The Dual Pillars of Progress: Institutional and Cultural Dynamics in Economic Development

Abstract

1. Introduction

2. Literature Review on the Interplay between Cultural and Institutional Backgrounds

2.1. Formal and Informal Institutions and Economic Development

2.2. The Co-Evolution of Culture and Institutions and Economic Development

3. Materials and Methods

3.1. Empirical Strategy

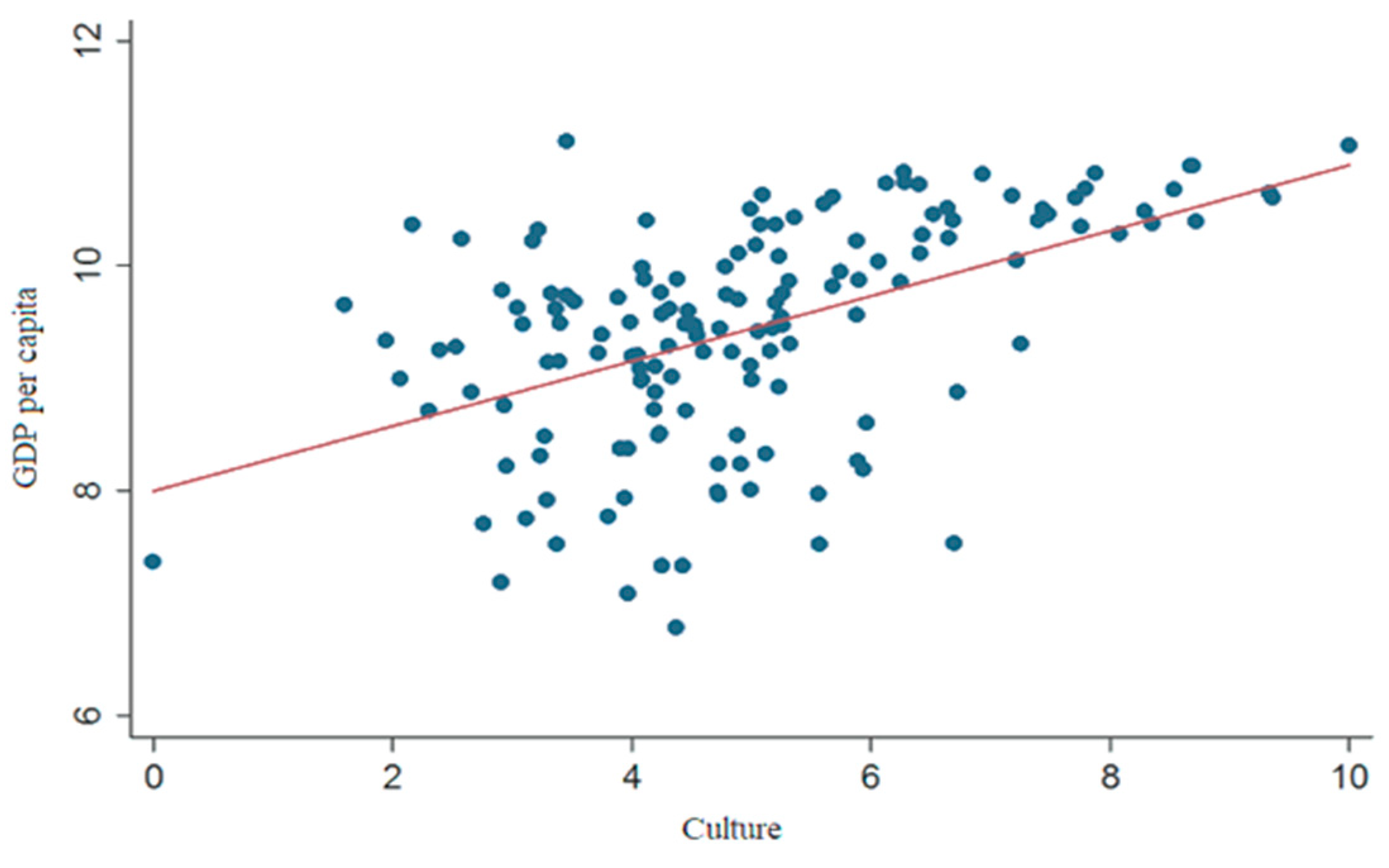

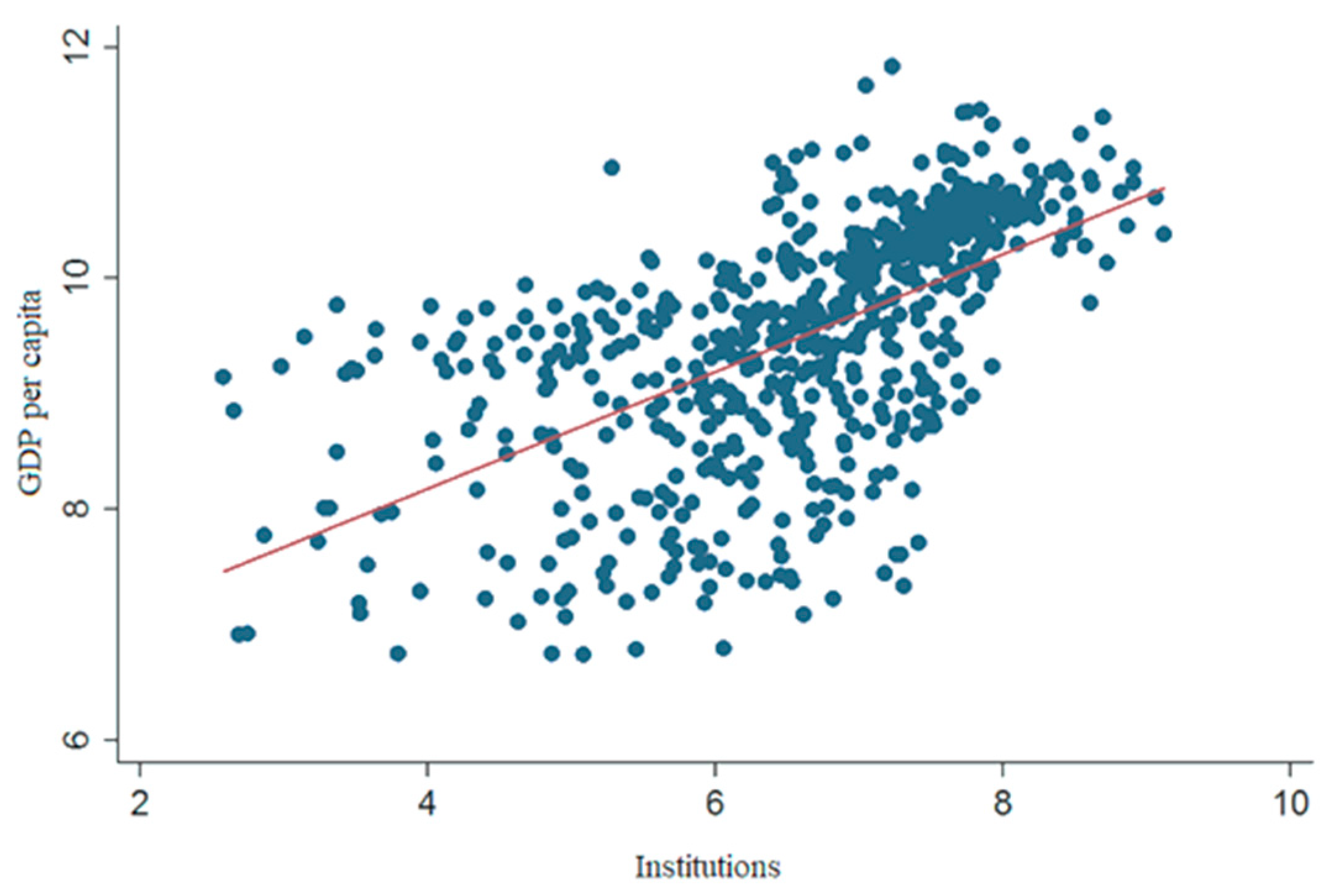

3.2. Data

3.3. Estimation Strategy and Economic Issues

4. Empirical Results

Robustness Analysis

5. Discussion and Conclusions

5.1. Synergy between Institutional and Cultural Backgrounds

5.2. Policy Implications and Challenges

5.3. Transformative Policy Interventions

5.4. Limitations and Directions for Future Research

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Cultural Dimension | Question/Definition | |

|---|---|---|

| Generalized trust | “In general, would you say that most people can be trusted or that you should be very careful in dealing with people?” The level of trust in each country is measured as the percentage of respondents who answered that “most people can be trusted”. | |

| Control of life | “How much freedom of choice and control do you feel you have over how you live your life”? The respondents’ response “a great deal of freedom of choice and control” is the one taken into account. | |

| Independence | “Which quality do you consider to be particularly important to teach to your children? Obedience or independence»?” The variable is defined as the percentage of respondents reporting “independence” as the most important quality. | |

| Honesty | Honesty I | “Is it justified to evade taxes? Honesty I corresponds to the answer “not acceptable”. |

| Honesty II | “Is it justified to avoid paying a fare on public transport?” Honesty II is derived from the percentage of respondents who also answer, “not acceptable”. | |

