Abstract

The Menor Preço Brasil application, based on a version developed in the state of Rio Grande do Sul, was launched in 2019 with the aim of expanding digital services to citizens. This application provides information on the nearest establishments and their product prices based on issued invoices. With the advent of the COVID-19 pandemic, this application adapted its service to facilitate access to prevention products. We are not aware of any other similar government application that uses individual invoice data to support citizens in finding products closer to them at better prices. This study aims to verify the impact of the COVID-19 pandemic on the use of the Menor Preço Brasil app service. To this end, it investigates both the correlation between confirmed cases of COVID-19 in Brazil and the changes in the application’s functionalities with the variation in citizens’ queries to the application. It is a quantitative approach. For this purpose, Bai and Perron’s method of identifying multiple structural breaks and regression models are employed. The results indicate five structural breaks in the number of queries to the application, and that a 1% increase in COVID-19 cases led to a 0.2% increase in queries. These results confirm that user behavior related to the Menor Preço Brasil application was influenced not only by changes in the number of confirmed COVID-19 cases but also by those in the app’s features and inflation rates. The literature also tends to consider the relevance of the relative effects of risk aversion on behavior, especially in the relationship with the tax authorities. This study reinforces the position of the initial relevance of risk aversion and when trust gradually strengthening the aversion to losses diminishes. The public sector has progressively increased the availability of digital services over time, and the results of this study underscore their significance in coping with extreme situations, such as pandemics, natural disasters, and other challenges to accessing goods and services.

1. Introduction

The demand for digital services has become increasingly relevant in our society, posing significant challenges for service providers, particularly in the public sector. There has been a prevalent notion suggesting that the private sector does generate value, asserting that value creation is solely the responsibility of this sector and that it should only intervene in cases of market imperfections, and only if such interventions do not lead to even greater distortions.

This perspective about the public sector was contested by Mazzucato (2021), who argues that the role of governments should not be limited to reactively fixing market issues, but actively structuring them to deliver the outcomes expected by society. In her view, the public sector has not been passive throughout history, and she provides examples of innovations created by American agencies in co-participation with the private sector. Many current day-to-day technologies would not exist either because of risk/return or financing volume issues.

According to Gu et al. (2021), the spread of the COVID-19 pandemic and the growing importance of e-commerce have made the study of online consumer behavior increasingly relevant. Their research focuses on the shifts in online consumer behavior in the context of the COVID-19 pandemic. They argue that consumer awareness and experience have become more impactful, leading online consumers to be savvier in their purchasing decisions. They also note the growing importance of speed in consumer decision making. Drawing on a review of the contemporary literature, Gu et al. (2021) identified the main areas of research in online consumer behavior, which include marketing, consumer characteristics, social determinants, and other factors.

The relationship between the government and citizens in the digital economy is not widely understood, which makes this study particularly relevant. As the digital economy continues to accelerate, both governments and companies must focus on enhancing digital capabilities while seeking to build trust. Freeguard et al. (2020) reported the factors that contributed to the successes and failures of digital government during the pandemic. The authors put emphasis on transparency about use of personal data and new technology as algorithms, to avoid public concern about their use by government. Much more information about data sharing agreements and how our information flows across government should be published. The openness would also help a better collaboration between different departments.

A study by Zolkepli et al. (2021) explored perceived consumer values in mobile app behavior and investigated whether app cost and rating influence behavior. He confirmed that usage is influenced by rating and cost to some extent. The study suggests that users attribute greater value and rating to apps that are trending and are also willing to pay for higher-rated apps. The users are not in favor of analytical or complicated apps.

The App Menor Preço Brasil1 is free, and the rating is 3.1 in google play and 2.5 in the Apple store. So far, there have been more than 100,000 downloads.

A study by Alavi and Buttlar (2019) highlights the detection capacity of smartphones and their crowdsourcing power to monitor several different civil infrastructure systems. The collection of multisensory information via smartphones can be a differentiator in decision making in smart cities. This is based on the active collaboration of citizens.

A study by Tandon et al. (2021) on consumers’ behavioral responses when using food delivery applications (FDAs) found that visibility acted as an antecedent of all consumption values and significantly influenced purchase intentions.

Muangmee et al. (2021) investigated the factors that influenced the behavioral intention to use food delivery apps during the COVID-19 pandemic, a time when online transactions were viewed as important for preventing the virus’s spread. Their findings indicated that performance expectancy, effort expectancy, social influence, opportunity, task technology suitability, perceived trust, and perceived security all significantly affected behavioral intention to use food delivery apps during the pandemic.

Considering the increase in mobile transactions replacing offline payments as a social distancing measure in the times of the pandemic, and therefore also a protective measure against any other outbreaks, Sreelakshmi and Prathap (2023) examined how the perceived health threat posed by COVID-19 and mobile-payment-service quality influenced consumers’ perceived value of the continued use of mobile payment services in India. The study was based on customers who used mobile payment apps to make cashless transactions during the pandemic. It was found that the perceived susceptibility and perceived severity of COVID-19 significantly improved consumers’ value perceptions regarding mobile payment services, which led to satisfaction and intention to continue using it.

Zhou et al. (2021) showed a brief survey of some mobile apps for COVID-19 that were implemented during the pandemic. They also mentioned the important role of Alipay and WeChat in China, or Aarogya Setu in India, among others. Their study also carried out interviews with healthcare and public safety experts to understand how mobile applications were used in China’s response to COVID-19. Four relevant themes were mentioned: personal privacy, community involvement, government involvement, and situational specificity. They found that a great concern was maintaining a balance between collecting and utilizing personal information while also protecting this information. The most valuable feature of the mobile apps is information and data.

Islam et al. (2020) studied mobile applications developed for the COVID-19 pandemic. The apps were selected in the popular application stores; at the beginning there were 189 apps, but many were excluded for different reasons. By the end, 25 apps were analyzed regarding their functionalities, user ratings, and user reviews. The majority of the analysis was about its current status and statistics from a local and global perspective (18), followed by the population aware of it (17), and the services it provided for the prevention of COVID-19 (15). The study provides design recommendations for future apps. According to the authors, the applications should provide quick and accurate responses, and should be usable, useful, responsive, flexible, and reliable. The apps should perform well, and security and privacy issues should be addressed properly. Finally, the application should be culturally sensitive.

Looking at cutting-edge knowledge, Kumar et al. (2023) reviewed the literature on IoT-assisted COVID-19 investigation to extensively examine the technological impact and the outbreak. The authors identified crucial domains where IoT-assisted technology has proven effective in combating the pandemic but has also improved traditional healthcare systems. The findings of this study revealed that blockchain technology, deep learning techniques, and digital twin technology were the latest trends in COVID-19 research. The limitations to the adoption of these technologies were data availability and quality, ethical concerns, regulatory barriers, and the digital divide. The research highlights the critical need for interdisciplinary collaborations. Vaishya et al. (2020) reviewed the role of Artificial Intelligence (AI) as a decisive technology to analyze, prepare and fight COVID-19. For the authors, this technology plays an important role in detecting the cluster of cases and to predict where this virus will affect by collecting and analyzing all previous data. AI works as a mimic of human intelligence. The significant applications are applied to track data of cases.

In the context of Brazilian tax administration, there are examples of processes that create value for citizens. One of them is the Brazilian digital-invoice system, which has existed for over a decade and has brought significant benefits to companies, the State, and consumers. This innovation represented a shift from an essentially analog model to a digital one. These digital invoices have enabled the development of new products and services, including the Menor Preço application, launched by the government of the state of Rio Grande do Sul in 2019. Later that year, the application was extended to other Brazilian states under a cooperative agreement and renamed Menor Preço Brasil. In the context of the COVID-19 pandemic, this application played a crucial role by enabling citizens to compare product prices, thereby informing their online or in-person shopping decisions. By using the application, citizens could find needed products at lower prices and in nearby locations, reducing the risk of disease contagion and transmission.

The general objective of this study is to analyze the impact of COVID-19 on the use of information technologies. In more specific terms, this study intends to evaluate whether changes in the number of people infected by the virus influenced the use of the Menor Preço Application. The hypothesis is that in the most serious moments of the pandemic, the use of the application increased due to legal restrictions on circulation or even due to the individual fear of leaving home. This type of study is relevant, as its results can help to formulate both new communication strategies and new services provided by public authorities to citizens in other risk situations, such as weather alerts.

