Abstract

Inspired by the limited research regarding the influence of CEO succession origin on corporate misconduct, this study draws on organizational identification theory and agency theory to examine this issue. Empirical analysis indicates that insider CEOs significantly constrain corporate misconduct in China. Furthermore, the moderating results indicate that internal control strengthens the negative association between insider CEOs and corporate misconduct, whereas institutional ownership weakens this governance effect. Further analysis confirms that the restraining effect of insider CEOs on corporate misconduct remains robust across different types of misconduct. Overall, our study emphasizes the positive role of insider CEOs from the perspective of CEO succession origins and provides valuable practical implications for controlling corporate misconduct.

1. Introduction

Corporate misconduct has long been a central concern for key stakeholders, including regulators, shareholders, and the general public, because of its detrimental impact on firm value, market confidence, and broader economic stability (Lei et al. 2025; Zhao et al. 2024; Eugster et al. 2024; Yang et al. 2025). Corporate misconduct has increasingly attracted worldwide attention, with frequent scandals across both developed and emerging economies. The substantial negative consequences of corporate misconduct have prompted researchers to investigate its underlying causes from multiple perspectives, including both internal and external corporate governance (Braun and Mueller 2025; Eugster et al. 2024; Shi et al. 2017).

The CEO plays a pivotal role in corporate operations and is often closely associated with corporate misconduct. When violations occur, the CEO typically becomes the focus of public scrutiny and bears direct responsibility for the associated consequences (Connelly et al. 2022). Research has revealed numerous traits of CEOs that could be substantially linked to the probability of unethical behavior within corporations. For instance, CEOs with foreign experience, poverty imprints, or narcissistic traits are more likely to implement internal control measures, thereby reducing the likelihood of corporate misconduct (Dong and Yu 2024; Liu et al. 2023; Donker et al. 2023). The length of a CEO’s contract exhibits a U-shaped association with corporate misconduct (Yang and Zou 2025). Female CEO leadership facilitates the containment of organizational diversity-related misconduct (Dadanlar and Abebe 2020). Moreover, CEO political connections have also been found to be associated with misconduct (Fewer and Tarakci 2024; Mei et al. 2023; Liu et al. 2023). Recent studies have also examined CEO succession sources, finding that home or local CEOs are less prone to misconduct (Lei et al. 2025; Chen et al. 2024a) and that family CEOs exhibit a lower propensity for earnings management (Yang 2010). These findings offer practical implications for identifying the “right kind of CEO” for firms.

As one of the key succession sources, CEOs appointed from within the firm (insider CEOs) have attracted increasing scholarly attention. However, the literature provides no consistent theoretical framework or robust evidence regarding insider CEOs’ influence on corporate misconduct, and the mechanisms underlying this relationship remain underexplored. Most prior research has focused on other outcomes, such as firm performance (Haque et al. 2022) and financial reporting readability (Oradi et al. 2024). These studies suggest that insider CEOs, owing to their firm-specific knowledge and skills, can achieve superior performance in crisis contexts (Haque et al. 2022) and are less likely to engage in earnings management or accounting manipulation (Kuang et al. 2014). In addition, their in-depth insight into the business environment and lower information asymmetry with the board enhance the readability of financial reports (Oradi et al. 2024). Nevertheless, the influence of insider CEOs may also be contingent on internal and external governance mechanisms. For example, the ability of insider CEOs to enhance the readability of reports may be constrained by CEO power (Oradi et al. 2024). The misconduct-reducing effect of local CEOs is more pronounced when external monitoring is weak (Chen et al. 2024a). These insights provide a useful foundation for exploring the underexamined link between insider CEO succession and corporate misconduct.

This study seeks to fill a gap in the existing literature regarding the impact of insider CEO succession on corporate misconduct. Specifically, it seeks to answer two key questions: (1) Do insider CEOs significantly reduce the level of corporate misconduct? (2) Do corporate governance mechanisms, such as internal control systems and institutional ownership, moderate the relationship between insider CEOs and misconduct? To explore these questions, we utilize data from China’s non-financial A-share listed firms between 2013 and 2023. By developing an empirical model connecting insider CEO succession to corporate misconduct, this study explores the underlying mechanisms and identifies the factors that condition this relationship.

China was chosen as the empirical context for several reasons. First, corporate misconduct is relatively widespread in the country because of weak enforcement, underdeveloped legal frameworks, and significant information asymmetry (Yang et al. 2025; Chen et al. 2024a; Zhao et al. 2024). Second, Chinese companies typically prioritize internal loyalty and continuity, which often leads to the common practice of appointing CEOs through insider succession (Sun et al. 2023). These features make China an optimal setting for investigating the potential dual role of insider CEOs in instances of corporate misconduct. Although our research focuses on China, the rising trend of insider CEOs worldwide (Islam et al. 2021; Oradi et al. 2024) indicates that our results are likely relevant in various institutional environments.

This study contributes to the literature in two key aspects. First, it explores the impact of internal CEO succession, thereby further advancing the literature on determinants of corporate misconduct. The insider CEO emerges as a unique and largely overlooked governance variable that may play an essential role in reducing corporate wrongdoing. Second, our research deepens the understanding of how internal governance mechanisms affect corporate misconduct. While previous research indicates that internal controls take an active role in limiting misconduct (Tian and Sun 2023), we provide additional depth to the literature by theorizing how these controls may mitigate corporate misconduct through the reinforcement of insider CEOs’ roles. Furthermore, our framework contributes to the broader discussion on external governance mechanisms in shaping corporate behavior (Braun and Mueller 2025). By demonstrating how institutional ownership may act as a substitute for insider CEOs in curbing misconduct, we broaden the comprehension of how monitoring mechanisms at the firm level affect corporate misconduct.

