Abstract

This paper proposes an integrated, comprehensive financial model that can provide startup capital to socially committed business ventures, such as social enterprises and Yunus Social Business (YSB), by using Islamic social funds (ISFs), Zakat (almsgiving), Waqf (endowments), Sadaqat (charity), and Qard Hasan (interest-free benevolent loans). The literature review method was adopted to explain this model’s architecture, applications, implications, and viability. On the basis of logical reasoning, it concludes that ISFs can yield greater social wellbeing if utilised in SEs and YSB than in unconditional charity because both business models work for social betterment in entrepreneurial ways while remaining operationally self-reliant and economically sustainable. Additionally, ISFs can complement Yunus Social Business’s zero-return investment approach to make it more robust towards social contributions. The implementation of the model orchestrated in this paper would enhance societal business practices and, hence, scale up social wellbeing while helping rejuvenate pandemic-stricken economies. It paves the way for new research too.

1. Introduction

Yunus Social Business (YSB) and conventional social enterprises (SEs) are defined as socially committed businesses for their capabilities of addressing social issues. These unique ventures contribute to socioeconomic upliftment by creating social values and solving social problems (Sugahara et al. 2021), such as unemployment, poverty, illiteracy, and numerous other social ills, while remaining operationally sustainable. Nevertheless, YSB, a nondividend and nonloss business model, contradicts the conventional nature of investment by unsatisfying individuals’ profit-seeking desires (Aydin 2015). It does not share the business profit with investors and instead utilises that money for business expansion or meeting pressing social needs (Yunus 2010; Yunus et al. 2010). However, this zero-return provision is unattractive to acquisitive investors and profit seekers. Hence, the Yunusian social business, for its startup capital, relies primarily on philanthropic and charitable attention or grants.

Islam embodies the principle of a bond between individuals and society; hence, it encourages individuals to be enveloped in social interest. That is why social problem-solving, according to the Islamic social value system, is a mutual and individual responsibility. The Islamic financial system, in this regard, inbounds some financial instruments to address social issues and enhance social wellbeing (Kooli et al. 2022). The Islamic economic system comprises a comprehensive financial framework that includes some special financial tools, namely social funds, such as Zakat (mandatory almsgiving), Waqf (endowments), Sadaqah (charity), and Qard Hasan (interest-free benevolent loans) to ensure the equitable distribution of wealth (Hakim and Dalimunthe 2022). The sole purpose of these financial instruments is to enhance social wellbeing (Majid 2021; Yazdi et al. 2021). These instruments are deemed more useful if used in socially committed businesses (Andriyani et al. 2020). In this regard, Professor Yunus reiterated, “a charity dollar has only one life; a social business dollar can be invested over and over again” (Yunus Social Business 2019). However, so far, they have been inadequately institutionalised to finance social businesses.

The recent devastating COVID-19 pandemic introduced numerous problems to human society. Like many other developmental initiatives, YSB and SEs could be utilised to rejuvenate the pandemic-stricken socioeconomic body given that they are committed to addressing social issues in entrepreneurial ways while remaining operationally self-reliant and sustainable. Hence, the integration of ISFs with YSB and SEs will presumably boost their performances and thus help enhance economic rejuvenation.

This paper aims to design an integrated financial model that can provide startup capital to social enterprises (SEs) and Yunus Social Business (YSB), by using Islamic social funds (ISFs). The following sections delineate the literature on value-based financial intermediation, Yunusian social business, and social enterprises while narrating the method and discussing how ISFs can be integrated with these societal ventures.

2. Value-Based Intermediation (VBI)

The central bank of Malaysia, Bank Negara Malaysia (BNM), has defined Islamic value-based intermediation (VBI) as “an intermediation function that aims to deliver the intended outcomes of Shariah through practices, conduct and offerings that generate positive and sustainable impact to the economy, community and environment, consistent with the shareholders’ sustainable returns and long-term interests” (BNM 2018, p. 6).

In the above definition, a few phrases, such as “Shariah practices”, “positive and sustainable impact”, “economy, community and environment”, and “long-term interests” impregnate the core functions of VBI. That implies that VBI foregrounds sustainable socioeconomic progress, community, and environmental wellbeing through Shariah-compliant investment. Nevertheless, it encourages innovative products and services to the existing market, high-impact areas, and underserved segments. It pursues financial intermediation upon impact-based assessment, comprehensive measurement, impact-focused disclosure, constructive collaboration, and inclusive governance, creating value and impact while remaining Shariah compliant. Nonetheless, this approach can benefit financial institutions by promoting impact-driven mindsets in stakeholders while expanding market opportunities by offering innovative financial solutions. It primarily addresses the unserved and underserved segments of society. Through the improved supply chain and with employees’ skills and creative business models, it simultaneously achieves operational efficiency, stakeholders’ interests, and solutions to issues faced by communities and stakeholders (BNM 2018). To sum up, BVI extends financial services to the unserved or underserved market segment paying particular attention to underprivileged people while remaining operationally viable and sustainable.

