Abstract

This study examines Pakistan’s steel sector’s readiness to comply with the European Union’s Carbon Border Adjustment Mechanism (CBAM), which mandates verified emissions disclosures for carbon-intensive imports. Although the sector primarily uses electric arc furnace (EAF) technology, recognized for its lower emissions, Pakistan lacks a formal Monitoring, Reporting, and Verification (MRV) framework to support product-level emissions certification. Through qualitative research, including stakeholder engagements and policy analysis, the study identifies key barriers related to emissions data, institutional capacity, and trade exposure. This study proposes actionable policy recommendations to strengthen MRV systems, facilitate compliance, and enhance the sector’s competitiveness in regulated markets.

1. Introduction

The steel industry is a major global emitter, contributing approximately 7% of greenhouse gas (GHG) emissions and 11% of global CO2 emissions [1]. Around 95% of these emissions are linked to iron and steel production via blast furnace–basic oxygen furnace (BF–BOF) routes, which are highly coal-dependent [2]. Average emissions have reached 1.89 tonnes of CO2 per tonne of steel [3], underscoring the need for cleaner production pathways. In contrast, emerging methods such as electric arc furnaces (EAFs) and hydrogen-based direct reduction present lower-carbon alternatives and are gaining global traction [4]. The demand for low-carbon steel is rising rapidly, with market projections climbing from USD 4.33 billion in 2024 to USD 117.13 billion by 2031 at a CAGR of 60.2% [5]. Notably, 93% of new global steel capacity aligns with EAF technology [6], marking a transition toward secondary production and renewables-powered processes. This transformation is being driven by decarbonization regulations, carbon pricing, ESG-aligned finance, and shifting consumer preferences. Whereas, around the world, the shift toward low-carbon steel is evident, developing economies such as Pakistan will have to survive under diverse pressures due to the lack of policy and economic support.

1.1. Overview of the Steel Sector in Pakistan

Pakistan’s steel sector, while modest in scale globally, plays a critical role domestically, contributing approximately 3.5% to the country’s Large-Scale Manufacturing (LSM) output, which itself accounts for 9.1% of GDP [7]. With an installed capacity of over 5 million metric tons and annual production ranging between 3.3 and 4 million metric tons, the sector supports infrastructure, energy, transportation, and industrial manufacturing [8]. The industry comprises nearly 600 enterprises across formal and informal segments and is characterized by high energy intensity, capital costs, and dependence on iron ore and scrap inputs.

Production in Pakistan is dominated by the EAF (secondary) route, which utilizes up to 105% scrap and emits only 0.357 tonnes of CO2 per tonne of steel, significantly lower than the 1.987 tonnes associated with the BF–BOF route that uses just 13.8% scrap [9]. This makes the domestic sector relatively cleaner compared to global norms. The market is segmented into long products (54%), flat products (38%), and pipes/tubes (8%) [10]. Long products, mostly rebars, wire rods, and structural steel, are produced using EAFs but suffer from quality compliance issues, with only 10% of manufacturers meeting standard benchmarks.

1.2. Low Carbon Development

However, as global carbon regulations tighten, Pakistan’s steel industry faces serious competitiveness risks. The EU’s Carbon Border Adjustment Mechanism (CBAM), in its transitional phase since October 2023, mandates emissions reporting on carbon-intensive imports like steel, with carbon levies taking effect from 2026 [11]. Without a national Monitoring, Reporting, and Verification (MRV) system, Pakistani exporters risk being assigned default, high-emission values, eroding the environmental advantage of their cleaner EAF-based production [12]. Moreover, Pakistan’s updated Nationally Determined Contributions (NDCs) under the Paris Agreement prioritize emissions reductions in energy, agriculture, and transport but omit industry-specific pathways for sectors like steel [13].

