Abstract

This study examines how ambidextrous balanced innovation and ambidextrous combined innovation affect international entrepreneurial-oriented enterprise growth within the holistic paradigm of systems thinking and discusses the systemic impact of industry international competitiveness and industry financing dependence. We select the unbalanced panel data of China’s ICT industry international enterprises from 2010 to 2021 for empirical research, and we employ the fixed effect model for testing. The empirical results indicate that both ambidextrous balanced innovation and ambidextrous combined innovation promote international entrepreneurial-oriented enterprise growth, that the industry’s international competitiveness positively moderates the relationship between ambidextrous balanced innovation and international entrepreneurial-oriented enterprise growth, and that the industry’s financing dependence negatively moderates the relationship between ambidextrous balanced innovation and international entrepreneurial-oriented enterprise growth. The aforementioned conclusion is robust against a series of robustness tests. This study expands the theoretical research on international entrepreneurship and ambidextrous innovation strategy selection and may help in the selection of ambidextrous innovation strategies for international entrepreneurial-oriented enterprises.

1. Introduction

International entrepreneurial-oriented enterprise is an innovative, proactive, and adventurous behavior that is not limited by national boundaries and aims to create organizational value [1]. Enterprise internationalization is a crucial method of achieving high-quality economic development, and innovation-driven international entrepreneurial-oriented enterprises can critically enable enterprises to achieve sustainable development. The research object of the international entrepreneurial-oriented enterprise includes international business and entrepreneurial activities of born global companies, international start-ups, and established companies [2]. Enterprises with a higher degree of internationalization can obtain higher investment returns and competitive advantages through economies of scale. The resource dependence theory holds that all the resources of an enterprise are limited and that the limited resources should be rationally allocated. International entrepreneurial-oriented enterprises should solve the difficulties occasioned by the shortcomings of the “outsider disadvantage”, “new entrant disadvantage”, and “small scale disadvantage” [3]. How to choose the innovation strategy as a method of obtaining core competitiveness under the condition of limited resources and capabilities is the key problem for international entrepreneurial-oriented enterprises; this calls for making trade-offs with systematic thinking [4].

Researchers have discovered that both exploratory innovation and exploitative innovation contribute to the growth of multinational start-ups. Specifically, through exploratory innovation, enterprises can continuously acquire new knowledge, master new skills, create new development opportunities, more effectively adapt to the changes in the international market, and, thus, enhance the success rate of international entrepreneurial-oriented enterprises [5,6,7]. However, new international ventures are subjected to more financial strain, worse corporate stability, and higher business risks when conducting exploratory innovation activities. The degree of product innovation and return on investment achieved by exploitative innovation activities are lower than those achieved through exploratory innovation; however, the stability of exploitative innovation is higher, and the capital requirements for international entrepreneurial-oriented enterprises are smaller. Generally, both exploratory innovation and exploitative innovation can effectively enhance the performance of international entrepreneurial-oriented enterprises and enhance their competitive advantages. However, due to the diverse internal and external contexts, scholars have placed an emphasis on discussing which innovation strategy to use in particular situations [4]. Recently, scholars have begun to realize that the excessive utilization of exploratory innovation or exploitative innovation can easily lead enterprises into an innovation failure trap or capability trap. In order to better capitalize on the benefits of innovation strategy in global entrepreneurial firms, they started to systematically analyze how to integrate exploratory innovation and exploitative innovation inside a research framework.

Duncan (1976) [8] introduced the “ambidextrous innovation” concept [9]. According to different logical mechanisms of interaction between exploratory innovation and exploitative innovation, it can be further divided into ambidextrous balanced innovation and ambidextrous combined innovation [10,11]. Ambidextrous balanced innovation refers to the comprehensive utilization of a coordination mechanism to maintain a relatively consistent balance between exploratory innovation and exploitative innovation. In the aforementioned process, exploratory innovation and exploitative innovation are regarded as two ends of a continuum, which compete for organizational resources and development; thus, enterprises should comprehensively utilize the coordination mechanism. If the difference between exploratory innovation and exploitative innovation in input and output is small, the enterprise exhibits a satisfactory ambidextrous balance. Ambidextrous combined innovation refers to the combination of exploratory innovation and exploitative innovation in the execution degree. Ambidextrous combined innovation regards exploratory innovation and exploitative innovation as a complementary relation, and these two innovation typologies can support each other in the research and development process and promote the growth of international entrepreneurial-oriented enterprises. A higher degree of exploitative innovation can support international new ventures to conduct exploratory innovation as a method of developing novel technologies, markets, and products [10]. Similarly, more optimal exploratory innovation can strengthen its exploitative innovation in complementary fields. If the combination of exploratory innovation and exploitative innovation is large, it means that the enterprise exhibits a more optimal degree of ambidextrous integration.

It is worth noting that although ambidextrous innovation can promote the growth of entrepreneurial entrepreneurial-oriented enterprises, there are some differences in the specific effects [12]; the influencing mechanism of its relevant action path and influence mechanism has not been comprehensively opened, and the preference of innovation strategies under different scenarios should still be clarified by empirical methods. Industry heterogeneity is a key factor affecting the growth of international entrepreneurial-oriented enterprises. Different industries are subjected to different industry cycles, fierce market competition, and high-speed technological evolution, which inevitably creates a scenario in which international entrepreneurial-oriented enterprises exhibit different sensitivity levels when subjected to different innovation strategies and different innovation incentive effects [13]. Scholars have analyzed the selection pertaining to innovation strategies of international innovative enterprises in sectors such as the paper industry [14], biomedicine [15], and catering industry [16], and they have conducted an increasing number of studies based on the industry perspective. However, the following question remains unanswered: how does industry heterogeneity affect the innovation strategy selection of international entrepreneurial-oriented enterprises? In addition, current studies on how the aforementioned enterprises affect innovation strategy selection based on industry heterogeneity mostly focus on qualitative analysis, and most studies focus on a single feature. Thus, systematic and quantitative empirical research is lacking.

