Does Digitalization Strategy Affect Corporate Rent-Seeking? Evidence from Chinese-Listed Firms

Abstract

1. Introduction

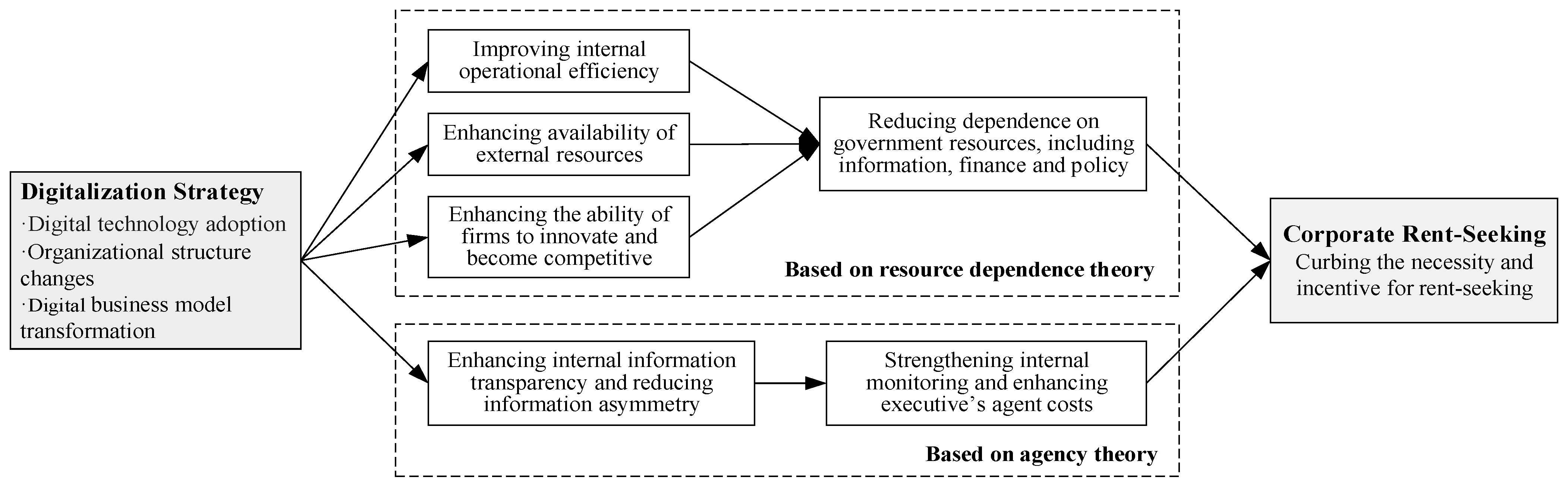

2. Literature Review and Hypotheses Development

2.1. Corporate Rent-Seeking

2.2. Digitalization Strategy

2.3. Digitalization Strategy and Corporate Rent-Seeking

2.4. The Contingent Effect of the Nature of Enterprise Ownership

2.5. The Contingent Effect of Executives’ Legal Background

3. Research Methodology

3.1. Research Sample and Data Sources

3.2. Variable Measurement and Model Setting

3.2.1. Dependent Variable

β6Big4i,t + β7Agei,t + β8Magini,t + β9Herfindahl_5i,t + ∑Industryi,t + ∑Yearit + εi,t

3.2.2. Independent Variable

3.2.3. Control Variables

3.2.4. Model Setting

4. Analysis of Empirical Results

4.1. Descriptive Statistics and Correlations

4.2. Results of Basic Regression Analyses

4.3. Endogeneity and Robustness Tests

4.4. Heterogeneity Test

5. Discussion and Conclusions

5.1. Discussion

5.2. Theoretical Implications

5.3. Management Implications

5.4. Research Limitations and Future Prospects

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ciabuschi, F.; Dellestrand, H.; Kappen, P. The good, the bad, and the ugly: Technology transfer competence, rent-seeking, and bargaining power. J. World Bus. 2012, 47, 664–674. [Google Scholar] [CrossRef]

- Du, W.; Fan, Y.; Liang, S.; Li, M. The power of belief: Religious traditions and rent-seeking of polluting enterprises in China. Financ. Res. Lett. 2023, 54, 103801. [Google Scholar] [CrossRef]

- Liu, B.; Lin, Y.; Chan, K.C.; Fung, H.-G. The dark side of rent-seeking: The impact of rent-seeking on earnings management. J. Bus. Res. 2018, 91, 94–107. [Google Scholar] [CrossRef]

- Ivy, J. State-controlled economies vs. rent-seeking states: Why small and medium enterprises might support state officials. Entrep. Reg. Dev. 2013, 25, 195–221. [Google Scholar] [CrossRef]

- Romero, J.A. Lobbying and political expenses: Complements or substitutes? J. Bus. Res. 2022, 149, 558–575. [Google Scholar] [CrossRef]

