Abstract

This paper investigates how monetary and ESG-related risks—especially those stemming from asymmetric policy transmission across Eurozone economies—have evolved over time, with a focus on the post-COVID-19 era. Using a mixed-method bibliometric analysis of 216 peer-reviewed articles (1996–2025), it maps thematic developments in monetary governance and sustainability discourse. Findings reveal a post-2020 surge in scholarly engagement, marked by a decisive shift: ESG risks, once peripheral, are now central to discussions of macro-financial stability and institutional resilience. This thematic realignment aligns with major EU regulatory milestones (e.g., SFDR, EU Taxonomy, CSRD), signaling a structural transformation in EU governance. The study concludes that the convergence of monetary asymmetry and ESG integration represents a new frontier in economic policy and academic inquiry, raising critical questions about institutional convergence, regulatory capacity, and sustainability-informed monetary frameworks in post-crisis Europe.

1. Introduction

The European Monetary Union (EMU) has long been challenged by persistent asymmetries—differences in fiscal capacity, economic resilience, and institutional infrastructure—that limit the effectiveness of a unified monetary policy. These structural imbalances were further exposed during the Eurozone debt crisis and the COVID-19 pandemic. At the same time, Environmental, Social, and Governance (ESG) frameworks have risen in prominence, reshaping financial regulation and introducing new dimensions of systemic risk and governance complexity. (Joia et al. 2022).

In parallel, the rise of Environmental, Social, and Governance (ESG) frameworks has begun to reshape the normative foundations of financial regulation and economic planning within the European Union. With the adoption of the European Green Deal and a series of regulatory instruments—including the Sustainable Finance Disclosure Regulation (SFDR), the EU Taxonomy Regulation, the Corporate Sustainability Reporting Directive (CSRD), and the ESG Ratings Regulation—reflects the EU’s strategic pivot toward embedding sustainability risk management into its financial and institutional architecture.

The COVID-19 pandemic served as a critical inflection point, accelerating these parallel agendas and bringing them into sharper alignment. It also accelerated the EU’s transition toward a risk-aware, sustainability-centered recovery strategy. This convergence of crises has catalyzed a new wave of academic inquiry, particularly focused on the intersection of monetary transmission risk, fiscal asymmetry, and ESG governance—an area that has historically remained fragmented across disciplines and policy domains.

This study responds to this transformative moment by offering a comparative bibliometric analysis of academic literature published before and after the COVID-19 pandemic. It investigates how scholarly engagement with monetary and ESG-related risks has evolved—both in terms of research volume and thematic focus—and whether a more integrated conceptual framework is emerging in response to regulatory and institutional realignments. Through this lens, the study traces the intellectual trajectory of European economic governance in an era increasingly defined by structural divergence, sustainability imperatives, and risk-centered financial integration. Using a longitudinal bibliometric approach, the paper analyzes 216 peer-reviewed articles indexed in Scopus between 1996 and 2025. By examining trends in thematic development, conceptual structures, and institutional affiliations, it maps the transformation of scholarly priorities and methodological approaches over time.

The synthesis of this paper proceeds as follows: Section 2 reviews the literature on monetary asymmetry and sustainable finance in the EU context. Section 3 outlines the methodology, including the tools and datasets employed. Section 4 presents the bibliometric findings and thematic evolution of the literature. Section 5 offers a critical discussion of the intellectual shift identified, emphasizing the integration of ESG into macro-financial governance. Section 6 concludes with a reflection on the study’s contributions and broader implications, and Section 7 outlines limitations and avenues for future research.

2. Literature Review

2.1. Monetary Asymmetry and Institutional Divergence in the EMU

Monetary asymmetry remains a defining structural feature of the EMU, reflecting persistent differences in how common monetary policies affect member states. Since the introduction of the euro, the EMU has struggled to balance the uniformity of its monetary framework with the economic heterogeneity of its member countries. This divergence stems from foundational asymmetries in fiscal capacity, competitiveness, labor market flexibility, financial structure, and institutional strength. While the European Central Bank (ECB) administers a single monetary policy for the entire euro area, the policy’s transmission varies widely across national economies—a phenomenon that has only become more visible in times of crisis (Suardi 2001).

Historically, the Eurozone has been characterized by a core–periphery dynamic. Core countries such as Germany, the Netherlands, and Austria tend to exhibit stronger fiscal positions, lower sovereign risk, and higher industrial productivity. In contrast, peripheral economies—including Greece, Portugal, and Italy—have often struggled with higher debt burdens, slower structural reforms, and greater susceptibility to speculative pressures. These divergences are not simply cyclical, but reflect long-standing structural and institutional differences, lines that contribute to monetary transmission risk, financial instability, and uneven sovereign credit exposure and exacerbated by the 2008 global financial crisis and the subsequent Eurozone sovereign debt crisis (Attinasi et al. 2011).

The global financial crisis exposed the EMU’s incomplete institutional architecture. Without a central fiscal authority or effective risk-sharing mechanisms, the burden of adjustment fell disproportionately on fiscally weaker member states. These countries faced procyclical austerity, higher borrowing costs, and limited policy space—despite being subject to the same ECB policies as their more resilient peers. As (Clausen and Wohltmann 2005) and others have noted, the lack of a fiscal union meant that monetary integration proceeded without adequate tools to address asymmetric shocks or support economic convergence. This institutional gap laid the groundwork for the divergence in recovery trajectories.

Empirical research has consistently shown that the ECB’s interest rate decisions, though designed for the aggregate Eurozone, have heterogeneous effects across countries. (Yang and Chang 2020) highlights how differences in private sector balance sheets and financial intermediation lead to asymmetrical monetary transmission. For instance, a rise in interest rates may dampen consumption and investment more strongly in countries with high levels of household indebtedness or underdeveloped capital markets. Moreover, sovereign bond yields, which should theoretically converge under a single monetary authority, have often diverged in times of uncertainty, driven by country-specific risk perceptions and debt sustainability concerns (Wang et al. 2017).

The COVID-19 pandemic offered a new lens through which to assess the resilience of the EMU and the evolving nature of monetary asymmetry. Unlike the previous crises, which were largely endogenous to the Eurozone’s financial system, COVID-19 was an exogenous shock that simultaneously affected all member states. However, its economic impact was far from uniform. Countries with pre-existing structural weaknesses, limited fiscal space, and high public debt faced steeper recessions and greater difficulties in mounting effective policy responses. These disparities reignited long-standing debates over solidarity, fiscal coordination, and the future of European integration (De Souza Guilherme 2025).

In response to the pandemic, the European Union implemented an unprecedented policy package, including the €750 billion NextGenerationEU recovery fund. The adoption of common debt issuance marked a potential shift in the EU’s approach to crisis management and economic governance. However, the deployment of these funds still depends heavily on national institutional capacities, administrative efficiency, and the ability to integrate green and digital transition goals into recovery planning. This has once again exposed the uneven readiness of member states to implement large-scale, transformative investment strategies, including those aligned with ESG criteria (Pancotto et al. 2023).

The integration of ESG frameworks into macroeconomic governance adds a new layer of complexity to existing monetary asymmetries. While some member states have embedded sustainability considerations into fiscal planning, public procurement, and regulatory reform, others lag in their adoption of non-financial disclosure standards, green budgeting, or climate-related stress testing. This divergence raises concerns about policy convergence in the post-COVID era, particularly as the EU seeks to align its economic recovery strategy with long-term sustainability goals outlined in the European Green Deal (Buti and Fabbrini 2023).

Recent scholars points to the risk of a “dual asymmetry” emerging in the EMU: not only does monetary policy continue to affect countries differently, but the capacity to implement sustainability-focused reforms and comply with ESG expectations also varies significantly. This divergence may deepen structural imbalances unless accompanied by coordinated support, capacity building, and institutional reform. Moreover, the intersection of monetary governance and ESG regulation remains underexplored in much of the literature, reflecting the disciplinary silos that have long characterized economic and sustainability research (Kiseľáková et al. 2020).

The pandemic also sparked a re-evaluation of the role of the ECB in promoting sustainability. While traditionally focused on price stability, the ECB has gradually acknowledged climate-related risks to financial stability and asset portfolios. Through initiatives such as the inclusion of green bonds in asset purchase programs and calls for improved climate-related financial disclosure, the ECB is stepping into a more proactive role. However, this transition raises complex questions about mandate expansion, democratic accountability, and the appropriate instruments for integrating ESG into central banking (Deyris 2023).

Thus, the post-COVID landscape reveals both continuity and change. Monetary asymmetry remains a central challenge in the EMU, amplified by new demands for sustainability integration and just transition strategies. At the same time, institutional innovation—such as joint debt issuance, the creation of the Recovery and Resilience Facility, and emerging ESG frameworks—indicates an ongoing recalibration of the EMU’s governance model. The extent to which these reforms can address long-standing asymmetries will depend on the depth of fiscal integration, the coherence of regulatory standards, and the ability of member states to coordinate at the intersection of economic stability and environmental stewardship (Garefalakis and Dimitras 2020; Ragazou et al. 2023).

2.2. Sustainability, ESG, and Green Finance Within EU Governance

The progressive integration of ESG considerations into EU economic governance has redefined the landscape of financial regulation, policy coordination, and institutional oversight. This transformation reflects a broader commitment to sustainable development, as enshrined in the strategic objectives of the EU, and is characterized by a coordinated regulatory push to mainstream ESG across financial markets and public institutions. Over the past decade, the EU has established a pioneering framework that aligns capital flows with sustainability objectives, institutionalizes ESG in corporate reporting, and strengthens the regulatory infrastructure to ensure coherence across member states (Ionașcu et al. 2025).

At the core of this evolution is a suite of legislative instruments, most notably the SFDR and the EU Taxonomy Regulation. Together, these frameworks aim to standardize ESG-related disclosures and classify sustainable economic activities in a way that facilitates comparability, reduces information asymmetries, and improves investor confidence. The SFDR imposes obligations on financial market actors to report how ESG risks are integrated into their decision-making processes, while the Taxonomy provides the reference structure to evaluate whether economic activities contribute meaningfully to sustainability targets. These instruments are central to the EU’s ambition of steering private capital toward sustainable finance and anchoring long-term environmental considerations in the financial sector (Martinez-Meyers et al. 2024).

Parallel to disclosure requirements, the introduction of the CSRD significantly expands the scope and depth of corporate ESG reporting. It mandates detailed, assured, and digitally accessible sustainability information from a broader range of companies across the EU. This development is not merely an extension of earlier initiatives but a substantive shift in how corporate governance, transparency, and risk are conceived in the post-pandemic context. The CSRD complements the objectives of the Green Deal and reinforces the EU’s attempt to embed ESG metrics into economic planning and financial oversight mechanisms (Fricke and Schlepper 2024).

Complementing disclosure reforms, the EU has also initiated regulation of ESG rating providers. The adoption of the ESGR Regulation reflects mounting concerns about the opacity and methodological inconsistency of ESG scores. This regulation introduces supervisory oversight, governance standards, and transparency obligations for ESG rating agencies, with the aim of enhancing the reliability of ESG indicators used by investors, companies, and regulators. The harmonization of rating methodologies is seen as critical to the broader credibility of the EU’s sustainable finance strategy (Chrzan and Pott 2024).

In addition to regulatory disclosures and ratings, the expansion of green finance instruments—especially green bonds—has become a vital component of EU sustainability policy. The development of the EUGBS marks a decisive move toward standardizing issuance frameworks and establishing robust criteria for evaluating the environmental integrity of bond-financed projects. The EUGBS is closely aligned with the Taxonomy and disclosure regulations, creating a coherent structure that connects financial instruments with sustainability benchmarks. This standardization is crucial for market integrity, investor protection, and the broader goal of redirecting financial flows toward sustainable economic activities (Boni and Scheitza 2025).

Institutionally, the EU has adopted a multi-level governance approach to ESG integration. Key EU bodies—including the EC, EP, ESAs, and ECB—have increasingly coordinated efforts to develop, implement, and monitor ESG-related policies. The EC serves as the primary architect of the legislative framework, while the EP plays a central role in democratic oversight and legitimacy. The ESAs (EBA, EIOPA, ESMA) contribute to regulatory convergence, supervisory consistency, and technical guidance, particularly in the implementation of SFDR, CSRD, and ESGR rules. The ECB, while primarily tasked with price stability, has also acknowledged the relevance of climate-related risks and ESG factors for financial stability and monetary policy transmission. This has been reflected in the inclusion of climate criteria in its asset purchase programs and collateral frameworks (Bruno and Lagasio 2021).

Despite the regulatory ambition, challenges remain in ensuring consistent and effective implementation across member states. Institutional capacity, administrative readiness, and political will vary considerably, leading to uneven uptake and enforcement of ESG standards. These disparities reflect broader structural asymmetries within the EU and may hinder the goal of policy convergence. Moreover, while ESG frameworks are expanding, concerns persist about regulatory fragmentation, reporting burdens, and potential trade-offs with economic competitiveness, especially for smaller firms and peripheral economies (Jiang and Vitenu-Sackey 2025).

To address these challenges, the EU has proposed streamlining overlapping ESG obligations through omnibus regulatory packages that integrate SFDR, CSRD, ESGR, and Taxonomy requirements into a more coherent framework. These efforts aim to reduce duplication, improve clarity, and enhance regulatory efficiency. At the same time, the EU has emphasized capacity-building initiatives, technical support, and stakeholder engagement to facilitate national-level implementation and close compliance gaps (Wu 2025).

The literature increasingly recognizes that ESG integration within EU governance is not merely a technical adjustment but represents a paradigmatic shift in economic policymaking. ESG is no longer confined to corporate responsibility or environmental regulation; it has become a structural dimension of financial regulation, risk assessment, and strategic planning. This shift has implications not only for market behavior but also for macroeconomic coordination, fiscal policy, and cross-border regulatory alignment. In this sense, ESG acts as both a policy objective and a governance instrument, shaping the institutional logic of EU economic integration (Tang 2023).

Furthermore, the incorporation of ESG into economic governance is seen as a mechanism for fostering policy convergence across member states. By establishing shared reporting standards, supervisory expectations, and market norms, ESG frameworks provide a common regulatory language that transcends national differences. This is particularly significant in a union marked by historical asymmetries in institutional capacity and economic development. ESG may thus contribute to narrowing governance gaps and promoting a more cohesive and resilient integration model (Tian et al. 2025).

However, several areas remain underexplored. There is limited empirical research on how ESG regulation affects monetary transmission, financial inclusion, or intergovernmental coordination. Additionally, the interaction between ESG and fiscal rules, particularly under the reformed Stability and Growth Pact, warrants further investigation. The potential of ESG frameworks to act as catalysts for institutional reform and policy synchronization across the Eurozone remains a crucial area of inquiry, especially in the wake of COVID-19 and the green recovery agenda.

