1. Introduction

Environmental concerns, significant and diverse economic risks stemming from climate change, and a desire to achieve energy security are driving many nations to develop renewable energy technology. The pivot toward renewable energy is also being facilitated by the rapid decline in renewable electricity production costs. For instance, a Report by the International Renewable Energy Agency [

1] indicates that the 62 per cent of total renewable power generation added in 2020 was at a lower cost than the cheapest new fossil fuel option. Since 2017, the South Korean (Korea thereafter) government has mandated an increase in the share of renewable energy in total electricity production—20 percent by 2030 and 30–35 percent by 2040. However, despite these lofty goals, according to the 9th Basic Plan for Long-term Electricity (BPLE) [

2] by 2019, about 40 percent of electricity in the country was still fuelled by coal, while nuclear and liquid natural gas (LNG) contributed only 26 percent, and the share of renewables stood at a mere 6 percent. According to the Korean Ministry of Trade, Industry, and Energy (MOTIE), an investment of KRW 92 trillion (USD 80.4 billion) is required to achieve a 20 percent share of renewable energy in the energy mix by 2030 (USD 1 = KRW 1145 as per annual average exchange rate in 2020). Slow progress notwithstanding, the number of small-scale solar PV in Korea has increased from 27,000 in 2018 to over 63,000 in 2019. Therefore, it is critical how to control small-scale and intermittent renewable electricity sources, as they increase the instability and inefficiency of the electricity supply system.

The transformation and greening of energy systems requires “flexibility” in balancing supply and demand due to the high unpredictability and variability of renewable energy sources such as solar and wind [

3]. As such, flexibility, i.e., the capacity of an energy system to adjust electricity demand or supply in reaction to both anticipated and unanticipated variability, is a good indicator of the stability of the system to handle the expansion of renewable energy. Traditionally, conventional power systems have provided flexibility by adjusting supply (generation) to electricity demand. To ensure stable electricity supply with a high share of renewable energy, backup facilities such as quick output-controllable ESS (energy storage system), pumped-storage, and single-cycle gas turbines have been developed in Korea [

2]. In addition, small-scale distributed energy resources (DERs) such as rooftop solar PV, micro wind turbines, mini-grids, plug-in electric vehicles, etc., also have the potential to impact system flexibility by converting passive electricity consumers into active consumers and energy prosumers (e-prosumers). Where E-prosumers or energy prosumers mean individuals who both consume and produce electricity either for self-consumption or consumption by others.

Worldwide, P2P electricity trading platforms (ETPs) are rapidly gaining recognition as enablers of erstwhile “passive” consumers (from the system operators’ point of view) to become “active” consumers or e-prosumers. Such frameworks are inherently efficiency-enhancing, as they permit excess electric power from energy e-prosumers to be utilized by other end-users. According to the IRENA report [

4], a P2P trading framework has the potential of not only increasing renewable energy deployment but also enhancing grid flexibility. P2P ETPs can also enable better management of decentralized generators and thereby help reduce costs related to generation capacity and transmission infrastructure. Finally, in a P2P business model, exchanges can potentially be tracked via a blockchain platform, which can potentially result in a significant reduction of transaction costs [

1,

5].

At present, Korea’s P2P ETP for e-prosumers is in very early stages of development. Prior to 2016, Korean e-prosumers with small-scale distributed energy sources such as roof solar PV could sell electricity surpluses only to Korea Electric Power Corporation (KEPCO, Naju-si, Korea) through KPX (Korea Power Exchange, Naju-si, Korea) but not to end-users. To stimulate greater deployment of renewable energy, MOTIE has permitted e-prosumers with small-scale renewable energy sources (generation capacity less than 10 KW) to sell electricity surpluses to end-users within pilot projects. However, most electricity trades are limited to the electricity generated by solar PVs with the help of intermediate agencies such as KEPCO. A pilot project called “smart energy trading based on blockchain” has been initiated in Sejong City, but there is no reliable evaluation of the project yet.

Are Korean electricity consumers willing to participate in a P2P renewable ETP that is based on blockchain technology? We investigate this research question via a choice experiment (CE) for Korean customers to examine their willingness to pay (WTP) for a blockchain based “hypothetical” P2P ETP. While a prior study by Lee and Cho [

6] estimated the WTP of P2P ETPs in Korea using a contingent valuation (CV) approach, our study utilizes a CE framework, which enables us to consider monetary as well as non-monetary attributes of using a P2P ETP. We assume that a P2P ETP with blockchain technology manifests non-monetary attributes such as a reduction in the clearance time for electricity trades, more secure trades, and monetary attributes including cost savings relative to current electricity trading systems and installation/maintenance costs of smart meters.

The CE study utilizes an online survey to collect data on consumer preferences for a hypothetical P2P trading system with blockchain and then estimate the parameters of attributes by employing several non-linear econometric models such as a mixed logit, Kernel density functions, and a hybrid estimation that combines mixed logit and latent class models. To estimate above mentioned model(s), this paper utilizes Stata statistical software [

7]. The use of various estimation methods will reveal unobservable preference heterogeneity of the respondents. We measure respondents’ WTPs for the hypothetical P2P trading platform based on the various estimation methods.

2. Blockchain Anchored P2P Electricity Trading

A P2P network is a group of computers on the internet that have agreed to share files with one another. There is no centralized server storing information on a P2P network; rather, each computer serves as both a client and a server [

8]. P2P ETPs have already been commercialized in Germany, the UK, and the Netherlands, among others. Some scholars [

9,

10] argue that blockchain can help anchor a P2P network and broaden the energy market by providing an exchange platform where consumers and e-prosumers (“peers”) can trade their energy surpluses. Green e-prosumers who invest in green energy generation technologies such as wind, PVs, or micro-grid can potentially participate and sell their surplus or excess energy directly to end-use consumers instead of simply feeding such surpluses into the grid for a fixed fee. Opportunities that enable direct transactions between green e-prosumers and consumers can also help broaden the energy space by potentially attracting more e-prosumers to the renewables market. This can result in not only greater competition between e-prosumers and conventional energy suppliers but can also boost the growth and utilization of renewables.

