Abstract

This study focused on exploring the influence of infrastructural development on foreign direct investment (FDI) in BRICS countries, including Brazil, Russia, India, China, and South Africa, using a fixed-effects approach. Secondary data ranged from 1991 to 2021. Existing theoretical and empirical literature on the subject (the infrastructural development-led FDI nexus) is quite mixed, which therefore makes it difficult for policy makers to make decisions. Internet penetration and fixed telephone subscriptions had a significant enhancing effect on FDI, whilst renewable energy infrastructure’s effect was found to be minimal and non-significant. In the fixed-effects model, the interaction term produced results showing that financial development enabled infrastructural development and significantly enhanced FDI inflows into BRICS countries. To improve FDI inflows, BRICS nations should implement policies with the aim of enhancing Internet penetration, fixed telephone subscriptions, and financial development. A threshold analysis of the infrastructural development levels that significantly improve FDI inflows is recommended to provide more clarity and specificity for policy making.

1. Introduction

The importance of FDI in the economy—in finance, investments, and economics—is now understood. It brings in extra capital, skills, technology, labour training, managerial skills, and easy access to international markets (Lucas, 1988; Solow, 1956; Kumar & Pradhan, 2002). Despite the economic benefits that FDI brings, Stephane (2020) argued that it does not mechanically accrue in the host country, but its inflow increases in response to certain variables such as the financial sector, infrastructure, human capital, macroeconomics, and political stability. Apart from attracting FDI into the host country, these characteristics quicken the rate at which the host country benefits from inflows. This study only focuses on infrastructural development, examining its influence on FDI inflows into BRICS countries.

In theory, infrastructural development (ports, railways, airports, energy, roads, and telecommunication) enhances FDI through reducing operating costs and enabling easy market accessibility. C. A. Rehman et al. (2011) argued that reduced operation costs make the position of foreign investors in the host country more competitive. It is also argued that a developed infrastructure in the host country removes the barriers that stifle foreign investors from fully participating in international and global commerce. A firm’s productivity, employment, investment profitability, sunk cost reduction, and economic growth are enhanced by a developed infrastructure.

Estache and Fay (2010) argued that a developed infrastructure enhances FDI through boosting investments, employment, firm productivity, and economic growth, as well as through cutting business costs. Improved infrastructural development removes some of the barriers that stifle international firms’ participation in commerce networks and global production and promotes international capital mobility by improving competition, prices, and the cost of conducting business (Limao & Venables, 2001). A country’s ability to enjoy the international capital mobility related to spillovers depends on its quality of infrastructural development (Richaud et al., 1999), although there is a consensus that from a theoretical point of view, this is not consistent with empirical findings.

Regarding the influence of infrastructure development, empirical research has produced mixed results. The majority of researchers support the view that FDI is enhanced by infrastructural development, while a minority present results that show that such development has a minimal influence on FDI. A few even report a negative influence in this regard. Lastly, other empirical studies have noted that certain host country characteristics are essential in enabling FDI to be significantly enhanced by infrastructural development. These contradictions in the literature prompted this study to further examine the influence of infrastructural development on FDI in BRICS countries and investigate whether financial development is a channel through which such development significantly improves FDI.

The effect of infrastructural development on FDI has been studied before by several empirical researchers; however, similar empirical research is characterised by a few methodological deficiencies. Firstly, none of these empirical studies have focused on the very important global economic players in BRICS countries. Secondly, the data they used are now outdated and can no longer be relied upon to make economic and financial decisions. Thirdly, they used econometric estimation techniques that failed to address the endogeneity issues prevalent in FDI data. The current study addresses this gap by using a fixed-effects approach.

2. Literature Review

The eclectic paradigm hypothesis developed by Dunning (1973) outlines that ownership, location, and internalisation (OLI) attract FDI into host nations. According to Dunning (1980), locational advantages include infrastructure, government policies, market size, attitudes toward embracing diversity, and economy-associated advantages that attract FDI into the host nation; this view was also shared by Denisia (2010).

According to Stephane (2020), FDI inflow does not accrue mechanically but increases due to national characteristics such as a developed infrastructure, financial sector, and human capital, including political and macroeconomic stability. The same author also argued that these host countries’ favourable characteristics enable the economy to fully benefit from FDI inflow. C. A. Rehman et al. (2011) explained that infrastructure, such as railways, ports, airports, telecommunication, energy, and roads, reduces tariffs and operating costs as well as enabling easy access to all markets in the host country. The same author argued that the competitive position of a host country in terms of luring FDI hinges on its ability to reduce transport costs and general tariffs and improve accessibility to new and old markets for foreign investors.