2. Literature Review and Hypothesis Development

2.1. Theoretical Foundations

According to social identity theory Organizational identification, which originates from social identity theory (Tajfel 1978), refers to an individual’s perceived oneness with or belongingness to an organization (Ashforth and Mael 1989). It represents a self-concept based on organizational membership and influences attitudes and behaviors through in-group identification and intergroup comparison (Hogg et al. 1995). Organizational identification is characterized by persistence, meaning that members may maintain their attachment to the organization even after leaving it (Gioia et al. 2000). It also exhibits multiplicity, reflected in the coexistence of moral and economic identifications and the presence of identification at multiple levels within the organization (Albert and Whetten 1985; Sluss and Ashforth 2007). High identification strengthens self-esteem and promotes cooperation and compliance (Bamber and Iyer 2002; Van Dick et al. 2004). Long-serving insider CEOs are more likely to align closely with the company’s culture and values. This attachment motivates them to protect their corporate reputation and avoid actions that could harm their collective image.

Complementing this behavioral lens, agency theory highlights conflicts arising from the separation of ownership and control (Jensen and Meckling 2019). Information asymmetry and weak monitoring enable managers to pursue personal gains, increasing the risk of opportunism and misconduct (Efendi et al. 2007). Insider CEOs, however, possess firm-specific knowledge, longer tenure, and closer ties to the board and key shareholders. These factors reduce information gaps and increase accountability. Moreover, internal successors face greater reputational costs if misconduct occurs, given their embedded careers and social capital within the firm.

Taken together, organizational identification emphasizes the psychological mechanism of in-group commitment, whereas agency theory underscores economic and governance constraints. These frameworks suggest that insider CEOs, influenced by their values and incentives, tend to be more cautious in their governance and less likely to engage in misconduct.

2.2. CEO Succession Sources and Corporate Misconduct

Recent studies on CEO succession have focused primarily on family and local CEOs, generally suggesting that such executives are less prone to opportunistic behavior (Chen et al. 2024b; Lei et al. 2025; Wu et al. 2024). The underlying explanation often lies in their strong hometown attachment and social identification, which enhance reputation concerns and reduce self-serving actions (Lai et al. 2020). Empirical evidence shows that family CEOs exhibit a lower propensity for earnings management (Yang 2010), whereas local CEOs demonstrate a reduced tendency toward fraudulent conduct (Cao et al. 2024).

Moreover, corporate governance mechanisms shape this relationship. For instance, hometown CEOs show greater effectiveness in curbing misconduct when internal control mechanisms are relatively weak (Cao et al. 2024). Evidence from Chen et al. (2024a) indicates that local CEOs markedly reduce corporate wrongdoing. Moreover, stricter external monitoring, such as auditor and analyst oversight, tends to weaken the deterrent role of a CEO’s hometown identity. In contrast, Wu et al. (2024) find that hometown chairpersons, with their deeper local ties and greater social pressure, are less likely to engage in misconduct. This constraining effect is even stronger when institutional investors hold a larger share of ownership.

Compared with research on local CEOs, studies on insider CEOs remain relatively limited, especially in the area of corporate misconduct. Existing work has focused mainly on accounting manipulation and earnings management (Jongjaroenkamol and Laux 2017; Kuang et al. 2014), firm performance (Haque et al. 2022), and report readability (Oradi et al. 2024), with little attention given to organizational wrongdoing. Some studies argue that insider CEOs may act more cautiously because they value reputation and avoid actions that could harm it. They often have deeper organizational knowledge and stronger alignment with the firm’s long-term interests (Haque et al. 2022; Sun et al. 2023). Because insider CEOs have been embedded in the organization for many years and place greater value on internal reputation, they are less prone to engaging in earnings manipulation (Oradi 2021); however, other studies present different views. Islam et al. (2021) argue that insider CEOs, who have more resources and power, may engage in aggressive or self-serving actions. This finding indicates that insider CEOs exhibit behavioral heterogeneity, which may be influenced by contextual factors or identity motives, leading to mixed findings.

In summary, previous research has not thoroughly explored the link between insider CEOs and corporate misconduct, with most research focusing on family or hometown backgrounds. There is also limited evidence on how governance factors, such as internal control and institutional investors, moderate the relationship between insider CEOs and misconduct. This study aims to fill this gap by (1) developing a theoretical framework to explain the link between insider CEOs and corporate misconduct and (2) testing the moderating effects of variables such as internal control and institutional investors, providing more targeted implications for governance practices and policy making.

2.3. Hypothesis Development

From the perspective of organizational identification theory, insider CEOs are more inclined to internalize and share the organization’s fundamental values and culture (Brockman et al. 2022). Their deep understanding of internal processes and long-term relationships with the organization cultivates a stronger sense of belonging and organizational identification. This organizational attachment motivates them to safeguard corporate reputation (Oradi et al. 2024) and mitigates adverse selection risk (Choi et al. 2022). Empirical evidence suggests that such identification can translate into improved firm performance (Haque et al. 2022), greater readability of annual reports (Oradi et al. 2024) and a reduced tendency to engage in earnings manipulation (Oradi 2021). This emotional connection enhances their drive to maintain a favorable reputation as members of the organization, thereby decreasing the chances of corporate misconduct.

Under the framework of agency theory, the transfer of authority from shareholders to top executives leads to a centralization of decision-making authority among management, such as the CEO (Sun et al. 2023). Boards generally show more trust and tolerance for insider CEOs than for outsider CEOs. This increased trust tends to lead to a decrease in monitoring efforts, which subsequently mitigates agency issues and reduces both agency costs and conflicts (Choi et al. 2022). As a result, insider CEOs usually receive more freedom in their decisions, which diminishes their likelihood of participating in corporate wrongdoing.

In contrast, agency theory suggests that external CEOs typically exhibit a weaker alignment with the interests of shareholders and encounter heightened information asymmetry (Brockman et al. 2016). This situation increases the probability of opportunistic actions. As outsiders, these CEOs often have less specific knowledge about the firm and fewer internal social connections, leading to increased pressure to demonstrate performance to key stakeholders quickly (Islam et al. 2021). To achieve performance targets or maintain their roles, external CEOs may be more likely to partake in earnings management and manipulate revenue (Kuang et al. 2014). Additionally, they might use information asymmetry to delay reporting adverse news, which can heighten the likelihood of stock price drops (Choi et al. 2022). High agency costs stem from information asymmetry and misaligned interests between managers and shareholders, which encourage opportunistic behavior and undermine governance. In line with the theoretical framework, we formulate the following hypothesis:

H1.

