Abstract

This study examines the public’s adoption preferences for China’s central bank digital currency (e-CNY) through an improved Unified Theory of Acceptance and Use of Technology framework. Analyzing 3509 consumer and 1630 retailer questionnaires, we investigate five psychological dimensions: perceived risk, cost, benefit, social influence, and marketing promotion. The findings reveal distinct adoption mechanisms: while perceived benefit drives both groups’ adoption intention, marketing promotion significantly influences consumers but shows a limited effect on retailers. Conversely, social influence substantially affects retailers while demonstrating minimal impact on consumers. Perceived cost negatively affects both groups, whereas perceived risk shows no significant deterrent effect. This research provides novel insights into CBDC adoption psychology and offers evidence-based guidance for differentiated promotion strategies targeting consumers and retailers, contributing to both technology adoption theory and CBDC implementation practice.

1. Introduction

China has prioritized the research and development of a central bank digital currency. It started the research and development of central bank digital currency as early as 2014 and has been in a leading position. Since April 2020, DC/EP (Digital Currency/Electronic Payment, the earliest name of China’s central bank digital currency project) has been conducting internal closed pilot tests in Shenzhen, Suzhou, Xiong’an New Area and Chengdu. Subsequently, the project was officially named as e-CNY (short for electronic China Yuan). So far, the number of pilot areas for e-CNY has been expanded to 26 regions across 17 provinces1. On 16 July 2021, Working group on e-CNY research and development of the People’s Bank of China released the “Progress of Research & Development of E-CNY in China”, which comprehensively explained the research and development background, target vision, design framework and related policy considerations of the e-CNY system.

On 8 October 2020, the e-CNY was issued in Shenzhen in the form of red envelopes. This marked the first open environment pilot for public use. Since then, cities like Shenzhen, Suzhou, Beijing, Chengdu, Changsha, Shanghai, Xiong’an, Qingdao, Hainan, Dalian, and others have conducted multiple large-scale e-CNY red envelope activities. Banks and related companies have also launched various special subsidy programs to support the issuance of e-CNY. According to the PBoC, as of the end of September 2025, the cumulative transaction volume in pilot areas reached 14.2 trillion yuan, a total of 3.32 billion transactions had been processed in pilot areas, with 225 million personal wallets opened through the e-CNY app, used in shopping, dining, transportation, tourism, and government payment services2.

China’s central bank digital currency (e-CNY) represents more than just another mobile payment option. As a legal digital currency backed by sovereign credit, its unique attributes—such as “dual offline payment,” “controlled anonymity,” (Working Group on E-CNY Research and Development of the People’s Bank of China, 2021) and its potential as a monetary policy tool—suggest that its adoption drivers may differ fundamentally from those of traditional e-wallets (e.g., Alipay, WeChat Pay). However, most existing studies uncritically apply established technology acceptance models to understand its adoption, failing to fully capture the uniqueness of e-CNY as a new financial infrastructure that embodies technological, monetary, and policy attributes simultaneously. Specifically, two critical research gaps remain: first, a lack of an integrated theoretical framework that simultaneously explains the decision-making behaviors of both consumers and retailers in the e-CNY context; second, a failure to delve into how macro-level institutional factors, such as state credit and financial regulatory policies, influence individual adoption intentions through micro-level psychological mechanisms.

Facing the trend of China’s large-scale digital currency pilot, it is necessary to understand whether the current setting of e-CNY is in line with the needs of consumers and retailers. What are the main factors affecting the use of e-CNY to pay? How influential are the different factors? Currently, most of the research on the willingness to use e-CNY is based on media reports and market analysis. This paper integrates the knowledge of economics, psychology, and sociology, uses the methods of questionnaire survey and statistical analysis, and conduct a theoretical based on the improved unified theory of acceptance and use of technology (UTAUT) to do empirical research on consumers’ preference for e-CNY, in order to obtain some meaningful and inspiring conclusions, and provide policy suggestions for China to better issue e-CNY in the future.

This study contributes to the literature in several ways: (1) It offers a novel research perspective. This paper studies consumers’ preference for e-CNY from a psychological perspective, which is different from the previous research on the demand for e-CNY. (2) The questionnaire is detailed, and the survey data are unique. 3509 valid consumers’ and 1630 retailers’ questionnaires were recovered with the help of the Wenjuanxing website and on-site survey, and the samples were representative to a certain extent. The survey date will help to evaluate the degree of cognition and preferences of consumers on e-CNY was analyzed. (3) A contextual adaptation of the classic UTAUT model to fit the unique research object that is a CBDC. By integrating the core logic of the Value-based Adoption Model (VAM) and explicitly incorporating the “Marketing Promotion” construct—paramount in state-led financial innovation—this paper developed a more robust analytical framework. (4) Provide theoretical insights and policy implications derived from China’s pioneering practice for the future global rollout of CBDCs.

The structure of this paper is as follows: the first part is the introduction, the second part is the literature review, the third part is the consumers’ e-CNY cognition analysis based on the survey data, and the fourth part is the consumers’ e-CNY preference analysis based on the improved UTAUT model, the fifth part is the retailers’ e-CNY preference analysis based on the improved UTAUT model, the sixth part is the discussion and the seventh part is the investigation conclusion and enlightenment.

2. Literature Review

Due to the strong timeliness of the topic selection of this paper, there are not many direct results in the academic and theoretical circles at home and abroad. This paper lists some indirect and direct research literature, which are mainly reviewed from the following three aspects.

2.1. Payment Preference Based on Perceived Value Acceptance Theory (VAM)

Within the framework of classical economics research, consumers are rational people whose goal is to maximize their own interests. Keynes (1936) put forward the theory of liquidity preference, that is, people’s desire or motivation to keep a part of their wealth in the form of money. Ricardo (1817) used a mathematical method to introduce the concept of margin and pointed out that consumers’ payment method is only based on its utility to consumers. Under the framework of behavioral finance theory, as Shiller (2000) pointed out, people are not necessarily rational, and their payment preference decisions are also affected by risk and herd mentality, etc.

Among the technology adoption theories, the most important theories include the theory of reasoned action (TRA), the technology acceptance model (TAM), the theory of planned behavior (TPB), and the recent rise in the unified theory of acceptance and use of technology (UTAUT).

Theories such as TPB, TAM, and UTAUT all originated from TRA. Based on social psychology, Fishbein and Ajzen (1975) proposed the theory of rational behavior and found that an individual’s behavior can be predicted to a certain extent through behavioral intention, which is determined by an individual’s attitude and subjective awareness of the relevant behavior.

Based on TRA, Davis (1986, 1989) proposed the Technology Acceptance Model (TAM), which added perceived ease of use and perceived usefulness into the decision of behavioral intention, making the model more explanatory. TAM is also used in payment preference analysis. L. Chen (2008) combined the technology acceptance model and the innovation diffusion theory to study the willingness of mobile payment consumers, and the results showed that the perceived ease of use, perceived usefulness, perceived risk, and compatibility significantly affected the consumer’s willingness to use. Sleiman et al. (2021) conducted a model based on the TAM to investigate the influencing factors of the mobile payment environment such as Alipay and WeChat in China, and found that government regulation is the most important factor for customer trust, followed by reputation and security, in addition, mobility, subjective norms, usefulness, ease of use, and perceived enjoyment influence customer behavioral intent.

However, the structure of TAM is relatively simple. In subsequent studies, different variables were added to the basic model according to different situations. Kim and Chan (2007) studied the reasons and influencing factors of users’ use of mobile Internet, and found that TAM had strong explanatory power in the organizational environment, but it was more necessary to proceed from a voluntary situation in consumption choice. Therefore, they proposed a value-based adoption model (VAM) from the perspective of maximizing perceived value. This model indicated that perceived value had a direct impact on consumers’ willingness to use, and perceived value was the result of the combined influence of perceived gains and perceived losses. Meanwhile, Kim and Chan proposed that perceived gains mainly include perceived usefulness and perceived entertainment, and perceived losses include perceived costs and expertise.