This study weighs the differences between the international scenario and the local scenario, selects the key industry heterogeneity as the moderating effect, and uses ICT industry data to construct a fixed effect model that affects the ambidextrous balanced innovation and ambidextrous combined innovation of international entrepreneurial-oriented enterprises. This study selected the ICT industry because it is a typical high-innovation, high-growth enterprise with very active innovation behavior, which provides a good realistic basis for the research of innovation strategy [17]. In addition, the ICT industry covers a variety of industries such as ICT manufacturing, ICT services, and ICT trade, which meets the need for industry diversity when classifying industry heterogeneity.

We hope to systematically sort out and empirically test the mechanism of two kinds of ambidextrous innovation affecting the growth of international entrepreneurial-oriented enterprises. At the same time, they attempt to clarify how enterprises in different industries choose innovation strategies according to industry characteristics, which will provide corresponding opinions on the innovation strategy selection of international entrepreneurial enterprises and the formulation of targeted innovation policies.

2. Theoretical Background and Hypothesis Development

2.1. Ambidextrous Balanced Innovation, Ambidextrous Combined Innovation, and International Entrepreneurial-Oriented Enterprises

The organizational learning theory holds that enterprises should build a knowledge system around their daily business activities and strategic planning, exert knowledge efficiency, and promote enterprise growth. Ambidextrous balanced innovation and ambidextrous combined innovation are two innovative approaches that simultaneously apply and organically combine exploratory innovation and exploitative innovation in an organization. Single exploratory innovation can create a scenario in which international entrepreneurial-oriented enterprises are subjected to the “innovation trap”, and single exploitative innovation can create a scenario in which international entrepreneurial-oriented enterprises are subjected to the “capability trap” [18,19]. It is crucial to optimize the allocation of resources for exploratory innovation and exploitative innovation. Both exploratory innovation and exploitative innovation can effectively promote the growth of international entrepreneurial-oriented enterprises [20,21]. Ambidextrous balanced innovation and ambidextrous combined innovation integrated can encourage international entrepreneurial-oriented enterprises to construct a knowledge system through organizational learning [7,10,22].

The implementation of ambidextrous innovation is not aimed at indiscriminately performing two learning activities simultaneously; it is aimed at mitigating the deficiency of implementing only a single learning behavior by effectively weighing two different innovation modes [23]. Ambidextrous balanced innovation tends to be a competitive relationship between exploratory innovation and exploitative innovation, and international entrepreneurial-oriented enterprises should balance the two to achieve ambidextrous balanced innovation, thereby enabling international new ventures to realize the effective allocation of innovation resources and stimulate their own growth potential. Ambidextrous combined innovation proposes that exploratory innovation and exploitative innovation complement and support each other and that ambidextrous innovation can promote the resource development of international new ventures and facilitate their own growth. Scholars have proven that both ambidextrous balanced innovation and ambidextrous combined innovation can promote the growth of enterprises [24] and stimulate the business model innovation of new ventures [25]. In addition, Wu et al. (2019) [26] prove that ambidextrous balanced search and ambidextrous combined search can enhance the innovation performance of international new ventures and that innovation complexity and industrial competition pressure positively moderate the relationship between two-type ambidextrous innovation and firm performance. Xiao et al. (2020) [27] prove that the balance and combination of exploratory internationalization and exploitative internationalization are conducive to the improvement of enterprise performance and that the more balanced the allocation of resources between exploratory innovation and exploitative innovation, the more conducive the strategy is to enterprise growth. In summary, the following hypothesis is proposed.

Hypothesis 1a.

Ambidextrous balanced innovation can promote the growth of international start-ups.

Hypothesis 1b.

Ambidextrous combined innovation can promote the growth of international start-ups.

2.2. Moderating Industry International Competitiveness

Industry international competitiveness refers to the relative competitive advantages of different countries or regions in different industries. Due to the differences in factor endowment, development priorities, and the labor productivity of different countries, the international competitiveness of various industries is different [28]. Contingency theory holds that factors such as innovation strategies, organizational structures, and corporate culture that are highly compatible with enterprises can positively moderate the promoting effect of innovation on enterprise performance; contrastingly, an inappropriate strategic choice can inhibit the promoting effect [29,30]. Scholars attempt to utilize the contingency theory as a method of addressing the problems of intensified competition and high uncertainty faced by enterprises in the internationalization process, and they utilize the contingency theory to explain the leadership characteristics [30] and social networks [10] that affect international entrepreneurial-oriented enterprises in the operation process. International entrepreneurial-oriented enterprises should respond to changes in the internal and external environment and formulate appropriate innovation strategies.

Regarding the impact of ambidextrous balanced innovation from the perspective of industry international competitiveness, the external competitive environment and competitiveness level are crucial directions that should be considered in the formulation of strategies for international entrepreneurial-oriented enterprises. When the industry’s international competitiveness is stronger, international entrepreneurial-oriented enterprises should comprehensively leverage existing product technology advantages to increase overseas market share and increase business income [31]. Meanwhile, international entrepreneurial-oriented enterprises should expand the industrial chain through exploratory innovation based on their existing competitive advantages and consolidate their competitive advantages by launching novel products and developing novel technologies [5]. When international entrepreneurial-oriented enterprises exist in industries with strong international competitiveness, both exploratory innovation and exploitative innovation are crucial to the development of international start-ups. International entrepreneurial-oriented enterprises should consider the balance between exploratory innovation and exploitative innovation, avoid indulging in short-term performance improvement owing to a favorable market scenario, avoid falling into innovation traps, or ignore the importance of securing the market and developing customers. Accordingly, the following hypothesis is proposed.