This study examines whether the behavior of the Menor Preço Brasil application’s queries, carried out by citizens, correlated with changes in the number of confirmed COVID-19 cases in Brazil between 1 January 2020 and 28 December 2022. For this purpose, initially, Bai and Perron’s (1998) method of identifying multiple structural breaks is employed. Subsequently, econometric models are estimated to ascertain the effects of these changes. Two models are generated: one without the structural breaks, and another incorporating the identified breaks. While the public sector has increased the availability of digital services over time, thus facilitating citizens’ accessibility, it is important to analyze their usefulness and importance in extreme situations, such as pandemics, natural disasters, physical-mobility restrictions, and challenges to accessing goods and services. Among these, natural disasters have become increasingly frequent.

In addition to this Introduction, Section 2 details the features of the Menor Preço application. Section 3 elucidates the context of behavior economics within which this article should be understood. Section 4 outlines the methodological procedures employed in the study. Section 5 analyzes the results obtained. The final section presents the study’s conclusions.

2. The Digital Government and the Menor Preço Brasil Application

In response to the passive and risk-averse nature of public service, many public administrations have undertaken modernization initiatives, introducing digital services. Despite the widespread proliferation of internet access and new technologies in recent years, many public services remain mired in disconnected, slow, and inefficient procedures (Borges De Carvalho 2020). Digital government initiatives demand a cultural change in public management. According to Borges De Carvalho (2020), citizens expect a level of service similar to what they encounter on private digital platforms. However, the public sector is more complex due to strict procedural regulations. Since the 1990s, public administration has undergone considerable changes, gradually incorporating information and communication technologies into processes, culminating in what could be termed electronic government. Its main feature is the improvement in internal work processes, without changing its logic or compromising its citizen-centric focus.

Legal frameworks have also evolved in step with digital government. In the past 20 years, noteworthy developments include the introduction of the Digital Government Portal in 2000, the Transparency Portal in 2004, the Digital Inclusion Portal in 2006, the Access to Information Act in 2011, the institution of the National Electronic Process, and most recently, the inauguration of portal GOV.BR in 2019, which consolidated all digital channels of the Federal Government (Cristóvam et al. 2020).

The trend involves continuous technological advancement and digital improvement within the public sector. When public administration formulates its development plans and administrative systems based on technological advancements, it becomes part of what is known as the 4th Industrial Revolution (Industry 4.0). This tends to steer public authorities towards a perspective of Public Administration 4.0 (public management 4.0). However, this concept seems somewhat distant from the reality of Brazilian public administrations (Cristóvam et al. 2020).

It is important to point out that services should strive for universality, yet Brazil faces restrictions on access to information and services due to its socioeconomic characteristics. A survey conducted by the Brazilian Institute of Geography and Statistics (IBGE 2018) addressing internet access, television, and mobile phone ownership revealed that home internet usage has risen rapidly in recent years, reaching 74.9% in 2017. Among households without internet, the main reasons were a lack of interest (34.9%), prohibitive costs (28.7%), and a lack of knowledge on how to use the internet (22.0%). Considering age demographics, only 31% of people over 60 used the internet.

As part of the transition to digital government, there is a need for administrations to shift focus from automation and cost reduction associated with e-government, towards fostering co-creation with citizens and companies. This moment of maturation of technologies and their governmental application signals the transformation toward a digital government that engages in a dialogue with citizens. The citizens participate in the creation and receipt of services, grounded in a government of open data, while maintaining data security (Aguilar Viana 2021). Creating public value through digital government is no longer optional. Digital services must align with citizens’ perceptions. However, the concept of public value is still incipient in public services provided by governments (Lopes et al. 2018).

Adjusting to new changes within organizations can be difficult for several reasons, including complacency, attachment to old methods, current and future expectations, fear of change, and cognitive dissonance. These factors can render the process challenging (Hubbart 2023).

According to Mazzucato (2018), public institutions must participate in the upcoming transformations, such as climate issues, an aging population, and the need for infrastructure and innovation. This author emphasizes the need to overcome the fear of failure and to realize that experimentation and the trial-and-error method are part of the learning process.

Mazzucato and Kattel (2020) argue that governments, to manage a pandemic, need dynamic capabilities that are often absent, such as the ability to adapt and learn, to align public services with citizens’ needs, and to govern data and digital platforms.

For Agostino et al. (2021), when an onsite public service cannot be provided, it must be delivered online, relying on the available digital technology. The authors discuss the digital acceleration that governments and organizations have faced during the pandemic, with focus on 100 Italian state museums. The study showed how digital technologies and social media can be a powerful tool, helping new ways of service delivery, for example broader audiences and new ways of interacting with users.

Gertler et al. (2018) provided elements for policymakers and program managers to consider impact evaluations as part of a change theory. This theory should clearly define the causal mechanisms through which a program works to produce and influence outcomes. They emphasize the importance of combining impact assessments with monitoring and supplementary evaluation to obtain a comprehensive view of the results.

Within this context, the State Revenue Department of Rio Grande do Sul created an application allowing citizens to search for the lowest-priced products, backed by invoices. The Menor Preço application enables users to find the lowest prices of a product in over 300,000 establishments in the state, including stores, pharmacies, gas stations, supermarkets, etc. This innovation empowers citizens to save money and avoids unnecessary travel. The application uses the user’s location to find the lowest prices and closest establishments (refer to Figure 1).

Figure 1.

Fastest route (a); gasoline price history (b); and shortcut to COVID-19 prevention items (c). Source: Direct in-app search.

The Menor Preço application allows users to filter by distance, showing a list of product prices, points of sale, the time of invoice issuance, and the issuer. Users can call the indicated location to check product availability. The application shows the store’s prices over the last seven days and compares them with those of neighboring stores. After choosing a store, users can use navigation features to reach it. The search limit covers a maximum radius of 30 km, with a default setting of 5 km, and users can also share their searches.

Prices are updated in real-time based on the values from Electronic Invoices (NF-e) and Consumer Electronic Invoices (NFC-e). The database includes only invoices associated with a CPF (Cadastro de Pessoas Físicas, Brazilian Individual Taxpayer Registry), which promotes tax compliance and encourages citizens to contribute to the shared database. The buyer’s identity remains confidential. This is an important point because it is a collaborative tool, where the more citizens that demand the inclusion of their identification in the invoice, the larger the application database will be, and this will bring more price and establishment options to other citizens.

Regarding fiscal education, Souza and Souza (2018) support the hypothesis that changing the patrimonial culture and the invisibility of the tax system’s role in citizens’ lives involves knowledge about tax education being conveyed and applied to everyday life.

In the last months of 2019, the National Council for Finance Policy (Confaz), along with the federative units, approved the creation of the Menor Preço Brasil application, leading to the signing of a related agreement (Brasil 2019). This application was launched in December 2019, and by 2022, it had accumulated more than 44 million searches. In January 2020, the application recorded 197,000 queries, which increased to 1.174 million in April amidst the COVID-19 pandemic.

A special COVID-19 version of the application was launched in March 2020, at the onset of the pandemic, providing a shortcut to disease-protective items such as masks, gloves, and hand sanitizer. This version removed the need for CPF registration and password use, thereby allowing any citizen to use the tool during this difficult period. However, the average number of queries dropped from 1.2 million in 2020 to 745 thousand in 2021 because of the mandatory login with CPF, leading to a sharp drop from 2.4 million per month to less than 300 thousand in December 2020.

This fact demonstrates a reluctance among citizens to provide identification. This drop in the number of queries following the introduction of the CPF requirement gives us a glimpse into the behavioral obstacles that inhibit the exercise of tax citizenship by including the consumer’s CPF on invoices, which are, as a rule, much greater. With the application’s update in November 2020, which mandated logging in through a GOV.BR account, which is a means for users to access digital public services, these barriers were heightened. The unified login, used by several applications and services such as the digital CNH, INSS services, and TSE biometric voting, contributed to the initial drop in queries. However, there was a gradual recovery in the use of the Menor Preço Brasil application from month to month in 2021 and 2022. In 2022, the monthly average number of queries reached 1.7 million, exceeding the 2020 level. The peak monthly usage so far occurred in August 2020, with 2.57 million queries. The Menor Preço Brasil application, by removing the CPF requirement for consultation, eliminated an important mental barrier to its use. The urgency of the pandemic encouraged its usage, as the application identified where and at what price products were available, thus minimizing unnecessary travel and reducing contagion risk. However, when the CPF requirement was reintroduced in November 2020, there was a sharp drop in usage. This reflects the reappearance of mistrust, causing a cost–benefit analysis to occur in the user’s mind.

The return of the requirement to use identification to access the application in November 2020 was probably caused by the notion or desire that the end of the pandemic was near. However, it was at a time when the second wave of COVID-19 was flourishing. In the citizen’s relations with the tax authorities, the power of an empire is always present, along with the fear that the information collected could affect not only privacy but could also be used in tax audits. So, aversion to these risks will always be present in some way, probably more intense or not depending on the degree of transparency.