It is anticipated that organizations with insider CEOs will experience a lower incidence of corporate misconduct than those with outsider CEOs.

3. Research Design

3.1. Sample Selection and Data Sources

This research employs panel data derived from China’s non-financial A-share listed firms, spanning from 2013–2023. Our sample begins in 2013 to ensure a consistent institutional environment. Although the Basic Standard for Enterprise Internal Control was issued in 2008 and piloted in 2009, it was not until approximately 2013 that the standard and its supporting guidelines were fully implemented and disclosure requirements were widely enforced among listed companies in China. Thus, starting from 2013 captures firms’ behavior under a stable internal control framework. As an important emerging economy, China’s capital markets exhibit comparatively limited legal enforcement, providing a distinctive institutional framework to explore the link between types of CEO succession and corporate wrongdoing (Ren et al. 2022). In addition, China, the world’s second-largest economy, is an empirical research site for corporate governance (Wang et al. 2023). Companies registered in the A-share markets must disclose their financial information regularly to ensure transparency and accessibility. These companies operate in various industries and regions. Their operations are under the strict supervision of the China Securities Regulatory Commission (CSRC). Therefore, this improves the representativeness and reliability of the dataset.

The sample was constructed through the following filtering steps to improve its validity and representativeness: (1) firms classified as ST, *ST or PT were removed from the sample as being financially distressed; (2) financial firms were removed from the sample as they followed different accounting standards from the rest of the firms and operated under different regulatory frameworks; and (3) firms with incomplete data or missing insider CEO information were also excluded from the data. The last sample comprises 2065 listed firms, which yields 10,437 firm-year observations during the period 2013–2023 (Table 1).

Table 1.

Sample selection.

In addition, winsorizing of 1% and 99% was performed for continuous variables to lessen the effect of outliers. We used STATA 18.0 to process all the data and perform the regression analysis. We gathered financial data, executive team features, and corporate misdeed records predominantly from the China CSMAR database, as it is frequently cited in the recent literature (Yang and Zou 2025; Chen et al. 2024a; Mei et al. 2023). We collected data on internal control quality from the China DIB database’s Internal Control Index for listed companies, a measure commonly applied in corporate governance and internal control research (Jin 2024).

3.2. Measurement of Variables

3.2.1. Dependent Variable

We incorporate corporate misconduct identified by stock exchanges, the China Securities Regulatory Commission (CSRC), and additional government agencies such as the State Taxation Administration. In the Chinese capital market, listed firms are found to engage in various types of misconduct, including profit fabrication, asset misstatements, false or misleading disclosure, delayed disclosure, material omission, other forms of inaccurate disclosure, improper accounting treatment, irregular capital contributions, unauthorized use of funds, asset appropriation, illegal guarantees, insider trading, prohibited stock transactions, and stock price manipulation. The data are obtained from the “Violation and Punishment” database of the CSMAR.

Following prior studies (Chen et al. 2024a; Wu et al. 2024; Zaman et al. 2021), we construct Mis_Num, measured as the annual count of misconduct incidents disclosed for each firm. To test the robustness of our findings, we further construct a binary variable, Mis_Dumy, which equals 1 if a firm commits at least one misconduct event in a given year and 0 otherwise, on the basis of the actual occurrence year of the violation (Yang and Zou 2025).

3.2.2. Independent Variable

To capture CEO origin, we construct a binary indicator (Insider CEO), which takes a value of 1 if the chief executive officer previously held a position within the same company prior to appointment and 0 if the CEO was hired externally (Oradi 2021; Sun et al. 2023).

3.2.3. Moderating Variable

To assess the effectiveness of internal control mechanisms, we utilize the internal control index developed from the China DIB database. The internal control is measured as the internal control index divided by 100 (Jin 2024). The index comprehensively considers the implementation status of the internal control of listed companies in China. Moreover, disclosure reveals the effectiveness of a company’s internal controls, helping stakeholders understand the status of internal controls and interpreting financial reports correctly.

3.2.4. Control Variables

We account for a range of factors that may influence corporate misconduct across three dimensions. First, we include basic firm characteristics as control variables, namely firm size, firm age, return on assets, and leverage. Second, we control for governance factors, including ownership concentration, board size, supervisory board size, CEO duality, shareholding balance, and auditor quality. To control for CEO heterogeneity, we included CEO gender, CEO age, CEO education, CEO overseas, and CEO academic. Table 2 summarizes the definitions and measurement approaches for the key variables employed in this study.

Table 2.

The definitions of the main variables.

3.3. Empirical Model

Negative binomial regression (NBR) is used to address the problem of overdispersion in the count data, characterized by a positive skew distribution of the number of company violations (Huang et al. 2025; Yang and Zou 2025). In this study, regression models are constructed on the basis of the following logic. Initially, we analyze how insider CEOs influence corporate misconduct to test Hypothesis 1.

Model 1: Main-effect NBR model:

MIS_Numit = β0 + β1 Insider CEOit + ∑ βk Controlsit,k + γit + µit + εit

In Equation (1), the dependent variable MIS_Num represents the number of corporate misconduct incidents. The primary explanatory variable, Insider CEO, indicates whether the CEO is internally promoted. β0 denotes the constant term, whereas β1 indicates the coefficients of interest. The terms γit and μit represent the fixed effects for industry and year, respectively. We excluded firm fixed effects in the main model because insider CEO status varies little within firms, and firm-level controls capture most heterogeneity (Table 3). Including firm fixed effects would greatly reduce the sample size, so only industry and year fixed effects were used in the negative binomial regression. εit refers to the random error term. We correct for possible heteroskedasticity and within-firm correlation of errors by applying firm-clustered robust standard errors.

Table 3.

Distribution of Internal Promotion CEO Changes.

