Abstract

We propose a stochastic model to develop a partial integro-differential equation (PIDE) for pricing and pricing expression for fixed type single Barrier options based on the Itô-Lévy calculus with the help of Mellin transform. The stock price is driven by a class of infinite activity Lévy processes leading to the market inherently incomplete, and dynamic hedging is no longer risk free. We first develop a PIDE for fixed type Barrier options, and apply the Mellin transform to derive a pricing expression. Our main contribution is to develop a PIDE with its closed form pricing expression for the contract. The procedure is easy to implement for all class of Lévy processes numerically. Finally, the algorithm for computing numerically is presented with results for a set of Lévy processes.

1. Introduction

Barrier options are derivatives with a pay-off that depends on whether a reference entity has crossed a certain boundary. Common examples are the knock-in and knock-out call and put options that are activated or deactivated when the underlying crosses a specified Barrier-level. Barrier and Barrier-type options belong to the most widely traded exotic options in the financial markets.

A class of models that has been shown to be capable of generating a good fit of observed call and put option price data is formed by the infinite activity Lévy models, such as normal inverse Gaussian, CGMY and Meixner. This class of models has been extensively studied and we refer for background and further references to the book by [1]. In this paper, we consider Barrier options driven by Lévy processes with infinite activity. This class contains many of the Lévy models used in financial modelling as the fore-mentioned ones.

Several approaches have been proposed during the last few years. The calculation of first-passage distributions and Barrier option prices in (specific) Lévy models has been investigated in a number of papers. In [2], the authors proposed a Laplace transformed based approach to compute the prices and greeks of Barrier options for a class of Lévy process with Wiener-Hopf factorisation. The authors of [3] calculated prices and deltas of double Barrier options under the Black-Scholes model. For spectrally one-sided Lévy processes with a Gaussian component [4] derived a method to evaluate first-passage distributions. The authors of [5,6,7] followed a transform approach to obtain Barrier prices for a jump-diffusion with exponential jumps. In the setting of infinite activity Lévy processes with jumps in two directions Cont and [8] investigated discretisation of the associated integro-differential equations. In [9], the author employed Fourier methods to investigate Barrier option prices for Lévy processes of regular exponential type. These approaches are based on exponential Lévy process with a risk neutral measure considering a complete market, involving extremely complex techniques and applicable for a specific class of Lévy process.

Summarizing all the issues in the previous work, we find a few challenges in pricing the Barrier option under Lévy processes. First of all, the Lévy market is incomplete and more than one measure exists leading to multiple prices for a single contract and hedging is not possible. Therefore, the pricing model requires the selection of the correct measure from the market and finding market price of risk with the help of market price available by calibration method with better goodness of fit. Secondly, as the distribution of the underlying stock prices is unknown, in general no explicit analytical expression is available. Finally, it is also difficult to derive a closed form expression of the contract. Our model is proposed to take care of all the challenges. The approach first developed a PIDE for pricing and solved it using Mellin transform and its inverse. In [10], the author proposed a similar method for Asian options of arithmetic type but used Fourier transform instead of Mellin transform. The advantage of our model is that it has a closed form expression of the Mellin transform applicable for any class of Lévy processes and the standard inverse Mellin transform can be applied to construct prices. The Mellin transform based method for option pricing was proposed earlier by [11,12,13] for pricing American options.

The organization of different sections in this paper is as follows. Section 2 recalls some basic facts about exponential Lévy processes and provides a model used in this paper. Section 3 derives the partial integro-differential equation (PIDE) for the option pricing of Barrier options. It also provides a pricing formula in terms of the inverse Mellin transform. Numerical results are provided in Section 4 and a brief conclusion is provided in Section 5.

2. Model with Lévy Processes

We denote the stock-price of the underlying asset at a given time t by . It is well known that contrary to the Brownian process the log-return of stock-price (that is, ) is neither Gaussian, nor homogeneous and it does not have independent increments (see, e.g., [14]). Thus, we study the return considering the stock price as the exponential Lévy process described by the following equations:

with , where N is the jump measure of Z and is the Brownian motion. The Lévy triplet for Z is with respect to some measure .

For convenience, we assume for the rest of the paper. The parameters σ, and μ are called the volatility and drift of stock price respectively. We assume that has finite moments , for all positive integer p (see [15]). The examples of such a class of Lévy processes are the infinite activity processes like VG, NIG, CGMY, Meixner processes. Some of these processes are described in Appendix B. Details of these processes are also described in [1].

We briefly describe the procedure of finding the equivalent martingale measure. All the details are provided in the Appendix A. To find an equivalent martingale measure for the stock-price process , let Y be a Lévy type stochastic integral of the form

where and for each (where is defined in the Appendix A). The equivalent martingale measure , on a fixed time interval , satisfies , for .

Clearly, the Lévy triplet of Z with respect to in terms of the Lévy triplet with respect to is given by

We make the following assumption related to the nature of the function .

Assumption 1.

.

Therefore, with respect to the equivalent martingale measure , the dynamics of is given by

It is clear from Equations (2) and (A3) that there are non-unique ways (depending on various choices of and ) of selecting density function Y. The choice for the equivalent martingale measure in this paper will be the Föllmer-Schweizer minimal measure which minimizes the quadratic risk of the associated cost function. In this procedure there is an unique measure for which , so that

for some adapted process which satisfies

for and . We define

Then we obtain the following expression from Equation (A3).

