Abstract

Bibliometric analysis is crucial in understanding the evolution of research trends and knowledge in various fields. This study applies bibliometric analysis to explore the growth of the research paradigm on agility in the FinTech literature, using co-citation analysis and bibliographic coupling of selected articles. Based on this bibliometric analysis, the evolution of research on agility in the FinTech domain has been prepared, focusing on the literature related to FinTech agility between 1984 and 2022. In this study, we also address the limitations of individual analyses from Scopus and Web of Science (WOS) and propose a comprehensive approach by merging the two research databases. The results reveal significant disparities between authors, publication influences, and keyword occurrences between the WOS and merged databases. Our research highlights the importance of combining a database approach in bibliometric studies, providing valuable insights for scholars, researchers, and stakeholders. Finally, the in-depth bibliometric analysis demonstrates the significance of “FinTech agility” in the rapidly evolving FinTech sector. Financial technology companies’ agility, or ability to adapt quickly, is the foundation of their success and innovation.

1. Introduction

In the age of modern financial institutions, customers have grown accustomed to instantaneous service, leading to an expectation of seamless, immediate assistance across all channels. Numerous financial technology companies (FinTechs) are emerging to meet this demand, aiming to provide customer value by tackling specific problems. Often, these FinTech firms collaborate with established financial institutions, Big Tech companies, and other FinTech ventures to deliver innovative solutions.

The rapid growth of FinTech can be attributed to several factors, including the rise of the sharing economy, advancements in information technology, and supportive legislation. Digital innovation, characterized by using digital technology during the invention process, has significantly shaped new financial products and services (Sahid et al. 2018). As a result, novel methods of creating and appropriating value have emerged, transforming the financial technology services industry. Recent research has focused on identifying and characterizing the unique aspects of digitalization across industries, product classes, and marketplaces (Briter Bridges 2021). These disruptive technologies often cause substantial economic shifts in established markets, displacing long-standing market leaders, goods, and partnerships (Schueffel 2017).

In the banking sector, disruptive technology refers to the widespread adoption of new technologies at the consumer and small business levels, leading to the general use of financial technology throughout the industry. This adoption is evident in various areas, such as digital reporting, digital loan origination, digital payment transfers, and demonetization. Leveraging technology and innovation, FinTech companies can provide specific services directly to consumers, bypassing traditional financial institutions (Anagnostopoulos 2018). Notably, FinTech firms can disintermediate established businesses due to advancements in infrastructure, big data, data analytics, and mobile devices. The rate of investment expansion in FinTech has accelerated significantly. However, these companies have faced challenges from the worsening macroeconomic situation globally and in Europe, leading to decreased valuations and more complex access to finance. Nonetheless, looking at the bigger picture, European FinTechs continue to grow significantly, with at least one of the top five financial institutions in Europe’s seven significant economies being a FinTech (Botta et al. 2022).

Africa has also witnessed a remarkable surge in FinTech, which has become the most rapidly expanding start-up industry. In 2021, it secured an impressive 54 percent of known start-up funding, as reported by Africa: The Big Deal, a comprehensive database documenting funding deals of USD 100,000 or more obtained by start-ups operating within the African continent. The dynamic and agile nature of technology-driven start-ups, actively responding to diverse and significant market demands across the continent, has contributed to this substantial growth. Despite Africa’s promising economic indicators, with a considerable GDP of approximately USD 2.4 trillion and a population exceeding 1.3 billion, financial inclusion remains a pressing issue, with 65 percent excluded from or lacking adequate access to formal financial services. This disparity underscores the need for FinTech companies to leverage their agility, technological prowess, and innovation to bridge the financial inclusion gap and empower millions of individuals across the continent (Briter Bridges 2021; Flötotto et al. 2022).

The significance of agility in the rapidly evolving FinTech industry cannot be underestimated. As technological advancements reshape the financial landscape, FinTech companies must navigate a dynamic and competitive environment. Agility, the ability to respond quickly and effectively to market changes, is critical for these firms to remain successful and drive innovation (Maleh and Maleh 2022). This study explores the central role and paramount importance of agility within the dynamic and rapidly evolving FinTech sector. Our research endeavors to meticulously examine how agility empowers FinTech companies to not only adapt their business models but also to proactively identify, seize, and capitalize on emerging opportunities in the ever-changing financial landscape. Furthermore, we aim to gain profound insights into how the application of agile methodologies and practices enables these companies to deliver state-of-the-art financial products and services that are not only responsive to market demands but also at the forefront of innovation within the industry.

To understand the past, present, and future drivers of agility in the FinTech sector, we conducted a bibliometric analysis using data from Scopus and WOS. This analysis provides valuable insights into the knowledge and trends in this domain. Specifically, we explored the relationship between FinTech and agility, identifying the most prolific authors, relevant sources, influential articles and authors, and the most prolific nation using co-citation analysis for a more in-depth study of agility in the FinTech literature.

The paper is organized as follows: In Section 2, we detail our methodology, including the study design, data collection, data cleaning, and the merging of data from WOS and Scopus for a bibliometric analysis. Section 3 presents the results of our analysis, offering insights into the relationship between FinTech and agility. In Section 4, we engage in a comprehensive general discussion, exploring the implications of our findings for the FinTech sector and shedding light on the critical role of agility in driving innovation and adaptability. Section 5 addresses the limitations of our study and outlines potential avenues for future research. Finally, in Section 6, we conclude by summarizing our key findings and their broader significance in the evolving landscape of financial technology.

2. Methodology

2.1. Study Design

Exploring the relevant literature and gaining valuable insights from scholarly works are critical aspects of academic research. One powerful approach that has gained widespread popularity is bibliometric analysis, a method that has evolved significantly since its introduction in 1969 by Pritchard (Pritchard 1969). Through algorithms, mathematics, and statistics, bibliometric analysis enables researchers to study, organize, and investigate vast amounts of data, unveiling hidden patterns during the literature review process (Donthu et al. 2021). In this section, we delve into the diverse applications of bibliometric analysis, its fundamental approaches, and the transformative impact of advanced software tools in this field. The versatility of bibliometric analysis makes it a valuable tool across various academic domains, with applications ranging from business economics to tourism and sustainability (Ertz et al. 2019). By identifying the most productive scientific authors, journals, institutes, universities, and countries, bibliometric analysis plays a pivotal role in exploring trends and knowledge within different academic fields (Ellegaard and Wallin 2015).

Understanding the Origins and Evolution of Bibliometrics: Before we delve into the details, it is essential to provide some historical context. Initially introduced by Pritchard (1969), bibliometrics was used by mathematicians and statisticians to analyze literature and communication patterns (Pritchard 1969). Over time, it has evolved into a powerful method for analyzing research structures and practices within a given body of literature, as highlighted by more recent definitions proposed by Muhuri et al. (2019).

Comparative Analysis of Selected Databases: To ensure a comprehensive overview and to address the reviewer’s request, it is essential to emphasize the comparative aspect between the Scopus and Web of Science databases, as they serve as the foundation for our bibliometric analysis (Goodman 2007). We carefully selected these databases due to their prominence and extensive coverage of the scholarly literature. While both databases provide valuable insights, they offer distinct datasets, and our research methodology involves analyzing the differences and similarities between them. This comparison enriches the scope of our analysis, enabling us to provide a more nuanced and comprehensive understanding of the research landscape related to agility in the FinTech sector.

Two primary approaches underpin bibliometric analysis, performance analysis and science mapping. Performance analysis employs quantitative metrics, like average citations per publication or year, h-index, g-index, and i-index, to evaluate the output and impact of studies (Donthu et al. 2021). Conversely, science mapping allows researchers to visualize and map the literature within specific domains, methods, or theories using bibliographic data. Techniques such as bibliographic coupling, co-citation analysis, and co-occurrence analysis generate thematic clusters based on shared bibliographic data, commonly cited articles, and frequently appearing bibliographic data like keywords (Donthu et al. 2021; Kraus et al. 2021). Bibliometric analysis, combined with machine learning techniques and big data analytics, has revolutionized systematic literature reviews (SLRs), enabling scholars to harness technology and analyze bibliographic data from technologically empowered scientific databases (Fabregat-Aibar et al. 2019; Kumar et al. 2022). This fusion of methodologies has significantly expanded the depth and scope of knowledge discovery within academic research.