3.4. Descriptive Statistics

Table 4 summarizes the main variables. The mean and standard deviation of the dependent variable mis_num are 1.10 and 2.54, respectively, suggesting positive skewness. The maximum value is 13, and our misconduct measure magnitude is similar to that of Wu et al. (2024) studies. The variable mis_dumy indicates that approximately 26% of firms engaged in at least one violation, a proportion slightly less than the 30% documented by Yang and Zou (2025). The results show that most misconduct is consistent with previous Chinese evidence from the same period as this sample. The Insider CEO variable has a mean of 0.70, showing that 70% of the sample firms are headed by a CEO promoted from within the firm. Chinese listed companies have a strong preference for internal leadership development (Sun et al. 2023). Insider CEOs are also common in other countries. For example, 58% of CEO successions in Australia are made through internal promotion (Islam et al. 2021), whereas in the US, 67% of S&P 500 CEO appointments are made from internal candidates (Oradi 2021). This suggests that the succession of an insider CEO is a globally relevant governance practice.

Table 4.

Summary Statistics.

Table 5 presents the industry distribution of the sample, which is based on the CSRC Industry Classification Guidelines (2012). Overall, manufacturing firms account for 70.07% of the sample, while the remaining firms are distributed across other industries, ensuring sufficient representation of China’s listed companies. This distribution aligns with findings from prior research on Chinese listed firms, highlighting that a few sectors play a dominant role in China’s economic structure.

Table 5.

Industry distribution (CSRC Industry Classification Guidelines, 2012).

3.5. Correlation and Multicollinearity Analysis

Table 6 reports the Pearson correlations for all variables. The analysis shows that mis_num is significantly correlated with the explanatory variable. Specifically, a statistically significant negative relationship is observed between insider CEOs and misconduct (r = −0.085, p < 0.01), suggesting that insider CEOs show a lower propensity for unethical conduct. The correlations are all below 0.5, suggesting no serious multicollinearity and supporting model robustness.

Table 6.

Pairwise correlations.

Variance inflation factor (VIF) diagnostics were also performed for models both without and with interaction terms (Table 7). The average VIFs were 1.35 (maximum value of 2.20) and 1.71 (maximum value of 4.79), respectively. Since all VIF values are under 5, multicollinearity is unlikely to be an issue.

Table 7.

Multicollinearity diagnostics (VIF).

4. Empirical Results

4.1. Baseline Results

The findings of the regression analysis are summarized in Table 8. Columns (1)–(3) focus primarily on the coefficient of the Insider CEO variable, which reflects how CEO insider status influences corporate misconduct. This stepwise regression design first establishes the baseline effect of insider CEOs on misconduct and then gradually introduces control variables and year and industry fixed effects to account for unobserved heterogeneity. Across all model specifications, the estimated coefficients of Insider CEO on misconduct remain consistently negative, decreasing in magnitude from −0.399 in the baseline model to −0.218 after adding controls and further to −0.182 when both industry and year fixed effects are included, with all results statistically significant at conventional levels. These results offer strong support for Hypothesis 1, implying that insider CEOs are vital in reducing instances of corporate misconduct.

Table 8.

NBR Results.

On the basis of the negative binomial regression in Column (3), the coefficient of −0.182 implies a 16.64% reduction (e−0.182 − 1) in the expected number of misconduct incidents. Concerning the control variables, the estimated signs and significance levels generally correspond to those identified in previous research (Yang and Zou 2025; Chen et al. 2024a).

4.2. Robustness Tests

We carry out robustness analyses to ensure the results are reliable. To assess the sensitivity of our findings, we employ a different measure of corporate misconduct. Based on the approach of Yang and Zou (2025), we develop a different proxy for corporate misconduct (mis_dumy). We subsequently re-evaluate the model through logit regression analysis. As illustrated in Panel A of Table 9, the coefficient associated with mis_dumy is significantly negative, thereby providing further support for Hypothesis 1. To measure corporate misconduct, we exclude leader-related violations, such as insider trading, stock price manipulation, and illegal stock trading (Chen et al. 2024b). Panel B of Table 9 reports the results for this adjusted measure (Excluding_leader), which shows a significantly negative coefficient. This robustness check confirms the consistency of our main hypothesis. Given that the dependent variable mis_num is a non-negative and potentially left-censored count variable, we further employ a Tobit model to address possible lower-limit censoring and to increase the robustness of our main results, as reported in Panel C of Table 9. To further assess the robustness of our findings, we also re-estimate the model with firm fixed effects while excluding the control variables. The results remain consistent with those of the main analysis (Panel D of Table 9).

Table 9.

Robustness checks.

Despite incorporating comprehensive control variables and year and industry fixed effects, endogeneity remains an important concern in our model. First, to mitigate the possible endogeneity arising from the non-random selection of insider CEOs, we implement the Heckman two-stage estimation approach. During the initial phase, the proportion of insider CEO appointments within the corresponding industry and region are utilized as instrumental variables. These variables are anticipated to influence decisions regarding CEO selection without having a direct effect on corporate misconduct. The inverse Mills ratio (IMR), obtained from the selection equation, is incorporated as an additional regressor in the subsequent negative binomial regression. As shown in Table 9, Panel E, the Insider CEO variable retains a statistically significant negative coefficient, which reaffirms the robustness of our primary findings against selection bias.

Insider CEO appointment may suffer from endogeneity because unobserved firm-level factors (e.g., corporate culture) could simultaneously affect the likelihood of internal CEO promotion and corporate misconduct. Reverse causality is also possible if firms adjust CEO selection strategies on the basis of perceived misconduct risk. To mitigate these concerns, we employ an instrumental variable (IV) estimation via a control function approach. Confucian culture shapes managerial norms and organizational values, affecting the likelihood of internal CEO promotion while plausibly having no direct effect on firm misconduct. We employed a control function approach using Confucian culture as the instrumental variable. Following Zhang et al. (2024), Confucian culture is proxied by the natural log of one plus the count of Confucian temples located within 100 km of a firm’s registered address and is used as the instrument. The results reported in Panel F of Table 9 align closely with the primary findings.

