Crowdfunding Amidst FinTech Winter: Complement or Substitute?

Abstract

1. Introduction

2. Research Methodology

2.1. Data

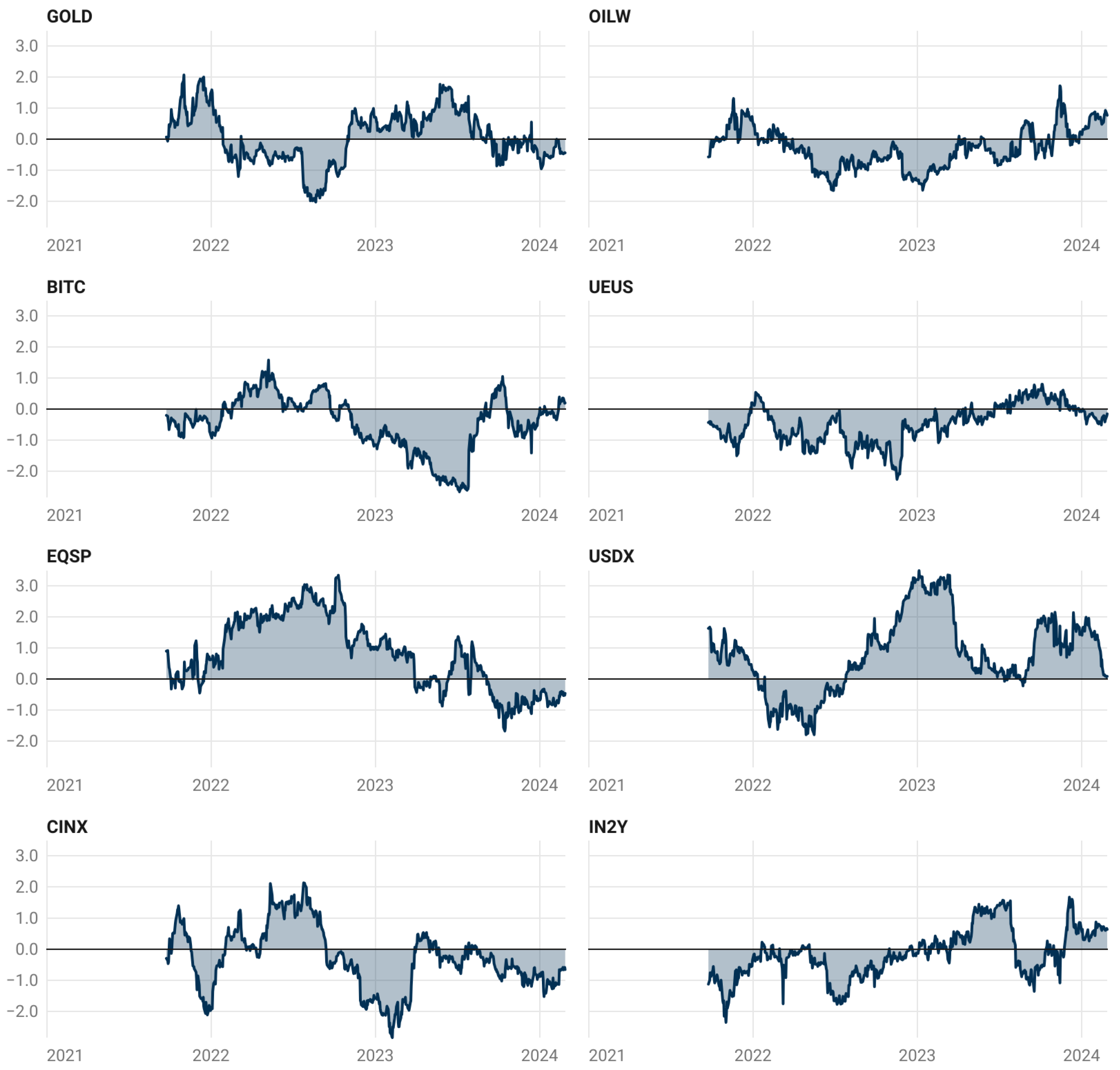

- Commodities: GOLD (based on Handy–Harman gold price index) and OILW (based on WTI Cushing crude oil price) track daily gold and oil prices. Gold, a traditional safe-haven asset, influences investment behavior across conventional and alternative financial markets (Baur & Lucey, 2010). Its role as a hedge against economic instability can impact crowdfunding ventures (Baur & Beckmann, 2017). Similarly, oil prices, a key driver of global economic conditions (Hamilton, 2009), affect market sentiment and investor risk appetite. Both commodities can influence crowdfunding investment decisions.

