Abstract

The global steel industry emits 1.92 tons of CO2 per ton of output and faces urgent pressure to decarbonize. In Pakistan, the sector accounts for 0.29 tons of CO2 per ton of output, with limited mitigation frameworks in place. Green hydrogen (GH2)-based steelmaking offers a strategic pathway toward decarbonization. However, realizing its potential depends on access to renewable energy. Despite Pakistan’s substantial technical wind potential of 340 GW, grid limitations currently restrict wind power to only 4% of national electricity generation. This study explores GH2 production through sector coupling and power wheeling, repurposing curtailed wind energy from Sindh to supply Karachi’s steel industry, and proposing a phased roadmap for GH, enabling fossil fuel substitution, industrial resilience, and alignment with global carbon-border regulations.

1. Introduction

The global steel industry is a major contributor to economic activity, projected to reach 2.2 billion metric tons by 2030, growing at a CAGR of 2.9% from 2024 to 2030, driven by construction, automotive, and infrastructure demands [1]. The Asia Pacific market size accounted for USD 960 billion in 2024 [2]. However, the sector is also one of the largest industrial sources of carbon emissions. Average CO2 emissions per ton of steel increased from 1.85 tons in 2018 to 1.92 tons in 2023, accompanied by an energy intensity of 21.27 GJ per tonne of crude steel cast, largely due to its dependence on coal, which supplies about 75% of its energy and feedstock. In response, there is increasing momentum toward green steel, produced via low-emission technologies such as hydrogen-based direct reduction and electric arc furnaces (EAFs) powered by renewable energy [3,4]. This shift is being driven by tightening regulations, carbon pricing mechanisms, investor pressure on Environmental, Social, and Governance (ESG) performance, and growing consumer demand for sustainable materials. Technological advances are making green steel increasingly cost-competitive, accelerating its adoption. Notably, 93% of newly announced steelmaking capacity globally now follows the EAF route, signaling a clear transition away from coal-based production [4].

1.1. Significance of Green Hydrogen (GH2) for Decarbonization of Steel Industry

Hydrogen-based steelmaking is emerging as a key enabler. Sweden’s HYBRIT initiative has already produced the world’s first hydrogen-reduced steel, and commercial H2-DRI plants are under construction in Europe. Globally, however, near-zero-emission steel output remains nascent, less than 1 million tonnes annually as of 2023 [5].

Despite progress, key challenges persist, including technological limitations and the need for extensive infrastructure investment. GH2 and its production through renewable energy remain expensive, and scaling technologies like H2-DRI to industrial levels poses significant hurdles. Infrastructure for hydrogen production and distribution, as well as regulatory certainty, are essential for widespread adoption. Furthermore, public policy is beginning to align with decarbonization goals, as the EU’s Carbon Border Adjustment Mechanism (CBAM), introduced in 2023, will impose carbon tariffs on high-emission steel imports and phase out free EU ETS allowances by 2034 [6]. The EU Green Deal Industrial Plan and Hydrogen Bank are also promoting low-carbon industrial investments [7].

1.2. Status Quo of Decarbonization in Steel Industry of Pakistan

In contrast to global trends, Pakistan’s steel industry remains small but is poised for transformation. Against the global benchmark of 2.5 tons of CO2 per ton of steel produced via the Blast Furnace-Basic Oxygen Furnace (BF-BOF) route, Pakistan’s steel sector, driven by secondary steelmaking through the Electric Induction Furnace (EIF) process, emits 0.29 tons of CO2 per ton of steel [8]. Per capita steel consumption is approximately 48 kg/year, suggesting room for growth [9]. Domestic production is based almost entirely on scrap recycling via electric arc and induction furnaces, as the country’s only integrated steel mill, Pakistan Steel Mills (PSM), has been non-operational since 2015. According to a 2020 report by Climate Transparency, Pakistan’s steel industry has an approximate emission footprint of 0.59 MtCO2e and an emissions intensity of 2360 kgCO2e/tonne [10]. The widespread use of outdated induction furnace technology leads to high energy consumption and inefficiency. Emissions are projected to rise steadily, yet there are no dedicated national policies for steel sector decarbonization. As of January 2025, Pakistan imported iron and steel products worth PKR 60,804 million [11], showing how the dependence on imported steel exposes the sector to price volatility and forex risks. Thus, decarbonizing Pakistan’s steel sector faces considerable barriers including high capital costs, outdated equipment, limited access to clean technologies, unreliable electricity supply, and a lack of policy or financial incentives.

