Abstract

As the production of battery cells experiences exponential growth and electric vehicle fleets continue to expand, an escalating number of traction batteries are nearing the conclusion of their operational life for mobility purposes, both presently and in the foreseeable future. Concurrently, the heightened interest in sustainable energy storage solutions has spurred investigations into potential second-life applications for aging traction batteries. Nonetheless, the predominant practice remains the removal of these batteries from electric vehicles, signifying the end of their life cycle, and their subsequent incorporation into recycling processes, with limited consideration for life-extending measures. This study seeks to elucidate the reasons behind the deprioritization of battery repurposing strategies. Therefore, the research team conducted two industry studies with over 20 battery experts from Europe, revealing concerns about the economic viability of repurposing batteries for stationary storage applications. A literature review of studies published since 2016 confirmed the industry’s struggles to address this issue theoretically. In conclusion, a research question was formulated, and a solution approach was delineated to assess the economic prospects of aged traction batteries within the industry’s landscape in the future. This solution approach encompasses pertinent market analysis, the identification of representative second-life applications, as well as the formulation of a methodology for evaluating the residual value of these batteries.

1. Introduction

In order to counteract global warming, fossil fuel combustion engines in the transportation sector are increasingly being replaced by electric, battery-powered vehicles. In 2021, 84 percent more electric vehicles (EVs) were sold in Germany compared with the previous year [1]. Due to the steady increase in EVs, more and more Lithium-Ion Batteries (LIBs) are being produced to be integrated as battery packs in the vehicles. Currently, EV battery packs are considered to be viable until their state of health (SOH) declines to approximately 80% [2,3,4]. While these end-of-life (EoL) batteries may no longer meet the demanding requirements of vehicle applications, their condition remains good enough for other applications. As a result, recycling may not always be the optimal solution. To address this, a business model has emerged where these batteries are repurposed for less-demanding applications that still benefit from their remaining capacity. This practice grants the used vehicle batteries a second life, leading to the adoption of the term “second-life battery” (SLB). Stationary battery energy storage systems (BESSs) have proven to be a useful secondary application, as they exhibit lower cycle numbers, depths of discharges (DODs), and temperature peaks compared to EV application, resulting in lower demands on the batteries [5]. BESSs have multiple applications, acting as peak shaving solutions, buffer storage for charging infrastructure, and reliable back-up power sources [6]. They are also increasingly being used on the grid to compensate for fluctuations in renewable energy generation [7].

The repurposing of retired vehicle batteries could be useful on two counts. Firstly, an economical repurposing process could reduce the price of the EV battery and subsequently of the EV [8,9]. In addition, SLBs enable affordable energy storage systems and extend the service life of LIBs. Secondly, on the ecological side, the extended lifetime reduces the carbon footprint of the battery, which in turn increases the sustainability of EV use [6,10,11]. Second-life battery storage also supports the expansion of renewable energies by increasing grid stability. The economic and ecological motivation is shown in Figure 1.

Figure 1.

Motivation for a battery’s second life [12].

While there are already some pilot projects demonstrating the general feasibility of SLBs [13,14,15], there are still significant barriers holding back the widespread adoption of this approach. In our preliminary work (Kampker et al. [16]), a comprehensive review of challenges associated with the rededication of SLBs was made. The review emphasizes the challenges encountered throughout the process chain, as well as the economic and legal barriers that need to be addressed. The identified barriers are summarized in Figure 2. However, prioritizing the identified challenges was not the focus of this research. Therefore, it remains crucial to identify the key challenges that pose the greatest obstacles to the widespread adoption of the SLB approach. This knowledge is vital for companies in this sector as it enables them to focus their efforts on overcoming these obstacles and driving progress in this field. This paper focuses on the determination of the most relevant challenges for battery repurposing and, finally, the definition of a suitable approach to overcome this challenge. The methodology is explained in the following.

Figure 2.

Summary of identified challenges for second-life battery in the literature.

2. Methodology

At the beginning of this research work, a literature review was carried out to identify the most relevant challenges and which was summarized in our preliminary work (Kampker et al. [16]). Based on this, two independent industry studies were conducted, comprising a total of 17 companies and experts from different sub-sectors of the battery industry within Europe. In August 2022, the first industry study was conducted, wherein seven companies were surveyed to gather their perspectives on the greatest challenges associated with SLBs. The surveyed companies are from the field of automobile production, renewable energies, power supply (generation and trade), and storage technologies. The survey consisted of 39 thematic questions addressing various barriers along the second-life process chain, encompassing battery availability, transport, condition assessment of battery systems, technical processing, as well as economic and legal barriers. The survey employed a mixed-methods approach, incorporating the collection of both qualitative and quantitative data. The qualitative questions consisted of free assessment questions and free assessment statements. For the quantitative data collection of the survey, questions and statements were formulated, which the experts evaluated using both a five-level Likert scale, where 0 means “Strongly disagree” and 5 means “Strongly agree”, and multiple-choice questions. An overview of the topics is given in Table 1.

Table 1.

Overview of topics of the first industry study.

Next, the experts were asked to name and rank the top 3 challenges at the survey’s conclusion to identify the most relevant barriers concerning the rededication process, rentability, and legal framework of SLBs. This involved selecting the challenges most relevant to their company’s perspective from a list of challenges mentioned in the literature. Through this, a final prioritization of the challenges was conducted.