Finally, given that firms with insider and outsider CEOs may differ systematically in unobserved characteristics that influence misconduct, we adopt a propensity score matching (PSM) approach to reduce selection bias. Propensity scores are estimated via a logit model with the baseline control variables as covariates. We then implement 1:1 nearest-neighbor matching within a specified caliper to create a balanced matched sample. Based on this matched sample of 9349 firm-year observations, we re-estimate the baseline regression. As reported in Panel G of Table 9, the results remain qualitatively consistent with our main findings, confirming the robustness of the insider CEO effect. Table 10 reports the PSM results. Insider CEOs exhibit significantly lower misconduct than control firms do. In the unmatched sample, the difference was −0.473 (t = −8.70, p < 0.01), which slightly decreased to −0.426 after matching (t = −2.82, p < 0.01), indicating that the negative effect of insider CEOs on corporate misconduct remains robust after controlling for observable covariates.

Table 10.

Propensity score matching.

4.3. Moderating Effect Analysis

While prior research shows that insider CEOs can reduce misconduct through stronger organizational identification, reputation concerns, and lower information asymmetry. However, it is still unclear whether and how this effect depends on other governance mechanisms. Prior studies suggest that governance factors significantly shape misconduct (Braun and Mueller 2025; Eugster et al. 2024). Internal control and institutional investors, in particular, are key mechanisms constraining managerial opportunism (Bhat 2023; Thosuwanchot and Lee 2025). We therefore examine how governance mechanisms moderate the insider CEO–misconduct relationship.

4.3.1. Internal Control

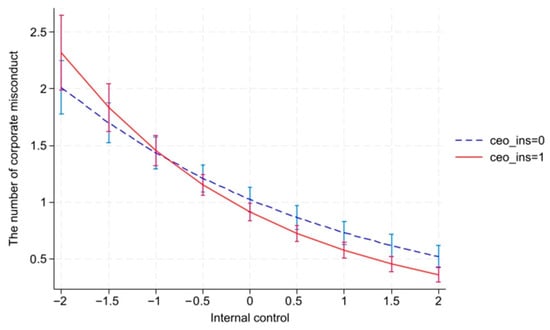

Building on agency theory, effective internal control mechanisms reduce information asymmetry and mitigate principal–agent conflicts by providing monitoring and behavioral constraints (Bhat 2023). Prior studies have shown that robust internal controls can curb managerial opportunism and lower the risk of fraud (Tian and Sun 2023). They also facilitate accurate risk identification and timely responses (Li et al. 2025). Although insider CEOs often demonstrate stronger organizational identification and reputational concerns, insufficient institutional constraints may still leave room for moral hazard. Thus, a strong internal control system can act as a complementary governance mechanism, reinforcing accountability and aligning managerial discretion with shareholders’ interests. Thus, the ability of insider CEOs to limit corporate misconduct is expected to be greater in firms with well-developed internal controls. Columns (1) and (3) of Table 11 show that the interaction term is positively significant, supporting this finding. Figure 1 further validates this effect.

Table 11.

NBR Results.

Figure 1.

The moderating effects of internal control on the relationship between insider CEOs and corporate misconduct.

4.3.2. Institutional Ownership

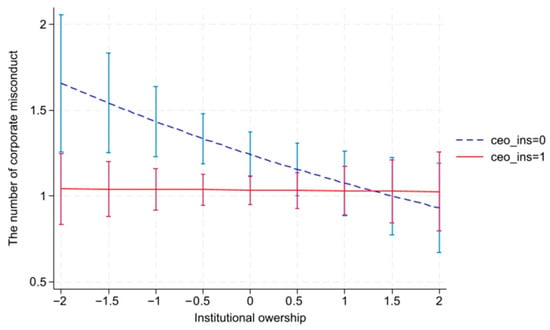

Insider CEOs’ ability to reduce misconduct may depend on the strength of external governance pressure (Gu 2022). Specifically, institutional investors—recognized as key external monitors—typically exert pressure for increased transparency, accountability, and short-term financial performance (Zaman et al. 2021; Eugster et al. 2024). While such oversight is generally effective in disciplining managerial behavior (Thosuwanchot and Lee 2025), its marginal effectiveness may diminish in the context of insider CEOs with strong organizational identification. Rather than reinforcing governance, strong institutional ownership may disrupt the internalized alignment between the CEO and organizational values (Chen et al. 2024a). This argument aligns with that of Boivie et al. (2011), who contend that under conditions of strong internal governance or self-regulating leadership, added layers of external pressure may become redundant. Therefore, we believe that the effectiveness of insider CEOs in curbing corporate misconduct diminishes with greater institutional ownership. Columns (2) and (3) of Table 11 indicate that the interaction terms remain positive and significant, and this result is further reinforced by Figure 2.

Figure 2.

The moderating effects of institutional ownership on the relationship between insider CEOs and corporate misconduct.

5. Additional Analyses

How insider CEOs shape different types of misconduct remain uncertain. As suggested by prior studies, the impact of governance mechanisms may differ depending on the type of misconduct (Chen et al. 2024a; Zaman et al. 2021). Accordingly, we obtain misconduct data from the CSMAR Corporate Violation Database. Based on this dataset, we construct three measures that capture the annual number of violations in distinct domains. First, disclosure-related misconduct (Vio_Dis_Num) refers to violations involving profit fabrication, asset misstatements, false or misleading disclosure, delayed disclosure, material omissions, other forms of inaccurate disclosure, and improper accounting treatment. Second, operational misconduct (Vio_Oper_Num) includes irregular capital contributions, unauthorized use of funds, asset appropriation, illegal guarantees, and other similar violations. Finally, CEO-related misconduct (Vio_Lead_Num) comprises violations such as insider trading, prohibited stock transactions, and stock price manipulation. Specifically, we re-estimate the negative binomial model employing three distinct measures of misconduct.

Through this approach, we can assess the consistency of our primary results across various forms of corporate misconduct. Table 12 shows that the coefficients for Insider CEOs remain consistently negative for all three categories of misconduct, suggesting that insider CEOs act as a key determinant in mitigating corporate misconducts. However, the impact may differ in scale among the various types of misconduct. These results further confirm the reliability of the main findings and suggest that insider CEOs exert a multidimensional governance effect.

Table 12.

Additional analyses.

