Abstract

Green building materials play a vital role in mitigating the significant carbon emissions produced by the construction industry. However, the widespread presence of greenwashing, where firms falsely portray their products or practices as environmentally friendly, presents a critical obstacle to the adoption of genuinely sustainable materials. The risk of collusion between building material enterprises and certification institutions further exacerbates this challenge by undermining trust in green certification processes. To investigate these issues, this study develops an evolutionary game model that captures the strategic interactions between building material enterprises and certification institutions. The model incorporates the behavioral assumptions of prospect theory, specifically bounded rationality, loss aversion, and diminishing sensitivity, to reflect the real-world decision-making behavior of the involved actors. The findings reveal three evolutionarily stable strategies (ESS) within the system. First, a higher initial willingness by both enterprises and certifiers to engage in ethical practices increases the likelihood of convergence to an optimal and stable outcome. Second, a greater degree of diminishing sensitivity in the value function promotes the adoption of authentic green behavior by enterprises. In contrast, a lower degree of diminishing sensitivity encourages certification institutions to refrain from collusion. Third, although the loss aversion coefficient does not directly affect strategy selection, higher levels of loss aversion lead to stronger preferences for green behavior among enterprises and noncollusive behavior among certifiers. This research makes a novel theoretical contribution by introducing prospect theory into the analysis of greenwashing behavior in the building materials sector. It also provides actionable insights for improving regulatory frameworks and certification standards to mitigate greenwashing and enhance institutional accountability.

1. Introduction

The construction industry contributes significantly to urban development [1], but it also leads to significant energy consumption and carbon emissions [2]. According to the United Nations Environment Programme at the 27th United Nations Climate Change Conference, the construction industry contributes 34% of global energy consumption and 37% of greenhouse gas emissions [3]. Among them, carbon emissions in the production stage of building materials account for the largest share in the construction industry [4]. Building materials emit 3.6 billion tons of carbon dioxide, accounting for 10% of global emissions [5]. The output of building materials is usually not highly sustainable [6], and it is difficult to achieve energy savings and emission reductions by using common building materials [7]. Using green building materials can protect the ecological environment and improve energy efficiency, promoting sustainable development [7,8]. Green building materials are the key factor in the development of green buildings [9]. Therefore, promoting the development of the current construction industry urgently needs to promote the production and use of green building materials [10].

Fortunately, various countries and organizations around the globe have focused on green building materials. For example, the United Nations proposed 17 sustainable development goals in 2015 to address the sharp opposition of economic development and environmental protection [11]. The European Commission released four legislative proposals on sustainable products in 2022, aiming to make physical products on the EU market consistently environmentally friendly, reusable, and energy-efficient throughout their life cycle [12]. China has been vigorously researching and promoting green building materials since the 1990s and has been actively promoting the green certification of materials, requiring the strengthening of the green building materials certification system [10]. In addition, in developed countries in Europe and North America, the market share of green building material products has reached more than 90% [10].

Although relevant policies provide building material enterprises with opportunities to protect the environment through green transformation, it is still challenging to avoid greenwashing. This is because the production of green building materials has higher costs [9], but the benefits are lower [13]. Therefore, some building material enterprises choose greenwashing behavior to mislead consumers with false environmental protection claims, thereby reducing costs [14], and to obtain additional income and a good corporate image [15]. For example, Valspar Enterprises has repeatedly violated air pollution control regulations, in significant contrast to its claimed commitment to green production. It was penalized a total of five times between 2016 and 2018 alone, with the highest single fine amounting to $120,000 [16]. Among the 150 projects reviewed by the European Commission, more than half had vague or misleading environmental claims [17]. In the entire green building materials market, more than 30% of Chinese building material enterprises are included in the “environmental risk list” [18]. In addition, owing to the risk of green product certification and the high cost of green certification, some building material enterprises have colluded with certification institutions to obtain green certification [19]. For example, four certification organizations, including Shanghai Zhongzhiwei Certification Co., Ltd., and four other certification bodies issued false certification conclusions and were revoked according to the law [20]. The China International Green Environmental Protection Management Committee and China Green Environmental Circular Development Center violated the “Regulations of the People’s Republic of China on Certification and Accreditation” and conducted illegal certification without certification permission [21]. The high-cost input, complex process, and result uncertainty (such as market acceptance and policy change) of building material enterprises in the face of green certification are consistent with the risk decision-making framework described by prospect theory. At the same time, prospect theory provides a basis for understanding the behavior decisions of building material enterprises in the complex certification process [22]. For example, prospect theory measures the subjective judgment of decision makers on events through the value function [23].

Prospect theory studies the influence of psychological factors on risky decisions and introduces parameters such as the loss aversion coefficient and the marginal decreasing degree of the value function of perceived profits and losses for decision makers. According to prospect theory, decision-making behavior is based on a subjective expected value rather than absolute utility maximization [24]. Therefore, it is not completely rational for building material enterprises to choose whether to carry out greenwashing, and certification institutions choose whether to collude with building material enterprises. In addition, the value function is the core concept of prospect theory, which emphasizes that decision makers take the reference point as the benchmark and regard the income and loss ratings as positive or negative changes relative to the reference point [25]. Therefore, when losses and profits are uncertain, they tend to make choices on the basis of the perceived losses and perceived profits of greenwashing and collusion. There is a deviation between perceived value and actual utility [26]. However, the market confusion caused by certification institutions’ failure to fulfill their social responsibility in relation to negative certification and the greenwashing behavior of building material enterprises has damaged consumers’ trust in green building materials. Therefore, preventing collusion between building material enterprises and certification institutions has important practical significance. How to control the greenwashing behavior of building material enterprises has become a complex problem that urgently needs to be solved.

In summary, this paper focuses on answering the following scientific question: how does the marginal decreasing degree of the value function of perceived profits and losses for decision makers and the loss aversion coefficient affect the greenwashing behavior of building material enterprises and the collusion behavior of certification institutions? To answer this scientific question, this paper constructs a game model consisting of building material enterprises and certification institutions from the perspective of prospect theory, aiming at revealing the evolution mechanism of the greenwashing behavior of building material enterprises and the collusion behavior of certification institutions. The specific objectives are as follows: (1) reveal the evolution mechanism of the greenwashing behavior of building material enterprises and the collusion behavior of certification institutions through prospect theory. (2) to propose measures and suggestions to control the greenwashing behavior of building material enterprises and prevent collusion between certification institutions and building material enterprises. The reasons for establishing the above objectives are as follows: First, greenwashing behavior not only damages consumer trust but also undermines real environmental protection initiatives and hinders environmental progress in various industries [27]. Second, the certification process enables the government to intervene in corporate green product decisions [28], but the collusion behavior of certification institutions is often difficult to curb [29]. Finally, no scholars have studied the greenwashing behavior of building material enterprises and the collusion between building material enterprises and certification institutions from the perspective of prospect theory.

In addition, the contributions of this paper are as follows: (1) innovatively introduces prospect theory into the field of the greenwashing behavior of building material enterprises. This study reveals a new evolution mechanism of the greenwashing behavior of building material enterprises and provides a more theoretical basis for promoting the governance of the greenwashing behavior of these enterprises. (2) this study innovatively considers the collusion behavior between building material enterprises and certification institutions in the context of the greenwashing behavior of building material enterprises, which enriches the literature in the field of collusion behavior. (3) this study provides targeted suggestions for the governance of the greenwashing behavior of building material enterprises and the prevention of collusion between building material enterprises and certification institutions.

The rest of the paper is structured as follows. Section 2 provides relevant literature reviews. Section 3 constructs a two-party evolutionary game model between building material enterprises and certification institutions and examines the outcomes of the constructed evolutionary model. Section 4 analyzes the asymptotic stability of the strategy of building material enterprises and certification institutions and determines the stability conditions of different evolutionary stability strategies (ESS). Section 5 simulates key parameters numerically, followed by an analysis and discussion of their impact on the game’s evolutionary trajectory. Section 6 summarizes the research conclusions and provides insights for management.

2. Literature Review

This section reviews the literature on three aspects: prospect theory, greenwashing behavior, and collusion behavior.

2.1. Prospect Theory

Prospect theory is a decision theory proposed by Kahneman and Tversky to describe the decision-making behavior of decision makers under uncertain and risky conditions [24]. This theory focuses on the psychological factors of decision makers, clarifies the influence of psychological factors on decision-making results, and provides a theoretical basis for studying uncertain decision-making [30]. Prospect theory suggests that decision makers are more inclined to avoid losses and that their risk preferences are asymmetric [31]. Compared with decision makers with the same benefits, decision makers are more sensitive to losses [32]. At present, prospect theory has been widely used in various decision-making fields. In the field of medical devices, some scholars have used prospect theory to analyze human error factors to reduce risks in the clinical use of medical devices [33]. In the field of construction engineering, some scholars have incorporated prospect theory into the PTF-VIKOR model to evaluate the risk of prefabricated buildings at the construction stage [30]. In the field of new energy vehicles, some scholars have studied intelligent charging decisions on the basis of prospect theory. Research has shown that a strategy based on prospect theory can reduce the charging cost of new energy vehicles [34]. Moreover, some scholars have constructed a tripartite evolutionary game model based on prospect theory to explore opportunistic behavior in PPP projects. The results show that the loss aversion coefficient significantly affects the strategy choice of the game subject [35]. On this basis, some researchers have also combined prospect theory with the Delphi method, interval intuitionistic fuzzy theory, gray relationship theory, and the entropy weight method and proposed a comprehensive decision-making method to solve the capacity planning problem of pumped storage power plants [36]. In addition, the applicability of prospect theory in the fields of nuclear wastewater management [37], carbon emission pollution control [38], and ecological environment compensation [39] has also been confirmed.

Although scholars have conducted extensive research on the application of prospect theory in different fields, unfortunately, few studies have focused on the prospect theory of greenwashing behavior. In particular, the influence of psychological factors on the greenwashing behavior of building material enterprises has been neglected. However, when building material enterprises face uncertain losses and gains, the perceived value is not equal to the actual expected utility value [40]. Moreover, when engaging in greenwashing, building material enterprises face risks such as reputation damage and consumer trust loss [41]. When considering greenwashing behavior as a risk decision, it is important to consider the impact of risk preference on the decision-making of building material enterprises [42]. Therefore, it is necessary to study the influence of psychological factors on the decision-making of the greenwashing behavior of building material enterprises on the basis of prospect theory, and this topic should be fully researched and revealed.

