Abstract

This research examines the macroeconomic determinants of inflation in Cambodia with an ARDL cointegration analysis. The results demonstrate a long-run negative association between inflation and exchange rates, tax revenue, and broad money. In the short run, growth in tax revenues dampens inflation, while money supply growth boosts it. Looking at the results, we can infer that expansionary fiscal policy (in particular, tax effort) and prudent monetary policy can control Cambodia’s currency and inflation. Policymakers should take into account the system of relationships among these macroeconomic variables to design such policies, which can cause price stability and long-term growth in the economy.

JEL Classification:

C32; C53; E4; E31

1. Introduction

It is difficult for policymakers to maintain the wealth and growth of an economy; yet, it is even more important that they understand the intimate relationship between macroeconomic variables. In Cambodia, the relationship between foreign exchange, tax revenue, money supply, and inflation is very important for the country’s economic welfare. The forces driving inflation in different economies are depicted rather differently in the existing literature. Research has demonstrated the importance of monetary factors, for example, interest rate (Henira et al., 2020) and money supply. Studies have also shown that money supply influences inflation in countries such as Vietnam and China (Doan Van, 2020). This link enjoys great support in the Quantity Theory of Money, as revealed in The Gambia (Ceesay & Njie, 2021). In addition, it was found that price stability was achieved through stability in foreign exchange, where this indicator played a very significant role in defining long-run equilibrium in Tanzania and Sri Lanka (Milanzi & Sanga, 2019; Washima, 2022). Theoretical models also emphasize such dynamics, trying to give an overall view of this intricate connection; they indicate that inflation rate and exchange rates negatively affect money supply (Basu et al., 2024).

Cambodia’s strong economic success during the last decade has led to moderate and controllable inflation, forming good macroeconomic conditions (Tang & Li, 2021). Yet, the high level of dollarization in the country because of its historic economic and political context creates a set of particular challenges (Hay, 2021). Although dollarization has contributed to delivering low inflation and a stable exchange rate, it leaves Cambodia vulnerable to international economic vicissitudes. Inflation is also central to policymakers and economic analysts, as the ability to control it with monetary policy can directly affect growth in the economy (Sean, 2019). Furthermore, inflation rate shows a positive relationship with GDP that underscores the need to control it (Sean et al., 2019; Ky & Lim, 2023). Given the relatively low exchange rate of the Khmer Riel to the US dollar, loosening the monetary aggregate would cause a further increase in imported inflation (Sean et al., 2019), thereby requiring appropriate money supply policy.

Fiscal theory also gives an insight into the way taxes affect inflation. According to the Fiscal Theory of the Price Level, an unsustainable government budget imbalance, or more pertinently, tax revenues that are too low in the face of steady-state government spending, can generate fiscal insolvency perceptions by forward-looking agents, as they expect deficit monetization, so higher inflation thereby comes into play (Cochrane, 2001). In the same vein, Keynesian economics implies that a reduction in taxes can have an impact on aggregate demand and create price pressures for an economy operating close to full capacity. Higher tax revenues, though, can reduce inflation by curbing demand, and by doing so, strengthen the government’s fiscal position. Hence, the presence of vigorous and trustworthy taxation systems is a stabilizing factor in intercontinental price stability (Blanchard, 2017). Fiscal theory suggests that changes in tax revenues can affect price level. However, in the Cambodian context, previous empirical studies examining the determinants of the inflation rate have largely ignored the potential impact of tax revenues. This omission represents a research gap that needs to be addressed.

This paper investigates macroeconomic factors that drive inflation in Cambodia, and uses the Autoregressive Distributed Lag (ARDL) cointegration approach. The main aim of this research is to assess the long-run and short-run impacts of government tax revenue and broad money supply as policy variables at the price level. Furthermore, we include the exchange rate as a control variable given its importance for inflation in the country. The empirical findings of the study are expected provide guidance to policymakers by exploring the interrelations of these macroeconomic variables in order to contribute to a better fiscal and monetary control of the price level in Cambodia. In Section 2 of this paper, we present a literature review of the inter-relationships between exchange rates, tax revenue, broad money supply, and inflation. Section 3 describes the methodology of the study. Section 4 contains the empirical results and interpretation. Section 5 concludes and discusses the policy implications.

2. Literature Review

The association between exchange rates and inflation is complicated, and has been investigated by economists from various angles. A long-run relationship between exchange rates and inflation has been found in various other studies. For example, studies on five fragile countries, including Brazil, India, Indonesia, South Africa, and Turkey, demonstrate that exchange rates and inflation rates closely change over time, with devaluation causing domestic prices to increase by increasing import cost (Şen et al., 2020). Likewise, it was found that negative exchange rate changes affect inflation rates in Turkey in a significant way (Hameli & Rençber, 2020).