We note that given r and the Lévy triplet of Z with respect to measure , i.e., , Equation (4) gives a constant function , for . Thus, is also constant. On the other hand, is a function of x alone and it is given by . Consequently, the Lévy density . The derived parameter is also known as the market price of risk for the Lévy market.

In [16] it is shown that this method coincides with the general procedure described by Föllmer and Schweitzer (see [17]) which works by constructing a replicating portfolio of value and discounting it to obtain . If we now define the cumulative cost , then minimizes the risk

3. Pricing Barrier Options

In this section, we present two main theorems related to single Barrier options. Let S be the stock price and B is a fixed single Barrier. In general, there are four different types of Barrier options according to the payoff functions. Let T be the time of expiry of the option. For fixed strike (K) call and put Up-And-Out Barrier options payoffs are given by and respectively. For fixed strike call and put Down-And-Out Barrier options the payoffs are given by and respectively. In this section, we develop a technique for pricing fixed strike call for both Up-And-Out and Down-And-Out options. Option pricing for other type options can be done by a very similar procedure. We first show that the price of the both Up-And-Out and Down-And-Out Barrier option is given by a PIDE.

For the convenience of notation, in this section, we write simply W and in lieu of and respectively. Since in this section we mostly work with the equivalent martingale measure this abuse of notation will not create any confusion. However, we will keep the notation for the Lévy density with respect to and as the same as in the previous section, viz. ν and respectively. For the Föllmer Schweizer minimal equivalent martingale measure ,

where is given by Equation (4). Also, assume the Lévy density corresponding to Lévy measures and ν are denoted as and respectively. Thus for the Föllmer Schweizer case

Theorem 1.

The price of Up-And-Out and Down-And-Out Barrier call option , where the stock-price dynamics is described by Equation (1), is given by

with final condition

Proof.

Under an equivalent martingale measure , the Up-And-Out and Down-And-Out Barrier call option can be written as

where

From the dynamics of the stock price under is given by Equation (3). We define the continuous part and jump of by

and

respectively.

The continuous part of S(t) is defined to be

Now has a smooth density with derivative vanishing at infinity and so is a smooth function of S and we can apply I formula.Let us consider and and if we can apply I’s formula to this function,

where

and

Clearly, is a Martingale. By construction and both are martingales, then is also a martingale. But is a continuous process with finite variation. Thgerefore, we must have almost surely. Thus, we obtain the partial integro-differential equation (PIDE),

for and and as with the boundary conditions are

| Up and Out Barrier Option | Down and Out Barrier Option | ☐ | |

Theorem 2.

The Mellin transform of the price of Barrier option is given by

with

and

with

Proof.

Let us assume that , then

Using above we have as follows,

with the following boundary conditions

Now, the Mellin transform of the PIDE, gives us,

At boundary condition , , and we can write

where

and

Mellin Tranform of the boundary condition Up-and-Out Barrier option

and for Down-and-Out Barrier option is

| (1) Up and Out Barrier Option | (2) Down and Out Barrier Option |

Hence, we can derive the expression for Call price for the both type of options described in Equation (10). ☐

Theorem 3.

The Mellin transform of the sensitivities of Barrier option is given by

with

and

with

Proof.

Since

and

By differentiating, we will have the desired result. ☐

4. Numerical Results

As the Lévy market is incomplete, there exists more than one or mathematically infinite number of equivalent martingale measures. We describe a method to determine an unique Lévy measure ν from the market data by using non-parametric calibration. Given observed market prices of options, we follow the non-parametric approach for identification of the Lévy measure.

Let us consider the (observed) market prices , , for a set of liquid put options. The objective is to find constants ν such that

where is the option price computed for parameters ν. The popular approach to non-linear least squares is

The usual formulations of the inverse problems via nonlinear least squares are ill-posed and in [18] a regularization method is proposed on relative entropy. In [18] the calibration problem is reformulated into problem of finding a risk-neutral jump-diffusion model that reproduces the observed option prices and has the smallest possible relative entropy with respect to a chosen prior model. In the calibration for the present paper we use this technique. The following parameters estimated by calibration of S&P 500 options (1970 to 2001) in [1], has been considered for computing the prices

| Algorithm 1 Algorithms for computing the Barrier Call option |

| Require: Initial time t and stock price , Maturity time T, Stock growth r and Volatility σ , Lévy triplet and put price available from Market. Ensure:

|

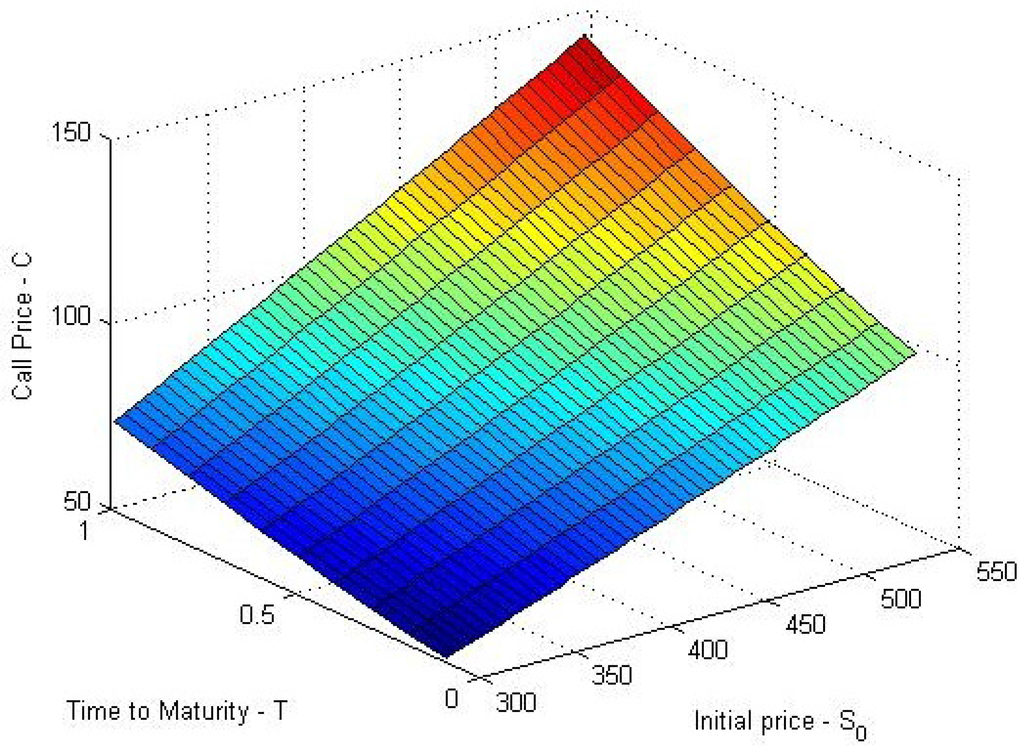

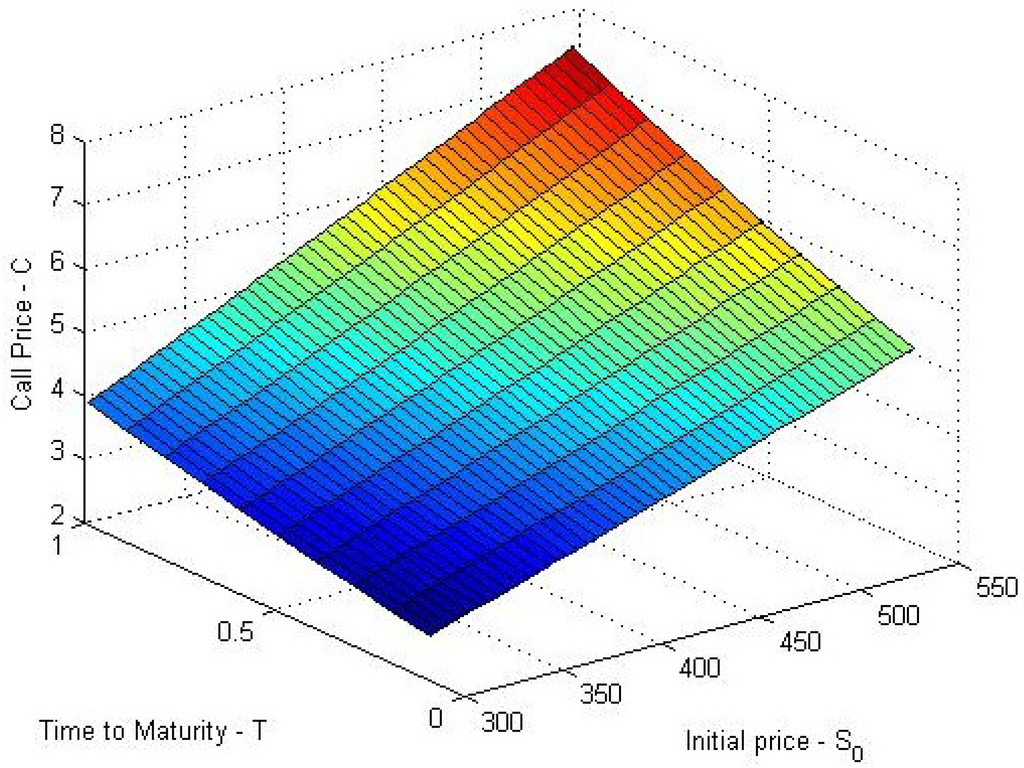

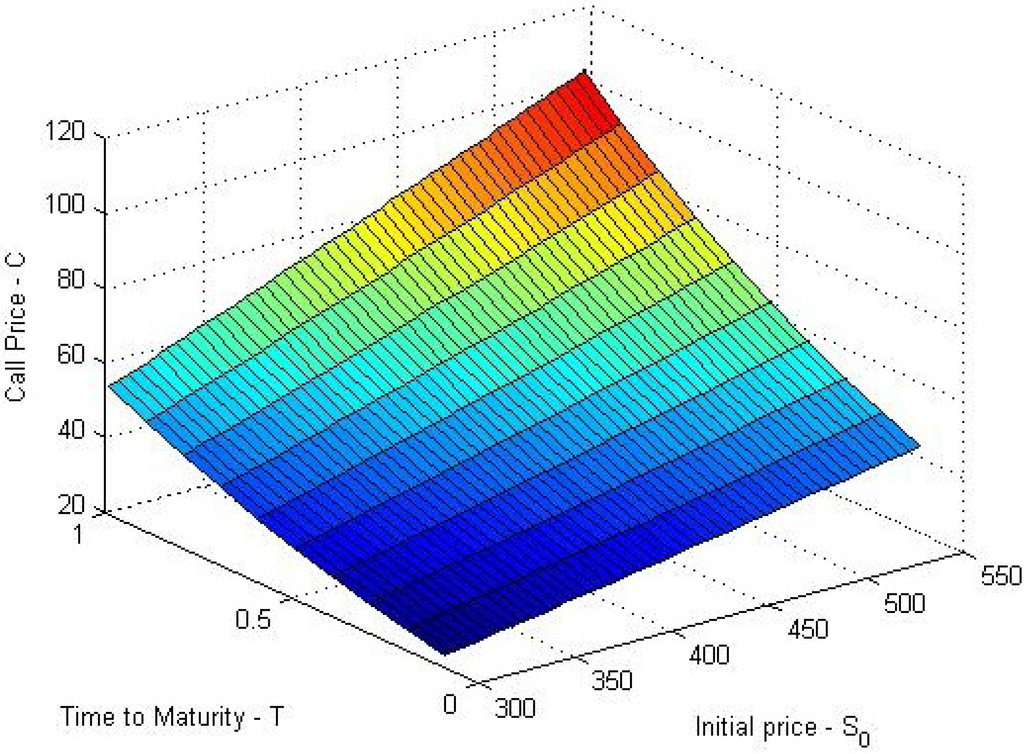

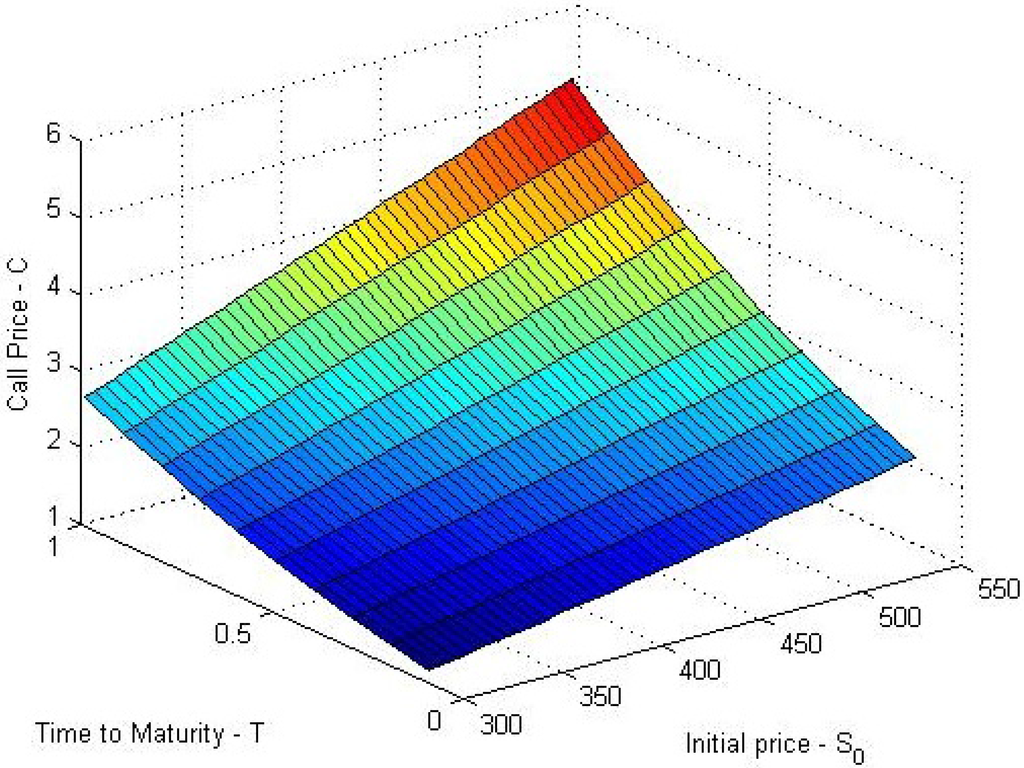

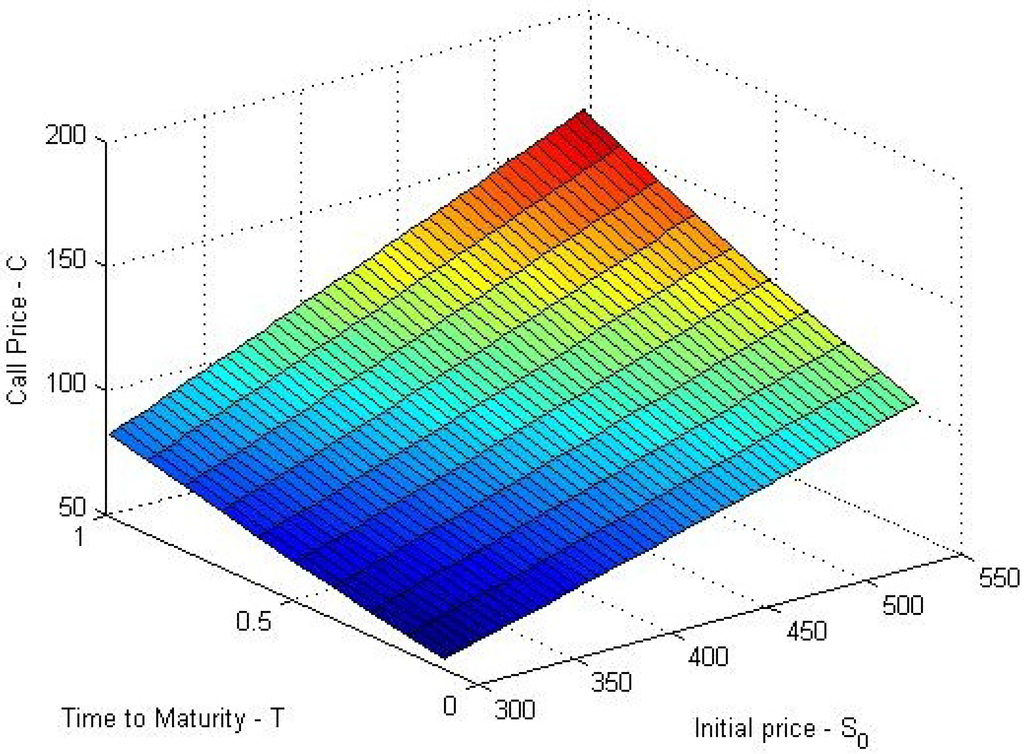

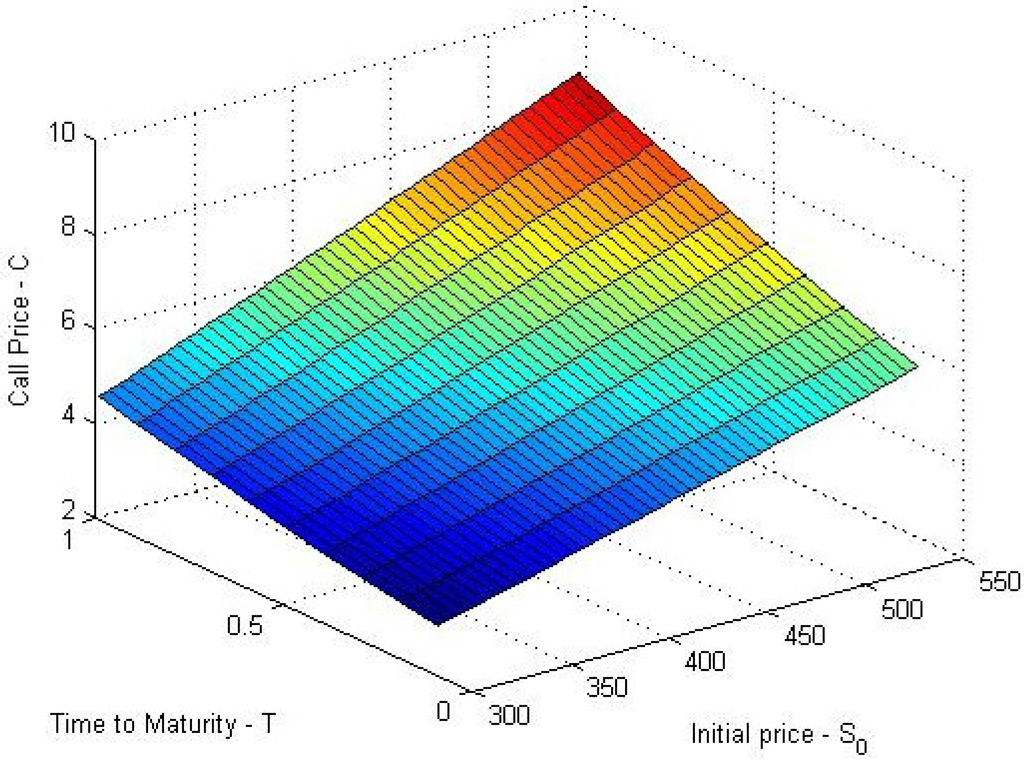

Algorithm 1 describes the procedure for computing the call price of the both Down-And-Out and Up-And-Out Barrier options. We have used above calibrated parameters to plot the call price plot against the Time-to-Maturity and Initial stock price for NIG, CGMY and Meixner processes in Figure 1, Figure 2, Figure 3, Figure 4, Figure 5 and Figure 6. This help us to understand how the call price changes with the change in stock price and maturity. The change of call price and sensitivities are also computed with the change of parameters such as volatility σ, Interest rate r, initial stock price and Barrier B.

Figure 1.

Down-And-Out call with NIG process with Stock Price = 450, Strike price K = 150, Barrier B = 350, σ = 0.1812, r = 0.167 and Time to maturity T = 1.1.

Figure 2.

Up-And-Out call with NIG (, , ) with Stock Price = 450, Strike price K = 150, Barrier B = 350, σ = 0.1812, r = 0.167 and Time to maturity T = 1.1.

Figure 3.

Down-And-Out call with CGMY(, , , ) with Stock Price = 450, Strike price K = 150, Barrier B = 350, σ = 0.1812, r = 0.167 and Time to maturity T = 1.1.

