Abstract

We examine the lead-lag effect between the large and the small capitalization financial institutions by constructing two global weekly rebalanced indices. We focus on the 10% of stocks that “survived” all the rebalancings by remaining constituents of the indices. We sort them according to their systemic importance using the marginal expected shortfall (MES), which measures the individual institutions’ vulnerability over the market, the network based MES, which captures the vulnerability of the risks generated by institutions’ interrelations, and the Bayesian network based MES, which takes into account different network structures among institutions’ interrelations. We also check if the lead-lag effect holds in terms of systemic risk implying systemic risk transmission from the large to the small capitalization, concluding a mixed behavior compared to the index returns. Additionally, we find that all the systemic risk indicators increase their magnitude during the financial crisis.

1. Introduction

Seeking for positive expected return and managing portfolio risk are two sides of the same coin, accompanied by a risk-return trade-off that depends on the risk appetite of the market participants. The early literature includes many studies that focus on the behavior of asset returns and the possibility of significant profits due to information diffusion. One of the major financial economic concerns is to understand how firms transmit information to markets and how markets impose this information on stock prices. Traditional asset-pricing theories assume that information is disseminated instantaneously in a complete and frictionless market. However, there is a considerable empirical reason to believe that investors are facing significant frictions, and information can sometimes be slowly transmitted to the market. Specifically, there is ample evidence pointing to a lead-lag effect on equity markets where the stock prices of some firms show a delayed reaction to other firms’ price innovations. Lo and MacKinlay (1990) mentioned that the forecasting ability of stock returns can be attributed to what is known as the “stock market overreaction” hypothesis, based on the waves of optimism or pessimism of investors creating a “momentum”. Hou (2007) primarily focused on explaining the lead-lag effect as a sluggish reaction of certain firms to common information compared to others. The author conditioned on the industry membership, because slow diffusion of common information should be more prevalent among firms from the same industry, and he showed that within the same industry, large firms lead small firms. DeMiguel et al. (2014) studied whether investors can exploit serial dependence in stock returns to improve out-of-sample portfolio performance. Using raw returns rather than returns in excess of the risk-free rate and a rolling-horizon procedure, they estimated a VAR model of a small and large stock portfolio and verified a lead-lag relationship with large stock returns leading small stock returns.

In this study, we also restricted to a single industry, that is financial institutions. Why financial institutions? The fact that a healthy financial system is the backbone of economic progress is addressed by many papers1. Additionally, the waves of optimism or pessimism are not limited to one institution as the financial system’s structure is comprised of many financial institutions with linkages between them that may transfer and magnify financial stress during times of crisis (e.g., Billio et al. 2012). The financial institutions’ connectivity is investigated in many works focusing on the systemic risk2, emphasizing the importance of the financial system’s structure during systemic events and the homogeneity or asset commonality between financial institutions3. The works in Wagner (2010) and Allen et al. (2012) pointed out that an increasing homogeneity between financial institutions makes them vulnerable to the same risks, as they become more similar to each other. The former Fed Chairman, Paul Volcker, supported imposing restrictions on the risk level of large banks, on their size, their interconnections, and activities (Volcker 2012).

The systemic risk as a function of the financial system’s architecture and the size of the financial institutional participants is still under debate among regulators and researchers, especially that large banks were found to have an integral role at the center of the recent financial crisis; see Laeven et al. (2016). The authors studied the significant variation in the cross-section of systemic risk measures of large banks during the recent financial crisis in a broad sample of countries, intending to identify bank-specific factors, like banks size, capital, funding, and activities, that determine systemic risk and shed light on the ongoing debate on the merits of restricting bank size, imposing capital surcharges on large banks, and/or restricting their unstable funding and risky activities. Several theories support the view that large and complex banks contribute to systemic risk. According to one view, which the authors named “the unstable banking hypothesis”, large banks tend to engage in risky activities more (e.g., trading) and to be financed more by short-term debt, which makes them more vulnerable to generalized liquidity shocks and market failures such as liquidity shortages and fire sales (Kashyap et al. 2002; Shleifer and Vishny 2010; Gennaioli et al. 2013). In our view, the importance and the implications of this “hypothesis” are not addressed much by the literature. We chose to expand the sample of financial institutions to a broader one because the results of a shock and its dissemination have not been studied or highlighted so far. For example, the removal of the floor of the Euro/Swiss franc exchange rate from the Swiss National Bank was at a time when the markets were not turbulent. However, some financial services companies have been insolvent due to poorly, for such an event, margined positions. The questions that arise are: How much can the insolvency of small financial institutions become a problem? Who are the “vulnerable” portfolio constituents? Can a financial institution be vulnerable, but at the same time a leader in terms of returns?

The literature discussing measures of banks’ systemic risk is vast, and Benoit et al. (2017) provided an excellent survey of systemic risk measures. The literature either uses only market data, i.e, financial returns or credit default swaps (CDS) (e.g., Billio et al. 2012; Acharya et al. 2012; Allen et al. 2012; Adrian and Brunnermeier 2016), or enriches the dataset with balance sheet data (among others, Brownlees and Engle (2017)) to measure systemic risk. A combination of both microeconomic and macroeconomic data was used by Calabrese and Giudici (2015), who built a statistical model of bank distress, based on the balance sheet of a bank, and on macroeconomic information on the country where the bank operated. Several authors discussed the systemic risk vulnerability in the context of financial networks facing the challenge to provide not only a good fit, but also a good interpretation. This may result in choosing a model that has little support from the data, leading to predictions worse than could be obtained with other models. Additionally, the graphical models are essentially static, photographing a situation in a given period. This assumption seems to be restrictive in economics, in the case of variables that change over time, for example during periods of financial stress. Giudici and Green (1999) and recently in Ahelegbey et al. (2016) proposed more advanced, Bayesian, graphical models to overcome this limitation. Battiston et al. (2012) contributed to the debate on the resilience of financial networks by introducing a dynamic model for the evolution of financial robustness, showing that, in the presence of financial acceleration and persistence, the probability of default did not decrease monotonically with diversification. As a result, the financial network was most resilient for an intermediate level of connectivity. Diebold and Yilmaz (2014) proposed several connectedness measures built from pieces of variance decompositions, and they argued that they provided natural and insightful measures of connectedness. They also showed that variance decompositions define weighted, directed networks, so that our connectedness measures are intimately related to key measures of connectedness used in the network literature. Building on these insights, they tracked daily time-varying connectedness of major U.S. financial institutions’ stock return volatilities in recent years, with emphasis on the financial crisis of 2007–2008. Abedifar et al. (2017) compared the results of three different measures to gauge systemic risk, employing an application of the graphical network model described by Giudici and Spelta (2016) to identify the most interconnected banking sector. Avdjiev et al. (2019), based on a tensor decomposition method that extracted an adjacency matrix from a multi-layer network, proposed a distress measure for national banking systems that incorporated not only banks’ CDS spreads, but also how they interacted with the rest of the global financial system via multiple linkage types, using banks’ foreign exposures. Despite the vast amount of literature, there is no widely accepted methodology to determine the systemically important nodes in a network. To answer this, Battiston et al. (2012) introduced the DebtRank metric to determine the impact of the distress of one or several financial institutions through their counterparties’ network. Soramaki and Cook (2013) introduced SinkRank to predict the influence of disturbance caused by the collapse of a bank and identify most affected banks in the system, and Brunnermeier and Cheridito (2019) developed SystRiskto capture the a priori cost to society for providing tail-risk insurance to the financial system. In addition, Elliott et al. (2014) proposed a simple model of cross-holdings to analyze cascades in financial networks; they concluded that diversification and integration of financial institutions had non-monotonic effects on financial contagions, whereas Amini et al. (2016) considered the magnitude of contagion in large counterparty network, giving analytical expression for the asymptotic fraction of defaults, emphasizing in this way the key role of contagious links via the institutions with large connectivity and a large fraction of contagious links.

