Abstract

This study considers an application of the first-order Grey Markov Model to foresee the values of Italian power generation in relation to the available energy sources. The model is used to fit data from the Italian energy system from 2000 to 2022. The integration of Markovian error introduces a random element to the model, which is able now to capture inherent uncertainties and misalignments between the Grey Model predictions and the real data. This application provides valuable insights for strategic planning in the energy sector and future developments. The results show good accuracy of the predictions, which could provide powerful information for the effective implementation of energy policies concerning the evolution of energy demand in the country. Results show an improvement in the performance of more than 50% in terms of Root Mean Squared Error (RMSE) when the Markov chain is integrated in the analysis. Despite advancements, Italy’s 2032 energy mix will still significantly rely on fossil fuels, emphasizing the need for sustained efforts beyond 2032 to enhance sustainability.

1. Introduction

Grey systems theory (GST) was initiated by Julong Deng in 1982 [1] and further developed in [2]. It represents an approach aimed at forecasting systems characterized by small sample sizes and poor information. This methodology excels in managing systems where only fragments of information are known by identifying, unearthing, and refining the valuable data present. Grey systems theory has proven to be an effective strategy for handling uncertainty in information. In applied sciences, it is common to encounter systems that are not fully understood and are supported by minimal datasets and vague information, highlighting the need to apply this theory.

Since its inception, GST has witnessed consistent expansion in terms of cross-disciplinary applications and in the diversity of its methodologies. In particular, the proposal of novel approaches and techniques for addressing data that are unknown, incomplete, or inadequate is at the core of recent developments. GST has been employed across a broad spectrum of fields, for example, in predictive scientometrics [3], energy and environmental emissions [4,5], materials science [6], engineering disciplines [7], the development of electric vehicles [8], environmental studies [9], the management of water leaks [10], and the fields of economics and social sciences [11], and additional examples are illustrated in [12,13].

Generally, the Grey Model comprises M-order partial differential equations and N variables. The principle of Grey modeling is founded on the assumption that a process’s underlying mechanisms can be abstracted by a specific, standard partial differential equation, which mirrors the method’s degree of complexity. The estimation of model parameters is conducted through the analysis of accident data. This modeling framework is distinguished by its ability to use just four pieces of data to project future events [14]. In the literature, two single-variable Grey Models are predominantly utilized: the first-order and the second-order .

In practice, observed data are frequently subject to various random influences, leading to data series that exhibit unpredictability and volatility. The forecasting model is an effective tool for data sequences with minimal data, but it struggles with sequences that exhibit significant fluctuations [15]. To overcome this issue and to increase forecast precision, the Grey Markov Chain Model was created to correct the residual errors produced by . This model merges the first-order single-variable Grey forecasting model with a Markov-chain () model that adjusts for residuals [16,17]. This integration of models has been widely applied to datasets that are small in size but characterized by randomness and fluctuation [18,19,20]. The core concept behind the model involves identifying discrete states for the residual errors from and computing Markov probability transition matrices to grasp the statistical properties of these random residuals. Subsequently, adjustments are made based on these Markov matrices to refine the forecasting accuracy of the original model.

In this article, one of the main contributions is the implementation and full retraction of the model described above for forecasting the mix of primary energy consumption in mature industrial economies, using Italy as an ideal representative case.

The importance of this topic lies in the strategic planning and policymaking to meet environmental goals and energy security. Forecasting the energy mix enables the assessment of future energy scenarios, including the adoption of renewable energy sources, and helps in evaluating their impact on carbon emissions reduction and energy security. A recent application study to the Australian framework is discussed in [21].

For Italy, as part of the European Union (EU), forecasting the energy mix is crucial for aligning with the ambitious targets of the EU for reducing greenhouse gas emissions and increasing the share of renewable energy in total energy consumption by 2030 and beyond. Moreover, the relevance of Italy as a case study is due to its status as a mature industrial economy. Italy’s unique geographical position makes it particularly sensitive to shifts in renewable energy sources and the implications of having no nuclear power facilities. These aspects are crucial, as they influence both the national energy strategy and the broader European energy landscape. Understanding the future energy mix aids in planning for the necessary infrastructure developments, such as grid upgrades and energy storage solutions, to accommodate an increased share of variable renewable energy sources like wind and solar power; see [22]. This prediction is also important, as it directly informs strategies for carbon sequestration, an essential component in mitigating CO2 emissions from the depletion of fossil sources. Understanding the scale of carbon sequestration required enables us to align our strategies with international efforts to reduce the environmental impact of energy production, thereby contributing to the global sustainability objectives [23].

