Abstract

Peer-to-Peer (P2P) energy trading is a new financial mechanism that can be adopted to incentivize the development of distributed energy resources (DERs), by promoting the selling of excess energy to other peers on the network at a negotiated rate. Current incentive programs, such as net metering (NEM) and Feed-in-Tariff (FiT), operate according to a centralized policy framework, where energy is only traded with the utility, the state-owned grid authority, the service provider, or the power generation/distribution company, who also have the upper hand in deciding on the rates for buying the excess energy. This study presents a comparative analysis of three energy trading mechanisms, P2P energy trading, NEM, and FiT, within a rural microgrid consisting of two prosumers and four consumers. The microgrid serves as a practical testbed for evaluating the economic impacts of these mechanisms, through simulations considering various factors such as energy demand, production variability, and energy rates, and using key metrics such as economic savings, annual energy bill, and wasted excess energy. Results indicate that while net metering and FiT offer stable financial returns for prosumers, P2P trading demonstrates superior flexibility and potentially higher economic benefits for both prosumers and consumers by aligning energy trading with real-time market conditions. The findings offer valuable insights for policymakers and stakeholders seeking to optimize rural energy systems through innovative trading mechanisms.

1. Introduction

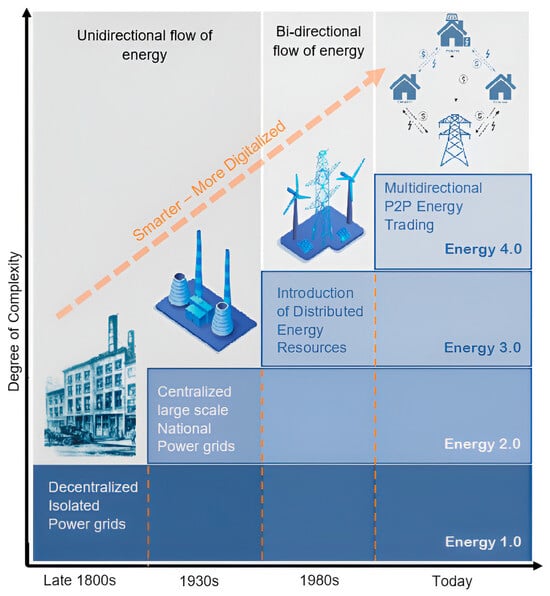

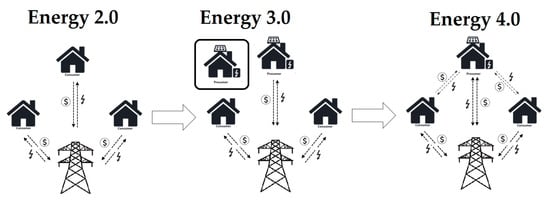

Nearly 140 years ago, the world witnessed the emergence of the first electrical grids. In the early stages, electrical grids were localized, decentralized, and unregulated. However, within the next five decades, driven by the increased demand for electricity induced by the second industrial revolution and a pressing need to regulate the energy markets, electrical grids metamorphosed into large, centralized power grids. The early primitive decentralized grids formed the first era of electrical grids, or what we define as Energy 1.0, followed by the centralized architecture that formed the second era, or Energy 2.0 (Figure 1). However, with both Energy 1.0 and Energy 2.0 grids, the consumer was completely dependent on the utility, and the energy flow was unidirectional (Figure 2), from the grid to the end-user. Concurrently, utility companies worldwide were under the continuous pressure of balancing their power generation capacities with the increasing demand, over and above a constantly fluctuating fuel supply market, environmental restraints, and growing end-user expectations [1]. Nevertheless, centralized electrical grids remained a substantial solution for the electrical market until the end of the twentieth century, when the image started to change again.

Figure 1.

Evolution of the electric grid.

Figure 2.

Dependent, independent, and interdependent energy markets.

Bounded by new global considerations such as climate change and new market trends such as energy security [2], renewable energy (RE), and energy efficiency (EE), the electrical grid developed into a decentralized architecture based on distributed energy resource (DER) microgrids. The technological advancement and commercialization of RE-based solutions enabled the wide deployment of utility-scale strategies and small-scale DER projects. This change led to a new fundamental restructuring of the electrical grid’s architecture that no longer relied on centralized power generation plants but was dependent on supply and demand resources mainly located towards the edge of the grid, at the consumers’ side. Hence, the new electrical grid became a decentralized grid that encouraged a bidirectional flow of energy, from the grid to the end-user and vice versa, defined in this article as Energy 3.0 (Figure 1).

Moreover, at the core of this new Energy 3.0 framework, the consumer became a fundamental stakeholder, a proactive, engaged member in managing the energy grid [3]. The active consumers became prosumers through their investments in clean energy and participation in power generation and demand-side management [4]. In addition, the progression of energy storage systems opened the door for off-grid microgrids [5], and for the first time, end-users were no longer dependent on the utility grid but had the option to be independent (Figure 2). Nonetheless, this energy transition would not have been possible without the proper incentives to encourage consumers to invest in DER solutions. For small-scale projects, billing arrangements such as net metering (NEM) and Feed-in-Tariff (FiT) were adopted [6]. As for medium and large-scale projects, financial agreements such as Power Purchase Agreements (PPAs) were implemented to encourage investments in RE-based power generators [7].

Though microgrids provide a platform to implement more cost-effective DERs, their development faces numerous technical, economic, and infrastructure challenges associated with grid capacity and stability, hindering the wide integration of RE resources and distributed power generation. However, the variable and intermittent nature of RE resources has added a new level of complexity to the current formula [8]. Peak load management and power imbalance have developed into a fundamental dilemma that challenges the proper performance of electrical grids by impacting the quality and reliability of the power supply. Moreover, despite their wide acceptance by prosumers, billing arrangements like NEM and FiT face several limitations and challenges that can be unfavorable for both the utility and the end-user. Among those challenges is the problem of uncompensated excess energy injected into the grid in the case of NEM [9] and the issue of decreasing energy rates in the case of FiT [10]. Over and above, all existing compensation mechanisms share the same disadvantage of not reflecting the cost of electricity at the time of injection into the grid, as well as the lack of a competitive pricing mechanism, where a monopolist, the utility, has the upper hand in fixing the energy rates [11]. On the other hand, through the past decade, the energy market has witnessed a digital revolution driven by the need for a more intelligent, more efficient, more resilient, and more flexible grid, as well as by new client requirements. Under the influence of a global trend of digital transformation, the energy sector was not exempt from the impact of disrupting emerging technologies, such as the Internet of Things (IoT), Artificial Intelligence (AI), blockchain, and Big Data, that affected the electrical grid’s complete value chain, from generation to transportation and finally to distribution [12]. Furthermore, new energy apprehensions, such as energy democracy and energy poverty [13,14], emerged in response to new socio-economic challenges. In addition, prosumers were requesting higher involvement and transparency in managing their energy consumption [15].

Accordingly, in response to a need for higher digitalization and a more user-centric energy system, the energy market is once again propelled to change. This article is part of a larger project that proposes a new blockchain-based decentralized electric grid model. This new model, defined as Energy 4.0 (Figure 1), is based on P2P energy trading. P2P energy trading offers a new multidirectional decentralized model for selling and buying energy. Contrary to the previously existing model, the P2P energy trading model is considered an interdependent model (Figure 2), where the energy trading is not monopolized by the grid operator or the utility company but offers households, businesses, or even communities to be both consumers and producers of energy while trading energy among each other. However, this concept requires a digital platform capable of connecting peer nodes without intermediaries and securing and managing transactions in real time while leveraging transparency, immutability, and anonymity. A need that is best served using blockchain technology. Blockchain is a digital data management solution based on distributed ledger technology (DLT). It allows transactions to be securely recorded and anonymously shared via a network of computers [16]. Blockchain achieved its fame through the cryptocurrency Bitcoin, though its uses go far beyond digital currencies. Blockchain-based P2P energy trading is one of these applications. P2P energy trade on the blockchain is an innovative use of blockchain technology in the energy industry. This concept leverages blockchain’s decentralized and transparent nature to enable direct transactions between energy producers and consumers within a network.

This article sheds light on the advantages of blockchain-based P2P energy trading models as an incentive mechanism for a higher implementation and integration of DERs. The main contribution of this work is that it offers a direct comparison between the P2P energy trading mechanism, NEM, and FiT in terms of rentability for prosumers using different key performance indicators (KPIs) such as the total amount of unremunerated excess energy and financial revenue from the traded energy. To validate the competitiveness of the P2P energy trading model as a new billing model for DERs, a rural microgrid composed of two prosumers and four consumers was considered. The microgrid was tested under different scenarios and billing models, and the results were analyzed to evaluate the most adequate model. Additionally, sensitivity and feasibility analyses were performed to complete the image. In Section 2 of this article, a review and evaluation of the existing billing models and related works is conducted. Afterward, the blockchain-based P2P energy trading model is introduced. In Section 4, our choice of a rural microgrid is justified, and our selected microgrid is presented in addition to the simulation algorithm and flow chart. In Section 5, the simulation results are presented and analyzed, and in Section 6, a financial study and sensitivity analysis are conducted.