Some scholars have analyzed consumers’ willingness for payment tools using VAM. Han and Yang (2010) investigated consumers’ willingness to switch from online banking to alternative mobile banking services provided by the same company from the perspective of perceived value, and established a model including comparative advantage, enjoyment improvement, perceived cost, learning cost, perceived value, and switching intention. Ling et al. (2020) studied Malaysian consumers’ willingness to adopt electronic wallets based on the VAM, and found that the higher the perceived value, the higher the willingness to adopt electronic wallets, and the willingness to adopt electronic wallets is not only triggered by external benefits, but also the internal result of using it. Shelvia et al. (2020) studied consumer willingness to use mobile payment services in Indonesia by VAM and found that not all suggested factors have a significant positive influence, but perceived interest was the strongest determinant. In addition to perceived convenience, social influences also play a role in consumers’ willingness to use mobile payments. Taufiq (2021) developed a TAM (Technology Acceptance Model) by integrating a VAM (Value-based Adoption Model), PAM (Pos Acceptance Model), and security perceptions to explain the perspective perceived by fintech services users in terms of security, perceived value, benefits, and satisfaction in using fintech. S. Chen et al. (2023) built a model framework to help Chinese mobile payment operators identify factors that affect consumers’ use of mobile payment to expand consumer groups and enhance the competitiveness of mobile payment companies.

2.2. Payment Preference Based on the Unified Theory of Acceptance and Use of Technology (UTAUT)

With the deepening of research and the pursuit of higher accuracy, Venkatesh et al. (2003) proposed the unified theory of acceptance and use of technology, which contains four core dimensions of performance expectancy, effort expectancy, social influence and facilitating conditions. UTAUT also pointed out that there were four control variables that significantly affected the above core dimensions, namely, gender, age, experience and voluntariness of use.

After that, UTAUT, as an important theory to explain the user’s technology use intention and behavior, has also been applied to the study of payment behavior preference. Luarn and Lin (2005) studied Taiwanese consumers’ willingness to use mobile banking based on UTAUT, and the results showed that perceived ease of use, perceived cost, perceived credibility, and perceived self-utility are important factors affecting consumers. Shin (2009) added perceived security and trust factors to UTAUT, conducted a study on the willingness of Korean mobile wallet consumers, and found that perceived security, trust, and attitudes significantly affect consumers’ willingness to use. Hsu et al. (2011) added factors such as perceived security, perceived cost, and subjective norms to the technology acceptance model to study consumers’ willingness for mobile financial services. The results show that perceived usefulness, attitude, and subjective norms significantly affect their willingness, while perceived cost has no significant effect. Oliveira et al. (2014) combined the task technology fit (TTF) model, UTAUT, and initial trust model (ITM), studied the use of mobile banking: m-Banking in Portugal, and found that convenience conditions and behavioral intentions directly affect the adoption of m-Banking, and they showed that initial trust, performance expectancy, and technical characteristics have an overall impact. Phonthanukitithaworn et al. (2016) empirically tested the behavioral intentions of using mobile payment services in Thailand and found that the factors affecting users’ willingness are compatibility, subjective norms, perceived trust, and perceived cost. Cao and Niu (2019) used UTAUT to study Alipay’s user adoption and found that it was influenced by performance expectancy and effort expectancy. Al-Saedi et al. (2019) reviewed 25 papers on mobile payment adoption using UTAUT as a theoretical model and found that perceived risk and perceived trust were the most important determinants. Wei et al. (2021) conducted a survey with 295 samples to study the risk perception and bonus/rewards provided by the mobile-pay firms of Generation Y and Generation Z based on the extended USAUT.

2.3. Related Research on Central Bank Digital Currencies

In recent years, the research enthusiasm of scholars on central bank digital currencies (CBDCs) has not diminished. According to the fifth survey released by the Bank for International Settlements (BIS) in 2023, 94% of surveyed central banks are exploring a central bank digital currency (CBDC), and the central banks are proceeding at their own speed, taking diverse approaches and considering different design features.

Some scholars focus on the usage intention of CBDCs. Tronnier and Kakkar (2021) investigated the usage intention in the digital euro in a UTAUT model extended with additional factors identified to be of importance for individuals in digital payment research. Bai (2020) built a conceptual framework from the two well-established user-theory models: theory of planned behavior (TPB) and the extended unified theory of acceptance and use of technology (UTAUT2), and collected 200 participants’ surveys to discover the factors influencing behavioral intention to adopt CBDC. Wu et al. (2022) conducted a UTAUT model to understand Chinese users’ adoption of DCEP and found that perceived fairness, habits, social influence, and national identity significantly impact the use of DCEP. Jamader et al. (2022) concentrate on elements that influence customer behavior towards the digital payment system, fintech, and CBDC acceptance. Gupta et al. (2023) examined the influence of users’ experiences with the unified payments interface (UPI) system on the usage behavior of central bank digital currency (CBDC) in India and developed a novel conceptual framework that investigated the relationships between technology, cognitive factors, and behavioral intentions towards CBDC use. Liu et al. (2024) employed the UTAUT to construct a research model that identifies the various factors influencing individual adoption of DCEP with 401 surveys. Tang and Si (2025) demonstrated through multinational experiments that tiered privacy designs—granting anonymity for small transactions while enabling traceability for larger ones—can elevate adoption intention by 23%, though regulatory alignment remains essential.

From the above research results and literature, consumers’ willingness to use payment tools is discussed on the basis of the classic technology acceptance model and innovation diffusion theory. It is believed that the factors affecting consumers’ willingness to use payment tools can be summarized as perceived cost, perceived risk, perceived benefit, attitude, subjective norm, trust, and security. However, there is still a lack of research on the willingness and preference for digital currency use. Based on the existing research, this paper attempts to make certain improvements to the value-based adoption model and unified theory of acceptance and use of technology. By designing a questionnaire, this paper discusses consumers’ e-CNY cognitive situations, as well as their willingness to use, and tries to construct a model that could explain consumers’ psychological preferences on e-CNY.

The data in this paper mainly comes from over 5000 valid questionnaires recovered with the help of the Wenjuanxing website. The samples are representative to a certain extent. Using statistical methods, consumers’ willingness to use e-CNY is decomposed into five dimensions, and the transmission path and specific impact of each dimension on the willingness to use are found. The results will help fully demonstrate the psychological preference of consumers for the use of e-CNY and provide reliable recommendations for the large-scale issuance of e-CNY in the future.

3. Analysis of Consumers’ e-CNY Cognition Based on Survey Data

3.1. Questionnaire Design and Survey Respondents’ Basic Information

To understand consumers’ preferences for e-CNY deeply and intuitively, this paper designed a questionnaire, mainly for individual consumers (companies, schools, and institutions are not considered). Based on the literature, this paper used UTAUT to investigate consumers’ willingness and psychological preference for e-CNY through five dimensions: perceived risk, perceived cost, perceived benefit, social influence, and marketing promotion.

The questionnaire is divided into four parts: The first part is the collection of basic personal information, mainly to obtain the gender, age, education level, income level, residential area of the sample, and the current use of card, third-party payment and other non-cash payment instruments. The second part is consumers’ current cognition of e-CNY; the third part is the focus of the survey, which measured consumers’ willingness to use and psychological preference of e-CNY through the perception of perceived benefits, perceived risks, and perceived costs, social influence, and marketing promotion. The fourth part is the comprehensive perception of e-CNY and its suggestions for e-CNY.

Data were collected through Wenjuanxing (www.wjx.cn), a leading online survey platform in China. To enhance the sample’s representativeness and mitigate sampling bias, a quota sampling method was employed. The platform’s service was configured to match the demographic profile (age, gender, and region, with a particular focus on e-CNY pilot areas) of Chinese internet users as per the latest statistical report on internet development published by the China Internet Network Information Center (CNNIC).

The survey adopted the form of online anonymous questionnaires, from January 2025 to June 2025, and 3588 questionnaires were collected through the Wenjuanxing website, of which 3509 were valid responses, with a 97.80% effective rate. The regional distribution of the samples was as follows: Shanghai (14.31%), Jiangsu Province (26.7%), Zhejiang Province (13.94%), Fujian Province (9.72%), Shandong Province (34.31%), and 1.03% from other regions.

The respondents currently use non-cash payment tools (bank cards, WeChat payment, Alipay, etc.) at a relatively high frequency. The proportion of respondents who currently use non-cash payment tools more than 80% was 62.44%, those who spent 61–80% accounted for 24.23%, 41–60% accounted for 7.15, 21–40% accounted for 2.76%, and the proportion of less than 20% was 3.41%. The current frequency of the respondents using non-cash payment tools is “every day”, accounting for 71.22%; “more than 3 times a week”, 22.28%; “about once a week” accounted for 2.93%; “1–2 times a month” accounted for 0.98%; and “rarely used” accounted for 2.6%. These data reflected their strong user stickiness to non-cash payment tools.

