Abstract

This paper considers the agency selling channel in a supply chain under platform service investment. We construct Stackelberg game models to study the impact of the manufacturer’s encroachment strategy on supply chain members. Research results indicate that the encroachment strategy always has a positive impact at the levels of the manufacturer and platform service, which should dynamically change in response to the manufacturer’s action; the platform may actively implement a service strategy without encroachment, while the platform should be cautious in providing services to avoid backlash when encroachment occurs; the high commission rate may prompt the platform to increase the service effort and hinder manufacturer encroachment; when the channel substitution rate is high, both the manufacturer and platform may suffer from it and hence they should slow down their strategy implementation and consider cooperation; when the elasticity coefficient is large and the service cost is high, it may hinder the platform from providing services and the manufacturer may take the opportunity to encroach and thus seize the market.

1. Introduction

As is known to us, online platform sales have demonstrated strong development momentum and vitality in recent years. Many manufacturers have turned to more convenient and faster online sales, intending to provide customers with a more comfortable and comprehensive shopping experience through online retailing. As a country with large-scale electronic sales, China’s online retail sales in 2022 amounted to RMB 13.79 trillion, with a year-on-year increase of 4%. In the first half of 2023, China’s online retail sales amounted to 7.16 trillion RMB, up 13.1% year-on-year, and hence online retail manifests great vitality. Online platforms act as marketplace by charging commission fees from manufacturers and allowing them to sell products through the platforms, which is called agency selling [,]. It is notable that commission fees are usually not fixed and are usually strategically determined by online platforms. For example, Amazon re-evaluates its referral fee annually in line with revenue and seller feedback []. In real life, such a mode has been widely embraced, like Taobao in China, Flipkart in India, Newegg.com in the United States, and Darty in France [,]. Obviously, agency selling is becoming increasingly important in commerce strategies.

In addition to traditional channels, expanding new selling channels has become an emerging path for manufacturers. This study focuses on an operational strategy in which manufacturers encroach by establishing direct selling channels, which is also known as manufacturer encroachment []. It is remarkable that the encroachment strategy is very common, e.g., Apple, Dell, Sony, Xiaomi, Samsung, Lenovo, Huawei, Estee Lauder, Adidas, Nike, Coca-Cola, etc. [,]. For example, by establishing direct sales ordering pattern, Dell directly contacts with customers one-to-one and customers can order directly through Internet or by phone, which greatly reduces inventory and effectively lessens production costs. Samsung sells its products through wireless carriers (e.g., Verizon, AT&T, and T-Mobile) and its website []. In reality, a growing number of manufacturers have been absorbed in establishing online direct sales stores. For instance, Apple began to sell its products in China in October 2009 by launching an online Apple Store approximately a year later, which makes it easier for consumers to shop online (https://www.apple.com/newsroom/2010/10/26Apple-Launches-Online-Store-in-China/) (accessed on 26 October 2010).

Manufacturer encroachment may intensify channel competition and conflicts, threaten downstream firms, and reduce other channels’ shares in the market, which may limit the profitability of retailers []. On the contrary, manufacturer encroachment can suppress manufacturers’ wholesale prices to prevent retailers from setting high retail prices and thereby mitigate double marginalization and bring a win–win outcome to supply chain members [,,]. Consequently, subsequent impact of encroachment deserves further exploration.

In order to cope with market competition, platforms need to seek other outlets so as to attract consumers through relatively complete services such as product display, storage, logistics, pre-sale, and after-sale consultation []. High-level platform services can encourage and attract more consumers to purchase through platforms and thereby improve their competitiveness. For example, Amazon began to promote third-party open platforms on a large scale in 2001, launched online services in 2002, introduced Prime services in 2005, and provided Fulfillment by Amazon in 2007 (https://www.zhihu.com/question/479160190/answer/2085208673) (accessed on 26 August 2021). By launching these services, Amazon has become a comprehensive provider rather than an online retailer. JD.com has built its own service system since 2012 and its self-built repair center has unified industry standards and innovated service models. In 2014, JD Help was established to focus on the rural service market in counties and towns, and JD.com launched Jing Pin Merchant in 2020. As a high-quality service platform with JD.com Logistics, JD Service+ relies on its core capabilities to lay out three leaps in the service network of “self-built repair center + JD Help + Jing pin Merchant”, covering all the scenarios of delivery repair, home delivery, store service, all categories of 3C, home appliances, home furnishing, as well as all areas of urban and rural (https://zhuanlan.zhihu.com/p/139897885) (accessed on 12 May 2020). Through high-quality platform services, the platforms hope to bring a win–win situation.

This study integrates platform services into manufacturer encroachment to seek to elucidate the strategic significance of manufacturer encroachment under intervention from the platform service and evaluate their effects on equilibrium decisions and optimal profits. In addition to delineating the advantageous aspects of encroachment for manufacturers, we focus on analyzing the detrimental effects of channel conflicts and their implications for enterprise operations. By providing managerial insights, this research aims to assist enterprises in establishing a mutually beneficial collaboration framework. Specifically, our work aims to investigate the following issues:

- How does the manufacturer encroachment strategy affect supply chain members’ optimal decisions and profits?

- How does the manufacturer encroachment strategy affect platforms’ service-imposed strategy?

- How do the key system factors such as commission rate, inter-channel substitution rate, unit service cost elasticity coefficient, etc. influence the performance and action of manufacturers and platforms?