- Gorsira, M.; Denkers, A.; Huisman, W. Both Sides of the Coin: Motives for Corruption Among Public Officials and Business Employees. J. Bus. Ethics 2018, 151, 179–194. [Google Scholar] [CrossRef]

- Bi, W.; Li, J.; Xu, W.; Zhang, X. How corporate rent-seeking affects outward FDI—Empirical evidence based on A-share listed manufacturing companies. Financ. Res. Lett. 2023, 58, 104266. [Google Scholar] [CrossRef]

- Athanasouli, D.; Goujard, A. Corruption and management practices: Firm level evidence. J. Comp. Econ. 2015, 43, 1014–1034. [Google Scholar] [CrossRef]

- Du, W.; Li, M.; Wang, F. Role of rent-seeking or technological progress in maintaining the monopoly power of energy enterprises: An empirical analysis based on micro-data from China. Energy 2020, 202, 117763. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, X.T. Rent-seeking in bank credit and firm R&D innovation: The role of industrial agglomeration. J. Bus. Res. 2023, 159, 113454. [Google Scholar] [CrossRef]

- Kong, G.; Huang, J.; Ma, G. Anti-corruption and within-firm pay gap: Evidence from China. Pac.-Basin Financ. J. 2023, 79, 102041. [Google Scholar] [CrossRef]

- Hellmann, O. The visual politics of corruption. Third World Q. 2019, 40, 2129–2152. [Google Scholar] [CrossRef]

- Zhou, D.; Yan, T.; Dai, W.; Feng, J. Disentangling the interactions within and between servitization and digitalization strategies: A service-dominant logic. Int. J. Prod. Econ. 2021, 238, 108175. [Google Scholar] [CrossRef]

- Liu, Y.; Guo, M.; Han, Z.; Gavurova, B.; Bresciani, S.; Wang, T. Effects of digital orientation on organizational resilience: A dynamic capabilities perspective. J. Manuf. Technol. Manag. 2023, 35, 268–290. [Google Scholar] [CrossRef]

- Martin, K.; Shilton, K.; Smith, J. Business and the Ethical Implications of Technology: Introduction to the Symposium. J. Bus. Ethics 2019, 160, 307–317. [Google Scholar] [CrossRef]

- Li, J.; Li, S.; Zhang, Y.; Tang, X. Evolutionary game analysis of rent seeking in inventory financing based on blockchain technology. Manag. Decis. Econ. 2023, 44, 4278–4294. [Google Scholar] [CrossRef]

- Trequattrini, R.; Palmaccio, M.; Turco, M.; Manzari, A. The contribution of blockchain technologies to anti-corruption practices: A systematic literature review. Bus. Strategy Environ. 2023, 33, 4–18. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Harper & Row: New York, NY, USA, 1978. [Google Scholar]

- Meznar, M.B.; Nigh, D. Buffer or Bridge? Environmental and Organizational Determinants of Public Affairs Activities in American Firms. Acad. Manag. J. 1995, 38, 975–996. [Google Scholar] [CrossRef]

- Birnbaum, P.H. Political Strategies of Regulated Organizations as Functions of Context and Fear. Strateg. Manag. J. 1985, 6, 135–150. [Google Scholar] [CrossRef]

- Hillman, A.J.; Withers, M.C.; Collins, B.J. Resource Dependence Theory: A Review. J. Manag. 2009, 35, 1404–1427. [Google Scholar] [CrossRef]

- Fang, X.; Rao, X.; Zhang, W. Social networks and managerial rent-seeking: Evidence from executive trading profitability. Eur. Financ. Manag. 2024, 30, 602–633. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs, and ownership structure. In Economic Analysis of the Law; Wittman, D.A., Ed.; Blackwell: Oxford, UK, 2003; pp. 162–176. [Google Scholar]

- Walker, M. How far can we trust earnings numbers? What research tells us about earnings management. Account. Bus. Res. 2013, 43, 445–481. [Google Scholar] [CrossRef]

- Han, H.; Shiwakoti, R.K.; Jarvis, R.; Mordi, C.; Botchie, D. Accounting and auditing with blockchain technology and artificial Intelligence: A literature review. Int. J. Account. Inf. Syst. 2023, 48, 100598. [Google Scholar] [CrossRef]

- Zhang, L.; Niu, F.; Su, W. Association Between State Ownership Participation and Rent-Seeking Behavior of Private Firms in China. Singap. Econ. Rev. 2024, 69, 81–117. [Google Scholar] [CrossRef]

- Le, H.Q.; Vu, T.P.L.; Do, V.P.A.; Do, A.D. The enduring effect of formalization on firm-level corruption in Vietnam: The mediating role of internal control. Int. Rev. Econ. Financ. 2022, 82, 364–373. [Google Scholar] [CrossRef]

- Wang, L.; Jin, J.L.; Banister, D. Resources, state ownership and innovation capability: Evidence from Chinese automakers. Creat. Innov. Manag. 2019, 28, 203–217. [Google Scholar] [CrossRef]

