Abstract

The COVID-19 outbreak has rapidly affected global economies and the parties involved. There was a need to ensure the sustainability of corporate finance and avoid bankruptcy. The reactions of individuals were not routine, but covered a wide range of approaches to surviving the crisis. A creative way of accounting was also adopted. This study is primarily concerned with the behavior of businesses in the Visegrad Four countries between 2019 and 2021. The pandemic era was the driving force behind the renaissance of manipulation. Thus, the purpose of the article is to explore how the behavior of enterprises changed during the ongoing pandemic. The Beneish model was applied to reveal creative manipulation in the analyzed samples. Its M-score was calculated for 6113 Slovak, 153 Czech, 585 Polish, and 155 Hungarian enterprises. Increasing numbers of handling enterprises were confirmed in the V4 region. The dependency between the size of the enterprise and the occurrence of creative accounting was also proven. However, the structure of manipulators has been changing. Correspondence analysis specifically showed behavioral changes over time. Correspondence maps demonstrate which enterprises already used creative accounting before the pandemic in 2019. Then, it was noted that enterprises were influenced to modify their patterns in 2020 and 2021. The coronavirus pandemic had a significant potency on the use of creative accounting, not only for individual units, but for businesses of all sizes. In addition, the methodology may be applied for the investigation of individual sectors post-COVID.

1. Introduction

The beginning of the COVID-19 pandemic occurred in Wuhan, China, at the beginning of December 2019 [1]. On 11 March 2020, the World Health Organization declared that the COVID-19 disease had become a pandemic. It is among the most lethal infectious diseases [2]. In the past three years, all aspects of modern society were affected. Businesses, as well as the economies of the world, were forced to take a variety of drastic anti-pandemic measures [3]. The COVID-19 pandemic precipitated a worldwide crisis [4]. This crisis had a significant impact on the majority of industries and the global economy as a whole. As global connectivity increases, the economic effects of the pandemic will intensify [5]. It exacerbated pre-existing issues caused by long-term structural challenges, such as population aging, climate change, rising inequality, digitization, and automation [6]. COVID-19 caused a significant crisis in corporate finance. According to Adamikova and Corejova [7], the COVID-19 pandemic may increase the interest in creative accounting techniques. For example, businesses can change their financial performance to obtain help from the government or their financial status when they want to borrow money [8]. However, most often, an instinctive reaction was used by enterprises to survive and avoid bankruptcy. Griffiths [9] argues that creative accounting is the largest fraud tactic since the Trojan Horse. According to Ado et al. [10], creative accounting is more prevalent in Europe than it is in the United States, where earnings management is preferred. Durana et al. [11] note that accounting manipulation research is less frequently used in emerging economies, especially in Central European nations, than it is in countries with developed capital markets. However, the pandemic era encouraged behaviors that caused the spread of manipulation to countries in Central Europe as well.

Thus, the aim of the article is to explore how the behavior of enterprises changed during the ongoing pandemic in the Visegrad Four countries between 2019 and 2021.

Figure 1 demonstrates the structure of the article. Recent studies on the issue are described in the Section 2. The structure of the final sample is defined in the Section 3. This chapter also clarifies the methods used to examine the purpose of the article and the hypotheses. The correspondence analysis provides significant findings in the Section 4. The outputs of other investigations using similar methodologies, but in different environments and conditions, are then discussed. Finally, the overall picture is summarized. In addition, the limitations and future directions are presented.

Figure 1.

Structure of the article. Source: the authors.

2. Literature Review

This article focuses on creative accounting in particular; the most recent approaches and incentives are as follows: Ado et al. [10] define creative accounting as an accounting practice that may or may not adhere to accounting standard practices, but that clearly deviates from these rules. Blazek et al. [12] add that any business that does not adhere to the fundamentals of real accounting uses creative accounting practices. Creative accounting, according to Kliestik et al. [13], is the process of changing the accounting values from their actual value to the values that are required. The adjusted accounting values are then utilized to assist the business.

The main goal of creative accounting is to trick the public by hiding how the enterprise is doing financially [14]. Creative accounting practices, such as renewing income, increasing amortization, wrongly reporting assets and liabilities, having trouble reporting profits and losses, or using the profit-and-loss statement, may show the level to which creativity is possible [15]. Adamikova and Corejova consider the execution of planned legal actions and enhancing the image of the company as the primary reasons for using these practices. Ruddy and Everingham [16] state that creative accounting can be understood on two levels. Creative accounting is defined, at the first level, as procedures designed to account for new situations that are not subject to existing accounting standards. The second level includes a general understanding of this concept, as activities leading to financial statement manipulation.

Ababneh and Aga [16] discuss that corporate governance is necessary if creative accounting is to be kept to a minimum. However, they also point out that corporate governance may not be sufficient. Poradova and Kollar [17] utilize a well-established internal control system of the enterprise to detect fraudulent activities. Utilizing the anonymous internal line of enterprise is one way to impersonate the internal system. Concurrently, the authors emphasize the significance of ending creative accounting [18]. Companies should make sure their employees receive ongoing training, update their code of ethics to include problems that have been fixed, or create a corporate culture that does not support these kinds of activities. Gowthorpe and Amat [19] address the ethical implications of using macro- or micro-manipulation (at the level of regulatory authorities or the state) at the company level. According to the author, the use of creative accounting practices is morally reprehensible and is not a fair action towards stakeholders, or it is an unfair exercise of power with the intent of undermining the accounting authority of regulators. Popescu et al. [20] and Gadelha Dias [21] study the ethical situation more deeply.

High-level manipulation practices are a sign of low-quality accounting and financial information, which can be seen as a sign of opportunistic behavior [22]. In addition, misleading financial statements have negative consequences for all stakeholders. Financial statements are the primary source of information regarding economic stability and financial stability and health [23]. This study also confirms the use of the Beneish model because of the previous proof of its suitability for the conditions in the Visegrad Four.

Many creative accounting practices do not break the law; they just take advantage of legal loopholes that the management of the company prefers [24]. This method is not only used by companies. Creative accounting at the state level also occurs [25,26,27,28].

At the enterprise level, Kliestik et al. [13] look at creative accounting in the transport sector of the Visegrad Four countries. Blazek et al. [12] examine agribusiness in the Slovak Republic. Kovalova and Frajtova Michalikova [29] focus on the link between creative accounting and bankruptcies. The business environment has a significant impact on the setting for future business development [30]. The change to a green economy and the Green Deal itself make it harder for businesses to make money. Profit setting and optimization, which are closely related to profit maximization and saving enough money for a time that cannot be predicted, go hand in hand with this kind of financial success. In order to persuade investors who will be able to finance their future ambitions or assist in meeting quotas set by international organizations, businesses strive to complete this endeavor as quickly as possible. Michalkova et al. [31] investigate the speed with which strategic goals can be met in the context of achieving the desired goals through profit management. This fact is investigated further in a study by Gajdosikova and Valaskova [32] that examines corporate debt in the context of the Slovak Republic. Nagy et al. [33] focus on the publicly traded corporations of the Visegrad Four and their profit management. They examined this management by comparing the concept of CSR to how individuals handle their earnings.