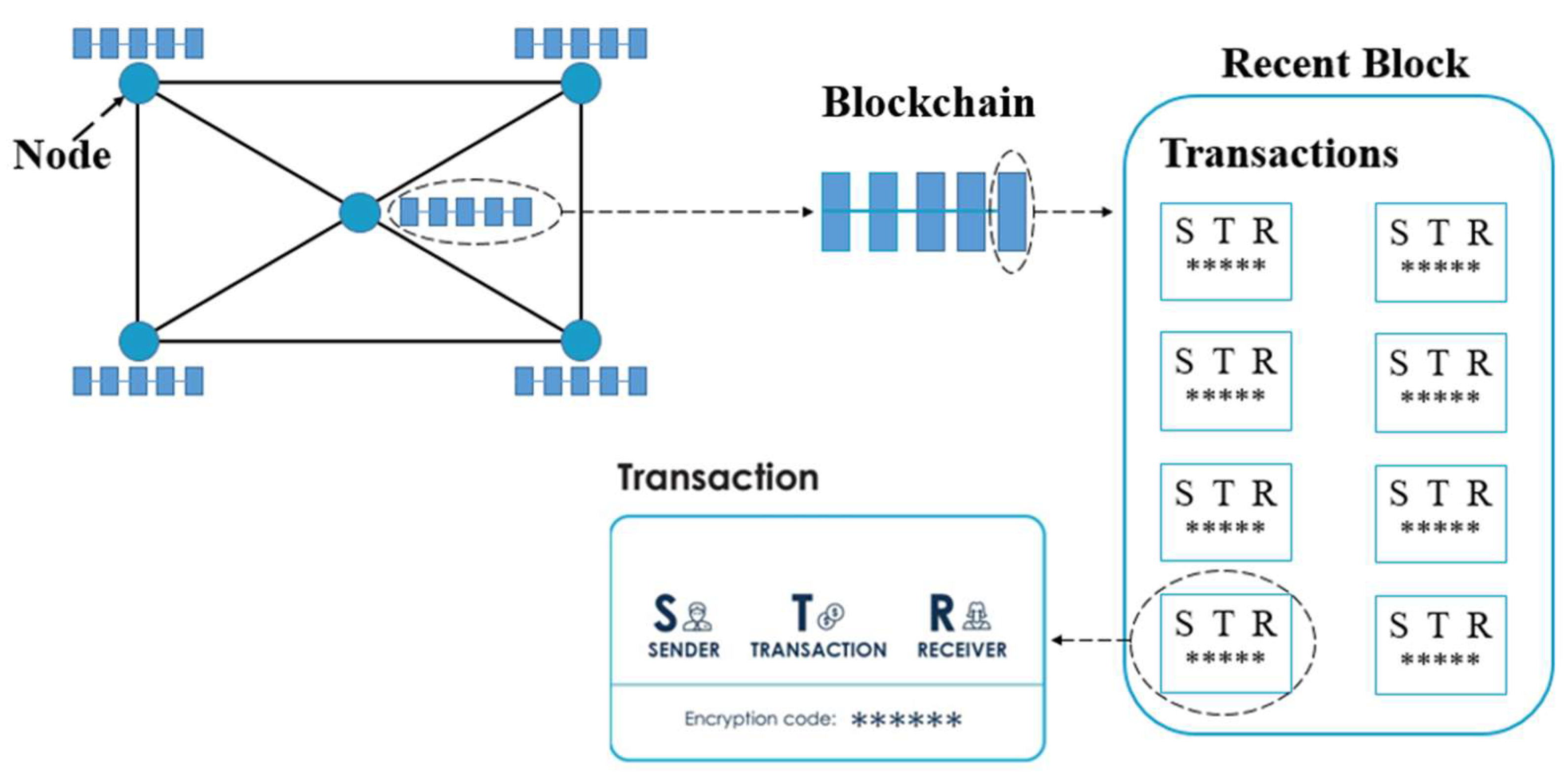

In a blockchain system, new transactions (blocks) are linked to previous transactions (blocks) by cryptography and form a chain of blocks, which makes blockchain networks resilient and secure. Each block holds a set of transactions, the size of which depends on how many transactions were completed at a given time interval. A simplified distributed ledger network is illustrated in

Figure 1.

A blockchain-based P2P system in the energy sector offers several benefits, including lower transaction costs, increased reliability, transparency, and security [

9,

11]. Within the blockchain, once a date is inscribed, it cannot be changed, and the bigger network, the lesser the chances of it being altered. Every node (network user) has access to all transactions that are verifiable and can be collated at any time. A renewable energy P2P ETP anchored in blockchain technology can thus potentially increase awareness about the real cost of energy. A Deloitte report [

12] also highlights other benefits of blockchain for energy markets, such as increased speed of exchange, improvement of data availability and reliability, and better auditability. Under conventional energy trading, electricity is transmitted from large-scale plants over long distances to final consumers that can result in significant transmission and distribution losses. In contrast, a P2P ETP can be established on a “green” distributed micro grid powered by distributed generators, batteries, and renewable resources such as solar panels or wind energy. A micro grid is a local energy grid with control capability, which means it can disconnect from the traditional grid and operate autonomously. A micro grid not only provides backup for the grid in case of emergencies but can also be used to cut costs, allowing communities to be more energy-independent and more environmentally friendly. The economic feasibility of P2P initiatives for both consumers and e-prosumers has been recently demonstrated by the success of P2P sharing communities in the Portuguese energy market [

13].

Despite the several above-mentioned advantages, there are also some disadvantages of applying blockchain technology to a P2P ETP. The cumulative energy costs of some public blockchain-based platforms have been driven to huge levels due to the many decentralized transaction verification processes that must be carried out simultaneously. One of possible ways to reduce the energy cost of blockchain systems proposed by [

14,

15] involves the use of NRGcoin. In contrast to ordinary cryptocurrency such as Bitcoin, NRGcoin is generated by injecting energy into the grid rather than spending energy on computational power. In addition, P2P ETPs based on NRGcoin provide incentives to e-prosumers to balance electricity production and consumption through a changing reward function that depends on supply–demand balance. Ref. [

16] also noted that private blockchain systems consume much less energy compared to public blockchain systems.

3. Literature Review

There is emergent and active scholarly interest for studying the technical feasibility of P2P ETPs. Ref. [

17] proposed a four-layer system architecture of P2P energy trading that enables the identification and categorization of the key elements and technologies involved in P2P energy trading. The authors demonstrate that P2P energy trading can help to balance local renewable power generation and local electricity demand and therefore has the potential to promote the dissemination of renewable energy resources in the power grid. In addition, the study showed that P2P energy trading can reduce the energy exchange and peak load by 42% and 17.6%, respectively, compared to the scenario without P2P energy trading.

Ref. [

18] reviewed 10 existing P2P energy trading projects. One such project is the UK-based Piclo. The Piclo Trading Engine uses data from half-hourly meters and existing grid infrastructure to automatically match energy generated and consumed. Generators have control and visibility over who buys electricity from them, and consumers can select and prioritize from which generators to buy electricity based on a range of criteria, including location, technology type, ownership, and cost. Another online trading platform like Piclo is Vandebron in the Netherlands (

https://vandebron.nl/ (accessed on 2 May 2022)). The Vandebron does not produce any energy itself but instead sells wind, solar, and biomass energy generated by independent energy producers to individual and business customers. Thus, it acts like an intermediary between consumers and generators and balances the whole market. Since electricity is supplied via the national electricity grid, all consumers are 100% secured. Consumers can choose between various suppliers and various prices. Producers set their own prices, which are market-determined. What the consumer pays for the energy goes directly to the producer, who receives a price that is higher than prices obtained from energy sales to utilities.

Another example of P2P ETP is sonnenCommunity (

https://sonnengroup.com/sonnencommunity/ (accessed on 2 May 2022)), which operates in Germany, Austria, Switzerland, and Italy. For every kilowatt hour that members share, they will receive a financial compensation that is well above the level of compensation offered by conventional electricity providers. Moreover, members can take sonnenCommunity benefits, such as a 10-year guarantee on sonnenBatterie, energy from 23 Cent, extensive software updates for all existing functions, free remote maintenance and monitoring, intelligent usage control, and low-priced energy from the sonnenCommunity.