The digital era has ushered in an array of software solutions that enrich literature reviews. From built-in features within statistical packages to specialized tools for meta-analyses, researchers can select from proprietary and freely available alternatives. Tailoring the analysis software to the dataset’s nature and individual preferences contributes to the effectiveness of bibliometric research. Many scholars favor combining the R programming language with VOSviewer software for its practicality (Echchakoui 2020). Sophisticated software tools have transformed bibliometrics, empowering researchers to extract meaningful insights from vast amounts of scholarly data, leading to software applications like CiteSpace, SciMAT, and Bibliometrix (Roblek et al. 2022), which have earned prominence due to their advanced functionalities and user-friendly interfaces. CiteSpace effectively visualizes citation networks and identifies intellectual structures, key contributors, and emerging trends. On the other hand, SciMAT focuses on co-occurrence analysis of scientific terms, facilitating the exploration of knowledge creation and diffusion dynamics. The comprehensive R package Bibliometrix offers various bibliometric analysis functions, enhancing data processing and generating high-quality visualizations, network maps, and insightful reports (Donthu et al. 2021; Echchakoui 2020).

Bibliometric analysis has become an indispensable tool in academic research, uncovering trends and patterns within the scholarly literature. Leveraging sophisticated software solutions, researchers can delve deeper into scholarly communication, extract valuable insights, and contribute to advancing knowledge discovery. The seamless integration of bibliometric analysis with innovative technology paves the way for a new era of evidence-based research and informed decision making.

2.2. Data Collection

The selection of keywords at the initial stage of our research was a meticulous process aimed at constructing an effective search query to identify relevant publications. We employed a Boolean keyword combination strategy, incorporating a comprehensive set of keywords to capture studies related to agility and FinTech. These keywords encompassed variations of “agility”, agile aspects within FinTech, and terms associated with financial technology and start-up companies in the banking sector. To ensure specificity, we also excluded irrelevant terms. This strategy enabled us to cast a wide net while maintaining focus, resulting in an initial dataset of 5718 publications from Scopus and 394 from Web of Science, forming the foundation for our research analysis, as show in Table 1.

Table 1.

The Boolean keyword combination used to extract files from Scopus and WOS.

2.3. Data Cleaning

This stage involved a meticulous manual review by the researchers, who considered the titles, abstracts, keywords, and conclusions to ensure alignment with the research phenomenon. We utilized the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) technique proposed by Moher et al. (2010).

To pick articles from a database, PRISMA contains four steps: research identification, selection, eligibility, and inclusion. Consequently, 488 papers were selected for analysis from Scopus and 131 from WOS. It is important to note that the combined database of Scopus and WOS exhibited some imbalance, comprising 654 records, with 14.67% identified as duplicates.

2.4. Merging WOS and Scopus for Bibliometric Analysis

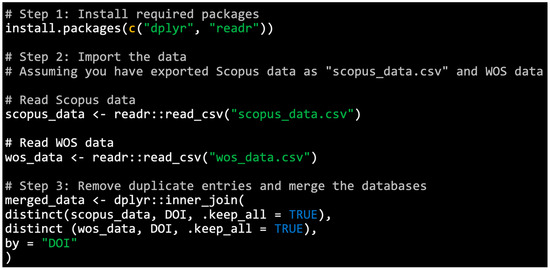

To integrate the Scopus and Web of Science datasets, we imported the Scopus data from the “scopus_data.csv” file and the Web of Science data from the “wos_data.csv” file. To ensure data integrity, we utilized the distinct() function from the dplyr package to remove any duplicate entries from each dataset. We retained only the unique entries by focusing on the identification column (e.g., ‘DOI’). The next step involved merging the two datasets using the inner_join() function from dplyr. Utilizing the common ‘DOI’ column as the key, we seamlessly combined the Scopus and Web of Science data while avoiding duplication. The merged dataset was then stored in the merged data variable (Figure 1).

Figure 1.

Data integration and analysis procedure in R: combining Scopus and Web of Science datasets.

3. Results

3.1. Data-Related Information

Table 2 details the combined articles in the Scopus, WOS, and merged databases. Scopus included 448 articles, 317 more than WOS (131 articles), an increase of 26.84%. Table 2 also reveals that the first articles published in WOS in our search phenomenon appeared in 2010, whereas the first articles published in Scopus date back to 1984. The number of authors and keywords was around three times higher in Scopus, although the number of author appearances in WOS (394) was lower than in Scopus (1201). However, the number of authors per document in Scopus (124) and the number of co-authors increased in comparison (to 10).

Table 2.

Primary information about Scopus, WOS, and merged data.

3.2. Research Evolution

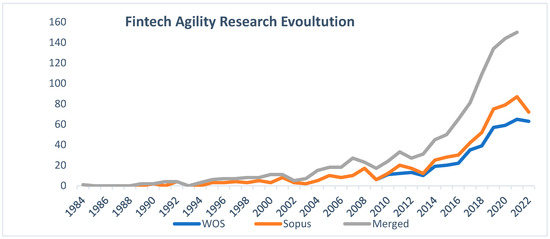

The evolution of publications from 1984 to 2022 in Scopus, WOS, and the combined database is shown in Figure 2. Between 2000 and 2006, the integrated database’s growth rate slowed down. However, after 2014, the number of articles increased considerably until 2022. The increase in publications in the merged database is comparable to that of Scopus, with a slight distinction due to the more significant number of articles in the WOS database.

Figure 2.

Annual FinTech agility publications in Scopus, WOS, and combined databases.

The Evolution of Agility in FinTech Litigation and its Impact on Financial Firms

Figure 2 illustrates the evolution of publications addressing agility in FinTech litigation. Our research identifies two seminal articles that mark the inception of discussions on agility and its implications for financial firms. The first article in the WOS, by Luftman and Ben-Zvi (2010), explored the aftermath of the global financial crisis, revealing that organizations worldwide had suffered severe revenue declines, leading to IT budget cuts, salary reductions, and project suspensions. Based on a Society for Information Management (SIM) survey of 243 US organizations conducted in June 2009, Luftman’s article highlighted the top five management concerns at the time: enhancing business productivity and reducing costs, strengthening IT–business alignment, fostering business agility and speeding up time-to-market, re-engineering business processes, and trimming IT-related expenses.

For the Scopus research database, the first article to delve into agility and its impact on financial companies was published Cho et al. (1996). This publication underscores the critical necessity of agility within manufacturing, particularly in shortening product life cycles and the growing demand for high-quality products. Jung introduces the concept of “agility” as a solution and outlines the primary architectural prerequisites for agile manufacturing systems, addressing aspects such as control, function, process, and communication. Additionally, the article acknowledges past challenges in system architecture when building automated manufacturing systems (Sánchez et al. 2017).

The relationship between agility and FinTech, as well as the evolution of their interaction over the years, is a topic of significant interest within the financial industry. In this context, agility refers to the ability of financial institutions and FinTech firms to adapt rapidly and effectively to changes in the market, technology, and customer preferences. FinTech, a contraction of “financial technology”, encompasses innovative solutions and technologies within the financial sector.

Early Stages (2000s):

FinTech Emergence: In the early 2000s, FinTech start-ups began to surface, offering diverse financial services that harnessed technology to provide more efficient and customer-friendly alternatives to traditional banking and financial services.

Agility as a Competitive Advantage: FinTech companies recognized agility as a critical competitive edge, enabling them to develop and launch new financial products and services more swiftly than traditional banks, which often grappled with legacy systems and regulatory constraints.

Changing Landscape: The financial industry experienced substantial transformations as FinTech firms introduced innovations, such as digital payment solutions, peer-to-peer lending platforms, robo-advisors, and more, significantly disrupting traditional financial services.

Mid-2010s:

Partnerships and Collaboration: As FinTech firms matured, traditional financial institutions began to acknowledge the value of agility in maintaining competitiveness. Many banks initiated partnerships with or investments in FinTech start-ups to leverage their innovative capabilities.

Regulatory Challenges: Regulatory bodies started to catch up with the FinTech industry, introducing a level of regulatory uncertainty. FinTech companies had to adapt swiftly to comply with evolving regulations.

Agile Methodologies: Agile development methodologies, emphasizing flexibility and collaboration, gained traction in FinTech start-ups and traditional financial institutions. These methodologies enabled expedited product development and iteration.

Late 2010s to Present:

Agility Becomes Core: Agility is now regarded as a fundamental attribute for any financial institution, whether traditional or FinTech. The capacity to respond rapidly to shifting market conditions, customer needs, and regulatory requirements has become indispensable.

Digital Transformation: Traditional banks have embarked on extensive digital transformation endeavors to modernize their operations, enhance customer experiences, and compete with FinTech firms. They are increasingly adopting agile practices to facilitate this transformation.

Mergers and Acquisitions: Large financial institutions have acquired some FinTech start-ups, enabling them to scale their innovations and agility while tapping into traditional banks’ resources and customer bases.

Blockchains and Cryptocurrency: The ascendancy of blockchain technology and cryptocurrencies has introduced a new dimension to FinTech. Agility is pivotal in navigating this sphere’s regulatory complexities and evolving technological landscape.

