Abstract

This article investigates the fundamental value of digital platforms, such as Facebook and Google. Despite the transformative nature of digital technologies, it is challenging to value digital services, given that the usage is free of charge. Applying the methodology of discrete choice experiments, we estimated the value of digital free goods. For the first time in the literature, we obtained data for the willingness-to-pay and willingness-to-accept, together with socio-economic variables. The customer’s valuation of free digital services is on average, for Google, 121 € per week and Facebook, 28 €.

JEL Classifications:

C82; I30; O40

1. Introduction

Digital technologies have fundamentally transformed the nature of the economy, including the provision and consumption of digital goods and services (Van Alstyne et al. 2016; Tirole 2017). The daily usage of search engines, among others, Google, Bing, Baidu, Yahoo, or DuckDuckGo, has deeply changed customer’s consumption patterns. Similarly, more than 1 billion people in the world use Facebook in order to share information and stay informed about news. In fact, these platforms are the guardians of the digital economy.

Looking at the fundamental value of digital platforms—such as Google or Facebook—is however, sophisticated, because platforms grow thanks to very low prices. Indeed, most digital services are offered at zero price (Anderson 2008). This attracts users on one side of the market, and enables the platform to earn revenue on the other side of the market. Consequently, platforms are the matchmakers in two-sided markets (Evans and Schmalensee 2016).

No doubt, the standard financial valuation metrics have limitations for digital platforms in general and digital services in particular. This is also a challenge from a macroeconomic perspective, because free goods are not included in the Gross Domestic Product (GDP), which measures the value of all produced goods and services in a country. Consequently, even the measurement of GDP is becoming increasingly inaccurate (Brynjolfsson and Saunders 2009; Brynjolfsson and McAfee 2014). This paper addresses the following fundamental research question: How can we determine the fundamental value of digital platforms, even if the price of digital goods is zero?

The stock market value of digital firms is mainly derived from targeted advertising revenues. One example would be the short advertisements at the beginning of most YouTube videos. This is the main channel for profits, because the price of using digital services is the provision of personalized data from customers to the platform.

Recently, there has been growing interest from researchers to estimate the value or consumer surplus from digital goods. For instance, Greenstein and McDevitt (2011) estimate the consumer surplus created by broadband internet, and Brynjolfsson et al. (2018) estimate the value of free digital goods in general. The latter study applies an indirect form of measuring preferences via discrete choice experiments, according to Louviere et al. (2000). In the experiment, consumers choose between sequential options, and select the alternative that they value the most (Rao 2014).

In this paper, we follow new literature in order to estimate the monetary value of free digital goods. In contrast to the papers above, we investigate the value of Facebook and Google, and, for the first time, distinguish between the valuation of the willingness-to-pay and the willingness-to-accept, using a newly designed experimental setup. In addition, we include in our study socio-economic data in order to obtain novel findings across gender and educational backgrounds.

Digitization represents a marvelous opportunity for platform businesses, but it introduces new challenges to public policy as well. We find that digital goods have a significant value, despite the fact that they are available free of charge. Firstly, the value for Google is 121 € per week and Facebook is 28 € per week. Secondly, the older the people, the lower is the willingness-to-pay and willingness-to-accept. Thirdly, high-skilled persons value digital services more than low-skilled persons. Furthermore, the people that are concerned about data protection, value digital goods less than goods in general. Overall, our findings corroborate high valuations for digital platforms. This demonstrates the market power of digital platforms and the need for public regulation, particularly new European competition regulations.

2. Literature Review

This paper relates to at least two areas of the economic literature. Firstly, there is long-standing and established literature about public goods. In general, public goods comprise all those, which can be obtained by everyone without direct payment, such as national defense (Samuelson 1954). A free good is an extreme form of a public good, for instance air, which is even free of charge in general (Schmidt 1970). Already, Musgrave (1959) realized that some public goods create bad economic outcomes, for instance, bad consumer choices or market failures. He labelled demerit goods as those with disadvantages to the citizens, and merit goods as those with advantages.

New digital businesses, such as Facebook and Google, also create services at zero price (Anderson 2009). Thus, the provision of digital services has similar characteristics to free goods. In the literature, we further distinguish club goods and public goods. A club good excludes some people from using it, for instance a golf court. In general, digital services are defined by the following two properties: first, they are completely free of charge; second, they require a once-in-a-time but free registration. Consequently, digital goods are in a spectrum between private and public goods or so-called mixed goods (Goldin 1977; Loehr and Sandler 1978).

