Determining Factors and Scenarios of Influence on Consumer Migration from the Regulated Market to the Deregulated Electricity Market

Abstract

1. Introduction

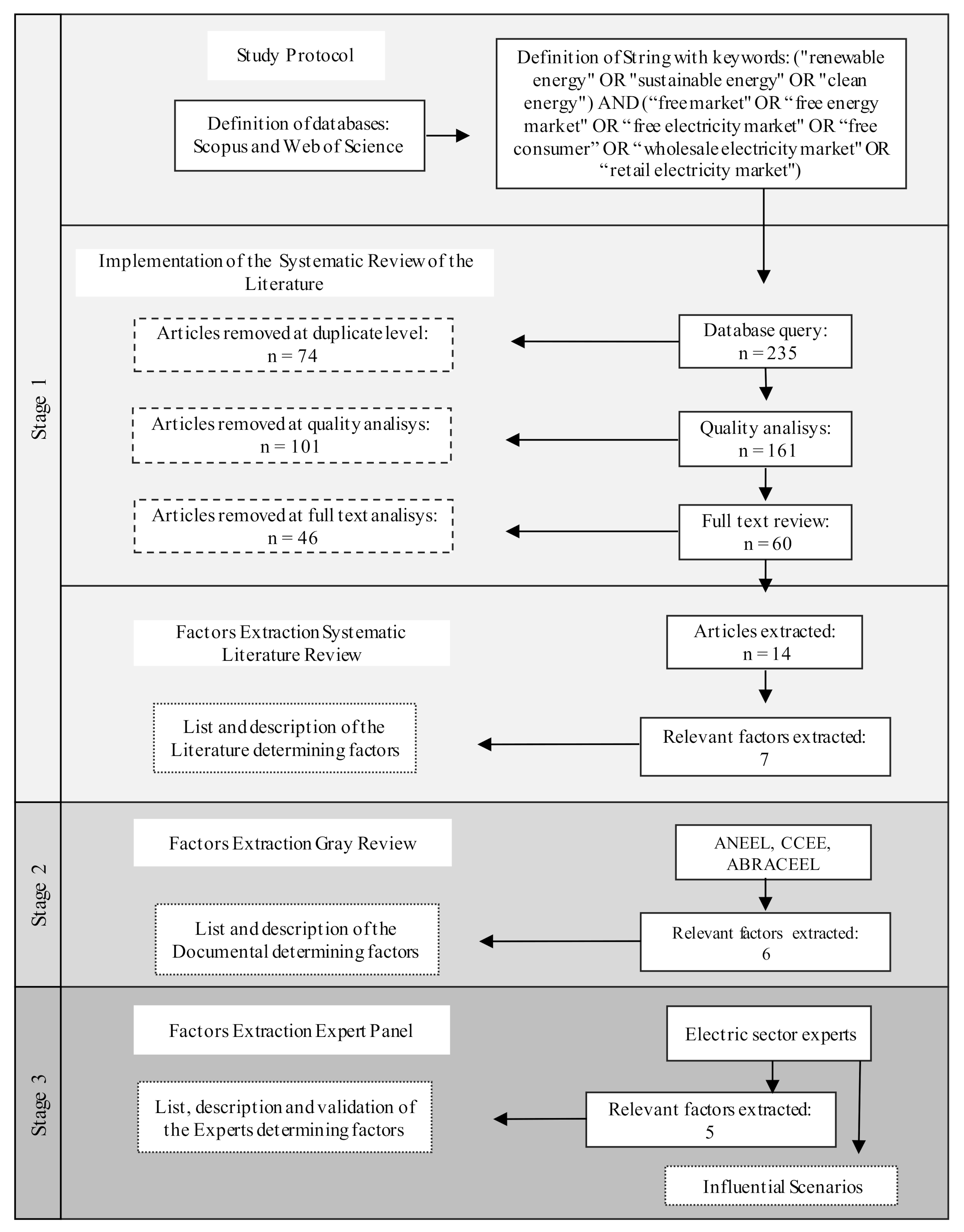

2. Energy Markets

3. Materials and Methods

4. Results and Discussions

4.1. Factors Determining the Migration of Consumers from the Regulated to the Deregulated Electricity Market

4.2. Factors Determining the Migration of Consumers from the Regulated to the Deregulated Environment from the Perspective of Specialists

