Abstract

This research aimed to examine the relationship between the barriers to the development of innovation and innovative performance. This is a quantitative, not experimental, cross-sectional research, and the National Survey of Innovation Activities of Ecuador is used. Bivariate Probit regression was used to process the data. The results show empirical evidence that Ecuadorian companies have a great number of barriers to innovation. The main barriers to product innovation and process innovation are as follows: lack of company funds, high costs of innovation, and lack of qualified personnel in the company and the country. In addition product innovation is affected by the lack of market information, and process innovation is affected by the lack of financing from external sources, lack of information on technology, and a market dominated by established companies. The research has theoretical implications because it contributes empirical evidence on the relationship between innovation barriers and innovative performance in developing countries where evidence is scarce. The research has practical implications because it serves as a basis for forming public policies. Business managers and administrators can improve innovative performance by minimizing the impact of the main barriers to innovation.

1. Introduction

In the theories of economic development, technological change and innovation have an important role; thus, in the economic development theory of Schumpeter (Schumpeter 1934), he considers that the fundamental force that causes the processes of transformation of the production and economic system is technological innovation, which can cause decisive transformations in society and in the economy. Meanwhile, the theory of endogenous economic growth (Romer 1994) considers that an improvement in human capital leads to economic growth through new forms of technologies and means of production that can be created.

The long-term growth of a country is related to technological innovation, so there is an endogenous capacity of countries to create technology and growth through knowledge. Therefore, government policies, research and development (R&D) and property laws are necessary factors to develop knowledge and drive innovation in a country (Romer 1994).

Innovation has been explained through the resource-based view of the firm (Penrose 1959; Wernerfelt 1984), which considers that the results that companies obtain are in relation to the various resources and capabilities that they use in their processes, among the various resources. Knowledge is considered the most important resource to achieve innovation in companies (Farooq 2018; Grant 1996), and according to the open innovation paradigm (Chesbrough and Bogers 2014), companies implement external knowledge search strategies to complement internal knowledge to increase the flow of knowledge and its innovative potential.

According to OECD (2018), innovation requires the use of new knowledge or a new combination of existing knowledge and found that there are several types of innovation: product innovation, which is a new or improved good or service; in process innovation implements new processes or significant change processes to existing ones; organizational innovation; and marketing innovation.

Due to the importance of innovation for companies and the development of countries, several studies have examined the different factors that influence the innovative performance of companies, however, very few studies address the study of barriers or obstacles faced by companies to develop innovation, so there is still a gap in the literature on the effect of barriers to developing innovation that they have on companies, especially in developing countries (Pellegrino 2018).

The development of successful innovations in companies depends on a set of factors such as exploring and incorporating new technologies, implementing new innovation-oriented practices, mechanisms for the development of new ideas, and mitigating the effect of the barriers that affect the ability to succeed in innovation (Das et al. 2018), so companies that place importance on managing barriers to innovation are generally among the most innovative (Wilches-Ocampo et al. 2020).

Barriers to innovation are the conditions present in an organization or their environment that hinder the development of innovation (Barrera 2017; Pellegrino 2018). Organizational rigidity and lack of resources become barriers to achieving innovation (Kim and Park 2018). There are three groups of innovation barriers: (a) cost and financing barriers, including lack of internal funds, lack of external financing, and high costs for innovation (D’Este et al. 2012; Pellegrino 2018); (b) knowledge barriers, which includes lack of qualified personnel, lack of information on technology, lack of access to market information, and the difficulty in finding cooperation partners for innovation (D’Este et al. 2012; Pellegrino 2018); and (c) market barriers established by dominant companies and uncertainty barriers regarding the demand of products and services (D’Este et al. 2012; Pellegrino 2018).

In the practice of open innovation, several barriers, restrictions, and limitations to innovation that the company has can be mitigated or reduced because it is not only limited to carrying out R&D activities, but the company also develops collaboration with other organizations, and professionals to be able to access knowledge and skills that they do not have internally (Chesbrough and Bogers 2014).

Many academics have examined the relationship between the effect of the barriers to innovation and the innovative performance of companies. Much of the research on barriers to innovation has found relationship between the firms’ innovation barriers and their innovative performance (Yen et al. 2019). Different explanations have been given regarding these positive connections, including the ability to overcome the obstacles presented by the barriers (Galia and Legros 2004; Mohnen and Röller 2005; Pellegrino 2018). The effects of financial barriers and market barriers are similarly crucial for developing innovation, so companies must direct their attention to all types of barriers as they can limit innovation development (Pellegrino and Savona 2017).