The Brooklyn MicroGrid block-chain-based platform run by Transactive Grid, a partnership between LO3 Energy, Consensys, Siemens, and Centric, is another example of a P2P ETP. Participants in the Brooklyn MicroGrid are located across three distribution grids networks (

https://solaredition.com/energy-paradigm-shift-by-implementing-decentralized-communities-a-case-study-of-the-brooklyn-microgrid/ (accessed on 2 May 2022)), which are linked via a blockchain and connect e-prosumers and consumers. E-prosumers sell their excess solar energy onto the marketplace for consumers to bid on once they have installed the smart meter system, which gathers and records energy data for use within the energy markets. Energy surplus is measured by energy tokens by use of blockchain technology. Local solar energy is “won” by consumers via an auction, and purchased tokens are deducted from the consumer’s smart metering device. Consumers can select their energy sources, set their daily budget for purchasing local energy, and set their bid price for purchasing local energy on the marketplace. Every member of the community has access to all historic transactions in the ledger and verifies transactions for themselves. The Brooklyn MicroGrid has been approved to conduct a 12-month pilot program for energy trading on its platform. The pilot program’s expected start was in the early part of 2020, with 40 e-prosumers and 200 consumers (

https://energycentral.com/c/iu/brooklyn-microgrid-gets-approval-blockchain-based-energy-trading?utm_medium=PANTHEON_STRIPPED (accessed on 2 May 2022)).

There are also several survey-based studies on consumer and e-prosumer preferences for P2P electricity trading. However, most of these studies are based on experiences of European countries such as Germany, Austria, Switzerland, Norway, Spain, and the UK. A survey for Germany, Switzerland, Norway, and Spain [

19] revealed that 79 percent of respondents agreed to participate in a local electricity market, guided by their strong preferences for savings on energy bills, the diffusion of renewable energy, and improving the local environment. Ref. [

20] noted that for German electricity consumers, economic aspects such as monthly and investment costs are the main drivers for participation in local electricity markets.

Ref. [

21] utilized 2017 survey data to run multiple regression models on preferences for P2P electricity trading. They also estimated ordinal regression models to evaluate consumers’ intent to purchase P2P electricity trading products. Their results indicated that consumers and e-prosumers were primarily motivated by environmental concerns, followed by purchase probability of microgeneration assets such as PV. The authors also found that purchase probability is a primary determinant of respondent openness for P2P electricity trading and microgeneration units. Other factors such as home ownership of respondents, their knowledge about P2P, independence aspirations, technical interest, and education had a weaker impact on preferences for P2P electricity trading.

A survey for the UK [

5] tried to identify the key factors to be integrated into blockchain user interface to simplify the transition from the current electricity trading mechanism to a P2P system. The authors identified five key factors: (1)

ease and automation, particularly for consumers; (2)

third party, such as trusted energy service providers involved in electricity trading; (3) the

electricity price; (4)

trust, especially for consumers; and (5) a

positive “green” image signalled by the purchase of or generation of renewable electricity.

Despite the foregoing, research on consumers’ willingness to pay (WTP) for P2P electricity trading platform remains scarce and confined to mostly European nations. For Korea, as mentioned above, only [

6] estimated WTP of potential users in a P2P ETP. The CV approach utilized by the authors yielded a WTP of KRW 5958.86 (or USD 5.5) per month. The analysis also suggested that respondents with more background knowledge and those who paid higher electricity bills tended to have higher WTPs. In contrast to the [

6] CV study, our analysis utilizes a choice experiment (CE) methodology to estimate respondent WTPs for a P2P ETP in Korea. We explicitly account for installation fees for smart meters, saving rate of electricity, security level in the P2P system, and trading agent (neighbour or Korea Electric Power Corporation, KEPCO) as attributes of P2P trading of renewable electricity.

4. Estimation Method

Models used to implement a CE should be based on an explicit utility theory. Much of the recent work in this area is based on random utility maximization (RUM) by assuming that utility is linear in parameters [

22]. Thus, it is presented as

where

is the true but unobservable indirect utility associated with profile

j,

is the preference parameter associated with attribute

k,

is attribute

k in profile

j,

is the parameter on profile cost, and

is the unobservable factors with zero mean.

One of the estimation procedures that this study uses is a mixed logit model (MLM). According to [

23], MLM allows to obviate limitations of standard logit model by allowing the capture of unobservable heterogeneity of respondents, unrestricted substitution patterns, and correlation of unobserved factors over time.

Following [

24], we assume a sample of

N respondents with the choice of

J alternatives on

T choice occasions. The utility that individual

n derives from choosing alternative

j on choice occasion

t is given by:

where

is a vector of individual-specific coefficients,

is a vector of observed attributes relating to individual

n and alternative

j on choice occasion

t, and

is a random term that is assumed to be an independently and identically distributed extreme value. Conditional on knowing

, the probability of respondent

n choosing alternative

i on choice occasion

t is given by

The unconditional probability of the observed sequence of choices is

The unconditional probability is thus a weighted average of a product of logit formulas evaluated at different values of , with the weights given by the density .

The MLM can take account of random coefficients of attributes (

) that are different over individuals in the population with density

. Therefore, the probability distribution of the random parameters in the MLM must be defined because it is impossible to know in advance how the random parameters are distributed among the population. In general, random parameters are supposed to have normal distributions [

23,

25]. In this study, we also assume a normal distribution for the random parameters in the MLM. However, MLM might be inappropriate when the sample consists of discrete groups with different group-specific tastes. One possible way to overcome this limitation is using a latent class model (LCM), which can detect discrete heterogeneity by dividing respondents into discrete groups with group-specific tastes but cannot capture within-group heterogeneity.

To combine the advantages of MLM and latent class model, we utilize a hybrid model where the total sample is divided into latent classes and then applied to the MLM to capture unobservable heterogeneity of respondents [

25]. Suppose

S segments exist in the population, each with different preference structures, and that individual

n belongs to segment

s (

s = 1,…,

S). The conditional indirect utility function presented above (2) can be expressed as

The preference parameters (

) vary by segment. The probability of choosing alternative

i depends on the segment that one belongs to and can be expressed as:

Then, the probability that an individual n belongs to a class

s is

where

is a parameter vector of a specific group

s, and

represents the individual’s socio-demographic characteristics.

The probability that individual

n chooses alternative

i within a class

s when the probability that the individual belongs to the class

s is given by

In addition to the MLM and hybrid models, we also employ an individual-level coefficients for attributes (ICE) model based on Kernel density function [

25]. This ICE framework enables us to effectively discern similar choices made by a group of individuals who face similar alternatives. The procedure requires drawing a large number (

N = 500 in this study) of parameter vectors from a multivariate normal distribution of the parameter vectors based on the mixed logit or hybrid estimation results. Approximation of the expected value of coefficients, which is conditional on a given response pattern and attributes, can be obtained from a simulation with Halton draws.

Based on the parameter estimates from the MLM and hybrid models, the WTP for a non-monetary attribute can be calculated by the following formula:

where

MUa and

MUc are marginal utility from the non-monetary and monetary attributes, respectively.

βa and

βc are parameter estimates for non-monetary and monetary attributes, respectively.