In addition to this application, the State Revenue Department has developed a series of innovations, including the Devolve-ICMS Program, whose impact assessment was reported in Tonetto et al. (2023), and the Receita Certa Project. Both initiatives involve digital invoices and fiscal education.

3. Behavior Economics

Behavioral Economics (BE) is a recent field of research that combines economics with scientific disciplines such as psychology, neuroscience, and other human and social sciences, in addition to empirical discoveries. It challenges the concept of purely rational decision making by introducing real-life factors that more precisely define human behavior.

Varian (2010) argues that BE focuses on the study of consumer choices, employing psychological insights to predict people’s decisions, many of which diverge from the conventional economic model’s assumption of consumer rationality.

Samson, on the other hand, defines BE as the study of cognitive, social and emotional influences economic behavior. This field primarily employs experimentation to develop theories about human decision making (Avila and Bianchi 2015; Samson 2014).

DellaVigna (2009) suggests that this research area identifies three significant deviations from the standard model: (1) nonstandard preferences, (2) nonstandard beliefs, and (3) nonstandard decision making. He presents empirical evidence from several applications, ranging from consumption to finance, and from crime to voting. This author discusses time preferences, self-control problems, risk preferences, and social preferences. Regarding nonstandard decision making, he points out menu effects, social pressure, and emotions.

In BE, decisions are shaped by habits, experiences, and heuristic rules. Satisfactory solutions are accepted, and not maximization ones. It recognizes that it difficult to reconcile short- and long-term interests and that decisions are strongly influenced by emotional factors and interactions with other decision makers (Avila and Bianchi 2015).

The experimental method is the primary tool that behavioral economists use for empirical investigation. Despite initial opposition from scholars such as John Stuart Mill and Milton Friedman to applying this method in the social sciences, BE and its research methodologies have gradually developed and gained academic recognition (Avila and Bianchi 2015).

Experimental economists began to analyze how humans behave when sharing an amount of money with anonymous partners. This practice enabled the detection of unexpected and unusual responses in human behavior, as viewed by microeconomic theory. Currently, these experiments have transitioned from the laboratory to real-life settings, with the aim of reproducing more reliable conditions.

BE started in the 1930s and was devoted to experimentally determine individual indifference curves. The publication of Von Neumann and Morgenstern’s book on Game Theory (GT) in 1944 was a great stimulus, establishing a close relationship between BE and GT. The first formulation of the prisoner’s dilemma marked another key development (Bianchi and da Silva Filho 2001). The increase in natural experiments, largely carried out online, allows participants to remain unaware of their involvement in the study.

Recently, BE has started migrating from university laboratories to real-life contexts. In the public sector, the ‘test and learn’ approach enhances accuracy and reduces costs by focusing on policies that yield consistent results. Although Big Data solutions aim to identify patterns in vast datasets, they often rely excessively on correlation rather than causation. It is important to scrutinize these results critically, even if no substantive differences are found between studied groups, of the knowledge gained can be valuable for redesigning experiments.

Cleto (2019) observed a steady increase in the number of BE publications in the Web of Science database from 2000 to 2018. From a mere 10 publications per year until 2005, it surged to more than 100 annually from 2016 onwards. Most publications are from the United States (55%), followed by the UK and Germany, with approximately 10 and 6%, respectively, adding to 71% of all publications. The predominant language for publications is English, with approximately 96% (Cleto 2019).

It can be speculated that the notoriety achieved by Nobel Prize laureates like Daniel Kahneman and Vernon Smith in 2002, Robert Shiller in 2013, and Richard Thaler in 2017 significantly influenced this trend. Thaler’s research advocates that people tend to simplify their financial decisions and do not always make rational choices.

In 2010, the UK government, with the aim of improving the efficiency and quality of public management, created an organization called the Behavioral Insights Team (BIT), also known as the Nudge Unit. Today, BIT has disseminated studies to several countries (Feitosa and Cruz 2019; Meneguin and Ávila 2019).

In behavioral analysis, a series of circumstances and aspects directly influence or even define behavior. Ariely (2020) provides a simple example of inappropriate behavior often exhibited by drivers—texting while driving. This behavior greatly increases the risk of traffic accidents, causing harm to oneself and others, and potentially resulting in fatalities. It represents an action that contradicts our long-term interests.

On the other hand, the economic world seeks our immediate attention and money, not necessarily our well-being 20 years from now. Some studies indicate that half of the deaths among adults aged 15 and 64 in the United States are caused or influenced by poor personal decisions, usually associated with physical inactivity, drug use, and smoking, among other factors. If people were 100% rational, they would simply need to be provided with the necessary information and they would make the right decisions. However, the behavioral approach demonstrates that this is not how things work. The information is not always fully available or presented in a way that promotes understanding, and our capacity to evaluate is also limited and conditioned—an idea encompassed in the concept of bounded rationality.

There are many behavioral biases and two blind spots: the belief in consumer and market rationality. Usually, the analysis of concrete phenomena dispels these beliefs. Our choices are often made automatically, rather than through careful deliberation. Many BE approaches supplement the rational choice model. These include the Prospect Theory, Bounded Rationality, Dual System, and Social and Temporal Dimensions (Avila and Bianchi 2015).

According to Kahneman and Tversky (1979), and the Prospect Theory, decisions are not always optimal. Our willingness to take risks is influenced by the way choices are framed, that is, how they are presented to us. The context in which choices are made will influence the decision. The presentation of choices as either wins or losses will influence the response. Kahneman and Tversky (1979) also presents a critique of utility theory in relation to decision making under risk. According to the authors, people underestimate merely probable results in relation to results obtained with certainty, generating a certainty effect that contributes to risk aversion in choices that involve certain gains and to the search for risk in choices that involve certain losses. Tversky and Kahneman (1974) describe heuristics that are employed to make judgments under uncertainty. One of them is anchoring, which is normally employed in numerical prediction when a relevant value is available. These heuristics are highly cost-effective and generally effective, but they lead to systematic and predictable errors. A better understanding of these heuristics and the biases they lead to can improve judgment and decision in situations of uncertainty.

Tversky and Kahneman (1991) explain that trade can involve two dimensions, and loss aversion may operate in both. In the case of loss aversion for the good, the owner will be reluctant to sell; conversely, if the buyer perceives the money spent on the purchase as a loss, there will be reluctance to buy. These two effects can be estimated by comparing sellers and buyers to a chooser who has a choice between the good and the money, where there is no loss aversion.

Bounded rationality acknowledges the limitations of information and processing, leading to decisions that are not always optimal. This approach confronts us with heuristics and biases, simple but effective algorithms that can lead to near-optimal results. Kahneman (2012) suggests that making quick decisions is effective when the likelihood of correct conclusions is high, and the cost of an occasional error is acceptable. However, it becomes problematic in unfamiliar situations, where the potential loss is significant, and there is insufficient time to gather more information.

According to Thaler (1999), mental accounting influences choice. This process comprises a set of cognitive operations that individuals and families employ to organize, evaluate, and monitor their financial activities.

According to Fehr et al. (2015), behavior is shaped by two interconnected elements: willingness and awareness. In the fiscal context, monetary stimuli represented by prizes and draws, as in the state of Rio Grande do Sul, can motivate taxpayers to include their CPF in the invoices and boost the tax citizenship program. In terms of awareness and education, applications such as the Menor Preço Brasil can effectively engage citizens.

When Value Added Tax (VAT) was introduced in Europe, awareness of the effects of excluding some items from full taxation, and policymakers, relied on intuition. It seemed logical that essential items should not be taxed, and it was believed that the natural regressivity of a general consumption tax could be lessened by excluding these items from total taxation. Evidence shows that tax cuts are often not fully passed on to consumers, and wealthier households benefit the most when they are. Although tax policy experts have highlighted many of these concerns for decades, resistance to broad-based VATs surprisingly persists. In public opinion, there is a backlash to reforms that is permeated by a variety of cognitive biases, including cognitive dissonance and loss aversion (de la Feria and Walpole 2020).

According to Costa et al. (2022), the application of BE-based interventions designed to draw attention to moral standards for tax compliance can be effective, notably in cases where dishonesty does not arise from rational motivation. They emphasize that the mind’s interpretation of heuristics depends on understanding the context in which they are used. For these authors, individuals with higher property or income may be less sensitive to treatment due to lower risk aversion. Risk aversion varies among individuals.

Feitosa and Cruz (2019) advise that when implementing incentives for taxpayers, it is important to avoid triggering aversion to state control and disengagement. An experiment with taxpayers in Minnesota found that when taxpayers are aware that compliance with the law is high, they become less likely to evade tax authorities.