3.2. Analysis of Consumers’ Perception of e-CNY

3.2.1. The Survey Respondents Have a Moderate Understanding of e-CNY

The respondents’ self-evaluation of their understanding of e-CNY is as follows: 9.76% are “not understood”, 28.29% are “not understood much”, 36.42% are “some understood”, 22.44% are “basically understood”, and 3.09% are “well understood”. Weighted average calculation, the total score of 5.62 points (assign 2 points for not understood, 4 points for not understood much, 6 points for some understood, 8 points for basically understood, and 10 points for well understood, and take the weighted average). It indicates that most people are in a state of some understood, the promotion of e-CNY needs to be further strengthened.

In terms of gender, men’s understanding of e-CNY is slightly higher than women’s, with a score of 5.84 for men and 5.38 for women. Young people have a deeper understanding of e-CNY, with little difference between income groups. In terms of educational level, the understanding score of those with doctoral and master’s degrees is the highest, 5.80, followed by undergraduates, 5.66. The understanding score of high school graduates is 5.14, and the understanding score of junior high school and below is 4.29, showing that the higher the education level, the higher the understanding of e-CNY. From the point of view of whether it is a pilot area, the understanding degree of the respondents in the pilot cities was 5.96, and that in the non-pilot areas was 5.26. The understanding of e-CNY among the respondents in the pilot cities was 0.7 higher than that in the non-pilot areas.

3.2.2. The Survey Respondents Have a High Level of Understanding of the Definition of e-CNY

As defined in the Progress of Research & Development of E-CNY in China, e-CNY is the digital version of fiat currency issued by the PBOC and operated by authorized operators. It is a value-based, quasi-account-based, and account-based hybrid payment instrument, with legal tender status and loosely-coupled account linkage. Regarding the question of what e-CNY is, 82.93% of the respondents choose the correct answer “the legal digital currency issued by the People’s Bank of China”, and 11.87% think it was “another form of Alipay and WeChat payment”, 4.88% think it was a “virtual currency similar to Bitcoin”, and 0.33% chose “others”.

3.2.3. The Survey Respondents Believe That e-CNY Has Less Impact on Third-Party Payments Such as Alipay and WeChat Pay, and Has a Greater Impact on Cash

The respondents believe that the impact of e-CNY on third-party payments such as Alipay and WeChat Pay is as follows: 8.62% think e-CNY will not replace the third-party payments, 44.39% think it will replace a small part, 40.81% think it will replace most of the third-party payments, and 6.18% think it will completely replace the third-party payments. The respondents believe that the impact of e-CNY on cash is as follows: 5.85% think e-CNY will not replace cash, 23.74% think it will replace a small part, 62.6% think it will replace most, and 7.8% think it will completely replace cash.

3.2.4. The Survey Respondents Believe There Are Multiple Reasons for the Central Bank to Issue e-CNY

The respondents believe that the first reason for the central bank to issue e-CNY is “strengthening financial supervision, combating money laundering and tax evasion and other crimes”, accounting for 80.16%; followed by “replacing cash, reducing circulation costs, and preventing counterfeiting”, accounting for 78.21%; the third is “following the trend of digital economy development, providing convenient and safe payment”, accounting for 76.42%; the forth is “accurately implementing macro monetary policies” accounting for 69.43%; the fifth is “breaking the monopoly of payment companies and protecting consumers’ rights and interests”, accounting for 60%; the sixth is “responding to the impact of private digital currencies such as Bitcoin and Libra, and accelerating the internationalization of the RMB”, accounting for 59.35%; and 1.14% choose others.

3.2.5. The Survey Respondents Ranked the Importance of e-CNY’s Characteristics in a Reasonable Order

The importance of e-CNY’s characteristics ranking from high to low by the respondents is as follows: the first is zero-cost use and no handling fee, scored 4.04 points (full score is 5, same below), the second is guaranteed by national credit, scored 3.4 points, the third is ensuring payment security, scored 3.38 points, and 3.25 points for convenience, quickness and ease of use, 2.86 points for “dual offline payment” (that is, no network is required, and both payer can pay offline), and 2.86 points for managed anonymity that is, anonymity for small value and traceable for high value) and payment privacy protection.

3.2.6. The Use of Digital Currency Is Characterized by Low Frequency and Regional Concentration

The overall usage frequency of digital currency is currently low, with over 60% of users engaging in low-frequency use or not activating their wallets. Specifically, 64.29% of users utilize it less than once a month or have not activated their wallets, while only 35.71% are high-frequency users. The largest proportion of users (33.11%) have not activated their wallets, and the high-frequency group (multiple times daily or weekly) accounts for just 12.57%.

Further cross-regional analysis reveals that Jiangsu Province has a notably high proportion of high-frequency users, with 59.98% using it multiple times a month, far exceeding other regions. In contrast, Fujian Province shows a bimodal distribution with both high-frequency (35.48%) and non-activated (29.33%) users. Shanghai and Shandong Province both have non-activation rates exceeding 40%, highlighting significant regional disparities in promotion efforts.

3.2.7. The Usage Scenarios of Digital Currency Are Primarily Concentrated in Small-Value, High-Frequency Consumption Areas, Yet There Are Notable Differences in the Adoption Rates of Certain Scenarios

Regarding transaction amounts, 82.36% of users prefer transactions under 100 yuan, significantly higher than other ranges, while transactions exceeding 500 yuan account for only 3.19%. This indicates that small-value payments are the main usage scenario for digital currency.

Online shopping (4.52 points) is the most common scenario for digital currency usage, with a top-choice share of 84.88%, far surpassing other options. Offline shopping (1.93 points) and dining (1.63 points) rank second and third, respectively, but with a significant gap between their combined scores. Notably, utility bill payments (1.33 points) account for 30.29% of the fifth-choice selections, reflecting users’ preference for periodic fixed expenditures. In contrast, the usage rate of “smart contract” pre-funded payments is the lowest at 0.28 points, with 68.18% of users ranking it sixth, indicating that awareness and application scenarios for this feature require further development.

3.2.8. The Motives for Using Digital Currency Are Characterized by a Focus on Security, Policy Incentives, and Significant Regional Differences

High security (49.76%) and government promotion (37.13%) are the dominant factors driving the adoption of digital currency. Users in Jiangsu Province show the highest acceptance of government promotion (69.69%). Individuals aged 31–40 are particularly sensitive to security (62.42%) and red envelope discounts (56.74%). Fujian Province users pay more attention to smart contracts (27.27%) and offline payments (18.18%). Meanwhile, Jiangsu Province leads in red envelope discounts (73.32%) and government promotion (69.69%), reflecting varying degrees of policy implementation across regions.

3.2.9. The Digital Currency Ecosystem Needs to Prioritize Breaking User Habits and Address Regional and Age-Related Differences

Long-term user habits are a core issue across all groups, especially pronounced in older age groups and certain pilot regions. Data shows that 74.41% of respondents believe personal user habits are a significant problem. This proportion reaches 80% among individuals aged 31–40 and as high as 90.32% among those aged 61 and above. Additionally, there is a notable difference in the perception of user habit issues between Jiangsu Province (88.05%) and Fujian Province (50.44%), indicating regional divergence in this regard.

The relevant data mentioned above is summarized in Table 1.

Table 1.

Survey Data on Public Perception and Usage of e-CNY.

4. Analysis of Consumers’ Psychological Preference for Using e-CNY Based on Improved UTAUT

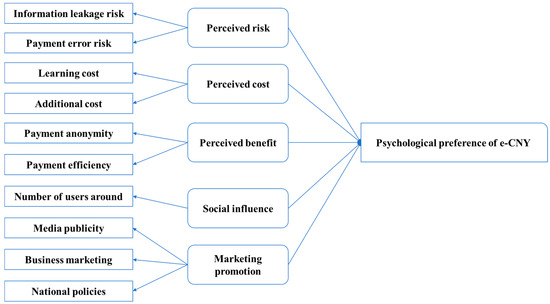

4.1. Research Framework and Hypothesis Development: An Improved UTAUT Model for e-CNY

To address the limitations of existing models in explaining e-CNY adoption, this study proposes an improved UTAUT framework (see Figure 1). The improvements are twofold: first, theoretical integration, combining the UTAUT with the VAM, placing “Perceived Benefit” and “Perceived Cost” at the core, emphasizing users’ calculation of the net value of e-CNY; second, contextualized construct introduction, adding the “Marketing Promotion” dimension to capture the unique role of state power in driving CBDC adoption.