Hypothesis 2a.

The industry’s international competitiveness positively moderates the promotion effect of ambidextrous balanced innovation on the growth of international entrepreneurial-oriented enterprises

Regarding the impact of ambidextrous combined innovation from the perspective of industry international competitiveness, the weaker the industry’s international competitiveness, the more severe the scenario that affects international entrepreneurial-oriented enterprises in the international market. International entrepreneurial-oriented enterprises should flexibly choose exploratory innovation and exploitative innovation at different points in accordance with the contingency theory and in conformance with the development needs of enterprises and the changing market scenario, and they should facilitate the interaction and dynamic matching of the two types of ambidextrous innovation. Exploitative innovation can promote the rapid return of enterprise funds in the short term, and exploratory innovation can promote the long-term development of enterprises. In an industry with low international competitiveness, the two innovation modes are adopted to make a flexible choice, which can better play the value of existing resources and advantages and promote the growth of international entrepreneurial enterprises. Accordingly, the following hypothesis is proposed.

Hypothesis 2b.

The industry’s international competitiveness negatively moderates the promotion effect of ambidextrous combined innovation on the growth of international entrepreneurial-oriented enterprises

2.3. Moderating Industry Financing Dependence

The degree pertaining to an industry’s external financing dependence indicates the average degree to which enterprises operating in the industry depend on external funds. Due to the differences in factor intensity among industries, financing dependence exhibits certain industry characteristics. According to the degree of external dependence exhibited by an industry, industries are divided into external financing-dependent industries and internal financing-dependent industries [32]. Capital restricts the formulation of innovation strategies for international start-ups. According to the prioritized financing theory, to reduce financing costs, enterprises successively choose internal funds, bond financing, and equity financing. Industries with enterprises exhibiting an abundant cash flow seldom utilize external financing and are mostly dependent on internal financing [33].

Regarding the impact of ambidextrous balanced innovation from the perspective of industry financing dependence, exploratory innovation and exploitative innovation compete for organizational resources and form corresponding organizational practices. In the absence of organizational resources, it is imperative that international entrepreneurial-oriented enterprises achieve the balance between exploratory innovation and exploitative innovation [4]. However, ambidextrous balanced innovation is more commonly utilized in resource-constrained firms [10]. Therefore, in external financing-dependent industries, it is relatively difficult for international start-ups to perform ambidextrous combined innovation owing to the cash flow restrictions of enterprises, and most of them adopt the ambidextrous balanced innovation strategy. Accordingly, the following hypothesis is proposed.

Hypothesis 3a.

The degree of industry financing dependence positively moderates the promotion effect of ambidextrous balanced innovation on the growth of international entrepreneurial-oriented enterprises

Regarding the impact of ambidextrous combined innovation from the perspective of industry financing dependence, if the organizational resources are relatively sufficient and if exploratory innovation and exploitative innovation do not need to compete for organizational resources, it is more suitable to adopt ambidextrous combined innovation. The ambidextrous combined innovation is targeted at the coordinated development of exploratory innovation and exploitative innovation and requires enterprises to simultaneously support both of them, with relatively high capital requirements for the organization [34,35]. Scholars have found that ambidextrous combined innovation exhibits higher capital reserve requirements for enterprises and is more suitable for resource-rich enterprises. International start-ups in internal financing-dependent industries consider exploratory innovation and exploitative innovation due to relatively abundant cash flow and fewer financial constraints; thus, they can achieve complementary and coordinated development. In summary, the following hypothesis is proposed. Accordingly, the following hypothesis is proposed.

Hypothesis 3b.

The degree of industry financing dependence negatively moderates the promotion effect of ambidextrous combined innovation on the growth of international entrepreneurial-oriented enterprises

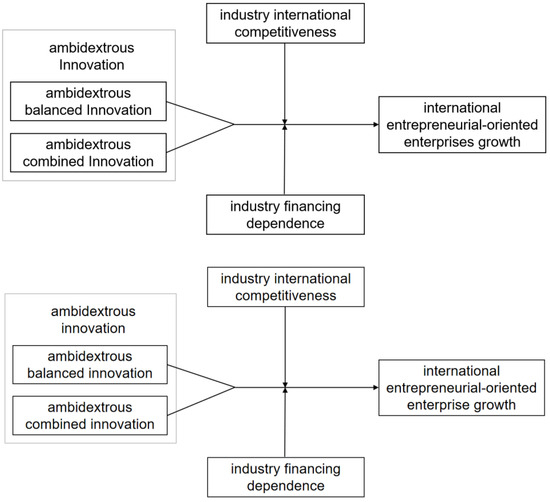

The theoretical framework presented herein analyzes the impact of industry heterogeneity on the ambidextrous balanced innovation and ambidextrous combined innovation of international start-ups (Figure 1).

Figure 1.

Theoretical framework.

