Abstract

In recent years, the interest in electric vehicles (EVs) in the research community has been growing, particularly in the context of decarbonization. Additionally, there is a growing increase in their number, leading to massive energy demand on the charging stations (CSs). Energy trading management for CSs puts great pressure on the power grid and is a stimulating challenge in smart cities. In this paper, we propose an innovative market formulation in which autonomous vehicles and smart charging and discharging stations are motivated to cooperate dynamically with changing roles. In order to mathematically formulate the energy trading market, we adopt a double auction strategy that is repeated in steps. In this strategy, EVs and CSs participate by buying and selling energy. The investigated problem has high complexity, and thus, multi-objective optimization is employed so as to encapsulate the opposing objectives that the EVs and CSs have. Multi-objective optimization leads to a fairer and more efficient market operation. The performance of the presented approach is investigated through analytical and experimental results. More specifically, the proposed algorithm achieves up to reduction in energy consumption. The performance evaluation proves that the suggested strategy offers both fairness and significant energy benefits, encouraging both electric vehicles and charging stations to take part in a double auction energy trading system.

1. Introduction

1.1. Motivation

The rapid development of the Internet of Things (IoT) has enabled new technologies and innovative solutions in smart cities and affected every single aspect of everyday life. One noteworthy advancement in smart cities is electric vehicle (EV) technology. The market for EVs has grown rapidly in recent years and is predicted to grow at a fast pace over the coming decades, since their use is expected to decarbonize road transport [1,2]. EV sales are expected to reach 16.21 million vehicles by 2027 [3].

Electric vehicles are by design pollution free and environmentally efficient, often use renewable resources, and have a positive impact on the smart city transportation system. However, their extensive use poses great challenges for the power grid network, as the charging and discharging of the EVs incur high amounts of total energy transfers. A single vehicle does not impact the energy market significantly, but as vehicle owners use the smart grid network during specific hours of the day, we contend that the cooperation of large numbers of vehicles could provide remarkable energy reductions, especially during peak load periods. Additionally, the dynamic use of charging and discharging stations plays a key role in the energy balancing of the smart transport system. The question is how to motivate the EV and CS owners to participate and cooperate in a market model, considering that they are self-interested, competitive, and seeking to maximize their individual benefits. The main challenge is to design an incentive-compatible market that leads to social welfare maximization and efficient energy allocation.

1.2. Related Work

Numerous works in the literature focused on innovative strategies in smart cities and a number of them center around the use of EVs. An overview of energy trading algorithms is offered in [4]. The authors focus on the most important milestones in the evolution of smart cities and compare dynamic pricing approaches concerning the energy trading of EVs.

The imbalance between energy demand and supply poses a great challenge in the management of transportation systems; thus, dynamic pricing [5] has drawn attention in the past years and has been thoroughly investigated in the literature. A multi-leader multi-follower Stackelberg game for energy trading is proposed by the authors in [6]. The paper considers multiple parameters (e.g., electricity usage, time of use, location, and type of EVs) in order to design a dynamic pricing system. Dai et al. [7] propose a dynamic pricing scheme based on a Stackelberg game for EV charging stations as well. Game theory is employed, as well, to solve the problem of dynamic pricing in the competitive environment, where multiple EVs and CSs coexist. A hierarchical game approach is proposed in [8]. The authors propose an integrated framework in order to effectively navigate EVs to electric vehicle charging stations in real time. Similarly, the price competition is modeled through game formulations that adjust the energy prices dynamically in [9,10,11]. The authors in [12] propose a prediction-based charging scheme that receives dynamic pricing information via wireless communication.

A novel coordinated dynamic pricing model that aims at reducing the overlaps between residential and CS loads is presented in [13]. The pricing policy is formulated as a constrained optimization problem in order to encourage the vehicle owners to uniformly use the charging and discharging stations. Different applications of dynamic pricing strategies are discussed in [14,15]. In [16,17], one-state and two-stage stochastic models for EV charging scheduling are presented. In these works, the dynamic pricing and the challenges of renewable resources are examined. A mathematical formulation problem focuses on the minimization of the charging waiting time in [18]. The approach is based on a cloud computing calendar that schedules the priorities and the arrivals of the vehicles’ owners to the CSs. An intelligent pricing scheme for EVs management is investigated in [19]. A real-time dynamic pricing model for the energy trading between EVs is proposed in [20]. The authors use a decentralized cloud computing architecture based on software-defined networking technology and network function virtualization. Different pricing models are proposed to maximize the utility of the smart grid. However, in previous works, the cooperation between different participants in the energy market is not explicitly considered and explained. In order for energy trading to be efficient, a lot of information needs to be exchanged. However, EVs and CSs often prefer not to disclose their energy information. Thus, the research community explored the challenges of auctions in the energy trading market.

Many works in the literature adopted auctions. In [21,22], blockchain technology and double auction theory are combined in a vehicle transport system. Double auction is employed for energy trading and pricing valuation and different mechanisms for EV networks are presented in [23,24]. The authors in [23,24] propose an energy trading platform for EV charging that allows EVs with excess energy to provide for the empty batteries of other EVs. Furthermore, in [25,26], double auction strategies exploit surplus energy to be stored and shared among vehicle owners. Truthful double auction frameworks for dynamic energy trading that incentivize vehicles to participate in an energy trading market are proposed in [27,28,29]. To address false bidding attacks, a multi-round incentive compatibility auction mechanism is proposed in [30]. Zhai et al. [31] investigate the use of an exponential-based online auction scheme that ensures differential privacy of the bidders and trades the energy between the vehicles and CSs. The works in [32,33] proposed bidding and scheduling models for microgrids, which include electric vehicles. In [34], a fair double auction model is investigated that finds an equilibrium based on price anticipation where the social welfare of the participating market players is maximized. The authors in [35] propose an online double auction for energy trading between electric vehicles and a microgrid center controller.