To measure systemic risk, we used the marginal expected shortfall (MES) of Acharya et al. (2017) and its alternatives proposed by Hashem and Giudici (2016). MES is simply calculated by each firm’s average return during the C% worst days for the market. It measures how exposed a firm is to the aggregate tail shocks, and together with leverage, it has a significant explanatory power for which firms contribute to a potential crisis (see, Acharya et al. 2017). Additionally and for the portfolio allocation, we used MES because, under the assumption that the individual financial institution and the index returns are driven by a bivariate GARCH, the MES of the financial institution is proportional to its systematic risk, as measured by its time-varying beta (see Benoit et al. 2017). On the other hand, there is much criticism of the systemic risk measures, and various papers have presented their shortcomings (among others, Danielsson et al. 2016; Benoit et al. 2019; Idier et al. 2014). The discussion of the adequacy of the systemic risk measures is out of the scope of this paper, and we chose to use MES and its two alternatives, for three main reasons: First, the stock returns used for its calculation are easily obtained and updated, contrary to the balance sheet data used in other measures that are updated at a quarterly frequency. Second, MES provides a clear measure of the expected loss of financial institutions when an extreme event occurs. Third is its additive property. The sum of MES from all banks is equal to a measure of the total systemic risk, allowing for macroprudential tools to be implemented at the bank level (see Tarashev et al. 2010; Qin and Zhou 2013). The disadvantage of this method is that it does not reflect characteristics like the size and the leverage. However, we would like to address that MES is based on historical data like measures of risks built on the covariance matrix. Given the uniqueness of each crisis, the assumption that the risk measures or the parameters involved in their calculation are sufficiently invariant makes these measures “forensic” tools, as Malevergne and Sornette (2006) pointed out. Therefore, MES complements other forensic approaches without being a forward-looking indicator for an upcoming crisis.

This paper contributes to the size and interconnectedness debates in three ways:

- First, we examine the lead-lag effect reported by Lo and MacKinlay (1990) between large and small capitalization financial index returns. To obtain the two indexes, we divide the financial institutions based on their market capitalization into top ones that are the largest until reaching the top 50th percentile of market capitalization and the remaining bottom ones, repeating this procedure on a weekly basis over the pre- and post-financial crisis period of 2007. We choose to use market capitalization (market cap), as it is widely used to create a context for judging company financial performance and business outlook. Larger cap tend to have more broadly diversified business structures than smaller firms. This may give them more stable business performance from year-to-year, with relatively less variable earnings and revenue streams. As a result, large companies may have less volatile share prices than smaller firms in many circumstances. Large companies generally have also tended to be the least sensitive to economic headwinds. Smaller companies, on the other hand, tend to have a tighter business focus. They may have the potential for more rapid revenue and profit growth, but this potential is often more variable. As a result, small-company shares may be, on average, more volatile and more sensitive to macroeconomic shifts than the shares of larger companies.

- Second, we form a large and a small cap portfolio of the stocks that remained as index constituents in every rebalance (named “survived” large and small cap stocks), and we test whether the lead-lag effect is sustained within the systemic risk measures of those. For this purpose, we use a non-directional systemic risk measure, which does not take size into account upon its construction. This allows us to control for the contemporaneous size effect that results from the systemic risk measure specification. Thus, we use the bivariate marginal expected shortfall (MES) systemic risk measure of Acharya et al. (2017) to estimate the risk exposure of an individual institution to the market.

- Third, we test if the size impact holds upon taking into consideration the financial system structure. The use of network analysis gives insightful information about important players in terms of network connectivity. For this purpose, we use two alternatives of MES that take the interconnectedness relations into account: the network based MES (NetMES), which extends MES by taking multivariate dependencies into its estimation; and the Bayesian NetMES, which further accounts for the network model uncertainty.

We further investigate the size impact at the individual institution level. Upon the estimation of MES, NetMES, and Bayesian NetMES, we rank the institutions based on the systemic risk indicators in descending order for the systemic risk level. We select the top six ranking institutions across the different systemic risk measures, and we evaluate their network connectedness.

The paper is organized as follows: Section 2 describes in detail the dataset and the construction of the large and the small capitalization indices. Section 3 states the VAR model, which explains the lead-lag relation between the large and the small cap index returns and tests its statistical significance to identify the origin of the predictability in index returns. Section 4 discusses the systemic risk indicators, and Section 5 presents the results of the lead-lag relations between the systemic risk indicators. We also give details about the systemically important financial institutions derived from the previous analysis. Section 6 concludes.

2. Data and Market Indices

We examined the interrelations between the large and small capitalization financial stocks by constructing our own indices, instead of using an existing benchmark market index. An already available index would be like a black box, as details like the constituents of the index, the weights in each distinct point of time, and the re-balancing dates are unknown. Indeed, comparing the available benchmark market indices, three separate causative influences can be uncovered. First, the behavior of equity indices is partly attributable to the technical procedures of its construction. Some indices have a small number of stocks, while others have a large number4. Some local benchmark market indices are industrially concentrated, while others are very diversified. These diversification elements explain part of the observed inter-market differences in price indices’ behavior, which do not correspond to differences in the individual stocks behaviors. Second, local indices may vary in their industrial composition and have industries that are inherently more or less volatile. We can think of a local index as a country-specific managed portfolio with particular industry sector “bets”. In this context, even a large portfolio can be influenced by disproportionate investments in certain industries. Third, exchange rates play a significant role. With returns expressed in a local currency, part of a stock index’s return volatility is induced by monetary phenomena such as changes in anticipated and actual local inflation rates. Converting local currency returns into common currency returns (e.g., the U.S. dollar) does not entirely eliminate the exchange rate’s influence.

The steps followed to construct our indices were: First, we collected stocks across the globe, which according to the Global Industry Classification Standard (GICS) were classified as banks and diversified financial institutions, excluding consumer finance, diversified financial services, insurance, and real estate companies. The fact that our sample contained a wide range of financial institutions and not only banks allowed us to take into account other sources of risks. In particular, our sample contained financial institutions exposed to sovereign systemic risk (the case of Greece during the debt crisis), to geographic risk (for example, periods of turmoil in Middle Eastern countries), and/or to risks driven by different banking business models (e.g., banks, asset management and custody banks, etc.). We remark that, as the GICS was applied to companies around the world and it was annually revised, the universe was continuously up-to-date and, therefore, so were our results. Second, we divided them into two tiers: the top 50 sequential percentile rank and the bottom 50 sequential percentile rank, obtaining the large and the small capitalization groups, respectively. The sample was free of survivorship, restatement, and lagging bias and contained the five largest world companies, which accounted for 63.02% of the 2010 world banking sector and represented the fundamentals as they were known in the market at each observation point. Then, all the stock prices were converted into U.S. dollars, since according to Roll (1992), the best way to combine stocks in the same industry, but traded in different currencies was to convert all first to a common currency and then construct the industry index. Beginning from 31 December 2014, and going back to 1 January 2005, our portfolio was weekly rebalanced, ending up with 522 different groups of large and small capitalization financial stocks. During the coverage period, the indices covered 2590 stocks; 1361 appeared in the weekly large cap portfolios and 2064 in the small cap portfolios, and 835 stocks moved between the two groups. The set of large cap stocks spanned 98 countries, 3 industry groups (Banks, Capital Markets, Thrifts & Mortgage), 6 sub-industries (Asset Management & Custody Banks, Diversified Banks, Diversified Capital Markets, Investment Banking & Brokerage, Regional Banks, Thrifts & Mortgage Finance)5, and 103 primary exchanges. For the small cap stocks group, there were 108 countries and 118 primary exchanges. The number of industry and sub-industry groups was the same. Only 321 out of 1361 large cap stocks “survived” through the years in each rebalance, having a positive weight in the indices. On the other hand, 193 out of the 2064 small cap stocks survived. In both cases, we called these groups as “survived”. Following the sub-industry classifications, from the 321 large cap survived financial institutions, 39 belonged to the Asset Management & Custody Banks (AMC), 131 to the Diversified Banks (DB), 8 to the Diversified Capital Markets (DCM), 19 to the Investment Banking & Brokerage (IBB), 98 to the Regional Banks (RB), and 11 to the Thrifts & Mortgage Finance (TMF) sub-industry. Accordingly, from the 193 small cap survived financial institutions, 23 belonged to the Asset Management & Custody Banks (AMC), 18 to the Diversified Banks (DB), 32 to the Investment Banking & Brokerage (IBB), 87 to the Regional Banks (RB), and 14 to the Thrifts & Mortgage Finance (TMF) sub-industry. Unlike the large cap survived group, the Diversified Capital Markets sub-industry for the small cap survived financial institutions was omitted due to missing observations.