The pass-through of exchange rates induces changes in the domestic price level, and can differ substantially between countries and over time. Factors matter, including the type of shock driving currency movement, as well as country-specific features. For instance, countries with flexible exchange rates that also have credible inflation targets generally tend to show lower pass-through ratios. Independence of the central bank has also been shown to stabilize inflation after large movements in currency (Ha et al., 2020). An understanding of the exchange rate pass-through can assist central banks in the development of effective monetary policy. Countries with smaller pass-through ratios can keep their actual exchange rate realignment effective by not transmitting inflation abroad. In addition, the association of exchange rates and inflation encourages health institutions to take into account the inflationary consequences of currency devaluation in designing economic policies (Şen et al., 2020; Dzupire, 2020).

Various econometric models have been used to investigate the causality between exchange rates and inflation. Indonesia demonstrated that exchange rate causes inflation, but not otherwise (Aji et al., 2021). Another study in China discovered long-term cointegration between interest rates, inflation, and exchange rates, albeit not significantly impacting the dependent variables (Silitonga et al., 2023). The connection between tax revenue and inflation is a complex one, and depends on the country or a context. It is a well documented fact that as inflation is initially increased, the tax yields tend to increase due to a nominal rise in the value of tax bases, including VAT and income taxes. For example, in Serbia, prices increases have also been related to increases in VAT revenues and social contributions (Đukić et al., 2022). Moreover, the elastic nature of contemporary tax systems makes it possible for high inflation to improve fiscal positions (Mihaljek, 2023).

The Olivera–Tanzi effect, however, implies no such trend, as second-round effects increase government income. More public revenue can also lead to an increase in inflation rates in certain OECD countries, at least, but with a decrease in their real amount owing to collection lag (Güneş, 2020). This negative effect also exists in Indonesia, where inflation has a negative impact on tax revenue, state spending, and economic growth (Maulid et al., 2022). In Turkey, taxes are influenced by the consumer price index, but not the other way around (Yurttagüler & Kutlu Horvath, 2022). One more Turkish study identified a one-way causality of inflation on tax revenues (Kaya et al., 2022). In Indonesia, inflation had no positive and significant impact on tax revenues, suggesting additional possible channels of influence as well (Hamdani, 2023). While tax revenue may initially rise with inflation, the expansion of government expenditures can also eventually catch up with it in the long run, especially if buoyant revenues encourage loosening of fiscal policy (in other words, more spending or tax reductions) (Mihaljek, 2023).

The aggregate demand and inflation are complex. Another study using the Markov switching vector autoregressive model revealed that there were significant relationships between monetary aggregates and CPI in Malaysia, suggesting that broad money supply can change the inflationary dispensation (Phoong & Yeoh, 2021). Exploring sixteen IT and four non-IT regimes using time–frequency methodology, we found a tenuous long-run relationship between money growth and inflation. Nevertheless, when studying the Great Recession, strong causality and co-movements were detected, indicating that short-term fluctuations in money growth may indeed impact inflation (Ryczkowski, 2021).

As suggested by the Johansen cointegration test, there is no long-run relationship between money supply, exchange rate, GDP, and price level. Lagged values of monetary aggregate, on the other hand, have shown a positive impact in short-run inflation dynamics, explaining the nature of the time dimension (Biswas, 2023). A report focused on the economics and theories of Fischer, Friedman, and Marx suggested that “high rates of money growth lead to inflation over longer as well as shorter periods,” with strong correlation between money growth and inflation in Vietnam and China (Doan Van, 2020).

ARDL modeling and cointegration analysis have been performed to investigate the determinants of inflation. A few studies indicate the importance of the exchange rate. For example, in Egypt, volatility of the exchange rate has a critical impact on inflation (Abonazel & Elnabawy, 2020). Likewise, in DR Congo, the foreign exchange rate is a main driver of inflation both in the short run and long run (Christian, 2023). Inflation is not affected only by the exchange rate, but also by money supply. Long-run causality (Granger-causal relationship) runs from money supply to inflation in India (Kaur, 2021). In line with this, in Nepal, it was found that there is a long-run relationship between money supply and inflation (Joshi, 2021). In Ethiopia, broad money supply is a short-run determinant of the inflation (Tolasa et al., 2022). Money supply is a major determinant of inflation in both the short and long run in Iran (Hemmati et al., 2023). Inflationary pressures are relieved by the growth of money in China (Lee & Yu, 2021).