This dual exposure to external trade risks from carbon pricing and the internal policy vacuum signals an urgent need for sectoral reform. Yet, the steel industry remains underrepresented in climate policy and research discourse. So far, the decarbonization pathways in the Pakistan steel sector have been barely empirically examined, especially as regards export competitiveness and international compliance mechanisms such as CBAM. This paper addresses this gap focusing on assessing the readiness of Pakistan’s steel sector to comply with the European Union’s Carbon Border Adjustment Mechanism (CBAM). Specifically, it aims to (i) evaluate the current status of emissions monitoring and reporting practices in relation to CBAM (ii) identify key institutional, regulatory, and technical barriers to compliance, including gaps in data availability and sectoral capacity; (iii) examine the potential trade and competitiveness risks that Pakistani steel exporters may face under CBAM implementation; and (iv) propose a phased and actionable roadmap to support compliance through improved MRV systems, policy alignment, and targeted industry support.

2. Methodology

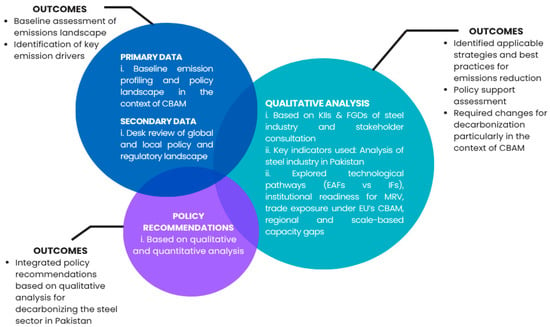

Figure 1 illustrates the methodological framework of the study. To support the qualitative analysis, the study conducted four Key Informant Interviews (KIIs) and four Focus Group Discussions (FGDs) conducted during 2024 and 2025 with purposively selected participants representing key institutional and industrial stakeholders, including large-scale and SME steel producers, the Ministry of Commerce, the Ministry of Climate Change and Environmental Coordination (MOCC&EC), the National Energy Efficiency and Conservation Authority (NEECA), and independent experts in trade and energy policy. Selection criteria emphasized direct involvement in emissions reporting, steel production processes, and export compliance. Thematic coding was employed to analyze the qualitative data, enabling the identification and synthesis of stakeholder insights across three principal dimensions: (i) emissions profile and data availability, (ii) trade exposure and compliance risks, and (iii) institutional preparedness for Monitoring, Reporting, and Verification (MRV).

Figure 1.

Methodological Framework.

Globally a higher share of emissions come from the carbon intensive sectors, whereas, Pakistan’s steel sector operates primarily in the mid- and downstream segments of the value chain, namely, billet reheating, rolling, and finishing, where global emissions shares typically remain below 10% for each stage. The sector avoids the most carbon-intensive upstream processes like ironmaking via blast furnaces, which account for 45–50% of global steel emissions [14]. Moreover, Pakistan’s reliance on electric arc furnaces (EAFs) and induction furnaces (IFs) for secondary steel production further positions it as relatively lower emitting within the global steel landscape.

Despite this, Pakistan’s steel sector is estimated to emit between 1.9 and 2.5 million tonnes of CO2 annually, largely due to inefficient energy use and the absence of heat recovery and emissions monitoring systems. With 30–40% of its semi-finished and finished steel products exported, primarily to markets with rising climate regulations, the lack of a formalized Monitoring, Reporting, and Verification (MRV) framework exposes exporters to default high-emission values under the EU’s Carbon Border Adjustment Mechanism (CBAM). As a result, the inability to credibly report lower emissions intensity could undermine Pakistan’s competitiveness in regulated markets as highlighted in Table 1 below.

Table 1.

Emission across the Global Value Chain [14].

3. Results and Discussion

The results are organized thematically to reflect the structure of the steel value chain and the core dimensions of the study, including emission profile, trade exposure and compliance risk, MRV, and Institutional Readiness. Each thematic area is discussed with reference to global decarbonization benchmarks, contextual challenges specific to Pakistan’s steel sector, and implications for policy and practice. Notably, Pakistan is already exporting steel and related products to the European Union, placing its producers within the scope of the EU’s Carbon Border Adjustment Mechanism (CBAM). While the current transitional phase requires emissions reporting, full implementation beginning in 2026 will introduce financial levies on embedded carbon. The mechanism is expected to gradually expand beyond its initial coverage of cement, iron and steel, aluminum, fertilizers, hydrogen, and electricity. Although only 1.23% of Pakistan’s total exports are currently at risk under CBAM, this figure is expected to grow as both the product scope and enforcement of the regulation expand. This underscores the urgency for Pakistani exporters to establish credible emissions reporting and low-carbon production pathways to maintain market access and competitiveness [15]. The integration of qualitative insights with international evidence allows for a grounded yet forward-looking understanding of the sector’s readiness for climate-aligned transformation.

