Abstract

As pivotal actors in market economies, corporations are strategically positioned to enhance environmental, social, and governance (ESG) performance to advance sustainable development. The digital technology revolution has stimulated scholarly inquiry into the influence of digital technology innovation on corporate ESG performance. Nevertheless, critical questions remain unresolved regarding the multidimensional measurement of digital technology innovation quality (DTIQ) and its mechanism paths empowering ESG enhancement. Using panel data for China’s listed companies from 2012 to 2022, this study quantifies DTIQ through its depth (technology specialization) and breadth (technology diversification), empirically investigating their impacts on ESG performance and focusing on the mediating effects of digital transformation and digital technology diffusion. Empirical results reveal that both the breadth and depth of DTIQ have significantly positive impacts on ESG performance. Mechanisms analysis identifies two ways to reinforce their positive impacts: advancing corporate digital transformation and facilitating digital technology diffusion. Discussions on the heterogeneity of the effects demonstrate that in regions with strong intellectual property protection, Eastern regions, high-tech and heavily polluting industries, and among non-SOEs and large firms, the impact of DTIQ on corporate ESG performance is more pronounced. This research expands the literature on the relationship between digital technology innovation and corporate ESG performance.

1. Introduction

As key subjects of market economic activity, corporations are increasingly expected to fulfill sustainability by integrating financial activities and environmental governance simultaneously [1,2], especially due to the alarming volume of greenhouse gas emissions that result in the global climate crisis and pose a critical threat to the sustainability of our planet [3,4]. Corporate environmental, social, and governance (ESG) performance is considered a key indicator for contributing to sustainability goals, emphasizing the coordination of environmental, social, and governance performance rather than only focusing on financial profitability [5]. The benefits of corporate ESG performance have been widely recognized, such as promoting human capital investment efficiency [6], improving corporate financial performance [7], mitigating stock pledge risk [8], and relieving financing constraints [9]. However, the challenge lies in how to promote corporate ESG performance through effective strategies [5,10,11]. In the digital growth frontier, breakthroughs in digital technology provide a new opportunity for promoting corporate ESG performance [4,12]. Therefore, digital technology innovation, whether and how to empower corporate ESG performance, is an urgent issue to be explored, as it is of great significance to corporate long-term development and to increase their contributions to sustainability.

The rapid development of digital technology innovation, such as artificial intelligence, blockchain, cloud computing, and big data, is reshaping the business landscape and emerging as a key driver of economic growth and non-financial performance [5,10,13]. There is a close relationship between digital technology and corporate ESG performance, which has become a focal point in corporate governance literature [4,14], but the impact of digital technology innovation on corporate ESG performance has not yet formed a unified conclusion [3]. One stream of literature considers that digital technology innovation can bring new products, improvements in production processes, and changes in business models, thereby enhancing productivity, reducing resource waste, improving governance efficiency, and strengthening ESG performance [2,15]. In contrast, some researchers have demonstrated that digital technology innovation has potential negative impacts, such as technical costs, privacy concerns, security risks, information issues, and digital divide, which may actually hurt ESG performance [3]. Especially in China, there are still significant gaps in some critical areas of digital technology innovation compared to western developed countries [16], leading some Chinese companies to depend on patent quantity to demonstrate superficial technology innovation results rather than truly generating social and environmental benefits [17,18], and even causing harms such as data leakage, digital exploitation, and privacy invasion [19,20]. Therefore, examining the impact of digital technology innovation quality (DTIQ) on corporate ESG performance is essential for eliminating the potential negative impacts of digital technologies and improving social well-being.

DTIQ is different from the digital technology innovation in prior research, which is generally evaluated by the frequencies of patent citations [21], or the number of digital patent applications [18], or by constructing a dictionary of relevant terms and counting their occurrences in corporate financial reports as a proxy [22]. Existing studies remain constrained by superficial metrics and fail to adequately assess either the depth of digital technology implementation or true corporate innovation quality. According to previous research [23], digital technology innovation depth (DTID) and digital technology innovation breadth (DTIB) are the two dimensions of the digital technology innovation quality (DTIQ). Wherein, DTID refers to the specialization intensity of a company’s digital R&D activities [24], while DTIB indicates the extent of a company’s engagement across diverse domains of digital research and development [25]. On the one hand, based on a competitive perspective, DTID can improve corporate ESG performance through building core competitiveness, forming a green competitive barrier, constructing technical compliance standards, and reconstructing the market valuation logic. On the other hand, based on the collaborative perspective, DTIB can be a core driver for promoting corporate ESG performance through resource integration, efficiency improvement, and governance optimization. Although the significant impact of DTIQ (especially its depth and breadth) on the corporate ESG performance has been attended by academia and preliminary explored, academic discussions are limited due to its inconsistent definition [23], and also, current measurements of DITD and DTIB face inherent methodological constraints: the lexical analysis approaches operationalized through term-frequency counts in corporate financial reports [22], which underpin dictionary construction and subsequent computational metric, are fundamentally constrained by three factors: (1) subjective lexicon design, (2) technical limitations of textual mining algorithms, and (3) strategic disclosure biases in corporate communications. Therefore, using intellectual property patent data related to the core industries of the digital economy, this paper constructs a dual-dimensional framework to quantify DTIQ through its breadth (technology diversification) and depth (technology specialization), and empirically investigates their impacts on ESG outcomes, providing theoretical and empirical support for exploring the mechanisms of the impact of DTIQ on corporate ESG performance.

In academia, the question of mechanism paths has received high attention in the literature on the relationships of digital technology innovation and corporate ESG performance, because this helps to reveal the essence of phenomena by dismantling the causal chain and refining the mechanism of action, thereby providing precise intervention targets for management practices [2,5,14]. They demonstrated that digital technology innovation can promote corporate ESG performance through raising the attention of analysts, improving firm performance [5], enhancing internal control quality, increasing human capital [14], enhancing corporate green innovation capabilities, and enhancing corporate governance structures [2]. These research findings not only provide theoretical contributions to improving the theoretical model of how digital technology innovation empowers corporate ESG performance, but also provide important practical insights for companies to take intervention measures. Nevertheless, critical questions remain unresolved regarding empowerment mechanisms, such as corporate digital transformation and digital technology diffusion, which have not yet been fully analyzed. Due to the characteristics of digital technology innovation involving multiple subjects and multiple propagation paths, these two pathways can reveal empowerment mechanisms from the reconstruction process and diffusion process, respectively. Therefore, drawing on stakeholder theory and technology diffusion theory, this study further explores the “reconstruction effect” of digital transformation and “diffusion effect” of digital technology diffusion, elucidating how DTIQ influences ESG performance. In addition, there are significant differences in the scale, industry attributes, and regional environment of different enterprises, which are likely to lead to the heterogeneity of the impact of digital technological innovation on the ESG performance of enterprises [2]. This study further systematically analyzes the differentiated impact of digital technological innovation in different types of enterprises, thus improving the generalizability and guiding significance of the research results.