- Cryptocurrency: BITC monitors the daily USD to Bitcoin exchange rate. Bitcoin, as a volatile cryptocurrency and potential alternative asset class, can impact investor behavior towards crowdfunding platforms, especially those focused on innovation (Corbet et al., 2018). Its inclusion provides insights into its relationship with traditional finance and crowdfunding (Baur et al., 2018).

- Economic Indicators: UEUS measures daily US economic policy uncertainty, USDX tracks the US dollar trade-weighted index, and EQSP represents the S&P 500 composite index. The USDX measures the dollar’s value against a basket of major currencies. Its fluctuations affect foreign investment flows and the success of crowdfunding campaigns with global reach (Ahlers et al., 2014). The USDX is crucial for assessing global financial stability (Branson & Henderson, 1985). Meanwhile, the UEUS captures market and economic sentiment, influencing investment decisions and market volatility (Baker et al., 2016). High uncertainty may lead investors to seek more conservative investment options, impacting crowdfunding activity (Ahmad et al., 2018).

- Interest Rates: IN2Y tracks the daily market yield of the 2-Year US Treasury Security. Interest rates, set by central banks, significantly influence borrowing costs, investment returns, and overall economic activity (Bernanke & Blinder, 1992). These factors impact the attractiveness of crowdfunding versus traditional financing options for both businesses and investors (Mollick, 2014).

2.2. Vector Auto-Regression—VAR

2.3. Estimation of the Model

- Static Spillovers Analysis: The static spillovers analysis examines the contemporaneous relationships among the variables in the VAR model. It focuses on estimating the impact of shocks in one variable on others at the same time period. This analysis is conducted by estimating the contemporaneous elements of the VAR model’s coefficient matrix (see Equation (3)).

- Total Dynamic Spillovers Analysis: The total dynamic spillovers analysis investigates the cumulative impact of shocks in one variable on others over time. It involves analyzing the impulse response functions (IRFs) of the VAR model. IRFs illustrate how each variable responds to a one-unit shock in another variable over multiple time periods. To estimate the total dynamic spillovers, we compute the IRFs for each variable in response to shocks in all other variables. This allows us to assess the persistence and magnitude of spillover effects over time (see Equation (4)).

- Directional Spillovers Analysis (FROM): The directional spillovers analysis (FROM) assesses the directionality of spillover effects transmitted by each variable to others. It involves decomposing the variance of each variable into components attributable to shocks from other variables. By identifying the variables that contribute most to the variance of each variable, we can determine which variables exert the most influence on others in the system (see Equation (5)).

- Directional Spillovers Analysis (TO): Conversely, the directional spillovers analysis (TO) examines the directionality of spillover effects originating from each variable to others. This analysis is conducted by decomposing the variance of each variable into components attributable to its own shocks and those originating from other variables. We calculate the contribution of each variable to the total variance of all variables in the system, thereby identifying which variables act as major sources of spillovers (see Equation (6)).

