1. Introduction

With the evolution of modern financial markets, many classic financial theories have struggled to fully explain the role of behavioural finance in stock market price behaviour (

Subrahmanyam, 2008;

Ung et al., 2023;

Mandala et al., 2023). Traditional models often assume rational investors and efficient markets; however, empirical evidence suggests that investor sentiment, as captured by Business Confidence Index (BCI), plays a crucial role in influencing stock returns and their volatility (

Atukeren et al., 2013). Understanding these behavioural dynamics is essential in addressing market inefficiencies and predicting return variations across different market conditions (

Kahneman & Tversky, 1979).

Behavioural finance theories emphasize the psychological and emotional factors that drive investor decision-making, leading to deviations from traditional asset pricing models. The Business Confidence Index (BCI) serves as a proxy for investor sentiment (

Loang, 2022), reflecting expectations about economic conditions, which in turn influence stock market behaviour. A positive BCI suggests optimism (

Chipeta & Dickason, 2021), leading to increased investment activities and potentially higher stock returns, while a declining BCI may signal pessimism (

Hölttä, 2023), causing reduced investment and increased volatility. This linkage is particularly crucial in financial markets where sentiment-driven behaviours amplify price fluctuations beyond what fundamental indicators justify.

Empirical studies have shown that business confidence significantly influences market volatility (

An et al., 2022); for instance, periods of heightened business confidence are often associated with increased economic activity and market optimism, leading to higher investment but also greater volatility due to speculative activities. Conversely, low confidence often triggers cautious investment behaviour, reducing volatility in some cases but amplifying it in others during prolonged periods of uncertainty (

Van Eyden et al., 2023;

An et al., 2022).

Despite the growing recognition of behavioural finance, there remains a gap in the literature regarding the quantifiable relationship between BCI and stock return volatility, particularly across different market conditions. Existing studies have largely focused on developed economies, particularly on stock returns, with limited research on emerging markets where investor sentiment may play a more pronounced role due to market inefficiencies (

Gerrans et al., 2015). Additionally, prior research has not adequately explored how structural changes, such as financial crises or pandemics, moderate this relationship. This study aims to bridge this gap by employing quantile regression techniques to analyse the impact of BCI on stock return volatility across various quantiles, thus capturing heterogeneous effects across different market conditions (

Spulbar et al., 2020).

Empirical studies have shown that business confidence significantly influences market volatility (

An et al., 2022). Periods of heightened confidence are often associated with increased economic activity and market optimism, leading to greater volatility due to speculative activity. Conversely, low confidence can trigger cautious investment behaviour, reducing volatility in some cases but amplifying it during prolonged uncertainty (

Van Eyden et al., 2023). Extending this perspective,

Tsagkanos et al. (

2023) identify a sentiment-induced volatility transmission mechanism, where shifts in business confidence can generate volatility spillovers across sectors and markets. This finding is particularly relevant for structurally interconnected markets like South Africa’s, where sectoral linkages can magnify the impact of sentiment shocks.

Similarly,

Van Eyden et al. (

2023) show that investor sentiment plays a central role in the formation and persistence of both positive and negative stock market bubbles across G7 economies. Their multi-scale analysis reveals that sentiment can drive asset prices away from fundamentals for prolonged periods, thereby sustaining elevated volatility during both boom and bust phases. These insights complement the behavioural finance view by highlighting that sentiment not only affects volatility directly but also operates through transmission channels and bubble dynamics, which can be particularly pronounced in emerging markets with concentrated sectoral composition and high exposure to global capital flows, features that characterise the South African context examined in this study.

Recent research has highlighted the influence of investor sentiment on stock market behaviour, particularly in response to events that elevate collective mood. For instance, studies by

M. Abudy et al. (

2022) demonstrate that international competitions and national celebrations can generate measurable effects on market returns. In the context of the Eurovision Song Contest, a positive swing in investor sentiment is observed in the winning country, with an abnormal return of approximately 0.35% on the first trading day, which subsequently reverses. Similarly, in the lead-up to national Independence Day celebrations, countries exhibit positive abnormal returns that are also reversed in the days following the event. These findings indicate that investor sentiment is significantly shaped by collective emotions such as national pride and festive anticipation, rather than by direct economic gains. Overall, this evidence underscores the role of behavioural factors in shaping market outcomes, aligning with the broader literature on sentiment-driven financial behaviour (

M. M. Abudy et al., 2023).

Recent economic disruptions, such as the COVID-19 pandemic, have brought renewed attention to the role of investor sentiment in financial markets (

Marozva & Magwedere, 2021a). The pandemic-induced uncertainty significantly impacted investor behaviour, highlighting the limitations of traditional asset pricing models in explaining stock market volatility. Given the structural changes in global markets and the increasing influence of sentiment-driven trading, this study seeks to rekindle the debate on the role of BCI in stock return volatility. The extent to which BCI’s impact is altered by crises and market shifts remains an open question, necessitating further empirical investigation.

Stock market returns are shaped by complex interactions between economic indicators, investor sentiment, and external shocks like financial crises and pandemics (

Fama, 1970;

Shiller, 2003). In South Africa, with its distinct economic structure, these dynamics remain unpredictable (

Aron et al., 2009). This unpredictability is further exacerbated by global economic shifts, policy changes, and external shocks such as the COVID-19 pandemic. Unlike developed markets, where investor sentiment follows more structured patterns, emerging markets like South Africa exhibit greater volatility due to liquidity constraints, regulatory shifts, and macroeconomic uncertainties (

Asafo-Adjei et al., 2021;

Marozva & Magwedere, 2021b). This study examines the relationships, focusing on the financial, resources, and industrial sectors vital to the country’s economy (

Small & Hsieh, 2017). The effects of business confidence on these sectors are not uniform; financial sector stocks tend to be more reactive to sentiment changes, while resource sector stocks may exhibit delayed responses due to global commodity price dependencies. The industrial sector, on the other hand, responds to both local and international economic sentiment, making it an interesting area of study (

Ardiyono & Patunru, 2023). By considering sector-specific dynamics and structural changes, this research contributes to a deeper understanding of how sentiment-driven volatility manifests in an emerging market setting.

Niu et al. (

2023) demonstrate that investor sentiment affects Chinese industrial and financial sectors differently. Our findings echo these patterns in an African emerging market context, where we observe attenuated BCI effects in the industrial sector and heightened sensitivity in financial and resource sectors, as seen in both Chinese and developed markets.

The main findings suggest that BCI has a significant positive effect on stock return volatility across different quantiles. This implies that higher business confidence is associated with increased market fluctuations, likely due to heightened investor activity and market expectations.

However, the effect varies across quantiles, indicating that the impact of BCI is not uniform as it is stronger at certain levels of volatility. This suggests that during periods of high uncertainty or market stress, the influence of business confidence on stock volatility may be more pronounced. Additionally, the findings reinforce the behavioural finance perspective, where investor sentiment and business expectations contribute to stock market dynamics beyond traditional risk-return frameworks.

This study utilised OLS, quantile regression, and GARCH (1,1) models to analyse the impact of consumer and business confidence indices on stock returns and volatility across different quantiles. Quantile regression, a robust alternative to OLS, captures relationships varying across the dependent variable’s distribution, highlighting market response heterogeneity. GARCH (1,1) accounted for the persistent nature of stock return volatility (

Koenker & Hallock, 2001).