After the attentive study of the literature, we concluded that the researchers have investigated the energy trading problem of electric vehicles thoroughly and their mathematical and experimental results are remarkable and worth mentioning. Nonetheless, there are still challenging gaps that can be investigated in the energy trading problem between the vehicles and charging stations network. To this end, we mention the following limitations of the works of the literature that leave the research field open for further investigation:

- Most of the works consider a rather small number of electric vehicles and charging stations. However, an algorithm for energy trading needs to be applicable to a larger network of EVs and CSs.

- A subset of the state-of-the-art works do not consider energy savings to be a main objective for their proposed strategy. Rather privacy and security issues receive great attention. For example, obtaining anonymity in the auction is examined.

- Fewer works motivate the involved participants to enter the energy trading market through the environmentally profitable use of renewable energy sources.

Table 1 summarizes the conceptions and formations of the previous works in the literature, concerning the number of involved parties, the strategy they proposed, and the objectives For the number of players, let us highlight the two following observations: First, the number of players consists of the number of EVs and CSs. Second, small refers to the case when the number of EVs is less than 100 and CSs are less than 10).

Table 1.

Comparison to the state of the art with respect to the NET scheme.

1.3. Contributions

In this paper, we explore an energy trading market with asymmetric information. Asymmetric information means that the independent participants of the market (i.e., vehicles and charging stations) may not know which actions are beneficial for their opponents, which poses a great challenge in the energy trading problem. It is observed that vehicles often need more energy during peak hours, a fact that creates large imbalances in the energy demand during the day. Moreover, the charging stations are motivated to trade energy in the market depending on their needs that differ through the time of the day. As a consequence, the buyers (i.e., EVs) and the sellers (i.e., EVs and CSs) can be motivated to disclose truthfully their demands by using an incentive-compatible strategy. Assuming that the market can gather this information, the question is how to reach an equilibrium between the buyers’ and sellers’ requests, while optimizing the operation of the market. Another challenge that we need to deal with in the energy model is the different desires and needs of the participants. More specifically, the interests of the EVs and CSs may be conflicting. Thus, the tool to be employed needs to solve the aforementioned issues. We regard double auction for the complex energy trading market for the aforesaid reasons [36]. Double auction is an appropriate tool to converge to an optimal solution when the participants have conflicting interests, are not willing to disclose their bidding information, and have a large number of participants involved in the market. More specifically, concerning the privacy issued, double auction employs data privacy and communication mechanisms (e.g., public key cryptography, homomorphic encryption, and cryptographic hash functions [37]) and assures the security of the procedure.

In this paper, an energy trading strategy is presented. The investigated strategy takes into account the distinctive characteristics of the market participants (i.e., vehicles and charging stations), the system layout and the time-varying energy characteristics (i.e., peak and off peak periods). In the energy trading algorithm that we propose, EVs can either buy or sell energy and the CSs can sell energy. In the investigated approach, the EVs that act as buyers bid for energy, and the EVs and CSs that act as sellers ask a price for energy through an iterative algorithm that gradually converges to an optimal efficient solution, without the need for any other information.

The main contributions of the paper are as follows:

- We present a novel energy trading market; EVs compete with one another to purchase energy from different EVs and CSs. The CSs serve as sellers whereas each EV acts as a buyer or a seller.

- We propose an iterative double auction approach that optimizes social welfare, and at the same time is individually rational and incentive-compatible. More specifically, our approach motivates participation among EVs and CSs and the truthful disclosure of their actual energy needs and demands.

- In order to gather pertinent information concerning the performance of the proposed strategy, we validate the problem theoretically and through simulations. The outcomes of our investigation show the possible energy and monetary gains and provide the EVs with the motivation they need to choose to engage in an energy allocation negotiation with the CSs and the rival vehicles.

The remainder of the paper is organized as follows. Section 2 describes the system layout. In Section 3, we introduce the double auction strategy and the optimization approach that formulates the market. In Section 4, we present the iterative double auction algorithm. The outcomes, analytical and experimental, are shown in Section 5, Section 6 and Section 7 and conclude this paper.

2. System Model and Operation

2.1. System Model

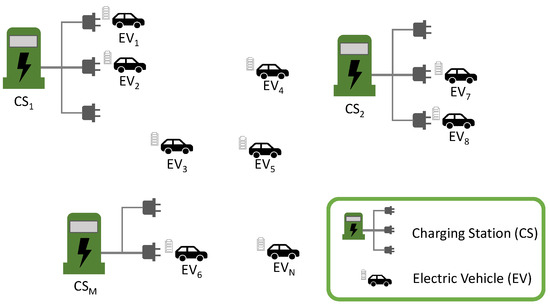

We consider a geographical area where a number of charging and discharging stations are deployed and a number of electric vehicles are moving. The illustration below shows the system configuration used in this experiment (Figure 1). More specifically, in the investigated system layout, we have the following entities along with their individual characteristics:

Figure 1.

System model with N EVs and M CSs.

- EVs: In the examined geographical area, we consider a number of N vehicles, denoted by , where . The vehicles perform charging and discharging in the CSs in order to charge their batteries or offer energy to other vehicles.

- CSs: Each station has a number of plug-in sockets and is equipped with a bidirectional charge and discharge controller to ensure bidirectional energy flows. We assume that there is a set of M CSs, denoted by , where . The set of CSs may be under different ownership parties and buy electricity from the power grid in order to offer it to the vehicles.

2.2. Vehicle Traffic

The number of EVs is rapidly growing and is expected to grow even more significantly in the upcoming years. As a result, the charging infrastructure is also increasing; however, not at the same pace as the number of vehicles. The vehicle owners expect to charge their vehicles quickly, posing great pressure on the electric grid. Additionally, substantial imbalances are observed in the charging demand of the vehicles throughout the day [38]. More specifically, more users are expected to charge their vehicle batteries during the morning, from 6 a.m. to 9 a.m., and in the evening, from 2 p.m. to 6 p.m., since around these time periods, most of the vehicles are expected to be on the move and would need charging [13,18].