- Carpenter, M.A.; Geletkanycz, M.A.; Sanders, W.G. Upper Echelons Research Revisited: Antecedents, Elements, and Consequences of Top Management Team Composition. J. Manag. 2016, 30, 749–778. [Google Scholar] [CrossRef]

- Boatright, J.R. Rent Seeking in a Market with Morality: Solving a Puzzle About Corporate Social Responsibility. J. Bus. Ethics 2009, 88, 541–552. [Google Scholar] [CrossRef]

- Chen, J.; Xu, H.; Lin, J. How Does Enterprise Rent-seeking Affect Audit Opinion Shopping? Account. Res. 2021, 7, 180–192. [Google Scholar]

- Fu, L.; Wu, F. Culture and Enterprise Rent-Seeking: Evidence from Native Place Networks among Officials in China. Emerg. Mark. Financ. Trad. 2018, 55, 1388–1404. [Google Scholar] [CrossRef]

- Lin, B.; Xie, J. Superior administration’s environmental inspections and local polluters’ rent seeking: A perspective of multilevel principal–Agent relationships. Econ. Anal. Policy 2023, 80, 805–819. [Google Scholar] [CrossRef]

- Ma, Y.; Ni, H.; Yang, X.; Kong, L.; Liu, C. Government subsidies and total factor productivity of enterprises: A life cycle perspective. Econ. Polit. 2023, 40, 153–188. [Google Scholar] [CrossRef]

- Nguyen, N.; Dang-Van, T.; Vo-Thanh, T.; Do, H.-N.; Pervan, S. Digitalization strategy adoption: The roles of key stakeholders, big data organizational culture, and leader commitment. Int. J. Hosp. Manag. 2024, 117, 103643. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Li, S.; Gao, L.; Han, C.; Gupta, B.; Alhalabi, W.; Almakdi, S. Exploring the effect of digital transformation on Firms’ innovation performance. J. Innov. Knowl. 2023, 8, 100317. [Google Scholar] [CrossRef]

- Trzaska, R.; Sulich, A.; Organa, M.; Niemczyk, J.; Jasiński, B. Digitalization Business Strategies in Energy Sector: Solving Problems with Uncertainty under Industry 4.0 Conditions. Energies 2021, 14, 7997. [Google Scholar] [CrossRef]

- Yu, F.; Jiang, D.; Zhang, Y.; Du, H. Enterprise digitalisation and financial performance: The moderating role of dynamic capability. Technol. Anal. Strateg. Manag. 2023, 35, 704–720. [Google Scholar] [CrossRef]

- Matt, C.; Hess, T.; Benlian, A. Digital transformation strategies. Bus. Inf. Syst. Eng. 2015, 57, 339–343. [Google Scholar] [CrossRef]

- Zhai, H.; Yang, M.; Chan, K.C. Does digital transformation enhance a firm’s performance? Evidence from China. Technol. Soc. 2022, 68, 101841. [Google Scholar] [CrossRef]

- Singh, S.; Sharma, M.; Dhir, S. Modeling the effects of digital transformation in Indian manufacturing industry. Technol. Soc. 2021, 67, 101763. [Google Scholar] [CrossRef]

- Tsou, H.-T.; Chen, J.-S. How does digital technology usage benefit firm performance? Digital transformation strategy and organisational innovation as mediators. Technol. Anal. Strateg. Manag. 2023, 35, 1114–1127. [Google Scholar] [CrossRef]

- Zhao, Q.; Li, X.; Li, S. Analyzing the Relationship between Digital Transformation Strategy and ESG Performance in Large Manufacturing Enterprises: The Mediating Role of Green Innovation. Sustainability 2023, 15, 9998. [Google Scholar] [CrossRef]

- Begnini, S.; Oro, I.M.; Tonial, G.; Dalbosco, I.B. The relationship between the use of technologies and digitalization strategies for digital transformation in family businesses. J. Fam. Bus. Manag. 2023. [Google Scholar] [CrossRef]

- Low, M.P.; Bu, M. Examining the impetus for internal CSR Practices with digitalization strategy in the service industry during COVID-19 pandemic. Bus. Ethics Environ. Responsib. 2021, 31, 209–223. [Google Scholar] [CrossRef]

- Li, Q.; Zhang, H.; Liu, K.; Zhang, Z.J.; Jasimuddin, S.M. Linkage between digital supply chain, supply chain innovation and supply chain dynamic capabilities: An empirical study. Int. J. Logist. Manag. 2023. [Google Scholar] [CrossRef]

- Badakhshan, E.; Ball, P. Applying digital twins for inventory and cash management in supply chains under physical and financial disruptions. Int. J. Prod. Res. 2022, 61, 5094–5116. [Google Scholar] [CrossRef]

- Tan, K.H.; Zhan, Y.; Ji, G.; Ye, F.; Chang, C. Harvesting big data to enhance supply chain innovation capabilities: An analytic infrastructure based on deduction graph. Int. J. Prod. Econ. 2015, 165, 223–233. [Google Scholar] [CrossRef]