In view of this, based on the data of China’s A-share listed companies from 2012 to 2022, this study constructs a dual-dimensional framework to quantify DTIQ through its breadth and depth, empirically investigating their impacts on ESG outcomes and focusing on the mediating roles of digital transformation and digital technology diffusion. Compared with existing academic research, the contributions of this study are as follows. First, using intellectual property patent data related to the core industries of the digital economy, this paper introduces a dual-dimensional framework to quantify DTIQ and develop its quantification methods, advancing the theoretical understanding of DTIQ by distinguishing between its breadth (technology diversification) and depth (technology specialization). Second, we empirically test the different impacts of DTID and DTIB on ESG performance. It not only compensates for the traditional measurement of digital technology innovation level, which is singly evaluated by the frequencies of patent citations, or the number of digital patent applications, but also expands the literature by explaining how these dimensions influence corporate ESG performance, as well as provides more detailed and comprehensive empirical evidence to enhance understanding of how DTIQ influences corporate ESG performance. Again, adopting a dual perspective of reconstruction and diffusion, we uncover the two ways to reinforce the empowerment mechanism between the digital innovation quality and ESG performance: advancing corporate digital transformation and facilitating digital technology diffusion. This dual-effect framework not only provides theoretical contributions to improving the theoretical model of how digital technology innovation empowers corporate ESG performance, but also provides important practical insights for companies to take intervention measures.

2. Literature Review and Hypotheses

2.1. Digital Technology Innovation Quality and ESG Performance

Digital technology innovation refers to transforming or developing products, services, business models, and a company’s innovation process by integrating new combinations of digital elements and physical components [26], it can enhance managers’ abilities to allocate resources more efficiently and offer rigorous external supervision, thus enhancing company ESG performance, which has become a focal point in corporate governance literature [4,14]. However, some companies depend on patent quantity to demonstrate their superficial technology innovation level, increasing risk uncertainty, bringing challenges in fulfilling their social responsibilities, leading to a decline in ESG performance [3,4]. Therefore, based on the quality perspective, this paper explores the impact of digital technology innovation quality (DTIQ) on corporate ESG performance, aiming to eliminate the potential negative impacts of digital technologies. According to previous research [23], we categorize DTID into digital technology innovation depth (DTID) and digital technology innovation breadth (DTIB) and examine their impacts on corporate ESG performance.

2.1.1. The Impact of DTID on Corporate ESG Performance

Drawing on the connotation of the knowledge depth [24,25,27], digital technology innovation depth (DTID) refers to the specialization intensity of a company’s digital R&D activities, focusing on whether a company is centered on a specific dominant digital technology area. In the transition economy context, the market is shifting from traditional price and scale competition to competition for technological barriers, ecological construction, and future scenarios [28]. Based on the resource-based view, DTID centering on a specific dominant digital technology area can form patent barriers, positively affecting corporate ESG performance by improving enterprise competitiveness and enhancing production and business performance [29]. This is because enterprise competitiveness and production and operation performance are the ability of enterprises as a competitive subject to survive and develop in the competitive market environment. Higher enterprise competitiveness can enhance the firm’s value and other economic benefits [3]. In addition, DTID can also form a green competitive barrier, effectively break through the physical limits of resource conversion efficiency, reshape the energy utilization paradigm, and promote corporate environmental performance.

Furthermore, building deep technical solutions in specific fields can enable enterprises to build domain knowledge bases, rewrite technical compliance standards, and upgrade enterprises from ESG participants to rule makers. Specifically, this process utilizes its deep technology in a certain professional field to effectively improve ESG execution efficiency, promote the transformation of technological achievements into ESG performance, and further define its technical framework as the industry ESG standard, thereby reshaping the definition of ESG value [30]. Besides, DTID is the new currency for corporate competition. Shallow digital innovation can only deal with basic compliance, while deep innovation can reconstruct the valuation logic of the capital market, obtaining excess ESG premiums. Therefore, DTID can systematically reconstruct the underlying logic of the ESG value chain through technical expertise and has risen from a differentiation tool to a core strategy for survival and dominance. In short, based on a competitive perspective, DTID can improve corporate ESG performance through building core competitiveness, forming a green competitive barrier, constructing technical compliance standards, and reconstructing the market valuation logic.

Based on the above logic, we propose the following hypothesis:

Hypothesis 1:

Digital technology innovation depth exerts a significant positive impact on corporate ESG performance.

2.1.2. The Impact of DTIB on Corporate ESG Performance

Drawing on the connotation of the knowledge depth [24,25,27], digital technology innovation breadth (DTIB) refers to the extent of a company’s engagement across diverse domains of digital R&D activities. First, DTIB, with multiple fields of digital technology innovation, is conducive to helping enterprises integrate internal and external resources through combining and complementing different digital technologies [31], forming a heterogeneous resource pool, and breaking through the limitations of a single technology. From the perspective of resource integration, DTIB can reduce waste and promote the circular economy by integrating resource data, such as energy and raw materials, in terms of environmental performance; integrate the demands of multiple stakeholders such as communities and employees in terms of social performance; and improve compliance efficiency by integrating internal and external governance rules in terms of corporate governance.

Second, the current economic market environment is unpredictable. The diverse technology combination is conducive to improving the flexibility and adaptability of corporate governance through rapid process reconstruction and intelligent decision-making in a complex and dynamic environment [32], so as to quickly respond to market changes, flexibly adjust governance strategies, and improve governance efficiency, thereby improving corporate ESG performance. In addition, DTIB plays a crucial role in mitigating technology dependence and the associated risks of technology lock-in, and helps avoid the potential paralysis of the governance system that could occur due to the failure of a single technology [33]. From the vantage point of stakeholder collaboration, DTIB offers significant advantages. Through the integration of various digital technologies, it promotes corporate information transparency. This enhanced transparency, in turn, strengthens stakeholder trust. Moreover, DTIB enables the reconstruction of corporate governance models via decentralized collaboration, leading to the formation of a multi-party governance ecosystem. It can further combine digital platforms to improve the efficiency of stakeholder collaborative decision-making, thereby improving corporate ESG performance. Finally, from a synergistic perspective, DTIB has the potential to magnify ESG performance through the synergy among technology, organization, and environment. In terms of technology, the synergy of diversified digital technologies expedites data flow and facilitates cross-departmental alignment of ESG goals [34]. Organizationally, it breaks down departmental silos and integrates environmental, social responsibility, and governance objectives. Environmentally, it fosters the alignment of policies with corporate practices, reducing institutional friction. Although some studies argue that technological diversification may lower a company’s financial performance due to high technology costs [32], DTIB can form a multi-dimensional synergistic effect through the interaction of resource integration, efficiency improvement, and governance optimization, and ultimately achieve a systematic improvement in ESG performance.

Thus, we propose the hypothesis as follows:

Hypothesis 2:

Digital technology innovation breadth exerts a significant positive impact on corporate ESG performance.

2.2. Mediating Effect of Corporate Digital Transformation

Digital transformation is a process that reflects an organization’s integration and utilization of digital technologies to fundamentally reshape its operations, business models, and value creation mechanisms [35,36]. The increasing scholarly attention on the pivotal role of digital transformation in economic progress, and most research has predominantly focused on the effects of digital transformation on digital technology innovation [17,37,38]. They reveal that digital transformation improves the core competitiveness, alleviates financing constraints, enhances internal control quality, and increases R&D investment, thereby influencing corporate digital technology innovation, and also demonstrate that enterprise digital transformation often fulfills the corporate social responsibility obligations of an organization by enhancing innovation, cutting costs, increasing information transparency, and increasing resource utilization efficiency, thereby enhancing the ESG performance of the enterprise [39,40,41].