The remainder of the paper is organized as follows. Section 2 reviews some relevant literatures. We construct two models in Section 3 and give a theoretical and numerical analysis in Section 4. In Section 5, we conclude the paper with future research directions. All proofs are given in an Appendix A.

2. Literature Review

This study is most relevant to three main streams, namely, agency selling pattern, platform service input, and manufacturer encroachment. Below, we examine the relevant literatures in the above streams.

2.1. Agency Selling Pattern

Nowadays, the most prevailing sales pattern on platforms is the agency selling pattern. There has been a large body of literature to study the agency selling pattern [,,,,,]. Under the agency selling pattern, platforms collect a portion of commission from manufacturers and permit them to sell products through the platforms. Quite a few studies investigated the causation for the growing prevalence of agency selling. In particular, according to Abhishek et al., agency selling is an efficient selling pattern and e-tailers have a greater incentive to use agency selling as market competition increases []. Zheng et al. examined the optimal strategy for downstream retailers to introduce a marketplace where fungible products are sold. They found that such a strategy can alleviate double marginalization between manufacturers and retailers to bring a win–win outcome and even improve consumer surplus []. Li et al. explored how platforms and manufacturers formulate an efficient extended warranty strategy under an agency selling pattern []. On this basis, many studies have discussed the advantages of agency selling in a supply chain. Specifically, Ryan et al. were the first to analyze competition in the online marketplace []. Yan et al. considered the decision of whether to introduce agency selling channel and their findings suggested that manufacturers are more willing to introduce agency selling channel []. Based on the above findings, Yan et al. continued to explore issues related to agency selling by introducing sale efficiency and demand information []. Xu et al. investigated manufacturers’ pricing and carbon abatement decisions and the results showed that, when the cross-channel spillover effect is relatively high, the agency selling mode can provide more profits to manufacturers [].

The above studies mainly focus on the pricing decision and there is very little research on launch volume decision. This paper investigates manufacturers’ encroachment strategy and launch volume decisions when incorporating the platform service level and excavates some management insights.

2.2. Platform Service Input

Recently, consumers have been paying more attention to the product service level beyond price. More and more platforms provide consumers with a variety of services. Therefore, platform services have become an important component in market competition. Many studies have explained the importance of service [,,,,]. In this respect, Davis et al. started with the service brand and argued that it acts as a relationship lever to build trust between service providers and consumers []. Taylor described the impact of channel rebate and sales effort on channel coordination so as to achieve channel coordination and a win–win situation []. In addition, Yan and Pei focused on the strategic role of retail services in dual-channel supply chains and the findings showed that improving retail services can effectively improve the entire supply chain’s performance []. Wang et al. integrated the service effort competition into the issue of manufacturers sharing demand information with retailers []. Li et al. analyzed a retailer that provides coupons online and invests in service work offline, and studies coupon promotion policies and omni-channel operation strategies for three omni-channel retail models [].

Service can affect decision makers’ execution of operational strategies and hence sharing services become an inevitable trend in the e-commerce market. Some publications focus on the factors influencing service efforts. For example, Bai et al. showed that, in a two-echelon supply chain, retailers can increase demand and thus increase profit through promotional service efforts []. Liu et al. considered the factors such as value-added service and matching capabilities and found that value-added service always helps improve platform profitability []. Similarly, Li et al. discussed how to choose a logistics service strategy provided by online platforms under different selling modes and investigated how the competition intensity and demand sensitivity of logistics services affect firms’ decision making and profits []. Bai et al. examined how government subsidies affect pricing and service quality strategies of different online recycling channel structures []. Moreover, Li et al. studied retailers’ decisions regarding the construction of in-house and outsourcing service in a supply chain and found that the existence of a service outsourcing market alleviates the supply chain’s double marginalization effect []. Taleizadeh et al. considered several models supported by different marketing efforts and described the impact of an exerted marketing effort on optimal decisions and supply chain members’ profits []. Zhang et al. established a game model to analyze the interaction between platforms’ service investment strategy and suppliers’ encroachment decision. They showed that the platforms’ investment can observe spillover effects, which may increase suppliers’ profits [].

By observing the aforementioned literature, we know that manufacturer encroachment can cause intensified competition among channels. How do supply chain members make decisions on market launch volume? How do the actions of manufacturers and platforms affect their respective performance? This study tries to answer these questions.

2.3. Manufacturer Encroachment

Some classic studies have found that, due to double marginalization effects, encroachment is beneficial to all supply chain parties [,,]. Based on these studies, some literatures have considered more factors when deciding whether to encroach. For example, Yoon found that the spillover effect is strong and able to improve retailers’ profits and ultimately generate Pareto returns, as long as the encroachment does not lead to extreme retail competition []. Sun et al. explored the interplay of quantity-based cost reduction and supplier encroachment, as well as their impact on supply chain members []. Xu and Xu discussed channel encroachment and the carbon reduction strategies of enterprises in the absence of information and information asymmetry []. Wan et al. examined how leadership in retail pricing affects manufacturers’ encroachment decision and how manufacturer encroachment affects retailers’ profitability []. Hou et al. discussed the impact of manufacturer encroachment and cooperative advertising on supply chain members []. They found that, under a cost-sharing contract, manufacturer encroachment can help supply chain members to achieve Pareto improvement. Tong et al. analyzed a game between a manufacturer and a retailer, and studied the impact of encroachment by a well-informed manufacturer []. They found that encroachment is more likely to lead to a lose–lose outcome for both parties.