The descriptive statistics (Table A2) of the weekly returns of the indices showed a departure from normality. Both the skewness and the excess kurtosis statistics were significantly higher than those of the normal distribution at all meaningful significance levels, and these suggested that both series were negatively skewed and leptokurtic. For the large cap index returns, the maximum positive change was 13.605% in November 2008 and the maximum drop −17.78% in October 2008. For the small cap index returns, the maximum positive change was 8.25% in May 2009 and the maximum drop −13.67% in October 2008. For both series, the worst weekly change took place at the end of the second week of October 2008, when UniCredit, Italy’ s second biggest bank by market capitalization, was rumored to be insolvent and a large International Monetary Fund (IMF)-EU rescue package was needed to stabilize the situation in Hungary, where the short-term swap and bond markets were frozen. The period with the highest increases was in April 2009, when the G20 and Japan announced a U.S.$1-trillion and a U.S.$150-billion economic stimulus package, respectively, against the financial crisis. In terms of Granger causality and assuming one period of lagged returns, it was found that the null hypothesis that the returns of the large cap index did not Granger cause the returns of the small cap index was rejected with a test F-statistic of 6.1035, which was significant at the 1.49% level. On the other hand, the null hypothesis that the small cap index did not Granger cause the large cap index could not be rejected at any conventional levels of significance (see Table A2).

3. Lead-Lag Effect

The integration of world financial markets has hastened due to the economic globalization and Internet communication spreading effortless and immediately the price movements from one to another market. Thus, financial markets are more dependent on each other than ever before; one market may lead another one under some circumstances, yet the relationship may be reversed under other circumstances. Consequently, knowing how the markets are interrelated is of great importance. In the same way, for an investor or a financial institution holding multiple assets, the dynamic relationships between asset returns play a vital role in decision making. Furthermore, stock trades do not occur in a synchronous manner, since the trading intensity varies from hour-to-hour and from day-to-day. This important phenomenon known as the lead-lag relationship was first documented by Lo and MacKinlay (1990). Assume that and are the returns of the large and the small cap index, and let be a vector of the index returns at time t. The dynamics of are presumed to be governed by a first-order Gaussian vector autoregressive model:

where is the error vector, c is a vector of intercepts, and is a matrix of slopes. The VAR specification assumes that the next period’s index return is linearly dependent on today’s with the linear dependency captured by the slope matrix. The analytic representation of the VAR(1) defined above suggests the following regression model:

Following Hou (2007), who estimated the VAR equations assuming one lag and four lags using weekly data, we considered monthly returns of the large cap and the small cap indices, and we estimated a VAR(1) model. The results are as follows (p-values appear in brackets below estimates):

The above-estimated coefficients derived a number of interesting conclusions. First, we confirmed the lead-lag reported by DeMiguel et al. (2014) and Lo and MacKinlay (1990), that the large cap index returns led the small cap index returns, since the large cap interaction coefficient was positive and statistically significant. Second, the autoregressive coefficient of the large cap stocks was statistically significant and positive, and finally, in line with the Granger causality results obtained previously, large cap index returns did not depend on past small cap index returns ().

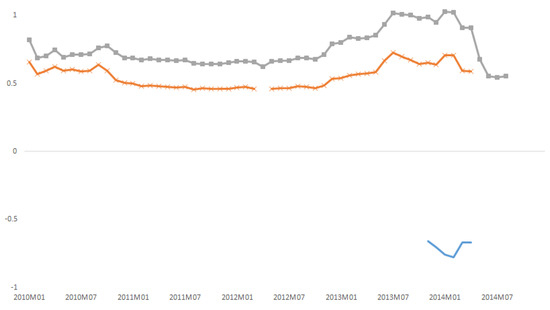

We now present some robustness checks of our lead-lag effect exercise. A rolling analysis was used to evaluate the stability of the parameters identifying the periods where the interaction between the two different segments of the market was more intense. Rolling analysis is also useful to study if and how the direction of the interaction changes over time. Finally, with the rolling analysis, we could examine the evolution of the autoregressive coefficients through time. The VAR model was estimated using a 60 month window (close to the 2000 day estimation window of DeMiguel et al. (2014)) testing along side the significance of the coefficients. In Figure 1, we present the time path of the estimated autoregressive coefficients and interaction terms. The gaps indicate the periods where they were not statistically significant. The large cap autoregressive coefficient was statistically significant for almost the entire sample period until August 2014. The estimates of were quite variable, indicating that the market trend in the large cap index was not constant over time. The joint conditions , were needed to test for momentum, which in our case were eliminated to test that , since was not significant in our benchmark model. It was apparent that the coefficient was statistically positive for the entire sample period, highlighting the existence of momentum in the large cap segment of the market. The small cap interaction term was statistically significant for the sample periods ending in November 2013 to April 2014, implying that the large cap index returns were affected by the lagged small cap index returns for a very short period. On the other hand, the interaction term of the lagged large cap return index on the small cap index return was statistically significant for almost the entire period ending in January 2010 to April 2014, with the exception of the period March 2012–May 2012.

Figure 1.

Coefficient estimates of regression (1) plotted only when they are statistically significant. The grey-square marked line shows the estimates of the autoregressive coefficient of the lagged large cap index returns. The orange-cross marked line shows the estimates of the interaction term of the lagged large cap index returns on the small cap index returns. The blue solid line presents the interaction of the lagged small cap index returns on the large cap index returns.

4. Systemic Risk and Network Measures

The number of systemic risk definitions is vast, and the underlying idea is either based on the market’s efficiency, and therefore the information dispersion, or on the information coming from market data (e.g., accounting data). One prominent example of the market data based measure is the marginal expected shortfall (MES) of Acharya et al. (2017). In our analysis, we used MES and some variations of it.

4.1. Marginal Expected Shortfall

Consider the bivariate vector of the ith financial institution returns and of its reference market, m, at time t. Based on the expected shortfall, which is, in other words, the tail conditional expectation of Artzner et al. (1999), Acharya et al. (2017) introduced the marginal expected shortfall (MES) to capture the marginal contribution of the institution to the risk of the financial system, defined as:

where is the weight of the financial institution in the total portfolio and C is a threshold that defines the distress event examined. Institutions with higher MES are the ones contributing the most to the market decline; hence, they are more likely to be systemically risky. Given our global dataset, we would be able to identify global systemically important financial institutions by estimating an institution’s capital shortfall in the case of a worldwide shock. In the aspect of the “cause and effect”, MES is on the “cause” side, in the sense that it is calculated assuming that the market index is already at the tail; therefore, MES captures the “effect” the later has, on the systemic risk of the stock. The aggregate MES is interpreted as the marginal expected shortfall of the returns of a portfolio consisting of individual banks’ equities when the market returns fall below a certain threshold level. In our implementation of MES, we used the dynamic conditional correlation to take into account the increase in volatility during crisis times. To this aim, we followed Brownlees and Engle (2012) and Engle (2012), who employed a bivariate GARCH model for the demeaned returns process, based on a capital asset pricing model (CAPM).

Let H be the variance-covariance matrix of , Brownlees and Engle (2012). Engle (2012) proposed that:

where represents a vector of zero mean innovations, and:

where is the standard deviation of the reference market returns, is the standard deviation of the financial institution’s returns, and is its correlation with the reference market returns. To estimate , we used the dynamic conditional correlation model of Engle (2002) and Engle and Sheppard (2001). Under the model structure described by (5) and (6)6 and the definition of MES, it is shown that:7

The last relationship states that MES is a weighted function of the tail expectation of the standardized market residual and the tail expectation of the standardized idiosyncratic financial institution’s residual, measuring the vulnerability of the financial institution i to the systemic risk originated from the financial market given that the market returns are less than an assumed threshold C. The intuition behind higher values of MES is that the more vulnerable the institution is to systemic risk, the higher is its contribution to the risk of the financial system. Benoit et al. (2017) showed that MES and the systematic risk of the financial institution are proportional, that is:

where is the time-varying beta and is the expected shortfall of the market.

The functional form of MES implies that it can be aggregated, resulting in an aggregate measure, which is interpretable as the marginal expected shortfall of the return of the portfolio of stocks conditional on the market returns being below a certain threshold level.

