Abstract

The digitalization of business activities is already a reality in most developed countries. India, driven by strong information technology, is rapidly digitalizing across business industries. In the retail industry, this shift is visible in the adoption of omnichannel strategies to enhance value for customers, loyalty and trust, retailer’s image, overall shopping experience, and operational productivity. The present study assesses the extent of omnichannel transformation in the five leading Indian retail sectors viz. Consumer Electronics, Fashion and Apparel, Furniture and Home Decor, Grocery and Supermarkets, and Personal Care and Hygiene. The research design uses mystery shopping approach to collect data from 166 nationally present retailers to analyze their level of omnichannel implementation and digital adoption. The authors performed all statistical analyses and visualizations in R using the ggstatsplot package. The results highlight a less-than-ideal picture of channel integration, suggesting that while top retailers in each sector dominate channel integration, most others have made limited progress. Among the sectors, the Furniture and Home Decor sector leads in channel integration. Other contributions of this study include the enhancement of the existing measuring tool by introducing new indicators. The study reveals gaps in omnichannel implementation to help managers plan strategic improvements.

1. Introduction

The COVID-19 pandemic opened the door to accelerated digital retail transformation, pushing brick-and-mortar establishments to adopt omnichannel strategies ensure survival. It also compelled late-adopting customers to shop online, thereby expanding the scope of e-commerce [1]. Such accelerated digitization contrasts with the pre-pandemic period, when successful digital transformation typically took mostly three to seven years. The retailers were suddenly compelled to adopt digital technologies to remain in the market in the post-pandemic era. This shift in strategy demanded quick facilitation by establishing appropriate infrastructures, operations, and even the culture in the organization. Even though the pandemic acted as a catalyst for change across all industries, the extent and impact of transformation were not uniform and differed significantly. Sectors such as healthcare, finance, and banking underwent a major revolution, whereas consumer goods retail experienced a more moderate shift [2]. In the meantime, online retailers capitalized on growing digital demand but faced increasing pressure to enhance sensory and social experiences. As a result, the line between digital and physical retail has become increasingly blurred, driving both toward a more cohesive, customer-centric omnichannel ecosystem [1].

Leaders in the retailing sector today are motivated to adopt omnichannel strategies because omnichannel customers are believed to spend more per shopping trip, demonstrate greater satisfaction and loyalty, are more likely to recommend the brand to family and friends [3], and exhibit a more substantial webrooming effect, leading to increased basket size resulting in higher sales growth for firms [4,5]. Customers are likely to engage more with the multiple channels of omnichannel retailers due to satisfaction, perceived fluency, a positive image of the retailer and consumer trust [6,7,8]. In the study of Sopadjieva et al. [5], among 46,000 US customers, 73% were omnichannel shoppers who spent more per trip (4% in-store, 10% online), increased in-store spending with channel use (9% more with 4+ channels, 13% more after online research), and logged 23% more repeat store visits within six months. The omnichannel retailer’s channel integration gives customers more control, which makes them more likely to shop there [9].

Although small retailers dominate the retail sector in emerging economies and are constrained by limited financial resources and access to affordable capital [10], customers are increasingly seeking the convenience of seamlessly purchasing products from diverse platforms. As a result, omnichannel retailing is poised to become the new standard in the retail industry [11,12]. Consequently, business leaders in countries like India feel a sense of urgency to embark on omnichannel transformation to enhance the overall customer experience [13].

India, an emerging economy with a large population and a strong information technology base, is rapidly digitalizing business sectors across the country. Additionally, the potential for Indian consumers to use the internet for shopping is immense. As per the report by Data Reportal [14], by early 2025, India’s population stood at 1.46 billion, having grown by 13 million (+0.9%) since early 2024. Of this, 37.1% lived in urban areas and 62.9% in rural regions, with a gender split of 48.4% female and 51.6% male. Among these, India has 1.12 billion active mobile connections (76.6% of the population), although not all the active mobile connections have internet access, and many people maintain multiple connections for both personal and work use. The number of mobile connections in India decreased by 1.3 million (−0.1%) between the start of 2024 and the beginning of 2025. The country counted 806 million internet users (55.3% penetration), a staggering increase from 718.74 million in 2019, and 491 million social media identities (33.7%). Actual adoption and growth rates are likely higher than reported as internet user data takes time until compiled and published [14]. India also has high smartphone penetration (over 75%) and widespread adoption of UPI for digital payments (over 80%) [15]. These figures highlight significant digital adoption by the Indian population and signify the importance of tracking evolving trends and behaviors.

Therefore, it is very critical for retailers in India to leverage these shifts in consumer lifestyle with respect to digital adoption. Hence, it becomes essential to assess the readiness for omnichannel transformation with respect to the level of channel integration among the retailers. Building on the discussion above, this study aims to answer the following research questions:

RQ1. What is the overall status of omnichannel channel integration among prominent retailers in India?

RQ2. How do omnichannel integration levels differ across the retail sectors studied?

RQ3. What sectoral differences exist in the adoption and implementation of omnichannel services across the consumer purchase journey?

In line with this need, the present study aims to determine the current state of channel integration and digital adoption in the retail sector in India, spanning multiple retail industries, where prior research is limited. The study attempts to provide an integrated view of sector-wise distinctions and emerging patterns that shape omnichannel readiness in India by examining how different industries implement omnichannel practices. According to the authors’ detailed study of the reported literature, this is one of the earliest systematic attempts to evaluate the omnichannel implementation performances of the retail sectors in India. The study extends the framework used in the literature to measure the channel integration levels of omnichannel retailers by incorporating additional retail sectors that have not been previously examined. It also highlights gaps in integrated services and areas of channel integration across industries, addressing the importance of considering sector-specific characteristics when evaluating omnichannel implementation.

2. Background

Omnichannel retail strategies are influenced by the advances in digital transformation, representing an evolution of traditional multichannel models, as highlighted in the academic literature [16]. We are in an era characterized by the extensive digital transformation of businesses, society, and consumers [17]. Digital transformation implemented by businesses is enabled by a set of information, computing, communication, and connectivity technologies, such as big data analytics, cloud-based services, augmented reality and virtual reality, artificial intelligence including Generative AI, mobile technologies, social media, the Internet of Things, blockchain, and 5G networks, whose capabilities continue to evolve [17,18]. Digital transformation, as perceived by the consumer, encompasses the digitization of sales, services, and communication, enabling them to interact and engage with retailers more effectively, thereby enhancing their experience with the firm’s physical store, products, and services [18]. Omnichannel retailers pursue digital transformation to enhance company performance and create greater value for consumers by improving customer experiences and optimizing operational and logistical processes [19].

The retail leaders’ survey presented in the 2025 Deloitte Retail Industry Outlook identifies the enhancement of omnichannel experiences as one of the sector’s most significant growth opportunities, highlighting the need for more seamless, integrated, and personalized consumer journeys [20]. Despite growing interest in the application of digital transformation in retailing [21] and a growing number of reported research, there remain meaningful opportunities to further deepen our understanding of omnichannel retailing, particularly within emerging economies. For instance, although retail infrastructures in India, particularly the adoption of digital technologies and advancements in last-mile logistics [15], have developed rapidly, academic research on omnichannel marketing in the Indian context, an emerging economy with significant retail potential, remains limited.

As a result, it becomes necessary to evaluate channel integration for retailers intending to embark on this transformation. The existing literature on determining the level of channel integration among retailers is primarily based on European markets, particularly Spain [22,23,24]. The practices and challenges of channel integration in emerging markets like India remain largely unexplored. Moreover, most prior research has focused primarily on the fashion, grocery, and furniture industries [18,22,24,25]. This study considers consumer electronics (which includes home appliances) and personal care and hygiene sectors in addition to these industries. These sectors contribute significantly to the retail economy and increasingly engage customers with omnichannel strategies.

The consumer electronics sector is increasing in prominence within the Indian economy [26], driven by rising incomes, a growing middle class, and shifting consumer aspirations. Notably, the consumer electronics and appliances industry in India is expected to become the fifth largest in the world by 2025 [27]. The sector also faces intense competition, not only from domestic firms but from global players. In such a situation, retailers adopting omnichannel strategies can help attract and engage consumers more effectively.

The personal care and hygiene sector has also expanded rapidly, with revenues projected to reach US$33.08 billion in 2025, generating approximately US$22.74 per person in 2025, with an expected annual growth rate of 3.48% between 2025 and 2030 [28]. Given this scale and evolving consumer expectations, the sector’s continued growth will depend heavily on retailers’ ability to deliver seamless, convenient, and personalized experiences across channels.

Considering the varied characteristics of the selected sectors, an important issue in evaluating channel integration is the selection of a suitable measurement instrument. The study aims to improve and utilize a validated measurement instrument, enabling more accurate and context-sensitive assessments of omnichannel maturity, particularly in light of the new sectors included in this study. Overall, the gaps identified in this study present new avenues for research, offering insights with both academic and practical implications for a rapidly digitizing retail ecosystem.

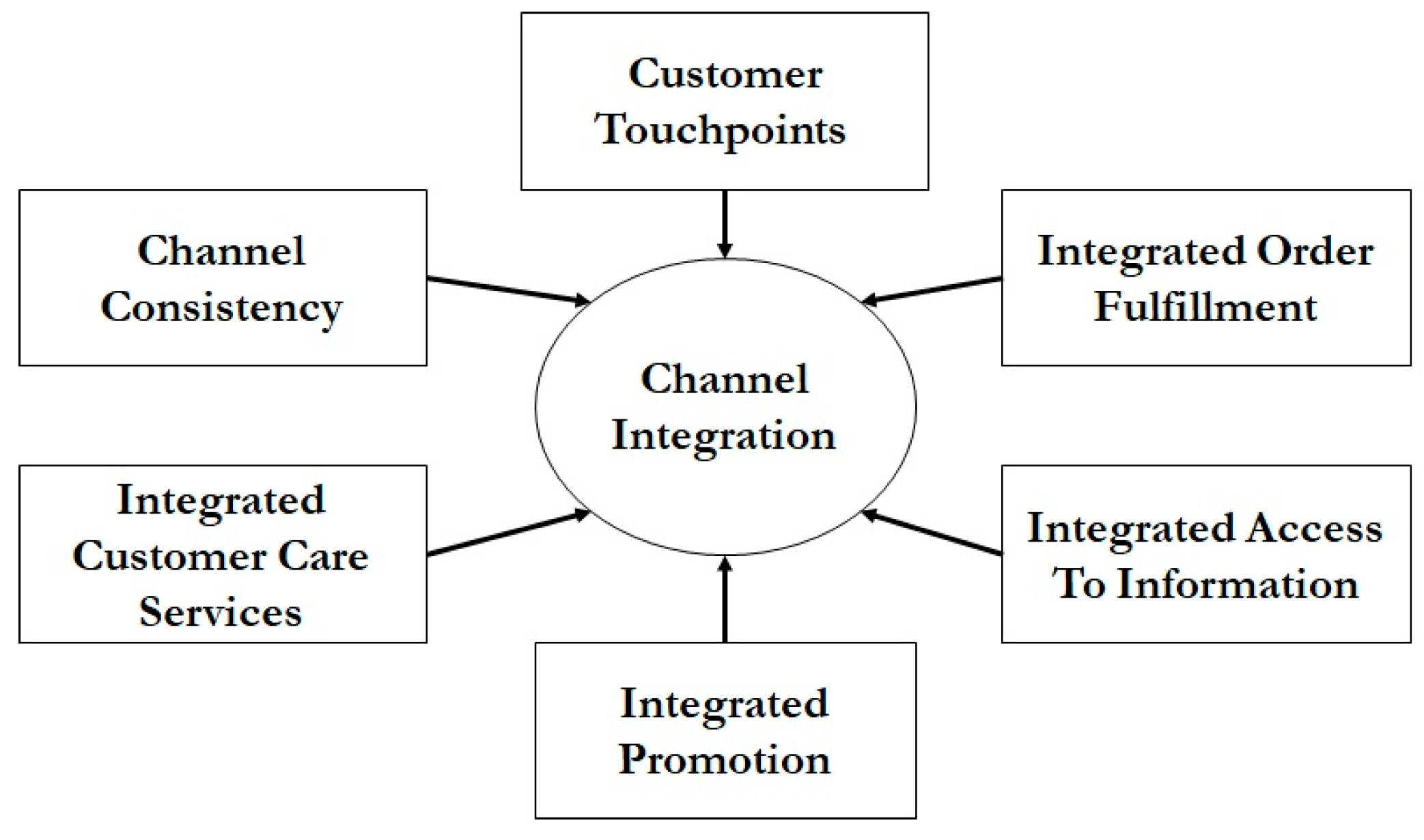

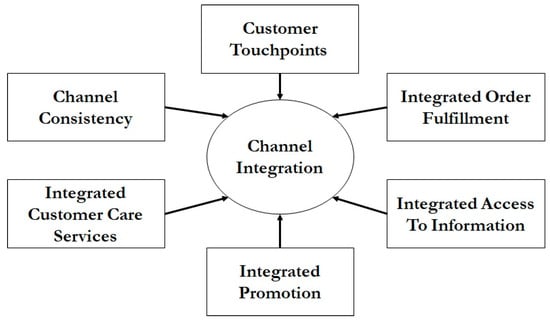

Therefore, in order to address the identified research gap, this study aims to determine the status of omnichannel transformation among prominent retailers in India. It is achieved by examining how effectively physical and digital channels are integrated throughout the customer’s purchase journey. With this, the research will provide insights into the operational maturity of omnichannel retailers. Furthermore, the study seeks to compare the degree of channel integration across different retail sectors considered in this study with the aim of identifying sector-specific differences in channel integration. Second, it investigates how retailers differ in their adoption and implementation of dimensions of channel integration, including the availability of multiple touch points, channel consistency, integrated customer care service, consistent promotion between channels, integrated access to information, and order fulfillment.