3. Problem Formulation

3.1. The Energy Market

We introduce an energy trading market, where the owners of the EVs and the charging stations compete to purchase energy and distribute it among them. Each one of them pursues dissimilar goals and reaps a variety of advantages. To implement the trading market’s process, a central auctioneer is therefore used. With a specific role to play, the EVs and CSs take part in the decision-making process. In order to maximize their energy and cost profits, EVs simultaneously submit bids (i.e., offers to receive and buy energy from other vehicles and CSs), as well as asks (i.e., offers to deliver and sell energy to other EVs). The EVs take part in the auction multiple times; however, each round allows each electric vehicle to either buy energy or sell energy. However, the CSs are willing to sell energy to the EVs by submitting asks to the central auctioneer.

Designing a market mechanism that addresses the issue of energy trading while also satisfying the desired economic features is a difficult task. Since the true needs of the involved parties are unclear, an impartial entity must serve as the auctioneer in the market. Additionally, since the sources of bids and asks are the only ones who know their values, a method that compels players to be completely honest about their truthful needs and demands is required. The auctioneer is in charge of acquiring these data and utilizing their knowledge, he uses an auction to match the bids and asks in order to limit market energy consumption and assure lower participant costs. The successful buyers and sellers, the precise transaction prices, and the agreed-upon amounts are decided at the conclusion of the procedure. We assume that the auctioneer has no motivation to stray from the overarching objective (such as social welfare) the auctioneer imposed. We conclude that a double auction technique is best for our situation after taking the aforementioned facts into account.

3.2. The Double Auction Strategy

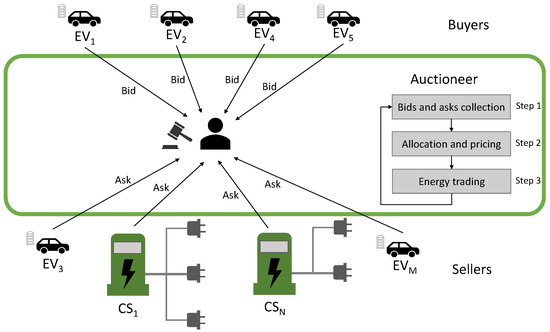

The three phases of the proposed auction-based method are described here, together with the decision-makers responsible for each phase (in parenthesis).

- In the bids and asks collection phase (EVs, CSs), the vehicles submit their bids and asks to the auctioneer, requesting energy trading. The SCs simultaneously submit their asks. The details of the needed energy and the associated costs are included in each bid and ask that is submitted to the auctioneer.

- In the allocation and pricing phase (auctioneer), the auctioneer gathers the bids and the asks. The energy trading problem is solved in a way that maximizes the system’s social welfare and the auctioneer determines the successful bids and asks. At the end, the auctioneer should end up with non-negative payments.

- In the energy trading phase (auctioneer, EVs, CSs), using the allocation from the previous phase as a guide, the auctioneer chooses the payment amount for each winner. The decision of the energy allocation problem is used by EVs and SCs to decide whether to receive or send energy.

Figure 2 illustrates the double auction strategy.

Figure 2.

Auction illustration.

3.3. The Bids and Asks Collection Phase

The vehicles and the charging stations are responsible for determining how much energy they are willing to trade in the market. From their side, the EVs need to calculate the amount of energy they want to either buy or sell from CSs and other EVs. Thus, the auctioneer receives both bids and asks from the vehicles. On the other side, the CSs that may be owned by different parties are responsible for determining the price for selling energy to the vehicles. Thus, the CSs acknowledge to the auctioneer their asks. In a previous work [39], we exploited a double auction approach to mathematically formulate a different problem. A resource-sharing market was developed in order to motivate mobile network operators (owning base stations, with various traffic load and diverse numbers of subscribers) and a third party (owning a network of small cells) to trade bandwidth resources through a double auction mechanism. A similar approach is followed in this work and is presented below.

3.3.1. Bids

We assume that one vehicle is willing to receive energy from another vehicle or from a charging station. Furthermore, we assume that the EV (represented by ) requests energy from another vehicle () or a charging station (), and this amount of energy is denoted by , where with , or . We define the energy trading request vector for to all vehicles and CSs as and the total traded energy of as .

Each bid corresponds to the unit of the traded energy. Thus, the EVs determine how much energy is needed for charging. Energy offers are sent by the EVs for different energy requests based on the utility they receive when charging the vehicle. The charging benefit can be calculated as:

where corresponds to the amount of energy that the battery of the vehicle has before bidding and is the requested energy. The amount of energy that a vehicle requests from other vehicles and charging stations must satisfy the following inequalities:

where is the available energy of other vehicles () or charging stations (), and

where is the maximum capacity of the vehicle. Based on the cost of the exchanged energy, a price can be used to valuate the utility produced from the requested energy. This starting bid amount is provided to the auctioneer.

3.3.2. Asks

The EVs calculate asks to offer energy to other vehicles. The energy traded between the vehicles is calculated to produce the asks in a manner similar to that of the bids. To begin with, we consider each EV to be ready to contribute energy resources equal to to other EVs denoted by , where . The electric vehicles must determine how much energy they are willing to exchange. We define the energy trading vector for to other vehicles as and the total traded energy of as .

The traded energy corresponds to each ask. As a result, the EVs decide how much energy they are willing to release for recharging other vehicles. Based on the utility they obtain when providing energy to the vehicles, the EVs are anticipated to submit requests for multi-unit energy offers. Thus, the utility is represented as:

where, . The cost can be evaluated by a price , based on the electricity cost of the traded energy, and is sent to the auctioneer.

Additionally, requests for energy to be provided to electric vehicles are also generated by the charging stations. The requests match the energy that can be provided in order to boost the CSs’ revenue. The amount of energy provided to the EVs is calculated by the CSs. We assume that a is willing to offer units of energy to a vehicle denoted by , where . We define the energy trading vector for as and the total traded energy as .

The unit of traded energy is represented by each ask. As a result, the CSs choose how much energy to give to electric vehicles. The CSs are required to determine requests for multi-unit energy offers depending on the utility they obtain when providing energy to the EVs. The utility is represented as:

where corresponds to the available energy of the charging station . The corresponding ask is denoted with and sent to the auctioneer.