2.3. Research Gaps and the Need for Interdisciplinary Integration

Despite the expanding corpus of research on sustainability, monetary policy, and EU governance, the current literature remains characterized by thematic fragmentation and disciplinary compartmentalization. While substantial attention has been devoted to each of these domains individually, few studies attempt to systematically connect ESG governance with the structural asymmetries of the EMU, particularly in the context of post-pandemic economic recovery. The gap is especially apparent in the limited exploration of how ESG frameworks intersect with monetary and institutional divergences across Eurozone member states. This disconnection persists even as both academic and policy discourses increasingly acknowledge the relevance of sustainability to macroeconomic stability and governance legitimacy.

In the field of monetary integration, scholars has primarily focused on the historical asymmetries within the EMU, examining issues such as uneven monetary transmission, fiscal imbalances, and the limitations of the ECB’s policy tools in the absence of fiscal union. Conversely, the literature on ESG has evolved largely within financial economics and corporate governance, often emphasizing firm-level performance, regulatory disclosure, or sustainable finance instruments such as green bonds. Although both fields recognize the need for systemic resilience and long-term sustainability, they rarely converge in addressing how ESG priorities are operationalized within a structurally uneven monetary union.

This fragmentation is further amplified by the methodological boundaries between disciplines. Macroeconomists often work within formal, model-based paradigms, while ESG research tends to adopt qualitative, institutional, or market-oriented approaches. As a result, key questions concerning the feasibility of ESG integration in monetary governance—such as whether the institutional capacities of Eurozone states permit the uniform adoption of sustainability-linked monetary tools—remain underexplored. Moreover, while central banks have begun to consider climate risk and sustainability in asset purchasing programs and financial stability assessments, there is little comparative research assessing how these developments interact with existing monetary asymmetries across EMU members.

The COVID-19 pandemic has intensified the urgency of addressing these gaps. The crisis exposed and exacerbated pre-existing economic and institutional divergences while simultaneously accelerating the normative and regulatory momentum toward sustainability. It also prompted a reconfiguration of policy priorities at both national and EU levels, with ESG principles being increasingly embedded in recovery packages, fiscal stimulus, and regulatory innovation. However, the academic response to this convergence remains nascent, scattered across disconnected thematic clusters. Few studies systematically examine how the pandemic catalyzed a structural realignment of scholarly discourse around the intersection of monetary asymmetry, ESG integration, and EU governance.

Against this backdrop, there is a clear need for an interdisciplinary approach that synthesizes insights from monetary economics, institutional governance, and sustainability studies. Bridging these domains is not merely an academic exercise; it is essential for informing cohesive policy frameworks capable of addressing the complex, interdependent challenges facing the Eurozone. The post-pandemic context provides a unique opportunity to study whether—and to what extent—academic literature is beginning to reflect this interdisciplinary convergence.

To address these limitations, this study adopts a bibliometric methodology that allows for the systematic mapping of research trajectories, thematic intersections, and structural patterns within the academic literature. By comparing pre- and post-COVID periods, the analysis not only identifies dominant and emerging themes but also reveals the extent to which ESG, monetary policy, and EU governance are becoming intellectually integrated. This method provides a data-driven foundation for assessing the evolution of scholarly attention and detecting whether previously siloed domains are converging in response to external shocks and policy realignments.

The bibliometric analysis is complemented by a qualitative review of the conceptual literature, offering a dual perspective that enhances both breadth and depth of inquiry. Together, these methods allow the study to evaluate the degree of thematic convergence and assess the implications of institutional asymmetries for sustainability governance within the EMU.

The structure and evolution of the literature analyzed in this study also reflect the logic of the ADO-TCM framework, which synthesizes the Antecedents-Decisions-Outcomes (ADO) framework developed the Theory-Context-Methodology (TCM) model. In this context, the antecedents consist of entrenched macro-financial asymmetries within the EMU, uneven institutional capacity, and the exogenous shock of the COVID-19 pandemic. These conditions prompted a wave of policy and regulatory decisions, including the introduction of ESG-oriented mechanisms such as the EU Taxonomy, the SFDR, and the CSRD. The observed outcomes include both discursive shifts—evident in the bibliometric structure—and institutional redesigns aimed at embedding sustainability within macroeconomic governance. The theoretical dimension of this literature is increasingly informed by frameworks linking resilience, legitimacy, and sustainable finance, while the context remains rooted in the evolving architecture of EU integration. Methodologically, the field blends qualitative legal-institutional analysis with bibliometric, policy-evaluative, and network-based approaches. The ADO-TCM lens thus provides a useful scaffold for interpreting the dynamics of ESG integration in relation to persistent monetary divergence.

Based on these observations, the study is guided by the following research questions:

RQ1: To what extent does the current literature address the institutional asymmetries within the EMU regarding the integration of ESG criteria into national and supranational monetary policy frameworks?

RQ2: How has the COVID-19 pandemic influenced the thematic convergence of ESG, monetary policy, and EU governance in the Eurozone, and what are the emerging interdisciplinary patterns in the post-pandemic academic literature?

3. Methodology

To address the second research question concerning the evolution of the academic discourse around monetary asymmetry, ESG, and governance within the Eurozone, we employed a bibliometric analysis. This method is particularly suited for systematically evaluating large volumes of academic literature, as it enables the identification of patterns, trends, influential contributions, and thematic developments within a defined research field. Bibliometric analysis goes beyond simple citation counting by allowing the exploration of knowledge structures, scientific collaboration, and thematic evolution over time. It provides a robust and reproducible methodology for uncovering the intellectual and social foundations of research domains (Passas 2024).

Our study followed a structured six-step approach as shown in Table 1. In the first step, we constructed a detailed search query using Boolean operators to capture the intersection of five key conceptual areas: monetary policy asymmetry, the Eurozone/EMU, the COVID-19 pandemic, ESG and sustainability frameworks, and EU governance structures. The final query was as follows: ((“monetary policy” OR “monetary asymmetry” OR “policy divergence”) AND (“Eurozone” OR “European Monetary Union” OR “EMU”) AND (“COVID-19” OR “pandemic” OR “pandemic crisis”) AND (“ESG” OR “environmental social governance” OR “corporate governance” OR “sustainable finance” OR “sustainability reporting” OR “non-financial disclosure” OR “green recovery” OR “green bonds”) AND (“EU governance” OR “regulatory frameworks” OR “policy convergence” OR “economic integration”)). This formulation ensured the retrieval of literature relevant to the intersection of economic governance, monetary coordination, and sustainable policy responses to systemic crises.

Table 1.

Steps of the Bibliometric Analysis.

The second step involved selecting Scopus as the data source, chosen for its broad disciplinary coverage and rigorous indexing of peer-reviewed publications. In the third step, the selection criteria were defined: the analysis focused on original and research articles published within two time periods—1993 to 2018 (Pre-COVID-19) and 2019 to 2024 (Post-COVID-19)—and restricted to journals included in the ABS and Scimago rankings, thereby ensuring academic relevance and quality.

In the fourth step, we selected Bibliometrix, an R-based open-source tool, and its graphical interface Biblioshiny, to conduct the quantitative analysis. Bibliometrix allows for the extraction and visualization of bibliographic data, including publication trends, source impact, author productivity, collaboration networks, and thematic mapping. In parallel, we used VOSviewer version 1.6.20, a widely recognized software for constructing and visualizing bibliometric networks. VOSviewer was particularly valuable for generating co-authorship, co-citation, and keyword co-occurrence maps, as well as for performing cluster analysis that reveals the cognitive structure of the field. Its visual outputs enhance interpretability by grouping related items into colored clusters based on their proximity and frequency of association (Donthu et al. 2021; Kirby 2023).

The fifth step involved applying these tools to perform an in-depth analysis of country-level collaboration, thematic clusters, keyword dynamics, author contributions, and network structures. This included mapping the co-occurrence of keywords, constructing co-citation and bibliographic coupling networks, identifying the most influential sources and documents, and conducting factorial and multiple correspondence analyses to detect emerging themes. Furthermore, thematic maps were created to distinguish between basic, motor, niche, and declining research themes (Petropoulou et al. 2024; Ragazou et al. 2022).

Finally, the sixth step entailed synthesizing the results across the two periods to uncover thematic continuities and ruptures. By comparing pre- and post-pandemic structures, the study revealed not only an expansion in scientific production but also a discernible thematic shift toward sustainability, governance, and institutional resilience. This step enabled us to propose future research directions addressing underexplored areas within the intersecting fields of monetary integration, crisis management, and ESG governance in the Eurozone.

4. Results

4.1. Bibliometric Analysis in the Pre COVID Period (1993–2018)

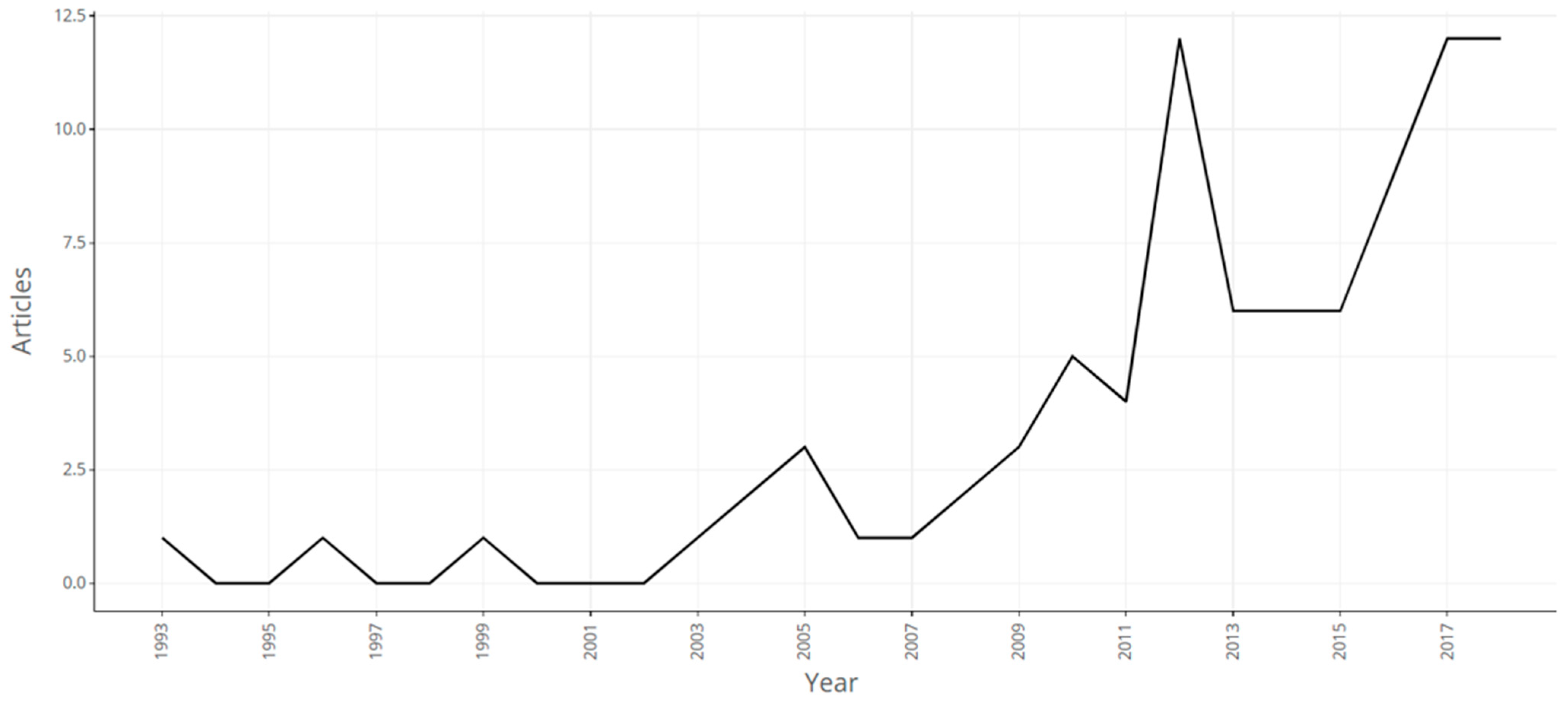

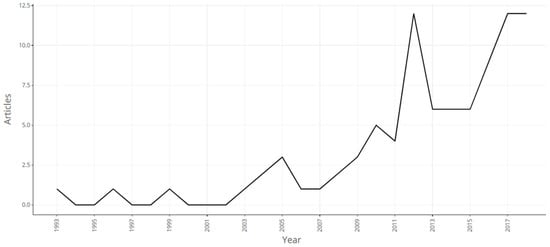

Figure 1 illustrates the annual scientific production of research articles aligned with our bibliometric query during the pre-COVID-19 period. The data reveals a relatively sparse but gradually increasing interest in the intersection of monetary policy, Eurozone governance, sustainability, and regulatory frameworks prior to the global health crisis. Between 1993 and the early 2000s, scholarly activity remained minimal, often yielding fewer than two publications per year. This limited output suggests that the convergence of the chosen thematic areas—particularly the integration of ESG concerns with monetary and fiscal policy discourses—had not yet emerged as a significant academic focus. However, a slow upward trend becomes visible beginning in the mid-2000s, with notable increases around 2005 and again in 2010. The sharp rise in 2011, reaching a preliminary peak, could reflect growing awareness of sustainability and governance issues in the wake of the 2008 global financial crisis and the Eurozone sovereign debt crisis. Despite a temporary drop in 2012, the number of publications stabilized at a higher level from 2013 onwards, reflecting a sustained, albeit moderate, interest in these intersecting topics. By 2017, the annual scientific output had reached a local maximum, underscoring a maturing scholarly interest in the dynamic interplay between EU monetary governance and sustainable finance. This pre-pandemic trajectory set a foundation for the intensified research efforts observed during the subsequent COVID-19 period, which will be discussed in the following section (Jebe 2019).

Figure 1.

Annual Scientific Production of papers in the Pre COVID-19 period by Bibliometrix.

Table 2 displays the geographical distribution of scientific production during the pre-COVID-19 period, reflecting a diverse yet uneven global engagement with the thematic focus of this study. The United States, India, and the United Kingdom account for the highest number of publications, followed by China, Germany, and Italy. While several Western European countries are well represented, the relative absence of Southern and Eastern European member states—despite their key roles in both monetary asymmetries and ESG policy challenges—is striking. This imbalance reflects broader structural disparities in research capacity and funding, which may influence the framing and prioritization of governance issues within the literature. The concentration of output in Anglophone and Western institutions underscores the need for more inclusive scholarly engagement across the EU and beyond.

Table 2.

Table of Countries Scientific Production in the Pre COVID-19 period by Bibliometrix.