2. Related Works

In a world grappling with the challenges of climate change, governments worldwide have taken significant steps to promote distributed energy sources and reduce dependence on fossil fuels. However, one of the main drivers is adopting the proper financing mechanism [17]. These mechanisms encourage consumers to become prosumers and contribute to power generation at the edge of the grid where energy is consumed. Moreover, they enable countries to achieve individual and collective renewable energy targets. The main idea behind these financing mechanisms, such as NEM, FiT, and PPA, is to incentivize consumers to generate their own electricity and contribute to the grid. However, despite this shared objective, each mechanism has significant differences in the operation and benefits offered. This section thoroughly explores these compensation mechanisms, highlighting their unique features, advantages, and considerations.

The NEM mechanism charges consumers for their net electricity consumption from the grid after deducting the electricity they have injected into the grid. This bidirectional flow of energy is measured with bidirectional meters, also known as net meters, which track the net flow of electricity. Prosumers are typically compensated for their injected electricity at the retail electricity tariff, as their electricity consumption is offset by the electricity they have injected into the grid.

In contrast, FiT schemes use two separate meters to track electricity generation and consumption from the grid and compensate for them differently. While energy consumed from the grid is priced at the retail electricity tariff, the excess energy injected by the prosumer into the grid is renumerated at a different predefined rate set by the regulator or the utility company, known as the “feed-in tariff.” These FiTs are often set at a higher tariff than the retail market rate to incentivize consumers to install renewable energy power generators. However, they have led to some issues, such as in Germany and the United Kingdom (UK), where rooftop solar photovoltaic (PV) adoption increased due to higher FiTs but has since been reduced [18,19]. Under the FiT framework, consumers should consider the long-term stability and potential changes in FiT rates.

Although these systems are broadly adopted, they do not offer fair compensation to the prosumer since the timing of the energy injection into the grid is not considered. For instance, under a NEM scheme, 1 kWh injected into the grid during peak hours should not have the same weight as 1 kWh injected during off-peak hours [20] since excess renewable electricity is more valuable during peak load hours compared to off-peak hours. Additionally, an oversupply of renewable electricity during low demand can result in curtailment or negative electricity prices in wholesale markets [21]. Prosumers can optimize their earnings from distributed renewable generation by utilizing battery storage systems or adjusting their demand in response to time-varying compensation tariffs. Because prosumers are incentivized to feed electricity into the grid when necessary and draw from it when demand is low and renewable output is plentiful, this improves system flexibility. Additionally, incorporating locational signals in tariff designs can help reduce network congestion and potentially defer or minimize network investments [22]. These signals are used to incentivize efficient use of the electricity grid and resources, as well as to manage congestion and optimize system reliability. Moreover, electric tariffs may include additional charges such as customer fees, service fees, correction charges, and rebates, which are not accounted for in the compensation given to consumers under the NEM mechanism. Therefore, the best way to look at the NEM mechanism is that it offers a free virtual storage system for the prosumer, by injecting his excess energy into the grid when it is not needed and getting it back at any time for the same price. Recently, a new concept called virtual net metering (VNM) emerged as an alternative to NEM. VNM is a billing arrangement that allows multiple electricity consumers to share the benefits of a renewable energy system, such as solar panels, even if they are not physically connected to the same generation source. In a VNM setup, the electricity generated via a renewable energy system installed at one location can be credited against the electricity consumption of one or more separate accounts elsewhere [23]. VNM allows for greater flexibility and access to the benefits of renewable energy, particularly in scenarios where physical connections between the generation source and the consumers are not feasible or practical.

On the other hand, net billing schemes offer several benefits to the grid. The primary purpose behind most DER incentive mechanisms is to encourage end-users to maximize their self-consumption thus reducing their demand from the grid. Additionally, since energy is generated where it is needed, the grid’s technical losses are reciprocally lowered, and in most cases, they contribute to a lower levelized cost of energy [24]. However, under schemes like NEM and FiT, energy retailers are at risk of induced “death spiral” phenomenon [25]. This happens when overcompensation for distributed renewable generation leads to oversupply, distorted price signals, and grid-integration challenges, resulting in revenue losses for retailers. The “electricity death spiral” is a term used to describe a potential scenario in which the traditional utility business model becomes economically unsustainable due to disruptive changes in the energy landscape, particularly the increasing adoption of DERs and renewable energy technologies. The concept of the electricity death spiral typically involves declining revenues, rising costs, and customer defection. As more customers install rooftop solar panels, battery storage systems, energy-efficient appliances, and other DERs, they may reduce their reliance on grid-supplied electricity. This can lead to decreased electricity sales for traditional utilities, resulting in declining revenue. Moreover, utilities usually incur fixed costs on end-user bills associated with maintaining the grid infrastructure, such as transmission lines, substations, and distribution networks. As electricity sales decline, these fixed costs per unit of electricity sold increase, putting upward pressure on electricity rates for remaining customers. Thus, to compensate for lost revenue and cover fixed costs, utilities may raise electricity rates for customers who remain connected to the grid. However, higher rates can further incentivize customers to invest in DERs or pursue energy efficiency measures, exacerbating the decline in electricity sales and perpetuating the cycle. Additionally, faced with higher electricity rates and the availability of cost-effective alternatives like rooftop solar and battery storage, more customers may choose to disconnect from the grid entirely or significantly reduce their reliance on utility-provided electricity. This further accelerates the decline in utility revenues and increases the financial strain on the remaining customers. The electricity death spiral poses significant challenges for utilities and regulators tasked with ensuring the electricity system’s reliability, affordability, and sustainability. Regulators may need to reassess utility business models, rate structures, and regulatory frameworks to address the evolving energy landscape and mitigate the risks associated with declining grid revenues. However, it is important to note that the electricity death spiral is not an inevitable outcome but rather a potential scenario driven by market dynamics, technological advancements, policy decisions, and consumer behavior. To navigate these challenges, utilities may need to embrace innovation, invest in grid modernization and flexibility, and adapt their business models to accommodate distributed energy resources and emerging customer preferences for clean and resilient energy solutions. Regulatory reforms and supportive policies are also fundamental to the transition to a more sustainable and equitable energy system [26].

A third existing financing mechanism is PPA. A PPA is a contractual arrangement in the energy sector where a power generator, often a renewable energy project developer, sells electricity to a buyer, typically an off-taker such as a utility or corporation. One of the main advantages of PPAs is their capacity to give renewable energy projects a steady source of income, ensuring their long-term financial viability. [27]. The off-taker commits to purchasing the generated electricity at agreed-upon prices for an extended period, often 15 to 25 years, providing the project with predictable cash flows. In addition, PPAs have the potential to be a catalyst of private investments and help develop a sustainable energy infrastructure. However, challenges include the potential for off-taker credit risks and the dependence on policy and regulatory frameworks that may impact the stability of the agreed-upon terms. Additionally, technological changes or market conditions could pose risks to both parties. Despite these challenges, PPAs remain crucial for advancing renewable energy projects and fostering a transition to more sustainable energy sources. Overall, PPAs are well suited for large-scale renewable energy projects [28] because they can mitigate risks, provide long-term revenue certainty, leverage economies of scale, enhance creditworthiness, facilitate grid integration, and ensure regulatory compliance. These factors contribute to the attractiveness of PPAs for developers, purchasers, and investors involved in large-scale renewable energy ventures.

On the other hand, billing mechanisms are governed and influenced by the nature of the energy market. Two models exist: the regulated and deregulated markets [29]. The terms regulated and deregulated refer to the level of government intervention in setting prices and managing competition. In a regulated market, government authorities set prices, determine service standards, and may control the entry rights for generation, transmission, and distribution, thus creating a market monopoly. However, regulatory bodies typically set these prices to ensure affordability and fairness. This framework can be secure and beneficial for consumers as long as the government has everything it takes to offer an affordable energy supply to its end users. However, when the government or the utility are in no position to supply low-cost energy, end users are left with the single option of paying the high price due to the lack of alternatives caused by the government’s monopoly. Hence, it is essential to note that regulated markets may limit innovation and efficiency. In contrast, the deregulated market allows competition by removing entry, exit, and pricing restrictions, enabling multiple entities to operate in the same market and promoting healthy competition. Prices in a deregulated market are determined by supply and demand and open market competition and are subject to negotiation between the supplier and the end user [30]. Therefore, a deregulated market has the potential for cost savings due to competition, innovation, and improved efficiency. However, while competition is expected to keep prices in check, monopolistic behavior can occur if one company gains too much control. The impact of regulated and deregulated markets on billing mechanisms such as NEM, FiT, and PPA varies depending on the regulatory environment and market structure. Regulated markets may offer more stability and control from the regulatory body, while deregulated markets may provide more flexibility and room for market-driven negotiations. The choice of billing mechanism will be influenced by the goals of policymakers, the level of market competition, and the desired balance between stability and flexibility in the energy sector.

