Abstract

We study a class of fractional stochastic differential equations (FSDEs) with coefficients that may not satisfy the linear growth condition and non-Lipschitz diffusion coefficient. Using the Lamperti transform, we obtain conditions for positivity of solutions of such equations. We show that the trajectories of the fractional CKLS model with are not necessarily positive. We obtain the almost sure convergence rate of the backward Euler approximation scheme for solutions of the considered SDEs. We also obtain a strongly consistent and asymptotically normal estimator of the Hurst index for positive solutions of FSDEs.

Keywords:

fractional Brownian motion; backward Euler approximation; fractional Ait–Sahalia model; fractional CKLS model; Hurst index MSC:

60H10; 60G22

1. Introduction

The models defined by stochastic differential equations (SDEs)

where B is a standard Brownian motion, g is a continuous function on , is nonrandom initial value, and is a constant, include several well-known models such as Chan–Karolyi–Longstaff–Sanders (CKLS), Cox–Ingersoll–Ross (CIR), Ait–Sahalia (AS), Cox–Ingersoll–Ross variable-rate (CIR VR), and others used in many financial applications [1,2,3,4,5,6]. The positivity is a desirable property for many financial models, such as option pricing, stochastic volatility, and interest rate models. Thus, it is important to find conditions under which the solutions to Equation (1) are positive. Preservation of positivity is a desirable modelling property, and in many cases the non-negativity of numerical approximations is needed for the scheme to be well defined. Therefore, many numerical methods have been developed to preserve the positivity of the approximate solution in the case of the positive true solution.

For an SDE to have a unique global solution (i.e., with no explosion in a finite time) for any given initial value, the coefficients of the equation are in general required to satisfy the linear growth and local Lipschitz conditions. These conditions are not satisfied in the models mentioned. The existence of positive solutions of SDEs corresponding to these models and implicit numerical schemes preserving the positivity were studied in [1,2,3,4,5,6].

An important research area in financial mathematics is the long memory phenomenon in financial data. Hence, since fractional Brownian motion (fBm) introduces a memory element, there is much attention in recent years to models with fBm. Consider the FSDEs

with . The stochastic integral in Equation (2) is a pathwise Riemann–Stieltjes integral, but SDE (2) cannot be treated directly since the functions , , , do not satisfy the usual Lipschitz conditions.

For fractional CIR, CKLS, and AS models, the existence of a unique positive solution of Equation (2) was obtained in [7,8,9,10,11,12,13,14]. The proof can be provided in several ways. One approach is based on the consideration of the conditions under which the equation

admits a unique positive solution, where is a locally Lipschitz function with respect to the space variable . This approach was used in [7,8,9,11,14], where the inverse Lamperti transform was used to obtain conditions under which Equation (1) admits a unique positive solution for fractional CIR, CKLS, and AS models. Unfortunately, we cannot apply the proof of positivity of the solution of (3) given in [14] (e.g., it is not applicable to the AS model).

Marie [10] used the rough-path approach to find the existence of a unique positive solution of the fractional CKLS model.

A simulation of the fractional CIR process was given in [11] by using the Euler approximation. In [8,14] an almost sure strongly convergent approximation of the considered SDE solution is constructed using the backward Euler scheme, which is positivity preserving.

In this paper, we consider the SDE

where is a constant. This type of equation is obtained after the Lamperti transformation of the FSDE (2). The purpose of the paper is finding sufficiently simple conditions when the solution of (4) for and is positive. Moreover, using the backward Euler scheme, which preserves the positivity for (4), we obtain an almost sure convergence rate for X. Since the problem of the statistical estimation of the long-memory parameter H is of great importance, we construct an estimate of the Hurst index in the same way as for the diffusion coefficient satisfying the usual Lipschitz conditions (see [15,16]). This can be done since the solution of Equation (2) is positive. More results on parameter estimations for the FSDEs can be found in the book [17].