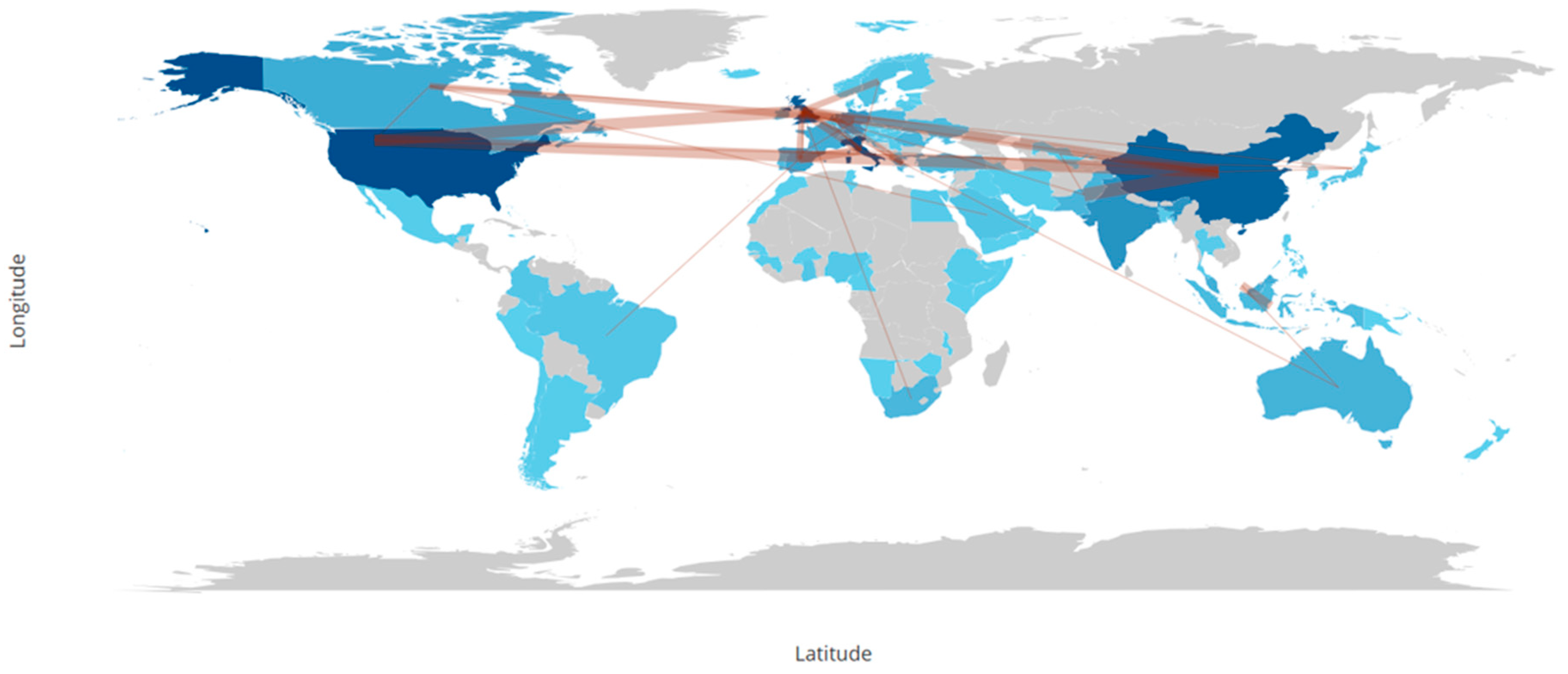

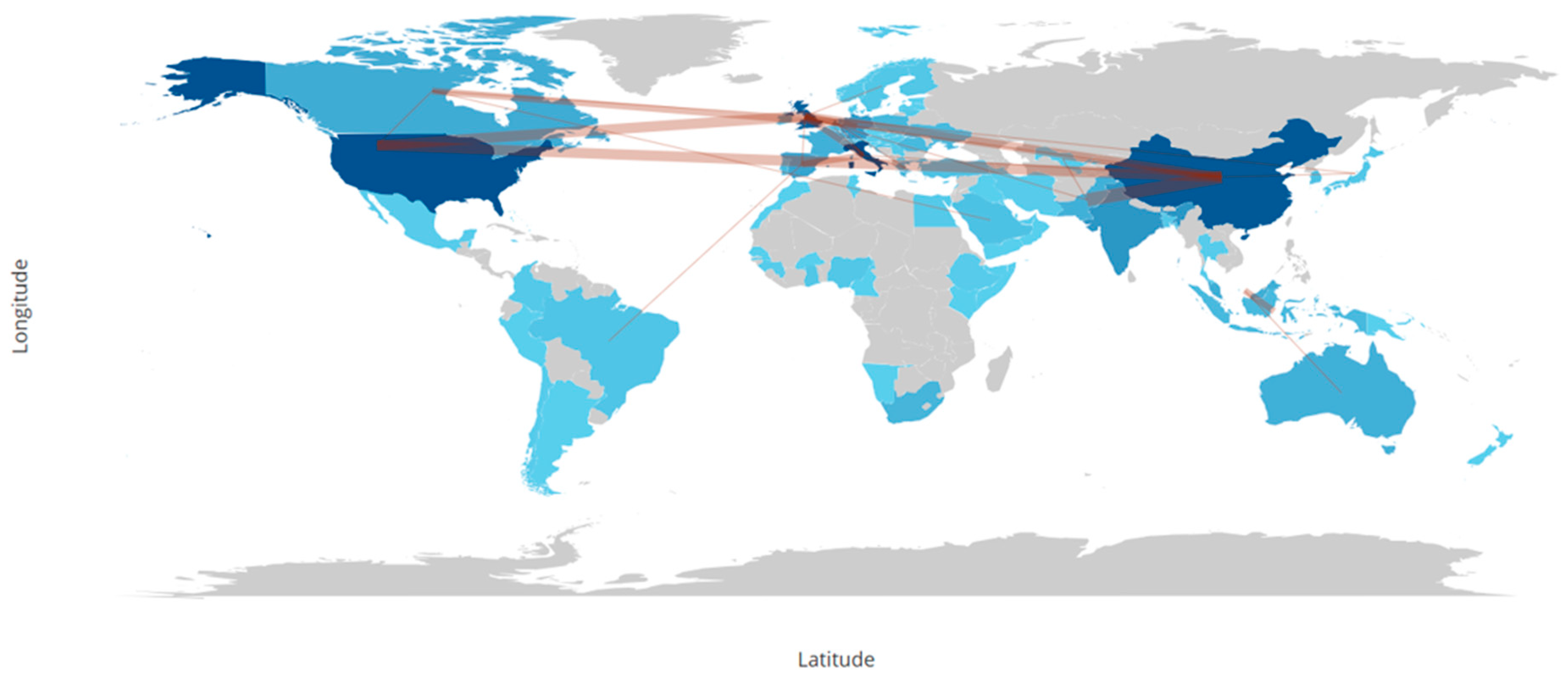

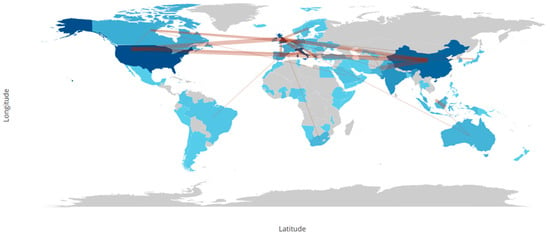

Figure 2 depicts the countries collaboration map during the pre-COVID-19 period, illustrating the global network of co-authorship and academic partnerships in the selected thematic domain. The visualization reveals a relatively concentrated and Eurocentric collaboration pattern, with prominent linkages among Western Europe, North America, and select regions in Asia. Countries such as the USA, UK, Germany, France, and Italy emerge as central nodes, serving as key hubs in facilitating international research collaboration. This aligns with their established academic infrastructures and access to transnational funding schemes, particularly within EU and OECD frameworks. China also features as a significant partner, reflecting its rising engagement with global sustainability and governance discourses in the years preceding the pandemic.

Figure 2.

Countries Collaboration Map in the Pre COVID-19 period by Bibliometrix.

Despite these connections, the collaboration network appears somewhat fragmented, with limited linkages involving the Global South and Eastern Europe. This uneven distribution suggests that, prior to the pandemic, research on ESG, EMU, monetary asymmetry, and regulatory convergence remained largely concentrated among a core group of high-income and institutionally connected countries. The relative lack of dense collaboration clusters outside of Europe and North America may be explained by disparities in research funding, institutional capacity, and access to collaborative platforms. Furthermore, the highly specialized and interdisciplinary nature of the research themes may have posed barriers to broader participation, particularly in countries where sustainability governance or monetary policy is less embedded in academic agendas. While international collaboration was present, it was characterized by regional silos and a reliance on established research powers. These pre-pandemic patterns serve as a baseline for comparison with the post-COVID-19 period, where shifts in global priorities and the digitalization of academic exchange are likely to have reconfigured collaboration dynamics significantly (Petropoulou et al. 2024).