In summary, agility has played a pivotal role in the rapid growth of the FinTech industry and its disruption of traditional financial services. Over the years, traditional financial institutions have recognized agility’s paramount importance and adopted agile methodologies and partnerships with FinTech firms to remain competitive. The relationship between agility and FinTech continues to evolve as technology advances and regulatory frameworks adapt to this ever-changing landscape.

Most productive authors

Table 3 shows the 10 most productive authors in the Scopus, WOS, and merged databases, a ranking based on the number of publications. The first ranking criterion is the number of publications; concerning the merged database, the table shows that three authors are the most productive researchers in the literature on agility in FinTech between 1984 and 2022. These authors are RATH.S (eight publications), PANDA. S (seven publications), and GLIGOR.D (five publications). RATH.S is also the most productive author in the Scopus database (eight publications), followed by PANDA. S A.J. (seven publications), and in third place we find L.U.F.T.M.A.N. J (four publications). In the WOS database, PANDA. S is the most productive author, with seven publications, while G.U.P.T.A. S is third, with four publications.

Table 3.

Most productive authors.

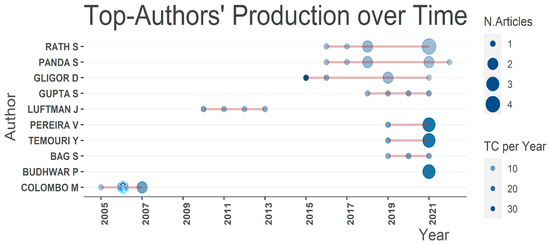

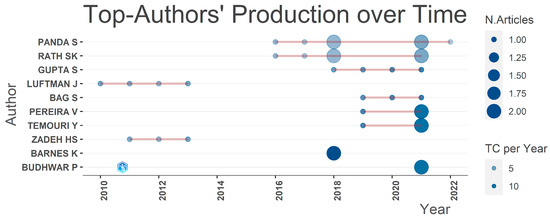

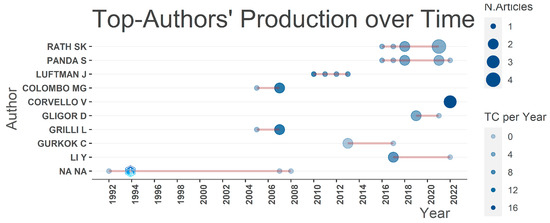

Figure 3 demonstrates that between 1984 and 2022, RATH.S was the most consistently productive author in the consolidated base of the FinTech agility literature, followed by PANDA.S and GLIGOR.D. WOS, RATH.S, and PANDA.S are ranked in the same position as L.U.F.T.M.A.N. J., in third place (Figure 4). Regarding the Scopus database (Figure 5), PANDA.S is in top place, RATH.S is in second place, and G.U.P.T.A.S. is in third place.

Figure 3.

Authors’ production over time: merged database.

Figure 4.

Authors’ production over time: WOS.

Figure 5.

Authors’ production over time: Scopus.

Table 4 shows the 10 most productive authors in the Scopus, WOS, and merged databases, a ranking based on the number of publications and h-indexes. The first ranking criterion is the number of publications, but if two or more authors have the same number of publications, the second criterion is the h-index. Concerning the merged database, the table shows that three authors are the most productive researchers in the literature on agility in FinTech between 1984 and 2022. These authors are RATH.S (eight publications, h-index = 5), PANDA. S (seven publications, h-index = 5), and GLIGOR.D (five publications, h-index = 4). RATH.S (eight publications, h-index = 5) is also the most productive author in the Scopus database, followed by PANDA. S (seven publications, h-index = 5), and in third place we find L.U.F.T.M.A.N. J (four publications, h-index = 4). In the WOS database, PANDA. S (seven publications, h-index = 5) is the most productive author, followed by RATH.S (eight publications, h-index = 5), while G.U.P.T.A. S is third (four publications, h-index = 5).

Table 4.

The 10 most productive authors in the Scopus, WOS, and merged databases by the number of publications.

Based on our comparison between the merged database and Scopus, as well as between WOS and the combined database, we argue that there are similarities and differences between MDB and Scopus and between MDB and WOS. The similarity mainly concerns the first author, RATH.S, and the second, PANDA.S, who is constantly productive. In contrast, the differences involve the third consistently effective author. Based on our results for MDB, we can state that the most productive researchers on agility in the FinTech literature between 1984 and 2022 are RATH.S, PANDA. S, and G.L.I.G.O.R. D.

In agility and FinTech, RATH.S and Panda.S are standout researchers with notable contributions. RATH.S delves into the interplay of information technology (IT) capabilities, strategic alignment, environmental factors, and human capabilities, primarily in Indian financial enterprises. His work emphasizes the crucial role of IT-enabled solutions like service-oriented architectures (SOAs) and machine learning in addressing modern banking challenges, such as fraud detection and market responsiveness. Meanwhile, Panda.S’s research focuses on adopting cloud-based Enterprise Resource Planning (ERP) by small and medium enterprises (SMEs), considering organizational, technological, and extrinsic factors. Both authors consistently highlight the moderating influence of environmental factors on IT capability and organizational agility, revealing the interconnectedness of these dimensions. Their research serves as a valuable resource for scholars and practitioners navigating these domains.

- The most relevant sources

The results in Table 5 show that the most relevant sources in the merged database are found in three journals with the same number (four) of publications, thus placing in first position the Global Journal of Flexible Systems Management, the International Journal of Supply Chain Management, and the Journal of Operations Management. The remaining seven journals have the same output (four publications). As far as Scopus is concerned, we found a similarity with the merged database at all positions. In the WOS database, the Journal of Operations Management (four publications) is in first position, Industrial Management & Data Systems is in second position, and the International Journal of Productive Economics is in third position.

Table 5.

The most relevant sources in the Scopus, WOS, and merged databases, a ranking based on the number of publications and h-indexes.

The above results show a similarity between the merged database and Scopus regarding the most relevant sources. However, there is a difference between the merged database and the WOS database. Among the top ten most relevant sources in the merged database is a single source, the newspaper, which occupies first place in WOS and is in third position in the merged database.

Based on the merged database, we can affirm that the literature on agility in FinTech remains scarce due to the novelty of agility and FinTech, except that the first position is shared by three journals whose outputs do not exceed four publications. In comparison, the second position is occupied by seven journals (see Table 5).

In our comprehensive exploration of the intricate interplay between agility and financial technology (FinTech), we ventured into the realm of distinguished academic journals that have assumed pivotal roles in shaping this discourse.

Global Journal of Flexible Systems Management: This interdisciplinary journal serves as a vanguard, directing its scholarly lens towards organizational adaptability, responsiveness, and agility. By adeptly employing the SAP-LAP framework, it meticulously dissects its constituent elements, thus establishing itself as an indispensable platform for meticulously examining the dynamic interplay between agile strategies and the burgeoning landscape of financial technologies.

International Journal of Supply Chain Management (IJSCM): Despite its primary purview of supply chain management, the IJSCM makes substantial contributions to FinTech research. It enjoys widespread acclaim for its unwavering commitment to methodological rigor and determined managerial relevance. This journal consistently showcases research that seamlessly converges with the agile assimilation of financial technologies. It offers crucial perspectives on how contemporary supply chains navigate the intricate intricacies of FinTech integration, extending its relevance far beyond the constraints of traditional finance-focused publications.

Journal of Operations Management (JOM): The Journal of Operations Management (JOM) stands as a stalwart platform in the expansive domain of operations management, spanning across diverse sectors. While it encompasses both for-profit and non-profit operations, it steadfastly situates operations at the epicenter of any research inquiry. Remarkably, this journal actively encourages investigations that forge clear linkages between theoretical insights and industries’ multifaceted practical operational challenges. This distinctive approach renders JOM a compelling conduit for bridging the chasm between academic research and the burgeoning FinTech industry.

Despite their primary non-finance focus, these journals exhibit an impressive capacity to adapt and respond to the ever-evolving FinTech landscape. They continue to attract diverse research contributions, thus fortifying their unassailable significance within the scholarly discourse. As our academic expedition progresses, we explore the seminal publications authored by influential scholars while unveiling the most salient sources within the folds of these esteemed journals.