3. Data and Methods

3.1. Data Sources

To test the aforementioned hypotheses, we utilize the unbalanced panel data of listed international start-ups in China’s ICT industry from 2010 to 2021 for empirical research. The ICT industry refers to the industry engaged in ICT, including the ICT manufacturing industry, ICT trade industry, and ICT service industry. Herein, data pertaining to ICT enterprises are selected, and according to the definition criteria of international entrepreneurial-oriented enterprises postulated by Zander [36], enterprises whose turnover in overseas markets accounts for an average of more than 25% of their respective turnover during the data availability period are classified as international entrepreneurial-oriented enterprises. To enhance data stability, the following companies are excluded: (1) ST and ST* enterprises and enterprises with crucial data missing or omitted. (2) Enterprises with data available for less than three years. (3) Enterprises with no patent output in recent years. Finally, a total of 289 sets of sample data in the ICT industry were obtained. The patent data of the companies were obtained one by one from the Chinese and multinational patent examination information inquiry websites, the industry data was obtained from the WOID database, and the remaining company data were obtained from the CSMAR database.

3.2. Variable Design

3.2.1. Explained Variables

Roe denotes the ratio of after-tax corporate net profit to average earnings per share, which reflects the earning capacity of an enterprise and can effectively reflect the level of equity obtained by shareholders [37].

3.2.2. Explanatory Variables

By selecting the patent applications of the sample enterprises and by focusing on the realization of their exploratory innovation and exploitative innovation, this study refers to the studies conducted by Guan and Liu (2016) [38] and Venkatraman (2005) [39], adopts the patent classification numbers of ICP as the basis for patent classification, and sets a five-year gap period as the basis for patent number data comparison. If the patent number declared by the sample enterprise within the year is the same as that during the five-year gap period, it is considered the exploitative innovation output, and is denoted as Ki; contrastingly, if the patent number declared by the sample enterprise within the year is the patent number that does not appear during the five-year gap period, it is considered the exploratory innovation output, and is denoted as Ti. With reference to Cao et al. (2009) [10], the ambidextrous innovation strategy is divided into ambidextrous balanced innovation and ambidextrous combined innovation. Using the calculation method utilized by Venkatraman et al. (2005) [39], the ambidextrous balanced innovation is defined as , and the ambidextrous combined innovation is defined as .

3.2.3. Moderating Variables

Regarding the industry’s international competitiveness, trade volume indicators such as the RCA and HHI are utilized to measure the international competitiveness of an industry. This study refers to the calculation method pertaining to the international competitiveness of an industry, which was developed by Dai (2015) [40] and obtains data from the WOID database to measure the international competitiveness of the ICT industry. The formula is depicted in Equation (1). If the RCA index is larger than 1, the industry’s export level accounts for a relatively large proportion of the total export, and it is a highly internationally competitive industry; otherwise, it is a weakly internationally competitive industry. The RCA calculation results are depicted in Table 1.

Table 1.

International competitiveness of the industry.

Regarding industry financing dependence, the sources pertaining to the operating funds of enterprises are mostly self-raised funds, debt financing, and government subsidies. Affected by the industry’s capital demand, the recovery time limit of industry receivables, the intensity and type of industry policy subsidies, and the degree of financing dependence exhibit certain industry characteristics [33,41]. This study refers to the method proposed by Rajan et al. (1998) [32] to divide the degree of industry financing dependence; the external financing-dependent industry is denoted as 1, and the internal financing-dependent industry is denoted as 0.

3.2.4. Control Variables

To reduce the impact of the differences in the sample enterprises’ development status on the relationship between variables, this study selects the company size (size) and utilizes the natural logarithm of the company’s total assets to measure the company size. Debt/asset ratio (lev) represents the ratio of total liabilities to total company assets; the age of the company represents the difference between the year of data and the company’s year of establishment; and ownership concentration (cen) is analyzed by utilizing the shareholding ratio of the largest shareholder as the control variable. The variable settings and definitions are illustrated in Table 2.

Table 2.

Variable setting and definition.

3.3. Model Design

To verify Hypothesis 1 (i.e., the promoting effect of ambidextrous balanced innovation and ambidextrous combined innovation on the growth of international entrepreneurial-oriented enterprises), a main effect regression model is constructed, as illustrated in Model (2), where represents the sample individual, represents the year, and represents the control variables considered in this model in a set mechanism, thereby controlling the influence of multiple factors on the performance of international entrepreneurial-oriented enterprises. represents a random disturbance term.

To test the moderating effect of the industry’s international competitiveness and the degree of industry financing dependence on the impact of ambidextrous innovation on the growth of international entrepreneurial-oriented enterprises, the interaction term of the independent variable and the moderating variable , , , is added to Model (2), and Model (3)–Model (6) are constructed.

4. Results

4.1. Descriptive STATISTICS

Herein, unbalanced panel data from China’s ICT industry international enterprises are utilized to obtain descriptive statistics on the data; thus, the variable characteristics are understood more optimally. The results are depicted in Table 3. Using descriptive statistics, it can be observed that different companies exhibit a large difference in innovation investment, some companies exhibit a large deviation in exploratory innovation and exploitative innovation investment, and exploratory innovation or exploitative innovation is one-sided. In regard to industry characteristics, international start-ups in the ICT industry are relatively large in industries with high international competitiveness and internal financing dependence. The scale of international start-ups in the ICT industry is large, the debt/asset ratio is different, the profitability gap is large, most of the enterprises are not state-owned enterprises, and the average age of enterprises is 18.19 years.

Table 3.

Descriptive statistical results.

4.2. Correlation Analysis

To avoid the multicollinearity problem occasioned by excessive correlation between variables, the correlation relationship between variables was analyzed, and the results, which were depicted in Table 4, indicate that there is a positive relationship between the realization of ambidextrous balanced innovation and ROE and ambidextrous combined innovation and ROE. In the preliminary verification of Hypothesis 1, the correlation coefficient of key variables is all below 0.35, and there is no correlation between variables. The results of the correlation analysis indicate that there is no close correlation between variables, which offers a satisfactory data basis for empirical research.