3.4. The Allocation and Pricing Phase

The objectives of the vehicles and the charging stations obviously contradict one another. The vehicles requesting energy want the energy at the lowest price they can obtain. The vehicles and the charging stations offering energy want to offer it at the highest price possible. Therefore, it is extremely improbable that the parties involved are able to come to an agreement if they decide how much energy to trade on their own.

Due to the auctioneer’s goal of obtaining a balance between the competing interests of the involved parties (i.e., EVs and CSs), their job is essential to achieve a smooth operation of the market. According to the total amount of energy required, energy trading decisions must be made while simultaneously the auctioneer takes into account the various expenses associated with energy trading between vehicles and CSs. Therefore, a social welfare optimization problem can be used to resolve these particular market characteristics. It is also highlighted that social welfare optimization is a general paradigm for ensuring justice in systems where there are several involved parties. The choice represents the overall best option after social welfare optimization maps out each person’s preferences. Individual preferences are mapped through social welfare optimization and the solution to the problem represents the overall system optimum.

In the start of the allocation and pricing phase, the auctioneer is tasked with selecting the energy trading matrices denoted as:

The next step is for the auctioneer to define the matrices for the bids and asks, denoted as:

To find the optimal solution for the bids and asks, we need to define the optimization problems.

The purpose of the following optimization problem, which involves the bidding of the EVs seeking energy, is to have each EV’s unique cost for asking energy for charging be as low as possible:

The EVs address the following optimization problem and their will is to maximize the income of providing energy through the offered asks:

In order to determine the optimal asks of the CSs, the charging stations tackle the maximization problem shown below:

The auctioneer determines the optimal , , and , after receiving the bids and asks, by figuring out the social welfare minimization problem:

The objective function (16) is strictly concave and tries to reduce the disparity between the advantages of trading energy among the various participants. The constraints (17)–(19) make sure that the overall quantity of energy to be traded does not exceed the amount that is available for the EVs and CSs. According to constraint (20), each vehicle’s desired amount of exchanged energy must be satisfied by the amount that the EVs and CSs decide to admit. A vehicle can only be a buyer or a seller, thanks to constraint (21). Last but not least, constraint (22) ensures that the transferred energy resources are not negative.

The constraint set is not convex, since the constraint (21) is not linear. By using the Big-M notation, the problem is transformed as follows:

The problem P2 belongs to the class of multi-objective optimization problems, with objectives that are contradictory. The minimization of the vehicles’ cost for energy requesting does not necessarily imply the maximization of the EV and CS income for offering the energy. More specifically, the problem P2 is an NP-Complete problem. Thus, a global optimum is difficult to approach, especially when there is a large number of variables [40]. However, there are different solutions that represent the best feasible state of the investigated system. In our previous work [39], the social welfare multi-objective maximization problem is solved through the use of the method of Lagrange multipliers and the determination of the Karush–Kuhn–Tucker conditions. In [39], the energy market consisted of one third-party small cell network owner and just a few (up to five) mobile network operators. However, in the energy market that we investigate, we came to the conclusion that this method was not suitable. In the investigated problem, the number of involved parties is really high, consisting of a large number of CSs and an even larger number of EVs. Thus, a different approach needs to be investigated. Additionally, an optimization problem with antagonistic parties may have a variety of solutions, some of them being optimal. In order to find the optimal solutions, every objective should be examined separately and with the consideration of the conflicting objectives. To that end, a mechanism needs to be found in order to narrow down the solutions, so as to find the ones that are optimal. To overcome the high level of complexity of the multi-objective optimization problem, metaheuristics are employed. More specifically, metaheuristic approaches are used to determine the best representation or a good approximation of these optimal solutions, which are sometimes referred to as the Pareto optimal set or as the optimal Pareto Front. These metaheuristic methods (also sometimes called genetics) have become a very active research area, and several algorithms have been proposed [41].

For our multi-objective optimization issue, the metaheuristic algorithm searches through a collection of potential combinations of the decision variables to identify the Pareto optimal [40]. However, it is impossible to simultaneously optimize all or even a large number of objectives. As a result, first, separate calculations are made for the objectives that reduce the energy cost of EVs and increase seller energy income. Obviously, these solutions belong to the Pareto Front and, in fact, are its endpoints. Continuously, a simple procedure to locate additional Pareto solutions (if there are any) is started. The solutions are then sorted in accordance with one of the objectives (e.g., income of CSs). Finally, the algorithm begins at the point with the lowest cost for the vehicles and moves on to succeeding options until the lowest-cost solutions are discovered. The search is then restarted from this solution and added to the Pareto Front.

Through the use of metaheuristics, the multi-objective problem can be solved efficiently and quickly for different numbers of EVs and CSs [41,42,43].

4. Double Auction Algorithm

In this section, we present the Iterative Minimization Energy Trading (IMET) algorithm that solves the energy trading problem. This method uses an iterative process that builds up to equilibrium to determine the optimal values for the bids and asks of the EVs and the CSs. Algorithm 1 provides a description of the iterative procedure.

Proposition 1.

The Iterative Minimization Energy Trading (IMET) algorithm is efficient, individually rational, and incentive compatible.

Proof.

The Pareto Front, which depicts the ideal and optimal set of solutions, is where the IMET method converges. The solutions integrate the bidders’ objectives that were described by the optimization problems, denoted as BIDS (vehicles), ASKS (vehicles), and ASKS (charging stations). Then, these contradicting objectives are incorporated in the optimization problem P2, and through Algorithm 1, the optimal solutions are reached, proving the efficiency of the algorithm. Individual rationality is demonstrated by the fact that the utility of the winning participants is always non-negative. Towards achieving incentive compatibility, submitting to the auctioneer the real bids and asks is the preferred tactic for all players. When a player makes an untruthful bid, the winning bid must be higher than the lower truthful bid; as a result, the utility is lower than it would have been if the player had made an untruthful bet. When the player changes the bidding approach, the dishonest bidder is unable to maximize their utility. This demonstrates that the buyer has no reason to be dishonest. The asks also follow the same rationale. □

| Algorithm 1 Iterative Minimization Energy Trading (IMET) algorithm |

|

5. Performance Evaluation

In this section, numerical results are presented to validate our analysis. The section is composed of three parts. We first describe the simulated scenario that was used for our performance assessment. The results of the algorithm’s convergence are then shown. Finally, we demonstrate a performance assessment of the suggested approach in terms of convergence, bidding values and energy savings compared to the works of the literature.