- Most Globally Cited Documents

Table 6, Table 7 and Table 8 show the most influential articles in Scopus, WOS, and the merged database from 1984 to October 2022. We constructed the list based on publications with the highest number of citations (Knoke and Yang 2019; Strozzi et al. 2017). Lee et al. (2001), “Internal capabilities, external networks, and performance: a study on technology-based ventures”, published in the Strategic Management Journal, was the most cited in the merged databases (1215 citations). The second and third most-cited articles in the merged database are, respectively, Ivanov’s (2020) “Viable supply chain model: integrating agility, resilience, and sustainability perspectives-lessons from and thinking beyond the COVID-19 pandemic”, in Annals of Operations Research (374 citations), and Gligor et al.’s (2015) “Performance outcomes of supply chain agility: When should you be agile?”, in the Journal of Operations Management (278 citations). These most-influential articles and authors are the same for the Scopus database. Regarding the WOS database, we found papers occupying second and third place in the Scopus database but with fewer citations than in the merged database. The most influential paper in the WOS database is Ivanov’s (2020) “Viable Supply Chain Model: agility, resilience, and Sustainability perspectives-lessons from and Thinking Beyond the COVID-19 Pandemic”, published in “Annals of Operations Research” (336 citations). In the second position, we find Gligor et al.’s (2015) paper “Performance outcomes of supply chain agility: When should you be agile?” (224 citations). In third place, we find “Liu et al. (2016)” with the paper “The Configuration between supply chain integration and information technology competency: A resource orchestration perspective” in the Journal of Operations Management (200 citations).

Table 6.

The most relevant papers in the merged database.

Table 7.

The most relevant papers in Scopus.

Table 8.

The most relevant papers in WOS.

Based on the merged database, we can state that the three most influential articles in FinTech agility research between 1984 and October 2022 are: (1) Lee et al. (2001), “Internal Capabilities, external networks, and performance: a study on technology-based ventures”, published in the Strategic Management Journal, which was the most cited in the merged database (1215 citations); (2) Ivanov (2020), “Viable supply chain model: integrating agility, resilience, and sustainability perspectives-lessons from and thinking beyond the COVID-19 pandemic”, in Annals of Operations Research (374 citations); and (3) Gligor et al. (2015), “Performance outcomes of supply chain agility: When should you be agile? “, in the Journal of Operations Management (278 citations). More than agility in finance and FinTech, we also found among the most-influential early articles works that assess agility in the supply chain and agility regarding information systems governance and new technologies’ adoption and optimization. We therefore argue that the literature on agility in FinTech is influenced by research that evaluates agility and information systems as well as emerging technologies.

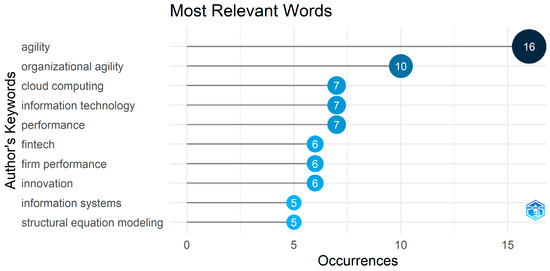

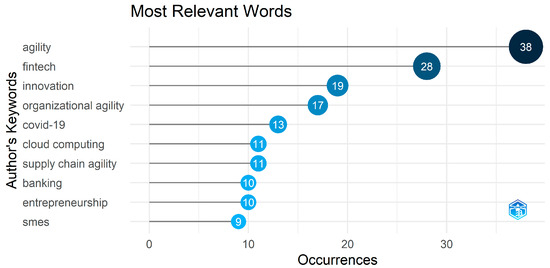

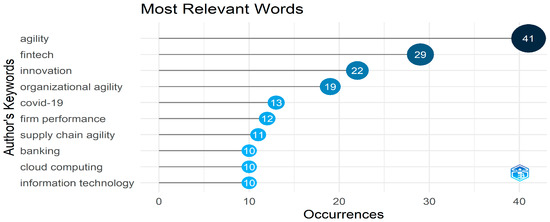

- Most Frequent Words

- ○

- Keywords Plus

The present study aimed to comprehensively analyze the frequency and occurrence of keywords in FinTech agility research from 1984 to 2022. Our investigation discovered and investigated the most frequently occurring terms in three databases: the merged database (MDB), Web of Science (WOS), and Scopus. The primary purpose was to identify the dominant ideas and their enduring significance in the academic discourse on FinTech agility.

Table 9 overviews the most-repeated words and their respective occurrences in the databases. “Agility” emerges as a consistent and highly recurrent keyword, appearing among the top three words in each table, with 41, 16, and 38 occurrences in the merged database, WOS and Scopus, respectively. “FinTech” and “Innovation” are predominant themes, appearing prominently in all three tables, with occurrences of 29 and 22, 6 and 6, and 28 and 19, respectively. In addition, the terms “Organizational Agility”, “COVID-19”, “Business Performance”, “Cloud Computing”, and “Supply Chain Agility” are recurrent in each dataset, indicating their importance and relevance in the academic literature.

Table 9.

Most frequent words in the three databases.

Comparative analysis of the three tables highlights a remarkable overlap of the most-repeated keywords, underscoring their importance in academic research across various databases. The prominence of “Agility”, “FinTech”, and “Innovation” as recurring themes highlights their enduring relevance in academic discourse. In addition, the constant appearance of related concepts, such as “organizational agility”, “business performance”, and “supply chain agility”, underlines their interconnectedness and integral role in various fields of research. The frequently repeated word “COVID-19” also signifies its influence on contemporary research discussions. However, minor differences are observed in the number of occurrences, perhaps due to variations in data sources and coverage periods. Nevertheless, the consistent appearance of key terms underlines their importance in the academic landscape and indicates potential areas of interest for researchers, practitioners, and policymakers. Overall, this analysis offers valuable insights into recurring themes in the literature and contributes to a better understanding of intellectual trends and advances in the respective research fields.

- ○

- Analysis of Most Frequent Words Across Authors’ Keywords

Authors’ keywords indicate the frequency of discussion of agility in the FinTech literature (Figure 6, Figure 7 and Figure 8). The three databases’ top words reveal their study themes. All three databases use “agility” to evaluate firms’ ability to adapt and thrive in dynamic situations. This shows a shared interest in organizational agility’s many aspects and drivers. The merged database (MDB) and Scopus promote “FinTech”, indicating a focus on finance and technology. Technology has transformed financial systems, services, and institutions. “Innovation” is another significant word in all three databases, reflecting a shared research interest in organizational innovation’s motivations, processes, and consequences. Researchers in these databases agree that innovation drives organizational performance and competitiveness.

Figure 6.

Most frequent words in WOS.

Figure 7.

Most frequent words in Scopus.

Figure 8.

Most frequent words in MDB.

The merged database (MDB), Web of Science (WOS), and Scopus emphasize “organizational agility” as well. This means there is a shared goal in enhancing organizations’ ability to adapt, embrace flexibility, and optimize performance. Comparing databases shows disparities. The merged database (MDB) commonly uses “COVID-19”, focusing on the pandemic’s effects on organizational flexibility, finance, and innovation. The worldwide crisis presents a pertinent research direction.

“Cloud computing”, “supply chain agility”, “banking”, “entrepreneurship”, and “S.M.E.s” also dominate Scopus. Technology, supply chain management, banking sector dynamics, and the entrepreneurial environment are studied in the contexts of agility, FinTech, and innovation. The three bases share “agility”, “innovation”, and “organizational agility” themes. “FinTech” in the merged database (MDB) and Scopus shows the collective interest in studying finance and technology convergence.

In addition, the distinct keywords in the Scopus database suggest specific avenues of research into agility, FinTech, and innovation. Based on the authors’ keywords, this analysis provides valuable insights into the joint and unique research interests manifested through the most frequent words in these databases.

Researchers can draw on these results to identify critical areas of inquiry, establish potential collaborations, and deepen their understanding of the dominant trends and focal points of organizational agility, FinTech, and innovation. The comprehensive exploration of the most frequent keywords contributes to a better understanding of the research field and its evolving dynamics, paving the way for informed decision making and advances in FinTech agility research.

- Uncovering Crucial Domains through Co-Citation Analysis

By applying co-citation analysis, we obtained critical insight into the intellectual links and the academic structure behind the agility of FinTech. As examined by Briter Bridges (2021), this strategy investigates the frequency with which two earlier studies are mentioned in later works. It enabled us to map the academic structure of the discipline and find critical articles with an intellectual relationship.

Co-citation analysis helps identify the principal, peripheral, and relay researchers in the FinTech agility sector. Even though co-citation links suggest a shared general research topic, they do not necessarily show perfect agreement between the publications. Instead, they illuminate the relationships and influences between works. In addition, co-citation analysis answers essential queries, such as “Who are the leading contributors to the FinTech agility field?” and “How has this field’s structure evolved?” By deciphering these findings, we can fully understand the academic ecosystem and the prominent scholars driving FinTech’s agility forward.

- Bibliometric co-citation analysis

Citation analysis uses bibliographic linkage, co-citation, co-author, and co-word analysis. A bibliographic connection links two records citing the same article. Co-citation analysis quantifies articles’ influence by the frequency with which they are cited. Co-author citation analyzes the network co-occurrence of authors’ works. Co-word analysis also maps a network’s cognitive structure across time using terms in article abstracts, titles, and keywords (Boyack and Klavans 2010).