4.3. Scenarios of Influence on Electricity Contracting

- Climate Risks

- Growth of the Renewable Sources Sector

- Political Risks and Regulatory Changes

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| Abbreviations | Explanation |

| ACL | Free Contracting Environment |

| ACR | Regulated Contracting Environment |

| CCEE | Electric Energy Trading Chamber |

| ANEEL | National Electric Energy Agency |

| SIN | National Interconnected System |

| SLR | Systematic Literature Review |

| MME | Ministry of Mines and Energy |

| CPFL | Paulista Power and Light Company |

| PFV | Points of Fundamental Views |

| SMF | Billing Measurement System |

| MCP | Short Term Market |

| PLD | Settlement Price for Differences |

| ONS | National Electricity System Operator |

References

- Koo, C.; Hong, T.; Park, J. Development of the life-cycle economic and environmental assessment model for establishing the optimal implementation strategy of the rooftop photovoltaic system. Technol. Econ. Dev. Econ. 2018, 24, 27–47. [Google Scholar] [CrossRef]

- Putti, K.; Toth, Z. Economic analysis of the Hinkley Point C nuclear power plant based on the available data. In Proceedings of the 6th International Youth Conference On Energy, IYCE, Budapest, Hungary, 21–24 June 2017. [Google Scholar]

- Helgesen, P.I.; Tomasgard, A. An equilibrium market power model for power markets and tradable green certificates, including Kirchhoff’s Laws and Nash-Cournot competition. Energy Econ. 2018, 70, 270–288. [Google Scholar] [CrossRef]

- Ari, E.S.; Gencer, C. Proposal of a novel mixed integer linear programming model for site selection of a wind power plant based on power maximization with use of mixed type wind turbines. Energy Environ. 2020, 31, 825–841. [Google Scholar] [CrossRef]

- EIA. Today in Energy. Available online: https://www.eia.gov/todayinenergy/detail.php?id=41433 (accessed on 13 August 2020).

- Wu, W.; Lin, B. Application value of energy storage in power grid: A special case of China electricity market. Energy 2018, 165, 1191–1199. [Google Scholar] [CrossRef]

- Teberge, C.R.; Sodré, E. Estudo de Viabilidade: Mercado Livre vs Mercado Cativo. Rev. Eng. e Pesqui. Apl. 2019, 4, 81–89. [Google Scholar] [CrossRef]

- Panikovskaya, T.; Chechushkov, D. Consumer behavior on the Russian electricity market. In Proceedings of the 55th International Scientific Conference on Power and Electrical Engineering of Riga Technical University, Riga, Latvia, 12–13 October 2014; pp. 227–231. [Google Scholar]

- Ahlstrom, M.; Ela, E.; Riesz, J.; O’Sullivan, J.; Hobbs, B.F.; O’Malley, M.; Milligan, M.; Sotkiewicz, P.; Caldwell, J. The Evolution of the Market: Designing a Market for High Levels of Variable Generation. IEEE Power Energy Mag. 2015, 13, 60–66. [Google Scholar] [CrossRef]

- Li, G.; Shi, J. Agent-based simulation on WGenCo bidding in day-ahead electricity markets. In Proceedings of the 61st Annual IIE Conference and Expo Proceedings, Reno, NV, USA, 21–25 May 2011. [Google Scholar]

- Chawda, S.; Bhakar, R.; Mathuria, P. Uncertainty and risk management in electricity market: Challenges and opportunities. In Proceedings of the 2016 National Power Systems Conference (NPSC), Bhubaneswar, India, 19–21 December 2016; pp. 1–6. [Google Scholar]