Table 4.

Correlation coefficient matrix.

4.3. Fixed Effect Model

The Hausmann test rejects the null hypothesis, and this study utilizes the fixed effect model for empirical research. We obtain the result chi2(6) = 11.62 (Prob > chi2 = 0.0709), and the p-value at the significance level of 10% rejects the null hypothesis of using the random effects model, so this paper chooses to use the fixed effect model. Model (1) analyzes the impact of ambidextrous balanced innovation and ambidextrous combined innovation on the growth of international start-ups, and the empirical results are depicted in Table 5, where the values in parentheses are T-values. Since the data were converted for intra-group deviation during the fixed effect model operation, which may cause some observations to be 0 or missing, the sample data is reduced to 285 sets. The empirical results indicate that both ambidextrous balanced innovation and ambidextrous combined innovation promote the growth of international start-ups with a 10% significance, assuming Hypothesis 1 is established. The value range of explained variables and explained variables is limited, and so is the R2 after model calculation; thus, the model’s reliability is unaffected.

Table 5.

Fixed effect model.

4.4. Moderating Effect Test

To avoid the scenario in which sample size differences and sample differences reduce the moderating effect accuracy, this study conducted decentralized processing of the explained variables, explaining variables, and moderating variables. Model (2)–Model (5) tested the moderating effect pertaining to the industry’s international competitiveness and its degree of financing dependence, and the empirical results are illustrated in Table 6.

Table 6.

Test table of moderating effect.

The empirical results indicate that the industry’s international competitiveness positively moderates the promotion effect of ambidextrous balanced innovation on the growth of international start-ups and that the industry financing dependence negatively moderates the promotion effect of ambidextrous balanced innovation on the growth of international start-ups. This observation indicates that the stronger the industry’s international competitiveness, the stronger the promotion effect of the ambidextrous balanced innovation strategy on the growth of international start-ups, and that the more international entrepreneurial-oriented enterprises rely on internal financing, the more optimal the promotion effect is of ambidextrous balanced innovation on international start-ups.

In addition, industry international competitiveness and industry financing dependence exhibited no observable impact on the relationship between ambidextrous combined innovation and international entrepreneurial growth. Therefore, Hypothesis 2b and Hypothesis 3b were not supported.

4.5. Robustness Test

To guarantee the results of the empirical research, this study utilizes the method of modifying both the data processing and sample size to test the robustness. The two robustness test methods prove that the empirical test results are robust and that the conclusions are reliable.

4.5.1. Change the Data Processing Method

The differential GMM estimation method was utilized to empirically test the relationship between variables, the main effect model, and the moderating effect model, and the conclusions were obtained as illustrated in Table 7. According to the research conclusions of Arellano and Bond (1991) [42], the GMM model can solve the endogeneity problem caused by simultaneity causality. The overall AR results of the model are not significant, indicating that with the exception of a class correlation, the model does not exhibit a higher-order sequence correlation. The Hansen test proves that the selection of instrumental variables exhibited by the model is reliable. The significance and sign direction of the main effect and the moderate effect are consistent with the original regression results, and the empirical regression results of the original data are robust. At the same time, after eliminating the interference of endogenous problems, the results still support the relevant hypotheses of this paper, and the research conclusions are further supported.

Table 7.

Robustness test of the differential GMM method.

4.5.2. Change the Sample Size

With reference to the Toft–Kehler (2014) [43] study, tail shrinkage treatment at the 1% level was performed on the samples for the robustness test, and the results are depicted in Table 8. The significance and sign direction of the main effect and moderating effect are consistent with the original regression results, which indicates that the linear regression analysis results of the original data are robust and reliable.

Table 8.

Change sample size robustness test table.

5. Discussion

Innovation drives the development of international entrepreneurial-oriented enterprises, and international entrepreneurial-oriented enterprises subjected to fierce market competition and crucial difficulties associated with new entrants should comprehensively match the innovation strategy. This study selects the unbalanced panel data of the Chinese ICT industry from 2010 to 2021 to systematically analyze the impact of ambidextrous balanced innovation and ambidextrous combined innovation on the growth of international start-ups and discusses the moderating role of industry international competitiveness and industry financing dependence. Thus, the following conclusions are offered.

Both ambidextrous balanced innovation and ambidextrous combined innovation can effectively promote the growth of international start-ups, among which ambidextrous combined innovation exerts a more significant promoting effect. Hypothesis 1a and Hypothesis 1b have been verified, which is consistent with the research conclusions offered by Wu et al. (2019) [26] and Xiao (2023) [27]. Ambidextrous balanced innovation enables Chinese international entrepreneurial-oriented enterprises to systematically coordinate the allocation of innovation resources between exploratory innovation and exploitative innovation, perform exploratory innovation and exploitative innovation activities in a relatively balanced manner, facilitate the incentive effect of the two innovation strategies on the growth of international entrepreneurial-oriented enterprises, and prevent the scenario in which international entrepreneurial-oriented enterprises are subjected to the innovation trap or capability trap due to innovation imbalance. Ambidextrous combined innovation enables exploratory innovation and exploitative innovation to complement each other and grow together. A higher degree of exploitative innovation can support international entrepreneurial-oriented enterprises to perform exploratory innovation; thus, they can develop novel technologies, markets, and products [10]. Similarly, a more optimal exploratory innovation can strengthen its exploitative innovation in complementary fields. By contrast, ambidextrous combined innovation exerts a more apparent incentive effect on international start-ups than ambidextrous balanced innovation, which may be rationalized as follows: ambidextrous combined innovation requires international enterprises to effect a timely switch between exploratory innovation and exploitative innovation according to the internal and external environment, which can enable international start-ups to implement innovation strategies that are more suitable for their development.