Figure 1.

Analysis Framework for Consumers.

The following sections elaborate on the specific connotations of each construct in the e-CNY context and their hypothesized relationships.

First are the perceived risk and the trust paradox of e-CNY.

Despite being backed by state credit, as a digital form of money, users may still worry about information leakage risk and payment error risk. Retailers are additionally concerned about liquidity risk (fund settlement timing). However, the infusion of state credit may partially offset these risk perceptions. Thus, we propose a more nuanced hypothesis:

H1:

Perceived risk has a significant negative effect on users’ (both consumers and retailers) intention to adopt e-CNY.

Second are the perceived cost and the switching barriers of e-CNY.

The perceived cost of e-CNY goes beyond mere financial cost. For users, learning cost (familiarizing with a new wallet and payment process) and potential additional cost (e.g., upgrading hardware) are significant considerations. For retailers, installation cost and staff training cost are crucial factors influencing their decision. We hypothesize the following:

H2:

Perceived cost has a significant negative effect on users’ (both consumers and retailers) intention to adopt e-CNY.

Third are the perceived benefits and the utility advantages of e-CNY.

In the e-CNY context, perceived benefit encompasses not only the traditional “usefulness” and “ease of use” (e.g., payment efficiency) but also its unique advantages as a sovereign digital currency. One of these advantages is payment anonymity. The “controlled anonymity” feature of e-CNY strikes a balance between protecting individual privacy and meeting anti-money laundering regulations, which is absent in traditional electronic payments. The other advantages are zero-cost usage. The promise of no transaction fees for e-CNY transfers, compared to potential fees charged by third-party payment platforms, constitutes a core attraction. Thus, we hypothesize the following:

H3:

Perceived benefit has a significant positive effect on users’ (both consumers and retailers) intention to adopt e-CNY.

Fourth are the social influence and the network effects of e-CNY.

The network effect, whereby the value of e-CNY increases with its user base, is key to its success. However, during the pilot stage, this effect might not be fully realized. We hypothesize:

H4:

Social influence has a significant positive effect on users’ (both consumers and retailers) intention to adopt e-CNY.

Fifth are the marketing promotion and the state-led push for e-CNY.

This is the most distinctive construct for e-CNY in our model. In China, state-led promotion is a powerful engine for technology diffusion. For e-CNY, marketing promotion includes: Firstly, national policy influence, which indicates clear government support and promotion policies serve as a strong signal for building initial trust. Secondly, media publicity, which indicates the widespread coverage by official media, shapes public perception and legitimacy. Thirdly, business marketing activities include subsidies and promotional activities in cooperation with retailers. We hypothesize the following:

H5:

Marketing promotion has a significant positive effect on users’ (both consumers and retailers) intention to adopt e-CNY.

Taking into account the accuracy of the questionnaire data and the convenience of the respondents to answer the questionnaire, all questions in the questionnaire design are expressed in the form of a five-point Likert scale, and consumers are required to express their attitudes towards the questions provided in the questionnaire. Strongly disagree, disagree, neutral, agree, and strongly agree are the options they expressed, giving 2, 4, 6, 8, 10 points, respectively. The complete set of measurement items and their sources is provided in Appendix A.

4.2. Consumers’ e-CNY Psychological Preference Based on Survey Data

Firstly, consumers overall felt the advantages and benefits of e-CNY. 21.14% rated 10 points (strongly agree), 21.63% rated 9 points, 23.41% rated 8 points, 17.4% rated 7 points, and 7.97% rated 6 points. Taking 6 points as the passing point, the passing rate is as high as 91.55%; the proportion of 7 points or more is 83.58%. The weighted average score for this item was 8.01.

From the gender analysis, men felt the advantages and benefits of e-CNY with a weighted score of 8.25, which was 0.49 points higher than women’s score of 7.76. From the age analysis, respondents under the age of 18 scored 9.14, which is the highest; 18–25 years old scored 7.59, 26–30 years old scored 8.11, 31–40 years old scored 8.27, 41–50 years old scored 7.94, 51–60 years old scored 7.78, and over 60 years old scored 8.5. From the analysis of educational level, high school graduates scored the highest, 8.46 points, and there is little difference between the other groups. From the analysis of the income group, those who have a monthly income of 8000–20,000 yuan scored the highest, while other groups scored below average. There is little difference in the evaluation of e-CNY, whether it is in a pilot area or not; the pilot areas scored 8.03, and the non-pilot areas scored 8.00.

It is worth noting that there are significant differences in the scores of the advantages and benefits of e-CNY among survey respondents who currently use non-cash payment instruments with different usage frequencies and quantities. Overall, the survey respondents who use non-cash payment tools more frequently and pay a higher percentage have higher evaluations of the benefits of e-CNY.

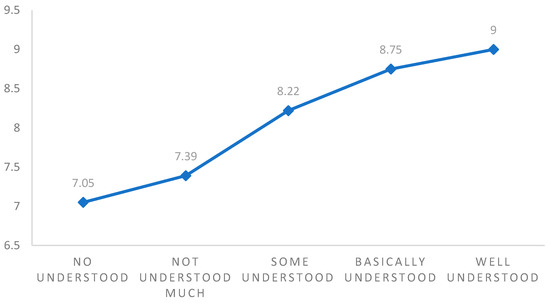

In addition, the analysis found that the more the respondents knew about e-CNY, the higher their evaluation of its benefits. Those who do not know at all scored 7.05, those who do not know much scored 7.39, those who have some understanding scored 8.22, those who have a basic understanding scored 8.75, and those who know well scored 9.0, as shown in Figure 2.

Figure 2.

Cross-analysis of Understanding Degree and Perceived Benefit.

Second, in terms of perceived risk, about half of the respondents agree that there may exist information leakage risk, with an average score of 5.59; only 37% of the respondents agree that there may exist payment errors risk, with an average score of 5.53. Overall, consumers are not sensitive to perceived risk.

Third, in terms of perceived cost, most of the respondents disagree with the learning cost and the additional cost, with an average score of 4.38 and 4.79, respectively. Generally, consumers disagree about perceived cost.

Fourth, in terms of perceived benefits, more than 80% of the survey respondents agreed or strongly agreed with the payment anonymity and payment efficiency of e-CNY, with an average score of 8.11 and 8.45, respectively. In general, people’s perceived benefits of e-CNY are relatively high.

Fifth, in terms of social influence, more than 60% of the respondents hold a positive attitude, and the community benefit is relatively high. The average score of this indicator is 7.50.

Sixth, in terms of marketing and promotion, nearly 80% of the survey respondents agree with the influence of media introduction and publicity, business marketing promotion, and the influence of national policies. The average scores of the three indicators are 8.29, 7.81, and 8.32, respectively.

4.3. Empirical Analysis of the Transmission Path of Consumers’ e-CNY Psychological Preference

This study employed a Covariance-Based Structural Equation Modeling approach to test the theoretical model and verify the research hypotheses. Data analysis was conducted using SPSS 29. CB-SEM is suitable for confirming theoretical models and simultaneously evaluating both the measurement model (reliability, validity) and the structural model (path relationships), which aligns with the confirmatory rather than exploratory nature of this research.

The data analysis followed a systematic procedure to ensure the robustness of the findings. First, descriptive statistics of the sample were generated, and the reliability of the scales was assessed using Cronbach’s alpha. Subsequently, an exploratory factor analysis was conducted to preliminarily examine the scale structure. Second, a confirmatory factor analysis was performed to rigorously evaluate the measurement model’s reliability, convergent validity, and discriminant validity. Prior to testing the structural model, multicollinearity diagnostics were conducted for the predictor variables, and common method bias was assessed using Harman’s single-factor test. Finally, the structural equation modeling technique was employed to test the research hypotheses proposed in this research.