This method offers insights into the temporal growth of conceptual frameworks, fostering a scholarly discourse through textual conversation. By employing co-citation analysis, we can effectively identify existing knowledge and study the roles, clusters, and connections between articles, ultimately enhancing our understanding of the impact of publications on the development of agility in FinTech from 1984 to October 2022. According to the work of Small and Rosen (1981), this method illuminates conceptual frameworks’ temporal growth, facilitating scholarly dialogue through textual conversation. Co-citation analysis can reveal existing knowledge and study article roles, clusters, and links from 1984 to October 2022 to understand better how publications affected FinTech agility.

- Co-citation Analysis by Paper

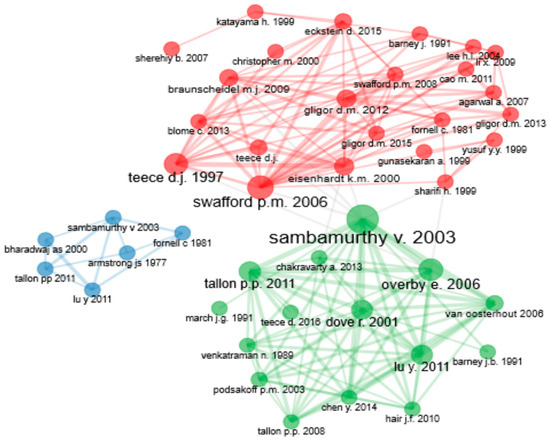

Our research used rigorous co-citation analysis to illuminate the complex web of interconnected scholarly discourse in FinTech strategy and performance studies. Our analyses revealed three major clusters, each defining necessary academic fields of study. We derived unique labels for these clusters by meticulously scrutinizing research paper interrelationships, exposing their topics and scholarly relevance (Figure 9).

Figure 9.

Bibliographic coupling by paper: Cluster 1 (red), Cluster 2 (blue), and Cluster 3 (green) from the merged DB.

Cluster 1, aptly titled “Influential Researchers in Business Strategy and Performance Measurement”, encompasses esteemed scholars whose works have garnered considerable attention. Among them are Sambamurthy et al. (2003); Overby et al. (2006); Tallon and Pinsonneault (2011); and Lu et al. (2011a).

They have greatly improved our understanding of strategy design, execution, and organizational performance measurement. They have studied strategic alignment, performance measurement methods, and how information technology transforms company performance. These critical researchers guide aspiring academics and practitioners seeking practical solutions for increasing business performance and establishing lasting competitive advantage.

Cluster 2, titled “The Role of Intellectual Capital and Knowledge Management in Organizational Performance”, sheds light on renowned scholars who have dedicated their intellectual endeavors to unraveling the interplay between intellectual capital, knowledge management, and organizational performance. This cluster features esteemed researchers, such as Eisenhardt and Martin (2000), Teece et al. (1997), Gligor and Holcomb (2012), and Li et al. (2009). Intellectual capital knowledge assets, human capital, and social capital have a significant impact on corporate performance, according to their seminal research. Knowledge creation, acquisition, transfer, and use are carefully investigated in this cluster. These scholars’ insights help academics and practitioners use intellectual capital and apply effective knowledge management techniques to improve competitive advantage and organizational performance.

Cluster 3, designated “Information Technology and Strategic Alignment in Organizations”, uncovers the strategic relationship between information technology (IT) and organization alignment. Esteemed researchers, such as Bharadwaj (2000), Armstrong and Overton (1977), and Fornell and Larcker (1981), contribute to this cluster, shedding light on the pivotal role of IT investments and capabilities in achieving strategic alignment and enhancing organizational performance. Within this domain, investigations delve into subjects such as IT governance, IT-enabled business transformation, and aligning IT strategies with overall organizational goals. The prominence accorded to papers within this cluster, as evidenced by high citation scores, underscores their profound impact on the scholarly landscape. Scholars and practitioners who seek a comprehensive understanding of the strategic implications of IT and its influence on organizational performance will find this cluster a treasure trove of invaluable insights. Table 10 shows the Co-citation analysis of research papers from merged DB.

Table 10.

Co-citation analysis of research papers from merged DB.

- Co-citation Analysis by Authors

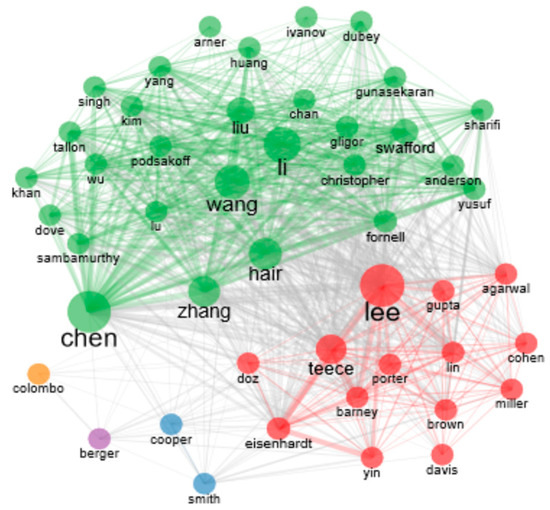

Our study used comprehensive citation analysis to uncover the extensive network of experts in FinTech agility. Our research revealed three distinct clusters that we interpret to represent different areas of inquiry within this field of study. These clusters’ difficulties and scholastic significance are hinted at by their titles. Our study used comprehensive citation analysis to uncover the extensive network of experts in FinTech agility. Our research found three distinct clusters that we interpret to represent specific areas of inquiry within this field of study (Figure 10). These clusters’ difficulties and scholastic significance are hinted at by their titles.

Figure 10.

Co-citation analysis based on first authors from merged DB.

Cluster 1, aptly titled “Influential Researchers in Business Strategy and Performance Measurement”, encompasses esteemed scholars whose works have garnered considerable attention. Contributors such as Sambamurthy et al. (2003), Overby et al. (2006), Dove (2001), Tallon and Pinsonneault (2011), and Lu et al. (2011a) have substantially advanced our understanding of critical aspects, such as strategy formulation, execution, and organizational performance measurement. Their research covers topics ranging from strategic alignment and performance measurement systems to the transformative role of information technology in improving business performance. These influential researchers guide academics and practitioners toward practical strategies for improving corporate performance and achieving sustainable competitive advantage. Cluster 2, “The Role of Intellectual Capital and Knowledge Management in Organizational Performance”, highlights prominent scholars studying the relationship between intellectual capital, knowledge management, and organizational performance. Esteemed researchers, such as Eisenhardt and Martin (2000), Teece et al. (1997), Gligor and Holcomb (2012), and Li et al. (2009), have pioneered research on how intellectual capital knowledge assets, human capital, and social capital affect corporate performance. Scholars carefully study organizational knowledge development, acquisition, transfer, and use in this cluster. These researchers’ insights can help academics and practitioners use intellectual capital and knowledge management to improve competitive advantage and organizational performance.

Cluster 3, designated “Information Technology and Strategic Alignment in Organizations”, unveils the strategic relationship between information technology (IT) and organization alignment. Esteemed researchers, such as Bharadwaj and Menon (2000), Armstrong (1977), and Fornell and Larcker (1981), contribute to this cluster, shedding light on the pivotal role of IT investments and capabilities in achieving strategic alignment and enhancing organizational performance. This domain investigates IT governance, IT-enabled business transformation, and integrating IT strategy with corporate goals. This cluster’s strong citation scores demonstrate their significant impact on scholarship. This cluster is a goldmine for scholars and practitioners interested in IT’s strategic implications and organizational effectiveness. Table 11 presents the co-citation analysis of authors from merged DB.

Table 11.

Co-citation analysis of authors from merged DB.

- Co-citation Analysis by Sources

Table 12 highlights the critical journals publishing FinTech and management research. Prominent journals in this cluster include MIS Quarterly, the Journal of Operations Management, the Strategic Management Journal, the International Journal of Production Economics, Information Systems Research, the Journal of Business Research, and others. These journals are crucial in disseminating cutting-edge research on FinTech agility, operations management, strategic management, information systems, and marketing. These journals’ high centrality and PageRank scores reflect their significance and influence within the scholarly community, making them essential references for researchers and practitioners in the field. This co-citation analysis based on sources gives us valuable insights about the key journals publishing research in the FinTech research agility field. By understanding the interconnections among sources and the emerging thematic clusters, researchers can navigate the scholarly landscape more effectively, contribute to advancing the area, and stay abreast of the latest developments in FinTech research.

Table 12.

Co-citation analysis of sources: mapping interconnections in FinTech agility research.