5.1. Simulation Scenario

The simulation scenario corresponds to a dense network of charging and discharging stations in an urban area where a large number of electric vehicles are moving and are willing to trade their energy by participating in the double auction market. We assume that there is a large number of EVs and CSs, so as to have a variety of bids and asks that vary significantly from one to another. More specifically, our simulation scenario consists of 50 charging stations that are distributed around the area of a city center. We assume that the EVs are moving around the city center and their numbers range between 500 to 1000. Additionally, we assume that the maximum battery capacity of the EVs is set approximately to 400 km and the power consumption is set to 22 kWh for every 160 km [29].

Regarding the works of the literature [13,18], we decided to examine two different charging scenarios as representatives, since the charging behavior is categorized into two distinctive cases:

- Weekend: The electric vehicles are charged on Saturdays and Sundays. These days, it is observed that less energy is needed since the vehicles are not moving a lot.

- Weekday: The electric vehicles are charged during the days of the week, meaning from Monday to Friday. The energy needed these days is higher since the EVs require more energy due to working days.

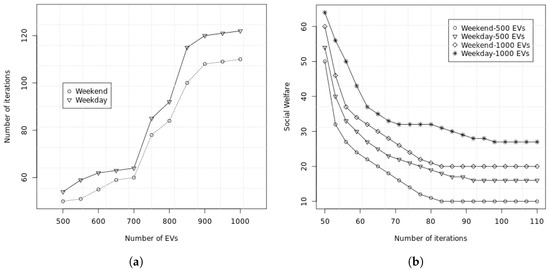

5.2. Convergence Analysis

In our research analysis, we take into account various numbers of EVs that travel across the network of charging stations and investigate how the suggested method behaves. In Figure 3, we first demonstrate how the number of EVs affects the number of iterations, and then we depict the social welfare attained in each iteration by the optimization problem P2 for various electric vehicles and for different days. In Figure 3a, we observe that as the number of EVs increases, the number of iterations increases as well, since the higher the number of EVs, the higher the number of possible combinations for energy trading. When our configuration consists of more EVs, it is more difficult to converge. It is important to point out that when the number of vehicles is relatively low, the number of iterations is small and this number is still not high for even a higher number of EVs. As a result, since the decision to trade energy is made within a short period of time—usually a few minutes—the number of repetitions is never prohibitive. Additionally, we observe that for weekdays, the number of iterations is a bit higher than the ones on weekends, since the charging traffic is higher on weekdays, when more vehicles require higher energy trading. In the second subplot (Figure 3b), we notice that the proposed algorithm only needs about 100 iterations to reach the optimal solution. For a lower number of electric cars (500 EVs), the social welfare is lower than when the number of EVs is higher (1000 EVs). This is explained since when our configuration consists of fewer cars, there is no need for achieving more energy trading agreements. As the number of cars increases, there are more possible combinations for energy trading and thus, better solutions are chosen. When comparing the days that the energy trading takes place, we observe that during weekends, the social welfare is lower due to the lower charging needs that the vehicles have these days.

Figure 3.

Convergence analysis and social welfare. (a) Number of iterations vs. the number of electric cars in the system configuration. (b) Evolution of social welfare for different number of EVs.

To verify the effectiveness of the iterative algorithm, the computation time for convergence for various numbers of vehicles is shown in Table 2. As it is observed, the algorithm is completed in polynomial time. From the results in the table, we conclude two observations. First, the computation time for convergence increases as the number of electric vehicles increases, something that is logical. Second, the time for convergence is lower on weekends, since the charging needs of the EVs are lower than on weekdays.

Table 2.

Computation time for convergence (in s).

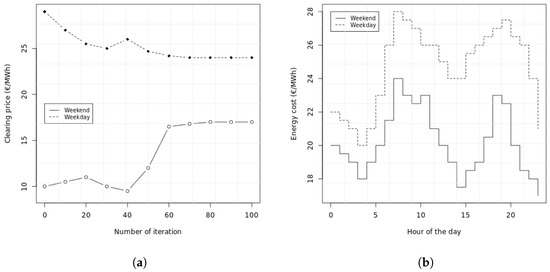

5.3. Numerical Results

In Figure 4, we plot the clearing price of the involved participants in terms of iterations (Figure 4a) and in terms of the daytime (Figure 4b). As we explained before in Section 3.2, the vehicles and the charging stations participate in the trading market in order to share energy. Thus, EVs and CSs propose bids and asks referring to the price that each one of them valuates the energy to be traded. It is clear that the bids and asks cannot be matched due to the participants’ different objectives. However, by motivating the involved parties to participate in the energy trading market, a clearing price can be reached. The clearing price refers to the price where the bids and asks are in equilibrium. This clearing price is reached through price discovery as buyers and sellers attempt to find the most beneficial price and this is achieved through the proposed iterative algorithm. By observing the first subplot (Figure 4a), the clearing price of the energy trading auction for the iterative algorithm (i.e., IMET) is plotted. It is evident that after a few rounds, the clearing price converges to an optimal value. Despite the fact that the initial values of bids and asks were chosen at random, we see that the optimal values for maximizing social welfare are quickly determined. It is also observed that the bids increase as the energy to be traded increases since the energy needs of the vehicles grow. This is the reason why the bidding prices are higher on weekdays instead of the price on weekends. During the weekdays, the higher energy needs increase the competition, and as a consequence, higher clearing prices are reached. Following similar observations, the energy cost is plotted during the different hours of the day in Figure 4b. More specifically, the energy cost refers to the clearing price that is achieved through the iterative auction strategy. Referring to Section 2.2, we recall that the energy needs are higher during the morning, from 6 a.m. to 9 a.m., and in the evening, from 2 p.m. to 6 p.m., since around these time periods, most of the vehicles are expected to be on the move and would need charging. Accordingly, the energy price fluctuates with the energy demands during the day. Over and above that, it is noted that the equilibrium energy cost is decided every hour of the day and is highly affected by the demands of that time. Last but not least, as mentioned in previous figures, the energy cost is lower over the weekends, when the energy trading is lower.