Secondly, there is growing literature about digital technologies and their impact on the macro-economy (Brynjolfsson and Saunders 2009; Brynjolfsson and McAfee 2014). The surplus that consumers obtain from using the free goods is, however, hard to scale in general (Brynjolfsson et al. 2018). In recent years, researchers have developed new methods in order to estimate consumer’s well-being of free goods. Shelanski (2013) investigated the increasing value of intangible assets such as customer attention and personal information in the digital world. He identified that the compensation for offering a free good is the access to valuable consumer data.

Tucker (2010), for instance, determined the value of customer information. He studied click sequences while purchasing goods on online platforms. Tucker (2010) and Evans (2009, 2013) found that the increasing consumer interest to social media switches the attention of customers. In fact, online platforms compete for attention and personal data. However, “the value of privacy is underestimated by many consumers and that further stimulates the consistency of free goods in the digital world” (O’Brien and Smith 2014).

More recently, Gal and Rubinfeld (2015) studied the hidden costs of free goods and identified their effect on welfare. Another stream of research has tried to find how much a user would pay to use a web search if it is not available for free (Evans and Schmalensee 2007; Edelman 2009). They found that users would pay substantial fees. Similarly, Brynjolfsson et al. (2018) evaluated free goods that carry no monetary price tag. They used experimental data in order to obtain consumer valuations. In principle, they asked the consumers to keep the digital goods—for instance Facebook—or accept the monetary compensation for giving it up for a certain period. They estimated the median willingness-to-pay (WTP) for giving up Facebook to be $37.76 for a month. The main reason for the high valuation of digital platforms is due to the benefits of network effects (Rochet and Tirole 2006; Rysman 2009).

For the first time, our research estimates the socio-economic impact on how much a consumer is willing-to-pay and willing-to-accept in order to give up Facebook or Google. Additionally, we focus on consumer’s age, as well as on their privacy concerns with online data. We study these issues with Facebook, because it has the largest user base with more than 1 billion users. Similarly, we collected data about Google, because it is one of the most popular search engines in the world, covering more than 88% of the market share. Both digital services have the characteristic that they are available free of charge (von Hippel 2001; Lessig 2002). Contrary to the present literature, we included socio-economic characteristics such as gender and educational background. As a by-product, we studied the relationship to the stock market valuation of digital platforms.

3. Methodology

This paper is based on an online choice experiment accompanied by a survey methodology, in order to obtain socio-economic and geographic data. The objective is the measurement of peoples’ characteristics and the WTP, as well as the willingness-to-accept (WTA) for Facebook and Google. Based on this information, we analyzed the data and derived the fundamental value of digital platforms in general. The WTP and the WTA might differ across goods because of diverse preferences. Hence, the experimental data helps to discover new behavioral patterns. Moreover, our data is the prerequisite for the valuation of digital platforms.

In theory, one approach to find out the monetary value of a good is to ask the customer directly. In general, however, directly asking consumers for valuation is tricky. Firstly, they would probably hide the true value. Secondly, there are high costs involved in asking consumers. Thirdly, customers merely reveal a subjective willingness-to-pay or willingness-to-accept, and they do not reveal the price or welfare in general (Miller et al. 2011; Carson and Groves 2007). Therefore, we utilize the idea of choice experiments that provide more flexibility in order to find out the true valuations. Of course, there are also limitations to this approach, namely: in the progress of the experiment, you must gather all of the relevant information of potential customers with a survey.

The application of discrete choice experiments, combined with a survey methodology, however, tackles this challenge and provides original data. This approach has recently been utilized in order to find consumer preferences (Louviere et al. 2000). It gives consumers fixed alternatives to choose, while the experiment varies the options, including the prices. This methodology reveals the price sensitivity of consumers and allows for the derivation of demand curves (Rao 2014; Brynjolfsson et al. 2018).

Our methodology combines the experiment with a survey. Thus, it further enhances the literature, because it directly distinguishes between the WTP and WTA in relation to socio-economic variables. Firstly, we offer respondents several fixed prices to keep access to Facebook and Google. Here, the respondents can answer with yes or no. Secondly, if the answer is no, we offer those respondents the chance to enter a free specific amount of money (WTA), in return for accepting the offer. If they have chosen to keep using the good, we ask the same question, but a higher amount of money is proposed. If the respondent still wanted to keep the good, we asked them again to write the minimum amount of money they would be satisfied with in order to accept the offer to give up Facebook or Google for a certain period (a week, month, or year). This method allows us to find the WTP and WTA for different price ranges.