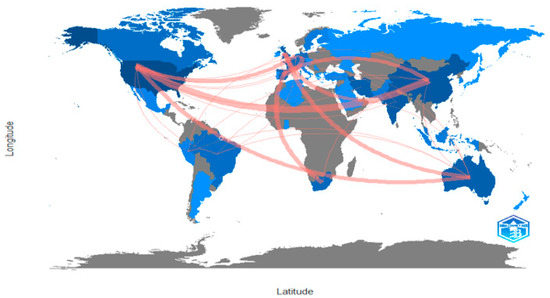

- Analysis of the Most Productive Countries

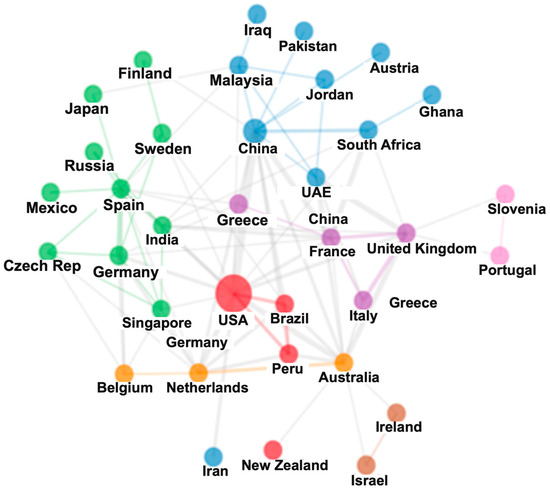

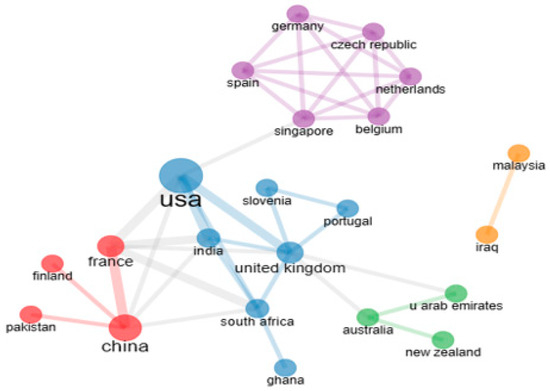

Examining the most productive countries in the three databases, the merged DB, WOS, and Scopus, provides valuable insights into their research contributions based on distinct metrics. In the merged DB, the United States is the leading country, with 84 occurrences in Cluster 1, closely followed by the United Kingdom (76 occurrences) and China (35 occurrences). These countries exhibit robust research productivity within the field represented by this database. Similarly, in the WOS (Figure 11) database, Malaysia attains the top position, with 50.33 occurrences in Cluster 1, followed by Spain (90.58 occurrences) and the United Kingdom (73.25 occurrences) in Clusters 2 and 3, respectively. In the Scopus database (Figure 12), China, Italy, Norway, and Sweden each have a perfect score of one occurrence in Cluster 1, underscoring their prominent positions in the research landscape covered by this database.

Figure 11.

Scopus WOS visualization network of co-citation (by countries).

Figure 12.

Merged DB visualization network of co-citation (by countries).

China is among the most productive countries in all three databases, highlighting its significant contributions across different academic networks. The USA and the United Kingdom also maintain a strong presence, consistently ranking among the top countries in each database. However, some differences exist, such as the appearance of countries like Spain, Malaysia, and Sweden in the top positions in specific clusters, showcasing their distinct research influence within the respective databases.

- Analysis of the Collaboration Networks

Exploring the collaboration networks in the merged DB, WOS, and Scopus reveals insights into the relationships and interactions between nodes (countries) based on betweenness, closeness, and PageRank measures. In the merged DB, countries like China and the USA demonstrate higher betweenness values (35 and 84, respectively), signifying their pivotal roles in connecting other countries within the collaboration network. The USA also exhibits the highest PageRank value (0.0788), suggesting its overall influence and significance in the network. In contrast, some countries, such as Ghana and Pakistan, show relatively low values across all measures, indicating their limited participation in collaborative efforts. Within the WOS database, Malaysia demonstrates the highest betweenness (50.33) and PageRank (0.0316) values in Cluster 1, indicating its central position and influence in connecting other countries within the collaboration network. The USA and China also maintain a substantial presence, with high PageRank values (0.0969 and 0.0846) in Cluster 5. Countries like Iran and Peru exhibit relatively lower values across all measures, suggesting less active collaboration involvement. The Scopus database offers a distinctive perspective, as some countries, including China, Italy, Norway, and Sweden, attain perfect scores in Cluster 1 for all three measures (betweenness, closeness, and PageRank). This observation could imply a highly interconnected and cohesive collaboration network among these countries.

In summary, the analysis of the collaboration networks in the three databases underscores varying degrees of country interactions and participation. China, the USA, and the United Kingdom emerged as influential players across the databases, with their contributions extending to multiple clusters. The study underscores the significance of global collaboration and knowledge exchange, contributing to advancing research and innovation in the respective academic fields represented by the databases. Figure 13 shows the world map network: relationships and interactions between countries. Dark blue countries: high interaction, medium blue countries: moderate interaction and light blue countries: low interaction.

Figure 13.

World map network: relationships and interactions between countries (Dark blue countries: high interaction, medium blue countries: moderate interaction and light blue countries: low interaction).

4. Discussion and Analysis

The FinTech industry has undergone rapid growth and transformation, driven by continuous technological advancements and evolving market dynamics. Within this dynamic landscape, “FinTech agility” has emerged as a critical factor for success and innovation. FinTech agility refers to financial technology companies’ ability to swiftly and efficiently adapt to changing circumstances, ensuring that they stay competitive and responsive to customer needs. In this paper, we present a comprehensive bibliometric study that combines data from the Scopus and Web of Science (WOS) databases to conduct an in-depth examination of FinTech agility within the scholarly literature, covering the period from 1984 to October 2022.

Evolution of FinTech Agility in the Scholarly Literature

Through rigorous bibliometric analyses, we trace the evolutionary trajectory of FinTech agility in the scholarly literature. By mapping the research’s growth over time, we identify critical inflection points, influential breakthroughs, and paradigm shifts shaping FinTech agility’s development. This review sheds light on how the concept has evolved in response to the changing demands and challenges in the FinTech industry, providing a profound understanding of its role and significance.

Figure 1 showcases the evolution of publications from 1984 to 2022 in three distinct databases: Scopus, WOS, and the combined database. Notably, between 2000 and 2006, the growth rate for the integrated database experienced a slowdown. However, after 2014, there was a substantial increase in papers until 2022. The surge of publications in the merged database mirrors that of Scopus, with a slight distinction due to the greater quantity of articles in the WOS database. This comprehensive analysis highlights the dynamic nature of scholarly output on FinTech agility, providing a broad perspective over the years.

Top Productive Authors

The study identifies the ten most productive authors in the Scopus, WOS, and merged databases based on the number of publications. Three authors stand out as the most productive researchers on agility in FinTech between 1984 and 2022: RATH.S (eight publications), PANDA. S (seven publications), and GLIGOR.D (five publications). RATH.S is the most productive author in the Scopus database (eight publications), followed by PANDA. S AJ (seven publications), with LUFTMAN. J ranking third (four publications). In the WOS database, PANDA. with G.U.P.T.A., S emerges as the most productive author (seven publications), with S in third place (four publications).

Influential Papers

Table 6, Table 7, and Table 8 list the most influential papers in Scopus, WOS, and the merged databases from 1984 to October 2022. “Internal Capabilities, External Networks, and Performance- A Study on Technology-Based Ventures” by Lee et al. (2001) tops the list, with 1215 citations, followed closely by “Viable supply chain model- integrating agility, resilience, and sustainability perspectives—lessons from and thinking beyond the COVID-19 Pandemic” by Ivanov (2020), with 374 citations, and “Performance Outcomes of supply chain agility- When should you be agile?” by Gligor et al. (2015), with 278 citations. Ivanov (2020) accumulated 336 citations, Gligor et al. (2015) 224 citations, and Liu et al. (2016) 200 citations. These influential publications address agility in finance, FinTech, supply chain management, information systems governance, and integrating and maximizing emerging technologies.

Most Relevant Sources

Regarding the most relevant sources, the merged database features three journals with four publications each: the Global Journal of Flexible Systems Management, the International Journal of Supply Chain Management, and the Journal of Operations Management, ranking first. Seven other journals have the same number of publications (four). The Scopus database aligns with the merged database’s top ranks. However, the WOS database slightly differs, with the Journal of Operations Management taking first position, followed by Industrial Management & Data Systems and the International Journal of Production Economics. Notably, the merged database indicates that research on agility in the FinTech literature remains limited due to its novelty, with only one journalistic source occupying the first position in WOS but third position in the merged database.