Limao and Venables (2001) argued that some of the barriers that hinder full and active participation in global production and commerce networks include a lack of adequate communication, energy, roads, and transport infrastructure. They also noted that good infrastructural development enhances business competitiveness by reducing transport costs and reducing prices.

Estache and Fay (2010) explained that a developed infrastructure enhances firm productivity, investments, employment, and economic growth. They also noted that it reduces investment and sunk costs and private capital durability. Richaud et al. (1999) argued that improved infrastructure enables a country to enjoy the advantages of FDI inflow (spillover effects). They also noted that enhanced infrastructural development increases investment profitability in foreign countries.

The empirical literature presents mixed results that fall into three categories: infrastructural development-led FDI, negative infrastructural development-led FDI, and the neutral view that the relationship between the two variables is minimal or insignificant. In addition, the omitted bias view stipulates that certain characteristics must exist in the host country to enable FDI to be significantly enhanced by infrastructural development.

The infrastructural development-led FDI rationale is supported by Ogunjimi and Amune (2019); Nketiah-Amponsah and Sarpong (2019); Michiels (2018); Stephane (2020); Bakar et al. (2012); Msane (2012); Shah (2014); F. U. Rehman et al. (2022a); Yamin and Sinkovics (2009); Wekesa et al. (2017); Mandisi (2014); Khadaroo and Seetanah (2009); Owusu-Manu et al. (2019); Ogundipe et al. (2020); Hasan et al. (2022); Kingori (2022) and Nyaosi (2011).

Ogunjimi and Amune (2019) examined infrastructural development’s impact on FDI in Nigeria, employing autoregressive distributive lag (ARDL) with time series data (1981–2014). Their study focused more on the type of infrastructure that had a more significant influence on FDI during the period under review. Their results confirmed the long-running relationship between the major variables. In the long run, electricity production was observed to have had a significant effect on FDI in Nigeria, whilst in the short term, this was not the case for any of the infrastructural development variables (telephone lines, tractors, and electricity supplies).

Using panel methods (fixed effects, system-generalised methods of moments, and random effects) with data spanning from 2003 to 2017, Nketiah-Amponsah and Sarpong (2019) examined the interaction between FDI and infrastructural development in Sub-Saharan Africa. According to the system GMM approach, transport and electricity infrastructure induced a significant positive influence on FDI. The same study noted that the interaction between FDI and infrastructural development enhanced economic growth in Sub-Saharan Africa during the period under study.

Focusing on Malaysia, Bakar et al. (2012) investigated the FDI–infrastructural development nexus with time series data spanning from 1970 to 2010. Their study proved the existence of a long-running relationship among all the variables including FDI, infrastructural development, market size, human capital, and openness to trade. Infrastructural development, alongside these other explanatory variables, had a significant enhancing influence on FDI in Malaysia during the period under review.

Shah (2014) examined the relationship between FDI and infrastructural development in developing nations from 1980 to 2007 using panel data analysis approaches. Telephone density had a positive enhancing influence on FDI in developing countries. Other explanatory variables, such as exchange rate, inflation, market size and economic growth, had a significant impact on FDI in developing nations during the period under study. Focusing on South Africa, Msane (2012) examined the relationship between FDI and infrastructural development. The study used time series secondary data from 1980 to 2015 and noted that energy, railway, and communication infrastructure were found to have a positive and significant effect on FDI. All the explanatory variables used in this study had a positive influence on FDI.

Using the system GMM approach with panel data (2000–2019), F. U. Rehman et al. (2022b) explored the FDI–infrastructural development nexus in BRICS nations. They showed that FDI was significantly enhanced by transport, financial, telecommunications, and energy infrastructural development and positively influenced by explanatory variables such as economic growth, foreign aid, institutional quality, trade openness, human capital, and domestic investment.

Yamin and Sinkovics (2009) conducted a literature review examining the infrastructure–FDI nexus. They noted that infrastructural development enhanced FDI in less developed countries, being characterised by high levels of human capital development. Wekesa et al. (2017) used multiple regression analysis with time series data (2010–2013) to examine the interlinkages between FDI and infrastructural development in Kenya. Quality infrastructure was found to have enhanced FDI through its ability to reduce business costs. FDI was positively improved by water, communication, transport, and waste infrastructural development. Independent variables such as economic growth, exchange rate, and trade openness were also found to be key drivers of FDI in Kenya.