2.1. Yunusian Social Business

Yunusian social business refers to a unique market-driven business model that has been conceptualised, practised, promulgated, and popularised by Professor Muhammad Yunus, a Nobel Peace Prize laureate. This business model solely addresses pressing social needs in entrepreneurial ways by remaining financially sustainable, operationally self-reliant, and harmless to the environment. Worth mentioning, through social business, Professor Yunus aspires to create a world of three zeros: zero poverty, zero unemployment, and zero carbon emissions. He broadly envisions a world of a rational economic system where equitable wealth distribution and fundamental human rights are fulfilled; human potentials are nurtured, valued, and utilised; and the environment is protected and preserved. He aspires to attain all these possibilities through a business model, which he named Yunus Social Business (YSB). YSB features an employee value proposition and gender parity while incorporating the mechanism of sustainability and growth by defending market forces. It is innately conditionalised with zero-return investment, wherein the investor is unentitled to receive any dividend from the business profit. After a certain period, they can recoup only the net amount invested. The profit stays with the business for its growth or addressing specific social problems. Nonetheless, positive social changes bring unalloyed joy to investors and employees (Yunus 2010).

The business community and academia are seemingly univocal against the Yunusian zero-return investment approach and consider it an implementational barrier. The ubiquitous argument is that the zero-return aspect is unattractive to investors unless they are benevolent or philanthropists. Notwithstanding, zero-return investment profoundly benefits society while incentivising investors in numerous nonmonetary ways, such as bringing celestial joy, social reputation, human dignity, etc. From this point of view, YSB is worth practising as a noble deed attained by amplifying social and environmental wellbeing.

However, the individualistic mindset might look for monetary incentives or tangible returns on investment (ROI) for self-gratification (Aydin 2015). Further, the time value of money also encourages investors to seek a higher return to increase their wealth or at least remain afloat on the increasing tide of inflation. Therefore, the zero-return investment fails to attract acquisitive investors and seeks generous and selfless individuals for funding. The socioeconomic implications of YSB are described in the following section.

2.2. Economic Implications

The present economic structure regarding wealth distribution and social value creation is seemingly inequitable and irrational. This system dispenses enormous opportunities to a few hands to concentrate wealth and, thus, gives birth to a handful of exorbitantly wealthy people while keeping the vast majority within poverty and deprivation (Goda et al. 2017). Wealth gravitates towards wealth. The economic distance and income disparity between rich and poor exponentially increases because of rich people’s ability to make capital investments that poor people cannot. The neoliberal market economy tends towards the elimination of price controls, the deregulation of the capital market, and low trade barriers, thus accelerating wealth concentration (Smith 2023). In production functions, firms employ cost cutting to gain competitive advantages as price leaders or become price takers by monopolising and hegemonising and through illusive branding. Nevertheless, thanks to the exceedingly inconsistent wealth distribution system, a colossal divide and discrimination surface on the socioeconomic landscape (Karmakar and Jana 2022; Sgambati 2022).

In many cases, in addition to the inexpensive labour supply, firms are inclined towards using economical energy sources and ignore environmental wellbeing and waste management; as a result, they produce greenhouse gases, causing extensive ecological damage (Abadli and Kooli 2022; Dong et al. 2019; Wang et al. 2020). They routinely harm the world and turn it into an unliveable place. In many countries, deregulation in the governing system or the improper utilisation of resources exacerbates unemployment and poverty while raising gender discrimination, child labour, social injustice, etc. Consequently, human society is deprived of balanced progress and mutual prosperity.

In such a situation, if viewed from the social and humanitarian standpoints, Yunus Social Business could be regarded as a helpful device capable of offering higher social incentives by benefiting people of all walks of life (Faza 2022). Further, this business is ordinarily market driven, extraordinarily environmentally conscious, and rationally gender sensitive (Yunus 2010). The success of this venture is measured on the basis of human development, social welfare, and subjective wellbeing. YSB is economically viable, operationally sustainable, and socially beneficial and is, therefore, worth practising.

2.3. ISFs for the Socially Responsible Businesses

As discussed above, the Yunusian social business model is designed on the zero-return-investment approach, which means that after the tenure of the investment, investors who contribute the startup capital can recoup the net amount only, not any surplus as dividends or interest as an increment. The profit stays with the business for addressing social problems or augmenting the business itself (Yunus 2010). In this regard, two Islamic social funds, namely Qard Hasan and Waqf, could be utilised as the startup capital for YSB. The following sections shed light on the utilisation of these two instruments.

2.4. Usages of Qard Hasan

According to Shariah rules, Qard Hasan, a benevolent loan, is not tied up with the “time value of money” principle. It does not seek surplus returns such as interest or profit share; only the principal amount must be paid back after a certain period (Hakim and Dalimunthe 2022). Nevertheless, Qard Hasan is a dignified option for the needy rather than being charity-dependent. It can be loaned repeatedly, and thus, it increases socioeconomic values (Aydin 2015). The proper utilisation of this financial instrument can enhance individual and social wellbeing. That is why this financial instrument is suitable for financing YSB initiatives.

The Qur’an encourages Muslims to render Qard Hasan (benevolent loans):

“If you give Allah Qard Hasan … he will grant you forgiveness” (Qur’an 64:17).“Establish regular prayer and give regular charity and give Allah Qard Hasan” (Qur’an 73:20).“Who is he that will give Allah Qard Hasan? For Allah will increase it manifold to his credit” (Qur’an 57:11).[Translation: (Islamic Relief Worldwide n.d.)]