Because industry international competitiveness moderates the incentive effect of ambidextrous balanced innovation on the growth of international start-ups, Hypothesis 2a is verified. The international entrepreneurial-oriented enterprises operating in the strong international competitiveness industry should consider the market’s stability, the development of customers, and the development of new competitive advantages. Exploratory innovation and exploitative innovation are both crucial for companies with strong international competitiveness in the industry, and enterprises should control the proportion of the two factors. For the international entrepreneurial-oriented enterprises in the weak international competitive industries, the effect of adopting the ambidextrous balanced innovation strategy on the growth of the international entrepreneurial-oriented enterprises is lower than that in the strong international competitive industries.

The degree of industry financing dependence negatively moderates the incentive effect of ambidextrous balanced innovation on the growth of international start-ups. The higher the dependence on the industry’s external financing, the weaker the dependence on the growth of international entrepreneurial-oriented enterprises by adopting ambidextrous balanced innovation. This observation may be rationalized as follows: when the capital of international entrepreneurial-oriented enterprises is relatively scarce, enterprises focus on the common development of their own exploratory innovation and exploitative innovation to avoid being subjected to the innovation trap or capability trap, and the effectiveness of ambidextrous balanced innovation has been comprehensively developed in the early stage. Through external financing dependence, international entrepreneurial-oriented enterprises have obtained a certain amount of capital inflow. Ambidextrous balanced innovation focuses more on the balance between exploratory innovation and exploitative innovation, which can maintain the steady development of international entrepreneurial-oriented enterprises. However, when new international ventures exhibit sufficient cash flow, they can achieve the synergy between exploratory innovation and exploitative innovation. The incentive effect of ambidextrous balanced innovation on the growth of international entrepreneurial-oriented enterprises is weakened; therefore, the industry financing dependence negatively moderates the relationship between ambidextrous balanced innovation and the growth of international entrepreneurial-oriented enterprises.

In addition, H2b and H3b have drawn non-significant conclusions, with no significant moderating effect on the growth of ambidextrous combined innovation and international entrepreneurial-oriented enterprise growth. In the case of changes in the various industry characteristics, ambidextrous combined innovation can maintain a good promotion of the growth of international entrepreneurial-oriented enterprises. This may be because the ICT industry is a typical technology-intensive enterprise with high innovation and high growth characteristics, and innovation is a key driver for the development of international entrepreneurial-oriented enterprises in this industry. In the ICT industry, enterprise innovation activities are intensive and the demand for innovation activities is high [17]. Both exploratory innovation and exploitative innovation activities can play an important role in promoting the growth of international entrepreneurial enterprises. This has led to differences in industry characteristics, with the ICT industry still maintaining a high demand for innovative activities, as well as a high sensitivity and high return on innovative R&D investment.

6. Conclusions and Suggestions

6.1. Theoretical Implications

This study weighs the differences between the international environment and the local scenario, selects the key industry heterogeneity as the moderating effect, and uses systems thinking to consider the strategy choice of ambidextrous balanced innovation and ambidextrous combined innovation. Herein, the study makes some key theoretical contributions to the innovation and international enterprise literature. First, this paper reviews the existing literature and deepens the understanding of ambidextrous balanced innovation and ambidextrous combined innovation. At present, most of the empirical studies on duality have adopted the cross-sectional research method based on questionnaires, and most of them have described the simple balance relationship between exploratory innovation and exploitative innovation [20,21], without involving the more complex and dynamic dimensions and mechanism of strategic duality. This study has promoted the deepening of the research on ambidextrous innovation through the test of panel data. Meanwhile, this study revises the measurement methods of ambidextrous balanced innovation and ambidextrous combined innovation based on the research of Wang et al. (2015) [24] and introduces a novel concept of the measurement methods of ambidextrous balanced innovation and ambidextrous combined innovation. Second, although the environment in which international start-ups and local enterprises operate is quite different [1,2], there are still few targeted studies on the innovation strategy choice of international start-ups. Based on the characteristics of international entrepreneurial-oriented enterprises, this study discusses the influence mechanism of ambidextrous balanced innovation and ambidextrous combined innovation on the growth of international entrepreneurial-oriented enterprises and expands the theoretical research on innovation strategy choice of enterprises. Third, previous studies mostly explored the selection of innovation strategies for international start-ups from the perspective of causal mechanisms [10] and human resources [24]. This paper considers that industry characteristics are key factors affecting the formulation of corporate strategies and analyzes the ambidextrous innovation strategy choice of international entrepreneurial-oriented enterprises from the industry heterogeneity perspective. This research clarifies the internal logic among industry heterogeneity, international entrepreneurial-oriented enterprises, and innovation strategy selection. And we expand the boundary and universality of international entrepreneurial research from the aforementioned perspective.

6.2. Practical Implications

This study offers management implications and policy proposals on Chinese international entrepreneurial-oriented enterprises governance through theoretical analysis and empirical research in the international entrepreneurship field, providing novel concepts for enhancing Chinese international entrepreneurship governance. Ambidextrous innovation can effectively enhance the performance of international entrepreneurship and international entrepreneurship should pay attention to innovation input, in order to give full play to the incentive role of innovation in the growth of enterprises. International entrepreneurship can no longer choose only exploratory innovation or exploitative innovation strategy but must weigh the two innovation strategies according to their own industry heterogeneity and react appropriately to international scenario change. In this way, international entrepreneurial-oriented enterprises can forbid falling into the failure trap or capability trap.

