Study on the Technological Innovation Supply–Demand Matching Mechanism for Major Railway Projects Based on a Tripartite Evolutionary Game

Abstract

1. Introduction

2. Literature Review

2.1. Research on Technological Innovation in Major Infrastructure Projects

2.2. Research on Supply–Demand Matching

3. Materials and Methods

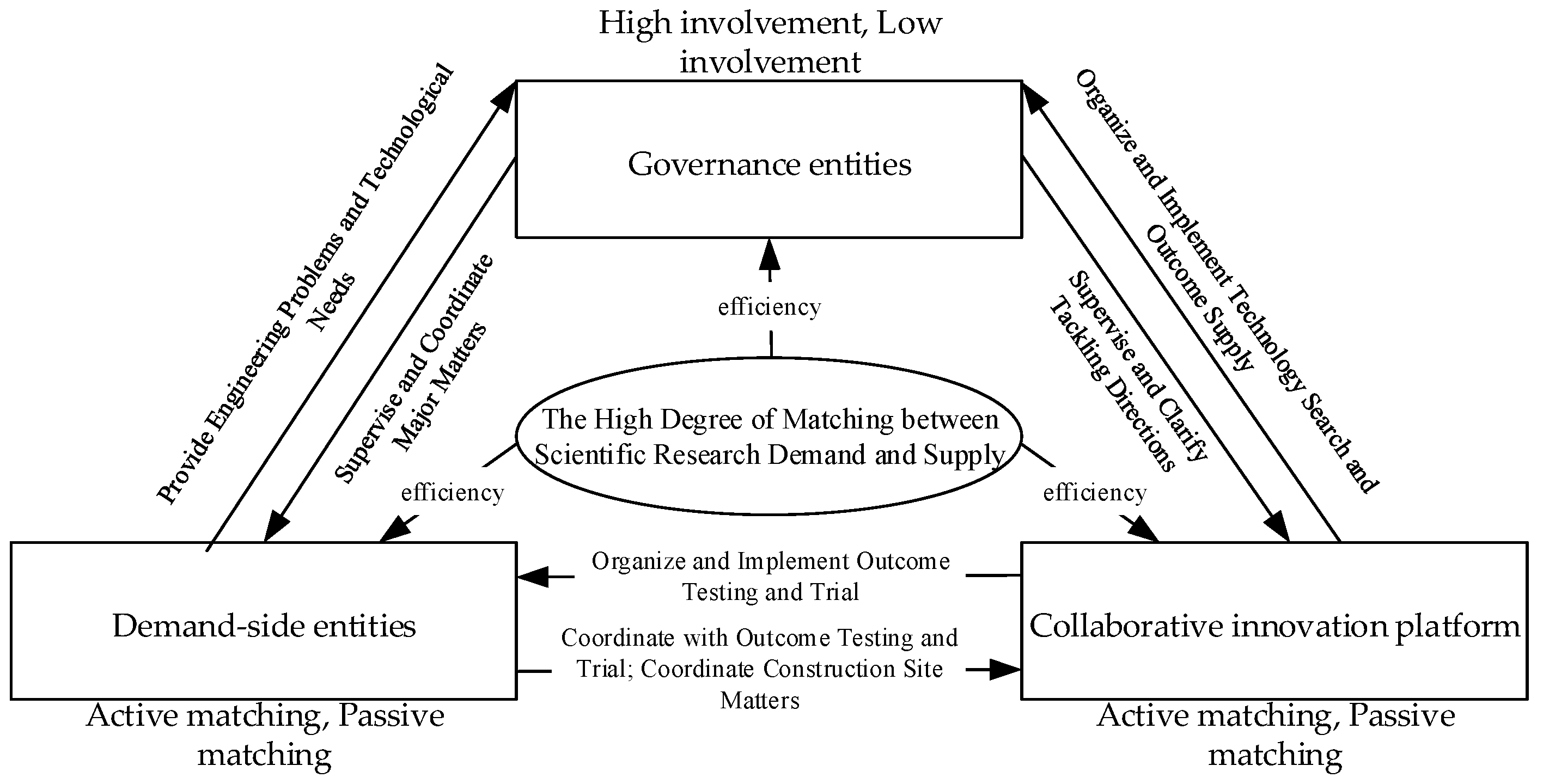

3.1. Connotations of Technological Innovation Supply–Demand Matching Mechanisms

3.2. Key Stakeholders and Behavioral Analysis in Technological Innovation Supply–Demand Matching Mechanisms

3.3. Tripartite Game Model Construction for Technological Innovation Supply–Demand Matching Mechanisms

3.3.1. Basic Assumptions and Parameter Settings of Evolutionary Game

3.3.2. Evolutionary Game Payoff Matrix

3.3.3. Replicator Dynamics Equation

4. Results

4.1. The Stability Analysis of Key Entities

4.1.1. Stability Analysis of Governance Entities

4.1.2. Stability Analysis of Collaborative Innovation Platforms

4.1.3. Stability Analysis of Demand-Side Entities