2.2. Greenwashing Behavior

Greenwashing refers to the deceptive behavior of enterprises that shape a green image by making misleading environmental claims to consumers through false publicity [43]. Greenwashing behavior not only causes a loss of corporate reputation [41] but also destroys consumers’ trust in green products and weakens their willingness to buy them [44]. Moreover, the implementation of greenwashing by enterprises hinders the realization of a circular economy and sustainable development [45]. Compared with other industries, the greenwashing behavior of the building material industry is unique. Building material enterprises may take advantage of loopholes in green standards or the complexity of the certification process for greenwashing. Specifically, the certification of building material enterprises focuses on hard indicators of physical environmental impacts (such as resource consumption and pollution [46]), while other industries (such as the financial industry) focus on non-substantive assessments such as ESG investment, which makes it difficult to detect the greenwashing behavior of building material enterprises. In addition, building material products are closely related to consumers, and if the product quality is unqualified, it will be subject to public supervision and reporting [46].

At present, the greenwashing behavior of enterprises in terms of environmental, social, and governance (ESG) disclosure has become a research hotspot, and scholars have carried out a series of studies on the ESG greenwashing behavior of enterprises. As enterprises are under increasing environmental pressure [47] and are required to implement green behavior to improve ESG performance [48], greenwashing behavior has become an important strategy for enterprises to cope with the enormous pressure caused by environmental sustainability [49]. Enterprises with lower ESG scores are more likely to engage in greenwashing than enterprises with higher ESG scores are [48]. This may be because enterprises’ ESG greenwashing will increase the cost of debt financing [50], and financial constraints will in turn lead enterprises to choose greenwashing in ESG disclosure [51]. Therefore, to manage corporate ESG greenwashing behavior, some scholars note that improving corporate ESG disclosure requirements and reporting standards can curb greenwashing behavior [52]. However, for enterprises with a low degree of greenwashing, environmental regulations can promote green innovation but have a negative effect on enterprises with a high degree of greenwashing [53]. Fortunately, enabling digital finance can reduce greenwashing by alleviating financial constraints [54] and information asymmetries [55]. In addition, artificial intelligence (AI) can control greenwashing by improving the quality of ESG scores [56] and strengthening investors’ external attention [57].

Above all, extensive research has been conducted on the greenwashing behavior of enterprises in terms of ESG disclosure, revealing the influencing factors of enterprise ESG greenwashing, which is highly important for strengthening the management of enterprise ESG greenwashing. However, the greenwashing behavior of building material enterprises has not received enough attention. In fact, owing to the close relationship between building materials and construction projects [58], the greenwashing behavior of building material enterprises can also cause serious harm to the environment [2]. Therefore, more research is needed to reveal the influence mechanism of greenwashing in building material enterprises.

2.3. Collusion Behavior

Collusion is the act of regulators assisting agents in concealing true information and deceiving their clients [59]. The parties involved in collusion seek to gain benefits by manipulating the socioeconomic or political environment [60]. Collusion leads to the misallocation of social resources, thus affecting economic efficiency and social equity [61]. Therefore, collusion has received extensive attention from the academic community. The existing research has focused mainly on the field of collusion between enterprises and third-party testing institutions.

In recent years, an increasing number of third-party testing institutions have entered various industries. However, when there are improper interests, collusion between enterprises and third-party testing institutions is inevitable [62]. Some scholars have studied the collusion between carbon emission enterprises and third-party testing institutions. Research shows that carbon emission enterprises and third-party testing institutions are highly willing to collude under the motivation of economic interest. The collusion between carbon emission enterprises and third-party testing institutions to falsify carbon emission reports severely affects the stability of the carbon emission trading system. However, the high cost of collusion and government fines can effectively prevent them from colluding [63]. This finding was also confirmed in a study on the energy industry [64]. In addition, other scholars have noted collusion between the government and enterprises. In the process of information transmission between the central government and enterprises, local governments adopt information concealment strategies to address enterprises’ polluting production behaviors in terms of political and economic interests [65]. Therefore, economic benefit is the main motive for collusion between the government and enterprises [66]. On the one hand, enterprises hope to obtain more lenient environmental policies to reduce related costs, such as pollution control costs [67] and technological innovation costs [68]. On the other hand, local governments want enterprises to invest more money to increase regional GDP [69].

Although scholars have conducted in-depth research on the collusion between enterprises and third-party testing institutions in different industries, the collusion between building material enterprises and third-party testing institutions in the certification process has not received sufficient attention. In fact, owing to the large scale of investment in construction projects and the number of stakeholders involved, collusion is widespread in this field [70] when building material enterprises can benefit from certification [71]. The collusion of construction project participants severely deteriorates project performance [72]. Therefore, it is urgent to explore the influence mechanism of collusion between building material enterprises and third-party testing institutions from the perspective of prospect theory, which should be fully studied and revealed.

2.4. Summary of Knowledge Gaps

Table 1 provides a comprehensive comparison of the literature and explains the outstanding features and originality of this paper in the last line. The existing research has the following three shortcomings.

Table 1.

The difference between this research and the previous research.

First, in the field of prospect theory, scholars have extensively researched the application of prospect theory in different fields, such as nuclear wastewater treatment, carbon pollution treatment, and ecological environment compensation. However, almost no scholars have introduced prospect theory into the field of the greenwashing behavior of building material enterprises, considering the influence of psychological factors on the decision-making of the greenwashing behavior of these enterprises. On the basis of prospect theory, this paper constructs an evolutionary game model for building material enterprises to explore the influence of psychological factors on the strategic choice of the greenwashing behavior of these enterprises.

Second, in the field of greenwashing, the existing research has focused mainly on the greenwashing behavior of enterprises in terms of ESG disclosure, and few studies have focused on the greenwashing behavior of building material enterprises. In particular, there are few evolutionary game studies on the greenwashing behavior of building material enterprises. In this paper, building material enterprises are included in the evolutionary game model, and the evolutionary mechanism of the greenwashing behavior of building material enterprises is studied on the basis of prospect theory.

Finally, in the field of collusion, scholars have deeply studied collusion between enterprises and third-party testing institutions in different industries, such as the business logistics industry, the battery manufacturing industry, the food production industry, and other industries. However, few scholars have studied collusion between building material enterprises and certification institutions in the process of green building material certification. Starting from the two main bodies of building material enterprises and certification institutions, this paper explores the influence mechanism of the collusion behavior of certification institutions.

3. Methodology

3.1. Research Method

This paper applies the evolutionary game method. Evolutionary game theory holds that people’s decision-making behavior in reality achieves dynamic balance through continuous learning, imitation, and adjustment [74]. In this paper, building material enterprises make strategic choices on the basis of the loss of greenwashing behavior and the income from green behavior. Certification institutions make strategic choices on the basis of the benefits of collusion with building material enterprises and the costs of noncollusion with building material enterprises. Moreover, building material enterprises and certification institutions constantly adjust their strategies to maximize their own interests. This is completely consistent with the assumption that the game subject in the evolutionary game continues to use the high-yield strategy instead of the low-yield strategy through the dynamic mechanism and finally converges to a stable state [75]. In addition, the evolutionary game assumes that the game subject has bounded rationality rather than being completely rational [76]. This is consistent with the bounded rationality hypothesis of prospect theory. Other game models, such as the Stackelberg game model, are more focused on reflecting the master–slave hierarchical structure and are mainly used for pricing decision research. Other models, such as regression models and infectious disease models, cannot accurately describe the dynamic evolution process of subject behavior over time. Therefore, it is appropriate to use evolutionary games based on prospect theory to study the evolutionary mechanism of the greenwashing behavior of building material enterprises and the collusion behavior of certification institutions.

