Abstract

We studied the relationship between sustainable investment indexes and examine whether this relationship varies in bullish, bearish, and stable financial markets. To understand this issue more deeply, we analyzed the connectedness between three indexes—the Sustainable Impact investments, Paris-aligned stocks, and green bonds indexes—using the daily closing prices from 1 June 2017 to 15 April 2024, encompassing 1793 observations. We used a quantile vector autoregressive (QVAR) model to understand the dynamic relationship among the considered indices. The findings indicate that sustainable investments are strongly interconnected in both high and low quantiles, but this connection weakens significantly during periods of market stability. The Sustainable Impact investments and Paris-aligned stocks indexes are net transmitters of impacts to other sustainable alternatives, while the green bonds index is a net receiver. We also observed an increase in interconnectedness across all quantiles during the pandemic, the Russia–Ukraine military conflict, and changes in the European Union and the United States’ monetary policies.

1. Introduction

The agenda for sustainable development adopted by the United Nations (UN) member states in 2015 identified 17 sustainable development goals (SDGs) for 2030 regarding prosperity for people and a sustainable planet. Achieving the SDGs requires a vast amount of funding efforts (), which have sometimes been threatened and dispersed across different goals, due to events such as the pandemic, the growing pace of climate change, and military conflicts such as that between Russia and Ukraine. Additionally, countries face unequal challenges regarding SDGs, making global investment in SDGs uncertain and generally tilting them to sectors such as renewable energies. Therefore, since there are synergies and tradeoffs between investments in SDGs and investments with a specific sustainability orientation, e.g., climate change (; ; ), the outcomes of those investments may reasonably differ.

Our study finds that returns on different sustainable investment indexes are connected, and that this connection might vary under market circumstances such as bull, bear, and calm financial markets. Sustainability-conscious investors are particularly concerned with those issues, as it would facilitate decision-making regarding portfolio investments and risk management by considering only the financial instruments aligned with their sustainability stance. Likewise, the transmission of shocks between sustainable investments under different market conditions provides valuable information for policymakers regarding supporting SDG funding when the private sector is reluctant to do so due to the return and risk considerations of sustainable assets.

Investigating the connectedness of different sustainable investments is crucial as it offers both theoretical and practical implications. From a theoretical perspective, understanding the interconnected behavior of various sustainable investments can elucidate the dynamics and spillover effects within the sustainable finance sector, enriching the literature on financial market interdependencies. Practically, this knowledge aids investors in optimizing their portfolios to enhance returns while adhering to sustainability goals, and assists policymakers in designing frameworks to support and stabilize sustainable investments, especially in times of economic uncertainty, where coordinated policies can help stabilize sustainable investment flows and ensure continued progress towards achieving the SDGs.

Related literature includes studies that examine the private funding of sustainable goals (e.g., ; ; ) and the de-risking of sustainable investments (e.g., ; ). Our analysis is also related to the socially responsible investment literature that considers spillovers between sustainable investments across countries (e.g., ; ), and also the literature on environmental, social, and governance (ESG) standards and climate mitigation investment outcomes, that examines the relative performance of sustainable vs. traditional assets when investors include sustainability concerns in their investment decisions (see, e.g., ; ; ; ). By examining the relationship between different sustainable financial instruments, including stock and bond securities, we add to the literature by providing a more comprehensive view of how conditional dependence between sustainable investment returns differ according to market conditions, and on how diversification strategies could be adapted depending on the state of the financial markets.

Sustainable investing is a broader term that includes various approaches to integrating ESG considerations into investment decisions, aiming to balance financial returns and societal benefits (). There are important characteristics between three key values-based investment or sustainable investing approaches: SRI (socially responsible investing), ESG investing, and impact investing. With its historical roots in screening investments to align with personal values, SRI excludes companies conflicting with ethical principles (). ESG investing focuses on companies actively managing societal and environmental impact, while impact investing directly connects capital to values-based priorities, striving to quantify and generate positive societal outcomes (). Also, impact investing primarily involves private funds, offering transparency into capital allocation for specific causes but posing accessibility challenges compared to publicly traded options (). In this way, investors and managers need to understand these approaches to make informed choices in the ever-evolving landscape of values-based investing.

We specifically consider three kinds of returns on sustainable investments. First, we consider returns on investments in companies involved in at least one of the SDGs defined by the UN and included in the MSCI All Country World Index (MSCI ACWI) Sustainable Impact Index. Second, regarding sustainable investments, we consider returns on investments in companies included in the MSCI World Natural Capital Paris-Aligned Index (Paris-aligned stock index), which comply with the Paris-aligned benchmarks, minimize their adverse impact on natural resources, and positively contribute to the environment. Finally, we consider the outcome of investments in green bonds, which are fixed-income financial instruments that raise funds for pro-environmental projects. Given that the connection between returns on those three sustainable investment types and their response to natural catastrophes, social and military conflicts, financial market stability, and green technological innovations may differ due to their nature (e.g., stocks vs. bonds), this study examines their interdependence using the quantile vector autoregressive (QVAR) model. The QVAR model addresses the conditional quantile dependence between variables while allowing quantile heterogeneity in the impact of shocks. Thus, different types of connectedness emerge depending on boom-and-bust moments in the financial markets. Furthermore, using the generalized forecast error variance decomposition, it is possible to build a quantile-based connectedness network () that yields information on whether and how each sustainable investment class acts as a transmitter or recipient of return spillover shocks, considering bull, bear, and calm moments in financial markets.

This study contributes to the literature from both practical and academic perspectives in three significant ways. Firstly, we employ a quantile vector autoregressive (QVAR) model to examine sustainable investment indexes, revealing their increased interconnectedness during crucial periods influenced by geopolitical events and monetary policy changes. This information aids investors and policymakers in better understanding sustainable investing dynamics. Secondly, we highlight the role of the Sustainable Impact Index as a leading transmitter of effects among sustainability indexes, underscoring its growing importance and potential impact on sustainable investment decisions, thus providing valuable guidance for investors and academics interested in socially responsible investing. Thirdly, our research integrates empirical methodologies into exploring sustainable investment dynamics, bridging the gap between theoretical frameworks and real-world applications (; ). Through this integration, we aim to advance the theoretical understanding of sustainable investment and provide actionable insights for scholars and practitioners in the field. Thus, our findings help to attain sustainable development goals by promoting informed investment decisions, guiding policymakers, and supporting efficient funding allocation towards sustainable projects.

2. Context of the Analysis and Literature Review

2.1. Context of the Analysis

Understanding the interchangeable use of terms like sustainable investing, SRI, ESG investing, and impact investing is crucial for investors and policymakers. By recognizing their distinctions and commonalities, stakeholders can develop more coherent and effective investment strategies that promote both financial returns and positive societal outcomes. The study of () provides a foundational analysis that can guide future research and practice in this dynamic field (Figure 1).

Figure 1.

Scheme for interchangeable use of sustainable investing terms. Source: Authors, based on ().