The first part of the experiment consisted of standard binary choice questions (Carson and Groves 2007; Carson et al. 2014). We proposed giving up Facebook or Google for monetary compensation, or alternatively, if the price was too low, they could keep using the service. Secondly, we utilized the Becker–DeGroot–Marschack lotteries in order to find the minimum WTA for giving up the service (Becker et al. 1964). The combination of both approaches simplifies the questionnaire for the respondents on the one hand. On the other hand, it provides new consumer data, given that ordinary people are not used to thinking about the WTP for free digital goods, such as Facebook and Google. Therefore, respondents have to first choose between several fixed prices, before we ask for a free valuation of the digital service in step two.

We conducted the overall experiment with a standard procedure. All of the voluntary participants had to do a survey at first. The survey gathered socio-economic and geographic data as well as digital knowledge, digital skills, and other characteristics. Next, in step two, all of the participants had to do the online discrete choice experiment, as explained above. Here, the participants revealed their WTP (or WTA) in order to give up Facebook or Google for different periods, in exchange for monetary compensation. We conducted the experiments and survey between February and April 2018. The details regarding the survey and experiment are in Appendix B.

Our sample consisted of two independent experiments. All participants voluntarily agreed and gave an inform consent for this study. Sample A was for Facebook and sample B was for Google. Sample B (Google) had 75 participants in total. Sample A (Facebook) had 80 participants. The majority of sample A, 91.3%, were in the range of 20 to 30 years old. In sample B, 73 out of 80 respondents had a Facebook account. The age ranged from 17 to 88 years old, but the majority, 94%, were below 30 years in sample B. Thus, the two samples are similar in their socio-economic characteristics.

In sample A, people are from 14 different nationalities—50% Germans, 19% Chinese, 9% Ghanaian, and 7% Vietnamese, as well as other nationalities such as American, French, Italian, British, Chilean, Malaysian, Nigeria, Cameroonian, Turkish, and Pakistani. Both samples consisted of roughly 53% males and 47% females. In terms of education level, 29% had a high school degree, while 55% held a Bachelor’s degree, and the remaining 16% held a Master or PhD degree. In total, both samples are similar and represent the average the younger generation in a modern society.

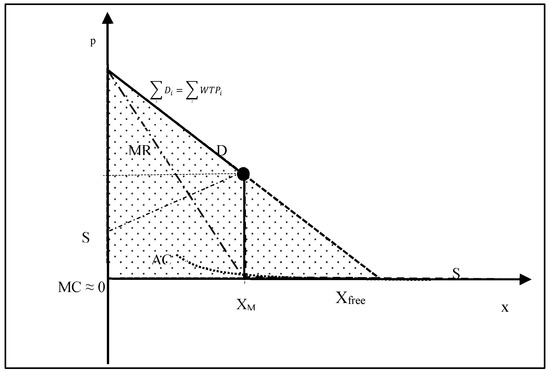

Given the data, we use economic methods in order to find the demand of the digital service as well as the fundamental value of platforms in a two-sided market. Figure 1 illustrates the economic model graphically. The optimal pricing of the platform services is characterized by high fixed costs and a low—almost zero—marginal cost (MC). Hence, in the early stage of platform companies, the pricing is similar to a natural monopoly (Tirole 2017). The fixed costs for the platform, for instance for online data storage, are sizeable. The marginal cost, however, is always very low. Over time, the average cost (AC) declines towards zero at the critical mass, XM. In fact, new users create a benefit for the other side of the two-sided market. The platform exponentially monetizes the personal data of users and so reduces the cost of serving each user. Machine learning (ML) magnifies the profit because platforms extract new consumption patterns. These data patterns are sold to other firms for targeted advertising. As a result, the average cost is almost zero, while the number of customers is greater than the critical mass, x > XM.

Figure 1.

Pricing Schedule for online platforms. Source: Author.

The profit-maximizing quantity is determined, where the marginal revenue equals the marginal cost, as indicated by the optimal point, XM. However, this is also the break-even point for digital platforms. Thus, for free digital goods, the consumer surplus is represented by the scattered triangular area. Note, over the time, that the demand curve for digital goods is of an S-shape. This shape characterizes a slow demand in the beginning, and after hitting the break-even, the demand is free of scale, due to the network effect and economies of scale.