- Nakano, R.; Miwa, T.; Morikawa, T. Comparative analysis on citizen’s subjective responses related to their willingness to pay for renewable energy in Japan using latent variables. Sustainability 2018, 10, 2423. [Google Scholar] [CrossRef]

- Gallego-Castillo, C.; Victoria, M. Cost-free feed-in tariffs for renewable energy deployment in Spain. Renew. Energy 2015, 81, 411–420. [Google Scholar] [CrossRef]

- Yang, J.; Zhao, J.; Luo, F.; Wen, F.; Dong, Z.Y. Decision-Making for Electricity Retailers: A Brief Survey. IEEE Trans. Smart Grid 2018, 9, 4140–4153. [Google Scholar] [CrossRef]

- Jin, L.; Chen, C.; Wang, X.; Yu, J.; Long, H. Research on information disclosure strategies of electricity retailers under new electricity reform in China. Sci. Total Environ. 2020, 710, 136382. [Google Scholar] [CrossRef]

- Machado, V.d.C.; Barassuol, R.M. Viabilidade econômico-financeira da migração do mercado cativo para o mercado livre de energia: Um estudo de caso da universidade de Cruz Alta. In Proceedings of the Seminário Internacional sobre Desenvolvimento Regional, Santa Cruz do Sul, Rio Grande do Sul, Brasil, 11–13 September 2019; p. 23. [Google Scholar]

- Do Prado, J.C.; Qiao, W.; Qu, L.; Agüero, J.R. The next-generation retail electricity market in the context of distributed energy resources: Vision and integrating framework †. Energies 2019, 12, 491. [Google Scholar] [CrossRef]

- Hanna, R.; Disfani, V.R.; Kleissl, J. A game-theoretical approach to variable renewable generator bidding in wholesale electricity markets. In Proceedings of the 48th North American Power Symposium, NAPS–2016, Denver, CO, USA, 18–20 September 2016. [Google Scholar]

- Ndebele, T.; Marsh, D.; Scarpa, R. Consumer switching in retail electricity markets: Is price all that matters? Energy Econ. 2019, 83, 88–103. [Google Scholar] [CrossRef]

- Neumann, R.; Mehlkop, G. Framing electricity plan choices to enhance green energy usage: A choice experiment with panel data from Germany. Energy Res. Soc. Sci. 2020, 70, 101741. [Google Scholar] [CrossRef]

- Kaller, A.; Bielen, S.; Marneffe, W. The impact of regulatory quality and corruption on residential electricity prices in the context of electricity market reforms. Energy Policy 2018, 123, 514–524. [Google Scholar] [CrossRef]

- Razeghi, G.; Shaffer, B.; Samuelsen, S. Impact of electricity deregulation in the state of California. Energy Policy 2017, 103, 105–115. [Google Scholar] [CrossRef]

- Gao, Y.; Zhou, X.; Ren, J.; Zhao, Z.; Xue, F. Electricity purchase optimization decision based on data mining and Bayesian game. Energies 2018, 11, 1063. [Google Scholar] [CrossRef]

- Mulder, M.; Willems, B. The Dutch retail electricity market. Energy Policy 2019, 127, 228–239. [Google Scholar] [CrossRef]

- Pezzutto, S.; Grilli, G.; Zambotti, S.; Dunjic, S. Forecasting Electricity Market Price for End Users in EU28 until 2020—Main Factors of Influence. Energies 2018, 11, 1460. [Google Scholar] [CrossRef]

- Ndebele, T. Assessing the potential for consumer-driven renewable energy development in deregulated electricity markets dominated by renewables. Energy Policy 2020, 136, 111057. [Google Scholar] [CrossRef]

- Dahlke, S. Effects of wholesale electricity markets on wind generation in the midwestern United States. Energy Policy 2018, 122, 358–368. [Google Scholar] [CrossRef]