With widespread research on the impact of manufacturer encroachment, scholars shift their attention to explore the constraints of manufacturer encroachment. It has been shown that, in a symmetric information environment, manufacturer encroachment can alleviate double marginalization and bring a win–win situation to supply chain members. In particular, Li et al. found that, under symmetric information, the benefit of encroachment disappears if manufacturers use nonlinear pricing []. Yang et al. attempted to understand the impact of nonlinear pricing on manufacturer encroachment in a linear demand environment []. Xia and Niu proposed four parsimonious models to study a monopoly of manufacturers’ optimal encroachment strategy under service spillover and different channel power []. Guan et al. incorporated a voluntary disclosure strategy into manufacturer encroachment, in which retailers can gain a positive free-riding effect when they free ride on the disclosure []. Ha et al. studied manufacturer encroachment and information sharing decisions when selling through online platforms. They showed that encroachment and information sharing are mutually reinforcing with one decision enhancing the value of the other []. Moreover, Xiao et al. investigated the interplay between manufacturer encroachment and retailer information-sharing in gray markets under advertising investment. They found that, under an exogenous channel structure, even if manufacturers encroach, retailers still have the motivation to share information. Under endogenous channel structure, manufacturer encroachment depends on the encroachment cost and retailer information sharing depends on advertising effect []. Zhang et al. considered three different information structures, namely, full information, asymmetric information, and no information, to explore the effect of encroachment and information on product quality and profits []. In contrast to the above studies on comparison between symmetric and asymmetric environments, Ponnachiyur Maruthasalam and Balasubramanian studied manufacturer encroachment in the case of asymmetric retail competition, and they showed that asymmetric retail competition not only makes it easier for manufacturers to encroach, but also boosts direct selling quantity [].

In contrast to the above existing works, this study incorporates the platforms’ service level factor into manufacturers’ encroachment decision making. We aim to study the impact of the service level on manufacturers’ encroachment decision making, as well as market launch volume and coordination issues in supply chain.

3. Model Framework

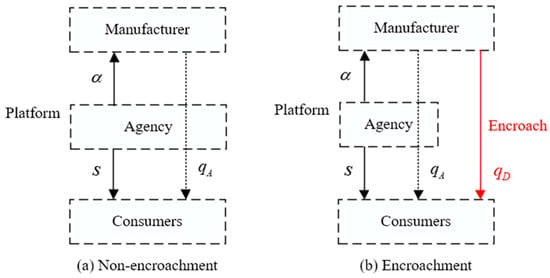

Consider a supply chain consisting of one manufacturer and one platform. The manufacturer can sell homogeneous alternative products through the platform’s agency selling channel, while the platform provides consumers with some optional certain services. Apart from platform agency selling, the manufacturer can establish a direct selling channel by encroaching and selling products directly to consumers. The research structure of the supply chain is shown in Figure 1.

Figure 1.

Modeling framework.

In Figure 1a, there only exists a single sales mode for the manufacturer through the agency selling channel. The manufacturer determines the market launch volume and pays a commission rate to the platform, which is referenced to the tariff of various categories of JD Open platform in 2023 (https://rule.jd.com/rule/ruleDetail.action?ruleId=950583665543483392&btype=8) (accessed on 4 February 2024). Particularly, the platform provides a certain service level to consumers. In Figure 1b, the manufacturer also has a direct selling channel through encroachment and hence there are two channels to sell products to consumers.

We assume that the service cost provided by the platform is given by a quadratic expression , where denotes the unit cost factor for service inputs. This assumption has been widely used in the previous literature [,,], which implies that the cost borne by the platform increases as the service level increases. Here, the magnitude of represents the platform’s level of marginal cost to increase unit service level, which specifically refers to the fund required to increase the unit service level of product warehousing service, logistics service, payment service, customer service, after-sales service, and return service, etc. Without loss of generality, the manufacturer’s production cost and the platform’s selling cost are normalized to zero, which has also been widely adopted in the existing literature [,,]. Additionally, we use the subscripts ‘−E’ and ‘E’ to represent the equilibrium results in non-encroachment and encroachment situations, respectively.

3.1. The Case without Encroachment

In this case, the manufacturer sells products on the platform only through the agency selling channel. The inverse demand function in the agency selling channel is assumed to be . To help the manufacturer make optimal decision, we construct the following Stackelberg game model for the case without encroachment:

where the manufacturer’s profit comes from the agency selling channel, while the platform’s profits include the commission profit in the agency selling channel and the cost of providing platform services.

We use the backward induction method to solve the above bilevel program. The results are given in the following proposition, which is shown in the Appendix A.

Proposition 1.

In the model , when , the optimal decisions and the optimal profits of the manufacturer and the platform are

Proposition 1 shows that, when the manufacturer does not encroach, if the service cost elasticity coefficient is at a high level, the platform represents a small threat to the manufacturer. It should be noted that, when the manufacturer and the platform agree on commission rate or determine the market launch volume in practice, they not only need to follow the characteristics of key system factors, but also need to adjust according to actual market conditions.

3.2. The Case with Encroachment

When the manufacturer decides to encroach by establishing a direct selling channel, there exists two sales modes in the supply chain, namely, the platform agency selling mode and the direct selling mode. Due to the competitive relationship between two channels, we assume the inverse demand function in the agency selling channel to be and the inverse demand function in the direct selling channel to be , where represents the inter-channel substitution rate between two channels.