Nevertheless, today’s energy market is driven by more significant needs and higher expectations [31]. Needs and expectations that can no longer be met with traditional financing models. Thus, there is a need for a new billing model capable of providing a higher customer contribution, not only to power generation but also to the management of the grid in general and precise control of prices. This is where the P2P energy trading model comes into play. Conversely, more than a decade ago, a new energy trading model surfaced. The emergence of P2P energy trading can be traced back to the early 2010s. The concept gained momentum as technological advancements, particularly blockchain and smart contracts, offered new possibilities for decentralized energy transactions. However, it was around the mid-to-late 2010s that P2P energy trading gained substantial recognition and saw practical implementations [32,33]. P2P energy trading has emerged as a promising paradigm in transitioning towards decentralized and sustainable energy systems. The evolution of this concept is ongoing, and its trajectory is influenced by technological advancements, regulatory developments, and the growing awareness of the need for more sustainable energy practices. The P2P energy trading mechanism enables the direct exchange of electrical energy between prosumers and consumers, at a price negotiated by the two parties, without selling this energy to the grid operator first. Therefore, P2P energy trading models eliminate the need for utility companies or grid operators to interfere as intermediaries. P2P energy trading offers several distinct advantages over traditional energy trading models. Primarily, P2P trading enhances the efficiency of energy distribution by enabling direct transactions between prosumers and consumers, effectively reducing intermediary costs and transmission losses. This direct exchange fosters a more dynamic and responsive energy market where prices can more accurately reflect real-time supply and demand conditions. The book in [34] systematically explores distributed economic operation in smart grids, addressing both model-based and model-free approaches to optimize coordination among generation units and loads, while also tackling the challenges of randomness in renewable energy and electric vehicle charging. Additionally, P2P trading promotes the utilization of locally generated renewable energy, thus supporting sustainability and reducing the reliance on centralized, non-renewable energy sources [35]. The increased adoption of renewable energy through P2P networks also contributes to lower greenhouse gas emissions and improves the overall environmental footprint. Moreover, P2P trading can enhance grid resilience by decentralizing energy resources, thereby mitigating the risk of widespread outages. It also empowers consumers by giving them more control over their energy choices and potentially reducing their energy bills through cost-effective transactions. Furthermore, the transparent and automated nature of blockchain-based P2P platforms can streamline administrative processes, reduce fraud, and improve trust among participants. Overall, P2P energy trading presents a promising approach for creating more efficient, sustainable, and consumer-centric energy systems [36,37].

P2P energy trading designs frequently use game theory approaches [38], auction-based procedures [39], optimization methods [40,41], and blockchain-based technology. Numerous studies have explored the technical aspects of P2P energy trading, including communication protocols [42], market mechanisms, and grid integration. Smart contracts based on blockchain technology are commonly used to automate transactions and ensure trust and transparency among participants. Other approaches utilize P2P networks or centralized platforms for energy trading. Economic models play a crucial role in P2P energy trading systems, determining pricing mechanisms, cost allocation, and incentives for participants [43]. Dynamic pricing based on supply and demand, time-of-use tariffs, and incentive-based schemes are commonly employed to optimize resource utilization and encourage renewable energy generation. However, thanks to blockchain technology and smart contracts, P2P energy trading systems were made possible and easy to implement [44]. This concept aims to create a more efficient and sustainable energy ecosystem by directly empowering individuals to participate in energy production, consumption, and transactions, fostering local energy communities. Nevertheless, despite its potential benefits, P2P energy trading faces several challenges, including regulatory hurdles, technical complexities, market design issues, and privacy concerns. Scalability, interoperability, and grid stability are significant challenges that need to be addressed for the widespread adoption of P2P trading models. The challenges and limitations of P2P energy trading are detailed in [45].

This article investigates the application of blockchain-based P2P energy trading as a financing mechanism for DERs. With the growing adoption of DERs such as solar PV systems and battery storage, there is a need for innovative financing solutions to overcome barriers to deployment and maximize their economic viability. Traditional financing models often face challenges related to uncompensated excess energy, monopolized energy tariffs, time of energy injection into the grid, and transaction costs. In this study, we explore how blockchain technology can facilitate decentralized energy trading among prosumers, enabling direct transactions and value exchange within a distributed energy network. We examine the potential benefits of blockchain-based P2P energy trading, including open market rate negotiation, fair energy compensation, higher asset revenue, and increased autonomy for energy consumers. Overall, this article contributes to providing insights into the potential of blockchain-based P2P energy trading as an alternative billing mechanism to NEM and FiT, especially for rural and isolated microgrids, as well as a financing mechanism for DER development, thus advancing the transition to a more sustainable and resilient energy future.

3. Blockchain-Based P2P Energy Trading Model

P2P energy can potentially revolutionize the energy landscape by promoting decentralization, flexibility, and consumer engagement. Free trade among peers offers more options for sellers and buyers, promoting mutually beneficial transactions. A blockchain-based P2P ecosystem would offer consumers access to a diversified portfolio of energy resources that can answer to their specific requirements in terms of time, price, and sustainability goals. The open aspect of the P2P energy trading model stimulates healthy competition among providers, ensuring high-quality service at the lowest possible prices. In contrast, a regulated market limits consumers’ options, often leaving them with a single supplier. This lack of competition allows the supplier to dictate both the quality and price. An open market with diverse DERs, such as solar, wind, and electric vehicles, presents exciting opportunities and competitive market prices for the consumer as well as the prosumer. Hence, prosumers with surplus energy can manage the quantity and timing of their sales to maximize profit. The chance to sell energy among peers would encourage investors to expand into DER projects, benefiting developing countries suffering from electricity shortages. P2P energy trading would increase local energy exchange, reducing dependency on the utility grid and enhancing power reliability. Additionally, P2P energy trading can enhance grid resilience and flexibility by leveraging DERs, demand-side management, and local energy trading to mitigate grid disturbances and optimize grid operations. By decentralizing energy production and consumption, P2P trading can enhance grid reliability and reduce dependency on centralized generation and transmission infrastructure.

Similarly, P2P energy trading can help improve voltage regulation in the distribution grid by reducing voltage fluctuations and optimizing voltage profiles. When energy is generated and consumed locally within the same distribution network segment, it can help maintain voltage levels within acceptable limits, thereby reducing losses associated with voltage deviations. Moreover, P2P energy trading can facilitate load balancing within the distribution grid by enabling energy transactions between local producers and consumers. When surplus energy generated via DERs is consumed locally rather than being transmitted over long distances, it can help alleviate congestion on distribution feeders and reduce losses associated with overloaded circuits. Also, P2P energy trading can potentially reduce transmission losses by minimizing the need for long-distance energy transmission from centralized power plants to end-users. When energy is generated and consumed locally, it avoids the losses incurred during transmission over high-voltage transmission lines, which tend to have higher losses than distribution lines. At the distribution level, by promoting the use of distributed generation and localized energy consumption, P2P energy trading can improve the overall efficiency of the distribution system.

For a P2P energy trading model to properly operate, several prerequisites must be met:

- –

- A power grid connecting the two ends of an energy transaction must be present, along with essential electrical components like cables, transformers, and meters;

- –

- An advanced metering infrastructure is needed to manage transactions and ensure energy is transferred from the correct source to the correct user. A control system is also necessary to check and control energy quality parameters like frequency and voltage;

- –

- A secure end-to-end device communication protocol is required for the flow of information between peers;

- –

- An online platform is required to allow users to transparently and anonymously communicate and exchange information about available energy, load demand, and prices as well as other information.

The first two points are usually provided in most modern grids. However, the third and fourth points require a data management platform capable of offering transparency, auditability, anonymity, and immutability as well as security. These characteristics can be found in blockchain platforms. Blockchain technology is pivotal in P2P energy trading by providing a decentralized, autonomous, transparent, and secure platform for facilitating energy transactions between producers and consumers. Blockchain technology has the potential to further P2P energy trading mechanisms by offering the following features:

- –

- Decentralization and distributed ledger technology: blockchain eliminates the need for centralized authorities, creating a distributed ledger across a network of computers. This ensures transactions are recorded transparently and immutably, enhancing trust among participants;

- –

- Transparency: blockchain’s distributed ledger technology maintains a transparent and immutable record of all energy transactions. Every transaction is cryptographically verified and recorded on the blockchain, providing transparency and auditability. This transparency helps build trust among participants and ensures the integrity of the energy trading process;

- –

- Smart contracts: these are self-executing contracts with the terms of the agreement directly written into lines of code. They automate the energy trading process, executing transactions when predefined conditions are met, thus reducing the need for intermediaries, and streamlining processes;

- –

- Real-time settlements: blockchain enables real-time settlement of energy transactions, allowing producers to receive payment immediately upon energy delivery to consumers. This instantaneous settlement process eliminates delays and reduces counterparty risk, enabling more efficient energy trading and cash flow management;

- –

- Integration with IoT Devices: blockchain can be integrated with Internet of Things (IoT) devices to facilitate automated energy trading at a large scale. This allows real-time consumption data to be used in transactions, making the process more efficient and responsive to energy needs.

Furthermore, blockchain’s ability to ensure security through robust encryption techniques and provide real-time prices to consumers makes it an ideal solution for P2P energy trading. This not only empowers prosumers by enabling them to trade surplus energy directly but also promotes the use of renewable energy sources by ensuring the traceability and authenticity of the energy traded.

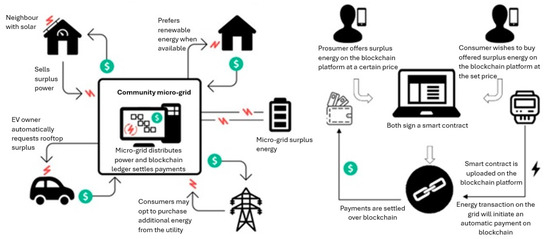

The blockchain-based P2P energy trading model offers prosumers, with excess generated energy, the opportunity to sell it to other interested consumers at a negotiated price. Ethereum and Hyperledger are common platforms used for such an application due to their smart contract capabilities that allow the automatic execution of transactions when predefined conditions are met. Prosumers list their excess energy for sale on the blockchain platform along with their desired price. Consumers browse available energy offers on the platform and select the ones that meet their price, quantity, and source requirements. Once a consumer selects an offer, the smart contract automatically executes the transaction, transferring the agreed-upon amount of energy from the producer to the consumer. Payment for the energy is transferred directly to the producer’s digital wallet upon completion of the transaction.