The Quran asserts that Qard Hasan brings lenders divine blessings and increases in wealth while being as good as regular prayer. Therefore, the individual lender may offer this fund as startup capital to social entrepreneurs who want to run social businesses for social benefits (Kooli 2020). Similarly, the government may allocate some taxpayers’ money to Qard Hasan to invest in social business. Islamic financial institutions may offer Qard Hasan for social businesses as part of their corporate social responsibilities or social business practices (Kooli et al. 2022). This practice would benefit them by enhancing their reputation and public trust while widening the market segment and increasing brand value.

This instrument is suitable for risk management.

The Quran says, “if the debtor is in a difficulty, grant him time till it is easy for him to repay. But if you remit it by way of charity. That is best for you if you only knew” (Qur’an, 2:280). [Translation: (Adnan n.d.)]

The above verses indicate that the time should be extended if the debtor fails to repay Qard Hasan within the lending tenure. Further, in borrowers’ critical conditions, the loan is suggested to be forgiven. Therefore, if YSB or SEs are capitalised by Qard Hasan, the continuation of the ventures and social benefits will be emphasised thanks to the lenient nature of the loan.

2.5. Usages of Cash and Corporate Waqf

Another source of Islamic social funds is Waqf, which embodies the characteristics of perpetuity, irrevocability, and inalienability (Ambrose and Asuhaimi 2021; Ismail Abdel Mohsin 2014) and could be integrated into Yunus Social Business (YSB). This is basically of two kinds: asset Waqf and cash Waqf. Asset Waqf (immovable property) has a longstanding history of being utilised for social welfare by building educational institutions, orphanages, hospitals, etc. (Sugianto et al. 2022). Cash Waqf (Aaqf al-nuqud) is a trust fund formed with cash to render service to humanity in the name of God (Aldeen et al. 2021; Çizarça 1995). Nevertheless, cash Waqf is comparably easy to invest and manage, and increasing its value is likewise easy. It is also convenient for adherent Muslims to practise it by contributing money (Chowdhury et al. 2011). Both types of Waqf could be utilised for practising YSB. Recently, a different kind of Waqf has come forward, called corporate Waqf, which is issued in the form of shares (Mawquf/Waqf asset) and managed by a corporation. This Waqf’s primary intent is to fulfil social obligations by giving back to society and reaching out to the community. It nurtures all characteristics of Waqf while meeting business and corporate objectives (Saad et al. 2017). It is generally managed by a Waqf administrative body (WAB) by issuing Waqf certificates with different denominations as low, medium, or high to individuals or institutions. Any predetermined social businesses could be initiated with that capital when it reaches the targeted amount. The business’ income will cover its operational expenses; otherwise, it may rely on secondary schemes. For instance, if the primary project is a hospital, the secondary project could be a shopping complex. The profit generated from the second project will finance the primary one (Nurrachmi 2012). Corporate Waqf can address crucial socioeconomic needs by establishing large projects such as hospitals, schools, universities, pharmaceutical companies (generic medicine, vaccines, etc.), water treatment plants, irrigation, etc. Nevertheless, if appropriately structured, planned, and managed, this corporate body can function well in the marketplace with all the usual competencies and vitalities (Saad et al. 2017).

2.6. Social Enterprise (SE)

Dees et al. (2001) differentiated enterprises into three categories: purely philanthropic, hybrid, and strictly commercial. Purely philanthropic ones are driven by social missions. Their sole purpose is to create social values. Beneficiaries are not required to pay for the products or services. The startup capital for this type of venture comes from donations and grants and its workforce from volunteers. Hybrid enterprises combine mission- and market-oriented approaches to create social and economic values. Low-income people, the targeted beneficiaries, pay the subsidised rate for the goods and services, while well-off purchasers pay the market price. Similarly, the workforce earns lower salaries or wages than the market rate. Sometimes, they employ combinedly fully paid staff and volunteers. They also look for discounted prices from suppliers. Purely commercialised enterprises are entirely market driven. They are focused on meeting self-interest by increasing economic value. Customers pay fair market prices, investors pay the capital at market rates, and the workforce receives market-standard salaries. The suppliers charge the total market prices as well.

Mair and Marti (2006) defined social enterprises as exploiting and exploring opportunities to create social values to meet social needs. Hence, social entrepreneurship can leverage resources to resolve social problems. SEs, as noneconomic, charity, or business initiatives, aim to create positive social change. As a business entity, it prefers to develop social values rather than maximise profits to satisfy individuals’ desires (Volkmann et al. 2012; Kickul et al. 2012). Thus, they marked the sheer differences between conventional entrepreneurship and social entrepreneurship. They further argued that conventional entrepreneurs enact visions that are based on new ideas and innovations while being profit oriented with an economic motive. Contrarily, the primary objective of social enterprises (SEs) is to ensure social change and wellbeing through social wealth creation. These entities seek new opportunities through innovation, adaptation, and learning to generate social and economic wealth. SEs solve social problems by creating social values through their organisational form, which could be nonprofit or profit oriented (Volkmann et al. 2012). In this regard, Dacin et al. (2010) underscored four key factors that SEs focus on: (i) characteristics of the venture, (ii) scopes of activities, (iii) process and resource utilisation, and (iv) the primary objective of social value creation. Therefore, SEs are considered the driving forces of social change and economic nourishment.