4. Analysis and Discussion

4.1. Facebook

Based on our survey, we found that the main purpose of using Facebook is for communication with family and friends (38.9%) and gathering information about friends (40.3%). The other purposes are negligible, such as entertainment, posting and sharing, or business. Only 15.3% used Facebook primarily for entertainment, 4.2% to share news, and about 1.4% relied on Facebook for business purposes. This finding indicates that the value of Facebook depends somewhat on the quality of the relationships among users, particularly between their family and the number of friends.

A correlation analysis of the number of friends reveals that the more friends they have, the higher the willingness-to-pay to keep Facebook. In fact, there is a significant positive correlation of 71.6%. In addition, we found that 75.7% of all participants were willing-to-give-up Facebook for 20 € for one week. Another 15.0% were willing-to-give-up this platform for 50 € and 7.1% for 100 € per week. Only two participants required a higher compensation. Their WTA in order to give up Facebook was extremely high, because they rely on Facebook for business or work. Hence, the WTA has to compensate or exceed the profits. These two participants estimated an amount of 5000 € in order to give up Facebook for one week. Later on, in our analysis, we treat these two responses as outliers.

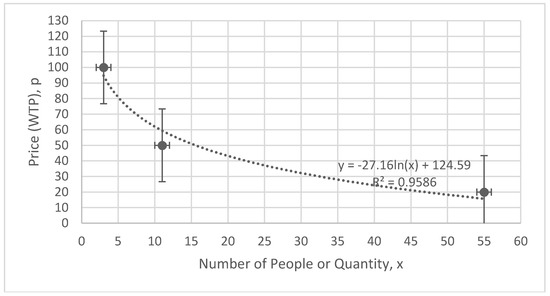

Figure 2 represents the demand curve or willingness-to-pay for Facebook. The experimental data reveals that 55 respondents had a WTP of 20 € per week, 11 respondents had a WTP of 50 € per week, and three respondents had a WTP of 100 € per week. In total, we had 69 data points, with the exclusion of two outliers. The logarithmic fit of the data was of good quality, with an R-squared of 0.95. From this approximation, we found the prohibitive price of approximately 125 € and computed the minimum number of people for a free good (network effect) per week, as follows:

Figure 2.

Willingness-to-pay (WTP) for Facebook.

Moreover, we indicate the standard errors by the statistical intervals in Figure 2. The error denotes a certain overlap of the WTP of 20 € and 50 €, respectively (Hausman 2012). In total, we found a weighted average willingness-to-pay (WTP) of 28.26 € for Facebook per week.

Interestingly, we also found in our survey that 99% use multiple social media platforms such as Instagram, Twitter, Snapchat, Skype, and so on. These platforms serve somewhat as substitutes for Facebook. For instance, LinkedIn focuses on business related people and Snapchat revolutionized the social media platforms with a story-telling feature, where users can upload their daily videos for 24 h. Instagram, however, is the best substitute to Facebook, according to our survey. Hence, the large number of substitutes to Facebook and its critical dependence on the network effect, might explain the lower WTP in comparison to other digital goods, such as search engines in the next subsection.

4.2. Google

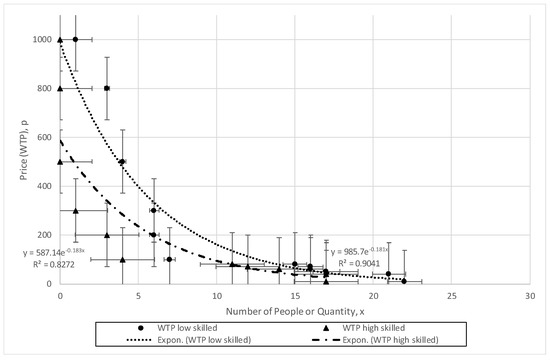

We found that the valuation of Google as well as other search engines in general is rather high. In addition, the valuation varies somewhat with the educational background and across gender. People with a lower level of education, for instance high school or a Bachelor’s degree, tended to give up Google for a lower amount of money (Table 1 and Table 2). However, low-skilled people were more sensitive to price change, because of a lower disposal income (Appendix Figure A1). Interestingly, for a monthly horizon, the difference in the WTP between low- and high-skilled people was insignificant (Table 2).

Table 1.

Willingness-to-pay (WTP) for females and males.