Although most research focuses on the effects of digital transformation on digital technology innovation, with the in-depth study of the process of transforming digital technology innovation into corporate ESG performance, it can be found that digital technology innovation not only includes the realization of an unconstrained innovation process, but also requires the integration of digital technology innovation into all aspects of corporate business operations through the process of transforming digital technology innovation results [42]. This transformation includes fundamental reconstruction of corporate technology, organizational structure, and stakeholder relationships, production process, operation mode, business model, and product value driven by digital technology innovation application, technological penetration, resource reset pressure, and risk of digital divide, that is, organizations are required to use digital transformation to drive digital technology innovation into corporate performance [43]. In other words, application-based digital technology innovation will significantly promote digital transformation initiatives within enterprises to fully realize the potential of digital technology innovation in promoting enterprise performance [44]. This mechanism reveals that digital transformation is not only a process of technology application, but also a key leap for enterprises to transform digital technology innovation quality into sustainable value through systematic reconstruction.

Hence, the following hypothesis is proposed:

Hypothesis 3:

The quality of digital technology innovation enhances corporate ESG performance by accelerating digital transformation.

2.3. Mediating Effect of Digital Technology Diffusion

Digital technology diffusion refers to the process by which innovative digital technologies propagate across departments, organizations, geographical regions, and industry sectors, leading to their broader adoption and implementation [45,46]. Although digital technology has received wide attention from various countries and industries, it has to face the diffusion process, which has raised scholars’ attention [47]. Digital technology can effectively realize its contribution to economic growth after it has been fully diffused and deeply embedded in various economic and social fields. Many scholars have empirically demonstrated that technology diffusion has a positive effect on firm performance [48,49]. This is because implementing innovative digital technologies often requires substantial upfront investments, which can strain a company’s financial performance and short-term profitability. The diffusion of digital technology can facilitate knowledge sharing and collaboration through large-scale application of innovative digital technologies, thereby compensating innovation costs [50]. In addition, the diffusion can generate significant spillover effects [51], accelerating the widespread dissemination and adoption of digital technologies [47], thereby substantially enhancing enterprise productivity and competitive advantage, ultimately promoting firm performance.

The above principle of digital technology diffusion through large-scale application and knowledge spillover is also applicable in the research on improving corporate ESG performance through digital technology innovation quality. First, the higher quality of digital technology innovation, the more likely the technology will attract the attention of other organizations, resulting in a strong market effect and more easily diffuse in different industries [51], which has a greater compensating innovation cost. Furthermore, digital technology innovation quality leverages network effects to accelerate the diffusion of digital technology and optimize ecosystem development [52]. Ultimately, advancing the diffusion and application of digital technology not only enhances a company’s ESG performance but also drives the sustainable transformation of the broader economic system. Therefore, the mechanism of digital technology diffusion between digital technology innovation quality and corporate ESG performance is reflected in the large-scale penetration of digital technology from the R&D end to the application end and transforms the innovation potential of digital technology into ESG performance improvement through large-scale application, knowledge spillover, and ecological reconstruction.

Therefore, this study proposes the following hypothesis:

Hypothesis 4:

Digital technology innovation quality enhances corporate ESG performance by accelerating the diffusion of digital technologies.

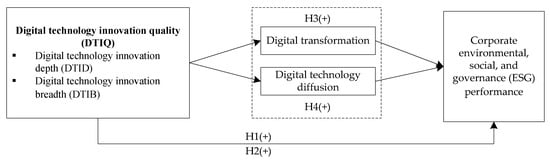

To sum up, the conceptual framework of this study is presented in Figure 1.

Figure 1.

Conceptual framework.

3. Data and Methodology

3.1. Sample Selection

We select A-share listed companies from 2012 to 2022 as the initial research sample. Data information is extracted from the China Digital Economy Innovation Development (CDEI) database, the China Stock Market & Accounting Research (CSMAR) database, the Wind Information database, and the Hua Zheng ESG rating index. The initial samples are refined as follows: (1) excluding the companies in the financial industry, (2) removing the sample of ST, *ST, and PT-type companies, and (3) eliminating observations with missing values. Finally, a panel dataset of 4627 listed companies from 2012 to 2022 is created. This process resulted in a final sample of 32,031 observations. To mitigate the impact of outliers, a 1% tail reduction treatment is performed for all continuous variables.

3.2. Variable Measurement

3.2.1. Dependent Variable

Corporate ESG Performance: In academic research, two predominant approaches are employed to quantify ESG performance. The first approach involves the construction of a multi-dimensional indicator system, and the second relies on ratings or scores provided by third-party rating agencies. The self-constructed indicator systems, though valuable, are inherently fraught with subjectivity. Different researchers may select different indicators, assign different weights, and adopt different measurement methods according to their own research perspectives and goals. In addition, there is a lack of an authoritative and widely recognized reference framework that is fully consistent with China’s institutional context. Given these limitations, utilizing rating data from professional agencies has emerged as a reliable alternative for empirical research. Therefore, according to previous research [3], the ESG index adopted in this paper was developed by Shanghai Huazheng Index Information Service Co., Ltd., Shanghai, China. It is based on the public data of Chinese listed companies and has constructed a three-level indicator evaluation system with Chinese characteristics, centered on environmental responsibility, social responsibility, and governance capacity. It is used to assess the sustainability performance of listed companies in the three dimensions of environment, society and corporate governance. The Hua Zheng ESG rating index is used as the core indicator of corporate ESG performance. Specifically, the Hua Zheng ESG rating, ranging from C to AAA, is assigned values from 1 to 9, respectively. This approach enables a quantitative analysis of firms’ ESG performance and enhances the accuracy of assessing the impact of digital technological innovation on ESG outcomes. Additionally, in a later section, ESG rating data from Bloomberg Consulting is used to replace the dependent variable for robustness testing.

3.2.2. Independent Variable

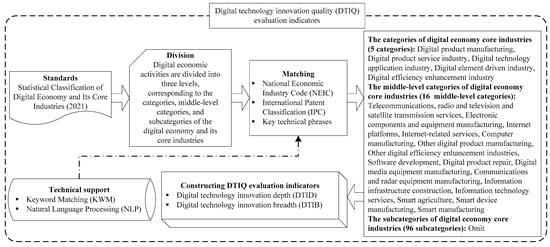

Digital Technology Innovation Quality (DTIQ): Previous scholars employ citation frequency of digital patents as a proxy for DTIQ [53]. However, this methodology exhibits inherent limitations due to its reliance on unidimensional evaluation parameters. To address this limitation, referring to previous research [23], we construct a dual-dimensional framework to quantify DTIQ through its breadth (technology diversification) and depth (technology specialization). According to the digital economy industry catalog defined in the Statistical Classification of Digital Economy and Its Core Industries (2021) issued by the National Bureau of Statistics, the core digital economy industries are mainly divided into three levels: the 5 categories of digital economy core industries are the strategic field level, which indicates the macro direction of the digital strategic development of enterprises; the 32 middle-level categories of digital economy core industries are the core field level, which focuses on specific digital professional fields, each of which represents a set of digital technologies; and the 156 subcategories of digital economy core industries are the application field level, which emphasizes the specific application scenarios of enterprises in economic activities. With reference to the national economy industry codes and the IPC numbers, keyword matching and natural language processing techniques are then used to filter intellectual property patent data related to the core industries of the digital economy [5,54]. This study ultimately screened digital industry patents covering 5 categories, 16 middle-level categories, and 96 subcategories of digital economy core industries. The construction process of the DTIQ evaluation indicators is visually delineated in Figure 2.

Figure 2.

The construction process of the DTIQ indicator system.

Digital Technology Innovation Depth (DTID): Unlike the research methods of Mu [22], they consider innovation depth as the extent to which the full potential of a technology can be used and assess the innovation depth by calculating the ratio of the total number of digital technology keywords to the number of digital technology types in corporate financial reports, DTID in this study is considered as the specialization intensity of a company’s digital R&D activities [24], focusing on whether a company is centered on a specific dominant digital technology area. Referring to previous research [55], we developed a weighting system that calculates the proportion of companies operating within their respective dominant digital technology fields, compared to the total patent pool within the core sectors of the digital economy. These weights are then used to formulate a measure for the depth of digital technology innovation.