This study contributes to the growing body of behavioural finance literature by providing empirical evidence on the dynamic relationship between BCI and stock return volatility. By utilising quantile regression, it offers a more nuanced understanding of how sentiment-driven market behaviours vary across different levels of volatility. Furthermore, this study extends the existing research to emerging market economies, offering valuable insights for policymakers, investors, and financial analysts in better predicting market movements and formulating risk management strategies.

2. Materials and Methods

This analysis focuses on key sectors within the Johannesburg Stock Exchange (JSE) South Africa, including the financial, industrial, and resources sectors. This study covers a period marked by significant economic events, such as the Global Financial Crisis (2007–2009) and the COVID-19 pandemic (2020–2022). The Data frequency is monthly. Data for the BCI is sourced from reliable institutional repositories, while stock return volatility is computed using historical price data from JSE indices.

Monthly stock return volatility was calculated as the standard deviation of daily returns within each month, following prior studies (e.g.,

Atukeren et al., 2013;

Yang et al., 2017). This measure was chosen to align with the monthly frequency of BCI data, ensuring consistent temporal matching. While GARCH-based conditional variance is also modelled, using standard deviation as a direct observable measure allows for sectoral comparison across quantiles. This direct, observable measure is transparent, easy to replicate, and facilitates sectoral comparability without the parametric assumptions of model-based approaches. Nonetheless, relative to realized volatility from high-frequency data or GARCH-based conditional variance, it may smooth over short-term volatility shifts, exhibit greater sensitivity to extreme daily returns, and overlook persistence and clustering effects. To address these limitations, the analysis incorporates complementary GARCH (1,1) estimates, enabling the capture of both unconditional volatility patterns and the time-varying dynamics of market risk. volatility dynamics refers to the persistence, clustering, and time-varying nature of volatility captured by the GARCH (1,1) framework. The definition now appears at the first use of the term.

Table 1 provides the definition of variables and data sources.

2.1. Quantile Regression

This paper employs a combination of econometric models to analyse the relationship between BCI and share return volatility. Quantile regression is employed to capture heterogeneous effects of BCI across different points of the volatility distribution, which OLS cannot fully detect. This choice is theoretically motivated by behavioural finance literature, which suggests that investor sentiment can have asymmetric effects in tranquil versus turbulent market regimes. The selection of the 0.25, 0.50, and 0.75 quantiles was made to represent low-volatility (calm), median-volatility (normal), and high-volatility (stress) market conditions, consistent with prior studies. Unlike traditional regression techniques, quantile regression allows for a more nuanced understanding of the relationship by analysing it across the entire distribution of the dependent variable. Even when point estimates appear similar, quantile regression provides distributional insights and robustness against heteroskedasticity that OLS cannot, making it valuable in volatility research.

The quantile regression was employed for data analysis, consistent with the approach adopted by

Tuyon and Ahmed (

2016). The reason for the adaptation and addition of variables was to include fundamental behavioural factors to determine their effect on stock market returns and stock market returns volatility. Behavioural theory postulates that not all investors are rational and that financial phenomena can be explained with greater clarity if the models that are used are not based on the assumption that all market participants are fully rational (

Barberis & Thaler, 2003). Therefore, the extended model for the stock market return is given by:

where:

= Lagged stock index i return

The results are examined in a non-crisis market state and a state of crisis to deepen our understanding of market behaviour (

Tuyon & Ahmad, 2016). The foregoing models were contrasted to corresponding results from the OLS approach by using quantile plots generated by a statistical software package. The following equations are used to test the relationship between behavioural proxies and stock return volatility.

Using standard deviation as the measure of volatility, the extended model for stock market return volatility were put into perspective as follows:

2.2. Generalised Autoregressive Conditional Heteroscedasticity (GARCH) (1,1)

GARCH (1,1) was chosen as a baseline due to its widespread use and ability to capture volatility clustering. The GARCH (1,1) Model addresses the persistent nature of stock volatility, the GARCH model estimates the impact of BCI while accounting for volatility clustering a common feature in financial data. (

Koenker & Hallock, 2001). GARCH (1,1) Model is used to calculate the error distribution in stock returns and assists in finding volatility in stock prices. It is a good tool to use in the presence of volatility clustering and heteroskedastic data (

Naik et al., 2020). GARCH (1,1) differs from quantile regression as it is used to model the variance of a time series, whereas quantile regression estimates conditional quantiles of a response variable. The GARCH (1,1) Model was previously used to study volatility on the stock market by

Sekati et al. (

2020).

The foregoing Equations) were further adapted, as GARCH (1,1) models are widely used for modelling processes with time-varying volatility. These include financial time series, which can be particularly heavy tailed (

Preminger & Storti, 2017). The Standard Garch (1,1) model is formulated as (

Nelson, 1991):

where:

the conditional variance depends both on the past values of the shocks captured by the lagged squared error term and the past values of itself. ω is the constant α and β are the coefficients of the lagged square error terms

and

, respectively. The GARCH (1,1), assists to capture volatility clustering in time series data.

Quantile regression was applied to model stock return volatility, proxied by the standard deviation of returns, across the 25th, 50th, and 75th quantiles. This approach was chosen to examine the heterogeneous impact of BCI under varying market conditions—calm (Q0.25), normal (Q0.50), and volatile (Q0.75) regimes. Temporal dependence was addressed by including lagged dependent variables (e.g., LSD_FS, LSD_IND, LSD_RES) and controlling for autocorrelation using Durbin-Watson statistics. The quantile regression was implemented independently from the GARCH framework, serving as a distributional sensitivity check to complement the time-series volatility modelling provided by the GARCH(1,1).

The same equation is used to explain market movements in the All Share Index and sectorial industries including the financial sector, industrial sector, and resources sector in South Africa. As alluded to earlier, the efficiency of the All Share Index is dependent on the industrial, financial and resources sector it also stated that these are the three prominent sectors on the JSE (

Small & Hsieh, 2017).

3. Results

3.1. Unit Root Tests

The test for stationarity is an important pre-testing diagnostic for time series analysis. Therefore, in this study the Augmented Dickey-Fuller Schwarz Info Criterion (ADF) and the Phillips and Perron (PP) are employed test to confirm the order of integration of the data to test the hypothesis, that is the time series are stationary. The tests were conducted using the Schwarz info criterion automatic lag length selection, the Bartlett kernel selection criteria, and the Newey-West automatic bandwidth selection. The unit root test output results are presented in

Table 2. The results show that in at least one column the

p-value is less than 5% meaning that all the variables are stationary at level. The test for stationarity was carried out to eliminate any variable that is not stationary at level as ordinary least square models that potentially contain non-stationary variables can result in a spurious regression, therefore yielding statistically significant relationships where there are none.