However, the sector presents opportunities for green development. Pakistan’s abundant renewable resources offer a long-term pathway to clean energy. Given the predominance of secondary steelmaking, grid decarbonization would have an immediate impact. Sindh, in particular, hosts a growing steel industry and substantial wind power capacity, yet much of this renewable potential is currently underutilized due to curtailment issues. A sector coupling approach, such as utilizing the region’s renewable energy for green hydrogen (GH2) production, could address this challenge while providing a clean energy feedstock for industry. Additionally, the potential revival of PSM is gaining strategic traction, with renewed Russian interest in modernizing or replacing the facility, via energy-efficient, hybrid gas or electric furnaces [12]. A successful revival could reduce import dependency, generate employment, and promote low-carbon steel production.

As international markets shift toward decarbonized value chains and stringent regulations, Pakistan must act decisively to align its steel sector with global climate and trade realities. Building on the preceding discussion, this study aims to (i) analyze the existing conditions, opportunities, and challenges in the context of decarbonizing Pakistan’s steel industry, (ii) explore how Pakistan can utilize its renewable energy resources to align with global decarbonization goals, and (iii) propose feasible low-carbon development pathways to enhance the competitiveness and sustainability of Pakistan’s steel sector by leveraging sector coupling and power wheeling, enabling industrial symbiosis for GH2 co-production.

2. Methodology

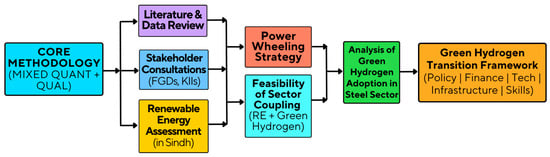

This study employs a mixed-method approach to assess the current state and decarbonization potential of Pakistan’s steel sector, with a dedicated focus on enabling the transition to GH2 via sector coupling. The methodology integrates both quantitative and qualitative data, sourced from an extensive review of literature, policy documents, financial data, and industrial reports. Key sources include the Pakistan Credit Rating Agency (PACRA) [9], the International Renewable Energy Agency (IRENA) [5], and SDPI’s analysis under the Annual State of Renewable Energy (ASRE) 2024 [13] and Pakistan Industrial Decarbonization Program (PIDP), specifically addressing low-carbon development potential in the steel industry [4]. Figure 1 outlines the methodology employed in this study.

Figure 1.

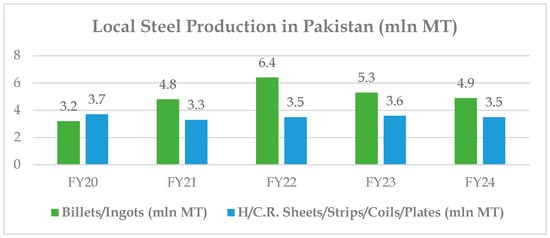

Trends of local steel production in Pakistan expressed in million metric tons [9].