In the African context, Khadaroo and Seetanah (2009) used panel data analysis to explore the impact of infrastructural development on FDI and reported that it was significantly enhanced. C. A. Rehman et al. (2011) examined the FDI–infrastructure interlinkages in Pakistan using the ARDL methodology with annual time series (1975–2008) data. FDI was observed to have been significantly enhanced by infrastructure in Pakistan, both in the long and short term. In their study of the FDI–infrastructural development relationship, Yamin and Sinkovics (2009) noted that the latter enhanced the former through reducing business costs.

Mandisi (2014) examined the interrelationships between infrastructural development, economic growth, and FDI in developed nations using panel data methods, observing a unidirectional causality relationship between composite infrastructural development and FDI and economic growth. Information communication technology, transport, and power infrastructure were all found to have significantly enhanced FDI in developing nations.

Employing GMM estimation approaches, Khadaroo and Seetanah (2009) studied the impact of transport infrastructure on FDI in Africa and found that it had a more significant enhancing influence. The same study noted that other independent variables in the model had a non-significant enhancing influence on FDI. Owusu-Manu et al. (2019) studied the FDI–infrastructural development causal relationship in Ghana using vector autoregression method (VECM) analysis and two-stage least squares. A significant positive relationship between infrastructure and FDI was observed in both the short and long term. Trade openness and economic growth were also both found to have negatively affected FDI in Ghana.

Ogundipe et al. (2020) used system GMM with panel data from 1995 to 2017 to assess whether infrastructural absorption capacity enhances FDI in the ECOWAS region; they concluded that FDI enhanced economic growth, while both infrastructure development and economic growth had a positive influence. Using time series data (1980–2018) and, for example, vector autoregressive methods, Hasan et al. (2022) analysed the influence of infrastructure on FDI in Pakistan. All transport proxies, such as energy, sanitation, water, telecommunication, and transport, were found to have a significant enhancing effect on FDI both in the short and long term. Kingori (2022) also examined infrastructural development-led FDI in Kenya using the error correction model with data ranging from 1970 to 2019. They noted that infrastructural development showed Granger causality in terms of FDI in both the short and long term, that economic growth enhanced FDI, and that there is a bi-directional causality relationship between infrastructural development and economic growth.

Nyaosi (2011) used multiple regression analysis and descriptive statistics to analyse the relationship between FDI and infrastructural development in Kenya. They observed that, in the long run, the infrastructural development index (lagged twice) significantly enhanced FDI. Using both disaggregated and aggregated data from South Asian economies, F. U. Rehman et al. (2022a) studied the interplay between exports, sectoral infrastructure, and FDI. They observed that, in the long run, both aggregated and disaggregated infrastructural development (transport, financial, energy, and telecommunication) data had a significant improving effect on FDI and exports. No reverse Granger causality from FDI to infrastructural development was observed either in the short or long run.

Stephane (2020) supported the negative infrastructural development-led FDI view after examining the FDI–infrastructural development nexus in Cameroon using the ARDL approach with time series data (1984–2014). Energy, communication, and transport infrastructure were the three proxies used in this study. In both the short and long term, FDI was observed to have been significantly enhanced by communication technology, whilst energy infrastructure had a deleterious effect on FDI during the same period. Transport infrastructure’s positive influence on FDI was found to be very minimal in both the long and short term.

However, Michiels (2018) supported the neutral view after examining the FDI–infrastructure nexus in the African context using panel methods (GMM and fixed effects). The results show that various infrastructural development proxies (transport, communication, and electricity) had an insignificant impact on FDI in Africa; this contradicted expectations, as the continent is much more resource-driven.

The theoretical studies discussed above show that research on the influence of infrastructure development on FDI is quite varied, and firm conclusions are far from being drawn. Although the majority of researchers mentioned here support the infrastructure development-led FDI view, there is still an absence of consensus in the literature.

3. Methodology

Equation (1) outlines the general model specification and consists of the dependent (foreign direct investment) and independent variables, including infrastructure development (INFR), financial development (FIN), trade openness (OPEN), human capital development (human capital development), savings (SAV), and personal remittances (REMIT). These independent variables are in line with prior similar empirical research conducted by Mandisi (2014); Owusu-Manu et al. (2019); Khadaroo and Seetanah (2009); Hasan et al. (2022); Ogundipe et al. (2020); F. U. Rehman et al. (2022b); Kingori (2022); and Nyaosi (2011).

FDI = f (INFR, FIN, OPEN, HCD, SAV, REMIT)

Table 1 explains how each independent variable theoretically influences FDI.

Table 1.

Theoretical explanation of independent variables.