The nexus of how money supply, inflation, and currency operate in Cambodia is particularly important. This is because an expansionary monetary policy can result in a depreciation of the Khmer Riel with respect to the US Dollar, thus causing inflation rates to grow after a time (Sean et al., 2019), even if the disturbances are low. This highlights the National Bank of Cambodia (NBC)’s need for prudent monetary policy to keep the economy from becoming overheated. Furthermore, exchange rate variations can exert a substantial influence on monetary supply variables in terms of their impact on inflation rates (Ky & Lim, 2023). It is empirically established that the NBC has to carefully control money expansion in order to escape high inflation. It requires a continuum balance to ensure economic stability (Sean et al., 2019). Knowledge about the effect of exchange rates on economic growth is important for policy formulation to reduce their negative impact and support sustainable development (Vorlak et al., 2019).

Although there is an abundance of research regarding the macroeconomic factors that affect inflation in many countries, this issue in Cambodia has not been explored much. This proposed study intends to address this gap, as it is expected that an empirical investigation of the determinants of inflation in Cambodia could be helpful. On the one hand, this review of the literature uncovers conflicting results about the link between exchange rates and inflation. Some studies show a strong long-term effect, while others find a weak to no relationship. With respect to the broader money supply, there is also conflicting evidence as to whether it affects inflation. Some other studies found a positive long-run relationship; some others showed a significant short-run effect with an insignificant long-run impact. An examination of this association in Cambodia may add to the discussion. In addition, the linkage between tax revenue and inflation has been less studied than other macroeconomic variables. This gap is addressed through the investigation of government tax revenue as a potential determinant of inflation in Cambodia.

Although the ARDL cointegration methodology has been used in various studies on inflation determinants, it seems to have not been widely applied in Cambodia. This approach can be an important tool for unraveling the relationship between inflation in the long run and the short run in Cambodia. Therefore, this research seeks to empirically examine the combined influence of government tax revenue, broad money supply, and foreign exchange rates on inflation in Cambodia. The inclusion of all these variables in one study will help to provide a holistic view on the macroeconomic determinants of inflationary pressures in the economy.

3. Methodology

The purpose of this study is to explore the long-run dynamics between foreign exchange rates (FX), tax revenue (TAX), broad money supply (M), and consumer price index (CPI). We use ARDL Bound testing by Pesaran and Shin (1995) to check the long-run association. This model makes it possible to consider the empirical results via three ways. First, we check for cointegration between the dependent variable and the explanatory variables using the Bound test based on the ARDL model. Upon identifying a long-run equilibrium relationship, we formulate a long-run equation model. Additionally, we develop an error correction model (ECM) to elucidate the short-run dynamics and measure the speed of adjustment, indicating how swiftly the model returns to equilibrium following short-term deviations from long-term stability. The specifications of the models used in this study are detailed in Equations (1) and (3).

3.1. Autoregressive Distributed Lag Model

In this structure, the parameters to be estimated are , ∂, ϑ, ϕ, and , with ξ as a residual term. T denotes the time trend. All of these variables are in natural logarithms except the time trend. The first difference (∆) of log-formatted time series is considered the growth rate.

The best lag length for the ARDL model is based on the Akaike Information Criterion (AIC), with a lower AIC value suggesting better fit of the model (Akaike, 1973). To ensure the robustness of the model, a number of diagnostic checks are carried out, such as nth-order autocorrelation using the Lagrange Multiplier (LM) test, functional form misspecification by Ramsey’s RESET test, and heteroscedasticity testing utilizing White’s test.

Meanwhile, the Bound test tests if the dependent variable and independent variables possess long-run equilibrium relationships, regardless of integration, or if both are I(0) or both are I(1) (Pesaran et al., 2001). Before using the Bound test to explore long-run relations between price levels, exchange rate, tax revenue, and broad money supply variables, the Augmented Dickey–Fuller (ADF) unit root test (Dickey & Fuller, 1979) should be applied. This pre-processing step tests the stationarity of each time series data.

Regarding the ARDL methodology for cointegration and the model specification outlined in Equation (1), the null hypothesis (H0) and the alternative hypothesis (HA) associated with the Bound test, as determined by the F-Statistic and W-Statistic, are articulated as follows.

F-Statistic and W-Statistic values are then compared with the critical bound, as established by Pesaran et al. (2001). To test the existence of cointegration, we examine if the tested F-Statistic or W-Statistic for models between one and four variables (four is too complex) falls below the lower critical bound, in which case we do not reject the null hypothesis in favor of no cointegration among all variables. So, if the estimated F-Statistic or W-Statistic is greater than the upper critical bound, then there is cointegration and we reject the null hypothesis. If the value of the F-Statistic or W-Statistic is between the lower and upper critical bounds, then the test result is inconclusive. In addition to the diagnostic assessments and the constrained test of the ARDL model, the Cumulative Sum (CUSUM) of the recursive residuals and the Cumulative Sum of Squares (CUSUMSQ) of the recursive residual tests, as established by Brown et al. (1975), are utilized to evaluate the model’s stability.