3.2. Problem Description

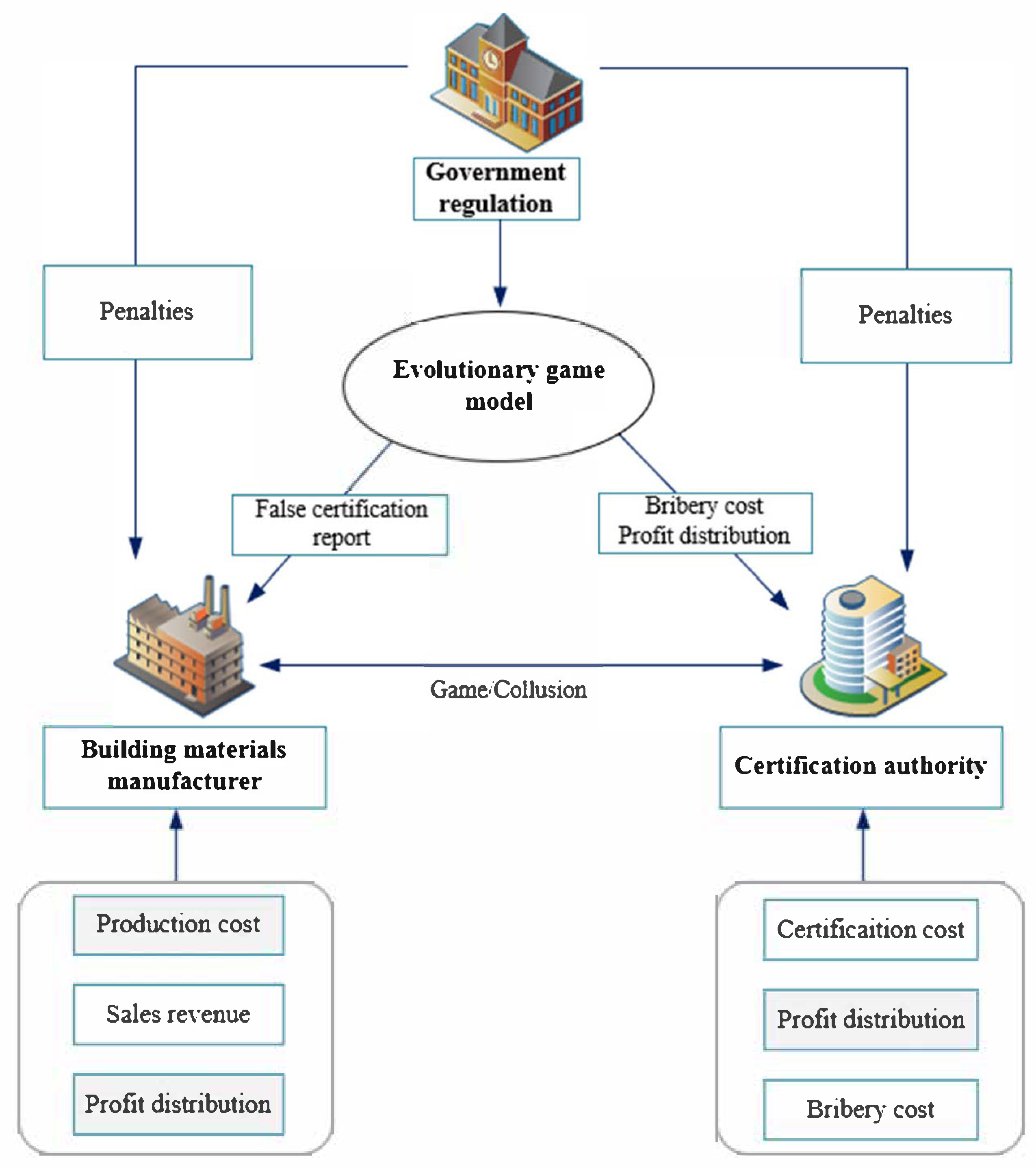

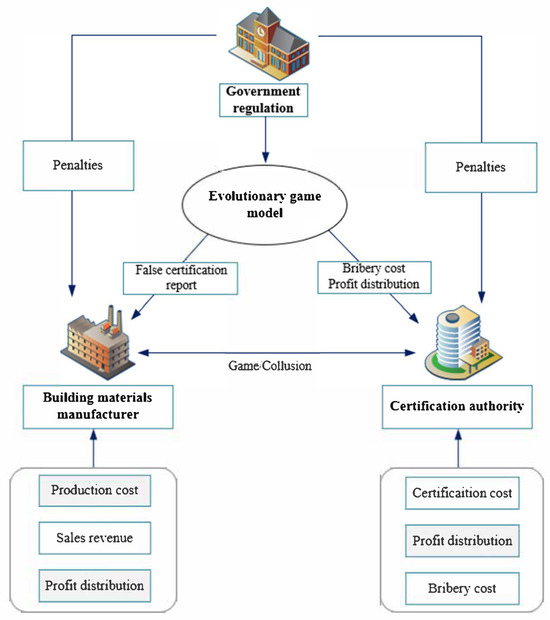

Green building materials have comprehensive benefits for the environment, economy, and society [77]. However, the production of green building materials requires additional costs such as green production and technological innovation, and the benefits of green building materials are low. Some building material enterprises may implement greenwashing behavior to maximize their own interests. When building material enterprises implement greenwashing behavior to produce greenwashing building materials that do not meet the requirements, they may bribe certification institutions to issue false detection reports to pass the certification. During the certification process, the certification institutions are responsible for the professional testing of building materials in accordance with relevant regulations and are able to identify the greenwashing behavior of building materials companies. However, to reduce costs as much as possible and maximize their own interests, certification institutions may give up fulfilling their social responsibilities and collude with building material enterprises. Therefore, this paper incorporates building material enterprises and certification institutions into the evolutionary game model and considers the evolution mechanism of the greenwashing behavior of building material enterprises and the collusion behavior of certification institutions under prospect theory. The game relationship between the two is shown in Figure 1.

Figure 1.

The game relationship between the building material enterprise and the certification institution.

3.3. Model Assumption

On the basis of the above analysis, this paper makes the following assumptions. Table 2 lists the corresponding parameter settings and instructions.

Table 2.

Parameter settings and descriptions.

Assumption 1.

The building material enterprise has two strategies: green behavior and greenwashing behavior. When a building material enterprise chooses greenwashing behavior, the cost of producing greenwashing building materials that do not meet the requirements of the government is [78]. These materials are referred to as green building materials [88]. When a building material enterprise chooses green behavior, it produces green building materials that meet the requirements of the government, resulting in additional costs [89] (such as the cost of realizing green production [79] and technological innovation [89]). When the building material enterprise sells green building materials, sales revenue [78] is obtained. When greenwashing building materials are sold, they are whitewashed into green building materials [90] and sold at the price of green building materials [78]. This paper does not consider the impact of consumer willingness on the sales of green building materials and greenwashing building materials, so the sales revenue of the building material used to sell greenwashing building materials is equal to the sales revenue of green building materials.

Assumption 2.

When a building material enterprise produces greenwashing building materials that do not meet the requirements of the government, it will invite the certification institution to collude to pass the test [80]. Therefore, the certification institution has two strategies: noncollusion and collusion. When the certification institution chooses not to collude, it will carry out normal testing of building materials, generate basic costs [80] (including consumables, equipment, etc.), and charge the building material enterprise certification fees [85]. When the certification institution chooses to collude, it will generate additional costs [19] (including tampering with detection records, issuing false reports, etc.), incur bribery costs [82], and collusion profit distribution [91] of the building material enterprise, where [83] is the proportion of collusion profit distribution. In addition, they do not charge certification fees to the building material enterprise [85].

Assumption 3.

The government plays a vital role in the governance of the greenwashing behavior of building material enterprises [92]. Therefore, the government’s fines for the greenwashing behavior of building material enterprise are [82], and the government’s fines for the collusion of certification institution are [80], [93]. The government’s fines for the greenwashing behavior of the building material enterprise are positively correlated [84] with the degree of greenwashing of the building material enterprise [7].

Assumption 4.

There are certain risks for building material enterprise to choose greenwashing behavior and for certification institution to choose collusion [94]. Under uncertain conditions, the decision-making basis of the game subject is not the expected utility value but rather its own perception of the value of the strategy [24]. According to the prospect theory proposed by Tversky and Kahneman (1992) [95], perceived value can be measured by the prospect value, as shown in Equation (1).

Here, denotes the deviation of gain or loss based on the reference point. When , the decision maker’s perception of random events is gained; when , the decision maker’s perception of random events is lost. represents the marginal decreasing degree of the value function of perceived profits and losses for the decision makers. As increases, the decision maker tends to take risks. represents the loss aversion coefficient. As increases, the decision maker is more averse to the loss. According to prospect theory, assume that represents the perceived loss of the building material enterprise to the government fines, represents the perceived benefit of the certification institution to the collusion profit distribution, and represents the perceived benefit of the building material enterprise to the collusion profit distribution. According to Yong [93] and Wang [96], , , and .

Assumption 5.

The probability of the building material enterprise choosing green behavior is , and the probability of greenwashing behavior is ; the probability of the certification institution choosing noncollusion behavior is , and the probability of collusion behavior is . Here, are functions of time. As time progresses, the values of and are constantly changing.

On the basis of the research assumptions and model parameters, this paper establishes a payoff matrix of the building material enterprise and the certification institution under different combinations of strategies, as shown in Table 3.

Table 3.

The payoff matrix of the two-party game.

In Table 3, and are the benefits of the noncollusion of the certification institution and the benefits of the green behavior of the building material enterprise, respectively; and are the benefits of the collusion of the certification institution and the benefits of the green behavior of the building material enterprise, respectively; and are the benefits of the noncollusion of the certification institution and the benefits of the greenwashing behavior of the building material enterprise, respectively; and and are the interests of the certification institution when it colludes and the interests of the building material enterprise when it drifts green.

3.4. Equilibrium Point Calculation

According to the payoff matrix, the expected payoffs and average expected payoffs of the building material enterprise choosing green behavior and greenwashing behavior strategies are shown in Equations (2) to (4):

On the basis of Equations (2) to (4), the replicated dynamic equation of the building material enterprise is obtained as shown in Equation (5):

According to the payoff matrix, the expected payoffs and average expected payoffs of the certification institution choosing noncollusion and collusion strategies are shown in Equations (6) to (8):

On the basis of Equations (6) to (8), the replicated dynamic equation of the certification institution is obtained as shown in Equation (9):

3.5. Stability Analysis

By setting and to 0, five ESS , , , , and of the evolutionary game are obtained, where and are as follows:

According to the analysis method proposed by Friedman [97], the stability of the equilibrium point of the evolutionary game can be determined by the local stability of the Jacobi matrix. The Jacobi matrix of the system is shown in Equation (10):

The specific expressions of , , and are shown in Equations (11) to (14):

When the equilibrium point satisfies the following two conditions, it is the evolutionary stability strategy: (1) ; (2) . The representation of the values in the matrix at different equilibrium points is shown in Table 4:

Table 4.

The value of each equilibrium point.

The specific expressions of , , , and are shown in Equations (15) to (18):

In Table 4, the values of and at are both 0, which does not satisfy and , so this point is not an evolutionary stable strategy; the value at is positive, which does not satisfy and , so this point is not an evolutionary stable strategy. The stability of the remaining three points in Table 4 is analyzed as follows.

When , ESS is . In this case, due to the lack of government supervision at this time, the degree of greenwashing of the building material enterprise is very small and difficult for the government to find, and the perceived loss of the building material enterprise to government fines is small. In addition, the additional costs of producing green building materials by the building material enterprise are greater than the profits when it engages in greenwashing and invites the certification institution to collude. Therefore, to save costs and obtain more profits, the building material enterprise will take the risk of choosing a greenwashing behavior strategy. At the same time, the building material enterprise allocates more profits to the certification institution, and the perceived utility of the certification institution on the profits of collusion distribution given by the building material enterprise is greater than the government’s fines on their collusion. In addition, the certification fees charged to the building material enterprise when the certification institution chooses not to collude are not as high as the profits of the choice of collusion. As a result, the certification institution, driven by its interests, abandons its social responsibility and chooses to collude with the building material enterprise.

When , ESS is . In this case, government supervision has increased, but the degree of greenwashing of the building material enterprise is still small and not easy for the government to notice. The perceived loss of the building material enterprise to government fines is still less than the additional costs of producing green building materials. To avoid the high cost of producing green building materials, the building material enterprise will continue to choose the greenwashing behavior strategy. Moreover, the profits of the building material enterprise for greenwashing are also decreasing. At this time, to maximize its own interests, the building material enterprise will reduce the collusion profit distribution of the certification institution. The profits obtained by the certification institution to accept the collusion invitation of the building material enterprise are not as high as the certification fees charged to the building material enterprise. Therefore, the certification institution chooses the noncollusion strategy.

When , ESS is . The degree of greenwashing of the building material enterprise is increasing, and the government’s supervision is also increasing. Therefore, the probability of a building material enterprise’s greenwashing being discovered by the government is increasing. At this time, the perceived loss of the building material enterprise to government fines will exceed the additional costs of producing green building materials. The building material enterprise will face losses if it continues to drift green. Therefore, the strategic choice of the building material enterprise has changed from greenwashing behavior to green behavior. Moreover, when a building material enterprise chooses green behavior to produce green building materials, it will not invite the certification institution to collude. Correspondingly, the certification institution will choose the noncollusion strategy. In this case, the evolutionary stability strategy of the system is (green behavior, noncollusion), which is the optimal state of the system.