4.3.1. Reliability and Validity Analysis of the Consumer Sample

Prior to path analysis, we assessed scale reliability using Cronbach’s alpha. A commonly accepted threshold in behavioral and social science research is α > 0.6, indicating acceptable reliability (Feng, 2009). The α of the ten factors in the five dimensions of the questionnaire is 0.606, which meets the requirements of reliability analysis. The output coefficients are shown in Table 2.

Table 2.

Reliability Statistics of the Consumer Sample.

As can be seen from Table 3 below, if a certain indicator is deleted, the improvement of reliability is not significant, so the current 5-dimensional system is suitable.

Table 3.

Item-Total Statistics of the Consumer Sample.

This paper uses construct validity to measure the validity of the questionnaire; the higher the validity, the more the measurement results can show the true characteristics of the indicators. Factor analysis method is used in the measurement of validity.

The KMO coefficient represents the ratio of all correlation coefficients related to the variable to the net correlation coefficient. The larger the ratio, the better the correlation. As shown in Table 4, the KMO test value is 0.851. According to the standard that the KMO test value is greater than 0.7, which shows that the questionnaire data can undergo factor analysis to test validity further.

Table 4.

KMO and Bartlett’s Test of the Consumer Sample.

As can be seen from Table 5, the factor loadings of the 10 extracted variables are all above 0.45, which means all the factors can be retained.

Table 5.

Factor Loadings of the Consumer Sample.

4.3.2. Multicollinearity Diagnosis and Common Method Bias Test of the Consumer Sample

Prior to conducting the structural equation modeling analysis, we performed diagnostic tests to ensure the robustness of our model.

For multicollinearity assessment, we calculated the Variance Inflation Factor (VIF) and tolerance statistics for all predictor variables in the structural model. VIF values above 10 (or tolerance below 0.1) typically indicate severe multicollinearity issues.

The multicollinearity diagnostics revealed that all VIF values were well below the threshold of 10, ranging from 1.12 to 1.35 for the consumer sample (Table 6). This indicates that multicollinearity is not a serious concern in our structural model.

Table 6.

Multicollinearity Diagnostics (VIF) of the Consumer Sample.

For common method bias (CMB) assessment, we employed Harman’s single-factor test, which is widely used in behavioral research. All measurement items from the five constructs were subjected to an exploratory factor analysis (EFA) without rotation, constraining the solution to a single factor. The unrotated factor solution was examined to determine if a single factor accounted for the majority of the covariance among variables.

It can be seen from Table 7 that the factor loads of the 10 extracted indicators all reach the standard of greater than 0.45, and the overall explanatory power of the 3 extracted factors reaches 69.489%, indicating that the validity of the questionnaire data is good, and all the indicators can be retained.

Table 7.

Total Variance Explained of the Consumer Sample.

Regarding common method bias, Harman’s single-factor test showed that the first factor explained 43.808% of the total variance for consumers, below the 50% threshold. This suggests that common method bias does not pose a serious threat to the validity of our findings.

4.3.3. Exploratory Factor Analysis (EFA) and Confirmatory Factor Analysis (CFA) of the Consumer Sample

Prior to path analysis, a Confirmatory Factor Analysis (CFA) was conducted to assess the reliability and validity of the measurement model. The average variance extracted (AVE) and composite reliability (CR) are key indicators for assessing convergent validity. Table 8 shows the AVE and CR values for each factor.

Table 8.

Confirmatory Factor Analysis Results and Reliability & Validity Tests of the Consumer Sample.

The AVE values for all ten constructs in this study exceed 0.5, indicating that more than half of the variance in their respective indicators can be explained by the construct, which demonstrates good convergent validity. Composite Reliability is another key metric for assessing convergent validity, evaluating the internal consistency reliability based on factor loadings. All CR values are above 0.7, indicating high internal consistency and strong reliability among the indicators within each construct, further confirming the convergent validity of the data.

Discriminant validity was assessed by comparing the square root of the Average Variance Extracted (AVE) for each construct with its correlation coefficients with all other constructs. All diagonal elements (square roots of AVE) are greater than any correlation coefficient in their respective rows and columns, demonstrating good discriminant validity of the measurement model, as seen in Table 9. There is a relatively strong positive correlation between Perceived Benefit and Marketing Promotion (0.48), suggesting that in users’ perception, the benefits of e-CNY are closely associated with official promotion activities. Perceived Risk shows positive correlation with Perceived Cost (0.35), indicating that users tend to associate risks with costs. Perceived Benefit shows negative correlations with both Perceived Risk and Perceived Cost, which aligns with theoretical expectations.

Table 9.

Discriminant Validity: Pearson Correlations and Square Roots of AVE of the Consumer Sample.

4.3.4. Validation and Selection of the Measurement Model of the Consumer Sample

Although the Exploratory Factor Analysis (EFA) suggested the data could yield different factor structures (a three-factor solution for the consumer sample and a four-factor solution for the retailer sample), this study is grounded in a theoretical framework—the improved UTAUT—which posits a five-factor measurement model. To validate the plausibility of this theoretical model, a Confirmatory Factor Analysis (CFA) was conducted.

The results indicated a good fit between the hypothesized five-factor model and the data. As shown in Table 10, all fit indices for both consumer and retailer samples met or exceeded acceptable thresholds (χ2/df < 3, CFI > 0.92, TLI > 0.90, RMSEA < 0.08). All standardized factor loadings of the observed variables on their respective latent constructs were above 0.6 and statistically significant at p < 0.001. Furthermore, as demonstrated in the subsequent tables, the Composite Reliability (CR) for all constructs exceeded 0.7, and the Average Variance Extracted (AVE) for all constructs surpassed 0.5, indicating excellent convergent validity for the measurement model.

Table 10.

Five-Factor Model Fit Indices of the Consumer Sample.

While the five-factor model is less parsimonious than the EFA-derived solutions, it possesses a stronger theoretical foundation. It allows for a more nuanced and clear interpretation of the psychological mechanisms driving e-CNY adoption (e.g., distinguishing between ‘Perceived Benefit’ and ‘Marketing Promotion’ has clear theoretical and practical implications). Consequently, the CFA-validated five-factor model was retained for the subsequent structural model analysis to ensure the theoretical coherence and depth of the research findings.

4.3.5. Path Analysis of the Consumer Sample

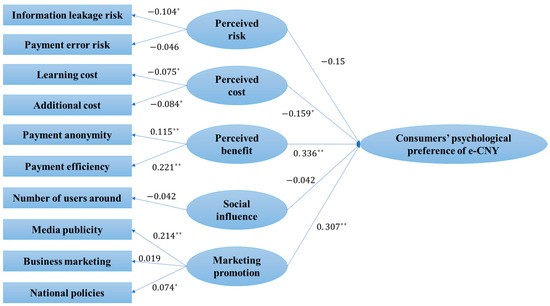

Based on the causal relationship structure model constructed in the previous section, the empirical result of the path analysis is shown in Table 11 and Figure 3.

Table 11.

Structural Model Path Coefficients and Hypothesis Testing of the Consumer Sample.

Figure 3.

Empirical Results of Consumers’ Preference Path, * p ≤ 0.05; ** p ≤ 0.01.

Based on the above hypothetical model formed based on the improved UTAUT, and through empirical analysis of the questionnaire data, the main factors affecting consumers’ e-CNY psychological preference and the degree of influence can be accurately identified.

First, perceived risk did not exhibit a statistically significant effect on consumers’ behavioral intention (β = −0.15, p = 0.062). Therefore, hypothesis H1 was not supported. Specifically, the path from information leakage risk to behavioral intention was significant (β = −0.104, p < 0.05). By analyzing the respondents who are willing to use e-CNY and those who are unwilling to use e-CNY, it can be found that for the respondents who are willing to use e-CNY, the information leakage risk is significant, but for respondents who are unwilling to use e-CNY, the risk of information leakage is still significant at the 1% level, and the coefficient is −0.654, indicating that consumers who are unwilling to use e-CNY are more worried about information leakage. In contrast, the path from payment error risk to behavioral intention was not significant (β = −0.046, p > 0.05), indicating that people have a high degree of trust in payment technology because the development of mobile payment tools is relatively mature right now.

Second, perceived cost had a significant negative effect on behavioral intention (β = −0.159, p <0.001), with both learning cost (β = −0.075, p < 0.05) and additional cost (β = −0.084, p < 0.05) exhibiting significant negative effects. It shows that consumers are more worried about the possible cost of e-CNY, especially because of the additional expenses brought by the purchase of new hardware equipment, etc. There is no significant difference between respondents who are willing to use e-CNY and those who are unwilling to use e-CNY in terms of perceived cost.