This section presents a comprehensive analysis of the relationship between the Business Confidence Index (BCI) and share return volatility across key sectors of the South African stock market. The results are organised to first offer a descriptive overview of the data, including key summary statistics and correlation patterns, before proceeding to more advanced econometric analyses. Ordinary Least Squares (OLS), quantile regression, and GARCH (1,1) models are employed to explore both average effects and variations across the distribution of stock returns. By focusing on sector-specific dynamics, namely the resources, financial, and industrial sectors. This study captures the heterogeneous impact of business sentiment under different market conditions, including periods of financial crises and pandemic-induced uncertainty. The findings provide robust evidence supporting the behavioural finance perspective, demonstrating that shifts in business confidence play a significant role in driving stock return behaviour and volatility in an emerging market context. For brevity the descriptive statistics and correlations are presented in

Appendix A and

Appendix B.

Appendix A reports the descriptive statistics, highlighting pronounced sectoral differences. Resources exhibit the highest mean volatility, consistent with commodity price sensitivity, while Industrials record the lowest, reflecting more stable earnings. The BCI shows moderate dispersion, indicative of sentiment cycles without extreme swings. The correlation matrix in

Appendix B reveals a positive relationship between BCI and sectoral returns, suggesting sentiment-driven performance effects, and a negative association between volatility and returns, consistent with the risk–return trade-off. Crisis dummies correlate positively with volatility, reflecting heightened market stress during the GFC and COVID-19 periods.

Quantile regressions and GARCH models are estimated separately for pre-GFC (2002–2006), GFC (2007–2009), post-GFC (2010–2019), and COVID-19 (2020–2022). The results indicate stronger BCI effects during periods of high uncertainty (GFC and COVID-19), confirming time-varying sensitivity. Targeted interventions may be warranted in sectors such as resources, where sentiment surges tend to amplify volatility, versus the financial sector, where positive sentiment appears to have a stabilising effect. Quantile regression was applied to model stock return volatility, proxied by the standard deviation of returns, across the 25th, 50th, and 75th quantiles. This approach was chosen to examine the heterogeneous impact of BCI under varying market conditions, calm (Q0.25), normal (Q0.50), and volatile (Q0.75) regimes. Temporal dependence was accounted for through the inclusion of lagged dependent variables, and the models were estimated using robust standard errors to ensure reliable inference.

The asymmetric effects observed in the quantile regression results resonate strongly with behavioural finance mechanisms. In the financial sector, the heightened impact of BCI at upper quantiles can be interpreted through the lens of overconfidence theory (

De Bondt & Thaler, 1985), where investors, buoyed by strong sentiment, may underestimate risks and engage in excessive trading, thereby amplifying volatility. In contrast, the muted effect in median or lower quantiles suggests that during calmer periods, sentiment-driven trading is less dominant, and fundamentals play a greater role.

In the resources sector, the consistently positive and significant BCI coefficients across all quantiles are consistent with herding behaviour (

Banerjee, 1992), where investors collectively follow market trends during both booms and downturns. This behaviour may be reinforced by the sector’s global commodity price exposure, which provides common focal points for investor expectations.

The quantile-specific variations have stronger effects in high-volatility regimes thus, the results align with prospect theory’s loss aversion (

Kahneman & Tversky, 1979). Investors tend to react more sharply to potential gains in euphoric markets than to equivalent losses in tranquil periods, which helps explain why BCI shocks in upper quantiles drive disproportionate volatility surges. This behavioural asymmetry offers a richer explanation for the empirical patterns than traditional risk-return frameworks.

3.2. Analysis of the Impact of BCI on JSE Financial Services Index Volatility

To analyse the impact of the Business Confidence Index (BCI) on the volatility of JSE Financial Services Index, we will explore the relationships between these two metrics. The Business Confidence Index (BCI) measures the level of optimism or pessimism among business leaders regarding economic conditions, serving as a critical indicator of business sentiment and investment intentions. On the other hand, the JSE Financial Services Index tracks the performance of the financial services sector on the Johannesburg Stock Exchange, which includes banking, insurance, and other financial institutions.

The Wald test yielded a t-statistic of 2.67 (

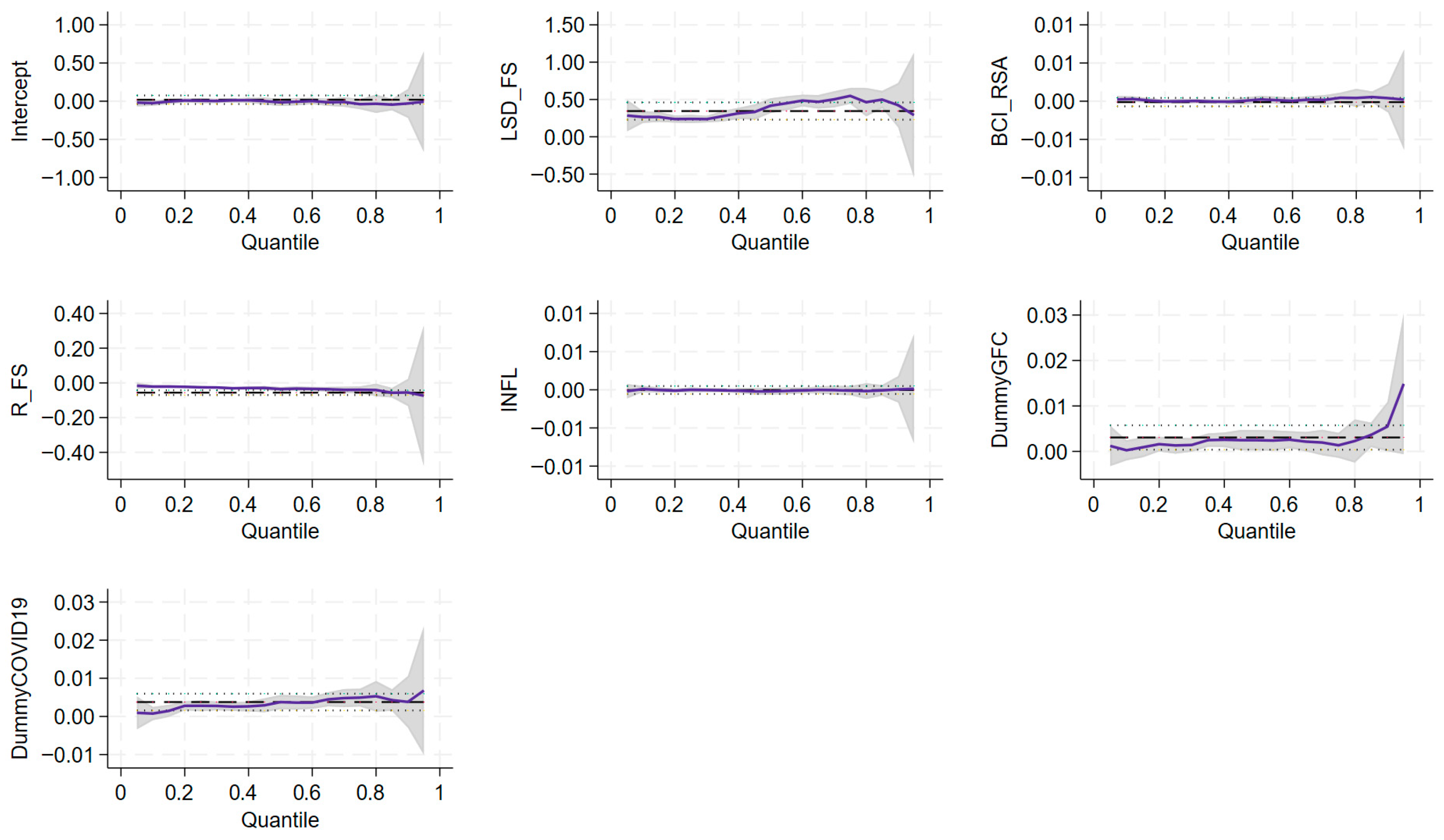

p-value = 0.031), indicating that the BCI coefficients were heterogeneous across quantiles. The results from