Table 2.

Valuations: full sample and low- and high-skilled.

In addition, we found differences on the valuation of Google based on geographic data. Respondents from Africa were willing to sacrifice more than from Europe, Asia, or America. Note, Google is not available in China, therefore, we also asked for the WTP for search engines in general.

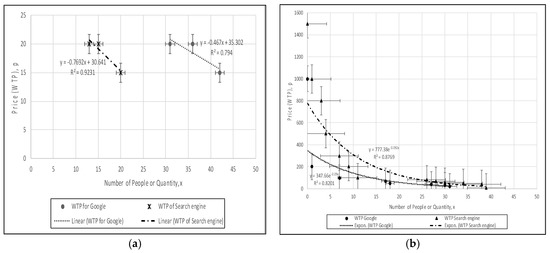

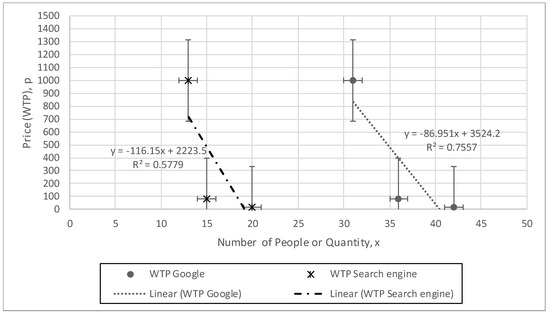

Our experiment reveals the expected finding. Analyzing the WTP for the fixed price categories of 15 €, 80 €, and 1000 € reveals a downward sloping shape of the demand curve (Figure 3a). This is a robust finding. The same downward sloping curve occurs for the free price categories (or willingness-to-accept), where the participants can freely enter a price in order to stop using Google or other search engines (Figure 3b).

Figure 3.

(a) Willingness-to-pay (WTP) fixed price schedule (per week); (b) willingness-to-accept (WTA) free price schedule (per week).

The experimental data demonstrate that the demand for search engines, including Google, is rather inelastic. A more inelastic demand curve provides a greater producer surplus because consumers are willing to pay a high price. Again, other search engines are perceived as substitutes for Google.

In addition, we found a gender gap in the willingness-to-pay for the Google and other search engines. Female participants were willing to give up Google for 162.67 € and male for 85.29 €, significant at 1%, for a week. The WTP was even higher if it was about search engines in general. The average female had a WTP of 267.62 € and male of 192.22 € for a week (Appendix A). Again, the difference is significant at 5%. If we ask people to give up Google or a search engine in general for a month or year, of course the WTP is higher. Strikingly, for a longer time horizon, the gender gap is insignificant.

Finally, we found that the weighted average of the willingness-to-accept in order to give up Google was about 121.56 € per week. The computation of this value was based on the WTA or the free price categories. However, the willingness-to-accept for search engines in general, was even higher and was 232.82 € per week. The higher amount was expected, because giving up search engines in general is a great loss in daily consumption and work convenience. While giving up merely Google is less problematic, because there are other online search engines available.

Another observation stands out. The WTA for the longer horizon is hump-shaped (i.e., slightly increasing in the medium-term and declining in the long-term). In order to give up Google for a month, the WTA is 620 € (Appendix Figure A2). Dividing this number by four in order to obtain the weekly amount is 155 €. The average WTA for giving up Google for a year is of 1326.25 €. Computing the weekly amount by dividing it by 52 weeks is only 25.50 €.

Finally, we computed an ordinary least square (OLS) regression. The independent variables are the WTA for Google and the WTA for search engines in general. We estimated the regressions with and without log-transforms of the data. The regression equation is as follows:

where the variable GDPR denotes individual concerns about the “General Data Protection Regulation” (GDPR) in Europe, and is a standard random noisy. The variable EDU denotes the educational level (i.e., either high- or low-skilled). First, we expect that the willingness to give up digital services declines with age. Indeed, for model 1 and model 2, the age coefficient is significantly negative (Table 3). The older a person, the lower the WTA in order to give up search engines. In fact, we obtained a negative and significant coefficient of −0.17 at 5% significance, and of −0.49 at 10% significance.

Table 3.

Regression for fixed price category.