Two layers are required to achieve a P2P energy exchange: a money exchange layer and an energy exchange layer. The concepts of money exchange and energy exchange layers refer to the distinct functionalities and processes involved in facilitating transactions between energy prosumers and consumers. The money exchange layer handles the financial aspect of P2P energy trading, including pricing, payment, and settlement. It involves the exchange of cryptocurrency or fiat currency in return for the energy consumed or produced. Smart contracts within the blockchain platform automatically execute payment transactions once energy transactions are completed. The money exchange layer ensures secure and transparent financial transactions between parties involved in energy trading. On the other hand, the energy exchange layer focuses on the actual energy exchange between producers and consumers. It involves listing available energy for sale by producers and selecting and purchasing energy by consumers. In this context, smart contracts govern the terms of energy transactions, including quantity, price, and timing. This layer ensures efficient and transparent energy transactions, allowing producers to monetize excess energy and consumers to access clean energy sources. Additionally, renewable energy certificates (RECs) or other verification mechanisms may be used to ensure the authenticity and sustainability of traded energy. Hence, the money exchange layer manages the financial transactions associated with P2P energy trading, while the energy exchange layer facilitates actual energy exchange between participants. These layers enable decentralized, transparent, and efficient energy trading while ensuring trust and security through blockchain technology (Figure 3).

Figure 3.

Blockchain-based P2P energy trading model.

Moreover, the blockchain’s decentralized nature ensures transparency and security by recording all transactions across multiple nodes in the network. This eliminates the need for intermediaries and reduces the risk of fraud. Additionally, mechanisms for consumers and producers to leave feedback and ratings, based on their experiences, can be integrated to help build trust within the P2P energy trading community. This article, introducing a new blockchain-based P2P financing mechanism for DERs, offers substantial added value to renewable energy investment and deployment. By proposing an innovative billing approach explicitly tailored to DERs, this article addresses critical shortfalls in current billing mechanisms, thus providing an opportunity to overcome the traditional barriers associated with funding DER projects, such as wasted excess energy, tariffs monopoly, and fair compensation for the time of injection of energy back to the grid.

On the other hand, blockchain-based P2P energy trading can solve multidirectional billing. Today’s energy billing systems are designed for unidirectional or at most bidirectional energy transactions. Thus, there is a need to develop an automatic decentralized energy trading system that can automatically collect energy consumption, offer a user-centric approach, and ensure a simple settlement for energy transactions in a multidirectional way. Furthermore, current billing systems are based on the Point-of-Delivery (PoD) concept, which means that the bill is issued per meter at a specific location where energy is delivered and not per end-user. Conversely, an aggregated bill per customer refers to a billing arrangement where multiple premises owned by the same customer are grouped together, and their energy consumption is aggregated for billing purposes. The aggregated bill per customer simplifies billing administration and can be fairer than a PoD billing in conditions where an increasing block rate billing structure is used, or demand side management (DSM) programs are applied. Moreover, the current data collection, processing, and financial settlement processes are highly inefficient and error-prone, resulting in significant time delays in value settlement and the need for costly reconciliation processes. Billing constitutes 5% to 15% of retailers’ total operating costs. Blockchain technology can be the answer for an aggregated efficient, transparent, immune to tampering, and immutable billing system.

4. Modeling of the Microgrid

Urban and rural areas provide prospects for solar PV systems, but with different considerations [46]. Rooftop solar in urban areas focuses on distributed energy generation, while rural areas can cater to larger-scale utility installations. Optimizing solar PV potential involves considering geographical factors, energy demands, infrastructure, and regulatory frameworks specific to each setting. Urban areas have a substantial potential for rooftop solar installations on buildings [47]. However, shading from other buildings, limited roof space, and obstructions like vents or HVAC systems can reduce the effectiveness of solar panels. Urban areas generally have higher energy demands, making rooftop solar PV a viable option for meeting some of this demand. It also reduces transmission losses by generating electricity closer to where it is consumed. Rural areas often have more open land available, making them suitable for utility-scale solar farms. This allows for larger installations without the constraints of urban space limitations. Rural areas tend to have fewer obstructions like buildings and trees, which can maximize solar panels’ exposure to sunlight. However, the demand is limited, burdening DER projects’ return on investment, especially under the NEM billing mechanism. For this purpose, we decided to consider the case of a rural micro-gird that includes two prosumers and four consumers. This microgrid is tested using three billing mechanisms: NEM, FiT, and P2P energy trading. The same conditions are applied for the three scenarios and KPIs such as unused energy, financial gain for prosumers, and annual bill reduction for consumers are used to compare the three models.

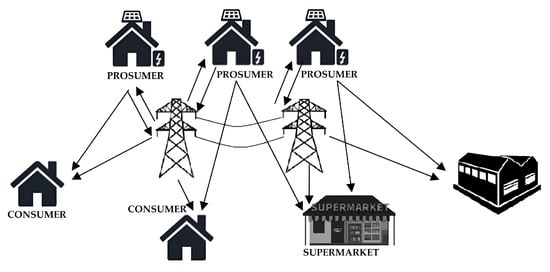

In the simulated model, we considered two prosumers for every four consumers. This reflects an optimistic perspective where 1/3 of the population would have a renewable source of generation. Moreover, the simulated microgrid considers as sources of energy the utility grid for all participants and rooftop PV solar systems for prosumers. At the same time, the consumers are residential, small-commercial, and industrial loads (<100 kW). The use case microgrid, presented in Figure 4, is detailed hereafter:

Figure 4.

Simulated microgrid model.

- –

- Prosumer A is a residential house occupied for the entire year and equipped with a 12.8 kWp solar PV system;

- –

- Prosumer B is a residential summer house occupied only during the summer and equipped with a 12.8 kWp solar PV system;

- –

- Consumer #1 is a residential house occupied for the entire year. Prosumer A and Consumer #1 have been modeled with the same load profile. They are a household of 4 family members where one family member works during the day. The house covers an area of around 180 m2;

- –

- Consumer #2 is an industrial load; it is a vehicle bodywork workshop that is operational during the entire year;

- –

- Consumer #3 is a commercial load; it is a supermarket that is operational during the entire year;

- –

- Consumer #4 is a residential house that is occupied during the entire year.

Since an hourly load profile for an entire year was unavailable for all the loads, we decided to have an hourly load profile for over 4 weeks, each week corresponding to a different season. Then, the results of each week were extrapolated to 13 weeks to cover an entire season, and the overall result would be 52 weeks to represent an entire year.

The household used as a benchmark, Prosumer A, has a rooftop solar PV system. However, the current trend in the market is to replace traditional equipment with more efficient options. This includes switching from traditional lamps to light emitting diode (LED) lamps, using converter type air conditioning units, and upgrading to higher efficiency appliances. Given this trend, we have chosen to examine the scenario where Prosumer A is substituted with Prosumer A′. This substitution allows us to evaluate the effects of increased energy efficiency on our three billing models, resulting in lower energy demand. Prosumer A′ is an improved version of Prosumer A, with a 30% increase in efficiency. As a result, its residential load is 30% lower than Prosumer A’s, which serves as our benchmark. Prosumer A′ could also represent a newly constructed house compared to an older one being represented by Prosumer A. The new house would have better insulation, reduce the need for heating and cooling, and be equipped with high efficiency appliances, decreasing overall energy consumption. The purpose of introducing Prosumer A′ in the model is to investigate the impact of a reduced load, with the same PV system capacity, on the use of P2P. This allows us to determine if it is a cost-effective option or not.

Prosumer B is a type of residential load where the owners only utilize the house for vacation during the summer season, specifically for 3 months from June 22nd to September 21st. The energy consumption for the remainder of the year is represented by a small and constant load, including gardening and operating the security system. Prosumer B is a unique type of load that may have different outcomes when subjected to incentive programs compared to a full-time load. It would be intriguing to investigate the effects of installing a PV system on this particular load, potentially resulting in surplus energy during the unoccupied period.

Both Prosumer A/A′ and Prosumer B have a rooftop solar PV system with a capacity of 12.8 kWp. However, to evaluate the effect of the solar PV peak power on the three models, we have decided to analyze a situation where the 12.8 kWp system is replaced with a 10 kWp system. This particular scenario is referred to as scenario #2, while the original scenario will be referred to as scenario #1. We initially assumed that neither prosumer has a battery energy storage system (BESS). Therefore, we have simulated a scenario where a BESS was added for both prosumers. In this case, the BESS consists of 220 Ah, 12 V solar batteries, with 2 strings of 6 batteries connected in series, resulting in a total of 12 batteries. At a depth of discharge of 80%, the total capacity of the batteries is equivalent to 4.22 kWh. The purpose of including a BESS is to evaluate the impact of storing excess energy during hours of solar availability and selling it back to consumers during periods of low demand. This scenario is known as scenario #3.