() explores the interchangeability of terms like “sustainable investing”, “socially responsible investing (SRI)”, “environmental, social, and governance investing” (ESG), and “impact investing” in the literature. It aims to enhance the understanding of these concepts by analyzing previous research and elucidating their distinctions and commonalities. It posits sustainable investing as an overarching term encompassing these approaches. ESG investing involves evaluating a company’s ESG practices alongside financial metrics, primarily aiming for financial returns. SRI entails investment decisions guided by moral criteria. Impact investing allows investors to support ventures generating social value. As the field evolves, there is a growing recognition of the need for standardized definitions and frameworks to enhance clarity and comparability.

Sustainable investing is a broad concept that encompasses various strategies, such as SRI, ESG investing, and impact investing (Figure 1). Sustainable investing primarily aims to generate long-term financial returns while promoting environmental stewardship, social responsibility, and sound governance practices. This broad approach integrates ESG criteria into the investment process, recognizing that addressing these factors can contribute to the long-term value creation of a portfolio. While it encompasses several specific strategies, sustainable investing’s overarching goal is to consider the broader impacts of investment decisions on society and the environment.

Each strategy within sustainable investing has its unique focus and methodology (Figure 1). SRI is guided by moral or ethical criteria, often excluding specific industries, such as tobacco or fossil fuels, from investment portfolios. This strategy aims to align investments with personal or organizational values. ESG investing, on the other hand, involves evaluating companies based on their ESG practices alongside traditional financial metrics, primarily aiming for financial returns while considering ESG factors to enhance long-term performance. Impact investing is more targeted, with investments made specifically to generate positive, measurable social and environmental impacts alongside financial returns. It directly supports ventures or projects that address critical social or environmental issues, such as renewable energy or education. While all these strategies fall under the sustainable investing umbrella, their specific objectives and approaches differ, reflecting a spectrum of priorities from ethical alignment to targeted impact.

Recognizing the differences among terms such as sustainable investing, SRI, ESG investing, and impact investing is crucial for several reasons. Each term represents distinct objectives and methodologies, leading to varied implications for investment strategies and outcomes. For instance, while ESG investing focuses on integrating ESG factors into financial analysis to enhance risk-adjusted returns, SRI emphasizes alignment with ethical values, often employing exclusionary screens. Impact investing, on the other hand, seeks to generate specific social or environmental benefits alongside financial returns. By clearly distinguishing these terms, investors can make more informed decisions that align with their financial goals and ethical priorities, ultimately contributing to more targeted and effective investment portfolios.

The concepts underlying these investment strategies often exhibit co-movements over time, driven by evolving market trends, regulatory developments, and societal expectations. For example, the increasing awareness and urgency of addressing climate change have propelled the integration of ESG factors across various investment strategies, including SRI and impact investing. As regulatory frameworks and corporate reporting standards advance, these approaches become more interconnected, promoting a cohesive shift toward sustainability in financial markets. Moreover, investor demand for transparency and accountability fosters the convergence of these terms, as stakeholders seek comprehensive approaches that encompass financial performance and broader social and environmental impacts. Understanding these co-movements helps investors and policymakers anticipate and navigate the dynamic landscape of sustainable finance, fostering a more resilient and inclusive economic system.

2.2. Literature Review

We conducted a literature review by carefully selecting articles from the Scopus and Web of Science (WoS) databases in April 2024. Our search queries included terms such as [sri], [esg], and [“Impact Invest*”] or [“sustainable invest*”] to identify articles related to sustainable investing, encompassing topics like SRI, ESG investing, and impact investing. Initially, we identified 44 articles in Scopus and 33 in Web of Science. After removing 22 duplicate articles, we were left with 55 unique and relevant articles for further analysis. This search approach was adopted to ensure a comprehensive selection of literature concerning the intersection of SRI, ESG investing, and impact investing, thereby laying the foundation for a systematic review of pertinent scholarly contributions.

2.2.1. Keyword Analysis

The filtered articles were then analyzed using the online text analytic software Voyant Tools version 2.4 (), followed by a manual review of the abstract, introduction, and conclusion sections to select the most relevant articles for our study.

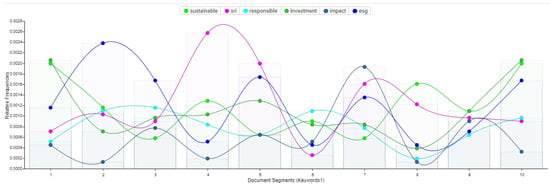

In scrutinizing the words identified in abstracts and author keywords gathered from the literature review, several metrics unveil valuable insights into the corpus. The vocabulary density, calculated at 0.181, suggests a moderate level of lexical diversity, indicating the ratio of unique words to the total number of words in the text. Meanwhile, the readability index, computed at 17.503, hints at the text’s comprehensibility, indicating a moderate level of complexity suitable for individuals with some college education. The average number of words per sentence, averaging at 27.7, sheds light on the text’s syntactic complexity, suggesting the presence of longer, more intricate sentence structures. Delving into the frequency of keywords, prominent terms such as “SRI” (189 occurrences), “ESG” (188 occurrences), “sustainable” (184 occurrences), “investment” (175 occurrences), responsible (123 occurrences), and “impact” (93 occurrences) emerge as central themes within the corpus, underlining the prevalent focus on SRI and ESG considerations throughout the analyzed literature (Figure 2).

Figure 2.

Bubble lines from the most frequent words in abstracts and author keywords on the study of interchangeable use of sustainable investing terms. Notes: Each chosen word is depicted as a bubble, where the size of the bubble reflects the word’s frequency within the corresponding text segment. A larger bubble indicates that the word appears more often. Source: analysis conducted using Voyant tools and data from the Scopus WoS databases.

Additionally, the results of relative frequency and trend analysis for the most frequent words in abstracts and author keywords related to the interchangeable use of sustainable investing terms are presented in Figure 3. In Voyant Tools, the “Trends” visualization depicts the frequencies of terms across studies identified using our search equation in the Scopus and Web of Science databases. The identified words “SRI”, “ESG”, “sustainable”, “investment”, “responsible”, and “impact” generally exhibit an increasing trend over time, with the exception of “impact”. This trend highlights these topics’ growing importance and relevance in contemporary discourse.

Figure 3.

Relative frequencies and trends from the most frequent words in abstracts and author keywords on the study of the interchangeable use of sustainable investing terms. Notes: Each series in the graph is colored to represent a specific word, and at the top of the graph, a legend indicates which colors correspond to which words. Source: analysis conducted using Voyant tools and data from the Scopus WoS databases.