When , ESS is or . In this case, the building material enterprise and the certification institution have a close game relationship. When the building material enterprise chooses green behavior to avoid the extra costs of producing green building materials, the certification institution chooses a collusion strategy to obtain a collusion profit distribution. When a building material enterprise chooses green behavior, it will not invite the certification institution to collude. At this time, the certification institution will also choose the noncollusion strategy.

4. Numerical Simulation

This paper focuses on how to achieve a stable state in which the building material company chooses green behavior and the certification institution chooses noncollusion. The strategic choices of the building material enterprise and the certification institution are affected by the willingness of the subject, the marginal decreasing degree of the value function of perceived profits and losses for the decision makers, and the loss aversion coefficient. To describe the dynamic evolution of the strategy of the building material enterprise and the certification institution more intuitively, this paper uses MATLAB R2021a to simulate the evolution of the system.

First, this paper considers the influence of the initial willingness of the building material enterprise and the certification institution on the evolutionary stable state of the system. In this way, whether the improvement in the initial willingness of a single subject can promote the evolution of the system to the ideal state is tested.

Second, this paper further analyzes the influence of the marginal decreasing degree of the value function of perceived profits and losses for decision makers and the loss aversion coefficient on the evolutionary stable state of the system. This helps clarify the marginal decreasing degree of the value function of perceived profits and losses for decision makers and the loss aversion coefficient of the optimal value function and further analyzes how to promote the evolution of the system to the ideal state .

On this basis, this paper determines the initial values of the parameters through literature surveys, as shown in Table 5.

Table 5.

Initial parameter settings.

4.1. Impact of Initial Willingness on the Evolutionary Steady State of the System

In this section, the evolution path of the game subject is studied under three scenarios of low, medium, and high initial willingness. The initial low, medium, and high willingness values are set to 0.2, 0.5, and 0.9, respectively [83].

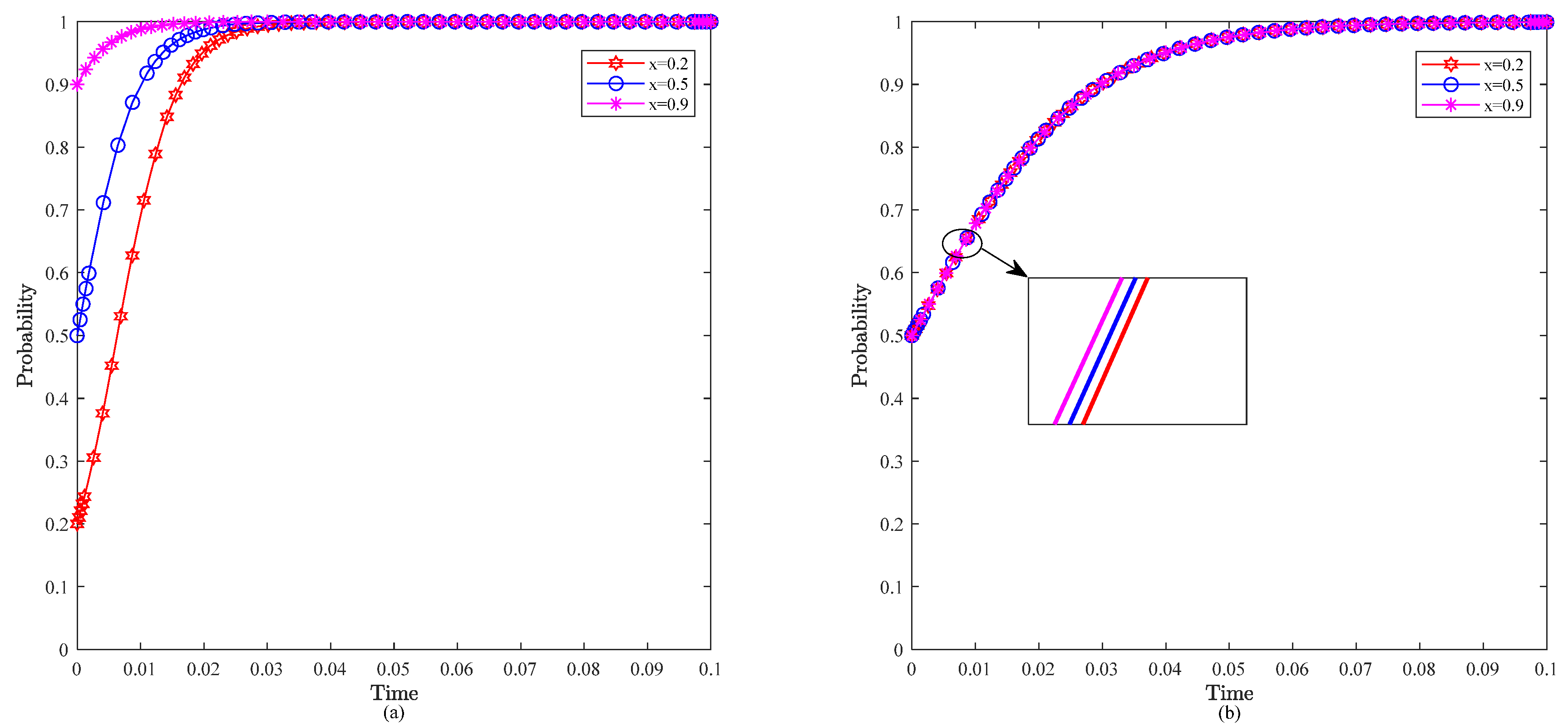

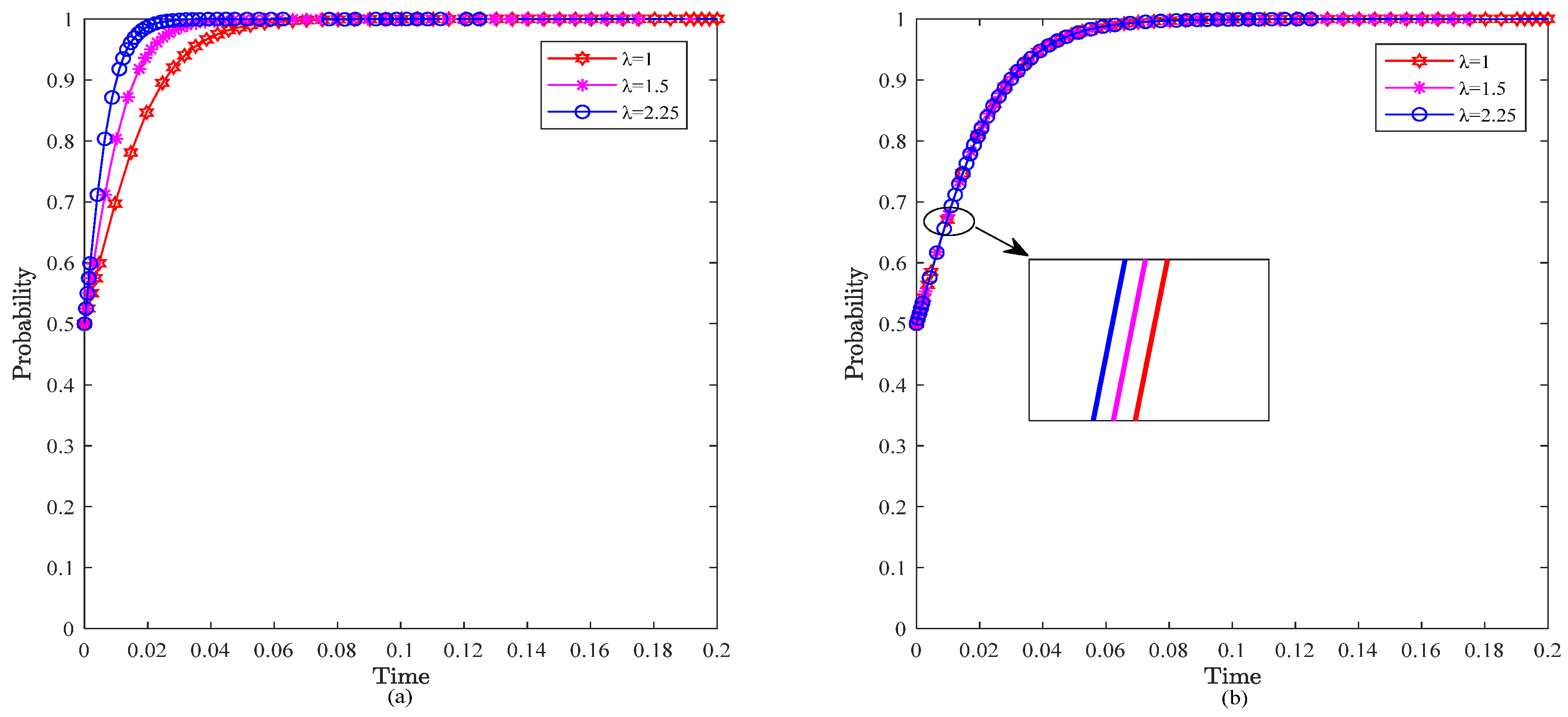

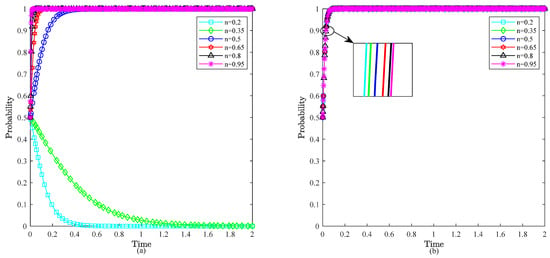

4.1.1. Impact of Changes in the Initial Willingness of the Building Material Enterprise on System Evolutionary Steady States

Figure 2 shows the effect of changes in the initial willingness of the building material enterprise on the evolution of the system. That is, regardless of whether the initial willingness of the building material enterprise is low, medium, or high, it does not change the evolution of the system. The building material enterprise always converges to the stable state of choosing green behavior, and the certification institution always converges to the stable state of choosing noncollusion. The greater the initial willingness of the building material enterprise is, the faster the evolution of the system. When the initial willingness of the building material enterprise is 0.9, the system quickly evolves to the stable state. This finding indicates that increasing the willingness of the building material enterprise to produce green building materials can motivate the building material enterprise and the certification institution to adopt a positive strategy.