Moreover, forecasting the energy mix is essential for identifying potential challenges and opportunities within the energy transition. For instance, it can highlight the need for Italy to diversify its energy sources to reduce dependence on imported fossil fuels, thus enhancing energy security. It also allows for the identification of economic opportunities related to the energy transition, including job creation in the renewable energy sector and potential for technological innovation [24].

Furthermore, an accurate forecast of the energy mix is vital for ensuring the reliability and stability of the energy supply. As Italy moves towards a more sustainable energy system, understanding the balance between supply and demand, the integration of renewable energy and the role of energy efficiency becomes increasingly important. This insight is critical for maintaining a stable energy supply while meeting environmental targets.

In conclusion, forecasting the energy mix is of paramount importance for Italy as it navigates its energy transition. It supports strategic planning, policy development, and infrastructure investment decisions aimed at achieving a sustainable, secure, and competitive energy system.

Given the absence of prior applications of this model for this specific purpose in the literature, we have endeavored to outline its implementation steps towards the applied results.

This study provides an insightful look into Italy’s future energy composition, using a forecasting model that integrates the Grey system theory with Markov chains to address the uncertainties in energy prediction. The obtained results reveal a significant trend towards the adoption of renewable energy sources while indicating that fossil fuels will still play a dominant role in Italy’s energy mix by 2030. This dual dependence underscores the complexity of transitioning to a sustainable energy framework and highlights the critical need for Italy to enhance its efforts in renewable energy development. The results serve as a call to action for policymakers, suggesting that while strides are being made towards a greener energy future, more aggressive policies and investments are required to reduce fossil fuel dependency significantly. This study not only sheds light on the potential energy landscape of Italy in the coming years but also emphasizes the importance of innovative forecasting techniques in planning and policymaking for energy transition.

The paper is organized as follows. In Section 2, we present the model. Specifically, in Section 2.1, we illustrate the steps of the Grey Model , and in Section 2.2, we explain how to apply the Markov chain for error adjustment. Subsequently, in Section 3, we introduce our case study focused on forecasting the consumption of primary energy from each energy source for Italy until 2032 and we demonstrate the accuracy of our forecasts and the robustness of our models through a sensitivity analysis as well. In Section 4, the conclusions of our work are given.

2. The Model

The model employs a first-order differential equation to describe the forecasting target, and it stands as a primary tool in Grey system forecasting. Additionally, the enhanced approach, merging the principles of the model with those of the Markov chain, delivers improved statistical assessments for datasets that demonstrate significant fluctuations. The Grey Markov Model does not require restrictive assumptions concerning the relationships between variables and data stationarity [25]. However, for reasonable outcomes, its deterministic component should be able to explain the data trend, while the Markov chain should enhance the deterministic predictions.

2.1. GM(1,1) Model

The GM(1,1) model is widely recognized for its ability to generate reliable short-term forecasts using a limited dataset of non-negative values. In this section, we will discuss the steps required to implement this model.

Let be the vector representing the original data sequence containing n observations:

Firstly, we perform a one-time accumulated generating operation in the following way:

in order to create the array

It should be observed that the first element of the vector in Equation (1) corresponds to the first element of the vector in Equation (2), symbolically represented as .

Then, set as the vector of the background values computed as follows:

This is equivalent to stating that the general element is the arithmetic mean of the two neighboring data points.

The equation is defined as follows:

where a is the developing coefficient and b is the Grey effect.

Next, the cumulative values can be approximated by the first-order Grey differential equation:

Based on the principles of Least Square Estimation (LSE), the estimation of parameters and can proceed in the following way:

where

To calculate an estimate of the Standard Error associated with the parameters and , we compute

Finally, the solution of (6) leads us to the time response function

Therefore, the predicted values of are:

given the assumption that the first value is known, that is .

2.2. Markov Chain Residual Modification

Observed data often fluctuate due to various random influences. Consequently, accurate forecasts with the model are difficult to obtain. To overcome this problem, we integrate a Markov chain approach to refine the residual errors. In particular, the model merges the Grey forecasting approach of with a Markov chain mechanism to adjust for residual errors. The core concept behind the involves first identifying discrete states for the residual errors from , then calculating Markov probability transition matrices to understand the statistical behavior of these residuals, and finally applying corrections based on these matrices. This process enhances the original forecasting accuracy of the model. The step-by-step residual modification is described in the current section.