Further, the study also examines variations in the adoption of individual integration indicators (services) across these sectors, shedding light on implementation patterns, gaps, and emerging best practices. This comparison aims to provide insights into the strategic advantages and operational maturity of each retail industry type within the Indian market. The study will overall help understand the omnichannel retail in the Indian market, including how common it is, the extent of its implementation, and how it differs across retail industries.

3. Materials and Methods

Despite the greater adoption of omnichannel strategies, there is a lack of standard measurement methods to evaluate omnichannel implementation. The present study, therefore, measures the degree of channel integration to assess the omnichannel implementation, as channel integration is considered a proxy for measuring the company’s level of omnichannel operations [22]. The measurement method is based on the comprehensive framework developed by Acquila-Natale and Chaparro-Peláez [22] and later refined by Iglesias-Pradas et al. [24]. The framework defines channel integration as the degree to which a retailer coordinates its multiple channels to create synergy for the firm and offer its customers a seamless shopping experience. Applied initially to assess channel integration in clothing and apparel retailing from a customer perspective, it has subsequently been employed in both service-based sectors, such as electricity [25] and product-based sectors such as fashion and apparel, furniture, and grocery [18,24].

The research methodology followed in this study is illustrated in Table 1. Since omnichannel retailing requires the integration of channels concerning its management, information, and operations, we employed channel integration level measures with six major dimensions/areas of channel integration mainly extracted from the work of Iglesias-Pradas and Acquila-Natale [24].

Table 1.

Research Design.

3.1. Sample Selection

Omnichannel strategies are more common among larger enterprises, as they require substantial investments in technology, logistics, and integration [30]. Based on this information, the researchers first compiled the initial list of companies and brands based on their prominence in the Indian retail context. As mentioned in Table 1, the selection focused on brands and retailers operating nationally across the Indian territory, regardless of their origin. As mentioned in Table 1, the selection focused on brands and retailers operating nationally across the Indian territory, regardless of their origin. Furthermore, as defined in the criteria, researchers selected only retailers offering their products through at least two distinct channels (e.g., physical stores and online platforms) to ensure relevance to omnichannel retailing. We further explored and identified retailers through physical visits to major shopping malls and high streets across key Tier I and Tier II cities such as Bangalore, Kochi, Kozhikode, Kolkata, and Mumbai, which represent the largest and most digitally advanced retail markets in India [31], with a scope of large operational scale and high-footfall attracting retailer interest [32].

The researchers further ensured that the selected retailers are only relevant to the sectors defined, which included (a) Consumer Electronics (CE) (b) Fashion and Apparel (F&A), (c) Personal Care and Hygiene (PC&H), (d) Home Decor and Furniture (HD&F), and (e) Grocery and Supermarkets (G&S). For example, the retailers selected in the fashion and apparel sector excluding those selling footwear, children’s clothing, and those selling designer clothes. Similarly, the retailers selected for furniture mainly deal with home decor and furniture, which does not include mattresses, lighting, and other hardware stores. In the grocery sector, apart from exclusive grocery retailers, we also included supermarkets and hypermarkets, which have a significant section dedicated to groceries. Another important sector considered is consumer electronics, where we considered shops exclusively for consumer electronics or home appliances, and retailers selling both types of products. Another important sector considered was personal care and hygiene, an important emerging retail sector in India.

Unlike some prior studies that applied financial thresholds (e.g., a minimum turnover of $3 million) or relied on third-party databases to characterize retailers as omnichannel [22,24], the present study adopts a more operationally grounded criterion, also followed by Buldeo Rai et al. [33]. Given the limited availability of public financial data of many Indian retailers, especially unlisted and privately held companies, this study defined omnichannel retailers as those operating both physical stores and any or all online platforms (web store, Mobile app store) without differentiating retailers by organizational size or enterprise classification. The online channel must be fully operational, enabling customers to complete their purchase transactions. This criterion offers a clear and practical way to identify which retailers truly operate as omnichannel businesses. Since financial indicators are largely unavailable, because most of the selected retailers (71%) are private limited and therefore unlisted, the criterion instead focuses on consumer access points, which more accurately reflect how customers experience and interact with a retailer across different channels.

3.2. Measurement Instrument (Channel Integration and Digital Adoption)

3.2.1. Channel Integration

A set of 35 binary indicators (non-financial), as shown in Table 2, is developed to guide the data collection process, ensuring a consistent and objective evaluation across all retail brands. These indicators correspond to six core dimensions of channel integration, adapted from the updated instrument list by Iglesias-Pradas et al. [24]. These dimensions primarily address the pre-purchase stage, while also encompassing other stages of the shopping process. Figure 1 illustrates the areas of channel integration being measured.

Table 2.

List of Indicators used to measure channel integration.

Figure 1.

Areas of channel integration [18,22,24].

Studies reported in the literature, such as by Iglesias-Pradas et al. [24], built their measurement instrument based on the study by Acquila-Natale and Chaparro-Peláez [22]. To tailor the instrument to the Indian retail context and the diverse sectors included in this study, the authors added specific instruments to the total list. For example, in the customer touchpoint dimension, we added social media stores as an indicator (e.g., WhatsApp-based or any other social media-based shopping with integrated payment options) to reflect recent innovations by Indian retailers, which the literature also discusses as a growing touchpoint in omnichannel retailing [34,35]. In this study, a retailer is considered to have a social media store, and therefore receives a score for this indicator, if any of its social media pages include a shopping link that directs users to the retailer’s webstore or mobile app store, even if the transaction cannot be completed within the social media platform itself. In the integrated customer care services dimension, we included an indicator for the physical contact address for legal concerns (e.g., company head office). These inclusions highlight a clear gap in the omnichannel literature, which focuses on building customer trust through enhanced experience and product/service quality [36].

We further introduced two new indicators under the integrated promotion dimension—consistency in brand name, slogan, and logo across channels, and display of physical store location with contact details on web/mobile stores—both commonly discussed in omnichannel promotion literature [37,38,39]. Lastly, based on the broader sectoral scope of this study, the authors added four additional indicators to the integrated order fulfillment dimension. These indicators comprise aspects related to the elements of the outbound logistics process, such as delivery and return options, as used by Iglesias-Pradas et al. [24], and align with the fulfillment strategies discussed in the listed research articles [36,40,41,42,43]. The additional indicators added are (a) Buy in store, return to online, (b) Buy online, home delivery, (c) Buy online, delivery in a locker/curbside/post-office, and (d) Buy offline and take home. The authors considered these additions of indicators to include all the possible scenarios of order fulfillment by the omnichannel retailer.

3.2.2. Digital Adoption

To assess the extent of digital adoption among the sampled retailers, the study evaluates digital adoption using a list of digital tools and platforms as indicators. These tools and platforms are commonly employed to facilitate customer reach and engagement, digital transactions, data management, and data-driven decision-making. The study adopts the indicators proposed by Iglesias-Pradas et al. [24] to measure digital adoption, with the notable addition of online or digital payment options. The list includes mobile apps, websites, emails, live and instant chat systems, and presence on prominent social media platforms such as Facebook, X (formerly Twitter), Instagram, YouTube, Pinterest, and WhatsApp, which represent the primary digital touchpoints for consumer interaction and feedback on their experiences. Furthermore, an online payment option has been added along with online billing systems to capture the transactional dimension of omnichannel integration. Meanwhile, we also considered the adoption of customer data management systems, which reflect the analytical and operational mechanisms that support personalized and seamless customer experiences across channels. Table 3 demonstrates the indicators under digital adoption used for the measurement.

Table 3.

List of Indicators used to measure digital adoption.

3.3. Performance Measurement

We measured channel integration based on indicators listed in the previous section. Each indicator is measured on a simple yes/no basis, focusing solely on whether a service was available, not how well it performed. Every retailer was assessed using the same checklist, allowing for fair comparisons across different sectors and reducing researchers’ personal bias in the evaluations. This methodical approach ensured that every mystery shopping visit, whether in the physical store or online, followed the same predefined criteria.

In line with the approach followed by Acquila-Natale and Chaparro-Peláez [22], the retailer scored one for the indicator if it offered the particular channel integration, and zero otherwise. However, in contrast to the previous approach, the evaluation is purely binary, and no partial scores are given for partial integration. The scores of all 35 indicators are then added up and divided by the total number of indicators to determine the overall level of channel integration as a percentage. A perfect score of 35 would represent full (100%) channel integration. The top performing retailer in the sample, for example, provides 30 omnichannel services from the listed 35 indicators, scoring 85.7 percent as the channel integration performance level.

3.4. Data Collection—Mystery Shopping Technique

This study used the mystery shopping method to evaluate how effectively businesses are implementing omnichannel strategies from a consumer-oriented perspective. In this approach, researchers act as typical shoppers to observe and assess the actual service experienced firsthand [29]. The method focuses objectively on evaluating tangible integration features rather than customer satisfaction or subjective experiences, making it suitable for the study’s objective of assessing channel integration. The method has been used extensively by organizations across various industries, including in financial services, retailing, motor dealerships, hotels and catering, passenger transportation, public utilities, and government departments, as a reliable tool to measure service performance against internal standards [29]. Many researchers, such as Acquila-Natale and Chaparro-Peláez [22], Chaparro-Peláez et al. [25], Iglesias-Pradas et al. [24], and Acquila-Natale et al. [18] have recently used this approach to assess omnichannel services.

We collected data from a total of 166 retailers primarily by visiting their physical stores and interacting with store employees, pretending to be customers or potential customers. The details of the data collection are shown in Table 4. The process of data collection also involved exploring retailers’ websites and app stores to gather information about their online channel services. We interacted with their online support teams through WhatsApp, chat, and occasionally phone calls in cases where certain service elements were unclear or not mentioned. These interactions helped confirm the services offered to both online and offline customers and assess how the online stores integrate with their nearest physical stores. We looked for additional information from publicly available sources, including corporate websites and app store listings. This multi-step verification process ensured objectivity in the data collection, minimizing researcher bias, and addressing one of the commonly cited limitations of the mystery shopping method [44].

Table 4.

Data Collection details.

This approach works well for the Indian retail sector because getting employees or executives to participate in interviews is often difficult, as the companies rarely share details about their internal tech processes. Furthermore, as mentioned earlier, financial data is not easily accessible. By focusing on consumer-experience features, the study captures the actual level of integration experienced by end users, thereby contributing a practical and scalable measurement approach to the emerging literature on omnichannel retailing in India.

4. Results and Discussion

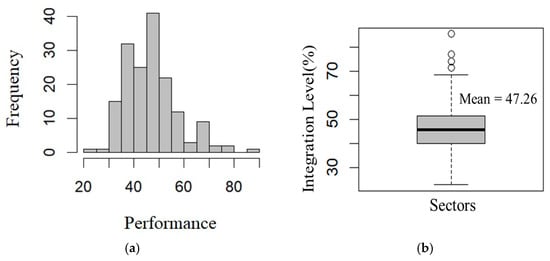

4.1. Overall Channel Integration Performance

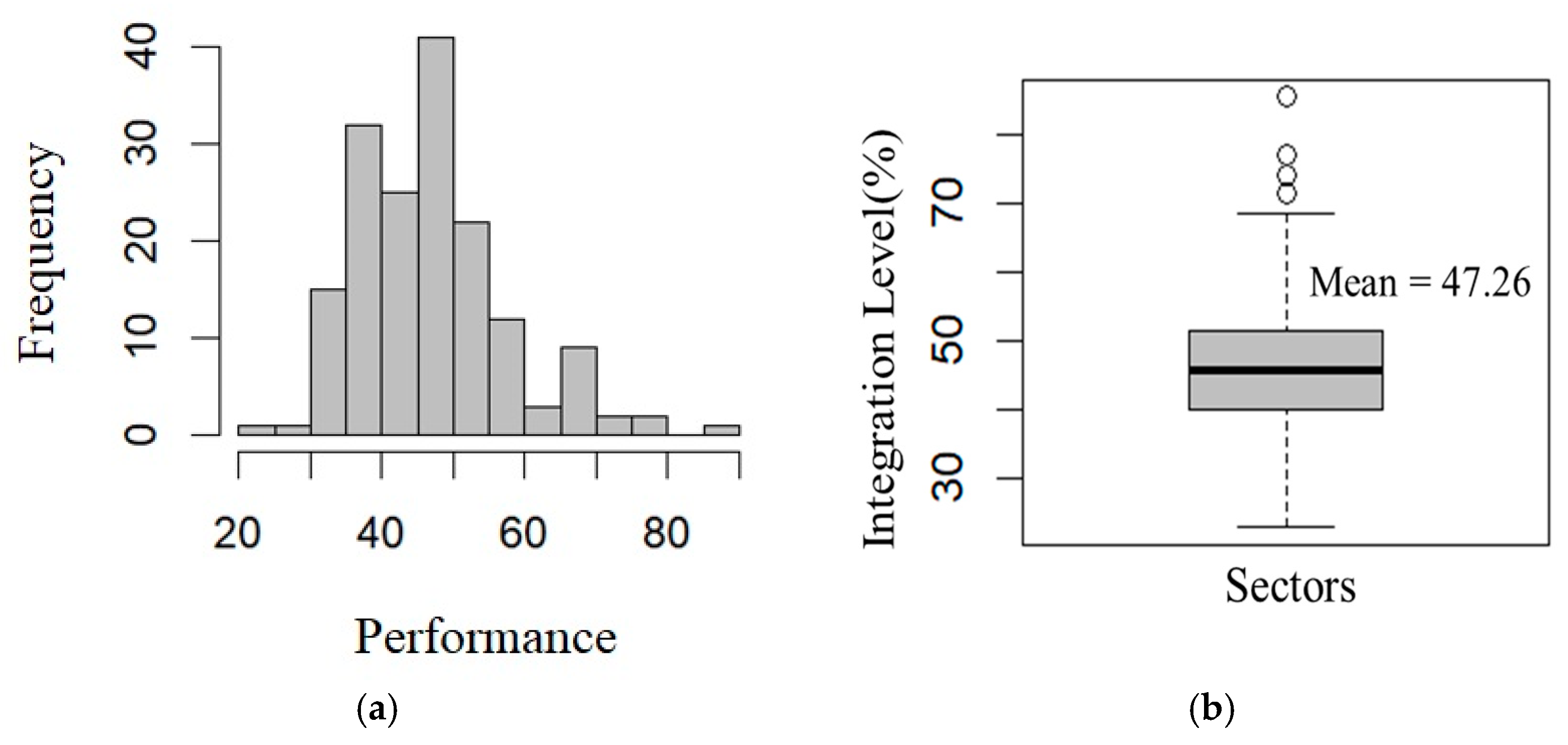

We gathered data from approximately 166 leading Indian companies representing five selected retail sectors mentioned earlier. A simple histogram and bar plot are plotted by using the performance (integration) scores of each retailer (as discussed in Section 3.3). Figure 2a illustrates the distribution of integration levels across the retailers, with the majority of retailers scoring between 40 and 60. Figure 2b further highlights retailer performance, including the presence of outliers, indicating that a small number of retailers exhibit highly advanced omnichannel integration. Overall, the results suggest that the status of channel integration among Indian retailers is not very impressive, with a mean integration score of 47.26% (below 50%) as shown in Figure 2b. However, a few retailers demonstrate exceptional performance in channel integration.