2.7. ISFs for Social Enterprises

As discussed above, social enterprises are dedicated primarily to assuring social wellbeing. However, these entities differ from the Yunusian social business model in their investment mechanisms. Social enterprises (SEs) do not abide by the zero-return investment rule. ISFs can capitalise on purely philanthropic and hybrid enterprises. For instance, mission-oriented, purely philanthropic enterprises could be operated with Sadaqat and Zakat funds. These charity funds do not require returning funds to fund givers. However, hybrid enterprises can seek capital from Qard Hasan and Waqf funds. Here, the principal amount needs to be retrieved, and the profit will be disbursed to improve social wellbeing. Nevertheless, Zakat and Sadaqat could be integrated to cover certain operating costs or tackle business risks.

3. Materials and Method

This paper conceptualises a comprehensive model of ISFs to stream the startup capital to YSB and SEs. It adopts the literature review method to articulate the model and explain its application, implications, viability, and sustainability. Most articles were collected from the Web of Science and SCOPUS databases using specific keywords, social business, social enterprise, Islamic social funds, and value-based financing through the Google Scholar search engine. The recentness of the articles was given higher priority. However, some outdated sources were rigorously studied and cited according to their underpinning theoretical merits.

4. Institutionalisation of ISFs

Islamic social funds such as Zakat (almsgiving), Waqf (endowments), Sadaqat (charity), and Qard Hasan (interest-free benevolent loans) could be utilised in an institutional setting to inject startup capital into YSBs and SEs.

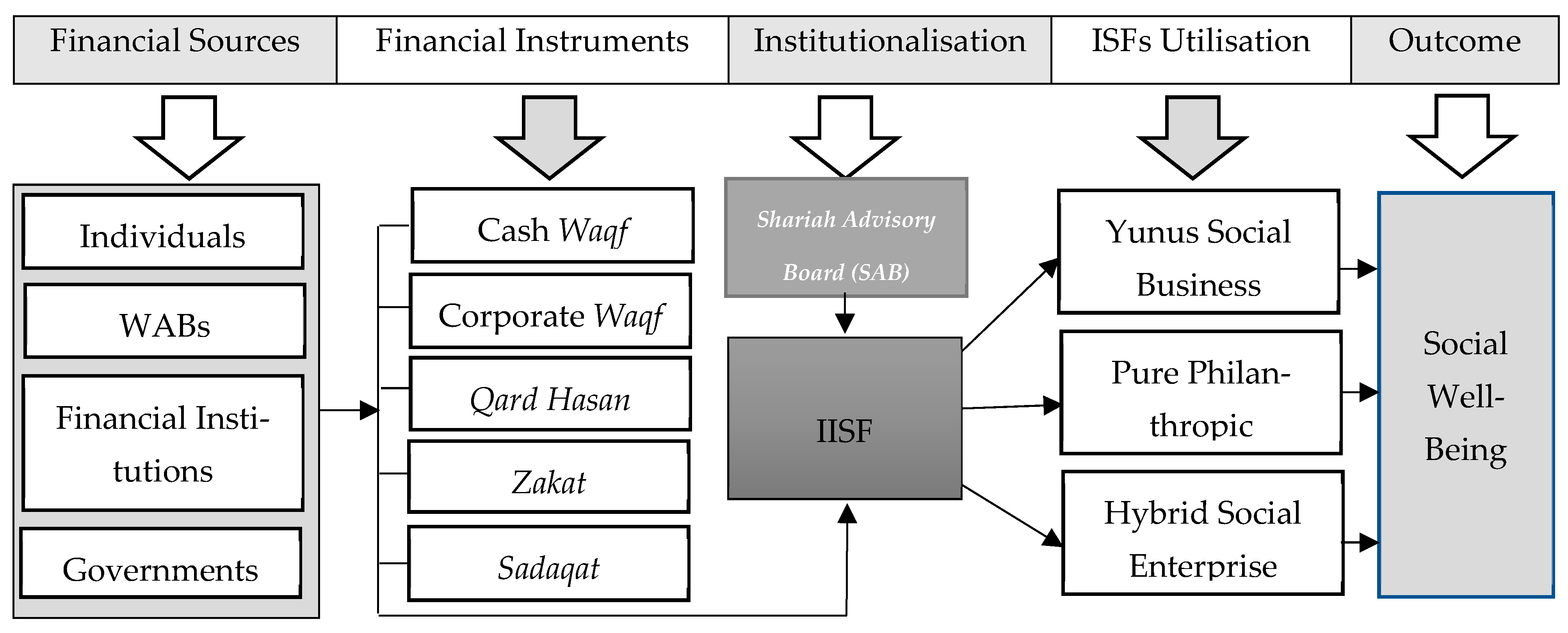

According to Figure 1, a government-regulated entity, such as the “Institution of Islamic Social Fund (IISF)”, which incorporated with a Shariah advisory board (SAB) and Islamic social funding bodies, could be aligned with Yunusian social business and conventional social enterprises. Individuals, Waqf administrative bodies (WABs), financial institutions, and the government could primarily contribute funds to IISF. In the same vein, Islamic financial institutions can offer Qard Hasan as a way of practising their CSR. The government can allocate interest-free funds/grants using taxpayers’ money. Similarly, corporate Waqf can be integrated with a WAB, whereby this entity will participate in this venture by issuing Waqf certificates in different denominations.