4.2. Stability Analysis of the Technological Innovation Supply–Demand Matching Mechanism

5. Discussions

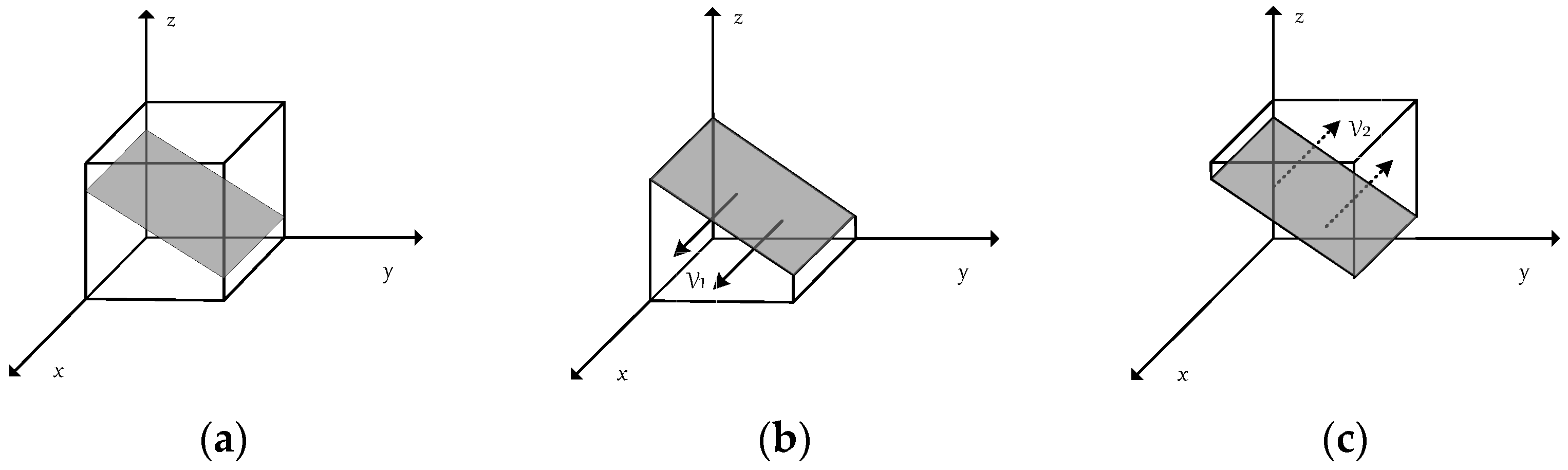

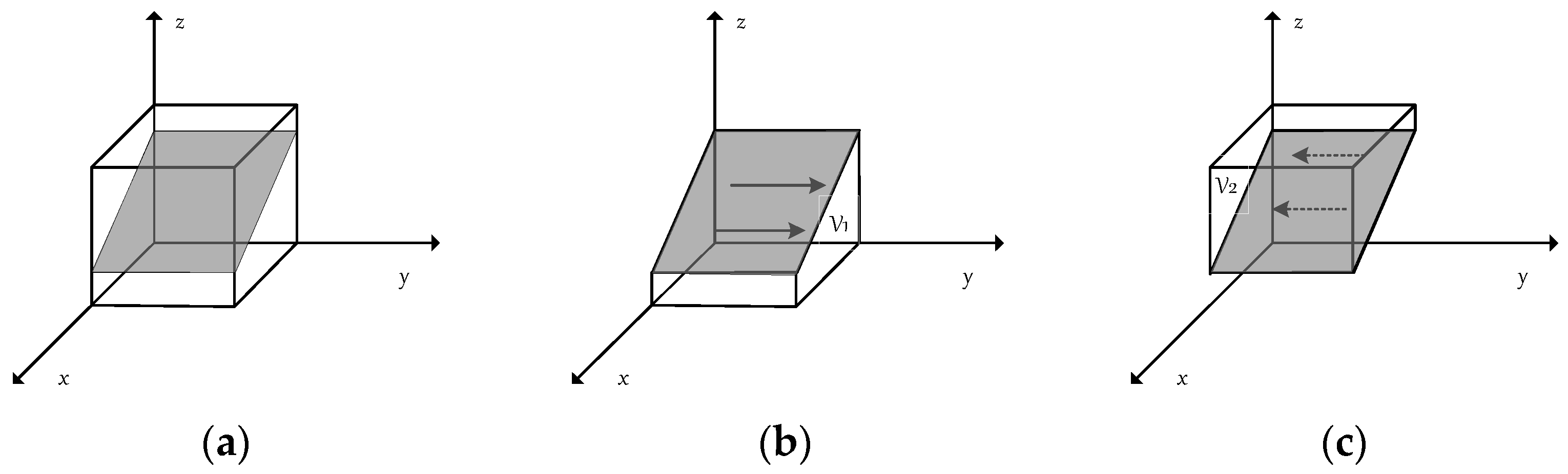

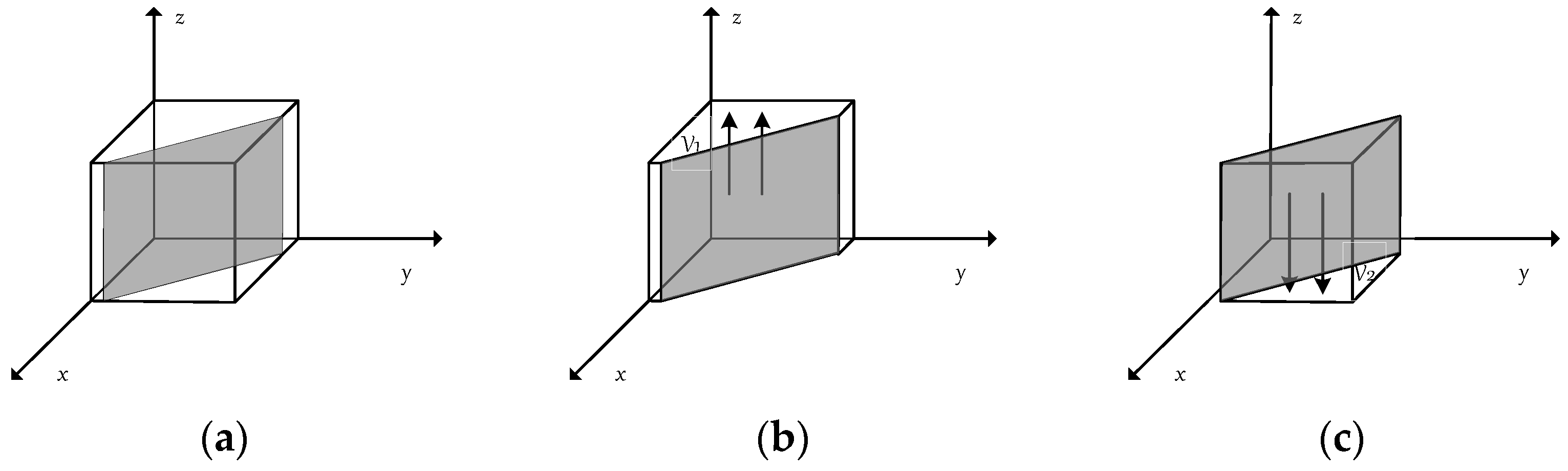

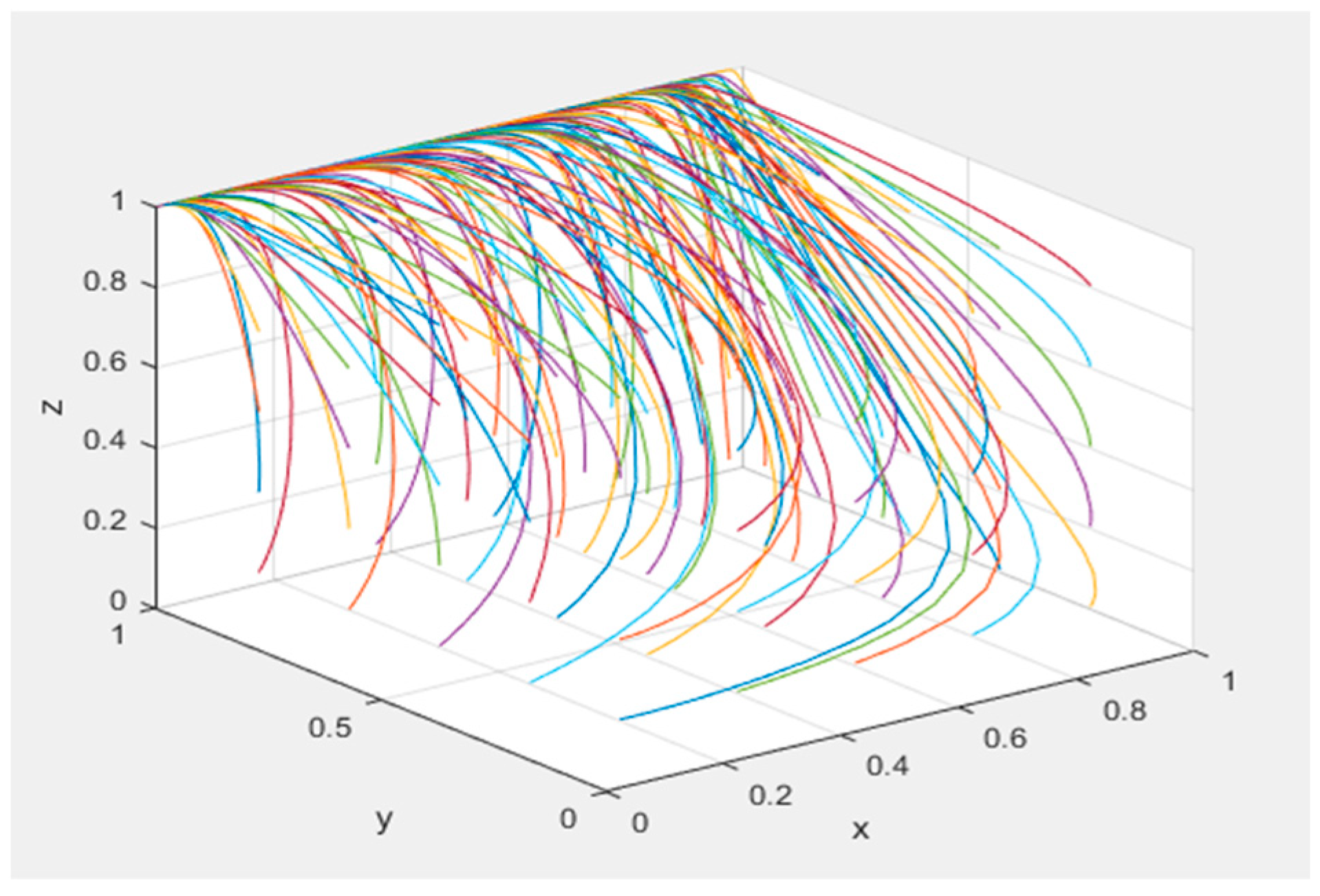

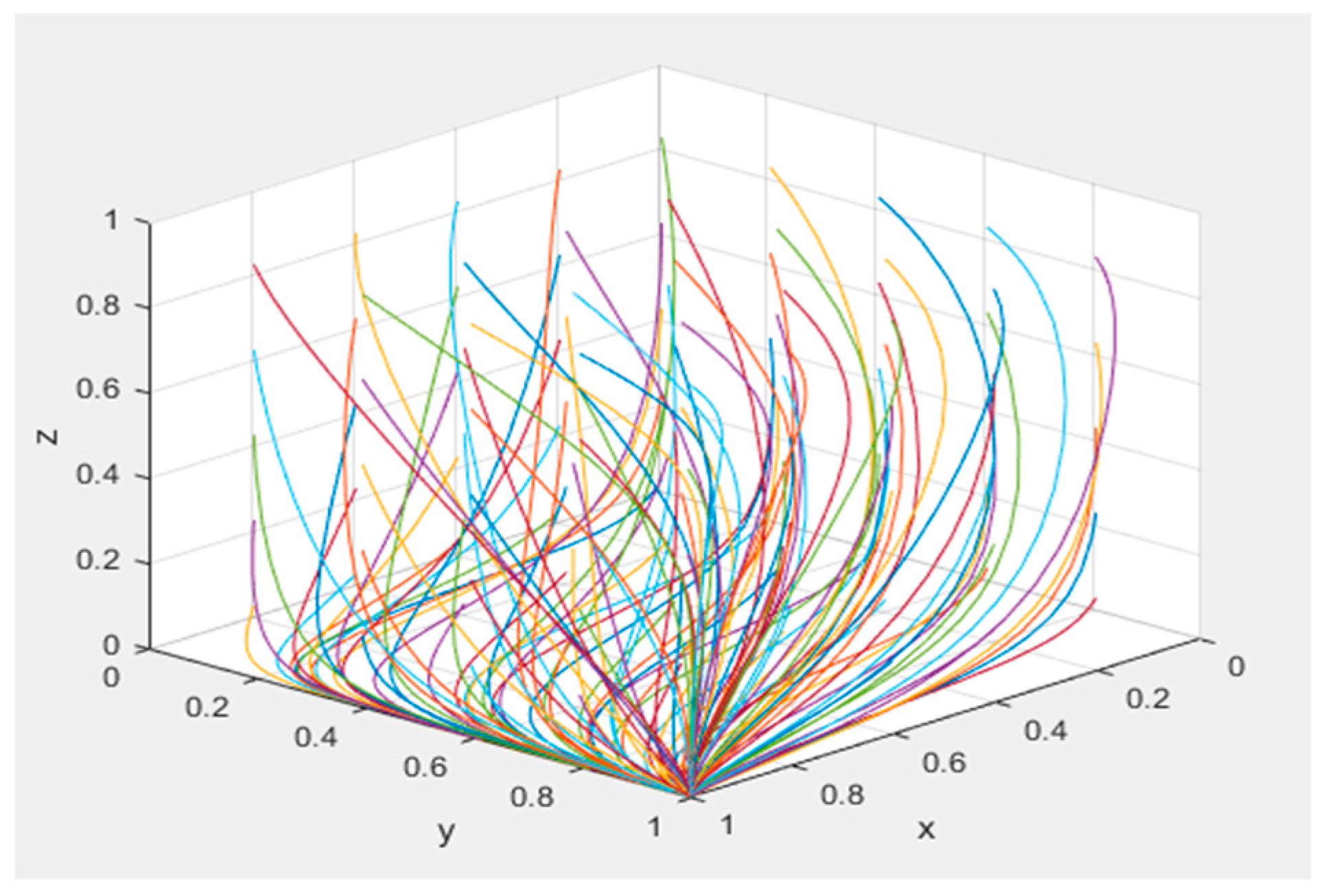

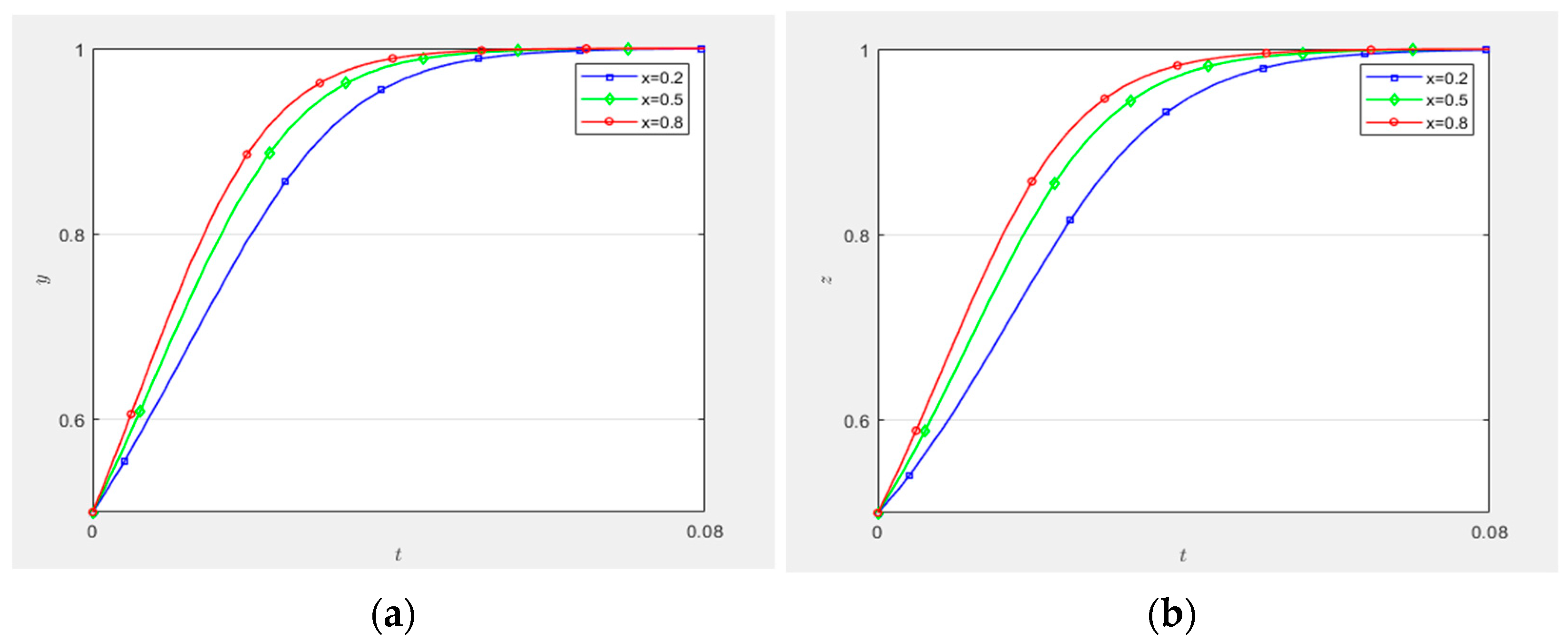

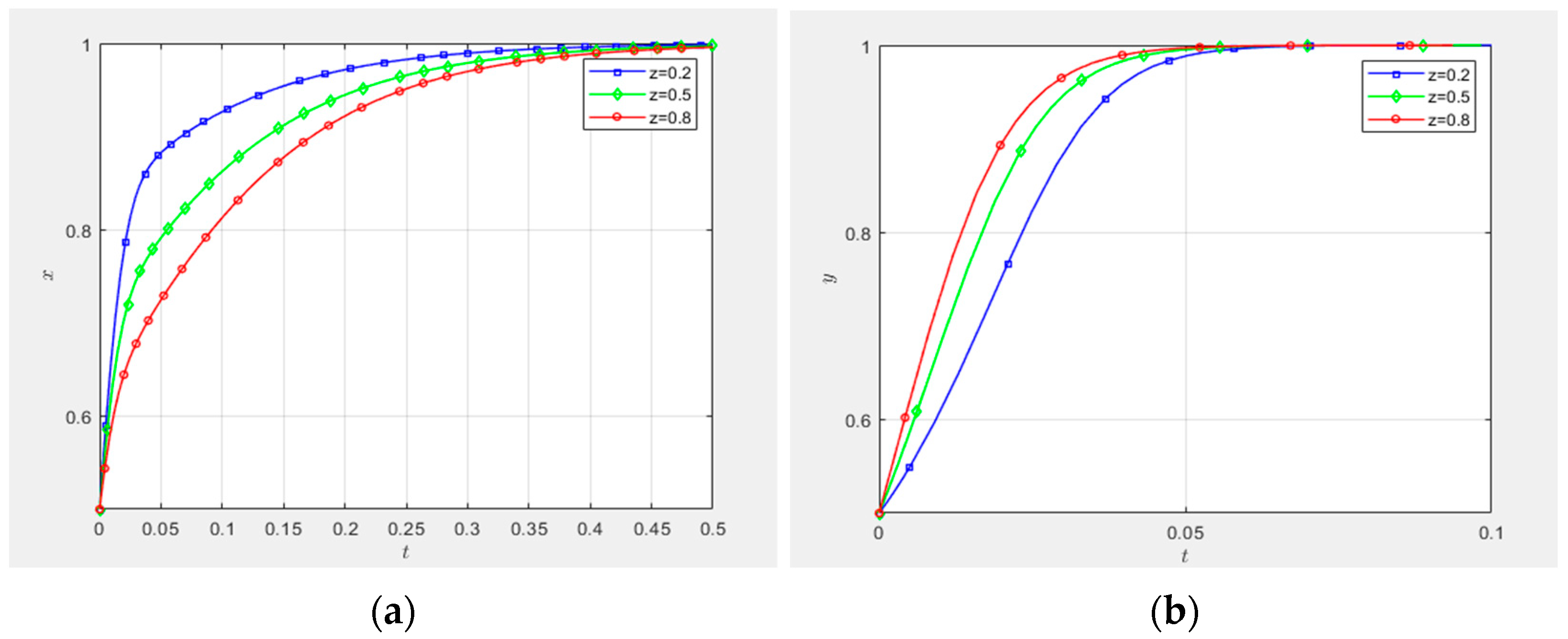

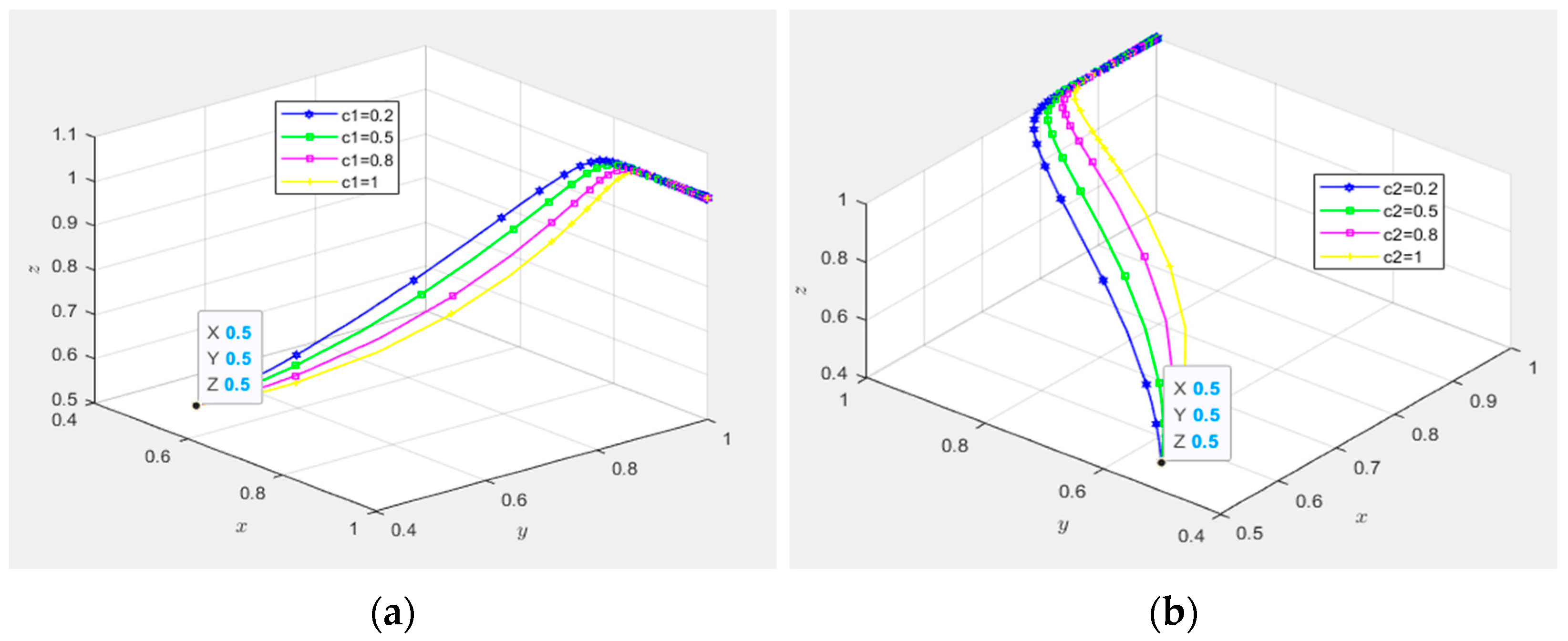

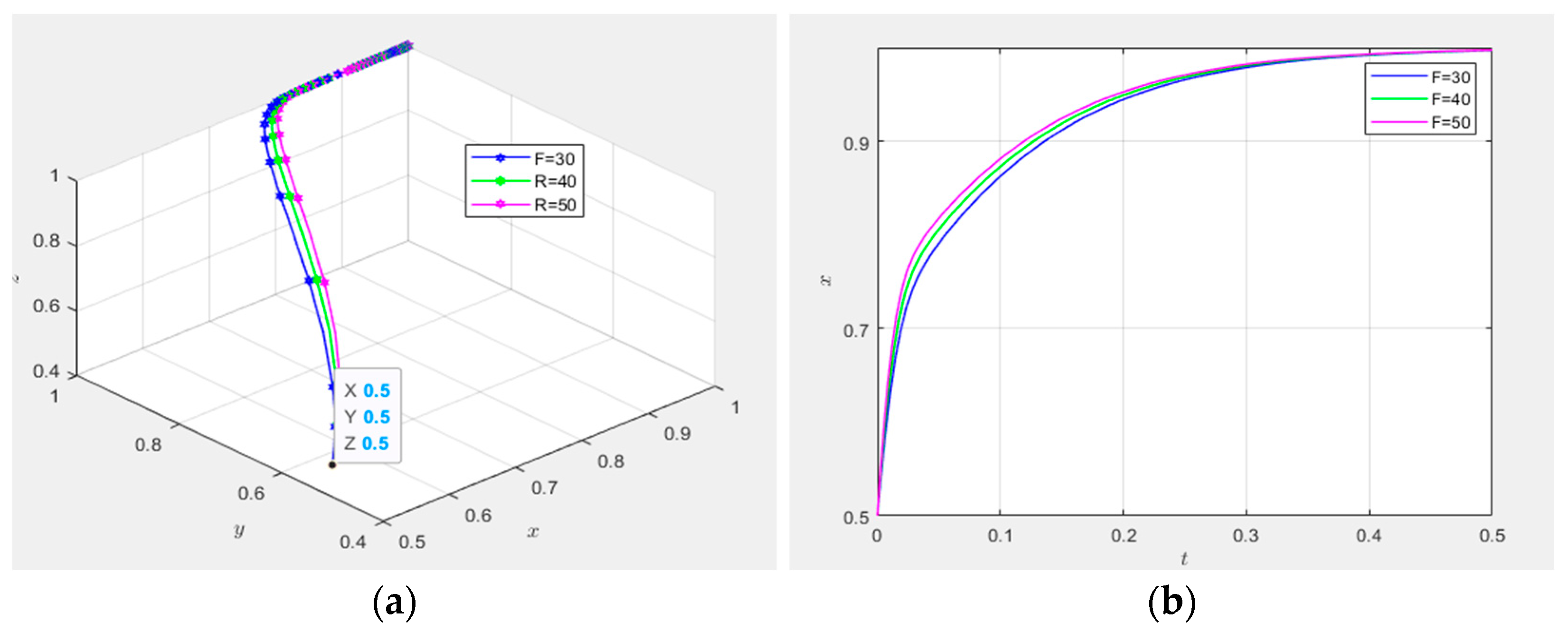

5.1. The Impact of Key Entities’ Initial Willingness on Mechanism Evolution

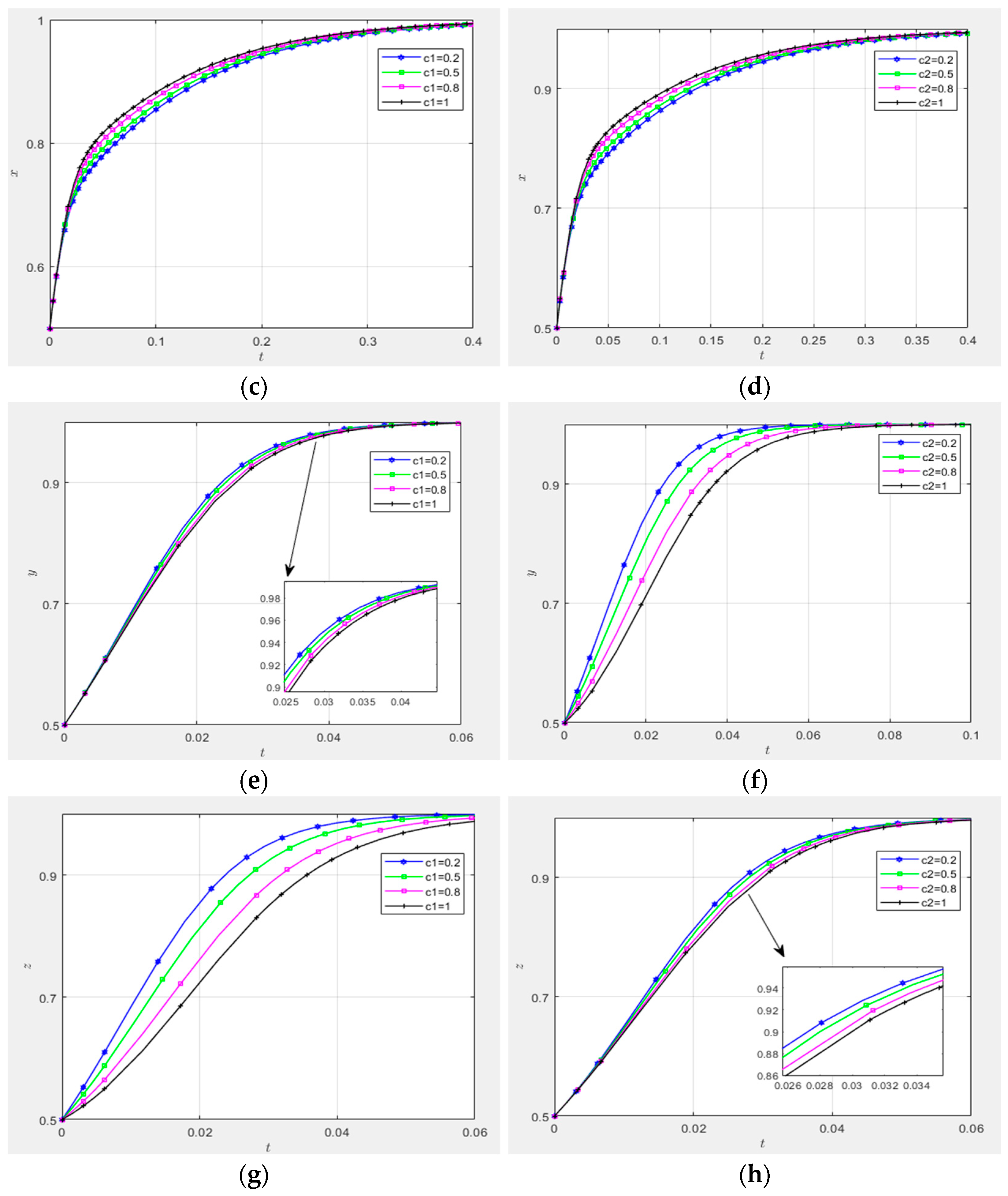

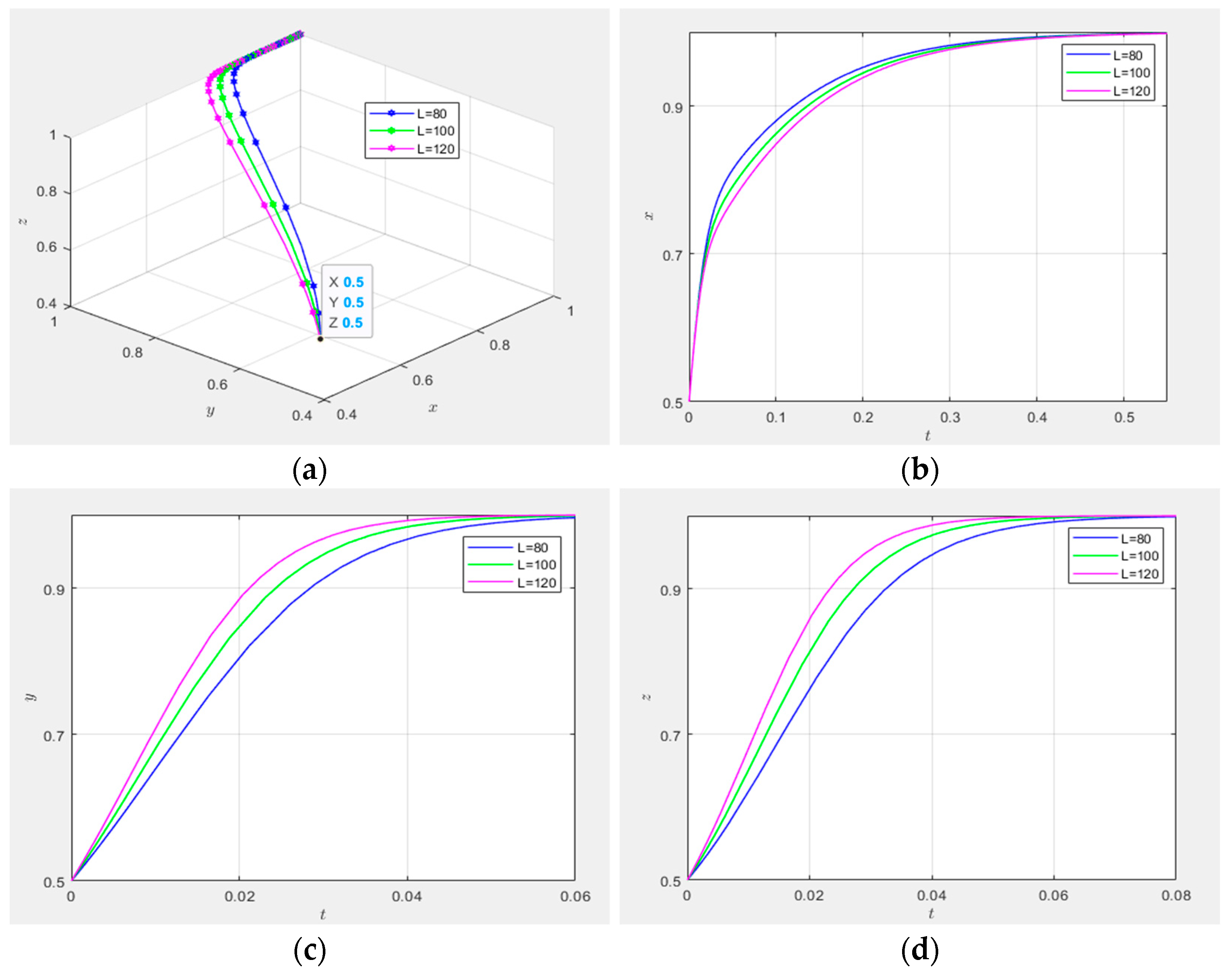

5.2. Tripartite Game Parameter Sensitivity Analysis

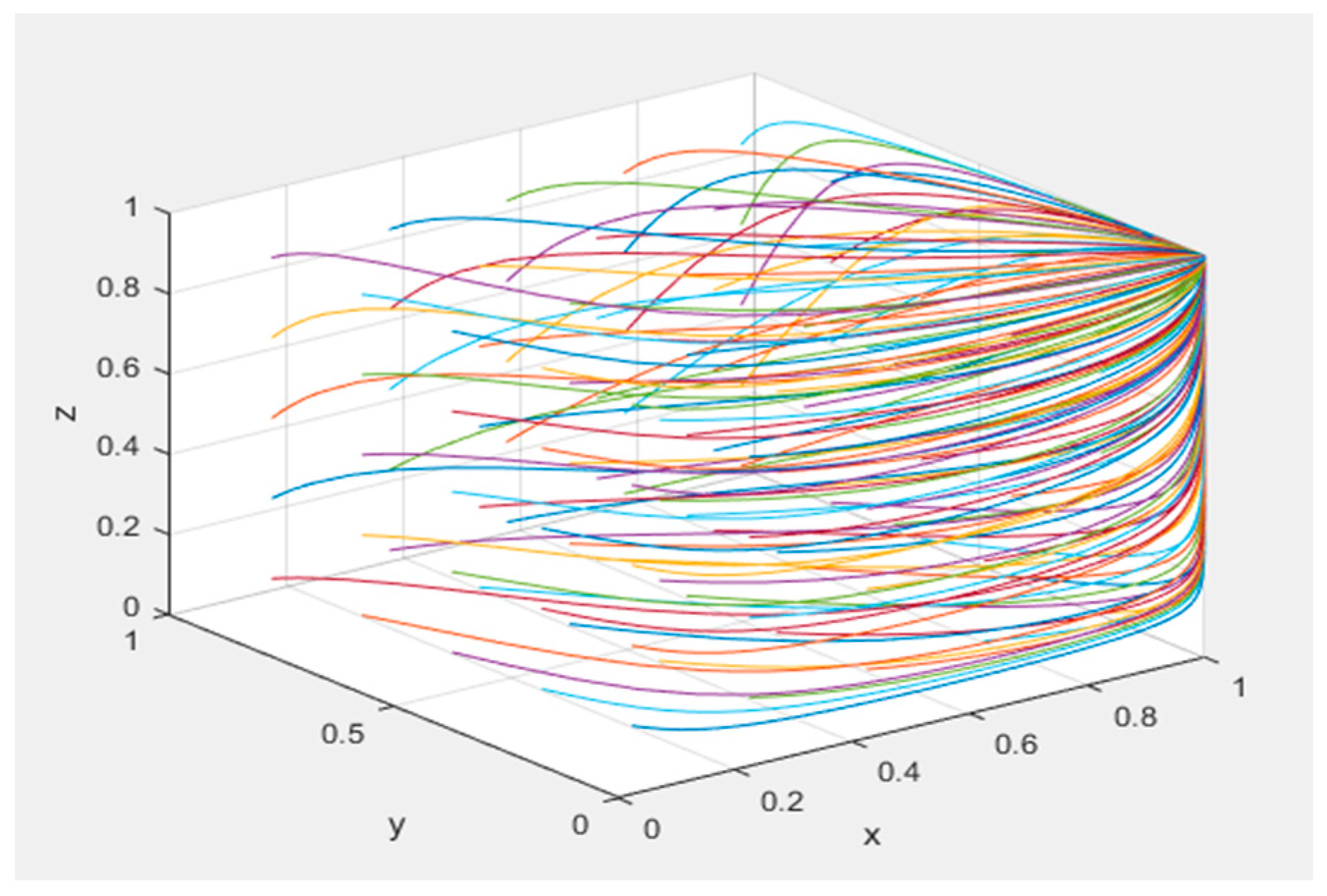

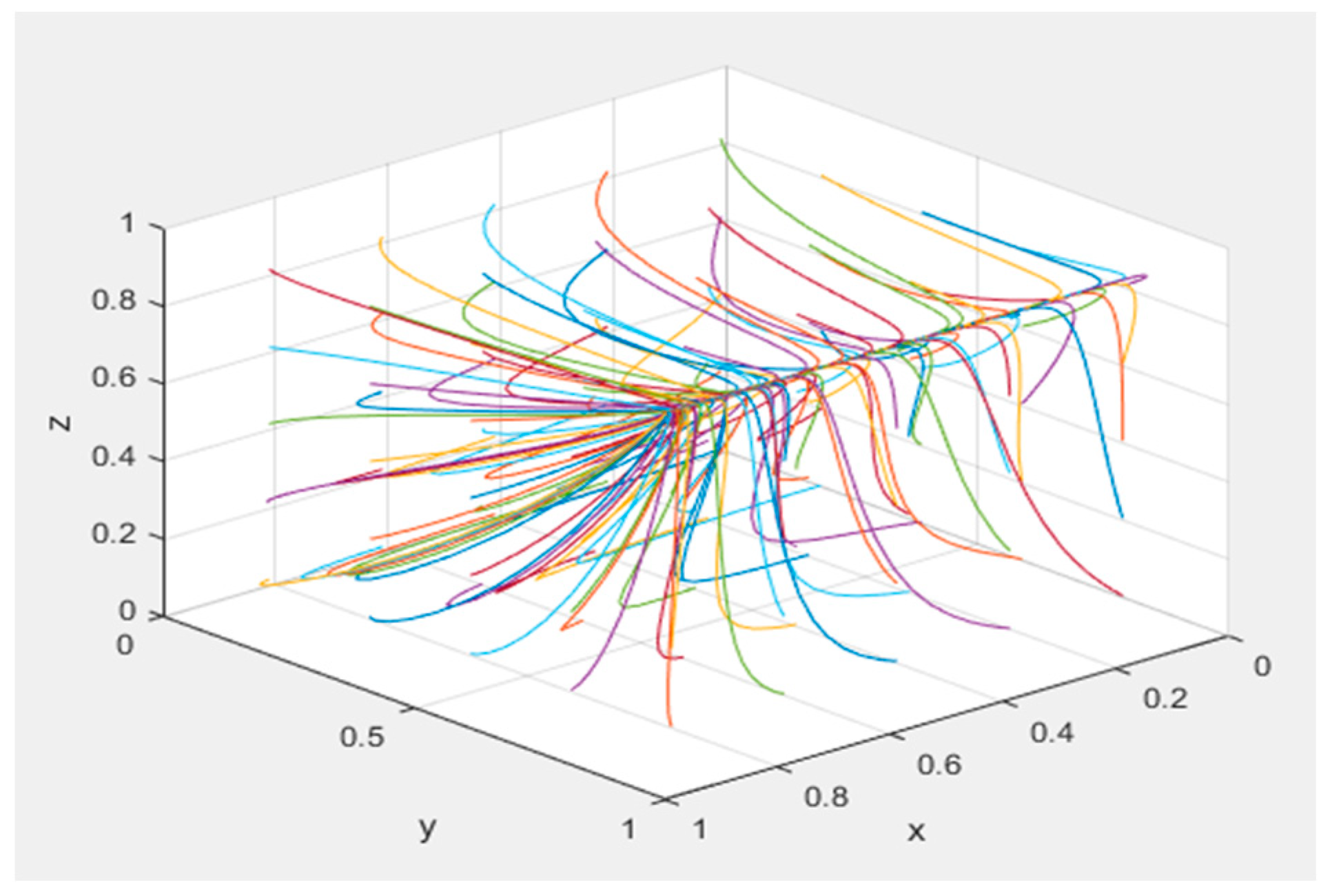

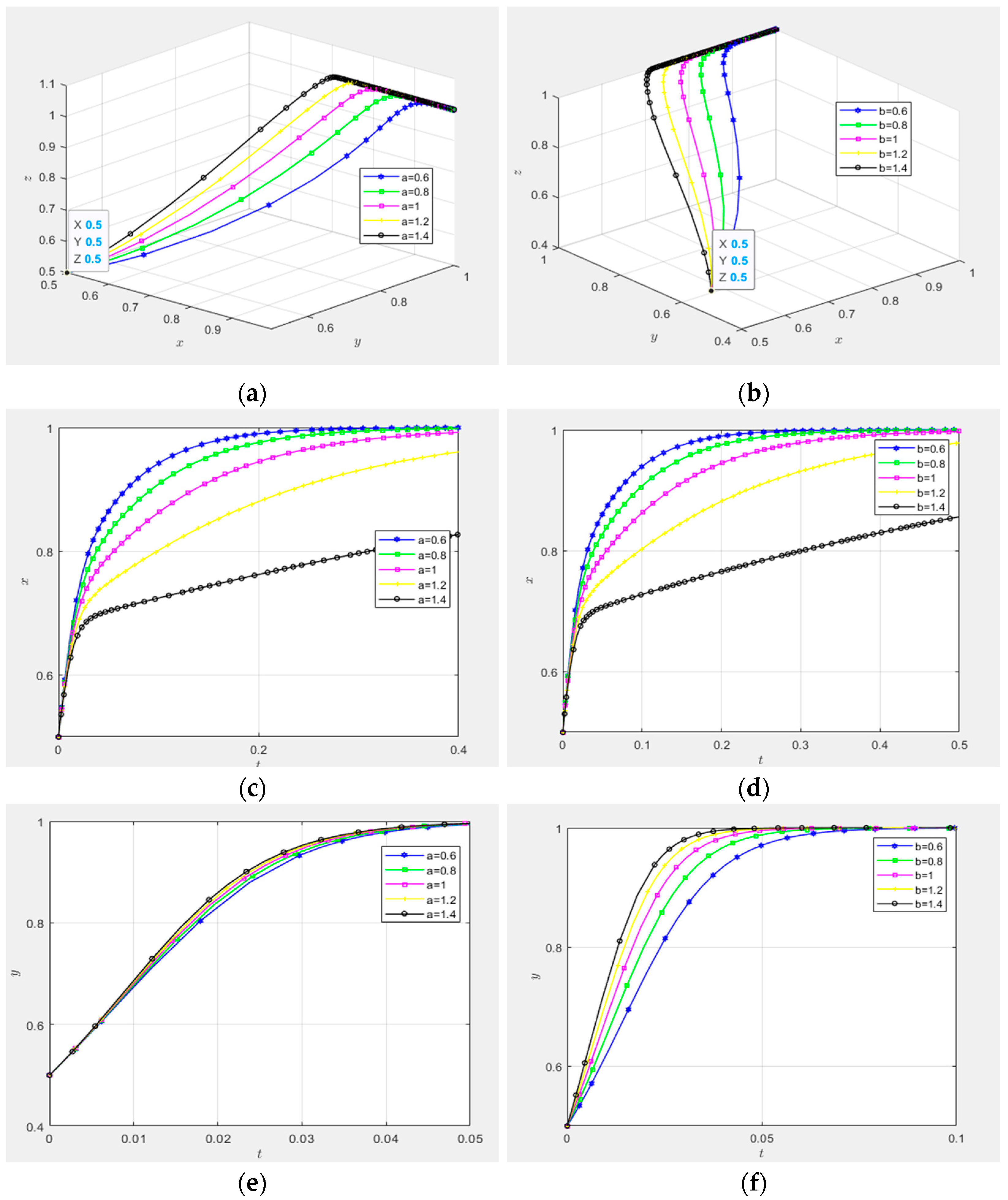

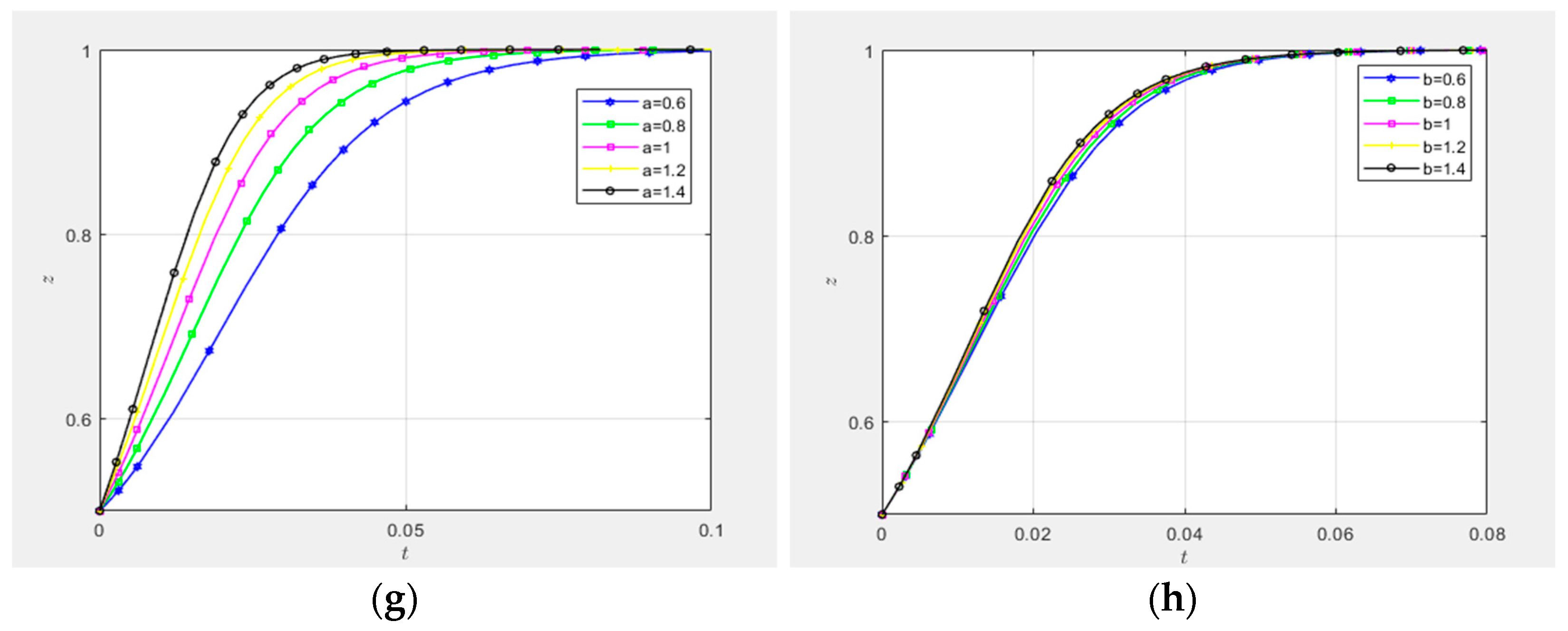

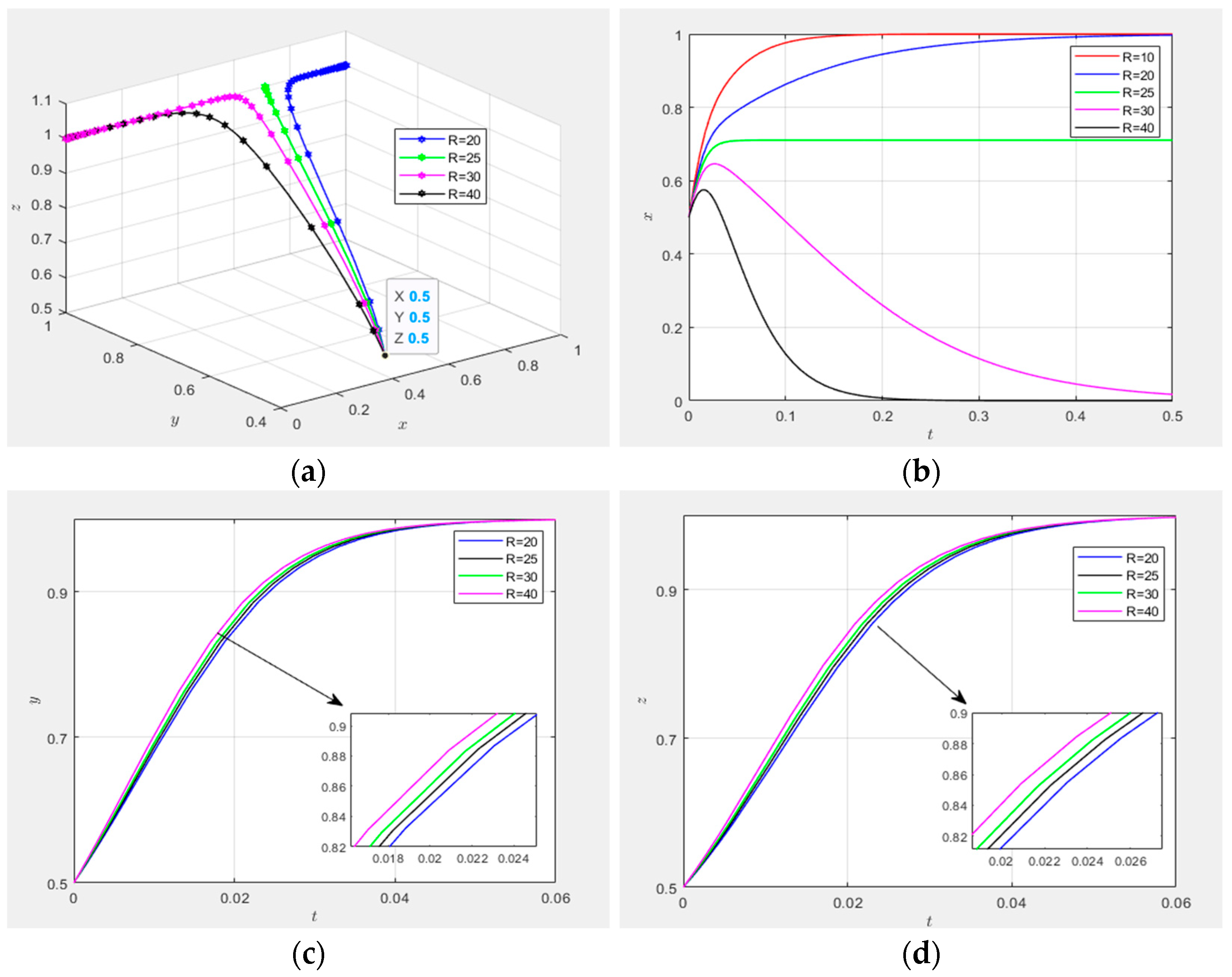

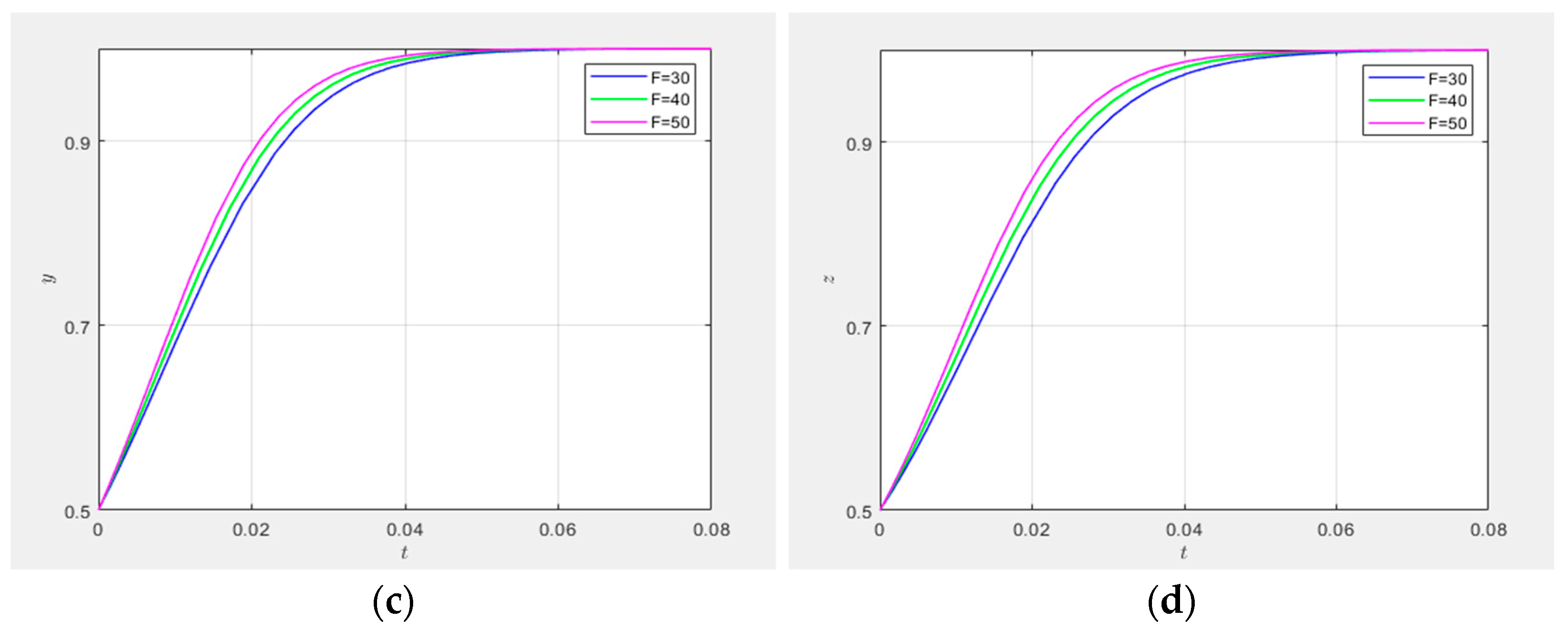

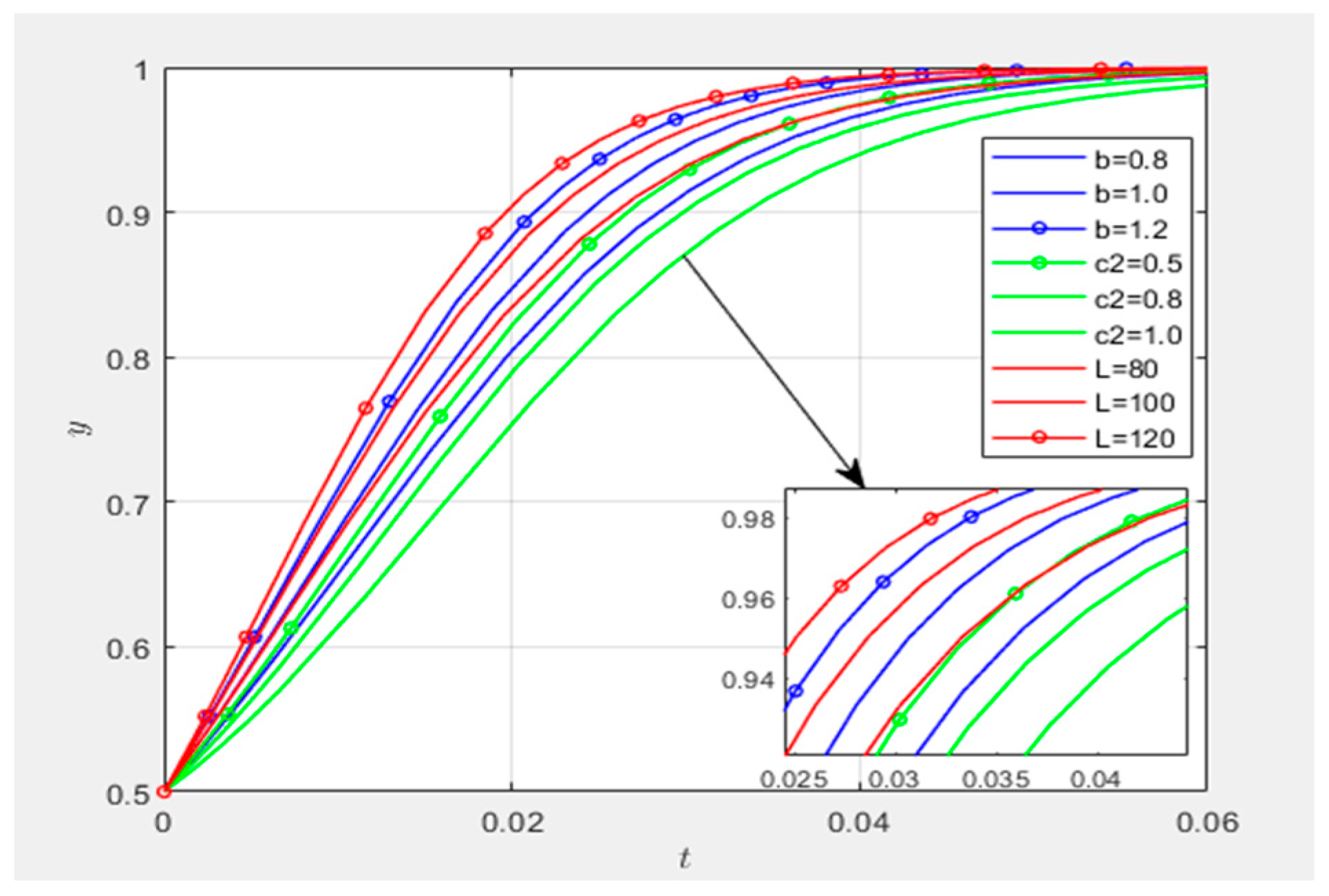

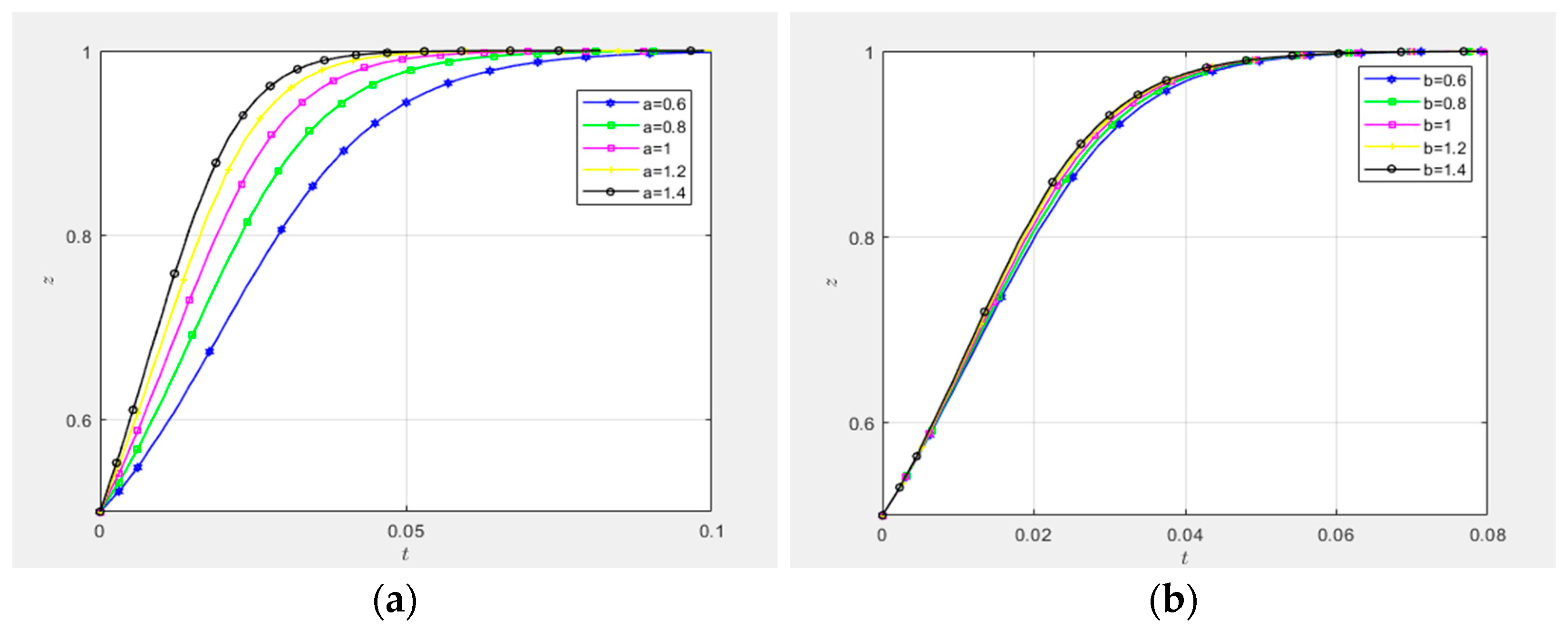

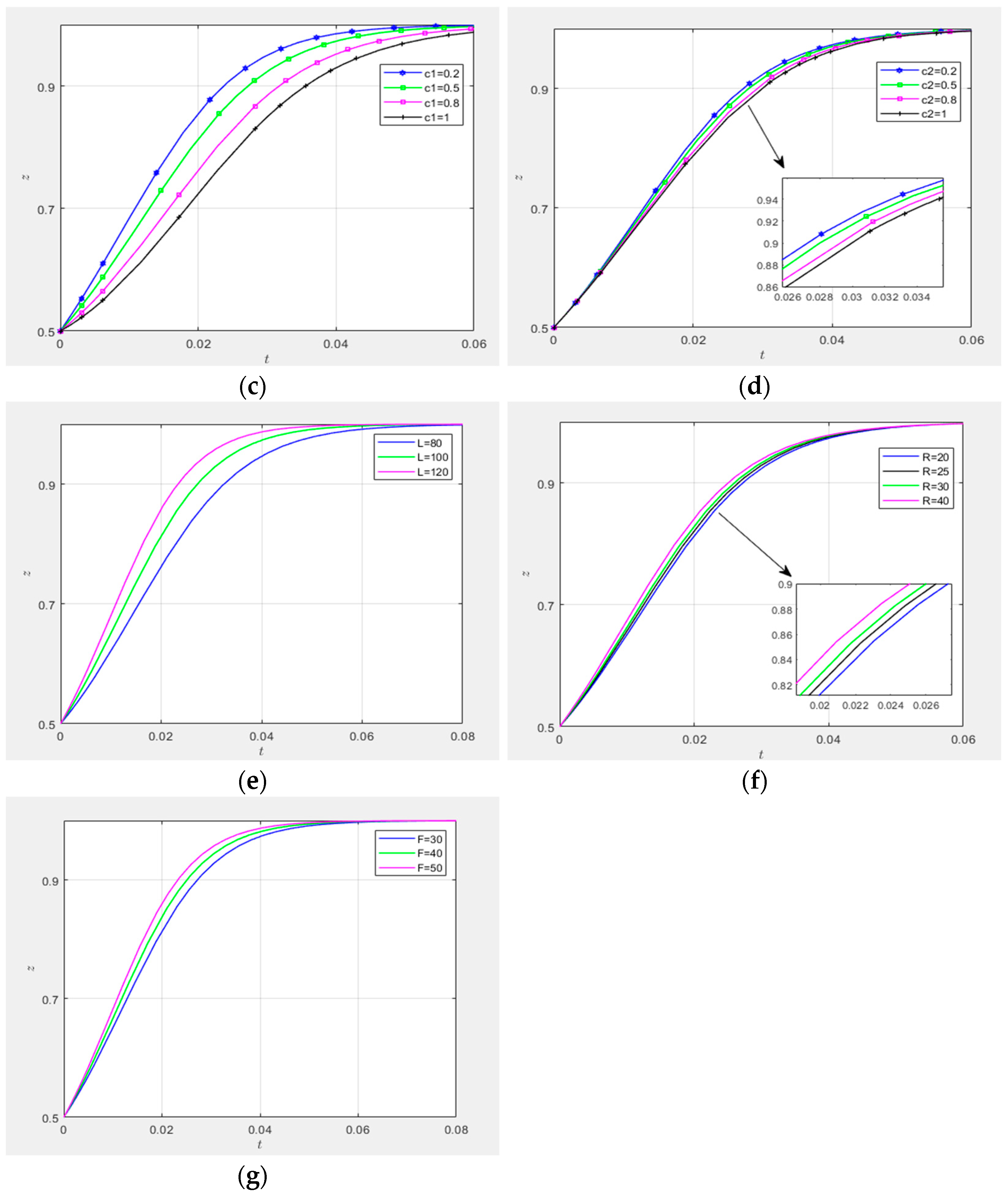

