Effects of Investment Experience on the Stock Investment Task: The Mediating Role of Risk Perception

Abstract

1. Introduction

1.1. Two Contrasting Views on Whether Investment Behavior Is Influenced by Investment Experience

1.2. The Laboratory-Based Gambling Tasks: The Balloon Analogy Risk Task

1.3. The Relationship among Initial Experience, Risk Perception and Risk-Taking Behavior

2. The Current Study

2.1. Hypothesis Development

2.2. Simulating the Stock Market Using SIT Paradigm Based on the BART Paradigm

3. Method and Materials

3.1. Participants

3.2. Stock Investment Task

3.3. Stock Risk Probability Assessment Task

3.4. Procedure

3.5. Data Analysis

4. Results

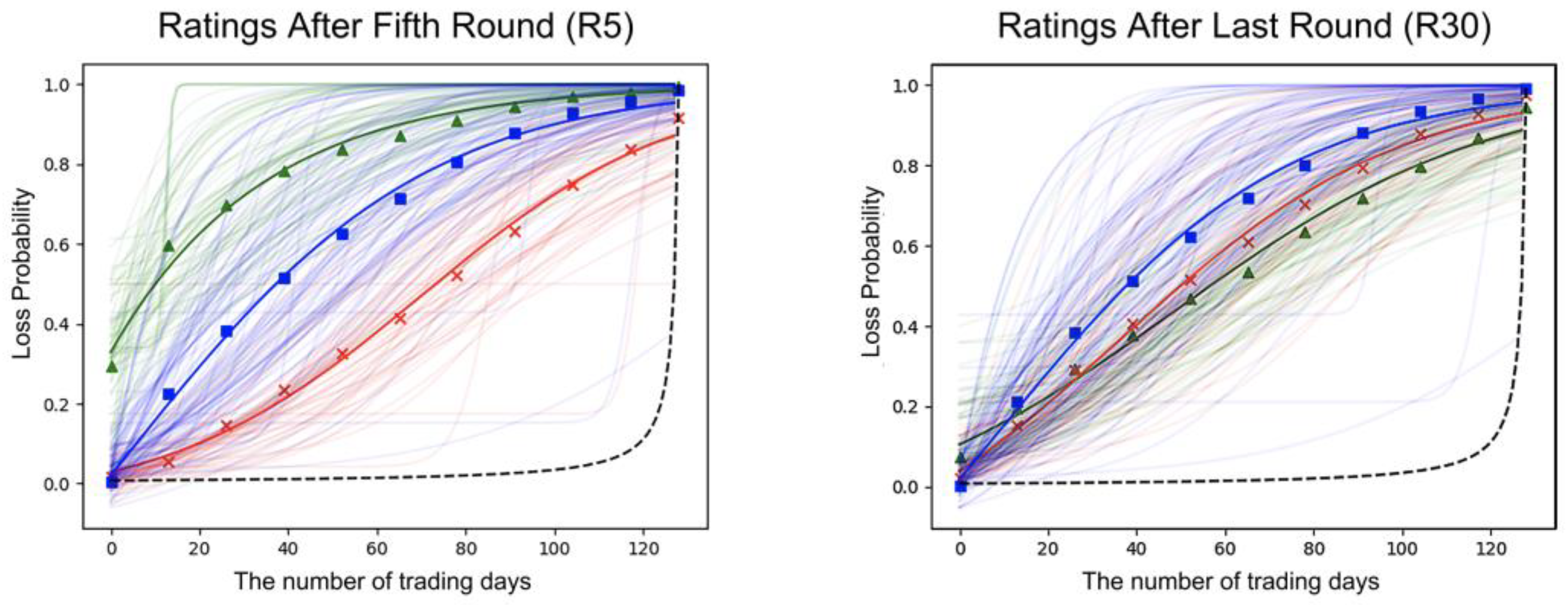

4.1. Psychometric Curve

4.2. Mediating Mechanisms

5. Discussion

5.1. The Continuity of Risk Perception of Novice Investors

5.2. Self-Corrected Risk Perception in Repeated and Dynamic Decisions of Novice Investors

5.3. Limitations and Future Research

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Capelle, B.G. Curbing the Growth of Stock Trading? Order-to-Trade Ratios and Financial Transaction Taxes. J. Int. Financ. Mark. Inst. Mon. 2017, 49, 48–73. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, Z.; Dang, Y. Illiquidity and the Risk of Stock Market Crash. Am. J. Ind. Bus. Manag. 2020, 10, 421–431. [Google Scholar] [CrossRef]