Co-citation Analysis and Bibliographic Linkage

Central to our bibliometric study are co-citation analysis and bibliographic linkage. Co-citation analysis involves identifying and analyzing the patterns of co-occurrence of citations between scholarly articles and uncovering the most influential and frequently cited works. This provides valuable insights into the foundational research that has contributed to understanding FinTech agility. Additionally, we explored bibliographic linkage, examining the references cited in selected articles, revealing the interconnectedness of research works and the intellectual network underpinning FinTech agility. Through co-citation analysis, we identified existing knowledge and connections between papers, enhancing our understanding of the impact of publications on the development of FinTech agility from 1984 to October 2022.

In our co-citation analysis to explore the interconnected academic discourse in FinTech agility research, we identified influential authors in the field. Scholars such as Sambamurthy et al. (2003), Overby et al. (2006), Dove (2001), Tallon and Pinsonneault (2011), and Lu et al. (2011b) have significantly advanced our understanding of strategy formulation, execution, and organizational performance measurement. Additionally, Eisenhardt and Martin (2000); Teece et al. (1997); Gligor and Holcomb (2012); and Li et al. (2009) have contributed significantly to our knowledge of the impact of intellectual capital on corporate performance and knowledge management practices. Furthermore, Bharadwaj and Menon (2000), Armstrong (1977), and Fornell and Larcker (1981) have explored the strategic relationship between information technology and organizational alignment. These influential authors offer valuable insights for advancing corporate strategy and performance research.

Our analysis of the most relevant keywords reveals the continued significance of “Agility”, “FinTech”, and “Innovation” in academic research. These themes are interconnected across various academic disciplines, and the prominence of the keyword “COVID-19” indicates its influence on current scientific discussions.

In addition to co-citation analysis, we explored collaboration networks in three databases (the merged DB, WOS, and Scopus) to understand the relationships and interactions between countries. In the merged DB, China and the USA are pivotal players, connecting other countries within the collaboration network. In WOS, Malaysia shows central influence in fostering collaborations. The Scopus database reveals highly interconnected cooperation between China, Italy, Norway, and Sweden. Overall, China, the USA, and the United Kingdom have emerged as influential contributors across databases, underlining the importance of global collaboration in advancing research and innovation in FinTech agility. Visual representations, such as charts or graphs, could further enhance the clarity of the analysis.

The comprehensive bibliometric study reveals the critical role of “FinTech agility” in the rapidly evolving FinTech industry. FinTech agility, referring to financial technology companies’ ability to adapt swiftly to changing circumstances, has emerged as a driving force behind success and innovation. By analyzing data from the Scopus and Web of Science databases (Mingers and Lipitakis 2010), the study traces the evolution of FinTech agility, identifying influential authors, key research milestones, and the most relevant sources. The analysis emphasizes the limited literature on FinTech agility, calling for further research in this emerging field. Moreover, the study highlights the continued importance of “Agility”, “FinTech”, and “Innovation” as vital keywords in academic research, with “COVID-19” significantly influencing current scientific discussions. Collaboration networks illustrate the pivotal roles of China, the USA, and the United Kingdom in advancing research and innovation, underscoring the significance of global collaboration in driving progress in the FinTech sector. Overall, this study contributes valuable insights into the dynamic landscape of FinTech agility and provides a solid foundation for future research in this field.

The Impact of Agility on FinTech: Navigating Challenges and Embracing Innovation

The rapid evolution of contemporary business has placed immense importance on agility. This text synthesizes and analyzes a selection of abstracts from academic papers published between 2019 and 2021 to shed light on the diverse facets of agility and its implications for various industries. These abstracts delve into agility’s relationship with financial performance, supply chain management, marketing, and organizational dynamics, providing valuable insights into the role of agility in modern organizations.

Several key findings emerge:

Marketing Agility and Financial Performance: Studies Pulakos et al. (2019) highlight the significance of marketing agility in influencing financial performance. Zhou et al. reveal that market turbulence moderates this relationship, emphasizing the nuanced role of agility in a dynamic market. Pulakos et al. (2019) stress the role of agility–resilience in enhancing financial performance, challenging conventional best practices.

Supply Chain Agility: Gligor et al. (2019) emphasize the importance of considering environmental uncertainty when assessing supply chain agility. They highlight that the appropriate level of supply chain agility depends on the specific environmental factors faced by the firm.

Logistics Strategies and Supply Chain Agility: Hwang and Kim (2019) demonstrate logistics strategies’ direct and indirect impacts on financial performance through supply chain agility. Their research underscores the central role of supply chain agility in responding to changing environments.

Government Agility and Financial Reporting: Ahmad et al. (2020) show that applying ICT-based management information systems positively influences transparency and accountability in government financial reports. They emphasize the importance of government agility in enhancing financial transparency.

FinTech Agility: Sánchez-Bayón and Lominchar (2020) analyze the competitive advantage of FinTech in delivering agile financial services. They stress the importance of agility in the FinTech ecosystem and discuss the challenges of evolving regulatory frameworks.

E-commerce and Organizational Agility: Li et al. (2020) reveal that e-commerce capabilities positively influence agricultural firms’ performance gains by leveraging organizational agility, with talent capability playing a crucial role.

These diverse academic explorations underscore the multifaceted nature of agility in contemporary business environments. Agility emerges as a pivotal element influencing financial performance in various industries. The studies provide valuable insights for practitioners and managers seeking to enhance their organizations’ agility and, in turn, achieve superior financial performance in today’s dynamic business world.

Relationship between Agility and FinTech: History, Challenges, and Trends

The relationship between agility and FinTech has a fascinating history. Initially, FinTech primarily focused on automating financial processes and providing digital banking solutions. However, as technology advanced and customer expectations evolved, FinTech companies recognized the need to be agile in responding to market changes and delivering innovative financial services.

Historical Evolution: In the early days of FinTech, between 1984 and 2010, discussions around agility were relatively limited. FinTech was primarily concerned with leveraging technology for cost efficiency and customer convenience. However, agility became a central theme as FinTech gained momentum after 2010.

Challenges: FinTech agility faces several challenges, including regulatory constraints. The fast-paced nature of FinTech innovation often clashes with traditional financial regulations, requiring agility to navigate complex compliance issues. Additionally, cybersecurity threats pose significant challenges, necessitating rapid responses to protect financial systems and customer data.

Trends: Recent trends indicate that FinTech companies are increasingly adopting agile methodologies in their development processes. Agile practices allow them to iterate quickly, respond to customer feedback, and stay ahead of competitors. Moreover, integrating artificial intelligence and blockchain technologies is reshaping FinTech, driving the need for agility in adapting to these transformative technologies.

These developments highlight the dynamic interplay between agility and FinTech. Agility is no longer a choice but a necessity for FinTech companies seeking to thrive in the competitive landscape and address the challenges and opportunities presented by evolving technologies and customer demands.

In summary, the comprehensive bibliometric study reveals the critical role of “FinTech agility” in the rapidly evolving FinTech industry. By analyzing data from the Scopus and Web of Science databases, the study traces FinTech agility’s evolution, identifying influential authors, key research milestones, and the most relevant sources. The analysis emphasizes the limited literature on FinTech agility, calling for further research in this emerging field.

Furthermore, the study highlights the continued importance of “Agility”, “FinTech”, and “Innovation” as vital keywords in academic research, with “COVID-19” significantly influencing current scientific discussions. Collaboration networks illustrate the pivotal roles of China, the USA, and the United Kingdom in advancing research and innovation, underlining the significance of global collaboration in driving progress in the FinTech sector.

Overall, this study contributes valuable insights into the dynamic landscape of FinTech agility and provides a solid foundation for future research in this field. It addresses the feedback received by incorporating a more interpretative approach, emphasizing research contributions, and discussing the historical evolution, challenges, and trends in the relationship between agility and FinTech.

5. Limitations and Future Research Directions

This study primarily relied on the Scopus and Web of Science (WOS) databases for data extraction. While these databases offer extensive coverage of the scholarly literature, they may not encompass all relevant publications on FinTech agility. Grey literature, conference proceedings, and non-English language publications were not included, potentially leading to some relevant research being omitted. Future research should consider expanding the database sources to provide a more comprehensive view of the field.

The study employed a Boolean keyword combination strategy to identify relevant publications. Despite careful keyword selection, variations in terminology and the evolving nature of FinTech agility may have resulted in some relevant articles being excluded. Employing advanced natural language processing techniques for keyword selection could enhance the study’s comprehensiveness. Additionally, the exclusion of certain terms may have inadvertently omitted relevant research, necessitating a more refined keyword strategy in future investigations.

Some future directions aim to address the limitations of the study and further advance the understanding of FinTech agility:

- Incorporate additional databases: To address the limitation of database coverage, future research should consider incorporating a wider range of databases and sources. This could include repositories of grey literature, conference proceedings, and non-English language publications, ensuring a more exhaustive dataset for analysis.