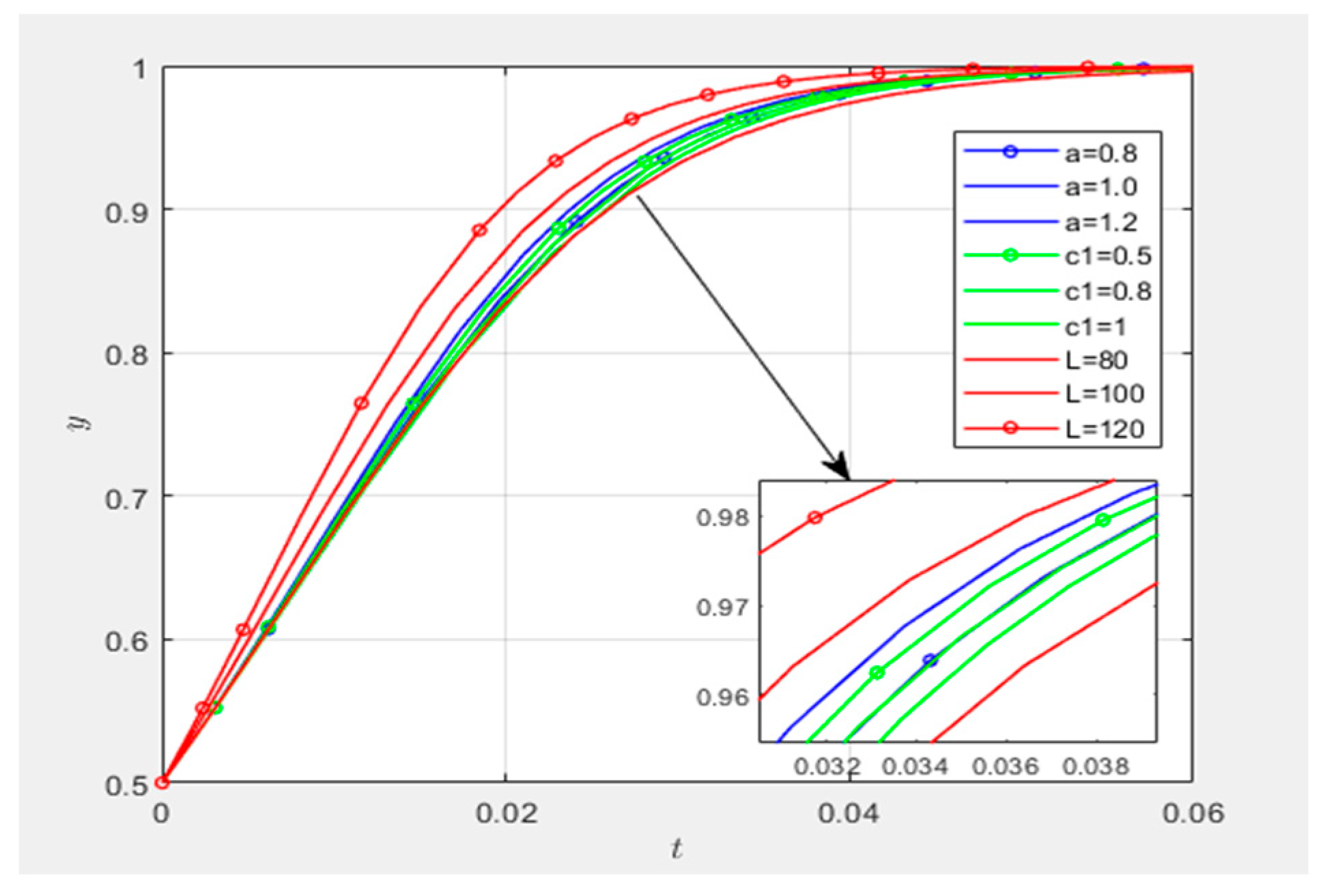

5.3. Comparative Sensitivity Analysis of Key Agents’ Game-Theoretic Parameters

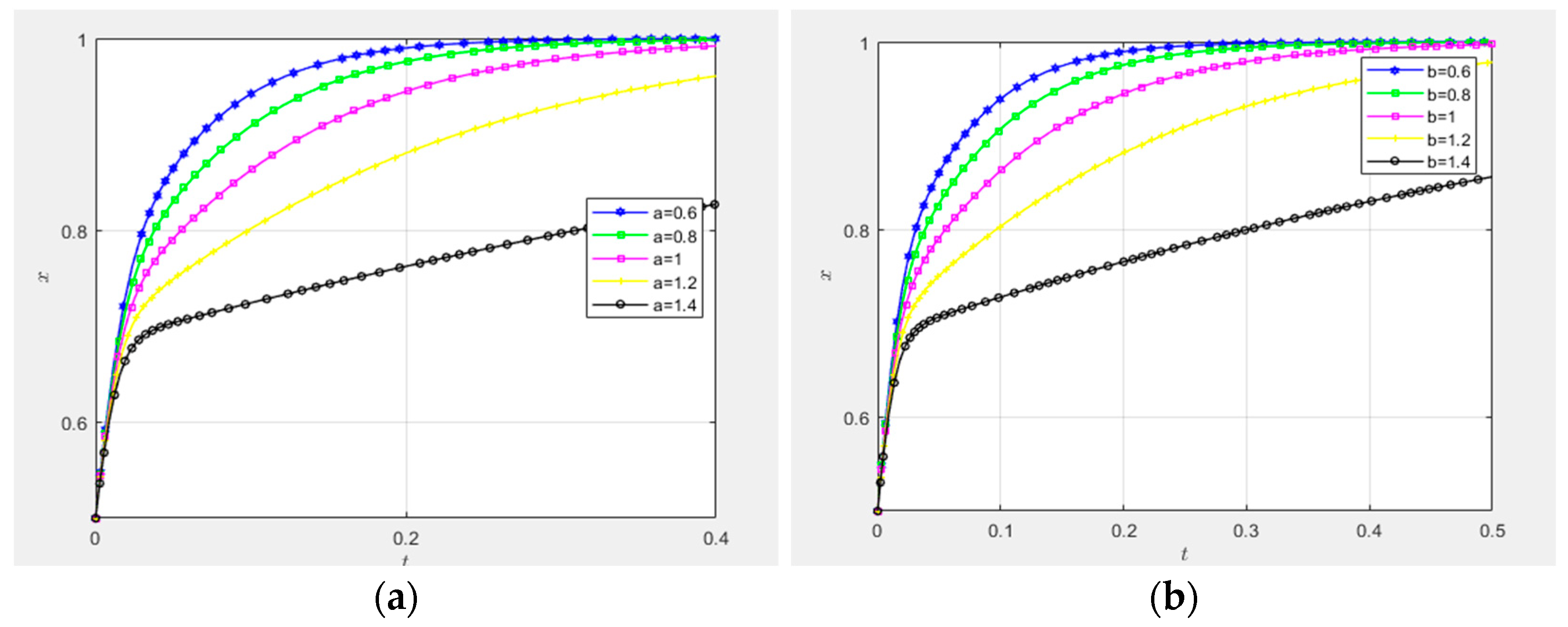

6. Conclusions and Recommendations

6.1. Conclusions

6.2. Research Implications

6.3. Limitations and Future Research Directions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Davies, A.; Gann, D.; Douglas, T. Innovation in Megaprojects: Systems Integration at London Heathrow Terminal 5. Calif. Manag. Rev. 2009, 51, 101–125. [Google Scholar] [CrossRef]

- Cantarelli, C.C.; Genovese, A. Innovation potential of megaprojects: A systematic literature review. Prod. Plan. Control 2023, 34, 1350–1370. [Google Scholar] [CrossRef]

- Jia, F.; Wang, D. Research on innovation decisions in industry-university-research cooperation based on differential games. Technol. Anal. Strateg. Manag. 2023, 1–20. [Google Scholar] [CrossRef]

- Wu, Y.; Gu, X.; Tu, Z.; Zhang, Z. System dynamic analysis on industry-university-research institute synergetic innovation process based on knowledge flow. Scientometrics 2022, 127, 1317–1338. [Google Scholar] [CrossRef]