6. Discussion

Corporate misconduct remains a pressing global challenge, eroding investor confidence and market stability worldwide (Zhao et al. 2024; Yang et al. 2025). While extensive research has been conducted, prior studies still lack a comprehensive understanding of its determinants and how governance mechanisms shape these outcomes (Eugster et al. 2024; Chen et al. 2024a). Our study addresses this gap by examining the role of CEO origin in corporate misconduct and situates its findings within the international academic discourse through comparative analysis with influential prior works.

Globally, researchers have adopted varied methodologies and sample constructions to explore similar questions, allowing for richer comparative insights. Our result that insider CEOs reduce misconduct is consistent with the findings of Kuang et al. (2014), whose study of U.S. public firms showed that externally hired CEOs are more likely to engage in accrual-based earnings management due to stronger career concerns and shorter expected job tenure. Such behavior significantly increases the risk of financial information distortion and potential future violations. This alignment underscores the relevance of CEO origin as a critical governance factor in mitigating corporate misconduct across different contexts. However, our result appears partially inconsistent with González et al. (2019), who reported that internal succession is not a significant predictor of price-fixing violations among cartel firms in the U.S. market. This discrepancy may be attributed to differences in sample composition and the specific types of misconduct examined. In particular, collusive practices such as price-fixing often involve entrenched organizational behaviors and industry-level dynamics that may diminish the influence of individual CEO characteristics. By contrast, the misconduct examined in our study and in Kuang et al. (2014) is more directly tied to individual executive decision-making. These comparisons show that differences in local rules and types of misconduct affect how governance works, reminding researchers to carefully consider specific conditions when studying corporate violations across countries.

Beyond the main effect, we explore governance mechanisms as boundary conditions. For internal governance, internal control systems were found to strengthen the negative insider CEO–misconduct relationship, as indicated by a significant interaction term. This finding extends prior work showing that strong internal controls reduce fraud risk and extend the global consensus on its importance (Bhat 2023; Okeke et al. 2021). It highlights how governance tools reinforce insiders’ identity-driven motives. The mechanism involves clear behavioral constraints, transparent reporting, and process accountability. These elements, coupled with insiders’ stronger reputation concerns, collectively limit opportunities and rationalizations for misconduct. For external governance, institutional investors serve as key monitors but also partially substitute for the compliance advantage of insider CEOs. Our results support the substitution hypothesis advanced by Chen et al. (2024a). It suggesting that institutional investors’ external oversight can replace some of the governance benefits brought by insider succession (Eugster et al. 2024; Thosuwanchot and Lee 2025).

7. Conclusions

7.1. Theoretical Implications

Prior research has not thoroughly explored the relationship between insider CEOs and corporate misconduct, with the majority of studies focusing on family CEOs (Yang 2010; Lei et al. 2025) or home background CEOs (Chen et al. 2024a; Lai et al. 2020; Cao et al. 2024). This study extends the theoretical perspective on the drivers of corporate misconduct by examining the role of insider CEOs in curbing corporate misconduct. Furthermore, this research deepens the theoretical understanding of how internal governance mechanisms influence firm behavior. Although existing work, including Tian and Sun (2023), has established that internal control systems can suppress misconduct, this study expands this discourse by introducing a conceptual model that emphasizes the reinforcing role of insider CEOs. Additionally, the framework offers new avenues for understanding how external governance mechanisms, such as institutional ownership, shape corporate behavior (Braun and Mueller 2025; Thosuwanchot and Lee 2025). The findings indicate that institutional ownership can partially substitute for internal CEOs in mitigating corporate misconduct, thereby broadening the theoretical scope of firm-level monitoring mechanisms in influencing compliance behavior.

7.2. Implications for Practice

This conclusion offers valuable insights for practice. For CEOs, internally promoted executives should leverage their organizational commitment and reputation concerns to foster compliant behavior. For boards of directors, CEO selection should balance the benefits of internal promotion with those of external hiring while reinforcing internal control systems to reduce the likelihood of corporate misconduct. For shareholders, attention to executive career paths is crucial, as internal promotions are generally associated with lower misconduct risk, thereby protecting shareholder interests. When institutional ownership is high, governance efforts should focus on balancing external monitoring and internal controls to avoid redundancy and efficiency losses.

7.3. Limitations and Future Research Directions

Our findings indicate a negative correlation between insider CEOs and corporate misconduct. However, we recognize some limitations in this study and outline directions for further work. First, our sample is restricted to firms listed on China’s non-financial A-share listed firms, which may constrain the applicability of the results to other contexts. Future studies could examine the relationship between insider CEO succession and corporate misconduct in different institutional settings, industries, or countries. Second, although we consider various forms of misconduct, subsequent studies could investigate the effects of insider CEOs on specific categories of misconducts. Finally, future work could further explore the role of additional governance mechanisms, particularly potential mediating or moderating factors, in shaping the impact of insider CEO succession on corporate misconduct.

Author Contributions

Conceptualization, Y.Z., R.b.G. and D.b.S.; methodology, Y.Z.; software, Y.Z.; validation, Y.Z.; formal analysis, Y.Z.; resources, Y.Z.; data curation, Y.Z.; writing—original draft preparation, Y.Z.; writing—review and editing, Y.Z., R.b.G. and D.b.S.; visualization, Y.Z., R.b.G. and D.b.S.; supervision, R.b.G. and D.b.S.; project administration, Y.Z., R.b.G. and D.b.S.; funding acquisition, Y.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to them being part of an ongoing Ph.D. dissertation.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Albert, Stuart, and David Allre Whetten. 1985. Organizational identity. Research in Organizational Behavior 7: 263–95. [Google Scholar]

- Ashforth, Blake Edward, and Fred Mael. 1989. Social identity theory and the organization. Academy of Management Review 14: 20–39. [Google Scholar] [CrossRef]

- Bamber, E. Michael, and Venkataraman M. Iyer. 2002. Big 5 auditors’ professional and organizational identification: Consistency or conflict? Auditing: A Journal of Practice & Theory 21: 21–38. [Google Scholar] [CrossRef]

- Bhat, Subrahmanya. 2023. The effectiveness of internal controls in preventing fraud and financial misconduct. Journal of Law and Sustainable Development 11: e1178. [Google Scholar] [CrossRef]