The paper is organized as follows. In Section 2, we present the main results of the paper. In Section 3, we prove the main auxiliary result on the existence and uniqueness of a positive solution for SDE (4). Section 4 contains proofs of the main theorems. In Section 5, we consider fractional CKLS and AS models as examples. Finally, in Appendix A, we recall the Love–Young inequality, the chain rule for Hölder-continuous functions, and some results for fBm.

2. Main Results

We are interested in conditions under which the SDE

has a unique positive solution. The stochastic integral in Equation (5) is a pathwise Riemann–Stieltjes integral.

To state our main results, we assume that the following conditions on the function f in (5) are satisfied:

f is a locally Lipschitz on ;

There exist constants and such that

for all sufficiently small ;

The function satisfies the one-sided Lipschitz condition, that is, there exists a constant such that

for all .

Theorem 1.

If a function f satisfies conditions –, then Equation (5) is well defined and has a unique positive solution of order for , where denotes the space of Hölder-continuous functions of order on .

Consider the SDE

A strong approximation of the SDE that has locally Lipschitz drift for is constructed by applying the backward Euler scheme in [14] (see also [1] for ). By using the backward Euler scheme, which preserves positivity for (6), we obtain an almost sure convergence rate for X.

A sequence of uniform partitions of the interval we denote by and let and , . We introduce the backward Euler approximation scheme for Y

The following assumption is needed for the positivity of the backward Euler approximation scheme to be preserved:

Let on , where the function satisfies condition . There exists such that and for .

Remark 1.

Please note that under condition the function is strictly monotone on for small h. This follows from and the inequality

where . Thus, from the condition it follows that for each , the equation has a unique positive solution for . As a result, we see that the positivity is preserved by the backward Euler approximation scheme.

For the simplicity of notation, we introduce the symbol . Let be a sequence of r.v.s, let be an a.s. nonnegative r.v., and let be a vanishing sequence. Then means that for all n. In particular, means that the sequence is a.s. bounded.

Theorem 2.

Suppose that the function f in (5) is continuously differentiable on and satisfies condition and that there exists a constant such that the derivative is bounded above by K, that is, . If the sequence of uniform partitions π of the interval is such that , then for all and ,

where

For positive solutions of Equation (5), we construct a strongly consistent and asymptotically normal estimator of the Hurst parameter H from discrete observations of a single sample path.

For a real-valued process , we define the second order increments along uniform partitions as

Theorem 3.

Let X be a unique positive solution of SDE (5) with . Then

and

with known variance defined in Appendix, where

3. Auxiliary Results

As mentioned in Introduction, we are interested in conditions under which the SDE (6) has a unique positive solution.

Proposition 1.

Suppose that a function f satisfies conditions –. If , , and , then there exists a unique positive solution of Equation (6) such that , , where and .

We easily to see that the same proof as in Proposition 1 [8] remains valid for Proposition 1.

Applying Proposition 1 to the fractional AS model and Heston-3/2 volatility model, we obtain that the trajectories of these models are positive (see Section 5). Our proof scheme gives no answer about the behavior of the trajectories of the CKLS model

with the initial value and deterministic constants , , and .

Now we will explain why we cannot give an answer about the behavior of the trajectories of the CKLS model. Consider the SDE

Suppose that the solution of the SDE (11) is positive. Then by applying the chain rule (see Appendix A.2) and the inverse Lamperti transform we can prove that X is a positive solution of (10).

Unfortunately, it is easy to see that the function does not satisfy condition . So, we cannot apply Proposition 1 and say anything about the positivity of the solution of (11).

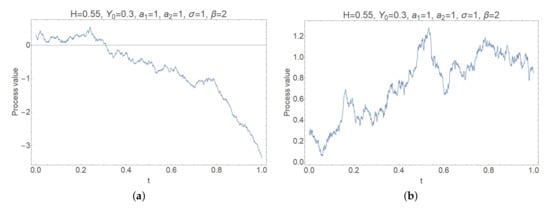

Computer modelling using Wolfram Mathematica shows that the trajectories of the process Y may have negative values for (see Figure 1).

Figure 1.

Trajectory of Y: (a) with negative values. (b) with positive values.