- Chen, D.; Yan, G. Evolutionary Model and Countermeasures of Industry-University-Research Collaborative Innovation in Local Engineering College from the Perspective of Game Theory. J. Coast. Res. 2020, 104 (Suppl. 1), 951–955. [Google Scholar] [CrossRef]

- Song, Y.; Zhang, J.; Song, Y.; Fan, X.; Zhu, Y.; Zhang, C. Can industry-university-research collaborative innovation efficiency reduce carbon emissions? Technol. Forecast. Soc. Change 2020, 157, 120094. [Google Scholar] [CrossRef]

- Xu, A.; Qiu, K.; Zhu, Y. The measurements and decomposition of innovation inequality: Based on Industry∓University∓Research perspective. J. Bus. Res. 2023, 157, 113556. [Google Scholar] [CrossRef]

- Chen, K.; Zhang, Y.; Zhu, G.; Mu, R. Do research institutes benefit from their network positions in research collaboration networks with industries or/and universities? Technovation 2020, 94–95, 102002. [Google Scholar] [CrossRef]

- Bai, X.-J.; Li, Z.-Y.; Zeng, J. Performance evaluation of China’s innovation during the industry-university-research collaboration process—An analysis basis on the dynamic network slacks-based measurement model. Technol. Soc. 2020, 62, 101310. [Google Scholar] [CrossRef]

- He, Q.; Chen, X.; Wang, G.; Zhu, J.; Yang, D.; Liu, X.; Li, Y. Managing social responsibility for sustainability in megaprojects: An innovation transitions perspective on success. J. Clean. Prod. 2019, 241, 118395. [Google Scholar] [CrossRef]

- Zhu, J.; Chen, J.; Jin, W.; Li, Q. Developing incentive mechanisms for long-term and short-term technological innovation in major engineering projects using principal-agent theory. Eng. Constr. Archit. Manag. 2023, 32, 1947–1969. [Google Scholar] [CrossRef]

- Zhao, N.; Fan, D.; Chen, Y.; Wu, C. Impact of innovation organization network on the synergy of cross-organizational technological innovation: Evidence from megaproject practices in China. J. Civ. Eng. Manag. 2023, 29, 50–66. [Google Scholar] [CrossRef]