3.1. Emissions Profile and Data Availability

Pakistan’s steel sector is largely based on secondary production technologies, primarily electric arc furnaces (EAFs) and induction furnaces (IFs), which use scrap metal as the principal feedstock. These technologies are significantly less carbon-intensive compared to primary steelmaking routes, such as the blast furnace–basic oxygen furnace (BF–BOF) process. According to PACRA’s sector analysis, the average emissions intensity for EAF-based steel production in Pakistan is approximately 0.357 tonnes of CO2 per tonne of steel, in contrast to 1.987 tonnes of CO2 per tonne for BF–BOF production.

Despite using electric arc furnace (EAF) technology, which is generally less carbon-intensive than conventional blast furnace–basic oxygen furnace (BF–BOF) routes, the sector lacks the necessary systems and protocols to quantify and report product-level emissions as required under CBAM. Most firms do not conduct facility-level energy audits or maintain reliable records of Scope 1 and Scope 2 emissions. There is currently no standardized methodology in place for calculating embedded emissions, and mechanisms for third-party verification or product carbon footprint certification are virtually absent.

This absence of credible emissions reporting infrastructure presents a material compliance risk. Under the CBAM transitional phase (2023–2025), importers are obligated to submit emissions declarations based on verified product-level data. From January 2026 onward, carbon levies will be imposed on imports based on these declared values. In cases where exporters fail to provide verifiable data, the EU assigns default emissions values reflecting high-emitting BF–BOF benchmarks. As a result, Pakistani steel, despite having a significantly lower emissions profile, may be treated as if it has over 450% higher embedded carbon content, leading to disproportionately high carbon costs and undermining the sector’s trade competitiveness.

3.2. Trade Exposure and Compliance Risks

Although steel currently constitutes a minor share of Pakistan’s exports to the European Union, its presence in CBAM-covered product categories is growing. According to data from the State Bank of Pakistan, exports to Western Europe reached USD 7.533 billion during the first ten months of FY2025, marking an 8.62% year-on-year increase. Within this portfolio, products such as rebars, flat-rolled steel sheets, and welded steel tubes are increasingly being exported to CBAM-participating member states, including Germany, the Netherlands, and Italy [16].

Under CBAM provisions, exporters are required to submit quarterly emissions declarations for covered goods and subsequently pay a carbon levy reflecting the embedded CO2 content of each product. As of mid-2025, the prevailing EU Emissions Trading System (ETS) price for carbon ranges between EUR 70 and EUR 80 per tonne of CO2 [17]. For instance, as mentioned in Table 2 below, a Pakistani steel product that is not accompanied by verified emissions data could be assigned the default BF–BOF value of 1.987 tCO2/tonne, resulting in a CBAM cost of EUR 139.09–EUR 158.96 per tonne. In contrast, a properly verified EAF-based product with actual emissions of 0.357 tCO2/tonne would incur a significantly lower cost of EUR 24.99–EUR 28.56 per tonne.

Table 2.

Simulated CBAM Cost Scenarios for Pakistani Steel Exports under Verified and Default Emissions Values.

Under CBAM’s transitional phase, exporters are required to submit quarterly declarations of embedded emissions for each covered product. From January 2026, a financial levy will be imposed based on the declared or default emissions content, calculated using the prevailing carbon price under the EU Emissions Trading System (ETS). If an exporter provides verified emissions data, the CBAM levy is calculated accordingly. In the absence of verification, the EU applies a default value, typically based on the more carbon-intensive blast furnace–basic oxygen furnace (BF–BOF) method.