In this case, the direct selling channel captures a part of the market, which further affects the agency selling channel’s market launches. We construct a Stackelberg game model as follows:

where the manufacturer’s profit comes from the agency and direct selling channels, while the platform’s profits include the profit share obtained from the agency selling channel and the cost of platform service inputs.

The backward induction method is used to solve the model and leads to the following proposition, which is shown in the Appendix A.

Proposition 2.

In the model , when and , the optimal decisions and the optimal profits of the manufacturer and the platform are

Proposition 2 suggests that, when the channel substitution rate is too high, supply chain members will suffer from increasingly fierce market competition and thus decrease the efficiency of the supply chain, which further results in a loss of profits. When the service cost elasticity coefficient is too low, despite the platform can temporarily benefit, an excessive service effort may lead to an imbalance structure in the supply chain. It may even lead to more intense competition in the channel, which has a negative impact on supply chain members. Consequently, the appropriate values of key factors may preferably ensure that both parties obtain optimal decisions in the case with encroachment.

4. Model Analysis

4.1. Comparative Analysis

In this subsection, we explore how the manufacturer encroachment strategy affects equilibrium results in two cases. First of all, we give a sensitivity analysis for two cases.

Proposition 3.

In the model , the sensitivity analysis results for equilibrium results are as follows:

- (1)

- (2)

Proposition 3 shows that all equilibrium results increase with the increase in the commission rate and a decrease with the increase in the service cost elasticity coefficient. Specifically, as the commission rate increases, the manufacturer increases the agency selling channel’s product launch volume to compensate for the loss caused by a high commission rate, while the platform enhances its service level to attract consumers so as to achieve a profitable goal. So, both the manufacturer and the platform are able to gain high profits with the increase in the commission rate. Moreover, as the service cost elasticity coefficient increases, the platform attempts to enhance the commission rate so as to reduce the profit loss caused by the increase in the service cost and, at the same time, the manufacturer appropriately reduces the agency selling channel’s launch volume. Under the influence of a high service cost, the profits of both the manufacturer and the platform are reduced. Therefore, the platform should consequently keep the cost of service level inputs within reasonable limits. With the increase in fierce market competition, excellent cost control may promote the improvement of firms’ business management, which may facilitate the continuous development and improvement in enterprises and ultimately enhance their profitability.

Proposition 4.

In the model , the sensitivity analysis results for equilibrium results are as follows:

- (1)

- (2)

- (3)

Proposition 4 shows that, as the commission rate increases, the platform increases its input on the service level to attract consumers, while the manufacturer increases its agency selling channel’s product launch volume and reduces its direct selling channel’s product launch volume as the commission rate increases, which can be explained by the market shift towards the agency selling channel due to the improved service level. However, the profits brought by manufacturer encroachment cannot offset the losses caused by increasing commission rate. There is no doubt that a high commission rate may bring high profits to the platform, but the manufacturer may incur additional channel competition due to encroachment. Intriguingly, all equilibrium results decrease with the increase in inter-channel substitution rate, which means that the intensified channel competition has a wide impact on supply chain members. Combined with Proposition 2, the optimal decisions and optimal profits can only be guaranteed when the inter-channel substitution rate is at a low level. In addition, as the service cost elasticity coefficient increases, the service level imposed by the platform declines, leading to a decline in the attractiveness of agency selling channel. At this time, the manufacturer may shift a greater product launch volume from the agency selling channel to the direct selling channel. The manufacturer and the platform can reply to their own competitor’s challenges and change by some measures, such as determining differentiation strategies, strengthening channel cooperation, and monitoring market changes, thereby helping themselves establish dominance over the competition.

By comparing the optimal decisions between two cases, we can obtain the following proposition, which is shown in the Appendix A.

Proposition 5.

Manufacturer encroachment leads to a reduction in the agency selling channel’s market launch volume (i.e., ) and makes the platform’s service level decrease (i.e., ).

Proposition 5 shows that, through the direct selling channel, manufacturer encroachment can divide up a portion of the market. Meanwhile, manufacturer encroachment triggers fierce channel competition with less motivation to exert service inputs for the platform. Furthermore, manufacturer encroachment reduces the attractiveness of the agency selling channel.

By comparing the optimal profits of between two cases, we can obtain the following proposition, which is shown in the Appendix A.

Proposition 6.

(1) The profit of the manufacturer in the model is always higher than that in the model , i.e., .

From Proposition 6, we can observe that the manufacturer’s profit in the encroachment case is always greater than that in the non-encroachment case. On the one hand, manufacturer encroachment scales up a new direct selling channel and then increases the manufacturer’s profit. On the other hand, manufacturer encroachment stimulates channel competition. Prominently, the negative effect brought by intensifying channel competition is less than the positive effect brought by expanding market demand and thus the manufacturer can always benefit from encroachment. Moreover, the platform’s profitability from the manufacturer’s encroachment strategy is limited by its input to the service level. When is within different threshold bounds, the platform’s gain situation may even be reversed. Therefore, the appropriate service level input is more likely to result in a win–win situation for both parties.