- Tan, S.T.; Chen, Y.Y. Do Individual Investors Learn from Their Trading Experience? J. Financ. Res. 2012, 5, 164–178. [Google Scholar] [CrossRef]

- Shefrin, H. Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing. Oup. Cata. 2007, 78, 99–101. [Google Scholar] [CrossRef]

- Doukas, J.A.; Petmezas, D. Acquisitions, Overconfident Managers and Self-attribution Bias. Eur. Financ. Manag. 2010, 13, 531–577. [Google Scholar] [CrossRef]

- Bianchi, F.; Ilut, C.; Schneider, M. Uncertainty shocks, asset supply and pricing over the business cycle. CEPR Dis. Pap. 2017, 85, 810–854. [Google Scholar] [CrossRef]

- Busch, P.; Obernberger, S. Actual Share Repurchases, Price Efficiency, and the Information Content of Stock Prices. Rev. Financ. Stud. 2017, 30, 324–362. [Google Scholar] [CrossRef]

- Schlottmann, F.; Seese, D. Modern Heuristics for Finance Problems: A Survey of Selected Methods and Applications. Birk. Bos. 2004, 9, 331–359. [Google Scholar] [CrossRef]

- Nicolosi, G.; Peng, L.; Zhu, N. Do individual investors learn from their trading experience? J. Financ. Mark. 2009, 12, 317–336. [Google Scholar] [CrossRef]

- Barber, B.M.; Odean, T. All That Glitters: The Effect of Attention and News on the Buying Behavior of Individual and Institutional Investors. Rev. Financ. Stud. 2008, 2, 785–818. [Google Scholar] [CrossRef]

- Gloede, O.; Menkhoff, L. Financial professionals’ overconfidence: Is it experience, function, or attitude? Eur. Financ. Manag. 2014, 20, 236–269. [Google Scholar] [CrossRef]

- Papapostolou, N.C.; Pouliasis, P.K.; Kyriakou, L. Herd behavior in the dry bulk market: An empirical analysis of the decision to invest in new and retire existing fleet capacity. Transp. Res. E Logist. Transp. Rev. 2017, 104, 36–51. [Google Scholar] [CrossRef]

- Lei, F.; Seasholes, M. Do Investor Sophistication and Trading Experience Eliminate Behavioral Biases in Financial Markets? Rev. Financ. 2005, 9, 305–351. [Google Scholar] [CrossRef]

- Bernard, D.; Cade, N.L.; Hodge, F. Investor Behavior and the Benefits of Direct Stock Ownership. J. Account. Res. 2018, 56, 431–466. [Google Scholar] [CrossRef]

- Jacobs, B.I.; Levy, K.N. The complexity of the stock market. J. Portf. Manag. 1989, 16, 19–27. [Google Scholar] [CrossRef]

- Luo, Y.; Salterio, S.E. The Effect of Gender on Investors’ Judgments and Decision-Making. J. Bus. Ethics 2021, 2, 1–22. [Google Scholar] [CrossRef]

- Bergh, L.A.; Ferreira, S.S.; Dickason, K.Z. Individual Investor Risk Tolerance from a Behavioural Finance Perspective in Gauteng, South Africa. Int. J. Econ. Financ. Issues 2021, 11, 53–65. [Google Scholar] [CrossRef]

- Bird, G.; Du, W.; Willett, T. Behavioral Finance and Efficient Markets: What does the Euro Crisis Tell us? Open Econ. Rev. 2017, 28, 273–295. [Google Scholar] [CrossRef]

- Summers, B.; Duxbury, D.; Hudson, R.; Keasey, K. As time goes by: An investigation of how asset allocation varies with investor age. Econ. Lett. 2006, 91, 210–214. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. The Economic Importance of Financial Literacy: Theory and Evidence. J. Econ. Liter. 2014, 52, 5. [Google Scholar] [CrossRef] [PubMed]

- Mandal, B.N.; Phaujdar, S. An Inventory Model for Deteriorating Items and Stock-dependent Consumption Rate. J. Oper. Res. Soc. 2017, 40, 483–488. [Google Scholar] [CrossRef]

- Ozdagli, A.; Weber, M. Monetary Policy through Production Networks: Evidence from the Stock Market. Soc. Econ. Dyn. 2017, 2, 3424. [Google Scholar] [CrossRef]