Second, we asked the respondents to rank their personal data concerns on a scale from zero (no data concerns) to ten (extreme data concerns). The coefficient was insignificant in model 1. However, in models 2, 3, and 4, this coefficient is positive and significant (Table 3). Thus, the higher the data concerns of the respondents, the higher the WTA. One can interpret this finding as follows: people likely reveal more private data on a Facebook profile than while searching a term on Google, where the search engines instead helps get transparency in the jungle of the internet. Thus, search engines create transparency and, so, support people with data concerns. In model 3 and model 4, we obtained a positive and significant dummy-variable for education at 10% and 1%, respectively. This means that high-skilled people do value free digital goods more. Interestingly, for the WTA the gender dummy is insignificant. In general, the log-model is of better quality given the R-squared and significant F-test.

4.3. Discussion

The statistical analysis accompanied with the regression results corroborates the robustness of our results, particularly, the log-models show a high R-squared and significant F-test.1 Furthermore, our findings are in-line with the recent literature in this field. The average willingness-to-pay is 12.50 USD for Facebook for one week, according to Brynjolfsson et al. (2018, p. 24). This is lower than our 28.26 €. However, as our results are based on a rather young group of people (average age is 24.6), the higher valuation of digital goods is expected. In addition, our results focus on the WTA, which is always higher than WTP.

Facebook has currently around 1.9 billion active users worldwide. Given this number, we obtained an approximate fundamental value of 28.26 € × 1.9bn = 53.69bn € per week. The estimated market value of Facebook was around 441 billion USD in 2017, according to analysts (YCharts 2018; STATISTA 2018). Consequently, our experimental approach corroborates the high fundamental market value for Facebook.

For Google, we conclude that the average willingness-to-accept is of 121.56 € per week. In comparison, the literature finds a WTP of 337.11 USD in 2017 (Brynjolfsson et al. 2018, p. 56). The fundamental value of Google and other search engines is reasonable in general. The worldwide market share of Google is estimated at 88% (STATISTA 2018). In Germany, the market share is even at 95%. Given that the experiment was conducted in Germany, and the sample consists of rather young people, our valuations can be justified. Moreover, in 2017, Google had 3.36 billion registered accounts, but the total number of users is likely around 4 to 5 billion, because most of the daily Google users who do not have a Google account (STATISTA 2018). Consequently, a rough estimate based on our experimental data is of 121.56 € × 3.36bn = 408.44bn € per week. Note, the Google market value was 246 billion USD in 2017 (STATISTA 2018). Consequently, the experimental approach confirms the high market valuations of these platforms in general.

Indeed, the results reveal the massive market power of digital platforms. Customers see fundamental value in digital services, despite the fact that they are free of charge. Thus, a price of zero does not mean that platforms have no market power, rather, the opposite. Hence, there is the need of new guidelines for competition policy (Tirole 2017, p. 393). The new approach requires that the two sides of the market are considered together, rather than being analyzed independently. Of course, our estimates might be too high. Nevertheless, our results are broadly in-line with the literature and confirm the high market valuations of digital goods.

4.4. Limitations

Note, the results cannot be generalized easily, because our data consists of a young age cohort. Roughly, 93% of the people in our experiment were between 20 and 30 years old. In addition, there is another limitation, namely, the framing of questions might also lead to behavioral biases. Some respondents were very sensitive to the WTA question in part one. They entered outrageous prices as compensation, without sufficiently thinking about their financial sources and alternatives. Furthermore, in countries such as China, platforms such as Google and Facebook are not available or common. In fact, the Chinese people in our experiment valued Google as, on average, only 77 € per week. While the valuation of search engines in general was equally high to other nationalities. Hence, the unbalanced sample with respect to geography is a further limitation to our study.

5. Conclusions

This paper corroborates that Facebook and Google have an intrinsic value to users, despite the fact that the service of the digital platforms is free of charge. The valuation for Facebook and Google is of 28.26 and 121.56 € per week, respectively. These mean numbers are sizeable if you compute the customers’ value of the digital free services per year. In addition, the value of digital goods is lower for older people. Younger people, higher educated people, and females have a slightly higher willingness-to-pay for digital services. In order to obtain results that are more robust, in the future, we suggest a follow-up study, particularly considering alternative digital platforms, and a balanced sample with respect to nationalities and ages.

Funding

This research received no external funding. The APC was funded by institutions through the Knowledge Unlatched initiative.

Acknowledgments

I thank Trenton Bruce, Jing Wang, Alice G. Kwasibea, Nhi Pham, Lars Kübler, Aziza Sharipova, Marko Predmestnykov, Jihad Mia, Katharina Gorcenkova, and all of the participants at the Interdisciplinary Studies workshop at ESB Business School in 2018, for their helpful support in the survey and data collection, as well as for their comments. In addition, for funding support I thank the Reutlingen Research Institute (RRI).