| Competition affinity | Competition affinity I | “How would you place your view, on a scale of 1 to 10, from competition being good to competition being harmful?” Competition I corresponds to the answer “competition is good”. |

| Competition affinity II | “Can people only get rich at the expense of others?” Competition II is derived from the percentage of respondents answering, “at the expense of others”. | |

| Work ethic | Work ethic I | “What quality is considered particularly important to teach your children?” “Work Ethic I” corresponds to the responses “hard work”. |

| Work ethic II | “Work is very important to your life?” Work Ethic II is derived from the percentage of respondents answering, “very important”. | |

| Respect | “Which quality do you consider to be particularly important to teaching your children?” The variable “respect” is defined as the percentage of respondents in each country reporting the quality “tolerance and respect for others” as important. | |

| Strong Institutions–Weak Culture | Strong Institutions–Strong Culture | ||||||

|---|---|---|---|---|---|---|---|

| Country | Culture | Institutions | GDP Per Capita | Country | Culture | Institutions | GDP Per Capita |

| Vietnam | 5.89 | 6.05 | 3330.30 | Norway | 9.35 | 7.38 | 55,653.87 |

| New Zealand | 5.76 | 8.05 | 28,268.62 | Sweden | 8.74 | 7.34 | 37,068.91 |

| Georgia | 4.06 | 7.59 | 5716.39 | Netherlands | 8.71 | 7.61 | 40,332.87 |

| Armenia | 3.23 | 7.57 | 5075.77 | Finland | 8.71 | 7.60 | 33,646.95 |

| Estonia | 5.57 | 7.52 | 19,887.70 | Hong Kong | 7.87 | 8.86 | 37,889.14 |

| Chile | 5.28 | 7.31 | 15,360.80 | Japan | 7.72 | 7.65 | 33,247.75 |

| Latvia | 4.99 | 7.25 | 16,185.53 | Germany | 7.60 | 7.69 | 37,573.25 |

| Czech republic | 4.15 | 7.21 | 26,175.23 | Switzerland | 7.54 | 8.35 | 49,494.08 |