- Fu, H.; Zhang, X.-P. Market Equilibrium in Active Distribution System with μ VPPs: A Coevolutionary Approach. IEEE Access 2017, 5, 8194–8204. [Google Scholar] [CrossRef]

- Fontana, M.; Iori, M.; Nava, C.R. Switching behavior in the Italian electricity retail market: Logistic and mixed effect Bayesian estimations of consumer choice. Energy Policy 2019, 129, 339–351. [Google Scholar] [CrossRef]

- ANEEL. Decreto No 5.163, de 30 de julho de 2004. Available online: http://biblioteca.aneel.gov.br/index.html (accessed on 12 January 2020).

- CCEE. Ambiente livre e ambiente regulado: Contratação de energia. Available online: https://www.ccee.org.br/portal/faces/pages_publico/como-participar/ambiente-livre-ambiente-regulado?_afrLoop=432799226429957&_adf.ctrl-state=js6o0tv0d_1#!%40%40%3F_afrLoop%3D432799226429957%26_adf.ctrl-state%3Djs6o0tv0d_5 (accessed on 10 April 2020).

- CCEE. Informações ao mercado mensal: Contabilização junho de 2020. Available online: https://www.ccee.org.br/portal/faces/pages_publico/o-que-fazemos/infomercado?_afrLoop=432998264672552&_adf.ctrl-state=js6o0tv0d_14#!%40%40%3F_afrLoop%3D432998264672552%26_adf.ctrl-state%3Djs6o0tv0d_18 (accessed on 15 May 2020).

- ANEEL. Energia no Brasil e no Mundo. Available online: http://www2.aneel.gov.br/ (accessed on 17 August 2020).

- ANEEL. Portaria No 514, de 27 de dezembro de 2018. Available online: http://biblioteca.aneel.gov.br/index.html (accessed on 15 January 2020).

- Liu, M.; Quilumba, F.; Lee, W. A Collaborative Design of Aggregated Residential Appliances and Renewable Energy for Demand Response Participation. IEEE Trans. Ind. Appl. 2015, 51, 3561–3569. [Google Scholar] [CrossRef]

- Pillot, B.; Al-Kurdi, N.; Gervet, C.; Linguet, L. An integrated GIS and robust optimization framework for solar PV plant planning scenarios at utility scale. Appl. Energy 2020, 260, 114257. [Google Scholar] [CrossRef]

- Panos, E.; Densing, M. The future developments of the electricity prices in view of the implementation of the Paris Agreements: Will the current trends prevail, or a reversal is ahead? Energy Econ. 2019, 84, 104476. [Google Scholar] [CrossRef]

- CCEE. 20 anos do mercado brasileiro de energia elétrica. Available online: https://www.ccee.org.br/relatoriodeadministracao/ (accessed on 5 May 2020).

- ABRACEEL. Cartilha Mercado Livre de Energia Elétrica. Available online: https://abraceel.com.br/biblioteca/2019/05/cartilha-mercado-livre-de-energia-eletrica/ (accessed on 26 April 2020).

- ABRACEEL. Boletim Abraceel da Energia Livre. Available online: https://abraceel.com.br/topico/biblioteca/boletim/ (accessed on 2 May 2020).

- Dresch, A.; Lacerda, D.P.; Antunes Júnior, J.A.V. Design Science Research: A Method for Science and Technology Advancement; Springer: New York, NY, USA, 2014. [Google Scholar]

- Littell, J.; Corcoran, J.; Pillai, V. Systematic Reviews and Meta-Analysis; Oxford University Press: New York, NY, USA, 2008. [Google Scholar]

- Fink, A. Conducting Research Literature Reviews: From the Internet to Paper, 2nd ed.; Sage Publications: London, UK, 2005. [Google Scholar]