Domestic savings as a ratio of GDP are the proxy of savings used in this study. Total trade as a ratio of GDP was used as a measure of trade openness, whilst domestic credit to the private sector as a proportion of GDP was the proxy of financial development. Human capital development was measured according to its index, whilst personal remittances received as a ratio of GDP were used to proxy personal remittances, consistent with similar previous studies (Nyaosi, 2011). Data were collected from international, reputable secondary sources, including World Development Indicators, International Financial Statistics, and the Africa Development Bank.

Equation (2) is an econometric representation of the FDI function. In line with the second objective of this study, it incorporates the complementarity function (INFR × FIN) as an additional independent variable influencing FDI.

Fixed effects were employed to estimate the econometric model represented by Equation (2), due to their superiority in enabling researchers to control variables omitted because of time invariance (Boateng et al., 2017). A significant positive value of the coefficient implies that financial development improved infrastructural development’s positive influence on FDI in BRICS countries. For robustness, this study employed a fully modified ordinary least squares (FMOLS) panel. The argument is that using this method enhances heterogeneity checks in co-integrated panels and resolves simultaneity bias. The Hausman test was used to help in choosing between random or fixed effects. This approach tests the null hypothesis that fixed-effects estimated coefficients are the same as those of random-effects estimators, consistent with Boateng et al. (2017, p. 310). The Wald test value, which is insignificant under fixed effects, indicates an absence of heteroscedasticity. There is, however, heteroscedasticity in the random-effects model, because its corresponding Wald test value is positive and significant, in line with Boateng et al. (2017). This was also another reason for selecting fixed over random effects.

4. Results

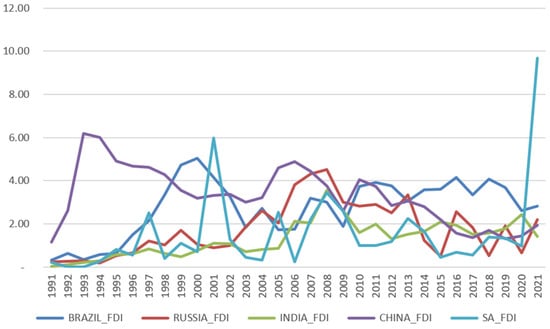

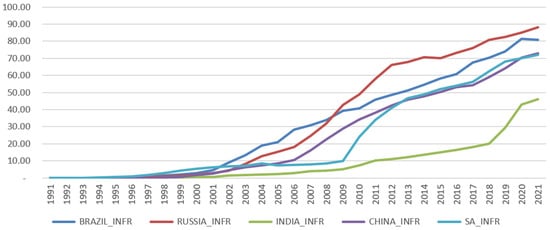

Figure 1 and Figure 2, respectively, present a trend analysis of BRICS countries in terms of foreign direct investment and infrastructure development.

Figure 1.

Net foreign direct investment inflow (% of GDP) trends for BRICS countries.

Figure 2.

Trends in individuals using the internet (% of population).

Figure 1 shows that the net FDI inflows for Brazil increased from 0.36% of GDP in 1991 to 1.48% in 1996; this further increased by 2.67 percentage points between 1996 and 2001, before decreasing by 2.16 during the subsequent five-year period (between 2001 and 2006). Brazil’s net FDI inflows in 2011 were 3.92% of GDP and increased to 4.14% in 2016, before plummeting by 1.32 percentage points during the subsequent five-year period, ranging from 2016 to 2021.

Russia’s net FDI inflows went up from 0.24% of GDP in 1991 to 0.66% in 1996, before further increasing to 0.90% in 2001. The period between 2001 and 2006 saw the country’s net FDI increasing by 2.90 percentage points, whilst the subsequent five-year period (2006–2011) was characterised by a 0.91 percent decline in net FDI inflows. Russia’s net FDI inflows declined from 2.89% of GDP in 2011 to 2.55% in 2016, before decreasing by 0.35 percentage points during the five-year period from 2016 to 2021.

The net FDI inflow for India was 0.03% of GDP in 1991; this went up to 0.61% in 1996 before further increasing to 1.11% in 2001. The period between 2001 and 2006 was characterised by a 1 percentage point gain in India’s net FDI inflows, whilst the subsequent five-year timeframe (2006 to 2011) showed a 0.12 percent decline. The country’s net FDI inflow was 1.99% of GDP in 2011, which decreased to 1.94% in 2016 and then by a further 0.52 percent during the subsequent five-year period, ending 2021 at 1.42%.

China’s net FDI inflow increased from 1.14% of GDP in 1991 to 4.67% in 1996; this plummeted to 3.32% in 2001 before recording a growth of 1.56 percent in 2006, closing at 4.88%. The country’s net FDI inflow decreased from 4.88% of GDP in 2006 to 3.74% in 2011; this further decreased to 1.56% of GDP in 2016 before increasing 0.38 percent, ending 2021 at 1.93%.