Figure 2.

Impact of the initial willingness of the building material enterprise on the strategy choices of the game subjects. In particular, (a) and (b) represent the effects of the initial willingness of the building material enterprise on the evolution of the decision-making of the building material enterprise and the certification institution, respectively.

4.1.2. Impact of Changes in the Initial Willingness of the Certification Institution on the Evolutionary Steady State of the System

Figure 3 shows the effect of changes in the initial willingness of the certification institution on the evolution of the system. These findings are basically consistent with the results shown in Figure 2. This indicates that enhancing the initial willingness of the building material enterprise and the certification institution has a positive effect on the evolution of the system to a stable state where the building material enterprise chooses green behavior and the certification institution chooses noncollusion.

Figure 3.

Impact of the initial willingness of the certification institution on the strategy choices of game subjects. In particular, (a) and (b) represent the effects of the certification institution’s initial willingness on the evolution of the decisions of the building material enterprise and the certification institution, respectively.

4.2. Impact of the Degree of Marginal Decrease of the Value Function on the Evolutionary Steady State of the System

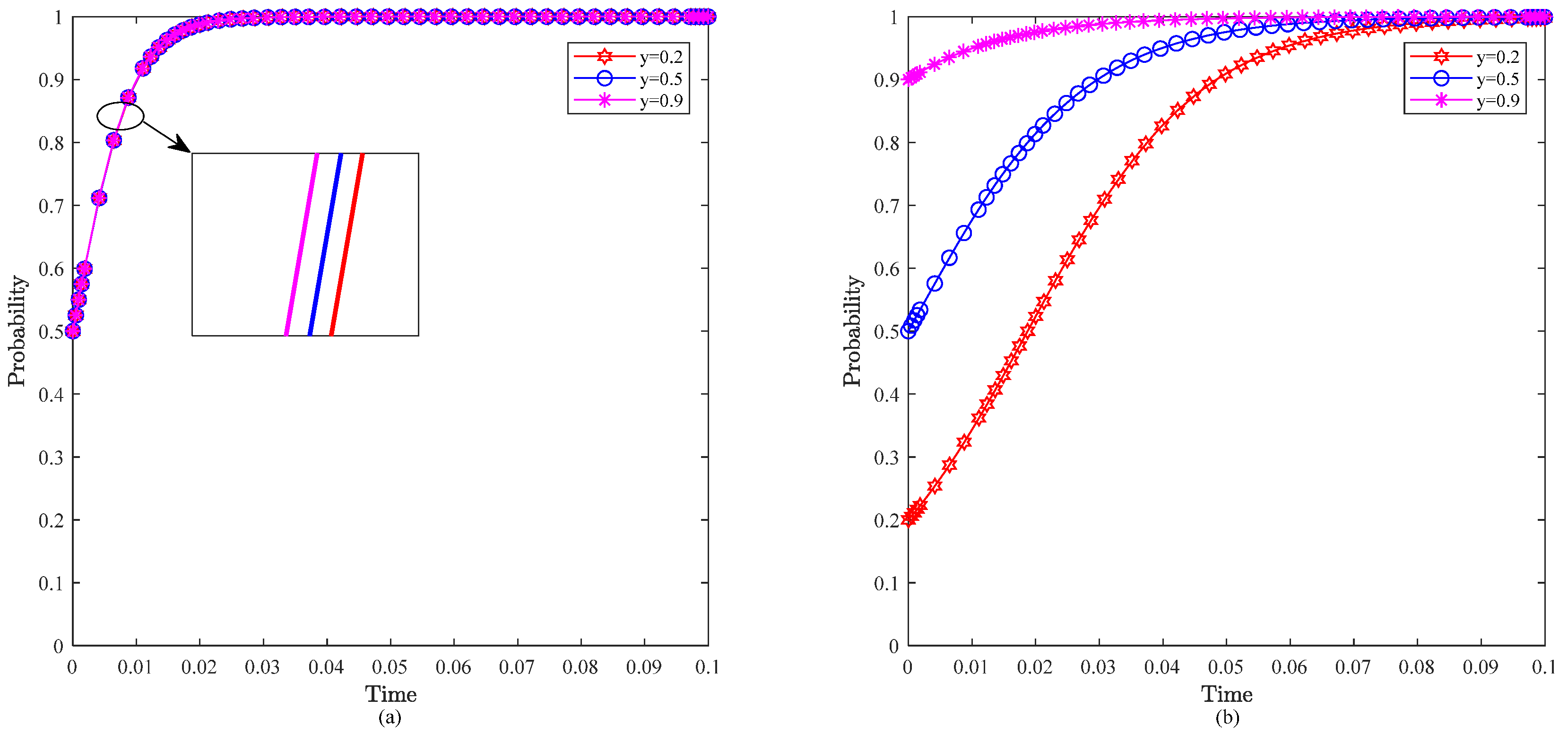

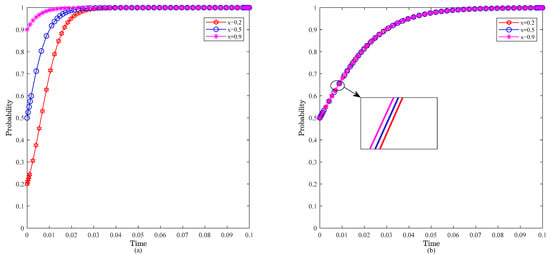

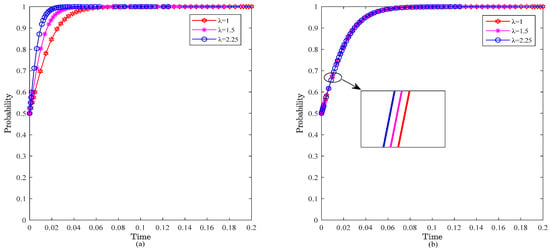

This section considers the effects of different degrees of marginal decrease in the value function of perceived profits and losses for decision makers on the evolutionary steady state of the system. The initial willingness of the game subjects is set to 0.5 to eliminate the effect of the subjects’ initial willingness.

Figure 4a illustrates that for the building material enterprise, as the marginal decreasing degree of the value function of perceived profits and losses for the decision makers gradually increases, gradually changes from the result of converging to 0 to converging to 1. There is a critical value between 0.35 and 0.5. When is less than this critical value, converges to 0. When is greater than this critical value, converges to 1, and the larger the value is, the faster the convergence speed. Figure 4b illustrates that for the certification institution, as the marginal decreasing degree of the value function of perceived profits and losses for decision makers gradually increases, always converges to 1, and an increase in will not affect the final state of . The greater the value of is, the slower the convergence rate.

Figure 4.

The effect of the marginal decreasing degree of the value function of perceived profits and losses for decision makers on the behavioral evolution of the game subjects. In particular, (a) and (b) represent the evolutionary paths of the building material enterprise and the certification institution when , respectively.

4.3. Impact of the Loss Aversion Coefficient on the Evolutionary Steady State of the System

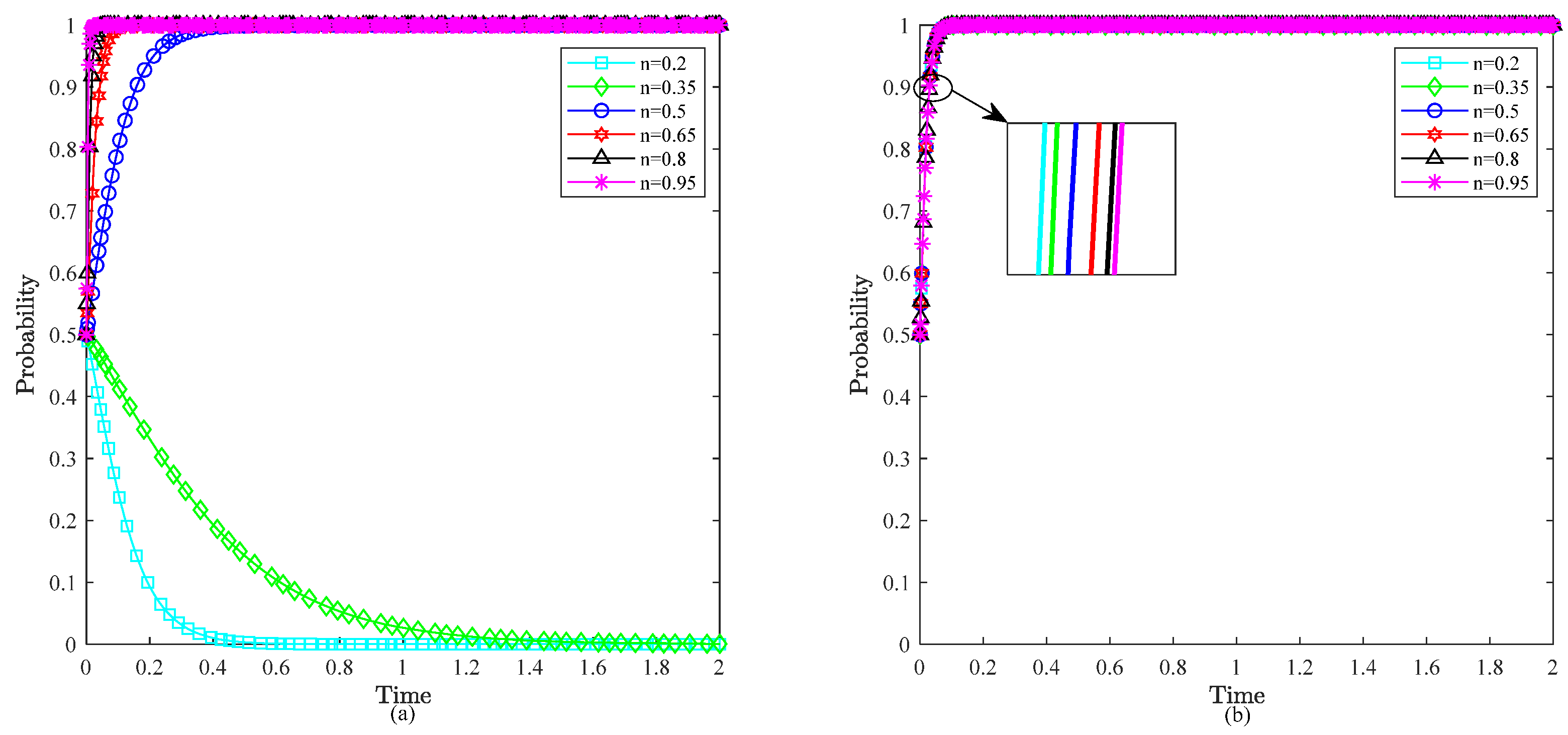

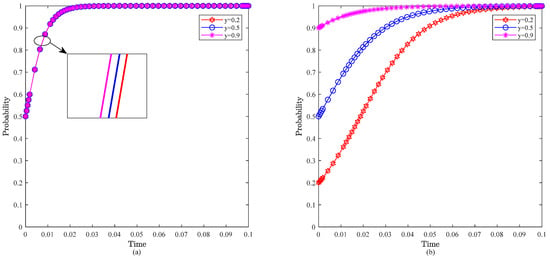

This section considers the effects of different loss aversion coefficients on the evolutionary steady state of the system. The initial willingness of the game subjects is set to 0.5 to eliminate the effect of the subjects’ initial willingness.