Fostering desirable behaviors is possible, according to Sunstein and Thaler (2019). Governments and tax authorities are increasingly engaging with taxpayers through automated income tax declarations, a trend that began in Nordic countries and has gained popularity elsewhere. Some countries even allow changes to tax declaration via text message, as noted by Sunstein and Thaler (2019). Trust gradually strengthens in relationships, and aversion to losses diminishes as a result of increased transparency.

According to Sunstein and Thaler (2019), loss aversion is well-documented, as exemplified by the case of donated coffee mugs where donors demanded significantly higher prices than potential buyers were willing to pay. It is worth highlighting that loss aversion leads to inertia, which can only be overcome by another influencing factor.

Empirical evidence suggests a potential role for behavioral factors in tax compliance analysis, with certain behavioral decision-making features possibly leading to greater tax compliance. For example, individuals may overestimate the likelihood of audits. Another influential behavior is social preference, which may lead individuals to comply with taxes at a higher rate than if they were solely driven by personal interest (Congdon et al. 2011).

4. Methodology

For Hendry (2000), in many situations of economic life, statistical tests are not necessary to distinguish between the conditions of 1899 and 1999. However, a series of parameter changes in econometric models cannot be easily detected by conventional tests, while some changes are manifest and easy to identify.

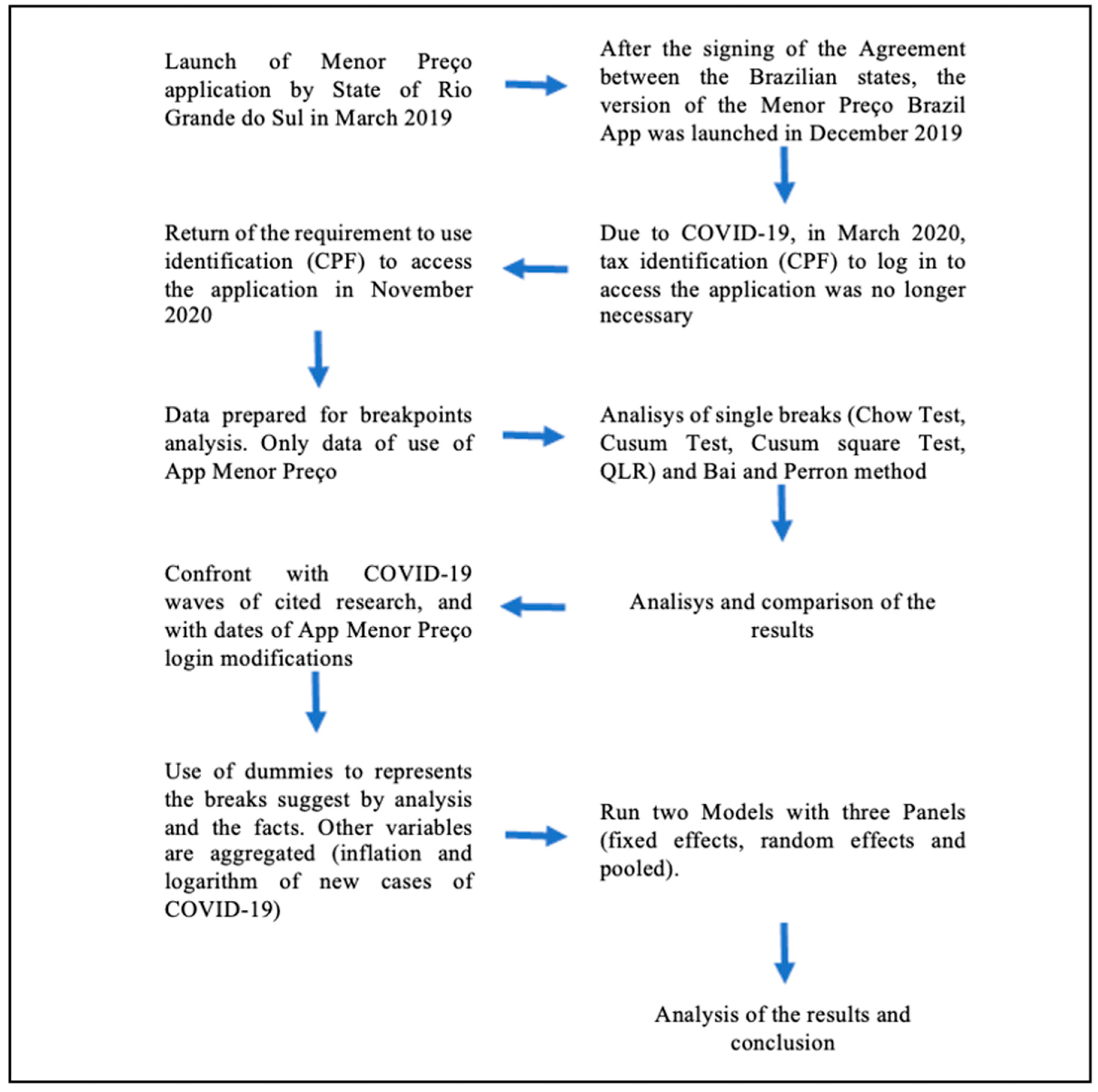

To achieve the objectives, an analysis of structural breaks in the number of queries made to the Menor Preço Brasil application is initially carried out. Subsequently, econometric models are estimated to ascertain the effects of these changes in the number of confirmed COVID-19 cases on the number of product price queries using the application. The identification of structural breaks enables the verification of whether there has been a shift in citizen behavior concerning queries to the application over the period analyzed. Consequently, it becomes possible to determine whether these breaks are associated with changes in the number of confirmed COVID-19 cases during the same period. Furthermore, these breaks are used as dummy variables in econometric models. Figure 2 shows the procedures of methodologic analysis.

Figure 2.

Schematic illustration of the methods. Source: prepared by the authors.

When using regression models involving time series data, there may be a structural change in the relationship between the dependent variable Y and the explanatory variables. A structural change occurs when the model parameter values do not remain consistent throughout the period being analyzed. One of the many practical advantages of estimating and inferring models with structural changes is that it allows for the identification of events that may have induced these structural changes. Consequently, this enables a comparison between the estimated date of interruption and the effective date of a policy’s implementation.

In the test carried out in this study, Y represented the number of price queries made through the Menor Preço application, while the explanatory variable was the time trend. Several tests can detect structural breaks, including the Chow, CUSUM, and QLR tests. In this study, these tests were used alongside Bai and Perron’s (1998) method of identifying multiple breaks.

The Chow test checks for a structural break in a time series divided into two periods by comparing the regression coefficients between these periods and testing the hypothesis that they are statistically equal. This test is applied when there are reasons to believe that the sample can be split into two sub-samples, each corresponding to different contexts. The CUSUM test tracks the cumulative sum of differences between the observed and expected values of a time series. If this sum reaches a certain critical value, it could indicate the presence of a structural break.

The test constructs significance bands so that the probability of crossing these bands is equal to the intended significance level. These significance bands are constructed along the lines. The CUSUM-sq test is based on cumulative sums of squares of recursive residuals. Dufour (1982) highlights that this test should essentially be considered as a heteroscedasticity test, indicating instability in variances. However, in terms of recursive residues, it could also suggest instability in the model’s coefficients. Vasco (2002) outlines the two tests, detailing their characteristics and applications.

The QLR test, in turn, endogenously provides an estimate of the date of a structural break.

Feio et al. (2022), aiming to analyze the dynamics of the public debt from November 2002 to September 2020, employed the method of identifying multiple structural breaks. They discussed the evolution of Brazilian public debt and emphasized the importance of the structural break test, specially the Chow test, in macroeconomic analysis. This is a recent example of using structural break analysis in the realm of public finance.

For Bai and Perron (1998), the economic and statistical literature contains many studies on change or a structural break; however, it is designed for cases of a single break. The authors presented a method that identifies multiple structural changes, which occur at unknown dates, using a linear regression model estimated by least squares. Its main advantages are related to the properties of the estimators, the estimates of break dates and the construction of tests that allow for inferring the presence of structural changes and the number of breaks. Finally, the method by Bai and Perron (1998) represents an important evolution in relation to other tests, which is to test multiple structural changes.

Clements and Hendry (1996) emphasize that forecasting analyses that assume a constant and time-invariant data generation process, which thus implicitly rule out structural or regime changes in the economy, overlook a significant aspect of the real world and consequently generate inaccurate forecasts. Certain models can provide more robust protection against unforeseen structural breaks than others, and several techniques can further enhance the resilience of forecasting models.