Table 3 demonstrates that Business Confidence Index (BCI) has a significant positive influence on financial index stock market volatility. While the OLS estimate shows a modest effect (0.0121), quantile regression reveals interesting relationships: the impact weakens in middle quantiles but intensifies significantly at the 0.25 quantile (0.0563) and the 0.75 quantile (0.0453). This pattern suggests that business confidence exerts greater influence on volatility during high-stress or highly optimistic periods. The findings align with

Nowzohour and Stracca (

2020) and

Khan and Upadhayaya (

2020), who emphasize BCI’s predictive power for market dynamics during economic upswings. Conversely, the reduced effect during middle quantiles and the potential insignificance in crisis periods, as highlighted by

Loang (

2022), underscore that BCI’s role varies with macroeconomic context. Policymakers should thus treat BCI as a valuable early-warning tool, using it to guide countercyclical interventions, particularly when confidence shifts abruptly and could amplify market volatility.

According to

Table 3, the JSE Financial Services Index’s return volatility displays a clear quantile-dependent persistence as the coefficient on lagged volatility rises from the lower quantiles (0.10: 0.265; 0.25: 0.239) to the median and upper quantiles (0.50: 0.417; 0.75: 0.549), before falling at the extreme upper tail (0.90: 0.425). These results suggest that volatility clustering is not uniform across the distribution of market states but intensifies in moderate-to-high volatility regimes. Thus, past volatility is a stronger predictor of future volatility when the market is experiencing larger, but not necessarily extreme, shocks (see for example

Muguto & Muzindutsi, 2022).

The JSE Financial Services Index’s return volatility was found to be negatively and significantly related to the index’s own return across all quantiles. The coefficient strengthened from the lower to upper tails (0.10: −0.0212; 0.25: −0.0255; 0.50: −0.0357; 0.75: −0.0395; 0.90: −0.0549). This inverse relationship is consistent with the leverage effect, where positive returns are associated with lower future volatility as improved market confidence and reduced uncertainty dampen risk (

Christie, 1982). The increasing magnitude of the coefficients suggests that the relationship is more pronounced during periods of heightened volatility (

Gupta et al., 2023;

Tabash et al., 2024).

The COVID-19 dummy variable exhibited a positive and significant relationship with return volatility across most quantiles. The strong effects were observed in the 0.25 quantile (0.00280), 0.5 quantile (0.00376), and 0.75 quantile (0.00494). This indicates that the pandemic period was associated with heightened volatility in the JSE Financial Services Index, reflecting elevated market uncertainty, abrupt changes in investor sentiment, and increased risk aversion during the crisis.

Figure 1 illustrates The stronger effects in the upper quantiles suggest that COVID-19 amplified volatility particularly during high-risk market states, consistent with global evidence showing that pandemic-related shocks significantly increased financial market turbulence, especially in emerging markets (

Rakshit & Neog, 2022).

The Global Financial Crisis dummy variable exhibited a positive and significant relationship with return volatility only at the 0.50 quantile, suggesting that the crisis period was associated with heightened volatility primarily under median market conditions rather than at the extremes.

3.3. Analysis of the Impact of BCI on JSE Industrial Index

To analyse the impact of the Business Confidence Index on the JSE Industrial Index, we will examine the relationship and possible causal links between these two metrics. The Business Confidence Index (BCI) reflects the level of optimism or pessimism among business concerning economic conditions, serving as an important gauge of business sentiment and investment plans. In contrast, the JSE Industrial Index measures the performance of the industrial sector on the Johannesburg Stock Exchange, encompassing industries such as manufacturing, construction, and other industrial activities.