In Equations (1) and (2), represents the weight coefficient of enterprise if in core industry j of the digital economy, and is the number of patents granted to enterprise i within category j. denotes the average weight coefficient for enterprise i across all enterprises in category j. This formulation systematically quantifies the relative innovation contributions of enterprises within specific digital economy sectors. By incorporating a weight coefficient, this study achieves a more precise evaluation of patent depth, thus accurately reflecting enterprises’ technological expertise and innovation capacity in these core industries.

Building on this framework, this study identifies core industry fields where the proportion of patents exceeds 10% as the key digital technology domains of enterprises. To quantify this, the natural logarithm of the calculated results is used as a measurement metric. A higher DTID value indicates a greater specialization of an enterprise in the digital technology field, reflecting a more pronounced depth of innovation. Additionally, to ensure the robustness of the findings, a supplementary analysis is conducted by excluding the bottom 10% of patents in the core industry field. This serves as an alternative measure of DTID in subsequent sections.

Digital Technology Innovation Breadth (DTIB): Different from mu’s method [22], they primarily employ textual analysis to assess the digital technology innovation breadth by counting the occurrences of the number of digital technology types in corporate financial reports. DTIB in this study indicates the extent of a company’s engagement across diverse domains of digital research and development [25]. The patents analyzed in this study, which pertain to the core industries of the digital economy, span five major categories, 16 middle-level categories, and 96 subcategories. Based on this framework, this study adopts the methods proposed by predecessors to measure the DTIB of enterprises [25]. This metric is defined by the number of medium categories within the digital economy’s core industries covered by the firm’s granted patents. To standardize the measurement, the natural logarithm of the calculated result is applied. A higher DTIB value indicates a broader scope of digital technology expertise within the enterprise. Furthermore, robustness tests are conducted in subsequent analyses using the number of broad categories of core industries in the digital economy covered by the firm’s authorized patents as an alternative proxy for DTIB.

3.2.3. Intermediate Variables

Digital Transformation (DT): Some empirical studies have employed text mining methods to quantify the frequency of keywords related to digital transformation in corporate annual reports as an indicator for evaluating digital transformation [56]. However, it is important to note that the text content in corporate annual reports may be strategically manipulated, selectively presenting information to meet market expectations or enhance corporate image. As a result, such text-based measures may not accurately reflect the actual level of digital transformation [57]. To address this limitation, following previous research [58], we use the proportion of year-end intangible assets related to digital transformation—disclosed in the notes to the financial statements of listed companies—to total intangible assets as an indicator for measuring the level of corporate digital transformation.

Digital Technology Diffusion (DTD): This study follows Zhou’s method [47]. We utilize the number of digital patent citations as an indicator to measure digital technology diffusion. This approach allows for a more comprehensive understanding of the complexity and dynamics of technology diffusion, enabling a more accurate assessment of the diffusion and impact of digital technologies across companies, industries, and countries.

3.2.4. Control Variables

Control variables were selected based on prior research [59,60]. We include firm size, firm age, Tobin’s Q, leverage ratio, return on assets, board of directors, cash flow, intangible asset ratio, and other patents to mitigate the impact of firm-specific characteristics on the regression results. To account for the effects of economic cycles and industry environment across years, industries, and provinces, we incorporated dummy variables for each. Measurement details are provided in Table 1.

Table 1.

Variables and measurements.

3.3. Methodology

Drawing on previous research [5], this study constructs the following fixed-effect baseline regression model to test the impacts of digital technology innovation depth (DTID) and digital technology innovation breadth (DTIB) on corporate ESG performance (ESG):

In this model, is the ESG performance of firm i in year t. and represent the DTID and DTIB within each firm i in year t. denotes all the control variables included in this research. Based on existing literature [5,61,62], we control for industry-fixed effects and year-fixed effects to eliminate unobservable factors shared across firms within the same industry and those specific to the time dimension. In addition, to account for other potential unobservable factors, such as geographical differences, we include province-fixed effects in our model.

To verify H3 and H4, this study first employs the stepwise mediation test method to examine the impact mechanism of digital innovation quality on corporate ESG [63]. We estimated Equations (5)–(8) to test Hypothesis 3 and Hypothesis 4.

In an effort to surmount the inherent constraints of the conventional step-wise mediation test approach, we undertook a further mediation analysis by employing a robust Bootstrap Test [64]. The traditional stepwise mediation test method has several well-documented limitations. For example, it is inadequate when mediators are endogenous. By re-running the mediation analysis with the robust Bootstrap Test, we aimed to obtain more precise and trustworthy estimates of the mediation effect, thereby enhancing the validity and reliability of our research findings.

4. Empirical Results

4.1. Descriptive Statistics

The results of the descriptive statistics are presented in Table 2. The analysis reveals that ESG scores range from a minimum of 36.62 to a maximum of 92.93, with a range of 56.31. This substantial variation suggests significant differences in ESG performance among listed companies, indicating that some firms in China may still have limited engagement in ESG initiatives. The mean ESG score is 73.086, with a standard deviation of 5.103, suggesting that, on average, firms perform well in ESG dimensions, although there is some variability in their scores. Regarding digital technology innovation, the mean values for depth and width are 0.411 and 0.655, respectively, with standard deviations of 0.805 and 0.882. These results indicate that firms generally exhibit stronger performance in the breadth of digital technology innovation compared to its depth. However, the relatively large standard deviations highlight significant variability in the application and expansion of digital technologies. This suggests an imbalance in digital technology development, with some firms excelling in specific technological fields or innovation breadth, while others may need to enhance both the depth and breadth of their technological capabilities.

Table 2.

Descriptive statistics.

Table 3 presents Pearson’s correlation analysis results for the main variables. The findings show that Pearson’s correlation of digital technology innovation quality is significantly positively correlated with corporate ESG performance at the 1% level, indicating that higher digital technology innovation quality is associated with better ESG performance. Additionally, the correlation coefficients between ESG and most other variables are also significant at the 1% level, suggesting that the selection of control variables is appropriate. The absolute values of the correlation coefficients among the control variables remain relatively low, indicating the absence of serious multicollinearity. Furthermore, a multicollinearity test was conducted, and the collinearity results VIF < 5, confirmed that multicollinearity is not a concern in the model.

Table 3.

Pearson’s correlation coefficients.

4.2. Regression Analysis

4.2.1. The Direct Effect

Table 4 presents the results of the direct impacts of DTID and DTIB on corporate ESG performance. Based on the empirical results obtained from models (1) and (2), columns (1) and (2) examine the effects of digital technology innovation depth and breadth on corporate ESG indicators, with regression coefficients are 1.091 and 1.032, respectively, and significant at the 1% level, without including control variables. Columns (3) and (4) expand the model by incorporating control variables, as well as time, industry, and provincial fixed effects. The regression coefficients of the core explanatory variables decrease, likely because some of the impact relationships are absorbed by the control factors. However, the t-test confirms that the regression coefficients remain significant at the 1% level. The coefficients of all models are consistently positive and significant, supporting that both dimensions of digital technology innovation quality have a positive impact on the ESG performance of enterprises. Therefore, Hypothesis 1 and Hypothesis 2 are supported. These findings are different from some previous studies, which suggest that digital technology innovation has potential negative impacts, such as technical costs, privacy concerns, security risks, information issues, and digital divide, which may actually hurt ESG performance, and excessive investment in digital technology may squeeze corporate resources for environmental governance and social responsibility [3]. The research on the relationship between DTIQ and corporate ESG performance eliminates the potential negative impacts of digital technologies and provides timelier and context-specific evidence on the relationship between digital technology and corporate sustainability.