- Boivie, Steven, Donald Lange, Michael L. McDonald, and James D. Westphal. 2011. Me or we: The effects of CEO organizational identification on agency costs. Academy of Management Journal 54: 551–76. [Google Scholar] [CrossRef]

- Braun, Max C., and Simone Mueller. 2025. External corporate governance and corporate misconduct: A meta-analysis. Corporate Governance: An International Review 33: 832–49. [Google Scholar] [CrossRef]

- Brockman, Paul, Gopal Krishnan, Hye Seung Lee, and Jesus Manuel Salas. 2022. Implications of CEO succession origin and in-house experience for audit pricing. Journal of Accounting, Auditing & Finance 37: 173–204. [Google Scholar] [CrossRef]

- Brockman, Paul, Hye Seung Grace Lee, and Jesus Manuel Salas. 2016. Determinants of CEO compensation: Generalist–specialist versus insider–outsider attributes. Journal of Corporate Finance 39: 53–77. [Google Scholar] [CrossRef]

- Cao, Fei, Shuang Li, Hua Jian, and Yong Lu. 2024. Do local CEOs commit less fraud? Evidence from chinese listed firms. Applied Economics Letters 31: 849–53. [Google Scholar] [CrossRef]

- Chen, Jing, Junjie Hong, Weifeng Zhong, Chengqi Wang, and Xinghe Liu. 2024a. Doing right at home: Do hometown CEOs curb corporate misconduct? Technological Forecasting and Social Change 205: 123461. [Google Scholar] [CrossRef]

- Chen, Jing, Peiwen Hu, Shan Liu, and Xinghe Liu. 2024b. Too scared to make mistakes at home: CEO hometown identity and corporate risk-taking. Research in International Business and Finance 70: 102387. [Google Scholar] [CrossRef]

- Choi, Heeick, Khondkar Karim, and Anqi Tao. 2022. CEO origin and stock price crash risk: Insider versus outsider CEOs. Corporate Governance: An International Review 31: 105–26. [Google Scholar] [CrossRef]

- Connelly, Brian L., Wei Shi, H. Jack Walker, and Matt C. Hersel. 2022. Searching for a sign: CEO successor selection in the wake of corporate misconduct. Journal of Management 48: 1035–66. [Google Scholar] [CrossRef]

- Dadanlara, Hazel H., and Michael A. Abebeb. 2020. Female CEO leadership and the likelihood of corporate diversity misconduct: Evidence from S&P 500 firms. Journal of Business Research 118: 398–405. [Google Scholar] [CrossRef]

- Dong, Jinting, and Lianchao Yu. 2024. Impact of CEO foreign experience on corporate environmental violations: The role of enhanced environmental ethics and general competency. Economic Modelling 141: 106923. [Google Scholar] [CrossRef]

- Donker, Han, John Nofsinger, and Corey A. Shank. 2023. CEO narcissism and corporate misconduct. Economics Letters 228: 111178. [Google Scholar] [CrossRef]

- Efendia, Jap, Anup Srivastavab, and Edward P. Swansonb. 2007. Why do corporate managers misstate financial statements? The role of option compensation and other factors. Journal of Financial Economics 85: 667–708. [Google Scholar] [CrossRef]

- Eugster, Nicolas, Oskar Kowalewski, and Piotr Śpiewanowski. 2024. Internal governance mechanisms and corporate misconduct. International Review of Financial Analysis 92: 103109. [Google Scholar] [CrossRef]

- Fewer, Thomas, and Murat Tarakci. 2024. CEO political partisanship and corporate misconduct. Academy of Management Journal 68: amj.2022.909. [Google Scholar] [CrossRef]

- Gioia, Dennis A., Majken Schultz, and Kevin G. Corley. 2000. Organizational identity, image, and adaptive instability. Academy of Management Review 25: 63–81. [Google Scholar] [CrossRef]

- González, Tanja Artiga, Markus Schmid, and David Yermack. 2019. Does price fixing benefit corporate managers? Management Science 65: 4813–40. [Google Scholar] [CrossRef]

- Gu, Junjian. 2022. Do at home as romans do? CEO overseas experience and financial misconduct risk of emerging market firms. Research in International Business and Finance 60: 101624. [Google Scholar] [CrossRef]

- Guo, Lihong, and Zhibang Wang. 2021. CEOs Succession Source, Diversified Career Experience and Zombie Firms Governance. Business and Management Journal 43: 86–104. (In Chinese). [Google Scholar] [CrossRef]

- Haque, Md Reiazul Haque, Bobae Choi, Doowon Lee, and Sue Wright. 2022. Insider vs. outsider CEO and firm performance: Evidence from the COVID-19 pandemic. Finance Research Letters 47: 102609. [Google Scholar] [CrossRef] [PubMed]

- Harris, Jared, and Philip Bromiley. 2007. Incentives to cheat: The influence of executive compensation and firm performance on financial misrepresentation. Organization Science 18: 350–67. [Google Scholar] [CrossRef]

- Hogg, Michael A., Deborah J. Terry, and Katherine M. White. 1995. A tale of two theories: A critical comparison of identity theory with social identity theory. Social Psychology Quarterly 58: 255–69. [Google Scholar] [CrossRef]

- Huang, Guowei, Heiner Evanschitzky, and Hai-Anh Tran. 2025. The impact of influence tactics on brand message sharing. Journal of Business Research 199: 115497. [Google Scholar] [CrossRef]

- Islam, Md Ariful, Shahadat Hossain, Harjinder Singh, and Nigar Sultana. 2021. Outsider CEOs and corporate debt. International Review of Financial Analysis 74: 101660. [Google Scholar] [CrossRef]

- Jensen, Michael Cole, and William Henry Meckling. 2019. Theory of the firm: Managerial behavior, agency costs and ownership structure. In Corporate Governance. London: Gower, pp. 77–132. [Google Scholar]

- Jin, Yuxi. 2024. Management risk appetite, internal control and corporate financialization. Finance Research Letters 63: 105393. [Google Scholar] [CrossRef]

- Jongjaroenkamol, Prasart, and Volker Laux. 2017. Insider versus outsider CEOs, executive compensation, and accounting manipulation. Journal of Accounting and Economics 63: 253–61. [Google Scholar] [CrossRef]