| Lithuania | 5.16 | 7.16 | 19,989.40 | Australia | 7.24 | 7.81 | 36,647.47 |

| Spain | 5.21 | 7.14 | 28,817.90 | Canada | 7.18 | 8.00 | 36,705.35 |

| France | 5.61 | 7.08 | 34,558.47 | Average | 8.07 | 7.83 | 39,825.96 |

| Slovakia | 4.00 | 7.07 | 20,558.37 | ||||

| Lebanon | 3.36 | 7.05 | 12,649.27 | ||||

| Malaysia | 5.57 | 7.01 | 17,286.46 | ||||

| Kazakhstan | 4.78 | 7.00 | 15,735.42 | ||||

| Average | 4.84 | 7.21 | 17,973.04 | ||||

| Weak Institutions–Weak Culture | Weak Institutions–Strong Culture | ||||||

| Country | Culture | Institutions | GDP per capita | Country | Culture | Institutions | GDP per capita |

| Burkina Faso | 2.91 | 5.99 | 1195.23 | - | - | - | - |

| India | 3.33 | 5.99 | 3413.81 | ||||

| Dominican Rep. | 4.19 | 5.98 | 9441.76 | ||||

| Haiti | 0.00 | 5.96 | 1777.94 | ||||

| Russia | 4.58 | 5.94 | 19,549.52 | ||||

| Poland | 5.44 | 5.81 | 16,716.41 | ||||

| Ghana | 2.17 | 5.75 | 3585.80 | ||||

| Ecuador | 3.72 | 5.69 | 8530.45 | ||||

| Pakistan | 3.97 | 5.59 | 3639.66 | ||||

| Ethiopia | 4.37 | 5.52 | 977.15 | ||||

| Mali | 2.57 | 5.43 | 1641.60 | ||||

| Zambia | 3.29 | 5.41 | 2782.47 | ||||

| Egypt | 4.69 | 5.40 | 8778.71 | ||||

| Argentina | 4.60 | 5.38 | 15,807.43 | ||||

| Bangladesh | 4.43 | 5.34 | 2180.83 | ||||

| Ukraine | 4.74 | 5.32 | 7201.05 | ||||

| Brazil | 2.73 | 5.27 | 12,418.27 | ||||

| Nigeria | 2.07 | 5.13 | 4075.95 | ||||

| Iran | 3.46 | 4.87 | 14,920.61 | ||||

| Libya | 3.33 | 4.69 | 26,331.32 | ||||

| Zimbabwe | 3.12 | 4.60 | 2540.86 | ||||

| Algeria | 3.09 | 4.48 | 11,667.48 | ||||

| Venezuela | 1.60 | 4.45 | 15,032.13 | ||||

| Average | 3.41 | 5.39 | 8443.76 | ||||

| 1 | See Kostis et al. (2018) for a discussion on the role of generalized trust in economic development. See Banfield (1958) for the role of control of life in economic outcomes. To see the role of honesty, see Guiso et al. (2010) for a discussion on the extent to which individuals try to increase their benefits regardless of the potentially negative social externalities of their actions. See Inglehart and Baker (2000) and Phelps (2006) for a discussion on the roles of competition affinity and work ethic in economic outcomes. See Tabellini (2010) for a discussion on the role of respect in the economy. |

| 2 | Given socio-economic research’s dynamic and evolving nature, applying a PCA over time warrants careful consideration. It is essential to address potential concerns regarding introducing bias in constructing composite indicators, as highlighted by Mazziotta and Pareto (2016, 2018). These authors provide valuable insights into adjusting composite indices to reflect changes more accurately over time, emphasizing the importance of methodological rigor in longitudinal analyses. However, it is pertinent to note the distinctive characteristics of cultural values compared to other socio-economic phenomena. Cultural values are inherently stable and evolve over significantly longer horizons than economic indicators or institutional changes. This inherent stability of cultural dimensions provides a methodological advantage when applying a PCA over time in this study. The long-lasting nature of cultural values suggests that potential biases associated with temporal dynamics are considerably mitigated, allowing for the reliable use of a PCA to aggregate cultural indicators across different time periods. |

| 3 | The variation in the number of observations across different specifications and robustness checks in this study is attributed to data availability for the variables related to institutions and culture. Specifically, the analyses incorporating “institutions” as the sole independent variable include a broader dataset, reflecting the comprehensive availability of institutional data across all countries over the seven analysis waves. In contrast, when “culture” is introduced as a variable, the number of observations is reduced due to the more limited availability of cultural data. This discrepancy is consistent across all tables and is an inherent study limitation influenced by the external constraint of data availability. Despite these variations, the data utilized across all analyses remain consistent, ensuring the integrity of the comparative analysis within the bounds of the available data. |

References

- Acemoglu, Daron, and James Robinson. 2012. Why Nations Fail: The Origins of Power, Prosperity, and Poverty. New York: Crown Publishing. [Google Scholar]

- Acemoglu, Daron, Simon Johnson, and James Robinson. 2005. Chapter 6 Institutions as a Fundamental Cause of Long-Run Growth. In Handbook of Economic Growth. Edited by Philippe Aghion and Steven N. Durlauf. Amsterdam: Elsevier, Volume 1, Part A. pp. 385–472. [Google Scholar] [CrossRef]