Figure 5a,b illustrate that the change in the loss aversion coefficient does not affect the final states of either party. The building material enterprise always converges to the stable state of choosing green behavior, and the certification institution always converges to the stable state of choosing noncollusion. The larger the value of is, the faster the convergence speed. When , the system quickly converges to the stable state. This finding indicates that the more sensitive the game subject is to loss, the greater the possibility of choosing a positive strategy [96]. Therefore, the larger the loss aversion coefficient is, the easier it is for the building material enterprise to choose green behavior, and the easier it is for the certification institution to choose noncollusion.

Figure 5.

The effect of the loss aversion coefficient on the behavioral evolution of the game subjects. In particular, (a) and (b) represent the evolutionary paths of the building material enterprise and the certification institution when , respectively.

5. Discussion

5.1. Impact of the Initial Willingness of the Building Material Enterprise and the Certification Institution on the Evolution Results of the System

According to the simulation results in Section 4.1, the initial willingness changes of the building material enterprise and the certification institution do not affect the evolution results of the system. This may be because the loss of greenwashing by the building material enterprise is always greater than the income from its production of green building materials. For the certification institution, the profit distribution and bribery fees obtained by collusion with the building material enterprise are always less than the certification fees charged when it does not collude with the building material enterprise. This means that greenwashing will bring additional losses to the building material enterprise. Moreover, collusion between the building material enterprise and the certification institution does not lead to higher returns for the institution. Moreover, according to prospect theory, decision makers show risk aversion to earnings and risk preference for losses [31]. Therefore, regardless of the initial willingness of the building material enterprise and the certification institution being low, medium, or high, the building material enterprise chooses to produce green building materials to avoid risks, and the certification institution will always choose not to collude with the building material enterprise to maximize its own interests. However, the findings of Luo et al. [83] are inconsistent with this paper. That is, Luo et al. [83] concluded that enterprises have a certain tendency to speculate and that their strategy choices are influenced by the government and third-party testing institutions. This may be because Luo et al. [83] focused on the dishonest business behavior of enterprises, and both enterprises and third-party testing institutions have a speculative nature and choose to collude. This paper is based on prospect theory and pays more attention to the influence of psychological factors, such as the loss aversion coefficient, on the strategy choices of game subjects. Driven by psychological factors, enterprises will transform objective gains and losses into subjective perceived value to make decisions [101]. Therefore, this difference is reasonable.

5.2. Impact of the Degree of Marginal Decrease of the Value Function on the Strategic Choices of the Building Material Enterprise and the Certification Institution

According to the simulation results in Section 4.2, for the building material enterprise, the marginal decreasing degree of the value function of perceived profits and losses for the decision makers has a significant effect on its strategy choice. There is a critical value between 0.35 and 0.5 that makes the building material enterprise change from choosing greenwashing behavior to choosing green behavior. This may be because when it is smaller than the critical value, the perceived loss of the government fines for greenwashing is smaller than the perceived benefit of the collusive distribution of profits, and the building material enterprise will take the risk of greenwashing. When it is greater than the critical value, the perceived benefit of the building material enterprise from the collusion does not offset its perceived loss to the government fines, and then the building material enterprise turns to producing green building materials. According to prospect theory, the greater the degree of marginal decrease in the value function of perceived profits and losses for decision makers is, the more sensitive decision makers are to gains and losses [96]. Therefore, increasing the degree of marginal decrease in the value function of perceived profits and losses for decision makers can encourage the building material enterprise to choose green behavior. For the certification institution, the marginal decreasing degree of the value function of perceived profits and losses for the decision makers does not change its strategy choice. This may be because even if the building material enterprise invites the certification institution to collude to give it bribes and conspiracy profit distribution, the certification institution’s perceived benefits of conspiracy profit distribution are always smaller than the government’s fines for its collusion. Therefore, the certification institution will never collude with the building material enterprise. Therefore, reducing the degree of marginal decrease in the value function of perceived profits and losses for decision makers can encourage the certification institution to choose noncollusion.

This finding is inconsistent with the findings of Shen et al. [86]. Shen et al. [86]. argue that as the marginal decreasing degree of the value function increases, the game subject always converges to a steady state of choosing positive strategies. In this paper, the certification institution always chooses the positive strategy, but the building material enterprise’s strategy choice changes from greenwashing behavior to green behavior. This difference may arise from the fact that the subject of Shen et al. [86]’s study is fundamentally different from the enterprise greenwashing behavior explored in this paper. As greenwashing behavior itself has the characteristics of information asymmetry and is difficult to identify, the building material enterprise often takes risks to implement greenwashing when facing the temptation of potential interest [7,102]. Therefore, this difference is reasonable. In addition, the findings of Liu et al. [37] are also inconsistent with this paper. Liu et al. [37] argue that reducing the marginal decline of the value function can promote the game subject to choose the positive strategy. This paper argues that the greater the marginal diminishing degree of the value function, the more inclined enterprises are to make positive strategic choices. This may be because the greenwashing behavior of building material enterprises studied in this paper is less harmful than that caused by nuclear wastewater discharge, resulting in the perceived benefits of building material enterprises from greenwashing behavior being greater than the perceived losses to choosing greenwashing.

5.3. Impact of the Loss Aversion Coefficient on the Strategic Choices of the Building Material Enterprise and the Certification Institution

According to the simulation results in Section 4.3, the loss aversion coefficient does not change the strategic choices of the building material enterprise or the certification institution. This may be because with the increase in the loss aversion coefficient, the perceived value of the building material enterprise and the certification institution to losses is magnified. According to prospect theory, decision makers are more sensitive to losses than gains. Compared with the pursuit of interest, decision makers are more inclined to avoid losses [103]. Therefore, to avoid losses such as government fines, the building material enterprise will not risk choosing greenwashing. At this time, the certification institution will also actively fulfill its social responsibility and test the building materials according to the regulations.

The above findings are different from those of Dong et al. [87]. Dong et al. [87] argue that the loss aversion coefficient is negatively correlated with the speed at which the game player’s strategy reaches a stable state. The research findings of this paper show that the speed with which the game subject strategy reaches a stable state increases with increasing loss aversion coefficient. This may be because Dong et al. [87] studied the pricing decisions of the consumer and the retailer, whereas this paper focused on the environmental decisions of the building material enterprise and the certification institution. The building material enterprise faces greater risks than the consumer and the retailer do; thus, the building material enterprise is affected by the loss aversion [104] effect and tends to choose a positive strategy. Therefore, this difference is reasonable. Moreover, the research findings of Wu et al. [105] are also inconsistent with this paper. Wu et al. [105] argue that reducing loss aversion can promote enterprises to choose positive strategies. This paper argues that to promote enterprises to choose positive strategies, the loss aversion coefficient should be increased. This may be because Wu et al. [105] considered the complex network environment in the evolutionary game model. This paper focuses on the psychological factors in prospect theory.

6. Conclusions and Limitations

6.1. Conclusions

On the basis of prospect theory, this paper constructed an evolutionary game model of the building material enterprise and the certification institution via the evolutionary game method. The effects of the initial willingness of the building material enterprise and the certification institution, the marginal decreasing degree of the value function of perceived profits and losses for the decision makers, and the loss aversion coefficient on the building material enterprises’ greenwashing behavior and the certification institution’s collusion behavior were studied. The main conclusions are as follows:

- (1)

- In the process of the two-party evolutionary game, there are three ESS points, , , and . Among them, indicates that the building material enterprise chooses greenwashing behavior and that the certification institution chooses collusion. At this time, government regulation is weak, and both parties are dominated by the drive of interest. indicates that the building material enterprise chooses greenwashing behavior and the certification institution chooses noncollusion, which originates from the dual role of reduced profit distribution and increased regulatory pressure. is the optimal stable state; that is, the building material enterprise chooses green behavior, and the certification institution refuses to collude, which needs to meet the strict regulatory conditions and cost‒benefit trade-offs. At the same time, improving the initial willingness of the building material enterprise and the certification institution helps to evolve to the optimal stable state.

- (2)

- The marginal decreasing degree of the value function of perceived profits and losses for decision makers affects the building material enterprise’s strategy choice. When is smaller than the critical value between 0.35 and 0.5, the building material enterprise will eventually choose greenwashing behavior. When is greater than this critical value, the building material enterprise will eventually choose green behavior. In addition, the greater the degree of marginal decrease in the value function of perceived profits and losses for decision makers is, the more it can encourage the building material enterprise to choose green behavior. Therefore, increasing the degree of marginal decrease in the value function of perceived profits and losses for decision makers can help control the green behavior of the building material enterprise. The marginal decreasing degree of the value function of perceived profits and losses for decision makers will not affect the strategy choice of the certification institution but will affect the evolution speed. The smaller the marginal decreasing degree of the value function of perceived profits and losses for decision makers is, the more it can promote the certification institution’s choice of noncollusion. Therefore, reducing the degree of marginal decrease in the value function of perceived profits and losses for decision makers helps to discourage the certification institution from colluding with the building material enterprise.

- (3)

- The loss aversion coefficient does not affect the strategic choices of the building material enterprise or the certification institution. The building material enterprise always chooses green behavior, and the certification institution always chooses noncollusion. However, it affects the evolution speed, and the effect on the building material enterprise is more obvious than the effect on the certification institution. The greater the loss aversion coefficient is, the greater the ability of the building material enterprise to choose green behavior and the certification institution to choose noncollusion. Therefore, increasing the perceived value of losses between the two parties can effectively control the greenwashing behavior of the building material enterprise and prevent collusion between the certification institution and the building material enterprise.

6.2. Management Implications

On the basis of the above findings, the following management implications were obtained in this paper.