In the present study, there is also exogenous information that indicates probable break dates. According to Lopes (2021), if there is prior information, exogenous to the data, suggesting a potential failure on a certain date due to an institutional change, this information can and should be used without any restriction. If the information is exogenous, it will not distort the dimension properties and is likely to yield a test with substantial power. However, the data may indicate a slightly different date. This discrepancy might arise because major adjustments or changes in conduct often do not coincide precisely with the date of institutional change.

Two important moments to consider are the dates when the requirement to log in to use the application was removed (29 March 2020) and reinstated (11 November 2020). The removal of the login requirement was implemented to facilitate the use of the application to foster online purchases and thereby reducing the risk of contagion in in-person transactions.

The focus of this research is not on analyzing the covariance of behavioral theoretical aspects, but rather on examining the influence of context.

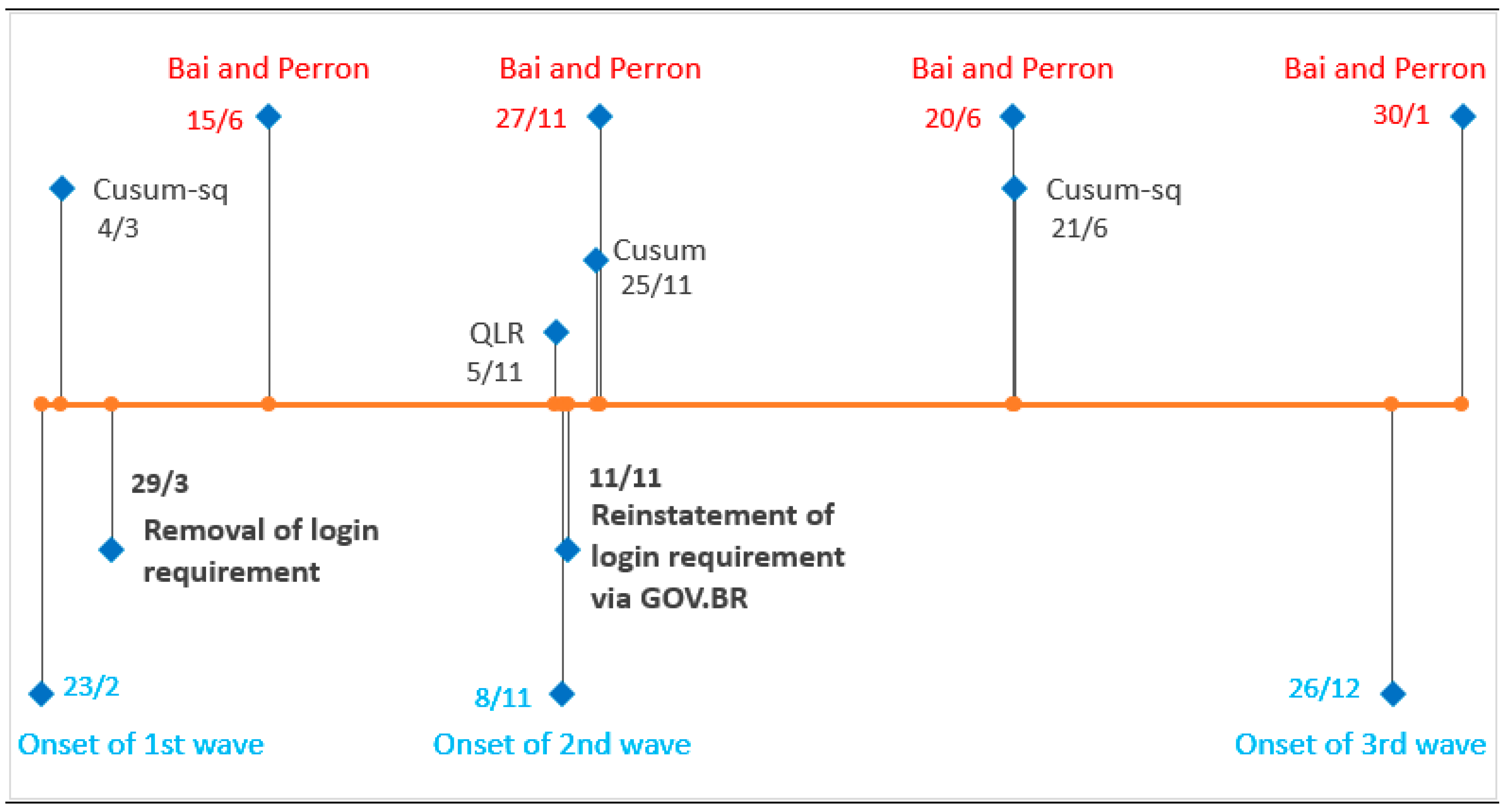

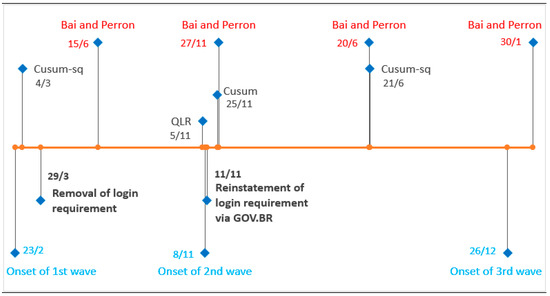

Another important piece of information is the periodization of COVID-19 waves in Brazil. Moura et al. (2022) analyzed the temporal evolution of the contagion from the first reported case to 21 May 2022. According to their findings, the three distinct waves are evident: the first from 23 February to 25 July 2020; the second on 08 November 2020 to 10 April 2021; and the third from 26 December 2021 to 21 May 2022. Thus, it was expected that structural breaks would occur around these periods.

The dates of the breaks identified by Bai and Perron’s method and their possible explanations are as follows on Table 1, and one detected using the Cusum-Sq test.

Table 1.

Dates of breaks detected.

This date aligned closely with the onset of the first wave of COVID-19 and the removal of the login requirement for the use of the Menor Preço Brasil application. Chow’s test was subsequently used and it confirmed the significance of these breaks.

We should consider that increased familiarity with the application likely contributed to a rise in app queries over time.

The data used for the analyses consisted of time series that represent the daily queries made to the Menor Preço Brasil application and the number of new daily confirmed COVID-19 cases in Brazil. The data for application queries were sourced from the Secretary of Finance of Rio Grande do Sul, while the data for confirmed COVID-19 cases were obtained from the Johns Hopkins Coronavirus Resource Center (CRC). The period analyzed ranged from 1 January 2020 to 28 December 2022. Table 2 shows the definitions of the variables used in the study, along with some descriptive statistics and their respective sources.

Table 2.

Definition of variables and descriptive statistics. Source: prepared by the authors.

In summary, multiple breaks were initially estimated using the Bai and Perron method. Subsequently, a regression analysis was performed between queries made to the application and the number of new daily COVID-19 cases. Finally, dummy variables representing the structural breaks found in the regression analysis were included. This was performed to verify the possible associations between the dates. The following models were estimated:

where α and β are the estimated parameters and ε is the residual of the models. The other variables are defined in Table 2.

LNAPP = α + β1 × LNCovid + β2 × IPCA + ε,

LNAPP = α + β1 × LNCovid + β2 × IPCA + β3 × D1 + β4 × D2 + β5 × D3 + β6 × D4 + ε,

5. Results and Discussion

From 30 December 2019 to 28 December 2022, the Menor Preço Brasil application logged a total of 44,718,086 consultations. At the end of 2020 and again in 2022, the most sought-after products were medicines and supermarket items. The system supporting the application does not keep records of product queries beyond the current month, which underscores the relevance of this study.

Table 3 shows some differences in preferences between Brazilians overall and Gauchos (citizens of the state of Rio Grande do Sul). In the case of Rio Grande do Sul, it is noteworthy that food items constituted 50% of the top 10, followed by alcoholic beverages at 30% and medicinal items at 20%. In contrast, medications dominating the searches in Brazil prevailed; if we characterize vitamin D supplements as medication, this type of item accounted for 70% of the searches. Interestingly, in the Brazilian context, cement topped the list, with tomatoes being the primary food item. The price of tomatoes has been a topic of much discussion throughout the year. It is also worth mentioning that, in the case of Rio Grande do Sul, “chester”—a Christmas-related item, and “picanha”—a famous steak, featured prominently on the list, underscoring regional preferences.

Table 3.

Top ten items searched in Menor Preço (Rio Grande do Sul) and Menor Preço Brasil applications in December 2022. Source: SEFAZ RS.