4.2. Numerical Analysis

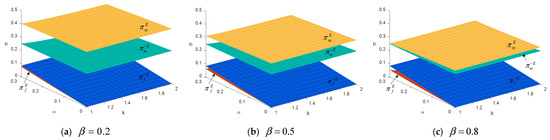

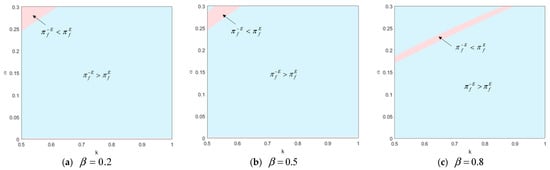

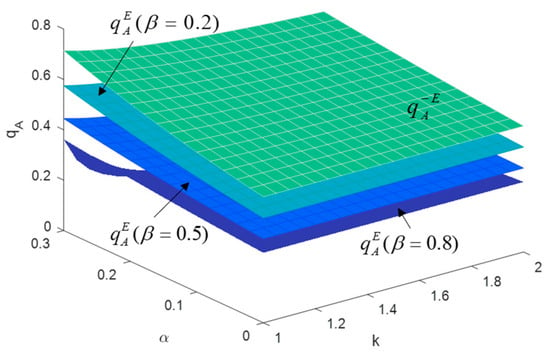

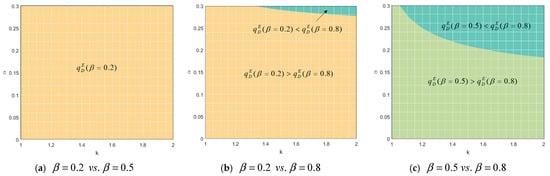

This section examines the impact of some key parameters, including the commission rate , the inter-channel substitution rate , and the service cost elasticity coefficient , on supply chain members. From historical data, the commission rate ranges from 1% to 15% of the sales price depending on product category on Amazon.com (http://kaidian.amazon.cn/services/cb/pricing.html) (accessed on 17 January 2023), varies from 5% to 12% (https://rule.jd.com/rule/ruleDetail.action?ruleId=638209647311982592&btype=1) (accessed on 1 April 2023) on JD.com, and changes from 20% to 30% on Vip.com (https://www.sohu.com/a/60917291_116672) (accessed on 28 February 2016). Consequently, in our experiments, we took from 1% to 30% as the range of the commission rate at which the platform was allowed to charge. When the manufacturer implements the encroachment strategy, the most intuitive change is the addition of a direct selling channel, which intensifies the channel competition. Channel conflicts are inevitable and, if conflicts and obstacles in channel operation develop permanently, they will inevitably affect the entire supply chain. Therefore, we need to investigate the impact of inter-channel substitution rate on the supply chain members’ profits. In our experiments, we focused on three scenarios of (i.e., , , ) and the other parameters were set to be , . The numerical results are shown in Figure 2 and Figure 3.

Figure 2.

Strategic selection under different .

Figure 3.

Effects of on the comparison of the platform’s profit between two cases.

Figure 2 reveals that manufacturer encroachment always brings a positive effect on the manufacturer, while Figure 3 indicates that the impact on the platform is mostly negative. When the manufacturer does not encroach, there only exists an agency selling channel in the market, without channel competition in the supply chain, and hence the profits of the manufacturer and the platform are not related to the inter-channel substitution rate. The impact of manufacturer encroachment on supply chain is mainly manifested in the three following aspects: firstly, the channel competition is intensified and the newly added direct selling channel created by encroachment inevitably seizes part of the market demand so as to trigger fierce channel competition. Secondly, channel competition may stimulate the platform to improve its service input and thus enhance its competitiveness and counteract the negative impact of channel competition. Thirdly, due to the added direct selling channel, the manufacturer may expand the source of profit. In addition, we can notice that the manufacturer’s profit is always higher than the platform’s profit, regardless of whether the manufacturer encroaches or not. This is due to the fact that, whether it is through the agency selling channel or the direct selling channel, the manufacturer has more adequate market information and historical data to decide the market launch volume and hence the manufacturer is more likely to dominate the market than the platform. From Figure 3, we can intuitively catch that the manufacturer’s encroachment strategy and temporarily bring a bright side to the platform. As the inter-channel substitution rate increases, such a bright side is tilted toward a low commission rate and a high service cost elasticity coefficient, which is not conducive to the health of the platform’s operation. For supply chain members, the benefits of any party cannot be based on the damage to the other party’s benefit. Both the manufacturer and the platform need to reach a better balance in terms of benefits based on safeguarding their respective rights and interests.

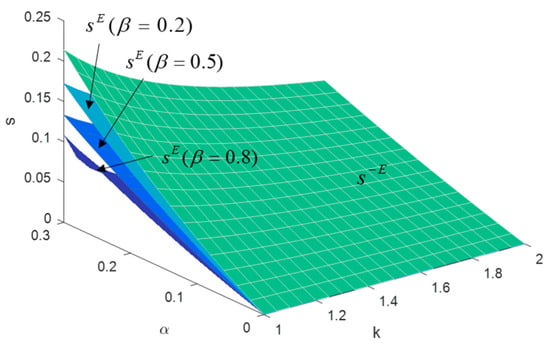

Based on the above results, we examined the impacts of different channel substitution rates on the manufacturer’s and the platform’s decisions as well. The numerical results are shown in Figure 4, Figure 5 and Figure 6. Figure 4 shows that, regardless of the level of inter-channel substitution rate, the platform’s service level in the encroachment case is lower than that in the non-encroachment case. It can be explained that, when manufacturer encroachment occurs, the newly added direct selling channel divides up part of the market demand, leading to reduction in the platform’s profit. As a result, channel competition augments while the marginal investment benefit of the platform service level decreases, that is, the platform loses the motivation to invest in the service level. Moreover, we can observe that, as the service cost elasticity coefficient increases, the platform’s service level shows a downward trend, which is because, since the cost of providing service increases, the platform’s marginal benefit decreases accordingly. According to the results given in Figure 4, we can find that, as the commission rate increases, the platform’s service level shows an upward trend, which is due to the fact that the platform has a greater incentive to invest in its service. For the platform, providing a service may improve attractiveness, enhance competitiveness, and obtain a high profit. Nevertheless, for the manufacturer, improving the service level may help increase the profitability of the agency selling channel and hinder the establishment of the direct selling channel. In this case, the manufacturer should weigh the loss of the agency channel resulting from encroachment against the benefit of opening up a direct sales channel.