There are specific approaches to using different statistical methods to reveal creative accounting. The following manipulations were revealed using the Pearson chi-square test and correspondence analysis: Kliestik et al. [34] used both methods to identify the dependency between the CEO and creative accounting. The dependency between the gender of the CEO and handling as defined by the Beneish model was confirmed. It was deduced that women prefer non-manipulative behavior. Enterprises with men who are CEOs are identified as manipulators, and enterprises with mixed CEO lines are identified as potential manipulators.

Valaskova et al. [35] address the interdependence of creative accounting and corporate financial stability. The financial health of businesses was assessed using Altman’s Z score, and creative accounting was detected using the modified Jones model and Beneish M-score. The findings of the chi-square test showed a statistically significant correlation between financial distress and creative accounting. Based on correspondence analysis, it was discovered that businesses in the grey area or facing insolvency tended to manipulate. Valaskova et al. [36] reveal creative accounting by a modified Jones model. The correspondence analysis identified certain industries (F, J, K, M, and N) where income-increasing earnings manipulation is performed, and vice versa, where income-decreasing earnings management is typical for firms in sectors A, C, D, G, or L.

Gajdosikova et al. [37] focus on identifying how corporations manage their revenues using the Kasznik model. They use both statistical methods to determine the dependency between earnings management practises and the size, legal form, and sectoral classification (based on NACE) of enterprises. The findings show that small businesses with a public limited ownership structure, primarily in the sectors R and M, frequently engage in aggressive (income-increasing ones) profit management strategies. Enterprises in sectors J or F are known to utilize conservative (income-decreasing ones) strategies, as are medium-sized businesses and those with a private limited ownership structure. The findings showed that both large businesses and those in sector K do not frequently falsify their earnings.

Gajdosikova et al. [38] also used Benford’s Law to look at businesses and try to figure out if earnings management was being used based on the order and value of the digits. This article applies the Beneish model to disclose creative accounting. The results were based on the Pearson chi-square test. There was no reason to suspect the corporation of engaging in profit management or accounting manipulation because, according to the null hypothesis, there is no statistically significant difference between the empirical and predicted probabilities, i.e., they are equal. Only two instances—the revenue accounts 601 for 2019 and 604 for 2020—in which the indications of earnings management procedures were subject to our rejection of this theory.

3. Materials and Methods

This study looked into whether or not businesses of different sizes were already using creative accounting before the COVID-19 pandemic in 2019. Then, in the pandemic era of 2020 and 2021, their behavior changed, particularly toward non-manipulation and possible manipulation or handling. The research focused on countries in the V4 region.

Mention grouping, which is made up of the economically and historically linked Visegrad Four, was the main database used to study creative accounting before and during the COVID-19 pandemic. The validity of the comparison of countries within this group has been proven in many studies, including [39,40,41,42,43,44,45,46].

The following methodology was used in this investigation.

3.1. Making a Sample of Enterprises from the V4 Region

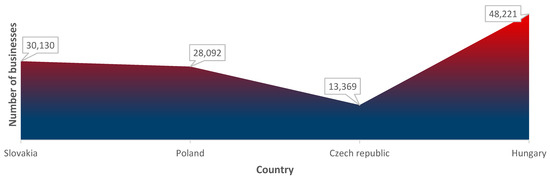

This study utilized data from the V4 nations, which are interconnected by a variety of trade, economic, and contractual connections. These countries form a large cluster of enterprises in Central Europe. One hundred and nineteen thousand, eight hundred and twelve financial statements of enterprises were first collected. These data were gained from the ORBIS database provided by Bureau van Dijk. Figure 2 shows the number of enterprises in the original subsamples that are classified according to country.

Figure 2.

Origin subsamples of enterprises. Source: the authors.

The ORBIS database contains raw financial statements of the indicators, including also, missing values. The use of a sample with incomplete data would affect the results in a fundamental way. Lyan et al. [47], Yang et al. [48], Chung et al. [49], Garrido-Izard et al. [50], and Suzuki et al. [51] drew attention to this fact and recommend data cleansing. Thus, data cleansing was performed. Figure 3 depicts the procedure for data preprocessing.

Figure 3.

Data preprocessing. Source: the authors.

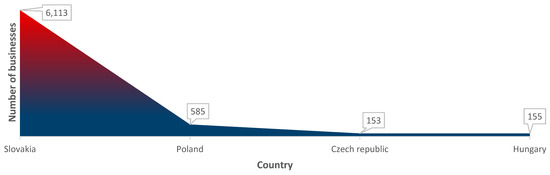

One hundred and twelve thousand, eight hundred and twelve enterprises were removed based on the clearing of missing data. The final sample consisted of 7006 enterprises (Figure 4).

Figure 4.

Original and final sample of enterprises. Source: the authors.

Figure 5 shows the number of enterprises in the final subsamples that are classified according to country. It involved related samples for the whole period. It included the same enterprises per country each year. Thus, the Beneish model could calculate annually 6113 Slovak, 153 Czech, 585 Polish, and 155 Hungarian enterprises.

Figure 5.

Final subsamples of enterprises. Source: the authors.

Table 1 illustrates the categorization according to the ORBIS database. The enterprises must meet the criteria listed in the table in order to be classified as a medium, large, or very large enterprise. If not, the enterprise was classified as a small enterprise.

Table 1.

The categorization according to the ORBIS database. Source: the authors.

The behavior of the enterprises was explored based on their size. Table 2 shows the number of final subsamples in the Visegrad Group that are classified according to size.

Table 2.

Size structure of the enterprises. Source: the authors.

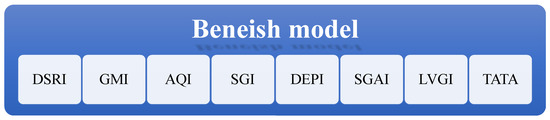

3.2. Calculating the M-Score Based on the Beneish Model

The Beneish model was used to figure out which category sizes of enterprises used or did not used creative techniques. A number of authors that analyze creative accounting have utilized this concept, for example, Mousari et al. [52], Micah et al. [53], Sasongko et al. [54], Novianti et al. [55], Khatun et al. [56], Febrilia [57], Toplu et al. [58], and Nugroho et al. [59]. The Beneish model has eight indicators, and its composition is demonstrated in Figure 6.

Figure 6.

Composition of the Beneish model. Source: the authors.