Based on the results, a working hypothesis was drawn up for the most relevant challenges, which was evaluated in the second industry study. This study included a total of 10 experts interviews with a focus on the economic viability of second-life batteries. As in the first study, all of the experts surveyed work in battery-related companies, including automotive production, renewable energy, power supply/generation/trading, and storage technologies. The objective was to identify the most decisive factors on the rentability of SLBs. This study, consisting of 8 questions, comprised a combination of quantitatively evaluable multiple-choice questions and qualitative open questions. The findings were used to derive four main challenges for the industry and to formulate a practical deficit.

In order to prove whether the identified practice deficit is still relevant, i.e., whether it has not yet been resolved by research results on the theoretical path, a literature review was carried out to compare scientific research articles with the identified deficit based on their content and results. The selection of publications was limited to thematically appropriate content that either aimed to quantify the residual value of aged traction batteries or to carry out a price evaluation for these storages. In addition, a degree of fulfillment was defined based on five content-related requirements to assess the extent to which the practical deficit has already been solved. Finally, a proposal was formulated for solving the practical deficit, enabling the industry to overcome the challenges in future.

3. Results

3.1. First Industry Study to Rank Existing Challenges for SLBs

The findings from the first industry study have revealed that the primary challenge to be overcome regarding SLBs is ensuring their economic viability. This challenge is primarily attributed to the significant variability among battery types from different manufacturers, which presents obstacles in achieving a uniform repurposing procedure for a second-life application [6,17,18,19]. Through the evaluation of all interviews, the following five economic challenges were determined as the most important to overcome:

- Challenge 1: uncertainty regarding profitability of a battery’s second life;

- Challenge 2: price competition and competitiveness against new batteries and new storage technologies;

- Challenge 3: low return rate of batteries;

- Challenge 4: uncertainty about quality and remaining lifetime in second-life applications;

- Challenge 5: time-consuming testing of suitable and compatible batteries.

Thus, it becomes evident that rentability is the main barrier for the second-life battery. In order to effectively address this barrier, it is crucial to thoroughly understand its underlying causes. In Kampker et al. [16], four key challenges regarding profitability were identified. Firstly, the economic viability of second-life batteries is hindered by price competition with new batteries [20,21,22]. Secondly, since SLBs come as used goods, they are generally perceived with a lower value [14,23]. Furthermore, the uncertainty regarding residual value and capacity lowers the “willing to pay” price [24]. Lastly, the economic viability is questioned by the high costs for condition assessment, rededication, and subsequent warranties of the batteries [6,23].

The main cause of these challenges lies in the individuality that second-hand goods inherently possess, coupled with the considerable variability in end-of-life batteries from different manufacturers: The varied battery designs from different manufacturers create difficulties in uniformly and cost-effectively determining the condition and conducting technical rededication (sources). Additionally, the unique characteristics of individual batteries (Figure 3), such as their residual value and usage history, introduce uncertainty and diminish the perceived value of the SLB. Moreover, the second-life applications are also characterized by their high variability. While the battery was initially designed for only one use-case, namely the vehicle application, in a second life, it can be used in a wide variety of applications, which in turn place different load requirements on the battery [23]. This increases the uncertainty for both the rededication company and the end customer and makes a clear business case evaluation unfeasible. From this, the hypothesis can be derived that the economic viability of SLBs is hindered by the individuality of the battery systems and the variability in their rededication and repurposing scenarios.

Figure 3.

Individuality of LIB aging (battery aging behavior according to [25]).

3.2. Second Industry Study to Analyze the Economic Viability of Aged Battery Systems

In order to gather evidence from the industry and support the hypothesis that the profitability of a battery’s second life is primarily hampered by the variability in repurposing and integration effort and by the individuality of used battery systems, a second study was conducted with experts from the SLB sector. The evaluation of this study showed that the condition of the battery and the dismantling costs of the rededication are among the most significant cost factors of SLBs. Unanimously, all the interviewed experts concurred that a universally acknowledged procedure for determining the residual value of retired battery systems is still missing. Additionally, the majority of respondents expressed that relying solely on state-of-health (SOH) determination is insufficient for assessing the battery’s condition.

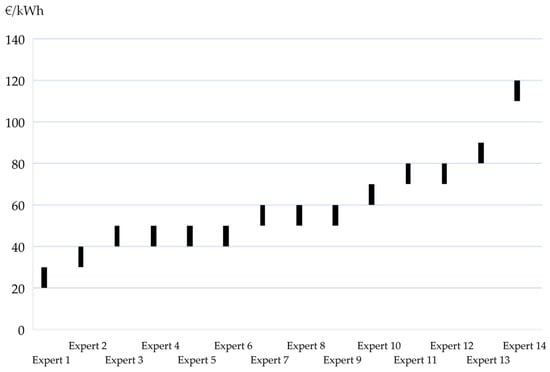

Regarding the individuality of battery systems, experts highlighted that determining the battery’s condition and the potential returns from the repurposing scenario cannot be universally quantified. Instead, these factors must be assessed on an individual basis due to the distinct characteristics of each battery system. As for the market price, there was disagreement among the experts. The market price of aged battery systems was estimated by the experts to be between 30 and 120 EUR/kWh as presented in Figure 4. Also, Figure 5 represents an updated survey of 2024. Both figures indicate the presence of only imprecise data in this regard. In Table 2, the main findings of the second industry study are presented.

Figure 4.

Market price of aged battery systems (NMC622, pack level) estimated by battery industry experts (industry survey from 2022).

Figure 5.

Market price of aged battery systems (NMC622, pack level) estimated by battery industry experts (industry survey from 2024).

Table 2.

Main findings of the second industry study.