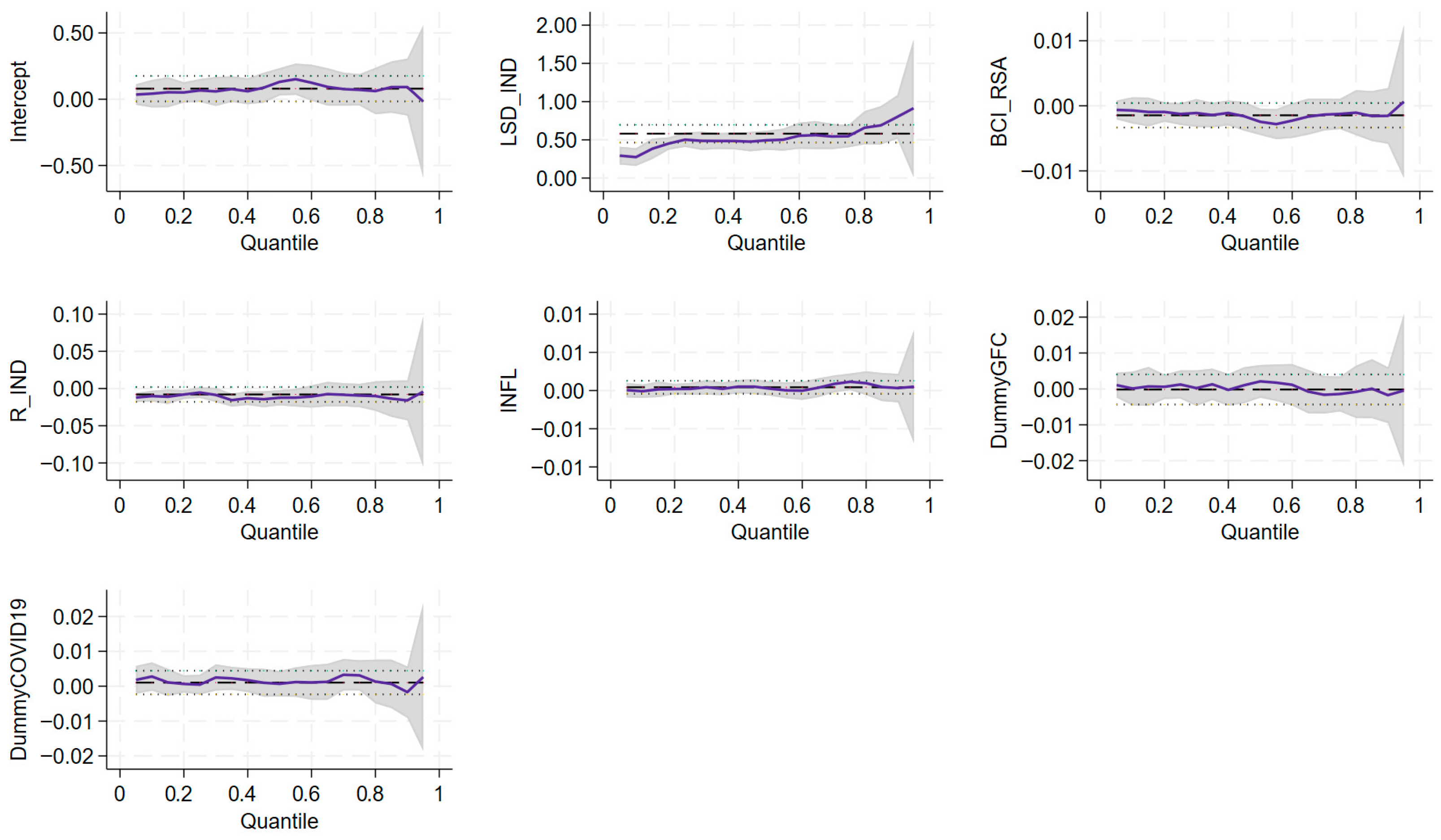

Table 4 illustrates The Wald test yielded a t-statistic of 2.53 (

p-value = 0.0416), indicating that the BCI coefficients were heterogeneous across quantiles. The Business Confidence Index (BCI) demonstrates a quantile-dependent relationship with stock volatility in the industrial sector. While it is statistically significant in the median quantile (0.5), it is insignificant in all the other quantiles, suggesting that BCI influences industrial index stock volatility primarily during normal market conditions rather than during extreme downturns or booms. This finding aligns with

Nowzohour and Stracca (

2020), who argue that increasing business confidence supports stock market stability by encouraging investment and optimism. However, its diminished significance in more volatile conditions supports the critique by

Montes and Nogueira (

2022), who note that in times of instability, external shocks and policy responses can overshadow sentiment indicators like BCI. These results imply that while business confidence plays a role in stabilizing markets during average conditions, its effectiveness is limited during market extremes. Therefore, policymakers should pair confidence-building measures with structural reforms and crisis management tools to ensure stability across all market regimes.

The return volatility of the JSE Industrial Index exhibits clear quantile-dependent persistence, as indicated by the increasing coefficient of lagged volatility from the lower to upper quantiles (0.10: 0.338; 0.25: 0.538; 0.50: 0.583; 0.75: 0.470; 0.90: 0.735). Findings displayed in

Figure 2 ngs suggest that volatility clustering is not uniform across market conditions but becomes more pronounced in moderate-to-high volatility regimes. Consequently, past volatility serves as a stronger predictor of future volatility when the market experiences larger, albeit not extreme, shocks.

Moreover, the return volatility of the JSE Industrial Index is found to be negatively and significantly related to its own return across the first four quantiles. The strength of this inverse relationship increases from the lower to the upper quantiles (0.10: −0.0350; 0.25: −0.0457; 0.50: −0.0447; 0.75: −0.0516). This pattern is consistent with the leverage effect, whereby positive returns are associated with reduced future volatility due to improved market confidence and diminished uncertainty (

Christie, 1982). The increasing magnitude of the coefficients further implies that this relationship is more pronounced during periods of heightened volatility.

3.4. Analysis of the Impact of BCI on JSE Resource Index Volatility

To analyse the impact of the Business Confidence Index on the JSE Resource Index volatility, the exploration of the relationship between these two indicators is conducted. The JSE Resource Index tracks the performance of resource-based sectors on the Johannesburg Stock Exchange, including industries such as mining, energy, and other natural resources. By examining these metrics, we aim to understand how shifts in business confidence might influence the stock return volatility of the resource sector in South Africa.

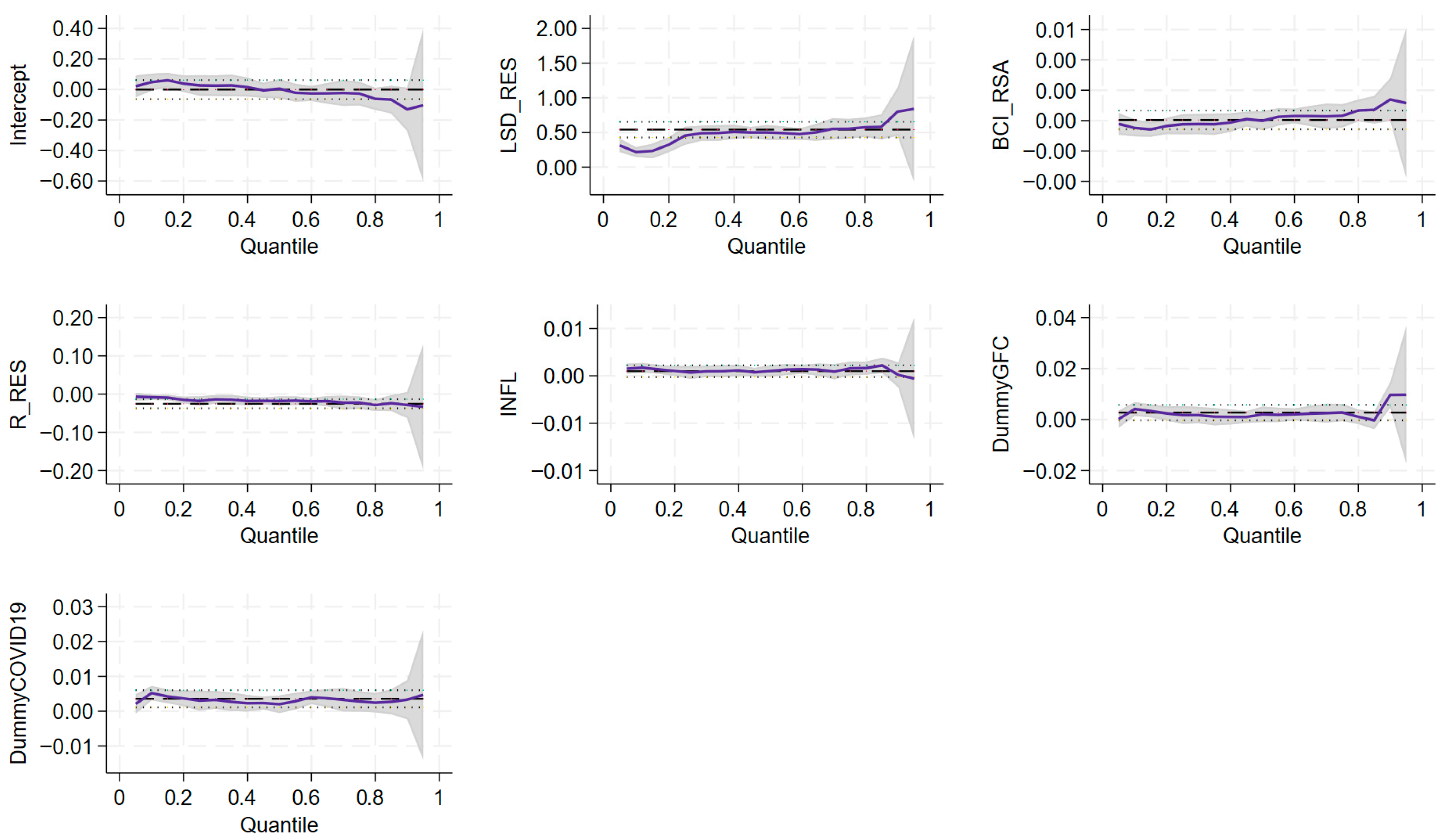

The Wald test yielded a t-statistic of 2.83 (

p-value = 0.0259), indicating that the BCI coefficients exhibit heterogeneity across quantiles. The Business Confidence Index (BCI) in South Africa exhibits a consistently positive and significant effect on stock volatility in the resources sector across all quantiles and the OLS model. This indicates that higher levels of business confidence are associated with increased volatility, likely due to heightened market activity and risk-taking behaviour during optimistic periods. The findings are in line with

Shah et al. (

2023), who highlight the role of confidence-driven investment surges in raising market volatility. However,

Hölttä (

2023) cautions that in periods of extreme sentiment, business confidence may disconnect from market fundamentals, potentially leading to unpredictable market dynamics. This suggests that while BCI is a reliable predictor of volatility during normal conditions, its influence may become distorted in speculative or irrational environments. Policymakers should closely monitor business sentiment in the resources sector and consider moderating excessive optimism or pessimism through timely fiscal or monetary interventions to reduce unnecessary volatility and maintain market stability.