Another practical implication concerns policy proposals in our findings. Both ambidextrous balanced innovation and ambidextrous combined innovation promote the growth of international start-ups, and policymakers should put more effort into settling regulations to push organizations toward innovation. Industry heterogeneity is an essential factor affecting the choice of innovation strategy for international entrepreneurship. Policymakers must consider the characteristics of the industry to formulate an innovation incentive policy, which will play a better role in policy incentives.

6.3. Limitations and Future Studies

There are still some limitations to this article. First, using panel data to measure ambidextrous innovation is more objective and dynamic, but this inevitably has some limitations. Exploratory innovation is highly subversive and difficult to produce. Compared with exploitative innovation, exploratory innovation obtains fewer patent outputs. The utilization of the patent data to measure exploratory innovation and exploitative innovation may induce a scenario in which the overall measurement quantity of exploratory innovation becomes smaller than that of exploitative innovation, which may occasion a bias in the measurement of ambidextrous balanced innovation and ambidextrous combined innovation. In subsequent studies, the measurement methods of ambidextrous balanced innovation and ambidextrous combined innovation can be further discussed and corrected, thereby enhancing the research credibility of ambidextrous balanced innovation and that of the ambidextrous combined innovation of international entrepreneurial-oriented enterprises. Second, in addition to the moderating effect of industry heterogeneity, there are still many moderating variables that can affect the selection of international entrepreneurial-oriented enterprise growth and innovation strategies. Therefore, the research scope can be expanded, and the moderating effect of aspects such as organizational structure, property rights heterogeneity, and cultural distance on the innovation strategy selection of international entrepreneurial-oriented enterprises can be further explored to enrich the research.

Author Contributions

Conceptualization, J.Z. and T.S.; methodology, J.Z.; writing—original draft preparation, T.S.; writing—review and editing, J.Z. and T.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Humanities and Social Science Fund of the Ministry of Education (23YJC630200); the Jilin University 2024 graduate innovation research plan (2024CX030); and the Jilin University Labor Relations Research Project (2021LD013).

Data Availability Statement

The data that support the findings of this study are available from the corresponding author (Tingshu Sun) upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Oviatt, B.M.; Mcdougall, P.P. Defining International Entrepreneurship and Modeling the Speed of Internationalization. Entrep. Theory Pract. 2005, 29, 537–553. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive Capacity: A Review, Reconceptualization, and Extension. Acad. Manag. Rev. 2002, 27, 185. [Google Scholar] [CrossRef]

- Casillas, J.C.; Barbero, J.L.; Sapienza, H.J. Knowledge acquisition, learning, and the initial pace of internationalization. Int. Bus. Rev. 2015, 24, 102–114. [Google Scholar] [CrossRef]

- Li, R.; Peng, C.; Yang, X. Dual Innovation and Corporate Sustainable Development: The Mediating Role of Short-Term Financial Performance and Long-Term Competitive Advantage. Sci. Technol. Prog. Policy 2019, 36, 81–89. [Google Scholar]

- Levinthal, D.A.; March, J.G. The myopia of learning. Strateg. Manag. J. 1993, 14, 95–112. [Google Scholar] [CrossRef]

- Cheng, Y.; Awan, U.; Ahmad, S.; Tan, Z. How do technological innovation and fiscal decentralization affect the environment? A story of the fourth industrial revolution and sustainable growth. Technol. Forecast. Soc. Change 2021, 162, 120398. [Google Scholar] [CrossRef]

- Xie, X.; Wu, Y.; Devece, C. Is collaborative innovation a double-edged sword for firms? The contingent role of ambidextrous learning and TMT shared vision. Technol. Forecast. Soc. Change 2022, 175, 121340. [Google Scholar] [CrossRef]

- Duncan, R.B. The Ambidextrous Organization: Designing Dual Structures for Innovation. Manag. Organ. 1976, 1, 167–188. [Google Scholar]

- Zhang, J.A.; Edgar, F.; Geare, A.; O’Kane, C. The interactive effects of entrepreneurial orientation and capability-based HRM on firm performance: The mediating role of innovation ambidexterity. Ind. Mark. Manag. 2016, 59, 131–143. [Google Scholar] [CrossRef]

- Cao, Q.; Gedajlovic, E.; Zhang, H. Unpacking Organizational Ambidexterity: Dimensions, Contingencies, and Synergistic Effects. Organ. Sci. 2009, 20, 781–796. [Google Scholar] [CrossRef]

- Chang, Y.Y.; Hughes, M. Drivers of innovation ambidexterity in small- to medium-sized firms. Eur. Manag. J. 2012, 30, 1–17. [Google Scholar] [CrossRef]

- Gupta, A.K.; Smith, K.G.; Shalley, C.E. The Interplay Between Exploration and Exploitation. Acad. Manag. J. 2006, 49, 693–706. [Google Scholar] [CrossRef]

- Hollenstein, H. Innovation strategies of Swiss firms: Identification, dynamics and intra-industry heterogeneity. Economics 2019, 13, 20190018. [Google Scholar] [CrossRef]

- Onufrey, K.; Bergek, A. Second wind for exploitation: Pursuing high degrees of product and process innovativeness in mature industries. Technovation 2020, 89, 102068. [Google Scholar] [CrossRef]