Figure 4.

Convergence analysis and social welfare. (a) Evolution of clearing price. (b) Clearing price for the energy trading auction.

We evaluate the effectiveness of our proposed scheme by comparing the auction-based energy trading technique (referred to as IMET), with two benchmark approaches:

- A double auction scheme, wherein the income of the involved participants is the dominant objective to be maximized [23]. The trading price is proposed to be estimated by the k-factor rule and, thus, we will be referring to this solution as k-factor Double Auction (k-DA),

- one benchmark solution (No Energy Trading (NET)), where each vehicle is charged independently without any agreement and consensus with the other EVs and the CSs.

To provide more context for the potential advantages that can be realized through the suggested energy trading method, the energy savings and the completion time are quantified in Table 3. The comparison of energy savings between the suggested IMET algorithm and the work from the literature (i.e., k-DA) in relation to the NET scheme is shown in the table. Particularly, as observed, the proposed iterative algorithm guarantees higher energy gains compared to the state-of-the-art work. By adopting the IMET strategy, the involved parties are motivated to participate in the energy trading market more often, and thus, higher gains are achieved. Another observation is that the higher the energy needs, the higher the energy gains are. More specifically, during weekdays, energy gains reach up to . Furthermore, our proposal achieves better performance in terms of completion time. The IMET scheme is designed to converge in very few seconds.

Table 3.

Comparison to the state of the art with respect to the NET scheme.

6. Discussion

We analyzed a double auction that is significantly distinct from other designs investigated in the literature. Earlier works have quantified the benefits of energy trading in rather restricted areas, with a relatively small number of vehicles and charging stations. Other works examine markets with complete data and select competitive strategies. However, in the market, it becomes more difficult to reach an agreement when participants are unwilling to disclose their needs and demands. The selected solution for such markets is the double auction theory, in which the auctioneer attempts to match the desires of buyers and sellers. Different double auction approaches have been analyzed in the literature. In this paper, we adopted a market mechanism based on the maximization of social welfare. We formulated a social welfare function to map the individual preferences of the energy market in a single objective. At this point, we recall that the EVs are motivated to minimize the cost of buying energy to charge and, at the same time, they want to maximize the price at which they are willing to sell the offered energy for charging other vehicles. To these conflicting interests, the maximization of asks of the CSs is also added. Multi-objective problems often belong to NP-hard problems, and an optimal solution is difficult to be found, especially when the number of variables is large. In order to converge the optimal solution, social welfare optimization is preferred, since the social welfare function combines the multiple objectives in a single function without neglecting the different and often conflicting preferences of the involved participants, e.g., EVs and CSs. The social welfare function that we propose ranks the solutions as less desirable, more desirable, or indifferent. The different solutions that exist represent the best feasible state of the investigated system. In order to find the best possible approximation of these optimal solutions, Pareto Front is employed. An iterative double-auction mechanism that satisfies all the desirable economic properties is used to resolve the limited market information and the conflicting objectives of the participants (i.e., electric vehicles and charging stations). Therefore, the proposed algorithm optimizes energy and cost efficiency in emergent and future applications for smart cities.

7. Conclusions

In this paper, motivated by the challenges of smart cities, e.g., an increasing number of electric vehicles and charging stations’ novel capabilities, an innovative double auction strategy was proposed. The investigated algorithm achieved energy savings and quick optimal decision, thus encouraging the EVs and CSs to participate in a trading market to share their energy. To meet the economic goals of all involved parties, an iterative algorithm (referred as IMET) was devised. A variety of EVs and the energy demands during different days were tested with the innovative scheme in the performance evaluation section. The findings demonstrate that our suggested algorithm considerably enhances the operation of the market with regards to energy savings. In some cases, the energy savings amount to a reduction of up to . The optimal values are also achieved in only a few steps. The suggested strategy offers both fairness and significant energy benefits, encouraging both electric vehicles and charging stations to take part in a double auction energy trading system. The involved stakeholders of the energy trading market are the following:

- The owners of the electric vehicles. We assume that each EV is owned by a different independent owner that acts individually and has individual objectives.

- The owners of the charging stations. Different energy operators may own multiple charging stations or each CS may be owned by independent third parties. Similarly, the owners have distinctive objectives.

The distinctive objectives of the EV and CS owners consist of cost reduction and the efficient use of energy resources independently and for the whole energy trading market. Therefore, the social welfare function combines multiple objectives in a single function without neglecting the different and often conflicting preferences of the involved participants. The algorithm converges to the optimal solution that motivates EVs and CSs to participate in the energy market.

A potential extension of the work could involve the evaluation of alternative algorithms for solving the energy trading problem. In addition, we intend to examine the market under different cases and scenarios and evaluate double auction strategies in terms of different parameters and various metrics. Last but not least, privacy and security issues are an emerging challenge that could be investigated in future work.