Third, perceived benefit had a significant positive effect on behavioral intention (β = 0.336, p < 0.001). The effects were driven by both payment anonymity (β = 0.115, p < 0.001) and payment efficiency (β = 0.221, p < 0.001). Even for respondents who are unwilling to exchange e-CNY, the perceived benefits of efficiency are still significant. This result shows that the ease of use and convenience of e-CNY have a very significant impact on consumers’ willingness.

Fourth, social influence did not have a significant effect on behavioral intention (β = −0.042, p = 0.161). The negative sign of the path coefficient was contrary to our initial expectation. However, since e-CNY is still in the pilot stage, most of the users are internal beta users and users who won the e-CNY red pocket lottery. The network externalities of the internal test users and the merchants and consumers around them have not been fully exerted at this stage. With the continuous popularity of e-CNY, the social influence will be more apparent in the future.

Fifth, marketing promotion had a significant positive effect on behavioral intention (β = 0.307, p < 0.001). This effect was primarily driven by media publicity (β = 0.214, p < 0.001), which occupies the most significant influence in marketing promotion, that is, with the continuous promotion and popularization of media, consumers’ willingness to use will continue to increase; whereas business marketing promotion was not a significant driver (β = 0.019, p > 0.05), indicating that consumers are currently familiar with the “marketing routines” of merchants and are not sensitive to subsidies; and national policy influence (β = 0.074, p < 0.05), indicating that the country’s promotion will increase consumers’ willingness to use.

4.4. Analysis of Consumers’ Willingness to Exchange and Use e-CNY

91.54% of the respondents indicate that they will actively exchange and use e-CNY in the future, and are willing to use e-CNY in various scenarios in their life, including online shopping, in-store payment, consumer services, transfer and remittance, financial management, and cross-border payment.

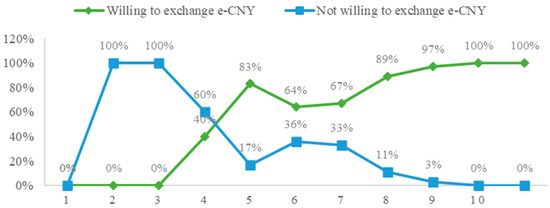

It is worth noting that the survey respondents who currently use non-cash payment tools with higher frequency and payment ratio are more willing to exchange and use e-CNY. The analysis also found that the more respondents knew about e-CNY, the higher the proportion of respondents who were willing to exchange and use it. 80% of those who do not know at all are willing to exchange and use it, 87% of those who do not know much will use it, and more than 95% of those who know have some understood, have basic understood, and know well are willing to actively exchange and use e-CNY.

The more the respondents feel the advantages and benefits of e-CNY, the higher the proportion of them willing to exchange and use e-CNY. The two indicators are highly positively correlated, which also verifies the credibility of the survey from one perspective. For the advantages and benefits of e-CNY, the ratio of willingness to use for a score of 0–2 is 0, the proportion of willingness to use for a score of 3 is 40%, the proportion of willingness to use for a score of 6 is 67%, and the proportion of willingness to use for a score of 7 is 89%, 97% of those who scored 8, and 100% of those who scored 9 and 10 would be willing to exchange, seen Figure 4.

Figure 4.

Cross-analysis of the benefits and willingness to exchange e-CNY.

5. Analysis of Retailers’ Psychological Preference for Using e-CNY Based on UTAUT

5.1. Analysis Framework for Retailers’ Psychological Preferences for e-CNY

5.1.1. The Design of the Retailers’ Questionnaire

Building upon the consumer model, this study introduced critical adaptations to the analytical framework to align with the commercial decision-making nature of retailers, thereby more accurately capturing the core factors influencing their e-CNY adoption. While grounded in the same improved UTAUT theory, the framework exhibits significant differences in the measurement of specific constructs.

First is the perceived risk. Moving beyond the individual-level risks that concern consumers, this construct incorporates liquidity risk, which is critical for business operations, reflecting concerns about potential delays in fund settlement or cash flow disruptions when using e-CNY.

Second is the perceived cost. The consumers’ “learning cost” and “additional cost” are specified in business-oriented installation cost (e.g., payment system overhaul, hardware upgrades) and training cost (time and financial investment in training staff).

Third is the perceived benefit. Unlike consumers who focus on “anonymity” and “efficiency,” retailers place greater value on the direct business operation improvements offered by e-CNY, including improved transaction speed, enhanced transaction success rate, and accelerated receivables recovery, which are vital for improving their cash flow and operational efficiency.

Fourth is the social influence. This construct is contextualized for retailers as the pressure stemming from the number of consumers using e-CNY and the competitive pressure from surrounding peer retailers. In business decisions, the actions of competitors often serve as a critical reference point.

Fifth is the marketing promotion. Similarly to consumers, but with a focus on evaluating the impact of promotion behaviors by the government and operating institutions (e.g., subsidy policies, pilot collaborations) on their commercial decisions.

1630 retailers were surveyed through online questionnaires and on-site visits. The regional distribution of the samples is as follows: Shanghai (15.5%), Jiangsu Province (26.2%), Zhejiang Province (12.8%), Fujian Province (10.3%), Shandong Province (33.4%), and 1.8% from other regions.

5.1.2. Heterogeneous Scaling and Identification Constraints

Given the multi-group nature of our analysis (consumers vs. retailers) and the contextual adaptation of measurement items, we employed a standardized yet flexible scaling approach. To establish metric equivalence across groups while respecting contextual differences, we implemented the following identification constraints:

First is the marker variable method. For each latent construct, one indicator was fixed to 1.0 to set the scale, while other factor loadings were freely estimated.

Second is the cross-group equivalence. We maintained conceptual equivalence of constructs while allowing for minor variations in item wording to reflect the distinct perspectives of consumers and retailers.

Third is the metric consistency. All constructs were measured using consistent 5-point Likert scales (2, 4, 6, 8, 10 points) to ensure comparability of parameter estimates.

5.2. An Overview of Retailers’ Psychological Preferences for e-CNY Based on Survey Data

Firstly, on perceived risk, the average scores for information leakage (7.60) and payment errors (6.80) indicate majority agreement, while views on liquidity risk (6.42) are more divided. Overall, retailers are fairly agreeable regarding perceived risk.

Secondly, on perceived cost, installation costs are generally acceptable (5.98), but views on training costs are polarized, with an average score of 6.24. Retailers are quite cost-conscious overall.

Thirdly, on perceived benefit, over 70% of respondents agree or strongly agree that digital currency speeds up and improves transaction success, with average scores of 8.34 and 8.22, respectively. The perceived benefits are high among retailers.

Fourthly, on social influence, nearly 80% of respondents agree or strongly agree with the impact of consumer numbers and peer merchants, with average scores of 8.02 and 8.00, showing a strong social effect.

Fifthly, on marketing promotion, most respondents support government promotional policies like subsidies, with an average score of 7.9, indicating a significant marketing impact.

5.3. Empirical Analysis of the Transmission Path of Retailers’ e-CNY Psychological Preference

Following the same method as in Section 4, the empirical analysis in this section primarily utilizes path analysis.

5.3.1. Reliability and Validity Analysis of the Retailer Sample

The alpha coefficient for the 5 dimensions and 11 factors examined in this study was found to be 0.889, satisfying the requirement for reliability analysis. The output coefficients are presented in Table 12.

Table 12.

Reliability Statistics of the Retailer Sample.

As can be seen from Table 13, the improvement in reliability is not significant if a certain item is removed. Thus, the current five-dimensional system is appropriate.

Table 13.

Total Statistics for Items of the Retailer Sample.

As shown in Table 14, the KMO test value is 0.824. Since the KMO test value exceeds 0.5, the survey data are suitable for factor analysis to further test validity.

Table 14.

KMO and Bartlett’s Test of the Retailer Sample.

As can be seen from Table 15, the factor loadings of the 11 extracted variables are all above 0.45, which means all the factors can be retained.

Table 15.

Factor Loadings of the Retailer Sample.

5.3.2. Multicollinearity Diagnosis and Common Method Bias Test of the Retailer Sample

Similarly, for the retailer sample, we conducted tests for multicollinearity and common method bias. The Variance Inflation Factor (VIF) was examined for all predictor variables in the retailer structural model, and Harman’s single-factor test was performed on all items measuring the five constructs.