- Dixon-Woods, M.; Bonas, S.; Booth, A.; Jones, D.R.; Miller, T.; Sutton, A.J.; Shaw, R.L.; Smith, J.A.; Young, B. How can systematic reviews incorporate qualitative research? A critical perspective. Qual. Res. 2006, 6, 27–44. [Google Scholar] [CrossRef]

- Latapí Agudelo, M.A.; Johannsdottir, L.; Davidsdottir, B. Drivers that motivate energy companies to be responsible. A systematic literature review of Corporate Social Responsibility in the energy sector. J. Clean. Prod. 2020, 247, 119094. [Google Scholar] [CrossRef]

- Ela, E.; Billimoria, F.; Ragsdale, K.; Moorty, S.; Osullivan, J.; Gramlich, R.; Rothleder, M.; Rew, B.; Supponen, M.; Sotkiewicz, P. Future electricity markets: Designing for massive amounts of zero-variable-cost renewable resources. IEEE Power Energy Mag. 2019, 17, 58–66. [Google Scholar] [CrossRef]

- Roldán Fernández, J.M.; Burgos Payán, M.; Riquelme Santos, J.M.; Trigo García, Á.L. Renewable generation versus demand-side management. A comparison for the Spanish market. Energy Policy 2016, 96, 458–470. [Google Scholar] [CrossRef]

- Talwariya, A.; Singh, P.; Kolhe, M. A stepwise power tariff model with game theory based on Monte-Carlo simulation and its applications for household, agricultural, commercial and industrial consumers. Int. J. Electr. Power Energy Syst. 2019, 111, 14–24. [Google Scholar] [CrossRef]

- Pinter, T.; Vokony, I. Regulatory influence analysis on EOM (energy only market) in consideration of electric power generation mix. In Proceedings of the 6th International Youth Conference on Energy, IYCE, Budapest, Hungary, 21–24 June 2017; pp. 1–7. [Google Scholar]

- CCEE. O que fazemos: Medição, Medirores e Sazonalização. Available online: https://www.ccee.org.br/portal/faces/oquefazemos_menu_lateral/medicao?_adf.ctrl-state=14wef3wfn5_1&_afrLoop=152024028762476#!%40%40%3F_afrLoop%3D152024028762476%26_adf.ctrl-state%3D14wef3wfn5_5 (accessed on 4 February 2020).

- CCEE. Capacita CCEE: Portal de Aprendizado. Available online: https://ccee.micropower.com.br/Performa/Web/Lms/Student/CatalogView.aspx (accessed on 16 February 2020).

- Freire, L.M.; Neves, E.M.A.; Tsunechiro, L.I.; Capetta, D. Perspectives of Smart Grid in the Brazilian Electricity Market. In Proceedings of the 2011 IEEE PES Conference on Innovative Smart Grid Technologies Latin America (SGT LA), Medellin, Colombia, 19–21 October 2011. [Google Scholar]

- ANEEL. Gestão de Recursos Tarifários. Available online: https://www.aneel.gov.br/gestao-de-recursos-tarifarios (accessed on 24 March 2020).

- Aquila, G.; Rocha, L.C.S.; Rotela Junior, P.; Pamplona, E.D.O.; Queiroz, A.R.D.; Paiva, A.P.D. Wind power generation: An impact analysis of incentive strategies for cleaner energy provision in Brazil. J. Clean. Prod. 2016, 137, 1100–1108. [Google Scholar] [CrossRef]

- Block, C.; Collins, J.; Ketter, W. Agent-based competitive simulation: Exploring future retail energy markets. In Proceedings of the 12th International Conference on Electronic Commerce: Roadmap for the Future of Electronic Business, Honolulu, HI, USA, 2–4 August 2010; pp. 68–77. [Google Scholar]

- Jin, T.; Shi, T.; Park, T. The quest for carbon-neutral industrial operations: Renewable power purchase versus distributed generation. Int. J. Prod. Res. 2018, 56, 5723–5735. [Google Scholar] [CrossRef]