5. Choice Experiment Design

A choice experiment (CE) survey was conducted in February 2020 by the Hankook Research survey company (web-site:

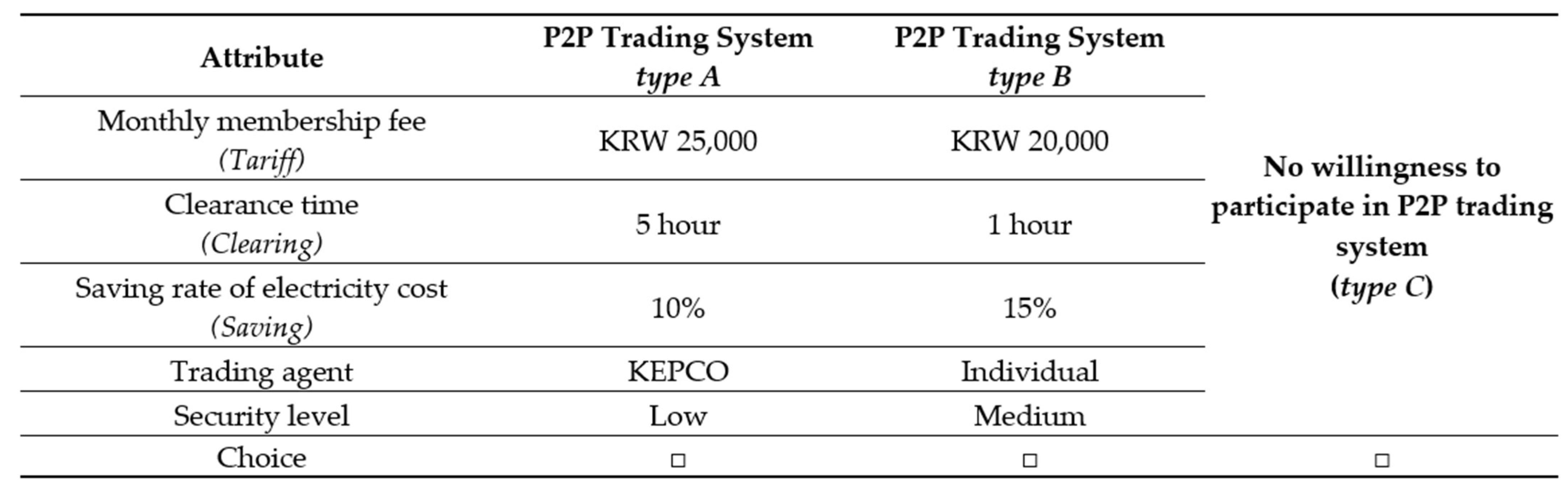

www.hrc.co.kr). A final survey questionnaire was designed after soliciting feedback from a preliminary survey and focus group interviews. The survey questionnaire was composed of four sections. The first section provided background and solicited information on each respondent’s gender, age, region of residence, education, job status, and occupation type. The second section gauged respondent awareness on blockchain technology, crypto currency, e-prosumers, and respondent experience with crypto currency and solar PV investment. In the third section, respondents were asked to declare their most preferred option among three P2P trading alternatives—

type A,

type B, and

opt-out (

type C), as indicated in

Figure 2. Alternatives

type A and

type B indicate a willingness to participate in P2P ETP based on different attribute values, while the

opt-out option means refusing P2P ETP with attribute values given in

type A and

type B options.

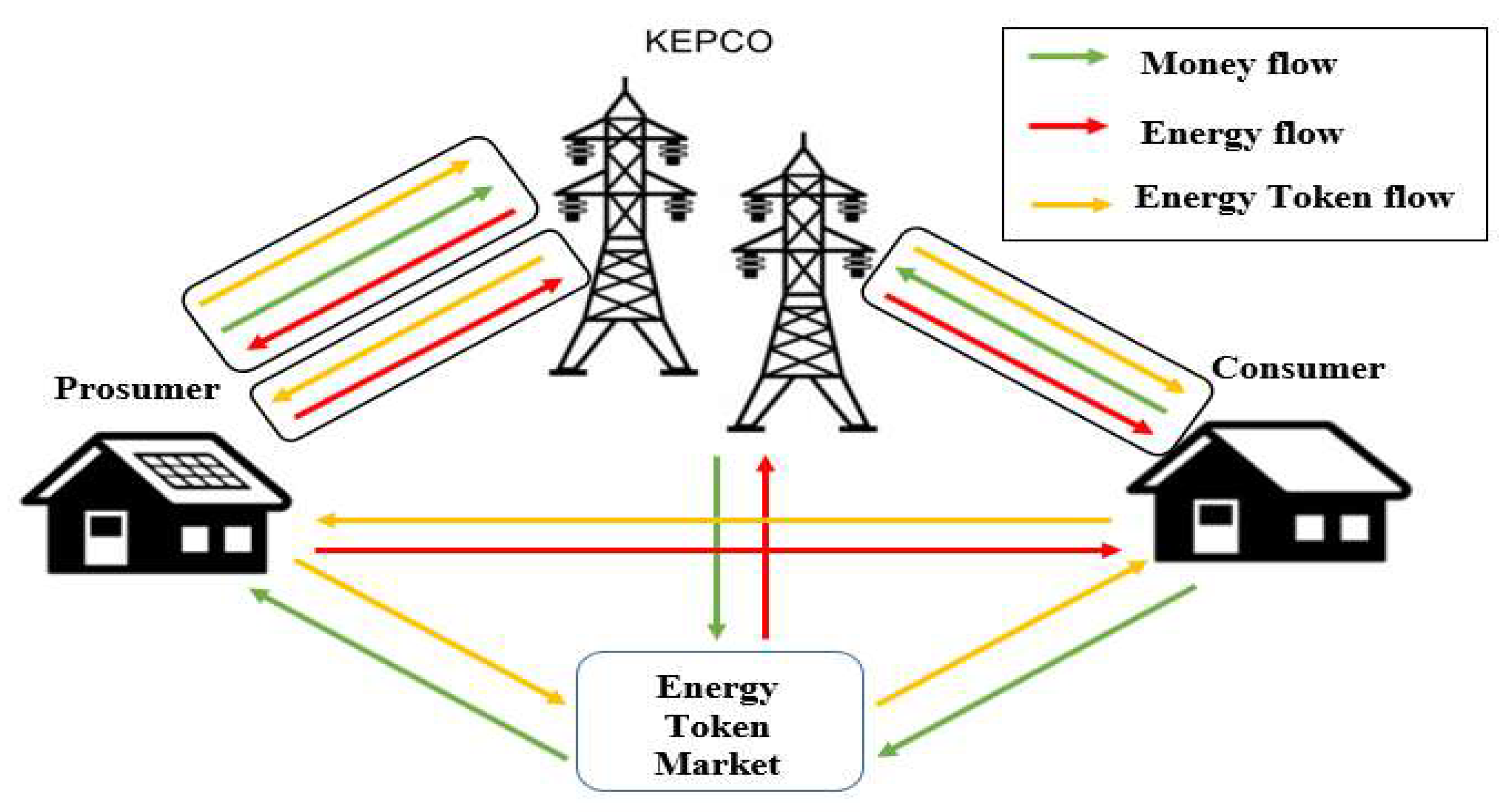

Respondents were also made aware of the operations of the P2P trading system with the aid of a visual, as shown in

Figure 3. In

Figure 3, three players, viz., KEPCO, an e-prosumer, and a consumer, interact in the blockchain-based P2P framework. The green, red, and yellow arrows represent monetary, electricity, and energy token flows between the three hypothetical players in the P2P trading system. The energy token refers to a cryptocurrency that is used for transaction in the P2P electricity trading. We assume that these energy token are not generated by a mining process similar to Bitcoin but created by injecting energy into the grid similar to the NRGcoin discussed above. The final section (fourth) asked respondents whether they regularly check their electricity bills and if they supported environmental NGOs. This section also contained questions on monthly electricity cost, the amount of electricity consumption, and respondent willingness to join a P2P trading and energy e-prosumer program.