- Kuang, Yu Flora, Bo Qin, and Jacco L. Wielhouwer. 2014. CEO origin and accrual-based earnings management. Accounting Horizons 28: 605–26. [Google Scholar] [CrossRef]

- Lai, Shufang, Zengquan Li, and Yong George Yang. 2020. East, West, Home’s Best: Do Local CEOs Behave Less Myopically? The Accounting Review 95: 227–55. [Google Scholar] [CrossRef]

- Lei, Zicheng, Dimitris Petmezas, P. Raghavendra Rau, and Chen Yang. 2025. Born to behave: Home CEOs and financial misconduct. Review of Accounting Studies 30: 1309–54. [Google Scholar] [CrossRef]

- Li, Yu, Tianpeng Bai, Ya Sha, and Zitong Xu. 2025. Concentration of supply chain, internal control, and corporate risk-taking. International Review of Financial Analysis 103: 104261. [Google Scholar] [CrossRef]

- Liu, Yang, Han Zhang, and Fukang Zhang. 2023. CEO’s poverty imprints and corporate financial fraud: Evidence from China. Pacific-Basin Finance Journal 81: 102128. [Google Scholar] [CrossRef]

- Mei, Mao, Xianyue Gao, and Wang Min. 2023. The power of belief: CEO political belief and corporate violations. International Journal of Frontiers in Sociology 5: 44–60. [Google Scholar] [CrossRef]

- Okeke, Stella Ehis, Stephanie Ifunanya Offor, and Onyekachi David Chukwunwike. 2021. Internal control: Its role in the reduction of fraud and professional misconduct among SMEs. Asian Journal of Economics, Business and Accounting 21: 57–66. [Google Scholar] [CrossRef]

- Oradi, Javad. 2021. CEO succession origin, audit report lag, and audit fees: Evidence from Iran. Journal of International Accounting, Auditing and Taxation 45: 100414. [Google Scholar] [CrossRef]

- Oradi, Javad, Reza Hesarzadeh, Sahar E-Vahdati, and Muhammad Nadeem. 2024. CEO succession origin and annual reports readability. The British Accounting Review 56: 101384. [Google Scholar] [CrossRef]

- Ren, Liuyang, Xi Zhong, and Liangyong Wan. 2022. Missing analyst forecasts and corporate fraud: Evidence from China. Journal of Business Ethics 181: 171–94. [Google Scholar] [CrossRef]

- Shi, Wei, Brian L. Connelly, and Robert E. Hoskisson. 2017. External corporate governance and financial fraud: Cognitive evaluation theory insights on agency theory prescriptions. Strategic Management Journal 38: 1268–86. [Google Scholar] [CrossRef]

- Sluss, David M., and Blake E. Ashforth. 2007. Relational identity and identification: Defining ourselves through work relationships. Academy of Management Review 32: 9–32. [Google Scholar] [CrossRef]

- Sun, Weizhang, Xue Zhizhong, Wang Yaping, Guo Shanshan, and Han Lanlan. 2023. CEO Succession Source, Survival Environment Heterogeneity and Corporate Innovation Input. Science and Technology Management Research 43: 136–45. (In Chinese). [Google Scholar] [CrossRef]

- Tajfel, Henri. 1978. Differentiation Between Social Groups: Studies in the Social Psychology of Intergroup Relations. Cambridge: Academic Press. [Google Scholar]

- Thosuwanchot, Nongnapat, and Min Suk Lee. 2025. Corporate misconduct and corporate social responsibility: The roles of CEO incentives and institutional ownership. Society and Business Review 20: 176–200. [Google Scholar] [CrossRef]

- Tian, Junmin, and Hui Sun. 2023. Corporate financialization, internal control and financial fraud. Finance Research Letters 56: 104046. [Google Scholar] [CrossRef]

- Van Dick, Rolf, Oliver Christ, Jost Stellmacher, Ulrich Wagner, Oliver Ahlswede, Cornelia Grubba, Martin Hauptmeier, Corinna Höhfeld, Kai Moltzen, and Patrick A. Tissington. 2004. Should I stay or should I go? Explaining turnover intentions with organizational identification and job satisfaction. British Journal of Management 15: 351–60. [Google Scholar] [CrossRef]

- Wang, Tao, Yongqing Ye, Jun Xia, and Xiaoyang Deng. 2023. Nonlocal CEOS and corporate financial fraud: Evidence from chinese listed firms. Available at SSRN 4474025. Available online: https://ssrn.com/abstract=4474025 (accessed on 10 September 2025).

- Wu, Yaqian, Jiyuan Li, and Chengfang Wang. 2024. Subdue One’ s Self and Return to Propriety: Local Chairman and Firm Violation. Accounting Research 4: 63–79. (In Chinese). [Google Scholar]

- Yang, Mei-Ling. 2010. The impact of controlling families and family CEOs on earnings management. Family Business Review 23: 266–79. [Google Scholar] [CrossRef]

- Yang, Shoufu, Dongmin Kong, and Jiaqiong He. 2025. Social identity or social capital: Local CEOs and corporate ESG performance. International Review of Economics & Finance 98: 103926. [Google Scholar] [CrossRef]

- Yang, Yang, and Mingyang Zou. 2025. The impact of CEO contract duration on corporate misconduct. Journal of Business Research 188: 115110. [Google Scholar] [CrossRef]

- Zaman, Rashid, Nader Atawnah, Ghasan A. Baghdadi, and Jia Liu. 2021. Fiduciary duty or loyalty? Evidence from co-opted boards and corporate misconduct. Journal of Corporate Finance 70: 102066. [Google Scholar] [CrossRef]

- Zhang, Ning, Lan Bo, and Xuanqiao Wang. 2024. Confucian culture and corporate default risk: Assessing the governance influence of traditional culture. International Review of Economics & Finance 94: 103378. [Google Scholar] [CrossRef]

- Zhao, Qifeng, Dongmin Kong, and Qianfeng Luo. 2024. Scientific disclosure and corporate misconduct. Pacific-Basin Finance Journal 88: 102547. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).