- Advanced NLP techniques: Enhancing keyword selection through advanced natural language processing (NLP) techniques could improve the study’s accuracy and comprehensiveness. NLP can help identify variations in terminology and adapt to the evolving landscape of FinTech agility research.

- Longitudinal analysis: Conducting a longitudinal analysis of the FinTech agility literature beyond 2022 would provide insights into emerging trends and the evolving discourse. Monitoring real-time developments in the field can offer a more up-to-date understanding of FinTech agility.

- Ethical dimensions: Future research should delve into the ethical considerations surrounding FinTech agility. Exploring issues such as data privacy, cybersecurity, and responsible innovation within the context of FinTech agility could contribute to a more comprehensive understanding of the field.

- Practical applications: Bridging the gap between academic research and industry practice is crucial. Future studies could focus on practical applications of FinTech agility concepts within financial technology companies, conducting case studies and empirical investigations to assess their real-world impact.

- Global perspective: Investigating the global dynamics of FinTech agility, including regional variations and international collaborations, could provide a broader perspective on the field. Understanding how different regions contribute to FinTech agility research and innovation is essential.

6. Conclusions

Our bibliometric study provides valuable insights into the evolving landscape of the FinTech agility literature from 1984 to October 2022. Utilizing data from both the Scopus and Web of Science (WOS) databases, our analysis delves into the dynamics of FinTech agility, making noteworthy contributions to the existing body of research. This comprehensive review not only enhances understanding but also serves as a valuable resource for researchers, industry practitioners, and policymakers, enabling informed decision making in this rapidly evolving domain.

We employed a meticulous bibliometric approach that incorporated co-citation analysis and examination of bibliographic links, shedding light on the foundational research shaping FinTech agility. While agility in finance and FinTech remains a focal point, our study also uncovered significant research related to supply chain agility, the governance of information systems, and the adoption of emerging technologies, demonstrating the interconnectedness of agility concepts across various domains.

In conclusion, our study underscores the critical role of agility in the dynamic FinTech sector, where the ability to adapt swiftly is a key driver of success and innovation. This research not only lays the foundation for future investigations but also offers a clear path for scholars and practitioners to deepen their understanding and contribute to the continued advancement of business strategy and performance in the financial technology domain. Future research endeavors should build upon these insights and explore the evolving facets of agility within the context of the FinTech literature.

Author Contributions

Conceptualization, A.S. and Y.M.; Data curation, A.S. and Y.M.; Formal analysis, A.S. and Y.M.; Funding acquisition, P.A.M.-C.; Investigation, A.S. and Y.M.; Methodology, A.S. and Y.M.; Project administration, P.A.M.-C. and S.A.A.; Resources, A.S. and Y.M.; Software, A.S. and Y.M.; Supervision, P.A.M.-C. and S.A.A.; Validation, A.S. and Y.M.; Visualization, P.A.M.-C. and S.A.A.; Writing—original draft, A.S. and Y.M.; Writing—review and editing, A.S. and Y.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahmad, Jamaluddin, Asdian Ekayanti, Nurjannah Nonci, and Muhammad Rohady Ramadhan. 2020. Government agility and management information systems: Study of regional government financial reports. The Journal of Asian Finance, Economics and Business 7: 315–22. [Google Scholar] [CrossRef]

- Anagnostopoulos, Ioannis. 2018. Fintech and regtech: Impact on regulators and banks. Journal of Economics and Business 100: 7–25. [Google Scholar] [CrossRef]

- Armstrong, Scott, and Terry Overton. 1977. Estimating nonresponse bias in mail surveys. Journal of Marketing Research 14: 396–402. [Google Scholar] [CrossRef]

- Armstrong, Scott. 1977. Social irresponsibility in management. Journal of Business Research 5: 185–213. [Google Scholar] [CrossRef]

- Bharadwaj, Anandhi. 2000. A resource-based perspective on information technology capability and firm performance: An empirical investigation. MIS Quarterly 24: 169–96. [Google Scholar] [CrossRef]

- Bharadwaj, Sundar, and Anil Menon. 2000. Making innovation happen in organizations: Individual creativity mechanisms, organizational creativity mechanisms or both? Journal of Product Innovation Management: An International Publication of the Product Development & Management Association 17: 424–34. [Google Scholar]

- Botta, Alessio, Alessia Vassallo, Sarina Deuble, Timo Mauerhoefer, Eckart Windhagen, Constance Emmanuelli, Fernando Figueiredo, Tunde Olanrewaju, Max Flötotto, Stefanie Vielmeier, and et al. 2022. Europe’s Fintech Opportunity. Available online: https://www.mckinsey.com/industries/financial-services/our-insights/europes-fintech-opportunity#/ (accessed on 15 October 2023).

- Boyack, Kevin W., and Richard Klavans. 2010. Co-citation analysis, bibliographic coupling, and direct citation: Which citation approach represents the research front most accurately? Journal of the American Society for information Science and Technology 61: 2389–404. [Google Scholar] [CrossRef]

- Briter Bridges. 2021. Africa Investment Report 2021. London: Briter Bridges. [Google Scholar]

- Cho, Hyunbo, Mooyoung Jung, and Moonho Kim. 1996. Enabling technologies of agile manufacturing and its related activities in Korea. Computers & Industrial Engineering 30: 323–34. [Google Scholar]

- Donthu, Naveen, Satish Kumar, Neeraj Pandey, Nitesh Pandey, and Akanksha Mishra. 2021. Mapping the electronic word-of-mouth (eWOM) research: A systematic review and bibliometric analysis. Journal of Business Research 135: 758–73. [Google Scholar] [CrossRef]

- Dove, Rick. 2001. Agile production: Design principles for highly adaptable systems. Maynard’s Industrial Handbook 5: 9.3–9.26. [Google Scholar]

- Echchakoui, Saïd. 2020. Why and how to merge Scopus and Web of Science during bibliometric analysis: The case of sales force literature from 1912 to 2019. Journal of Marketing Analytics 8: 165–84. [Google Scholar] [CrossRef]

- Eisenhardt, Kathleen M., and Jeffrey A. Martin. 2000. Dynamic capabilities: What are they? Strategic Management Journal 21: 1105–121. [Google Scholar] [CrossRef]

- Ellegaard, Ole, and Johan A. Wallin. 2015. The bibliometric analysis of scholarly production: How great is the impact? Scientometrics 105: 1809–831. [Google Scholar] [CrossRef]

- Ertz, Myriam, Sébastien Leblanc-Proulx, Emine Sarigöllü, and Vincent Morin. 2019. Made to break? A taxonomy of business models on product lifetime extension. Journal of Cleaner Production 234: 867–80. [Google Scholar] [CrossRef]

- Fabregat-Aibar, Laura, M. Glòria Barberà-Mariné, Antonio Terceño, and Laia Pié. 2019. A bibliometric and visualization analysis of socially responsible funds. Sustainability 11: 2526. [Google Scholar] [CrossRef]

- Flötotto, Max, Eitan Gold, Uzayr Jeenah, Mayowa Kuyoro, and Tunde Olanrewaju. 2022. Fintech in Africa: The End of the Beginning. Available online: https://www.mckinsey.com/industries/financial-services/our-insights/fintech-in-africa-the-end-of-the-beginning (accessed on 15 October 2023).

- Fornell, Claes, and David F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Gligor, David M., and Mary C. Holcomb. 2012. Understanding the role of logistics capabilities in achieving supply chain agility: A systematic literature review. Supply Chain Management: An International Journal 17: 438–53. [Google Scholar] [CrossRef]

- Gligor, David M., Carol L. Esmark, and Mary C. Holcomb. 2015. Performance outcomes of supply chain agility: When should you be agile? Journal of Operations Management 33: 71–82. [Google Scholar] [CrossRef]

- Gligor, David, Nichole Gligor, Mary Holcomb, and Siddik Bozkurt. 2019. Distinguishing between the concepts of supply chain agility and resilience: A multidisciplinary literature review. The International Journal of Logistics Management 30: 467–87. [Google Scholar] [CrossRef]

- Goodman, David. 2007. Update on scopus and web of science. The Charleston Advisor 8: 15. [Google Scholar]

- Hwang, Taewon, and Sung Tae Kim. 2019. Balancing in-house and outsourced logistics services: Effects on supply chain agility and firm performance. Service Business 13: 531–56. [Google Scholar] [CrossRef]

- Ivanov, Dmitry. 2020. Predicting the impacts of epidemic outbreaks on global supply chains: A simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transportation Research Part E: Logistics and Transportation Review 136: 101922. [Google Scholar] [CrossRef] [PubMed]