- Alesina, Alberto, and Paola Giuliano. 2015. Culture and Institutions. Journal of Economic Literature 53: 898–944. [Google Scholar] [CrossRef]

- Alonso-Borrego, Cesar, and Manuel Arellano. 1996. Symmetrically Normalised Instrumental Variable Estimation Using Panel Data. CEMFI Working Paper No. 9612. Madrid: Center for Monetary and Financial Studies (CEMFI). [Google Scholar]

- Antrup, Andreas Hermann. 2013. Co-evolution of Institutions and Preferences: The Case of the (Human) Mating Market. Journal of Theoretical Biology 332: 9–19. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Bakas, Dimitrios, Pantelis Kostis, and Petrakis Panagiotis. 2020. Culture and Labour Productivity: An Empirical Investigation. Economic Modelling 85: 233–43. [Google Scholar] [CrossRef]

- Banfield, Edward. 1958. Moral Basis of a Backward Society. New York: Free Press. [Google Scholar]

- Basu, Basudha. 2021. Do Institutional Norms Affect Behavioral Preferences: A View from Gender Bias in the Intra-Household Expenditure Allocation in Iran. Economic Modelling 97: 118–34. [Google Scholar] [CrossRef]

- Bengoa, Marta, and Blanca Sanchez-Robles. 2003. Foreign Direct Investment, Economic Freedom and Growth: New Evidence from Latin America. European Journal of Political Economy 19: 529–45. [Google Scholar] [CrossRef]

- Bisin, Alberto, and Thierry Verdier. 2015. On the Joint Evolution of Culture and Institutions. New York: Mimeo. [Google Scholar]

- Borovic, Zoran, and Dragana Radicic. 2023. Productivity Gap between the ‘New’ and ‘Old’ Europe and Role of Institutions. Economies 11: 254. [Google Scholar] [CrossRef]

- Bourdieu, Pierre. 1986. The Forms of Capital. In Handbook of Theory and Research for the Sociology of Culture. Edited by J. Richardson. New York: Greenwood, pp. 241–58. [Google Scholar]

- Bowles, Samuel. 1998. Endogenous Preferences: The Cultural Consequences of Markets and Other Economic Institutions. Journal of Economic Literature 36: 75–111. [Google Scholar]

- Bowles, Samuel. 2000. Group Conflicts, Individual Interactions, and the Evolution of Preferences. In Social Dynamics. Edited by Stephen Durlauf and Peyton Young. Cambridge: MIT Press. [Google Scholar]

- Bowles, Samuel. 2004. Microeconomics: Behavior, Institutions, and Evolution. Princeton: Princeton University Press. [Google Scholar]

- Bowles, Samuel. 2006. Group Competition, Reproductive Leveling, and the Evolution of Human Altruism. Science 314: 1569–72. [Google Scholar] [CrossRef]

- Bowles, Samuel. 2009. Did Warfare Among Ancestral Hunter-Gatherers Affect the Evolution of Human Social Behaviors? Science 324: 1293–98. [Google Scholar] [CrossRef]

- Bowles, Samuel, and Herbert Gintis. 2000. Walrasian Economics in Retrospect. Quarterly Journal of Economics 115: 1411–39. [Google Scholar] [CrossRef]

- Bowles, Samuel, Jung-Kyoo Choi, and Astrid Hopfensitz. 2003. The Co-Evolution of Individual Behaviors and Social Institutions. Journal of Theoretical Biology 223: 135–47. [Google Scholar] [CrossRef]

- Boyd, Robert, and Peter J. Richerson. 2002. Group Beneficial Norms Can Spread Rapidly in a Structured Population. Journal of Theoretical Biology 215: 287–96. [Google Scholar] [CrossRef]

- Bützer, Stefan, Christa Jordan, and Livio Stracca. 2013. Macroeconomic Imbalances: A Question of Trust? Working Paper 1584. Frankfurt: European Central Bank. [Google Scholar]

- Chadwick, Clifton, and Soledad Valenzuela. 2008. Culture, Change, and Educational Improvement. Educational Technology 48: 27–36. Available online: http://www.jstor.org/stable/44429590 (accessed on 15 March 2024).

- Choi, Jung-Kyoo, and Samuel Bowles. 2007. The Coevolution of Parochial Altruism and War. Science 318: 636–40. [Google Scholar] [CrossRef] [PubMed]

- Correa da Cunha, Henrique, Mohamed Amal, and James Mark Viminitz. 2022. Formal vs. Informal Institutional Distances and the Competitive Advantage of Foreign Subsidiaries in Latin America. Economies 10: 114. [Google Scholar] [CrossRef]

- Da Silva, Antonia Dias, Audrey Givone, and David Sondermann. 2017. When Do Countries Implement Structural Reforms? ECB Working Paper Series, No. 2078. Frankfurt am Main: European Central Bank. [Google Scholar]

- Dawson, John W. 1998. Institutions, Investment, and Growth: New Cross-Country and Panel Data Evidence. Economic Inquiry 36: 603–19. [Google Scholar] [CrossRef]

- De Jong, Eelke. 2009. Culture and Economics: On Values, Economics, and International Business. London: Routledge. [Google Scholar]

- Frederking, Laurence C. 2002. Is There an Endogenous Relationship Between Culture and Economic Development? Journal of Economic Behavior and Organization 48: 105–26. [Google Scholar] [CrossRef]

- Gaganis, Chrysovalantis, Fotios Pasiouras, and Fotini Voulgari. 2019. Culture, Business Environment and SMEs’ Profitability: Evidence from European Countries. Economic Modelling 78: 275–92. [Google Scholar] [CrossRef]