- Mcsherry, B.; Wilson, B.K.; Mcandrews, J.J. Net Settlement and Counterparty Risk: Evidence from the Formation of the New York Stock Exchange Clearing House in 1892. J. Money Credit. Bank 2017, 49, 1273–1298. [Google Scholar] [CrossRef]

- Lejuez, C.W.; Read, J.P.; Kahler, C.W.; Richards, J.B.; Ramsey, S.E.; Stuart, G.L.; Strong, D.R.; Brown, R.A. Evaluation of a behavioral measure of risk taking: The Balloon Analogue Risk Task (BART). J. Exp. Psychol. Appl. 2002, 8, 75–84. [Google Scholar] [CrossRef]

- Aklin, W.M.; Lejuez, C.W.; Zvolensky, M.J.; Kahler, C.W.; Gwadz, M. Evaluation of behavioral measures of risk taking propensity with inner city adolescents. Behav. Res. Ther. 2005, 43, 215–228. [Google Scholar] [CrossRef]

- Ferrey, A.E.; Mishra, S. Compensation method affects risk-taking in the Balloon Analogue Risk Task. Personal. Ind. Differ. 2014, 64, 111–114. [Google Scholar] [CrossRef]

- Hopko, D.R.; Lejuez, C.W.; Daughters, S.B.; Aklin, W.M.; Osborne, A.; Simmons, B.L.; Strong, D.R. Construct Validity of the Balloon Analogue Risk Task (BART): Relationship with MDMA Use by Inner-City Drug Users in Residential Treatment. J. Psychopathol. Behav. Assess. 2006, 28, 95–101. [Google Scholar] [CrossRef]

- Benjamin, A.M.; Robbins, S.J. The role of framing effects in performance on the Balloon Analogue Risk Task (BART). Personal. Ind. Differ. 2007, 43, 221–230. [Google Scholar] [CrossRef]

- Koscielniak, M.; Rydzewska, K.; Sedek, G. Effects of and Initial Risk Perception on Balloon Analog Risk Task: The Mediating Role of Processing Speed and Need for Cognitive Closure. Front. Psychol. 2016, 8, 659. [Google Scholar] [CrossRef] [PubMed]

- Shteingart, H.; Neiman, T.; Loewenstein, Y. The Role of First Impression in Operant Learning. Dis. Pap. 2013, 142, 476–488. [Google Scholar] [CrossRef]

- Stone, V.A. A Primacy Effect in Decision-Making by Jurors. J. Commun. 2010, 19, 239–247. [Google Scholar] [CrossRef]

- Walasek, L.; Wright, R.J.; Rakow, T. Ownership Status and the Representation of Assets of Uncertain Value: The Balloon Endowment Risk Task (BERT). J. Behav. Dec. Mak. 2014, 27, 419–432. [Google Scholar] [CrossRef]

- Schonberg, T.; Fox, C.R.; Poldrack, R.A. Mind the gap: Bridging economic and naturalistic risk-taking with cognitive neuroscience. Trends Cogn. Sci. 2011, 15, 11–19. [Google Scholar] [CrossRef] [PubMed]

- Lejuez, C.W.; Aklin, W.; Daughters, S.; Zvolensky, M.; Kahler, C.; Gwadz, M. Reliability and validity of the youth version of the Balloon Analogue Risk Task (BART-Y) in the assessment of risk-taking behavior among inner-city adolescents. J. Clin. Child. Adolesc. Psychol. 2007, 36, 106–111. [Google Scholar] [CrossRef]

- Sang, L.T.; Rasid, M.; Abd, K.; Karamah, A.; Junainah, J.; Raman, N. A serial mediation model of financial knowledge on the intention to invest: The central role of risk perception and attitude. J. Behav. Exp. Financ. 2018, 20, 74–79. [Google Scholar] [CrossRef]

- Kale, S.; Akkaya, M. The relation between confidence climate and stock returns: The case of turkey. Procedia Econ. Financ. 2016, 38, 150–162. [Google Scholar] [CrossRef]

- Abbas, Y.; Martinetti, A.; Moerman, J.J.; Hamberg, T.; Dongen, L. Do you have confidence in how your rolling stock has been maintained? a blockchain-led knowledge-sharing platform for building trust between stakeholders. Int. J. Inf. Manag. 2020, 55, 10. [Google Scholar] [CrossRef]

- Chen, S.S. Lack of consumer confidence and stock returns. J. Empir. Financ. 2011, 18, 225–236. [Google Scholar] [CrossRef]