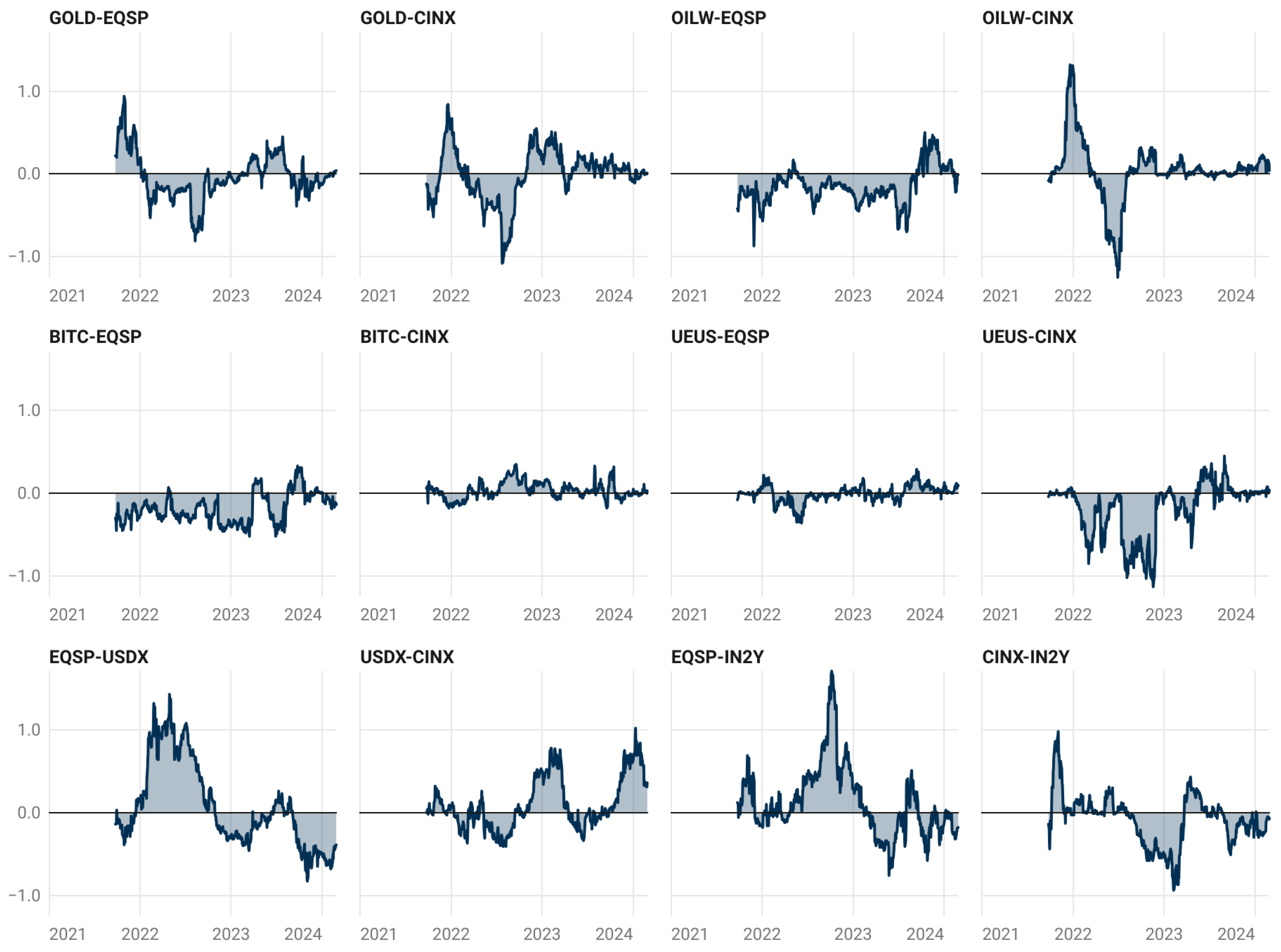

- Net Directional Spillovers Analysis: The net directional spillovers analysis combines the insights from the directional spillovers analysis (FROM) and (TO) to determine the net direction of spillover effects between pairs of variables. Essentially, it is a difference between Equations (6) and (5). This analysis enables us to identify the predominant direction of influence between variables in the system. We calculate net directional spillovers by comparing the contributions of each variable to the total variance of others, considering both the outgoing and incoming spillover effects (see Equation (7)).

- Net Directional Spillovers Analysis (Pairwise): The net spillovers analysis (pairwise) examines the net impact of each variable on every other variable in the system, accounting for both the direct and indirect effects. This analysis provides a comprehensive understanding of the interdependence between pairs of variables. By quantifying the net spillover effects between each pair of variables, we can identify the key relationships driving the dynamics of the system and assess their significance (see Equation (8)).

3. Discussion of Empirical Results

3.1. Preliminary Analysis

3.2. Static Spillovers

- Spillover Index: The total spillover index, which measures the overall contribution of spillovers of shocks across all variables, is 22.19%. This indicates a moderate level of interdependence among the variables in the system.