4.2. Network Marginal Expected Shortfall

In highly correlated markets, such as financial systems, it could be very well the case that the correlation between the market and the institution returns contains other effects, for example, the correlation of the institution with other institutions or the correlation of the market with other institution returns. To remove “spurious” effects, which may bias the relationship between the institution and the market returns, we replaced marginal correlations with partial correlations: the correlations between the residuals from the regression of the institution returns on all other institution returns and the residuals from the regression of the market returns on all other institutions. In this way, we obtained a “netted” estimate of H, not biased by spurious effects, and consequently, a “netted” estimate of MES. We followed the definition of NetMES as introduced by Hashem and Giudici (2016) to take interconnectedness into account in the estimation of MES, and the partial correlations, , are calculated by:

where are residuals of the regression of on all other variables excluding and are the residuals of the regression of on all other variables excluding . The partial correlation coefficient allows measuring the additional contribution of variable to the variability of that is not already explained by the other variables, and vice versa. In our setting, we regressed the market index and institution to the rest of institutions returns to extract the residuals and , that is:

and then, we obtained the partial correlation, that is . We repeated this extraction process for each pair of market and institution returns , which are inserted in (8), to obtain the variance-covariance matrix, H, and consequently the NetMES.

4.3. Bayesian Network Marginal Expected Shortfall

A network is comprised of a set of financial institutions, in which each institution represents a node. Assuming a multivariate Gaussian model for the time series observations of N financial agents, the linkages between the nodes can be described by an adjacency matrix A that has an dimension with elements , in which when two nodes are correlated and when they are not correlated. Partial correlations can be estimated assuming that the same observations follow a graphical Gaussian model, in which the variance-covariance matrix is constrained by the conditional independence described by a graph (see e.g., Lauritzen (1996)).

More formally, let be an N-dimensional random vector distributed according to a multivariate normal distribution . We assume throughout that the covariance matrix is not singular. For an undirected graph, let , with vertex set and edge set , a binary matrix, with elements , which describe whether pairs of vertices are (symmetrically) linked between each other () or not (). If the vertices V of a graph are put in correspondence with the random variables , the edge set E induces conditional independence on X via the so-called Markov properties (see, e.g., Lauritzen (1996)). More precisely, the pairwise Markov property determined by G states that for all :

The absence of an edge between vertices i and j is equivalent to independence between the random variables and , conditionally on all other variables .

In our context, all random variables are continuous, and it is assumed that . Let the elements of , the inverse of the variance-covariance matrix, whose elements are indicated by Whittaker (2009) proved that the following equivalence also holds:

where:

denotes the partial correlation. It can also be shown that the partial correlation coefficient is equal to the correlation of the residuals from the regression of on all other variables (excluding ) with the residuals from the regression of on all other variables (excluding ), as in the following:

In other words, the partial correlation coefficient measures the additional contribution of variable to the variability of not already explained by the others, and vice versa.

A graphical Gaussian model is a Gaussian distribution constrained by a set of partial correlations equal to zero, which corresponds to variables whose additional contribution is not statistically significant. Mathematically, by means of the pairwise Markov property, given an undirected graph , a graphical Gaussian model can be defined as the family of all N-variate normal distributions that satisfy the constraints induced by the graph on the partial correlations for all , as follows:

In practice, the available data are used to test which partial correlations are different from zero at the chosen significance level threshold . A drawback of this approach is that results are conditional on a fixed graphical structure. To overcome this problem, we employed a Bayesian model averaging approach, where the estimates were the averages of those coming from the different graphical structure, each with a weight that corresponded to the Bayesian posterior probability of the corresponding graph.

For the purpose of a Bayesian application, the first task was to derive the likelihood of a graphical network and specify an appropriate probability distribution over all graphical networks. For a given a graph G, we considered a sample X of size n from a Gaussian probability distribution , and let S be the observed variance-covariance matrix that estimates . The graph G has a defined subset of vertices , in which denotes the variance-covariance matrix of the variables in and has as the corresponding observed variance-covariance submatrix. When the graph G is decomposable, the likelihood of the data, under the graphical Gaussian model specified by P, nicely decomposes as follows (see, e.g., Giudici and Spelta (2016)):

where C and S respectively denote the set of cliques and separators of the graph G, and:

and similarly for . A convenient prior for the parameters of the above likelihood is the hyper inverse Wishart distribution. It can be obtained from a collection of clique specific marginal inverse Wishart distributions as follows:

where is the density of an inverse Wishart distribution, with hyper-parameters and , and similarly for . For the definition of the hyper-parameters, here we follow Giudici and Spelta (2016), and let and be the sub-matrices of a larger matrix of dimension , obtained in correspondence with the two complete sets of vertices C and S, assuming that . To complete the prior specification, for , we consider a uniform prior over all possible graphical structures. Dawid and Lauritzen (1993) showed that, under the previous assumptions, the posterior distribution of the variance-covariance matrix is a hyper Wishart distribution with degrees of freedom and a scale matrix given by:

where is the sample variance-covariance matrix. This result can be used for quantitative learning on the unknown parameters, for a given graphical structure. In addition, Dawid and Lauritzen (1993) showed that the proposed prior distribution can be used to integrate the likelihood with respect to the unknown random parameters, obtaining the so-called marginal likelihood of a graph, which is the main metric for structural learning. Such a marginal likelihood is equal to:

in which:

where is the multivariate gamma function, given by:

Assume that we have several possible graphs, say , and that they are equally likely a prior, so that the probability of is:

By Bayes rule, the posterior probability of a graph is given by:

and therefore, since we assume a uniform prior over the graph structures, maximizing the posterior probability is equivalent to maximizing the marginal likelihood. For graphical model selection purposes, we searched in the space of all possible graphs for the structure such that:

A Bayesian model averaging approach does not force conditioning inferences on the (best) model chosen. If we assume that the network structure G is random and we assign a prior distribution on it, we derive inference on unknown parameters as model averages to all possible graphical structures, with weights that correspond to the posterior probabilities of each network. This derives from the application of Bayes’ theorem, as follows:

Note that, in many real problems, the number of possible graphical structures could be very large, and we may need to restrict the number of models to be averaged. This can be done efficiently, for example, following a simulation based procedure for model search, such as Markov chain Monte Carlo (MCMC) sampling. In our context, given an initial graph, the algorithm samples a new graph using a proposal distribution. To guarantee irreducibility of the Markov chain, we followed Giudici and Spelta (2016) to test whether the proposed graph was decomposable. The newly sampled graph was then compared with the old graph, calculating the ratio between the two marginal likelihoods; if the ratio was greater than a predetermined threshold (acceptance probability), the proposal was accepted, otherwise, it was rejected. The algorithm continued until practical convergence was reached.

Following Hashem and Giudici (2016), we average NetMES as follows:

where x represents the observed data evidence and g a specific network model. The estimated is referred to as a Bayesian Network based marginal expected shortfall measure (Bayesian NetMES).

4.4. Centrality Measures

Centrality measures address the question of who is the most important in the network. There are many answers to this question, depending on what we mean by importance. There are a vast number of different centrality measures. We used the most popular ones, like closeness, node degree, eigenvector, and betweenness. Closeness calculates the inverse of the fairness, or the inverse of the sum of shortest paths between a node and all other nodes, and thus, it allows detecting nodes that are best placed to influence the entire network quickly and that represent influence or information broadcasters. Node degree centrality assigns the node importance score based on the summation of the number of links a node has with others. Eigenvector centrality can identify nodes that possess influence over the whole network, not just those directly connected to it; in other words, eigenvector centrality is a measure of the overall influence extent of a specific node on others in a network, this measure assigns scores to nodes based on the concept that connections to high-score nodes contribute more to the score of the specified node than equal connections to low-score nodes. Betweenness centrality measures the number of times a node lies on the shortest path between other nodes, or the number of times a node acts as a bridge along the shortest path between others. It was introduced as a measure for quantifying the control of a human of the communication between other humans in a social network by Linton Freeman. Intuitively, betweenness measures a node’s influence on the information flow circulating through the social network, under the assumption that the flow follows shortest paths.