- Liu, Y.; He, Q. Digital transformation, external financing, and enterprise resource allocation efficiency. Manag. Decis. Econ. 2024, 45, 2321–2335. [Google Scholar] [CrossRef]

- Zoppelletto, A.; Bullini Orlandi, L.; Rossignoli, C. Adopting a digital transformation strategy to enhance business network commons regeneration: An explorative case study. TQM J. 2020, 32, 561–585. [Google Scholar] [CrossRef]

- Stonig, J.; Schmid, T.; Müller-Stewens, G. From product system to ecosystem: How firms adapt to provide an integrated value proposition. Strateg. Manag. J. 2022, 43, 1927–1957. [Google Scholar] [CrossRef]

- Hess, T.; Benlian, A.; Matt, C.; Wiesböck, F. Options for formulating a digital transformation strategy. MIS Q. Exec. 2016, 15, 123–139. [Google Scholar]

- Giang, N.P.; Tam, H.T. Impacts of Blockchain on Accounting in the Business. SAGE Open 2023, 13, 1–13. [Google Scholar] [CrossRef]

- Pincus, M.; Tian, F.; Wellmeyer, P.; Xu, S.X. Do Clients’ Enterprise Systems Affect Audit Quality and Efficiency? Contemp. Account. Res. 2017, 34, 1975–2021. [Google Scholar] [CrossRef]

- Li, Z.F. Mutual Monitoring and Agency Problems. SSRN Electron. J. 2014, 2406191. [Google Scholar] [CrossRef]

- Ngo, H.-Y.; Lau, C.-M.; Foley, S. Strategic human resource management, firm performance, and employee relations climate in China. Hum. Resour. Manag. 2008, 47, 73–90. [Google Scholar] [CrossRef]

- Guo, Y.; Huy, Q.N.; Xiao, Z. How middle managers manage the political environment to achieve market goals: Insights from China’s state-owned enterprises. Strateg. Manag. J. 2017, 38, 676–696. [Google Scholar] [CrossRef]

- Chen, Z.; Zhou, M.; Ma, C. Anti-corruption and corporate environmental responsibility: Evidence from China’s anti-corruption campaign. Glob. Environ. Chang. 2022, 72, 102449. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Deliu, D.; Farcane, N.; Dontu, A. Managing change with and through blockchain in accountancy organizations: A systematic literature review. J. Organ. Chang. Manag. 2021, 34, 477–506. [Google Scholar] [CrossRef]

- Gao, D.; Yan, Z.; Zhou, X.; Mo, X. Smarter and Prosperous: Digital Transformation and Enterprise Performance. Systems 2023, 11, 329. [Google Scholar] [CrossRef]

- Ying, Q.; Liu, J. Anti-corruption campaign in China: Good news or bad news for firm value? Appl. Econ. Lett. 2017, 25, 1183–1188. [Google Scholar] [CrossRef]

- Guo, J.; Wang, Y.; Yang, W. China’s anti-corruption shock and resource reallocation in the energy industry. Energy Econ. 2021, 96, 105182. [Google Scholar] [CrossRef]

- Xia, F.; Walker, G. How much does owner type matter for firm performance? Manufacturing firms in China 1998–2007. Strateg. Manag. J. 2015, 36, 576–585. [Google Scholar] [CrossRef]

- Huang, C.; Ho, K.C. Does the presence of executives with a legal background affect stock price crash risk? Corp. Gov. 2022, 31, 55–82. [Google Scholar] [CrossRef]

- Pham, M.H.; Merkoulova, Y.; Veld, C. Credit risk assessment and executives’ legal expertise. Rev. Account. Stud. 2023, 28, 2361–2400. [Google Scholar] [CrossRef]

- Dai, Y.; Tong, X.; Jia, X. Executives’ Legal Expertise and Corporate Innovation. Corp. Gov. 2024. [Google Scholar] [CrossRef]

- Somaya, D.; Williamson, I.O.; Zhang, X. Combining Patent Law Expertise with R&D for Patenting Performance. Organ. Sci. 2007, 18, 922–937. [Google Scholar] [CrossRef]

- Labrecque, L.I.; Markos, E.; Swani, K.; Peña, P. When data security goes wrong: Examining the impact of stress, social contract violation, and data type on consumer coping responses following a data breach. J. Bus. Res. 2021, 135, 559–571. [Google Scholar] [CrossRef]

- Paik, A.; Southworth, A.; Heinz, J.P. Lawyers of the Right: Networks and Organization. Law Soc. Inq. 2007, 32, 883–917. [Google Scholar] [CrossRef]

- Sun, B.; Liu, P.; Zhang, W.; Zhang, T.; Li, W. Unpacking urban network as formed by client service relationships of law firms in China. Cities 2022, 122, 103546. [Google Scholar] [CrossRef]