Figure 2.

(a) Histogram showing spread of overall channel integration level; (b) box plot for overall channel integration level.

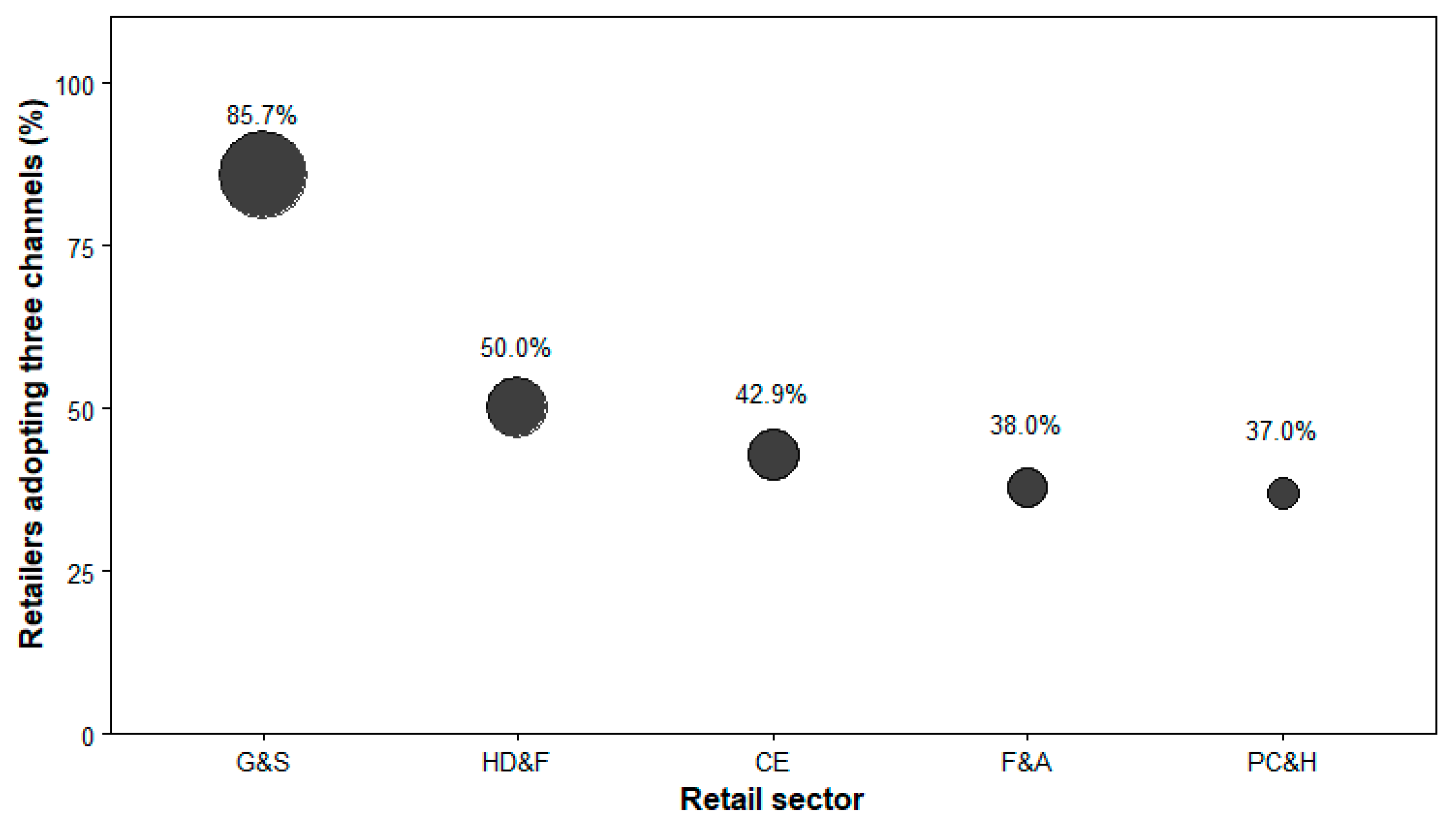

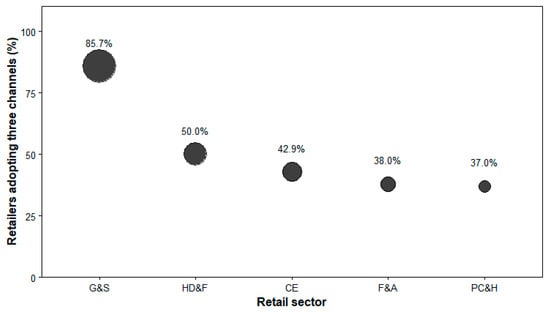

4.2. Adoption of Multiple Channels

The addition of multiple channels to the already existing channel increases convenience and consumer awareness of product variety, and reduces the perceived risk associated with products and retailers [45]. Evidence from 50 empirical studies conducted by Timoumi et al. [46] suggests that adopting more retail channels leads to improved overall sales. Therefore, we analyzed the adoption of multiple channels in our study. As evident from Figure 3, the G&S sector confirms the highest adoption of multiple channels (6 out of 7), followed by the HD&F sector (9 out of 18). However, many consumer electronics brands are behind in adopting more than two sales channels, along with brands and retailers from the F&A and PC&H sectors.

Figure 3.

Bubble plot showing percent of retailers adopting three channels sector-wise.