First, we define which residuals to be used. There are examples in the literature that show the use of absolute errors [25] and others that show the use of relative errors [20,26]. In our investigation, we focus on relative errors represented in the form

Let be the chosen series of residual values, be the minimum, and be the maximum. We split the range of residuals into q intervals of the same length. The generic interval is denoted by

Each of them is assumed to be a state. In particular, state 1 is the interval with the lower bound equal to , and state q is the one with as the upper bound.

This means that the sequence of residual values is converted into a sequence of states assuming values in the set . The state of residual depends on which interval it belongs to. The specific number of state divisions is not rigidly defined; rather, it is determined based on comprehensive factors such as the sample size and the error range of the fit [27]. Classifying them into three to five states is typically deemed suitable [28].

Now, take as the notation for the representative value of each state , whose lower bound is and upper bound is . In some circumstances, simple choices are considered. For example, the formula proposed in [25] is a weighted average of the lower and upper bounds of the intervals:

where are the weights that can be assigned to the extremes of each interval. In general, various choices are possible by producing statistical estimations of the representative values of the states of the Markov process. This is commonly performed in diverse application settings; see, for example, [29,30]. Accordingly, we consider the following estimation formula:

The next assumption is to consider this series of states as generated by a Markov chain . Hence, for every time , it results that

The above probabilities define the so-called one-step transition probability matrix, .

Now, we introduce the transition probability matrix as an matrix with elements , where i and j denote the rows and columns respectively, and m counts the number of the steps. Indeed, is called the m-steps transition probability matrix and represents the m-th power of the matrix :

According to the Markov chain assumption, it results that

Each element represents the probability of given that , i.e., the residual process transits from state to state in m steps. The one-step transition probability matrix is estimated as follows:

The term represents the total number of transitions from the i-th to the j-th state after step, and is the count of occurrences of state i within the residual sequence. To obtain the m-step transition matrix, the one-step matrix is raised to the m-th power.

Each row in has elements that sum to one. If the sum of a row’s elements for state i is nil because we never observed a residual belonging to the i-th interval , one choice could be to directly assign . This choice implies that state functions as an absorbing state.

Due to limited data, another problem may arise in the application of this model. It may be possible that a state of the process is only visited once and at the last observation of the time series of the residuals. In this eventuality, we are unable to estimate the transition probabilities over the row of the transition matrix which corresponds to the considered state. Here, the choice to characterize that state as an absorbing one poses a major risk when forecasting over a time span exceeding the observation time. In such a scenario, rendering state to be absorbing exclusively dictates the predictions, thereby introducing distortions. This is because it is unrealistic to assume that the process remains in the residual state until the end of the predictive interval.

Therefore, our recommendation is to assign to each element over the row an equal probability. This equates to the random initialization of errors within the system, subsequently allowing them to develop following the observed frequencies via the Markovian framework.

For example, this is equivalent to saying that for a number of states equal to , each row element would be equal to . In this way, when the chain reaches this particular state, it will not be absorbed by the starting state and it will be equally likely to reach in the next visit any other state.

The Markov chain method is employed to adjust the initial values obtained from the model predictions, revising it by adding the effect of a predicted residual. We can now describe this procedure as follows.

Let us assume that at the current time k, the residual process is in the state i, that is, . The model produces forecasting of the variable for future times . These forecasts are adjusted according to the formula

The prediction can be computed conditionally on the state of the residual process . Thus, if the residual at time k is in state , the prediction is given by:

The prediction formula (20) expresses m-steps forecasting.

Thus, for , we obtain a contemporary adjustment according to the state given by the relation

which is obtained setting into (20) and (21). Hence, the Markov chain corrects the initial prediction according to the representative value of the residual state at time k.

For and for the residual at time k being at state , we obtain

In this case, the forecast is corrected according to the factor which contains the expected value of the residual process at the next time, conditional to the occupancy of the state at current time k.

In general, as m varies, the model gives predictions for any future time .

3. Case Study

The transition towards a sustainable and diversified energy mix is a critical challenge and opportunity for countries worldwide. Italy, with its unique geographical, economic, and social landscape, presents an intriguing case for examining how future energy consumption patterns might evolve. This case study delves into forecasting Italy’s primary energy consumption mix-up to the year 2032, employing the innovative Grey Markov Model .