The return volatility of the JSE Resource Index exhibits clear quantile-dependent persistence, as evidenced by the increasing coefficients of lagged volatility across the distribution (0.10: 0.216; 0.25: 0.454; 0.50: 0.499; 0.75: 0.552; 0.90: 0.800) shown in

Table 5. These results suggest that volatility clustering is not homogeneous across different market states but becomes more pronounced in moderate-to-high volatility regimes. Accordingly, past volatility emerges as a stronger predictor of future volatility when the market experiences larger, though not necessarily extreme, shocks.

Furthermore, the return volatility of the JSE Resource Index is negatively and significantly associated with its own return across the first three quantiles. The magnitude of this inverse relationship increases from the lower to the upper quantiles (0.25: −0.0179; 0.50: −0.0180; 0.75: −0.0223). This finding is consistent with the leverage effect, which posits that positive returns tend to reduce future volatility as improved market confidence and lower uncertainty mitigate risk. The growing strength of this relationship across quantiles indicates that the leverage effect becomes more pronounced during periods of elevated volatility.

The COVID-19 dummy variable exhibits a positive and statistically significant relationship with return volatility at the lower quantiles, specifically at the 0.10 (0.00522) and 0.25 (0.00305) quantiles. Similarly, the Global Financial Crisis (GFC) dummy variable shows a positive and significant association with volatility at the 0.10 quantile. These results indicate that crisis periods were linked to heightened volatility in the JSE Resource Index, driven by increased market uncertainty, abrupt shifts in investor sentiment, and greater risk aversion. The stronger effects observed in

Figure 3 at the lower quantiles suggest that crisis episodes intensified volatility particularly during high-risk market states, consistent with broader evidence that crisis-induced shocks significantly amplify financial market turbulence.

3.5. Analysis of the Impact of BCI on JSE All Share Index

To assess the impact of the Business Confidence Index (BCI) on the JSE All Share Index volatility, the relationship between these two metrics was explored. The JSE All Share Index, on the other hand, captures the overall performance of all companies listed on the Johannesburg Stock Exchange, offering a comprehensive view of the market. By examining these indicators, we aim to determine how fluctuations in business confidence might affect the broader performance of the South African stock market.

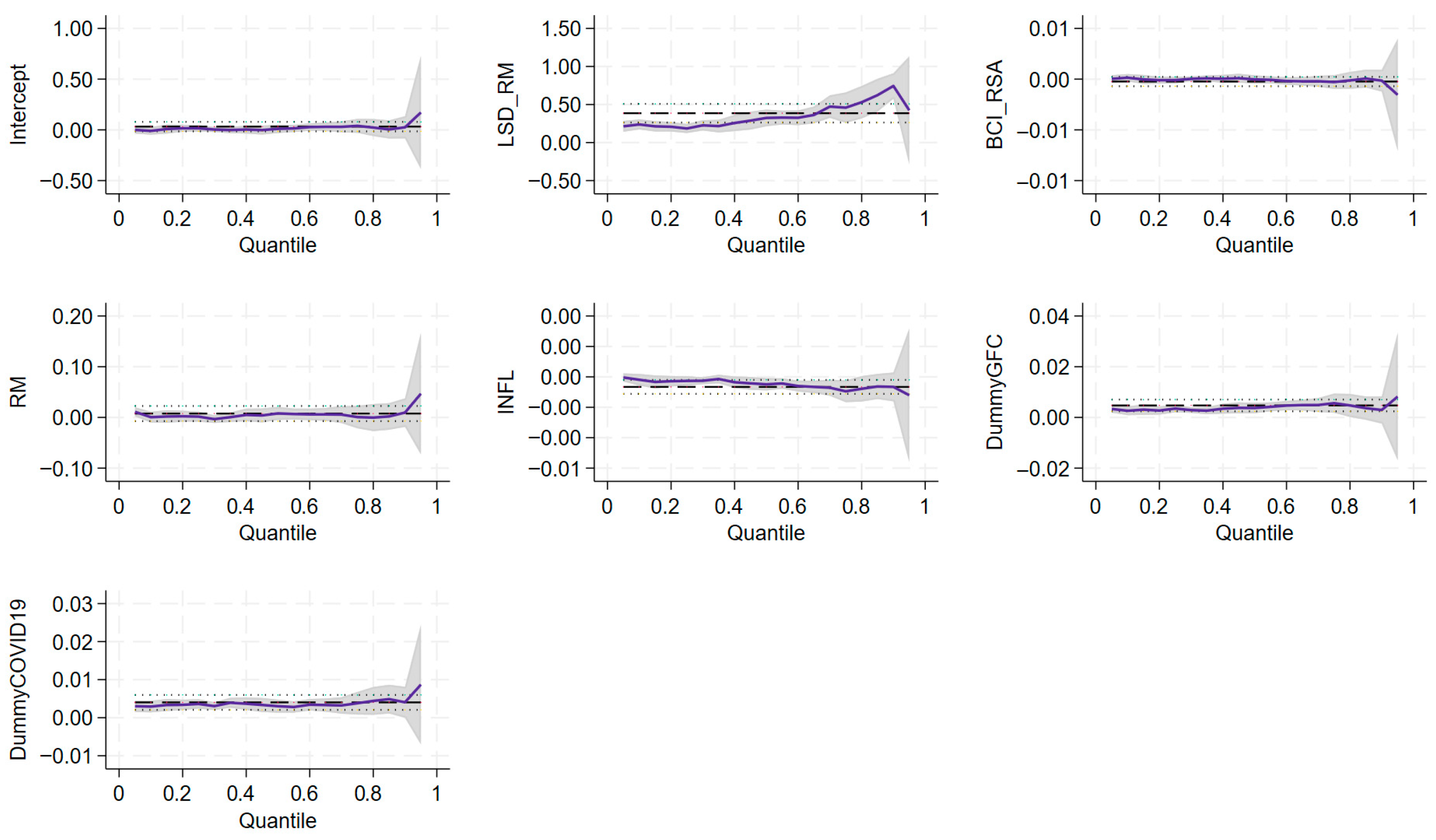

Table 6 illustrates that The Wald test yielded a t-statistic of 2.64 (

p-value = 0.035), indicating that the BCI coefficients were heterogeneous across quantiles. Thus, the Business Confidence Index (BCI_RSA) demonstrates a positive and statistically significant effect on volatility, particularly in the Lower and higher quantiles (e.g., 0.00942 at Q0.25 and 0.0286 at Q0.75). This implies that business sentiments have a stronger impact during periods of higher market returns and volatility. The result aligns with

Nowzohour and Stracca (

2020), who show that rising business confidence is often associated with increased investment activity and market performance, albeit accompanied by higher volatility due to elevated risk-taking. Similarly,

PH and Rishad (

2020) underscore the critical role of business and investor sentiment in driving volatility in emerging markets. However,

Teresiene et al. (

2021) caution that in times of heightened uncertainty or crisis, business confidence may lose its predictive power due to overriding exogenous shocks such as political instability or global downturns. Given its significant role in higher quantiles, policymakers should design initiatives to enhance business confidence during economic expansions, such as tax incentives, regulatory simplification, and industry-specific support measures. In times of uncertainty, open communication between government and business stakeholders can help anchor expectations and mitigate unwarranted volatility.