Following the acquisition of empirical estimates from the ARDL model and the long-run equation, a short-run dynamic framework, referred to as the ECM, is developed. This model aims to analyze the effects of variations in foreign exchange rate change, tax revenue growth rates, and money supply growth rates on fluctuations in the inflation rates. The primary objective is to assess the speed of adjustment, which clarifies how quickly the economy realigns itself to achieve long-term equilibrium following any shocks that affect the equilibrium of the short-term dynamic model. Equation (3) illustrates the ECM.

3.2. Error Correction Model

3.3. Data

The study spans from January 2009 to December 2023, encompassing 180 observations. This period is divided into two distinct intervals. The first interval, from January 2009 to June 2023, includes 174 observations used to estimate the model’s parameters. The second interval is reserved for evaluating the model’s predictive accuracy concerning price levels.

Data for this study is sourced from the International Financial Statistics of the International Monetary Fund. The CPI is measured across all goods. The monthly exchange rate is expressed in Khmer Riel per US dollar, calculated as the daily average for each month. An increase in the exchange rate signifies a depreciation of the Riel, while a decrease indicates an appreciation. Additionally, government tax revenue and the broad money supply are measured in billions of Riels.

4. Empirical Results

Evidence from the descriptive statistics in Table 1 highlights that consumer prices, exchange rates, tax revenue, and M2 develop at different rates and their in-sample volatilities fluctuate across time series variables, evidence of the volatility dynamics of these macroeconomic variables. The average increase in the CPI was 0.267 per month and experienced a little inflation stage. The relatively small standard deviation of 0.518 is consistent with moderate variability, monthly growth rates falling within the range −1.351 to 1.790, and essentially indicates a lively purchasing climate through which consumers have lived during this timeframe. The average monthly growth rate for foreign exchange rates (FX) was minimal at 0.007, suggesting a steady foreign exchange market. Nonetheless, the standard deviation of 0.523 and the range from −3.077 to 1.328 underscore the potential for substantial shifts, highlighting the intrinsic volatility in the forex market. Regarding tax revenue (TAX), the average monthly growth rate was 0.861. However, the significantly high standard deviation of 28.248 points to substantial variability. The wide range from −95.028 to 97.617 emphasizes the marked volatility in tax revenue growth rates, mirroring the cyclical pattern of fiscal revenues. Finally, the broad money supply (M) recorded a mean growth rate of 1.549 per month, along with a standard deviation of 2.425. The monthly growth rates covered a broad range from −12.640 to 16.624, illustrating the considerable variation in the money supply, a crucial gauge of monetary policy and economic health.

Table 1.

Descriptive statistics.

In order to determine whether there is a unit root in each of the data series, we use ADF tests with the following three different regression models: one for a constant so as not to pick up stochastic trends; one for a trend to capture deterministic trends; and neither the constant or trend. This analysis uses such variables as the CPI, exchange rates, tax revenue, and broad money in levels and first differences. The ADF test results in Table 2 show that the CPI is the only one among the four data series under investigation to be I(0). This conclusion from the linear model is consistent with a rejection of the null of a unit root at the five-percent level. On the other hand, other three variables are found to be individually I(1) integrated in all of the ADF test specifications, as the null hypothesis is rejected at the 1% level. These results categorize the time series as I(0) or I(1). For the next stage, we should choose the optimal lag lengths for the ARDL model. According to the AIC, ARDL(3,4,0,2) is selected as the best lag length of the model. It is also remarkable to note that the model has a time trend and an intercept.

Table 2.

ADF test.

The bound test findings under the ARDL approach are given in Table 3. In Panel A, the 95% confidence bounds are 4.120 (lower bound) and 5.148 (upper bound), as evaluated by the F-Statistic. Lower and upper limits at a 90% confidence level are also given (3.50 and 4.494). The calculated F-Statistic is 5.899, which is above the 90% and 95% critical values, respectively; thus, we reject the null hypothesis in Equation (2) at both the 5% and 10% significance levels. This implies that a long-run relationship exists between the dependent variables (foreign exchange and tax revenue, broad money supply, and CPI) and independent variable. The bound test results with the F-Statistic are consistent with the W-Statistic findings in Panel B of Table 3, where we reject the null hypothesis of no cointegration at either 5% or 10%.

Table 3.

Bound test.