2.2.2. Trends Analysis

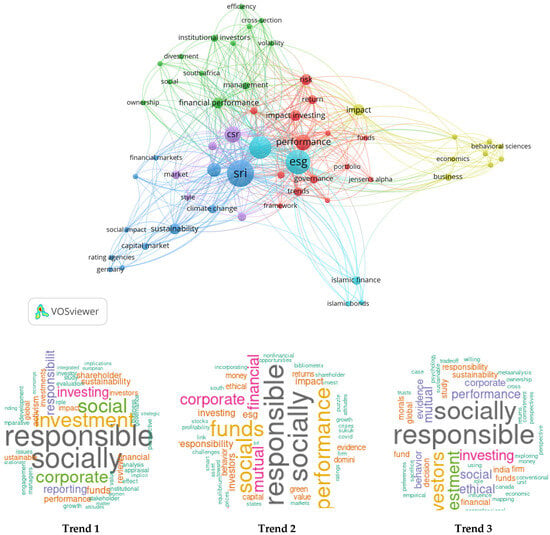

After the initial search, all identified research papers were downloaded and indexed in the Mendeley reference manager for further examination. The subsequent analysis was performed using VOSviewer version 1.6.19 () and a Tree of Science application that presents a clustering analysis of the three main subtopics (). Structural patterns and research trends were then identified using co-occurrence author keywords diagrams. This approach allowed for the detection and examination of three distinct research trends within the scientific literature, as in the study conducted by (). Figure 4 illustrates these findings: the top section displays key studies on the relationships among SRI, ESG investing, and impact investing, while the bottom section outlines the three identified research trends.

Figure 4.

Relationships among the most significant studies and research trends concerning SRI, ESG investing, and impact investing. Source: analysis conducted using VOSviewer and Tree of Science tools, and data from the Scopus and WoS databases.

The first trend derived from the provided information is the extensive exploration of SRI and corporate sustainability by authors such as (), (), (), (), (, ), and (). These studies cover a wide range of topics, including the evaluation and review of the SRI market, the impact of SRI policies on European stock portfolio value, comparative analyses of SRI in different regions, and the performance comparison of socially responsible and conventional investment funds, as well as the role of institutional investors in shareholder activism. This trend reflects a growing interest in understanding the relationship between ethical investment practices, corporate behavior, and financial performance, highlighting the significance of SRI in shaping investment decisions and corporate strategies.

The second trend is focused on SRI and ESG considerations in financial markets. Researchers such as (), (), and () explore the resilience of ESG funds during market downturns, the investment behavior in socially responsible mutual funds, and the performance comparison of green exchange-traded funds with conventional benchmarks like the S&P 500, respectively. This trend reflects a growing interest among investors and researchers in understanding the relationship between ethical considerations and financial performance, and the potential for sustainable investment strategies to contribute to financial market stability and sustainability.

Finally, the third trend explores the relationship between SRI behavior and financial performance, as evidenced by studies conducted by ; , ; and . These studies investigate various aspects of SRI behavior, including individual investor preferences, the influence of sustainability information on investment decision-making, and the performance of socially responsible mutual funds compared to conventional funds. Additionally, there is a growing interest in understanding the determinants of SRI decisions across different countries and investor segments, as evidenced by research conducted by () and (). This trend underscores the importance of considering ethical and social factors in investment decisions and highlights the evolving landscape of SRI research and practice.

After discerning the prevailing trends in the evolution of literature concerning sustainable investments, our next step involves scrutinizing the gaps exposed by preceding literature review research. This scrutiny aims to identify how our study addresses a gap delineated by prior research.

2.2.3. Further Research Identified from Previous Literature

The literature reviews by (), (), (), (), (), (), and () collectively reveal several trends and research gaps in the field of sustainable investment, albeit with differing emphases and methodologies.

()’s review highlights emerging themes such as SDG financing and the governance-related determinants of sustainable investments, providing a comprehensive foundation for future research. In contrast, ()’s study traces the evolution of SRI strategies and identifies a shift towards more nuanced approaches, like ESG integration and impact investing. These differing perspectives suggest a need for further exploration into the drivers and implications of evolving sustainable investment strategies.

()’s systematic review identifies gaps in the literature and proposes a holistic research agenda to develop sustainable investment as an applied field. Meanwhile, ()’s historic overview emphasizes the proliferation of SRI products and the increasing involvement of stakeholders, highlighting the need for research into the opportunities and challenges facing SRI stakeholders. These contrasting viewpoints underscore the complexity of the sustainable investment landscape and the importance of addressing both theoretical and practical considerations in future research.

()’s review focuses on ESG investing, identifying significant research themes such as investor behavior and motivations, portfolio screening, and ESG performance. Additionally, ()’s study examines the utilization of corporate sustainability information in SRI, highlighting the need for research on data utilization and analysis methods. These complementary perspectives underscore the interdisciplinary nature of sustainable investment research and the importance of integrating insights from diverse fields, such as finance, accounting, and sustainability.

()’s review of SRI Sukuk highlights challenges such as the lack of standardization and liquidity, suggesting avenues for future research in Islamic investing and sustainable finance. This perspective complements the broader discussions on sustainable investment strategies and underscores the need for tailored approaches to address the unique challenges and opportunities in different financial contexts.

Additionally, according to (), further research should focus on investigating the interplay between combined and individual sustainability (ESG) practices and banking sector stability in the GCC from 2000 to 2022. The findings underscore the critical roles of banking sector-specific factors and country-level dynamics in shaping stability outcomes. Notably, the study reveals a nuanced, non-linear relationship—displayed as an inverted U-shaped curve—between ESG practices and stability. This suggests that while sustainability initiatives can bolster stability, excessive investments in environmental (ENV), social (SOC), and governance (GOV) domains could potentially undermine it. Policymakers and bank executives are encouraged to adopt a balanced approach that aligns ESG investments with national SDGs to mitigate risks, such as profitability challenges and heightened instability. Moreover, future research should explore optimal resource allocation strategies within banks to reduce operational costs, enhance credit monitoring practices, and effectively manage non-performing loans (NPLs). This expanded investigation should also encompass other countries and consider external factors, such as the impact of global events like the COVID-19 pandemic on the identified relationships.

Lastly, the studies by (); (); and () significantly contribute to the understanding of interconnectedness in financial markets, which is pertinent to our investigation on the connectedness between sustainable investment indexes using the QVAR approach. ()’s use of multivariate quantile models across the Latin American and developed markets reveals varying degrees of tail-codependence in response to shocks, suggesting potential diversification strategies across regions following significant market events. ()’s analysis of African stock markets via quantile dynamic connectedness underscores the importance of understanding market interdependencies under different market phases, particularly highlighting South Africa’s dominant role in transmitting shocks regionally. This complements our focus on how sustainable investment indexes respond to market conditions and further underscores the relevance of considering diverse market environments. Finally, ()’s study on clean energy indices using a DCC-GARCH-based approach illuminates the dynamic nature of return propagation and identifies the NASDAQ OMX Green Economy Index as a key transmitter of shocks, offering insights into portfolio management strategies that are highly relevant to sustainable investments. Collectively, these studies provide a robust foundation for exploring the interconnections among sustainable investment indexes and advancing our understanding of their implications in global financial markets.

In summary, while the existing literature reviews provide valuable insights into sustainable investment, they highlight the critical need for empirical studies and co-movement analyses of the indices related to sustainable investment. This research specifically addresses this gap by investigating the empirical interconnectedness of various sustainable investment indexes, such as those linked to the SDGs, the Paris-aligned index, and green bonds. We hypothesize that the returns on these sustainable investment indexes exhibit significant interconnectedness, which varies under different market conditions, including bull, bear, and calm financial markets. By employing the quantile vector autoregressive (QVAR) model, this study delves into the conditional dependence and quantile heterogeneity of shocks on sustainable investment returns. This empirical approach fills existing knowledge gaps and provides practical insights for investors, policymakers, and other stakeholders navigating the complex landscape of sustainable finance. By synthesizing theoretical insights with empirical evidence, our research aims to offer a more holistic understanding of sustainable investment and its broader implications.