- Tang, Q.; Wang, C.; Feng, T. Research on the Group Innovation Information-Sharing Strategy of the Industry–University–Research Innovation Alliance Based on an Evolutionary Game. Mathematics 2023, 11, 4161. [Google Scholar] [CrossRef]

- Chen, X.; Liu, Y.; Locatelli, G.; He, Q.; Zhang, X. Exploring dynamics of stakeholder salience and functional roles in megaproject collaborative innovation system: Insights from the Hong Kong-Zhuhai-Macao Bridge. Eng. Constr. Archit. Manag. 2024; epub ahead of printing. [Google Scholar] [CrossRef]

- Jin, Z.; Zeng, S.; Chen, H.; Shi, J.J. Creating value from diverse knowledge in megaproject innovation ecosystems. Int. J. Proj. Manag. 2022, 40, 646–657. [Google Scholar] [CrossRef]

- Robertson, J.; Caruana, A.; Ferreira, C. Innovation performance: The effect of knowledge-based dynamic capabilities in cross-country innovation ecosystems. Int. Bus. Rev. 2023, 32, 101866. [Google Scholar] [CrossRef]

- Guo, Z.; Wang, Q.; Jing, H.; Gao, Q. How to promote the technological innovation cooperation in mega construction projects at the project level? Eng. Constr. Archit. Manag. 2025. [Google Scholar] [CrossRef]