In the analysis of the time series of queries to the Menor Preço Brasil application, Bai and Perron’s method was used. This was complemented by the CUSUM, CUSUM-sq, and QLR tests, which were validated using the Chow test. Exogenous events that suggest a structural break include the removal of the user identification requirements for queries and the reinstatement of the login according to the GOV.BR platform, both of which occurred in March and November 2020, respectively.

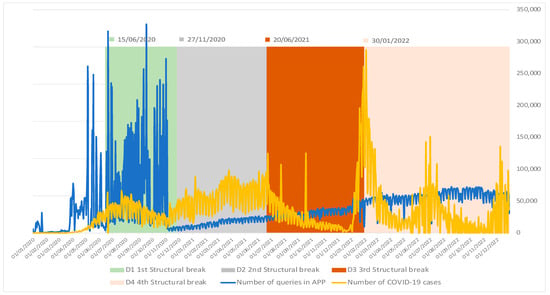

Figure 3 shows all the structural breaks found using statistical tests and exogenous event dates. Bai and Perron’s method identified four structural break dates: 15 June 2020, 27 November 2020, 20 June 2021, and 30 January 2022. The CUSUM test indicated a break on 25 November 2020. The CUSUM-sq test pointed to two breaks: 4 March 2020 and 21 June 2021. The QLR test identified a break on 11 June 2020. The exogenous event dates—referring to the removal of the login requirement, the subsequent return of this requirement, and the three waves of COVID-19—were adequately captured by the statistical tests.

Figure 3.

Timeline with exogenous event dates (below) and probable structural break dates according to the different tests (above). Source: Search results. Prepared by the authors. Note: Below are the start dates for the COVID-19 waves and changes to the way you log in to the application. Above dates indicate structural breaks using different methods.

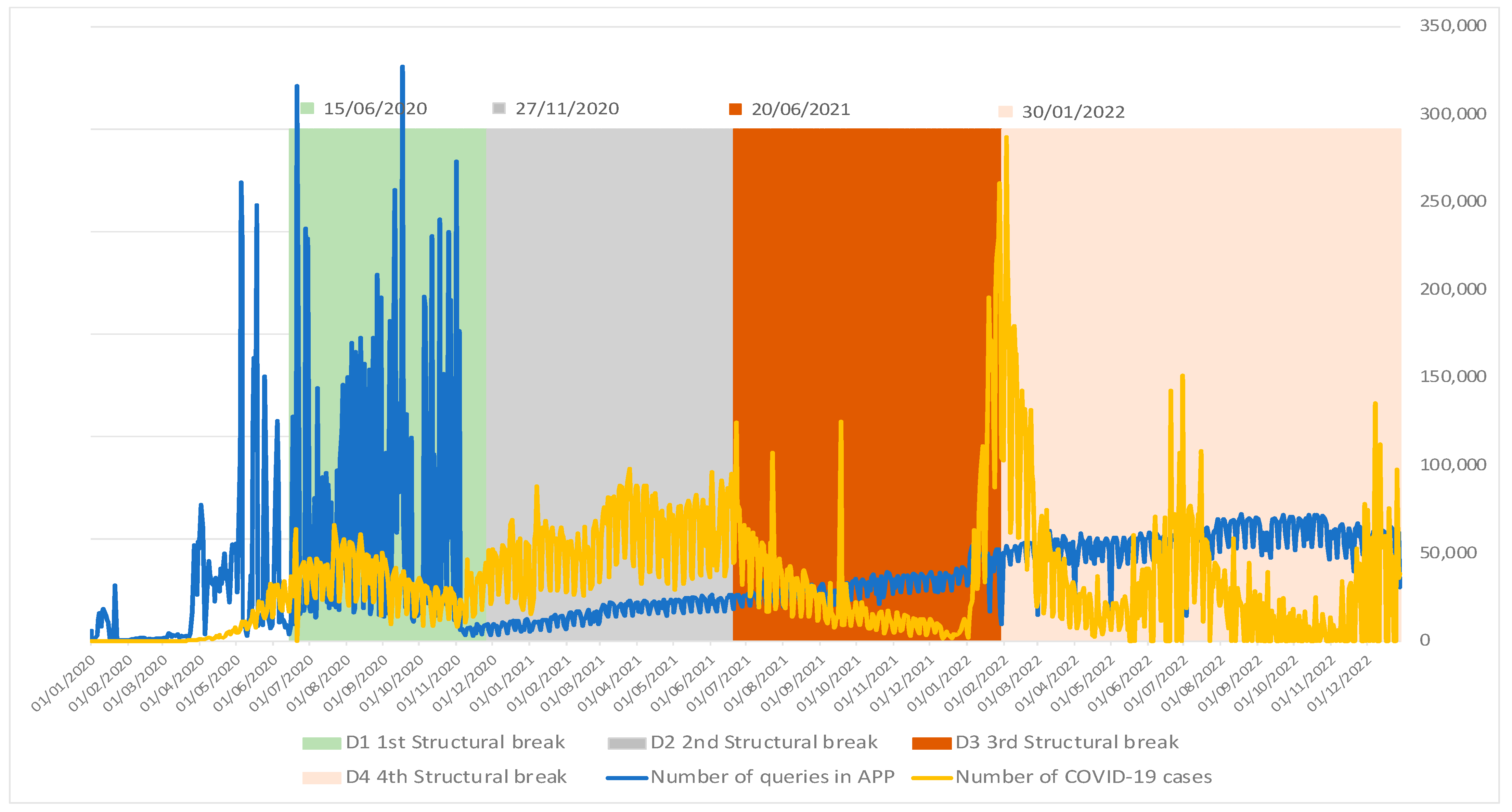

Figure 4 shows that the removal of the login requirement for accessing the application on 29 March 2020 increased the number of queries; conversely, the reinstatement of the user identification requirement on 11 November 2020 led to a drastic reduction in the number of queries (indicated by the blue line). Some of the dates identified as breaks were similar across the different tests.

Figure 4.

Queries made to the Menor Preço Brasil application and confirmed COVID-19 cases. Source: prepared by the authors. Note: D1 to D4 are periods based on structural breaks points detected on method of Bai and Perron (1998) that became dummy variables in regression model.

Using the information on daily queries to the Menor Preço Brasil application, on confirmed daily COVID-19 cases, and structural breaks identified by the Bai and Perron’s method (1998), two linear regression models were estimated according to Equations (1) and (2), as presented in the Methodology section. The results are in Table 4. The monthly IPCA inflation index was used as a control variable to capture the effect of prices during the analyzed period, which extended from 1 January 2020 to 28 December 2022. Although data collection on COVID-19 by the CRC commenced on 22 January 2020, the first case in Brazil was not reported until 26 February 2020. The CRC data series for Brazil continues until March 2023, and over 37 million cases were computed in this period.

Table 4.

Model results are estimated in robust form. Source: Prepared by the authors.

The results presented in Table 4 show a convergence of signs for the LNCovid and IPCA dummy variables. However, in model 2, the constant became insignificant, indicating that the inclusion of structural break dummy variables in this model captures much information omitted in model 1. The larger R2 also supports the improvement in the model’s explanatory power when structural breaks are incorporated. Model 2, with the inclusion of structural break dummy variables, shows greater explanatory power, confirming the hypothesis that queries to the Menor Preço Brasil application were influenced by the increase in new daily COVID-19 cases. It was observed that a 1% increase in COVID-19 cases (LNCovid) resulted in a 0.2% increase in queries to the application.

The main control variable used in the model, inflation (IPCA), also positively influenced queries to the application. As anticipated, a 1% increase in the inflation index led to an 8.6% increase in the number of queries made to the Menor Preço Brasil application. A review of the table of descriptive statistics (Table 2) reveals that this was a time of high inflation, with the index accumulating to 21% over this period.

Three of the four structural-break dummy variables incorporated in the model were significant, thus validating the Bai and Perron test. The negative sign for these variables was expected, as the break indicates a shift in the trajectory of the variable of interest—in this case, the number of queries to the application (LNAPP). Moreover, a negative sign suggests that the break represents a peak in the number of queries. This peak, in turn, is associated with the events discussed earlier, such as waves of COVID-19 and the changes in the login requirement to access the application. Figure 3 shows that the dummy variable D2 is associated with the second wave of COVID-19 and the reinstatement of the login requirement to access the application, whereas the dummy variable D4 is associated with the third wave of COVID-19.

6. Conclusions

This study aimed to describe and analyze the evolution of queries made by Brazilian citizens to the Menor Preço Brasil application over the last three years during the COVID-19 pandemic. The application was adapted to respond to the pandemic and was made available without the need for a login, thereby enabling people to more easily find the products they were searching for, thus reducing the risk of contagion. The hypothesis of structural breaks was tested seeking to identify changes in citizen behavior over this period. To this end, the Bai and Perron, Chow, QLR, CUSUM, and CUSUM-sq tests were employed. The data used in the analysis were obtained from the Finance Secretariat of the State of Rio Grande do Sul and Johns Hopkins University.