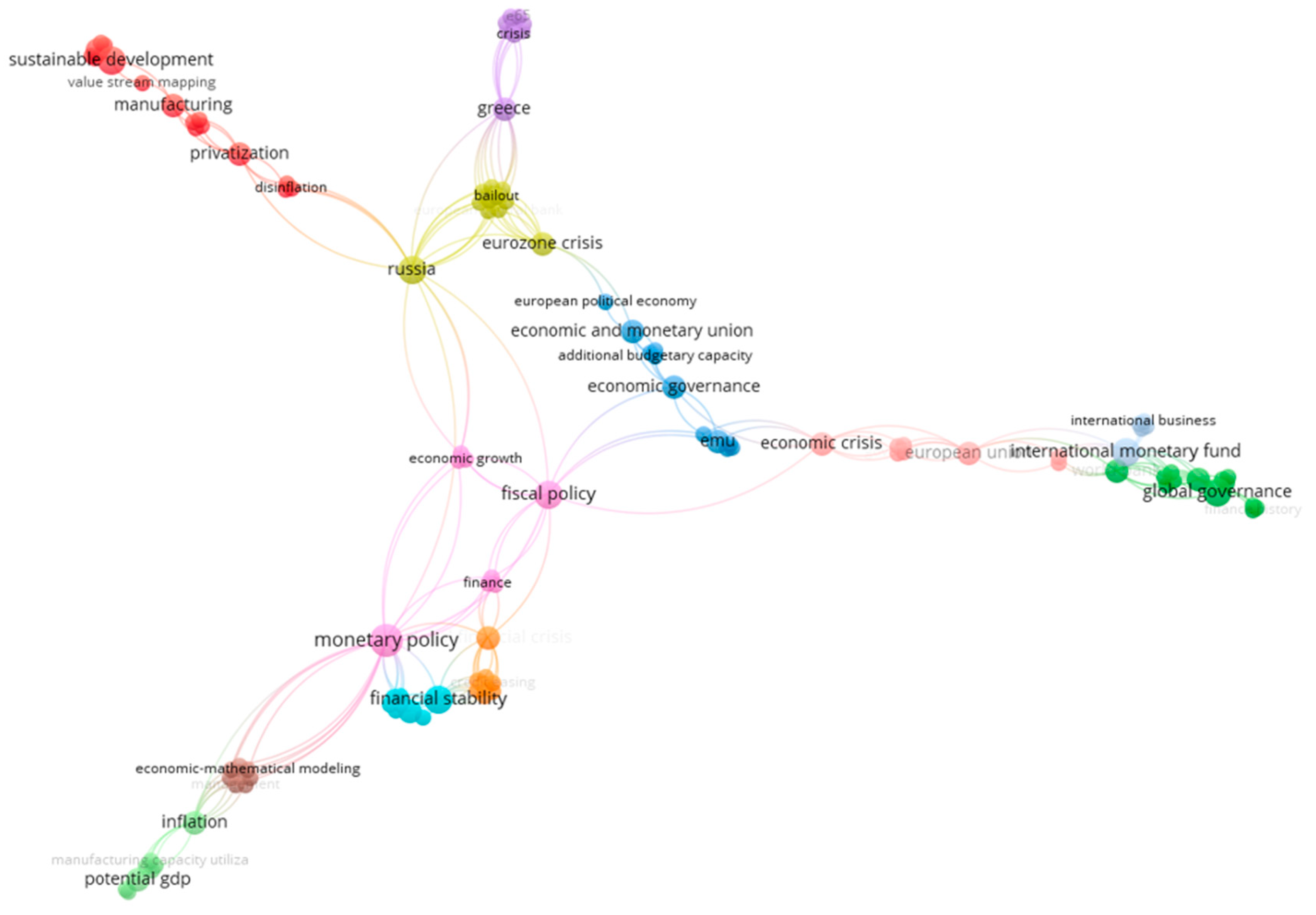

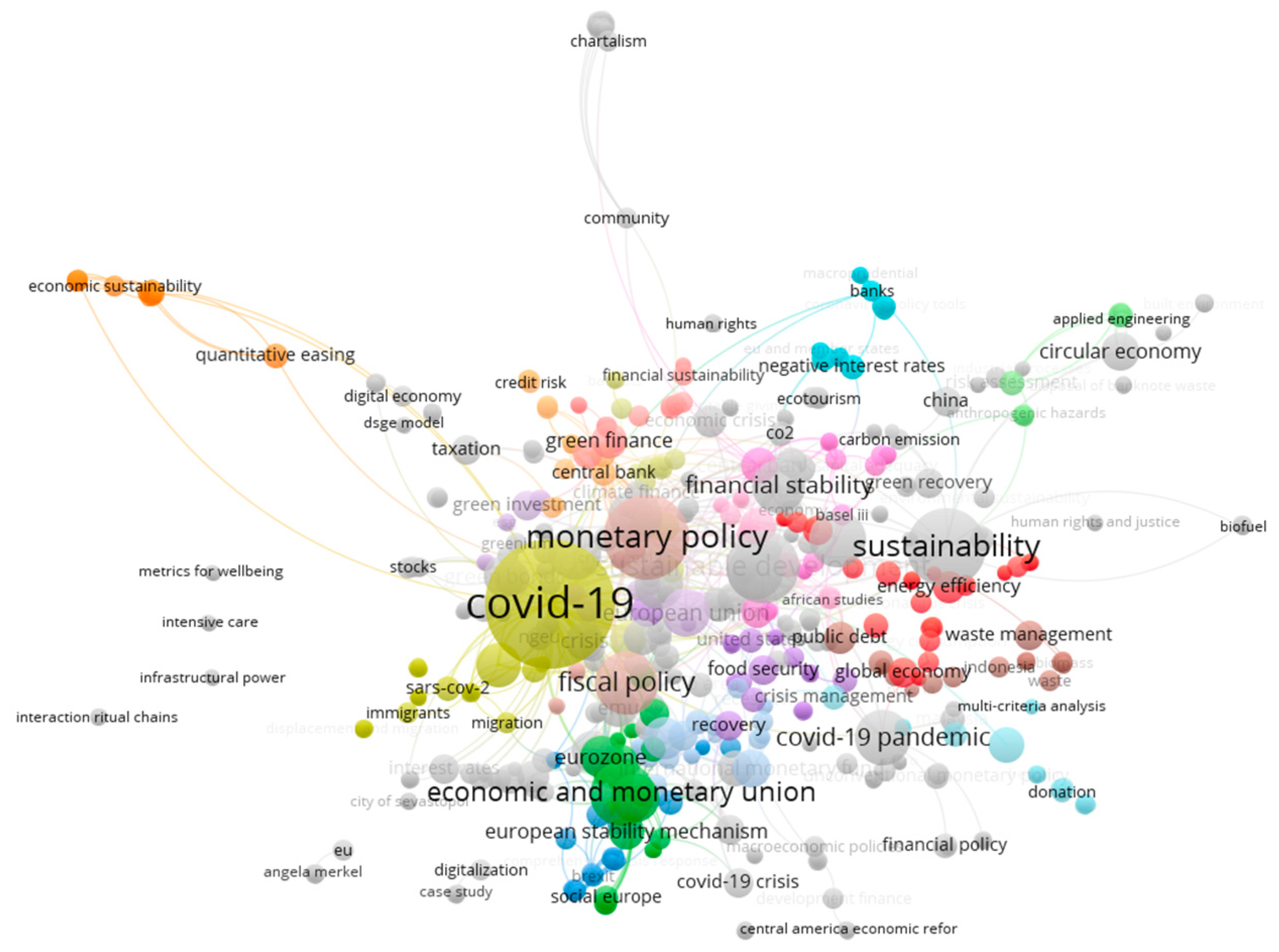

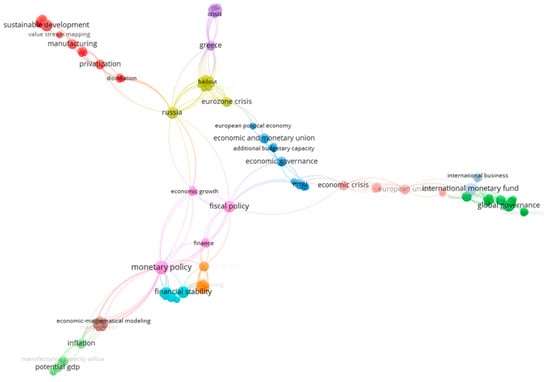

Figure 3 presents a co-occurrence analysis of authors’ keywords in the pre-COVID-19 period, generated using VOSviewer, revealing the thematic structure and conceptual relationships within the scholarly discourse. The visualization displays several distinct clusters of keywords, each representing a subdomain of research focus within the broader bibliometric query. The centrality of terms such as monetary policy, fiscal policy, EMU, and economic crisis underscores the dominant concern with macroeconomic governance, policy coordination, and institutional responses to financial instability in the European context. The frequent linkage between monetary policy and financial stability, inflation, and economic-mathematical modeling suggests a prevailing technical and analytical orientation during this period, where the literature often approached policy debates through quantitative and econometric frameworks.

Figure 3.

Co-occurrence analysis of Author’s keywords in the Pre COVID-19 period by VOS viewer.

A notable cluster links EMU, economic and monetary union, and economic governance with eurozone crisis, Greece, and bailout, indicating the continued salience of the post-2008 European debt crisis as a referential context for discussions on policy divergence and integration. This cluster reflects scholarly engagement with the institutional limitations and asymmetric vulnerabilities within the EMU framework—issues that remained central in pre-pandemic debates. Another prominent trajectory involves keywords such as global governance, international monetary fund, and European Union, suggesting a geopolitical dimension to the literature that frames monetary and regulatory issues within broader multilateral governance structures.

Peripheral but meaningful clusters include terms such as sustainable development, manufacturing, privatization, and potential GDP, hinting at early efforts to integrate ESG-related concerns and long-term economic productivity into discussions of monetary and fiscal policy. However, these ESG-linked concepts appear loosely connected to the core macro-financial terms, reflecting the still-nascent stage of interdisciplinary integration during the pre-COVID period. The presence of Russia, disinflation, and distribution in a separate cluster further points to the geopolitical and transitional economy contexts influencing certain strands of research. The keyword map reflects a landscape characterized by strong emphasis on monetary-fiscal dynamics within the EU, with limited but emerging engagement with sustainability themes. The structure suggests that while foundational macroeconomic and institutional debates dominated the pre-pandemic literature, the groundwork for broader ESG integration was being laid at the fringes of academic discourse.

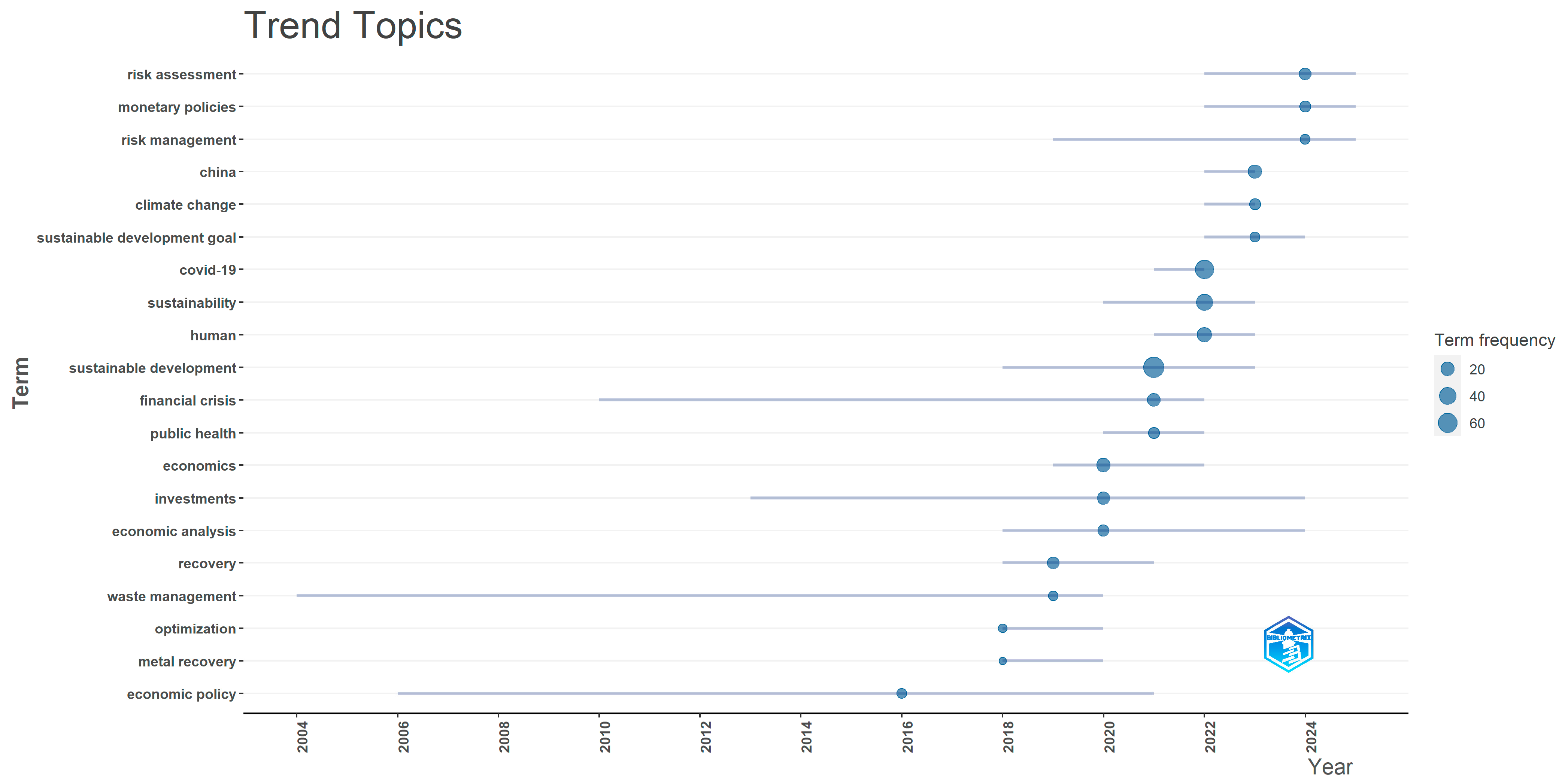

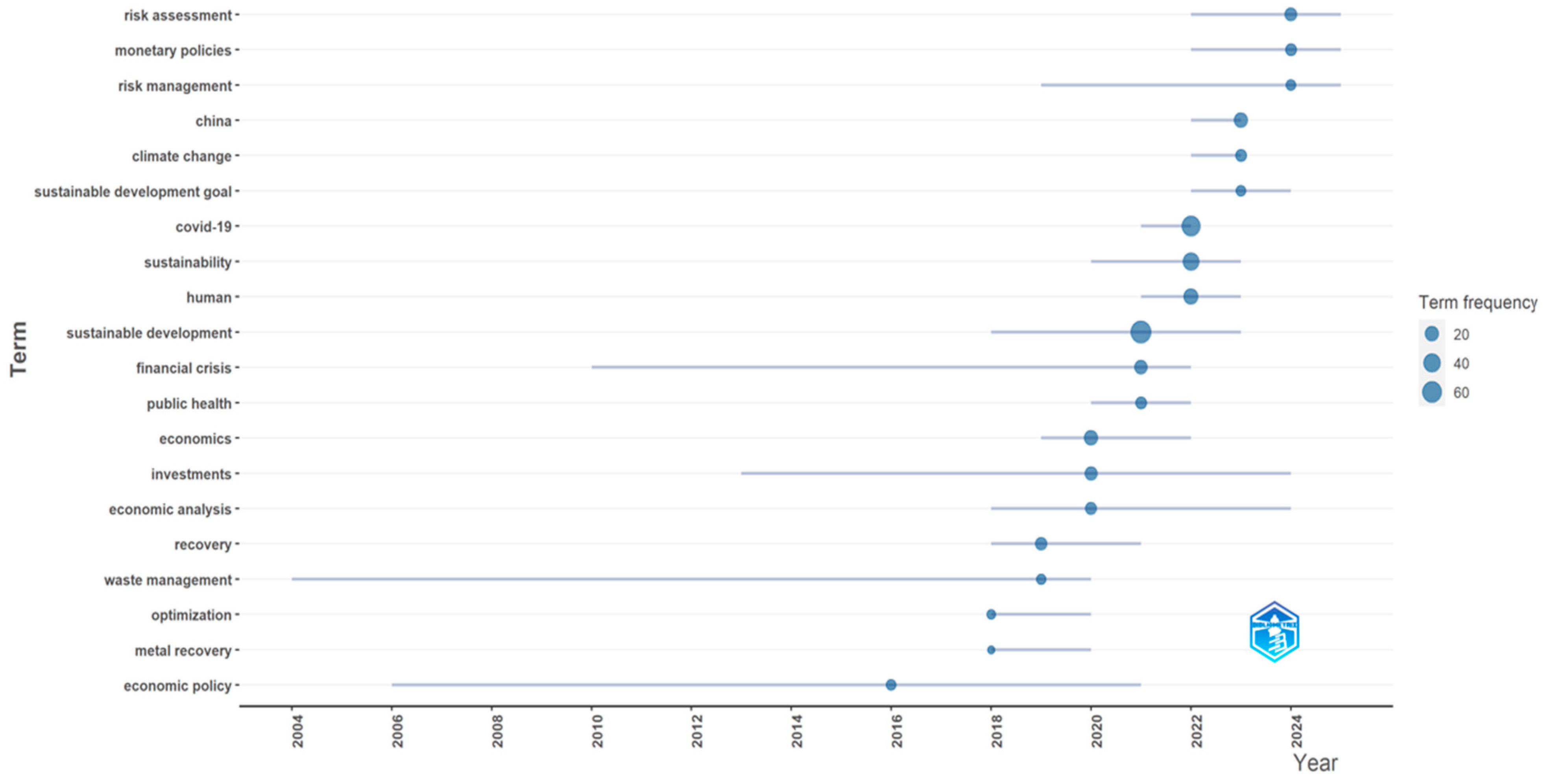

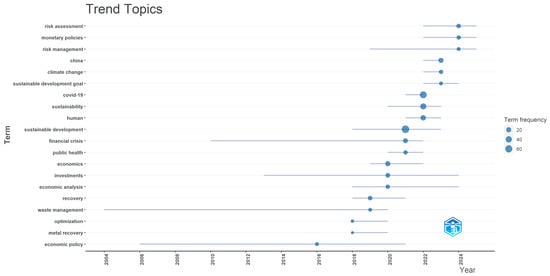

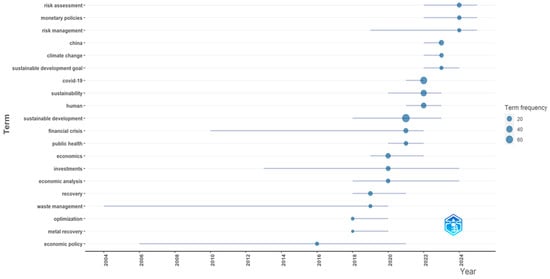

Figure 4 displays the trend topics in the pre-COVID-19 period based on term frequency analysis using Bibliometrix, revealing both the temporal evolution and the relative intensity of scholarly interest across key thematic areas. Each bubble represents a term, with its size indicating the relative frequency of occurrence in the literature. The horizontal lines show the time span during which each term was used. The visualization reveals a marked thematic transition in the post-COVID-19 period. Prior to 2020, scholarly focus centered on terms such as “economic policy”, “financial crisis”, “recovery”, and “investments”, reflecting concerns with macroeconomic stabilization and institutional response to earlier crises.

Figure 4.

Trend Topics in the Pre COVID-19 period by Bibliometrix.

From 2020 onward, there is a visible surge in sustainability-related language. Keywords like “climate change”, “risk assessment”, “sustainable development”, and “monetary policies” rapidly gained prominence. This shift signals a growing recognition of ESG risks as central to monetary governance and institutional resilience. The convergence of economic and environmental terminology underscores a deeper epistemic transformation in how the EU’s post-crisis governance is being theorized and evaluated. (Gherghina and Simionescu 2024).