5. Findings and Discussion

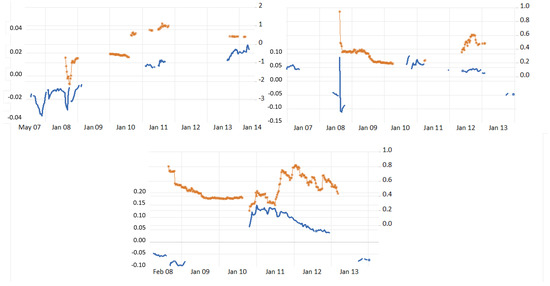

We examined the lead-lag relationship of the survived financial institutions systemic risk measures by estimating the regression (1) using a two year rolling window. Figure 2 shows the evolution of the interaction terms and identifying the periods where the large cap survived financial institutions led the small cap8 in terms of systemic risk, and vice versa. It is notable that the interaction terms did not show a pattern like that of the lead-lag behavior of the financial returns in Figure 1. The MES of the small cap led the MES of the large cap from 24 August 2007 until 12 September 2009. Moreover, the negative sign of the implied a decrease of the MES of the large cap when an increase of the MES of small cap occurred. It is also worth noticing that the magnitude of was 100 times larger than . The MES behavior was interpreted with the crisis effect on the stock market returns behavior. Sandoval and Franca (2012) showed that an increase in market volatility led to an increase in the correlation between market assets, indicating the increase in the level of uniform behavior of market participants during crisis times. This being said, and knowing that MES estimation was not size dependent, nevertheless, it captured the increase in the small cap volatility during crisis times, which may be interpreted in terms of both capitalization and liquidity availability. Terraza (2015) showed that the capital adequacy degree declined during 2008, but there was an increase in capitalization and liquidity after that except for small banks in 2011 and 2012. In addition, Ding and Sickles (2018) pointed out a positive relation between capital and risk adjustments of large banks that held low capital buffers; however, they pointed out a negative relation between capital and risk adjustments for small banks with low capital buffers. The decrease of the large cap MES upon the increase in MES of the small cap along with the larger magnitude of the small cap MES could be foreseen as a positive improvement in large cap returns compared to small ones, which may be viewed as a change in the market expectations for large cap risks in relation to governmental bailout plans. Brewer and Klingenhagen (2010) showed that large banks’ stock prices that were classified as too big to fail (TBTF) performed better in the short run than smaller banks in the USA as a reaction to the U.S. government bailout programs.

Figure 2.

Interaction terms (orange-cross marked line) and (blue solid line) (plotted only when they are statistically significant) estimates of regression (1) assuming as the dependent variable a systemic risk indicator. Beginning from the top-left and moving to the right, the figures present interaction terms between the marginal expected shortfall (MES), the network based MES (NetMES), and the Bayesian NetMES of the large and small cap survived financial institutions. In each graph, the left axis is (orange-cross marked), and in the right is (blue solid).

The evolution of NetMES showed that the small-large lead-lag relationship was present from 19 September 2008, until 11 November 2008. The coefficient was mostly negative as in the case of MES. Again, the magnitude of the interaction term was quite larger than the The results of NetMES were inline with MES, but were limited to a shorter time span that was located within the heart of the global financial crisis of 2008. Originally, MES was estimated using correlations that captured both direct and indirect relationships; mainly as it provided the degree of association between the financial institution and the specified index without controlling for the effects from other financial institutions, while NetMES was estimated using partial correlations that considered only the direct relationships; as the effect of the set of other financial institutions was removed. Therefore, NetMES excluded the impact from other institutions upon the computation of the co-movements between the selected institution and the market index. This estimation method of NetMES imposed sparsity on the financial network structure whenever the partial correlation coefficient was insignificant, indicating that the corresponding financial institution did not directly contaminate others. The lead-lag relationship was also confirmed by the Bayesian NetMES between the large and the small cap financial institutions from 10 October 2008, until 6 March 2009. From 3 December 2010–25 January 2013, the lead-lag relationship was supported again. The difference in Bayesian NetMES in terms of the longer periods of the lead-lag results referred to the model specification, which represented an averaging mechanism over the systemic risk measure. The Bayesian model allowed us to examine the network structure while tacking into account the model uncertainty.

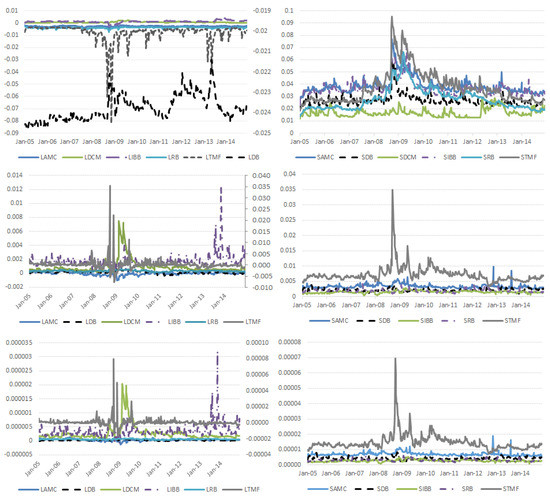

To reveal additional features of the evolution of the systemic risk level of financial institutions, we continued by examining the sub-industries. A careful examination of Figure 3 reveals that all the systemic risk indicators sharply increased their magnitude in 2009. In particular, for the large cap survived financial institutions, the MES showed that DB and TMF experienced the highest increase. The NetMES and Bayesian NetMES showed that except the aforementioned sub-industries, also DCM and IBB increased sharply. Furthermore, a notable feature was the negative signs of MES in the case of the AMC, DB, RB, and TMF. This suggested that the financial sub-industries responded negatively to the downfall of the market. Laopodis (2016) pointed out the presence of a significant explanatory power from industry to stock market returns, indicating the consistent informational leadership from the financial industry to other industries. When NetMES and the Bayesian NetMES were considered, the negative values were present mainly for AMC and TMF. Additionally, MES for DB and TMF started to increase again in 2012 (Greek default) and in 2013 reached another peak. In the case of NetMES and Bayesian NetMES, there was a peak of the systemic risk measures for the IBB sub-industry.

Figure 3.

Average MES, NetMES, and Bayesian NetMES per sub-industry of survived financial institutions. In the left (right) figures appear the evolution of the large (small) cap survived financial institutions, denoted with “L” (“S”) before the name of the sub-industry. On the right axis (when it exists), MES of large cap Diversified Banks DB (LDB), NetMES, and Bayesian of large cap Thrifts & Mortgage Finance (LTMF). AMC, Asset Management & Custody Banks; IBB, Investment Banking & Brokerage; DCM, Diversified Capital Markets; RB, Regional Banks.

For the small cap, the systemic risk measures reached their highs in late 2008–early 2009. The sub-industries systemic risk change in magnitude could be interpreted in relation to the level of the financial leverage ratio9. It was shown that TMF was the one that had the highest leverage increase during the crisis period, followed by DB. It is noticeable that the magnitude change of NetMES and Bayesian NetMES was affected by the magnitude change of leverage. This indicated that the change magnitude within the netted financial risk network was leverage driven, which captured the specificity of the subprime mortgage crisis. This feature infused the debate on the MES rational concept, in which the MES was argued to be close to the too interconnected to fail (TITF) logic rather than the too big to fail (TBTF) one. This logical relation could also be noticed from the sub-industries market capitalization (see Table A3) showing that large DB had the highest total market capitalization for the overall and the crisis periods, and the highest change in magnitude during the crisis period, while the change was a decrease for TMF, consistent with its higher leverage increase relative to its smaller capitalization. Several theories support the view that large and complex banks contribute to systemic risk. In the TBTF hypothesis, the regulators were reluctant to close or unwind large and complex banks, resulting in moral hazard behavior. As a result, the leading banks took on excessive risks in the expectation of government bailouts (Farhi and Tirole 2012).

Subsequent to our initial approach, we will tackle the issue in terms of the individual institution’s system risk importance capturing their vulnerability to a market-wide systemic shock10. The rankings were based on the MES, the NetMES, and the Bayesian NetMES, respectively. We compared the three rankings by implementing a Kolmogorov–Smirnov test that compared their corresponding cumulative distributions. For the large cap, we rejected at 5% the null hypotheses in favor of the alternative that the MES of the large cap institutions was larger than the NetMES. The null hypothesis was not rejected when we compared the distributions of NetMES and the Bayesian NetMES. For the small cap, the MES and NetMES were found again significantly different. The null hypothesis was not rejected for NetMES and Bayesian NetMES, and MES and Bayesian NetMES. Additionally, we examined the autocorrelation structure of the series. Kendall’s between the spot and the lagged value of the systemic risk measures equaled 0.7488 (MES), 0.6005 (NetMES), and 0.5631 (Bayesian NetMES) for the large cap survived financial institutions and 0.8856 (MES), 0.6566 (NetMES), and 0.6611 (Bayesian NetMES), indicating strong autocorrelation of the MES values, and consequently, the more reluctant to changes rankings compared to NetMES and Bayesian NetMES values.