- Net Spillovers: The ‘NET’ row reveals the net spillover effect for each variable. Positive values indicate net transmitters of shocks, while negative values denote net receivers. USDX (1.15) and EQSP (0.73) are the only net transmitters of shocks in the system. This suggests that these variables have a more significant influence on other variables than they receive in return. The US Dollar Index (USDX) being the largest net transmitter implies its central role in influencing other financial variables, which aligns with the dollar’s global importance. All other variables (GOLD, OILW, BITC, UEUS, CINX, IN2Y) are net receivers of shocks, with CINX (−0.56) and BITC (−0.43) being the largest net receivers. This implies that these variables are more susceptible to influences from other variables in the system than they are influential.

- Directional Spillovers: USDX (5.83) and EQSP (5.00) have the highest spillover effects on other variables, reinforcing their roles as key influencers in the system. Meanwhile, USDX (4.68) and EQSP (4.27) also receive significant spillovers from other variables, indicating a two-way interaction. UEUS (0.09) receives the least spillover from other variables, suggesting it is relatively isolated from the effects of other variables in the system.

- Own-Variable Effects: The diagonal elements represent the portion of forecast error variance explained by own shocks. UEUS (12.41) and OILW (11.50) have the highest own-variable effect, indicating they are largely driven by their own dynamics.

- Pairwise Spillovers: Some notable pairwise spillovers include: GOLD to USDX (1.30) and vice versa (1.61); IN2Y to GOLD (1.28) and vice versa (1.11); EQSP to BITC (1.57) and vice versa (1.37); USDX to EQSP (1.46) and vice versa (1.48); IN2Y to USDX (1.12) and vice versa (1.69); CINX to EQSP (1.28) and vice versa (1.59).These results indicate a strong bidirectional relationship.EQSP’s impact on BITC (1.57) and CINX (1.59) suggests that equity markets have a notable influence on both cryptocurrency and the crowdfunding index.

3.3. Total Dynamic Spillovers

3.4. Directional Spillovers

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agrawal, A., Catalini, C., & Goldfarb, A. (2014). The economics of crowdfunding. National Bureau of Economic Research, 14, 63–97. [Google Scholar]

- Ahlers, R., Dou, J., Fratzscher, M., & Gaus, M. (2014). Exchange rate fluctuations and foreign direct investment. Journal of International Money and Finance, 46, 1–22. [Google Scholar]

- Ahmad, N., Guo, X., & Khan, S. U. (2018). Economic policy uncertainty, financial constraints and firm innovation. Research Policy, 47(7), 1322–1336. [Google Scholar]

- Ahmed, A., Ucbasaran, D., Cacciotti, G., & Williams, T. (2022). Integrating psychological resilience, stress, and coping in entrepreneurship: A critical review and research agenda. Entrepreneurship Theory and Practice, 46(3), 497–538. [Google Scholar] [CrossRef]

- Bai, J., & Li, K. (2014). On generalized FEVDs. Econometrica, 82(4), 1655–1694. [Google Scholar]

- Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636. [Google Scholar] [CrossRef]

- Baruník, J., & Křehlík, T. (2018). Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics, 16(2), 271–296. [Google Scholar] [CrossRef]

- Baur, D. G., & Beck, R. G. (2006). Estimating volatility spillovers in international equity markets: Re-examining the empirical evidence. Journal of International Money and Finance, 25(10), 1617–1637. [Google Scholar]

- Baur, D. G., & Beckmann, J. (2017). Are gold and oil safe havens? A rolling window approach. Journal of Banking & Finance, 83, 185–196. [Google Scholar]

- Baur, D. G., Hong, K., & Lee, A. D. (2018). Bitcoin: Medium of exchange or speculative assets? Journal of International Financial Markets, Institutions and Money, 54, 177–189. [Google Scholar] [CrossRef]

- Baur, D. G., & Lucey, B. M. (2010). Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45(2), 217–229. [Google Scholar] [CrossRef]

- BBC. (2023, May 12). Ukraine war: Why is there a global food crisis? Available online: https://www.bbc.com/news/business-61036715 (accessed on 14 January 2025).