Figure 4.

Up-And-Out call with CGMY(, , , ) with Stock Price = 450, Strike price K = 150, Barrier B = 350, σ = 0.1812, r = 0.167 and Time to maturity T = 1.1.

Figure 5.

Down-And-Out call with Meixner(, , ) with Stock Price = 450, Strike price K = 150, Barrier B = 350, σ = 0.1812, r = 0.167 and Time to maturity T = 1.1.

Figure 6.

Up-And-Out call with Meixner(, , ) with Stock Price = 450, Strike price K = 150, Barrier B = 350, σ = 0.1812, r = 0.167 and Time to maturity T = 1.1.

In Table 1 we provide the calibration results for the given data set with three different processes (as Lévy density)- NIG, CGMY and Meixner. The Algorithm 1 used to compute the call price and sensitivities and result listed in Table 2, Table 3, Table 4 and Table 5. This result is also generated with the change of time-to-maturity, growth and volatility of the stock for different types of Lévy process.

Table 1.

Estimated parameters for Levy processes.

| Model | Parameters | |||

|---|---|---|---|---|

| NIG | ||||

| CGMY | ||||

| Meixner |

Table 2.

Change in Call Price with different types of Lévy Process.

| t | r | σ | NIG (α, β, δ) Call | CGMY (C, G, M, Y) Call | Meixner (α, β, δ) Call | |||

|---|---|---|---|---|---|---|---|---|

| Down-Out | Up-Out | Down-Out | Up-Out | Down-Out | Up-Out | |||

| 1 | 0.167 | 0.5 | 8.8249 | 9.5132 | 8.4641 | 9.1207 | 8.8331 | 9.5222 |

| 0.167 | 0.2 | 8.9626 | 9.6631 | 8.8112 | 9.4983 | 8.9689 | 9.6699 | |

| 0.8 | 0.167 | 0.5 | 8.6620 | 9.3362 | 7.6423 | 8.2272 | 8.6863 | 9.3626 |

| 0.167 | 0.2 | 9.0740 | 9.7843 | 8.6218 | 9.2924 | 9.0932 | 9.8052 | |

| 0.5 | 0.167 | 0.5 | 8.4232 | 9.0767 | 6.5559 | 7.0477 | 8.4706 | 9.1282 |

| 0.167 | 0.2 | 9.2436 | 9.9691 | 8.3454 | 8.9918 | 9.2827 | 10.0117 | |

Call option with stock Initial value S = 300, Strike price K = 150, Barrier B = 450 and Time to maturity T = 1.1.

Table 3.

Call Price & Sensitivities change with Barrier.

| Barrier (B) | Call | Delta | Gamma | Theta | ||||

|---|---|---|---|---|---|---|---|---|

| Down-Out | Up-Out | Down-Out | Up-Out | Down-Out | Up-Out | Down-Out | Up-Out | |

| 250 | 15.8960 | 3.4417 | 0.0410 | 0.0058 | 8.7909 | 1.9033 | −0.6604 | −0.1417 |

| 300 | 14.0080 | 5.3296 | 0.0374 | 0.0094 | 7.7468 | 2.9474 | −0.5825 | −0.2196 |

| 350 | 12.4266 | 6.9111 | 0.0342 | 0.0126 | 3.8220 | 6.8722 | −0.5172 | −0.2850 |

Option with Stock price S = 350, K = 150, σ = 0.1812, r = 0.167, Time to maturity T = 1.1 and NIG () as Lévy Process.

Table 4.

Change of Delta and Gamma over Stock price change.

| S0 | NIG (α, β, δ) | CGMY (C, G, M, Y) | Meixner (α, β, δ) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Delta | Gamma | Delta | Gamma | Delta | Gamma | |||||||

| Down-Out | Up-Out | Down-Out | Up-Out | Down-Out | Up-Out | Down-Out | Up-Out | Down-Out | Up-Out | Down-Out | Up-Out | |

| 350 | 0.03 | 0.01 | 6.87 | 3.82 | 0.02 | 0.01 | 4.97 | 4.61 | 0.02 | 0.01 | 5.53 | 5.13 |

| 400 | 0.03 | 0.01 | 9.09 | 5.05 | 0.02 | 0.01 | 6.58 | 6.09 | 0.03 | 0.01 | 7.32 | 6.78 |

| 450 | 0.04 | 0.01 | 11.64 | 6.45 | 0.03 | 0.01 | 8.42 | 7.80 | 0.03 | 0.02 | 9.38 | 8.67 |

Barrier Call option with Strike price K = 150, Barrier B = 350, σ = 0.1812, r = 0.167 and Time to maturity T = 1.1.

Table 5.

Change of Theta over Time to expire.

| t | NIG (α, β, γ) Theta | CGMY (C, G, M, Y) Theta | Meixner (α, β, δ) Theta | |||

|---|---|---|---|---|---|---|

| Down-Out | Up-Out | Down-Out | Up-Out | Down-Out | Up-Out | |

| 0.4 | −0.6851 | −0.3763 | 0.7374 | 0.6763 | −0.5246 | −0.4801 |

| 0.6 | −0.6753 | −0.3710 | 0.7536 | 0.6910 | −0.5175 | −0.4736 |

| 0.8 | −0.6655 | −0.3657 | 0.7702 | 0.7061 | −0.5104 | −0.4672 |

| 1.0 | −0.6560 | −0.3605 | 0.7871 | 0.7215 | −0.5034 | −0.4608 |

Barrier Call option with Stock Price = 450, Strike price K = 150, Barrier B = 350, σ = 0.1812, r = 0.167 and Time to maturity T = 1.1.