- Chierici, R.; Tortora, D.; Del Giudice, M.; Quacquarelli, B. Strengthening digital collaboration to enhance social innovation capital: An analysis of Italian small innovative enterprises. J. Intellect. Cap. 2020, 22, 610–632. [Google Scholar] [CrossRef]

- Chen, H.; Yoon, S.S. Government efficiency and enterprise innovation—Evidence from China. Asian J. Technol. Innov. 2019, 27, 280–300. [Google Scholar] [CrossRef]

- Du, X.; Chen, Y.; Du, Y. Rent-Seeking, political connection, and actual performance: Evidence from Chinese privately-owned listed companies. J. Financ. Res. 2010, 10, 135–157. Available online: https://kns.cnki.net/kcms2/article/abstract?v=0rU-DchPtsvyks_8emQ62p0xSQAN-7udXHrVzGWB1BdfJtw8MuSmbWr-nurOpK87SriTibD-fVzDzhiMgIudMkTfk5p2AjBMd-oSVbzhCA_TcMdZ2YqLxgVypkQ6xMjs&uniplatform=NZKPT&language=CHS (accessed on 1 May 2024). (In Chinese).

- Bertrand, M.; Mullainathan, S. Do people mean what they say? Implication for subjective survey data. Am. Econ. Rev. 2001, 91, 67–72. [Google Scholar] [CrossRef]

- Jin, X.; Lei, X.; Wu, W. Can digital investment improve corporate environmental performance?—Empirical evidence from China. J. Clean. Prod. 2023, 414, 137669. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X.; Xing, M. Enterprise Digital Transformation and Audit Pricing. Audit. Res. 2021, 3, 62–71. [Google Scholar]

- Liu, Z.; Zhou, J.; Li, J. How do family firms respond strategically to the digital transformation trend: Disclosing symbolic cues or making substantive changes? J. Bus. Res. 2023, 155, 113395. [Google Scholar] [CrossRef]

- Ganguli, S.K. Rent Seeking, Earning Management and Agency Cost: How Do They Impact Equity Value? Indian Evidence. Glob. Bus. Rev. 2023, 1–20. [Google Scholar] [CrossRef]

- Pereira, R.M.; Borini, F.M.; Oliveira, M.d.M. Interorganizational cooperation and process innovation: The dynamics of national vs foreign location of partners. J. Manuf. Technol. Manag. 2018, 31, 260–283. [Google Scholar] [CrossRef]

- Angrist, J.D.; Pischke, J.-S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Larcker, D.F.; Rusticus, T.O. On the use of instrumental variables in accounting research. J. Account. Econ. 2010, 49, 186–205. [Google Scholar] [CrossRef]

- Ji, Z.; Zhou, T.; Zhang, Q. The Impact of Digital Transformation on Corporate Sustainability: Evidence from Listed Companies in China. Sustainability 2023, 15, 2117. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. Digital Economy Development, Allocation of Data Elements and Productivity Growth in Manufacturing Industry. Economist 2021, 10, 41–50. Available online: https://kns.cnki.net/kcms2/article/abstract?v=0rU-DchPtssKnZt2pHq-EgPsPGcPI742Ci7zl93-M-t-4meh3Xnh5WwxdwkMX_wKpIKs9CFXpuhNVyskdqNCZgqUsXeuEvjtpjMeUy94SY-SK2BR9Qpr-eV5lKrD6dwRLu95We6ZMelY4AXpDjuJuA==&uniplatform=NZKPT&language=CH (accessed on 1 May 2024). (In Chinese). [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. The central role of the propensity score in observational studies for causal effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Stuart, E.A. Matching methods for causal inference: A review and look forward. Stat. Sci. 2010, 25, 1–21. [Google Scholar] [CrossRef] [PubMed]

- Moser-Plautz, B.; Schmidthuber, L. Digital government transformation as an organizational response to the COVID-19 pandemic. Gov. Inf. Q. 2023, 40, 101815. [Google Scholar] [CrossRef] [PubMed]

- Dang, C.; Li, Z.; Yang, C. Measuring Firm Size in Empirical Corporate Finance. J. Bank. Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Lewis, B.W.; Walls, J.L.; Dowell, G.W.S. Difference in degrees: CEO characteristics and firm environmental disclosure. Strateg. Manag. J. 2014, 35, 712–722. [Google Scholar] [CrossRef]

- Geletkanycza, M.A.; Blackb, S.S. Bound by the past? Experience-based effects on commitment to the strategic status quo. J. Manag. 2001, 27, 3–21. [Google Scholar] [CrossRef]

- Bamber, L.S.; Jiang, J.; Wang, I.Y. What’s My Style? The Influence of Top Managers on Voluntary Corporate Financial Disclosure. Account. Rev. 2010, 85, 1131–1162. [Google Scholar] [CrossRef]

- Nell, P.C.; Foss, N.J.; Klein, P.G.; Schmitt, J. Avoiding digitalization traps: Tools for top managers. Bus. Horiz. 2021, 64, 163–169. [Google Scholar] [CrossRef]