- Beck, T., Demirguc-Kunt, A., & Klapper, L. (2020). Financial inclusion and development. Oxford University Press. [Google Scholar]

- Belleflamme, P., Platteau, J.-P., & Pregnon, P. (2014). Crowdfunding failures. Journal of Economic Behavior & Organization, 108, 54–73. [Google Scholar]

- Bensoussan, E. (2022, April). Inflation could lay waste to many fintechs in 2022 unless they act now. Forbes. Available online: https://www.forbes.com/sites/forbesfinancecouncil/2022/04/22/inflation-could-lay-waste-to-many-fintechs-in-2022-unless-they-act-now/?sh=3d876ead2c70 (accessed on 5 June 2024).

- Bento, N., Gianfrate, G., & Thoni, M. (2019). Crowdfunding for sustainability ventures. Journal of Cleaner Production, 237, 117751. [Google Scholar] [CrossRef]

- Bernanke, B. S. (2009). The financial crisis and the effective conduct of monetary policy. Federal Reserve Bank of St. Louis Review, 91(4), 279–304. [Google Scholar]

- Bernanke, B. S., & Blinder, A. S. (1992). The federal funds rate and the channels of monetary transmission. The American Economic Review, 82(4), 901–921. [Google Scholar]

- Blanchard, O., & Gali, J. (2007). The macroeconomics of oil prices. Brookings Papers on Economic Activity, 2007(1), 69–159. Available online: https://www.nber.org/system/files/chapters/c0517/c0517.pdf (accessed on 5 June 2024).

- Branson, W. H., & Henderson, D. W. (1985). The specification and influence of asset markets. In R. W. Jones, & P. B. Kenen (Eds.), Handbook of international economics (pp. 749–805). Elsevier. [Google Scholar]

- Brozović, D., Amić, D., & Jurinčić, Č. (2017). Crowdfunding as an alternative financing source for small and medium-sized enterprises. Economic Research and Policy, 24(3), 545–558. [Google Scholar]

- Bureau of Labor Statistics. (2023, February 9). Consumer price index summary. Available online: https://www.bls.gov/cpi/ (accessed on 14 January 2025).

- Calic, G., & Mosakowski, E. (2016). Kicking off social entrepreneurship: How a sustainability orientation influences crowdfunding success. Journal of Management Studies, 53(5), 738–767. [Google Scholar] [CrossRef]

- Campello, M. C., Graham, J. R., & Kramer, M. C. (2020). The digital revolution in finance. Review of Financial Studies, 33(1), 280–344. [Google Scholar]

- Chen, Y., Gong, Y., & Li, S. (2020). Does mobile payment promote financial inclusion? Evidence from China. Journal of Economic Behavior & Organization, 178, 152–169. [Google Scholar]

- Clarke, S. (2022). The rise and fall of fintech: A cautionary tale. Available online: https://techcrunch.com/2022/08/15/the-rise-and-fall-of-fintech/ (accessed on 14 January 2025).

- Cong, Y., & Liu, X. (2019). Fintech, shadow banking, and financial stability in China. Journal of Financial Stability, 43, 100621. [Google Scholar]

- Corbet, S., Lucey, B., & Urquhart, A. (2018). Cryptocurrencies as a new asset class? The Economic and Social Review, 49(4), 519–543. [Google Scholar]

- Cordova, A., Dolci, J., & Gianfrate, G. (2015). The determinants of crowdfunding success: Evidence from technology projects. Procedia-Social and Behavioral Sciences, 181, 115–124. [Google Scholar] [CrossRef]

- Courtney, C., Dutta, S., & Li, Y. (2016). Resolving information asymmetry: Signaling, endorsement, and crowdfunding success. Entrepreneurship Theory and Practice, 41(2), 265–290. [Google Scholar] [CrossRef]

- Cumming, D., Leboeuf, G., & Schwienbacher, A. (2015). Crowdfunding models: Keep-it-all vs. all-or-nothing. Entrepreneurship Theory and Practice, 39(6), 1333–1363. [Google Scholar]

- Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66. [Google Scholar] [CrossRef]

- Diebold, F. X., & Yoo, J. S. (1996). Impulse response analysis in spectral regression. Journal of Econometrics, 72(1), 131–168. [Google Scholar]

- Enders, W. (2010). Applied econometrics using r (Vol. 151). Harvard University Press. [Google Scholar]

- Federal Reserve. (2023). Monetary policy report to the congress (Report). Federal Reserve. Available online: https://www.federalreserve.gov/monetarypolicy/publications/mpr_default.htm (accessed on 14 January 2025).