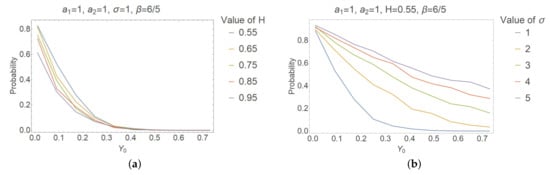

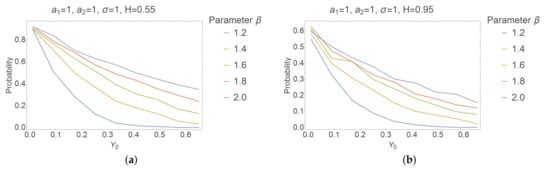

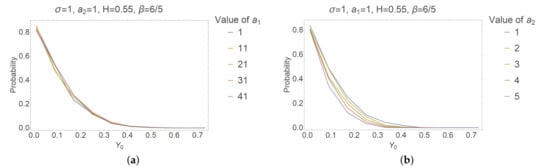

To investigate the probability of reaching the negative values by the process Y when , we simulate the “exact” solution by using the backward Euler approximation scheme for step size and repeat this process times counting the trajectories with negative values. We observe that the solution has a higher probability to reach the negative values for small initial values and that for large enough values of , this probability tends to zero. Additionally, the probability increases for greater values of the parameters (see Figure 2b and Figure 3) and decreases for greater values of the parameters (see Figure 2a and Figure 4b). The influence of on the probability (see Figure 4a) is not noticeable in comparison with other parameters.

Figure 2.

Probability that the trajectories have negative values: (a) Dependence of probability on for different H. (b) Dependence of probability on for different .

Figure 3.

Probability that the trajectories have negative values: (a) Dependence of probability on when . (b) Dependence of probability on when .

Figure 4.

Probability that the trajectories have negative values: (a) Dependence of probability on . (b) Dependence of probability on .

Thus, we can only state that Equation (10) has a solution until the moment at which Y becomes zero. On the other hand, we do know that the CKLS model driven by a standard Brownian motion (see [6]) with and the fractional CKLS model with (see [8]) have positive solutions.

4. Proofs

The main tool for proving Theorem 1 is Proposition 1.

Proof of Theorem 1.

Set and , where Y is a solution of Equation (6). Since the process Y is positive and continuous, for , we get

Thus, is a Hölder-continuous process up to the order on . The process is the solution of Equation (5). Indeed, by chain rule we obtain

□

Proof of Theorem 2.

We repeat the outlines of the proof of Theorem 3 in [8]. Please note that under the conditions of the theorem, conditions – are satisfied. Thus, there exists a unique positive solution of SDE (6).

By the definition of , for any , we have

Since the process Y is positive and continuous, from (A5) it follows that

and the asymptotic behavior of the first two terms is . Thus, it remains to obtain the asymptotics of the last two terms.

Please note that

where , . Then

where

Please note that for since , where . Applying the inequality , , we get

Furthermore,

This finishes the proof of (8).

It remains to prove (9). We will use the well-known inequalities

Since , we have

Please note that

Thus

From (8) and the finiteness of we have

This finishes the proof of (9). □

Proof of Theorem 3.

Repeats the proof of Theorem 2 in [8]. It is based on the following lemma. □

Lemma 1.

Assume that the conditions of Theorem 1 are satisfied and . Then

where .

Proof.

Let . Then can we write the second-order increments of the process X as follows:

Applying inequality (12), condition , and the fact that , , we obtain

Thus

Moreover, by the Love–Young inequality (see Appendix A.1), (12), and the Hölder continuity of we get

where a.s. Thus, the lemma is proved. □

5. Examples

Example 1.

Ait–Sahalia model. The Ait–Sahalia-type SDE has the form

with the initial value and , where , , and deterministic constants and .

By using the Lamperti transformation we get

where and

The function f is continuously differentiable on . Condition is satisfied since

with , .

Now we verify condition . Please note that

Since the derivative is continuous on , , and , there is a constant K such that for all .