Author Contributions

Conceptualization, A.B.; methodology, A.B., A.D.; software, A.B.; validation, A.B., A.D.; formal analysis, A.B.; investigation, A.B.; resources, A.B.; data curation, A.B., A.D.; writing—original draft preparation, A.B.; writing—review and editing, A.B., A.D.; visualization, A.B.; supervision, A.D., E.I.P.; project administration, A.D., E.I.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

| CS | Charging Station |

| EV | Electric Vehicle |

| IMET | Iterative Minimization Energy Trading |

| IoT | Internet of Things |

| Set of EVs | |

| Set of CSs | |

| Electric Vehicle n | |

| Charging Station m | |

| Amount of energy requested by from or | |

| Energy trading request vector by from EVs and CSs | |

| Total traded energy of | |

| Charging benefit for energy requested by from or | |

| Amount of energy of the or before bidding | |

| Available energy of or | |

| Maximum battery capacity of | |

| Cost of energy requested for and paid to or | |

| Amount of energy offered for from | |

| Energy trading request vector by from EVs | |

| Total traded energy of | |

| Charging benefit for energy offered by to | |

| Cost of energy requested from and paid to | |

| Amount of energy offered for from | |

| Energy trading request vector from to all vehicles | |

| Total traded energy of | |

| Charging benefit for energy offered by to | |

| Cost of energy requested from and paid to |

References

- Martin, C.; Starace, F.; Tricoire, J.P. Electric Vehicles for Smarter Cities the Future of Energy and Mobility; World Economic Forum: Cologny, Switzerland, 2018. [Google Scholar]

- Global X Research Team. The Future of Transportation Is Autonomous & Electric, Global X. Available online: https://www.globalxetfs.com/future-of-transportation-is-autonomous-electric/ (accessed on 28 April 2023).

- Electric Vehicles—Worldwide. Available online: https://www.statista.com/outlook/mmo/electric-vehicles/worldwide (accessed on 28 April 2023).

- Arumugam, R.; Subbaiyan, T. A Review of Dynamic Pricing and Peer-to-Peer Energy Trading in Smart Cities with Emphasize on Electric Vehicles. In Proceedings of the 4th International Conference on Energy, Power and Environment (ICEPE), Shillong, India, 29 April–1 May 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Deng, R.; Yang, Z.; Chow, M.; Chen, J. A survey on demand response in smart grids: Mathematical models and approaches. IEEE Trans. Ind. Inform. 2015, 11, 570–582. [Google Scholar] [CrossRef]

- Aujla, G.S.; Kumar, N.; Singh, M.; Zomaya, A.Y. Energy trading with dynamic pricing for electric vehicles in a smart city environment. J. Parallel Distrib. Comput. 2019, 127, 149–183. [Google Scholar] [CrossRef]

- Dai, Y.; Qi, Y.; Li, L.; Wang, B.; Gao, H. A dynamic pricing scheme for electric vehicle in photovoltaic charging station based on Stackelberg game considering user satisfaction. Comput. Ind. Eng. 2017, 154, 107–117. [Google Scholar] [CrossRef]

- Tan, J.; Wang, L. Real-time charging navigation of electric vehicles to fast charging stations: A hierarchical game approach. IEEE Trans. Smart Grid 2015, 8, 846–856. [Google Scholar] [CrossRef]

- Lee, W.; Xiang, L.; Schober, R.; Wong, V.W.S. Electric vehicle charging stations with renewable power generators: A game theoretical analysis. IEEE Trans. Smart Grid 2015, 6, 608–617. [Google Scholar] [CrossRef]

- Etesami, S.R.; Saad, W.; Mandayam, N.; Poor, H.V. Smart Routing of Electric Vehicles for Load Balancing in Smart Grids. 2017. Available online: https://arxiv.org/abs/1705.03805 (accessed on 28 April 2023).

- Yuan, W.; Huang, J.; Zhang, Y.J.A. Competitive charging station pricing for plug-in electric vehicles. IEEE Trans. Smart Grid 2017, 8, 627–639. [Google Scholar]

- Erol-Kantarci, M.; Hussein, T.M. Prediction-based charging of PHEVs from the smart grid with dynamic pricing. In Proceedings of the IEEE Local Computer Network Conference (LCN), Denver, CO, USA, 10–14 October 2010; pp. 1032–1039. [Google Scholar] [CrossRef]

- Moghaddam, Z.; Ahmad, I.; Habibi, D.; Masoum, M.A.S. A coordinated dynamic pricing model for electric vehicle charging stations. IEEE Trans. Transp. Electrif. 2019, 5, 226–238. [Google Scholar] [CrossRef]

- Barhagh, S.S.; Abapor, M.; Mohammadi-Ivatloo, B. Optimal scheduling of electric vehicles and photovoltaic systems in residential complexes under real-time pricing mechanism. J. Clean. Prod. 2020, 246, 119041. [Google Scholar] [CrossRef]

- Faddel, S.; Al-Awami, A.T.; Mohammed, O.A. Charge control and operation of electric vehicles in power grids: A review. Energies 2018, 11, 701. [Google Scholar] [CrossRef]

- Nezamoddini, N.; Wang, Y. Risk management and participation planning of electric vehicles in smart grids for demand response. Energy 2016, 116, 836–850. [Google Scholar] [CrossRef]

- Soares, J.; Ghazvini, M.A.F.; Borges, N.; Vale, Z. Dynamic electricity pricing for electric vehicles using stochastic programming. Energy 2017, 122, 111–127. [Google Scholar] [CrossRef]

- Eldjalil, C.D.A.; Lyes, K. Optimal priority-queuing for EV charging-discharging service based on cloud computing. In Proceedings of the IEEE International Conference on Communications (ICC), Paris, France, 21–25 May 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Misra, S.; Bera, S.; Ojha, T. D2P: Distributed Dynamic Pricing Policyin Smart Grid for PHEVs Management. IEEE Trans. Parallel Distrib. Syst. 2015, 26, 702–712. [Google Scholar] [CrossRef]

- Chekired, D.A.; Khoukhi, L.; Mouftah, H.T. Decentralized cloudSDN architecture in smart grid: A dynamic pricing model. IEEE Trans. Ind. Inform. 2018, 14, 1220–1231. [Google Scholar] [CrossRef]

- Luo, L.; Feng, J.; Yu, H.; Sun, G. Blockchain-Enabled Two-Way Auction Mechanism for Electricity Trading in Internet of Electric Vehicles. IEEE Internet Things J. 2022, 9, 8105–8118. [Google Scholar] [CrossRef]

- Kang, J.; Yu, R.; Huang, X.; Maharjan, S.; Zhang, Y.; Hossain, E. Enabling localized peer-to-peer electricity trading among plug-in hybrid electric vehicles using consortium blockchains. IEEE Trans. Ind. Inform. 2017, 13, 3154–3164. [Google Scholar] [CrossRef]