3. Data and Methods

3.1. Data

The dataset involves daily closing prices in US dollars from 1 June 2017 to 15 April 2024, encompassing 1793 observations. This study employs three indexes encapsulating SRI, ESG, and impact investing dimensions, as illustrated in Table 1. All variables were extracted from Bloomberg.

Table 1.

List of variables.

Then, the selected indexes reflect different aspects of sustainable and socially responsible investing. The ACWI Sustainable Impact Index (RNU751091) focuses on sustainable bonds, the Paris-aligned index (RMXCXBLRV) emphasizes stocks that meet the EU Paris-aligned benchmarks, and the Global Green Bond Index | (RI31572) combines various ESG factors for Eurozone corporations. Investors interested in socially responsible investing may use these indexes to evaluate opportunities that align with their investment portfolios.

The MSCI ACWI Sustainable Impact Index comprises listed companies that generate at least 50% of their income through one or more of the UN SDGs and maintain minimum ESG standards. Such companies focus on pollution prevention, sanitary and nutritious products, sustainable water, green building, affordable housing, education, the treatment of major diseases, alternative energies, energy efficiency, and credit for small and medium firms. Therefore, the performance of the MSCI ACWI Sustainable Impact Index reflects the outcome of impact-oriented investments in the global equity markets that are specifically related to SDG sectors and projects.

Additionally, the Paris-aligned stock index, composed of companies that (a) comply with the EU Paris-aligned benchmarks and annually reduce greenhouse gas emissions by 7%, (b) minimize their exposure to indicators associated with adverse impact on natural resources, and (c) positively contribute to the environment through their products, services, or management of natural-capital related risks. The Paris-aligned stock index provides information to sustainability-oriented investors who wish to reduce their exposure to physical and transition risks from climate change, focusing on investment opportunities from the transition to a low-carbon economy.

Finally, the MSCI Global Green Bond Index comprises fixed-income green bonds issued by corporations, the Treasury, and government-related entities to promote climate or sustainability objectives. Those green bonds are: (a) rated and categorized as green by MSCI ESG Research according to rules that are consistent with the green bond principles; (b) have a one-year minimum time to maturity; and (c) are used for investment in alternative energies, energy efficiency, pollution prevention and control, sustainable water supplies, green building, and climate adaption. The MSCI Global Green Bond Index performance reflects the outcome of investments in fixed-income securities, issued with the aim of funding projects with sustainable and environmental benefits.

We use the returns of the selected indexes to analyze connectedness. Table 2 provides the descriptive statistics of daily returns for the indexes analyzed. These returns exhibit asymmetry and negative skewness. The prevalence of negative values suggests leptokurtic and heavy-tailed characteristics. The Jarque–Bera (J-B) test statistics confirm that all return distributions deviate from normality with significant p-values. The Ljung–Box Q(20) and Q2(20) statistics for serial correlation and heteroscedasticity are significant, indicating the presence of these effects in the return series. The augmented Dickey–Fuller (ADF) () test results confirm the stationarity of all series.

Table 2.

Summary statistics for sustainable investment returns.

The correlation matrix reveals that indexes of Sustainable Impact investments and Paris-aligned indexes are strongly correlated (0.82), whereas the green bonds index shows moderate correlation with both the Sustainable Impact investments index (0.39) and the Paris-aligned index (0.27). These findings offer valuable insights into the various characteristics of sustainable investment returns and their interrelationships.

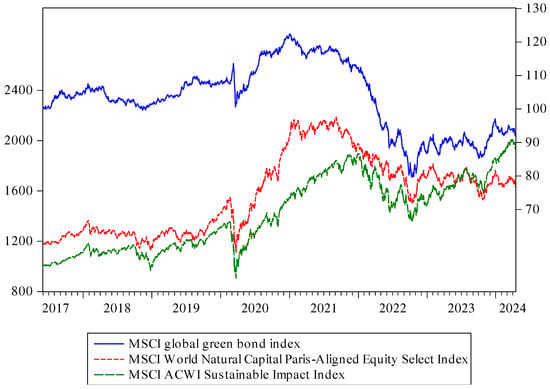

Figure 5 shows that both the Sustainable Impact investments and the Paris-aligned indexes closely co-move, and green bonds weakly co-moves with Sustainable Impact investments while, as expected, displaying lower variability. The indexes display a certain degree of synchronization, particularly during major economic events. This suggests that external macroeconomic factors influence all three indices, albeit to varying extents.

Figure 5.

Time series plot for Sustainable Impact investments and Paris-aligned stock indexes (left vertical axis) and for the green bonds index (right vertical axis), June 2017–April 2024. Source: Authors’ own research using data from Bloomberg.

3.2. QVAR Model

To assess quantile dependence and connectedness among the Sustainable Impact investments, Paris-aligned stocks, and green bonds indexes, we use a QVAR model with p lags as (), given by:

where is a 3 × 1 vector of k endogenous variables at time , and is a 3 × 1 vector of quantiles of the conditional distribution of the variables included in , with for . for is a 3 × 3 matrix of lagged coefficients in quantiles , where each element differs across equations and accounts for the effect of the lag j of the variable n, in the -th quantile of the conditional distribution of the variable . is a 3 × 1 vector of intercepts in quantile , and is a 3 × 1 vector of residuals with a 3 × 3 variance–covariance matrix . If the model is correctly specified, the conditional quantile of equals zero. Hence, the -th conditional of is given by:

The QVAR model in Equation (1) can be estimated—for a given value of and assuming that the value of p for the conditional mean model is valid for any conditional quantile—using quantile regressions equation by equation, computed for the -th quantile of each variable i as follows:

where is the usual check function for quantile regressions.

From Wold’s representation of the QVAR(p) model in Equation (1), we can assess the accumulated effects of a quantile shock over future horizons as follows:

where are the moving average (MA) coefficients, where is the kxk identity matrix and for , and where . Assuming that the quantile vector is fixed over the forecast horizon under analysis, the vector of forecast errors for the prediction of and the -th quantile is given by , and the forecast error variance is given by . Thus, the impact of a shock in the -th quantile of a variable j on variable i is derived by () as follows:

where denotes the j-th diagonal element of , and denotes a zero vector with 1 in the i-th position. is normalized as , so . Then, we can set up a spillover matrix with elements given by that accounts for the contribution that a shock in the quantile of a variable has on the quantiles of the other variables. Furthermore, the total information that a quantile of the variable i receives from the quantiles of the other variables derives as , so the net influence received by the variable i in the network in the -th quantile derives as , with positive (negative) values indicating that i is a net receiver (transmitter). Finally, the total connectedness index (TCI) can be computed as the average impact of a shock in one series coming from another series, i.e., .