- Gebauer, H.; Fleisch, E.; Lamprecht, C.; Wortmann, F. Growth paths for overcoming the digitalization paradox. Bus. Horiz. 2020, 63, 313–323. [Google Scholar] [CrossRef]

- Fabian, N.E.; Dong, J.Q.; Broekhuizen, T.; Verhoef, P.C. Business value of SME digitalisation: When does it pay off more? Eur. J. Inform. Syst. 2024, 33, 383–402. [Google Scholar] [CrossRef]

- Krafft, M.; Kumar, V.; Harmeling, C.; Singh, S.; Zhu, T.; Chen, J.; Duncan, T.; Fortin, W.; Rosa, E. Insight is power: Understanding the terms of the consumer-firm data exchange. J. Retail. 2021, 97, 133–149. [Google Scholar] [CrossRef]

- Ham, C.; Koharki, K. The association between corporate general counsel and firm credit risk. J. Account. Econ. 2016, 61, 274–293. [Google Scholar] [CrossRef]

- Jiang, X.; Jiang, F.; Cai, X.; Liu, H. How does trust affect alliance performance? The mediating role of resource sharing. Ind. Mark. Manag. 2015, 45, 128–138. [Google Scholar] [CrossRef]

- Mubarak, M.F.; Petraite, M. Industry 4.0 technologies, digital trust and technological orientation: What matters in open innovation? Technol. Forecast. Soc. Chang. 2020, 161, 120332. [Google Scholar] [CrossRef]

- Du, Z.; Zheng, L.; Lin, B. Does Rent-Seeking Affect Environmental Regulation? Evidence From the Survey Data of Private Enterprises in China. J. Glob. Inf. Manag. 2021, 30, 1–22. [Google Scholar] [CrossRef]

- Slater, S.F.; Olson, E.M.; Hult, G.T.M. The moderating influence of strategic orientation on the strategy formation capability–performance relationship. Strateg. Manag. J. 2006, 27, 1221–1231. [Google Scholar] [CrossRef]

| Source | Method/Source | Theory Perspective | Intra- Organizational Antecedents | Strategic Antecedents | Contingency Factors | Main Findings |

|---|---|---|---|---|---|---|

| Ciabuschi et al. (2012) [1] | Survey data; 63 subsidiaries of 23 multinational companies | —— | Y | N | N | Technology transfer competence leads to greater bargaining power for subsidiaries, which in turn increases their rent-seeking behavior. |

| Du et al. (2023) [2] | Panel data; 3,382,951 samples, China | Institutional theory | N | N | Y | Religious traditions have a significant negative impact on corporate rent-seeking behavior, with regional corruption and market monopolies attenuating this negative relationship. |

| Fu and Wu (2018) [32] | Panel data; 8761 samples from 288 cities, China | Resource dependence theory | N | N | Y | Officials’ native place culture increases rent-seeking costs for local firms. State-owned enterprises demonstrate a greater willingness to pay to benefit from officials’ native place networks. |

| Fang et al. (2024) [22] | Panel data; 32,286 samples, USA | —— | Y | N | N | The social network of the board of directors effectively inhibits management rent-seeking. |

| Lin and Xie (2023) [33] | Panel data; 11,226 samples, China | Agency theory | N | N | Y | Well-established inspections greatly reduce the rent-seeking behavior of polluting firms. Public attention and corporate bargaining power would greatly strengthen the relationship between the first two. |

| Ma et al. (2023) [34] | Panel data; 5109 observations and 1600 firms, China | Rent theory | N | N | N | Government subsidies greatly increase unproductive rent-seeking activities. |

| Zhang et al. (2023) [26] | Panel data; 17,204 samples, China | Shareholder resource theory and agency theory | N | N | Y | Economic policy uncertainty and government intervention weaken the disincentive effect of state-owned firms’ participation on private firms’ rent-seeking behavior. |

| This study | Panel data; 31,775 samples, China | Agency theory and resource dependence theory | Y | Y | Y | Digitalization strategy (DS) has a negative impact on rent-seeking behavior. In state-owned firms, DS are more likely to discourage corporate rent-seeking than in private firms. DS is more likely to inhibit rent-seeking behavior in firms without legal executives than in firms with legal executives. |

| Variable | Abbreviation | Operationalization |

|---|---|---|

| Rent-seeking | Rent | See the detailed description in Section 3.2, Model Setting and Variable Measurement. |

| Digitalization strategy | DS | See the detailed description in Section 3.2, Model Setting and Variable Measurement. |

| Return on assets | ROA | Net profit divided by the average balance of total assets. |

| Financial leverage | Lev | Total liabilities divided by total assets |

| Revenue growth rate | Growth | (Sales revenue of the current year − sales revenue of the previous year)/sales revenue of the previous year |

| Board size | Board | The natural logarithm of 1 plus the total number of directors on the board |

| Independent board | IndepBoard | The ratio of independent directors to the board |