South Africa’s net FDI inflow increased from 0.21% of GDP in 1991 to 0.55% in 1996. A 5.43 percent growth was recorded during the subsequent five-year period (1996–2001), which then declined by a massive 5.75 percent during the five-year period between 2001 and 2006. The country’s net FDI inflow was 0.23% of GDP in 2006, which went up to 0.99% in 2011 and declined to 0.68% of GDP in 2016, before seeing a massive 8.99 percent growth during the subsequent five-year period, ending 2021 at 9.68%.

As can be seen from Figure 2, all the five BRICS countries experienced an exponential growth in Internet penetration during the 30-year period ranging from 1991 to 2021. In terms of Internet penetration rate rankings, it is clear from Figure 2 that Russia was the best, followed by Brazil, then China, South Africa, and lastly India.

Table 2 and Table 3 present pre-estimation diagnostics (correlation and descriptive statistical results).

Table 2.

Analysis of correlation results.

Table 3.

Descriptive statistics.

The results of unit root tests, which were conducted to ascertain the stability of the data set used, are presented in Table 4. Across all four methods, not all of the data were stable at first difference. However, the data for all the variables were stable or stationary at first difference, as can be seen in Table 4. Consistent with Aye and Edoja (2017), the data were integrated to allow for the subsequent panel co-integration procedure.

Table 4.

Unit roots—individual intercept.

Rodrik (2012) argued that estimating panel data presents some challenges, which have been well documented in the empirical literature. These challenges are accounted for by choosing the appropriate estimation procedure for each study. Since macroeconomic data are deemed to be non-stationary, panel unit root tests were performed on all variables used (both dependent and explanatory). Consistent with Boateng et al. (2017), panel unit root tests block spurious econometric estimation and are hence quite vital in econometric modelling. For the four methods used (see Table 4), the joint null hypothesis that the data series is not stationary was accepted at the level stage and rejected at first difference. The stationarity of all data sets implied that an examination of co-integration among the variables employed could go ahead, consistent with Odhiambo (2021).

5. Discussion

According to Table 2, a significant positive relationship was observed between the following variables: (1) FDI and infrastructural development, (2) FDI and human capital development, and (4) FDI and savings. The correlation between FDI and financial development was found to be negative and insignificant, whilst a non-significant positive relationship between FDI and trade openness was observed. Remittances and FDI had a significant negative correlation (see Table 2). In line with Stead (2007), no multicollinearity problem was found between variables because their correlations were all below 70%.

Financial development outliers can be seen in Table 3 (descriptive statistics), because the data range was over 100. Apart from human capital development, the data for the remaining variables were positively skewed, hence the data set was not distributed normally. For all the variables used, the Jarque–Bera probability was zero, further proving that the data set was not normally distributed. At this stage, the transformation of all data sets in natural logarithms was influenced by Aye and Edoja (2017).

Panel co-integration tests were conducted in order to ascertain any long-running relationships between the variables used. Seven co-integrating relationships were observed among the studied variables (see Table 5). These results indicated a long-running relationship among the variables used in the model and paved the way for a causality analysis, the results of which are presented in Table 6 (fixed effects) and Table 7 (fully modified ordinary least squares). Table 8 presents results of the diagnostic tests.

Table 5.

Johansen Fisher’s approach.

Table 6.

Fixed-effects results.

Table 7.

Fully modified ordinary least squares (FMOLS) panel.

Table 8.

Diagnostic tests.

The probability value of 0.0000 shows that the alternative hypothesis, which says fixed effects should not be rejected in favour of random effects, was adopted (Table 6). Moreover, the three models were significant because the F-statistic’s probability values were 0.0000; this thus confirms that regression models fit quite well with the data set used. In Table 6 (main results), model 1 used individuals using the Internet (% of population) as a measure of infrastructural development. Renewable energy consumption (% of total final energy consumption) was the proxy of infrastructural development used in model 2. Model 3 used fixed telephone subscriptions (per 100 people) as a proxy for infrastructural development; this was the only distinction.

Both Internet connectivity (model 1) and telephone subscription rates (3) indicate that infrastructural development significantly improved FDI. Model 2 (renewable energy) shows that FDI was non-significantly enhanced by infrastructural development. These results support the argument that infrastructural development is a locational advantage of FDI (Dunning, 1973). They also align with theoretical studies in the literature that argue that inadequate infrastructure (communication, road, energy, and transport) hinders the full and active participation of firms in global manufacturing networks (Limao & Venables, 2001).