- Leuchtenberg, W.E.; Speizman, M.D. Franklin D. Roosevelt and the new deal: 1932–1940. Politics Sci. Qua 1963, 51, 47–51. [Google Scholar] [CrossRef]

- Webster, D.M.; Kruglanski, A.W. Individual differences in need for cognitive closure. J. Personal. Soc. Psychol. 1994, 67, 1049–1062. [Google Scholar] [CrossRef]

- Berenbaum, H.; Bredemeier, K.; Thompson, R.J. Intolerance of uncertainty: Exploring its dimensionality and associations with need for cognitive closure, psychopathology, and personality. J. Anxiety Disord. 2008, 22, 117–125. [Google Scholar] [CrossRef]

- Disatnik, D.; Steinhart, Y. Need for Cognitive Closure, Risk Aversion, Uncertainty Changes, and Th. Meta 2015, 58, 473–476. [Google Scholar] [CrossRef]

- Liao, S.G.; Yang, Z.J. The Impact of Short-Selling Mechanism on Stock Price: Evidence from Taiwan Stock Market. J. Financ. 2005, 10, 131–140. [Google Scholar] [CrossRef]

- Xuelian, B.A.; Nan, H.B.; Ling, L.C.; Lu, Z.D. Credit derivatives and stock return synchronicity. J. Financ. Stab. 2017, 28, 79–90. [Google Scholar] [CrossRef]

- Pleskac, T.J. Decision making and learning while taking sequential risks. J. Exp. Psychol. Learn. Mem. Cogn. 2008, 34, 167–185. [Google Scholar] [CrossRef] [PubMed]

- Pleskac, T.J.; Wershbale, A. Making assessments while taking repeated risks: A pattern of multiple response pathways. J. Exp. Psychol. Gen. 2014, 143, 142. [Google Scholar] [CrossRef] [PubMed]

- Wallsten, T.S.; Pleskac, T.J.; Lejuez, C.W. Modeling behavior in a clinically diagnostic sequential risk-taking task. Psychol. Rev. 2005, 112, 862–880. [Google Scholar] [CrossRef]

- Chiu, P.C.; Haight, T.D. Investor learning, earnings signals, and stock returns. Rev. Quant. Financ. Account. 2020, 54, 671–698. [Google Scholar] [CrossRef]

- Han, B.; Hirshleifer, D.; Walden, J. Social Transmission Bias and Investor Behavior. David. Hirshleifer. 2022, 57, 390–412. [Google Scholar] [CrossRef]

- Lejuez, C.W.; Aklin, W.M.; Jones, H.A.; Richards, J.B.; Strong, D.R.; Kahler, C.; Read, J.P. The Balloon Analogue Risk Task (BART) differentiates smokers and nonsmokers. Exp. Clin. Psychopharmaco. 2003, 11, 26. [Google Scholar] [CrossRef]

- Skeel, R.L.; Pilarski, C.; Pytlak, K.; Neudecker, J. Personality and performance-based measures in the prediction of alcohol use. Psychol. Addict. Behav. 2008, 22, 402. [Google Scholar] [CrossRef] [PubMed]

- Binder, S.; Nuscheler, R. Risk-taking in vaccination, surgery, and gambling environments: Evidence from a framed laboratory experiment. Health Econ. 2017, 26, 76–96. [Google Scholar] [CrossRef] [PubMed]

- Qi, W.; Hao, W.; Qing, Z.; Chen, D.F.; Lu, S.; Li, L. The ancient behavioral immune system shapes the medical-seeking behavior in contemporary society. Acta Psychol. Sin. 2022, 54, 931–950. [Google Scholar] [CrossRef]

- Epstein, L.G.; Zin, S.E. Substitution, Risk Aversion, and the Temporal Behavior of Consumption and Asset Returns: An Empirical Analysis. J. Political Econ. 1991, 99, 263–286. [Google Scholar] [CrossRef]

- Ying, Y.; Zhuang, X.T.; Jin, X. Measuring multifractality of stock price fluctuation using multifractal detrended fluctuation analysis. Phys. A Stat. Mech. Appl. 2009, 388, 2189–2197. [Google Scholar] [CrossRef]

- Hayes, A.F. Introduction to mediation, moderation, and conditional process analysis: A regression-based approach. Guilford. Pub. 2022, 3, 77–230. [Google Scholar] [CrossRef]

- Schürmann, O.; Frey, R.; Pleskac, T.J. Mapping risk perceptions in dynamic risk-taking environments. J. Behav. Decis. Mak. 2019, 32, 94–105. [Google Scholar] [CrossRef]