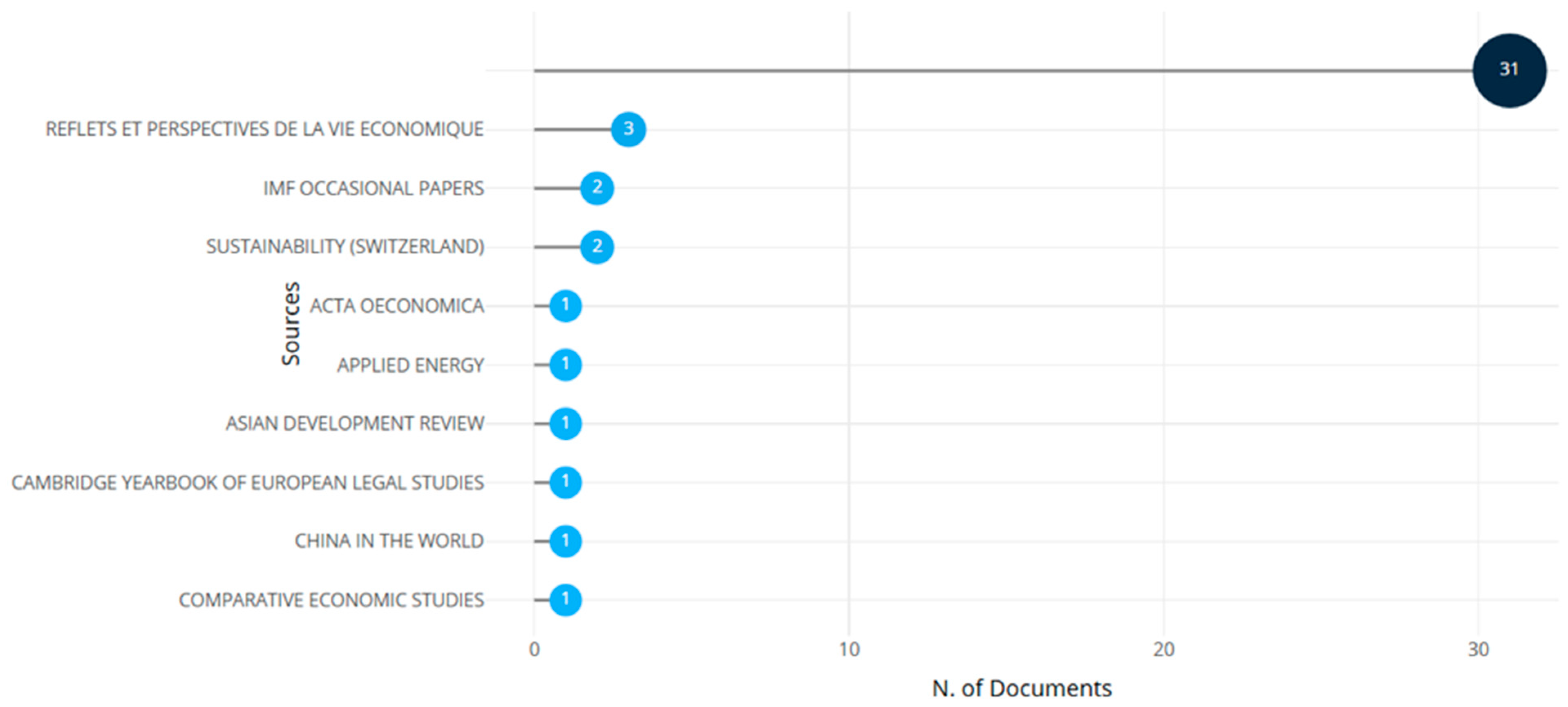

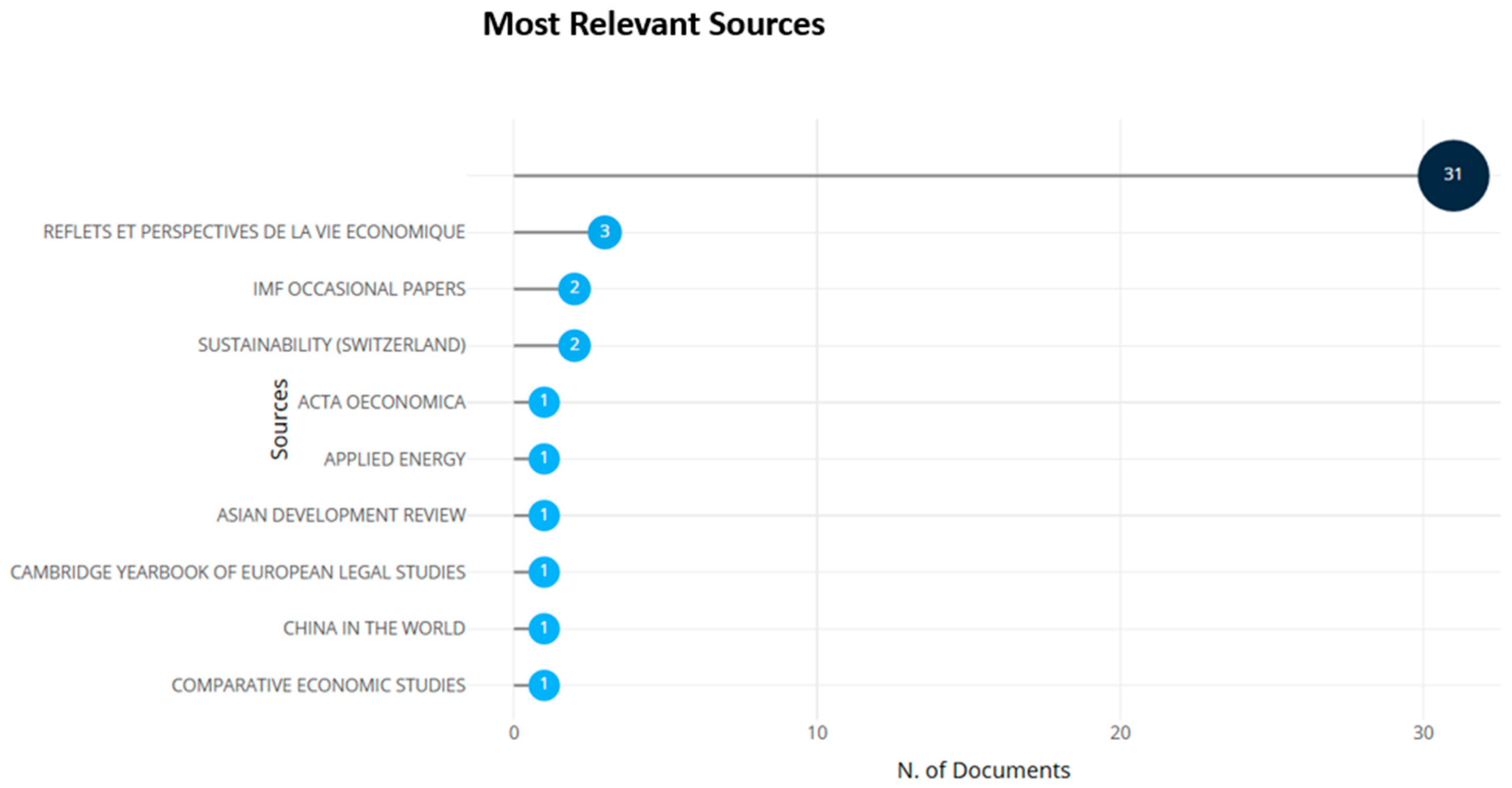

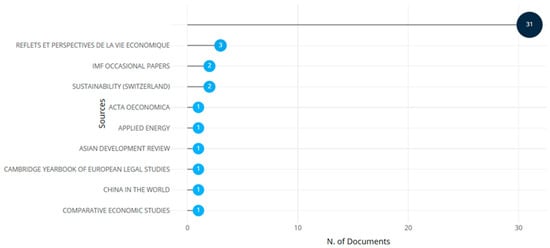

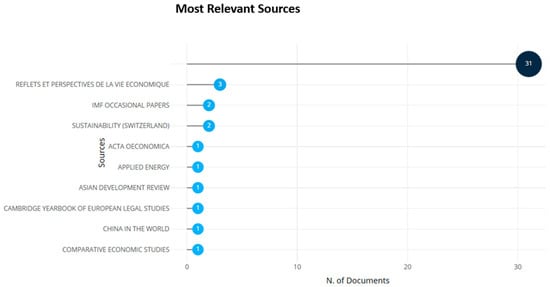

As shown in Figure 5, publication activity is highly concentrated. One journal—Reflets et Perspectives de la Vie Économique—accounts for a disproportionately large share of the literature, suggesting a degree of thematic specialization. Other sources, including IMF Occasional Papers and Sustainability, contribute modestly, while the remaining publications are dispersed across a wide range of journals, each with only one article. This fragmentation reflects the interdisciplinary nature of the topic and the evolving status of ESG-informed monetary governance as an emerging research domain without a single dominant publication venue.

Figure 5.

Most Relevant Sources in the Pre COVID-19 period by Bibliometrix.

In sum, while scholarly production during the pre-pandemic period was limited in volume, Figure 5 shows that a foundational network of journals already existed that enabled the early convergence of themes now central to post-COVID-19 research. These sources played a critical role in seeding the conceptual integration that would later accelerate significantly in response to the global health crisis and its accompanying socio-economic disruptions.

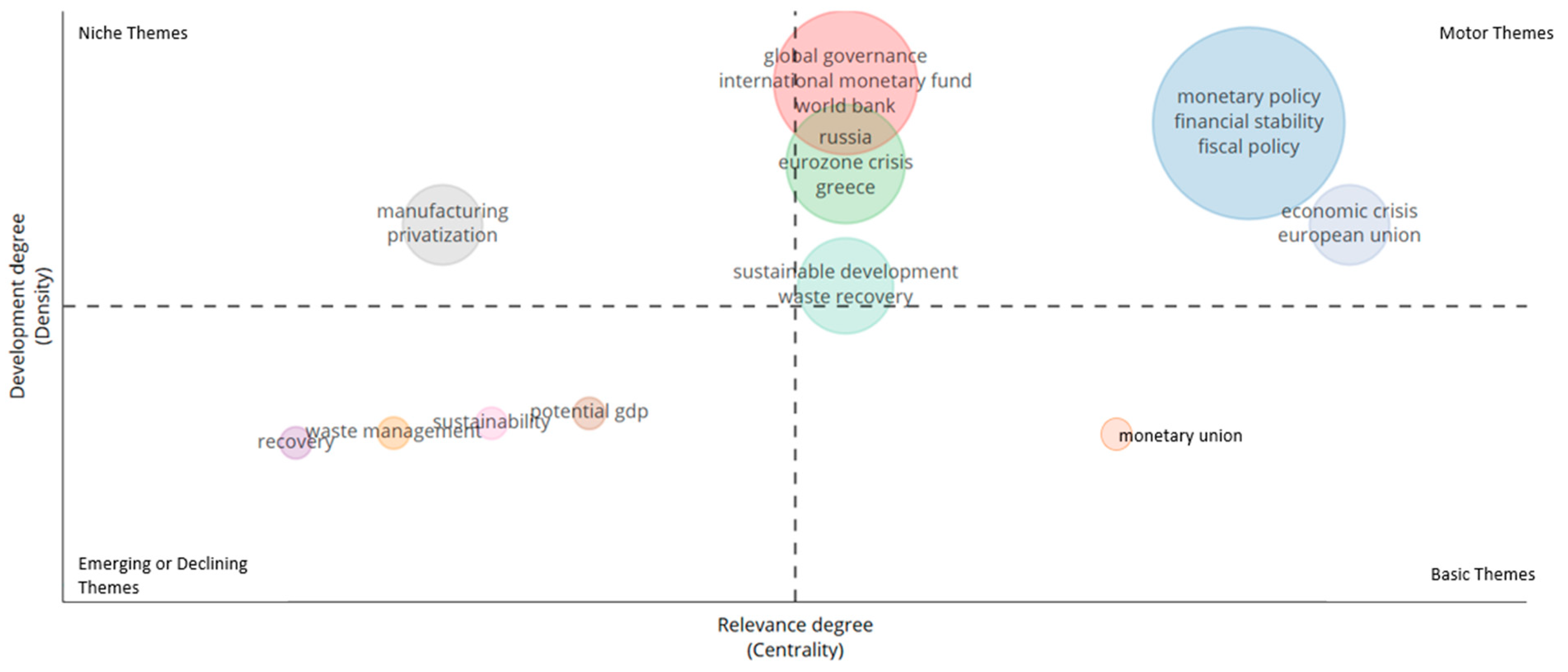

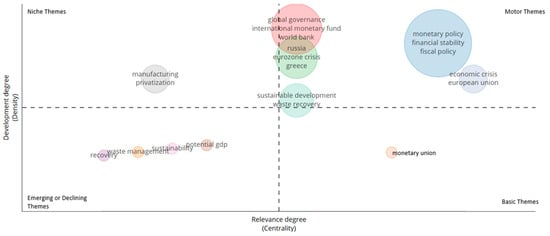

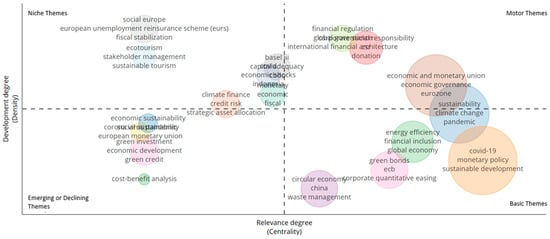

Figure 6 presents the thematic map for the pre-COVID-19 period, classifying key research themes based on their centrality (relevance) and density (development), thus offering a strategic visualization of how academic focus was structured before the pandemic. The map is divided into four quadrants—motor themes, niche themes, basic themes, and emerging or declining themes—each representing a different level of maturity and influence within the scholarly field.

Figure 6.

Thematic Map in the Pre COVID-19 period by Bibliometrix.

In the upper-right quadrant, the motor themes include monetary policy, fiscal policy, and financial stability, forming the conceptual and empirical backbone of the pre-pandemic literature. Their high centrality and density reflect their essential role in the academic discourse, driven by longstanding concerns over Eurozone architecture, policy asymmetry, and crisis response. Closely linked are economic crisis and European Union, reinforcing the continued scholarly emphasis on institutional responses to macroeconomic instability and integration challenges in the EMU.

The upper-left quadrant identifies niche themes, such as manufacturing and privatization, which are well-developed but less central to the core research agenda. These topics are likely explored in specialized contexts—such as post-Soviet transitions or sector-specific analyses—without significantly influencing the broader policy or sustainability discourse.

The lower-right quadrant features monetary union as a basic theme with relatively high centrality but low density, indicating that while it is a foundational concept, it was not deeply developed or frequently debated during the pre-COVID period. This may reflect an academic assumption of institutional stability, which was not yet challenged by the multi-dimensional crisis that COVID-19 would later introduce.

More revealing is the lower-left quadrant, which comprises emerging or declining themes like recovery, waste management, sustainability, health, and potential GDP. These topics, while peripheral and underdeveloped during this period, suggest early recognition of the need for integrating environmental, public health, and long-term growth considerations into macroeconomic frameworks. Their limited presence in the mainstream literature highlights the pre-pandemic underrepresentation of ESG and sustainability dimensions in economic policy discussions.

At the center of the map, in the transition zone between core and emerging areas, we find sustainable development, waste recovery, and crucial geopolitical and institutional nodes like global governance, international monetary fund, world bank, Russia, eurozone crisis, and Greece. This cluster reflects the lingering influence of the post-2008 financial crisis and the Eurozone debt crisis on the academic agenda, with a growing but still tentative linkage to global governance structures and sustainability transitions.

This figure shows that before COVID-19, scholarly work was dominated by conventional macroeconomic concerns, while ESG themes and global governance were emerging but not yet fully integrated. This thematic configuration set the stage for a major post-pandemic realignment, as will be evident in the following thematic evolution.