In the usage of the Menor Preço Brasil application, five structural breaks were identified. These breaks were investigated by changes in the access to the application and fluctuations in the daily number of reported COVID-19 cases in Brazil. A regression model confirmed the impact of new COVID-19 cases on the usage of the search application. A 1% increase in COVID-19 cases led to a 0.2% increase in queries to the application. Furthermore, a 1% rise in the inflation index resulted in an 8.6% increase in the number of queries to the application.

The empirical analysis confirms the impact of COVID-19 in the use of technology. The use of the application Menor Preço Brasil increased due to issues related to the pandemic in the form of legal restrictions on circulation or even due to self-restriction caused by fear of contamination when leaving home.

The theoretical approach revealed that initially, when the app did not require identification and there was no perceived risk of loss (BE), usage was high, spurred by the pandemic and inflation. However, when login requirements were introduced, concerns of loss aversion and increased tax scrutiny arose, as Congdon et al. (2011) announced, leading to a significant decline in usage.

The study proves that the risk of aversion was important at that time, but fortunately it was possible to overcome it (Feitosa and Cruz 2019; Costa et al. 2022; Sunstein and Thaler 2019). Over time, the risk aversion was mitigated probably by strengthening trust in the government service, by understanding that its use did not present an excess risk of audit and invasion of one’s privacy, and by the urgency of the COVID-19 situation, where the benefits of using the app—such as time savings, lower prices, and reduced risk of contagion—became more apparent.

It is plausible that what Sunstein and Thaler (2019) refer to as ‘herd behavior’ may have occurred, as information about the app’s usefulness spread among users.

The public sector has progressively increased the availability of digital services over time. The results of this study underscore their significance in coping with extreme situations, such as pandemics, natural disasters, and other challenges to accessing goods and services. Citizen responses to digital services can be immediate and have significant impact and value, as demonstrate by the data presented here.

Limitations of this study include the constraints of the available database, as it lacks records on federative units, user profiles, and the specific products being sought at the most granular level. Further studies can and should be carried out to understand more comprehensively citizen behavior concerning digital products and services.

This study demonstrates that digital solutions can significantly enhance citizens’ daily lives. However, it is also crucial to monitor the impact and evolution of these solutions. The study suggests that the login restriction imposed on the eve of the second wave of COVID-19 might have been avoidable if there had been proper data monitoring.

Author Contributions

Conceptualization, J.L.T.; methodology, J.L.T., A.F., and J.M.P.; validation, J.L.T., A.F., and J.M.P.; formal analysis, J.L.T., A.F. and J.M.P.; investigation, J.L.T.; writing—original draft preparation, J.L.T.; writing—review and editing, J.L.T., A.F., and J.M.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are available. App Menor Preço Brasil direct with authors. Covid data: Data available at: https://raw.githubusercontent.com/CSSEGISandData/COVID-19/master/csse_covid_19_data/csse_covid_19_time_series/time_series_covid19_confirmed_global.csv (accessed on 15 March 2023).

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | Link to download the Menor Preço application from the Apple store (also available for android): https://apps.apple.com/br/app/menor-pre%C3%A7o-brasil/id1483644418, accessed on 15 March 2023. |

References

- Agostino, Deborah, Michela Arnaboldi, and Melisa Diaz Lema. 2021. New Development: COVID-19 as an Accelerator of Digital Transformation in Public Service Delivery. Public Money & Management 41: 69–72. [Google Scholar] [CrossRef]

- Aguilar Viana, Ana Cristina. 2021. Transformação digital na administração pública: Do governo eletrônico ao governo digital. Revista Eurolatinoamericana de Derecho Administrativo 8: 115–36. [Google Scholar] [CrossRef]

- Alavi, Amir H., and William G. Buttlar. 2019. An Overview of Smartphone Technology for Citizen-Centered, Real-Time and Scalable Civil Infrastructure Monitoring. Future Generation Computer Systems 93: 651–72. [Google Scholar] [CrossRef]

- Ariely, Dan. 2020. Previsivelmente Irracional. Rio de Janeiro: Sextante. ISBN 978-85-431-1000-4. [Google Scholar]

- Avila, Flávia, and Ana Maria Bianchi. 2015. Guia de Economia Comportamental e Experimental, 1st ed. São Paulo: Editora EC. [Google Scholar]

- Bai, Jushan, and Pierre Perron. 1998. Estimating and Testing Linear Models with Multiple Structural Changes. Econometrica 66: 47–78. [Google Scholar] [CrossRef]

- Bianchi, Ana Maria, and Geraldo Andrade da Silva Filho. 2001. Economistas de avental branco: Uma defesa do método experimental na economia. Revista de Economia Contemporânea 5: 129–54. [Google Scholar]

- Borges De Carvalho, Lucas. 2020. Governo digital e direito administrativo: Entre a burocracia, a confiança e a inovação. Revista de Direito Administrativo 279: 115–48. [Google Scholar] [CrossRef]

- Brasil. 2019. Convênio de Cooperação Técnica Nº 03/19, de 27 de Setembro de 2019. Publicado no Diário Oficial [da República Federativa do Brasil] de 01.10.19, pelo Despacho 74/19. Brasília, DF. Available online: https://www.confaz.fazenda.gov.br/legislacao/Convenios-de-cooperacao-outros2/convenios/2019/convenio-de-cooperacao-tecnica-no-03-19 (accessed on 15 March 2023).

- Clements, Michael P., and David F. Hendry. 1996. Intercept Corrections and Structural Change. Journal of Applied Econometrics 11: 475–94. [Google Scholar] [CrossRef]

- Cleto, Victor Teixeira Vianna. 2019. Engenharia Econômica: Uma análise sobre as principais abordagens e aplicações da economia comportamental por meio de uma revisão bibliográfica sistemática. UNB. Available online: https://bdm.unb.br/handle/10483/23112 (accessed on 20 December 2022).

- Congdon, William J., Jeffrey R. Kling, and Sendhil Mullainathan. 2011. Policy and Choice: Public Finance through the Lens of Behavioral Economics. Washington, DC: Brookings Institution Press. [Google Scholar]

- Costa, Ana Carolina Astafieff Da Rosa, Morgana G. Martins Krieger, and Yuna Fontoura. 2022. Conformidade fiscal e economia comportamental: Uma análise da influência do contexto decisório. Brazilian Journal of Political Economy 42: 1062–79. [Google Scholar] [CrossRef]

- Cristóvam, José Sérgio Da Silva, Lucas Bossoni Saikali, and Thanderson Pereira De Sousa. 2020. Governo digital na implementação de serviços públicos para a concretização de direitos sociais no Brasil. Seqüência: Estudos Jurídicos e Políticos 43: 209–42. [Google Scholar] [CrossRef]

- de la Feria, Rita, and Michael Walpole. 2020. The Impact of Public Perceptions on General Consumption Taxes. British Tax Review. Available online: https://ssrn.com/abstract=3783048 (accessed on 6 May 2023).

- DellaVigna, Stefano. 2009. Psychology and Economics: Evidence from the field. Journal of Economic Literature 47: 315–72. Available online: https://www.jstor.org/stable/27739926 (accessed on 9 May 2023). [CrossRef]

- Dufour, Jean-Marie. 1982. Recursive stability analysis of linear regression relationships. Journal of Econometrics 19: 31–76. [Google Scholar] [CrossRef]

- Fehr, Gerhard, Alain Kamm, and Moritz Jäger. 2015. The behavioral change matrix—A tool for evicence-based policy making. In The Behavioral Economics Guide 2015. Edited by A. Samson. Available online: https://www.behavioraleconomics.com/be-guide/the-behavioral-economics-guide-2015/ (accessed on 30 December 2022).

- Feio, Kleydson Jurandir Gonçalves, Marina Delmondes de Carvalho Rossi, and Cícero Pereira Leal. 2022. A trajetória da dívida puública brasileira analisada por meio do método de quebras estruturais. In Administração: Gestão, Empreendedorismo e Marketing. Edited by E. M. Senhoras. Editora Atena. Ponta Grossa: PR. [Google Scholar] [CrossRef]

- Feitosa, Gustavo Raposo Pereira, and Antonia Camily Gomes Cruz. 2019. Nudges fiscais: A economia comportamental e o aprimoramento da cobrança da dívida ativa. Pensar Revista de Ciências Jurídicas 24: 1–16. [Google Scholar] [CrossRef]

- Freeguard, Gavin, Marcus Shepheard, and Oliver Davies. 2020. Digital Government during the Coronavirus Crisis. Available online: https://apo.org.au/node/309619 (accessed on 6 October 2023).