- Chen, H.; Jin, Z.; Su, Q.; Yue, G. The roles of captains in megaproject innovation ecosystems: The case of the Hong Kong-Zhuhai-Macau Bridge. Eng. Constr. Arch. Manag. 2020, 28, 662–680. [Google Scholar] [CrossRef]

- Wiesweg, N.; Schäpers, P.; Bernhold, T.; Hartmann, T. On the challenges of inter-organisational data in real estate: The role of knowledge sharing. Eng. Constr. Arch. Manag. 2024, 31, 247–263. [Google Scholar] [CrossRef]

- Xue, S.; Chen, S. The acceptance of digital intelligence technology in megaproject organisations from the perspective of innovation diffusion. Technol. Anal. Strateg. Manag. 2023, 1–16. [Google Scholar] [CrossRef]

- He, Z.; Wang, H.; Hu, Y.; Ma, X.; Zhao, H. Dynamic analysis and optimal control of knowledge diffusion model in regional innovation ecosystem under digitalization. Sci. Rep. 2024, 14, 13124. [Google Scholar] [CrossRef]

- Qiu, Y.; Chen, H.; Sheng, Z.; Cheng, S. Governance of institutional complexity in megaproject organizations. Int. J. Proj. Manag. 2019, 37, 425–443. [Google Scholar] [CrossRef]