Now the mean value theorem implies

where , . Thus, Equation (14) has a unique positive solution on .

Let us verify condition . Please note that

is continuous on . It is clear that for any and

Since the function satisfies condition , condition is satisfied as well. Therefore, the conditions of Theorem 2 are satisfied.

Example 2.

Heston-3/2 volatility mode. Consider the SDE

with the initial value , where , , and deterministic constants . If , then we call the SDE (16) the fractional Heston- volatility model.

By using the Lamperti transformation we get

where and

The function f is continuously differentiable on . Condition is satisfied since

with , . Now we verify condition . Please note that

Applying inequality (15), we obtain condition . Thus, Equation (16) has a unique positive solution on . From the obtained result it follows that the Heston- volatility model has a unique positive solution on .

Let us verify condition . Please note that

is continuous on . It is clear that for any and

Since the function satisfies condition condition is satisfied as well. Thus the conditions of Theorem 2 are satisfied.

6. Conclusions

In this paper, we gave sufficiently simple conditions under which the solution of SDE

has a unique positive solution. By applying the chain rule and the inverse Lamperti transform , we proved that X is a positive solution of equation

under certain conditions on the function f.

Equation (18) describes models, such as fractional Ait–Sahalia and Heston- volatility, in which the positivity is important for many financial applications. Usually, we are not aware of an explicit expression for the solution, and therefore we considered computable discrete-time approximations, which can be used in Monte Carlo simulations. To approximate the solution of Equation (17), we used an implicit Euler scheme, which preserves the positivity of the numerical scheme. By applying the inverse Lamperti transform to Y we obtained an approximation scheme for the original SDE (18). Moreover, we obtained the almost sure convergence rate for both processes.

Not all models defined by the stochastic differential Equation (18) necessarily have positive trajectories. The paths of the fractional CKLS model are not necessarily positive, in contrast to the classical CKLS model driven by the standard Brownian motion with or fractional CKLS model with .

The statistical estimation of the long-memory parameter H is of great importance, therefore, we constructed its estimate. For the first time, we obtained an estimate of the Hurst index for the solution of Equation (18). Finally, the positivity of solution of (18) allowed us to construct an estimate of the Hurst index, which is not only strongly consistent, but also asymptotically normal.

Author Contributions

Supervision, K.K.; software, A.M.; writing, original draft preparation, K.K. and A.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The author declares no conflict of interest.

Appendix A

Appendix A.1. Love–Young Inequality

For any , denotes the space of Hölder-continuous functions of order on . Let and with and

Love–Young inequality states that for any ,

with , where is the Riemann zeta function, i.e., ([17], p. 10).

Appendix A.2. Chain Rule

Let be a function such that for each , , . Let be a differentiable function with locally Lipschitz partial derivatives , . Then the functions are Riemann–Stieltjes integrable with respect to , and

(see [18]).

Appendix B. Several Results on fBm

Recall that fBm with the Hurst index is a real-valued continuous centered Gaussian process with covariance

For , fBm is a Brownian motion. To consider the strong consistency and asymptotic normality of the given estimators, we need several facts regarding .

Limit results (see [17,19]). Let

Then (see [17], pp. 46, 52, 58, 66)

and

where is a Gaussian vector with

Moreover,

and

with .

Hölder-continuity of. It is known that almost all sample paths of an fBm are locally Hölder of order strictly less than . To be more precise, for all , there exists a nonnegative random variable such that for all , and

for all , where (see [17], p. 4).

Sample modulus for. The function for is a sample modulus for , i.e., for almost all , there is such that

(see [20], p. 48).