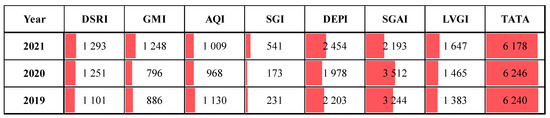

Table 3 contains the explanation of the abbreviations used for variables in the Beneish model.

Table 3.

Explanation of used abbreviations. Source: the authors.

Each of the indicators of the Beneish model has a predetermined threshold value. When this level is exceeded, the enterprise is identified as potentially manipulative. Figure 7 provides the total number of enterprises that was above the allowed level. In addition, the data bars show what percentage of the total number of enterprises had values that were over the limit.

Figure 7.

Number of potential manipulations for individual indicators. Source: the authors.

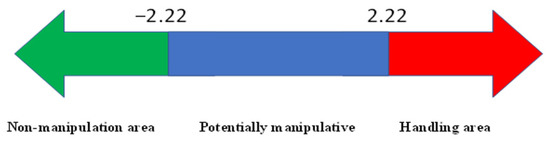

The Beneish model enables the classification of enterprises into three groups: enterprises that do not manipulate, enterprises that possibly manipulate, and enterprises that manipulate. This classification is based on the M-score to identify practices of creative accounting. Figure 8 depicts the limits for locating enterprise in a specific area.

Figure 8.

Procedure of categorization based on the M-score. Source: the authors.

The M-score was calculated for each enterprise in the V4 region. Figure 9 provides the total number of enterprises categorized into groups during whole period of investigation. In addition, the data bars show what percentage of the total number of enterprises represents a specific group sequentially in 2019, 2020, and 2021.

Figure 9.

Categorization of enterprises based on the M-score. Source: the authors.

3.3. Performing the Pearson Chi-Square Test, Pearson Contingency Coefficient C, and Cramer’s V

The fundamental idea underlying this test is to compare the observed data values to the expected values if the prerequisites are met. The first assumption is that 80% of expected observations must be equal to/higher than 5, and the second assumption is that all the cells of expected counts must be higher than 1 [60]. It tested the occurrence of a significant dependence between the size of enterprise and its behavior. The possible categories of enterprise were small, medium, large, and very large.

The behavior of the enterprise was detected by the M-score of the Beneish model, including non-manipulation, possible manipulation, and manipulation. The fundamental idea underlying this test is to compare the observed data values to the expected values. It was examined for the presence of a significant relationship between the size of the enterprise and its behavior. The following hypotheses were developed and tested:

H2019:

there was a significant dependence between the size of the enterprise and its behavior in creative accounting even before the COVID-19 pandemic.

H2020:

there was a significant dependence between the size of the enterprise and its behavior in creative accounting during the COVID-19 pandemic.

H2021:

there was a significant dependence between the size of the enterprise and its creative accounting behavior after the first wave of the COVID-19 pandemic.

After testing the hypotheses for 2019, 2020, and 2021, the strength between two nominal variables was measured. Pearson contingency coefficient C and Cramer’s V were used if the dependence was confirmed.

Olat et al. [61], Valaskova et al. [60], and Musova et al. [62] determined indicative limits for the strength of the dependence, determined by Pearson contingency coefficient C and Cramer’s V according to these limits:

the rate of the coefficients indicate weak dependence;

the rate of the coefficients indicate medium dependence;

the rate of the coefficients indicate strong dependence.

It is also necessary to test the significance of the identified coefficients of contingency [61]. The hypotheses for this test are as follows:

H0:

the Pearson contingency coefficient C (Cramer’s ) is not statistically significant.

H1:

the Pearson contingency coefficient C (Cramer’s ) is statistically significant.

3.4. Computing Behavioral Changes over Time by Correspondence Analysis

Correspondence analysis is gaining popularity as a method for gathering specific data [63]. The primary benefit of this analysis is its clarity and readability, as this visualization makes it possible to clearly depict large contingency tables. Correspondence analysis is one of the insufficient taxonomic methods [64]. This technique frequently employs multidimensional scaling and analysis of the principal components of factor analysis to validate the scales. This makes the data easier to understand and clearer, but it also means that some information is lost. This method provides researchers with simple, intuitive, graphical representations for comprehending the dependencies between the investigated data categories. According to Kral et al. [65], the Euclidean distance between plane points is comparable to chi-square, the distance between points in three-dimensional space. It is required to find a projection that preserves, as much as possible, the relationship between the original points in the multidimensional space [66]. It uses the matrix of standardized residuals to look for the projection. Each element in the -th row and -th column is defined by the members of the correspondence matrix and their respective marginal sums.

When one is looking for a good projection, they should use singular decomposition on the given matrix and add the resulting matrices to the matrices made from the row and column loads to obtain the coordinates of each row and column [67]. The indicated calculation method permits how the points in the multidimensional space are displayed in two-dimensional space (how the so-called correspondence map is generated), depending on whether it emphasizes the mutual comparison of rows, columns, both rows and columns, or, more precisely, their respective row and column categories. This is achieved by selecting additional criteria that must be met by the selected profiles. The transformation is considered to be appropriate if it retains the maximum proportion of the variability of multidimensional points. The variability measure is the total inertia, which is the weighted sum of the squared distance between each row profile and the average row profile. Column categories are calculated analogically [62]. Consequently, the resulting correspondence map is quite easy to interpret. The closer in proximity the points on the correspondence map are, the greater the similarity and correspondence between the categories are.

It was proven that COVID-19 caused behavioral changes based on Figure 9. The number of manipulating enterprises rose in 2020 and 2021 compared to the number in 2019. Correspondence analysis was used for each year of the monitored period. This method disclosed how the specific categories of sizes of enterprises matched to specific categories in terms of creative accounting. This analysis was performed to confirm how the ongoing pandemic creates new patterns of behavior of the enterprises.

The IBM SPSS software was used to test all the hypotheses by the Pearson chi-square test and calculate the Pearson contingency coefficient C and Cramer’s V. In addition, this software was perform to compute correspondence analysis, including correspondence maps.

4. Results

The results assessed the corporate environments of the V4 nations in relation to the use of creative accounting. The sample consisted of 7006 enterprises. Firstly, the dependency between the analyzed variables was tested. The strength of the dependencies was then assessed. Finally, the matches between the categories of variables were identified. These steps were realized for each year in the monitored period. For all the tests, the significance level alpha was set to 0.05.

H02019:

there was no significant dependence between the size of the enterprise and its behavior in creative accounting even before the COVID-19 pandemic.

H12019:

there was a significant dependence between the size of the enterprise and its behavior in creative accounting even before the COVID-19 pandemic.

As the computed -value of the Pearson chi-square test is lower than the significance level alpha, one should reject the null hypothesis and accept the alternative hypothesis in 2019, based on Table 4. There was a significant dependence between the size of the enterprise in the V4 region and its behavior in creative accounting even before the COVID-19 pandemic.

Table 4.