Multicollinearity diagnostics for the retailer sample indicated that all VIF values were below the threshold of 10 (see Table 16), suggesting the absence of severe multicollinearity.

Table 16.

Multicollinearity Diagnostics (VIF) of the Retailer Sample.

From Table 17, the total explanatory degree of the four extracted factors reaches 75.149%, indicating good validity of the questionnaire data and that all items can be retained.

Table 17.

Total Variance Explained of the Retailer Sample.

Harman’s single-factor test revealed that the first factor accounted for 45.448% of the total variance, which is below the 50% threshold, indicating that common method bias does not pose a serious threat.

5.3.3. Exploratory Factor Analysis (EFA) and Confirmatory Factor Analysis (CFA) of the Retailer Sample

Table 18 shows the AVE and CR values for each factor.

Table 18.

Confirmatory Factor Analysis Results and Reliability & Validity Tests of the Retailer Sample.

The AVE values for all eleven constructs in this study exceed 0.5, indicating that more than half of the variance in their respective indicators can be explained by the construct, which demonstrates good convergent validity. All CR values are above 0.7, indicating high internal consistency and strong reliability among the indicators within each construct, further confirming the convergent validity of the data.

All diagonal elements (square roots of AVE) are greater than any correlation coefficient in their respective rows and columns, demonstrating good discriminant validity of the measurement model, as seen in Table 19.

Table 19.

Discriminant Validity: Pearson Correlations and Square Roots of AVE of the Retailer Sample.

5.3.4. Path Analysis of the Retailer Sample

The results indicated a good fit between the hypothesized five-factor model and the data. As shown in Table 20, all fit indices for both consumer and retailer samples met or exceeded acceptable thresholds (χ2/df < 3, CFI > 0.92, TLI > 0.90, RMSEA < 0.08). All standardized factor loadings of the observed variables on their respective latent constructs were above 0.6 and statistically significant at p < 0.001. Furthermore, as demonstrated in the subsequent tables, the Composite Reliability (CR) for all constructs exceeded 0.7, and the Average Variance Extracted (AVE) for all constructs surpassed 0.5, indicating excellent convergent validity for the measurement model. Although AGFI is slightly below 0.90, it remains acceptable considering model complexity.

Table 20.

Five-Factor Model Fit Indices of the Retailer Sample.

Table 21.

Structural Model Path Coefficients and Hypothesis Testing of the Retailer Sample.

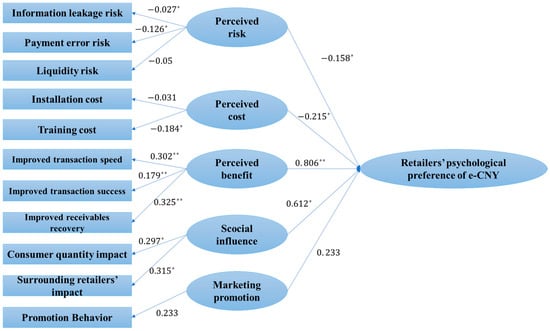

Figure 5.

Empirical Results of Retailers’ Preference Path, * p ≤ 0.05; ** p ≤ 0.01.

First, perceived risk had a significant negative effect on behavioral intention (β = −0.158, p = 0.002). Among the risk dimensions, financial loss risk was the most influential (β = −0.126, p < 0.01), while information leakage risk (β = −0.027, p > 0.05) and liquidity risk (β = −0.005, p > 0.05) were not significant. Financial loss risk is more significant than information leakage and liquidity risks.

Second, perceived cost had a significant negative effect on behavioral intention (β = −0.215, p < 0.001). This effect was primarily driven by training cost (β = −0.184, p < 0.001), as installation cost was not significant (β = −0.031, p > 0.05). Retailers are more sensitive to training costs.

Third, perceived benefit had a strong, significant positive effect on behavioral intention (β = 0.806, p < 0.001). All benefit dimensions were significant: improved transaction speed (β = 0.302, p < 0.001), improved receivables recovery (β = 0.325, p < 0.001), and improved transaction success rate (β = 0.179, p < 0.001). The usability and convenience of digital currency significantly affect retailers’ demand preferences.

Fourth, social influence had a significant positive effect on behavioral intention (β = 0.612, p < 0.001). The influence of surrounding retailers (β = 0.315, p < 0.001) was slightly stronger than that of consumer usage quantity (β = 0.297, p < 0.001).

Fifthly, marketing promotion did not have a statistically significant effect on retailers’ adoption intention (β = 0.233, p = 0.072). Thus, H5 was not supported. This may be due to the top-down promotion approach of digital currency differing from the bottom-up approach of e- payment.

Overall, 85% of retailers acknowledge the benefits of digital currency, 11.11% view its potential gains as average, and 3.7% find its advantages insignificant. Reasons include its novelty and prominent underlying issues, such as the need to enhance operational convenience, optimize offline payment solutions, improve payment security, and boost service quality and performance.

6. Discussion

6.1. Theoretical Explanations: The Underlying Behavioral Logic of e-CNY Adoption

The findings of this study can be deeply interpreted through classic theoretical frameworks, revealing that the adoption mechanism of e-CNY, as a state-backed sovereign digital currency, is fundamentally different from that of traditional electronic payments.

First, the non-significance of social influence among consumers (−0.042) is direct evidence that e-CNY is still in the early stages of innovation diffusion (Yang & Zhou, 2022). However, during the initial pilot phase, users are primarily “innovators” and “early adopters,” and a critical mass sufficient to trigger bandwagon effects has not yet formed. Consequently, while social influence is significant for mature tools like Alipay and WeChat Pay, its effect is temporarily suppressed in the current stage of e-CNY.

Second, retailers’ high sensitivity to training cost (−0.184) is a classic manifestation of behavioral inertia and the “Loss Aversion” principle in prospect theory. Retailers have internalized existing payment processes into their operational routines. Any change requiring staff retraining is perceived as a certain “loss.” According to prospect theory, the disutility from a loss is far greater than the utility from an equivalent gain, leading retailers to be significantly more sensitive to training costs than to one-time installation costs.

Finally, the non-significant effect of perceived risk, particularly when contrasted with the emphasis on risk perception in traditional mobile payment literature, can be explained by institutional trust theory. Issued by the People’s Bank of China, e-CNY’s state credit backing serves as a powerful external institutional guarantee, providing users with a sense of security that transcends the technology itself, thereby effectively mitigating concerns about potential risks like information leakage or payment errors.

6.2. Comparison with Previous Literature

Placing our findings within the broader literature highlights the distinctiveness of e-CNY. Our results share similarities with Tronnier and Kakkar’s (2021) study on the digital Euro, where the national context attenuated the negative impact of risk perception. However, compared to studies on general mobile payments (e.g., Phonthanukitithaworn et al., 2016; Oliveira et al., 2014), we observe a fundamental shift in the driver of marketing promotion: the effectiveness of national policy influence surpasses that of business marketing activities, reflecting that in top-down financial innovation, official signals are central to building initial trust.

A core contrast lies in social influence. Our finding of its non-significance among consumers contradicts most conclusions regarding mature payment tools (e.g., Alipay, WeChat Pay). This discrepancy stems precisely from e-CNY’s public good attribute and early diffusion stage. It is not spreading organically through market competition but is being gradually promoted through policy guidance, causing its network effects to lag those of commercial products.

6.3. Theoretical Implications

The primary theoretical contribution of this research lies in its contextual refinement and boundary expansion of the classic UTAUT and VAMs by integrating the unique phenomenon of CBDC as a state-led financial innovation. This contribution is manifested in two key aspects:

First, this study addresses a critical theoretical gap in existing adoption theories regarding their application to state-mandated technological innovations. Predominant models, largely derived from studying market-driven technologies, possess a construct system that fails to adequately capture the pivotal role of state influence in shaping user perception and behavior. By systematically deconstructing and empirically validating the “Marketing Promotion” construct—specifically establishing the centrality of the “National Policy Influence” dimension—we provide a crucial theoretical lens for analyzing top-down innovation diffusion pathways. This integration is vital, as it reveals that for public or quasi-public goods, institutional trust and policy signals are indispensable explanatory variables that operate beyond traditional cognitive factors like ease of use and usefulness.