- Johnson, B.B.; Slovic, P. Presenting Uncertainty in Health Risk Assessment: Initial Studies of Its Effects on Risk Perception and Trust. Risk. Anal. 2010, 15, 485–494. [Google Scholar] [CrossRef]

- Jones, R.A.; Ostroy, J.M. Flexibility and Uncertainty. Rev. Econo. Stud. 2015, 51, 13–32. [Google Scholar] [CrossRef]

- Marmer, V.; Slade, M.E. Investment and Uncertainty with Time to Build: Evidence from U.S. Copper Mining. SSRN Electron. J. 2016, 43, 4822–4832. [Google Scholar] [CrossRef]

- Klibanoff, P.; Mukerji, M.S. A Smooth Model of Decision Making under Ambiguity. Econometrica 2005, 73, 1849–1892. [Google Scholar] [CrossRef]

- Staudinger, M.R.; Büchel, C. How initial confirmatory experience potentiates the detrimental influence of bad advice. Neuroimage 2013, 76, 125–133. [Google Scholar] [CrossRef]

- Steiner, J.; Stewart, C.; Matejka, F. Rational Inattention Dynamics: Inertia and Delay in Decision-Making. Econometrica 2016, 85, 521–553. [Google Scholar] [CrossRef]

- Wambsganss, M. Collaborative Decision Making through Dynamic Information Transfer. Air Traffic Control Q. 2016, 4, 111–146. [Google Scholar] [CrossRef]

- Hogarth, R.M. Beyond discrete biases: Functional and dysfunctional aspects of judgmental heuristics. Psychol. Bull. 1981, 90, 197–217. [Google Scholar] [CrossRef]

- Aharoni, Y. The foreign investment decision process. Thunderbird Int. Bus. Rev. 2010, 8, 13–14. [Google Scholar] [CrossRef]

- Atkins, P.; Wood, R.E.; Rutgers, P.J. The effects of feedback format on dynamic decision making. Organ. Behav. Hum. Decis. Process. 2002, 88, 587–604. [Google Scholar] [CrossRef]

- Wright, A.L.; Zammuto, R.F.; Liesch, P.W.; Middleton, S.; Hibbert, P.; Burke, J.; Brazil, V. Evidence-based Management in Practice: Opening up the Decision Process, Decision-maker and Context. Br. J. Manag. 2016, 27, 161–178. [Google Scholar] [CrossRef]

- Carlin, B.I.; Manso, G. Obfuscation, Learning, and the Evolution of Investor Sophistication. Rev. Finan. Stud. 2011, 24, 754–785. [Google Scholar] [CrossRef]

- Loerwald, D.; Stemmann, A. Behavioral Finance and Financial Literacy: Educational Implications of Biases in Financial Decision Making; Springer: Singapore, 2016; pp. 25–38. [Google Scholar] [CrossRef]

- Mccann, C.; Qin, C.; Yan, M. How Widespread and Predictable is Stock Broker Misconduct? Soc. Sci. Electron. Pub. 2016, 26, 6–25. [Google Scholar] [CrossRef]

- Sanfey, A.G. Social Decision-Making: Insights from Game Theory and Neuroscience. Science 2007, 318, 598–602. [Google Scholar] [CrossRef] [PubMed]

- Ruff, C.C.; Fehr, E. The neurobiology of rewards and values in social decision making. Nat. Rev. Neurosci. 2014, 15, 549–562. [Google Scholar] [CrossRef]

- Batteux, E.; Ferguson, E.; Tunney, R.J. Risk preferences in surrogate decision making. Exp. Psychol. 2017, 64, 290–297. [Google Scholar] [CrossRef]

- Hu, X.; Meng, W.; Zhou, X.H. A Theoretical Analysis of Underpricing in IPOs Based on the Irrational Behavior of Investors. J. Chongqing Univ. Nat. Sci. Ed. CQU 2007, 30, 138–143. [Google Scholar] [CrossRef]

- Fukunaga, R.; Brown, J.W.; Bogg, T. Decision making in the Balloon Analogue Risk Task (BART): Anterior cingulate cortex signals loss aversion but not the infrequency of risky choices. Cogn. Affect. Behav. Neurosci. 2012, 12, 826. [Google Scholar] [CrossRef]

- Walasek, L.; Stewart, N. How to make loss aversion disappear and reverse: Tests of the decision by sampling origin of loss aversion. J. Exp. Psychol. Gen. 2015, 144, 7–11. [Google Scholar] [CrossRef] [PubMed]