- Xu, Y.; Wang, S.; Long, C. A Vehicle-to-vehicle Energy Trading Platform Using Double Auction With High Flexibility. In Proceedings of the IEEE PES Innovative Smart Grid Technologies Europe (ISGT Europe), Espoo, Filand, 18–21 October 2021; pp. 1–5. [Google Scholar] [CrossRef]

- Li, D.; Yang, Q.; An, D.; Yu, W.; Yang, X.; Fu, X. On Location Privacy-Preserving Online Double Auction for Electric Vehicles in Microgrids. IEEE Internet Things J. 2019, 6, 5902–5915. [Google Scholar] [CrossRef]

- Tushar, W.; Chai, B.; Yuen, C.; Huang, S.; Smith, D.B.; Poor, H.V.; Yang, Z. Energy storage sharing in smart grid: A modified auction-based approach. IEEE Trans. Smart Grid 2016, 7, 1462–1475. [Google Scholar] [CrossRef]

- Zeng, M.; Leng, S.; Maharjan, S.; Gjessing, S.; He, J. An incentivized auction-based group-selling approach for demand response management in V2G systems. IEEE Trans. Ind. Inform. 2015, 11, 1554–1563. [Google Scholar] [CrossRef]

- Yassine, A.; Hossain, M.S.; Muhammad, G.; Guizani, M. Double Auction Mechanisms For Dynamic Autonomous Electric Vehicles Energy Trading. IEEE Trans. Veh. Technol. 2019, 68, 7466–7476. [Google Scholar] [CrossRef]

- Behboodi, S.; Chassin, D.P.; Crawford, C.; Djilali, N. Electric Vehicle Participation in Transactive Power Systems Using Real-Time Retail Prices. In Proceedings of the 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016; pp. 2400–2407. [Google Scholar] [CrossRef]

- Saad, W.; Han, Z.; Poor, H.V.; Başar, T. A noncooperative game for double auction-based energy trading between PHEVs and distribution grids. In Proceedings of the IEEE International Conference on Smart Grid Communications (SmartGridComm), Brussels, Belgium, 17–20 October 2011; pp. 267–272. [Google Scholar] [CrossRef]

- Zhao, Y.; Jia, X.; Yang, Q.; Li, D.; An, D. Towards incentive compatible auction mechanism for electric vehicles bidding in microgrids. In Proceedings of the 33rd Youth Academic Annual Conference of Chinese Association of Automation (YAC) Conference, Nanjing, China, 18–20 May 2018. [Google Scholar] [CrossRef]

- Zhai, H.; Chen, S.; An, D. ExPO: Exponential-Based Privacy Preserving Online Auction for Electric Vehicles Demand Response in Microgrid. In Proceedings of the 13th International Conference on Semantics, Knowledge and Grids (SKG), Beijing, China, 13–14 August 2017; pp. 126–131. [Google Scholar] [CrossRef]

- Lin, C.; Deng, D.; Kuo, C.; Liang, Y. Optimal charging control of energy storage and electric vehicle of an individual in the Internet of Energy with energy trading. IEEE Trans. Ind. Inform. 2018, 14, 2570–2578. [Google Scholar] [CrossRef]

- Sarker, M.; Dvorkin, Y.; Ortega-Vazquez, M. Optimal participation of an electric vehicle aggregator in day-ahead energy and reserve markets. IEEE Trans. Power Syst. 2015, 31, 3506–3515. [Google Scholar] [CrossRef]

- Faqiry, M.N.; Das, S. Double-sided energy auction in microgrid: Equilibrium under price anticipation. IEEE Access 2016, 4, 3794–3805. [Google Scholar] [CrossRef]

- Li, D.; Yang, Q.; Yu, W.; An, D.; Yang, X. Towards double auction for assisting electric vehicles demand response in smart grids. In Proceedings of the 13th IEEE Conference on Automation Science and Engineering (CASE), Xi’an, China, 20–23 August 2017; pp. 1604–1609. [Google Scholar] [CrossRef]

- Krishna, V. Auction Theory, 1st ed.; Elsevier: Amsterdam, The Netherlands, 2002; Available online: https://EconPapers.repec.org/RePEc:eee:monogr:9780124262973 (accessed on 5 May 2023).

- Wang, C.; Leung, H.; Wang, Y.; Lim, J.I.; Lee, D.H. Secure Double Auction Protocols with Full Privacy Protection. In Information Security and Cryptology—ICISC 2003; Springer: Berlin/Heidelberg, Germany, 2003; pp. 215–229. [Google Scholar]

- Lohrmann, B.; Kao, O. Processing smart meter data streams in the cloud. In Proceedings of the 2nd IEEE PES International Conference and Exhibition on Innovative Smart Grid Technologies (ISGT Europe), Manchester, UK, 5–7 December 2011; pp. 1–8. [Google Scholar]

- Bousia, A.; Daskalopulu, A.; Papageorgiou, E.I. Double Auction Offloading for Energy and Cost Efficient Wireless Networks. Mathematics 2022, 10, 4231. [Google Scholar] [CrossRef]

- Sawaragi, Y.; Hirotaka, I.; Tanino, T. Theory of Multiobjective Optimization, 1st ed.; Academic: New York, NY, USA, 1985. [Google Scholar]

- Weise, T. Global Optimization Algorithms—Theory and Application, 2nd ed.; Thomas Weise: Hefei, China, 2009; Available online: http://www.it-weise.de/ (accessed on 28 April 2023).

- Beyer, H.G.; Deb, K. On self-adaptive features in real-parameter evolutionary algorithms. IEEE Trans. Evol. Comput. 2001, 5, 250–270. [Google Scholar] [CrossRef]

- Coello, C.A.; Lamont, G.B.; Van Veldhuizen, D.A. Evolutionary Algorithms for Solving Multi-Objective Problems. In Genetic and Evolutionary Computation, 2nd ed.; Springer: Berlin/Heidelberg, Germany, 2007. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).