- (1)

- The government should give priority to the procurement of green building materials that meet the standards through government procurement policies. For example, the Chinese government has further expanded the scope of policy implementation on the basis of the previous government procurement to support green building materials to promote the implementation of building quality improvement policies [106]. The demonstration effect of government procurement creates a stable market demand for green building material enterprises and encourages enterprises to increase investment in green production. At the same time, the government should also regularly audit and review the certification institutions to ensure that the test reports issued by them are true and reliable. For example, China’s National Certification and Accreditation Supervision and Administration Commission has promulgated the “Management Measures for Certification Agencies” since 2018 and strictly supervises the certification activities of certification agencies [107]. By strengthening supervision, this can prevent improper collusion between certification institutions and building material enterprises and maintain the credibility of the certification system.

- (2)

- Enlarge the marginal decreasing degree of the value function of the perceived gains and losses of building material enterprises and reduce the marginal decreasing degree of the value function of the perceived gains and losses of certification institutions. At the level of building material enterprises, the government should publicize the benefits of green building materials production by building material enterprises and negative cases of greenwashing by building material enterprises. At the same time, enterprise executives should improve their green cognition [46] to amplify the marginal decreasing degree of the value function of the perceived gains and losses of building material enterprises to encourage them to choose green behavior. At the level of certification institutions, the government can take measures to strengthen the sense of responsibility of certification institutions and encourage them to disclose building materials testing reports to the public to prevent their collusion with building material enterprises.

- (3)

- Amplify the perceived value of building material enterprises and certification institutions to losses. At the level of building material enterprises, the government should take measures to increase the sampling inspection of building materials and crack down on the greenwashing behavior of building material enterprises to encourage them to actively produce green building materials. At the level of certification institutions, on the one hand, the government can enrich punishment measures. For certification institutions with serious violations, in addition to fines, the government can also directly revoke their qualifications. On the other hand, the government can also strictly supervise the qualifications of the certification body, the certification process, the certification equipment, the qualifications of the certification personnel, and the test report issued to avoid collusion between certification institutions and building material enterprises.

6.3. Limitations and Future Work

The above conclusions provide suggestions for controlling the greenwashing behavior of building material enterprises and preventing collusion between certification institutions and building material enterprises. However, the following limitations remain. On the one hand, to simplify the model, this paper considered only the two main subjects of building material enterprises and certification institutions. However, the government also plays a vital role in the governance of the greenwashing behavior of building material enterprises. Future research can consider incorporating the government into the model. On the other hand, this paper assumed that the income of building material enterprises is equal when selling green building materials and greenwashing building materials. However, the actual sales of green building materials and greenwashing materials are also related to consumers’ green preferences. In the future, scholars can study the evolution mechanism of the greenwashing behavior of building material enterprises while considering consumers’ green preferences.

Author Contributions

Methodology, validation, formal analysis, investigation, resources, data curation, writing—original draft, writing—review and editing, visualization, Z.L.; conceptualization, methodology, writing—original draft, supervision, project administration, X.L. (Xingwei Li); writing—review and editing, Y.Z. (Yi Zhang), Z.H., Y.Z. (Yixi Zeng), X.D., X.L. (Xinbao Lu), J.P. and M.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Natural Science Foundation of China (grant number 72204178), the Sichuan Science and Technology Program, the Natural Science Foundation of Sichuan, China (grant number 2023NSFSC1053), and the National College Students Innovation and Entrepreneurship Training Plan (grant number 202410626004).

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

References

- Bao, Z.; Lu, W. Developing Efficient Circularity for Construction and Demolition Waste Management in Fast Emerging Economies: Lessons Learned from Shenzhen, China. Sci. Total Environ. 2020, 724, 138264. [Google Scholar] [CrossRef] [PubMed]

- Li, X.; Li, J.; Shen, Q. Infection Mechanism of Greenwashing Behavior of Construction Material Enterprises under Multi-Agent Interaction. Dev. Built Environ. 2024, 17, 100321. [Google Scholar] [CrossRef]

- Peng, J.; Zou, Y.; Zhang, H.; Zeng, L.; Wang, Y.; Li, X. Pricing Decision-Making Considering Ambiguity Tolerance in Consumers: Evidence from Recycled Building Material Enterprises. Systems 2025, 13, 98. [Google Scholar] [CrossRef]

- Su, Y.; Xu, Y.; Bao, Z.; Ng, S.T.; Gao, Q. Stakeholder Interactions of Government Intervention in Construction and Demolition Waste Recycling Market: A Game Theory Approach. Dev. Built Environ. 2024, 18, 100391. [Google Scholar] [CrossRef]

- Environment, U.N. 2022 Global Status Report for Buildings and Construction|UNEP—UN Environment Programme. Available online: https://www.unep.org/resources/publication/2022-global-status-report-buildings-and-construction (accessed on 11 May 2025).

- Ramakrishna Balaji, C.; de Azevedo, A.R.G.; Madurwar, M. Sustainable Perspective of Ancillary Construction Materials in Infrastructure Industry: An Overview. J. Clean. Prod. 2022, 365, 132864. [Google Scholar] [CrossRef]

- Li, X.; Ding, Z. Decision-Making Mechanisms of Greenwashing Behaviors of Building Materials Manufacturers: A Media Disclosure and Consumer Skepticism Perspective. Environ. Technol. Innov. 2024, 35, 103705. [Google Scholar] [CrossRef]

- Basbagill, J.; Flager, F.; Lepech, M.; Fischer, M. Application of Life-Cycle Assessment to Early Stage Building Design for Reduced Embodied Environmental Impacts. Build. Environ. 2013, 60, 81–92. [Google Scholar] [CrossRef]

- Darko, A.; Chan, A.P.C.; Yang, Y.; Shan, M.; He, B.-J.; Gou, Z. Influences of Barriers, Drivers, and Promotion Strategies on Green Building Technologies Adoption in Developing Countries: The Ghanaian Case. J. Clean. Prod. 2018, 200, 687–703. [Google Scholar] [CrossRef]

- Feng, H.; Ren, H.; Yang, S.; Xue, Y. Research on Stability Strategy Based on the Dynamic Evolution Game of Promoting Low-Carbon Building Green Building Materials Market. Environ. Dev. Sustain. 2024, 1–22. [Google Scholar] [CrossRef]

- Energy-United Nations Sustainable Development. Available online: https://www.un.org/sustainabledevelopment/energy/ (accessed on 11 May 2025).

- Ecodesign for Sustainable Products Regulation—European Commission. Available online: https://commission.europa.eu/energy-climate-change-environment/standards-tools-and-labels/products-labelling-rules-and-requirements/ecodesign-sustainable-products-regulation_en (accessed on 11 May 2025).

- Arouri, M.; El Ghoul, S.; Gomes, M. Greenwashing and Product Market Competition. Financ. Res. Lett. 2021, 42, 101927. [Google Scholar] [CrossRef]

- Lan, C.; Li, X.; Peng, B.; Li, X. Unlocking Urban Ecological Resilience: The Dual Role of Environmental Regulation and Green Technology Innovation. Sustain. Cities Soc. 2025, 128, 106466. [Google Scholar] [CrossRef]

- Seele, P.; Gatti, L. Greenwashing Revisited: In Search of a Typology and Accusation-Based Definition Incorporating Legitimacy Strategies. Bus. Strategy Environ. 2017, 26, 239–252. [Google Scholar] [CrossRef]

- Li, X.; Li, J.; He, J.; Huang, Y.; Liu, X.; Dai, J.; Shen, Q. What Are the Key Factors of Enterprises’ Greenwashing Behaviors under Multi-Agent Interaction? A Grey-DEMATEL Analysis from Chinese Construction Materials Enterprises. Eng. Constr. Archit. Manag. 2023, 31, 4659–4676. [Google Scholar] [CrossRef]

- Green Claims—European Commission. Available online: https://environment.ec.europa.eu/topics/circular-economy/green-claims_en (accessed on 11 May 2025).

- National Business Daily. Available online: https://www.nbd.com.cn/articles/2022-04-21/2231084.html (accessed on 11 May 2025).

- Li, X.; He, J. Evolutionary Mechanism of Green Product Certification Behavior in Cement Enterprises: A Perspective of Herd Behavior. Environ. Technol. Innov. 2024, 33, 103508. [Google Scholar] [CrossRef]

- National Certification and Accreditation Administration. Available online: https://www.cnca.gov.cn/ywzl/rzjdzl/rzxzcfjggk/art/2020/art_dc1bde633b7f4e9ea2765cce5888709b.html (accessed on 11 May 2025).

- National Certification and Accreditation Administration. Available online: https://www.cnca.gov.cn/ywzl/rzjdzl/ffrzjgjsgg/art/2017/art_ebbbd29a28864f449f84dda7c4de4a40.html (accessed on 11 May 2025).

- Mao, Q.; Zhao, M.; Sun, Q. How Supply Chain Enterprises Achieve Coordination between Green Transition and Profitability under the Carbon Trading Framework. J. Environ. Manag. 2025, 377, 124588. [Google Scholar] [CrossRef] [PubMed]

- Chen, T.; Wu, X.; Wang, B.; Yang, J. The Role of Behavioral Decision-Making in Panic Buying Events during COVID-19: From the Perspective of an Evolutionary Game Based on Prospect Theory. J. Retail. Consum. Serv. 2025, 82, 104067. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk Daniel. Econometrica 1979, 47, 363–391. [Google Scholar] [CrossRef]

- Gal, D.; Rucker, D.D. The Loss of Loss Aversion: Will It Loom Larger Than Its Gain? J. Consum. Psychol. 2018, 28, 497–516. [Google Scholar] [CrossRef]

- Grinblatt, M.; Han, B. Prospect Theory, Mental Accounting, and Momentum. J. Financ. Econ. 2005, 78, 311–339. [Google Scholar] [CrossRef]

- Gao, J.; Wei, H. Study on the Impact of Environmental Subsidies and Green Labels on Greenwashing in Sustainable Production. J. Clean. Prod. 2025, 486, 144531. [Google Scholar] [CrossRef]

- Gao, J.; Xiao, Z.; Wei, H.; Zhou, G. Dual-Channel Green Supply Chain Management with Eco-Label Policy: A Perspective of Two Types of Green Products. Comput. Ind. Eng. 2020, 146, 106613. [Google Scholar] [CrossRef]

- Zhang, T.; Qin, H.; Xu, W. Environmental Regulation, Greenwashing Behaviour, and Green Governance of High-Pollution Enterprises in China. Int. J. Environ. Res. Public Health 2022, 19, 12539. [Google Scholar] [CrossRef] [PubMed]