Figure 1.

Institutionalisation of Islamic social funds.

The primary roles of IISF are to collect funds and then allocate, distribute, and manage them for YSB and SEs. This entity must consider the business design’s comprehensiveness and the social needs to be addressed. It will distribute financial capital to individuals or groups willing to practise YSB or SEs to address specific social problems.

Regarding the Qard Hasan fund, IISF must duly pay back investors’ deposits after a stipulated period. In this regard, the government can play a vital role by offering a no-tax provision for capital owners. That means contributors to this fund will recoup their money after a stipulated period with a complementary tax redemption on their money. Nonetheless, the government also can form a Qard Hasan–based social venture capital fund to finance social businesses and social enterprises through IISF.

The Shariah advisory board (SAB), part and parcel of IISF, will look into the Shariah compliance of financial transactions and business designs. It will offer advisory services if any situations arise from Shariah regulations (Issa et al. 2022). Nevertheless, it will harness Shariah principles by balancing the operational principles of YSB regarding social issues, work environment, gender sensitivity, production process, remuneration, etc.

4.1. Odds and Nexus between YSB and ISFs

Yunus Social Business (YSB) and Islamic social fund (ISF) models seemingly aim to achieve social objectives. They have profound similarities in their social focuses while having significant differences in implementation and characteristics. YSB is a nonloss, nondividend business model. Like any market-driven conventional business, YSB responds to market forces. However, the distinct characteristics underpin profit equity, social objectives, and operational principles. The profit remains with the firm for its expansion or for meeting social goals. The investors recoup only the net investment amount, not a profit share (Yunus et al. 2010). ISFs fundamentally deal with social objectives to enhance social wellbeing. On the other hand, except for Waqf, the rest of the ISFs are utilised as charity. Hence, ISFs do not regenerate or grow themselves. These funds could be invested if businesses comply with Shariah law and its principles. ISFs, according to Shariah principles, avoid Riba (an increase without ‘iwad or equal countervalue/usury or interest), Khilabah (fraud), Ghishsh (deception), Al-ikrah (coercion), Gharar (uncertainty, indeterminacy, hazard, or risk), Qimar (gambling), and Maysir (games of chance/monetary gains derived from mere chance) (Saiti and Abdullah 2016; Uddin 2015). However, YSB and ISFs are accountable to their donors and stakeholders and are expected to operate transparently and ethically. ISF operates under the guidance of Shariah scholars, who ensure that the fund’s investments comply with Islamic principles. The scholars also provide guidance on profit distribution and risk-management issues. YSB functions under the seven principles defined by Professor Muhammad Yunus. YSB focuses on investing in social businesses that target low-income and marginalised communities. The aim is to create sustainable solutions that can help alleviate poverty and improve living standards (Yunus 2010).

In summary, YSB seeks startup capital to attain social goals in a sustainable entrepreneurial way. It intends to achieve a triple bottom line, namely people, planet, and profit (3Ps). Similarly, ISFs are the Islamic financial sources that serve underprivileged societies to scale up social wellbeing by ascertaining four ERs: economic reinforcement, economic rescue, economic recovery, and economic resilience (Widiastuti et al. 2022). Hence, in terms of social focus, YSB and ISFs go towards the same destinations. They fundamentally differ in their implementation and characteristics. YSB is dedicated to creating social impact. At the same time, ISFs are socially devoted funds that follow Islamic finance principles. In this regard, ISFs could be integrated into the veins of YSB to sustainably ensure social good.

4.2. Implications of YSB and SEs to Rejuvenate a Pandemic-Stricken Society

The unprecedented surge of COVID-19 has taken millions of lives and given rise to many socioeconomic problems (Messabia et al. 2022). It has intensified poverty and unemployment, enormously weakening our socioeconomic body. During the COVID-19 pandemic (in 2021), the average income of B40 people decreased by 6.5% compared with an ideal time. They could hardly recover their initial income losses. As a result, about 70 million additional people live below USD 1.9 in income per day (Sánchez-Páramo et al. 2021). Recently, more than 700 million people (on income less than USD 2.15 per person per day, according to the 2017 PPP) fell into extreme poverty because of the prolonged pandemic. Further, income inequality has risen as well. Thus, in 2019, global poverty increased to 9.3% from 8.4% (The World Bank 2022).

Because of lockdowns, mobility control, sickness, and fear, people could not regularly perform economic activities. In addition, illness and death took extra tolls on the economy. States’ production went down because of disruptions in the supply chain. The world has experienced economic consequences (Zimon et al. 2022). This pandemic also exacerbated many other socioeconomic issues, such as child marriage, child labour, school dropout, domestic violence, divorce, crime and injustice, inequalities, poverty, hunger, unemployment, etc. To tackle these issues, social enterprises and Yunusian social businesses would be the potential solutions. Because these businesses dedicatedly work to create social value, equitably distribute wealth, and relieve social ills rather than to maximise profit and concentrate wealth, they will presumably be more effective in economic reparation and rejuvenation.