4. Results and Discussion

Using the Bayesian information criterion (BIC), we estimate the QVAR model using one lag, and compute spillovers for a 20-day horizon () for extreme and median quantiles: . Table 3 presents evidence of connectedness between sustainable securities, indicating that spillover transmission differs widely depending on market conditions. Thus, sustainable markets are closely connected in times of upward or downward price movements, whereas sustainable investments in a calm market are considerably decoupled, offering investors more diversification opportunities. With positive net spillover effects, Sustainable Impact investments and the Paris-aligned stocks index are net transmitters, whereas the green bonds index is net receiver of spillovers.

Table 3.

Connectedness between sustainable investments under different market conditions.

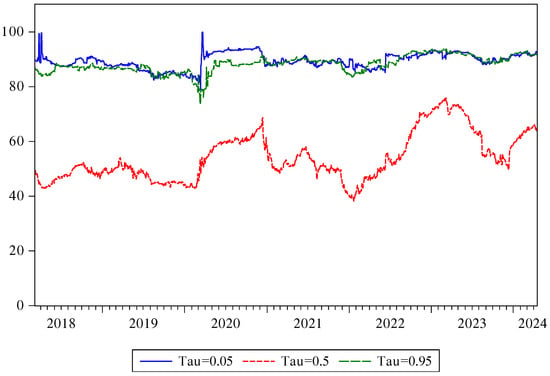

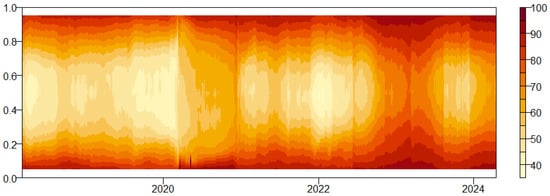

We assess whether previous spillover evidence differs over time due to specific events, such as the COVID-19 pandemic, the Russia–Ukraine conflict, and the changed EU and US monetary policies in 2022–2023. Therefore, we estimate the QVAR model using a 200-day rolling window that is moved forward daily. The graphical evidence in Figure 6 indicates that the spillover values given by the total connectedness index differ across quantiles and over time. We corroborate that spillovers are stronger in the extreme quantiles than in the median quantiles and are similar in size at the lower and upper tails, and that the temporal dynamics of spillovers is shaped by specific events, particularly in the median quantile. Thus, the COVID-19 pandemic, the Russia–Ukraine conflict, and the US and EU interest rate hikes intensified connectedness, corroborating previous studies (), and highlighting the relevance of major events on the hedging possibilities of sustainability-oriented investors using different sustainable securities.

Figure 6.

Total dynamic spillovers across quantiles between the indexes of Sustainable Impact investments, Paris-aligned stocks, and green bonds. Source: Authors’ own research using data from Bloomberg.

In Figure 7, we analyze the Dynamic Total Connectedness (TCI); those with greater connectedness levels are depicted in warmer shades. Also, positive and negative price changes (above 75% and below 25% quantiles) show strong linkages throughout the sample period. The 50% quantile corresponds to the average TCI, revealing a pattern in market linkage driven by special events, supported by average solid TCI in 2020, 2022, and 2023. The COVID-19 pandemic, the Russia–Ukraine conflict, and the US and European interest hikes demonstrate significant interconnectedness, aligning with previous studies () and emphasizing the profound impact of the recent events on an interconnected system of sustainability synergy indexes.

Figure 7.

Total dynamic spillovers across quantiles between the indexes of Sustainable Impact investments, Paris-aligned stocks, and green bonds. Source: Authors’ elaboration, with data gathered from Bloomberg. Notes: We took lags = 1 based on SIC for a 200-day rolling-window with a forecast horizon of 20 days. Those with greater connectedness levels are depicted in warmer shades, indicating stronger linkages. Positive and negative price changes (above 75% and below 25% quantiles) show robust connections throughout the sample period. Source: Authors’ own research using data from Bloomberg.

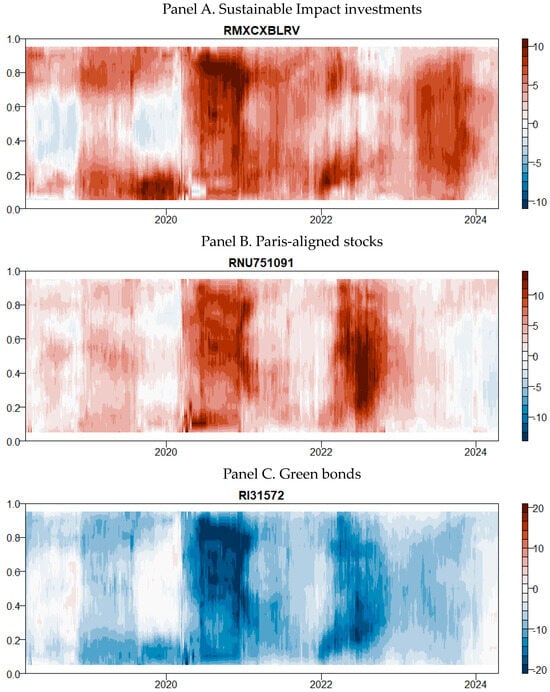

Figure 8 provides detailed evidence of net spillovers for the three sustainable investment indexes across quantiles and over time. As in (), warm (cold) shaded areas indicate net-transmitting (net-receiving) effects. Accordingly, Sustainable Impact investments are net transmitters to other sustainable securities over the sample period, with an intensity that is accentuated in the upper and lower quantiles in 2020 and after mid-2022. In contrast, the Paris-aligned stocks index strongly transmit net spillovers during the second semester of 2020 and 2022 across all quantiles but have a limited impact in the remaining sample periods. This evidence points to the fact that the influence of the Paris-aligned stocks index on other sustainable securities is circumscribed to specific periods and is independent of market conditions. Finally, green bonds behave as net receivers of impacts over the sample period in the extreme quantiles, particularly during the second semester of 2020 and in 2022. The size of the net impacts received by the green bonds index fluctuates over the sample period, with stronger net impact during the later periods of the sample, revealing that green bonds lack leadership in the transmission of shocks between sustainable investments; this can be explained by the relatively small size and low volatility of the fixed-income investments concerning stock investments.

Figure 8.

Net dynamic connectedness of the indexes of Sustainable Impact investments, Paris-aligned stocks, and green bonds. Notes: Warm (cold) shaded areas indicate periods of net-transmitting (net-receiving) effects across the indexes. Source: Authors’ own research using data from Bloomberg.

Overall, our results reveal that sustainable investments closely co-move, particularly in extreme quantiles and at times of disruptive events. However, the intensity of this co-movement differs across securities; as a more disconnected sustainable asset class, green bonds are net receivers and so have a relevant role as de-risking assets for sustainable investments, such as Sustainable Impact investments or the Paris-aligned stock indexes. Potential explanations of our evidence can be related to (a) shifts in investor sentiment and environmental awareness, in particular around relevant events; (b) the leadership of the Sustainable Impact Index over the other two indexes, underscoring the increasing importance of a holistic approach to sustainability investment, given that this index encompasses both environmental and social factors that may be more in line with investor preferences; and (c) the growth of the sustainable investing industry, which has contributed to interconnectedness between different asset classes reflecting social and environmental issues.