To illustrate the cost differential, this study simulated CBAM charges using the verified emissions intensity of Pakistan’s electric arc furnace (EAF)-based steel (0.357 tCO2/tonne) versus the default BF–BOF value (1.987 tCO2/tonne). The following Table 2 outlines the estimated CBAM cost per tonne of steel using mid-2025 EU ETS carbon prices, ranging from EUR 70 to EUR 80 per tonne of CO2.

Assuming a medium-sized steel exporter ships 10,000 tonnes of steel products annually to the EU, the total CBAM cost under each scenario would be as follows:

- Verified data: EUR 249,900–EUR 285,600I

- Unverified (default): EUR 1,390,900–EUR 1,589,600

- Difference (penalty): EUR 1.14–EUR 1.3 million annually

This highlights the severe financial disadvantage faced by exporters who lack the capacity to verify and report actual emissions. Even though Pakistani steel is inherently less carbon-intensive due to its reliance on EAF-based production, the absence of MRV infrastructure exposes exporters to default carbon pricing, resulting in disproportionately high adjustment costs.

These findings underscore the urgency of establishing a robust national MRV system and emissions verification mechanism. Without credible data and third-party certification, Pakistan’s exporters will struggle to maintain price competitiveness in CBAM-regulated markets. Moreover, as CBAM expands its scope and enforcement, the scale of exposure is likely to increase, affecting a broader range of industrial exports.

3.3. MRV and Institutional Preparedness

A foundational requirement of CBAM is the existence of robust national systems for Monitoring, Reporting, and Verification (MRV) of greenhouse gas emissions. As of 2025, Pakistan does not possess a sector-specific MRV framework tailored to the needs of the steel industry. The country’s existing greenhouse gas inventories are aggregated at the macro-sectoral level and lack the granularity needed for product-level emissions accounting.

Currently, no domestic guidelines exist that are aligned with internationally recognized standards such as ISO 14067 [18] (Carbon Footprint of Products) or EN 19694 (Industrial Emissions Quantification) [19]. Furthermore, Pakistan lacks accredited third-party verification bodies and digital infrastructure to support firm-level emissions monitoring and lifecycle assessments, both of which are required for CBAM compliance.

Institutional fragmentation further hinders the development of an integrated MRV framework. The Ministry of Climate Change and Environmental Coordination (MOCC&EC), while responsible for reporting under the Paris Agreement, does not oversee trade-related MRV functions. The Ministry of Commerce, which is responsible for export facilitation, has yet to issue formal guidance on CBAM-related obligations. The Pakistan Environmental Protection Agency (Pak-EPA) currently lacks the legal mandate and technical expertise to serve as a coordinating body for industrial MRV.

As a result, the institutional architecture necessary for operationalizing MRV in the steel sector remains underdeveloped. Stakeholder interviews revealed that more than 80% of firms were unaware of the emissions documentation required under CBAM, and none had obtained certification aligned with EU-recognized protocols. This unpreparedness limits the sector’s ability to demonstrate compliance and participate effectively in low-carbon trade regimes.

3.4. Discussions

Assessing Pakistan’s preparedness for the EU’s Carbon Border Adjustment Mechanism (CBAM) gains further clarity when viewed in relation to the experiences of other developing countries similarly exposed to carbon-related trade measures. Although institutional and technical capacity constraints are common across the Global South, several peer economies have taken more proactive steps to align their industrial policies with emerging carbon regulations. Comparative insights from India, Vietnam, South Africa, and Brazil demonstrate a spectrum of policy responses ranging from the development of national MRV systems to pilot certification mechanisms and engagement with EU regulators. These international examples offer valuable lessons for Pakistan and underscore the urgency of institutionalizing emissions tracking and compliance infrastructure to remain competitive in carbon-sensitive markets.

While Pakistan’s steel sector faces mounting pressure to comply with the EU’s Carbon Border Adjustment Mechanism (CBAM), other developing countries have taken more proactive steps to prepare their industries for this emerging trade reality. In India, for example, authorities have initiated sector-wide consultations and are developing a Green Steel Taxonomy under the Ministry of Steel, alongside domestic certification frameworks spearheaded by the National Institute of Secondary Steel Technology (NISST). Studies estimate that small and medium enterprises (SMEs) in India may face cost increases of up to 25% under CBAM due to limited emissions data and compliance infrastructure [20].