The return volatility of the JSE All Share Index exhibits pronounced quantile-dependent persistence, as indicated by the progressively increasing coefficients of lagged volatility across the distribution (0.10: 0.238; 0.25: 0.185; 0.50: 0.324; 0.75: 0.458; 0.90: 0.744) as shown in

Figure 4. These findings suggest that volatility clustering is not uniform across different market conditions but becomes more pronounced in moderate-to-high volatility regimes. Accordingly, past volatility constitutes a stronger predictor of future volatility when the market experiences larger extreme shocks.

The return volatility of the JSE All Share Index is negatively and significantly associated with inflation at the 0.50 (−0.000488) and 0.75 (−0.000948) quantiles. This inverse relationship suggests that periods of higher inflation are linked to slightly lower future volatility in the broader market, possibly reflecting market adaptation to anticipated price changes or a stabilizing effect of inflation expectations on investor behaviour. The effect is more pronounced in higher quantiles, indicating that during moderate-to-high volatility periods, inflation may act as a dampening factor on market fluctuations.

The COVID-19 dummy variable exhibits a positive and statistically significant relationship with return volatility across multiple quantiles (0.10: 0.00293; 0.25: 0.00362; 0.50: 0.00303; 0.75: 0.00381), while the Global Financial Crisis (GFC) dummy shows a similar positive association (0.10: 0.00263; 0.25: 0.00353; 0.50: 0.00391; 0.75: 0.00563). These results indicate that crisis periods were associated with elevated volatility in the JSE All Share Index, reflecting heightened market uncertainty, shifts in investor sentiment, and increased risk aversion.

Figure 4 illustrates that the persistence of these effects across multiple quantiles suggests that crises amplified volatility not only in extreme market states but also under more moderate conditions, highlighting the broad-reaching impact of systemic shocks on overall market stability.

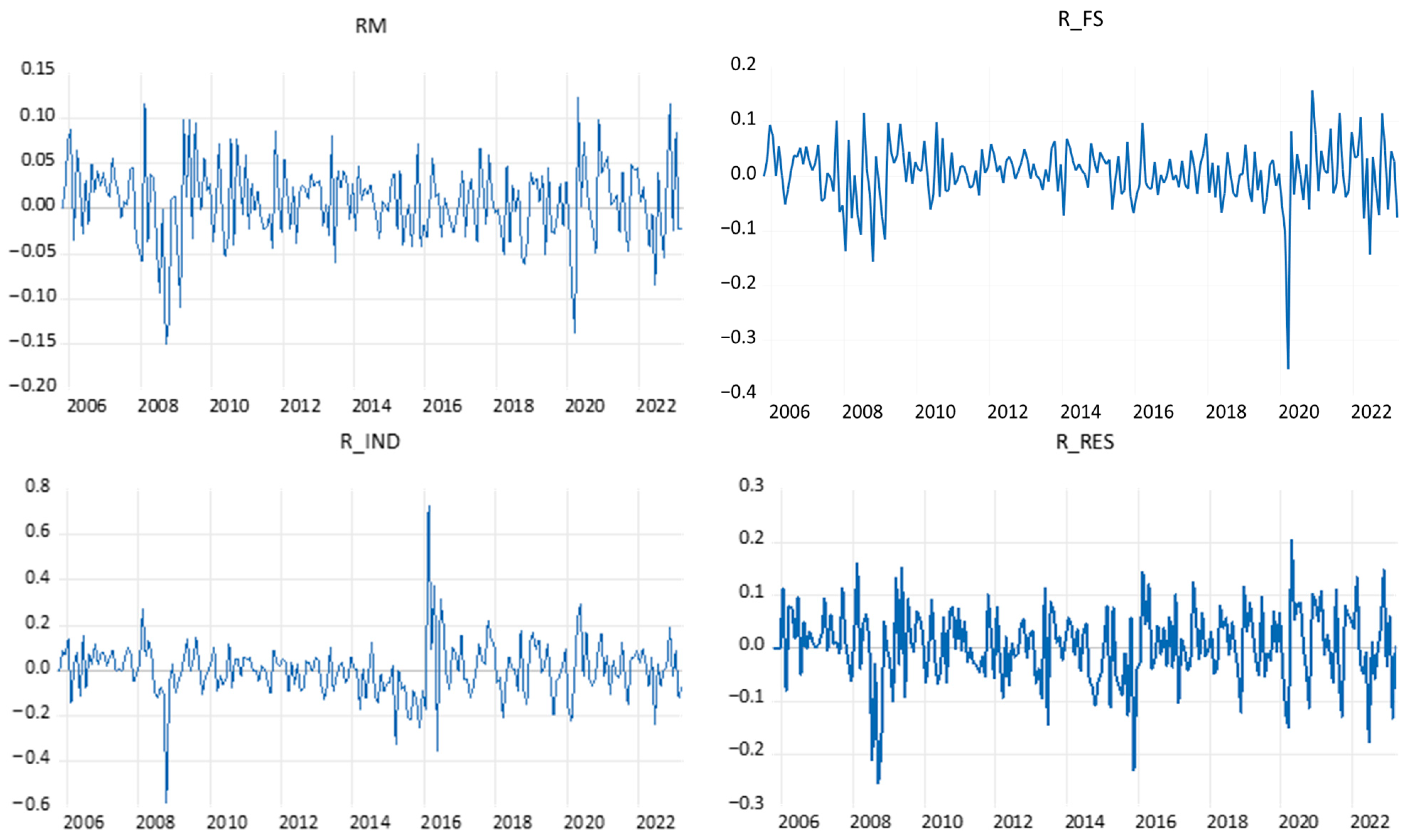

3.6. Indices Volatility Graphs GARCH

Figure 5 illustrates that for all indices, the return volatility is persistent. Implying that periods of high stock return volatility are followed by periods of low stock return volatility, and periods of low stock return volatility are followed by periods of high stock return volatility. Therefore, the GARCH (1,1) model was adopted to examine the relationship between stock volatility and behavioural sentiments.