The findings of the second study emphasized that the economic efficiency of second life is hindered by the individual characteristics of battery systems. Specifically, the unique SOH and the inherent variability resulting from different manufacturers significantly impact the overall profitability of second life. Therefore, the hypothesis from the previous chapter has been validated. This study identified a practical limitation, namely, the inability to make universally applicable assertions about the economic efficiency of SLBs due to their substantial individuality.

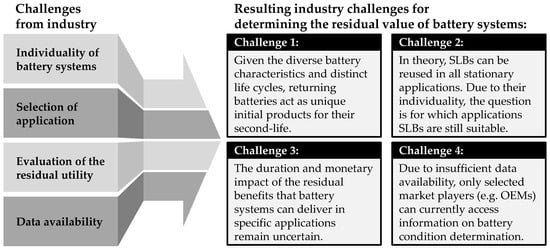

Overall, four main challenges for the industry could be derived, which are shown in Figure 6. The first challenge arises from the diverse battery characteristics and individual life cycles, so SLBs must be treated as individual new products. This means that each SLB has unique characteristics, whether in terms of its size, capacity, condition, or age. This individual aging depending on various factors is illustrated in Figure 3. As these batteries show different signs of use and wear, their integration into second-life applications requires a tailored approach. In other words, they need to be individually assessed, tested, and adapted to ensure that they can be used efficiently and reliably in new applications. The second challenge is the selection of a suitable second-life application. Although the second industry study identified SLB repurposing as particularly useful for frequency regulation and increasing PV self-consumption, the question of repurposing scenario still needs to be clarified on its own due to the individuality of each battery system. Determining the residual value of battery systems is another challenge for the industry. This is made particularly difficult by the unknown possible service life and the different areas of application of SLB. Finally, insufficient data availability is also a direct challenge for the industry. This barrier can only be removed if the original equipment manufacturer (OEM) is directly involved in the rededication process. From 2027, most batteries in the European Union will require a battery passport [26], offering details on their lifecycle, usage, and recycling advice to enhance transparency for all stakeholders.

Figure 6.

Four main challenges for the industry of battery repurposing.

3.3. Derivation of the Content-Related Requirements

Overall, five requirements for a methodology for determining the residual value of aged battery systems can be derived and are presented in Figure 7. The first methodological requirement for a solution procedure is the “completeness” of a model which includes the consideration of application- and market-relevant influencing factors. This relates directly to the challenge that it is not known which stationary applications make techno-economic sense for aged battery systems in a second life. In addition, market-relevant influencing factors are mostly insufficiently considered in economic feasibility studies. One reason for this could be the extensive scope of such a market impact analysis. Another complicating factor is that there is no uniform price for second-life battery systems on the market to date. The existing battery heterogeneity on the market as well as insufficient residual benefit forecasts in second-life applications further complicate an accurate evaluation. In addition, the early stage of development of the battery circular economy complicates this problem. Against this background, it is essential to include the mentioned criterion of “completeness” as a requirement.

Figure 7.

Presentation of the connection between industry challenges and content-related requirements for a solution methodology.

Furthermore, a solution approach must consider the “individuality” of aged battery systems, which represents the second methodological requirement. The individuality of aged batteries includes cell chemistry, battery condition, aging progression, and the determination of a single-case-specific EOL, which is performed indirectly by determining the Remaining Useful Lifetime (RUL) in second-life applications. The latter must be clearly distinguished from generic estimates of an EOL time point. Accordingly, the exemplary assumption of a battery EOL time point at 70% SOH is insufficient to fulfill this criterion. However, to account for the individuality of the overall business case, another sub-requirement is the consideration of a (representative) load profile of the stationary application. Based on the aspects mentioned, the individuality requirement directly addresses the first three identified industry challenges.

Another methodological requirement is “concreteness”. This criterion aims to ensure that a precise value is generated within the solution approach, so qualitative analyses are explicitly not sufficient to solve the inferred problem. In the evaluation, this requirement represents a binary variable that can be scored as either 100% or 0% fulfillment.

The fourth requirement is “efficiency” and describes the resource-saving execution of the methodology. Considering the number of returning batteries in the following decades, it can be deduced that the industry needs solutions to handle exponentially increasing quantities in a cost-efficient way. This requirement also represents a binary variable in the evaluation process.

The final methodology requirement is “accessibility”. The goal is to ensure the unrestricted usability of the solution approach by equal market participants. The background to this is that, to date, market participants have relied on battery manufacturers to communicate and provide data to deal efficiently with EOL batteries. This situation significantly complicates battery repurposing in second-life applications and must be addressed in the future.

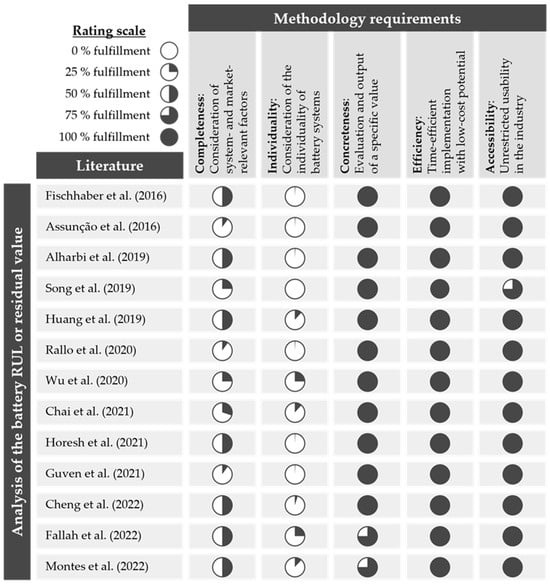

3.4. Identification of the Theory Deficit

Based on the requirements, it can be analyzed whether the existing challenges have already been solved in theoretical elaborations. To be able to evaluate the quality of the solution at the same time, it seems sensible to convert the identified requirements into an evaluation scale. The evaluation scale is individual for each requirement and is oriented to the total possible solution space. For the requirements efficiency, concreteness, and completeness, which can be evaluated exclusively with or without a fulfillment, the solution area resembles a binary variable and lies therefore with 0% or 100%. For the remaining requirements (individuality and completeness), the defined sub-requirements were formulated, which integrate a degree of fulfillment in the evaluation process and thus enable results between 0% and 100%. The evaluation was carried out without weighting and was based exclusively on the number of fulfilled sub-requirements.