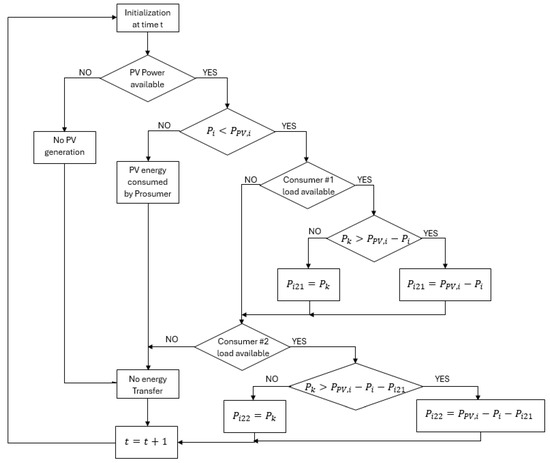

The blockchain-based P2P energy trading model allows prosumers to sell their excess energy to two consumers. Prosumer A/A′ prioritizes using their own produced energy for their own use before selling any remaining excess to Consumers 3 and 4 at a negotiated rate. Similarly, Prosumer B uses the energy it produces for its own needs and then sells any extra to Consumers 1 and 2. It is assumed that consumers would be interested in buying excess energy from prosumers, whenever it is available, as it would typically be priced lower than the utility’s tariff. However, any excess energy beyond the market demand would be wasted. Algorithm 1 summarizes the blockchain-based P2P energy trading model.

| Algorithm 1: P2P Energy Trading |

| 1: Initiate algorithm at time t 2: if PV power available, then 3: if Load of Prosumer < PV Generation, then 4: if the first consumer has a consumption, then 5: Pi2k = min (Pk, PPV, i − Pi); k = 1 6: else, if the second consumer has a consumption, 7: then Pi2k = min (Pk, PPV, i − Pi − Pi21); k = 2 8: else, no transfer of energy 9: else, PV generation totally consumed by load of Prosumer and complemented, if needed, by energy from the grid; no transfer of energy 10: else, no PV generation; no transfer of energy 11: t = t + 1 12: Goto 2//restart the algorithm |

Under the NEM billing system, any excess solar PV generation is injected into the grid at the same rate as the applicable utility tariff. Any excess energy that surpasses the prosumer’s total yearly consumption will not be compensated at the end of the year. Similarly, in the FiT billing model, the extra energy will be injected back into the grid at a lower rate based on current market trends. However, under this model, the yearly quantity of energy that exceeds the prosumer’s total annual consumption is compensated at the applicable FiT rate. The power equations that govern the model are defined hereafter:

If solar PV AC power is greater than or equal to the prosumer load, the latter is met solely by solar PV power. The power provided via the utility grid is zero.

The excess energy injected back into the grid or sold via the P2P energy trading model is calculated using Equation (2):

If solar PV AC power is less than the prosumer load, the latter is met by the solar PV power complemented by the utility grid power.

where

- Pi is the power demand of the consumer;

- PU,i is the power provided by the utility company;

- PPV,i is the power provided by the solar PV system;

- Psold is the excess power that can be used for trading.

In P2P energy trading models, managing the energy balance between supply and demand is crucial for ensuring stability and efficiency. When participants in a P2P network sell excess energy, this surplus is allocated to other users who need additional power. However, if the total amount of excess energy sold falls short of meeting the demand of buyers, the deficit must be supplemented from the traditional grid. This mechanism ensures that while P2P trading maximizes the use of locally generated renewable energy, it also maintains a reliable power supply by drawing from the grid when necessary. This integration helps to balance the fluctuating nature of renewable sources and ensures that energy needs are met even when P2P transactions alone cannot satisfy the demand. By effectively managing these scenarios, P2P systems can contribute to a more resilient and flexible energy infrastructure, supporting both sustainable energy use and grid stability.

In a real-world scenario of P2P energy trading, prices are determined through negotiations based on the balance of supply and demand, along with individual preferences and limitations. Despite the dynamic nature of markets, the presence of competition and price variations among markets or sources typically prevent drastic fluctuations, leading to price stability at a certain average level. An average negotiated rate was utilized to exchange energy in the blockchain-based P2P energy trading system to simplify the simulation model. Furthermore, in cases where electricity is not produced by the utility itself, such as in deregulated markets or P2P energy trading situations, the utility typically charges for electricity transmission through its networks. This charge, known as the wheeling charge, typically accounts for 15% of the applicable tariff. The tariffs and rates used in our simulation scenarios are defined in Table 1.

Table 1.

Applied tariffs and rates.

Figure 5 depicts a flow chart demonstrating our simulation model’s sequential processes and exchanges, providing a more organized and concise understanding of the workflow.

Figure 5.

Simulation algorithm flow chart.

To simplify the calculations and maintain this paper’s main objective, we have made certain assumptions in the model. The impact of holidays, where consumer loads may vary, has not been considered. This is because the proportion of holidays to the total number of days in a year is minimal and does not significantly affect the calculation results. As the PV system is connected to the main power source and operates in synchronization with it, it is assumed that the quality of the main source is standard in terms of voltage and frequency. The calculation does not consider energy transmission losses which occur when energy is transported over long distances from the source of generation to the point of consumption. These losses are usually significant at a transmission level. However, in our microgrid model on a regional distribution level, the distances are short, and when the distribution cables are appropriately sized, the losses due to energy transportation become negligible. A time slot of one hour is used to determine the energy consumed or produced, assuming that the load remains constant during this period. Although this one-hour period is valid for the loads and production capacity used, a smaller time slot can be chosen for more accuracy if needed.

5. Simulation Results

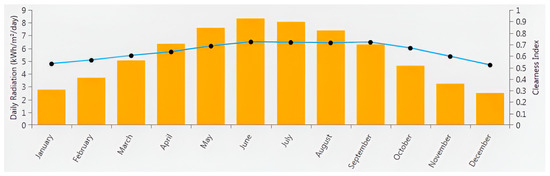

The solar PV power generation was simulated using an hourly irradiance profile for Lebanon at a latitude of 33.8° N and a longitude of 35.5° E. The solar constant is around 1460 W/m2, and the average annual solar radiation is 5.49 kWh/m2/day. The monthly solar radiation profile is shown in Figure 6. The characteristics of the solar PV panels used are provided in Table 2.

Figure 6.

Monthly solar radiation profile.

Table 2.

Solar PV panel characteristics.

The primary limitation of the NEM billing scheme is the issue of unremunerated excess energy, which refers to the amount of energy that is injected back into the grid and exceeds the prosumer’s annual energy demand. In NEM programs, any excess energy exported to the grid is credited at the same rate as retail electricity. These credits can accumulate over time if the customer consistently exports more energy than they consume. They can then be used to offset future electricity purchases, effectively rolling over the excess energy to the next billing period. However, at the end of the year, an annual settlement process takes place where all bills are reset, potentially resulting in a loss of any rolled over excess energy. This process may also involve reconciling any remaining excess energy credits, with the utility potentially compensating the customer at a predetermined rate for any unused credits. In our case, it is considered that at the end of the year, any rolled-over excess energy will be reset. Table 3 displays the amount of annual excess energy wasted by the three prosumer profiles under scenarios 1 and 2 using a NEM billing scheme. Under both scenarios, the annual energy bill will be null for all prosumers, because both solar PV systems (12.8 kWp and 10 kWp) can generate enough energy to fully compensate for the prosumer’s annual energy consumption.

Table 3.

Lost energy with net metering under scenario 1 and 2.