Conflicts of Interest

The author declares no conflicts of interest.

Appendix A

Figure A1.

Willingness-to-pay (WTP) for high- and low-skilled for Google.

Figure A2.

WTP of Google and search engines over different times (one week, one month, and one year).

Appendix B. Survey and Experimental Design

Valuation of Free Goods

We are researching the willingness to pay for free goods. This survey will be used for our research paper. It should take 5 min.

Survey Design:

- 1.

- Age

- 2.

- Nationality

- 3.

- Country of Residence

- 4.

- Gender

- Male

- Female

- 5.

- Level of Education

- High School

- Bachelor

- Master

- PhD

- Other

Experimental design for Google (example):

We will now ask you some questions regarding your valuation of digital goods. Note: when answering the threshold question with ‘YES’ the follow-up question can be neglected.

- 1.

- Do you have concerns about data collections in Facebook, Google, and so on?0 1 2 3 4 5 6 7 8 9 10Scale: not at all extremely

- 2.

- Would you give up Google for one week, if I give you 15 €?

- Yes

- No

- 3.

- If no, what is the amount you accept?

- 4.

- Would you give up Google for one month, if I give you 80 €?

- Yes

- No

- 5.

- If no, what is the amount you accept?

- 6.

- Would you give up Google for one year, if I give you 1000 €?

- Yes

- No

- 7.

- If no, what is the amount you accept?

- 8.

- Would you give up search engines for one week, if I give you 15 €?

- Yes

- No

- 9.

- If no, what is the amount you accept?

- 10.

- Would you give up search engines for one month, if I give you 80 €?

- Yes

- No

- 11.

- If no, what is the amount you accept?

- 12.

- Would you give up search engines for one year, if I give you 1000 €?

- Yes

- No

- 13.

- If no, what is the amount you accept?

References

- Anderson, Chris. 2008. Free! Why $0.00 Is the Future of Business. Wired Magazine. February 25. Available online: https://www.wired.com/2008/02/ff-free/ (accessed on 20 April 2018).

- Anderson, Chris. 2009. The Future of a Radical Price. Wired Magazine. July 7. Available online: https://www.wired.com/video/free-the-future-of-a-radical-price/28234922001/ (accessed on 20 April 2018).

- Becker, Gordon M., Morris H. DeGroot, and Jacob Marschak. 1964. Measuring Utility by a Single-Response Sequential Method. Behavioral Science 9: 226–32. [Google Scholar] [CrossRef] [PubMed]

- Brynjolfsson, Erik, and Andrew McAfee. 2014. The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies. New York: WW Norton & Company. [Google Scholar]

- Brynjolfsson, Erik, and Adam Saunders. 2009. What the GDP Gets Wrong. Why Managers Should Care? MIT Sloan Management Review 51: 95. [Google Scholar]

- Brynjolfsson, Erik, Felix Eggers, and Avinash Gannamaneni. 2018. Using Massive Online Choice Experiments to Measure Changes in Well-being. Working Paper No. 24514. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Carson, Richard T., and Theodore Groves. 2007. Incentive and informational properties of preference questions. Journal of the Association of Environmental and Resource Economists 37: 181–210. [Google Scholar] [CrossRef]

- Carson, Richard T., Theodore Groves, and John A. List. 2014. Consequentiality: A theoretical and experimental exploration of a single binary choice. Journal of the Association of Environmental and Resource Economists 1: 171–207. [Google Scholar] [CrossRef]

- Edelman, Benjamin. 2009. Priced and Unpriced Online Markets. Journal of Economic Perspectives 23: 21–36. [Google Scholar] [CrossRef]

- Evans, David S. 2009. The Online Advertising Industry: Economics, Evolution, and Privacy. Journal of Economic Perspectives 37: 36–60. [Google Scholar] [CrossRef]

- Evans, David S. 2013. Attention Rivalry among Online Platforms. Journal of Competition, Law and Economics 9: 313–57. [Google Scholar] [CrossRef]

- Evans, David S., and Richard Schmalensee. 2007. The Industrial Organization of Markets with Two-Sided Platforms. Competition Policy International 3: 151–79. [Google Scholar]