Primary data collection further complements the analysis through stakeholder consultations, including focus group discussions (FGDs) such as “Exploring the Potential of Green Hydrogen in Hard-to-Abate Sectors of Pakistan” [14] and “Special Lecture with Amreli Steels Limited on Charting the Course of the Decarbonization Drive in Pakistan’s Steel Industry” [15], along key informant interviews (KIIs) [16,17,18] with industry representatives, energy regulators, grid operators, and renewable energy experts provided critical qualitative insights and enriched the evidence base. Together, these data sources inform a strategic assessment and policy design process, examining the feasibility of sector coupling and renewable power wheeling as strategic enablers of GH2 integration. Given the co-location potential between steel clusters and renewable energy corridors in Sindh, the analysis explores how dedicated renewable electricity could be wheeled to industrial zones to power electrolyzers for hydrogen production, to support a low-carbon steel value chain. The findings are synthesized into a phased GH2 transition roadmap, structured around five core pillars, infrastructure, policy, finance, technology adoption, and capacity building, designed to catalyze the decarbonization of Pakistan’s steel sector. Figure 2 reflects the methodology adopted for the study.

Figure 2.

Snapshot of the study’s methodology.

3. Results and Discussion

3.1. Phenomenon of Wind Curtailment in Pakistan

Wind curtailment remains a persistent technical challenge in Pakistan’s renewable energy sector, particularly in high-potential zones like the Jhimpir–Gharo Wind Corridor in Sindh. Despite the “must-run” status of wind power plants, curtailment continues to affect 12 low-tariff projects, highlighting the structural rigidity of the national grid [19]. As of 2024, wind energy capacity has stagnated at 1.8 GW for the second consecutive year, with no new additions [20].

Wind Power Projects (WPPs) are facing significant financial strain due to insufficient billable energy, which jeopardizes their ability to meet debt servicing obligations. Over 90% of these projects are financed through loans from prominent foreign financial institutions, including the International Finance Corporation (IFC), Asian Development Bank (ADB), Islamic Development Bank, the U.S. Government, FMO Entrepreneurial Development Bank, and others. Table 1 presents primary data obtained from wind power producers, detailing the current state of wind curtailment and installed capacity by location. Table 2 provides a representative example of monthly wind power curtailment in 2023. Both datasets are based on primary information gathered through stakeholder dialogues and consultations, notably during the Pakistan Energy Conference 2023.

Table 1.

Current status of curtailment and installed capacity by location.

Table 2.

Example of WPP Curtailment (Monthly Data) as of 2023.

According to ASRE 2024, the National Transmission and Despatch Company (NTDC) has initiated high-capacity transmission lines to support wind farms in Jhimpir, which together contribute over 1200 MW to the national grid. However, persistent issues, including inadequate transmission infrastructure, voltage instability, and limited reactive power management, continue to restrict wind power integration. Despite a technical wind potential of nearly 340 GW, wind energy accounts for only 4% of Pakistan’s total electricity generation, underscoring the critical impact of grid-level constraints on renewable energy development [13].

3.2. Proposed Avenues/Models for GH2 Production from Curtailed RE

GH2 production through sector coupling with renewable energy offers a viable and strategic pathway, primarily due to Pakistan’s substantial renewable energy potential and industrial decarbonization needs. The country has high wind potential in regions such as Jhimpir, Gharo, and Thatta, which face frequent curtailment due to transmission constraints. A GIS-based study identifies that 8.67% (85,373.84 km2) of Pakistan’s total land area is suitable for renewable hydrogen production, especially in Baluchistan and southern Sindh, offering both land availability and proximity to coastlines for water intake and export logistics [21].

Economically, the Levelized Cost of Hydrogen (LCOH) for Pakistan is estimated at $3.80–$4.27/kg in 2024, with projected reductions to $1.00–$2.00/kg by 2050 due to declining CAPEX and efficiency gains. Monthly practical hydrogen production capacity is estimated at 69.97 million metric tons, which can support both domestic decarbonization and future exports. Crucially, Pakistan can potentially reduce up to 308 million tons of CO2 annually by replacing fossil-based hydrogen and industrial fuels with GH2, positioning itself as a regional green energy leader [21,22].