5. Conclusions

On the basis of monitoring current trends, the World Bank predicts that about 574 million people, nearly 7% of the total human population, will live in a state of hardcore poverty, with a USD 2.15 income per day in 2030 (The World Bank 2022). In addition, existential climate change has caused severe damage to the environmental ecosystem. Much effort must be paid to prevent ecological harm and ensure an equitable distribution of wealth. To a greater extent, that could be attained through a broader practice of Yunusian social business and social enterprises. Because YSB disregards the conventional capitalist formula of sharing dividends by embodying the zero-return-investment approach, Islamic social funds (ISFs) can help provide startup capital. Hence, Qard Hasan, cash Waqf, and corporate Waqf could be propulsive to enthuse and accelerate YSB practices.

Similarly, ISFs could be streamed into the vein of social enterprises to enhance social welfare by addressing numerous critical socioeconomic problems. Because both business models expose market forces, they might encounter market risks. In that case, some funds could be used for risk-mitigating and leveraging purposes. For instance, Zakat and Sadaqah can be utilised to tackle financial risks, while Waqf-based third-party guarantees can also reduce and leverage systematic and unsystematic risks. Notably, the size of global Zakat is about USD 600 billion (UNICEF 2019). If a portion of it could be utilised for funding Yunus Social Business and social enterprises, greater benefits could be earned for society.

Nevertheless, the sources and sizes of ISFs are seemingly innumerable but enormous. Muslims offer ISFs out of their faith with the expectation of divine blessings and social good. Proper usage of these funds could significantly contribute to economic reparation, social wellbeing, and, thus, development. Regulatory authorities and policymakers, especially in Muslim-majority countries, should come forward to institutionalise Islamic social funds to better practise YSB and SEs to ensure greater social good and sustainable development.

5.1. Originality of the Paper

The originality of this research lies in proposing an integrated financial model that utilises ISFs to provide startup capital to socially committed business ventures. The model’s focus on social enterprises and Yunus Social Business distinguishes it from traditional approaches, such as charity, and highlights the potential of utilising ISFs to promote sustainable social wellbeing. The paper’s emphasis on the rigorous citation of recent research articles strengthens the model’s viability and applicability. Nevertheless, the proposed model’s potential to enhance societal business practices, address socioeconomic issues, and rejuvenate pandemic-stricken economies presents a compelling case for further research and implementation. Overall, the integration of ISFs into the proposed model represents a novel and valuable contribution to the field of social entrepreneurship and finance.

5.2. Limitations

This paper confines its embodiment to a few tools of Islamic social funds, such as Zakat, Waqf, Sadaqat, and Qard Hasan. It discusses Yunus Social Business (YSB) in the context of the different nature of this business model (nonloss nondividend). It uses the general terminology of social enterprises, which refers to socially committed businesses keen on operational self-reliance and economic sustainability and are not obliged to comply with zero-return investment.

Author Contributions

The authors have collaborated together in every phase of the article. Conceptualization, R.I.; methodology, M.R.; writing—original draft preparation, R.I. and M.O.; writing—review and editing, R.I., M.O. and M.R. All authors have read and agreed to the published version of the manuscript.

Funding

Albukhary International University (AIU), 05200 Alor Setar, Kedah Darul Aman, Malaysia: Grant No: STG 04/2021.

Institutional Review Board Statement

This is a concept paper. Hence, ethical review and approval were waived.

Informed Consent Statement

This is a concept paper. Hence, informed consent was not necessary.

Data Availability Statement

Not necessary.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abadli, Riad, and Chokri Kooli. 2022. Sustainable Energy Policies in Qatar: On the Green Path. In Sustainable Energy-Water-Environment Nexus in Deserts. Cham: Springer. [Google Scholar]

- Adnan, Muhammad. n.d. If Someone Is Refusing to Pay His Debt. Available online: https://islamqa.org/hanafi/daruliftaa-birmingham/135932/if-someone-is-refusing-to-pay-his-debt/ (accessed on 1 January 2021).

- Aldeen, Khaled Nour, Inayah Swasti Ratih, and Risa Sari Pertiwi. 2021. Cash waqf from the millennials’ perspective: A case of Indonesia. ISRA International Journal of Islamic Finance 14: 20–37. [Google Scholar] [CrossRef]

- Ambrose, Azniza Hartini Azrai Azaimi, and Fadhilah Abdullah Asuhaimi. 2021. Cash waqf risk management and perpetuity restriction conundrum. ISRA International Journal of Islamic Finance 13: 162–76. [Google Scholar] [CrossRef]

- Andriyani, Lilik, Nurodin Usman, and Zulfikar Bagus Pambuko. 2020. Antecedents of Social Funds Productivity of Islamic Banks in Indonesia. Humanities & Social Sciences Reviews 8: 488–94. [Google Scholar] [CrossRef]

- Aydin, Necati. 2015. Islamic social business for sustainable development and subjective wellbeing. International Journal of Islamic and Middle Eastern Finance and Management 8: 491–507. [Google Scholar] [CrossRef]

- BNM. 2018. Value-Based Intermediation: Strengthening the Roles and Impact of Islamic Finance. Bank Negara Malaysia (BNM/RH/DP 034–2). Available online: https://www.bnm.gov.my/documents/20124/761682/Strategy+Paper+on+VBI.pdf/b299fc38-0728-eca6-40ee-023fc584265e?t=1581907679482 (accessed on 12 August 2021).