- Neto, D.P.; Domingues, E.G.; Calixto, W.P.; Alves, A.J. Methodology of Investment Risk Analysis for Wind Power Plants in the Brazilian Free Market. Electr. POWER COMPONENTS Syst. 2018, 46, 316–330. [Google Scholar] [CrossRef]

- Philpott, A.; Read, G.; Batstone, S.; Miller, A. The New Zealand Electricity Market: Challenges of a Renewable Energy System. IEEE Power Energy Mag. 2019, 17, 43–52. [Google Scholar] [CrossRef]

- ANEEL. Resolução Normativa No 247, de 21 de dezembro de 2006. Available online: http://biblioteca.aneel.gov.br/index.html (accessed on 16 January 2020).

- Jewell, S.T. 6—Providing meaningful information: Part D—Current awareness. In A Practical Guide for Informationists; DeRosa, A.P., Ed.; Chandos Publishing: Newark, NJ, USA, 2018; pp. 63–70. ISBN 978-0-08-102017-3. [Google Scholar]

- Garousi, V.; Felderer, M.; Mäntylä, M.V. Guidelines for including grey literature and conducting multivocal literature reviews in software engineering. Inf. Softw. Technol. 2019, 106, 101–121. [Google Scholar] [CrossRef]

- Soldani, J.; Tamburri, D.A.; Van Den Heuvel, W.-J. The pains and gains of microservices: A Systematic grey literature review. J. Syst. Softw. 2018, 146, 215–232. [Google Scholar] [CrossRef]

- Farace, D.; Schöpfel, J. Grey Literature in Library and Information Studiesnull; Walter de Gruyter: Berlin, Germany, 2010; ISBN 9783598441493. [Google Scholar]

- Kraines, M.A.; Uebelacker, L.A.; Gaudiano, B.A.; Jones, R.N.; Beard, C.; Loucks, E.B.; Brewer, J.A. An adapted Delphi approach: The use of an expert panel to operationally define non-judgment of internal experiences as it relates to mindfulness. Complement. Ther. Med. 2020, 51, 102444. [Google Scholar] [CrossRef]

- Waltz, T.J.; Powell, B.J.; Matthieu, M.M.; Chinman, M.J.; Smith, J.L.; Proctor, E.K.; Damschroder, L.J.; Kirchner, J.E. Innovative methods for using expert panels in identifying implementation strategies and obtaining recommendations for their use. Implement. Sci. 2015, 10, A44. [Google Scholar] [CrossRef]

- Washington, S.P.; Lord, D.; Persaud, B.N. Use of Expert Panels in Highway Safety: A Critique. Transp. Res. Rec. 2009, 2102, 101–107. [Google Scholar] [CrossRef]

- Portal da Comunicação. Uma Causa para Chamar de Sua. Available online: http://portaldacomunicacao.com.br/2019/03/uma-causa-para-chamar-e-sua/ (accessed on 18 February 2020).

- Ramos, D.S.; Guarnier, E.; Witzler, L.T. Using the seasonal diversity between renewable energy sources to mitigate the effects of Wind generation uncertainties. In Proceedings of the 6th IEEE/PES Transmission and Distribution: Latin America Conference and Exposition, Montevideo, Uruguay, 3–5 September 2012. [Google Scholar]

- ABRACEEL. Boletim Anual da Energia Livre—2019. Available online: https://abraceel.com.br/destaques/2020/02/boletim-anual-do-mercado-livre-2019/ (accessed on 5 March 2020).