The data for our study were collected from the comprehensive database of “Our World in Data” (https://ourworldindata.org/), renowned for its extensive global energy statistics. This rich dataset provided us with annual figures of primary energy consumption across various sources in Italy, measured in terawatt-hours (TWh), spanning from the year 2000 to 2022. The energy sources detailed in this dataset include Biofuel, Coal, Gas, Hydro, Nuclear, Oil, Solar, and Wind.

Table 1 presents data on primary energy consumption across various sources measured in terawatt-hours for the years 2000 through 2022. Each row represents a year, showing how much energy was consumed from each source during that year. The dataset shows no missing values for any observation year, reflecting a complete data collection process. Starting from 2000, when reliance on traditional sources like Coal, Gas, and Oil was predominant, there has been a noticeable diversification and increase in renewable energy sources over the years. For instance, Solar and Wind energy consumption started from nearly negligible amounts in 2000 but show significant growth, indicating a shift towards more sustainable energy sources. Notably, Nuclear energy consumption remains at zero. Following the Chernobyl disaster in 1986, Italy held a referendum in 1987, which resulted in the decision to discontinue the use of nuclear power for energy production. The table is a comprehensive depiction of the evolving energy landscape, highlighting the gradual transition from fossil fuels to renewable energy sources.

Table 1.

Primary energy consumption in terawatt-hours by source.

Primary energy is the energy that is produced when a source is burned in its raw form. It includes the energy required by the end user in the form of electricity, transportation and heating, as well as inefficiencies and energy lost during the conversion of raw materials into a usable form. Since renewable sources are reported in terms of their electricity output, they are corrected by the ‘substitution method’ for efficiency losses in fossil fuels [31]. It attempts to match non-fossil energy sources to the inputs that would be required if they were generated from fossil fuels. To this end, energy generation from non-fossil sources has been divided by a standard ‘thermal efficiency factor’ by Energy Institute [32]. In this way, it is reliable to compare inefficient fossil fuel inputs to renewable energy sources, which do not have this inefficiency.

In our analysis, we will not use the data referring to biofuel from 2000 to 2003 because they contain zero values which would affect the results unrealistically.

For illustrative purposes, let us revisit all the stages of the previously described model, employing data related to the coal energy consumption in terawatt-hours, and set them as the following vector

The vector containing the cumulative values is

and consequently, we compute

To estimate the parameters and , we use the following matrices:

Using Equation (7), we obtain the estimation of the developing coefficient and the Grey effect . Meanwhile, we use Equation (9) to compute the Standard Errors, obtaining and .

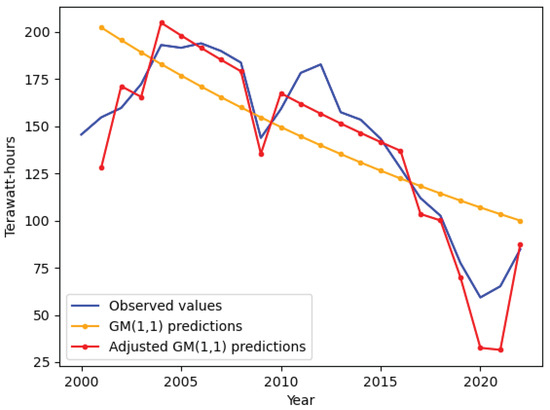

Wanting to obtain a forecast up to 2032, which is ten years ahead of the last available data, we use Equation (10) to obtain the cumulated values , and Equation (11) to obtain the predicted values . The results of the model are shown in Table 2. Moreover, in Figure 1, coal primary and predicted energy consumption in terawatt-hours are plotted. It shows that the prediction starts with the initial available data, rises up, and follows an exponential behavior.

Table 2.

Error analysis, state assignment, and adjusted prediction for the primary energy coal consumption in terawatt-hours from 2000 to 2022.

Figure 1.

Coal primary energy consumption observed values and predictions in terawatt-hours.

Now, let us proceed with the correction of predictions through the Markov chain. Consider the initial data and compute the relative errors utilizing Equation (12). Results are recorded in Table 2. In this series, the minimum is and the maximum is . Now, we split the range of residuals into intervals and assume each one to be a state:

In the last column of Table 2, states are assigned based on the interval each relative error falls into. From Equation (15), the centers of each state are , , , and .