- Chowdhury, Md Shahedur Rahaman, Mohd Fahmi bin Ghazali, and Mohd Faisol Ibrahim. 2011. Economics of Cash WAQF management in Malaysia: A proposed Cash WAQF model for practitioners and future researchers. African Journal of Business Management 5: 12155–63. [Google Scholar]

- Çizarça, Murat. 1995. Cash waqfs of Bursa, 1555–1823. Journal of the Economic and Social History of the Orient 38: 313–54. [Google Scholar] [CrossRef]

- Dacin, Peter A., M. Tina Dacin, and Margaret Matear. 2010. Social entrepreneurship: Why we don’t need a new theory and how we move forward from here. Academy of Management Perspectives 24: 37–57. [Google Scholar]

- Dees, J. Gregory, Jed Emerson, and Peter Economy. 2001. Enterprising Non-Profits: A Toolkit for Social Entrepreneurs. New York: Wiley. [Google Scholar]

- Dong, Feng, Ying Wang, Bin Su, Yifei Hua, and Yuanqing Zhang. 2019. The process of peak CO2 emissions in developed economies: A perspective of industrialisation and urbanisation. Resources, Conservation and Recycling 141: 61–75. [Google Scholar] [CrossRef]

- Faza, Amarta Risna Diah. 2022. Social Business Contribution of Grameen Bank Muhammad Yunus in The Development of Poverty Reduction Discourse in Indonesia. International Economic and Finance Review 1: 54–84. [Google Scholar] [CrossRef]

- Goda, Thomas, Özlem Onaran, and Engelbert Stockhammer. 2017. Income inequality and wealth concentration in the recent crisis. Development and Change 48: 3–27. [Google Scholar] [CrossRef]

- Hakim, Andi, and Zuliani Dalimunthe. 2022. The Probability of the Financing Sustainability of Micro-firms Supported by Islamic Social Fund. Etikonomi 21: 127–38. [Google Scholar] [CrossRef]

- Islamic Relief Worldwide. n.d. Qard Hasan (Benevolent Loan). Available online: https://islamic-relief.org/qard-hassan-benevolent-loan/ (accessed on 26 March 2023).

- Ismail Abdel Mohsin, Magda. 2014. Corporate Waqf: From Principle to Practice: A New Innovation for Islamic Finance. Kuala Lumpur: Pearson Malaysia Sdn Bhd. [Google Scholar]

- Issa, Jabbar Sehen, Mohammad Reza Abbaszadeh, and Mahdi Salehi. 2022. The Impact of Islamic Banking Corporate Governance on Green Banking. Administrative Sciences 12: 1–20. [Google Scholar]

- Karmakar, Asim K., and Sebak K. Jana. 2022. Globalisation, Income Inequality, and Wealth Disparity: Issues and Evidence Globalisation, Income Distribution and Sustainable Development. Bingley: Emerald Publishing Limited. [Google Scholar]

- Kickul, Jill, Siri Terjesen, Sophie Bacq, and Mark Griffiths. 2012. Social business education: An interview with Nobel laureate Muhammad Yunus. Academy of Management Learning & Education 11: 453–62. [Google Scholar]

- Kooli, Chokri. 2020. Islamic financing initiatives stimulating SMEs creation in Muslim Countries. Journal of Islamic Research 31: 266–79. [Google Scholar] [CrossRef]

- Kooli, Chokri, Mohammed Shanikat, and Raed Kanakriyah. 2022. Towards a new model of productive Islamic financial mechanisms. International Journal of Business Performance Management 23: 17–33. [Google Scholar] [CrossRef]

- Mair, Johanna, and Ignasi Marti. 2006. Social entrepreneurship research: A source of explanation, prediction, and delight. Journal of World Business 41: 36–44. [Google Scholar] [CrossRef]

- Majid, Rifaldi. 2021. The Model of Islamic Social Fund (Zakah, Infaq, Sadaqah, and Waqf) Utilisation through Synergy of the Mosque-Baitul Maal Wat Tamwil as an Economic Stimulus for Micro and Small Enterprises. In Islamic Sosial Finance and Its Role for Achieving Sustainable Development Goals: Islamic Economics Winter Course. Kota Bogor: PT Penerbit IPB Press, p. 227. [Google Scholar]

- Messabia, Nabil, Paul-Rodrigue Fomi, and Chokri Kooli. 2022. Managing restaurants during the COVID-19 crisis: Innovating to survive and prosper. Journal of Innovation & Knowledge 7: 100234. [Google Scholar]

- Nurrachmi, R. 2012. Implication of cash waqf in the society. AL-INFAQ 3: 150–55. [Google Scholar]