- Gintis, Herbert. 2007. A Framework for the Unification of the Behavioral Sciences. Behavioral and Brain Sciences 30: 1–16. [Google Scholar] [CrossRef]

- Glaeser, Edward L., Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei Shleifer. 2004. Do Institutions Cause Growth? Journal of Economic Growth 9: 271–303. [Google Scholar] [CrossRef]

- Greif, Avner, and Guido Tabellini. 2017. The Clan and the Corporation: Sustaining Cooperation in China and Europe. Journal of Comparative Economics 45: 1–35. [Google Scholar] [CrossRef]

- Guiso, Luigi, Sapienza Paola, and Zingales Luigi. 2010. Civic Capital as the Missing Link. NBER Working Paper 15845. Cambridge: National Bureau of Economic Research, Inc. [Google Scholar]

- Gwartney, James D., Randall A. Holcombe, and Robert G. Lawson. 2004. Economic Freedom, Institutional Quality, and Cross-Country Differences in Income and Growth. Cato Journal 24: 205–33. [Google Scholar]

- Gwartney, James, Robert Lawson, and Joshua Hall. 2019. Economic Freedom of the World: 2019 Annual Report. Calgary: Fraser Institute. ISBN 978-0-88975-561-1. [Google Scholar]

- Hall, Joshua, and Robert Lawson. 2014. Economic Freedom of the World: An Accounting of the Literature. Contemporary Economic Policy 32: 1–19. [Google Scholar] [CrossRef]

- Hall, Robert E., and Charles I. Jones. 1999. Why Do Some Countries Produce So Much More Output Per Worker than Others? The Quarterly Journal of Economics 114: 83–116. [Google Scholar] [CrossRef]

- Hansen, Lars Peter, and Kenneth J. Singleton. 1982. Generalized Instrumental Variables of Nonlinear Rational Expectations Models. Econometrica 50: 1269–86. [Google Scholar] [CrossRef]

- Hofstede, Geert. 1980. Culture’s Consequences: International Differences in Work-Related Values. Beverly Hills: Sage Publications. [Google Scholar]

- Hopp, Christian, and Ute Stephan. 2012. The Influence of Socio-Cultural Environments on the Performance of Nascent Entrepreneurs: Community Culture, Motivation, Self Efficacy and Start-Up Success. Entrepreneurship & Regional Development 24: 917–45. [Google Scholar]

- House, Robert J., Paul J. Hanges, Mansour Javidan, Peter W. Dorfman, and Vipin Gupta. 2004. Culture, Leadership, and Organizations: The GLOBE Study of 62 Societies. Thousand Oaks: Sage Publications. [Google Scholar]

- Huggins, Robert, and Piers Thompson. 2014. Culture, Entrepreneurship, and Uneven Development: A Spatial Analysis. Entrepreneurship & Regional Development 26: 726–52. [Google Scholar]

- Inglehart, Ronald. 1988. The Renaissance of Political Culture. American Political Science Review 82: 1028–34. [Google Scholar] [CrossRef]

- Inglehart, Ronald. 1990. Culture Shift in Advanced Industrial Society. Princeton: Princeton University Press. [Google Scholar]

- Inglehart, Ronald. 1998. The New Political Culture: Changing Dynamics of Support for the Welfare State and Other Policies in Postindustrial Societies. In The New Political Culture. Edited by Terry N. Clark and Vincent Hoffmann-Martinot. Colorado: Westview Press. [Google Scholar]

- Inglehart, Ronald, and Wayne E. Baker. 2000. Modernization, Culture Change, and the Persistence of Traditional Values. American Sociological Review 65: 19–51. [Google Scholar] [CrossRef]

- Johnston, Lucy. 1996. Resisting Change: Information-Seeking and Stereotype Change. European Journal of Social Psychology 26: 799–825. [Google Scholar] [CrossRef]

- Kafka, Kyriaki I. 2020. Economic Theory and Economic Reality: A Continuously Dialectic Relationship. In Bridging Microeconomics and Macroeconomics and the Effects on Economic Development and Growth. Edited by Pantelis C. Kostis. Hershey: IGI Global. [Google Scholar] [CrossRef]

- Kafka, Kyriaki I., and Pantelis C. Kostis. 2021. Post-Materialism and Economic Growth: Cultural Backlash, 1981–2019. Journal of Comparative Economics 49: 901–17. [Google Scholar] [CrossRef]

- Kafka, Kyriaki I., Panagiotis E. Petrakis, and Pantelis C. Kostis. 2020. Why Coevolution of Culture and Institutions Matters for Economic Development and Growth? In Perspectives on Economic Development—Public Policy, Culture, and Economic Development. Edited by R. M. Yong and Intech Open Publications. London: Intech Open. [Google Scholar] [CrossRef]

- Knack, Stephen, and Philip Keefer. 1997. Does Social Capital Have an Economic Payoff? A Cross-Country Investigation. The Quarterly Journal of Economics 112: 1251–88. [Google Scholar] [CrossRef]

- Knight, Jack. 1992. Institutions and Social Conflict. Cambridge: Cambridge University Press. [Google Scholar]

- Kostis, Pantelis C., Kyriaki I. Kafka, and Panagiotis E. Petrakis. 2018. Cultural Change and Innovation Performance. Journal of Business Research 88: 306–13. [Google Scholar] [CrossRef]

- Le Clech, Néstor, and Juan Carlos Guevara-Pérez. 2023. Latin America and the Caribbean’s Productivity: The Role of Pro-Market Policies, Institutions, Infrastructure, and Natural Resource Endowments. Economies 11: 142. [Google Scholar] [CrossRef]