References

- Alfonsi, A. Strong order one convergence of a drift implicit Euler scheme: Application to the CIR process. Stat. Probab. Lett. 2013, 83, 602–607. [Google Scholar] [CrossRef]

- Cheng, S.R. Highly nonlinear model in finance and convergence of Monte Carlo simulations. J. Math. Anal. Appl. 2009, 353, 531–543. [Google Scholar] [CrossRef]

- Dung, N.T. Tail probabilities of solutions to a generalized Ait-Sahalia interest rate model. Stat. Probab. Lett. 2016, 112, 98–104. [Google Scholar] [CrossRef]

- Neuenkirch, A.; Szpruch, L. First order strong approximations of scalar SDEs defined in a domain. Numer. Math. 2014, 128, 103–136. [Google Scholar] [CrossRef]

- Szpruch, L.; Mao, X.; Higham, D.J.; Pan, J. Numerical simulation of a strongly nonlinear Ait-Sahalia-type interest rate model. Bit Numer. Math. 2011, 51, 405–425. [Google Scholar] [CrossRef]

- Wu, F.; Mao, X.; Chen, K. A highly sensitive mean-reverting process in finance and the Euler–Maruyama approximations. J. Math. Anal. Appl. 2008, 348, 540–554. [Google Scholar] [CrossRef]

- Hu, Y.; Nualart, D.; Song, X. A singular stochastic differential equation driven by fractional Brownian motion. Stat. Probab. Lett. 2008, 78, 2075–2085. [Google Scholar] [CrossRef]

- Kubilius, K. Estimation of the Hurst index of the solutions of fractional SDE with locally Lipschitz drift. Nonlinear Anal. Model. Control 2020, 25, 1059–1078. [Google Scholar] [CrossRef]

- Lépinette, E.; Mehrdoust, F. A fractional version of the Heston model with Hurst parameter H∈(1/2,1). Dyn. Syst. Appl. 2017, 26, 535–548. [Google Scholar]

- Marie, N. A generalized mean-reverting equation and applications. ESAIM Probab. Stat. 2014, 18, 799–828. [Google Scholar] [CrossRef]

- Mishura, Y.; Yurchenko-Tytarenko, A. Fractional Cox–Ingersoll–Ross process with non-zero “mean”. Mod. Stoch. Theory Appl. 2018, 5, 99–111. [Google Scholar] [CrossRef]

- Mishura, Y.; Piterbarg, V.; Ralchenko, K.; Yurchenko-Tytarenko, A. Stochastic representation and pathwise properties of fractional Cox–Ingersoll–Ross process. Theor. Probab. Math. Statist. 2018, 97, 167–182. [Google Scholar] [CrossRef]

- Mishura, Y.; Yurchenko-Tytarenko, A. Fractional Cox–Ingersoll–Ross process with small Hurst indices. Mod. Stochast. Theory Appl. 2019, 6, 13–39. [Google Scholar] [CrossRef]

- Zhang, S.-Q.; Yuan, C. Stochastic differential equations driven by fractional Brownian motion with locally Lipschitz drift and their Euler approximation. arXiv 2018, arXiv:1812.11382. [Google Scholar]

- Kubilius, K.; Skorniakov, V.; Melichov, D. Estimation of parameters of SDE driven by fractional Brownian motion with polynomial drift. J. Stat. Comput. Simul. 2016, 86, 1954–1969. [Google Scholar] [CrossRef]

- Kubilius, K.; Skorniakov, V. On some estimators of the Hurst index of the solution of SDE driven by a fractional Brownian motion. Stat. Probab. Lett. 2016, 109, 159–167. [Google Scholar] [CrossRef]

- Kubilius, K.; Mishura, Y.; Ralchenko, K. Parameter Estimation in Fractional Diffusion Models; Bocconi & Springer Series; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar]

- Salopek, D.M. Inclusion of Fractional Brownian Motion to Model Stock Price Fluctuations. Ph.D. Thesis, Carleton University, Ottawa, ON, Canada, 1997. Available online: https://www.bac-lac.gc.ca/eng/services/theses/Pages/item.aspx?idNumber=46561235 (accessed on 23 November 2020).

- Kubilius, K. CLT for quadratic variation of Gaussian processes and its application to the estimation of the Orey index. Stat. Probab. Lett. 2020, 165, 108845. [Google Scholar] [CrossRef]

- Dudley, R.M.; Norvaisa, R. An Introduction to p-Variation and Young Integrals; Lecture Notes No. 1; Aarhus University: Aarhus, Denmark, 1998. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).