Furthermore, an extensive literature search was carried out to identify elaborations and results in the addressed research area. During this, 13 publications could be found whose main or partial objective was the economic evaluation of aged battery systems. At the same time, 12 of 13 publications address a further use scenario in stationary storage, whereby the specific applications and load profiles are irrelevant at this point. The identified publications could then be evaluated based on the content requirements and with the help of the rating scale. The result is summarized in Figure 8 which visualizes a theory deficit in relation to the described practice deficit. Analogous to the working hypothesis, the industry and research deficit is characterized by insufficient consideration of the individuality factors of a second-life business case. Instead, the techno-economic analysis of battery repurposing is based on static assumptions about the technical performance of batteries in a second life, including their lifetime and operating costs. In practice, however, operating costs are closely related to the duty cycles of individual applications, which dynamically change battery life depending on the intensity of battery operation in terms of discharge rates. Since battery life depends on operating conditions, not taking it into account in the financial analysis leads to an inaccurate estimate and potentially to an overvaluation of batteries. Therefore, it can be summarized that the literature is not sufficiently accurate and clearly cannot be used for investment decisions in the industry.

Figure 8.

Visualization of current research deficit regarding the determination of the individual residual value of aged traction batteries [27,28,29,30,31,32,33,34,35,36,37,38,39].

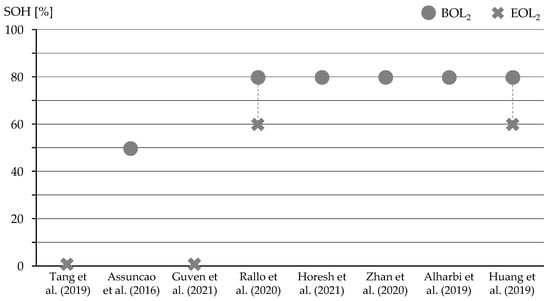

In addition, the identified deficit can be visualized by comparing used data such as the SOH at the beginning of the second life (BOL2), operating windows in terms of the SOC, as well as the battery costs in Euro/kWh. The data are visualized in Figure 9. For the SOH, the majority of the publications expect a BOL2 at about 80% SOH. This estimate can be explained by the fact that some traction battery warranties offered by OEMs are at 80% SOH or a certain number of cycles. Thus, traction batteries that meet the warranty conditions would be retired at about 80% SOH and then either resold with the EV or made available for the second-life market. In conclusion, it can be assumed that this value represents an interesting benchmark for calculation models.

Figure 9.

SOH values for BOL2 and EOL2 according to different studies [28,29,31,32,35,36].

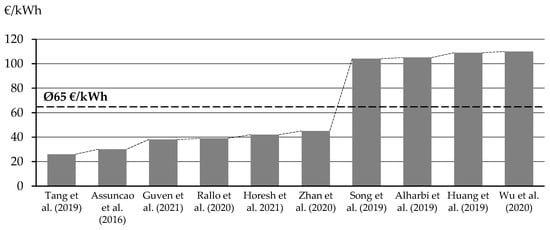

As industry experts were asked about the prices of obsolete battery systems (Figure 4 and Figure 5), it is interesting to see whether a similar opinion is present in research. Therefore, several studies have been compared regarding the estimated SLB cost in Euro/kWh. The research papers calculate SLB costs between 25 and 110 Euro/kWh, which is almost as inconsistent as the statements of the industry experts, and there is also no discernible trend regarding the publication date of the research projects. The results in Figure 10 visualize that there is no clear price indication on the market for aged battery systems. This has direct impact on the evaluability of SLB projects as well as the techno-economic reasonableness of this repurposing strategy.

Figure 10.

Estimated SLB cost according to different studies in [Euro/kWh] [28,29,30,31,32,33,35,36].

3.5. Formulation of a Solution for Overcoming Second-Life Challenges

Up to this section, content requirements for a solution methodology based on industry challenges have been defined. Furthermore, the formulated main and partial research questions outline a possible solution path, at least on a processual level. The following solution approach extends the elaboration by a content level. Specifically, this section addresses a stepwise solution approach which includes an impression of the solution logic as well as the necessary partial solutions. In addition, a proposal for a methodology and for the research process is formulated and finally concluded with targeted results.

The solution approach can be divided into three partial solution models, which complement each other. The first solution model addresses the first sub-research question, which is about the development of a market price model. The goal of this model is to quantify the value of aged traction batteries in Euro/kWh for a specific market. It is essential to consider technical as well as economic influencing factors in order to derive this value. These factors include aspects such as costs for labor, transportation, energy, material, regulations, and the state-of-the-art technology which is used in industrial environments. Based on this, a lower and upper price limit can be derived, spanning the solution space for a specific market. In simplified terms, the lower price limit corresponds to the marginal costs, which is roughly equivalent to the rededication costs from the vehicle application to the second-life application. In contrast, the upper price limit can be evaluated based on the existing market relationship of supply and demand in the specific market. The spanned solution space is then augmented by an expected value for the market price based on a price–sales function for aged traction batteries. This model can be neglected if a reliable market price for aged traction batteries already exists. Since a reliable market price typically requires high market transparency, technical process standardization, and advanced market conditions, this does not apply to the very young second-life market for traction batteries and therefore requires the model presented.