- Pinho, J.; Resende, J.; Soares, I. Capacity Investment on electricity markets undr supply and demand uncertainty. Energy 2018, 150, 1006–1017. [Google Scholar] [CrossRef]

- Cunha, J.; Ferreira, P. A risk analysis of small-hydro power (SHP) plants investments. Int. J. Sustain. Energy Plan. Manag. 2014, 2, 47–62. [Google Scholar] [CrossRef]

- Sorknæs, P.; Djørup, S.R.; Lund, H.; Thellufsen, J.Z. Quantifying the influence of wind power and photovoltaic on future electricity market prices. Energy Convers. Manag. 2019, 180, 312–324. [Google Scholar] [CrossRef]

- Burke, M.J.; Stephens, J.C. Political power and renewable energy futures: A critical review. Energy Res. Soc. Sci. 2018, 35, 78–93. [Google Scholar] [CrossRef]

- Vanegas Cantarero, M.M. Of renewable energy, energy democracy, and sustainable development: A roadmap to accelerate the energy transition in developing countries. Energy Res. Soc. Sci. 2020, 70, 101716. [Google Scholar] [CrossRef]

- Peng, D.; Poudineh, R. Electricity market design under increasing renewable energy penetration: Misalignments observed in the European Union. Util. Policy 2019, 61, 100970. [Google Scholar] [CrossRef]

- Tilt, B. China’s air pollution crisis: Science and policy perspectives. Environ. Sci. Policy 2019, 92, 275–280. [Google Scholar] [CrossRef]

- Moreno, B.; Díaz, G. The impact of virtual power plant technology composition on wholesale electricity prices: A comparative study of some European Union electricity markets. Renew. Sustain. Energy Rev. 2019, 99, 100–108. [Google Scholar] [CrossRef]

- CCEE. Informações ao mercado mensal: Contabilização dezembro de 2019. Available online: https://www.ccee.org.br/portal/faces/pages_publico/o-que-fazemos/infomercado?showFlag=F&_afrLoop=17701423003935 (accessed on 16 April 2020).

- dos Santos Carstens, D.D.; da Cunha, S.K. Challenges and opportunities for the growth of solar photovoltaic energy in Brazil. Energy Policy 2019, 396–404. [Google Scholar] [CrossRef]

- Genc, T.S.; Reynolds, S.S. Who should own a renewable technology? Ownership theory and an application. Int. J. Ind. Organ. 2019, 63, 213–238. [Google Scholar] [CrossRef]

- Watson, S.; Moro, A.; Reis, V.; Baniotopoulos, C.; Barth, S.; Bartoli, G.; Bauer, F.; Boelman, E.; Bosse, D.; Cherubini, A.; et al. Future emerging technologies in the wind power sector: A European perspective. Renew. Sustain. Energy Rev. 2019, 113, 109270. [Google Scholar] [CrossRef]

- ONS. Histórico da Operação. Available online: http://www.ons.org.br/paginas/resultados-da-operacao/historico-da-operacao (accessed on 21 September 2020).

- Breyer, C.; Bogdanov, D.; Aghahosseini, A.; Gulagi, A.; Child, M.; Oyewo, A.S.; Farfan, J.; Sadovskaia, K.; Vainikka, P. Solar photovoltaics demand for the global energy transition in the power sector. Prog. Photovoltaics Res. Appl. 2018, 26, 505–523. [Google Scholar] [CrossRef]

- Choudhary, P.; Srivastava, R.K. Sustainability perspectives—A review for solar photovoltaic trends and growth opportunities. J. Clean. Prod. 2019, 227, 589–612. [Google Scholar] [CrossRef]

- Rigo, P.D.; Siluk, J.C.M.; Lacerda, D.P.; Rediske, G.; Rosa, C.B. A model for measuring the success of distributed small-scale photovoltaic systems projects. Sol. Energy 2020, 205, 241–253. [Google Scholar] [CrossRef]

- Rediske, G.; Siluk, J.C.M.; Michels, L.; Rigo, P.D.; Rosa, C.B.; Cugler, G. Multi-criteria decision-making model for assessment of large photovoltaic farms in Brazil. Energy 2020, 197, 117167. [Google Scholar] [CrossRef]

- ANP. RenovaBio. Available online: http://www.anp.gov.br/producao-de-biocombustiveis/renovabio (accessed on 10 October 2020).