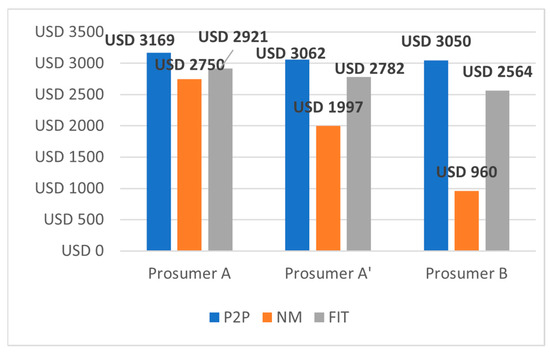

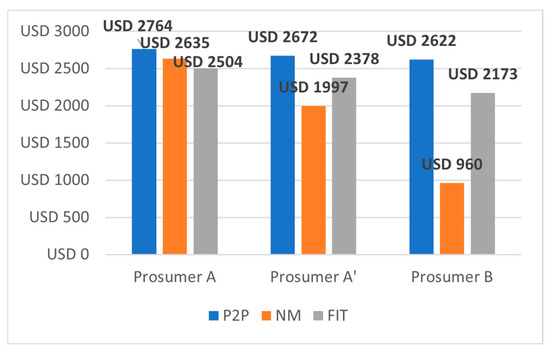

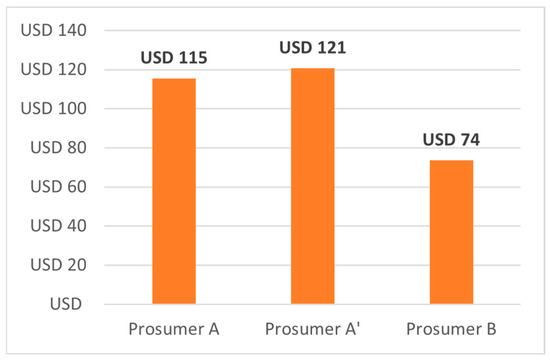

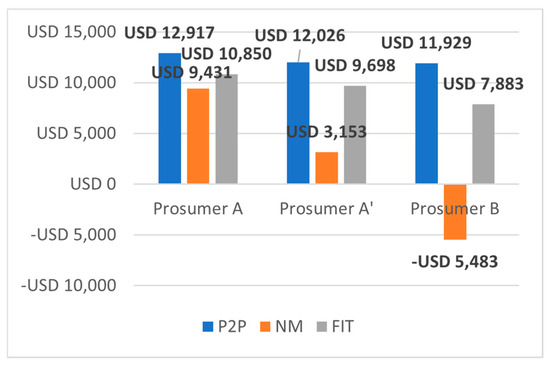

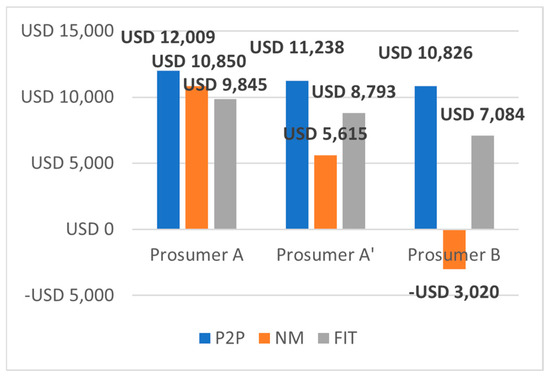

At another level, the issue with FiT billing schemes is the monopolized process of setting a tariff for grid-injected energy. Often, existing utilities are responsible for buying the energy and managing the grid. If there is only one utility company in an area (a monopoly), they have some control over setting the FiT rate. Critics argue that a monopoly utility might reduce the FiT rate to minimize costs, hindering renewable energy growth. This issue is avoided with P2P energy trading models since direct negotiations between the prosumer and the buyer set the rates. The annual gains of the three prosumers, under scenarios 1 and 2, are presented, respectively, in Figure 7 and Figure 8.

Figure 7.

Total yearly gains—scenario 1.

Figure 8.

Total yearly gains—scenario 2.

The gains under the NEM billing mechanism are the lowest for all prosumers due to the unremunerated lost excess energy, while FiT and P2P mechanisms present comparable gains. P2P has higher total savings because its average negotiated rate, even after the deduction of the wheeling charge, is higher than the FiT tariff. Additionally, simulation results show that the gap between P2P energy trading and the other two billing mechanisms is greater in the case of highly energy-efficient prosumers or occasionally occupied households. Additionally, the simulation results, shown in Figure 7 and Figure 8, reveal a clear trend: the more energy-efficient a prosumer is, the larger the disparity in total yearly gains between P2P energy trading and traditional mechanisms like NEM and FiT (by comparing the yearly gains of prosumer A and A′). Specifically, as prosumers reduce their energy consumption and maximize the use of their own generated energy, the financial benefits of participating in P2P energy trading become significantly more pronounced. This is because P2P trading allows energy-efficient prosumers to sell their surplus energy at more competitive rates, directly to other consumers, rather than relying on the fixed rates offered via NEM or FiT. Consequently, the yearly monetary gains for these prosumers are substantially higher in the P2P model, underscoring the economic advantage of this decentralized trading mechanism for those who have optimized their energy usage. Furthermore, the larger the size of the rooftop solar PV, the more significant this gap becomes, highlighting the financial advantages of P2P energy trading for prosumers with greater energy efficiency and larger renewable energy installations. In the case of scenario 1, the gap in yearly gains between P2P and NEM for Prosumer A’ is USD 1,065 and between P2P and FiT is USD 280. Additionally, by looking at the gains of Prosumer B, it shows that this gap in yearly gains is maximum when the household is only occasionally occupied. In such scenarios, the energy generated via the rooftop solar PV system is often surplus to the household’s needs, allowing more energy to be sold through P2P energy trading. This results in significantly higher returns compared to NEM or FiT, where excess energy may not be as effectively monetized. The occasional occupancy, combined with the ability to capitalize on surplus energy, underscores the financial benefits of P2P energy trading in these particular circumstances.

The results of the simulations conducted under scenarios 1 and 2 are highly dependent on the synchronization between the prosumer’s excess energy and the consumer’s demand. If those two factors are not synchronized, the P2P energy trade would not be executed which can yield higher economic losses for the prosumer. Thus, it is important to add a BESS that allows storing excess energy in periods of low or no demand and trading it at a later time when there is consumer demand for that energy. For scenario 3, a 4.22 kWh BESS system was added to the 12.8 kWp rooftop mounted solar PV system. The simulations under scenario 3 aim to provide the economic feasibility of adding a BESS in the case of a P2P energy trading mechanism. The BESS was only used to store the excess energy whenever the power provided via the solar PV system was greater than the prosumer’s demand and there were no requests to buy energy by other consumers. The additional gains resulting from adding a BESS are illustrated in Figure 9. A comparison of the gains generated in the case of a P2P energy trading mechanism, for the three scenarios, is shown in Figure 10.

Figure 9.

Additional gains generated by the addition of BESS.

Figure 10.

Total P2P gains comparison between all scenarios.

The highest gains are achieved when using a BESS since all the energy produced is being sold, while in scenarios 1 and 2, part of the energy that the solar PV could have generated was wasted due to the desynchronization of the solar PV potential and the consumers’ demand. Nevertheless, even though the results of scenario 3 prove that a BESS can generate additional gains for the prosumers, its economic feasibility will be analyzed in the next section and its worthiness will be assessed.

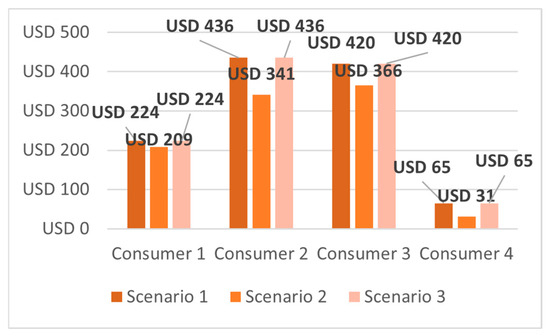

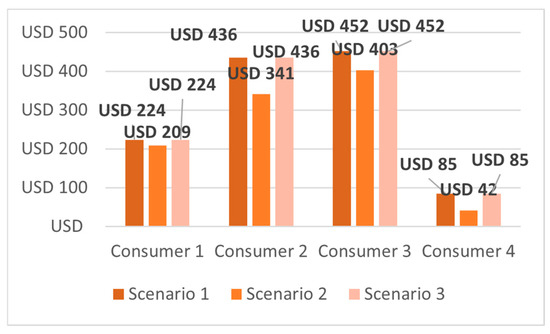

However, two parties are involved in this microgrid: the prosumers and the consumers. Therefore, it is worth assessing the impact of the blockchain-based P2P energy trading model on the consumers’ bills in terms of increase or savings. The NEM and FiT approaches do not offer consumers the option to purchase their energy from a third party other than the utility, so under any billing mechanism other than the P2P energy trading model, consumers’ bills would remain the same. Therefore, the annual consumer bills resulting from the P2P energy trading model were compared to the baseline annual bills. It was observed that the P2P energy trading model is not only capable of generating income for prosumers, but also capable of generating savings for consumers. The consumers’ savings generated under different scenarios are shown in Figure 11 and Figure 12.

Figure 11.

Consumers savings from buying energy from Prosumers A and B.

Figure 12.

Consumers savings from buying energy from Prosumers A′ and B.

6. Financial Feasibility Study and Sensitivity Analysis

Conducting a feasibility study is crucial for assessing the viability and potential success of any solution and comparing different financing mechanisms for the same project. Thus, under the three previously discussed scenarios, we conducted a Net Present Value (NPV) analysis to compare the savings generated from each of the three considered billing systems as a financing mechanism for the rooftop solar PV system. An NPV analysis is a financial technique used to evaluate the profitability of an investment or project by comparing the present value of its expected cash inflows with the present value of its expected cash outflows. It is based on the principle that a dollar received in the future is worth less than a dollar received today due to the time value of money. It is assumed that the initial cost of the solar PV system (with or without BESS) is covered by a bank loan over 10 years at an interest rate of 6%. The applied discount rate, which reflects the opportunity cost of capital or the minimum acceptable rate of return for the investment, is 10%. The discount rate is used to return future cash flows to their present value. It accounts for the riskiness of the investment, inflation, and the time value of money. All the assumptions considered to conduct the NPV analysis are shown in Table 4.

Table 4.

Feasibility study parameters.

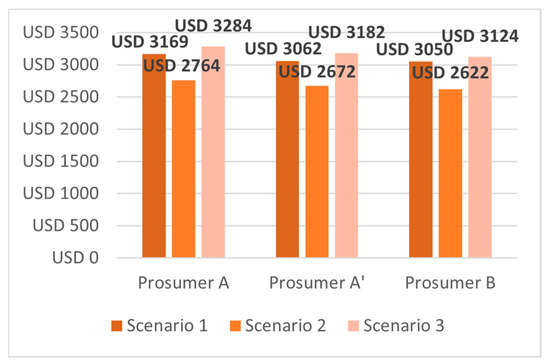

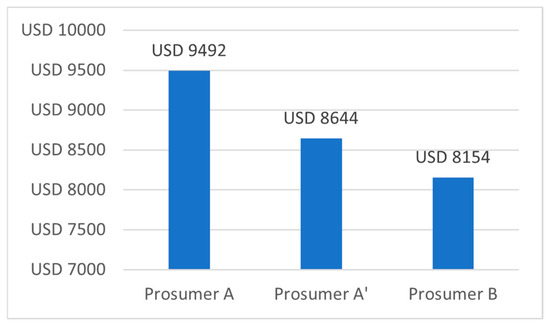

The NPV analysis results for the different billing mechanisms under scenarios 1 and 2 are shown in Figure 13 and Figure 14. These results indicate that the P2P energy trading model favors the prosumer’s investment in larger DER solutions since the NPV of the 12.8 kWp solar PV system is higher than the one for the 10 kWp system, which is not the case for the NEM billing system where a smaller size system would be more beneficial. Hence, a P2P energy trading mechanism can be considered as an incentive mechanism that encourages higher investments in DER solutions since it enables its users to exploit the full potential of their systems in an open market.