Subsequently, the one-step transition probability matrix is computed through Equation (19):

For example, the value represents the probability of reaching state 1 given that the chain at the previous step was in state 1; stands for the probability of reaching state 2 given that the chain was previously in state 1. Raising the matrix to the m-th power makes it possible to obtain the m-steps transition matrix. From the matrix in Equation (29), we obtain the following stationary distribution:

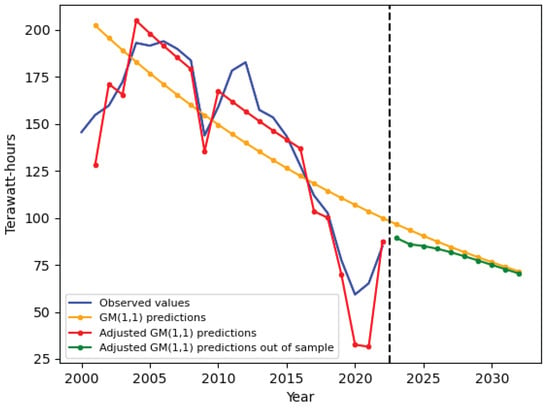

Since we know that all the real values referred to the years 2000–2022, for these years, we use the one-step transition probability matrix, updating the state i in Equation (21). For the years 2023–2032, we use the state , which is the last known state, and the matrix is raised to the m-th power. Finally, once all the adjustments are computed, Equation (20) is used to obtain the adjusted predictions from 2001 to 2032. See Table 2 for the results referring to the years of the sample and Table 3 for the prediction from 2023 to 2032. Figure 2 summarizes the coal primary and predicted energy consumption in terawatt-hours through the model before and after the Marvokian adjustment. Table 4 offers a clear comparison between the performance in terms of the Root Mean Squared Error (RMSE) of two models in predicting the consumption of various energy sources: the traditional model and its adjusted version that integrates the Grey Model (GM) with a Markov chain. From the data analysis, it is evident that the adjusted model demonstrates significant improvements in its estimates. The dashed vertical line separates the years of our sample from the years related to the forecast. To its left, as we have previously explained, the one-step transition matrix was used, updating the forecast with the observed value each time, while on the right, the forecast was made starting from the last observed value, using the m-step transition matrix. Compared to the forecast made with the Grey Model, the Markovian correction allows for predictions that follow the trend of the observed data, enhancing the predictive capability.

Table 3.

Adjusted prediction of coal primary energy consumption in terawatt-hours from 2023 to 2032.

Figure 2.

Coal primary and predicted energy consumption in terawatt-hours through model before and after the adjustment.

Table 4.

Comparison of Root Mean Squared Errors (RMSEs) for various energy sources predicted by and adjusted models.

All the previously described steps were repeated for each energy source, obtaining the predictions from 2023 to 2032. It should be noted that in the cases of Biofuel and Solar, it was not possible to calculate the representative values for all states because some states were never reached, as the relative errors pertained only to certain states. To overcome this problem, we employed Change Point analysis to identify the optimal point at which to truncate each data series [33]. The truncation point was determined to be in the year 2010 for Biofuel and in 2011 for Solar. After implementing these modifications, we were able to determine the representative values for each state and retrace all prior steps. In Table 5, all the adjusted predictions are shown for all the energy sources, while in Table 6, the estimates together with the Standard Errors (provided in parenthesis) of the developing coefficient and the Grey effect for each energy source are provided.

Table 5.

Primary energy consumption prediction in Italy in terawatt-hours from 2023 to 2032.

Table 6.

Estimate and the associated Standard Error of the developing coefficient and the Grey effect for each energy source.

Table 6 contains the data relating to the estimate and the Standard Error of the developing coefficient and the Grey effect for each energy source.

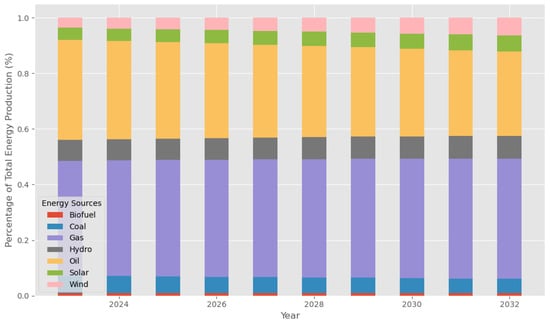

Figure 3 presents a forecasted breakdown of Italy’s primary energy consumption mix from 2023 to 2032, measured in terawatt-hours (TWh). The stacked bar chart displays the proportionate contribution of each energy source to the total national energy production on a year-by-year basis.

Figure 3.