- Schittenhelm, C. What is loss aversion? Sci. Am. Mind. 2016, 27, 72–73. [Google Scholar] [CrossRef]

- Brewer, N.T.; Chapman, G.B.; Gibbons, F.X.; Gerrard, M.; McCaul, K.D.; Weinstein, N.D. Meta-analysis of the relationship between risk perception and health behavior: The example of vaccination. Health Psychol. 2007, 26, 136–145. [Google Scholar] [CrossRef] [PubMed]

- Discussion, B.F. Reconciling Efficient Markets with Behavioral Finance: The Adaptive Markets Hypothesis. Soc. Sci. Electron. Pub. 2005, 31, 22–44. [Google Scholar] [CrossRef]

- Shiller, R. From Efficient Market Theory to Behavioral Finance. J. Econ. Perspect. 2003, 17, 83–104. [Google Scholar] [CrossRef]

| Number | Loss Points | Levels of Loss | Flat 1 | Flat 2 | Flat 3 |

|---|---|---|---|---|---|

| 1 | 13/98 | 0.5/0.25 | 10 | 21 | 50 |

| 2 | 12/104 | 0.75/0.25 | 35 | 59 | 100 |

| 3 | 10/100 | 1/0.5 | 4 | 16 | 19 |

| 4 | 5/85 | 1/0.25 | 45 | 48 | 57 |

| 5 | 6/110 | 1/0.25 | 3 | 8 | 11 |

| Path | Effect | SE | 95% CI |

|---|---|---|---|

| Total effect | |||

| HIE→IB | −0.550 *** | 1.73 a | [−11.41, −4.58] |

| LIE→IB | 1.17 *** | 1.88 a | [13.30, 20.70] |

| HIE→LRP | 0.003 | 19.33 | [−37.75, 38.46] |

| LIE→LRP | 0.39 * | 20.95 a | [7.63, 90.22] |

| Specific indirect effect | |||

| HIE→IRP→IB | 0.0004 | 0.84 | [−0.09, 0.14] |

| LIE→IPR→IB | −0.0004 | 0.80 | [−0.11, 0.10] |

| HIE→LRP→IB | 0.04 | 0.62 | [−0.003, 0.16] |

| LIE→LPR→IB | 0.004 | 0.17 | [−0.01, 0.04] |

| HIE→IRP→LRP→IB | −0.04 *** | 0.37 a | [−0.10, −0.004] |

| LIE→IRP→LRP→IB | 0.04 *** | 0.38 a | [0.004, 0.11] |

| Variable | M | SD |

|---|---|---|

| CIE Condition | ||

| μ5 | −9.42 | 114.61 |

| μ30 | −5.52 | 113.96 |

| adj SIT Score | 24.06 | 9.70 |

| Principal | 70.65 | 67.51 |

| Profit | 499.82 | 193.25 |

| HIE condition | ||

| μ5 | −85.20 | 138.13 |

| μ30 | −5.16 | 170.66 |

| adj SIT Score | 16.07 | 9.81 |

| Principal | 56.87 | 23.36 |

| Profit | 390.74 | 137.78 |

| LIE condition | ||

| μ5 | 68.20 | 18.08 |

| μ30 | 43.41 | 23.18 |

| adj SIT Score | 41.06 | 14.20 |

| Principal | 67.28 | 35.62 |

| Profit | 350.86 | 201.82 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Z.; Wu, Q.; Hong, P.; Tian, R. Effects of Investment Experience on the Stock Investment Task: The Mediating Role of Risk Perception. Behav. Sci. 2023, 13, 115. https://doi.org/10.3390/bs13020115

Li Z, Wu Q, Hong P, Tian R. Effects of Investment Experience on the Stock Investment Task: The Mediating Role of Risk Perception. Behavioral Sciences. 2023; 13(2):115. https://doi.org/10.3390/bs13020115

Chicago/Turabian StyleLi, Zewei, Qi Wu, Pengfei Hong, and Runzhi Tian. 2023. "Effects of Investment Experience on the Stock Investment Task: The Mediating Role of Risk Perception" Behavioral Sciences 13, no. 2: 115. https://doi.org/10.3390/bs13020115

APA StyleLi, Z., Wu, Q., Hong, P., & Tian, R. (2023). Effects of Investment Experience on the Stock Investment Task: The Mediating Role of Risk Perception. Behavioral Sciences, 13(2), 115. https://doi.org/10.3390/bs13020115