Our results underscore the critical role of understanding transmission mechanisms and network structures in shaping effective investment strategies that simultaneously promote environmental sustainability and financial stability. Similar to (), (), and (), our findings emphasize the importance of integrated approaches that leverage market interdependencies to support portfolio resilience, manage risks, and foster sustainable economic growth. By synthesizing findings from global financial markets, African stock exchanges, and clean energy sectors, our study contributes to a holistic understanding of interconnectedness in contemporary financial landscapes. This holistic view is crucial for guiding policymakers and investors in developing strategies that align financial objectives with sustainability goals, thereby advancing both economic resilience and environmental stewardship on a global scale.

5. Conclusions

This study analyzes the dynamic connectedness and spillover effects among prominent sustainable investment indexes, such as the Paris-aligned stocks index, the Sustainable Impact Index, and the Global Green Bond Index, using a quantile connectedness approach for the empirical analyses. This approach is pivotal in studies examining dynamic connectedness and spillover networks (; ; ; ; ). Moreover, we perform a comprehensive empirical analysis employing the rolling-window technique to examine alterations in interconnectedness and transmission effects during market events. This analysis explores time-varying features of financial markets in their spillovers. The indexes uniquely reflect key facets of sustainable and socially responsible investing, encompassing environmental impact and broader ESG considerations in Eurozone corporate settings. This exploration provides valuable insights for investors, researchers, and policymakers as they navigate the multifaceted terrain of ESG investing, ultimately contributing to more informed decision-making and a more sustainable and equitable future.

Our findings reveal that sustainable investments are especially connected in the upper and lower quantiles, and that Sustainable Impact investments are a net transmitter of impacts to the other sustainable alternatives, i.e., green bonds and Paris-aligned investments. In contrast, the connection between sustainable investments substantially weakens when financial markets are calmed, i.e., in intermediate quantiles. Finally, we also identify increased connectedness across all quantiles during the pandemic period, during the Russia–Ukraine conflict, and with the changed EU and US monetary policies after mid-2022.

The interconnectedness of sustainable investments is crucial for several theoretical and practical reasons. Theoretically, understanding these connections provides a deeper insight into the dynamics and dependencies within the sustainable finance sector. This knowledge contributes to the financial literature by revealing how different sustainable investment vehicles interact under varying market conditions, such as bull, bear, and calm periods. By examining these interactions, we can better understand the mechanisms through which shocks and volatility are transmitted across different types of sustainable investments. This enhances our comprehension of market behavior and the systemic risks associated with sustainable finance.

This interconnectedness has significant implications for investors, policymakers, and portfolio managers. For investors, understanding the relationships between different sustainable investments can inform better portfolio diversification strategies. By identifying which investments are likely to be affected by common shocks or market events, investors can make more informed decisions to optimize their portfolios, balancing financial returns with sustainability goals. For policymakers, insights into the connectedness of sustainable investments can guide the design of regulatory frameworks and support mechanisms. This is particularly important during periods of market instability, where coordinated policies can help stabilize sustainable investment flows and ensure continued progress towards achieving the Sustainable Development Goals (SDGs).

Our evidence also has implications for investment decisions by sustainability-conscious investors. Although there is a growing demand for sustainable investment themes in public equity markets, investments through an SDG lens need to identify which are specifically oriented to the SDGs and how they co-move with alternative sustainable investments. The results indicate that sustainable investors can find hedging opportunities within the set of sustainable asset classes, particularly using green bonds, although those opportunities are less attractive in times of abrupt financial market movements. Therefore, public support of sustainable investments should be concentrated in times of extreme conditions in financial markets, when investments might flock to non-sustainable assets because investors find it more difficult to diversify their sustainable assets.

While our study provides valuable insights into the dynamic connectedness and spillover effects among prominent sustainable investment indexes, several limitations should be acknowledged. For example, our empirical analysis using the rolling-window technique allows us to examine alterations in interconnectedness and transmission effects during market events, but it may not capture all nuances of market dynamics, especially in rapidly changing or extreme conditions. Moreover, our focus on Eurozone corporate settings may limit the generalizability of our findings to other geographic regions or market contexts. Additionally, while our study identifies increased connectedness across all quantiles during significant events, such as the COVID-19 pandemic and geopolitical conflicts, the causal mechanisms underlying these connections may require further investigation. Despite these limitations, our study contributes to understanding sustainable investment dynamics and provides valuable insights for the investors, researchers, and policymakers navigating the complexities of ESG investing.

Future research should focus on the impact of uncertainty on sustainable investments (). Understanding how economic, geopolitical, and environmental uncertainties affect these investments will provide valuable insights into their resilience, and guide investors and policymakers in managing risks in sustainable finance strategies. Additionally, future research could analyze the relation among the sustainable investment indexes using longer investment horizons due to the preference of some investors to make long-term investments (). Then, the analysis can be conducted using lower frequency data (e.g., weekly or monthly) and considering the diverse investment horizons of different investors (). This approach could provide more comprehensive insights into the behavior of sustainable investments over varying timeframes.

Lastly, exploring the connectedness between the selected indexes and including the S&P Global Clean Energy Index in the analysis could provide additional valuable insights. This comparison could reveal how sustainable investments perform relative to a widely recognized benchmark in the clean energy sector, offering a broader context for understanding their financial dynamics and market interactions.

Author Contributions

Conceptualization, N.J.M.-R.; methodology, N.J.M.-R. and J.D.G.-R.; validation, J.D.G.-R. and S.B.; formal analysis N.J.M.-R., J.D.G.-R. and S.B.; investigation N.J.M.-R. and J.D.G.-R.; data curation N.J.M.-R.; writing—review and editing, N.J.M.-R., J.D.G.-R. and S.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Datasets are available on request.

Acknowledgments

We want to extend our sincere gratitude to the four anonymous reviewers for their insightful comments and constructive feedback, which have significantly improved the quality of this study. We also thank the editor for their professional handling of the review process and their valuable guidance. Their efforts and expertise have helped shape this work.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Agrawal, Anirudh, and Kai Hockerts. 2021. Impact Investing: Review and Research Agenda. Journal of Small Business & Entrepreneurship 33: 153–81. [Google Scholar] [CrossRef]

- Ando, Tomohiro, Matthew Greenwood-Nimmo, and Yongcheol Shin. 2022. Quantile Connectedness: Modeling Tail Behavior in the Topology of Financial Networks. Management Science 68: 2401–31. [Google Scholar] [CrossRef]

- Aras, Güler, and David Crowther. 2009. Corporate Sustainability Reporting: A Study in Disingenuity? Journal of Business Ethics 87: 279–88. [Google Scholar] [CrossRef]

- Athari, Seyed Alireza. 2024. Does the Sovereign Environmental, Social, and Governance Sustainability Activities Jeopardize the Banking Sector’s Stability: Evidence from the Arab Economies. Sustainable Futures 7: 100204. [Google Scholar] [CrossRef]

- Auer, Benjamin R. 2016. Do Socially Responsible Investment Policies Add or Destroy European Stock Portfolio Value? Journal of Business Ethics 135: 381–97. [Google Scholar] [CrossRef]