Next, we followed Benoit et al. (2013), who used the top ten financial institutions by systemic risk importance, which accounted for 10% of their sample, and we proceeded with our analysis using the top six the financial institutions, which accounted for 12.84% of the total number of the survived financial institutions11. For each sub-period, the institutions and the countries are provided in a dot joint ticker country column (Ticker.Country). Table 1 and Table 2 summarize the financial institutions’ systemic importance assumed by at least one of the systemic risk measures examined (Analytically, the top six ranked institutions per sub-industry are provided in the Tables A.2–A.7 of (Arakelian et al. 2019)). From the tables above, if we focus on the financial institutions retained systemically important by all the measures, we obtained a list of companies that was consistent with what happened to them:

Table 1.

Top six systemically important large cap survived financial institutions. In the fourth column, “3”: systemically important by all three systemic risk measures (MES, NetMES, Bayesian NetMES); “2” systemically important by two of the three systemic risk measures; “1”: systemically important by one of the three systemic risk measures.

Table 2.

Top six systemically important small cap survived financial institutions. In the fourth column, “3”: systemically important by all the three systemic risk measures (MES, NetMES, Bayesian NetMES); “2”: systemically important by two of the three systemic risk measures; “1”: systemically important by one of the three systemic risk measures.

- In the United States, Legg Mason Inc. (LM.US) was one of the institutional investors that bore a huge loss when Bear Stearns collapsed, as the group held 11% of Bear Stearns, making the group the bank’s biggest shareholder. Legg Mason was also ranked among the most important institutions by Acharya et al. (2017), as well as Goldman Sachs, TD Ameritrade, and New York Community Bancorp for the period June 2006–June 2007 that the authors examined.

- In France, two prominent French financial institutions were among the most massively hit by the fear of contingent liabilities: Natixis, France’s fourth largest bank, also assumed systemically important, had announced a €1.2 billion write-down of exposure to bad U.S. mortgage debt. Natixis, a publicly-listed corporate and investment banking firm jointly controlled by Caisses d’ Epargne (the French Savings Banks group) and Banques Populaires, and Dexia, a French-Belgian bank specializing in the financing of municipalities. In both cases, the problems were related to their investments in bond insurers in the United States: CDC IXIS Financial Guaranty (CIFG) in the case of Natixis and Financial Security Assurance (FSA) in the case of Dexia12.

- In Germany, an investment-banking arm of Deutsche Bank deeply involved in toxic securities was found systemic by all measures. By some estimates, German banks at the outset of the crisis had an average ratio of debt to net worth of 52 to one compared with 12 to one in the U.S. Indeed, the U.S. Federal Reserve helped Deutsche Bank with $290 billion in mortgage securities.

- In South Africa, Investec Bank was systemically important by all the measures. Indeed, the British government was forced to act by injecting liquidity into financial markets through various schemes including a 50 billion Credit Guarantee Scheme in October 2008, in which Investec Bank was eligible to participate.

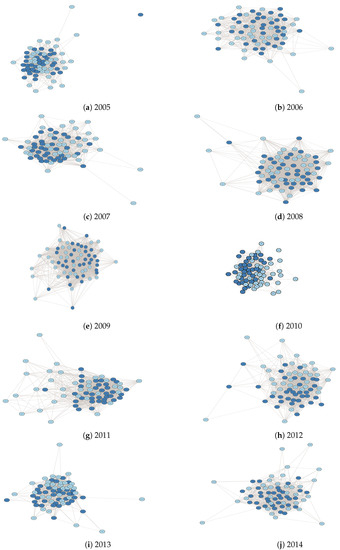

Subsequent to our initial objective was to investigate the network structure among the top six systemically important institutions per sub-industry. The network investigation aimed at modeling the interlinkages between the large and the small cap, revealing the channels through which shocks could propagate more widely in the financial system. Figure 4, Figure 5 and Figure 6 represent the yearly correlation networks for MES, NetMES, and Bayesian NetMES vectors of the top six financial institutions per sub-industry based on eigenvector centrality, providing a ranking of the nodes from the most to the least systemically important (the details of the graphs, as well as, the ranking provided by using other centrality measures are given summarized into centrality measures in Table A4, Table A5 and Table A6). The large cap financial institutions are represented by the dark blue nodes, and the small cap by the light blue nodes. The link between any two nodes of financial institutions represents the presence of a significant correlation coefficient between them. The main result was the strong clustering, both within the institution of the same market capitalization and between them. There were very few cases where an institution was not connected to the system, and digging more deeply could not identify any specific feature for them. For example, the country of domicile did not play any role, as the institutions that were not connected were based both in countries with many institutions in our sample, like the USA, or few, like Malaysia. Using the centrality measures in Table A4, Table A5 and Table A6, notice that the MES and Bayesian NetMES had a higher node degree during the global financial crisis of 2008 and than in 2012 during the European sovereign debt crisis, but NetMES had a higher increase in 2007 and 2010. This fact implied that the measures were complementary to each other and were responsive in identifying the presence of a crisis period. However, MES and Bayesian NetMES showed higher density during the crisis and upon the crisis materialization, while NetMES showed higher density during the early crisis stage. From the MES correlation network, we note that closeness, node degree, and betweenness centrality were mostly dominated by large cap, while eigenvector centrality identified SDBbriefly during 2008. NetMES and Bayesian NetMES exhibited a similar behavior for closeness and node degree centrality of the LAMCand LDB, but showed an interplay between SRBand several large cap sub-industries for eigenvector and betweenness centrality. Bayesian NetMES exhibited similar behavior to NetMES within the different centrality measures. The networks’ summary in terms of closeness indicated that large cap institutions could influence the entire network more quickly than small cap, and node degree indicated that large cap were very connected to the system, implying an informational advantage and most likely more cross-sectional positions with the other network participants than was the case for small cap institutions. Eigenvector centrality showed that the higher influence on the network in terms of risk during crisis times, and especially during 2008, cane from small cap rather than large cap. Betweenness centrality showed that small cap had the ability to influence the whole network during crisis times, and not just those connected to it, due to the behavior of the small cap as a connection bridge between the different network participants. It was obvious that both eigenvector centrality and betweenness reflected the difference in the network during turmoil times. Minoiu and Reyes (2013) showed that a change in the network interconnectedness of a country would signify a higher probability of a banking crisis that may lead to the instability of its financial system. In addition, Chowdhury et al. (2019) indicated the higher connectivity of the financial network during crisis periods. Furthermore, Heiberger (2014) showed that the stock network stability changed during crisis times as it changed its composition to become more tightened with a more centralized topology.

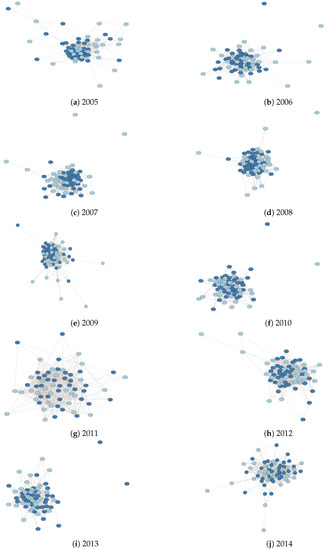

Figure 4.

Yearly correlation networks for MES vectors of the top six MES financial institutions per sub-industry based on eigenvector centrality. The large cap financial institutions are in dark blue and the small cap financial institutions in light blue. The link between any two nodes of financial institutions represents the presence of a significant correlation coefficient between them. The graphs are summarized into the centrality measures provided in Table A4. The centrality measures rank the financial institutions on a yearly basis from the most to the least systemically important.

Figure 5.

Yearly correlation networks for NetMES vectors of the top six NetMES financial institutions per sub-industry based on eigenvector centrality. The large cap financial institutions are in dark blue and the small cap financial institutions in light blue. The link between any two nodes of financial institutions represents the presence of a significant correlation coefficient between them. The graphs are summarized into the centrality measures provided in Table A5. The centrality measures rank the financial institutions on yearly basis from the most to the least systemically important.

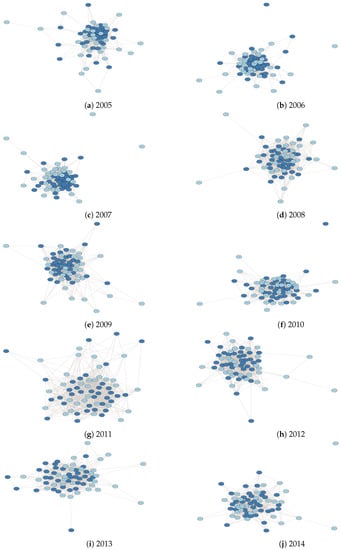

Figure 6.