Vietnam has projected a potential revenue loss of up to USD 1.1 billion in steel exports to the EU by 2030 if MRV reforms are not implemented. Major firms such as Hoa Phat and VNSteel are already investing in green energy strategies and emissions monitoring to avoid CBAM-related penalties [21]. Similarly, South Africa, whose iron and steel sector comprises about 19% of its exports to the EU, has begun developing MRV pilot systems and engaging in trade and sustainability policy dialogues, although it still lacks a centralized registry [22].

In Brazil, while the EU accounts for only about 10% of the country’s iron and steel exports, producers have integrated Environmental Product Declarations (EPDs) into their carbon disclosure practices and aligned their operations with voluntary carbon market frameworks. The World Economic Forum notes that Brazil’s alignment with internationally recognized MRV systems is part of a broader strategy to decarbonize its steel, aluminum, and aviation sectors [23].

In contrast, Pakistan has yet to establish a national MRV framework, third-party verification bodies, or a product-level emissions registry. Unlike its peers, it has not initiated national dialogues, sectoral certification mechanisms, or pilot tools to prepare exporters for CBAM enforcement. This comparative analysis underscores that while many developing countries face similar challenges, Pakistan risks falling behind unless it rapidly institutionalizes emissions tracking and compliance infrastructure aligned with international standards.

4. Policy Recommendations

Building on the sectoral assessment, stakeholder inputs, and compliance risks outlined in this study, the following policy recommendations propose a phased and actionable framework to guide Pakistan’s steel industry toward a competitive, climate-aligned future.

The key policy recommendations highlighted below aim at improving the institutional readiness of Pakistan to adhere to the Carbon Border Adjustment Mechanism (CBAM). Ensuring the effectiveness of the proposed MRV and certification systems will require clear institutional mandates, coordinated implementation, and a designated national authority to anchor Pakistan’s CBAM response.

Pakistan’s limited preparedness for CBAM is largely attributable to institutional fragmentation and the absence of clearly defined mandates. The Ministry of Climate Change and Environmental Coordination (MoCC&EC), while responsible for national greenhouse gas inventories and international climate commitments, lacks jurisdiction over trade-related emissions reporting. Conversely, the Ministry of Commerce, which oversees export facilitation, has yet to issue CBAM-specific guidance, and the Pakistan Environmental Protection Agency (Pak-EPA) neither holds the legal mandate nor possesses the technical capacity to conduct product-level emissions verification. To address these institutional gaps, the MoCC&EC should be designated as the lead agency for coordinating the national CBAM response, supported by an inter-ministerial task force comprising representatives from the Ministries of Commerce, Industries, and Pak-EPA. This coordinating body should be tasked with developing the MRV framework, aligning emissions reporting with export procedures, and serving as a liaison with EU regulatory authorities. Simultaneously, Pak-EPA’s legal mandate should be expanded to include industrial emissions verification, accompanied by targeted capacity-building investments in digital MRV systems, third-party certification protocols, and international compliance alignment. Without such structural reforms and institutional leadership, Pakistan risks falling short of CBAM enforcement requirements and losing competitiveness in an increasingly climate-regulated global trade environment. The key policy recommendations to strengthen the institutional readiness for CBAM in the case of Pakistan are summarized below in Table 3.

Table 3.

Phased Policy Roadmap for CBAM Compliance in Pakistan’s Steel Sector.

5. Conclusions

This study finds that while Pakistan’s steel sector predominantly uses lower-emission technologies like electric arc furnaces (EAFs) and induction furnaces (IFs), it remains ill-prepared for the EU’s Carbon Border Adjustment Mechanism (CBAM) due to the absence of standardized MRV systems, lack of accredited verification mechanisms, and weak institutional coordination. These gaps risk subjecting exporters to default emissions values, resulting in elevated carbon costs and reduced trade competitiveness. A phased policy response is urgently required, focusing on MRV development, capacity building, and institutional reforms to align industrial emissions transparency with international trade demands and to unlock opportunities in green exports and climate finance.

