochozka, M.; Stehel, V.; Rowland, Z. Determining development of business value over time with the identification of factors. Ad Alta J. Interdiscip. Res. 2019, 9, 358–363. [Google Scholar]

- Tang, Q.; Han, H. Can material asset reorganizations affect acquirers’ debt financing costs?—Evidence from the Chinese merger and acquisition market. China J. Account. Res. 2018, 11, 71–90. [Google Scholar] [CrossRef]

- Mihov, A.; Naranjo, A. Corporate internationalization, subsidiary locations, and the cost of equity capital. J. Int. Bus. Stud. 2019, 50, 1544–1565. [Google Scholar] [CrossRef]

- Liu, Z.J.; Wang, Y.S. Effect of earnings management on economic value added: G20 and African countries study. South Afr. J. Econ. Manag. Sci. 2017, 20, 1–9. [Google Scholar] [CrossRef]

- Salvi, A.; Vitolla, F.; Raimo, N.; Rubino, M.; Petruzzella, F. Does intellectual capital disclosure affect the cost of equity capital? An empirical analysis in the integrated reporting context. J. Intellect. Cap. 2020, 21, 985–1007. [Google Scholar] [CrossRef]

- Belkhir, M.; Saad, M.; Samet, A. Stock extreme illiquidity and the cost of capital. J. Bank. Financ. 2020, 112. [Google Scholar] [CrossRef]

- Penman, S.; Zhang, X.J. A theoretical analysis connecting conservative accounting to the cost of capital. J. Account. Econ. 2020, 69, 1–25. [Google Scholar] [CrossRef]

- Xu, Z. Economic policy uncertainty, cost of capital, and corporate innovation. J. Bank. Financ. 2020, 111, 1–59. [Google Scholar] [CrossRef]

- Gao, P. Idiosyncratic information, moral hazard, and the cost of capital. Contemp. Account. Res. 2019, 36, 2178–2206. [Google Scholar] [CrossRef]

- Callen, J.L.; Lyle, M.R. The term structure of implied costs of equity capital. Rev. Account. Stud. 2020, 25, 342–404. [Google Scholar] [CrossRef]

- Tagliapietra, S.; Zachmann, G.; Fredriksson, G. Estimating the cost of capital for wind energy investments in Turkey. Energy Policy 2019, 131, 295–301. [Google Scholar] [CrossRef]

- Yao, M.F.; Di, H.; Zheng, X.R.; Xu, X.B. Impact of payment technology innovations on the traditional financial industry: A focus on China. Technol. Forecast. Soc. Change 2018, 135, 199–207. [Google Scholar] [CrossRef]

- Kassem, E.; Trenz, O.; Hrebicek, J.; Faldik, O. Sustainability assessment using sustainable value added. In Proceedings of the 19th International Conference Enterprise and Competitive Environment, Brno, Czech Republic, 10–11 March 2016; Kapounek, S., Krutilova, V., Eds.; Elsevier Science: Amsterdam, The Netherlands, 2016; pp. 177–183. [Google Scholar] [CrossRef]

- Li, L. Private sector participation and performance of county water utilities in China. China Econ. Rev. 2018, 52, 30–53. [Google Scholar] [CrossRef]

- Marecek, J.; Rowland, Z. The importance of ROE for calculating EVA equity: The case of Motor Jikov Strojirenska, a.s. In Proceedings of the SHS Web of Conferences—Innovative Economic Symposium 2017 (IES2017): Strategic Partnership in International Trade, Ceske Budejovice, Czech Republic, 19 October 2017; Vachal, J., Vochozka, M., Horak, J., Eds.; EDP Sciences: Les Ulis, France, 2017. [Google Scholar] [CrossRef]

- Bazyliuk, V. Theoretical approaches to assess efficiency of the transformation of the key business processes in the publishing and printing activities in the region. Balt. J. Econ. Stud. 2016, 2, 4–9. [Google Scholar] [CrossRef]

- Lunardi, M.A.; Barbosa, E.T.; Rodrigues, M.M.; Silva, T.P.; Nakamura, W.T. Foundation of value in the economic performance of family and non-family Brazilian companies. Rev. Evid. Contab. Financ. 2017, 5, 94–112. [Google Scholar] [CrossRef]