The second solution model addresses the identification of a representative stationary second-life application as well as an associated load profile. For the identification and selection of such an application, various filter criteria such as technical compatibility, the compensation profile, and the market development must be considered. In the following, market development as a filter criterion is used as an example to illustrate the relevance.

The relevance arises from the aspect that a second-life application must be attractive in the long term and at the same time be able to represent a high volume. The background is that about 1.3 GWh of battery systems are expected to be available for a second life in Europe in 2025. In 2030, the expected rededication volume will already increase to 13 GWh in Europe [40]. In order to ensure that this exponential increase in battery return volumes can also be continuously transferred to stationary repurposing scenarios in the long term, an application with sufficient market development is required, i.e., one that is attractive and relevant in the long term. This includes partial aspects such as market maturity, market size, or also market potential, which must be analyzed for various application scenarios. Analogously, the technical compatibility and the compensation profile must be included in the identification process of a second-life application.

After a market price for second-life batteries (solution model 1) and a representative second-life application have been identified (solution model 2), an analysis of the actual product, the battery system, is necessary (solution model 3). In this last model, a battery’s remaining lifetime must be evaluated with consideration of the present aging progression (individual SOH), future load profile requirements, and RUL prediction method. The aging progression and future load profiles can be considered as available information in terms of battery repurposing in second-life applications. In contrast, there are several RUL prediction methods which can roughly be categorized into four classifications in proportion to the fundamental procedure: AI methods, physics-model-based methods, statistical-model-based methods, and hybrid methods [41]. In the following, the mentioned methods are reviewed with regard to their suitability for the required solution.

Especially in the current time, AI-based solutions are experiencing hype in different research and industry projects. The reason for this is the high-quality model results in almost unlimited application areas. However, in order to obtain these results, models require high data quality and quantity as well as maintenance and calibration. In addition, the more complex the analysis problem to be solved, the more demanding the development and implementation of AI models. Tailored to the goal of this work, it means that AI models must be developed, validated, and calibrated for any kind of load conditions and load profiles which cannot be reconciled with the addressed industry challenges. This context is similar for physics-model-based methods. Therefore, statistical models seem to be the most appropriate for the intended solution goal and the identified industry challenges, as even hybrid models cannot be applied if all but one type of model is excluded.

The statistical probabilities of battery failure are part of the general information of battery systems since there are several fault mechanisms such as overcharge, overdischarge, overheat, overcold, large charging and discharging rates, as well as parameter inconsistency. It is useful that fault mechanisms can potentially prevented, like overdischarge, by setting operating limitations such as the discharge cut-off voltage [41]. However, since these fault mechanisms occur inside the battery cell, the evaluation of pack or module level is challenging. Nevertheless, very recent research exists, such as by Kampker et al. [40], Zhao et al. [42], or Xing [43], using statistical models to study battery health and predict failure in different circumstances. For this purpose, the Weibull distribution as well as principal component analysis and improved Gaussian process regression are used.

Ideally, a statistical model can be built for solution model 3, combining the individual failure mechanisms with their individual probabilities of occurrence. Therefore, a representative load profile of the chosen application must be considered and analyzed in terms of load conditions which increase a certain failure probability. The main idea is to evaluate the influence using a common scale in order to make different operating conditions comparable. For this purpose, the representative load profile is checked for the occurrence of negative operating conditions. Based on the analysis, a classification is made, for example, how often (quantitatively) and to what extent (qualitatively) a negative operating condition would occur if the load profile were implemented. Based on this classification, a forecast of the aging progression of battery systems can be graphically depicted, considering the characteristic polynomial section. Based on this, a failure probability can be derived for each year of operation and an expected value for the battery failure can be calculated. The latter would ultimately be decisive for the research objective of predicting the residual value of aged battery systems. In cases where no quantitative default probabilities can be derived, an endeavor may be undertaken to qualitatively evaluate a default probability (with consideration that the nature of the default event permits this approach). It should be noted here that this aging progression must be analyzed individually for different cell chemistries, as individual active materials react physically differently to certain operating conditions.

An example for one very relevant failure mechanism for aged battery systems is cell-to-cell variation. The cell-to-cell variation describes an uneven current distribution and corresponding SOC as a consequence of deviations in the production process (e.g., inconsistent weights of active materials) and due to deviating conductor and contact resistances. In the case of in-series connected cells, this can ultimately lead to a limitation of the operating window by the “weakest cell”. This mechanism, which in the long term leads to an interruption of battery operation, is not caused by any explicit load conditions, which is why the probability of occurrence is considered independently of the load profile and the cell chemistry. In contrast, there are also failure mechanisms such as lithium plating, which describes the deposition of lithium ions on the anode surface and which occurs at low temperatures in combination with high charge and discharge currents. Accordingly, a connection to the load profile of the application can be derived and the probability of failure can be quantified. Based on this approach, a cell-specific pack-level failure model can be developed which predicts battery system failure as the expected value and within certain tolerances (e.g., standard deviation) for specific load conditions. For industrial application, this model finally has to be validated based on historical data. The approach is visualized in Figure 11.

Figure 11.

Approach for battery RUL determination.