- Levine, Ross, and David Renelt. 1992. A Sensitivity Analysis of Cross-Country Growth Regressions. American Economic Review 82: 942–63. [Google Scholar]

- Lewis, Orion, and Sven Steinmo. 2012. How Institutions Evolve: Evolutionary Theory and Institutional Change. Polity 44: 314–39. [Google Scholar] [CrossRef]

- Lothian, James R. 2006. Institutions, Capital Flows and Financial Integration. Journal of International Money and Finance 25: 358–69. [Google Scholar] [CrossRef][Green Version]

- Mathers, Rachel L., and Claudia R. Williamson. 2011. Cultural Context: Explaining the Productivity of Capitalism. Kyklos 64: 231–52. [Google Scholar] [CrossRef]

- Mazziotta, Matteo, and Adriano Pareto. 2016. On a Generalized Non-compensatory Composite Index for Measuring Socio-economic Phenomena. Social Indicators Research 127: 983–1003. [Google Scholar] [CrossRef]

- Mazziotta, Matteo, and Adriano Pareto. 2018. Measuring Well-Being Over Time: The Adjusted Mazziotta–Pareto Index Versus Other Non-compensatory Indices. Social Indicators Research 136: 967–76. [Google Scholar] [CrossRef]

- McClelland, David C. 1961. The Achieving Society. Princeton: Van Nostrand. [Google Scholar]

- Murphy, Ryan H. 2021. The Soft Stuff of Institutional Development: Culture, Cohesion, and Economic Freedom. Journal of Private Enterprise 36: 37–66. [Google Scholar]

- North, Douglass C., and Barry R. Weingast. 1989. Constitutions and Commitment: The Evolution of Institutions Governing Public Choice in Seventeenth-Century England. The Journal of Economic History 49: 803–32. [Google Scholar] [CrossRef]

- Patuelli, Roberto, Enrico Santarelli, and Annie Tubadji. 2020. Entrepreneurial Intention among High-School Students: The Importance of Parents, Peers and Neighbors. Eurasian Business Review 10: 225–51. [Google Scholar] [CrossRef]

- Pejovich, Svetozar. 2003. Understanding the Transaction Costs of Transition: It’s the Culture, Stupid. ICER Working Papers 24-2003. Torino: ICER—International Centre for Economic Research. [Google Scholar]

- Petrakis, Panagiotis E., and Pantelis C. Kostis. 2013. Economic Growth and Cultural Change. Journal of Behavioral and Experimental Economics (Formerly ”The Journal of Socio-Economics”) 47: 147–57. [Google Scholar] [CrossRef]

- Petrakis, Panagiotis E., Dionysis G. Valsamis, and Kyriaki I. Kafka. 2017. From an Optimal to a Stagnated Growth Prototype: The Role of Institutions and Culture. Journal of Innovation and Knowledge 2: 97–105. [Google Scholar] [CrossRef]

- Petrakis, Panagiotis E., Dionysis G. Valsamis, and Kyriaki I. Kafka. 2020. Economic Growth and Development Policy. London: Palgrave MacMillan. ISBN 978-3-030-43181-5. [Google Scholar]

- Phelps, Anne E. 2006. Emotion and Cognition: Insights from Studies of the Human Amygdala. Annual Review of Psychology 57: 27–53. [Google Scholar] [CrossRef]

- Roodman, David. 2008. Through the Looking-Glass, and What OLS Found There: On Growth, Foreign Aid, and Reverse Causality. Working Papers 137. Washington, DC: Center for Global Development. [Google Scholar]

- Roth, Felix. 2009. Does Too Much Trust Hamper Economic Growth? Kyklos 1: 103–28. [Google Scholar] [CrossRef]

- Schwarz, Shalom H. 2009. Culture Matters: National Value Cultures, Sources, and Consequences. In Understanding Culture. Edited by Robert S. Wyer, Chi-yue Chiu and Ying-yi Hong. New York: Psychology Press. [Google Scholar]

- Spolaore, Enrico, and Romain Wacziarg. 2013. How Deep Are the Roots of Economic Development? Journal of Economic Literature 51: 325–39. [Google Scholar] [CrossRef]

- Tabellini, Guido. 2010. Culture and Institutions: Economic Development in the Regions of Europe. Journal of the European Economic Association 8: 677–716. [Google Scholar] [CrossRef]

- Travkina, Elena Vladimirovna, Alim Borisovich Fiapshev, Marianna Tolevna Belova, and Svetlana Evgenievna Dubova. 2023. Culture and Institutional Changes and Their Impact on Economic and Financial Development Trajectories. Economies 11: 14. [Google Scholar] [CrossRef]

- Veblen, Thorstein. 1898. The Theory of the Leisure Class: An Economic Study of Institutions. New York: MacMillan. [Google Scholar]

- Weber, Max. 1996. The Protestant Ethic and the Spirit of Capitalism. Translated by Talcott Parsons. Los Angeles: Roxbury. First published 1930. [Google Scholar]

- Williamson, Claudia R. 2009. Informal Institutions Rule: Institutional Arrangements and Economic Performance. Public Choice 139: 371–87. [Google Scholar] [CrossRef]

- Williamson, Claudia R., and Rachel L. Mathers. 2011. Economic Freedom, Culture, and Growth. Public Choice 148: 313–35. [Google Scholar] [CrossRef]