Yearly correlation networks for Bayesian NetMES vectors of the top six Bayesian NetMES financial institutions per sub-industry based on eigenvector centrality. The large cap financial institutions are in dark blue and the small cap financial institutions in light blue. The link between any two nodes of financial institutions represents the presence of a significant correlation coefficient between them. The graphs are summarized into the centrality measures provided in Table A6. The centrality measures rank the financial institutions on yearly basis from the most to the least systemically important.

6. Conclusions

In this work, we investigated the lead-lag relation between the large and the small cap indices that were rebalanced on a weekly basis, in terms of returns and in terms of systemic risk. Constructing a large and a small cap index of financial institutions, we found that the large cap index returns almost always led the small cap index returns. Kinnunen (2017) similarly showed that the returns of the large portfolio led the returns of the small one with a variation in the effect over time in relation to the change in the variance of the large-firm portfolio returns and indicated the overly restrictive traditional vector autoregressive analysis with constant cross-autoregressive coefficients upon analyzing the lead-lag relation in stock markets.

We also examined if the lead-lag relation was sustained when using systemic risk indicators for the large and the small cap financial institutions that remained constituents of the indices in every weekly rebalancing. To estimate the risk exposure of an individual institutions to the market, we used the standard bivariate based marginal expected shortfall (MES) systemic risk measure, as well as two alternatives: the network based MES (NetMES) that extends MES taking multivariate dependencies into account; and the Bayesian NetMES, which further accounts for network model uncertainty. Those market based risk measures allowed modifying expectations regarding the risk effect from holding a specific firm’s returns within a portfolio on a real-time basis. Upon the estimation of the MES, NetMES, and Bayesian NetMES, we derived conclusions on which sub-industry and period led to the highest systemic risk. Our main findings implied that the risk measures reflected a change in the lead-lag relation during a financial downturn, in which the small cap led the large cap, which diverted from our findings in terms of returns. This implied that MES, NetMES, and Bayesian NetMES captured the change in the correlation between tranquil and turmoil market conditions, in addition to the lower capital buffers that small cap institutions possessed, making them exhibit higher volatility along with a herding behavior during a financial downturn relative to the behavior of larger cap institutions that were subject to receive governmental bailouts based on their size. Those results raised a question regarding the benefits of portfolio diversification during crisis times. Likewise, Chiang et al. (2007) showed a change in the correlation between two successive phases of the Asian crisis, with the first phase being characterized by an increase in the correlation as an implication of contagion, while the second implied the herding effect through the continuation of a high correlation that was accompanied by a change in variance during crisis times. Sandoval and Franca (2012) pointed out the presence of a link between the higher market volatility and stronger correlations, implying the herding behavior of market participants during a market crash, in addition to a common global comovements among the market indices that were characterized by non-normal correlation. Caporale et al. (2005) suggested the inefficiency of portfolio diversification during a financial crisis and the possible effect that resulted from bailouts.

We also identified the systemic importance of financial institutions by examining sub-industries. We found that for the large cap survived financial institutions, MES indicated higher importance of DB and TMF especially during the 2012-2013 European sovereign debt crisis, but NetMES and Bayesian NetMES indicated a higher importance of IBB. For the small cap, TMF and DB had higher importance during 2008 and early 2009. We also found that the magnitude change in the netted measures of NetMES and Bayesian NetMES was driven by leverage. On the other hand, large DB had the highest market capitalization and the highest change in market during the crisis period in market capitalization, which supported the point that large and complex banks’ structure would contribute to systemic risk.

Next, we followed up by investigating the top six systemically important financial institutions per sub-industry. We found that the MES of large cap firms was significantly larger than NetMES and Bayesian NetMES, but we did not find a significant difference between the three measures for the small cap firms. Digging more into financial institutions’ features, it appeared that large cap received financial aid due to their huge losses during the financial crisis of 2007. Additionally, we studied the evolution of the financial institutions network linkages as they changed during crisis times. The networks’ summary indicated that large cap institutions were very connected to the system and could influence the entire network more quickly than small cap. In addition, we found that the higher influence on the network in terms of risk came from small cap that had the ability to influence the whole network during crisis times, and not just those connected to it, due to the behavior of the small cap as a connection bridge between the different network participants. Our findings suggested the existence of contagion not only from large cap institutions, but also from small cap institutions that acted in a herding manner during crisis periods. Xu et al. (2019) showed that the financial system interconnectedness level peaked during market downturns and could not be ignored in estimating the systemic risk of individual institutions.

There are numerous avenues for future work. First, we would like to study the behavior of the network, the interlinkages, and channels of risk transmission using different portfolio strategies. Second, we would like to examine the importance of institutions’ corporate governance, as the market capitalization is not a factor that discriminates the institutions towards their behavior to major market events.

Author Contributions

V.A. and S.Q.H. contributed equally to this work. Both authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the European Union’s Horizon 2020 research and innovation program FIN-TECH: A Financial supervision and Technology compliance training program under Grant Agreement No. 825215 (Topic: ICT- 35-2018, Type of action: CSA). In addition, the research was also funded by Zamala Fellowship Program, which was initiated by the Bank of Palestine in collaboration with the Welfare Association and other sources including the “CCC” Consolidated Contractors Company, the Arab Monetary Fund, and a number of individual philanthropists and donors.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Global Industry Classification Standard (GICS) definitions.

Table A1.

Global Industry Classification Standard (GICS) definitions.

| Sector: Financials. Industry Group: Banks | |

|---|---|

| Industry | Sub-industry |

| Banks | Diversified Banks (abbrev. DB) (e.g., Citigroup Inc. (U.S.), Bank of America Corp (U.S.), JPMorgan Chase & Co (U.S.), Wells Fargo & Co (U.S.), Banco Santander SA (Spain)) |

| Large, geographically diverse banks with a national footprint whose revenues are derived primarily from conventional banking operations, have significant business activity in retail banking and small and medium corporate lending, and provide a diverse range of financial services. Excludes banks classified in the Regional Banks and Thrifts & Mortgage Finance sub-industries. Also excludes investment banks classified in the Investment Banking & Brokerage Sub-industry. | |

| Regional Banks (abbrev. RB) (e.g., SunTrust Banks Inc. (U.S.), BB&T Corp (U.S.), PNC Financial Services Group Inc/The (U.S.), Regions Financial Corp (U.S.), Fifth Third Bancorp (U.S.), M&T Bank Corp (U.S.)) | |

| Commercial banks whose businesses are derived primarily from conventional banking operations and have significant business activity in retail banking and small and medium corporate lending. Regional banks tend to operate in limited geographic regions. Excludes companies classified in the Diversified Banks and Thrifts & Mortgage Banks sub-industries. Also excludes investment banks classified in the Investment Banking & Brokerage sub-industry. | |

| Thrifts & Mortgage Finance | Thrifts & Mortgage Finance (abbrev. TMF) (e.g., Federal National Mortgage Association (U.S.), Federal Home Loan Mortgage Corp (U.S.), Housing Development Finance Corp Ltd. (India), MGIC Investment Corp (U.S.), New York Community Bancorp Inc. (U.S.)) |

| Financial institutions providing mortgage and mortgage related services. These include financial institutions whose assets are primarily mortgage related, savings & loans, mortgage lending institutions, building societies and companies providing insurance to mortgage banks. | |

| Capital Markets | Asset Management & Custody Banks (abbrev. AMC) (e.g., Bank of New York Mellon Corp/The (U.S.) Franklin Resources Inc. (U.S.), State Street Corp (U.S.), Brookfield Asset Management Inc. (Canada), T Rowe Price Group Inc. (U.S.) Man Group PLC (U.K.)) |

| Financial institutions primarily engaged in investment management and/or related custody and securities fee based services. Includes companies operating mutual funds, closed-end funds and unit investment trusts. Excludes banks and other financial institutions primarily involved in commercial lending, investment banking, brokerage and other specialized financial activities. | |

| Investment Banking & Brokerage (abbrev. IBB) (e.g., Goldman Sachs Group Inc/The (U.S.), Morgan Stanley (U.S.), Nomura Holdings Inc. (Japan) Charles Schwab Corp/The (U.S.), Daiwa Securities Group Inc. (Japan)) | |

| Financial institutions primarily engaged in investment banking & brokerage services, including equity and debt underwriting, mergers and acquisitions, securities lending and advisory services. Excludes banks and other financial institutions primarily involved in commercial lending, asset management and specialized financial activities. | |

| Diversified Capital Markets (abbrev. DCM) (e.g., UBS Group AG (Switzerland), Deutsche Bank AG (Germany), Credit Suisse Group AG (Switzerland), Natixis SA (France), Macquarie Group Ltd. (Australia)) | |

| Financial institutions primarily engaged in diversified capital markets activities, including a significant presence in at least two of the following area: large/major corporate lending, investment banking, brokerage and asset management. Excludes less diversified companies classified in the Asset Management & Custody Banks or Investment Banking & Brokerage sub-industries. Also excludes companies classified in the Banks or Insurance industry groups or the Consumer Finance Sub-industry. | |

Table A2.