Forecast of the Italian Primary Energy Consumption Mix (2023–2032).

The predictions highlight a steady increase in solar and wind energy, reflecting a global shift towards more sustainable and renewable energy sources. Biofuel predictions also show a consistent yet slight increase, indicating a modest contribution to Italy’s energy mix. Coal consumption, on the other hand, is forecasted to decline, echoing the broader transition away from fossil fuels. The forecast for gas and oil consumption suggests a decrease, aligning with efforts to reduce carbon emissions and dependency on non-renewable energy sources. Hydroenergy consumption shows minor fluctuations, indicating stability in its contribution to the energy mix.

The figure may serve as a critical tool for policymakers, indicating potential trajectories for energy policy and investment. It reflects the ongoing transition in the Italian energy landscape, highlighting the gradual decline in fossil fuels and the ascent in renewables, which are essential for achieving long-term sustainability and energy security goals.

Table 7 presents the results of a sensitivity analysis on the measured in terms of RMSE as parameters a and b are varied in the range of 2 times the Standard Error. The first row lists the values of parameter b, while the first column shows the values of parameter a. Their values were selected based on estimates obtained using the method of least squares, by adding and subtracting once and twice the Standard Errors, respectively. The trend of RMSE values generally increases from left to right across columns, suggesting the parameter’s influence on the prediction error. The table provides a clear overview of how tuning parameters a and b can optimize model performance.

Table 7.

Sensitivity Analysis of RMSE (Root Mean Squared Error) for varying parameters a and b in for coal primary energy consumption.

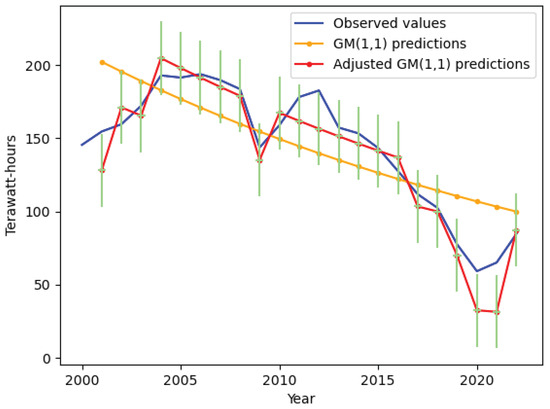

Since the uncertainty of prediction is closely related to the SE of the two parameters involved, in Figure 4, we show the updated version of Figure 1 with error bars reflecting the expected uncertainty.

Figure 4.

Coal primary energy consumption observed values and predictions in terawatt-hours with error bars.

4. Conclusions

In this comprehensive study, we introduced and applied the Grey Markov Model integrated with Markov Chain Residual Modification to forecast Italy’s power generation mix-up to the year 2032. This approach allowed us to incorporate both the uncertainty inherent in historical data and their fluctuating nature, reducing the in-sample prediction error, affirming the integration of Grey systems and Markov chains and thus attempting to improve the forecast for Italy’s primary energy consumption.

Our findings reveal a significant potential for renewable energy sources to increase their share in Italy’s energy mix, indicating a gradual decrease in reliance on fossil fuels. This transition aligns with global efforts towards more sustainable and environmentally friendly energy production methods.

The insights garnered from this study underscore the necessity for Italy’s energy policymakers to further encourage and invest in renewable energy sources. Strategic planning should incorporate the predicted shifts in energy production types, emphasizing sustainability and energy independence. Additionally, the model’s predictions can serve as a guide for adjusting current policies and devising new regulations to support the anticipated changes in the energy sector.

The evolving dynamics within the energy matrix suggest that shifts towards alternative energy sources may be approaching saturation. The potential for these sources to maintain the high growth rates observed in recent decades could be constrained by inherent limitations such as spatial requirements, intermittency of energy supply, and distribution challenges. These factors, rather than solely the governmental willingness to adopt these technologies, could significantly influence the future composition and sustainability of the energy matrix. These forecasts are based on current data, which should be updated with future observations, which is recommended via the repeated implementation of CPA.

While this study offers valuable forecasts and insights, it also opens several avenues for future research:

- Extending the model to other countries and regions to compare and contrast energy mix transitions on a global scale.

- Incorporating additional variables such as technological advancements, policy changes, and economic factors that could impact the power generation mix through a model.

- Exploring the potential impacts of increased renewable energy adoption on grid stability, energy prices, and environmental outcomes.