The final questionnaire was emailed to 38,456 Korean electricity consumers, and we received 813 completed surveys. It is well-known that web surveys have lower response rate compared to other survey models [

26]. Studies have suggested that sometimes lower response rates provide more accurate measurements than surveys with higher response rates [

27,

28]. Ref. [

29] examined the results of 81 surveys with response rates varying from 5 percent to 54 percent and found that surveys with much lower response rates did not significantly decrease demographic representativeness within the range examined.

A D-efficiency-based algorithm was employed to derive optimal attribute values in each choice set [

30]. Four different versions of the survey were constructed, and each survey version included four choice sets with different levels of the attribute. As each respondent was required to choose the most favourable alternative among

type A,

type B, or

opt-out in each of four choice sets, a total of 9756 observations were thus obtained (813 responses * 3 alternatives * 4 choice sets).

Table 1 presents distribution of respondents for the socio-demographic variables such as gender, age, residential areas, education level, and income level.

The attributes in the choice sets include monthly fee for P2P trading based on block chain system (

Tariff), clearing time spent from transaction commitment of the P2P electricity trading until it is settled (

Clearing), and the saving rate on electricity tariff due to the P2P trading (

Saving). We also employed effect codes for the choice of a trading agent and security attributes, as they are categorical variables [

22]. Categorical variables can take limited number of possible values. As an example, if an alternative included KEPCO as a trading agent, it was assigned an effect code of 1, and if the alternative included the individual consumer as a trading party, then the effect code was negative 1 (

e_KEPCO). Similarly, the security variable has three values: low (1), medium (2), and high (3).

Low_Security is an effect code for low security level, and

High_Security is an effect code for high security level, where medium security level is set as a reference level. The

Low_Security value is 1 if security level is low, zero if security level is high, and negative 1 for medium security level.

Table 2 shows all possible attributes levels which can occur in the choice sets.

The variable DTariff was generated by multiplying the Tariff variable by −1. Transformed this way, a positive sign of DTariff variable can be interpreted as indicating a lower preference for P2P trading when the monthly fee increases. In addition, we created an alternative specific constant (ASC) to gauge respondent preferences for a P2P trading option rather than an opt-out option. The ASC has a value of one for the opt-out option choice and zero for any P2P option.

6. Results

6.1. Mixed Logit Model (MLM)

An MLM estimation requires us to define which variables are fixed and whose coefficients are random. For our analysis, we assumed that only the cost attribute (DTariff) (we tested if cost parameter as well as the other attributes are random or not and found that the cost parameter was insignificant when the cost parameter was assumed to be random) is fixed, and the remaining coefficients are random parameters. Random parameters mean that the coefficients have mean and variances with specific probability distribution. We also assumed that all the random parameters follow a normal distribution. A possible interpretation of attributes with random parameters is that these attributes contain unobservable preference heterogeneity of respondents.

Table 3 presents the results of the MLM estimation. The table indicates that mean parameters for all the attributes have the expected signs and are statistically significant. In particular, the negative and significant coefficient for

Clearing shows that increases in the time spent on clearing of a P2P trade is associated with a lower likelihood of choosing a P2P trading option. Higher saving rate of electricity cost and KEPCO as a trading party increases probability of choosing a P2P trading option. Predictably, lower security level results in a lower likelihood of choosing a P2P trading option and vice versa. The coefficient of

ASC is negative, which implies that choosing the status quo option (opt-out) decreases respondents’ utility compared to their choosing a P2P trading option. The estimation results for the S.D. parameters show that all the non-monetary attributes except

Low_Security are associated with unobservable heterogeneity.

The estimated model also includes interaction terms between the

ASC and awareness of e-prosumers (

ASC_

EProsumer), respondents’ income (

ASC_

Income), age (

ASC_

Age) electricity use level (

ASC_

EUse), as well as a common factor (

ASC_F1). Several variables, such as experience of the investment on crypto currency (

Criptoinv), preference for energy e-prosumers (

Weprosumer), participation in the P2P trading system (

P2P), and propensity of early adopters (

Adopter), were used to derive the common factor (

F1). Although we used various common factors such as

F1, F2, F3, and

F4 based on eigenvalues (

Table 4), F1 was found to be the most significant common factor, and therefore, only F1 was included in the final model.

Table 5 details the composition of

F1 and suggests that respondents in the

F1 group are more interested in frontier technologies such as blockchain, P2P trading, and prosumerism and can be considered as early adopters.

As displayed in

Table 3, interaction terms for awareness of e-prosumer (

ASC_Eprosumer) and electricity use level (

ASC_Euse) have the expected signs but fail to achieve significance levels even at 10%. Negative and statistically significant interaction terms between

ASC and

Income as well as

ASC and factor

F1 imply that respondents with higher income or early adopters have higher preferences for P2P trading option. Finally, the interaction term between

ASC and

Age shows that older respondents have lower preference to P2P electricity trading system.

6.2. Hybrid Model

The random parameters in the mixed logit models are usually assumed to follow a normal distribution, and the resulting model is fit through simulated maximum likelihood. However, some studies [

31,

32,

33] note that unobserved heterogeneity in MLM suffers from a lack of interpretability since it is not usually explained by explanatory variables. Discrete latent class models (LCM) can be employed to overcome heterogeneity. In the LCM, the total sample is divided into a discrete number of latent classes that are sufficient to account for preference heterogeneity. Thus, we applied the LCM, which categorizes endogenous groups based on socio-demographic characteristics such as income, age, e-prosumers’ awareness, electricity usage level, and early adoption. Prior to estimation of the LCM, it is common to choose the optimal number of latent classes by examining information criteria such as the Bayesian information criterion (BIC) and consistent Akaike information criterion (CAIC). As indicated in

Table 6, both BIC and CAIC criteria are minimized with four latent classes.

Table 7 shows how membership parameters influence the four classes, with class IV set as the reference class. For the other three classes, positive (negative) membership parameters imply that respondents with higher values of that characteristic are more (less) likely to fall into that non-reference class relative to reference class. As denoted in

Table 7, class I, class II, class III, and class IV represent 29.9 percent, 12.3 percent, 20.3 percent, and 37.6 percent of total respondents, respectively.

Table 7 indicates that coefficients for

Income, common factors

F1 and

Age variables are significant within Class I. Specifically, the signs for common factors

F1 and

Income are negative, while

Age is positive, which implies that young early adopters with high income are less likely to be in class I relative to class IV. For class II, only

F1 is significant and negative, suggesting that early adopters are less likely be in class II relative to class IV. The coefficient for

F1 in class I is higher in absolute value relative to class II, and as the signs for both coefficients are negative, it implies that early adopters are more likely to be in class II relative to class I. Finally, for class III, only the coefficient for

EProsumer is statistically significant with a positive sign. This suggests that e-prosumers with greater awareness are more likely to be in class III relative to class IV.