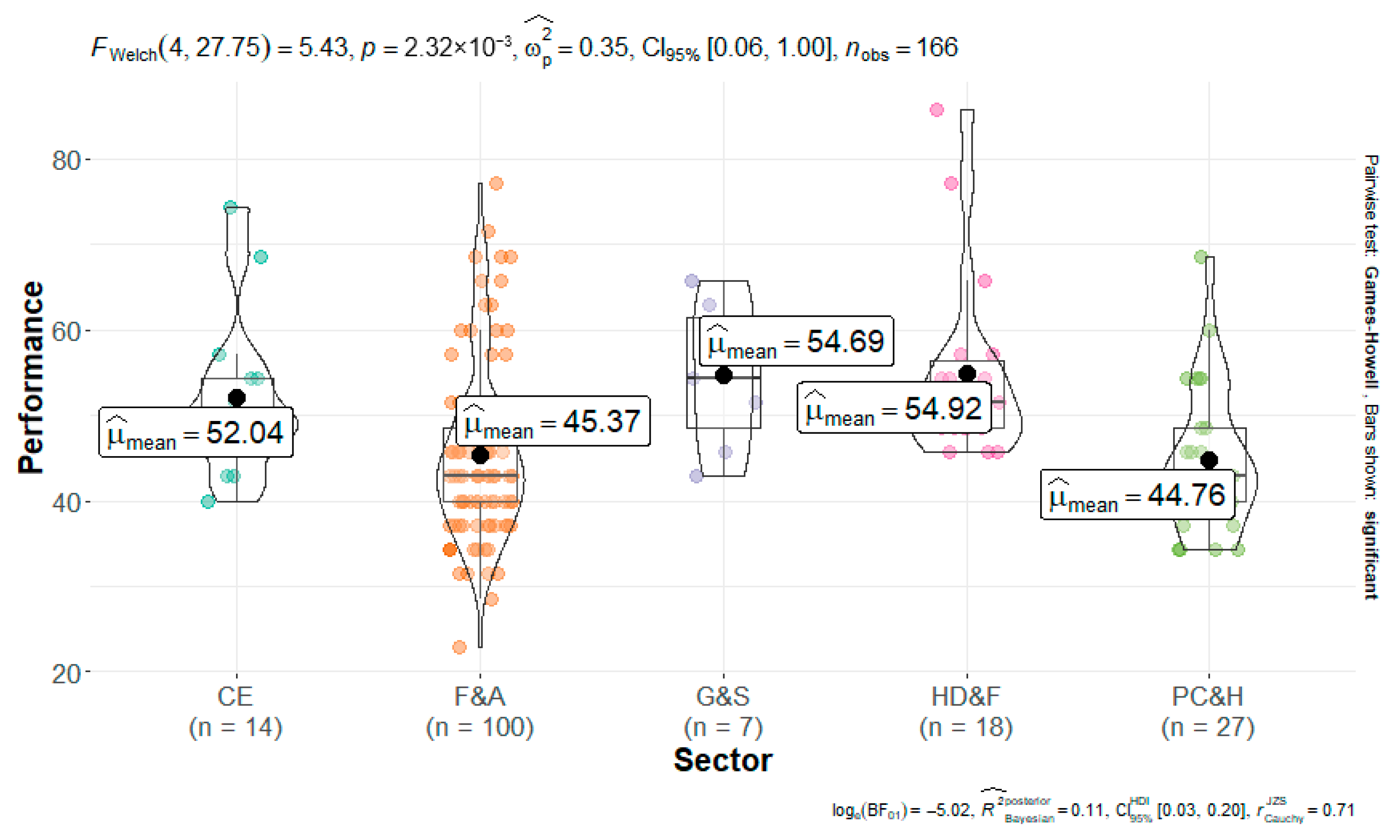

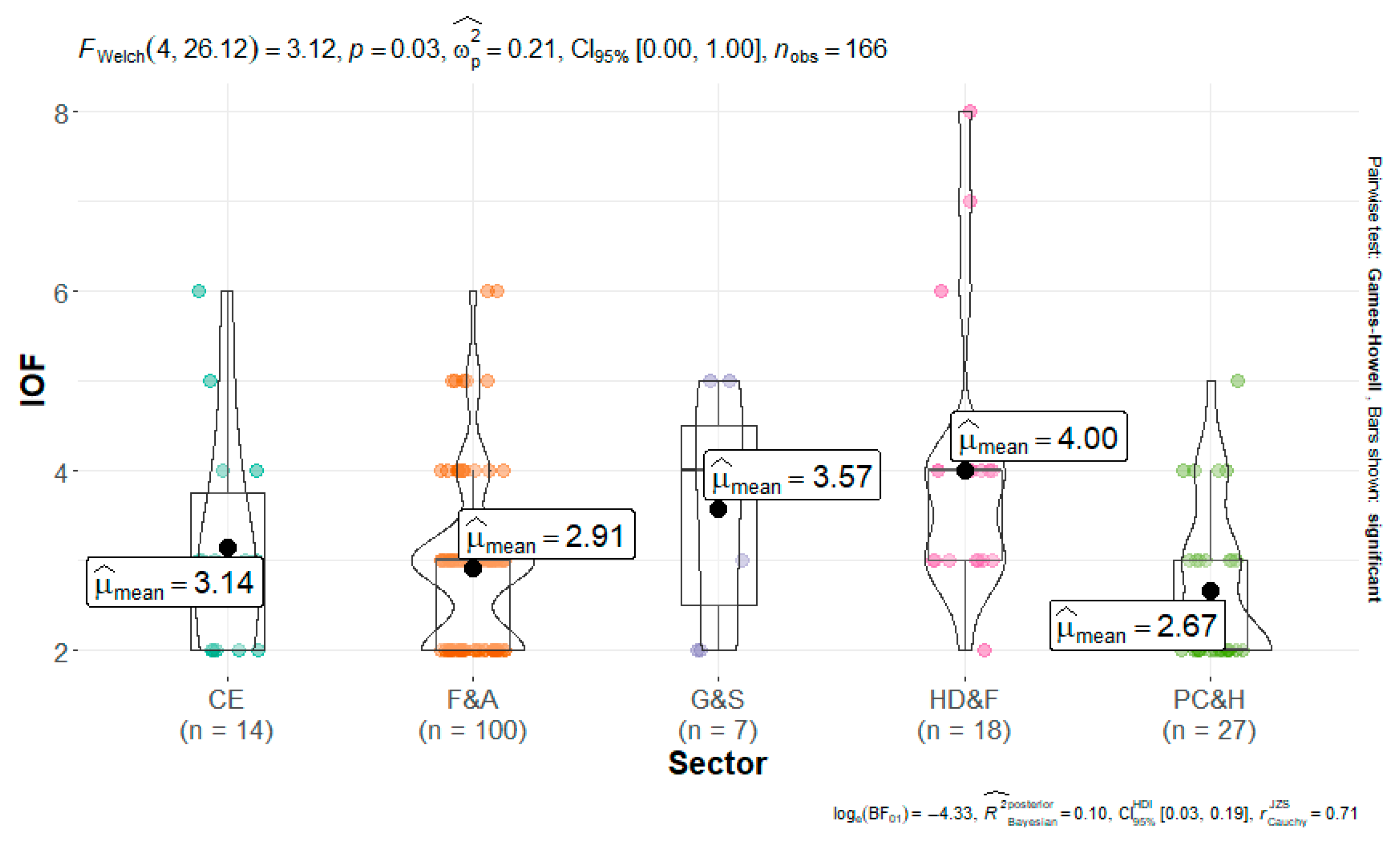

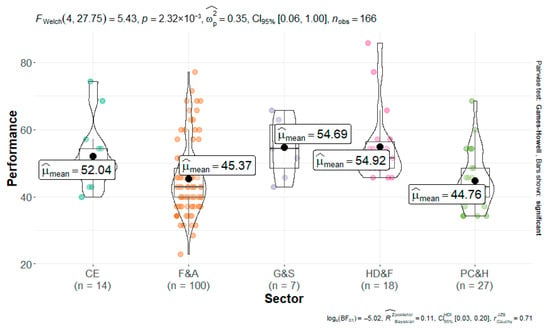

4.3. Sector Wise Comparison of Overall Channel Integration Level—One-Way ANOVA

Furthermore, the results of one-way ANOVA and post hoc analysis, as shown by the violin plot [47] in Figure 4 and Table 5, respectively, give insight into how the sectors performed differently. ANOVA yields a significant result (p = 0.0023; size effect = 0.35), indicating notable differences in channel integration levels among the sectors. The furniture and grocery sectors, with average scores of 54.92% and 54.69%, respectively, are among the top performers, followed by consumer electronics (average score of 53%), fashion and apparel (45.37%), and personal care and hygiene (44.76%) sectors. This result contrasts with reported results [24], which suggests that the fashion and apparel sectors are among the best-performing retailers in adopting omnichannel strategies. The plausible reason for this could be the inclusion of retailers with lower integration scores, which may have affected the overall performance of the F&A sector. The poor performance of the PC&H sector suggests that these retailers may be focusing on factors such as product innovation, emphasizing natural ingredients for efficacy and sustainability, branding, pricing, sales promotion, and other key aspects, rather than on omnichannel integration.

Figure 4.

Channel integration level across all sectors (One-Way ANOVA with Welch correction-assuming unequal variances).

Table 5.

Post hoc Test with the Bonferroni Correction (assuming unequal variances).

Post hoc analysis illustrated in Table 5 further highlights significant differences, particularly between the integration levels of HD&F and PC&H, as well as HD&F and F&A. An important observation here is that there are no significant differences between G&S and PC&H, as well as between G&S and F&A. It can be assumed that this particular result could be due to the difference in the sample size of the G&S sector, as it is very small compared to the sample of F&A (especially) and PC&H. This result may require further investigation as the sample size used in the grocery and supermarket sector is very small, since only a small number of retailers meet the criteria for sample selection.

4.4. Performance of Retailers and Their Comparison (Independent)

IKEA India is the leading omnichannel retailer in India based on the integration level, followed by Home Centre; both belong to the HD&F sector, as evident from Table 6. Shoppers Stop and Reliance Digital from F&A and CE, respectively, are next to them in performance ranking. Notably, five of the top ten retailers, based on their performance levels, belong to the fashion and apparel sector. The dominance of retailers from the F&A sector confirms findings from previous studies, which report that fashion and apparel retailers are among the leading adopters of omnichannel retailing strategies. We also found that the retailers leading channel integration in each sector are among the large companies in their respective categories. The above result aligns with the notion that financially stronger companies are spearheading the implementation of omnichannel operations across all domains [10,25,30]. Interestingly, although many brands have performed exceptionally well in their individual capacities, the overall performance of the F&A sector is among the lowest. The sector’s low overall integration level is presumably due to the large number of underperforming retailers. Furthermore, although no individual retailer in the G&S sector ranks among the top performers, most of the brands have performed consistently well, making the sector one of the top-performing sectors overall.

Table 6.

Top Omnichannel Retailers by Integration Level.

4.5. Individual Channel Integration Dimensions

This section highlights the analysis of individual indicators of channel integration. It summarizes the frequencies and resultant contingency tables for each indicator and the results of Fisher’s exact tests and post hoc analysis.

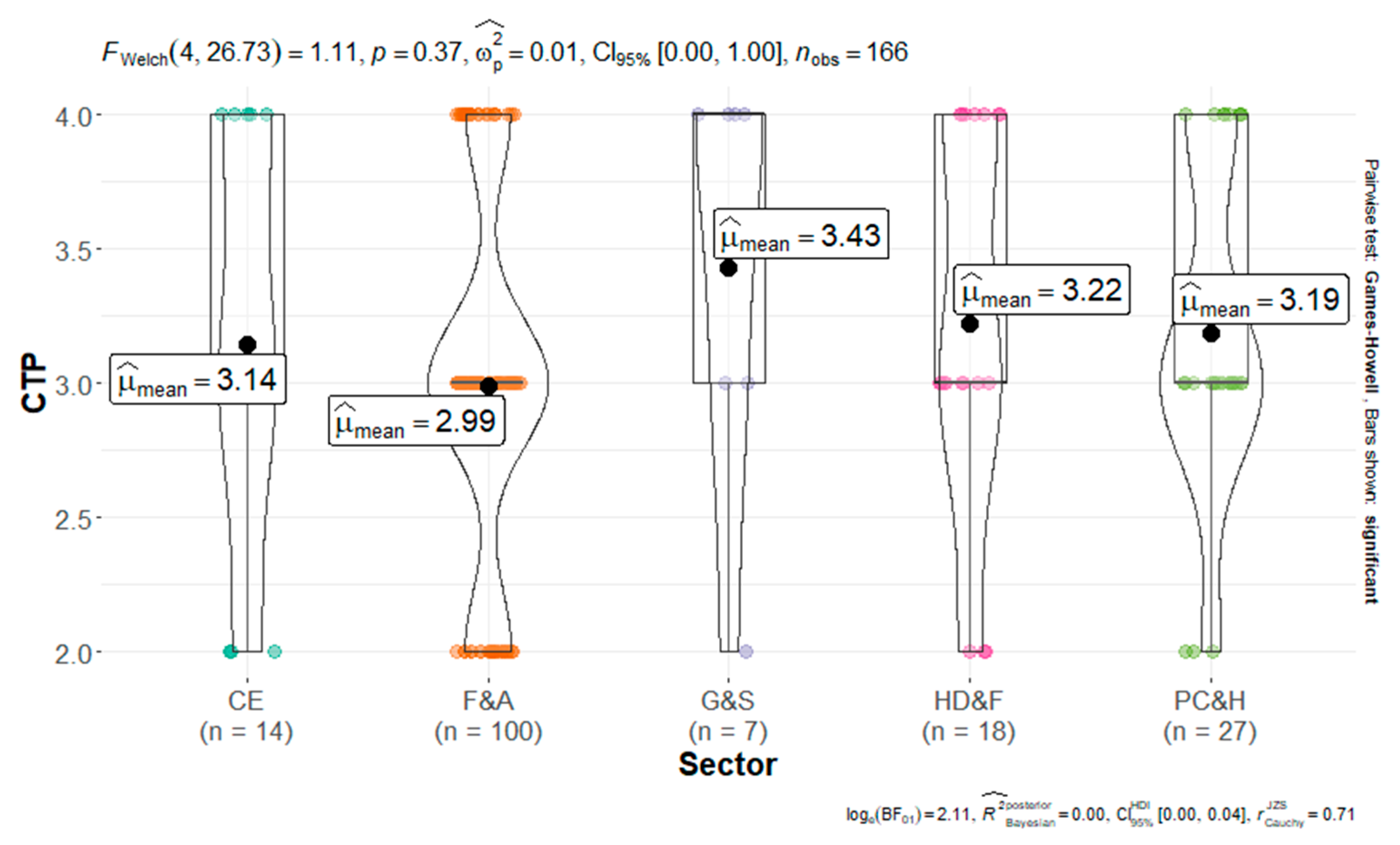

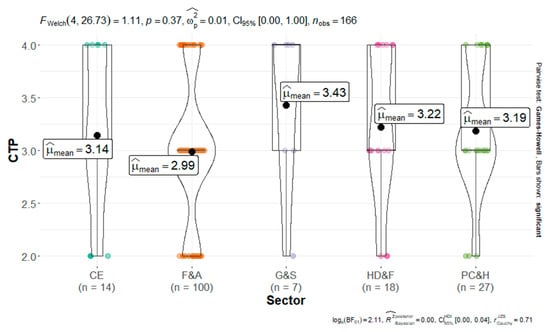

4.5.1. Customer Touch Points

Since the sampled retailers operate at least one physical store in addition to one or more online channels (as described in the methodology section), the analysis unsurprisingly shows no variation across the five sectors regarding physical store presence. Except for a single grocery retailer (More Retail Private Limited), all brands maintained a webstore, underscoring that a digital storefront has become a standard complement to physical retail in India and a regular touchpoint across sectors. Figure 5 demonstrates the one-way ANOVA result between the sectors for the implementation of customer touchpoints. The result suggests no significant difference (p = 0.37) between the sectors, thus indicating that there is similar adoption of physical, web, app, and social media stores.

Figure 5.

Result of One-Way ANOVA for Customer Touch Points (CTP) across all sectors.

However, significant sectoral differences emerge in adopting mobile app stores, as shown in Table 7. Grocery retailers and those in the Home Decor & Furniture (HD&F) sector provide evidence of the highest levels of app adoption. It is likely due to their need for frequent customer engagement and experiential shopping. In contrast, brands in CE, F&A, and PC&H stay behind in the mobile app adoption, relying more heavily on established online marketplace apps such as Amazon, Flipkart, and JioMart for online sales. These online marketplaces provide robust app-based shopping experiences for these products. This pattern reflects sector-specific strategies: while some retailers prioritize owning the digital relationship with customers through dedicated apps, others leverage the scale and convenience of third-party marketplaces, indicating varying preferences for control over the customer journey [48].

Table 7.

Contingency table and corresponding significant values of Fisher’s exact tests of all customer touchpoint dimension indicators.