Models 1 and 3 produced results showing that FDI was insignificantly improved by financial development, whilst a significant causality between financial development and FDI was observed in model 2. These results support the liquidity-easing rationale of Antras et al. (2009), who explained that deep financial markets enable foreign firms to increase their activities as they no longer have to overly depend on a parent company. These results also align with those of Ncube (2007), who argued that developed financial markets enable better diversification and risk cutting, thereby attracting more FDI inflows into the host country.

Across all the three models, infrastructural development significantly helped to attract FDI. These results show that the combination of infrastructural and financial development had a significant enhancing effect on FDI in BRICS countries during the period under study. In other words, financial development enhanced the capacity of infrastructural development to attract FDI in these countries. The results cement the argument that the availability of absorption capacities in the host country is key in facilitating a meaningful relationship between any macroeconomic variable and FDI (Hermes & Lensink, 2003; Adams, 2009; Vita & Kyaw, 2009). The results are also in line with those of Ogundipe et al. (2020), who observed that absorption capacities were quite relevant in the infrastructural development–FDI nexus in the ECOWAS region.

Trade openness negatively and non-significantly affected FDI in models 1 and 3. These results resonate with earlier research explaining that high levels of trade openness reduce FDI because foreign firms can market and sell their products easily from any location in the world. On the contrary, a non-significant positive relationship between trade openness and FDI was observed in model 2, supporting the explanation proffered by Denisia (2010), who argued that favourable government economic policies, such as high levels of trade openness, are a locational advantage of FDI.

A positive but non-significant causality between human capital development and FDI was observed in all the three models. These results indicate that FDI was enhanced by human capital development, albeit in a non-significant manner. This is generally aligned with Craigwell (2012), who noted that foreign investors are normally attracted to countries characterised by high levels of skilled and educated people, as they can easily adapt not only to new technology but to new ways of doing business. Our results our support Dunning’s (1988) argument that using the educated and skilled personnel already available in the host country is cheaper and will thus attract foreign direct investors.

The significant positive influence of savings on FDI was observed in model 1; this supports Lucas (1988) and Romer (1986)’s view that savings enhance economic growth through stimulating both foreign and domestic investment activities. Models 2 and 3 show that FDI was insignificantly improved by savings, supporting the argument that they are an indicator of a stable economy that provides an attractive macroeconomic environment for foreign investors.

Whilst models 2 and 3 indicate that FDI was non-significantly reduced by personal remittances, the model 1 results show that they had a significant deleterious influence. These results generally align with the theoretical reasoning that, to a certain extent, personal remittances replace FDI (Dash, 2020). If properly channelled towards the right sectors of the economy, their liquidity can help in achieving similar FDI objectives.

6. Study Limitations

The focus of this study was narrow, because it used only communication infrastructure (fixed telephone subscriptions and Internet penetration) as a measure of infrastructural development. Better quality proxies, such as port, road, health, and railway infrastructure (consistent with Abdullahi and Sieng (2023)), were not used in this study. The reason that we did not capture physical infrastructure in its entirety was because of the unavailability of such data in their complete form across major reputable databases. The omission of this necessary physical infrastructure makes our understanding of the infrastructure–FDI nexus quite elusive (Hasan et al., 2022).

7. Conclusions

This study focused on exploring the influence of infrastructural development on FDI in BRICS countries using a fixed-effects panel approach. The secondary data used ranged from 1991 to 2021. The existing theoretical and empirical literature on the infrastructural development-led FDI nexus is mixed and quite divergent, making it difficult for policy makers to make decisions. This study was carried out in order to help design and implement infrastructural development policies with which to influence FDI inflows. Internet penetration and fixed telephone subscriptions were found to have a significant improving effect on FDI, whilst renewable energy infrastructure’s enhancement effect was found to be minimal and non-significant. The interaction term in the fixed-effects model produced results showing that financial development enabled infrastructural development and significantly enhanced FDI inflows into BRICS countries. This study therefore recommends that BRICS authorities implement policies which enhance Internet penetration, fixed telephone subscriptions, and financial development to improve FDI inflows. For future studies, we recommend a threshold analysis of the infrastructural development levels that significantly improve FDI inflows in BRICS countries to provide more clarity and specificity in policy making.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author due to the privacy of the research.

Acknowledgments

I gratefully acknowledge the moral support provided by my employer, the University of South Africa.

Conflicts of Interest

The author declares no conflict of interest.