- Cohen, S.K.; Caner, T. Converting inventions into breakthrough innovations: The role of exploitation and alliance network knowledge heterogeneity. J. Eng. Technol. Manag. 2016, 40, 29–44. [Google Scholar] [CrossRef]

- Cho, M.; Bonn, M.A.; Han, S.J. Innovation ambidexterity: Balancing exploitation and exploration for startup and established restaurants and impacts upon performance. Ind. Innov. 2020, 27, 340–362. [Google Scholar] [CrossRef]

- Crrocher, N.; Malerba, F.; Montobbio, F. Schumpeterian patterns of innovative activity in the ICT field. Res. Policy 2007, 36, 418–432. [Google Scholar] [CrossRef]

- He, Z.L.; Wong, P.K. Exploration vs. Exploitation: An Empirical Test of the Ambidexterity Hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

- Simeoni, F.; Brunetti, F.; Mion, G.; Baratta, R. Ambidextrous organizations for sustainable development: The case of fair-trade systems. J. Bus. Res. 2020, 112, 549–560. [Google Scholar] [CrossRef]

- March, J.G. Exploration and Exploitation in Organizational Learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Danneels, E. The dynamics of product innovation and firm competences. Strateg. Manag. J. 2002, 23, 1095–1121. [Google Scholar] [CrossRef]

- Ali, M. Imitation or innovation: To what extent do exploitative learning and exploratory learning foster imitation strategy and innovation strategy for sustained competitive advantage? Technol. Forecast. Soc. Change 2020, 165, 120527. [Google Scholar] [CrossRef]

- Yuan, D.H.X. A balancing strategy for ambidextrous learning, dynamic capabilities, and business model design, the opposite moderating effects of environmental dynamism. Technovation 2021, 103, 102225. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, Y.; Cheng, H. Top management team heterogeneity, strategic ambidexterity and firm performance. Sci. Res. Manag. 2015, 36, 89–97. [Google Scholar]

- Soukhoroukova, A.; Spann, M.; Skiera, B. Sourcing, Filtering, and Evaluating New Product Ideas: An Empirical Exploration of the Performance of Idea Markets. J. Prod. Innov. Manag. 2012, 29, 100–112. [Google Scholar] [CrossRef]

- Wu, H.; Chen, J. Innovative effect of exploring and exploiting internationalization: A matching test based on contingency theory. Sci. Res. Manag. 2019, 40, 102–110. [Google Scholar]

- Xiao, P.; Xuan, S. Will the Ambidexterity of Internationalization Help to Improvethe Innovation Performance of Chinese Multinational Companies The Study on Moderating Effect of Host Countrys Regulatory Regime. Sci. Technol. Prog. Policy 2020, 37, 112–119. [Google Scholar]

- Balassa, B. Trade Liberalisation and “Revealed” Comparative Advantage. Manch. Sch. 1965, 33, 99–123. [Google Scholar] [CrossRef]

- Tosi, H.L., Jr.; Slocum, J.W., Jr. Contingency Theory: Some Suggested Directions. J. Manag. 1984, 10, 9–26. [Google Scholar] [CrossRef]

- Pérez Sigüenza, M.; Rodríguez-León Rodríguez, L.; Ramon Jeronimo, J.M.; Flórez López, R. Management Control Systems and International Entrepreneurship in Small, Young Firms from Resource-Based Theory, Contingence, and Effectuation Approach Perspectives. J. Risk Financ. Manag. 2022, 15, 363. [Google Scholar] [CrossRef]

- Gordon, I. Internationalisation and urban competition. Urban Stud. 1999, 36, 1001–1016. [Google Scholar] [CrossRef]

- Rajan, R.G.; Zingales, L. Financial Dependence and Growth. Am. Econ. Rev. 1998, 88, 559–586. [Google Scholar]

- Myers, S.C. The Capital Structure Puzzle. J. Financ. 1984, 39, 575–592. [Google Scholar] [CrossRef]

- Katila, R.; Ahuja, G. Something old, something new: A longitudinal study of search behavior and new product introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar] [CrossRef]

- Lewin, A.Y.; Long, C.P.; Carroll, T.N. The Coevolution of New Organizational Forms. Organ. Sci. 1999, 10, 535–550. [Google Scholar] [CrossRef]

- Zander, I.; Mcdougall-Covin, P.; Rose, E.L. Born globals and international business: Evolution of a field of research. J. Int. Bus. Stud. 2015, 46, 27–35. [Google Scholar] [CrossRef]

- Edwards, J.R.; Lambert, L.S. Methods for integrating moderation and mediation: A general analytical framework using moderated path analysis. Psychol. Methods 2007, 12, 1–22. [Google Scholar] [CrossRef]

- Guan, J.; Liu, N. Exploitative and exploratory innovations in knowledge network and collaboration network: A patent analysis in the technological field of nano-energy. Res. Policy 2016, 45, 97–112. [Google Scholar] [CrossRef]

- Venkatraman, N.; Lee, C.H.; Iyer, B. Strategic ambidexterity and sales growth: A longitudinal test in the software sector. In Unpublished Manuscript (Earlier Version Presented at the Academy of Management Meetings, 2005); Boston University: Boston, MA, USA, 2007. [Google Scholar]

- Dai, X. International Competitiveness of China’s Manufacturing Industry: A Measurement Based on Trade in Value Added. China Ind. Econ. 2015, 322, 78–88. [Google Scholar]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Toft-Kehler, R.; Wennberg, K.; Kim, P.H. Practice Makes Perfect: Entrepreneurial-Experience Curves and Venture Performance. J. Bus. Ventur. 2014, 29, 453–470. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).