Pearson chi-square test for 2019. Source: the authors.

The values of both coefficients that are recommended for nominal variables indicate a weak dependency between the size of the enterprise and its behavior in creative accounting. The significance of the provided coefficients of contingency was confirmed in the V4 region. As the computed -value is lower than the significance level alpha, one should reject the null hypothesis and accept the alternative hypothesis, based on Table 5. Thus, Pearson contingency coefficient C and Cramer’s V were statistically significant in 2019.

Table 5.

Strength of dependency for 2019. Source: the authors.

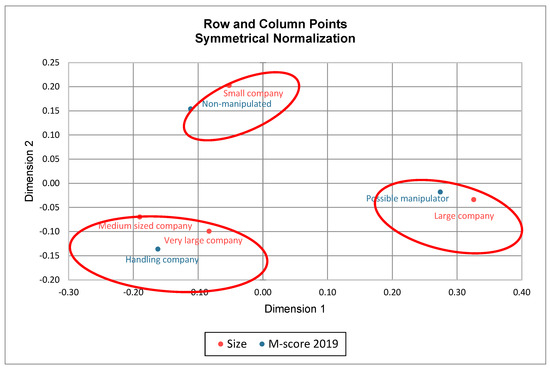

The correspondence analysis was completed for 2019. It used four categories to represent the size of the enterprises and three categories to represent membership in the groups of manipulation, non-manipulation, and probable manipulation. A correspondence map was generated for the era before the COVID-19 pandemic. The Euclidean distance measurement was used, and total inertia was equal to the value of one. This value represents very good transformation points in two-dimensional space in Table 6 and Table 7.

Table 6.

Overview of row points for 2019. Source: the authors.

Table 7.

Overview of column points for 2019. Source: the authors.

Figure 10 includes the matches of the Beneish model and the categorization of enterprises by size. Small enterprises were identified as non-manipulative in 2019. Then, it was deduced that large corporations had joined the ranks of those who might be manipulators. These enterprises were placed in the “gray zone” based on the M-score. This indicates that it was unclear if they were using creative accounting. The enterprises in the final category use creative accounting to transform accounting from its present state to its desired state. There were both medium-sized and very-large companies that engaged in this illegal conduct before the COVID-19 pandemic.

Figure 10.

Correspondence map for 2019. Source: the authors.

H02020:

there was no significant dependence between the size of the enterprise and its behavior in creative accounting during the COVID-19 pandemic.

H12020:

there was a significant dependence between the size of the enterprise and its behavior in creative accounting during the COVID-19 pandemic.

As the computed -value of the Pearson chi-square test is lower than the significance level alpha, one should reject the null hypothesis and accept the alternative hypothesis in 2020, based on Table 8. There was a significant dependence between the size of the enterprise in the V4 region and its behavior in creative accounting during the COVID-19 pandemic.

Table 8.

Pearson chi-square test for 2020. Source: the authors.

The values of both coefficients indicate a weak dependency between the size of the enterprise and its behavior in creative accounting. The significance of the provided coefficients of contingency was confirmed in the V4 region. As the computed -value is lower than the significance level alpha, one should reject the null hypothesis and accept the alternative hypothesis, based on Table 9. Thus, Pearson contingency coefficient C and Cramer’s V were also statistically significant in 2020.

Table 9.

Strength of dependency for 2020. Source: the authors.

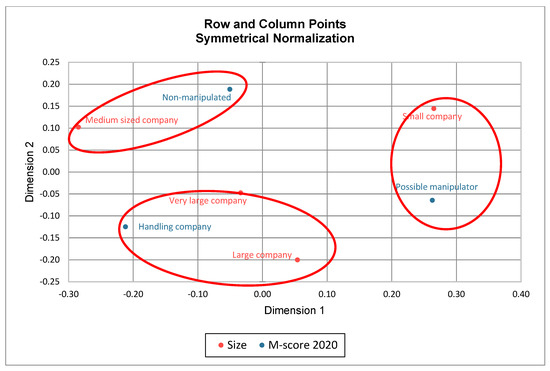

Then, the correspondence analysis was completed for 2020. A correspondence map was generated for the period during the COVID-19 pandemic. The Euclidean distance measurement was used, and total inertia was equal to the value of one. This value represents very good transformation points in two-dimensional space on Table 10 and Table 11.

Table 10.

Overview of row points for 2020. Source: the authors.

Table 11.

Overview of column points for 2020. Source: the authors.

On the basis of Figure 11, the behavior of enterprises has changed since 2019. In 2020, medium-sized businesses were identified as data manipulators. However, in 2019, they were classified among those that do not manipulate their financial statements. In 2020, small businesses were added to the “gray zone,” which is a term for businesses for which it is not clear if their accounting statements were manipulated. This behavioral movement could be attributed to the COVID-19 pandemic, which had a significant impact on the performance of small enterprises, which were closed for most of 2020. This kind of situation may lead the management to use illegal methods to keep the business going and avoid bankruptcy during the crisis. The final category included businesses that distort their bookkeeping. This group included both large and very large corporations. The coronavirus epidemic also impacted these businesses. The companies were closed in the initial months, which meant that the profits were negative, but fixed costs had to be paid. Because major companies need to generate profit to support their business plans to a far greater extent than smaller companies do, their engagement in creative accounting was projected to be considerably greater than that of smaller companies.

Figure 11.

Correspondence map for 2020. Source: the authors.

H02021:

there was no significant dependence between the size of the enterprise and its creative accounting behavior after the first wave of the COVID-19 pandemic.

H12021:

there was a significant dependence between the size of the enterprise and its creative accounting behavior after the first wave of the COVID-19 pandemic.

As the computed -value of the Pearson chi-square test is lower than the significance level alpha, one should reject the null hypothesis and accept the alternative hypothesis in 2021, based on Table 12. There was a significant dependence between the size of the enterprise in the V4 region and its behavior in creative accounting after the first wave of the COVID-19 pandemic.

Table 12.

Pearson chi-square test for 2021. Source: the authors.

The values of both coefficients indicate a weak dependency between the size of the enterprise and its behavior in creative accounting. The significance of the provided coefficients of contingency was confirmed in the V4 region. As the computed -value is lower than the significance level alpha, one should reject the null hypothesis and accept the alternative hypothesis, based on Table 13. Thus, Pearson contingency coefficient C and Cramer’s V were statistically significant in 2021 as well.

Table 13.

Strength of dependency for 2021. Source: the authors.