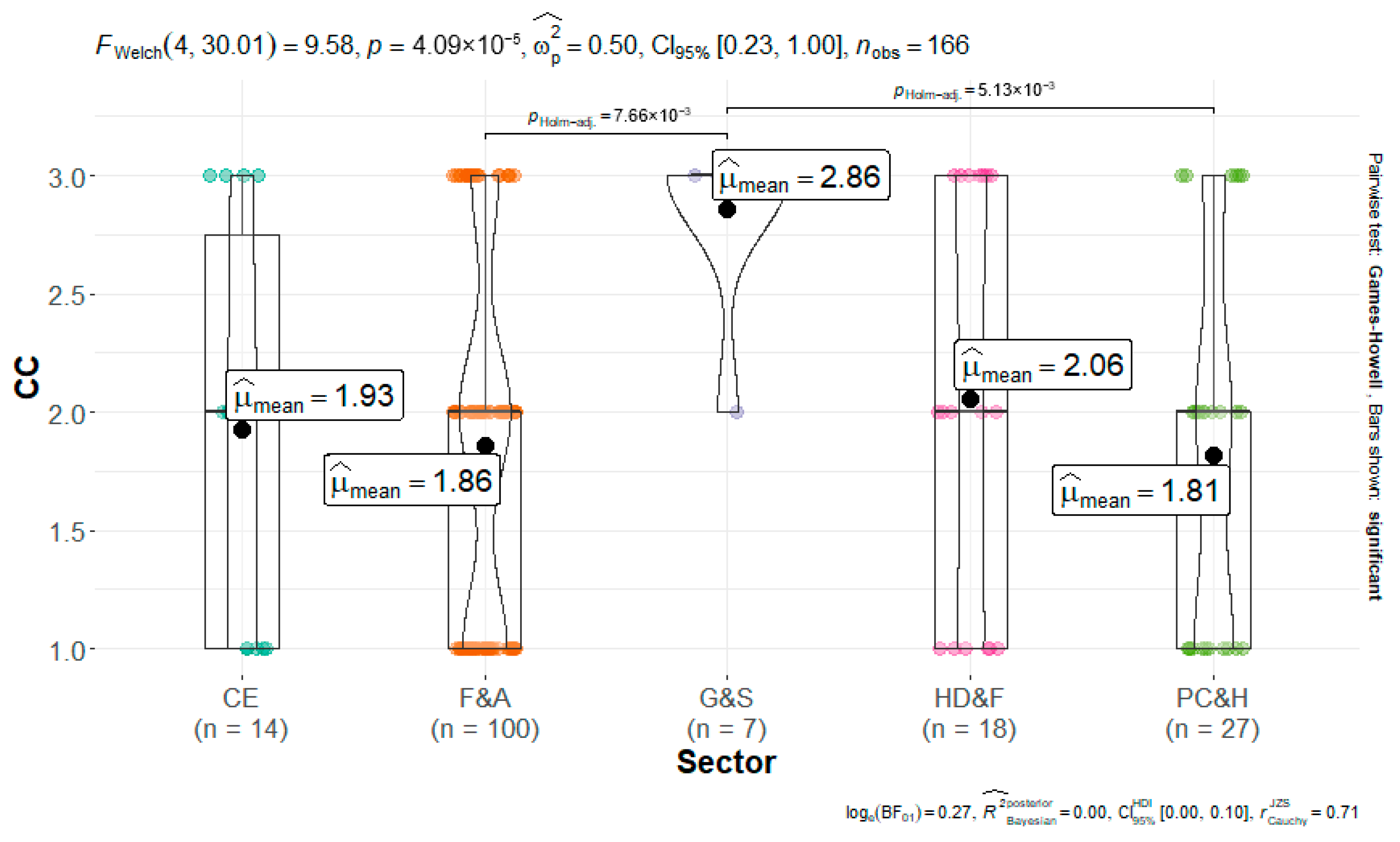

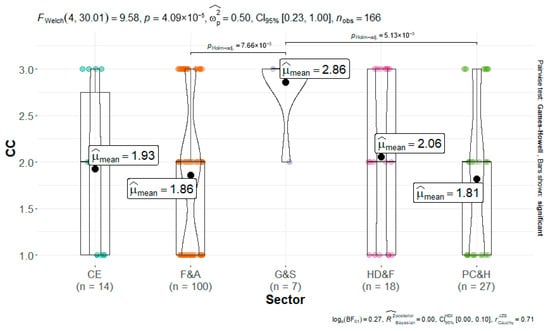

4.5.2. Channel Consistency

The differences in omnichannel retailers in digital presence, especially in the app store arena, are further reflected in the consistency between channels. Most sectors strongly implement basic channel consistency elements, such as standardized product descriptions, pricing, and even promotions. However, maintaining consistent product assortments across channels remains a challenging task. Table 8 illustrates this as only about 30% of companies offer identical product assortments across channels, highlighting that, in many cases, physical and online channels continue to operate independently. For instance, most clothing brands limit their physical stores to selling new and recently launched products. At the same time, a broader range, including older stock, is made available online by providing discount vouchers and other suitable offers. The limited product overlap between online and offline platforms suggests that comprehensive omnichannel integration is an ongoing challenge for many retailers.

Table 8.

Contingency table and corresponding significant values of Fisher’s exact tests of Channel Consistency indicators.

Two sectors, the grocery and supermarkets, and home decor and furniture, distinguish themselves in the channel consistency dimension. Due to their integration efforts, they are regarded as leaders in delivering a more consistent omnichannel experience. Furthermore, the ANOVA and the post hoc results presented in Figure 6 indicate significant differences in channel consistency between G&S and the sectors of F&A and PC&H. While pricing and promotional consistency vary slightly across sectors, G&S retailers adopt this strategy uniformly. This result of uniformity in the performance of G&S retailers could be due to the relatively small sample size of the sector, warranting further investigation.

Figure 6.

Result of One-Way ANOVA for Channel Consistency (CC) across all sectors.

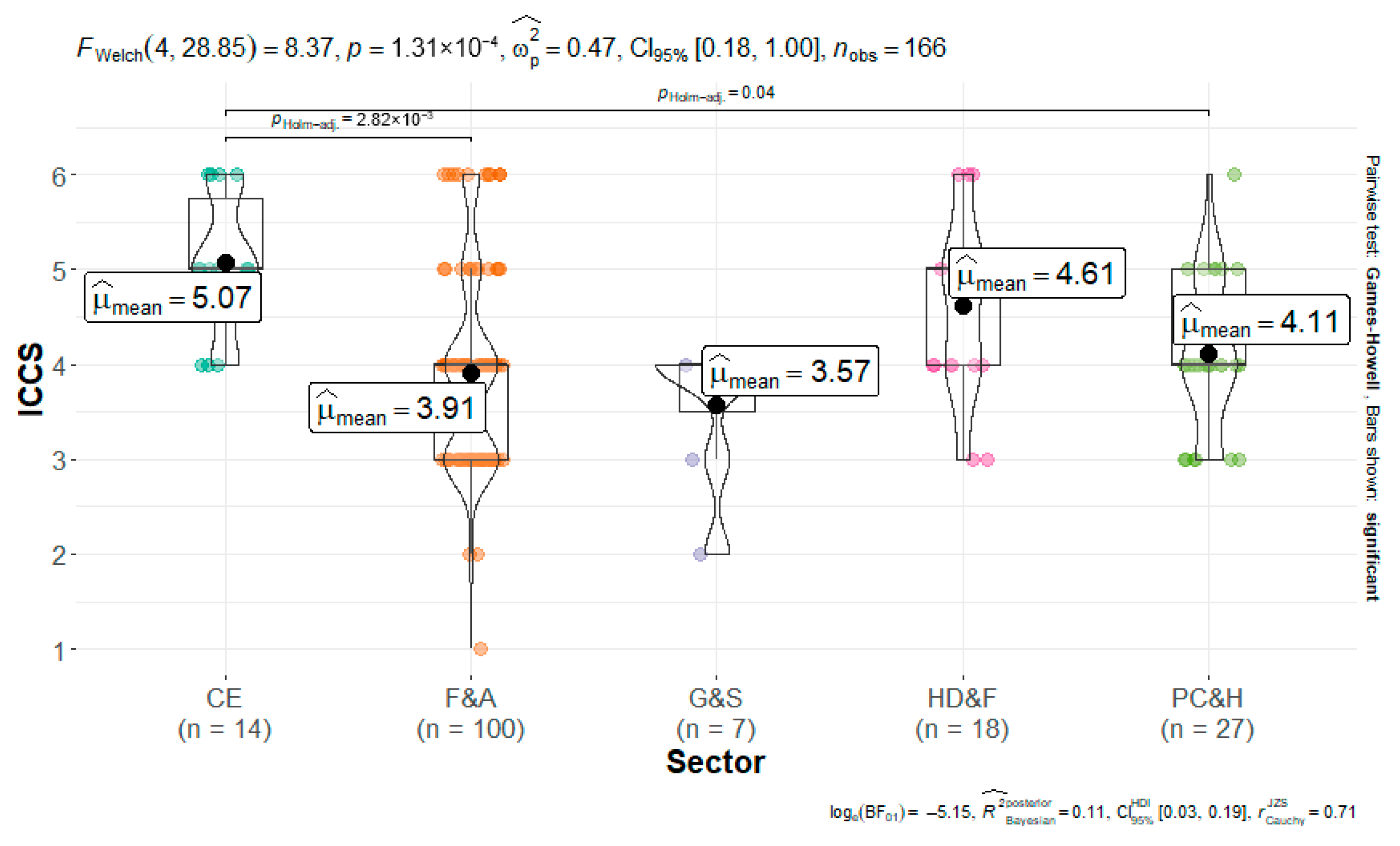

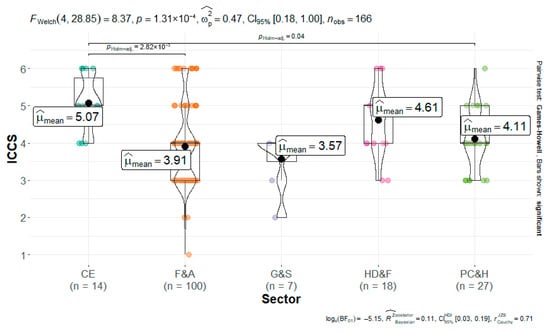

4.5.3. Integrated Customer Care Services

Customer service is another area where traditional approaches still dominate. There are no significant differences across sectors in how consumers can access integrated customer care services during shopping to resolve issues occurring in any channel. The analysis shows the widespread use of phone, email, and social media, as well as a relatively low adoption of online chat services across the sectors. However, as shown in Table 9, differences are visible in the availability of instant messaging services, such as contacting customer care through WhatsApp, a comparatively newer service.

Table 9.

Contingency table and corresponding significant values of Fisher’s exact tests of integrated customer care services indicators.

Therefore, disparities in adopting the emerging tools in the customer care services reveal shifting patterns in channel integration. The gap may soon narrow as more brands adopt instant messaging platforms, supported by AI for answering customer issues and frequently asked questions. Although brands generally do not actively promote social media for customer feedback, they still offer it to provide flexibility for customers who prefer these platforms. Furthermore, adopting platforms like WhatsApp and AI-driven chatbots will become increasingly essential as consumer expectations shift toward real-time engagement.

While overall differences across sectors are minimal, the CE sector stands out in performance in this channel integration dimension. Figure 7 shows the ANOVA and post hoc analysis indicating significant differences between CE and F&A, and PC&H sectors. Along with CE, the HD&F sector also performs well and takes the lead in this dimension too, likely due to the nature of both sectors’ products requiring more robust post-sales support.

Figure 7.

Result of One-Way ANOVA for Integrated Customer Care Services (ICCS) across all sectors.

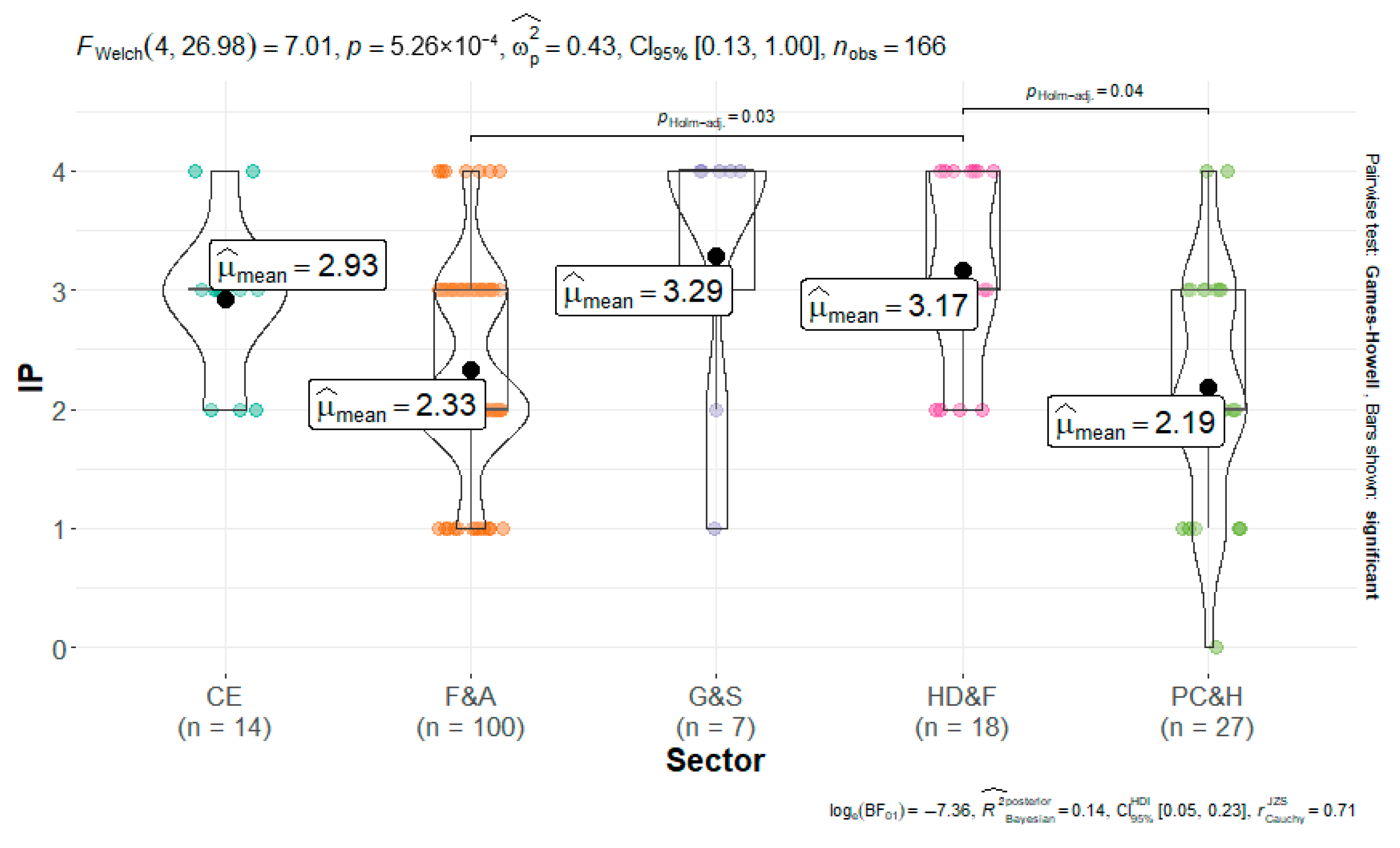

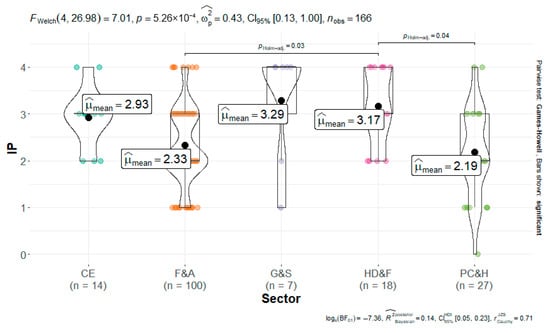

4.5.4. Integrated Promotion

As far as the integrated promotion strategies between the channels are concerned, many sectors fall short despite efforts to create a cohesive brand presence. While brand name, logos, slogans, and visual branding are generally aligned across channels, Online-Offline and Offline-Online promotional activities are often not so integrated. Similarly, no significant difference is observed the provision of physical store addresses on online platforms. However, substantial differences emerge when it comes to promoting physical stores on online channels and promoting online stores within physical outlets, as shown in Table 10. The poor implementation of cross-channel promotion, particularly in the PC&H and F&A sectors, reveals the disjointed state of current omnichannel approaches. Although top-performing brands within the F&A sector demonstrate a high level of implementation of integrated promotional strategies, the lower-performing brands contribute to the sector’s overall weak performance.