The Sensitivities like Delta, Gamma and Theta of the option with respect to initial stock price and t will be denoted by

Using the above equations for sensitivities, we will check how the Call, Delta, Gamma & Theta changes with the change of Barrier for a specific type of Lévy process (in this case NIG) in the Table 3.

5. Conclusions

In this paper, we have focused on three types of Lévy process with infinite activity but finite moments to option pricing and compared the results. We developed alternative techniques to compute prices and sensitives of the Barrier options. Here, we first determined the modified Lévy process under measure for incomplete market followed by development of a Partially Integro-Differential Equation and subsequently used the Mellin transform technique to get an expression for options. The expression computed numerically with a class of Lévy process with infinite activity where the distribution of the process is unknown.

Acknowledgments

We are thankful to Mrinal Ghosh at Indian Institute of Science (India), Gopal Basak at Indian Statistical Institute (India) and Indranil SenGupta, Department of Mathematics, North Dakota State University, Fargo, North Dakota, USA for providing valuable ideas.

Author Contributions

Both authors have contributed equally to this work and they agree to the final version.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix

A. Derivation of the Stock Dynamics under the Equivalent Martingale Measure

Define to be the set of all equivalence class of mappings which coincide everywhere with respect to , and satisfy the following conditions

where and for each .

- f is predictable.

- ,

The goal is to find the equivalent martingale measure , on a fixed time interval , for which , for . We consider the associated process is a martingale and hence is determined by and . With respect to the new measure , is a Brownian motion and

is a martingale (see [19], Section 5.6.3). Thus with respect to the new measure the dynamics of Z is given by

Also,

where

is the Lévy measure with respect to . Thus from Equations (A1) and (A2) it is clear that the Lévy triplet of Z with respect to in terms of Lévy triplet with respect to is given by

Remark A1.

Using Girsanov’s theorem (see [20]), there exist a deterministic process and a measurable non-negative deterministic process such that

Comparing with Equation (2) we obtain and .

With respect to , is a martingale. By Proposition 3.18(2), [21] and Equation (2), we thus obtain (since we have Assumption 1)

Therefore the dynamics of stock-price is given by the following theorem

Theorem A1.

With respect to the equivalent martingale measure , the dynamics of is given by

Proof.

Using results for exponential of a Lévy process (see Proposition 8.20, [21]) we obtain,

Thus the proof follows from Equation (A3). ☐

B. Examples of Lévy Process

B.1. Lévy Process with Infinite Activity

We have considered the following Lévy processes with infinite activity but .

- The Normal Inverse GaussianThe NIG distribution with parameters and , has a characteristic functionThe Lévy measure is given bywhere is the modified Bessel function of third kind with index λ.An NIG process has no Brownian component and its Lévy triplet is

- The CGMY ProcessThe CGMY(C, G, M, Y) distribution is four parameter distribution with characteristic functionThe Lévy measure of this process admits the representationThe CGMY process is a pure jump Lévy process with Lévy tripletwhereThe characteristic function of the pure jump KoBol process of order is given byAn ordinary KoBoL process is obtained from this definition by specializing to the case where and The relation between these parameters and the parameters is as follows:

- The Meixner ProcessThe Meixner process is defined by then Lévy measure is defined bySince , the process is of infinite variation but moments of all order exists. The first parameter of Lévy tripletIt has no Brownian part and a pure jump part governed by the Lévy measure.The Lévy triplet is given by

C. Numerical Techniques

C.1. Computing by Clenshaw Curtis Quadrature Rule

In this section, we will use Clenshaw-Curtis rule for integration [22] to calculate the integral because of its high accuracy level and low computational time. According to Clenshaw-Curtis rule for integration, any integral in can be written with the help of interpolation polynomial as

where are the moments of the Chaebyshev polynomials, which is the real part of an FFT, and .

The can be written,

A fast and accurate algorithm for computing the weights in the Fejér and Clenshaw-Curtis rules in computation has been given by [22]. The weights are obtained as the inverse FFT of certain vectors given by explicit rational expression.

Converting the any integration from interval to , we have

C.2. Properties of Mellin Transform

The Mellin transform of real valued function defined on (0,∞) where Mellin transform with respect to s which is a real number, is definded as

where its inverse is

There are some interesting properties of Mellin Transform on scaling and derivaties of first and second order available as follows (See [23],

C.3. Numerical Mellin Inversion

The Mellin transform is defined by the formulae [19]:

and its inverse is

where one-to-one correspondence is denoted as follows, if the inverse function exists:

The numerical Mellin inverse is first presented by [24] and later by [25].We have followed the approach proposed by [24] and can write the numerical inverse of Mellin as,

where

and

Now, we have observed that is defined in integer domain and so . But, in real case it is quite likely that the Mellin transform will have a strip of existence for where is not an integer rather real.In such case, we will apply a linear transform as to keep defined in integer domain as follows,

with

Since the function exists in interval we can invert to recover the function with the following

and thereafter original function can be derived by the following transformation:

References

- Shoutens, W. Chapter 5. In Lévy Processes in Finance: Pricing Financial Derivatives; Wiley: Hoboken, NJ, USA, 2003; p. 82. [Google Scholar]

- Jeannin, M.; Pistorius, M. A transform approach to compute prices and Greeks of Barrier options driven by a class of Lévy processes. Quantative Financ. 2010, 10, 629–644. [Google Scholar] [CrossRef] [Green Version]

- Geman, H.; Yor, M. Pricing and hedging double Barrier options: A probabilistic approach. Math. Financ. 1996, 6, 365–378. [Google Scholar] [CrossRef]

- Rogers, L. Evaluating first-passage probabilities for spectrally one-sided Lévy processes. J. Appl. Probab. 2000, 37, 1173–1180. [Google Scholar] [CrossRef]

- Kou, S.; Petrella, G.; Wang, H. Pricing path-dependent options with jump risk via Laplace transforms. Kyoto Econ. Rev. 2005, 74, 1–23. [Google Scholar]

- Lipton, A. Mathematical Methods for Foreign Exchange: A Financial Engineer’s Approach; World Scientific: Singapore, Singapore, 2001. [Google Scholar]

- Sepp, A. Pricing Barrier options under Local Volatility. Available online: http://kodu.ut.ee/ spartak/papers/locvols.pdf (accessed on 24 December 2015).

- Cont, R.; Voltchkova, E. A finite difference scheme for option pricing in jump diffusion and exponentiel Lévy models. SIAM J. Numer. Anal. 2005, 43, 1596–1626. [Google Scholar] [CrossRef]

- Boyarchenko, S.; Levendorskii, S. Barrier options and touch-and-out options under regular Lévy processes of exponential type. Ann. Appl. Probab. 2002, 12, 1261–1298. [Google Scholar] [CrossRef]

- Chandra, S.R.; Mukherjee, D.; Indranil, S. PIDE and Solution Related to Pricing of Lévy Driven Arithmetic Type Floating Asian Options. Stoch. Anal. Appl. 2015, 33, 630–652. [Google Scholar] [CrossRef]

- Panini, R.; Srivastav, R.P. Option pricing with Mellin Transform. Math. Comput. Model. 2004, 40, 43–56. [Google Scholar] [CrossRef]

- Frontczak, R.; Schöbel, R. Pricing American options with Mellin Transforms, No. 319; School of Business and Economics, University of TÃijbingen: Tübinger, Germany, 2010. [Google Scholar]

- Kamden, S.J. Option pricing with Lévy process using Mellin Transform. Available online: https://hal.archives-ouvertes.fr/file/index/docid/58139/filename/sadefo_resume_Mellin_levy_optionpricing.pdf (accessed on 29 December 2015).

- Amaral, L.; Plerou, V.; Gopikeishnan, P.; Meyer, M.; Stanly, H. The distribution of returns of stock prices. Int. J. Theor. Appl. Financ. 2000, 3, 365–369. [Google Scholar] [CrossRef]

- Applebaum, D. Lévy Processes and Stochastic Calculus; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar]

- Chan, T. Pricing Contingent Claims on Stocks Derived by Lévy Processes. Ann. Appl. Probab. 1999, 9, 504–528. [Google Scholar]

- Föllmer, H.; Schweizer, M. Hedging of Contingent Claims under Incomplete Information. In Applied Stochastic Analysis, Stochastics Monographs; Davis, M.H.A., Elliott, R.J., Eds.; Gordon and Breach: New York, NY, USA, 1991; Volume 5, pp. 389–414. [Google Scholar]

- Cont, R.; Tankov, P. Calibration of Jump-Diffusion Option Pricing Models: A Robust Non-Parametric Approach. SSRN Electron. J. 2002. [Google Scholar] [CrossRef]

- Doetsch, G. Handbuch der Laplace—Transformtion; Verlag Birkhauser: Basel, Switzerland, 1950. [Google Scholar]

- Jacod, J.; Shiryaev, A.N. Limit Theorems for Stochastic Processes, 2nd ed.; Springer: New York, NY, USA, 2003. [Google Scholar]

- Rama, C.; Peter, T. Chapter 2.6.3. In Financial Modelling with Jump Processes; Chapman & Hall/CRC Financial Mathematics Series; Chapman & Hall/CRC: London, UK, 2004. [Google Scholar]

- Waldvogel, J. Fast construction of the Fejér and Clenshaw-Curtis quadrature rules. BIT Numer. Math. 2004, 43, 001–018. [Google Scholar] [CrossRef]

- Debnath, L.; Bhatta, D. Chapter 8. In Integral Transforms and Their Applications, 2nd ed.; Chapman and Hall/CRC: London, UK, 2010. [Google Scholar]

- Theocaris, P.; Chrysakis, A.C. Numerical inversion of the Mellin transform. J. Math. Appl. 1977, 20, 73–83. [Google Scholar] [CrossRef]

- Iqbal, M. Spline regularization of Numerical Inversion of MellinTransform. Approx. Theory Appl. 2000, 16, 1–16. [Google Scholar]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).