- Becchetti, Leonardo, Rocco Ciciretti, Ambrogio Dalò, and Stefano Herzel. 2015. Socially Responsible and Conventional Investment Funds: Performance Comparison and the Global Financial Crisis. Applied Economics 47: 2541–62. [Google Scholar] [CrossRef]

- Bei, Jinlan, and Chunyu Wang. 2023. Renewable Energy Resources and Sustainable Development Goals: Evidence Based on Green Finance, Clean Energy and Environmentally Friendly Investment. Resources Policy 80: 103194. [Google Scholar] [CrossRef]

- Beisenbina, Marzhan, Laura Fabregat-Aibar, Maria-Glòria Barberà-Mariné, and Maria-Teresa Sorrosal-Forradellas. 2023. The Burgeoning Field of Sustainable Investment: Past, Present and Future. Sustainable Development 31: 649–67. [Google Scholar] [CrossRef]

- BinMahfouz, Saeed, and M. Kabir Hassan. 2013. Sustainable and Socially Responsible Investing. Humanomics 29: 164–86. [Google Scholar] [CrossRef]

- Bisaga, Iwona, Priti Parikh, Julia Tomei, and Long Seng To. 2021. Mapping Synergies and Trade-Offs between Energy and the Sustainable Development Goals: A Case Study of off-Grid Solar Energy in Rwanda. Energy Policy 149: 112028. [Google Scholar] [CrossRef]

- Bodhanwala, Shernaz, and Ruzbeh Bodhanwala. 2018. Does Corporate Sustainability Impact Firm Profitability? Evidence from India. Management Decision 56: 1734–47. [Google Scholar] [CrossRef]

- Bodhanwala, Shernaz, and Ruzbeh Bodhanwala. 2019. Relationship between Sustainable and Responsible Investing and Returns: A Global Evidence. Social Responsibility Journal 16: 579–94. [Google Scholar] [CrossRef]

- Bugg-Levine, Antony, and Jed Emerson. 2011. Impact Investing: Transforming How We Make Money While Making a Difference. Innovations: Technology, Governance, Globalization 6: 9–18. [Google Scholar] [CrossRef]

- Camilleri, Mark Anthony. 2020. The Market for Socially Responsible Investments. In Corporate social responsibility (CSR) and Socially Responsible Investing Strategies in Transitioning and Emerging Economies. London: IGI Global, pp. 171–88. [Google Scholar] [CrossRef]

- Camilleri, Mark Anthony. 2021. The Market for Socially Responsible Investing: A Review of the Developments. Social Responsibility Journal 17: 412–28. [Google Scholar] [CrossRef]

- Çatak, Ç. 2024. The Confusion over the Terminology of Sustainable, ESG, Socially Responsible and Impact Investing. In Sustainable Finance: Challenges, Opportunities and Future Prospects. Lausanne: Peter Lang AG, pp. 45–58. [Google Scholar]

- Chatziantoniou, Ioannis, David Gabauer, and Alexis Stenfors. 2021. Interest Rate Swaps and the Transmission Mechanism of Monetary Policy: A Quantile Connectedness Approach. Economics Letters 204: 109891. [Google Scholar] [CrossRef]

- Chatzitheodorou, Kyriakos, Antonis Skouloudis, Konstantinos Evangelinos, and Ioannis Nikolaou. 2019. Exploring Socially Responsible Investment Perspectives: A Literature Mapping and an Investor Classification. Sustainable Production and Consumption 19: 117–29. [Google Scholar] [CrossRef]

- Chuliá, Helena, Montserrat Guillén, and Jorge M. Uribe. 2017. Spillovers from the United States to Latin American and G7 Stock Markets: A VAR Quantile Analysis. Emerging Markets Review 31: 32–46. [Google Scholar] [CrossRef]

- Cocca, Teodoro, David Gabauer, and Stefan Pomberger. 2024. Clean Energy Market Connectedness and Investment Strategies: New Evidence from DCC-GARCH R2 Decomposed Connectedness Measures. Energy Economics 136: 107680. [Google Scholar] [CrossRef]

- Daugaard, Dan, Jing Jia, and Zhongtian Li. 2024. Implementing Corporate Sustainability Information in Socially Responsible Investing: A Systematic Review of Empirical Research. Journal of Accounting Literature 46: 238–76. [Google Scholar] [CrossRef]

- Delle Foglie, Andrea, and J.S. Keshminder. 2022. Challenges and Opportunities of SRI Sukuk toward Financial System Sustainability: A Bibliometric and Systematic Literature Review. International Journal of Emerging Markets. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A Fuller. 1979. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar] [CrossRef]

- ElBannan, Mona A. 2024. Returns Behavior of ESG ETFs in the COVID-19 Market Crash: Are Green Funds More Resilient? Journal of Corporate Accounting & Finance 35: 187–223. [Google Scholar] [CrossRef]

- Elsayed, Ahmed H., Giray Gozgor, and Larisa Yarovaya. 2022. Volatility and Return Connectedness of Cryptocurrency, Gold, and Uncertainty: Evidence from the Cryptocurrency Uncertainty Indices. Finance Research Letters 47: 102732. [Google Scholar] [CrossRef]

- Entine, Jon. 2003. The Myth of Social Investing. Organization & Environment 16: 352–68. [Google Scholar] [CrossRef]

- Geczy, Christopher C., Robert F Stambaugh, and David Levin. 2021. Investing in Socially Responsible Mutual Funds. The Review of Asset Pricing Studies 11: 309–51. [Google Scholar] [CrossRef]

- Gil-Bazo, Javier, Pablo Ruiz-Verdú, and André A. P. Santos. 2010. The Performance of Socially Responsible Mutual Funds: The Role of Fees and Management Companies. Journal of Business Ethics 94: 243–63. [Google Scholar] [CrossRef]

- Gillan, Stuart L., Andrew Koch, and Laura T. Starks. 2021. Firms and Social Responsibility: A Review of ESG and CSR Research in Corporate Finance. Journal of Corporate Finance 6: 101889. [Google Scholar] [CrossRef]

- Hawn, Olga, Aaron K. Chatterji, and Will Mitchell. 2018. Do Investors Actually Value Sustainability? New Evidence from Investor Reactions to the Dow Jones Sustainability Index (DJSI). Strategic Management Journal 39: 949–76. [Google Scholar] [CrossRef]

- Heine, Dirk, Willi Semmler, Mariana Mazzucato, Joao Paulo Braga, Arkady Gevorkyan, Erin Kate Hayde, and Siavash Radpour. 2019. Financing Low-Carbon Transitions Through Carbon Pricing and Green Bonds. Working Paper No. 8991. Available online: https://documents1.worldbank.org/curated/en/808771566321852359/pdf/Financing-Low-Carbon-Transitions-through-Carbon-Pricing-and-Green-Bonds.pdf (accessed on 15 April 2024).