The result of this solution model is an RUL forecast measured in kWh which can be used as an input variable in the remuneration profile of the representative application from solution model 2. This value, divided per payment period and with consideration of additional payments (e.g., maintenance and repair, energy costs, rents, or leases) as well as the initial investment sum (e.g., for infrastructural measures, storage costs, or costs for grid connection), can be used in a dynamic investment calculation to determine an individual residual value for second-life battery systems.

4. Conclusions

One goal of this work was to identify the main challenges for the repurposing of battery systems into a second-life application. To this end, an industry study was first conducted with the aim of listing, categorizing, and prioritizing the challenges. A working hypothesis was then defined that addresses the fact that both the reallocation costs of the battery systems to a second-life application and the revenue structure of the possible applications as stationary storage systems must be evaluated on a case-by-case basis. Due to this problem, there is no clear evidence of the economic viability of repurposing battery systems. This deficit in the industry was subsequently confirmed in a literature study by defining five evaluation criteria for a suitable method for determining the residual value of battery systems. A total of 13 scientific publications were identified. It was found that none adequately examined the individuality of repurposing. Instead, assumptions were mostly made for static SOH limits and estimates for the costs of aged battery systems. In addition, no distinction was made between cell chemistries, which can have a significant price difference due to their material variation. Overall, this showed that the identified deficit has not yet been resolved.

In the next step, a proposed solution was formulated with the aim of determining the residual value of aged battery systems, considering the individuality of the business case. The proposed solution can be divided into three sub-models:

- Evaluation of the repurposing process for traction batteries on the basis of economic considerations: This includes calculating the costs, with the focus on understanding the repurposing process. This includes, among other things, multiple transportation, safety testing, condition diagnosis, and, if necessary, dismantling if the battery is repurposed at the module level. The meaningfulness of this sub-model depends in particular on the quality of the data’s quality, making the involvement of the industry indispensable.

- Selection of a suitable second-life application: this includes the identification of stationary second-life applications combined with an assessment of their technical and economic suitability for aged batteries.

- Statistical determination of the residual lifetime of aged traction batteries by evaluating load-profile-specific failure probabilities: This includes determining the condition of the individual battery system in order to assess the current aging progression. In addition, the representative load profile of the stationary application is checked for negative operating conditions, which increases the probability of battery system failure.

The third solution module appears to be a suitable alternative to conventional approaches, which are usually based on very large aging data sets and have not yet been able to solve the problem of high battery diversity on the market. However, there is hardly any accessible data that allow a reliable statement to be made about the probability of failure of battery systems depending on their expected load profile. But if this approach is realized, high return volumes could be evaluated on a case-by-case basis in the future, which would enable the battery industry to establish an efficient circular economy.

Author Contributions

Conceptualization, M.F.; methodology, M.F.; validation, M.F. and D.S.H.; formal analysis, D.K., C.O., H.H.H. and A.K.; investigation, M.F. and D.S.H.; resources, M.F., D.K., C.O., H.H.H. and A.K.; data curation, M.F. and D.S.H.; writing—original draft preparation, M.F. and D.S.H.; visualization, M.F. and D.S.H.; supervision, D.K., C.O., H.H.H. and A.K.; project administration, M.F.; funding acquisition, D.K., C.O., H.H.H. and A.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the German Federal Ministry for Economic Affairs and Climate Action, grant number “01MV21006C”.

Data Availability Statement

Data are contained within the article.

Acknowledgments

The research project “Fluxlicon” on which this publication is based was funded by the German Federal Ministry for Economic Affairs and Climate Action. In Fluxlicon, the project team develops and produces modular energy storage systems based on second-life battery systems with different SOHs, capacities, and cell chemistries.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Statista. Electric Vehicles—Germany|Statista Market Forecast. Available online: https://www.statista.com/outlook/mmo/electric-vehicles/germany#unit-sales (accessed on 24 June 2023).

- Shahjalal, M.; Roy, P.K.; Shams, T.; Fly, A.; Chowdhury, J.I.; Ahmed, M.R.; Liu, K. A review on second-life of Li-ion batteries: Prospects, challenges, and issues. Energy 2022, 241, 122881. [Google Scholar] [CrossRef]

- Schulz, D. (Ed.) Nachhaltige Energieversorgung und Integration von Speichern: NEIS Conference 2016 = Sustainable Energy Supply and Energy Storage Systems; Springer: Wiesbaden/Heidelberg, Germany, 2017; ISBN 9783658150280. [Google Scholar]

- Thein, S.; Chang, Y.S. Decision making model for lifecycle assessment of lithium-ion battery for electric vehicle—A case study for smart electric bus project in Korea. J. Power Sources 2014, 249, 142–147. [Google Scholar] [CrossRef]

- Zhu, J.; Mathews, I.; Ren, D.; Li, W.; Cogswell, D.; Xing, B.; Sedlatschek, T.; Kantareddy, S.N.R.; Yi, M.; Gao, T.; et al. End-of-life or second-life options for retired electric vehicle batteries. Cell Rep. Phys. Sci. 2021, 2, 100537. [Google Scholar] [CrossRef]

- Olsson, L.; Fallahi, S.; Schnurr, M.; Diener, D.; van Loon, P. Circular Business Models for Extended EV Battery Life. Batteries 2018, 4, 57. [Google Scholar] [CrossRef]

- Hesse, H.; Schimpe, M.; Kucevic, D.; Jossen, A. Lithium-Ion Battery Storage for the Grid—A Review of Stationary Battery Storage System Design Tailored for Applications in Modern Power Grids. Energies 2017, 10, 2107. [Google Scholar] [CrossRef]