Sector coupling via electrolysis is a mature and flexible solution for converting intermittent wind energy into hydrogen. Technologies like Proton Exchange Membrane (PEM) and Alkaline electrolyzers offer high responsiveness to fluctuating renewable inputs, making them ideal for integrating with curtailed wind power. Deploying electrolyzers near high-curtailment zones like Jhimpir and Thatta, or close to major demand centers such as Karachi, minimizes transmission losses and optimizes infrastructure use. This approach not only maximizes renewable energy utilization but also supports deep decarbonization in hard-to-abate sectors. In particular, Karachi’s steel industry, a significant fossil fuel consumer, presents a prime candidate for hydrogen use, especially in Direct Reduced Iron (DRI) production where GH2 can directly replace natural gas. This substitution not only reduces fuel imports, estimated at $3.95 billion in natural gas imports in 2022 [23], but also cuts process emissions significantly. Behind-the-meter electrolyzers can further reduce curtailment impacts and act as non-wires alternatives, lessening pressure on the national grid. GH2 produced from Sindh’s renewable resources can serve as a clean feedstock, reducing emissions, lowering import dependence, and paving the way for a low-carbon industrial economy.

For operationalization, foremost, the expedited implementation of the Transmission System Expansion Plan (TSEP) 2024–2034, particularly high-voltage corridors like Thar–Gharo and Matiari–Moro–RYK, is critical to alleviate existing curtailment and support long-distance energy transfer. Concurrently, the Competitive Trading Bilateral Contract Market (CTBCM) reform must be leveraged to enable open-access power wheeling, allowing wind-rich regions to supply electricity directly to industrial hydrogen users in Karachi. Behind-the-meter electrolysis systems collocated with wind farms can further reduce curtailment by bypassing transmission bottlenecks altogether. These measures should be supported by expanded deployment of Battery Energy Storage Systems (BESS), such as the ongoing 50 MWh pilot in Jhimpir [13], to enable time-shifting of generation for electrolyzer operation during grid-compatible periods. Integration of SCADA-enabled smart grid systems will further enhance real-time monitoring and dynamic load balancing between renewable generation, hydrogen production, and industrial consumption.

3.3. Opportunities

Green hydrogen presents Pakistan with transformative opportunities across energy security, industrial modernization, and climate action. Leveraging its vast renewable energy potential, particularly in wind-rich regions like Jhimpir and Thatta, Pakistan can repurpose curtailed power for green hydrogen production, maximizing the value of existing infrastructure. This clean fuel offers a pathway to decarbonize hard-to-abate sectors such as steel, fertilizer, and cement, creating an enabling environment for meeting the national climate targets such as 50% reduction in emissions and achieving 60% renewable energy as set out in Pakistan’s updated Nationally Determined Contributions (NDCs) [24]. The industrial hub of Karachi, home to energy-intensive steel production, is especially well-positioned to benefit from green hydrogen in DRI processes. Beyond domestic use, Pakistan stands to gain a competitive edge in the rapidly expanding Asian hydrogen export market, projected to reach $406 billion by 2030, with 24% of investments expected in South Asia [25]. According to a recent study, Dhabeji and Port Qasim have emerged as the most economically viable zones for green hydrogen production in Pakistan. Dhabeji offers the lowest levelized cost of hydrogen (LCOH), estimated at $4.19/kg (off-grid) and $2.12/kg (grid-connected), while Port Qasim follows closely at $4.22/kg and $2.36/kg, respectively. In addition to cost advantages, Dhabeji demonstrates the lowest annual CO2 emissions, further reinforcing its strategic suitability. Grid-connected systems, in particular, present a compelling opportunity for Pakistan to produce low-cost, low-carbon green hydrogen, enabling industrial decarbonization and export competitiveness [26]. This shift could also catalyze sustainable economic growth through job creation, technology transfer, and industrial diversification, while enhancing grid flexibility through electrolyzers that provide ancillary services like frequency regulation. Collectively, these factors position green hydrogen as a cornerstone of Pakistan’s energy transition and green industrial strategy. Figure 3 shows the benefits offered by Green hydrogen-based steel production for Pakistan.

Figure 3.