Descriptive statistics and Granger causality test for the weekly large and small capitalization index returns (LCR and SCR, respectively) from 1 January 2005 to 31 December 2014.

Table A2.

Descriptive statistics and Granger causality test for the weekly large and small capitalization index returns (LCR and SCR, respectively) from 1 January 2005 to 31 December 2014.

| Mean | Median | Maximum | Minimum | Std.Dev. | Skewness | Kurtosis | Jarque-Bera | Prob. | |

|---|---|---|---|---|---|---|---|---|---|

| LCR | 0.0046 | 0.0127 | 0.2243 | −0.2128 | 0.0527 | −0.3325 | 7.4896 | 102.9966 | 0.0000 |

| SCR | 0.0076 | 0.0138 | 0.1793 | −0.1778 | 0.0449 | −0.3497 | 6.8502 | 76.57078 | 0.0000 |

| Pairwise Granger Causality Tests | |||||||||

| Null Hypothesis | F-Statistic | Prob. | |||||||

| SCR does not Granger cause LCR | 1.3653 | 0.2450 | |||||||

| LCR does not Granger cause SCR | 6.1030 | 0.0149 | |||||||

Table A3.

Financial leverage and market capitalization of survived financial institutions per sub-industry (GICS). Panels A and C provide leverage of the large and small cap survived financial institutions per sub-industry calculated over two year sub periods from 2005–2014. Panels B and D provide the market capitalization of the large and small cap survived financial institutions calculated like the financial leverage.

Table A3.

Financial leverage and market capitalization of survived financial institutions per sub-industry (GICS). Panels A and C provide leverage of the large and small cap survived financial institutions per sub-industry calculated over two year sub periods from 2005–2014. Panels B and D provide the market capitalization of the large and small cap survived financial institutions calculated like the financial leverage.

| Panel A: Financial Leverage of Large-Cap Survived Financial Institutions (Average Per Period) | |||||

|---|---|---|---|---|---|

| Sub-industry | 1/1/2005–12/31/2006 | 1/1/2007–12/31/2008 | 1/1/2009–12/31/2010 | 1/1/2011–12/31/2012 | 1/1/2013–12/31/2014 |

| Asset Management & Custody Banks (AMC) | 1.44 | 1.82 | 1.77 | 1.49 | 1.41 |

| Diversified Banks (DB) | 2.80 | 3.75 | 5.67 | 6.23 | 4.68 |

| Diversified Capital Markets (DCM) | 2.65 | 3.77 | 3.76 | 4.04 | 4.24 |

| Investment Banking & Brokerage (IBB) | 3.34 | 4.13 | 4.97 | 7.13 | 5.51 |

| Regional Banks (RB) | 1.81 | 2.28 | 2.92 | 2.58 | 2.36 |

| Thrifts & Mortgage Finance (TMF) | 5.75 | 20.64 | 144.54 | 382.19 | 82.07 |

| Panel B: Market Capitalization of Large-Cap Survived Financial Institutions (Total Per Period. Numbers in Billion U.S. Dollars) | |||||

| Sub-industry | 1/1/2005–12/31/2006 | 1/1/2007–12/31/2008 | 1/1/2009–12/31/2010 | 1/1/2011–12/31/2012 | 1/1/2013–12/31/2014 |

| Asset Management & Custody Banks (AMC) | 212,536 | 271,262 | 197,192 | 219,003 | 289,875 |

| Diversified Banks (DB) | 2,092,360 | 2,278,660 | 1,944,820 | 2,231,659 | 2,941,330 |

| Diversified Capital Markets (DCM) | 88,566 | 109,625 | 77,923 | 77,553 | 95,089 |

| Investment Banking & Brokerage (IBB) | 210,996 | 216,106 | 174,965 | 151,316 | 219,165 |

| Regional Banks (RB) | 342,808 | 300,445 | 228,424 | 257,018 | 322,905 |

| Thrifts & Mortgage Finance (TMF) | 125,271 | 90,002 | 36,084 | 37,321 | 67,174 |

| Panel C: Financial Leverage of Small-Cap Survived Financial Institutions Per Sub-Industry(Average Per Period) | |||||

| Sub-industry | 1/1/2005–12/31/2006 | 1/1/2007–12/31/2008 | 1/1/2009–12/31/2010 | 1/1/2011–12/31/2012 | 1/1/2013–12/31/2014 |

| Asset Management & Custody Banks (AMC) | 2.16 | 2.43 | 2.61 | 1.78 | 1.60 |

| Diversified Banks (DB) | 5.09 | 8.14 | 11.71 | 7.82 | 6.89 |

| Investment Banking & Brokerage (IBB) | 1.48 | 1.78 | 1.78 | 3.13 | 4.02 |

| Regional Banks (RB) | 1.78 | 2.31 | 3.54 | 2.99 | 2.23 |

| Thrifts & Mortgage Finance (TMF) | 5.36 | 27.92 | 56.08 | 23.04 | 10.45 |

| Panel D: Market Capitalization of Small-Cap Survived Financial Institutions(Total Per Period. Numbers in Billion U.S. Dollars) | |||||

| Sub-industry | 1/1/2005–12/31/2006 | 1/1/2007–12/31/2008 | 1/1/2009–12/31/2010 | 1/1/2011–12/31/2012 | 1/1/2013–12/31/2014 |

| Asset Management & Custody Banks (AMC) | 4634 | 5834 | 3727 | 3794 | 4039 |

| Diversified Banks (DB) | 4034 | 6734 | 6180 | 5345 | 5331 |

| Diversified Capital Markets (DCM) | 2077 | 2440 | 857 | 680 | 600 |

| Investment Banking & Brokerage (IBB) | 5857 | 7802 | 6015 | 5250 | 5904 |

| Regional Banks (RB) | 19,721 | 17,564 | 11,918 | 13,117 | 16,876 |

| Thrifts & Mortgage Finance (TMF) | 3468 | 2506 | 1690 | 1988 | 2632 |

Table A4.

Yearly centrality measures for MES correlation network of top 6 survived financial institutions per sub-industry provided in Figure 4. The table lists the highest 6 ranking institutions based on their centrality measure.

Table A4.

Yearly centrality measures for MES correlation network of top 6 survived financial institutions per sub-industry provided in Figure 4. The table lists the highest 6 ranking institutions based on their centrality measure.

| Industry | Closeness | Industry | Degree | Industry | Eigenvector Centrality | Industry | Betweenness % | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 | SANTGRU.CI | L.AM | 0.005181 | LM.US | L.AM | 14 | OCFC.US | S.TMF | 0.178653 | OCFC.US | S.TMF | 0.048558 |

| LM.US | L.AM | 0.004975 | SANTGRU.CI | L.AM | 12 | PGR.SJ | S.AMC | 0.177352 | ALBAV.FH | S.DB | 0.047278 | |

| MLP.GR | L.AM | 0.004608 | MLP.GR | L.AM | 6 | SANTGRU.CI | L.AM | 0.174771 | IMH.US | S.TMF | 0.037376 | |

| VONN.SW | L.AM | 0.003922 | 8616.JP | L.IBB | 4 | FSBK.US | S.RB | 0.173471 | 8614.JP | S.IBB | 0.035849 | |

| CAF.FP | L.RB | 0.003861 | BPI.PM | L.DB | 4 | SCB.TB | L.DB | 0.171668 | 8616.JP | L.IBB | 0.034817 | |

| CHFC.US | L.RB | 0.003861 | KN.FP | L.DCM | 4 | MQG.AU | L.DCM | 0.170623 | GKG.SP | S.RCS | 0.032493 | |

| 2006 | 8595.JP | L.AM | 0.005102 | LM.US | L.AM | 13 | TPEIR.GA | L.DB | 0.181499 | GKG.SP | S.RCS | 0.052294 |

| LM.US | L.AM | 0.005051 | MLP.GR | L.AM | 9 | CRAP.FP | L.RB | 0.180081 | FSBK.US | S.RB | 0.051185 | |