- Psarska, M.; Haskova, S.; Machova, V. Performance management in small and medium-sized manufacturing enterprises operating in automotive in the context of future changes and challenges in SR. Ad Alta J. Interdiscip. Res. 2019, 9, 281–287. [Google Scholar]

- Vrbka, J.; Rowland, Z. Assessing the financial health of companies engaged in mining and extraction using methods of complex evaluation of enterprises. Contrib. Econ. 2019, 13, 321–333. [Google Scholar]

- Khan, M. Corporate governance, ESG, and stock returns around the world. Financ. Anal. J. 2019, 75, 103–123. [Google Scholar] [CrossRef]

- Miralles-Quirós, J.L.; Miralles-Quirós, M.M.; Nogueira, J.M. Diversification benefits of using exchange-traded funds in compliance to the sustainable development goals. Bus. Strategy Environ. 2019, 28, 244–255. [Google Scholar] [CrossRef]

- Marin, G.; Marino, M.; Pellegrin, C. The impact of the European emission trading scheme on multiple measures of economic performance. Environ. Resour. Econ. 2018, 71, 551–558. [Google Scholar] [CrossRef]

- Bui, B.; Moses, O.; Houqe, M.N. Carbon disclosure, emission intensity and cost of equity capital: Multi-country evidence. Account. Financ. 2020, 60, 47–71. [Google Scholar] [CrossRef]

- Lemma, T.T.; Feedman, M.; Mlilo, M.; Park, J.D. Corporate carbon risk, voluntary disclosure, and cost of capital: South African evidence. Bus. Strategy Environ. 2019, 28, 111–126. [Google Scholar] [CrossRef]

- Jankalová, M.; Kurotová, J. Sustainability assessment using economic value added. Sustainability 2020, 12, 318. [Google Scholar] [CrossRef]

- Rodríguez-Fernández, M.; Sánchez-Teba, E.; López-Toro, A.A.; Borrego-Domínguez, S. Influence of ESGC indicators on financial performance of listed travel and leisure companies. Sustainability 2019, 11, 5529. [Google Scholar] [CrossRef]

- Gangi, F.; Daniele, L.M.; Varrone, N. How do corporate environmental policy and corporate reputation affect risk-adjusted financial performance? Bus. Strategy Environ. 2020, 29, 1975–1991. [Google Scholar] [CrossRef]

- Cubilla-Montilla, M.I.; Galindo-Villardón, P.; Nieto-Librero, A.B.; Galindo, M.P.V.; García-Sánchez, I.M. What companies do not disclose about their environmental policy and what institutional pressures may do to respect. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1181–1197. [Google Scholar] [CrossRef]

- Oduro, S.; Haylemariam, L.G. Market orientation, CSR and financial and marketing performance in manufacturing firms in Ghana and Ethiopia. Sustain. Account. Manag. Policy J. 2019, 10, 398–426. [Google Scholar] [CrossRef]

- Hou, T.C. The relationship between corporate social responsibility and sustainable financial performance: Firm-level evidence from Taiwan. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 19–28. [Google Scholar] [CrossRef]

- Blasi, S.; Caporin, M.; Fontini, M. A multidimensional analysis of the relationship between corporate social responsibility and firms’ economic performance. Ecol. Econ. 2018, 147, 218–229. [Google Scholar] [CrossRef]

- Compton, Y.L.; Kang, S.H.; Zhu, Z. Gender stereotyping by location, female director appointments and financial performance. J. Bus. Ethics 2019, 160, 445–462. [Google Scholar] [CrossRef]

- Gan, H.; Park, M.S.; Suh, S.H. Non-financial performance measures, CEO compensation, and firms’ future value. J. Bus. Res. 2020, 110, 213–227. [Google Scholar] [CrossRef]

- Omran, M.; Khallaf, A.; Gleason, K.; Tahat, Y. Non-financial performance measures disclosure, quality strategy, and organizational financial performance: A mediating model. Total Qual. Manag. Bus. Excell. 2019, 31, 1–24. [Google Scholar] [CrossRef]

- Grassmann, M.; Fuhrmann, S.; Guenther, T.W. Drivers of the disclosed “connectivity of the capitals”: Evidence from integrated reports. Sustain. Account. Manag. Policy J. 2019, 10, 877–908. [Google Scholar] [CrossRef]

- Zhou, S.; Simnett, R.; Green, W. Does integrated reporting matter to the capital market? Abacus 2017, 53, 94–132. [Google Scholar] [CrossRef]