| Top one | Top1 | The percent of ownership by the largest shareholder |

| Management shareholding ratio | Mshare | The percent of ownership by senior executives |

| Dual title | Dual | Dual title of chairman and CEO |

| Manager top three | ManagerTop3 | Ln (total compensation of the top three senior executives) |

| Firm size | Size | Ln (total assets at the end of the accounting period) |

| Firm age | Age | Current year minus the year in which the enterprise was established |

| Variable | Mean | SD | Min | Max |

|---|---|---|---|---|

| Rent | −0.002 | 0.044 | −0.099 | 0.176 |

| DS | 0.090 | 0.217 | 0.000 | 1.000 |

| ROA | 0.048 | 0.057 | −0.163 | 0.226 |

| Lev | 0.422 | 0.204 | 0.053 | 0.865 |

| Growth | 0.360 | 0.913 | −0.638 | 6.322 |

| Board | 8.689 | 1.728 | 5.000 | 15.000 |

| IndepBoard | 37.200 | 5.223 | 30.000 | 57.140 |

| Top1 | 35.130 | 14.900 | 8.910 | 74.450 |

| Mshare | 13.290 | 20.160 | 0.000 | 69.710 |

| Dual | 0.267 | 0.442 | 0.000 | 1.000 |

| ManagerTop3 | 14.350 | 0.762 | 12.390 | 16.400 |

| Size | 22.030 | 1.259 | 19.830 | 25.970 |

| Age | 2.783 | 0.377 | 1.609 | 3.466 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Rent | 1 | ||||||||||||

| 2. DS | −0.019 *** | 1 | |||||||||||

| 3. ROAb | −0.074 *** | 0.007 | 1 | ||||||||||

| 4. ALR | −0.038 *** | −0.026 *** | −0.390 *** | 1 | |||||||||

| 5. Growth | 0.022 *** | 0.145 *** | −0.021 *** | 0.079 *** | 1 | ||||||||

| 6. Board | 0.024 *** | −0.061 *** | −0.015 *** | 0.175 *** | −0.030 *** | 1 | |||||||

| 7. IndepBoard | 0.013 ** | 0.041 *** | −0.012 ** | −0.029 *** | 0.022 *** | −0.472 *** | 1 | ||||||

| 8. Top1 | 0.019 *** | −0.023 *** | 0.120 *** | 0.056 *** | 0.003 | 0.025 *** | 0.028 *** | 1 | |||||

| 9. Mshare | −0.031 *** | 0.074 *** | 0.221 *** | −0.348 *** | −0.022 *** | −0.224 *** | 0.097 *** | −0.093 *** | 1 | ||||

| 10. Dual | −0.022 *** | 0.045 *** | 0.080 *** | −0.166 *** | −0.017 *** | −0.185 *** | 0.123 *** | −0.045 *** | 0.271 *** | 1 | |||

| 11. ManagerTop3 | 0.138 *** | 0.086 *** | 0.176 *** | 0.045 *** | 0.010 * | 0.024 *** | 0.037 *** | −0.048 *** | −0.009 | 0.019 *** | 1 | ||

| 12. Size | 0.157 *** | −0.050 *** | −0.074 *** | 0.494 *** | 0.026 *** | 0.251 *** | 0.013 ** | 0.165 *** | −0.333 *** | −0.168 *** | 0.457 *** | 1 | |

| 13. Age | −0.053 *** | 0.014 ** | −0.127 *** | 0.131 *** | 0.050 *** | −0.041 *** | 0.030 *** | −0.146 *** | −0.167 *** | −0.052 *** | 0.290 *** | 0.230 *** | 1 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| DV | Rent | Rent (2SLS) | Rent (2SLS) | Rent | EAE |

| DigTransfYS | −0.005 *** | −0.051 ** | −0.203 * | −0.004 *** | |

| (0.001) | (0.023) | (0.118) | (0.001) | ||

| DigIntangA | −0.000* | ||||

| (0.000) | |||||

| ROA | −0.109 *** | −0.149 *** | −0.153 *** | −0.109 *** | −0.099 *** |

| (0.005) | (0.005) | (0.008) | (0.005) | (0.005) | |

| Lev | −0.034 *** | −0.049 *** | −0.047 *** | −0.034 *** | −0.034 *** |

| (0.002) | (0.002) | (0.003) | (0.002) | (0.002) | |

| Growth | 0.000 | 0.002 *** | 0.004 *** | 0.000 | 0.000 |

| (0.000) | (0.000) | (0.001) | (0.000) | (0.000) | |

| Board | 0.000 | −0.001 *** | −0.001 *** | 0.000 | 0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| IndepBoard | 0.000 | 0.000 | 0.000 | 0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Top1 | 0.000 | 0.000 ** | 0.000 * | 0.000 | 0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Mshare | −0.000 *** | 0.000 ** | 0.000 ** | −0.000 *** | −0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Dual | −0.002 ** | −0.000 | 0.000 | −0.002 ** | −0.001 ** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| ManagerTop3 | 0.005 *** | 0.010 *** | 0.012 *** | 0.005 *** | 0.004 *** |