- Reid, G.; Julve, J. Second Life-Batterien als Flexible Speicher für Erneuerbare Energien; Bundesverband Erneuerbare Energie e.V.: Berlin, Germany, 2016. [Google Scholar]

- Lee, J.W.; Haram, M.H.S.M.; Ramasamy, G.; Thiagarajah, S.P.; Ngu, E.E.; Lee, Y.H. Technical feasibility and economics of repurposed electric vehicles batteries for power peak shaving. J. Energy Storage 2021, 40, 102752. [Google Scholar] [CrossRef]

- Ahmadi, L.; Yip, A.; Fowler, M.; Young, S.B.; Fraser, R.A. Environmental feasibility of re-use of electric vehicle batteries. Sustain. Energy Technol. Assess. 2014, 6, 64–74. [Google Scholar] [CrossRef]

- Kamath, D.; Arsenault, R.; Kim, H.C.; Anctil, A. Economic and Environmental Feasibility of Second-Life Lithium-Ion Batteries as Fast-Charging Energy Storage. Environ. Sci. Technol. 2020, 54, 6878–6887. [Google Scholar] [CrossRef]

- Zhao, Y.; Pohl, O.; Bhatt, A.I.; Collis, G.E.; Mahon, P.J.; Rüther, T.; Hollenkamp, A.F. A Review on Battery Market Trends, Second-Life Reuse, and Recycling. Sustain. Chem. 2021, 2, 167–205. [Google Scholar] [CrossRef]

- Haram, M.H.S.M.; Lee, J.W.; Ramasamy, G.; Ngu, E.E.; Thiagarajah, S.P.; Lee, Y.H. Feasibility of utilising second life EV batteries: Applications, lifespan, economics, environmental impact, assessment, and challenges. Alex. Eng. J. 2021, 60, 4517–4536. [Google Scholar] [CrossRef]

- Cready, E.; Lippert, J.; Pihl, J.; Weinstock, I.; Symons, P. Technical and Economic Feasibility of Applying Used EV Batteries in Stationary Applications; US Department of Energy: Washington, DC, USA, 2003.

- Cicconi, P.; Landi, D.; Morbidoni, A.; Germani, M. Feasibility analysis of second life applications for Li-Ion cells used in electric powertrain using environmental indicators. In Proceedings of the 2012 IEEE International Energy Conference and Exhibition (ENERGYCON), Florence, Italy, 9–12 September 2012; IEEE: New York City, NY, USA, 2012; pp. 985–990, ISBN 978-1-4673-1454-1. [Google Scholar]

- Kampker, A.; Heimes, H.H.; Offermanns, C.; Vienenkötter, J.; Frank, M.; Holz, D. Identification of Challenges for Second-Life Battery Systems—A Literature Review. World Electr. Veh. J. 2023, 14, 80. [Google Scholar] [CrossRef]

- Nigl, T.; Rutrecht, B.; Altendorfer, M.; Scherhaufer, S.; Meyer, I.; Sommer, M.; Beigl, P. Lithium-Ionen-Batterien—Kreislaufwirtschaftliche Herausforderungen am Ende des Lebenszyklus und im Recycling. Berg Huettenmaenn Monatsh 2021, 166, 144–149. [Google Scholar] [CrossRef]

- Catton, J.; Walker, S.B.; McInnis, P.; Fowler, M.; Fraser, R.; Young, S.B.; Gaffney, B. Comparative safety risk and the use of repurposed EV batteries for stationary energy storage. In Proceedings of the 2017 IEEE International Conference on Smart Energy Grid Engineering (SEGE), Oshawa, ON, Canada, 14–17 August 2017; IEEE: New York City, NY, USA, 2017; pp. 200–209, ISBN 978-1-5386-1775-5. [Google Scholar]

- Engel, H.; Hertzke, P.; Siccardo, G. Second-Life EV Batteries: The Newest Value Pool in Energy Storage. McKinsey & Company, 30 April 2019. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/second-life-ev-batteries-the-newest-value-pool-in-energy-storage (accessed on 24 June 2023).

- Elkind, E. Reuse and Repower: How to Save Money and Clean the Grid with Second-Life Electric Vehicle Batteries. Available online: https://escholarship.org/content/qt32s208mv/qt32s208mv.pdf (accessed on 24 June 2023).

- Fan, E.; Li, L.; Wang, Z.; Lin, J.; Huang, Y.; Yao, Y.; Chen, R.; Wu, F. Sustainable Recycling Technology for Li-Ion Batteries and Beyond: Challenges and Future Prospects. Chem. Rev. 2020, 120, 7020–7063. [Google Scholar] [CrossRef]

- Jiao, N.; Evans, S. Business Models for Repurposing a Second-Life for Retired Electric Vehicle Batteries. In Behaviour of Lithium-Ion Batteries in Electric Vehicles; Pistoia, G., Liaw, B., Eds.; Springer International Publishing: Cham, Switzerland, 2018; pp. 323–344. ISBN 978-3-319-69949-3. [Google Scholar]

- Becker, J.; Beverungen, D.; Winter, M.; Menne, S. (Eds.) Umwidmung und Weiterverwendung von Traktionsbatterien: Szenarien, Dienstleistungen und Entscheidungsunterstützung; Springer: Wiesbaden/Heidelberg, Germany, 2019; ISBN 9783658210205. [Google Scholar]

- Viswanathan, V.V.; Kintner-Meyer, M.C. Repurposing of batteries from electric vehicles. In Advances in Battery Technologies for Electric Vehicles; Elsevier: Amsterdam, The Netherlands, 2015; pp. 389–415. ISBN 9781782423775. [Google Scholar]

- Spotnitz, R. Simulation of capacity fade in lithium-ion batteries. J. Power Sources 2003, 113, 72–80. [Google Scholar] [CrossRef]

- Weng, A.; Dufek, E.; Stefanopoulou, A. Battery passports for promoting electric vehicle resale and repurposing. Joule 2023, 7, 837–842. [Google Scholar] [CrossRef]

- Fischhaber, S.; Simon, F.; Schuster, A.R.; Holger, H. Second-Life-Konzepte für Lithium-Ionen-Batterien aus Elektrofahrzeugen. 2016. Available online: https://www.ffe.de/wp-content/uploads/2016/06/StudieSecondLifeKonzepte1.pdf (accessed on 24 June 2023).