Second, this study offers a deeper understanding of the dynamic nature of core relationships within the models and identifies a critical boundary condition. We demonstrate that the efficacy of “social influence” is not constant but is highly contingent on the specific stage of the innovation diffusion process. Its muted effect during the early pilot phase of e-CNY, where network effects were not yet fully realized, challenges the common assumption of static model relationships. This insight necessitates the formal incorporation of the development stage as a significant contextual factor in future research. Concurrently, we provide a contextual reinterpretation of the “value” concept within the VAM, proposing that in the CBDC context, user value assessment is a complex process synthesizing “institutional credit value” with “economic utility value,” thereby enriching the model’s explanatory power and scope of application.

6.4. Limitations and Future Research

This study has several limitations, providing clear directions for future research. The primary limitation lies in the sampling method. The consumer sample was primarily collected online via “Wenjuanxing,” which may introduce systematic biases in age, geography, and digital literacy (e.g., over-representation of young, urban netizens). Although the retailer data, supplemented by field surveys, enhances the robustness of that part, future research should employ stricter stratified random sampling to obtain more nationally representative samples.

Second, there are aspects of the data processing and analysis that can be further refined in future research. The descriptive nature of the subgroup comparisons and the analytical choices made (regarding scale use and control variables) provide a solid foundation for understanding initial patterns, but they also indicate opportunities for enhanced rigor in subsequent studies. For instance, future work could incorporate formal statistical tests for subgroup differences, integrate demographic controls into the structural model, and conduct a broader set of robustness checks to further validate the findings.

Third, due to the limited scope and transaction scale of the current pilot of e-CNY, there is not enough data to support empirical analysis. The respondents covered by this survey are also limited, and at this stage, some respondents’ understanding of e-CNY is biased, which also makes some data results not reach the expected level.

Fourth, our measurement invariance tests (see Appendix B) revealed that while configural invariance was established, full metric and scalar invariance were not achieved between consumer and retailer groups. Although we established configural invariance, the lack of full metric invariance suggests that our use of heterogeneous scaling across the consumer and retailer groups might influence the direct comparability of path coefficients. The robustness of the core conclusions was partially validated by comparing the relative importance ranking of the standardized path coefficients across the two groups (see Appendix B). Future research could strengthen the robustness of such cross-group comparisons by implementing stricter measurement invariance protocols and conducting comprehensive sensitivity analyses on scale constraints.

Furthermore, the cross-sectional data cannot infer causality. We recommend that future research adopt longitudinal panel designs to observe the dynamic changes in the influence of various factors as the pilot program deepens. Finally, while this study focused on adoption intention, future research could further explore the transition mechanism from intention to actual usage behavior and the long-term impact of e-CNY on payment habits and financial behavior.

7. Conclusions and Implications

Due to the advancement in technology, the central bank’s digital currency has become a new form of currency. This development trend is irreversible, subverting and changing people’s payment habits. At present, consumers’ psychological preference for payment has shifted from traditional cash and card-based non-cash payment tools to web-based Internet mobile payment, which has laid a good use habit and a solid user base for the large-scale promotion of the central bank’s digital currency in the future.

This study empirically examined the psychological factors influencing the adoption intention of China’s central bank digital currency (e-CNY) through an improved UTAUT framework. The findings reveal fundamental differences in the adoption mechanisms between consumers and retailers, justifying the need for a segmented research approach.

Overall, people currently have a general understanding of e-CNY. Zero-cost use and national credit guarantees are the characteristics of e-CNY that they attach more importance to. Most respondents can feel the benefits of e-CNY and are willing to exchange and use it. The more consumers know about e-CNY and the higher the proportion of non-cash payments currently used, the higher their evaluation of the benefits of e-CNY, and the more willing they are to use it. Adoption decisions are primarily driven by perceived benefits and external promotion rather than social networks. Through path analysis, it can be found that consumers’ perceived benefits have a significant impact on consumers’ psychological preference, marketing promotion has a significant impact, perceived cost has a significant negative effect, while perceived risk has no significant negative impact. At the current stage, the community effect has not yet been exerted.

For Retailers, decisions demonstrated greater commercial rationality and competitive awareness. The ease and convenience of digital currency are significant factors in its usage. They are significantly concerned about the risk of financial loss and are sensitive to potential costs, especially training costs, associated with using digital currency. Social influence, particularly the usage among surrounding businesses, has a notable impact on retailers’ willingness to adopt digital currency, with the influence of surrounding businesses being greater than that of consumer usage numbers. Similarly to consumers, marketing promotion does not significantly affect retailers’ willingness to adopt digital currency.

In order to optimize the issuance and promotion of e-CNY and increase consumers’ willingness to use it, this paper proposes the following policy recommendations.

7.1. Attach Importance to the Popularization of e-CNY’s Basic Knowledge and Strengthen Publicity and Promotion to Exert the Community Effect

At present, consumers only have a moderate understanding of e-CNY, and the community effect of using e-CNY has not been fully realized. Since the above analysis shows that the more consumers understand e-CNY, the higher their evaluation of the benefits, and the more willing they are to exchange and use e-CNY, the central bank and the media need to increase publicity and popularization of e-CNY. Using multimedia means to publicize the correct e-CNY’s knowledge to the public, and guiding the public to correctly understand e-CNY. More importantly, it is necessary to clarify the public’s misunderstandings about e-CNY and help them further understand the country’s intention to issue it as well as the benefits it brings, in order to encourage the exchange and use of e-CNY.

7.2. Ensure the Security of e-CNY Users’ Information and Funds, and Reduce Perceived Risks

The security of e-CNY is a very important factor for consumers; more than 80% of consumers believe that the payment security of e-CNY is the priority. Therefore, it is necessary to strengthen the encryption technology of e-CNY to ensure the information security and financial security of consumers during their use. Fighting against counterfeit software and punishing fraudulent activities in the name of e-CNY is also important. At the same time, by making full use of big data and cloud computing, a guaranteed mechanism should be established to provide recourse for consumers’ losses due to payment errors and protect consumers’ rights, to improve the consumer’s intention to use e-CNY.

7.3. Further Simplify the Payment Process, Take Care of the Needs of Special Groups, and Improve the Convenience of Operation

Since consumers are very sensitive to perceived benefits, more than 70% of the respondents believe that e-CNY needs to further improve the convenience of payment operations. Some of the internal test users said that the download and verification process of the e-CNY App was cumbersome, which affected the user experience to a certain extent. Therefore, the central bank and e-CNY service providers should strengthen their services, further simplify the payment process to make consumers’ payments more convenient and faster, so as to improve consumers’ perceived benefits and encourage more people to pay with e-CNY. At the same time, the design of e-CNY needs to take into account the elderly and people who are not comfortable with digital payments, and help them bridge the “digital divide” through hardware wallets such as e-CNY smart cards.

7.4. Improve Service Quality, Expand Application Scope, and Enhance User Stickiness

Since the launch of the e-CNY red pocket pilot activities, the related functions of e-CNY have been well popularized, and users have also felt the benefits of it. Although the signatories of the e-CNY App can continue to use it in the future, due to the limited coverage of merchants and the limited time of the red pocket activities, the user’s stickiness is not high. At present, consumers’ demand for e-CNY in online shopping, consumer services, and cross-border payment has not been fully met. In the future, it is necessary to further increase e-CNY’s online shopping channels and pilot cross-border payment of e-CNY, to expand the application scope of services and open up more usage scenarios. At the same time, operating agencies should improve service quality and functions, provide customers with diversified, personalized, safe, and efficient financial services.

7.5. Encourage Enterprises to Participate More Actively in the Circulation of e-CNY and Jointly Create an e-CNY Ecosystem

China has entered the era of mobile internet, and the scale of online payment users has reached 854 million, which is a good user base for accepting e-CNY. The huge user group provides a broad space for the implementation of e-CNY, and the massive mobile applications also provide more scenarios for future applications. All types of enterprises should actively participate in the circulation of e-CNY, carry out continuous activities, and improve service quality. At the same time, relevant government departments should improve relevant regulations and policy standards, provide operators and merchants with a more competitive business environment, and jointly create an e-CNY ecosystem.

7.6. Expand the Scope of the Pilot Program, Increase the Number of Pilot Areas, and Continue to Actively and Steadily Promote the Research and Development of e-CNY