The empirical findings from the short-run dynamic model, the long-run model, and the diagnostic assessment of the ARDL model are presented in Panels A, B, and C of Table 4, respectively. Before any interpretations of the empirical results from the either short-run or long-run model can be made, it is crucial to test for diagnostics to ascertain if the model is valid. These tests are the Breusch–Godfrey LM test to check for the absence of autocorrelation in the residuals; Ramsey’s RESET test, which tests whether the regression specification is correct; and the LM heteroscedasticity test, testing whether residual variance remains constant, called homoscedasticity. All diagnostic tests considered in Table 4 were designed with the Chi-square distribution.

Table 4.

Estimated results based on ARDL model.

As shown in Panel C of Table 4, the calculated Chi-square value from the LM test for serial autocorrelation is 0.0209, which is considered low. This finding indicates that the null hypothesis, which posits the absence of serial correlation in the residual term, is rejected at the 5% significance level. In contrast, we cannot reject the null hypothesis of no model misspecification under Ramsey’s RESET tests at the 5% level, as can be seen from the calculated Chi-square value for this test, which is equal to 1.0227, low once again. The LM test of heteroscedasticity shows that the variance of the error term is constant, i.e., homoscedasticity, as the test statistics are insignificant at the 5% level.

In addition to the previously discussed diagnostic tests, this study also conducts a stability test of the model, as indicated by the CUSUM and CUSUMQ analyses, confirming that the model in question is stable. The stability of the model is crucial for effective in-sample and out-of-sample forecasting. Additionally, the Adjusted R2 obtained from the ARDL model is 0.998, indicating a strong fit of the data to the model.

The empirical results of the ECM, or the short-run model, as shown in Panel A of Table 4, suggest that prices exhibit stickiness in the short run. This is evidenced by the statistically significant positive effects of the first and second lags of the inflation rate on the inflation rate itself, with significance levels of 5% and 10%, respectively. The fluctuation in foreign exchange rates does not exert a considerable effect on the inflation rate in the present context. In the short-run model, three lags of foreign exchange rates are incorporated; however, only the change in foreign exchange at the second lag demonstrates a statistically significant effect on the inflation rate, albeit at a marginally significant level of 10%. Based on these findings, it can be inferred that the variations in foreign exchange rates in the short term have minimal influence on the inflation rate.

The empirical results derived from the ECM indicate that the growth rate of tax revenue exerts a statistically significant negative influence on the inflation rate at the 5% level. This suggests that an increase in the growth rate of tax revenue corresponds to a decrease in the inflation rate. Concurrently, the inflation rate is also affected by the growth rate of the broad money supply, which is significant at the 5% level; however, the estimated slope coefficient is positive. This finding contrasts with the negative relationship observed between the growth rate of tax revenue and inflation. This finding indicates that a short-term expansion of the monetary aggregate by the National Bank of Cambodia leads to an elevation in price level. Conversely, the prior month’s increase in the money supply did not exert a notable influence on inflation during the current period.

An increase in the money growth rate has always produced an immediate and corresponding increase in inflation, implying that a rise in annual broad money supply will also result in a rise in the inflation rate of the same month. It is worth stressing that the change in the time trend included in the short-run model displays a very strongly positive relation with inflation rate at the 1% significance level, reflecting rising increases in inflation over time. The estimated parameter for the speed of adjustment is −0.1852 (with the expected negative sign according to econometric theory), and it is very strongly significant at the level of 1%. Based on this approach, it can also be deduced that for the inflation rate series, approximately five months are required so that after a short-run dynamic shock, equilibrium would be reestablished (18.52). In addition, judging from the estimated F-Statistic (4.2141), we can conclude that the slope coefficients of short-run dynamic model jointly explain (model) inflation rate to a large statistically significant extent at 1%.

The estimated results of the long-run model, as presented in Panel B of Table 4 and Equation (4), reveal that the coefficients for foreign exchange, tax revenue, and broad money supply are −0.8031, −0.0221, and −0.0821, respectively. This signifies negative slopes of the variables. The results reveal that exchange rate has a statistically significant impact on the overall price level at the 1% significance level; tax revenue and broad money supply have a statistically significant relationship at the 5% significance level. These results imply that over time, expansions in FX reserves, tax collections, and money supply will decrease the price level. The long-run model also contains a constant and linear trend element, with the coefficients on both being statistically significant at the 1% level of significance in Table 3.