- Saad, Norma Md, Suhaimi Mhd Sarif, Ahmad Zamri Osman, Zarinah Hamid, and Muhammad Yusuf Saleem. 2017. Managing corporate Waqf in Malaysia: Perspectives of selected SEDCs and SIRCs. Jurnal Syariah 25: 91–116. [Google Scholar] [CrossRef]

- Saiti, Buerhan, and Adam Abdullah. 2016. Prohibited elements in Islamic financial transactions: A comprehensive review. Al-Shajarah: Journal of the International Institute of Islamic Thought and Civilization (ISTAC) 21: 139–43. [Google Scholar]

- Sánchez-Páramo, Carolina, Ruth Hill, Daniel Gerszon Mahler, Ambar Narayan, and Nishant Yonzan. 2021. COVID-19 Leaves a Legacy of Rising Poverty and Widening Inequality. Available online: https://blogs.worldbank.org/developmenttalk/covid-19-leaves-legacy-rising-poverty-and-widening-inequality (accessed on 15 January 2023).

- Sgambati, Stefano. 2022. Who owes? Class struggle, inequality and the political economy of leverage in the 21st century. Finance and Society 8: 1–23. [Google Scholar] [CrossRef]

- Smith, Nicola. 2023. Neoliberalism. Bitannica. Available online: https://www.britannica.com/topic/neoliberalism (accessed on 30 March 2023).

- Sugahara, Cibele Roberta, Giovanni Moreira Rocha Campos, Marina Ardito Massaioli, Bruna Nunes Fantini, and Denise Helena Lombardo Ferreira. 2021. Social business: A report on social impacts. Independent Journal of Management & Production 12: 15–31. [Google Scholar]

- Sugianto, Sugianto, Andri Soemitra, Muhammad Yafiz, Ahmad Amin Dalimunthe, and Reza Nurul Ichsan. 2022. The implementation of waqf planning and development through Islamic financial institutions in Indonesia. JPPI (Jurnal Penelitian Pendidikan Indonesia) 8: 275–88. [Google Scholar] [CrossRef]

- The World Bank. 2022. Poverty. Available online: https://www.worldbank.org/en/topic/poverty/overview#:~:text=The%20number%20of%20people%20in,steepest%20costs%20of%20the%20pandemic (accessed on 6 March 2023).

- Uddin, Md Akther. 2015. Principles of Islamic finance: Prohibition of riba, gharar and maysir. Munich Personal RePEc Archive 67711: 1–8. [Google Scholar]

- UNICEF. 2019. UNICEF and the Islamic Development Bank Launch First Global Muslim Philanthropy Fund for Children. Available online: https://www.unicef.org/press-releases/unicef-and-islamic-development-bank-launch-first-global-muslim-philanthropy-fund#:~:text=It%20is%20estimated%20that%20global,to%20help%20achieve%20the%20SDGs (accessed on 15 January 2023).

- Volkmann, Ch, K. Tokarski, and Kati Ernst. 2012. Social Entrepreneurship and Social Business. An Introduction and Discussion with Case Studies. Wiesbaden: Gabler. [Google Scholar]

- Wang, Zhaohua, Yasir Rasool, Bin Zhang, Zahoor Ahmed, and Bo Wang. 2020. Dynamic linkage among industrialisation, urbanisation, and CO2 emissions in APEC realms: Evidence based on DSUR estimation. Structural Change and Economic Dynamics 52: 382–389. [Google Scholar] [CrossRef]

- Widiastuti, Tika, Sri Ningsih, Ari Prasetyo, Imron Mawardi, Sri Herianingrum, Anidah Robani, Muhammad Ubaidillah Al Mustofa, and Aufar Fadlul Hady. 2022. Developing an integrated model of Islamic social finance: Toward an effective governance framework. Heliyon 8: e10383. [Google Scholar] [CrossRef]

- Yazdi, Najmoddin, Ali Marvi, and Ali Maleki. 2021. Iran and COVID-19: An alternative crisis management system based on bottom-up Islamic social finance and faith-based civic engagement. In COVID-19 and Islamic Social Finance. London: Routledge. [Google Scholar]

- Yunus Social Business. 2019. The Social Business Revolution: Why Is Venture Philanthropy the Most Effective Form of Giving? Available online: https://www.yunussb.com/articles/the-social-business-revolution-why-is-venture-philanthropy-the-most-effective-form-of-giving#:~:text=Our%20Chairman%20and%20Co%2DFounder,of%20a%20traditional%20charity%20donation (accessed on 7 January 2023).

- Yunus, Muhammad. 2010. Building Social Business: The New Kind of Capitalism that Serves Humanity’s Most Pressing Needs. New York City: PublicAffairs. [Google Scholar]

- Yunus, Muhammad, Bertrand Moingeon, and Laurence Lehmann-Ortega. 2010. Building Social Business Models: Lessons from the Grameen Experience. Long Range Planning 43: 308–25. [Google Scholar] [CrossRef]

- Zimon, Grzegorz, Hossein Tarighi, Mahdi Salehi, and Adam Sadowski. 2022. Assessment of Financial Security of SMEs Operating in the Renewable Energy Industry during COVID-19 Pandemic. Energies 15: 9627. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).