- Chang, L.; Zhao, S. Risk Evaluation of Prefabricated Building Construction Based on PTF-VIKOR of Prospect Theory. Alex. Eng. J. 2025, 115, 147–159. [Google Scholar] [CrossRef]

- Trepel, C.; Fox, C.R.; Poldrack, R.A. Prospect Theory on the Brain? Toward a Cognitive Neuroscience of Decision under Risk. Cogn. Brain Res. 2005, 23, 34–50. [Google Scholar] [CrossRef]

- Zhang, X.; Yu, S. A Prospect Theory-Driven Three-Way Decision Framework: Integrating Prior Probability Tolerance and Dominance Relations in Fuzzy Incomplete Information Systems. Expert Syst. Appl. 2025, 264, 125833. [Google Scholar] [CrossRef]

- Zheng, Q.; Liu, X.; Wang, W.; Wu, Q.; Deveci, M.; Pamucar, D. The Integrated Prospect Theory with Consensus Model for Risk Analysis of Human Error Factors in the Clinical Use of Medical Devices. Expert Syst. Appl. 2023, 217, 119507. [Google Scholar] [CrossRef]

- Qian, Q.; Gan, M.; Yang, X. Empirical Analysis of Intelligent Charging Decisions: Boosting Efficiency for Electric Trucks. Transp. Res. Part Transp. Environ. 2025, 139, 104572. [Google Scholar] [CrossRef]

- Li, Z.; Jin, Y.; Meng, Q.; Chong, H.-Y. Evolutionary Game Analysis of the Opportunistic Behaviors in PPP Projects Using Whole-Process Engineering Consulting. J. Infrastruct. Syst. 2024, 30, 04024021. [Google Scholar] [CrossRef]

- Zhang, C.; Xia, P.; Zhang, X. Multi-Attribute Decision-Making Method of Pumped Storage Capacity Planning Considering Wind Power Uncertainty. J. Clean. Prod. 2024, 449, 141655. [Google Scholar] [CrossRef]

- Liu, X.; Yue, J.; Luo, L.; Liu, C.; Zhu, T. Evolutionary Analysis of Nuclear Wastewater Collaborative Governance Based on Prospect Theory. J. Clean. Prod. 2024, 465, 142856. [Google Scholar] [CrossRef]

- Zheng, P.; Pei, W.; Pan, W. Impact of Different Carbon Tax Conditions on the Behavioral Strategies of New Energy Vehicle Manufacturers and Governments—A Dynamic Analysis and Simulation Based on Prospect Theory. J. Clean. Prod. 2023, 407, 137132. [Google Scholar] [CrossRef]

- Zhang, Y.; Guan, D.; Wu, L.; Su, X.; Zhou, L.; Peng, G. How Can an Ecological Compensation Threshold Be Determined? A Discriminant Model Integrating the Minimum Data Approach and the Most Appropriate Land Use Scenarios. Sci. Total Environ. 2022, 852, 158377. [Google Scholar] [CrossRef] [PubMed]

- Li, X.; Chen, W. Can Ecological Compensation Promote Cross-Regional Collaborative Governance of Construction and Demolition Waste? Evidence from Prospect Theory. Dev. Built Environ. 2025, 22, 100679. [Google Scholar] [CrossRef]

- Huang, F.; Wu, J.; Wu, Z.; Fu, W.; Guo, P.; Zhang, Z.; Khan, F. Unpacking Greenwashing: The Impact of Environmental Attitude, Proactive Strategies, and Network Embeddedness on Corporate Environmental Performance. J. Environ. Manag. 2025, 373, 123625. [Google Scholar] [CrossRef]

- Liu, C.; Gong, W.; Dong, G.; Ji, Q. Regulation of Environmental, Social and Governance Disclosure Greenwashing Behaviors Considering the Risk Preference of Enterprises. Energy Econ. 2024, 135, 107637. [Google Scholar] [CrossRef]

- Parguel, B.; Benoît-Moreau, F.; Larceneux, F. How Sustainability Ratings Might Deter ‘Greenwashing’: A Closer Look at Ethical Corporate Communication. J. Bus. Ethics 2011, 102, 15–28. [Google Scholar] [CrossRef]

- Paramitha, V.; Tan, S.Z.; Lim, W.M. Undoing Greenwashing: The Roles of Greenwashing Severity, Consumer Forgiveness, Growth Beliefs and Apology Sincerity. J. Prod. Amp Brand Manag. 2025, 34, 433–449. [Google Scholar] [CrossRef]

- Choudhury, R.R.; Islam, A.F.; Sujauddin, M. More than Just a Business Ploy? Greenwashing as a Barrier to Circular Economy and Sustainable Development: A Case Study-Based Critical Review. Circ. Econ. Sustain. 2024, 4, 233–266. [Google Scholar] [CrossRef]

- Li, X.; Yao, Y.; Shen, Q. From Dilemma to Breakthrough: Fuzzy-Set Qualitative Comparative Analysis of Green Development Behavior Pathways in Construction Materials Enterprises. Humanit. Soc. Sci. Commun. 2025, 12, 198. [Google Scholar] [CrossRef]

- Walker, K.; Wan, F. The Harm of Symbolic Actions and Green-Washing: Corporate Actions and Communications on Environmental Performance and Their Financial Implications. J. Bus. Ethics 2012, 109, 227–242. [Google Scholar] [CrossRef]

- Lee, M.T.; Raschke, R.L. Stakeholder Legitimacy in Firm Greening and Financial Performance: What about Greenwashing Temptations? J. Bus. Res. 2023, 155, 113393. [Google Scholar] [CrossRef]

- Zhang, W.; Qin, C.; Zhang, W. Top Management Team Characteristics, Technological Innovation and Firm’s Greenwashing: Evidence from China’s Heavy-Polluting Industries. Technol. Forecast. Soc. Change 2023, 191, 122522. [Google Scholar] [CrossRef]

- Peng, Q.; Xie, Y. ESG Greenwashing and Corporate Debt Financing Costs. Financ. Res. Lett. 2024, 69, 106012. [Google Scholar] [CrossRef]

- Zhang, D. Are Firms Motivated to Greenwash by Financial Constraints? Evidence from Global Firms’ Data. J. Int. Financ. Manag. Account. 2022, 33, 459–479. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S.; Naciti, V.; Paltrinieri, A. A PRISMA Systematic Review of Greenwashing in the Banking Industry: A Call for Action. Res. Int. Bus. Financ. 2024, 69, 102262. [Google Scholar] [CrossRef]

- Zhang, D. Environmental Regulation, Green Innovation, and Export Product Quality: What Is the Role of Greenwashing? Int. Rev. Financ. Anal. 2022, 83, 102311. [Google Scholar] [CrossRef]

- Zhang, D. Can Digital Finance Empowerment Reduce Extreme ESG Hypocrisy Resistance to Improve Green Innovation? Energy Econ. 2023, 125, 106756. [Google Scholar] [CrossRef]

- Liu, Z.; Li, X. The Impact of Bank Fintech on ESG Greenwashing. Financ. Res. Lett. 2024, 62, 105199. [Google Scholar] [CrossRef]

- Zhang, D. The Pathway to Curb Greenwashing in Sustainable Growth: The Role of Artificial Intelligence. Energy Econ. 2024, 133, 107562. [Google Scholar] [CrossRef]

- Li, D.; Zhang, Z.; Gao, X. Does Artificial Intelligence Deter Greenwashing? Financ. Res. Lett. 2024, 67, 105954. [Google Scholar] [CrossRef]

- Araújo, A.G.; Pereira Carneiro, A.M.; Palha, R.P. Sustainable Construction Management: A Systematic Review of the Literature with Meta-Analysis. J. Clean. Prod. 2020, 256, 120350. [Google Scholar] [CrossRef]

- Tirole, J. Hierarchies and Bureaucracies: On the Role of Collusion in Organizations. J. Law Econ. Organ. 1986, 2, 181–214. [Google Scholar] [CrossRef]

- Lockard, A.A.; Tullock, G. Efficient Rent-Seeking: Chronicle of an Intellectual Quagmire, 1st ed.; Springer: New York, NY, USA; George Mason University: Fairfax, VA, USA, 2001; pp. 27–45. [Google Scholar]

- Auriol, E.; Straub, S.; Flochel, T. Public Procurement and Rent-Seeking: The Case of Paraguay. World Dev. 2016, 77, 395–407. [Google Scholar] [CrossRef]

- Li, Z.P.; Dong, M.S. The Three Sides Dynamic Game Model on Corruption Problem and Its Harness Countermeasures. Oper. Res. Manag. Sci. 2003, 12, 27–31. [Google Scholar]

- Wang, Y.; Zhou, Y. Can Government Incentive and Penalty Mechanisms Effectively Mitigate Tacit Collusion in Platform Algorithmic Operations? Systems. 2025, 13, 293. [Google Scholar] [CrossRef]

- Guo, W.; Lu, Y.; Lei, M.; Liang, Y.; Zhao, J. Government Constraints: Influences on Irregularities in the Energy Sector. Manag. Decis. 2025. [Google Scholar] [CrossRef]

- Zhou, Z.; Han, S.; Huang, Z.; Cheng, X. Anti-Corruption and Corporate Pollution Mitigation: Evidence from China. Ecol. Econ. 2023, 208, 107795. [Google Scholar] [CrossRef]

- Sun, W.; Song, Z.; Xia, Y. Government-Enterprise Collusion and Land Supply Structure in Chinese Cities. Cities 2020, 105, 102849. [Google Scholar] [CrossRef]

- Candau, F.; Dienesch, E. Pollution Haven and Corruption Paradise. J. Environ. Econ. Manag. 2017, 85, 171–192. [Google Scholar] [CrossRef]

- Zhou, Y.; Su, Q. Environmental Protection Tax, Management Efficiency, and Enterprise Green Technology Innovation. Finance Res. Lett. 2025, 75, 106860. [Google Scholar] [CrossRef]

- Li, X.; Wang, R.; Shen, Z.; Song, M. Government Environmental Signals, Government–Enterprise Collusion and Corporate Pollution Transfer. Energy Econ. 2024, 139, 107935. [Google Scholar] [CrossRef]

- Jarrín-V, P.; Falconí, F.; Cango, P.; Ramos-Martin, J. Knowledge Gaps in Latin America and the Caribbean and Economic Development. World Dev. 2021, 146, 105602. [Google Scholar] [CrossRef]