Table 10.

Contingency table and corresponding significant values of Fisher’s exact tests of Integrated Promotion indicators.

Among the various integrated promotion indicators, the promotion of online channels within physical stores is poorly established across all sectors. It may stem from a conflict of interest, particularly in franchise models where offline store owners are hesitant to advertise on online channels that could divert sales to them. These findings highlight the need for better coordination between franchise-operated physical stores and brand-managed digital platforms to deliver a cohesive omnichannel brand experience. Figure 8 indicates the differences in sectors F&A and PC&H with the HD&F sector. Overall, G&S and HD&F perform well in this dimension of channel integration.

Figure 8.

Result of One-Way ANOVA for Integrated Promotion (IP) across all sectors.

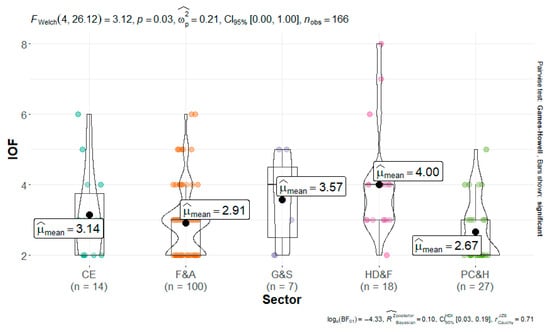

4.5.5. Integrated Order Fulfillment

The HD&F and G&S sectors perform slightly better than others, although the differences are not statistically significant, as shown in Figure 9. The performance of the HD&F sector in the integrated order fulfillment is based on some exceptionally well-performing retailers. Services such as cross-channel gift cards, BOPIS (Buy Online, Pick Up In-Store), and BORIS (Buy Online, Return In-Store) remain in the early stages of adoption and have yet to gain widespread acceptance across all sectors, as evident from Table 11. Reserve Online and Pick Up In-Store is not offered by any of the studied brands except Westside in India. The “Delivery to Curbside” service also shows significant variation, with only a few companies in the G&S and HD&F sectors offering this feature, while others do not.

Figure 9.

Result of One-Way ANOVA for Integrated Order Fulfillment (IOF) across all sectors.

Table 11.

Contingency table and corresponding significant values of Fisher’s exact tests of integrated order fulfillment indicators.

By contrast, fulfillment options like “Buy In-Store and Ship to Home” and curbside delivery show more apparent sectoral variation, most common in HD&F and G&S. In the case of HD&F, physical stores often function as experience centers, with bulky items shipped from centralized warehouses rather than being delivered directly from the stores. This pattern likely reflects the nature of the products sold; furniture, in particular, poses logistical challenges for in-store pickup due to its size and weight.

Like the HD&F sector, the order fulfillment strategies differ by product type for other sectors. Clothing brands (F&A) are relatively stronger in offering BOPIS and BORIS, reflecting consumer demand for convenient returns and in-store pickups. These patterns highlight how product characteristics and logistical feasibility shape the adoption of this area of integration. Overall, however, omnichannel fulfillment services remain nascent in India, with generally low adoption from retailers across sectors, underscoring that adoption is driven by individual brand initiatives rather than widespread industry practice.

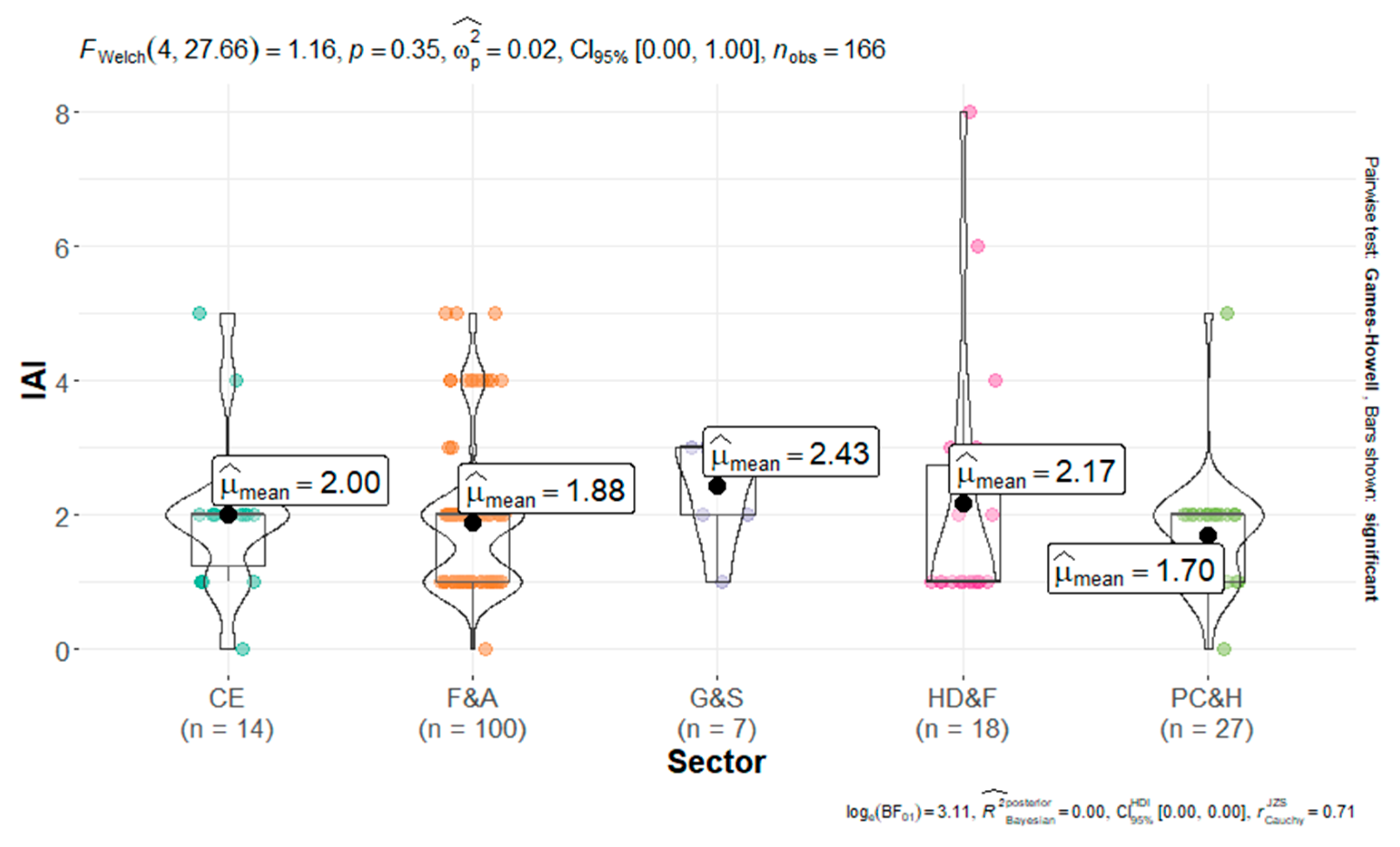

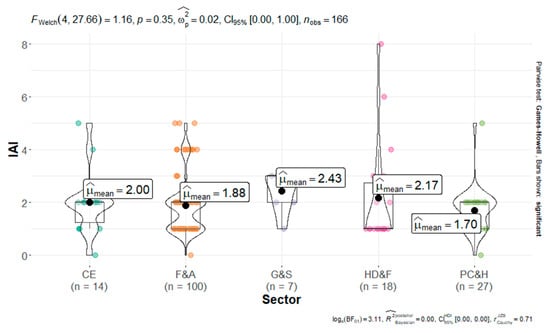

4.5.6. Integrated Access to Information

The analysis shown in Table 12 finds no significant differences in the availability of interactive kiosks, employees carrying electronic devices, product scanning, and integrated loyalty programs, as their adoption across sectors remains generally low. Only a few retailers across all sectors (except G&S) offer product scanning services. Product scanning is not offered by any G&S retailers, possibly due to frequent price changes and the constant introduction of discounts and promotional offers. Interactive kiosks, often called “virtual stores,” are available in only a few F&A and HD&F companies. Free Wi-Fi is offered by only the IKEA India store in the HD&F sector. This limited provision of free Wi-Fi may be attributed to the low cost of mobile data in India, which likely reduces retailers’ need to provide in-store Wi-Fi.

Table 12.

Contingency table and corresponding significant values of Fisher’s exact tests of integrated access to information indicators.

Some differences, though less pronounced, are observed in the following areas. Integrated product inventory systems show generally low levels of adoption but are significantly more prevalent in the F&A sector than in others. Order tracking is widely implemented across all sectors, except for a few brands in the CE sector, where this feature is not consistently available. The transfer of shopping carts, particularly from webstore to app store, is moderately adopted and only feasible when a brand operates both online channels. In conclusion, integrated access to information is another dimension of channel integration, where performance varies significantly across different sectors. However, there is no significant difference in implementing integrated access to information across the sectors, as shown in Figure 10. Although a few top-performing brands in HD&F and F&A offer well-integrated access to product and service information, no single sector dominates this aspect of channel integration. Therefore, progress in this integration area is driven more by individual brand initiatives than collective industry movement, leaving room for improvement across the sectors.

Figure 10.

Result of One-Way ANOVA for Integrated Access to Information (IAI) across all sectors.

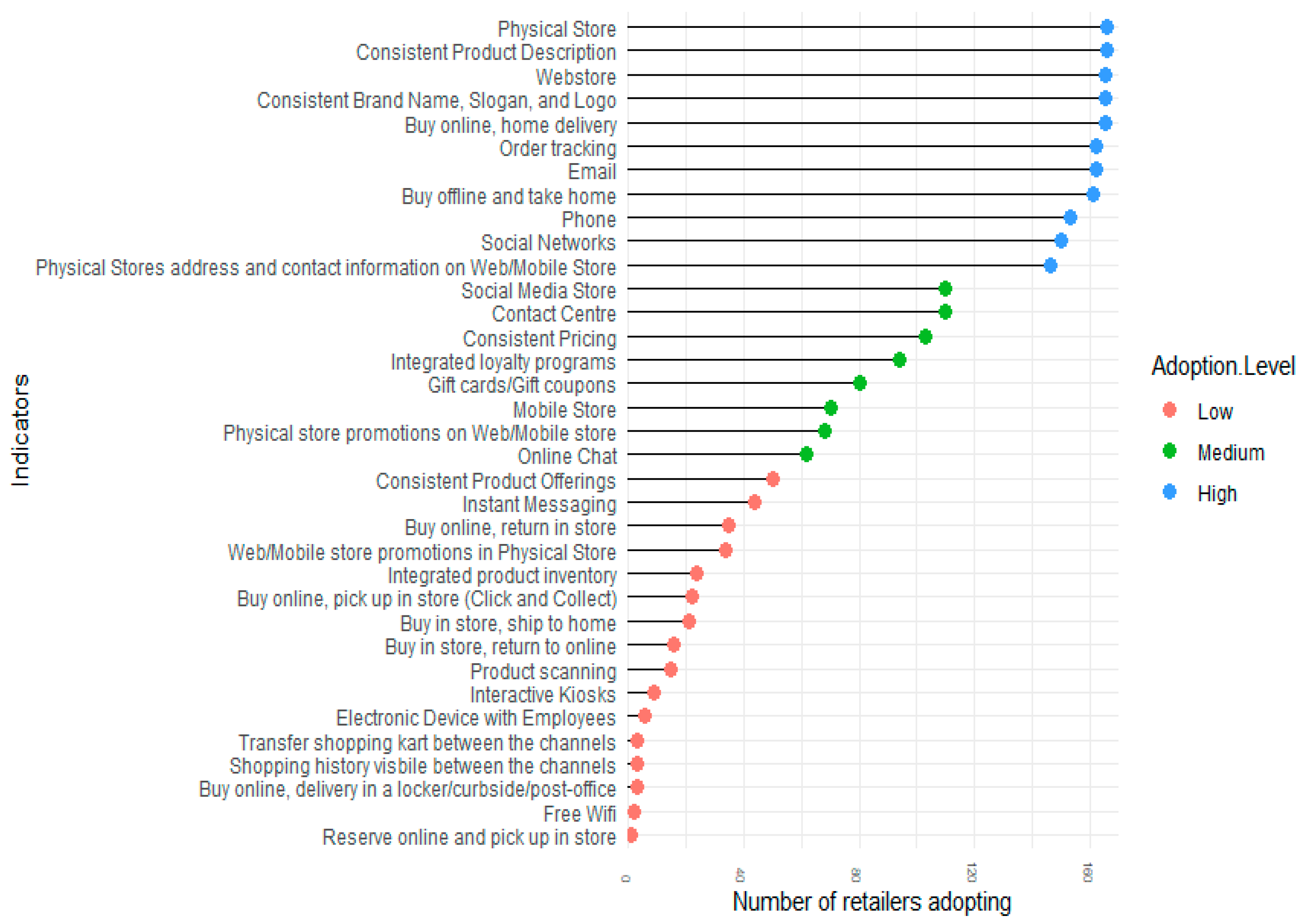

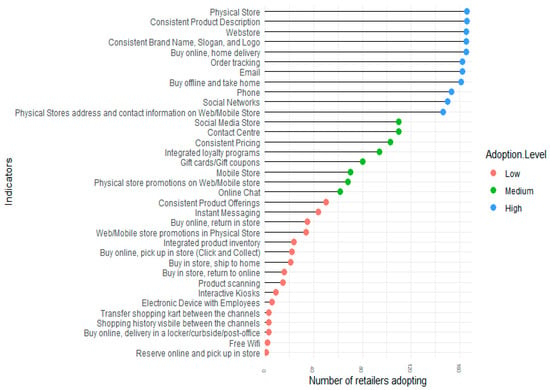

4.6. Adoption of Individual Indicator of Channel Integration Across the Sectors

It is evident from the analysis that variations exist in the implementation of channel integration both within individual dimensions and across different sectors. The lollipop chart presented in Figure 11 illustrates the extent to which the retailers adopted omnichannel services across the six dimensions of channel integration. The adoption level is defined into three categories based on the number of retailers implementing each indicator: indicators adopted by fewer than 55 retailers are considered low adoption, those adopted by 55 to 110 retailers are categorized as medium adoption, and those adopted by more than 110 retailers represent high adoption. Out of the total 166 retailers included in the study, within the multiple touchpoints dimension, the use of a webstore (not necessarily the mobile app store), in addition to a physical store, is widely adopted. In the consistent promotion dimension, indicators such as consistently using brand name, slogan, and logo, and displaying the physical store address and contact information on the web or mobile app stores, are widely adopted. Similarly, retailers tend to provide consistent product descriptions across channels in the dimension of channel consistency. However, there is a low adoption level of consistent product offerings.