- Gertler, Paul J., Sebastian Martinez, Patrick Premand, Laura B. Rawlings, and Christel M. J. Vermeersch. 2018. Avaliação de Impacto na Prática. Washington, DC: Banco Mundial. Available online: https://openknowledge.worldbank.org/server/api/core/bitstreams/4d0504c2-bedf-5218-939b-cc17b3c238f3/content (accessed on 12 July 2023).

- Gu, Shengyu, Beata Ślusarczyk, Sevda Hajizada, Irina Kovalyova, and Amina Sakhbieva. 2021. Impact of the COVID-19 Pandemic on Online Consumer Purchasing Behavior. Journal of Theoretical and Applied Electronic Commerce Research 16: 2263–81. [Google Scholar] [CrossRef]

- Hendry, David F. 2000. On Detectable and Non-Detectable Structural Change. Structural Change and Economic Dynamics 11: 45–65. [Google Scholar] [CrossRef]

- Hubbart, Jason A. 2023. Organizational Change: The Challenge of Change Aversion. Administrative Sciences 13: 162. [Google Scholar] [CrossRef]

- Instituto Brasileiro de Geografia e Estatística (IBGE). 2018. Pesquisa Nacional por Amostra de Domicílios Contínua: Acesso à Internet e à Televisão e Posse de Telefone móvel Celular para Usa Pessoal 2017; Rio de Janeiro: IBGE. Available online: https://biblioteca.ibge.gov.br/visualizacao/livros/liv101631_informativo.pdf (accessed on 17 May 2023).

- Islam, Muhammad Nazrul, Iyolita Islam, Kazi Md. Munim, and A. K. M. Najmul Islam. 2020. A Review on the Mobile Applications Developed for COVID-19: An Exploratory Analysis. IEEE Access 8: 145601–10. [Google Scholar] [CrossRef]

- Kahneman, Daniel. 2012. Rápido e Devagar: Duas Formas de Pensar, 1st ed. Rio de Janeiro: Editora Objetiva Ltda. [Google Scholar]

- Kahneman, Daniel, and Amos Tversky. 1979. Prospect Theory: An Analysis of Decision under Risk. Econometrica 47: 263–91. [Google Scholar] [CrossRef]

- Kumar, Dheeraj, Sandeep Kumar Sood, and Keshav Singh Rawat. 2023. IoT-Enabled Technologies for Controlling COVID-19 Spread: A Scientometric Analysis Using CiteSpace. Internet of Things 23: 100863. [Google Scholar] [CrossRef]

- Lopes, Artur Silva. 2021. Uma Introdução à Análise de Estabilidade dos Coeficientes. Lisboa: ISEG/ULISBOA. Available online: http://hdl.handle.net/10400.5/17668 (accessed on 7 July 2023).

- Lopes, Karen Maria Gross, Edimara Mezzomo Luciano, and Marie Anne Macadar. 2018. Criando valor público em serviços digitais: Uma proposta de conceito—Creating Public Value in Digital Services: Proposal of a concept. Gestão.org 16: 207–21. [Google Scholar] [CrossRef]

- Mazzucato, Mariana. 2018. O valor de tudo. Produção e apropriação na economia global. São Paulo: Editora Scharcz S.A. Portfolio-Penguin. [Google Scholar]

- Mazzucato, Mariana. 2021. Missão Economia. Um guia inovador para mudar o capitalismo. São Paulo: Editora Scharcz S.A. Portfolio-Penguin. [Google Scholar]

- Mazzucato, Mariana, and Rainer Kattel. 2020. COVID-19 and Public-Sector Capacity. Oxford Review of Economic Policy 36: S256–69. [Google Scholar] [CrossRef]

- Meneguin, Fernando B., and Flavia Ávila. 2019. A economia comportamental aplicada a políticas públicas. In Guia de Economia Comportamental e Experimental, 2nd ed. Edited by Flavia Ávila and Ana Maria Bianchi. Organizadores, Tradução Laura Teixeira Motta. São Paulo: EconomiaComportamental.org, p. 400. ISBN 978-85-5629-000-7. [Google Scholar]

- Moura, Erly Catarina, Juan Cortez-Escalante, Fabrício Vieira Cavalcante, Ivana Cristina De Holanda Cunha Barreto, Mauro Niskier Sanchez, and Leonor Maria Pacheco Santos. 2022. COVID-19: Evolução temporal e imunização nas três ondas epidemiológicas, Brasil, 2020–2022. Revista de Saúde Pública 56: 105. [Google Scholar] [CrossRef]

- Muangmee, Chaiyawit, Sebastian Kot, Nusanee Meekaewkunchorn, Nuttapon Kassakorn, and Bilal Khalid. 2021. Factors Determining the Behavioral Intention of Using Food Delivery Apps during COVID-19 Pandemics. Journal of Theoretical and Applied Electronic Commerce Research 16: 1297–310. [Google Scholar] [CrossRef]

- Samson, Alain. 2014. The Behavioral Economics Guide. Available online: https://www.behavioraleconomics.com/be-guide/the-behavioral-economics-guide-2014/ (accessed on 30 December 2022).

- Souza, Tânia Santos Coelho de, and Paulo Augusto Coelho de Souza. 2018. Desenvolvendo projetos para disseminação da cidadania fiscal. In Educação fiscal e cidadania. Porto Alegre: Editora da UFRGS/CEGOV. [Google Scholar]

- Sreelakshmi, C. C., and Sangeetha K. Prathap. 2023. Effect of COVID-19 Health Threat on Consumer’s Perceived Value towards Mobile Payments in India: A Means-End Model. Journal of Financial Services Marketing. [Google Scholar] [CrossRef]

- Sunstein, Cass, and Richard H. Thaler. 2019. Nudge: Como tomar melhores decisões sobre saúde, dinheiro e felicidade. Rio de Janeiro: Objetiva. [Google Scholar]

- Tandon, Anushree, Puneet Kaur, Yogesh Bhatt, Matti Mäntymäki, and Amandeep Dhir. 2021. Why Do People Purchase from Food Delivery Apps? A Consumer Value Perspective. Journal of Retailing and Consumer Services 63: 102667. [Google Scholar] [CrossRef]

- Thaler, Richard H. 1999. Mental accounting matters. Journal of Behavioral Decision Making 12: 183–206. [Google Scholar] [CrossRef]

- Tonetto, Jorge Luis, Adelar Fochezatto, and Giovanni Padilha da Silva. 2023. Refund of Consumption Tax to Low-Income People: Impact Assessment Using Difference-in-Differences. Economies 11: 153. [Google Scholar] [CrossRef]

- Tversky, Amos, and Daniel Kahneman. 1974. Judgment under Uncertainty: Heuristics and Biases. Science 185: 1124–31. Available online: http://www.jstor.org/stable/1738360 (accessed on 15 August 2023). [CrossRef]

- Tversky, Amos, and Daniel Kahneman. 1991. Loss Aversion in Riskless Choice: A Reference-Dependent Model. The Quarterly Journal of Economics 106: 1039–61. [Google Scholar] [CrossRef]

- Vaishya, Raju, Mohd Javaid, Ibrahim Haleem Khan, and Abid Haleem. 2020. Artificial Intelligence (AI) Applications for COVID-19 Pandemic. Diabetes & Metabolic Syndrome: Clinical Research & Reviews 14: 337–39. [Google Scholar] [CrossRef]

- Varian, Hal R. 2010. Intermediate Microeconomics: A Modern Approuch, 8th ed.New York and London: W.W. Northon & Company. [Google Scholar]

- Vasco, J. Gabriel. 2002. Testes de Alteração de Estrutura em Modelos Multivariados: Uma Visita Guiada pela Literatura. Notas Econômicas. Número 16. Faculdade de Economia da Universidade de Coimbra. Available online: https://digitalis-dsp.uc.pt/bitstream/10316.2/24973/1/NotasEconomicas16_artigo2.pdf?ln=pt-pt (accessed on 14 March 2023).

- Zhou, Sophia L., Xianhan Jia, Samuel P. Skinner, William Yang, and Isabelle Claude. 2021. Lessons on Mobile Apps for COVID-19 from China. Journal of Safety Science and Resilience 2: 40–49. [Google Scholar] [CrossRef]

- Zolkepli, Izzal Asnira, Sharifah Nadiah Syed Mukhiar, and Chekfoung Tan. 2021. Mobile Consumer Behaviour on Apps Usage: The Effects of Perceived Values, Rating, and Cost. Journal of Marketing Communications 27: 571–93. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).