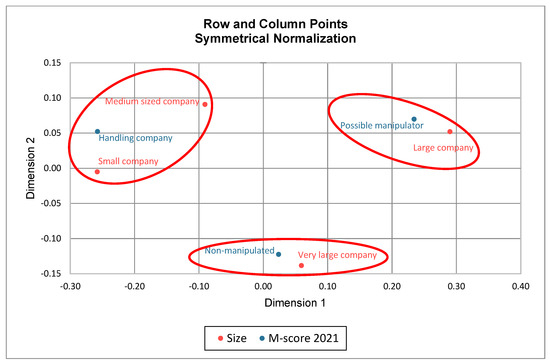

Finally, the correspondence analysis was completed for 2021. A correspondence map was generated for the period after the first wave of the COVID-19 pandemic. The Euclidean distance measurement was used, and total inertia was equal to the value of one. This value represents very good transformation points in two-dimensional space based on Table 14 and Table 15.

Table 14.

Overview of row points for 2021. Source: the authors.

Table 15.

Overview of column points for 2021. Source: the authors.

The collected data indicate that changes occurred in 2021, based on Figure 12. This period reinvigorated the markets, and the corporate profits ultimately returned to pre-pandemic levels. Due to the closure of numerous businesses during the epidemic, the populace had greater purchasing power, and consumers saved money that they would have spent on other goods. As the economy stabilized, their purchasing power increased. The inclusion of very large companies in the group of companies that did not modify their financial statements in 2021 was rare. Such a reversal was not anticipated from companies that not only last year (2020), but also the year before, were named among the most manipulative companies (2019). Large companies, which were in the same group before the COVID-19 epidemic, were included among those in the “gray zone”, where it is unclear if creative accounting is utilized or not. According to the findings, small- and medium-sized enterprises were among those that manipulated in 2022.

Figure 12.

Correspondence map for 2021. Source: the authors.

Table 16 summarizes the changes in behavior of enterprises in the Visegrad Four countries between 2019 and 2021. The findings showed that the COVID-19 epidemic resulted in a cycle of business transition from one zone to another. Thus, it can be noted that the COVID-19 epidemic led to changes. The manipulation may take many forms, such as changing data from its true form to the form that the enterprises want, distorting real income and assets, not telling the truth about the corporate finances, or taking advantage of legal loopholes to move the enterprise up in the overall benchmark.

Table 16.

The behavior of the enterprises according to size structure. Source: the authors.

5. Discussion

This chapter investigates whether the concept of “creative accounting” is truly required. The chapter comprises research by authors who focused on the solution, as well as a comparison of the findings with those of other researchers. Due to the fact that the results of this study and those of other authors may differ, we use Figure 13 to better illustrate the acquired results.

Figure 13.

Discussion progression of the study. Source: the authors.

Many authors have tried to obtain the right answer and direction for their research in order to improve their research conclusions on “creative accounting.” These authors include the study by Abed et al. [24]. They attempted to explain and determine the abilities that could accurately describe manipulation tactics. It was decided to learn these techniques in the financial industry. This research yielded the discovery of innovative determinants, which ultimately assist professionals to more accurately determine the practices of manipulative enterprises. This study showed the different sizes of companies that use this method to their advantage by combining it the work of Lyons [68], who noted that creative accounting was a key driver of regional growth in 2022. Gadelha Dias et al. [21] focused on the Big Four firms (KPMG, EY, PwC, and Deloitte), directly asking the workers of these firms how they deal with the creative accounting machinery. Their research found that the psychological behavior of respondents was inconsistent. The respondents were unable to distinguish between the various concepts linked to creative accounting, and the most remarkable finding was their inability to apply models indicating creative accounting.

Jouali et al. [69] concentrated on Moroccan enterprises that attempt to conduct creative accounting based on capital structure and financing needs optimization. These companies primarily served large and small businesses. Meldona et al. [70] concentrated on export-oriented SMEs, notably those operating in Indonesia and India. After using creative accounting, these organizations were no longer able to carry out the long-term plans that had been built up over years to set the right direction for the businesses. These plans and strategies had to be adjusted at the last minute for business applications, or the general direction of enterprises would be disastrous. In marketing, where weaknesses were turned into strengths, and vice versa, these kinds of situations were also used. Poradova and Kollar [71] investigated the problems of corporations using current components, notably “Big Bath,” “Big Bet in the Future,” “Flushing,” “Throwing out a problem child,” and others. As a result, they gained a broad perspective that is used for new accounting solutions and the management of corporate earnings. Their study, however, found that organizations are more devoted to improving cash flow reporting than earnings management. However, things changed when Denich and Hajdu [72] warned that corporate governance was starting to look too similar to creative accounting. Because corporate governance employs a variety of manipulative tactics, detecting its usage would present a new challenge. This would introduce a new variable into creative accounting, potentially undermining prior findings and claims.

Studies that are similar to the research described in this article include those by Musanovic and Halilbegovic [73], who used the Beneish model to uncover innovative accounting for Eastern European enterprises, focusing on SMEs. They augmented this model with a solution to the bankruptcy of enterprise. Their findings were successful, as they discovered that organizations at risk of bankruptcy are more likely to use creative accounting. Achmad et al. [74] are one of the authors who used the Beneish model. Instead of the original deception triangle, they used the deception hexagon. They found intriguing results by employing more angular perception. Businesses that use creative accounting are more stable, and this is reflected in their debt, which is higher than it should be. Indebtedness subsequently impacts the company’s liquidity, which is weakened as a result, although the profitability of the enterprises and total profitability gradually improve. However, these companies do not present their business outcomes to the directors, who are dependent on the scientific output of researchers.

Drabkova [75] conducted research similar to that of this study. The research focused on Czech enterprises and used the CFEBT model to solve risk triangle issues. She attempted to dissuade people of the use of creative accounting in the Czech Republic with her scientific research.

Patel et al. [76] utilized Benford’s law on Portuguese corporations to reveal creative accounting. They did not change the findings through correspondence analysis, but based on computer technology, he concluded that SMEs fail due to short-term strategic manipulations. Kasznik’s model was the issue in the research by Gajdosikova et al. [37], who applied it to Slovak businesses. They employed correspondence analysis. According to the findings, companies in NACE M and R boost their revenue management, whereas companies in NACE J and F decrease their revenue. An intriguing conclusion was that huge corporations, in general, do not engage in manipulation.

6. Conclusions

The aim of the article is to explore how the behavior of enterprises changed during the ongoing pandemic in the Visegrad Four countries between 2019 and 2021. It was focused on the behavior in the area of creative accounting. The Beneish model was used to determine the use of creativity in enterprises. The M-score of this model categorized enterprises into three groups: those that manipulate, those that do not manipulate, and those that are in the gray zone, where we cannot determine whether creative accounting is utilized or not. The collected results were then subjected to correspondence analysis. For a given year, the correspondence analysis matched the size categories of enterprises with relevant groups that conduct manipulation. The findings revealed data that could serve as a base for future research in the investigation of individual enterprises in the V4 countries.

There were some limitations in this article, which are depicted in Figure 14.

Figure 14.

A summary of the constraints. Source: the authors.