- Evans, David S., and Richard Schmalensee. 2016. Matchmakers: The New Economics of Platform Businesses. Boston: Harvard Business Press. [Google Scholar]

- Gal, Michal S., and Daniel L. Rubinfeld. 2015. The Hidden Costs of Free Goods: Implications for Antitrust Enforcement. Antitrust Law Journal 80: 521–62. [Google Scholar] [CrossRef]

- Goldin, Kenneth D. 1977. Equal Access vs. Selective Access: A Critique of Public Goods Theory. Public Choice 29: 53–71. [Google Scholar] [CrossRef]

- Greenstein, Shane, and Ryan C. McDevitt. 2011. The broadband bonus: Estimating broadband Internet’s economic value. Telecommunications Policy 35: 617–32. [Google Scholar] [CrossRef]

- Hausman, Jerry. 2012. Contingent valuation: From dubious to hopeless. Journal of Economic Perspectives 26: 43–56. [Google Scholar] [CrossRef]

- Lessig, Joshua. 2002. The Architecture of Innovation. Duke Law Journal 51: 1783–801. [Google Scholar] [CrossRef]

- Loehr, William, and Todd Sandler. 1978. Public Goods and Public Policy. Thousand Oaks: SAGE Publishing. [Google Scholar]

- Louviere, Jordan J., David A Hensher, and Joffre D. Swait. 2000. Stated Choice Methods: Analysis and Applications. Cambridge: Cambridge University Press. [Google Scholar]

- Miller, Klaus M., Reto Hofstetter, Harley Krohmer, and Z. John Zhang. 2011. How should consumers’ willingness to pay be measured? An empirical comparison of state-of-the-art approaches. Journal of Marketing Research 48: 172–84. [Google Scholar] [CrossRef]

- Musgrave, Richard A. 1959. The Theory of Public Finance: a Study in Public Economy. New York: McGraw-Hill. [Google Scholar]

- O’Brien, Daniel, and Doug Smith. 2014. Privacy in Online Markets: A Welfare Analysis of Demand Rotations. Available online: https://www.ftc.gov/reports/privacy-online-markets-welfare-analysis-demand-rotations (accessed on 19 April 2018).

- Rao, Vithala R. 2014. Applied Conjoint Analysis. New York: Springer, p. 56. [Google Scholar]

- Rochet, Jean-Charles, and Jean Tirole. 2006. Two-Sided Markets. Rand Journal of Economics 37: 645–67. [Google Scholar] [CrossRef]

- Rysman, Marc. 2009. The Economics of Two-Sided Markets. Journal of Economic Perspectives 23: 125–43. [Google Scholar] [CrossRef]

- Samuelson, Paul A. 1954. The Theory of Public Expenditure. Review of Economics and Statistics 26: 386–89. [Google Scholar]

- Schmidt, Kurt. 1970. Kollektivbedürfnisse und Staatstätigkeit. In Theorie Und Praxis Des Finanzpolitischen Interventionismus: Fritz Neumark Zum 70. Geburtstag. Edited by Heinz Haller, Lore Kullmer, Carl S. Shoup and Herbert Timm. Heidelberg: Mohr Siebeck, pp. 3–27. [Google Scholar]

- Shelanski, Howard A. 2013. Information, Innovation, and Competition Policy for the Internet. University of Pennsylvania Law Review 161: 1663–705. [Google Scholar]

- STATISTA. 2018. Available online: https://de.statista.com/ (accessed on 16 May 2018).

- Tirole, Jean. 2017. Economics for the Common Good. Princeton: Princeton University Press. [Google Scholar]

- Tucker, Catherine. 2010. The Economics Value of Online Customer Data. Background Paper #1, OECD Roundtable: The Economics of Personal Data Privacy: 30 Years after the OECD Privacy Guidelines. Available online: http://www.oecd.org/sti/ieconomy/46968839.pdf (accessed on 19 April 2018).

- Van Alstyne, Marshall, Geoffrey Parker, and Sangeet Paul Choudary. 2016. Platform Revolution. New York: Norton. [Google Scholar]

- von Hippel, Eric. 2001. Innovation by User Communities: Learning From Open-Source Software. MIT Sloan Management Review 42: 82–86. [Google Scholar]

- YCharts. 2018. The Modern Financial Data Research Platform. Available online: www.ycharts.com (accessed on 16 May 2018).

| 1 | Furthermore, we tested for heteroscedasticity and autocorrelation. |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).