We estimated parameters for each class by using a mixed logit procedure via the hybrid model discussed above.

Table 8 presents our estimation results. The table indicates that respondents in class II and class III are indifference to P2P trading options, as the coefficients of

ASC are statistically insignificant. For class IV, the estimation results indicate that respondents reveal a positive preference for P2P electricity trading system, while respondents in class I have higher utility by choosing opt-out option. Note that for class I, the coefficients for almost all attributes are insignificant, indicating that the change in attribute values does not change the preference for P2P trading option. Conversely, for class IV, all attributes are statistically significant at the 1% level and have expected signs, as in mixed logit model. Moreover, estimated AIC and BIC criteria are considerably lower for hybrid model (200–1184) compared to MLM (over 4000), indicating better fitness of the hybrid model.

In the MLM estimation, unobserved heterogeneity is present for all attributes except

Low_Security level (see

Table 3). Yet, in the hybrid model, there is no preference heterogeneity for class I. In the case of class II and class III, only

e-KEPCO and

Saving, respectively, are significantly associated with unobserved heterogeneity. Finally, for class IV, there is unobservable heterogeneity for clearing times (

Clearing),

Saving,

e-KEPCO, and

High_Security attributes. These results indicate that respondents in class I, II, and III will either avoid or remain indifferent to the P2P ETP no matter what their attribute values are.

6.3. Individual Level Coefficients for Attributes (ICE Model)

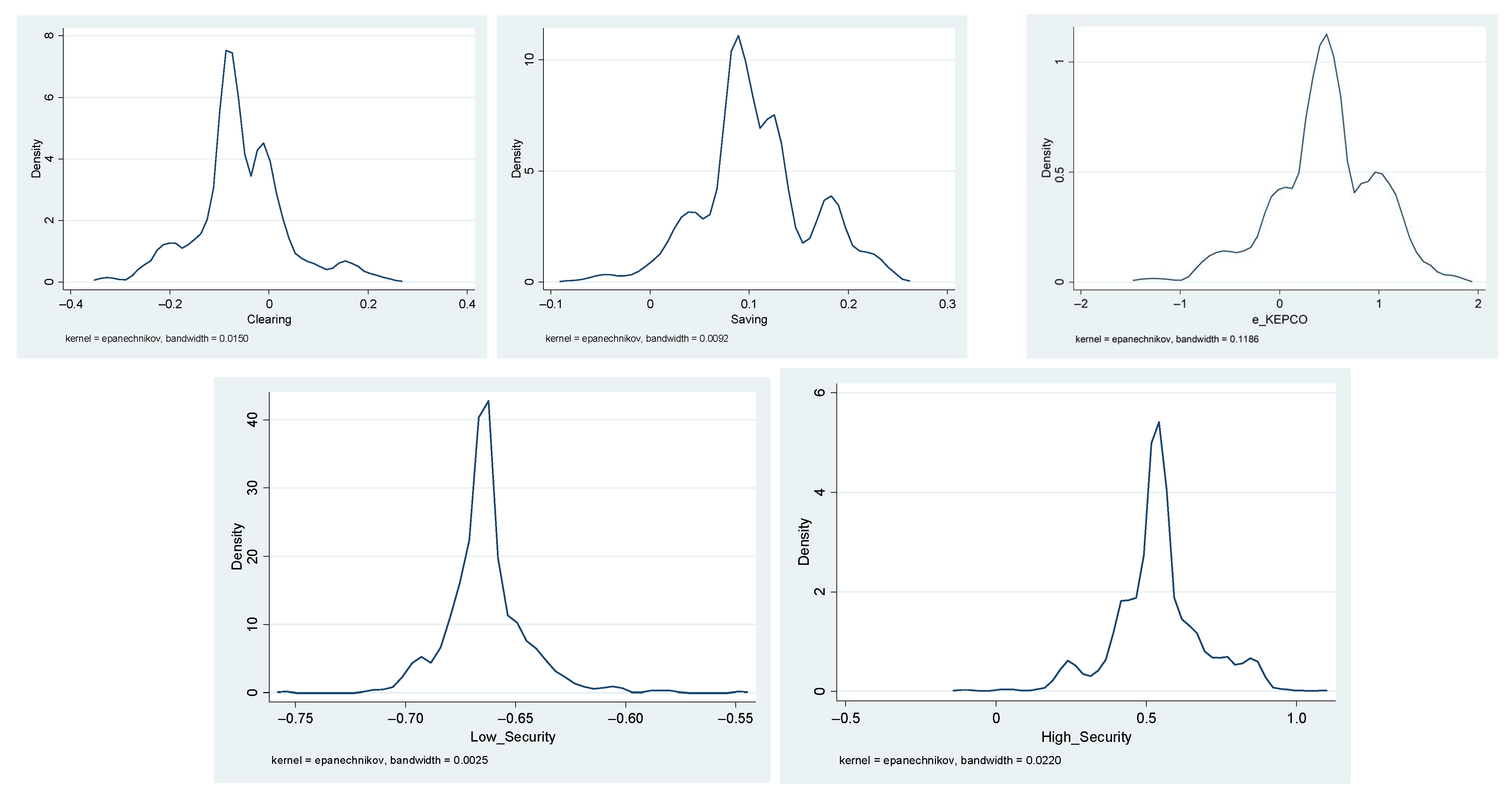

Although the MLM or hybrid models can detect if there is unobservable heterogeneity in respondents’ preferences, they cannot provide the distribution of the heterogeneity.

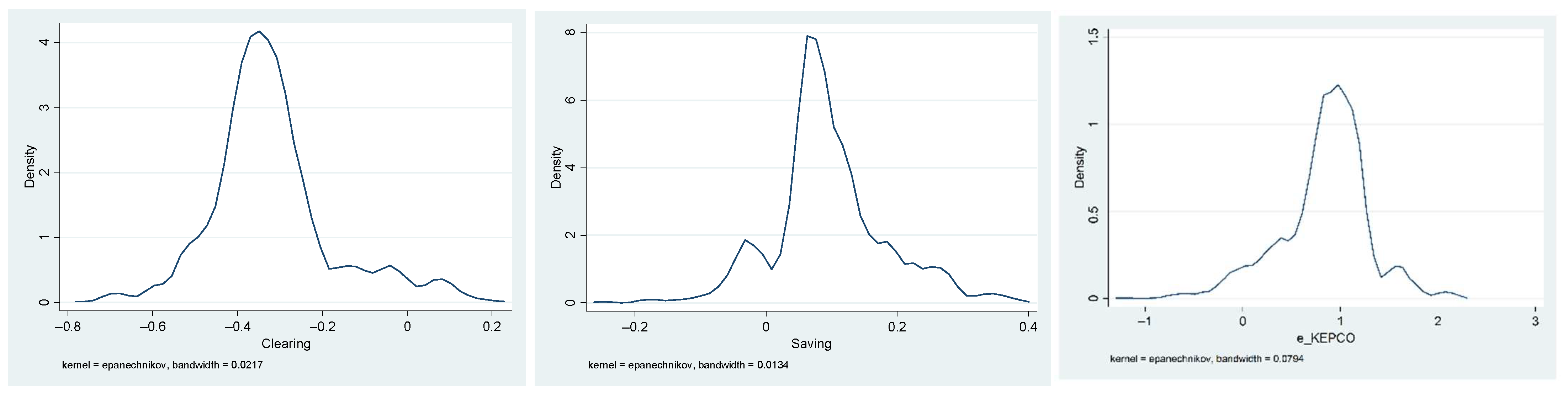

Figure 4 provides the Kernel density distributions for the individual coefficients of

Clearing,

Saving,

e_KEPCO,

Low_Security, and

High_Security based on our MLM estimation. Except for

Low_Security, Kernel density distributions for

Clearing,

Saving,

e_KEPCO, and

High_Security display negative as well as positive values. However, a greater number of respondents prefers lower clearing times, higher saving rates, KEPCO as a trade agent, and high security levels. Kernel density distribution for

Low_Security indicates that all the respondents have negative preferences for

Low_Security.