In conclusion, the application of Grey Markov Models to forecast Italy’s power generation mix presents a promising tool for energy researchers and policymakers alike. By understanding future trends, Italy can better prepare for a sustainable energy future, reducing carbon emissions and fostering a resilient energy system. Further research in this area will undoubtedly refine these predictions and contribute to the global knowledge base on energy-forecasting methodologies.

Author Contributions

Conceptualization, G.D.; methodology, G.D. and V.V.; software, V.V.; validation, G.D., A.K. and V.V.; formal analysis, V.V.; investigation, V.V.; resources, G.D. and A.K.; data curation, V.V.; writing—original draft preparation, G.D., A.K. and V.V.; writing—review and editing, G.D., A.K. and V.V.; visualization, V.V.; supervision, G.D. and A.K.; project administration, G.D.; funding acquisition, G.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research was partially funded by the program MUR PRIN 2022 n. 2022 ETEHRM “Stochastic models and techniques for the management of wind farms and power systems”.

Data Availability Statement

The data for this study were collected from the comprehensive database of “Our World in Data” (https://ourworldindata.org/).

Acknowledgments

V.V. expresses her profound gratitude to the University of Piraeus, particularly the Department of Statistics and Insurance Science, for their exceptional support and hospitality during the visiting period.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Deng, J.L. Control problems of grey system. Syst. Control Lett. 1982, 1, 288–294. [Google Scholar]

- Julong, D. Introduction to grey system theory. J. Grey Syst. 1989, 1, 1–24. [Google Scholar]

- Javed, S.A.; Liu, S. Evaluation of outpatient satisfaction and service quality of Pakistani healthcare projects: Application of a novel synthetic grey incidence analysis model. Grey Syst. Theory Appl. 2018, 8, 462–480. [Google Scholar] [CrossRef]

- Ma, X.; Lu, H.; Ma, M.; Wu, L.; Cai, Y. Urban natural gas consumption forecasting by novel wavelet-kernelized grey system model. Eng. Appl. Artif. Intell. 2023, 119, 105773. [Google Scholar] [CrossRef]

- Raheem, I.; Mubarak, N.M.; Karri, R.R.; Manoj, T.; Ibrahim, S.M.; Mazari, S.A.; Nizamuddin, S. Forecasting of energy consumption by G20 countries using an adjacent accumulation grey model. Sci. Rep. 2022, 12, 13417. [Google Scholar] [CrossRef] [PubMed]

- Wang, Y.; Gao, Y.; Sun, L.; Li, Y.; Zheng, B.; Zhai, W. Effect of physical properties of Cu-Ni-graphite composites on tribological characteristics by grey correlation analysis. Results Phys. 2017, 7, 263–271. [Google Scholar] [CrossRef]

- Tao, L.; Liang, A.; Xie, N.; Liu, S. Grey system theory in engineering: A bibliometrics and visualization analysis. Grey Syst. Theory Appl. 2022, 12, 723–743. [Google Scholar] [CrossRef]

- Candra, C.S. Evaluation of barriers to electric vehicle adoption in Indonesia through grey ordinal priority approach. Int. J. Grey Syst. 2022, 2, 38–56. [Google Scholar] [CrossRef]

- Tseng, M.L. Using linguistic preferences and grey relational analysis to evaluate the environmental knowledge management capacity. Expert Syst. Appl. 2010, 37, 70–81. [Google Scholar] [CrossRef]

- Jing, K.; Zhi-Hong, Z. Time prediction model for pipeline leakage based on grey relational analysis. Phys. Procedia 2012, 25, 2019–2024. [Google Scholar] [CrossRef]

- Delcea, C.; Cotfas, L.A. Advancements of Grey Systems Theory in Economics and Social Sciences; Springer: Berlin/Heidelberg, Germany, 2023. [Google Scholar]

- Delcea, C.; Javed, S.A.; Florescu, M.S.; Ioanas, C.; Cotfas, L.A. 35 years of grey system theory in economics and education. Kybernetes 2023. [Google Scholar] [CrossRef]

- Liu, S. Memorabilia of the establishment and development of grey system theory (1982–2021). Grey Syst. 2022, 12, 701–702. [Google Scholar] [CrossRef]

- Al-shanini, A.; Ahmad, A.; Khan, F.; Oladokun, O.; Nor, S.H.M. Alternative prediction models for data scarce environment. In Computer Aided Chemical Engineering; Elsevier: Amsterdam, The Netherlands, 2015; Volume 37, pp. 665–670. [Google Scholar]