Figure 11.

Lollipop diagram showing the adoption of Channel Integration Indicators across the sectors.

From the integrated customer care dimension, most retailers commonly adopt phone, email, and social networks as communication channels. However, several retailers also provide contact centre details for legal concerns. Furthermore, options such as ‘buy online, home delivery, and ‘buy offline, take home’ are consistently available in the integrated order fulfillment dimension. However, fulfillment options that define true omnichannel services, such as BOPIS and BORIS, are not implemented enthusiastically, suggesting logistical and operational difficulty. Likewise, in the integrated access to information dimension, many of the integrated services, such as product scanning, interactive kiosks, employees with electronic devices, and integrated product inventory, are not adopted by retailers, highlighting a technological barrier; nevertheless, order tracking is generally available among many of the retailers. The analysis indicates that most Indian retailers have yet to implement the full range of services that truly characterize an omnichannel retail model.

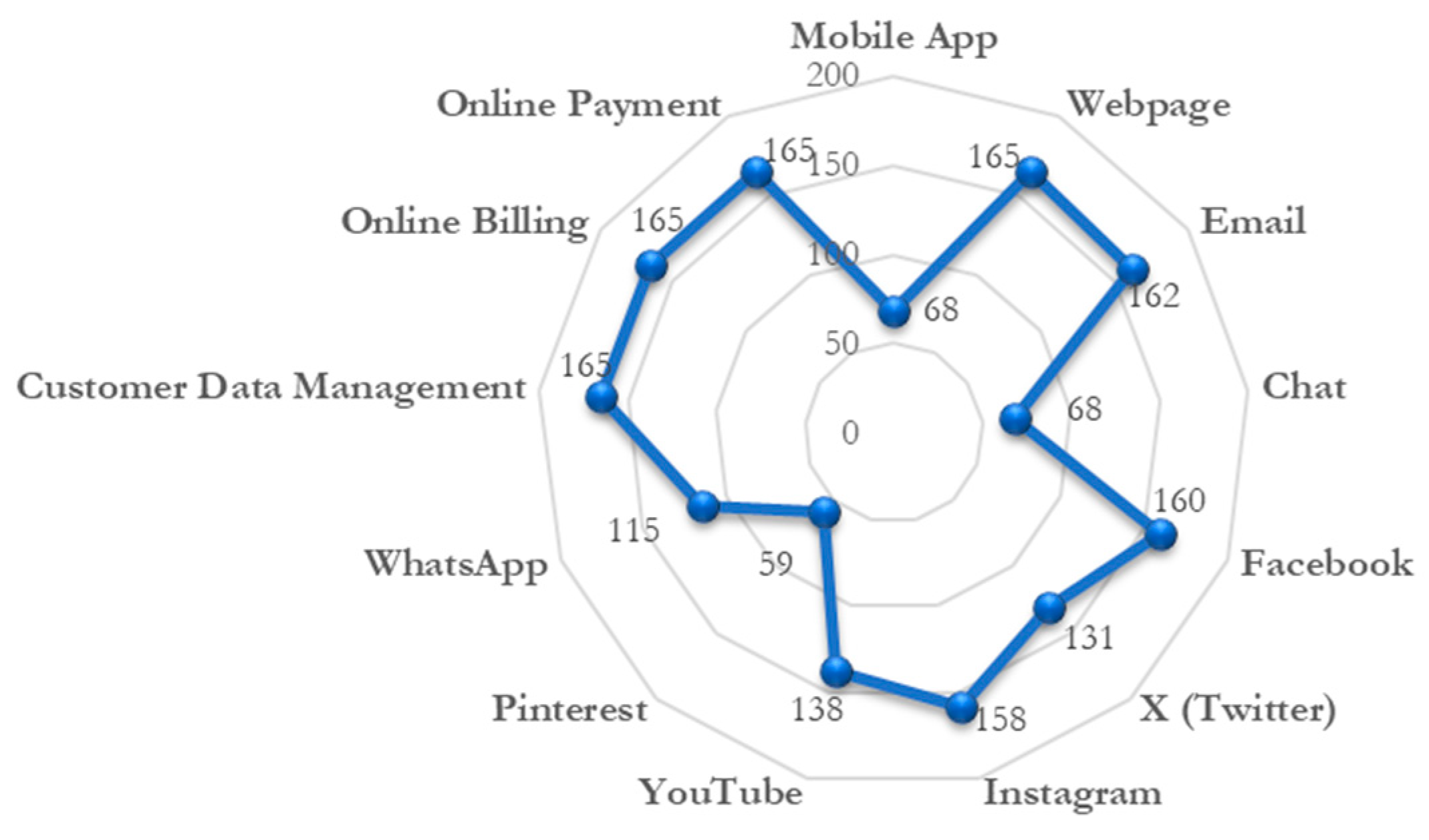

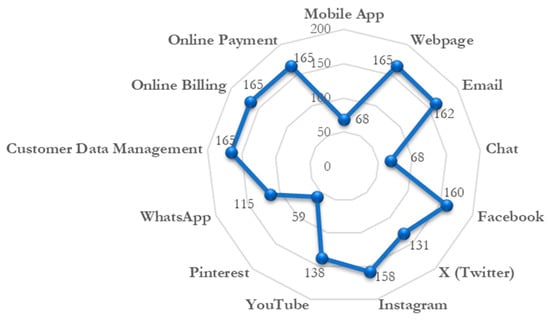

4.7. Digital Adoption Across the Sectors

The radar chart in Figure 12 illustrates the extent of digital adoption by omnichannel retailers across sectors, shifting focus from channel integration. Unlike mobile apps, webpages are the most widely adopted customer touchpoints for online transactions. The strong presence of retailers on platforms like Instagram and YouTube suggests growing investment in visual and social media marketing. Conversely, relatively lower adoption of tools such as Pinterest and live chat highlights opportunities for expansion in customer engagement. WhatsApp is the leading tool for engagement and direct communication channels with customers.

Figure 12.

Radar Chart for Digital Technologies’ Adoption.

It is also worth noting that the widespread use of online billing and payment systems reflects a growing readiness for digital transactions. Similarly, the growing adoption of customer data management systems reflects retailers’ readiness for advanced data analysis using big data and machine learning tools. These advanced technologies help provide customized customer recommendations based on their shopping history, thereby creating a more seamless shopping experience across channels. Overall, the results point to a mature stage of digital integration among Indian omnichannel retailers.

5. Conclusions

The study presents the following contributions to omnichannel retailing research. This study is among the earliest to systematically evaluate omnichannel implementation levels in the Indian context. It is the first to examine leading retail sectors, including consumer electronics, personal care and hygiene. The study also includes other major retail sectors, including fashion and apparel, home decor and furniture, as well as grocery and supermarkets. The study concludes that, overall, retailers in India exhibit only moderate levels of omnichannel integration. Only a few exceptional performers demonstrate strong integration across most dimensions, including multiple touchpoints, channel consistency, integrated promotions, integrated access to information, integrated order fulfillment, and integrated customer care services.

The study also provides a comparative analysis of sectoral performance, specifically examining channel integration across the defined areas within each sector. In line with the study’s objective, this analysis highlights differences in total channel integration levels between sectors. The results indicate that the home decor and furniture sector leads in terms of the performance score, closely followed by the grocery and supermarket sector. Retailers in the grocery sector perform consistently well, even though no individual retailer from the sector ranks among the top-performing retailers. Among the new sectors considered in the study, the consumer electronics sector performs comparatively well, whereas the personal care and hygiene sector performs very poorly. Interestingly, the overall performance of the fashion and apparel sector is impacted by many low-performing retailers, despite some retailers in this sector excelling in their omnichannel strategies.

The study also offers a comparative analysis of performances with respect to defined areas of channel integration across the sector, allowing companies to benchmark their performance against competitors within their respective sectors. The study highlights that the G&S sector leads the adoption of multiple channels in its operations. However, there were no significant variations in the adoption of multiple touchpoints when at least two channels were present. In contrast, there were significant sectoral differences in the adoption of the mobile app store.

HD&F and G&S sectors lead the integration area of channel consistency, with other sectors struggling to maintain consistency, especially in offering a consistent product across physical and online channels. With respect to integrated customer care services, there were no significant differences between the sectors with widespread use of phone, email, social media platforms, and lower adoption of instant messaging platforms. However, CE and HD&F sectors perform relatively well due to the characteristics of the products requiring critical post-sales support. There is a lack of an integrated promotion strategy, particularly evident among the PC&H and F&A sectors, primarily due to poor coordination between franchise-operated physical stores and brand-operated digital stores, which hinders the delivery of a seamless consumer experience.

Among all channel integration dimensions, integrated order fulfillment and access to information emerged as the areas with the most significant scope for improvement in the process of omnichannel transformation across sectors in India. Services related to order fulfillment, such as BOPIS, BORIS, and integrated gift cards, are in the early stages of adoption. The patterns of integrated fulfillment services suggest that the adoption is based on product characteristics and logistical feasibility and is driven by individual brand initiatives rather than the sectoral practice. The adoption of services related to access to information, such as product scanning, integration of product inventory, interactive kiosks, employees with electronic devices, and integrated loyalty programs, is also generally low across the sectors.

The study also highlights the sector-wide adoption of individual omnichannel services and categorizes them into low, medium, and high levels of adoption. The analysis indicated that the omnichannel retailers in India are yet to integrate several services that characterize omnichannel retailers. The study also enhances the theoretical framework of channel integration indicators used in prior studies by introducing additional indicators, thereby enabling a robust comparison across diverse retail sectors. The study achieves this by adding new, sector-specific indicators to the channel integration measurement instrument. One of the distinctive features of this study lies in its data collection methodology. Instead of relying solely on secondary sources or online audits, researchers physically visited stores and directly experienced and probed the services offered, enhancing the depth and authenticity of the observations.

Note that the retail landscape of India, an emerging economy, is structurally different from developed markets, say, European markets, characterized by rapid growth, a large and expanding middle-income population, the dominance of an unorganized retail sector, and the ongoing development of modern retail infrastructure. These unique dynamics influence how digital channels are adopted, integrated, and scaled across sectors. Such differences limit the direct generalizability of findings from studies conducted in advanced economies, representing a contextual limitation for comparative assessments. Nevertheless, with a rapidly expanding digital population with approximately 806 million internet users [14], 85.5% of households owning at least one smartphone, and 86.3% having internet access within the household premises [49], combined with the emphatic growth of online consumers in India, this research becomes highly relevant. The study lays a foundation for future sector-specific studies by revealing that distinctive characteristics and operational models of each retail industry shape the degree of omnichannel implementation in distinct areas of integration.

Limitations of the Study

Building on these findings, it is important to acknowledge that, as with most studies, this study had several limitations that should be considered. First, the sample comprised only brands and retailers operating in India, restricting the generalizability of the findings to other geographical contexts. Additionally, data was collected through visits to selected retailers in Tier I and Tier II cities. Future research could address this limitation by examining regional omnichannel retailers and extending data collection to Tier III and other urban cities. Second, the analysis is confined to five specific sectors, potentially overlooking the integration dynamics of other major retail sectors. Additionally, the grocery & supermarkets category retailers include hypermarkets that offer products spanning multiple sectors. However, the data derived from these retailers were analyzed solely within the G&S category, which may have introduced a classification bias. Third, the assessment method employed a binary measurement of integration features, which captures the presence or absence of integrated services but not their depth, quality, or consistency across channels. As a result, retailers offering basic capabilities (e.g., limited BOPIS availability or basic app features related to channel integration) may appear equivalent to those implementing more advanced, fully integrated features, masking differences in integration maturity across sectors.

Fourth, the study focuses on omnichannel integration features observable from the consumer’s perspective, rather than working based on customer experience or satisfaction metrics. Since subjective experience was outside the scope of this assessment, future studies should incorporate consumer perception and satisfaction indicators to provide a holistic evaluation. Fifth, the variation in sample composition across sectors could influence sectoral comparisons. As in our case, we had only seven retailers from the G&S sector, 14 from the CE, and 18 from the HD&F, compared to 100 from the F&A sector, primarily due to the selection criteria included in the research design. In future studies, researchers should consider statistical adjustments or appropriate sampling approaches to support cross-sectoral comparisons. Sixth, we assumed that retailers offer the same omnichannel services everywhere. In reality, these services may vary depending on the store location and the retailer’s convenience, taking into account factors such as business volume, logistical ease, and operational costs.