| (0.001) | (0.001) | (0.002) | (0.001) | (0.001) | |

| Size | 0.009 *** | 0.008 *** | 0.005 * | 0.009 *** | 0.009 *** |

| (0.000) | (0.001) | (0.002) | (0.000) | (0.000) | |

| Age | −0.008 *** | −0.011 *** | −0.012 *** | −0.008 *** | −0.005 * |

| (0.003) | (0.001) | (0.002) | (0.003) | (0.003) | |

| Constant | −0.251 *** | −0.244 *** | −0.206 *** | −0.255 *** | −0.235 *** |

| (0.016) | (0.014) | (0.029) | (0.016) | (0.015) | |

| Industry-, year-, and firm-fixed effects | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.047 | 0.053 | −0.710 | 0.047 | 0.041 |

| N | 31,795 | 31,771 | 28,522 | 31,795 | 31,770 |

| Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|

| DV | Rent | Rent | Rent | Rent |

| DigTransfYS | −0.007 *** | −0.004 *** | −0.005 * | −0.004 *** |

| (0.002) | (0.001) | (0.002) | (0.002) | |

| Constant | −0.214 *** | −0.270 *** | −0.251 *** | −0.269 *** |

| (0.021) | (0.017) | (0.030) | (0.016) | |

| Industry-, year-, and firm-fixed effects | Yes | Yes | Yes | Yes |

| R2 | 0.045 | 0.050 | 0.047 | 0.046 |

| N | 17,229 | 27,802 | 31,795 | 28,334 |

| Model 10a | Model 10b | Model 10c | Model 10d | |

|---|---|---|---|---|

| DV | Rent | Rent | Rent | Rent |

| DigTransfYS | −0.005 *** | −0.005 ** | −0.003 ** | −0.005 *** |

| (0.001) | (0.001) | (0.002) | (0.001) | |

| Constant | −0.111 *** | −0.252 *** | −0.216 *** | −0.255 *** |

| (0.015) | (0.016) | (0.018) | (0.016) | |

| Industry-, year-, and firm-fixed effects | Yes | Yes | Yes | Yes |

| R2 | 0.035 | 0.045 | 0.042 | 0.035 |

| N | 31,781 | 31,002 | 24,487 | 31,768 |

| Model 11 | Model 12 | Model 13 | Model 14 | |

|---|---|---|---|---|

| Dependent Variable | SOE | Low | ||

| Group | Yes | No | Yes | No |

| DigTransfYS | −0.009 *** | −0.001 | −0.001 | −0.009 *** |

| (0.002) | (0.002) | (0.002) | (0.003) | |

| Constant | −0.210 *** | −0.314 *** | −0.241 *** | −0.232 *** |

| (0.023) | (0.024) | (0.020) | (0.031) | |

| Control Variables | Yes | Yes | Yes | Yes |

| Industry-, year-, and firm-fixed effects | Yes | Yes | Yes | Yes |

| R2 | 0.045 | 0.058 | 0.045 | 0.050 |

| N | 12,288 | 19,015 | 21,697 | 10,032 |

| Model 15 | Model 16 | Model 17 | Model 18 | |

|---|---|---|---|---|

| Dependent Variable | SOE | Low | ||

| Group | Yes | No | Yes | No |

| DigTransfYS | −0.009 *** | −0.000 | −0.000 | −0.008 *** |

| (0.002) | (0.002) | (0.002) | (0.003) | |

| Constant | −0.203 *** | −0.287 *** | −0.225 *** | −0.223 *** |

| (0.023) | (0.023) | (0.019) | (0.031) | |

| Control Variables | Yes | Yes | Yes | Yes |

| Industry-, year-, and firm-fixed effects | Yes | Yes | Yes | Yes |

| R2 | 0.043 | 0.051 | 0.040 | 0.046 |

| N | 12,279 | 18,999 | 21,682 | 10,022 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, X.; Liu, Y. Does Digitalization Strategy Affect Corporate Rent-Seeking? Evidence from Chinese-Listed Firms. Systems 2024, 12, 209. https://doi.org/10.3390/systems12060209

Yu X, Liu Y. Does Digitalization Strategy Affect Corporate Rent-Seeking? Evidence from Chinese-Listed Firms. Systems. 2024; 12(6):209. https://doi.org/10.3390/systems12060209

Chicago/Turabian StyleYu, Xiang, and Yanzhe Liu. 2024. "Does Digitalization Strategy Affect Corporate Rent-Seeking? Evidence from Chinese-Listed Firms" Systems 12, no. 6: 209. https://doi.org/10.3390/systems12060209

APA StyleYu, X., & Liu, Y. (2024). Does Digitalization Strategy Affect Corporate Rent-Seeking? Evidence from Chinese-Listed Firms. Systems, 12(6), 209. https://doi.org/10.3390/systems12060209