- He, Jianjian, Yi Yang, Zhongju Liao, Anqi Xu, and Kai Fang. 2022. Linking SDG 7 to Assess the Renewable Energy Footprint of Nations by 2030. Applied Energy 317: 119167. [Google Scholar] [CrossRef]

- Iqbal, Najaf, Muhammad Abubakr Naeem, and Muhammed Tahir Suleman. 2022. Quantifying the Asymmetric Spillovers in Sustainable Investments. Journal of International Financial Markets, Institutions and Money 77: 101480. [Google Scholar] [CrossRef]

- Jonwall, Renu, Seema Gupta, and Shuchi Pahuja. 2023. Socially Responsible Investment Behavior: A Study of Individual Investors from India. Review of Behavioral Finance 15: 865–88. [Google Scholar] [CrossRef]

- Joo, Young C., and Sung Y. Park. 2023. Quantile Connectedness between Cryptocurrency and Commodity Futures. Finance Research Letters 58: 104472. [Google Scholar] [CrossRef]

- Kapil, Sheeba, and Vrinda Rawal. 2023. Sustainable Investment and Environmental, Social, and Governance Investing: A Bibliometric and Systematic Literature Review. Business Ethics, the Environment & Responsibility 32: 1429–51. [Google Scholar] [CrossRef]

- Karim, Sitara, Brian M. Lucey, Muhammad Abubakr Naeem, and Gazi Salah Uddin. 2022. Examining the Interrelatedness of NFTs, DeFi Tokens and Cryptocurrencies. Finance Research Letters 47: 102696. [Google Scholar] [CrossRef]

- Marín-Rodríguez, Nini Johana, Juan David González-Ruiz, and Alejandro Valencia-Arias. 2023a. Sustainability, Uncertainty, and Risk: Time-Frequency Relationships. Sustainability 15: 13589. [Google Scholar] [CrossRef]

- Marín-Rodríguez, Nini Johana, Juan David González-Ruiz, and Sergio Botero. 2022. Dynamic Relationships among Green Bonds, CO2 Emissions, and Oil Prices. Frontiers in Environmental Science 10: 992726. [Google Scholar] [CrossRef]

- Marín-Rodríguez, Nini Johana, Juan David González-Ruiz, and Sergio Botero. 2023b. A Wavelet Analysis of the Dynamic Connectedness among Oil Prices, Green Bonds, and CO2 Emissions. Risks 11: 15. [Google Scholar] [CrossRef]

- McLachlan, Jonathan, and John Gardner. 2004. A Comparison of Socially Responsible and Conventional Investors. Journal of Business Ethics 52: 11–25. [Google Scholar] [CrossRef]

- Muñoz, Fernando. 2021. Carbon-Intensive Industries in Socially Responsible Mutual Funds’ Portfolios. International Review of Financial Analysis 75: 101740. [Google Scholar] [CrossRef]

- Nerini, Francesco, Benjamin Sovacool, Nick Hughes, Laura Cozzi, Ellie Cosgrave, Mark Howells, Massimo Tavoni, Julia Tomei, Hisham Zerriffi, and Ben Milligan. 2019. Connecting Climate Action with Other Sustainable Development Goals. Nature Sustainability 2: 674–80. [Google Scholar] [CrossRef]

- Pástor, Ľuboš, Robert F. Stambaugh, and Lucian A. Taylor. 2022. Dissecting Green Returns. Journal of Financial Economics 146: 403–24. [Google Scholar] [CrossRef]

- Pesaran, H. Hashem, and Yongcheol Shin. 1998. Generalized Impulse Response Analysis in Linear Multivariate Models. Economics Letters 58: 17–29. [Google Scholar] [CrossRef]

- Reboredo, Juan C., and Luis A. Otero. 2021. Are Investors Aware of Climate-Related Transition Risks? Evidence from Mutual Fund Flows. Ecological Economics 189: 107148. [Google Scholar] [CrossRef]

- Reboredo, Juan C., Andrea Ugolini, and Javier Ojea-Ferreiro. 2022. Do Green Bonds De-Risk Investment in Low-Carbon Stocks? Economic Modelling 108: 105765. [Google Scholar] [CrossRef]

- Robledo, Sebastian, Martha Zuluaga, Luis-Alexander Valencia-Hernandez, Oscar Arbelaez-Echeverri Arbelaez-Echeverri, Pedro Duque, and Juan-David Alzate-Cardona. 2022. Tree of Science with Scopus: A Shiny Application. Issues in Science and Technology Librarianship. [Google Scholar] [CrossRef]

- Sabbaghi, Omid. 2011. Do Green Exchange-Traded Funds Outperform the S&p500. Journal of Accounting and Finance 11: 50–59. [Google Scholar]

- Saeed, Tareq, Elie Bouri, and Hamed Alsulami. 2021. Extreme Return Connectedness and Its Determinants between Clean/Green and Dirty Energy Investments. Energy Economics 96: 105017. [Google Scholar] [CrossRef]

- Sinclair, Stéfan, and Geoffrey Rockwell. 2020. Voyant-Tools. Available online: http://voyant-tools.org/ (accessed on 13 April 2024).

- Singhania, Monica, Ibna Bhan, and Gurmani Chadha. 2024. Sustainable Investments: A Scientometric Review and Research Agenda. Managerial Finance 50: 266–94. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, Farhad, and Naoyuki Yoshino. 2019. The Way to Induce Private Participation in Green Finance and Investment. Finance Research Letters 31: 98–103. [Google Scholar] [CrossRef]

- Talan, Gaurav, and Gagan Sharma. 2019. Doing Well by Doing Good: A Systematic Review and Research Agenda for Sustainable Investment. Sustainability 11: 353. [Google Scholar] [CrossRef]

- Umar, Zaghum, Dimitris Kenourgios, and Sypros Papathanasiou. 2020. The Static and Dynamic Connectedness of Environmental, Social, and Governance Investments: International Evidence. Economic Modelling 93: 112–24. [Google Scholar] [CrossRef] [PubMed]

- United Nations. 2018. Unlocking SDG Financing: Findings from Early Adopters. United Nations Sustainable Development Group. Available online: https://unsdg.un.org/sites/default/files/Unlocking-SDG-Financing-Good-Practices-Early-Adopters.pdf (accessed on 14 April 2024).

- van Eck, Nees Jan, and Ludo Waltman. 2017. Citation-Based Clustering of Publications Using CitNetExplorer and VOSviewer. Scientometrics 111: 1053–70. [Google Scholar] [CrossRef] [PubMed]

- Yaya, OlaOluwa, Olayinka Adenikinju, and Hammed A. Olayinka. 2024. African Stock Markets’ Connectedness: Quantile VAR Approach. Modern Finance 2: 51–68. [Google Scholar] [CrossRef]

- Yoshino, Naoyuki, Farhad Taghizadeh-Hesary, and Miyu Otsuka. 2021. COVID-19 and Optimal Portfolio Selection for Investment in Sustainable Development Goals. Finance Research Letters 38: 101695. [Google Scholar] [CrossRef] [PubMed]

- Zhang, He, Zhenting Gong, Yunglieh Yang, and Fan Chen. 2023. Dynamic Connectedness between China Green Bond, Carbon Market and Traditional Financial Markets: Evidence from Quantile Connectedness Approach. Finance Research Letters 58: 104473. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).