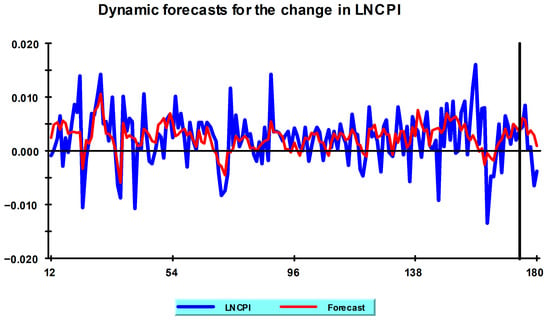

In addition to examining the determinants of the inflation rate in Cambodia, the study also evaluates the forecasting accuracy of the ARDL model. The total sample consists of 180 monthly observations from January 2009 to December 2023. This sample is divided into the following two parts: an estimation period with 174 observations from January 2009 to June 2023, and a forecast period with six observations from July 2023 to December 2023. The actual and forecasted rates of inflation under the ARDL regression are shown in Table 5. Moreover, the root mean square error of the estimation and forecast samples is 0.0043 and 0.0048 as reported in Table 6.

Table 5.

Dynamic forecasts for the level of lnCPI based on ARDL regression.

Table 6.

Summary statistics for residuals and forecast errors.

As indicated in Figure 1, there is a close match between the actual line and forecasted line, which reveal that the ARDL model applied in this study well estimates the inflation rate for each period. This implies the model is stable and reliable in modeling inflation dynamics for Cambodia’s economy, which is essential to help the process of economic planning and policy design.

Figure 1.

Dynamic forecasts for the inflation rate, lnCPI.

5. Concluding Remarks and Policy Implications

This paper examines the macroeconomic factors influencing inflation in Cambodia, utilizing the ARDL bounds test of cointegration for a more complete understanding of short-run and long-frameworks. Our results offer important implications for policy targets for price stability and sustainable growth.

Our study found a long-run negative and significant relationship between foreign exchange rate and inflation, meaning the devaluation of the Khmer Riel decreases inflation. This result is contrary to common perception that there would be a positive association. Research conducted on other low- and middle-income countries has demonstrated that depreciation of the local currency generally results in higher inflation due to rising import costs (Şen et al., 2020; Hameli & Rençber, 2020). However, the tightness of this relationship differs depending on factors like pass-through from exchange rate and central bank independence (Ha et al., 2020). What this counterintuitive result indicates is that there are particular dynamics operating Cambodia. Although our results imply a possibility, policymakers are expected to thoroughly monitor exchange rate frictions under possible inflation risks.

We also found this taming of inflation due to tax revenue growth to be statistically significant in the short and long run as well, meaning that higher inflow of tax revenue via taxes could have some dampening effect on inflation. The evidence on the relation between tax revenues and inflation is mixed. Certain studies emphasize a positive relation in the short run as a consequence of expanded nominal tax bases (Đukić et al., 2022; Mihaljek, 2023); other reports have established negative relations due to the recovery effect (Güneş, 2020; Maulid et al., 2022). Our results provide empirical evidence that fiscal policy viz a viz tax revenue mobilization can be a potent instrument to rein in inflation in Cambodia. Better tax administration and a wider tax net would also help improve revenue collection. This may help reduce the inflationary pressures to some extent. Creating tax policies that encourage investment and productivity may, in fact, be a way to achieve sustainable economic growth without inflation.

In addition, our results showed that there is a statistically significant positive relationship between broad money supply and inflation in the short run, while it has a negative significant impact on inflation in the long run. However, the empirical literature on the money–inflation link is not clear. Some researchers that it has beneficial short-term effects (Ryczkowski, 2021) and long-term associations, whereas others show inverse or no relationships depending on the context invoked (Biswas, 2023). The short-run findings are also positive, meaning that increases in money supply would induce initial growth to aggregate demand, hence prices. The negative long-run relationship indicates that other factors, such as supply-side rigidities or productivity trends, may be increasingly dominant in shaping longer-run inflation dynamics. The National Bank of Cambodia has to be careful with growth in money supply, controlling short-term inflation while aiming at stability. It is better to link monetary policy with fiscal and structural measures that will alleviate supply-side bottlenecks and encourage sustainable growth without inflation.

The issue of inflation management in Cambodia is further elaborated in this paper. It is essential that policymakers adopt a multi-purpose policy tool in an appropriate mix of fiscal, monetary, and structural policies. What this requires is a serious and earnest effort to delve into this intricate web of economic developments, which cause inflation in an ever-evolving and developing economy like that of Cambodia. This literature is the topic to which our paper adds, since it provides contributions helpful for those authorities attempting to design a macroeconomic policy oriented towards price stability and sustainable and inclusive growth.