The first issue was an imbalance in the enterprise size criterion. This constraint might be overcome by filling in the missing data in the financial statements, which would be supplied through the available registers of the financial statements. Another drawback was the employment of only one model to detect creative accounting, the Beneish model. This limitation could be removed by using multiple tests to find creative accounting, comparing their results, and, last but not least, conducting a correspondence analysis of the collected results. Another drawback is the choice of the studied time, as the representative sample was chosen based on the period preceding the pandemic, which may have affected the results. This limitation would be removed if people looked at what happened in previous years and agreed on which set of manipulators the size categories belong to.

Several constraints were discovered during the research. These limitations could be addressed in a subsequent paper that focuses on a longer period of time, is developed from a diverse sample of enterprises, considers more models that indicate creative accounting, and compares their results. However, the issue of creative accounting does not only affect enterprises located within V4. As a result, future research would also focus on other groupings of states, for example, the issue of the Baltic countries or a thorough assessment of the situation in the provided era for the countries of the European Union.

Author Contributions

Conceptualization, R.B. and J.M.; methodology, R.B.; software, R.B.; validation, P.D. and J.M.; formal analysis, R.B.; investigation, R.B.; resources, R.B. and P.D.; data curation, R.B.; writing—original draft preparation, R.B.; writing—review and editing, P.D.; visualization, R.B.; supervision, P.D.; project administration, P.D.; funding acquisition, P.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Acknowledgments

This research was financially supported by the Slovak Research and Development Agency—Grant VEGA 1/0677/22: Quo Vadis, Bankruptcy Models? Prospective Longitudinal Cohort Study with Emphasis on Changes Determined by COVID 19.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Haafza, L.A.; Awan, M.J.; Abid, A.; Yasin, A.; Nobanee, H.; Farooq, M.S. Big data COVID-19 systematic literature review: Pandemic crisis. Electronics 2021, 10, 3125. [Google Scholar] [CrossRef]

- Ben-Ahmed, K.; Ayadi, I.; Hamad, S.B. COVID-19 impact on digital companies’ stock return: A dynamic data analysis. Financ. Res. Lett. 2022, 46, 102340. [Google Scholar] [CrossRef] [PubMed]

- Svabova, L.; Tesarova, E.N.; Durica, M.; Strakova, L. Evaluation of the impacts of the COVID-19 pandemic on the development of the unemployment rate in Slovakia: Counterfactual before-after comparison. Equilib. Q. J. Econ. Econ. 2021, 16, 261–284. [Google Scholar] [CrossRef]

- Ilinova, A.; Dmitrieva, D.; Kraslawski, A. Influence of COVID-19 pandemic on fertilizer companies: The role of competitive advantages. Resour. Policy 2021, 71, 102019. [Google Scholar] [CrossRef]

- Kolahchi, Z.; De Domenico, M.; Uddin, L.Q.; Cauda, V.; Grossmann, I.; Lacasa, L.; Grancini, G.; Mahmoudi, M.; Rezaei, N. COVID-19 and its global economic impact. In Coronavirus Disease-COVID-19; Springer: Berlin/Heidelberg, Germany, 2021; Volume 1318, pp. 825–837. [Google Scholar] [CrossRef]

- Svabova, L.; Kramarova, K.; Chabadova, D. Impact of the COVID-19 pandemic on the business environment in Slovakia. Economies 2022, 10, 244. [Google Scholar] [CrossRef]

- Adamikova, E.; Corejova, T. Creative accounting and the possibility of its detection in the evaluation of the company by expert. J. Risk Financ. Manag. 2021, 14, 327. [Google Scholar] [CrossRef]

- Wielechowski, M.; Czech, K.; Grzęda, L. Decline in mobility: Public transport in Poland in the time of the COVID-19 pandemic. Economies 2020, 8, 78. [Google Scholar] [CrossRef]

- Griffiths, I. Creative Accounting; Sidgwick & Jackson: London, UK, 1986. [Google Scholar]

- Ado, A.B.; Rashid, N.N.M.; Mustapha, U.A.; Ademola, L.S. Audit quality and creative accounting strategy: Evidence from Nigerian public listed companies. Australas. Account. Bus. 2022, 16, 40–54. [Google Scholar] [CrossRef]

- Durana, P.; Michalkova, L.; Privara, A.; Marousek, J.; Tumpach, M. Does the life cycle affect earnings management and bankruptcy? Oecon. Copernic. 2021, 12, 425–461. [Google Scholar] [CrossRef]

- Blazek, R.; Durana, P.; Valaskova, K. Creative accounting as an apparatus for reporting profits in agribusiness. J. Risk Financ. Manag. 2020, 13, 261. [Google Scholar] [CrossRef]

- Kliestik, T.; Sedlackova, A.N.; Bugaj, M.; Novak, A. Stability of profits and earnings management in the transport sector of Visegrad countries. Oecon. Copernic. 2022, 13, 475–509. [Google Scholar] [CrossRef]

- Omurgonulsen, M.; Omurgonulsen, U. Critical thinking about creative accounting in the face of a recent scandal in the Turkish banking sector. Crit. Perspect. Account. 2009, 20, 651–673. [Google Scholar] [CrossRef]

- Ababneh, T.E.A.M.; Aga, M. The impact of sustainable financial data governance, political connections, and creative accounting practices on organizational outcomes. Sustainability 2019, 11, 5676. [Google Scholar] [CrossRef]

- Ruddy, T.; Everingham, G.K. Creative accounting, accounting errors, and the ability of users to detect and adjust for them. J. Account. Res. 2008, 22, 45–95. [Google Scholar] [CrossRef]

- Poradova, M.; Kollar, B. Creative accounting as a possible source of fraudulennt behaviour in commercial corporations. In Proceedings of the 9th International Scientific Symposium Region Entrepreneurship Development, Osijek, Croatia, 9–11 June 2020; pp. 1261–1271. [Google Scholar]

- Jarah, B.A.F.; Al Jarrah, M.A.; Al-Zaqeba, M.A.A.; Al-Jarrah, M.F.M. The role of internal audit to reduce the effects of creative accounting on the reliability of financial statements in the Jordanian islamic banks. Int. J. Financ. Econ. 2022, 10, 60. [Google Scholar] [CrossRef]

- Gowthorpe, C.; Amat, O. Creative accounting: Some ethical issues of macro-and micro-manipulation. J. Bus. Ethics 2005, 57, 55–64. [Google Scholar] [CrossRef]

- Popescu, V.A.; Popescu, G.N.; Roman, C.; Popescu, C.R. From creative accounting to the moral and financial crisis. Metal. Int. 2009, 14, 141–149. [Google Scholar]

- Dias, A.G.G.; da Cruz Cunha, J.H.; Sales, I.C.H.; Bezerra, P.C.S. Creative Accounting, Ethics and Earnings Management: Auditors versus Academics. Rev. Adm. Em Diálogo 2016, 18, 133–151. [Google Scholar]