Figure 4.

Changes of with .

Figure 5.

Changes of with .

Figure 6.

Strategic selection under different .

From Figure 5, it can be seen that, in the encroachment case, as the inter-channel substitution rate increases, the agency selling channel’s market launch volume decreases. At this point, even enhancing the service input cannot mitigate harm caused by the manufacturer’s encroachment to the platform’s profitability. This is because, when manufacturer encroachment occurs, the newly added direct selling channel may seize part of the market share and beget a decrease in the agency selling channel’s market share. With the increase in the inter-channel substitution rate, the market launch volume of the agency selling channel shows a downward trend. At this point, the manufacturer tends towards the direct selling channel for a large profit margin without a third party, whereas the platform is able to moderately improve the service level, increasing the attractiveness of the agency selling channel, so as to win some consumers and seize a greater market share.

In Figure 6, we compare the market launch volume of the direct selling channel under different inter-channel substitution rates (i.e., ). Figure 6a shows that the direct selling channel’s market launch volume under a low inter-substitution rate is always higher than that under a medium channel substitution rate. Remarkably, in Figure 6b,c, the bright side of high inter-channel substitution rate is fairly small. In practice, before implementing the encroachment strategy, the manufacturer should pay attention to determining the differentiated strategies by aiming to avoid backlash from the encroachment. Meanwhile, the platform should constantly pay attention to market changes so as to take preventive measures in a timely manner. Furthermore, the manufacturer and the platform can strengthen cooperation, jointly develop markets, and upgrade product quality, and thereby alleviate channel conflicts to achieve win–win cooperation.

5. Conclusions

We have explored the impact of manufacturer encroachment on supply chain members’ decisions and profits by considering the platform’s service inputs. Specifically, by comparing the equilibrium results in the encroachment and non-encroachment scenarios, we derive the following intriguing results: Firstly, when the manufacturer encroaches, this will reduce the agency selling channel’s market launch volume and the platform will reduce service level; the manufacturer encroachment is always favorable to the manufacturer, which is detrimental to the platform in most cases. Secondly, in the non-encroachment scenario, the platform can adopt an aggressive service strategy to enhance its attractiveness; since manufacturer encroachment may make the platform’s marginal benefit decrease, it is not advisable for the platform to input too much service to avoid losses. Thirdly, the manufacturer invariably dominates the market and its optimal strategy is always to encroach; when the commission rate is high, it is recommended that the manufacturer slows down the pace of encroachment, because it is more conducive to the platform to perform the service, so as to achieve the dual objective of a high-quality service in the agency channel and a high market share; when the channel substitution rate is high, the supply chain is prone to imbalance, with both the manufacturer and the platform suffer great losses so that two parties need to consider the cooperation of win–win situation; when the cost of service elasticity coefficient is high, it is clear that the platform is not suitable for inputting too much service and, instead, the manufacturer can appropriately encroach to capture market share.

Note that, in this paper, we only consider the case with one manufacturer and one platform, whereas competition typically arises among multiple manufacturers and multiple platforms in reality. Moreover, it is assumed that the platform can provide services to attract consumers, while the manufacturer may also form unique competitiveness in electronic services so as to compete with the platform. Based on these observations, in the future, we may consider more general cases with multiple manufacturers and platforms, as well as taking the electronic services by manufacturers into consideration. In addition, we may also extend single agency selling channel case to multiple selling channel cases.

Author Contributions

Conceptualization, G.L. and J.Z.; methodology, G.L.; software, J.Z.; validation, G.L., J.Z. and Q.Z.; formal analysis, Q.Z.; investigation, J.Z.; resources, J.Z.; data curation, J.Z.; writing—original draft preparation, J.Z.; writing—review and editing, G.L. and Q.Z.; visualization, J.Z.; supervision, J.Z.; project administration, G.L.; funding acquisition, G.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China, grant number No. 12071280.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Related notions in propositions.

Table A1.

Related notions in propositions.

| Notation | Definition |

|---|---|

Proof of Proposition 1:

Let . Since

the objective function is concave in . By solving and taking the nonnegative constraint into consideration, we obtain the optimal solution Then, by substituting into (1), the model becomes

Similarly, since

the objective function is concave in . By solving the equation and taking the non-negative constraint into consideration, we obtain the optimal solution . Furthermore, we have , , . This completes the proof. □

Proof of Proposition 2:

Let . Since

we know that is concave in . By solving the first-order condition and taking the non-negative constraint into consideration, we obtain Substituting into (3), the model becomes

The first-order conditions of are as follows:

Then, the Hessian matrix of is

It is easy to see that the above Hessian matrix is negative definite if

Since , the first inequality holds evidently. The second inequality is equivalent to

Thus, is concave in when and . Solving (A1) yields

Combined with (A2), to ensure the constraints , it requires

This means that when and . Noting that and , we have when and .