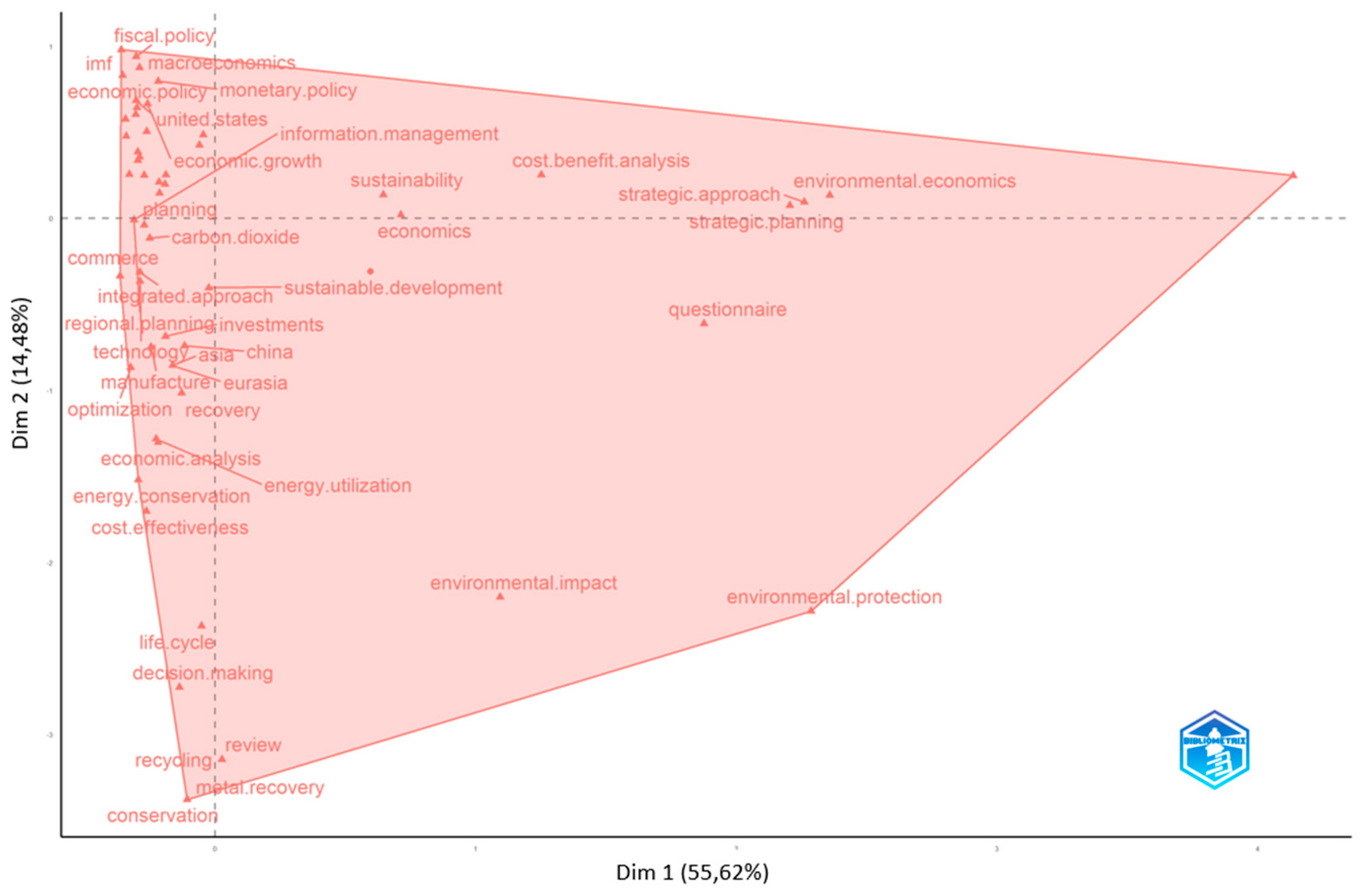

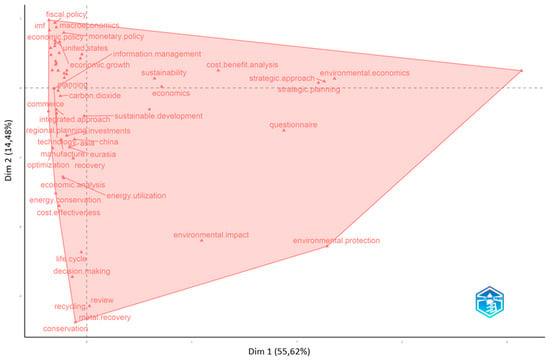

Figure 7 shows the conceptual structure of author keywords in the pre-COVID-19 period using a Multiple Correspondence Analysis (MCA) approach, offering a spatial representation of thematic proximities and intellectual groupings within the literature. The resulting map reveals a loosely clustered yet broadly defined field, where keywords related to macroeconomic governance, sustainability, and environmental concerns occupy distinct but partially overlapping regions. The horizontal and vertical dimensions (Dim 1 and Dim 2) together explain over 70% of the data’s variance, offering a meaningful overview of the conceptual underpinnings of pre-pandemic research.

Figure 7.

Conceptual Structure Method of Author’s Keywords in the Pre COVID-19 period by Bibliometrix.

In the upper-left quadrant, we find a dense grouping of terms related to macroeconomic governance, such as fiscal policy, monetary policy, economic policy, IMF, macroeconomics, and economic growth. These keywords form the traditional core of economic discourse, indicating a dominant analytical framework that prioritized institutional responses to monetary instability, often within a national or transatlantic policy context. The proximity of terms like information management, planning, and economic analysis suggests that policy tools were generally conceptualized through technocratic and administrative lenses.

Moving toward the center, terms like sustainability, economics, and cost-benefit analysis bridge macroeconomic concerns with emerging environmental and social considerations. However, their central placement and relatively sparse clustering indicate that these themes were still in the process of conceptual integration rather than fully embedded in dominant academic narratives. The fact that sustainable development and sustainability remain relatively distant from the more established macro-policy cluster supports the earlier interpretation that ESG topics were only beginning to gain traction before COVID-19.

The lower-right quadrant houses a clearly separate thematic space focused on environmental protection, environmental economics, impact assessment, life cycle analysis, and conservation. These terms, though conceptually well-formed, are positioned far from the economic-policy-heavy cluster, highlighting a disciplinary divide between environmental science and economic governance. This separation visually confirms the fragmentation seen in other pre-COVID visualizations, where sustainability was treated more as a parallel theme than an integrated analytical lens.

The lower-left and central regions feature keywords like metal recovery, recycling, energy conservation, decision making, and economic sustainability, reflecting more operational or applied strands of research related to resource efficiency and green technology. Their marginal position indicates that such topics, while practically relevant, had not yet achieved conceptual prominence within the broader field of economic policy and governance.

Overall, Figure 7 confirms that before the COVID-19 crisis, the academic field was still marked by disciplinary silos, with sustainability and environmental themes orbiting rather than intersecting with dominant macroeconomic concerns. The spatial distance between core economic terms and ESG-related keywords illustrates the structural fragmentation of pre-pandemic research—a fragmentation that would later be challenged and partially resolved in the post-COVID academic landscape.

4.2. Bibliometric Analysis in the Post COVID Period (2019–2025)

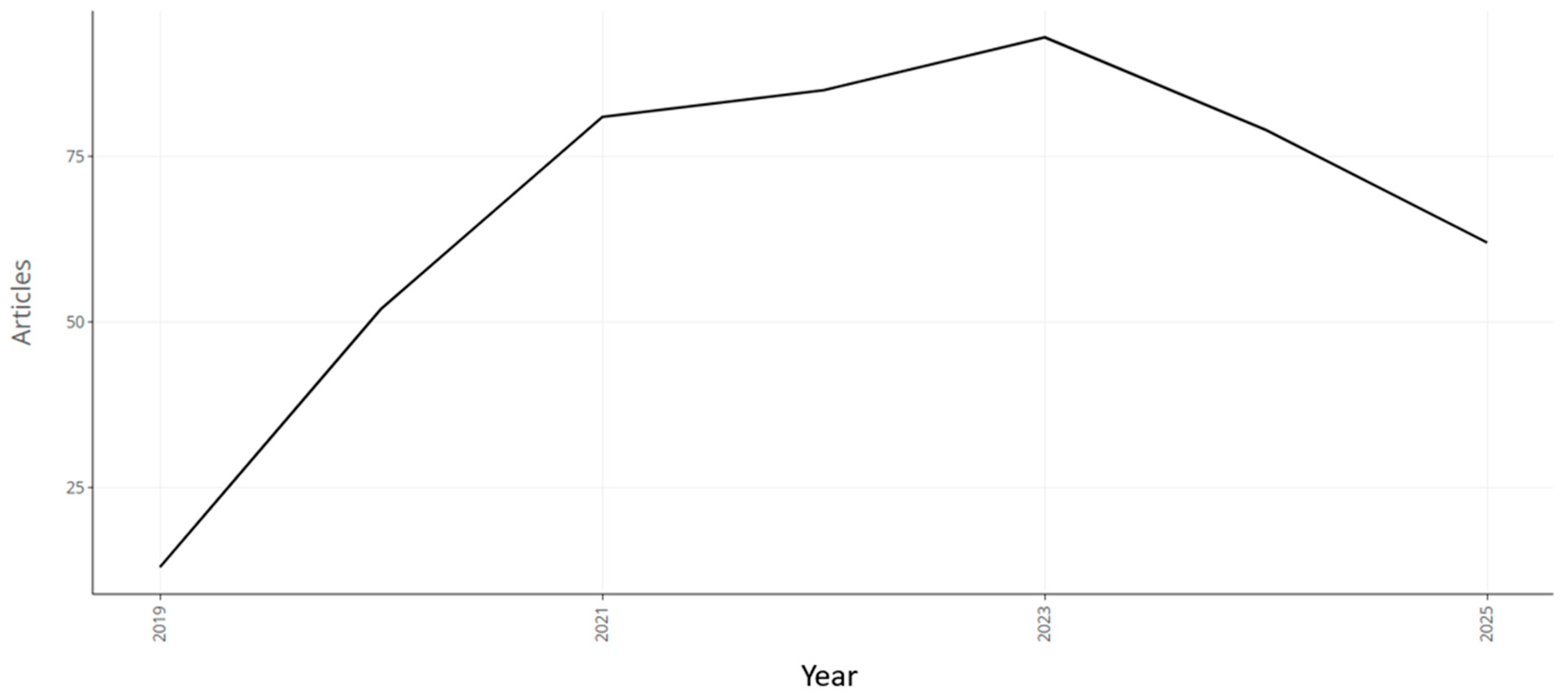

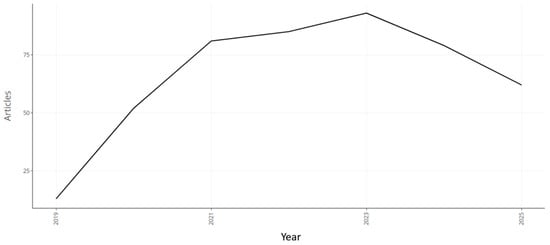

Figure 8 presents the annual scientific production of papers during the post-COVID-19 period based on our bibliometric analysis. The data reveals a substantial surge in scholarly output beginning in 2019, with the number of publications accelerating sharply through 2020 and peaking in 2023. This pattern reflects a marked intensification of academic interest in the intersection of monetary policy, EMU governance, ESG, and pandemic-induced policy responses within the EU framework. The significant rise between 2019 and 2021 corresponds with the heightened policy experimentation and regulatory reconfigurations driven by the pandemic, including the EU’s green recovery agenda, the role of ESG in financial resilience, and the increased visibility of non-financial disclosure mechanisms. The continued growth into 2022 and the peak in 2023 suggest that research momentum was sustained even beyond the immediate crisis, likely driven by ongoing debates on economic integration, policy divergence, and sustainability transitions. However, the slight decline observed in 2024 and further into 2025 indicates a possible stabilization of scholarly attention as the urgency of the pandemic receded and thematic saturation began to emerge. Nevertheless, the post-COVID period clearly represents a transformative phase in academic discourse, marked by a convergence of previously fragmented research streams into a more cohesive and policy-relevant body of literature (Zopounidis et al. 2020).

Figure 8.

Annual Scientific Production of papers in the Post COVID-19 period by Bibliometrix.

Table 3 presents the top contributing countries in the post-COVID academic literature on ESG and monetary governance. China, Italy, and the United States are clear leaders, each producing over 100 publications. The United Kingdom and India follow, along with a group of mid-sized contributors such as Malaysia, Spain, and Romania. The presence of countries like Pakistan, Saudi Arabia, and Ukraine reflects a broadening of scholarly engagement beyond traditional Western academic centers.

Table 3.

Table of Countries Scientific Production in the Post COVID-19 period by Bibliometrix.

However, the distribution remains uneven. While more countries are represented compared to the pre-COVID period, the bulk of publication activity is still concentrated in a handful of nations with established research infrastructure. This continued asymmetry underlines the need for greater support for underrepresented regions, especially within the EU, to ensure a more inclusive knowledge base for ESG policy and monetary reform.

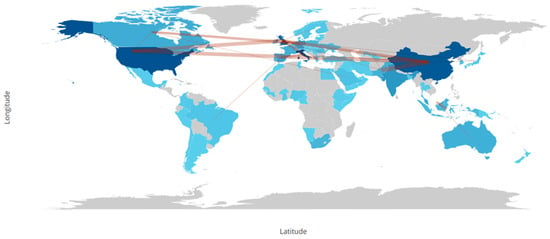

Figure 9 illustrates the countries collaboration map in the post-COVID-19 period, highlighting a significant expansion and intensification of international research partnerships compared to the pre-pandemic landscape. This map reveals a denser and more globally distributed network, with stronger intercontinental linkages, particularly between Europe, North America, and Asia. The USA, China, the UK, and Italy emerge as dominant nodes in the collaboration web, reflecting their leading roles in post-pandemic scientific output and their capacity to act as bridges between diverse research communities. The stronger connectivity between China and Western countries, as well as the reinforced ties between European states and North America, suggests a more cohesive and coordinated global research response to the complex challenges exposed by the pandemic.

Figure 9.

Countries Collaboration Map in the Post COVID-19 period by Bibliometrix.

Notably, countries such as Romania, Malaysia, and Pakistan—previously marginal in the global collaboration structure—are now more visibly integrated into transnational academic networks. This shift likely stems from both the digitalization of research cooperation during the pandemic and the increasing relevance of localized responses to global sustainability and governance issues. The post-COVID context, with its heightened focus on ESG, green recovery, non-financial disclosure, and economic resilience, required interdisciplinary and geographically inclusive approaches, which in turn stimulated broader participation and connectivity across academic communities.

The increase in collaborative density and geographic inclusivity reflects a growing recognition of the need for diverse perspectives in addressing sustainability transitions, policy convergence, and monetary governance in the wake of COVID-19. International funding mechanisms, open-access publication mandates, and virtual academic conferences may have also played a facilitating role in expanding access and reducing traditional barriers to global collaboration. Overall, the post-pandemic period marks a shift toward a more networked and cooperative academic environment, better aligned with the multidimensional nature of the policy and sustainability challenges explored in this research domain (Navaratnam et al. 2022; Pancotto et al. 2023; Ragazou et al. 2022).