Figure 13.

Scenario 1 NPV—all prosumers.

Figure 14.

Scenario 2 NPV—all prosumers.

Additionally, the NPV analysis results under scenario 3 (Figure 15), as compared to the P2P NPV results shown in Figure 13, proves that there is no profit from adding a BESS since even though it generates additional savings for the prosumer, the generated savings are not enough to increase the financial viability of the system.

Figure 15.

Scenario 3 NPV—all prosumers (P2P).

On the other hand, the results of our simulation model are affected by various factors, thus the necessity of conducting a sensitivity analysis. The first step in sensitivity analysis is to identify the key variables or assumptions that have the most significant impact on the analysis outcome. These variables are listed hereafter:

- –

- Negotiated price for the P2P energy trading as compared to the NEM and FiT utility set rates;

- –

- Applicable utility tariff structure;

- –

- Peak power of the rooftop PV system;

- –

- Prosumers’ demand load profile;

- –

- Consumers’ demand profiles;

- –

- Storage capacity of the BESS;

- –

- Number of prosumers versus consumers connected to the grid.

Considering the P2P energy trading negotiated price, if this rate is lower than the utility tariff, it would be considered a more appealing option for consumers. It increases the demand for traded energy, increasing the prosumer’s revenue and the consumer’s savings. However, any increase in the negotiated price, as long as it remains lower than the utility tariff, would favor the prosumer, leading to higher gains from his side but lower savings from the consumer’s side.

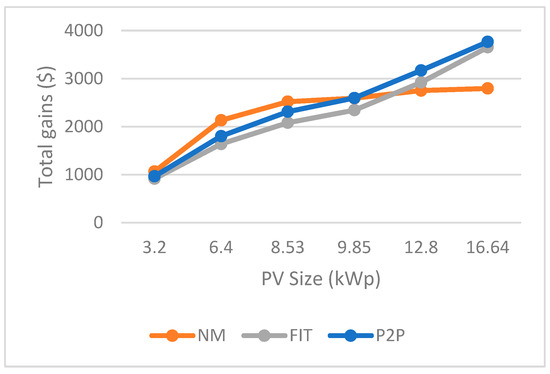

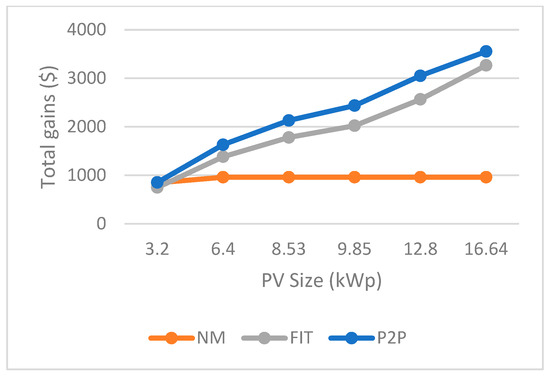

Figure 16 and Figure 17 show the variation in the prosumers’ gains as a function of the solar PV peak power. For Prosumer A, a small-scale rooftop solar PV system under a NEM scheme can be more profitable than P2P or FiT. This is explained by the fact that a small-scale PV system will only be able to serve the prosumer’s load and thus there will be little or no rolled-over energy and no considerable excess energy to trade. However, this would not be the case if the demand load of the prosumer is very low, such as that of Prosumer B. Additionally, this sensitivity analysis shows that P2P energy trading mechanisms may encourage prosumers to opt for larger DER systems to increase their profitability.

Figure 16.

PV size impact on total savings—Prosumer A.

Figure 17.

PV size impact on total savings—Prosumer B.

7. Conclusions

P2P energy trading is a new billing mechanism to incentivize prosumers to invest in DER projects, thereby contributing to the decentralization and decarbonization of the energy grid. This model allows private entities to generate and store energy and sell it back to other interested consumers in an open market ecosystem and without restrictions from the grid operator or the utility, thus turning the traditional electricity consumer into a proactive member of the electricity value chain and transforming the energy market into a consumer-driven model that can be beneficial to all stakeholders. Also, as shown in our simulations, the P2P energy trading model benefits consumers, allowing them to reduce their annual payments for electricity. In addition, P2P energy trading can also be beneficial for utilities. A utility’s annual net profit would range from 10% to 30%. By applying a 15% wheeling fee to the P2P transactions and automating the billing process and management of these transactions through blockchain technology, the wheeling fee can be considered as a net profit for utility companies.

P2P energy trading promotes deregulation of the energy market, thus breaking the monopoly of utility companies faced with other billing systems such as NEM and FiT. However, P2P energy trading is challenging in handling the technical and financial aspects of the transactions without relying on a common third-party that has the trust of all peers to manage the energy exchanges in a secure and controlled manner. Hence, a P2P energy trading model would not be feasible without relying on blockchain technology. Blockchain is the perfect match for P2P energy trading because of its capability to automate energy and financial transactions and establish trust between unknown peers while maintaining the anonymity of the peers, immutability and traceability of transactions, and transparency in the process as well as security and immunity against tampering. Hence, blockchain offers a low-cost platform for managing and operating any P2P energy trading mechanism.

The current P2P energy trading simulation model can be further applied to assess its impact on other DERs such as electric vehicles and demand response programs. For electric vehicles, the P2P energy trading model can be used to incentivize vehicle-to-grid (V2G) energy exchange as well as vehicle-to-vehicle (V2V) energy trading. Similarly, combining P2P energy trading with demand response capabilities offers several benefits. Consumers can adjust their energy consumption based on real-time pricing signals or supply–demand imbalances within the local energy market. Consumers can save money by buying electricity from nearby prosumers at lower prices or reducing consumption during peak demand periods when prices are high. By actively managing energy consumption and generation within the local network, P2P energy trading with demand response can help enhance grid stability and reliability, particularly during peak demand periods or in regions with high levels of renewable energy generation.

In conclusion, this study sheds light on a new billing mechanism that can benefit all stakeholders. Through simulation and analysis, we have demonstrated that P2P energy trading can be a better option than conventional billing mechanisms in many situations. Moving forward, it is essential to investigate the P2P energy trading mechanism further under other scenarios to build upon the foundation laid by this study and address any remaining questions or uncertainties.

Author Contributions

Conceptualization, A.A.; methodology, A.A.; software, A.A.; validation, A.I., M.A. and M.G.; formal analysis, A.A.; investigation, A.A.; resources, H.I.; data curation, A.A.; writing—original draft preparation, A.A.; writing—review and editing, A.I. and M.A.; visualization, A.A.; supervision, M.A.; project administration, H.I.; funding acquisition, A.I. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data are contained within this article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Kabeyi, M.J.B.; Olanrewaju, O.A. Sustainable Energy Transition for Renewable and Low Carbon Grid Electricity Generation and Supply. Front. Energy Res. 2022, 9, 743114. [Google Scholar] [CrossRef]

- Ang, B.W.; Choong, W.L.; Ng, T.S. Energy security: Definitions, dimensions and indexes. Renew. Sustain. Energy Rev. 2015, 42, 1077–1093. [Google Scholar] [CrossRef]

- Zafar, R.; Mahmood, A.; Razzaq, S.; Ali, W.; Naeem, U.; Shehzad, K. Prosumer based energy management and sharing in smart grid. Renew. Sustain. Energy Rev. 2018, 82 Pt 1, 1675–1684. [Google Scholar] [CrossRef]

- Kotilainen, K. Energy Prosumers’ Role in the Sustainable Energy System. In Affordable and Clean Energy. Encyclopedia of the UN Sustainable Development Goals; Leal Filho, W., Azul, A., Brandli, L., Özuyar, P., Wall, T., Eds.; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Zebra, E.I.C.; van der Windt, H.J.; Nhumaio, G.; Faaij, A.P.C. A review of hybrid renewable energy systems in mini-grids for off-grid electrification in developing countries. Renew. Sustain. Energy Rev. 2021, 144, 111036. [Google Scholar] [CrossRef]

- Del Carpio-Huayllas, T.E.; Ramos, D.S.; Vasquez-Arnez, R.L. Feed-in and net metering tariffs: An assessment for their application on microgrid systems. In Proceedings of the 2012 Sixth IEEE/PES Transmission and Distribution: Latin America Conference and Exposition (T&D-LA), Montevideo, Uruguay, 3–5 September 2012; pp. 1–6. [Google Scholar] [CrossRef]

- Jain, S. Exploring structures of power purchase agreements towards supplying 24×7 variable renewable electricity. Energy 2022, 244 Pt A, 122609. [Google Scholar] [CrossRef]