- Assunção, A.; Moura, P.S.; de Almeida, A.T. Technical and economic assessment of the secondary use of repurposed electric vehicle batteries in the residential sector to support solar energy. Appl. Energy 2016, 181, 120–131. [Google Scholar] [CrossRef]

- Alharbi, T.; Bhattacharya, K.; Kazerani, M. Planning and Operation of Isolated Microgrids Based on Repurposed Electric Vehicle Batteries. IEEE Trans. Ind. Inf. 2019, 15, 4319–4331. [Google Scholar] [CrossRef]

- Song, Z.; Feng, S.; Zhang, L.; Hu, Z.; Hu, X.; Yao, R. Economy analysis of second-life battery in wind power systems considering battery degradation in dynamic processes: Real case scenarios. Appl. Energy 2019, 251, 113411. [Google Scholar] [CrossRef]

- Huang, Z.; Xie, Z.; Zhang, C.; Chan, S.H.; Milewski, J.; Xie, Y.; Yang, Y.; Hu, X. Modeling and multi-objective optimization of a stand-alone PV-hydrogen-retired EV battery hybrid energy system. Energy Convers. Manag. 2019, 181, 80–92. [Google Scholar] [CrossRef]

- Rallo, H.; Canals Casals, L.; de La Torre, D.; Reinhardt, R.; Marchante, C.; Amante, B. Lithium-ion battery 2nd life used as a stationary energy storage system: Ageing and economic analysis in two real cases. J. Clean. Prod. 2020, 272, 122584. [Google Scholar] [CrossRef]

- Wu, W.; Lin, B.; Xie, C.; Elliott, R.J.; Radcliffe, J. Does energy storage provide a profitable second life for electric vehicle batteries? Energy Econ. 2020, 92, 105010. [Google Scholar] [CrossRef]

- Chai, S.; Xu, N.Z.; Niu, M.; Chan, K.W.; Chung, C.Y.; Jiang, H.; Sun, Y. An Evaluation Framework for Second-Life EV/PHEV Battery Application in Power Systems. IEEE Access 2021, 9, 152430–152441. [Google Scholar] [CrossRef]

- Horesh, N.; Quinn, C.; Wang, H.; Zane, R.; Ferry, M.; Tong, S.; Quinn, J.C. Driving to the future of energy storage: Techno-economic analysis of a novel method to recondition second life electric vehicle batteries. Appl. Energy 2021, 295, 117007. [Google Scholar] [CrossRef]

- Guven, D.; Kayalica, M.O.; Kayakutlu, G. Critical Power Demand Scheduling for Hospitals Using Repurposed EV Batteries. Technol. Econ. Smart Grids Sustain. Energy 2021, 6, 21. [Google Scholar] [CrossRef]

- Cheng, M.; Ran, A.; Zheng, X.; Zhang, X.; Wei, G.; Zhou, G.; Sun, H. Sustainability evaluation of second-life battery applications in grid-connected PV-battery systems. J. Power Sources 2022, 550, 232132. [Google Scholar] [CrossRef]

- Fallah, N.; Fitzpatrick, C. How will retired electric vehicle batteries perform in grid-based second-life applications? A comparative techno-economic evaluation of used batteries in different scenarios. J. Clean. Prod. 2022, 361, 132281. [Google Scholar] [CrossRef]

- Montes, T.; Etxandi-Santolaya, M.; Eichman, J.; Ferreira, V.J.; Trilla, L.; Corchero, C. Procedure for Assessing the Suitability of Battery Second Life Applications after EV First Life. Batteries 2022, 8, 122. [Google Scholar] [CrossRef]

- Kampker, A.; Heimes, H.H.; Offermanns, C.; Frank, M.; Klohs, D.; Nguyen, K. Prediction of Battery Return Volumes for 3R: Remanufacturing, Reuse, and Recycling. Energies 2023, 16, 6873. [Google Scholar] [CrossRef]

- Zou, B.; Zhang, L.; Xue, X.; Tan, R.; Jiang, P.; Ma, B.; Song, Z.; Hua, W. A Review on the Fault and Defect Diagnosis of Lithium-Ion Battery for Electric Vehicles. Energies 2023, 16, 5507. [Google Scholar] [CrossRef]

- Zhao, Q.; Jiang, H.; Chen, B.; Wang, C.; Xu, S.; Zhu, J.; Chang, L. Research on State of Health for the Series Battery Module Based on the Weibull Distribution. J. Electrochem. Soc. 2022, 169, 20523. [Google Scholar] [CrossRef]

- Xing, J.; Zhang, H.; Zhang, J. Remaining useful life prediction of—Lithium batteries based on principal component analysis and improved Gaussian process regression. Int. J. Electrochem. Sci. 2023, 18, 100048. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).