Author Contributions

Conceptualization, T.E. and S.L.; methodology, T.E. and S.L.; software, T.E. and S.L.; validation, T.E. and S.L.; formal analysis, T.E. and S.L.; investigation, T.E.; resources, T.E.; data curation, T.E. and S.L.; writing—original draft preparation, T.E. and S.L.; writing—review and editing, T.E.; visualization, T.E.; supervision, T.E.; project administration, T.E.; funding acquisition, T.E. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by CamEd Business School grant number CamEd-JD2025 and The APC was funded by CamEd Business School.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Dataset available on request from the authors.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abonazel, M. R., & Elnabawy, N. (2020). Using the ARDL bound testing approach to study the inflation rate in Egypt. Economic Consultant, 31(3), 24–41. [Google Scholar] [CrossRef]

- Aji, T. S., Prabowo, P. S., & Canggih, C. (2021). Causality relationship among interest rate, inflation, exchange rate using vector autoregression. Economics, Management and Sustainability, 6(1), 49–60. [Google Scholar] [CrossRef]

- Akaike, H. (1973). Information theory as an extension of the maximum likelihood principle. In B. N. Petrov, & F. Csaki (Eds.), Second international symposium on information theory (pp. 276–281). Akademiai Kiado. [Google Scholar]

- Basu, M., Basu, R., & Nag, R. N. (2024). Inflation adjustment, endogenous risk premium and exchange rate: A theoretical analysis. Foreign Trade Review, 59(2), 225–251. [Google Scholar] [CrossRef]

- Biswas, G. K. (2023). Inflation dynamics of Bangladesh: An empirical analysis. European Journal of Business and Management Research, 8(3), 288–292. [Google Scholar] [CrossRef]

- Blanchard, O. (2017). Macroeconomics (7th ed.). Pearson. [Google Scholar]

- Brown, R. L., Durbin, J., & Evans, J. M. (1975). Techniques for testing the constancy of regression relationships over time. Journal of the Royal Statistical Society Series B: Statistical Methodology, 37(2), 149–163. [Google Scholar] [CrossRef]

- Ceesay, M., & Njie, M. (2021). Is there a causal relationship between money supply and the inflation rate? Thoughts from the Gambia. The International Journal of Business & Management, 9(2). [Google Scholar] [CrossRef]

- Christian, M. (2023). Determinants of inflation in the democratic Republic of Congo: An application of ARDL modelling. International Journal of Economics, Business and Management Research, 7(7), 251–262. [Google Scholar] [CrossRef]

- Cochrane, J. H. (2001). Long-term debt and optimal policy in the fiscal theory of the price level. Econometrica, 69(1), 69–116. [Google Scholar] [CrossRef]

- Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427–431. [Google Scholar] [CrossRef] [PubMed]

- Doan Van, D. (2020). Money supply and inflation impact on economic growth. Journal of Financial Economic Policy, 12(1), 121–136. [Google Scholar] [CrossRef]

- Dzupire, N. C. (2020). Modeling the co-movement of inflation and exchange rate. Preprints. [Google Scholar] [CrossRef]

- Đukić, A., Kljajić, Ž., & Kojić, V. (2022). The effect of inflation on tax revenues in the Republic of Serbia. EMC Review-Economy and Market Communication Review, 24(2), 539–550. [Google Scholar] [CrossRef]

- Güneş, H. (2020). The effect of tax revenues on inflation in selected OECD countries. Fiscaoeconomia, 4(2), 422–436. [Google Scholar] [CrossRef]

- Ha, J., Stocker, M. M., & Yilmazkuday, H. (2020). Inflation and exchange rate pass-through. Journal of International Money and Finance, 105, 102187. [Google Scholar] [CrossRef]

- Hamdani, D. (2023). Indonesia’s tax revenue: The effect of inflation rate and economic growth. JAAF (Journal of Applied Accounting and Finance), 7(1), 57–69. [Google Scholar] [CrossRef]

- Hameli, P. C. K., & Rençber, P. C. Y. (2020). Examining the causal relationship between exchange rates, foreign investments and inflation rate: The case of Turkey using data from January 2008 to December 2018. ILIRIA International Review, 10(1), 135–158. [Google Scholar]

- Hay, C. (2021). Dollarization and macroeconomic performance in Cambodia since the first 1993 general election: A historical perspective. International Journal of Finance & Banking Studies, 10(2), 27–46. [Google Scholar] [CrossRef]

- Hemmati, M., Tabrizy, S. S., & Tarverdi, Y. (2023). Inflation in Iran: An empirical assessment of the key determinants. Journal of Economic Studies, 50(8), 1710–1729. [Google Scholar] [CrossRef]

- Henira, E. M., Masbar, R., & Seftarita, C. (2020). Inflation volatility as a phenomenon monetary-fiscal combination in Indonesia. Journal of Economic Development, Environment and People, 9(4), 80. [Google Scholar] [CrossRef]

- Joshi, U. L. (2021). Effect of money supply on inflation in Nepal: Empirical evidence from ARDL bounds test. International Research Journal of MMC (IRJMMC), 2(1), 84–98. [Google Scholar] [CrossRef]