- Deng, J. Gray Decision and Prediction; Huazhong University of Science and Technology Press: Wuhan, China, 1986. [Google Scholar]

- Huang, M.; He, Y.; Cen, H. Predictive analysis on electric-power supply and demand in China. Renew. Energy 2007, 32, 1165–1174. [Google Scholar] [CrossRef]

- He, Y.; Bao, Y. Grey-Markov forecasting model and its application. Syst. Eng. Theory Pract. 1992, 9, 59–63. [Google Scholar]

- Morcous, G.; Lounis, Z. Maintenance optimization of infrastructure networks using genetic algorithms. Autom. Constr. 2005, 14, 129–142. [Google Scholar] [CrossRef]

- Li, G.D.; Yamaguchi, D.; Nagai, M. A GM (1, 1)–Markov chain combined model with an application to predict the number of Chinese international airlines. Technol. Forecast. Soc. Change 2007, 74, 1465–1481. [Google Scholar] [CrossRef]

- Sun, X.; Sun, W.; Wang, J.; Zhang, Y.; Gao, Y. Using a Grey–Markov model optimized by Cuckoo search algorithm to forecast the annual foreign tourist arrivals to China. Tour. Manag. 2016, 52, 369–379. [Google Scholar] [CrossRef]

- De Rosa, L.; Castro, R. Forecasting and assessment of the 2030 australian electricity mix paths towards energy transition. Energy 2020, 205, 118020. [Google Scholar] [CrossRef]

- Álvarez-Arroyo, C.; Vergine, S.; D’Amico, G.; Escaño, J.M.; Alvarado-Barrios, L. Dynamic optimisation of unbalanced distribution network management by model predictive control with Markov reward processes. Heliyon 2024, 10, e24760. [Google Scholar] [CrossRef]

- Klunk, M.A.; Shah, Z.; Caetano, N.R.; Conceição, R.V.; Wander, P.R.; Dasgupta, S.; Das, M. CO2 sequestration by magnesite mineralisation through interaction of Mg-brine and CO2: Integrated laboratory experiments and computerised geochemical modelling. Int. J. Environ. Stud. 2020, 77, 492–509. [Google Scholar] [CrossRef]

- Ruoso, A.C.; Bitencourt, L.C.; Sudati, L.U.; Klunk, M.A.; Caetano, N.R. New Parameters for the Forest Biomass Waste Ecofirewood Manufacturing Process Optimization. Periód. Tchê Quím. 2019, 16, 560–571. [Google Scholar] [CrossRef]

- Hu, Y.C.; Jiang, P.; Chiu, Y.J.; Tsai, J.F. A novel grey prediction model combining markov chain with functional-link net and its application to foreign tourist forecasting. Information 2017, 8, 126. [Google Scholar] [CrossRef]

- Mao, Z.-L.; Sun, J. Application of Grey-Markov model in forecasting fire accidents. Procedia Eng. 2011, 11, 314–318. [Google Scholar]

- Guan, J.; Feng, Y.; Ying, M. Decomposition of quantum Markov chains and its applications. J. Comput. Syst. Sci. 2018, 95, 55–68. [Google Scholar] [CrossRef]

- Jia, Z.Q.; Zhou, Z.F.; Zhang, H.J.; Li, B.; Zhang, Y.X. Forecast of coal consumption in Gansu Province based on Grey-Markov chain model. Energy 2020, 199, 117444. [Google Scholar] [CrossRef]

- D’Amico, G.; Di Biase, G.; Manca, R. Income inequality dynamic measurement of Markov models: Application to some European countries. Econ. Model. 2012, 29, 1598–1602. [Google Scholar] [CrossRef]

- Barbu, V.S.; D’amico, G.; De Blasis, R. Novel advancements in the Markov chain stock model: Analysis and inference. Ann. Financ. 2017, 13, 125–152. [Google Scholar] [CrossRef]

- Ritchie, H.; Rosado, P. What’s the Difference between Direct and Substituted Primary Energy? Our World in Data. 2021. Available online: https://ourworldindata.org/energy-substitution-method (accessed on 1 January 2024).

- Energy Institute. Statistical Review of World Energy. 2023. Available online: https://www.energyinst.org/statistical-review (accessed on 1 January 2024).

- Kalligeris, E.N.; Karagrigoriou, A.; Parpoula, C. On stochastic dynamic modeling of incidence data. Int. J. Biostat. 2023. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).