Green hydrogen-based steel production presents a transformative opportunity for Pakistan, offering both technical and economic benefits.

3.4. Challenges

Despite its promise, Pakistan’s green hydrogen ecosystem faces significant technical, economic, and institutional challenges. Foremost is the high Levelized Cost of Hydrogen (LCOH), which remains uncompetitive without subsidies, carbon pricing, or premium markets [21]. Electrolyzers operated solely on curtailed wind power may suffer from low-capacity factors, increasing costs further and undermining project viability. Water availability also poses a constraint, especially inland, where electrolysis requires reliable input; while desalination is feasible in coastal areas, it adds complexity and infrastructure requirements. The lack of hydrogen-specific infrastructure, such as pipelines, compression, and storage systems, hinders scalability and reliability. Moreover, Pakistan lacks a comprehensive regulatory framework governing hydrogen production, trade, emissions monitoring, and safety protocols, which significantly dampens investor confidence. On the environmental front, Pakistan has been placed 179th as per the Yale Environmental Performance Index 2024, with a low overall score of 25.5 out of 100 [27], reflecting poor policy enforcement, transparency, and accountability, that pose substantial risks for securing both domestic and international investment in green hydrogen and broader industrial energy transition initiatives. Additionally, market mechanisms such as long-term offtake agreements and open-access wheeling, while under development through reforms like CTBCM and the TSEP 2024–2034, are not yet fully operational.

These challenges can be mitigated through an integrated strategy combining targeted policy frameworks, standardized hydrogen regulations, and reliable carbon accounting systems. Technology transfer agreements can accelerate deployment of high-efficiency electrolyzers, while performance-based financial incentives can offset high CAPEX and LCOH. Capacity building, especially in grid management, safety standards, and hydrogen storage, will ensure operational readiness. Collectively, these measures will enable scalable, bankable, and technically sound green hydrogen infrastructure. Table 3 presents a GH2 roadmap for Pakistan, outlining short-, medium-, and long-term recommendations, grounded in the country’s renewable energy potential and projected industrial demand.

Table 3.

Green Hydrogen Roadmap for Pakistan (2025–2040), anchored in Pakistan’s renewable base and industrial demand.

4. Conclusions

Green hydrogen (GH2) production from curtailed wind energy offers Pakistan a strategic solution to integrate renewables and decarbonize industry. By utilizing otherwise wasted energy, GH2 can power green steel production, boosting the global competitiveness of Pakistan’s steel sector amid tightening carbon regulations. Coordinated infrastructure, regulatory reforms, and advanced technologies can reduce curtailment, stabilize the grid, and enhance energy security. With $4.3 billion [28] in proposed GH2 investments, investor confidence signals strong economic potential. A domestic hydrogen economy could drive high-value job creation, attract further foreign investment, and spur industrial innovation. GH2 adoption also supports deep emissions cuts in hard-to-abate sectors, advancing Pakistan’s climate goals while strengthening sustainable economic growth. The high upfront costs are outweighed by long-term environmental and economic benefits, particularly for the industrial sector, which stands to gain new revenue streams while decarbonizing.

Supplementary Materials

The following supporting information can be downloaded at: https://sdpi.org/pakistans-potential-for-low-carbon-development-of-steel-industry/publication_detail (accessed on 21 June 2025), https://sdpi.org/annual-state-of-renewable-energy-report-pakistan-2023-2024/publication_detail (accessed on 14 June 2025), https://neeca.pk/documents/PakGreenHydrogenStudy.pdf (accessed on 11 July 2025).

Author Contributions

Conceptualization, A.I., S.Q., U.U.R.Z., S.Z., S.A.A.M. and M.Z.; methodology, A.I.; writing—original draft preparation, A.I.; writing—review and editing, U.U.R.Z. and S.Q.; supervision, U.U.R.Z. and S.Q. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article and Supplementary Materials.