- Food and Agriculture Organization. (2023). Food outlook: Biannual report on global food markets. Office of Communications, Publications and Multimedia. [Google Scholar]

- Gomber, P., Howell, S., & Liu, Y. (2020). The fintech revolution: How disruptive technologies are transforming the consumer finance landscape. Oxford University Press. [Google Scholar]

- Hamilton, J. D. (2009). Understanding crude oil prices. The Energy Journal, 30(2), 179–206. [Google Scholar] [CrossRef]

- Huang, D., & Xu, X. (2018). Fintech and financial inclusion in developing economies. China Economic Journal, 11(2), 1–20. [Google Scholar] [CrossRef]

- IMF. (2023, April 19). World economic outlook: War casts long shadow on global recovery (Report). International Monetary Fund (IMF). Available online: https://www.imf.org/en/Publications/WEO (accessed on 14 January 2025).

- King, M., & Wadhwani, S. (2013). Return and volatility spillovers between India and leading Asian and global equity markets: An empirical analysis. Journal of International Financial Management & Accounting, 24(2), 182–202. [Google Scholar]

- Kocollari, U., Pedrazzoli, A., Cavicchioli, M., & Girardi, A. (2021). Too tied to fail: A multidimensional approach to social capital in crowdfunding campaigns. Evidences from Italian agri-food businesses. Journal of Small Business and Enterprise Development, 29(5), 719–741. [Google Scholar] [CrossRef]

- Koop, G., Pesaran, M. H., & Potter, S. M. (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics, 74(1), 119–147. [Google Scholar] [CrossRef]

- Liang, X., Hu, X., & Jiang, J. (2020). Research on the effects of information description on crowdfunding success within a sustainable economy—The perspective of information communication. Sustainability, 12(2), 650. [Google Scholar] [CrossRef]

- Lütkepohl, H. (2005). Handbook of econometrics (Vol. 6). Elsevier. [Google Scholar]

- Maehle, N. (2020). Sustainable crowdfunding: Insights from the project perspective. Baltic Journal of Management, 15(2), 281–302. [Google Scholar] [CrossRef]

- Mollick, E. (2014). The dynamics of crowdfunding. Administrative Science Quarterly, 59(1), 1–60. [Google Scholar]

- Pesaran, M. H., & Shin, Y. (2006). Estimating long run economic relationships. Oxford University Press. [Google Scholar]

- Raj, V. (2022, August 4). Fintech has taken a hit, which means now is the time to invest and build. Forbes. Available online: https://www.forbes.com/sites/vikasraj/2022/08/04/fintech-has-taken-a-hit-which-means-now-is-the-time-to-invest-and-build/ (accessed on 14 January 2025).

- Reuters. (2023, March 22). U.S. federal reserve raises rates for first time since 2018 to fight inflation. Available online: https://www.reuters.com/markets/us/least-two-more-fed-rate-hikes-no-cut-this-year-say-economists-2023-02-14/ (accessed on 14 January 2025).

- Torkanovskiy, E., & Voinov, A. (2022). COVID-19 for crowdfunding: Catalyst or deterrent? Evidence from Russia. Indonesian Capital Market Review, 14(2), 103–120. [Google Scholar] [CrossRef]

- United States Department of Agriculture. (2023). Grain market report. United States Department of Agriculture. Available online: https://downloads.usda.library.cornell.edu/usda-esmis/files/zs25x844t/pc28cb940/wd377q597/grain.pdf (accessed on 14 January 2025).

- Venkataramakrishnan, S. (2022, August 22). Fintech’s double-edged sword and the cost of living crisis. Financial Times. Available online: https://www.ft.com/content/34c51863-9845-4189-a20b-46382f438e80 (accessed on 14 January 2025).