- Xiu, Zhou, Rui Liu, Peng Feng, and Jing Yin. 2023. Does Social Culture Matter for Firms’ Access to Trade Credit? Evidence from China. Economic Modelling 119: 106163. [Google Scholar] [CrossRef]

- Yegorov, Yuriy. 2015. Economic Role of Population Density. Paper presented at 55th Congress of the European Regional Science Association: “World Renaissance: Changing Roles for People and Places”, Lisbon, Portugal, August 25–28; Louvain-la-Neuve: European Regional Science Association (ERSA). [Google Scholar]

| N | Avg. | St. dev. | Min | Max | |

|---|---|---|---|---|---|

| GDP per capita | 712 | 9.44 | 1.09 | 6.35 | 11.83 |

| Institutions | 610 | 6.57 | 1.24 | 2.59 | 9.12 |

| Culture | 152 | 0.00 | 1.57 | −4.52 | 4.58 |

| Trust | 366 | 28.40 | 15.63 | 2.50 | 77.40 |

| Control of life | 352 | 15.36 | 8.52 | 0.00 | 43.90 |

| Respect | 359 | 67.87 | 13.24 | 14.20 | 96.30 |

| Independence | 364 | 48.10 | 18.79 | 7.90 | 90.00 |

| Honesty | 331 | 0.00 | 1.32 | −3.84 | 3.67 |

| Honesty I | 354 | 60.04 | 14.73 | 20.30 | 98.10 |

| Honesty II | 338 | 55.93 | 15.58 | 12.60 | 96.30 |

| Competition | 178 | 0.00 | 1.12 | −1.73 | 6.14 |

| Competition I | 327 | 26.10 | 12.32 | 3.70 | 66.30 |

| Competition II | 183 | 7.66 | 6.95 | 0.30 | 77.30 |

| Work ethic | 335 | 0.00 | 1.03 | −2.73 | 2.43 |

| Work ethic I | 362 | 52.85 | 25.43 | 2.10 | 94.60 |

| Work ethic II | 338 | 61.82 | 14.95 | 26.10 | 95.10 |

| FDI | 687 | 10.31 | 32.47 | −51.77 | 322.05 |

| Tertiary education | 579 | 33.42 | 23.43 | 0.27 | 113.77 |

| Investments | 672 | 24.04 | 6.72 | 3.35 | 49.31 |

| Population density | 742 | 253.66 | 860.10 | 1.99 | 7934.36 |

| Cultural Value | Principal Component Score |

|---|---|

| Trust | 0.466 |

| Control of life | −0.226 |

| Independence | 0.389 |

| Honesty | 0.027 |

| Competition | −0.457 |

| Work ethic | −0.507 |

| Respect | 0.325 |

| Eigenvalue | 2.463 |

| Var | 35.2% |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| Institutions | 0.05 *** (2.51) | 0.11 *** (5.05) | 0.08 ** (2.24) | 0.09 ** (2.01) | 0.19 *** (5.19) | 0.11 *** (2.40) | 0.23 *** (5.46) | 0.19 ** (2.08) | |

| Culture | 0.01 (0.27) | 0.04 ** (2.01) | 0.05 * (1.66) | 0.05 ** (2.35) | 0.07 * (1.59) | ||||

| Institutions × Culture | 0.01 * (1.65) | 0.08 *** (2.43) | |||||||

| Institutions/Culture | 0.17 ** (2.10) | 0.17 (0.98) | |||||||

| Culture/Institutions | −0.48 *** (−2.76) | −0.32 * (1.41) | |||||||

| Ν | 607 | 149 | 135 | 135 | 134 | 135 | 134 | 135 | 134 |

| R2 | 64.21% | 69.81% | 77.74% | 78.03% | 78.63% | 76.46% | 76.20% | 75.43% | 64.85% |

| F-stat | 108.43 *** | 32.19 *** | 27.00 *** | 65.13 *** | 79.71 *** | 181.02 *** | 189.26 *** | 182.08 *** | 33.82 *** |

| (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | |

|---|---|---|---|---|---|---|---|---|---|

| Institutions | 0.09 *** (9.03) | 0.14 *** (5.25) | 0.11 *** (4.63) | 0.11 *** (4.09) | 0.13 *** (5.30) | 0.14 *** (8.21) | 0.13 *** (7.40) | 0.14 *** (5.90) | |

| Culture | 0.02 (1.11) | 0.03 ** (1.95) | 0.03 * (1.78) | 0.03 * (1.69) | 0.04 * (1.63) | ||||

| Institutions × Culture | 0.01 * (1.91) | 0.01 * (1.69) | |||||||

| Institutions/Culture | 0.13 * (1.67) | 0.01 (0.34) | |||||||

| Culture/Institutions | −0.16 *** (−2.54) | −0.11 (1.19) | |||||||

| GDP per capita previous year | 0.64 *** (15.36) | 0.86 *** (11.61) | 0.58 *** (7.14) | 0.53 *** (8.90) | 0.54 *** (8.90) | 0.53 *** (8.94) | 0.58 *** (12.32) | 0.58 *** (6.85) | 0.53 *** (8.94) |

| Ν | 534 | 143 | 133 | 133 | 131 | 132 | 131 | 133 | 131 |

| R2 | 87.04% | 76.05% | 90.80% | 91.10% | 91,17% | 90.92% | 90.80% | 79.17% | 91.33% |

| F-stat | 505.15 *** | 73.12 *** | 77.24 *** | 138.14 *** | 109.48 *** | 135.14 *** | 133.27 *** | 184.35 *** | 111.62 *** |