Table 4.

Baseline regression between DTIQ and ESG performance.

Table 5 presents the results of a regression analysis regarding the influence of digital technology innovation quality (DTIQ) on the three dimensions of ESG performance: environment (E), society (S), and governance (G). This research endeavors to evaluate whether the effect of DTIQ on these three pillars is consistent or disparate [65]. The results indicate that DTIQ has a statistically significant positive influence on the environment (E), society (S), and governance (G) dimensions. Specifically, DTIQ is associated with improved environmental performance. It can facilitate green transformation by enabling refined management of production processes and the efficient and circular utilization of energy resources. Likewise, DTIQ may also boost social performance by building more transparent and secure supply chains and customer relationships, and improving employee well-being. DTIQ, centered on data-driven decision-making and strengthening internal control transparency, enhances the scientific nature and effectiveness of corporate governance. The improvements in these three dimensions jointly illustrate the fundamental role of digital technology as a core competency of enterprises in propelling their shift towards sustainable and responsible development models. In conclusion, DTIQ exhibits a significant positive impact across all three dimensions: environment (E), society (S), and governance (G). This finding is highly consistent with the findings of our baseline regression using overall ESG as the dependent variable. This finding confirms that the role of DTIQ in promoting corporate ESG performance is not isolated or one-sided, but rather a comprehensive and systematic empowerment. It reveals that high-quality digital technology can concurrently optimize a firm’s environmental management, strengthen its social responsibility initiatives, and refine its corporate governance framework. Ultimately, these efforts synergistically propel enhancements in overall ESG performance.

Table 5.

Baseline regression between DTIQ and decomposed ESG performance.

4.2.2. The Mediating Effects

Table 6 presents the regression results of the relationship among digital technology innovation quality, digital transformation and ESG performance. Digital transformation is represented by DT. As shown in the regression results in columns (1) and (2) in Table 6, the coefficients of the depth and width of digital technology innovation on DT are 0.226 and 0.121, respectively, and are significantly positive, indicating that digital technological innovation quality promotes digital transformation. In columns (3) and (4), the regression coefficients of the depth and width of digital technology innovation are 0.801 and 0.834, respectively, and are significantly positive at the 1% level. The regression coefficient of digital technology innovation quality on enterprise ESG is positive, indicating that DT plays a partial mediating role between digital technology innovation quality and enterprise ESG. That is, the quality of digital technology innovation enhances the ESG performance of enterprises by accelerating digital transformation. The empirical results support Hypothesis 3.

Table 6.

Mediator effect test of DT.

In an effort to surmount the inherent constraints of the conventional step-wise mediation test approach, we undertook a further mediation analysis by employing a robust Bootstrap Test [64] and conducted 5000 iterations to test the role of digital transformation as a mediating variable. Table 7 shows that the indirect effects have coefficients of 0.0026 and 0.0220, respectively, with 95% confidence intervals of (0.0005, 0.0048) and (0.0163, 0.0277). As for the direct effect, they have coefficients of 0.8007 and 0.9913, respectively, with 95% confidence intervals of (0.7223, 0.8790) and (0.9306, 1.0520). These findings reveal that the direct effect of the depth and breadth of digital technology innovation on ESG performance is strong; in this case, the indirect effect on the association between the depth and breadth of digital technology innovation and ESG performance is still significant. Therefore, the mediation role of digital transformation in this relationship is established, and the empirical results support Hypothesis 3.

Table 7.

Bootstrap test of DT.

Table 8 presents the regression results of the relationship between the quality of digital technology innovation, digital technology diffusion and ESG performance. As shown in the regression results of columns (1) and (2) in Table 8, the coefficients of digital technology innovation depth on the diffusion of digital technology are 0.816, respectively, which is significantly positive, while the coefficient of DTB is 0.645 (p < 0.05), and its significance is slightly lower than that of DTD. It indicates that the quality of digital technology innovation has promoted the diffusion of digital technology. In columns (3) and (4), the regression coefficients of digital technological innovation depth and digital technological innovation width are 0.715 and 0.802, respectively, which are significantly positive at the 1% level. The regression coefficient of digital technology innovation quality on corporate ESG performance remains positive. This finding shows that the diffusion of digital technology plays a partial role mediating role in digital technology innovation quality and corporate ESG performance; That is, digital technology innovation quality enhances enterprise ESG performance by promoting the diffusion of digital technology. Hypothesis 4 is supported.

Table 8.

Mediator effect test of DTD.

Table 9 shows that the indirect effects have coefficients of 0.0774 and 0.0510, respectively, with 95% confidence intervals of (0.0245, 0.1303) and (0.0121, 0.0899). As for the direct effect, they have coefficients of 0.7147 and 0.9815, respectively, with 95% confidence intervals of (0.6189, 0.8106) and (0.9099, 1.0537). These findings reveal that the direct effect of the depth and breadth of digital technology innovation on ESG performance is strong; in this case, the indirect effect on the association between the depth and breadth of digital technology innovation and ESG performance is still significant. Therefore, the mediation role of digital technology diffusion in this relationship is established, and the empirical results support Hypothesis 4.

Table 9.

Bootstrap test of DTD.

4.3. Endogeneity Test

4.3.1. Instrumental Variable Test

Previous empirical analyses are potentially vulnerable to endogeneity issues stemming from omitted-variable bias and sample-selection concerns. Notably, regional disparities in economic development levels and geographical location can significantly impact the relationship between DTIQ and corporate ESG performance. However, it is arduous to comprehensively incorporate these factors into the analysis. Furthermore, reverse causality may influence the baseline results. To address these concerns, this study employs the instrumental variable (IV) method to mitigate endogeneity bias. A valid instrumental variable is required to simultaneously meet two key conditions, relevance and exogeneity.

Concerning existing studies, we select the logarithm of the number of executives with digital-related education and work experience as an instrumental variable for the quality of digital technology innovation. According to previous research, executives with digital-related education or work experience are more likely to drive investment in digital technology R&D, which can help firms carry out digital technology innovation [66,67]. Moreover, no study has found that the executive’s digital technical background directly affects corporate ESG performance [2]. Using this instrumental variable, the regression test is conducted using the two-stage least square regression (2SLS).

Table 10 reports the regression result for the instrumental variable. The Wald F statistic is all greater than the critical value of 10, indicating that there is no weak instrumental variable. The p-value of the Kleibergen–Pape rk LM statistic is significant at the 1% level, strongly rejecting the null hypothesis of “insufficient identification.” The regression results in columns (1) and (2) of Table 10 demonstrate a significant correlation between the instrumental variable and the quality of digital technology innovation, confirming instrument strength. Columns (3) and (4) further show that the depth and breadth of digital technology innovation significantly improve ESG performance at the 1% level, validating the robustness of our baseline regression results.

Table 10.

Instrumental variable test.

4.3.2. Lagging the Independent Variable

The inclusion of a one-period lagged explanatory variable helps address potential endogeneity concerns by improving causal identification accuracy. This approach enhances causal inference by reducing reciprocal effects, avoiding simultaneity bias, minimizing measurement errors, and controlling for omitted variable bias. Following previous research [68], when the instrumental variable is difficult to identify, the lagged independent variable can also serve as an instrumental variable. Therefore, this study tests for endogeneity by using digital technology innovation quality lagged by one period as an instrumental variable.