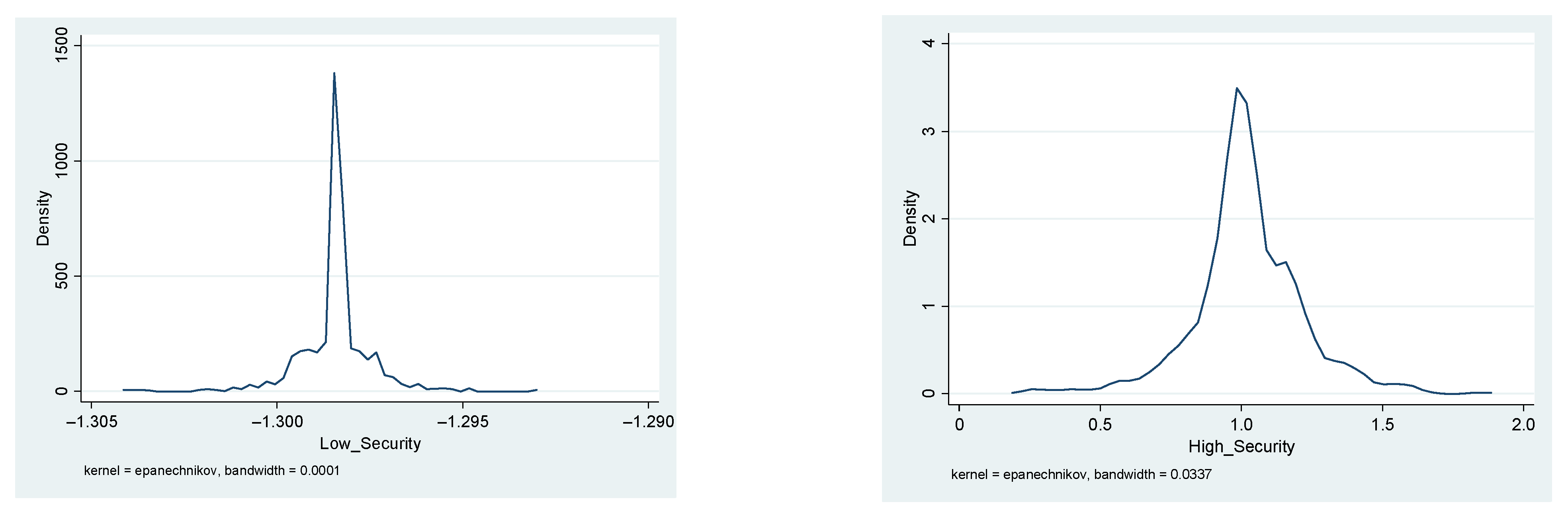

As mentioned above, respondents in class II and class III are indifferent to the P2P ETP, while respondents in class I prefer the opt-out option. Thus, we may eliminate these three classes and examine Kernel density plots for class IV respondents.

Figure 5 illustrates that class IV respondents have higher preferences for low clearing times (

Clearing) and KEPCO (

e-KEPCO) as a trading agent. They are also more sensitive to security levels relative to total sample of the mixed logit estimation (MLM). The density distributions for all attributes have single peaks. Similar to the Kernel density analysis for the MLM estimation, respondents indicate positive and negative preferences for

Clearing,

Saving, and

e-KEPCO but only negative preference for

Low_Security and only positive preference for

High_Security attributes.

6.4. WTP Estimation

Table 9 compares WTPs for the P2P electricity trading system. The WTPs were estimated by using the estimated coefficients of

ASC term (dummy for opt-out option) and the

DTariff (monthly fee for P2P ETP) variables. Due to the statistically insignificant coefficients of

ASC terms in class II and class III of the hybrid model, we cannot estimate corresponding WTPs. Thus, our mean WTP calculations are only based on class I and class IV.

There are three points of comparison—total WTPs are estimated based on the mixed logit estimation, while WTPs for class I respondents and WTPs for class IV are estimated via the hybrid estimation. The mean WTP for the P2P ETP from the MLM estimation is estimated as KRW 62,887 (USD 55.68)/ per month, while WTPs for the P2P ETP from the hybrid model work out to be negative KRW 17,944 (USD 15.86)/month for class I and KRW 223,689 (USD 198)/month for class IV. The weighted mean WTP for the hybrid model can be derived from multiplying WTPs in each group by the proportion of each class in the total sample. Recalling that class I and class IV represent 29.9% and 37.6% of total respondents, respectively, the mean WTP for the hybrid model is estimated at KRW 81,741 (UD 72.37)/month using the equation below.

According to the WTP estimation results from the MLM and hybrid models, respondents’ WTPs for joining a P2P ETP in Korea are between USD 56 and 72 per month. It is worth noting that unlike the WTP estimates from the MLM model, the WTP estimate for the hybrid model does not represent the entire sample.

7. Discussion

According to our choice experiment based on a sample of Korean households, there is broad support for the introduction of a P2P ETP—two-thirds of our respondents were in favour of such an innovative business platform. Our econometric analysis of the sample, centred on the MLM and the hybrid model estimation, suggests the following.

First, as indicated in both models, our respondents have a great deal of concern about the security level of P2P ETP. Although blockchain-based technologies ensure decentralised storage of transaction data and are typically regarded as highly secure, respondents were likely aware of risks such as those emanating from cyber-attacks and technical faults and system failures [

34].

Second, energy prosumers would like to trade electricity with KEPCO rather than with other individuals. It is likely that future e-prosumers believe that trading with KEPCO will be more reliable, as KEPCO is a state-owned enterprise (SOE) and therefore highly trustworthy. Respondents would also prefer to not incur transaction costs to locate potential buyers if trade with KEPCO was available as an option.

Third, the estimated MLM coefficients are lower (in absolute values) than those for class IV in the hybrid model. Such differences in coefficient values occur because class IV only includes respondents who are willing to participate in P2P ETP and are therefore more sensitive to changes in attribute values, as they understand the importance of these factors on effectiveness, convenience, and practicality. In contrast, MLM estimation utilized the entire sample, so it also includes respondents who oppose P2P ETP and therefore respondents who might not be concerned about security levels, trading partners, and clearance times. As a result, the mean values of these coefficients are lower.