Substituting (A3) into , we have . Substituting (A3) and into (3)–(4), we obtain

This completes the proof. □

Proof of Proposition 5:

From (A2) and (A4), we obtain

Thus, we obtain and . This completes the proof. □

Proof of Proposition 6:

(1) From (A2) and (A4), we obtain

Thus, we always have . On the other hand, we obtain

where is defined as in Table A1. Let , where are defined as in Table A1. From and , we have ,, , and . Thus, if , we have and if , we have .

Noting that ,, and , we have . This implies that, if , then and if , then . This completes the proof. □

References

- Guo, X.; Zheng, S.; Yu, Y.; Zhang, F. Optimal bundling strategy for a retail platform under agency selling. Prod. Oper. Manag. 2021, 30, 2273–2284. [Google Scholar] [CrossRef]

- Li, J.; He, S.; Chen, J.; He, Z. Optimal extended warranty strategy for a two-sided platform under agency selling. Comput. Ind. Eng. 2023, 178, 109129. [Google Scholar] [CrossRef]

- Hu, H.; Zheng, Q.; Pan, X. Agency or wholesale? The role of retail pass-through. SSRN Electron. J. 2022, 68, 7538–7554. [Google Scholar] [CrossRef]

- Abhishek, V.; Jerath, K.; Zhang, Z.J. Agency selling or reselling? Channel structures in electronic retailing. Manag. Sci. 2016, 62, 2259–2280. [Google Scholar] [CrossRef]

- Zheng, S.; Yu, Y.; Ma, B. The bright side of third-party marketplaces in retailing. Int. Trans. Oper. Res. 2022, 29, 442–470. [Google Scholar] [CrossRef]

- Tsay, A.A.; Agrawal, N. Channel conflict and coordination in the e-commerce age. Prod. Oper. Manag. 2004, 13, 93–110. [Google Scholar] [CrossRef]

- Chiang, W.K.; Chhajed, D.; Hess, J.D. Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Manag. Sci. 2003, 49, 1–20. [Google Scholar] [CrossRef]

- Yoon, D.H. Supplier encroachment and investment spillovers. Prod. Oper. Manag. 2016, 25, 1839–1854. [Google Scholar] [CrossRef]

- Bai, S.; Ge, L.; Zhang, X. Platform or direct channel: Government-subsidized recycling strategies for WEEE. Inf. Syst. E-Bus. Manag. 2022, 20, 347–369. [Google Scholar] [CrossRef]

- Arya, A.; Mittendorf, B.; Sappington, D.E.M. The bright side of supplier encroachment. Mark. Sci. 2007, 26, 651–659. [Google Scholar] [CrossRef]

- Tong, Y.; Lu, T.; Li, Y.; Ye, F. Encroachment by a better-informed manufacturer. Eur. J. Oper. Res. 2023, 305, 1113–1129. [Google Scholar] [CrossRef]

- Zhang, X.; Li, G.; Liu, M.; Sethi, S.P. Online platform service investment: A bane or a boon for supplier encroachment. Int. J. Prod. Econ. 2021, 235, 108079. [Google Scholar] [CrossRef]

- Hagiu, A.; Wright, J. Marketplace or reseller? Manag. Sci. 2015, 61, 184–203. [Google Scholar] [CrossRef]

- Li, Q.; Wang, Q.; Song, P. The effects of agency selling on reselling on hybrid retail platforms. Int. J. Electron. Commer. 2019, 23, 524–556. [Google Scholar] [CrossRef]

- Tian, L.; Vakharia, A.J.; Tan, Y.R.; Xu, Y. Marketplace, reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Prod. Oper. Manag. 2018, 27, 1595–1610. [Google Scholar] [CrossRef]

- Ryan, J.K.; Sun, D.; Zhao, X. Competition and coordination in online marketplaces. Prod. Oper. Manag. 2012, 21, 997–1014. [Google Scholar] [CrossRef]

- Yan, Y.; Zhao, R.; Liu, Z. Strategic introduction of the marketplace channel under spillovers from online to offline sales. Eur. J. Oper. Res. 2018, 267, 65–77. [Google Scholar] [CrossRef]

- Yan, Y.; Zhao, R.; Xing, T. Strategic introduction of the marketplace channel under dual upstream disadvantages in sales efficiency and demand information. Eur. J. Oper. Res. 2019, 273, 968–982. [Google Scholar] [CrossRef]

- Xu, X.; He, P.; Fan, Y. The pricing and carbon abatement decisions of a manufacturer selling with marketplace or reselling mode. Int. Trans. Oper. Res. 2022, 29, 1220–1245. [Google Scholar] [CrossRef]

- Amrouche, N.; Zaccour, G. Shelf-space allocation of national and private brands. Eur. J. Oper. Res. 2007, 180, 648–663. [Google Scholar] [CrossRef]

- Davis, R.; Buchanan-Oliver, M.; Brodie, R.J. Retail service branding in electronic-commerce environments. J. Serv. Res. 2000, 3, 178–186. [Google Scholar] [CrossRef]

- Mohr, L.A.; Bitner, M.J. The role of employee effort in satisfaction with service transactions. J. Bus. Res. 1995, 32, 239–252. [Google Scholar] [CrossRef]

- Parasuraman, A.P.; Zeithaml, V.; Berry, L. SERVQUAL: A multiple- item scale for measuring consumer perceptions of service quality. J. Retail. 1988, 64, 12–40. [Google Scholar]

- Taylor, T.A. Supply chain coordination under channel rebates with sales effort effects. Manag. Sci. 2002, 48, 992–1007. [Google Scholar] [CrossRef]