- Vena, L.; Sciascia, S.; Cortesi, A. Integrated reporting and cost of capital: The moderating role of cultural dimensions. J. Int. Financ. Manag. Account. 2020, 31, 191–214. [Google Scholar] [CrossRef]

- Vitolla, F.; Salvi, A.; Raimo, N.; Petruzzella, F.; Rubino, M. The impact on the cost of equity capital in the effects of integrated reporting quality. Bus. Strategy Environ. 2020, 29, 519–529. [Google Scholar] [CrossRef]

- Lee, J.E.; Glasscock, R.; Park, M.S. Does the ability of operating cash flows to measure firm performance improve during periods of financial distress? Account. Horiz. 2016, 31, 23–35. [Google Scholar] [CrossRef]

- Hong, S.J.; Najmi, H. The relationships between supply chain capability and shareholder value using financial performance indicators. Sustainability 2020, 12, 3130. [Google Scholar] [CrossRef]

- Bolos, M.-I.; Bradea, I.-A.; Delcea, C. Modeling the performance indicators of financial assets with Neutrosophic fuzzy numbers. Symmetry 2019, 11, 1021. [Google Scholar] [CrossRef]

- Chiwamit, P.; Modell, S.; Scapens, R.W. Regulation and adaptation of management accounting innovations: The case of economic value added in Thai state-owned enterprises. Manag. Account. Res. 2017, 37, 30–48. [Google Scholar] [CrossRef]

- Li, X.; Tian, L.; Han, L.; Cai, H. Interest rate regulation, earnings transparency and capital structure: Evidence from China. Int. J. Emerg. Mark. 2019, 15, 923–947. [Google Scholar] [CrossRef]

- Krishnamoorthy, S. Sentiment analysis of financial news articles using performance indicators. Knowl. Inf. Syst. 2018, 56, 373–394. [Google Scholar] [CrossRef]

- Halov, N.; Heider, F. Capital structure, risk and asymmetric information. Q. J. Financ. 2011, 1, 767–809. [Google Scholar] [CrossRef]

- Hahn, K. Innovation in times of financialization: Do future-oriented innovation strategies suffer? Examples from German industry. Res. Policy 2019, 48, 923–935. [Google Scholar]

- Aras, G.; Tezcan, N.; Kutlufurtuna, O. The value relevance of banking sector multidimensional corporate sustainability performance. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1062–1073. [Google Scholar] [CrossRef]

- Stewart, J.; Wang, T. Predicting private company failure: A multi-class analysis. J. Int. Financ. Mark. Inst. Money 2019, 61, 161–188. [Google Scholar]

- Jiang, Y.; Jones, S. Corporate distress prediction in China: A machine learning approach. Account. Financ. 2018, 58, 1063–1109. [Google Scholar] [CrossRef]

- Serrano-Cinca, C.; Gutiérrez-Nieto, B.; Bernate-Valbuena, M. The use of accounting anomalies indicators to predict business failure. Eur. Manag. J. 2019, 37, 353–375. [Google Scholar] [CrossRef]

- Scalzer, R.; Rodrigues, S.; Álvaro, M.; Macedo, D.; Wanke, P. Financial distress in electricity distributors from the perspective of Brazilian regulation. Energy Policy 2019, 125, 250–259. [Google Scholar] [CrossRef]

- Eling, M.; Jia, R. Business failure, efficiency, and volatility: Evidence from the European insurance industry. Int. Rev. Financ. Anal. 2018, 59, 58–76. [Google Scholar] [CrossRef]

- Ministry of Industry and Trade. Finanční Analýza Podnikové Sféry za Rok 2018 [Financial Analysis of the Business Sphere for the Year 2018]; Ministry of Industry and Trade: Prague, Czech Republic, 2019.

- Vochozka, M. Metody Komplexního Hodnocení Podniku [Methods of Comprehensive Evaluation of the Company]; Grada Publishing: Prague, Czech Republic, 2011; ISBN 978-80-247-3647-1. [Google Scholar]

- Jones, S.; Wright, C.; Smith, T. Fashion or future: Does creating shared value pay? Account. Financ. 2018, 58, 1111–1139. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S. Organization capital and the cost of equity financing in medium-sized manufacturing firms. Contemp. Account. Res. 2018, 35, 1616–1644. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).