- Shah, A.K. Creative compliance in financial reporting. Account. Organ. Soc. 1996, 21, 23–39. [Google Scholar] [CrossRef]

- Svabova, L.; Kramarova, K.; Chutka, J.; Strakova, L. Detecting earnings manipulation and fraudulent financial reporting in Slovakia. Oecon. Copernic. 2020, 11, 485–508. [Google Scholar] [CrossRef]

- Abed, I.A.; Hussin, N.; Ali, M.A.; Haddad, H.; Shehadeh, M.; Hasan, E.F. Creative accounting determinants and financial reporting quality: Systematic literature review. Risks 2022, 10, 76. [Google Scholar] [CrossRef]

- Milesi-Ferretti, G.M. Good, bad or ugly? On the effects of fiscal rules with creative accounting. J. Public Econ. 2004, 88, 377–394. [Google Scholar] [CrossRef]

- Ozkaya, A. Creative accounting practices and measurement methods: Evidence from Turkey. Economics 2014, 8, 1–27. [Google Scholar] [CrossRef]

- Reischmann, M. Creative accounting and electoral motives: Evidence from OECD countries. J. Comp. Econ. 2016, 44, 243–257. [Google Scholar] [CrossRef]

- Hirota, H.; Yunoue, H. Fiscal rules and creative accounting: Evidence from Japanese municipalities. J. Jpn. Int. Econ. 2022, 63, 101172. [Google Scholar] [CrossRef]

- Kovalova, E.; Michalikova, K.F. The creative accounting in determining the bankruptcy of business corporation. SHS Web Conf. 2020, 74, 01017. [Google Scholar] [CrossRef]

- Valaskova, K.; Gajdosikova, D.; Kramaric, T.P. How important is the business environment for the performance of enterprises? case study of selected European countries. Cent. Eur. Bus. Rev. 2022, 11, 85–110. [Google Scholar] [CrossRef]

- Michalkova, L.; Cepel, M.; Valaskova, K.; Vincurova, Z. Earnings quality and corporate life cycle before the crisis. A study of transport companies across Europe. Amfiteatru Econ. 2022, 24, 782–796. [Google Scholar] [CrossRef]

- Gajdosikova, D.; Valaskova, K. The impact of firm size on corporate indebtedness: A case study of Slovak enterprises. Folia Oeconomica Stetin. 2022, 22, 63–84. [Google Scholar] [CrossRef]

- Nagy, M.; Valaskova, K.; Durana, P. The effect of CSR Policy on earnings management behavior: Evidence from Visegrad Publicly listed enterprises. Risks 2022, 10, 203. [Google Scholar] [CrossRef]

- Kliestik, T.; Blazek, R.; Belas, J. CEO monitoring and accounting record manipulation: Evidence from Slovak agriculture companies. Econ. Sociol. 2022, 15, 204–218. [Google Scholar] [CrossRef]

- Valaskova, K.; Androniceanu, A.-M.; Zvarikova, K.; Olah, J. Bonds between earnings management and corporate financial stability in the context of the competitive ability of enterprises. J. Compet. 2021, 13, 167–184. [Google Scholar] [CrossRef]

- Valaskova, K.; Adamko, P.; Michalikova, K.F.; Macek, J. Quo Vadis, earnings management? Analysis of manipulation determinants in Central European environment. Oecon. Copernic. 2021, 12, 631–669. [Google Scholar] [CrossRef]

- Gajdosikova, D.; Valaskova, K.; Kliestik, T.; Machova, V. COVID-19 pandemic and its impact on challenges in the construction sector: A case study of Slovak enterprises. Mathematics 2022, 10, 3130. [Google Scholar] [CrossRef]

- Gajdosikova, D.; Valaskova, K.; Durana, P. Earnings management and corporate performance in the scope of firm-specific features. J. Risk Financ. Manag. 2022, 15, 426. [Google Scholar] [CrossRef]

- Kovacova, M.; Kliestik, T.; Valaskova, K.; Durana, P.; Juhaszova, Z. Systematic review of variables applied in bankruptcy prediction models of Visegrad group countries. Oecon. Copernic. 2019, 10, 743–772. [Google Scholar] [CrossRef]

- Czech, K.; Wielechowski, M.; Kotyza, P.; Benesova, I.; Laputkova, A. Shaking stability: COVID-19 impact on the Visegrad Group countries’ financial markets. Sustainability 2020, 12, 6282. [Google Scholar] [CrossRef]

- Kochanek, E. The role of hydrogen in the visegrad group approach to energy transition. Energies 2022, 15, 7235. [Google Scholar] [CrossRef]

- Lacko, R.; Hajduova, Z.; Zawada, M. The efficiency of circular economies: A comparison of Visegrád Group countries. Energies 2021, 14, 1680. [Google Scholar] [CrossRef]

- Kochanek, E. The energy transition in the Visegrad group countries. Energies 2021, 14, 2212. [Google Scholar] [CrossRef]

- Pavlicko, M.; Durica, M.; Mazanec, J. Ensemble model of the financial distress prediction in Visegrad group countries. Mathematics 2021, 9, 1886. [Google Scholar] [CrossRef]

- Tucki, K.; Krzywonos, M.; Orynycz, O.; Kupczyk, A.; Bączyk, A.; Wielewska, I. Analysis of the possibility of fulfilling the paris agreement by the Visegrad Group countries. Sustainability 2021, 13, 8826. [Google Scholar] [CrossRef]

- Godawska, J.; Wyrobek, J. The impact of environmental policy stringency on renewable energy production in the Visegrad Group countries. Energies 2021, 14, 6225. [Google Scholar] [CrossRef]

- Lyan, G.; Gross-Amblard, D.; Jezequel, J.M.; Malinowski, S. Impact of Data Cleansing for Urban Bus Commercial Speed Prediction. SN Comput. Sci. 2022, 3, 82. [Google Scholar] [CrossRef]

- Yang, K.; Ding, Y.; Jiang, H.; Zhao, H.; Luo, G. A two-stage data cleansing method for bridge global positioning system monitoring data based on bi-direction long and short term memory anomaly identification and conditional generative adversarial networks data repair. Struct. Control Health Monit. 2022, 29, e2993. [Google Scholar] [CrossRef]

- Chung, Y.; Lu, W.; Tian, X. Data cleansing for salt dome dataset with noise robust network on segmentation task. IEEE Geosci. Remote Sens. 2022, 19, 1–5. [Google Scholar] [CrossRef]

- Garrido-Izard, M.; Correa, E.C.; Requejo, J.M.; Villarroel, M.; Diezma, B. Cleansing data from an electronic feeding station to improve estimation of feed efficiency. Biosyst. Eng. 2022, 224, 361–369. [Google Scholar] [CrossRef]