This study is limited by its qualitative methodology, drawing on key informant interviews, focus group discussions, and policy reviews without access to firm-level emissions data or lifecycle assessments. As a result, it cannot provide quantitative estimates of sector-wide emissions performance or CBAM-related cost impacts. Moreover, while respondents were selected for their institutional relevance, their views may be shaped by organizational affiliations or commercial interests. These constraints highlight the need for future research based on standardized emissions datasets and robust, empirical benchmarking.

Author Contributions

Conceptualization, S.A.A.M. and S.Q., methodology, S.A.A.M. and A.I.; writing—original draft preparation, S.A.A.M.; writing—review and editing, S.Q.; supervision, S.Q. and M.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is contained within the article.

Acknowledgments

The authors would like to acknowledge the support received from the National Energy Efficiency and Conservation Authority (NEECA), the Ministry of Commerce, the Ministry of Energy, the National University of Science and Technology (NUST), and the Sustainable Development Policy Institute (SDPI). We also greatly appreciate the valuable inputs from Irfan Ahmad Gondal, Khalid Waleed, Nadeem Niwaz, and Fridolin Holm.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| CBAM | Carbon Border Adjustment Mechanism | EPA | Environmental Protection Agency (Pakistan) |

| CO2 | Carbon Dioxide | EU | European Union |

| EAF | Electric Arc Furnace | ETS | Emissions Trading System |

| BF–BOF | Blast Furnace–Basic Oxygen Furnace | SME | Small and Medium Enterprise |

| GHG | Greenhouse Gas | IF | Induction Furnace |

| MRV | Monitoring, Reporting, and Verification | FGD | Focus Group Discussion |

| LSM | Large-Scale Manufacturing | KII | Key Informant Interview |

| NDC | Nationally Determined Contribution | ISO | International Organization for Standardization |

| SDPI | Sustainable Development Policy Institute | NUST | National University of Sciences and Technology |

| NEECA | National Energy Efficiency and Conservation Authority | MOCC&EC | Ministry of Climate Change and Environmental Coordination |

References

- Lempriere, M. Steel Industry Makes ‘Pivotal’ Shift Towards Lower-Carbon Production. Carbon Brief 2023. Available online: https://www.carbonbrief.org/steel-industry-makes-pivotal-shift-towards-lower-carbon-production/ (accessed on 8 July 2025).

- Hasanbeigi, A. Steel Climate Impact: An International Benchmarking of Energy and CO2 Intensities. 2022. Available online: https://static1.squarespace.com/static/5877e86f9de4bb8bce72105c/t/624ebc5e1f5e2f3078c53a07/1649327229553/Steel+climate+impact-benchmarking+report+7April2022.pdf (accessed on 8 July 2025).

- World Steel Association. Climate Change and the Production of Iron and Steel. 2024. Available online: https://worldsteel.org/wp-content/uploads/Climate_PP_September-2024-1.pdf (accessed on 8 July 2025).

- Devlin, A.; Kossen, J.; Goldie-Jones, H.; Yang, A. Global green hydrogen-based steel opportunities surrounding high quality renewable energy and iron ore deposits. Nat. Commun. 2023, 14, 2578. [Google Scholar] [CrossRef] [PubMed]

- Shah, R. Green Steel Market to Witness High Growth Owing to Rising Environmental Concerns. The Daily Scrum News, 17 December 2024. Available online: https://www.thedailyscrumnews.com/green-steel-market-to-witness-high-growth-owing-to-rising-environmental-concerns/ (accessed on 8 July 2025).

- Lempriere, M. ‘Significant Shift’ Away from Coal as Most New Steelmaking Is Now Electric. Carbon Brief 2024. Available online: https://www.carbonbrief.org/significant-shift-away-from-coal-as-most-new-steelmaking-is-now-electric/ (accessed on 8 July 2025).

- Government of Pakistan, Finance Division. Pakistan Economic Survey 2024–25. 2025. Available online: https://www.finance.gov.pk/survey_2025.html (accessed on 8 July 2025).

- Sustainable Ships. What is the Carbon Footprint of Steel? Sustainable Ships, 15 March 2025. Available online: https://www.sustainable-ships.org/stories/2022/carbon-footprint-steel (accessed on 8 July 2025).