3.7. GARCH (1,1) Model Results and Analysis

The optimal lag length for the returns were determined using the Schwarz Information Criterion (SIC), which was equal to 1. Then the presence of autoregressive conditional heteroskedasticity (ARCH) in the return variables was examined, and both the F-statistic and the Observations × R-squared statistic were found to be statistically significant, and the results are presented in

Table 7. This result confirmed the existence of ARCH effects. Consequently, the null hypothesis of homoskedastic residuals was rejected, indicating that the residuals of the mean return equation exhibit heteroskedasticity. This finding justifies the application of the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model.

Furthermore, the GARCH model was evaluated alongside various TGARCH specifications, with model fit assessed using the Akaike Information Criterion (AIC) and the Schwarz Information Criterion (SIC). The AIC and SIC results indicate that the GARCH (1,1) with a constant provides the best fit for the Financial Services Index, the GARCH (1,1) with a constant and ARMA (1,1) model is superior for the Industrial Index, and the TGARCH (1,1) with a constant yields the best fit for the JSE All Share and Resources Indices. These results are presented in

Table 8.

Before estimating the FGARCH model the volatility dynamics of the return series were assessed for the presence of long memory. While the autocorrelation function of squared returns decayed slowly, suggesting potential persistence, the Geweke Porter Hudak test yielded fractional differencing parameters that were not statistically significant for all the four return series. This indicates that there is no strong evidence of long memory in volatility. Consequently, although standard GARCH models assume short memory, the coefficients of an FGARCH specification were presented in

Table 9 for robustness and to allow for a potentially more flexible volatility structure.

Table 8 presents coefficients from ARCH and GARCH tests across four South African stock indices, including the JSE ASLI, financial services, industrial, and resources indices. The significant GARCH coefficients (β) across all distribution models highlight the persistence of volatility, indicating that the previous month volatility continues to affect current stock return variability. Similarly, the ARCH coefficients (α) are also significant, suggesting that past residuals in stock returns contribute to present volatility. The coefficient φ, representing the relationship between Business Confidence Index (BCI) and index returns in the mean equation, is positive and statistically significant, implying that higher business confidence corresponds with higher returns volatility, particularly for the JSE ASLI. These findings align with the empirical work of

Chen et al. (

1986), and

Van Eyden et al. (

2023), who underscore the influence of macroeconomic sentiment on stock return behaviour.

The GARCH (1,1) analysis further reveals sectoral heterogeneity in the effect of BCI on volatility. In the financial sector, elevated business confidence is associated with a significant reduction in volatility, consistent with the notion that positive sentiment can reduce uncertainty and market risk (

Nowzohour & Stracca, 2020). Conversely, the industrial sector and the JSE All-Share Index display a positive and significant impact of the Business Confidence Index (BCI) on stock return volatility. Thus, results reveal that confidence increases trading activity, risk-taking, and speculative behaviour among investors, thus amplifying price swings and volatility. This is contrary to behavioural finance theory like the herding behaviour which is more associated with optimism as the market volatility is positively related to optimism (

Akin & Akin, 2024). However, some empirical studies have found a strong positive relationship between sentiment or confidence indices and return volatility as

Lakshmi et al. (

2024) found that overconfidence and herding behaviour significantly amplify market volatility

Daniel and Hirshleifer (

2015) in analysing investor sentiment and stock market volatility found that investor sentiment is significantly positively related to volatility.

In contrast, some studies find weak or no relationship; for instance, The relationship between business confidence surveys and stock market performance by

Belke and Beckmann (

2015) found that in several developed countries the link between business confidence and stock returns or volatility is either indirect or non-significant in the short term. These findings underscore the importance of sector-specific dynamics and global shocks in shaping volatility patterns within emerging markets.

The BCI variable enters the mean equation of the GARCH (1,1) model, as a regressor influencing expected returns, while volatility dynamics are captured by the standard ARCH and GARCH terms. volatility persistence was captured via α (ARCH) and β (GARCH) terms. Additionally, dummy variables for the Global Financial Crisis and COVID-19 periods were included to control for sub-period effects. Fully separate GARCH models for each sub-period were not conducted, we acknowledge this limitation and propose a robust check for future work.

4. Conclusions

The empirical analysis of the relationship between the Business Confidence Index (BCI) and the volatility of stock returns, using both quantile regression and GARCH (1,1) models across multiple South African market sectors, reveals a complex but informative pattern. The quantile regression results indicate that BCI significantly influences stock return volatility, particularly in the quantiles (0.25 and 0.75). This suggests that during periods of elevated market returns or heightened uncertainty, shifts in business sentiment have a stronger effect on volatility dynamics. The positive and significant coefficients in lower and upper quantiles imply that increased business confidence may coincide with greater market activity, which can elevate volatility in times of depression and expansion or exuberance. These results provide direct empirical support for key behavioural finance mechanisms, including sentiment-driven overreaction, herding behaviour, and volatility amplification during optimistic market phases. Conversely, muted effects in much lower quantiles (0.10) are consistent with behavioural theories predicting that pessimistic sentiment may lead to underreaction or delayed adjustment in calmer market conditions. The evidence also aligns with prospect theory’s notion of asymmetric responses to gains versus losses, as confidence-driven booms appear to generate larger volatility spikes than confidence declines.

The GARCH (1,1) results further reveal sector-specific heterogeneity: in the financial sector, higher BCI is associated with reduced volatility, suggesting a stabilising effect; in the resources sector, positive sentiment tends to amplify volatility, likely reflecting the sector’s exposure to speculative commodity cycles; and in the industrial sector, the relationship is weaker, possibly due to its longer investment horizons. These insights underscore the need for differentiated policy and investment strategies that account for sector-specific sensitivities to business sentiment when managing market risk and volatility. The predictive power of BCI is most relevant over short- to medium-term horizons (1–6 months) due to the nature of market sentiment cycles. It is noted that policy responses themselves can influence sentiment, reinforcing the potential bidirectional relationship. The GARCH (1,1) results offer sector-specific insights, showing that the effect of BCI on volatility is heterogeneous across the financial, industrial, and resources indices. In the financial sector, higher business confidence is associated with reduced volatility, indicating a stabilising effect likely due to improved investor sentiment and reduced perceived risk. Conversely, in the industrial sector, the impact of BCI on volatility is less pronounced, reflecting the sector’s structural focus on long-term investments that are less sensitive to short-term sentiment shifts. Overall, the findings suggest that while business confidence is an important determinant of stock return volatility, its influence varies across market conditions and sectoral structures. These insights underscore the need for differentiated policy and investment strategies that consider sector-specific sensitivities to business sentiment when managing market risk and volatility.

The findings highlight South Africa’s distinct market structure, which is characterised by lower liquidity, sectoral concentration, resource dependence, and sensitivity to global flows. This limits the direct applicability of the results to developed markets yet provides valuable insights for emerging economies with similar features. The quantile regression results reveal asymmetric effects consistent with behavioural finance theories: overconfidence drives volatility in periods of strong sentiment, herding behaviour sustains the resource sector’s sensitivity to business confidence, and loss aversion produces stronger volatility responses during expansions than contractions. These behavioural dimensions contextualise statistical asymmetries and offer practical implications, suggesting that monitoring sentiment surges can help anticipate volatility spikes and guide sector-specific interventions. Accordingly, policymakers should incorporate behavioural indicators into market monitoring frameworks to strengthen volatility management, while portfolio managers can adjust risk exposures during high-confidence phases.