Acknowledgments

The authors would like to acknowledge the support received from the National Energy Efficiency and Conservation Authority (NEECA), the National University of Science and Technology (NUST), Amreli Steels Ltd., Renewables First, and SDPI. Also, we really appreciate the valuable inputs from Irfan Ahmad Gondal, Khalid Waleed, Hina Aslam, and Nadeem Niwaz.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- BusinessWire. Steel Global Industry Business Report 2025: Trade Policies, Geopolitical Factors, and Cost of Raw Materials Significantly Impacting Prices—Global Forecast to 2030. BusWire 2025. Available online: https://www.businesswire.com/news/home/20250212852496/en/Steel-Global-Industry-Business-Report-2025-Trade-Policies-Geopolitical-Factors-and-Cost-of-Raw-Materials-Significantly-Impacting-Prices---Global-Forecast-to-2030---ResearchAndMarkets.com (accessed on 23 June 2025).

- Precedence Research. Iron and Steel Market Size, Share, and Trends 2025 to 2034. Precedence Research 2025. Available online: https://www.precedenceresearch.com/iron-and-steel-market#:~:text=The%20Asia%20Pacific%20market%20size,2024%20as%20the%20base%20year (accessed on 15 May 2025).

- World Steel Association. Sustainability Indicators Report. World Steel Association 2024. Available online: https://worldsteel.org/wider-sustainability/sustainability-indicators/ (accessed on 20 June 2025).

- Qureshi, S.; Younas, M.H. Pakistan’s Potential for Low Carbon Development of Steel Industry. SDPI 2024. Available online: https://sdpi.org/pakistans-potential-for-low-carbon-development-of-steel-industry/publication_detail (accessed on 21 June 2025).

- IEA; IRENA; U.C.C.H.-L. Champions. Breakthrough Agenda Report 2023. IEA 2023. in press. Available online: https://iea.blob.core.windows.net/assets/d7e6b848-6e96-4c27-846e-07bd3aef5654/THEBREAKTHROUGHAGENDAREPORT2023.pdf (accessed on 24 June 2025).

- EU Commission. Carbon Border Adjustment Mechanism. EU Commission 2025. Available online: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en (accessed on 22 June 2025).

- EU Commission. The Green Deal Industrial Plan: Putting Europe’s Net-Zero Industry in the Lead. EU Commission 2025. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/green-deal-industrial-plan_en (accessed on 22 June 2025).

- World Bank Group. Industrial Energy Efficiency and Decarbonization (EE&D) in Pakistan. World Bank Group 2025–26, in press.

- PACRA. Steel Sector Study. PACRA Res. 2024. Available online: https://www.pacra.com/view/storage/app/Steel%20-%20PACRA%20Research%20-%20Sep%2724_1725624982.pdf (accessed on 10 May 2025).

- Climate Transparency. Climate Transparency Report: Pakistan’s Climate Action and Responses to the COVID-19 Crisis. Climate Transparency 2020. Available online: https://www.climate-transparency.org/wp-content/uploads/2021/11/Pakistan-CP-2020.pdf (accessed on 10 June 2025).

- Pakistan Bureau of Statistics (PBS). Advance Release on External Trade Statistics for the Month of January, 2025. PBS 2025. Available online: https://www.pbs.gov.pk/sites/default/files/external_trade/monthly_external_trade/2025/Release_Statement_January_2025.pdf (accessed on 11 June 2025).

- Siddiqui, H.A. Are Better Days in Store for PSM? Dawn 2025. Available online: https://www.dawn.com/news/1918354 (accessed on 9 July 2025).

- SDPI. Annual State of Renewable Energy Report Pakistan 2023–2024. SDPI 2024. Available online: https://sdpi.org/annual-state-of-renewable-energy-report-pakistan-2023-2024/publication_detail (accessed on 14 June 2025).

- SDPI. Exploring the Potential of Green Hydrogen in Hard-to-Abate Sectors of Pakistan. SDTV 2024. Available online: https://www.youtube.com/watch?v=oUXxDh_OlFo&ab_channel=SDTV (accessed on 1 July 2025).