The regression test results, presented in Table 11, show that the coefficients for digital technological innovation quality on corporate ESG performance are 0.804 and 0.846, both significantly positive at the 1% level. This indicates that the effect of digital technological innovation quality on corporate ESG performance remains unchanged, aligning with the baseline regression results in Table 4. Thus, the study’s main findings are robust and not influenced by contemporaneous causality concerns.

Table 11.

One-period lagged test.

4.4. Robustness Test

4.4.1. Replacing the Independent Variable

To ensure the robustness of the empirical findings, we conducted several tests. First, to address potential measurement bias in explanatory variables, we reconstructed the digital technology innovation depth indicator. Specifically, we redefined a firm’s core digital technology fields by excluding the patent fields within the bottom 10% of patent counts. A baseline regression using this revised DTID yielded a significantly positive coefficient of 0.828 (Table 12, column 1), supporting the robustness of our main results. Second, we employed an alternative measure for DTIB. This was calculated based on the number of core industry economy broad industry categories covered by a firm’s granted patents, with the natural logarithm of this count used for measurement. A larger DTIB value indicates a broader range of digital technology fields mastered by the firm. The regression using this alternative DTIB (Table 12, column 2) also showed a significantly positive coefficient of 0.554, further confirming the robustness of our primary regression outcomes.

Table 12.

Robustness test results.

4.4.2. Replacing the Dependent Variable

In the benchmark regression, firms’ ESG performance is measured using the Hua Zheng ESG rating index. To further validate the findings, this study also employs ESG scores published by Bloomberg in the regression analysis. When using ratings as a proxy for the dependent variable, each of the nine ESG rating levels (C to AAA) is assigned a corresponding score from 1 to 9. The regression results, presented in columns (3) and (4) of Table 12, show that the coefficient of ESG-bp remains significantly positive at the 1% level. This significant difference arises because ESG ratings classify all publicly traded companies into nine broad categories, which may overlook finer differences in ESG performance between firms. In contrast, the Hua Zheng ESG rating index used in the baseline regressions evaluates firms individually based on an objective scoring system, providing a more granular and systematic assessment of ESG performance. Additionally, alongside the Hua Zheng ESG rating index, Bloomberg ESG is recognized as a mature ESG evaluation system in China. Therefore, this study adopts Bloomberg ESG scores as an alternative measure to further verify the robustness of the findings. The results confirm that the main conclusion of this study remains robust regardless of the ESG rating system used.

4.4.3. Change Sample Interval

Recognizing the strategic importance of technological innovation and the digital economy, as highlighted in the 19th National Congress report’s strategic direction and policy recommendations for digital transformation, we conducted a further robustness test. Given the government’s support for sustainable development and the integration of digital technological innovation into ESG strategies through policy assistance and guidance, we analyzed a post-2017 sample. The results, presented in columns (5) to (6) of Table 12, show that even after excluding relevant samples, the regression coefficients for DTID (0.888) and DTIB (0.931) remain significantly positive at the 1% level. This provides further strong evidence for the robustness of our regression findings.

4.4.4. Ordered Logit Model Test

Drawing on previous research [5], this study employed the fixed-effect baseline regression model to test the impacts of digital technology innovation quality on corporate ESG performance. In fact, Hua Zheng ESG ratings are ordinal and not continuous. Therefore, this study further uses the ordered logit regression method to conduct a robustness test on the relationship between digital technology innovation quality and corporate ESG. The results are shown in columns (7) and (8) of Table 12. The coefficients of digital technology innovation depth and breadth are 0.327 and 0.338, respectively, which are still significantly positive. The findings reveal that the depth and breadth of digital technology innovation have a clear promoting effect on ESG, which is consistent with the baseline regression results.

4.4.5. Firm Fixed Effects Test

This study further employed firm fixed effects and year fixed effects to conduct a robustness test and applied cluster-robust standard errors at the firm level. The results are shown in columns (9) and (10) of Table 12. The coefficients for the depth and breadth of digital technology innovation (DTID and DTIB) are significantly positive at the 1% level, indicating that the baseline regression results are robust.

4.5. Heterogeneity Test

This study finds that the quality of digital technology innovation enhances firms’ ESG performance by promoting digital transformation and facilitating digital technology diffusion. However, the motivations and pathways of digital technology innovation vary significantly across firms. To explore these differences, we analyze the heterogeneous impact of digital technology innovation quality on ESG performance from three dimensions: region, industry, and firm. In addition, this heterogeneity analysis provides valuable insights for companies, helping them tailor their development strategies based on their stages of digital technology innovation.

4.5.1. Heterogeneity of Regional Differences

According to the relevant interpretation of the market transaction theory [69], the core function of intellectual property protection (IPP) is to incentivize innovation by encouraging firms to increase their R&D investment through market supervision and legal enforcement, ultimately fostering high-quality innovation output. Following previous research [70], this study uses the ratio of technology market transaction volume to GDP to measure the effectiveness of IPP. A higher value of this indicator suggests stronger IPP, greater technology market activity, and higher IPP value per unit of GDP. Based on this index, firms are classified into two groups: stronger IPP regions and weaker IPP regions. Panel A of Table 13 presents the estimation results, showing that digital technological innovation quality has a significant positive effect on ESG performance in regions with stronger IPP. The coefficients for firms in these regions are significantly positive at the 1% level, and larger in magnitude, indicating that the impact of digital technological innovation quality on ESG performance is more pronounced in regions with stronger IPP.

Table 13.

Heterogeneity analysis of regional characteristics.

Due to significant regional differences in economic development, the impact of digital technology innovation quality on corporate ESG performance may vary across different regions. Following previous research [71], this study considers geographical location as a key factor, recognizing that economic development and digital technology innovation quality are generally higher in eastern China (East) compared to the central and western regions (Cent & West). Based on this distinction, firms are categorized into two groups: East and Cent & West, according to their geographical location. Panel B of Table 13 presents the results, showing that the impact of digital technology innovation quality on ESG performance is significant in the eastern region but weaker in the central and western regions. The stronger effect in the eastern region can be attributed to its higher degree of marketization, which not only encourages firms to invest more in digital innovation but also facilitates better ESG performance. In contrast, the central and eastern regions exhibit attenuated effects, likely due to lower levels of economic development and digital technology adoption.

4.5.2. Heterogeneity of Industry Differences

First, the industry competition may affect the external transaction costs of upstream and downstream firms in the industry [72], which in turn affects the ESG performance of firms. Therefore, the contribution of digital technology innovation quality to corporate ESG performance may differ significantly depending on the degree of industry competition. We classify listed companies in the electronics, defense and military industry, computer, communications, and pharmaceutical and health industries as high-tech enterprises (High-tech), and the rest as non-high-tech enterprises. The experimental results are shown in Table 14 Panel A, indicating that the benefits of digital technology innovation quality on ESG performance are more significant for high-tech enterprises compared with non-high-tech industries. The estimated coefficient for high-tech enterprises is significantly positive at the 1% level, with larger numerical values. This suggests that digital technology innovation has a more significant contribution to the ESG performance of high-tech enterprises.

Table 14.

Heterogeneity analysis of industry characteristics.

The impact of digital technology innovation quality varies across firms due to differences in industry characteristics and technological capabilities. To examine this, firms are categorized into two groups: heavily polluting enterprises and non-heavily polluting enterprises. The results, presented in Panel B of Table 14, indicate that the coefficients for digital technological innovation quality are all significantly positive at the 1% level for heavily polluting enterprises. Moreover, these coefficient values are higher compared to those of non-heavily polluting enterprises. This suggests that while digital technological innovation quality enhances ESG performance for both groups, its impact is more pronounced among heavily polluting firms. This may be because heavily polluting enterprises face greater regulatory pressure and environmental expectations, making digital innovation a more effective tool for improving sustainability and compliance efforts.