- Zsiborács, H.; Baranyai, N.H.; Vincze, A.; Zentkó, L.; Birkner, Z.; Máté, K.; Pintér, G. Intermittent Renewable Energy Sources: The Role of Energy Storage in the European Power System of 2040. Electronics 2019, 8, 729. [Google Scholar] [CrossRef]

- Sajjad, I.A.; Manganelli, M.; Martirano, L.; Napoli, R.; Chicco, G.; Parise, G. Net-Metering Benefits for Residential Customers: The Economic Advantages of a Proposed User-Centric Model in Italy. IEEE Ind. Appl. Mag. 2018, 24, 39–49. [Google Scholar] [CrossRef]

- Prahastono, I.; Sinisuka, N.I.; Nurdin, M.; Nugraha, H. A Review of Feed-In Tariff Model (FIT) for Photovoltaic (PV). In Proceedings of the 2019 2nd International Conference on High Voltage Engineering and Power Systems (ICHVEPS), Denpasar, Indonesia, 1–4 October 2019; pp. 76–79. [Google Scholar] [CrossRef]

- Zaki, D.A.; Hamdy, M. A Review of Electricity Tariffs and Enabling Solutions for Optimal Energy Management. Energies 2022, 15, 8527. [Google Scholar] [CrossRef]

- Lyu, W.; Liu, J. Artificial Intelligence and emerging digital technologies in the energy sector. Appl. Energy 2021, 303, 117615. [Google Scholar] [CrossRef]

- Szulecki, K.; Overland, I. Energy democracy as a process, an outcome and a goal: A conceptual review. Energy Res. Soc. Sci. 2020, 69, 101768. [Google Scholar] [CrossRef]

- González-Eguino, M. Energy poverty: An overview. Renew. Sustain. Energy Rev. 2015, 47, 377–385. [Google Scholar] [CrossRef]

- Kühnbach, M.; Bekk, A.; Weidlich, A. Towards improved prosumer participation: Electricity trading in local markets. Energy 2022, 239 Pt E, 122445. [Google Scholar] [CrossRef]

- Zheng, Z.; Xie, S.; Dai, H.; Chen, X.; Wang, H. An Overview of Blockchain Technology: Architecture, Consensus, and Future Trends. In Proceedings of the 2017 IEEE International Congress on Big Data (BigData Congress), Honolulu, HI, USA, 25–30 June 2017; pp. 557–564. [Google Scholar] [CrossRef]

- Qadir, S.A.; Al-Motairi, H.; Tahir, F.; Al-Fagih, L. Incentives and strategies for financing the renewable energy transition: A review. Energy Rep. 2021, 7, 3590–3606. [Google Scholar] [CrossRef]

- Castaneda, M.; Zapata, S.; Cherni, J.; Aristizabal, A.J.; Dyner, I. The long-term effects of cautious feed-in tariff reductions on photovoltaic generation in the UK residential sector. Renew. Energy 2020, 155, 1432–1443. [Google Scholar] [CrossRef]

- Böhringer, C.; Cuntz, A.; Harhoff, D.; Asane-Otoo, E. The impact of the German feed-in tariff scheme on innovation: Evidence based on patent filings in renewable energy technologies. Energy Econ. 2017, 67, 545–553. [Google Scholar] [CrossRef]

- Nguyen, T.A.; Byrne, R.H. Maximizing the cost-savings for time-of-use and net-metering customers using behind-the-meter energy storage systems. In Proceedings of the 2017 North American Power Symposium (NAPS), Morgantown, WV, USA, 17–19 September 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Martinez-Anido, C.B.; Brinkman, G.; Hodge, B.-M. The impact of wind power on electricity prices. Renew. Energy 2016, 94, 474–487. [Google Scholar] [CrossRef]

- Brandstätt, C.; Brunekreeft, G.; Friedrichsen, N. Locational signals to reduce network investments in smart distribution grids: What works and what not? Util. Policy 2011, 19, 244–254. [Google Scholar] [CrossRef]

- Shaw-Williams, D.; Susilawati, C. A techno-economic evaluation of Virtual Net Metering for the Australian community housing sector. Appl. Energy 2020, 261, 114271. [Google Scholar] [CrossRef]

- Caballero-Peña, J.; Cadena-Zarate, C.; Parrado-Duque, A.; Osma-Pinto, G. Distributed energy resources on distribution networks: A systematic review of modelling, simulation, metrics, and impacts. Int. J. Electr. Power Energy Syst. 2022, 138, 107900. [Google Scholar] [CrossRef]

- Castaneda, M.; Jimenez, M.; Zapata, S.; Franco, C.J.; Dyner, I. Myths and facts of the utility death spiral. Energy Policy 2017, 110, 105–116. [Google Scholar] [CrossRef]

- Pollitt, M.G. The role of policy in energy transitions: Lessons from the energy liberalisation era. Energy Policy 2012, 50, 128–137. [Google Scholar] [CrossRef]

- Rohankar, N.; Jain, A.K.; Nangia, O.P.; Dwivedi, P. A study of existing solar power policy framework in India for viability of the solar projects perspective. Renew. Sustain. Energy Rev. 2016, 56, 510–518. [Google Scholar] [CrossRef]

- Bolinger, M.; Seel, J.; Kemp, J.; Warner, C.; Katta, A.; Robson, D. Utility-Scale Solar, 2023 Edition: Empirical Trends in Deployment, Technology, Cost, Performance, PPA Pricing, and Value in the United States; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2023. Available online: https://escholarship.org/uc/item/9m7260r5 (accessed on 26 August 2024).

- Burin, H.P.; Siluk, J.S.M.; Rediske, G.; Rosa, C.B. Determining Factors and Scenarios of Influence on Consumer Migration from the Regulated Market to the Deregulated Electricity Market. Energies 2021, 14, 65. [Google Scholar] [CrossRef]

- Aggarwal, S.K.; Saini, L.M.; Kumar, A. Electricity price forecasting in deregulated markets: A review and evaluation. Int. J. Electr. Power Energy Syst. 2009, 31, 13–22. [Google Scholar] [CrossRef]

- Conejo, A.J.; Sioshansi, R. Rethinking restructured electricity market design: Lessons learned and future needs. Int. J. Electr. Power Energy Syst. 2018, 98, 520–530. [Google Scholar] [CrossRef]

- Feldmann, A.; Gladisch, A.; Kind, M.; Lange, C.; Smaragdakis, G.; Westphal, F.-J. Energy trade-offs among content delivery architectures. In Proceedings of the 2010 9th Conference of Telecommunication, Media and Internet, Ghent, Belgium, 7–9 June 2010; pp. 1–6. [Google Scholar] [CrossRef]

- Sergaki, A.; Kalaitzakis, K. A knowledge management platform for supporting Smart Grids based on peer to peer and service oriented architecture technologies. In Proceedings of the 2011 IEEE International Conference on Smart Measurements of Future Grids (SMFG) Proceedings, Bologna, Italy, 14–16 November 2011; pp. 154–159. [Google Scholar]

- Qin, J.; Wan, Y.; Li, F.; Kang, Y.; Fu, W. Distributed Economic Operation in Smart Grid: Model-Based and Model-Free Perspectives; Springer Nature: Singapore, 2023. [Google Scholar]

- Mussadiq, U.; Mahmood, A.; Ahmed, S.; Razzaq, S.; Koo, I. Economic and Climatic Impacts of Different Peer-to-Peer Game Theoretic–Based Energy Trading Systems. IEEE Access 2020, 8, 195632–195644. [Google Scholar] [CrossRef]

- Ali, L.; Muyeen, S.M.; Bizhani, H.; Simoes, M.G. Economic Planning and Comparative Analysis of Market-Driven Multi-Microgrid System for Peer-to-Peer Energy Trading. IEEE Trans. Ind. Appl. 2022, 58, 4025–4036. [Google Scholar] [CrossRef]

- Spiliopoulos, N.; Sarantakos, I.; Nikkhah, S.; Gkizas, G.; Giaouris, D.; Taylor, P.; Rajarathnam, U.; Wade, N. Peer-to-peer energy trading for improving economic and resilient operation of microgrids. Renew. Energy 2022, 199, 517–535. [Google Scholar] [CrossRef]

- Long, C.; Zhou, Y.; Wu, J. A game theoretic approach for peer to peer energy trading. Energy Procedia 2019, 159, 454–459. [Google Scholar] [CrossRef]

- Leong, C.H.; Gu, C.; Li, F. Auction Mechanism for P2P Local Energy Trading considering Physical Constraints. Energy Procedia 2019, 158, 6613–6618. [Google Scholar] [CrossRef]

- Huang, H.; Nie, S.; Lin, J.; Wang, Y.; Dong, J. Optimization of Peer-to-Peer Power Trading in a Microgrid with Distributed PV and Battery Energy Storage Systems. Sustainability 2020, 12, 923. [Google Scholar] [CrossRef]

- Pereira, H.; Gomes, L.; Vale, Z. Peer-to-peer energy trading optimization in energy communities using multi-agent deep reinforcement learning. Energy Inform. 2022, 5, 44. [Google Scholar] [CrossRef]

- Eltamaly, A.M.; Ahmed, M.A. Performance Evaluation of Communication Infrastructure for Peer-to-Peer Energy Trading in Community Microgrids. Energies 2023, 16, 5116. [Google Scholar] [CrossRef]