References

- Abdullahi, A., & Sieng, L. W. (2023). The effect of infrastructure development on economic growth: The case of Sub-Saharan Africa. Journal of Infrastructure, Policy and Development, 7, 1994. [Google Scholar] [CrossRef]

- Adams, S. (2009). Foreign direct investment, domestic investment and economic growth in sub-Saharan Africa. Journal of Policy Modelling, 31, 939–949. [Google Scholar] [CrossRef]

- Antras, P., Desai, M. A., & Foley, F. C. (2009). Multinational firms, FDI flows and imperfect capital markets. The Quarterly Journal of Economics, 124, 1171–1219. [Google Scholar] [CrossRef]

- Aye, G. C., & Edoja, P. E. (2017). Effect of economic growth on CO2 emission in developing countries: Evidence from a dynamic panel threshold regression model. General and Applied Economics, 5, 1379239. [Google Scholar] [CrossRef]

- Bakar, N. A. A., Mat, S. H., & Harun, M. (2012). The impact of infrastructure on foreign direct investment: The case of Malaysia. International Congress on Interdisciplinary Business and Social Science, 65, 205–211. [Google Scholar] [CrossRef]

- Boateng, E., Amponsah, M., & Baah, A. (2017). Complementarity effect of financial development and FDI on investment in Sub-Saharan Africa: A panel data analysis. African Development Review, 29, 305–318. [Google Scholar] [CrossRef]

- Craigwell, M. F. A. W. R. (2012). Economic growth, FDI and corruption in developed and developing countries. Journal of Economic Studies, 39, 639–652. [Google Scholar]

- Dash, R. K. (2020). Impact of remittances on domestic investment: A panel study of six South Asian countries. South Asia Economic Journal, 21, 7–30. [Google Scholar] [CrossRef]

- Denisia, V. (2010). Foreign direct investment theories: An overview of the main theories. European Journal of Interdisciplinary Studies, 2, 104–110. [Google Scholar]

- Dunning, J. H. (1973). The determinants of international production. Oxford Economic Papers, 25, 289–336. [Google Scholar] [CrossRef]

- Dunning, J. H. (1980). Toward an eclectic theory of international production: Some empirical tests. Journal of International Business Studies, 11, 9–31. [Google Scholar] [CrossRef]

- Dunning, J. H. (1988). The Eclectic paradigm of international production: A restatement and some possible extensions. Journal of International Business Studies, 19, 1–31. [Google Scholar] [CrossRef]

- Estache, A., & Fay, M. (2010). Current debates on infrastructure policy. In M. Spence, & D. Leipzinger (Eds.), Globalization and growth (pp. 151–194). The World Bank. [Google Scholar]

- Ezeoha, A. E., & Cattaneo, N. (2012). FDI flows to Sub-Saharan Africa: The impact of finance, institutions and natural resource endowment. Comparative Economic Studies, 54, 597–632. [Google Scholar] [CrossRef]

- Hasan, S. A., Baig, M. A., & Lal, I. (2022). Impact of infrastructure development index on FDI: A case of Pakistan. Academy of Accounting and Financial Studies Journal, 26, 1–9. [Google Scholar]

- Hermes, N., & Lensink, R. (2003). Foreign direct investment, financial development and economic growth. The Journal of Development Studies, 40, 142–163. [Google Scholar] [CrossRef]

- Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing unit roots in heterogeneous panels. Journal of Econometrics, 115, 53–74. [Google Scholar] [CrossRef]

- Kaur, M., Yadav, S. S., & Gautam, V. (2013). Financial system development and FDI: A panel study for BRICS countries. Global Business Review, 14, 729–742. [Google Scholar] [CrossRef]

- Khadaroo, J., & Seetanah, B. (2009). The role of transport infrastructure in FDI: Evidence from Africa using GMM estimates. Journal of Transport Economics and Policy, 43, 365–384. [Google Scholar]

- Kingori, Z. I. (2022). Effect of infrastructure on FDI behaviour in Kenya: A growth nexus analysis [Ph.D. Thesis, University of South Africa]. [Google Scholar]

- Kumar, N., & Pradhan, J. P. (2002). FDI, externalities and economic growth in developing countries: Some empirical explorations and implications for WTO negotiations on investment. RIS discussion paper No. 27/2002. International Economic Association Series. [Google Scholar]

- Levin, A., Lin, C. F., & Chu, C. S. J. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics, 108, 1–24. [Google Scholar] [CrossRef]

- Limao, N., & Venables, A. J. (2001). Infrastructure, geographical disadvantage, transport costs, and trade. The World Bank Economic Review, 15, 451–479. [Google Scholar] [CrossRef]

- Lucas, R. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22, 3–42. [Google Scholar] [CrossRef]

- Mandisi, R. (2014). The relationship between infrastructural development and foreign direct investment inflows and economic growth in developing countries [Master’s thesis, University of Pretoria]. [Google Scholar]