Seventh, the study does not attempt to link channel integration levels to business performance outcomes such as sales, customer retention, or market share. Exploring these relationships through quantitative performance data may provide valuable insights into the strategic value of omnichannel integration. Finally, because the data reflects conditions in 2024, the findings represent a snapshot of the current state of omnichannel adoption. Retailers are expected to continue advancing their digital strategies; therefore, longitudinal research would be beneficial for examining the evolution of integration and the long-term impacts of digital transformation.

Author Contributions

Conceptualization, M.A. and T.R.R.; methodology, M.A. and T.R.R.; software, M.A. and B.M.R.; validation, M.A., T.R.R. and B.M.R.; formal analysis, M.A. and T.R.R.; investigation, M.A. and B.M.R.; data curation, M.A.; writing—original draft preparation, M.A.; writing—review and editing, M.A., T.R.R. and M.S.K.; visualization, M.A.; supervision, T.R.R. and M.S.K.; project administration, T.R.R. and M.S.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used for the analysis will be made available by the authors, upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Willems, K.; Verhulst, N.; Brengman, M. How COVID-19 Could Accelerate the Adoption of New Retail Technologies and Enhance the (E-)Servicescape. In The ICT and Evolution of Work; Lee, J., Han, S.H., Eds.; Springer: Singapore, 2021. [Google Scholar]

- O’Toole, C.; Schneider, J.; Smaje, K.; LaBerge, L. How COVID-19 Has Pushed Companies over the Technology Tipping Point—And Transformed Business Forever; McKinsey & Company: Chicago, IL, USA, 2020. [Google Scholar]

- Lazaris, C.; Sarantopoulos, P.; Vrechopoulos, A.; Doukidis, G. Effects of Increased Omnichannel Integration on Customer Satisfaction and Loyalty Intentions. Int. J. Electron. Commer. 2021, 25, 440–468. [Google Scholar] [CrossRef]

- Cao, L.; Li, L. The Impact of Cross-Channel Integration on Retailers’ Sales Growth. J. Retail. 2015, 91, 198–216. [Google Scholar] [CrossRef]

- Sopadjieva, E.; Dholakia, U.M.; Benjamin, B. A Study of 46,000 Shoppers Shows That Omnichannel Retailing Works. Harv. Bus. Rev. 2017, 3, 1–2. [Google Scholar]

- Schramm-Klein, H.; Wagner, G.; Steinmann, S.; Morschett, D. Cross-channel integration—Is it valued by customers? Int. Rev. Retail. Distrib. Consum. Res. 2011, 21, 501–511. [Google Scholar] [CrossRef]

- Yen, Y.S. Channel integration in grocery retailers via mobile applications. Mark. Intell. Plan. 2023, 41, 427–441. [Google Scholar] [CrossRef]

- Li, Y.; Gong, X. What Drives Customer Engagement in Omnichannel Retailing? The Role of Omnichannel Integration, Perceived Fluency, and Perceived Flow. IEEE Trans. Eng. Manag. 2024, 71, 797–809. [Google Scholar] [CrossRef]

- Zhang, M.; Ren, C.; Wang, G.A.; He, Z. The impact of channel integration on consumer responses in omni-channel retailing: The mediating effect of consumer empowerment. Electron. Commer. Res. Appl. 2018, 28, 181–193. [Google Scholar] [CrossRef]

- Ghatak, R.R. Analysis of Implementation Barriers to Logistics Systems Integration for Omni-Channel Retailing using an Integrated ISM-Fuzzy MICMAC Approach. Oper. Supply Chain Manag. 2023, 16, 190–213. [Google Scholar] [CrossRef]

- von Briel, F. The future of omnichannel retail: A four-stage Delphi study. Technol. Forecast. Soc. Change 2018, 132, 217–229. [Google Scholar] [CrossRef]

- Subrammanian, R. Why Omnichannel Marketing Is Imperative for Indian Brands. Financial Express (Brand Wagon). 22 August 2020. Available online: https://www.financialexpress.com/business/brandwagon-why-omnichannel-marketing-is-imperative-for-indian-brands-2062369/ (accessed on 4 December 2024).

- Lambiwala, S. RetailTech Summit 2023: Industry Leaders Bet on Omnichannel and Automation to Drive Retail Growth. ETRetail. 22 May 2023. Available online: https://retail.economictimes.indiatimes.com/news/industry/retailtech-summit-2023-industry-leaders-bet-on-omnichannel-and-automation-to-drive-retail-growth/100426547/ (accessed on 4 February 2024).

- Kemp, S. Digital 2025: India; Datareportal: Singapore, 2025. [Google Scholar]

- Confederation of Indian Industry. Growth of Omnichannel Retail in India. CII Blog. August 2025. Available online: https://ciiblog.in/growth-of-omnichannel-retail-in-india/ (accessed on 3 December 2025).

- Park, J.; Dayarian, I.; Montreuil, B. Showcasing optimization in omnichannel retailing. Eur. J. Oper. Res. 2021, 294, 895–905. [Google Scholar] [CrossRef]

- Paul, J.; Ueno, A.; Dennis, C.; Alamanos, E.; Curtis, L.; Foroudi, P.; Kacprzak, A.; Kunz, W.H.; Liu, J.; Marvi, R.; et al. Digital Transformation: A Multidisciplinary Perspective and Future Research Agenda. Int. J. Consum. Stud. 2024, 48, e13015. [Google Scholar] [CrossRef]

- Acquila-Natale, E.; Chaparro-Peláez, J.; Del-Río-carazo, L.; Cuenca-Enrique, C. Do or Die? The Effects of COVID-19 on Channel Integration and Digital Transformation of Large Clothing and Apparel Retailers in Spain. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 439–457. [Google Scholar] [CrossRef]

- Acquila-Natale, E.; Iglesias-Pradas, S. A matter of value? Predicting channel preference and multichannel behaviors in retail. Technol. Forecast. Soc. Change 2021, 162, 120401. [Google Scholar] [CrossRef]

- Edsall, D.; Oliver, D.; Skelly, L. 2025 US Retail Industry Outlook: The Promise of Intelligent Interaction: Monetizing Mass to Micro. Deloitte Insights. 2025. Available online: https://www.deloitte.com/us/en/insights/industry/retail-distribution/retail-distribution-industry-outlook.html (accessed on 1 December 2025).

- Hoang, H.; le Tan, T. Unveiling digital transformation: Investigating technology adoption in Vietnam’s food delivery industry for enhanced customer experience. Heliyon 2023, 9, e19719. [Google Scholar] [CrossRef]

- Acquila-Natale, E.; Chaparro-Peláez, J. The long road to omni-channel retailing: An assessment of channel integration levels across fashion and apparel retailers. Eur. J. Int. Manag. 2020, 14, 999–1023. [Google Scholar] [CrossRef]

- Acquila-Natale, E.; Iglesias-Pradas, S. How to measure quality in multi-channel retailing and not die trying. J. Bus. Res. 2020, 109, 38–48. [Google Scholar] [CrossRef]

- Iglesias-Pradas, S.; Acquila-Natale, E.; Del-Río-Carazo, L. Omnichannel retailing: A tale of three sectors. Econ. Res.-Ekon. Istraz. 2022, 35, 3305–3336. [Google Scholar] [CrossRef]

- Chaparro-Peláez, J.; Acquila-Natale, E.; Hernández-García, Á.; Iglesias-Pradas, S. The digital transformation of the retail electricity market in Spain. Energies 2020, 13, 2085. [Google Scholar] [CrossRef]

- Grand View Research. India Consumer Electronics Market (2023–2030); Grand View Research: San Francisco, CA, USA, 2022. Available online: https://www.grandviewresearch.com/industry-analysis/india-consumer-electronics-market (accessed on 3 December 2025).

- Bansal, R.; Kar, S.; Gupta, S. Efficiency Assessment of Consumer’s Electronics Sector: Data Envelopment Analysis. J. Asia-Pac. Bus. 2021, 22, 279–297. [Google Scholar] [CrossRef]

- Statista. Beauty & Personal Care—India: Market Outlook 2024. Statista. Available online: https://www.statista.com/outlook/cmo/beauty-personal-care/india (accessed on 4 December 2025).

- Wilson, A.M. The use of mystery shopping in the measurement of service delivery. Serv. Ind. J. 1998, 18, 148–163. [Google Scholar] [CrossRef]

- Ryu, M.H.; Cho, Y.; Lee, D. Should small-scale online retailers diversify distribution channels into offline channels? Focused on the clothing and fashion industry. J. Retail. Consum. Serv. 2019, 47, 74–77. [Google Scholar] [CrossRef]

- Cushman & Wakefield; Confederation of Indian Industry. The Rise of India’s Omnichannel Retail: One Market, Many Touchpoints. September 2025. Available online: https://assets.cushmanwakefield.com/-/media/cw/apac/india/insights/research/one-market-many-touchpoints-indias-omnichannel-retail.pdf (accessed on 3 December 2025).

- Knight Frank India Pvt. Ltd. Think India, Think Retail 2024: Shopping Centre and High Street Dynamics Across 29 Cities. 2024. Available online: https://content.knightfrank.com/research/2830/documents/en/think-india-think-retail-2024-11173.pdf (accessed on 4 December 2025).

- Buldeo Rai, H.; Verlinde, S.; Macharis, C.; Schoutteet, P.; Vanhaverbeke, L. Logistics outsourcing in omnichannel retail: State of practice and service recommendations. Int. J. Phys. Distrib. Logist. Manag. 2019, 49, 267–286. [Google Scholar] [CrossRef]

- Piotrowicz, W.; Cuthbertson, R. Introduction to the Special Issue Information Technology in Retail: Toward Omnichannel Retailing. Int. J. Electron. Commer. 2014, 18, 5–16. [Google Scholar] [CrossRef]

- Gerea, C.; Gonzalez-Lopez, F.; Herskovic, V. Omnichannel customer experience and management: An integrative review and research agenda. Sustainability 2021, 13, 2824. [Google Scholar] [CrossRef]

- Wollenburg, J.; Holzapfel, A.; Hübner, A.H.; Kuhn, H. Configuring Retail Fulfillment Processes for Omni-Channel Customer Steering. Int. J. Electron. Commer. 2018, 22, 540–575. [Google Scholar] [CrossRef]

- Gao, W.; Fan, H.; Li, W.; Wang, H. Crafting the customer experience in omnichannel contexts: The role of channel integration. J. Bus. Res. 2021, 126, 12–22. [Google Scholar] [CrossRef]

- Chen, Y.; Chi, T. How does channel integration affect consumers’ selection of omni-channel shopping methods? An empirical study of U.S. consumers. Sustainability 2021, 13, 8983. [Google Scholar] [CrossRef]

- Cheah, J.H.; Lim, X.J.; Ting, H.; Liu, Y.; Quach, S. Are privacy concerns still relevant? Revisiting consumer behaviour in omnichannel retailing. J. Retail. Consum. Serv. 2022, 65, 102242. [Google Scholar] [CrossRef]

- Bayram, A.; Cesaret, B. Order fulfillment policies for ship-from-store implementation in omni-channel retailing. Eur. J. Oper. Res. 2021, 294, 987–1002. [Google Scholar] [CrossRef]

- Yang, L.; Li, X.; Zhong, N. Omnichannel retail operations with mixed fulfillment strategies. Int. J. Prod. Econ. 2022, 254, 108608. [Google Scholar] [CrossRef]

- Xie, C.; Gong, Y.; Xu, X.; Chiang, C.-Y.; Chen, Q. The influence of return channel type on the relationship between return service quality and customer loyalty in omnichannel retailing. J. Enterp. Inf. Manag. 2023, 36, 1105–1134. [Google Scholar] [CrossRef]

- Lin, S.W.; Huang, E.Y.; Cheng, K.T. A binding tie: Why do customers stick to omnichannel retailers? Inf. Technol. People 2023, 36, 1126–1159. [Google Scholar] [CrossRef]

- Mckechnie, D.S.; Grant, J.; Bagaria, V. Observation of listening behaviors in retail service encounters. Manag. Serv. Qual. Int. J. 2007, 17, 116–133. [Google Scholar] [CrossRef]

- Zhu, J.; Goraya, M.A.S.; Cai, Y. Retailer–Consumer Sustainable Business Environment: How Consumers’ Perceived Benefits Are Translated by the Addition of New Retail Channels. Sustainability 2018, 10, 2959. [Google Scholar] [CrossRef]

- Timoumi, A.; Gangwar, M.; Mantrala, M.K. Cross-channel effects of omnichannel retail marketing strategies: A review of extant data-driven research. J. Retail. 2022, 98, 133–151. [Google Scholar] [CrossRef]

- Patil, I. Visualizations with statistical details: The ‘ggstatsplot’ approach. J. Open Source Softw. 2021, 6, 3167. [Google Scholar] [CrossRef]

- Zaharia, S.; Schmitz, M. Customer experience in online retailing—An analysis of the main segments in German online retailing. In Advances in Human Factors, Business Management, and Leadership; Kantola, J., Nazir, S., Eds.; Advances in Intelligent Systems and Computing; Springer: Cham, Switzerland, 2020; Volume 961, pp. 141–147. [Google Scholar] [CrossRef]

- Press Information Bureau. Press Release: 29 May 2025. Press Information Bureau, Government of India. Available online: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2132330 (accessed on 2 December 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.