4.5.3. Heterogeneity of Firm Differences

Since firm ownership plays a crucial role in shaping digital technology innovation, this study categorizes firms into two groups: non-state-owned and state-owned enterprises. The results, presented in Panel A of Table 15, show that digital technology innovation quality enhances the ESG performance of both SOEs and non-SOEs. However, the contribution of non-SOEs is more prominent (0.927 *** > 0.888 ***), which is mainly due to the fact that non-SOEs, facing more intense market competition, have the advantages of flexible decision-making and a strong innovation culture, are able to respond quickly to market demand, have stronger policy support and access to resources, and have the willingness to take risks and focus on long-term development, which results in a greater emphasis on the quality and efficiency of innovation. The company’s performance in terms of environmental, social, and corporate governance has been effectively promoted.

Table 15.

Heterogeneity analysis of firm characteristics.

Considering that the quality of digital technology innovation may have different impacts on the ESG performance of companies of different sizes, this study uses asset size as a measure of firm size. According to the median for corporate size, we classify the sample into two groups: big-sized and small-sized firms. The results, presented in Panel B of Table 15, indicate that while digital technology innovation quality positively affects ESG performance in both large and small firms, the effect is stronger for large firms.

5. Theoretical and Practical Implications

5.1. Theoretical Implications

Compared to existing academic research, the theoretical contributions in this study primarily lie in the following areas. First, this study innovates the framework and methodology for quantifying digital technology innovation quality (DTIQ). This framework divides DTIQ into two dimensions: depth (technological specialization) and breadth (technological diversification). Although the DTIQ (especially its depth and breadth) has been attended by academia and preliminarily explored, academic discussions are limited due to its inconsistent definition [23], and also, current measurements of DITD and DTIB face inherent methodological constraints [22]. Drawing on intellectual property patent data associated with the core industries of the digital economy, this study introduces a dual-dimensional framework for quantifying DTIQ and develops a corresponding quantitative methodology. By clearly distinguishing these two dimensions, this study deepens the theoretical understanding of the essential characteristics of DTIQ, provides new analytical perspectives and quantitative tools for subsequent theoretical research, and contributes to the development of a more comprehensive DTIQ theoretical framework.

Second, this study enhances the empirical research on the relationship between digital technology innovation and ESG performance. This empirical examination examines the differential impacts of digital technology innovation depth (DTID) and digital technology innovation breadth (DTIB) on corporate ESG performance. This study also addresses the shortcomings of traditional approaches that rely solely on the frequencies of patent citations [21], or the number of digital patent applications [18], or by constructing a dictionary of relevant terms and counting their occurrences in corporate financial reports as a proxy [22]. This traditional single-item assessment fails to fully reflect the actual effects of digital technology innovation and its impact on ESG performance, which leads to an inconsistent conclusion of the impact of digital technology innovation on corporate ESG performance [3]. This study empirically analyzes the two dimensions of DTID and DTIB, detailing how these two dimensions influence corporate ESG performance and enriching the relevant literature. It provides a more detailed and comprehensive empirical basis for understanding the complex relationship between digital technology innovation and ESG performance, promoting the development of theoretical research in this field.

In addition, this study deepens theoretical understanding of the enabling mechanisms between DTIQ and ESG performance. The question of mechanism paths has received high attention in the literature on the relationships of digital technology innovation and corporate ESG performance, because this helps to reveal the essence of phenomena by dismantling the causal chain and refining the mechanism of action, thereby providing precise intervention targets for management practices [2,5,14]. Nevertheless, critical questions remain unresolved regarding empowerment mechanisms, such as corporate digital transformation and digital technology diffusion, which have not yet been fully analyzed. Employing a dual perspective of reconstruction and diffusion, this study reveals two pathways to strengthen the enabling mechanism between DTIQ and ESG performance: promoting corporate digital transformation and promoting the diffusion of digital technologies. This study clarifies the important role of these two approaches in strengthening the relationship between the two, providing a deeper and clearer theoretical understanding of the inherent connection and mechanism between digital innovation quality and ESG performance, and contributing to the construction of a more scientific and reasonable theoretical model.

5.2. Practical Implications

Based on the empirical research conclusions, this article draws the following practical implications for enterprise managers and governments. First, at the corporate level, amidst the rapid development of the digital economy, corporate managers should focus on formulating and implementing organizational strategies related to digital technological innovation quality. Instead of blindly pursuing the quantity of patents as a superficial indicator of innovation, they should adopt a more profound approach. This practice will enable companies to achieve a substantial improvement in their ESG performance. This study has shown that both the depth (technology specialization) and breadth (technology diversification) aspects of DTIQ can effectively drive corporate ESG performance. Innovation depth is conducive to building core competitiveness that is difficult to replicate; innovative breadth is conducive to coping with uncertain markets and enhancing risk resistance through technological combinations; the integration of the two, namely “deep vertical + broad foundation”, serves as an effective and advanced route to enhance corporate ESG performance through digital governance. Enterprises need to recognize that DTIQ represents an evolution of the competitive landscape and a technological safeguard for ESG performance. Therefore, it is essential for them to deeply embed both the depth and breadth of digital technology innovation into the very genes of their value chain. This integration will not only strengthen the company’s internal operations but also contribute to its long-term sustainable development in an ESG-conscious business environment.

Second, focusing on digital transformation and digital technology diffusion to accelerate the transformation of digital technology innovation quality into sustainable value through systematic reconstruction and diffusion effects. It can be seen from the conclusion of this paper that improving the digital transformation and promoting the diffusion of digital technology are the two key ways of empowering the impact of digital technology innovation quality on corporate ESG enhancement. Therefore, enterprises should strengthen digital transformation and technology diffusion to help enterprises implement ESG better and more efficiently. In addition, based on the reconstruction effect of digital transformation, enterprises should establish a progressive reconstruction path of technology-transformation-ESG performance: prioritize the deployment of core technologies with ESG empowerment potential; reconstruct the value creation process in stages through modular transformation; build a digital ESG performance dashboard to achieve closed-loop management. Based on the diffusion effect of digital diffusion, enterprises should optimize the diffusion path.

Finally, from the government level, government departments should further strengthen the concept of corporate ESG and digital innovation quality-driven corporate development in the new development stage, incorporate the improvement of digital technology innovation quality into national and local digital economy development plans, and enhance their role in signal optimization in promoting digital technology innovation quality. Simultaneously, it should promote the construction of the corporate digital technology innovation quality system, guiding corporate managers to balance investment in the digital technology depth and breadth rather than simply the number of patents. In addition, government departments can specially formulate scientific and practical incentive policies for the improvement of digital technological innovation depth and breadth, provide necessary financial support in terms of tax incentives and government subsidies, and reasonably guide the national resources and market resources to digital innovation depth and breadth to stimulate the enthusiasm of firms in R&D and innovation.

5.3. Research Limitations and Future Research Directions

Despite its findings and contributions, this study has several limitations that could be addressed in the future. First, this study focused solely on data from Chinese companies. This means the findings may only apply to the Chinese business environment. Due to significant differences in economic, cultural, and policy contexts across countries, the situation of Chinese companies may differ significantly from that of companies in other countries. Future research could validate the empowerment mechanisms between DTIQ and corporate ESG performance in other countries. For example, data from companies in countries with different levels of economic development and business cultures, such as the United States, Germany, and Japan, could be collected to expand the generalizability and applicability of the findings.