- Michiels, C. (2018). The effect of infrastructure on foreign direct investment in Africa [Master’s thesis, Erasmus School of Economics, Erasmus University Rotterdam]. [Google Scholar]

- Msane, Y. A. (2012). The impact of infrastructure on foreign direct investment inflow [Master’s thesis, Development Economics, School of Economics, University of Johannesburg]. [Google Scholar]

- Ncube, M. (2007). Financial services and economic development in Africa. Journal of African Economies, 16(Suppl. S1), 13–57. [Google Scholar] [CrossRef]

- Nketiah-Amponsah, E., & Sarpong, B. (2019). Effect of infrastructure on foreign direct investment on economic growth in Sub-Saharan Africa. Global Journal of Emerging Market Economies, 11, 183–201. [Google Scholar] [CrossRef]

- Nyaosi, E. N. (2011). The effect of infrastructure on foreign direct investment in Kenya. Discussion paper series number DP/127/2011. The Kenya Institute for Public Policy Research and Analysis. [Google Scholar]

- Odhiambo, N. M. (2021). Health expenditure and economic growth in Sub-Saharan Africa: An empirical investigation. Development Studies Research, 8, 73–81. [Google Scholar] [CrossRef]

- Ogundipe, A. A., Oye, Q. E., Ogundipe, O. M., & Osabohien, R. (2020). Does infrastructural absorption capacity stimulate FDI-growth nexus in ECOWAS? Cogent Economics and Finance, 8, 1751487. [Google Scholar] [CrossRef]

- Ogunjimi, J. A., & Amune, B. O. (2019). Impact of infrastructure on foreign direct investment in Nigeria: An autoregressive distributive lag (ARDL) approach. Journal of Economics and Sustainable Development, 10, 1–8. [Google Scholar]

- Owusu-Manu, D.-G., Edwards, D. J., Mohammed, A., Thwala, W. D., & Birch, T. (2019). Short run causal relationship between foreign direct investment (FDI) and infrastructure development. Journal of Engineering, Design and Technology, 17, 1202–1221. [Google Scholar] [CrossRef]

- Rehman, C. A., Ilyas, M., Alam, H. M., & Akram, M. (2011). The impact of infrastructure on foreign direct investment: The case of Pakistan. International Journal of Business and Management, 6, 268–276. [Google Scholar] [CrossRef]

- Rehman, F. U., Islam, M. M., & Sohag, K. (2022a). Does infrastructural development allure foreign direct investment? The role of belt and road initiatives. International Journal of Emerging Markets, 19, 1026–1050. [Google Scholar] [CrossRef]

- Rehman, F. U., Sohag, K., & Saeed, T. (2022b). Impact of sectoral infrastructure on export and foreign direct investment inflow: Evidence from selected South Asian economies by applying a new global infrastructure index. Journal of Infrastructure Systems, 29, 268–276. [Google Scholar] [CrossRef]

- Richaud, C., Sekkat, K., & Varoudakis, A. (1999). Infrastructure and growth spillovers: A case for a regional infrastructure policy in Africa. OECD, Economics Department. [Google Scholar]

- Rodrik, D. (2012). Why we learn nothing from regressing economic growth on policies. Seoul Journal of Economics, 25, 137–151. [Google Scholar]

- Romer, P. (1986). Increasing returns and long run economic growth. Journal of Political Economy, 94, 1002–1037. [Google Scholar] [CrossRef]

- Shah, M. H. (2014). The significance of infrastructure for FDI inflow in developing countries. Journal of Life Economics, 2, 1–16. [Google Scholar] [CrossRef]

- Solow, R. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70, 65–94. [Google Scholar] [CrossRef]

- Stead, R. (2007). Foundation Quantitative Methods for Business. Prentice Hall. [Google Scholar]

- Stephane, M. N. (2020). The impact of infrastructure development on foreign direct investment in Cameroon (pp. 1–12). University of Dschang, Faculty of Economics and Management, Larefa. [Google Scholar]

- Vita, G., & Kyaw, K. (2009). Growth effects of FDI and portfolio investment flows to developing countries: A disaggregated analysis by income levels. Applied Economics Letters, 16, 277–283. [Google Scholar] [CrossRef]

- Wekesa, C. T., Wawire, N. H., & Kosimbei, G. (2017). Effects of infrastructure development on foreign direct investment in Kenya. Journal of Infrastructure Development, 8, 93–110. [Google Scholar] [CrossRef]

- Yamin, M., & Sinkovics, R. R. (2009). Infrastructure or foreign direct investment? An examination of the implications of MNE strategy for economic development. Journal of World Business, 44, 144–157. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).