- Tauseef, S.; Sarwar, U. Steel Sector Study. 2022. Available online: https://www.pacra.com/sector_research/PACRA%20Research%20-%20Steel%20-%20Sep%2722_1662124643.pdf (accessed on 8 July 2025).

- Tauseef, S.; Wajih, A. Steel Sector Study. 2023. Available online: https://www.pacra.com/sector_research/PACRA%20Research%20-%20Steel%20-%20Sep%2723_1693919766.pdf (accessed on 8 July 2025).

- European Union. Carbon Border Adjustment Mechanism. 2025. Available online: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en (accessed on 8 July 2025).

- News Desk. Pakistan’s steel sector lacks energy efficiency monitoring system, hindering access to green financing, carbon credits: Report. Profit, 27 June 2025. Available online: https://profit.pakistantoday.com.pk/2025/06/27/pakistans-steel-sector-lacks-energy-efficiency-monitoring-system-hindering-access-to-green-financing-carbon-credits-report/ (accessed on 8 July 2025).

- Government of Pakistan. Pakistan Updated Nationally Determined Contributions 2021. 2021. Available online: https://unfccc.int/sites/default/files/NDC/2022-06/Pakistan%20Updated%20NDC%202021.pdf (accessed on 8 July 2025).

- Tiseo, I. Distribution of steel industry emissions across the value chain worldwide in 2022, by segment. Statista, 10 July 2025. Available online: https://www.statista.com/statistics/1609322/steel-industry-value-chain-emission-shares-by-segment/ (accessed on 15 July 2025).

- Hanif, U. Pakistan ill-prepared for CBAM environmental standards. The Express Tribune, 27 November 2024. Available online: https://tribune.com.pk/story/2512218/pakistan-ill-prepared-for-cbam-environmental-standards (accessed on 15 July 2025).

- Profit. Pakistan’s Exports to Europe Rise 8.62% to $7.553 Billion in 10 Months. Profit, 4 June 2025. Available online: https://profit.pakistantoday.com.pk/2025/06/04/pakistans-exports-to-europe-rise-8-62-to-7-553-billion-in-10-months/ (accessed on 15 July 2025).

- Lautier, V. European Carbon Market: Our Guide for 2025. 2024. Available online: https://www.homaio.com/post/eu-ets-definitions-updated-guide (accessed on 15 July 2025).

- ISO 14067; Greenhouse Gases (Carbon Footprint of Products). SGS Publishing: Geneva, Switzerland, 2025.

- BS EN 19694-1; Greenhouse Gases: Determination of Greenhouse Gas Emissions in Energy-Intensive Industries Part 1: General Guidance. BSI Standards Publication: London, UK, 2016.

- Clean Carbon. CBAM Reporting: How It Impacts Indian Iron and Steel Sector. 2025. Available online: https://cleancarbon.ai/cbam-reporting-how-it-impacts-iron-and-steel-sector/ (accessed on 15 July 2025).

- Southeast Asia Energy Transition Partnership. Carbon Border Adjustment Mechanism Impact Assessment Report for Vietnam. 2023. Available online: https://www.energytransitionpartnership.org/wp-content/uploads/2024/06/20240318_Final-CBAM-Assessment-Report-final.pdf (accessed on 15 July 2025).

- Maimele, S. Responding to the European Union’s Carbon Border Adjustment Mechanism (CBAM): South Africa’s Vulnerability and Responses. 2023. Available online: https://www.tips.org.za/research-archive/sustainable-growth/green-economy-2/item/4590-responding-to-the-european-union-s-carbon-border-adjustment-mechanism-cbam-south-africa-s-vulnerability-and-responses (accessed on 15 July 2025).

- World Economic Forum; Boston Consulting Group. Decarbonizing Brazil’s Steel, Aluminium and Aviation Sectors. 2024. Available online: https://www3.weforum.org/docs/WEF_Decarbonizing_Brazil%E2%80%99s_Steel_Aluminium_and_Aviation_Sectors_2024.pdf (accessed on 15 July 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).