Fourth, as expected, higher saving rates on electricity bills increase respondent willingness to participate in a P2P ETP. Korea uses increasing block rate tariffs that are based on the quantity of electricity consumed. If electricity usage per month is below 200 kWh, the price is KRW 88.3 per kWh. The corresponding prices are KRW 182.9 for electricity usage between 201 and 400 kWh and KRW 275.6 for usage over 401 kWh. Thus, a P2P ETP might be a good option for electricity-intensive consumers who would like to reduce their electricity bills. Hypothetically speaking, such a consumer can buy 200 kWh from the main grid and demand electricity above 200 kWh from the P2P ETP. An interesting finding about the Saving variable is that the coefficient values in both the MLM and hybrid models (class IV) are almost the same. This makes sense, as all respondents would like to reduce electricity bills regardless of their preferences for the P2P ETP.

As expected, socio-demographic variables such as

Age and

Income affect preferences for the P2P ETP. Other studies have also shown that age [

35,

36,

37] and income [

35,

37,

38,

39] are the most relevant socio-demographic variables related with public acceptance of energy-related projects. Estimation results for the interaction terms such as

ASC_Age and

ASC_Income in the MLM indicate that older respondents or those whose incomes are lower than the average are more likely to not choose the P2P ETP. Our results also reveal that the common factor variable

F1, which combines such characteristics as experience of investment in cryptocurrency, preference for energy prosumers, participation in the P2P trading system, and a propensity toward early adoption, has a significant impact on preferences for the P2P ETP. As the blockchain-based P2P ETP is an innovative business model, it is natural that respondents who are interested in cryptocurrencies, P2P trading, and are early adopters would display a predilection for the P2P ETP.

Finally, our mean WTPs for the P2P ETP were KRW 62,887 (USD 55.68)/per month for the MLM. The estimated WTPs are much higher than those obtained by Lee and Cho [

6] for a hypothetical P2P ETP in Korea as well as for actual P2P ETPs in operation, such as the German sonnenCommunity (EUR 19.99) or the Dutch Vandebron online platform (EUR 6.25). In addition to differences in sample size and methodology, one plausible reason for the difference in our mean WTP calculations might be due to the fact that the above-mentioned studies have omitted costs associated with smart-meters installation and maintenance. Our analysis is based on the assumption that P2P ETP participants do not need to buy smart meters or pay any operating costs, as these costs are included in the monthly fee. At any rate, such discrepancies suggest that additional studies on e-prosumers and electricity trading systems are essential to evaluate the applicable WTPs that can potentially enable the optimal operation of a P2P ETP in Korea.

8. Conclusions and Policy Implications

A reduction in greenhouse gases and a pivot toward greener energy has become a matter of urgency for a heating planet. One hundred and twenty nations attended the UN Climate Change Conference (UN Climate Change Conference (COP26) at:

https://ukcop26.org/ (accessed on 15 June 2022) in Glasgow (COP26) and stressed the need for stronger national plans to combat the exigencies of climate change. As the world’s 13th largest emitter of greenhouse gases, the Korean government has pledged action on climate change and has mandated an increase in the share of renewable energy in total electricity production—20 percent by 2030 and 30–35 percent by 2040. Renewable energy capacity in Korea has increased rapidly from 11.3 GW in 2017 to 20.1 GW in 2020 and is expected to scale up to 77.8 GW by 2034. The number of small-scale solar PV generators with capacity below 1 MW between 2018 and 2019 has also increased from 27,000 to 63,000 units. Under Korea’s current RPS system, only business power generators with capacity over 1 MW can participate in REC market. Thus, there is potentially latent demand from small-scale private solar PV generators. A P2P ETP can potentially help fill this gap.

P2P ETPs have emerged as significant and flexible platforms for green energy trading in many counties in the west. Although Korea is developing backup facilities such as output-controllable ESS, pumped-storage, and single-cycle gas turbines to increase system flexibility, these approaches are more suitable for large-scale renewable power plants. P2P ETPs are far more appropriate for small-scale DERs, which have been increasing rapidly over the past several years in the country. Another technology that can be suitable for small-scale DERs is vehicle-to-grid (V2G), but this technology is still very expensive and not commercialized yet. Therefore, a P2P ETP is considered as the best option for improving the flexibility of small-scale DERs.

As P2P ETPs are still in nascent stages in the country, this study explored the operation of a hypothetical P2P ETP and attempted to estimate respondent WTPs for the same using CE methodology. Our survey results note that about 35 percent of respondents chose to opt-out of the hypothetical P2P ETP, suggesting that two-thirds of the total respondents would like to participate in the P2P ETP if available. This finding is reinforced through our MLM that also indicates a similar preference in favour of the P2P ETP option over the opt-out choice. We also split our total sample into four groups by applying the latent class procedure combined with the MLM via a hybrid model. The first group (about 30 percent) displayed negative preferences for the P2P trading system. The second group (about 38 percent) indicated positive preferences, and the remaining two groups (about 12 percent and 20 percent) were indifferent.

Results indicate that respondents prefer to trade renewable electricity with KEPCO rather than with other individuals. Respondents also showed a positive preference for high security levels and higher (potential) savings rate on their electricity bills. However, respondent preferences were negative for low security and longer clearing times associated with the electricity trade. Some observable socio-demographic characteristics, such as age, income, and the common factor F1 that included variables related to new and high-tech projects as well as a propensity for early adoption, significantly impacted respondent choices for P2P ETP. Taken together, these results appear to suggest that while e-prosumers within our sample may be indifferent to ecological or energy-sharing rationales for participating in a P2P ETP framework, they are significantly intrigued by early adoption and the cryptocurrency investment potential of such a framework if they can realize cost-saving on their energy bills.

By using estimated coefficients of ASC term (dummy for opt-out option) and DTariff (monthly fee for P2P ETP), we calculated mean WTPs for a P2P ETP as KRW 62,887 (USD 55.68)/per month per an MLM estimation. Our calculations therefore suggest a monthly fee threshold for any potential power trading company that plans to join a P2P ETP framework. Taken together, our CE analysis suggests that Koreans may be ready for a P2P ETP. As more energy providers become cognizant of P2P ETPs and pivot to more consumer- and prosumer-centric approaches, our hypothetical energy-sharing analysis can offer useful guidelines to future energy service providers.

Our results also indicate that enhanced consumer awareness of P2P ETPs can motivate adoption. From a policy perspective, this suggests that policymakers may want to incentivize consumers to engage in better information campaigns. Our study suggests that designing a P2P ETP that appeals to innovation savvy and security minded e-prosumers. Thus, policy makers should design educational brochures that highlight the security features of block chain-based technology. Economic incentives matter, too, as our respondents’ choices demonstrated.

Although our study expands previous research in the P2P ETP, it is necessary to mention some limitations. First, our results are derived from a survey sample consisting of 813 respondents. Future surveys should focus on increasing the population of respondents to accommodate real-world diversity in participants’ gender, age, education, and income. Second, as this is a hypothetical study, we have not been able to test our proposed policy implications. Thus, we can suggest that future research applies our learnings in a real-world setting. Finally, there is only sparse country-study literature on investigating preferences and motivations for P2P electricity trading despite its promised potential. More WTP surveys are thus needed to discern whether our findings are only specific to Korea and to broaden the empirical analysis in this field.