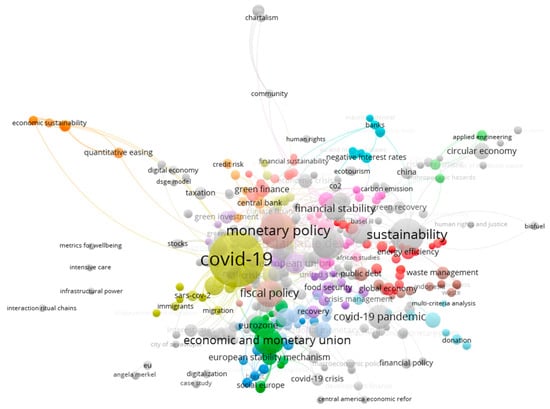

Figure 10 presents the co-occurrence analysis of authors’ keywords in the post-COVID-19 period using VOSviewer, offering a striking contrast to the more fragmented and disciplinary structure observed before the pandemic. At the center of the network, COVID-19 emerges as the most dominant and integrative term, acting as a thematic pivot around which formerly disconnected domains—such as monetary policy, sustainability, fiscal policy, green finance, and economic and monetary union—are now tightly clustered. This structural transformation suggests a significant interdisciplinary convergence catalyzed by the pandemic, where crisis-driven challenges demanded joint consideration of economic resilience, institutional reform, and sustainable recovery.

Figure 10.

Co-occurrence Analysis of Author’s Keywords in the Post COVID-19 period by VOS viewer.

The prominence of terms such as green finance, financial sustainability, green investment, and circular economy indicates that ESG principles moved from the periphery to the core of scholarly inquiry during this period. Unlike the pre-pandemic map, sustainability is no longer loosely affiliated but now intricately connected with monetary policy, financial stability, and economic governance, reflecting a systemic rethinking of how fiscal and monetary tools intersect with long-term environmental and social goals. Similarly, fiscal policy and financial stability show strong linkages with keywords like public debt, food security, migration, and infrastructure, expanding the scope of economic policy discourse to include broader dimensions of societal well-being and structural equity.

The map also reveals new thematic nodes such as economic sustainability, digital economy, supply chains, and quantitative easing, which reflect the intensified focus on macro-financial interventions, digital transformation, and vulnerabilities in globalized systems exposed by the pandemic. Notably, European stability mechanism, eurozone, and EMU remain visible, indicating the continued relevance of institutional integration and regulatory adaptation in the EU context. Moreover, the inclusion of terms like human rights, waste management, renewable energy, and CO2 emissions underscores the increasing relevance of ecological and ethical dimensions in policy debates (Carè et al. 2024).

This post-COVID landscape demonstrates not only a surge in publication volume but also a qualitative transformation in the conceptual architecture of the literature. The pandemic appears to have accelerated the fusion of economic and ESG discourses, embedding sustainability more deeply into macroeconomic governance frameworks. This reflects a growing scholarly consensus that post-crisis recovery must be not only economically robust but also socially inclusive and environmentally aligned.

Figure 11 illustrates the trend topics in the post-COVID-19 period based on term frequency, showing how the research landscape has evolved in response to the pandemic and the expanding policy relevance of ESG, EMU, and monetary governance themes. The visualization indicates a marked shift in the temporal and thematic concentration of scholarly interest, with the majority of high-frequency terms emerging or intensifying after 2020. Terms such as COVID-19, sustainability, sustainable development, and public health dominate the post-pandemic research agenda, signaling a rapid pivot toward crisis response, resilience, and socio-environmental sustainability.

Figure 11.

Trend Topics in the Post COVID-19 period by Bibliometrix.

The emergence of climate change, green finance, and risk management in close temporal proximity further reflects a growing convergence between macroeconomic policy and long-term environmental strategy. This convergence has been driven in part by the global recognition that post-pandemic recovery cannot replicate pre-crisis economic models, and must instead prioritize inclusive, low-carbon, and socially resilient pathways (Wang and Chen 2024).

Figure 12 reveals a significant realignment in the distribution of academic publication sources following the onset of COVID-19. Whereas pre-pandemic literature was often concentrated in conventional economic and policy journals with a narrow macroeconomic focus, the post-COVID period is marked by the rise of interdisciplinary and governance-focused platforms.

Figure 12.

Most Relevant Sources in the Post COVID-19 period by Bibliometrix.

Reflets et Perspectives de la Vie Économique emerges as the dominant outlet, publishing a substantial volume of work addressing the intersection of sustainability and monetary governance. Other contributors—such as Sustainability (Switzerland), the IMF Occasional Papers, and legal studies platforms—signal an expansion of the conversation into climate finance, risk assessment, and normative frameworks for EU-wide policy alignment.

This redistribution of publication activity mirrors the thematic shift observed in the post-pandemic period: from structural macroeconomic concerns to questions of institutional legitimacy, ESG regulation, and long-term resilience. The diversity of outlets also underscores the increasingly interdisciplinary nature of the research, reflecting a broader redefinition of economic governance in the context of systemic risks.

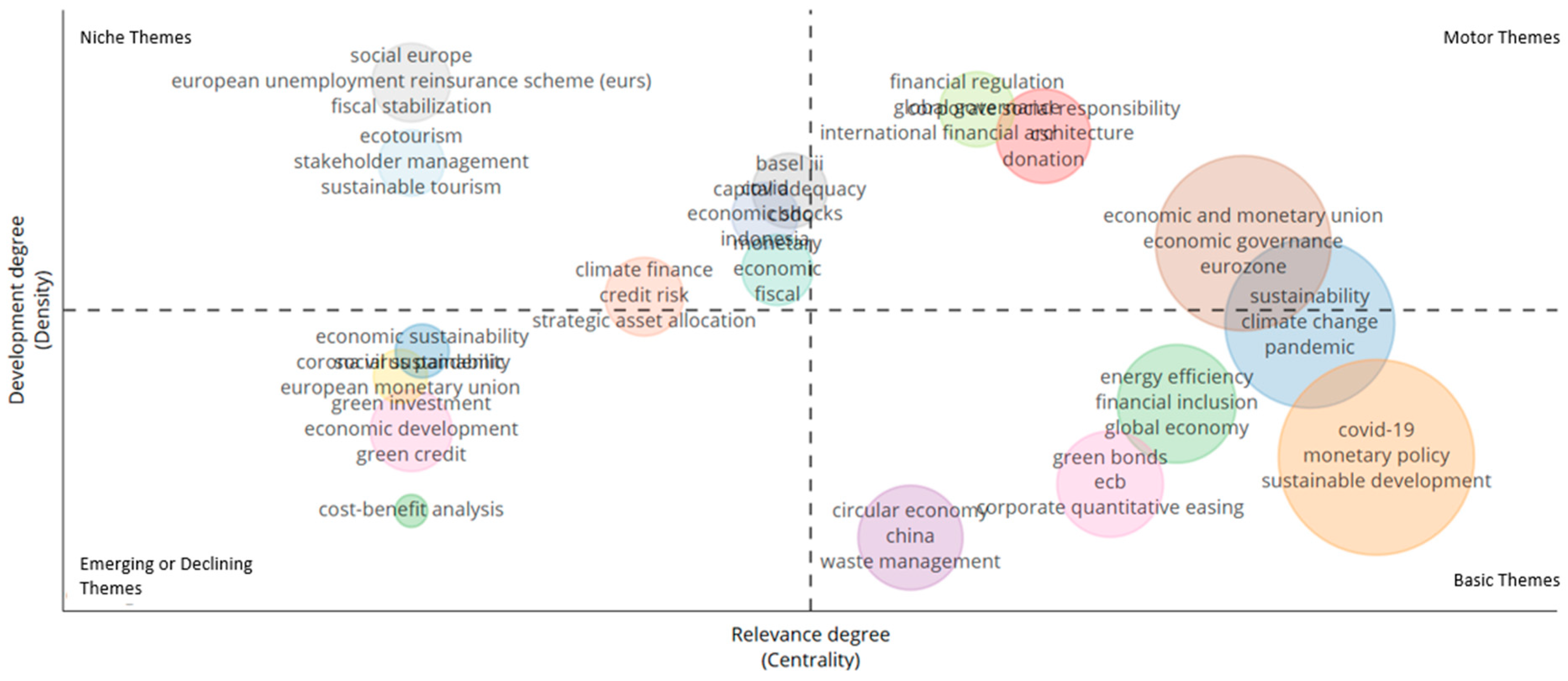

Figure 13 presents the thematic map of the post-COVID-19 period, illustrating a significantly restructured research landscape compared to the pre-pandemic configuration shown in Figure 6. The map offers a clear visual representation of the post-crisis thematic realignment, with notable shifts in the position, density, and centrality of research clusters. These changes reflect how the COVID-19 pandemic acted as a catalyst for integrating ESG, monetary policy, and sustainability discourses, ultimately redefining the strategic priorities of the academic field.

Figure 13.

Thematic Map in the Post COVID-19 period by Bibliometrix.

The most striking transformation lies in the expansion and repositioning of the “basic themes” quadrant, which now includes large and highly central clusters such as COVID-19, monetary policy, sustainable development, and climate change. While these themes were peripheral or underdeveloped in the pre-pandemic period, they have now become foundational to the scholarly conversation. Their placement as basic themes indicates that they form the bedrock of current research, serving as essential points of reference for a wide array of studies across economic, environmental, and institutional domains. This marks a significant shift from the pre-COVID map, where monetary policy was already well-developed (a motor theme), but sustainability and climate issues were less central and lacked conceptual maturity.

In the motor themes quadrant, we now observe the rise of economic and monetary union, economic governance, eurozone, and the explicit integration of sustainability and pandemic as central and dense topics. These themes have become not only relevant but also methodologically and conceptually mature, reflecting their role in driving interdisciplinary scholarly production. This stands in contrast to Figure 6, where EMU-related topics were present but less developed, and ESG-related terms were scattered across emerging and niche quadrants. The current positioning indicates that academic attention has shifted toward synthesizing institutional responses with long-term sustainability strategies, particularly in the context of EU-level integration.

Another notable shift is seen in the niche themes quadrant, now populated with specialized but technically advanced topics such as social Europe, fiscal stabilization, sustainable tourism, and stakeholder management. These topics show depth and specificity, suggesting that subfields within the broader sustainability and governance agenda are becoming more refined. In comparison, pre-COVID niche themes like manufacturing and privatization were more aligned with traditional structural reform narratives rather than socially embedded sustainability concerns (Baena and Cerviño 2024).

The emerging or declining themes quadrant has also evolved, now including clusters such as economic sustainability, green investment, green credit, and cost-benefit analysis. While some of these topics may be nascent or undergoing methodological development, their emergence signals a broadening of the research agenda to include more granular tools and concepts for evaluating sustainable recovery and green finance mechanisms. Compared to Figure 6, where this quadrant featured disconnected and underdeveloped ESG topics, the current configuration suggests a more deliberate attempt to build thematic continuity between macroeconomic governance and environmental finance.

Lastly, the appearance of clusters such as financial regulation, international financial architecture, and global governance in the upper-right quadrant reflects the growing importance of institutional design and multilateral coordination in addressing systemic risks, from pandemics to climate change. These topics, while present pre-COVID, have now gained both density and centrality, reinforcing the idea that sustainable recovery is not only a national or regional issue but also one of global institutional realignment.

In sum, the thematic evolution from Figure 6 to Figure 12 demonstrates a major intellectual shift: from a fragmented, economically centered literature to a more cohesive, interdisciplinary research field where ESG, pandemic response, macro-financial policy, and global governance are fully interlinked. This shift underscores the pandemic’s role as a structural turning point in the academic understanding of sustainability and economic integration.

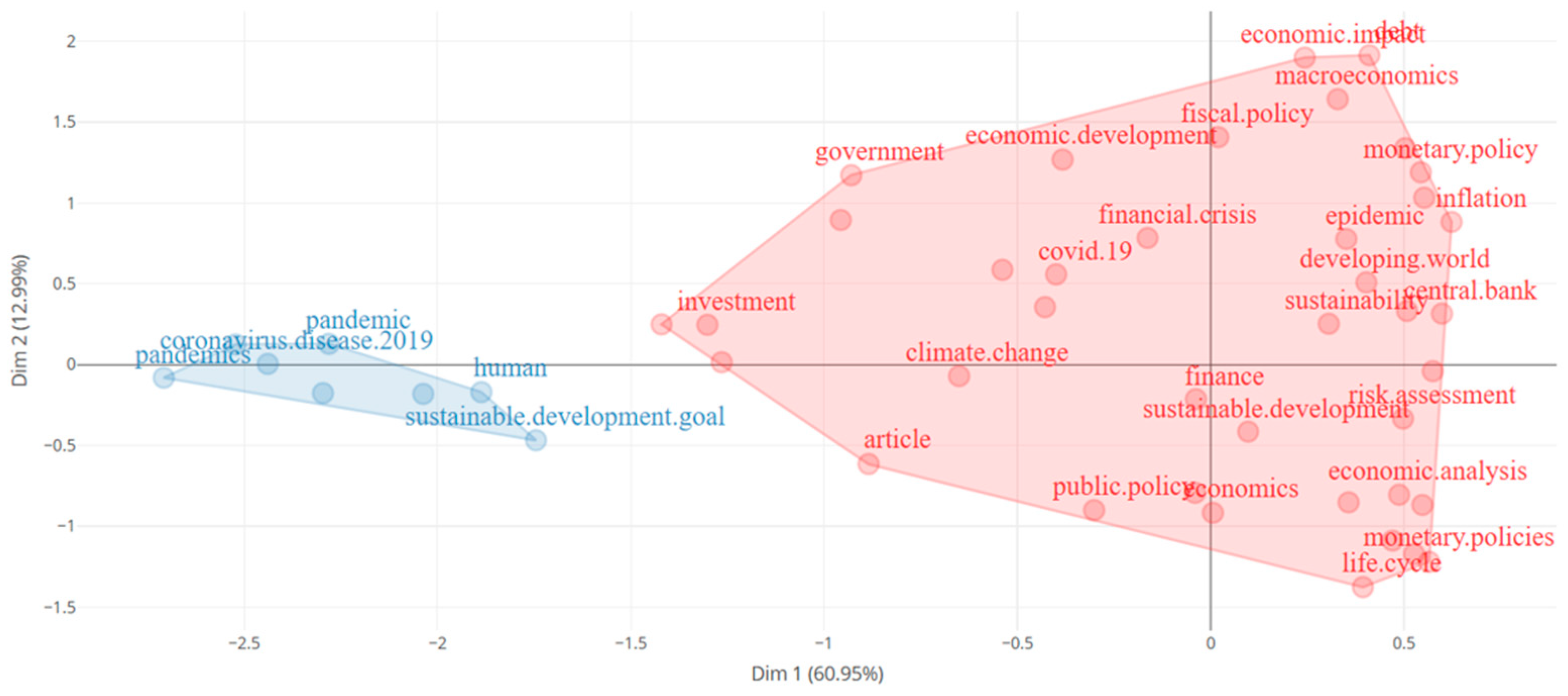

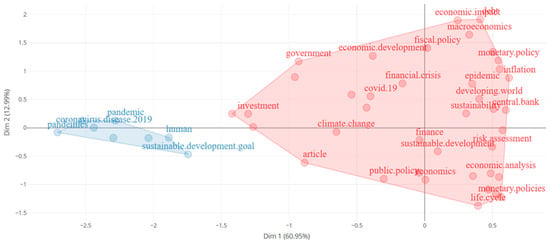

Figure 14 presents the Double Factorial Analysis (DFA) of author keywords in the post-COVID-19 period, offering a clear visual distinction between two dominant conceptual poles: the public health and global development dimension (left, in blue) and the economic policy and financial stability dimension (right, in red). This bivariate spatial analysis highlights not only the thematic diversity of the post-pandemic literature but also the integration of previously siloed domains into a shared intellectual space.