Second, existing ESG performance indicators are typically based on a composite rating. While composite ratings provide an overall assessment, they fail to deeply analyze the specific impacts of each dimension on the relationship between DTIQ and ESG performance. Although we have conducted specific research on the relationship between DTIQ and the three dimensions of ESG performance, within the three dimensions of environment (E), society (S), and governance (G), each dimension comprises multiple sub-dimensions, and composite ratings may mask differences and interactions between these sub-dimensions. Future research could construct more detailed sub-dimension indicators and conduct in-depth analysis of the impact of different dimensions. For example, within the governance dimension, sub-dimensions such as board structure, executive compensation, and information disclosure can be considered. Analyzing these sub-dimensions provides a more precise understanding of the impact of DTIQ on various aspects of ESG performance.

Finally, this study did not consider the dynamic impact of DTIQ on corporate ESG performance. In reality, digital innovation is an ongoing process, and its impact on ESG performance varies over time and at different stages of development. Companies of different sizes and industries face varying challenges and opportunities during digital transformation. Future research could further analyze the dynamic changes in ESG performance and the specific challenges faced by different types of companies as they improve their digital innovation quality, thereby formulating more targeted digital transformation and ESG improvement strategies for each company.

6. Conclusions

This paper presents a seminal theoretical framework that explores the relationship between firms’ digital technology innovation quality (DTIQ) and ESG performance, providing valuable insights into how different types of DTIQ effectively empower ESG performance. Using the data of Chinese A-share listed companies from 2012 to 2022, this study categorizes DTIQ into digital technology innovation depth (DTID) and digital technology innovation breadth (DTIB) and empirically examines their impacts on corporate ESG performance. Empirical results reveal that both the depth and breadth dimensions of DTIQ have significantly positive impacts on corporate ESG performance. DTID can improve corporate ESG performance through building core competitiveness, forming a green competitive barrier, constructing technical compliance standards, and reconstructing the market valuation logic. DTIB can form a multi-dimensional synergistic effect through the interaction of resource integration, efficiency improvement, and governance optimization, and ultimately achieve a systematic improvement in ESG performance. Mechanisms analysis identifies two ways to reinforce their positive impacts, including advancing corporate digital transformation and facilitating digital technology diffusion. The former accelerates DTIQ into ESG performance through the systematic reconstruction effect and while the latter relies on the diffusion effect. The study further reveals that the driving effect of digital technology innovation quality on ESG is more significant in enterprises in regions with intellectual property protection and in the eastern region, heavily polluting enterprises, high-tech enterprises, non-state-owned enterprises, and large enterprises.

Author Contributions

Conceptualization, X.X., L.L., J.C. and T.L.; methodology, X.X., L.L., J.C. and T.L.; software, L.L.; formal analysis, L.L.; validation, T.L.; investigation, J.C.; data curation, J.C.; writing—original draft, L.L.; writing—review and editing, T.L.; supervision, X.X.; project administration, T.L.; resources, X.X.; funding acquisition, X.X. and T.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Guangzhou Industrial Science and Technology Innovation Big Data and Intelligent Computing Technology Key Laboratory [grant number 2025A03J3140], the Guangdong Provincial Department of Education Innovation Team Project [grant number 2022WCXTD020], the National Natural Science Foundation of China [grant number 72571073], the Ministry of Education of Humanities and Social Science Foundation [grant number 24YJC630152], and the Guangdong Philosophy and Social Sciences Foundation [grant number GD25YGG23].

Data Availability Statement

These data are not publicly available for privacy protection reasons. If needed, one can request access to the data used in this study from the corresponding author.

Acknowledgments

The authors thank the Systems editors-in-chief and the anonymous reviewers for their guidance and advice throughout the review process.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Tapaninaho, R. Examining the competing demands of business and sustainability: What do corporate sustainability discourses reveal? Bus. Ethics Environ. Responsib. 2024, 34, 1278–1299. [Google Scholar] [CrossRef]

- Wang, L.; Yang, H. Digital technology innovation and corporate ESG performance: Evidence from China. Econ. Change Restruct. 2024, 57, 207. [Google Scholar] [CrossRef]

- Zhu, S.; Lv, K.; Zhao, Y. Trust (in)congruence, digital technological innovation, and firms’ ESG performance: A polynomial regression with response surface analysis. J. Environ. Manag. 2025, 373, 123689. [Google Scholar] [CrossRef]

- Wang, Z.; Tang, P. Substantive digital innovation or symbolic digital innovation: Which type of digital innovation is more conducive to corporate ESG performance? Int. Rev. Econ. Financ. 2024, 93, 1212–1228. [Google Scholar] [CrossRef]

- Huang, Q.; Fang, J.; Xue, X.; Gao, H. Does digital innovation cause better ESG performance? an empirical test of a-listed firms in China. Res. Int. Bus. Financ. 2023, 66, 102049. [Google Scholar] [CrossRef]

- Song, J. Corporate ESG performance and human capital investment efficiency. Financ. Res. Lett. 2024, 62, 105239. [Google Scholar] [CrossRef]

- Chen, S.; Song, Y.; Gao, P. Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef]

- Bai, K.; Jing, K.; Li, T. Corporate ESG Performance and Stock Pledge Risk. Financ. Res. Lett. 2024, 60, 104877. [Google Scholar] [CrossRef]

- Lian, Y.; Li, Y.; Cao, H. How does corporate ESG performance affect sustainable development: A green innovation perspective. Front. Environ. Sci. 2023, 11, 104877. [Google Scholar] [CrossRef]

- Zhang, C.; Yang, J. Artificial intelligence and corporate ESG performance. Int. Rev. Econ. Financ. 2024, 96, 103713. [Google Scholar] [CrossRef]

- Drempetic, S.; Klein, C.; Zwergel, B. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings Under Review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Wang, L.; Kong, L.; Zeng, H. Firm Digitalisation Empowers ESG Performance—Evidence from China. Int. J. Financ. Econ. 2025, 1–20. [Google Scholar] [CrossRef]

- Liu, Y.; Huang, H.; Mbanyele, W.; Li, X.; Balezentis, T. Harnessing supply chain digital innovation for enhanced corporate environmental practices and sustainable growth. Energy Econ. 2025, 142, 108161. [Google Scholar] [CrossRef]

- Feng, Y.; Nie, C. Digital technology innovation and corporate environmental, social, and governance performance: Evidence from a sample of listed firms in China. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 3836–3854. [Google Scholar] [CrossRef]

- Zheng, M.; Feng, G.; Jiang, R.; Chang, C. Does environmental, social, and governance performance move together with corporate green innovation in China? Bus. Strat. Environ. 2023, 32, 1670–1679. [Google Scholar] [CrossRef]

- Hao, X.; Miao, E.; Sun, Q.; Li, K.; Wen, S.; Xue, Y. The impact of digital government on corporate green innovation: Evidence from China. Technol. Forecast. Soc. Change 2024, 206, 123570. [Google Scholar] [CrossRef]

- Fang, X.; Liu, M. How does the digital transformation drive digital technology innovation of enterprises? Evidence from enterprise’s digital patents. Technol. Forecast. Soc. Change 2024, 204, 123428. [Google Scholar] [CrossRef]

- Liu, Y.; Dong, J.; Mei, L.; Shen, R. Digital innovation and performance of manufacturing firms: An affordance perspective. Technovation 2023, 119, 102458. [Google Scholar] [CrossRef]