- Papadonikolaki, D.E.; Morgan, D.B.; Papachristos, D.G. Megaprojects as niches of sociotechnical transitions: The case of digitalization in UK construction. Environ. Innov. Soc. Transition 2023, 48, 100728. [Google Scholar] [CrossRef]

- Liu, H.; Wu, Q. Evolutionary game analysis on technological innovation strategies of marine ranching enterprises considering government’s incentive policies and consumer preferences. Front. Mar. Sci. 2024, 11, 1470846. [Google Scholar] [CrossRef]

- Ali, A.; Ma, L.; Shahzad, M.; Hussain, S. Managing stakeholder pressure for megaproject success and green innovation: The key role of social responsibility. Eng. Manag. J. 2024, 36, 366–377. [Google Scholar] [CrossRef]

- Quint, T. The Lattice of Core (Sub)Matchings in a Two-Sided Matching Market. Math. Oper. Res. 1994, 19, 603–617. [Google Scholar] [CrossRef]

- Yu, D.; Xu, Z. Intuitionistic fuzzy two-sided matching model and its application to personnel-position matching problems. J. Oper. Res. Soc. 2020, 71, 312–321. [Google Scholar] [CrossRef]

- Han, T.; Lu, J.; Zhang, H. Two-sided matching model of service providers and demanders considering peer and synergy effects. Heliyon 2023, 9, e14732. [Google Scholar] [CrossRef]

- Tozlu, B.; Akgunduz, A.; Zeng, Y. Unbiased criteria identification for two-sided matching: An environment-based design approach. Expert Syst. Appl. 2025, 277, 127233. [Google Scholar] [CrossRef]

- Zhang, Z.; Kou, X.; Yu, W.; Gao, Y. Consistency improvement for fuzzy preference relations with self-confidence: An application in two-sided matching decision making. J. Oper. Res. Soc. 2021, 72, 1914–1927. [Google Scholar] [CrossRef]

- Cai, M.; Hu, S.; Wang, Y.; Xiao, J. A Dynamic Social Network Matching Model for Virtual Power Plants and Distributed Energy Resources with Probabilistic Linguistic Information. Sustainability 2022, 14, 14920. [Google Scholar] [CrossRef]

- Liu, L.; Zhang, C.; Wang, Z.; Liu, Y. Green technology investment selection with carbon price and competition: One-to-many matching structure. J. Clean. Prod. 2024, 434, 139893. [Google Scholar] [CrossRef]

- Jia, H. The even split rule in positive assortative matching. J. Math. Econ. 2019, 81, 57–61. [Google Scholar] [CrossRef]

- Pan, S. Exploding offers and unraveling in two-sided matching markets. Int. J. Game Theory 2018, 47, 351–373. [Google Scholar] [CrossRef]

- Aouad, A.; Saban, D. Online Assortment Optimization for Two-Sided Matching Platforms. Manag. Sci. 2023, 69, 2069–2087. [Google Scholar] [CrossRef]

- Yin, S.; Li, B. Matching management of supply and demand of green building technologies based on a novel matching method with intuitionistic fuzzy sets. J. Clean. Prod. 2018, 201, 748–763. [Google Scholar] [CrossRef]

- Jiang, P.; Guo, S.; Du, B.; Guo, J. Two-sided matching decision-making model for complex product system based on life-cycle sustainability assessment. Expert Syst. Appl. 2022, 208, 118184. [Google Scholar] [CrossRef]

- Liang, R.; Wu, C.; Sheng, Z.; Wang, X. Multi-Criterion Two-Sided Matching of Public–Private Partnership Infrastructure Projects: Criteria and Methods. Sustainability 2018, 10, 1178. [Google Scholar] [CrossRef]

- Ivascu, L.; Cirjaliu, B.; Draghici, A. Business Model for the University-industry Collaboration in Open Innovation. Procedia Econ. Financ. 2016, 39, 674–678. [Google Scholar] [CrossRef]

- Zhao, X.; Liu, Y.; Lang, X.; Liu, K.; Yang, X.; Liu, L. Study on the Characteristics and Operational Mechanisms of Industry–University–Research Collaborative Innovation in Megaprojects: The Case from China. Systems 2024, 12, 553. [Google Scholar] [CrossRef]

- Xiao, T.; Wang, H.; Chen, J. Evaluation of operational efficiency of technology transfer ecosystems from the perspective of supply and demand matching: An empirical study in China. J. Technol. Transf. 2025. [Google Scholar] [CrossRef]

- Capaldo, A.; Lavie, D.; Petruzzelli, A.M. Knowledge Maturity and the Scientific Value of Innovations. J. Manag. 2017, 43, 503–533. [Google Scholar] [CrossRef]

- McCabe, A.; Parker, R.; Osegowitsch, T.; Cox, S. Overcoming barriers to knowledge co-production in academic–practitioner research collaboration. Eur. Manag. J. 2023, 41, 212–222. [Google Scholar] [CrossRef]

- Zhang, S.-J.; Lu, X.-D.; Wang, S.-P.; Guo, W. Supply-Demand Matching in Non-Cooperative Social Networks. IEEE Access 2020, 8, 162458–162466. [Google Scholar] [CrossRef]

- Liu, Y.; Li, K.W. A two-sided matching decision method for supply and demand of technological knowledge. J. Knowl. Manag. 2017, 21, 592–606. [Google Scholar] [CrossRef]

- Luo, T.; Qu, J.; Cheng, S. Knowledge Network Embeddedness and Innovation Resilience. IEEE Trans. Eng. Manag. 2024, 71, 11454–11462. [Google Scholar] [CrossRef]

- Li, J.; Peng, D.; Zheng, L.; Yuan, L.; Li, R. Cooperative R&D networks embeddedness and innovation resilience: The moderating role of environmental turbulence. Eur. J. Innov. Manag. 2024; epub ahead of printing. [Google Scholar] [CrossRef]

- Han, J.; Li, B.; Liang, H.; Lai, K.K. A novel two-sided matching decision method for technological knowledge supplier and demander considering the network collaboration effect. Soft Comput. 2018, 22, 5439–5451. [Google Scholar] [CrossRef]

- Zhou, Q.; Deng, X. A configuration analysis on knowledge transfer between projects: From horizontal and vertical perspectives. Eng. Constr. Archit. Manag. 2024, 32, 3349–3374. [Google Scholar] [CrossRef]

- Dulipovici, A.; Baskerville, R. An eduction model of disciplinary emergence: The ripples of knowledge management. Knowl. Manag. Res. Pract. 2015, 13, 115–133. [Google Scholar] [CrossRef]

- Sergeeva, N.; Zanello, C. Championing and promoting innovation in UK megaprojects. Int. J. Proj. Manag. 2018, 36, 1068–1081. [Google Scholar] [CrossRef]

- Liu, N.; Zhou, G. Analysis of Collaborative Innovation Behavior of Megaproject Participants Under The Reward and Punishment Mechanism. Int. J. Strateg. Prop. Manag. 2022, 26, 241–257. [Google Scholar] [CrossRef]

- Qian, Y.; Yu, X.; Chen, X.; Song, M. Research on stability of major engineering technology innovation consortia based on evolutionary game theory. Comput. Ind. Eng. 2023, 186, 109734. [Google Scholar] [CrossRef]

- Zhong, Q.; Cui, H.; Yang, M.; Ling, C. Research on Stochastic Evolution Game of Green Technology Innovation Alliance of Government, Industry, University, and Research with Fuzzy Income. Sustainability 2025, 17, 2294. [Google Scholar] [CrossRef]

- Chen, X.; He, Q.; Zhang, X.; Cao, T.; Liu, Y. What Motivates Stakeholders to Engage in Collaborative Innovation in the Infrastructure Megaprojects? J. Civ. Eng. Manag. 2021, 27, 579–594. [Google Scholar] [CrossRef]

- Maynard Smith, J. Evolution and the Theory of Games, 1st ed.; Cambridge University Press: Cambridge, UK, 1982. [Google Scholar]

- Hofbauer, J.; Sigmund, K. Evolutionary Games and Population Dynamics, 1st ed.; Cambridge University Press: Cambridge, UK, 1998. [Google Scholar]

- Holmstrom, B. Moral Hazard and Observability. Bell J. Econ. 1979, 10, 74. [Google Scholar] [CrossRef]

| Parameter | Parameter Description |

|---|---|

| denotes governance entities’ payoff under a high-involvement strategy, with payoff normalized to 0 under a low involvement strategy (where > ). | |

| represents governance entities′ administrative costs under a high-involvement strategy, with administrative costs normalized to 0 under a low-involvement strategy (where > ). | |

| When both collaborative innovation platforms and demand-side entities adopt active matching strategies, high congruence between research demand and supply enables successful technological iteration/leapfrogging, generating social benefit | |

| The negative societal externality arising when both the collaborative innovation platform and demand-side entities adopt passive supply–demand matching strategies. | |

| signifies demand-side entities’ matching effort coefficient, where higher values indicate more frequent collaborative/sharing behaviors during matching processes (baseline = 1). | |

| represents collaborative innovation platforms’ matching effort coefficient, where higher values correspond to intensified coordination/sharing engagements (baseline = 1). | |

| Asymmetric active/passive matching exposes unilateral active participants to innovation risks from low congruence between research demand and supply, with denoting demand-side entities’ risk coefficient. | |

| Asymmetric active/passive matching exposes unilateral active participants to innovation risks from low congruence between research demand and supply, with denoting collaborative innovation platform’ risk coefficient. | |

| Under the high-involvement strategy, governance entities provide demand-side entities adopting active matching with subsidy to enhance technological innovation supply–demand alignment in mega-railway projects. | |

| Under the high-involvement strategy, governance entities provide subsidies to collaborative innovation platforms employing active matching strategies, thereby enhancing technological innovation supply–demand coordination in major railway engineering projects. | |

| Under a high-involvement strategy, governance entities impose a penalty on passive matching actors, with the constraint ensuring incentive compatibility. | |

| denotes demand-side entities’ baseline payoff. | |

| represents demand-side entities’ baseline participation costs in research alignment activities. | |

| When both collaborative innovation platforms and demand-side entities adopt active matching strategies, demand-side entities obtain additional economic benefits because of technological problem resolution. | |

| During technological innovation supply–demand matching processes, unilateral active matching by demand-side entities incurs extra technological innovation risk costs quantified as |

| Collaborative Innovation Platforms | |||||

|---|---|---|---|---|---|

| Active Matching | Passive Matching | ||||

| Demand-Side Entities | |||||

| Active | Passive | Active | Passive | ||

| Governance entities | high | (high, active, active) | (high, active, passive) | (high, passive, active) | (high, passive, passive) |

| low | (low, active, active) | (low, active, passive) | (low, passive, active) | (low, passive, passive) | |

| Strategy | Governance Entities | Collaborative Innovation Platforms | Demand-Side Entities |

|---|---|---|---|

| 0 | |||

| 0 | |||

| Equilibrium Points | Eigenvalues | Sign of the Real Part | ||

|---|---|---|---|---|

| Equilibrium Points | Stability Conditions |

|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, X.; Liu, Y.; Lang, X. Study on the Technological Innovation Supply–Demand Matching Mechanism for Major Railway Projects Based on a Tripartite Evolutionary Game. Systems 2025, 13, 434. https://doi.org/10.3390/systems13060434

Zhao X, Liu Y, Lang X. Study on the Technological Innovation Supply–Demand Matching Mechanism for Major Railway Projects Based on a Tripartite Evolutionary Game. Systems. 2025; 13(6):434. https://doi.org/10.3390/systems13060434

Chicago/Turabian StyleZhao, Xi, Yuming Liu, and Xianyi Lang. 2025. "Study on the Technological Innovation Supply–Demand Matching Mechanism for Major Railway Projects Based on a Tripartite Evolutionary Game" Systems 13, no. 6: 434. https://doi.org/10.3390/systems13060434

APA StyleZhao, X., Liu, Y., & Lang, X. (2025). Study on the Technological Innovation Supply–Demand Matching Mechanism for Major Railway Projects Based on a Tripartite Evolutionary Game. Systems, 13(6), 434. https://doi.org/10.3390/systems13060434