- SDPI. Special Lecture with Amreli Steels Limited on Charting the Course of the Decarbonization Drive in Pakistan’s Steel Industry. SDTV 2024. Available online: https://www.youtube.com/watch?v=lHUhWU9IYLM&ab_channel=SDTV (accessed on 1 July 2025).

- SDPI. Pakistan’s Industrial Decarbonization—Ep. 1: Steel Sector Pathways and Global Insights. SDTV 2025. Available online: https://www.youtube.com/watch?v=T_GWo2a-Leo&ab_channel=SDTV (accessed on 2 July 2025).

- SDPI. Pakistan’s Industrial Decarbonization—Ep. 2: Green Hydrogen Pathways for a Clean Industrial Future. SDTV 2025. Available online: https://www.youtube.com/watch?v=8gDSqYfGTGQ&ab_channel=SDTV (accessed on 4 July 2025).

- SDPI. Good Power, Good Steel! SDTV 2023. Available online: https://www.youtube.com/watch?v=Pe-Dgh5saic&ab_channel=SDTV (accessed on 1 July 2025).

- The Express Tribune. Businessmen Slam Wind Power Curtailment. Express Tribune 2025. Available online: https://tribune.com.pk/story/2533942/businessmen-slam-wind-power-curtailment (accessed on 15 May 2025).

- Babar, R.; Naveed, H.; Amjad, M.M. Pakistan Electricity Review. Renewables First 2024. Available online: https://uploads.renewablesfirst.org/Pakistan_Electricity_Review_2024_2_cda6c4cedd.pdf#:~:text=Wind%20energy%20experienced%20no%20growth%2C%20remaining%20flat,energy%20saw%20a%20minor%20increase%20of%200.04 (accessed on 18 June 2025).

- Khidirova, M. Green Hydrogen and Chemical Production in Pakistan: A Pathway to Decarbonization and Export Potential by 2050. SSRN 2025. Available online: https://ssrn.com/abstract=5243698 (accessed on 11 July 2025).

- Tahir, M.M.; Abbas, A.; Dickson, R. Green Hydrogen and Chemical Production from Solar Energy in Pakistan: A Geospatial, Techno-Economic, and Environmental Assessment. Int. J. Hydrogen Energy 2025, 116, 613–626. [Google Scholar] [CrossRef]

- Renewables First. Integrating Sustainability in Green Hydrogen Advancements in Pakistan. Renewables First 2024. Available online: https://uploads.renewablesfirst.org/Integrating_Susutainability_in_Green_Hydrogen_for_Pakistan_e0aff8fce7.pdf (accessed on 11 July 2025).

- Government of Pakistan (GoP). Updated Nationally Determined Contributions. UNFCCC 2021. Available online: https://unfccc.int/sites/default/files/NDC/2022-06/Pakistan%20Updated%20NDC%202021.pdf (accessed on 1 July 2025).

- Deloitte. Green Hydrogen: Energizing the Path to Net Zero. Deloitte 2023. Available online: https://www.deloitte.com/global/en/issues/climate/green-hydrogen.html (accessed on 1 July 2025).

- Laila, J.; Anwar, M.; Hassan, M.; Kazmi, S.A.A.; Ali, R.; SA, M.A.; Rafique, M.Z. Techno-Economic Analysis of Green Hydrogen Production from Wind and Solar along CPEC Special Economic Zones in Pakistan. Int. J. Hydrogen Energy. 2024, 96, 811–828. [Google Scholar] [CrossRef]

- Yale University. Environmental Performance Index. EPI 2024. Available online: https://epi.yale.edu/country/2024/PAK (accessed on 12 July 2025).

- Business Recorder. Green Energy: NEECA Prepares ‘Concept Note’ to Seek Assistance. Business Recorder 2024. Available online: https://www.brecorder.com/news/40294022/green-energy-neeca-prepares-concept-note-to-seek-assistance (accessed on 12 July 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).