- World Bank. (2023, April 6). Commodity markets price update (Report). World Bank. Available online: https://www.worldbank.org/en/research/commodity-markets (accessed on 14 January 2025).

| Variable | Description | Source |

|---|---|---|

| GOLD | Handy–Harman gold price index | Refinitiv |

| OILW | WTI Cushing crude oil price (USD/BBL) | Refinitiv |

| BITC | USD to Bitcoin crypto exchange rate | Refinitiv |

| UEUS | US economic policy uncertainty index | Refinitiv |

| EQSP | S&P 500 composite equity index | Refinitiv |

| USDX | US dollar trade-weighted index | Refinitiv |

| IN2Y | Market yield of US Treasury Securities (2 years) | USDT |

| CINX | Crowdfunding index (based on 5 stocks) | User created |

| Variable | GOLD | OILW | BITC | UEUS | EQSP | USDX | CINX | IN2Y |

|---|---|---|---|---|---|---|---|---|

| Mean | 0.01 | 0.03 | 0.00 | −0.06 | 0.02 | 0.02 | −0.01 | 3.02 |

| Min | −4.56 | −12.78 | −23.69 | −263.51 | −4.42 | −2.10 | −19.55 | 0.13 |

| Max | 3.78 | 8.21 | 18.05 | 227.90 | 5.40 | 1.52 | 10.20 | 5.19 |

| StD | 0.84 | 2.44 | 3.74 | 59.68 | 1.09 | 0.45 | 2.74 | 1.78 |

| Skew | −0.16 | −0.58 | −0.49 | 0.07 | −0.18 | −0.33 | −0.61 | −0.53 |

| Kurt | 2.31 | 2.09 | 4.33 | 1.23 | 1.86 | 1.46 | 4.35 | −1.33 |

| Obs | 732 | 732 | 732 | 732 | 732 | 732 | 732 | 732 |

| Var | GOLD | OILW | BITC | UEUS | EQSP | USDX | CINX | IN2Y | FROM |

|---|---|---|---|---|---|---|---|---|---|

| GOLD | 9.15 | 0.35 | 0.02 | 0.01 | 0.06 | 1.61 | 0.02 | 1.28 | 3.35 |

| OILW | 0.41 | 11.50 | 0.06 | 0.00 | 0.24 | 0.21 | 0.06 | 0.02 | 1.00 |

| BITC | 0.07 | 0.05 | 9.37 | 0.02 | 1.57 | 0.61 | 0.67 | 0.14 | 3.13 |

| UEUS | 0.03 | 0.00 | 0.03 | 12.41 | 0.00 | 0.00 | 0.01 | 0.01 | 0.09 |

| EQSP | 0.03 | 0.09 | 1.37 | 0.00 | 8.23 | 1.46 | 1.28 | 0.04 | 4.27 |

| USDX | 1.30 | 0.15 | 0.51 | 0.00 | 1.48 | 7.82 | 0.12 | 1.12 | 4.68 |

| CINX | 0.09 | 0.04 | 0.69 | 0.02 | 1.59 | 0.25 | 9.78 | 0.04 | 2.72 |

| IN2Y | 1.11 | 0.05 | 0.02 | 0.01 | 0.06 | 1.69 | 0.00 | 9.55 | 2.95 |

| TO | 3.05 | 0.73 | 2.70 | 0.07 | 5.00 | 5.83 | 2.16 | 2.65 | 22.19 |

| NET | −0.30 | −0.27 | −0.43 | −0.02 | 0.73 | 1.15 | −0.56 | −0.30 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Al Shebli, S.; Aysan, A.F.; Nagayev, R. Crowdfunding Amidst FinTech Winter: Complement or Substitute? J. Risk Financial Manag. 2025, 18, 154. https://doi.org/10.3390/jrfm18030154

Al Shebli S, Aysan AF, Nagayev R. Crowdfunding Amidst FinTech Winter: Complement or Substitute? Journal of Risk and Financial Management. 2025; 18(3):154. https://doi.org/10.3390/jrfm18030154

Chicago/Turabian StyleAl Shebli, Shadi, Ahmet Faruk Aysan, and Ruslan Nagayev. 2025. "Crowdfunding Amidst FinTech Winter: Complement or Substitute?" Journal of Risk and Financial Management 18, no. 3: 154. https://doi.org/10.3390/jrfm18030154

APA StyleAl Shebli, S., Aysan, A. F., & Nagayev, R. (2025). Crowdfunding Amidst FinTech Winter: Complement or Substitute? Journal of Risk and Financial Management, 18(3), 154. https://doi.org/10.3390/jrfm18030154

_Zheng.png)