- Zheng, L.; Na, M. A pollution paradox? The political economy of environmental inspection and air pollution in China. Energy Res. Soc. Sci. 2020, 70, 101773. [Google Scholar] [CrossRef]

| June/2019 | June/2020 | |||||

|---|---|---|---|---|---|---|

| ACR | ACL | Total | ACR | ACL | Total | |

| Consumption (MW) | 41.789 | 19.230 | 61.019 | 40.326 | 18.391 | 58.717 |

| Participation | 71% | 29% | 100% | 69% | 31% | 100% |

| ACL | ACR | |

|---|---|---|

| Consumer | Free and Special | Regulated |

| Supplier | Supplier and trader | Local energy distributor |

| Contract | Bilateral, flexible, and freely negotiated between agents | Long term between supplier, and traders to supply regulated consumers |

| Source | There is a possibility to choose the source to be contracted | There is no possibility to choose the contracted source |

| Prices | Agreements between buyer and seller | Prices established in auctions |

| Recruitment | Freely traded | Through government-regulated auctions |

| Predictability | Contracts fix prices and make it possible to forecast energy costs | There is no predictability, prices vary from month to month |

| Risks | Mistaken forecast of contracted demand, exposing itself to PLD | Consumer is protected by the local energy distributor |

| PFV | Factor | Research Technique | Study Authors |

|---|---|---|---|

| Internal Environment | High energy demand during peak hours | Systematic literature review | [35,46,47,48] |

| Peak energy hours | Systematic literature review | [8,46,49] | |

| Adequacy to the billing measurement system (SMF) | Gray literature | [39,50] | |

| Customer Insight | Gray literature | [51] | |

| Financial | Initial Investment | Systematic literature review | [48,52] |

| Contractual and financial customization | Gray literature | [51] | |

| Rate change in ACR | Gray literature | [51,53] | |

| External Environment | Risks with Contracts | Systematic literature review | [19,46,54,55,56,57] |

| Variation of prices in the short term market (MCP) | Systematic literature review | [46,49,54,56,57,58] | |

| Credibility in the supplier and trader | Systematic literature review | [19,46] | |

| Regulations | Migration procedures | Systematic literature review | [52] |

| Termination of the ACR energy contract | Gray literature | [39,51,59] | |

| Return from ACL to ACR | Gray literature | [30,39,51,59] |

| PFV | Factor | Specialist Company and Position |

|---|---|---|

| Internal Environment | Load profile evaluation | CCEE-specialist in energy models and studies |

| Financial | Expected return | CCEE-specialist in energy models and studies; CCEE-price analyst |

| Financial | Risk aversion | CCEE-price analyst |

| Regulations | ballast proof | CPFL-engineer |

| External Environment | Supply risk | CPFL and engineer; CCEE-analyst |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Burin, H.P.; Siluk, J.S.M.; Rediske, G.; Rosa, C.B. Determining Factors and Scenarios of Influence on Consumer Migration from the Regulated Market to the Deregulated Electricity Market. Energies 2021, 14, 65. https://doi.org/10.3390/en14010065

Burin HP, Siluk JSM, Rediske G, Rosa CB. Determining Factors and Scenarios of Influence on Consumer Migration from the Regulated Market to the Deregulated Electricity Market. Energies. 2021; 14(1):65. https://doi.org/10.3390/en14010065

Chicago/Turabian StyleBurin, Heloísa P., Julio S. M. Siluk, Graciele Rediske, and Carmen B. Rosa. 2021. "Determining Factors and Scenarios of Influence on Consumer Migration from the Regulated Market to the Deregulated Electricity Market" Energies 14, no. 1: 65. https://doi.org/10.3390/en14010065

APA StyleBurin, H. P., Siluk, J. S. M., Rediske, G., & Rosa, C. B. (2021). Determining Factors and Scenarios of Influence on Consumer Migration from the Regulated Market to the Deregulated Electricity Market. Energies, 14(1), 65. https://doi.org/10.3390/en14010065