- Suzuki, K.; Kobayashi, Y.; Narihira, T. Data cleansing for deep neural networks with storage-efficient approximation of influence functions. arXiv 2021, arXiv:2103.11807. [Google Scholar]

- Mousavi, M.; Zimon, G.; Salehi, M.; Stępnicka, N. The effect of corporate governance structure on fraud and money laundering. Risks 2022, 10, 176. [Google Scholar] [CrossRef]

- Micah, E.E.M.; Ibitomi, T.; Ibrahim, S. Audit quality and earnings manipulations in Nigeria: Beneish model. J. Account. Audit. 2022, 10, 56–73. [Google Scholar] [CrossRef]

- Sasongko, D.; Supriyadi, D.; Kosasih, K. Pendeteksian Kecurangan Laporan Keuangan Dengan Beneish Model. Bus. Innov. Entrep. J. 2022, 4, 251–261. [Google Scholar] [CrossRef]

- Novianti, D.R.M.; Habbe, A.H.; Nirwana, N. Analisis pengaruh fraud pentagon terhadap fraudulent financial reporting menggunakan Beneish model. Bongaya J. Res. Account. 2022, 5, 60–68. [Google Scholar] [CrossRef]

- Khatun, A.; Ghosh, R.; Kabir, S. Earnings manipulation behavior in the banking industry of Bangladesh: The strategical implication of Beneish M-score model. Arab Gulf J. Sci. Res. 2022, 40, 302–328. [Google Scholar] [CrossRef]

- Febrilia, E. Analisis Fraudulent Financial Reporting Menggunakan Beneish M-score Model Dengan Pengendalian Internal Sebagai Variabel Moderasi (Studi Empiris pada Perusahaan Pertambangan Batubara yang Terdaftar di Bursa Efek Indonesia tahun 2017–2020). Ph.D. Dissertation, UNSADA, Jakarta, Indonesia, 2022. [Google Scholar]

- Toplu, N.; Calayoglu, I.; Azaltun, M. Finansal bilgi manipülasyonu ortaya çikarmaya yönelik bir araştirma (Beneish model). Muhasebe Ve Finans. İncelemeleri Derg. 2021, 4, 16–25. [Google Scholar] [CrossRef]

- Nugroho, A.H.D.; Ardinata, M.; Ambarsari, R.Y. The effectiveness of pentagon fraud in detecting fraudulent financial reporting: Using the Beneish model in manufacturing companies on the Indonesia stock exchange. Adv. Econ. Bus. Manag. Res. 2020, 169, 389–394. [Google Scholar] [CrossRef]

- Valaskova, K.; Kliestik, T.; Svabova, L.; Adamko, P. Financial risk measurement and prediction modelling for sustainable development of business entities using regression analysis. Sustainability 2018, 10, 2144. [Google Scholar] [CrossRef]

- Olah, J.; Tudor, A.T.; Pashkus, V.; Alpatov, G. Preferences of Central European consumers in circular economy. Ekon. Manaz. Spektrum 2021, 15, 99–110. [Google Scholar] [CrossRef]

- Musova, Z.; Musa, H.; Drugdova, J.; Lazaroiu, G.; Alayasa, J. Consumer attitudes towards new circular models in the fashion industry. J. Compet. 2021, 13, 111–128. [Google Scholar] [CrossRef]

- Plumeyer, A.; Kottemann, P.; Boger, D.; Decker, R. Measuring brand image: A systematic review, practical guidance, and future research directions. Rev. Manag. Sci. 2019, 13, 227–265. [Google Scholar] [CrossRef]

- Cygler, J.; Wyka, S. Internal barriers to international R&D cooperation: The case of Polish high tech firms. Forum Sci. Oeconomia 2019, 7, 25–45. [Google Scholar] [CrossRef]

- Kral, P.; Kanderova, M.; Kascakova, A.; Nedelova, G.; Valencakova, V. Multivariate Statistical Methods with a Focus on Solving Problems of Economic Practice; Faculty of Economics UMB: Banska, Bystrica, 2009. [Google Scholar]

- Kliestik, T.; Valaskova, K.; Lazaroiu, G.; Kovacova, M.; Vrbka, J. Remaining financially healthy and competitive: The role of financial predictors. J. Compet. 2020, 12, 74–92. [Google Scholar] [CrossRef]

- Rilo, A.; Tavares, A.O.; Freire, P.; Zezere, J.L.; Haigh, I.D. Improving estuarine flood risk knowledge through documentary data using multiple correspondence analysis. Water 2022, 14, 3161. [Google Scholar] [CrossRef]

- Lyons, M. Creative Accounting? Assessing the Economic Impact of the Creative Industries: An input-output Approach for the Cardiff City-Region. Ph.D. Dissertation, Cardiff University, Cardiff, UK, 2022. [Google Scholar]

- Jouali, Y.; Kassi, M.A.; Faracha, A. Capital structure and company size as a determinant of creative accounting. Altern. Manag. Econ. 2022, 4, 101–118. [Google Scholar]

- Meldona, M.; Sudarmiatin, S.; Bidin, R. SMEs’ internationalization strategy in export creative industry: Case study from Kendang Djembe Creators at Blitar, East Java, Indonesia. Int. J. Res. Soc. Sci. Educ. 2022, 3, 1067–1079. [Google Scholar] [CrossRef]

- Poradova, M.; Kollar, B. Methods of earnings and risks management in insurance companies. In Proceedings of the Fifth International Conference on Economic and Business Management, Sanya, China, 17–19 October 2020; Volume 159, pp. 374–377. [Google Scholar]

- Denich, E.; Hajdu, D. Measurement of creative accounting by transparency and disclosure index (TDI) method in automobile industry. Public Financ. Q. 2021, 66, 381–396. [Google Scholar] [CrossRef]

- Musanovic, E.B.; Halilbegovic, S. Financial statement manipulation in failing small and medium-sized enterprises in Bosnia and Herzegovina. J. East. Eur. Cent. Asian Res. 2021, 8, 556–569. [Google Scholar]

- Achmad, T.; Ghozali, I.; Pamungkas, I.D. Hexagon fraud: Detection of fraudulent financial reporting in state-owned enterprises Indonesia. Economies 2022, 10, 13. [Google Scholar] [CrossRef]

- Drabkova, Z. CFEBT risk triangle of accounting errors and frauds–analytical tool of fraud risk management and reduction of information asymmetry between creators and users of accounting reports. In I. Jindrichovska & D. Kubickova, IFRS: Global Rules and Local Use; Anglo-American University: Prague, Czechia, 2017; pp. 286–299. [Google Scholar]

- Patel, P.C.; Tsionas, M.G.; Guedes, M.J. Benford’s law, small business financial reporting, and survival. MDE Manag. Decis. Econ. 2022, 43, 3301–3315. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).