- Yan, R.; Pei, Z. Retail services and firm profit in a dual-channel market. J. Retail. Consum. Serv. 2009, 16, 306–314. [Google Scholar] [CrossRef]

- Wang, Y.; Ha, A.Y.; Tong, S. Sharing manufacturer’s demand information in a supply chain with price and service effort competition. Manuf. Serv. Oper. Manag. 2022, 24, 1698–1713. [Google Scholar] [CrossRef]

- Li, Z.; Wang, D.; Yang, W.; Jin, H.S. Price, online coupon, and store service effort decisions under different omnichannel retailing models. J. Retail. Consum. Serv. 2022, 64, 102787. [Google Scholar] [CrossRef]

- Bai, Q.; Chen, M.; Xu, L. Revenue and promotional cost-sharing contract versus two-part tariff contract in coordinating sustainable supply chain systems with deteriorating items. Int. J. Prod. Econ. 2017, 187, 85–101. [Google Scholar] [CrossRef]

- Liu, W.; Yan, X.; Wei, W.; Xie, D. Pricing decisions for service platform with provider’s threshold participating quantity, value-added service and matching ability. Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 410–432. [Google Scholar] [CrossRef]

- Li, D.; Liu, Y.; Fan, C.; Hu, J.; Chen, X. Logistics service strategies under different selling modes. Comput. Ind. Eng. 2021, 162, 107684. [Google Scholar] [CrossRef]

- Li, G.; Huang, F.F.; Cheng, T.C.E.; Zheng, Q.; Ji, P. Make-or-buy service capacity decision in a supply chain providing after-sales service. Eur. J. Oper. Res. 2014, 239, 377–388. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Sane-Zerang, E.; Choi, T.-M. The effect of marketing effort on dual-channel closed-loop supply chain systems. IEEE Trans. Syst. Man Cybern. Syst. 2018, 48, 265–276. [Google Scholar] [CrossRef]

- Sun, X.; Tang, W.; Zhang, J.; Chen, J. The impact of quantity-based cost decline on supplier encroachment. Transp. Res. Part E Logist. Transp. Rev. 2021, 147, 102245. [Google Scholar] [CrossRef]

- Xu, W.; Xu, H. Channel encroachment and carbon reduction with demand information asymmetry. J. Clean. Prod. 2022, 371, 133443. [Google Scholar] [CrossRef]

- Wan, X.; Chen, J.; Li, W. The impact of retail pricing leadership under manufacturer encroachment. Eur. J. Oper. Res. 2023, 310, 217–237. [Google Scholar] [CrossRef]

- Hou, P.; Wang, J.; Zhang, Q.; Zhang, S. Implications of risk aversion behavior on the green product promotion strategy under manufacturer encroachment. Appl. Math. Comput. 2023, 447, 127911. [Google Scholar] [CrossRef]

- Li, Z.; Gilbert, S.M.; Lai, G. Supplier encroachment as an enhancement or a hindrance to nonlinear pricing. Prod. Oper. Manag. 2015, 24, 89–109. [Google Scholar] [CrossRef]

- Yang, H.; Luo, J.; Zhang, Q. Supplier encroachment under nonlinear pricing with imperfect substitutes: Bargaining power versus revenue-sharing. Eur. J. Oper. Res. 2018, 267, 1089–1101. [Google Scholar] [CrossRef]

- Xia, J.; Niu, W. Adding Clicks to bricks: An analysis of supplier encroachment under service spillovers. Electron. Commer. Res. Appl. 2019, 37, 100876. [Google Scholar] [CrossRef]

- Guan, X.; Liu, B.; Chen, Y.; Wang, H. Inducing supply chain transparency through supplier encroachment. Prod. Oper. Manag. 2020, 29, 725–749. [Google Scholar] [CrossRef]

- Ha, A.Y.; Luo, H.; Shang, W. Supplier encroachment, information sharing, and channel structure in online retail platforms. Prod. Oper. Manag. 2022, 31, 1235–1251. [Google Scholar] [CrossRef]

- Xiao, L.; Zhang, S.L.; Chen, J.X.; Chin, K.S. Information-sharing strategy and manufacturer encroachment under advertising investment in gray markets. INFOR Inf. Syst. Oper. Res. 2023, 61, 256–285. [Google Scholar] [CrossRef]

- Zhang, J.; Li, S.; Zhang, S.; Dai, R. Manufacturer encroachment with quality decision under asymmetric demand information. Eur. J. Oper. Res. 2019, 273, 217–236. [Google Scholar] [CrossRef]

- Ponnachiyur Maruthasalam, A.P.; Balasubramanian, G. Supplier encroachment in the presence of asymmetric retail competition. Int. J. Prod. Econ. 2023, 264, 108961. [Google Scholar] [CrossRef]

- Tsay, A.A.; Agrawal, N. Channel dynamics under price and service competition. Manuf. Serv. Oper. Manag. 2000, 2, 372–391. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, J.; Zhu, G. Retail service investing: An anti-encroachment strategy in a retailer-led supply chain. Omega 2019, 84, 212–231. [Google Scholar] [CrossRef]

- Li, T.; Xie, J.; Zhao, X. Supplier encroachment in competitive supply chains. Int. J. Prod. Econ. 2015, 165, 120–131. [Google Scholar] [CrossRef]

- Wang, X.; Chaolu, T. The impact of offline service effort strategy on sales mode selection in an e-commerce supply chain with showrooming effect. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 893–908. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).