| (19) | (20) | (21) | (22) | |

|---|---|---|---|---|

| Institutions | 0.17 *** (5.66) | 0.16 *** (5.86) | 0.12 *** (3.38) | 0.17 *** (5.17) |

| Culture | 0.05 ** (2.28) | 0.05 *** (2.64) | 0.05 * (1.81) | 0.04 ** (2.01) |

| GDP per capita previous year | 0.01 *** (4.28) | 0.01 *** (3.87) | 0.01 * (1.86) | 0.01 * (1.61) |

| Investments | 0.02 * (1.83) | 0.01 * (1.63) | 0.02 * (1.80) | −0.01 (−0.06) |

| Population density | 0.01 *** (5.02) | 0.01 *** (4.79) | −0.01 * (−1.88) | |

| Tertiary Education | 0.01 *** (2.49) | 0.01 (0.87) | ||

| FDI | 0.01 *** (2.77) | |||

| Ν | 132 | 130 | 114 | 111 |

| R2 | 74.16% | 78.47% | 77.62% | 85.76% |

| F-stat | 23.93 *** | 30.83 *** | 17.59 *** | 24.54 *** |

| (23) | (24) | (25) | (26) | |

|---|---|---|---|---|

| Institutions × Culture | 0.01 *** (3.05) | 0.01 *** (3.49) | 0.01 *** (2.67) | 0.01 *** (4.11) |

| GDP per capita previous year | 0.49 *** (4.28) | 0.48 *** (3.98) | 0.47 *** (3.21) | 0.37 ** (2.34) |

| Investments | 0.02 *** (7.03) | 0.02 *** (5.42) | 0.02 *** (5.05) | 0.01 *** (3.25) |

| Population density | 0.01 (0.27) | 0.01 (0.16) | −0.01 ** (−2.26) | |

| Tertiary Education | 0.01 (0.45) | 0.01 (0.69) | ||

| FDI | 0.01 * (1.89) | |||

| Ν | 132 | 130 | 114 | 111 |

| R2 | 92.48% | 85.37%% | 89.44% | 92.51% |

| F-stat | 93.88 *** | 89.35 *** | 69.15 *** | 33.91 *** |

| (27) | (28) | (29) | (30) | (31) | (32) | (33) | (34) | |

|---|---|---|---|---|---|---|---|---|

| Institutions | 0.12 *** (3.06) | 0.13 *** (2.98) | 0.11 *** (2.59) | 0.12 ** (2.91) | 0.09 ** (2.09) | 0.05 * (1.82) | 0.07 ** (2.42) | 0.12 ** (2.91) |

| Culture | 0.06 ** (1.95) | 0.05 ** (1.93) | 0.04 ** (1.89) | 0.04 ** (1.79) | 0.05 * (1.79) | 0.04 ** (2.24) | 0.04 * (1.63) | 0.04 * (1.61) |

| Institutions × Culture | 0.01 *** (4.21) | 0.01 *** (2.50) | 0.01 *** (2.91) | |||||

| Institutions/Culture | −0.02 (−0.29) | |||||||

| Culture/Institutions | 0.03 (0.24) | |||||||

| GDP per capita previous year | 0.73 *** (12.94) | 0.75 *** (13.21) | 0.87 *** (17.50) | 0.88 *** (24.27) | 0.78 *** (11.36) | 0.92 *** (16.52) | 0.82 *** (13.72) | 0.88 *** (2.18) |

| Investments | 0.01 * (1.89) | 0.01 *** (3.51) | 0.01 *** (2.42) | 0.01 ** (2.31) | ||||

| Population density | −0.01 (−0.70) | −0.01 (−1.19) | −0.01 (−0.92) | −0.01 (−0.83) | ||||

| Tertiary education | −0.01 (−1.34) | 0.01 (0.21) | ||||||

| FDI | −0.01 (−0.43) | 0.01 (0.48) | ||||||

| Arellano–Bond AR(1) test | 0.307 | 0.632 | 0.367 | 0.399 | 0.395 | 0.942 | 0.721 | 0.879 |

| Arellano–Bond AR(2) test | 0.318 | 0.472 | 0.258 | 0.237 | 0.291 | 0.263 | 0.374 | 0.294 |

| F-statistic | 246.76 *** | 324.29 *** | 352.67 *** | 512.47 *** | 269.29 *** | 680.02 *** | 411.37 *** | 476.41 *** |

| Hansen test | 0.086 | 0.104 | 0.112 | 0.092 | 0.563 | 0.265 | 0.121 | 0.254 |

| No. of instruments | 31 | 23 | 23 | 23 | 33 | 18 | 23 | 18 |

| No. of groups | 75 | 73 | 73 | 73 | 73 | 68 | 72 | 67 |

| No. of observations | 174 | 172 | 172 | 172 | 171 | 136 | 170 | 135 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kafka, K.I. The Dual Pillars of Progress: Institutional and Cultural Dynamics in Economic Development. Economies 2024, 12, 76. https://doi.org/10.3390/economies12040076

Kafka KI. The Dual Pillars of Progress: Institutional and Cultural Dynamics in Economic Development. Economies. 2024; 12(4):76. https://doi.org/10.3390/economies12040076

Chicago/Turabian StyleKafka, Kyriaki I. 2024. "The Dual Pillars of Progress: Institutional and Cultural Dynamics in Economic Development" Economies 12, no. 4: 76. https://doi.org/10.3390/economies12040076

APA StyleKafka, K. I. (2024). The Dual Pillars of Progress: Institutional and Cultural Dynamics in Economic Development. Economies, 12(4), 76. https://doi.org/10.3390/economies12040076