- Kaur, G. (2021). Inflation and fiscal deficit in India: An ARDL approach. Global Business Review, 22(6), 1553–1573. [Google Scholar] [CrossRef]

- Kaya, M. G., Yıldız, Y., & Kaya, P. H. (2022, May 12–13). Interaction of indirect taxes and inflation: The case of Turkey. 12th International Scientific Conference, Business and Management Kongresi’nde Sunulan Bildiri (pp. 12–13), Vilnius, Lithuania. [Google Scholar]

- Ky, S., & Lim, S. (2023). An examination of monetary aggregates in Cambodia: A vector autoregressive model. International Journal of Social Science, Management and Economics Research, 1(3), 22–35. [Google Scholar] [CrossRef]

- Lee, C. W., & Yu, H. Y. (2021). Money supply, inflation and economic growth in China: An ARDL bounds testing approach. Journal of Applied Finance and Banking, 11(1), 73–80. [Google Scholar] [CrossRef] [PubMed]

- Maulid, L. C., Bawono, I. R., & Sudibyo, Y. A. (2022). Analysis of causality among tax revenue, state expenditure, inflation, and economic growth in Indonesia between 1973 and 2019. Public Policy and Administration, 21(1), 143–157. [Google Scholar] [CrossRef]

- Mihaljek, D. (2023). Inflation and public finances: An overview. Public Sector Economics, 47(4), 413–430. [Google Scholar] [CrossRef]

- Milanzi, M., & Sanga, H. (2019). Inflation, exchange rate, and money supply nexus in Tanzania. Uongozi Journal of Management and Development Dynamics, 29(2), 1–14. [Google Scholar] [CrossRef]

- Pesaran, M. H., & Shin, Y. (1995). An autoregressive distributed lag modelling approach to cointegration analysis (Vol. 9514, pp. 371–413). Department of Applied Economics, University of Cambridge. [Google Scholar]

- Pesaran, M. H., Shin, Y., & Smith, R. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16, 289–326. [Google Scholar] [CrossRef]

- Phoong, S., & Yeoh, Y. (2021, October 8–9). An MSI-VAR approach on investigating the broad money supply and consumer price index in Malaysia. 12th Global Conference on Business and Social Sciences (p. 62), Penang, Malaysia. [Google Scholar] [CrossRef]

- Ryczkowski, M. (2021). Money and inflation in inflation-targeting regimes–new evidence from time–frequency analysis. Journal of Applied Economics, 24(1), 17–44. [Google Scholar] [CrossRef]

- Sean, M. (2019). The impact of monetary policy on economic growth in Cambodia: Bayesian approach. Journal of Management, Economics, and Industrial Organization, 3(2), 16–34. [Google Scholar] [CrossRef]

- Sean, M., Pastpipatkul, P., & Boonyakunakorn, P. (2019). Money supply, inflation and exchange rate movement: The case of Cambodia by Bayesian VAR approach. Journal of Management, Economics, and Industrial Organization, 3(1), 63–81. [Google Scholar] [CrossRef]

- Silitonga, B., Fajri, H. C., & Hutaria, T. (2023). China in terms of exchange rate, inflation and interest rate (Based on database 2018). Indonesian Journal of Banking and Financial Technology, 1(2), 157–166. [Google Scholar] [CrossRef]

- Şen, H., Kaya, A., Kaptan, S., & Cömert, M. (2020). Interest rates, inflation, and exchange rates in fragile EMEs: A fresh look at the long-run interrelationships. The Journal of International Trade & Economic Development, 29(3), 289–318. [Google Scholar] [CrossRef]

- Tang, Q., & Li, M. (2021). Analysis of Cambodia’s macroeconomic development. In E3S web of conferences (Vol. 235, p. 01015). EDP Sciences. [Google Scholar] [CrossRef]

- Tolasa, S., Whakeshum, S. T., & Mulatu, N. T. (2022). Macroeconomic determinants of inflation in Ethiopia: ARDL approach to cointegration. European Journal of Business Science and Technology, 8(1), 96–120. [Google Scholar] [CrossRef]

- Vorlak, L., Abasimi, I., & Fan, Y. (2019). The impacts of exchange rate on economic growth in Cambodia. International Journal of Applied Economics, Finance and Accounting, 5(2), 78–83. [Google Scholar] [CrossRef]

- Washima, M. F. (2022). The relationship between the exchange rate volatility and inflation in Sri Lanka. Asian Journal of Managerial Science, 11(2), 1–6. [Google Scholar] [CrossRef]

- Yurttagüler, İ., & Kutlu Horvath, S. (2022). Dolayli vergi gelirleri ve enflasyon ilişkisi: Türkiye üzerine bir araştirma. EKEV Akademi Dergisi, 91, 126–139. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.