Figure 14.

Double Factorial Analysis in the Post COVID-19 period by Bibliometrix.

On the left-hand side of the graph, we observe a concentration of terms such as pandemic, coronavirus disease 2019, human, sustainable development goal, and pandemics, forming a cohesive cluster around public health, human development, and global sustainability agendas. These keywords reflect the urgent societal and humanitarian responses that emerged during the early phases of the COVID-19 crisis. The emphasis on sustainable development goal and human indicates a focus on social equity, well-being, and resilience within the context of crisis response and recovery.

In contrast, the right-hand side of the analysis is heavily populated with terms like monetary policy, fiscal policy, macroeconomics, financial crisis, economic impact, inflation, and economic analysis. This region clearly represents the macro-financial governance dimension of post-pandemic research, which deals with systemic stability, monetary interventions, policy coordination, and regulatory transformation. The inclusion of climate change, developing world, public policy, and sustainable development within this area suggests that ESG considerations have become embedded within macroeconomic narratives—unlike the pre-pandemic period, where they remained on the conceptual periphery.

Importantly, the central positioning of keywords like COVID-19, economic development, investment, and climate change highlights their role as bridging concepts. These terms serve to connect the two poles of discourse—health and humanitarian concerns on one side, and financial and economic mechanisms on the other—demonstrating the interdisciplinary fusion that characterizes the post-pandemic scholarly landscape.

The DFA thus confirms what other visualizations have suggested: that the COVID-19 crisis served as a catalyst for thematic integration, collapsing disciplinary barriers between health, sustainability, and monetary governance. Unlike the fragmented conceptual structure seen in the pre-COVID period (as in Figure 7), the post-pandemic research field is marked by conceptual overlap and mutual reinforcement among formerly distinct domains (Joia et al. 2022).

In summary, Figure 14 illustrates the intellectual reconfiguration of the field, where previously parallel conversations—on public health and macroeconomic governance—have been brought into direct dialogue. This convergence reflects not only the realities of the COVID-19 crisis but also a broader epistemic shift toward holistic, systems-based approaches to sustainable recovery, resilience, and global policy reform.

5. Discussion

This study reveals a significant shift in academic focus on EU economic governance, catalyzed by the COVID-19 pandemic. Before 2019, research on monetary asymmetry and ESG governance was sparse and siloed. ESG topics such as green finance and non-financial disclosure remained marginal, while macroeconomic studies rarely addressed sustainability. The literature treated these domains as separate, mirroring the institutional gap between economic and environmental policymaking in the EU. (Kiseľáková et al. 2020).

In the post-COVID period, academic research underwent a clear paradigm shift—both in volume and in focus. One of the most striking developments is the integration of ESG themes into the core of macro-financial governance discourse. Terms like “sustainable development”, “climate change”, “green finance”, and “resilience” now appear alongside long-dominant keywords such as “monetary policy”, “EMU”, and “fiscal stability.” This thematic convergence mirrors EU-level regulatory reforms, including the SFDR and the EU Taxonomy Regulation, both of which aim to standardize ESG disclosures and steer capital toward sustainability goals. (Martinez-Meyers et al. 2024).

The adoption of the CSRD and the ESG Ratings Regulation further signals a structural redefinition of economic governance. These instruments go beyond technical compliance; they institutionalize ESG as a central metric of policy evaluation and financial accountability (Fricke and Schlepper 2024; Chrzan and Pott 2024). Our findings show that this regulatory momentum is echoed in academic discourse, where sustainability is no longer treated as peripheral but as foundational to EU monetary and fiscal coordination.

This period also marks the rise of what scholars describe as “dual asymmetry”—a compounding of traditional monetary divergences with unequal national capacities to implement ESG-aligned reforms and absorb recovery funds (Pancotto et al. 2023; Buti and Fabbrini 2023). Recent literature highlights how disparities in fiscal space, administrative efficiency, and regulatory readiness hinder uniform ESG implementation across the EMU (Tian et al. 2025).

Methodologically, the field has broadened significantly. Interdisciplinary collaboration has grown, with increased participation from emerging economies such as China, Malaysia, and Romania. Publication venues have expanded accordingly, with journals like Sustainability and institutional platforms such as IMF reports and European legal studies journals becoming central to the conversation.

Crucially, ESG is now discussed in operational terms—linked to tangible monetary and fiscal tools like green bonds, ECB climate stress testing, and ESG-sensitive asset purchases. This reflects a deeper transformation: ESG frameworks are no longer merely aspirational but function as instruments of institutional design and regulatory alignment (Tang 2023; Deyris 2023).

In sum, the contrast between pre- and post-pandemic scholarship reveals a fundamental intellectual and policy shift. Sustainability has become embedded in the logic of EU economic governance, prompting the emergence of more integrated, interdisciplinary frameworks. This evolution opens new avenues for research on institutional convergence, ESG’s impact on monetary transmission, and the governance implications of embedding sustainability into the financial system.

6. Conclusions

This study set out to explore how academic discourse on monetary asymmetry and ESG governance has evolved, particularly in the wake of the COVID-19 pandemic. By employing a dual bibliometric and conceptual approach, we traced the thematic and structural shifts that have redefined scholarly engagement with EU economic governance. The findings reveal more than just an increase in research volume—they signal a fundamental reorientation in focus, methodology, and intellectual priorities.

Prior to the pandemic, literature on EMU monetary asymmetry and sustainability governance followed separate trajectories. While monetary policy research addressed institutional divergence and transmission risks, ESG-related studies remained largely confined to corporate or financial subdomains. COVID-19 acted as a critical juncture, collapsing these disciplinary silos, and catalyzing a convergence of economic, environmental, and governance concerns.

Post-2020, ESG has moved from the margins to the center of macro-financial debates. This realignment parallels key EU regulatory developments—such as the SFDR, CSRD, and Taxonomy Regulation—which embed sustainability criteria into financial supervision, capital allocation, and institutional accountability. The literature now increasingly reflects this shift, addressing ESG not as an adjunct, but as an intrinsic dimension of economic resilience and policy legitimacy.

Our bibliometric analysis also highlights the growing influence of interdisciplinary collaboration and the diversification of research geographies. Emerging economies and non-traditional publication venues are playing a more visible role, reflecting the global relevance of the ESG-governance nexus. This transformation raises new research questions: How do ESG frameworks influence monetary transmission mechanisms? What role should supranational institutions like the ECB and ESAs play in advancing sustainability-driven convergence? And how can policy coherence be ensured across member states with divergent fiscal and administrative capacities?

Ultimately, this study argues that the integration of ESG into EU monetary governance is not just a policy response to crisis, but a deeper structural transition. Sustainability is now a defining feature of European integration. The challenge ahead is to ensure that this shift closes, rather than deepens, existing asymmetries—through coordinated governance, inclusive implementation, and sustained scholarly inquiry.

7. Limitations & Future Research

While this study provides valuable insights into the thematic evolution and intellectual convergence of ESG governance and monetary asymmetry within the Eurozone, several limitations must be acknowledged.

First, the analysis is inherently constrained by the scope of its data sources. Although Scopus offers broad disciplinary coverage and high-quality indexing, it may exclude relevant publications found in other databases such as Web of Science, SSRN, or non-English regional journals. This could result in a partial representation of the global academic conversation, particularly concerning scholars from emerging economies or interdisciplinary policy research not captured within the dominant economics or finance classifications.

Second, the bibliometric approach—though powerful in mapping patterns, co-authorship networks, and thematic clusters—does not fully capture the depth, nuance, or critical argumentation present in individual studies. As such, it is less effective in evaluating the theoretical robustness, methodological diversity, or empirical validity of the literature it analyzes. While visualizations and keyword networks offer macro-level insights, they may obscure important debates or dissenting perspectives that require close reading and qualitative analysis.

Third, the temporal segmentation between pre- and post-COVID-19 literature—while useful in identifying thematic shifts—risks simplifying the continuity of intellectual trends. Some ESG integration and sustainability governance developments predate the pandemic and may have been gradually maturing beneath the radar of mainstream academic attention. Similarly, the pandemic’s long-term impact on research agendas and policy priorities may not be fully observable within the 2019–2025 window analyzed in this study.

These limitations suggest several avenues for future research. First, content-based meta-analyses and systematic literature reviews could complement bibliometric findings by engaging more deeply with conceptual arguments and theoretical developments across disciplines. This would help uncover causal mechanisms, normative frameworks, and methodological innovations that are not readily captured through keyword co-occurrence alone.

Second, further studies should explore the real-world policy impact of academic research on EU institutions. A citation analysis of EU policy documents, regulatory texts, and parliamentary proceedings could reveal how scholarly knowledge is incorporated—or sidelined—in actual governance processes.

Third, future research should investigate the differentiated adoption of ESG frameworks across Eurozone member states, with a focus on national institutional capacity, political economy, and regulatory culture. This would help explain the persistence of structural divergence despite growing regulatory convergence at the EU level.

Finally, given the growing role of supranational institutions such as the ECB, ESAs, and EC, future inquiry should examine their evolving mandates and strategies in embedding sustainability within monetary and financial oversight. This includes the operational challenges of integrating climate risk into monetary policy tools, asset purchase programs, and prudential supervision—areas that remain critically underexplored in both academic and policy literatures.

Author Contributions

Conceptualization, A.G., E.A. and C.P.; methodology, A.G., E.A., C.P. and M.K.; software, A.G. and E.A.; validation, A.G. and E.A.; formal analysis, A.G., E.A., C.P. and M.K.; investigation, A.G., E.A., P.G. and M.K.; resources, A.G., E.A., C.P., P.G. and M.K.; data curation, A.G. and E.A.; writing—original draft, A.G., E.A., C.P., P.G. and M.K.; writing—review and editing, A.G., E.A., C.P., P.G. and M.K.; visualization, A.G. and E.A.; supervision, A.G. and M.K.; project administration, A.G.; funding acquisition, A.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Attinasi, Maria-Grazia, Cristina Checherita, and Christiane Nickel. 2011. What Explains the Surge in Euro Area Sovereign Spreads During the Financial Crisis of 2007–2009? In Sovereign Debt. Hoboken: Wiley, pp. 407–14. [Google Scholar] [CrossRef]

- Baena, Verónica, and Julio Cerviño. 2024. Tourism in the Era of Social Responsibility and Sustainability: Understanding International Tourists’ Destination Choices. Sustainability 16: 8509. [Google Scholar] [CrossRef]

- Boni, Leonardo, and Lisa Scheitza. 2025. Analyzing the role of regulation in shaping private finance for sustainability in the European Union. Finance Research Letters 71: 106435. [Google Scholar] [CrossRef]

- Bruno, Michelangelo, and Valentina Lagasio. 2021. An overview of the European policies on ESG in the banking sector. Sustainability 13: 12641. [Google Scholar] [CrossRef]

- Buti, Marco, and Sergio Fabbrini. 2023. Next generation EU and the future of economic governance: Towards a paradigm change or just a big one-off? Journal of European Public Policy 30: 676–95. [Google Scholar] [CrossRef]

- Carè, Rosella, Rabia Fatima, and Iustina A. Boitan. 2024. Central banks and climate risks: Where we are and where we are going? International Review of Economics and Finance 92: 1200–29. [Google Scholar] [CrossRef]

- Chrzan, Sandra, and Christiane Pott. 2024. The steering effect of the EU taxonomy: Evidence from German institutional and retail investors. Review of Financial Economics 42: 349–75. [Google Scholar] [CrossRef]

- Clausen, Volker, and Hans-Werner Wohltmann. 2005. Monetary and fiscal policy dynamics in an asymmetric monetary union. Journal of International Money and Finance 24: 139–67. [Google Scholar] [CrossRef]

- De Souza Guilherme, Bettina. 2025. The European Union Will Be Built on Solidarity: Lessons Learned and the Financial Crisis Management of the COVID-19 Pandemic. In Finance, Growth and Democracy: Connections and Challenges in Europe and Latin America in the Era of Permacrisis. Cham: Springer, pp. 65–80. [Google Scholar] [CrossRef]

- Deyris, Jérôme. 2023. Too green to be true? Forging a climate consensus at the European Central Bank. New Political Economy 28: 713–30. [Google Scholar] [CrossRef]

- Donthu, Naveen, Satish Kumar, Debmalya Mukherjee, Nitesh Pandey, and Weng Marc Lim. 2021. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–96. [Google Scholar] [CrossRef]

- Fricke, Daniel, and Kathi Schlepper. 2024. Greenwashing and the EU’s Sustainable Finance Disclosure Regulation. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4819454 (accessed on 20 December 2025).

- Garefalakis, Alexandros, and Augustinos Dimitras. 2020. Looking back and forging ahead: The weighting of ESG factors. Annals of Operations Research 294: 151–89. [Google Scholar] [CrossRef]

- Gherghina, Ștefan Cristian, and Liliana Nicoleta Simionescu. 2024. The Impact of COVID-19 Pandemic on Sustainable Development Goals. Sustainability 16: 5406. [Google Scholar] [CrossRef]

- Ionașcu, Alina Elena, Dereje Fedasa Hordofa, Alexandra Dănilă, Elena Cerasela Spătariu, Andreea Larisa Burcă, and Maria Gabriela Horga. 2025. ESG Performance in the EU and ASEAN: The Roles of Institutional Governance, Economic Structure, and Global Integration. Sustainability 17: 7997. [Google Scholar] [CrossRef]

- Jebe, Ruth. 2019. The Convergence of Financial and ESG Materiality: Taking Sustainability Mainstream. American Business Law Journal 56: 645–702. [Google Scholar] [CrossRef]

- Jiang, Zhu, and Prince Asare Vitenu-Sackey. 2025. Assessing the Impact of Environmental, Social and Governance Indicators on Corporate Financial Performance. SAGE Open 15: 1–20. [Google Scholar] [CrossRef]

- Joia, Luiz Antonio, Flavia Michelotto, and Manuela Lorenzo. 2022. Sustainability and the Social Representation of the COVID-19 Pandemic: A Missing Link. Sustainability 14: 10527. [Google Scholar] [CrossRef]