This research aims to examine the relationship between the barriers to the development of innovation and the innovative performance in Ecuadorian companies using the national survey of innovation activities 2015 because the evidence on this relationship generally corresponds to contexts of developed countries, and there is little empirical evidence of this relationship in developing countries that have another context and where the barriers to innovation can affect companies differently. The innovation activities survey of Ecuador is aligned with the Oslo manual (OECD 2018), which includes the guidelines for national innovation surveys that are used mainly in OECD countries.

The article is structured in the following parts: the introduction section that includes the review of the literature, the description of the general characteristics of the economy and companies of Ecuador, and the development of hypotheses. The methodology section includes the research design, the measures of the variables, and the econometric model. In the results sections the descriptive results and the results of the regression used are presented. In the discussion section, the results obtained are discussed with respect to other existing investigations, and in the conclusions section, the conclusions and the theoretical and practical implications of the investigation are presented.

1.1. Barriers to High Cost and Financing

Cost and financing barriers, including lack of internal funds, lack of external financing, and high costs for innovation, and can influence innovations since the company is limited in the expenses required for R&D and to acquire technologies, or, in turn, very expensive innovations can be avoided in the company due to the difficulties of financing and recovering the investment (D’Este et al. 2012; Pellegrino 2018).

Innovation presents economic risks of not recovering the investment when the market does not respond to the commercialization of innovated products (Leiponen 2012; Leiponen and Helfat 2010). This problem increases in developing countries, since they have many financial barriers to find financing for innovation (Zanello et al. 2016). In this way, financial barriers exert a strong negative effect on companies to invest in innovation (Amara et al. 2016; Ghisetti et al. 2017), which mainly impacts the innovation conception stage and affects the probability that companies abandon innovation projects (García-Quevedo et al. 2018).

Some companies that have high innovative capacity have found financial barriers but have managed to overcome these financial barriers and achieve innovation (Hottenrott and Peters 2012). This is explained because the financial resources that are used in expenses for innovation activities provide knowledge and develop capabilities in the company, but innovation can be achieved even with scarce financial resources because it is the product of the combination of several bodies of knowledge that come from R&D and external sources of information (Criscuolo et al. 2018; Laursen and Salter 2006). In these cases, companies have the ability to overcome the obstacles presented by financial barriers (Galia and Legros 2004; Mohnen and Röller 2005; Pellegrino 2018).

Madrid-Guijarro et al. (2009) examined the barriers in Spanish manufacturing small- and medium-sized enterprises (SMEs) in product, process and management innovation with the concept that innovation is doing something new or different, and found that cost and financial barriers are related to product and process innovation but with a different impact on both types of innovation, which limits the competitiveness and utility of the company, they also find that cost barriers have a greater impact on small companies than large companies. In addition, Zhu et al. (2012) examined institution-based barriers to the innovation of SMEs in new technology-based sectors in China with companies that have product, service, and process innovations and found that the companies have limited access to funds, which affects the innovation in these companies.

Demirbas et al. (2011) examined manufacturing SMEs in Turkey from the point of view of the perception and experience of business owners and found that there are barriers of high costs and lack of appropriate sources of financing, which impact the propensity of SME owners to innovate. Barrera (2017) used the 9th National Innovation Survey of Chile 2015 to examine SMEs that develop product, process, organizational, and marketing innovation and found that they have barriers to innovation due to the high costs to develop innovations. Furthermore, Seenaiah and Rath (2017) looked at Indian manufacturing companies with the aim of examining the impact of innovation barriers on innovation activities and found high cost of innovation and a lack of appropriate sources of finance, which affects innovation activities and significantly delays innovation projects in manufacturing companies. Hvolkova et al. (2019) conducted a study in SMEs in Slovakia to determine the impact of innovation barriers on innovation activities, and found that a lack of financing resources was the main barrier for micro and small enterprises, while the cost of innovation was a barrier for medium-sized enterprises. These barriers affected the innovation activities of companies.

1.2. Knowledge Factor Barriers

Knowledge barriers include a lack of qualified personnel, a lack of information on technology, a lack of access to market information, and difficulty in finding cooperation partners for innovation. These restrict the company’s capacity for innovation because innovation comes mainly from the knowledge resource and requires skills to manage knowledge that leads to innovation (D’Este et al. 2012; Pellegrino 2018).

Knowledge is an essential resource to attain innovation (Farooq 2018; Grant 1996). Companies having limitations in internal R&D seek to increase their innovative potential through external cooperation and often encounter barriers in absorbing external knowledge (Thomä 2017). Knowledge barriers in developing countries are associated with a less extensive search for external sources of information (Adeyeye et al. 2018). Innovation comes from combining a new body of knowledge with an old one in the company and the internal knowledge with the external knowledge acquired from their connections with other market players. A company with a lack of qualified personnel, market information, or technological information has limitations in combining knowledge and achieving innovation (Amara et al. 2016).

To manage knowledge, companies require human capital: the know-how, education, and the learning capacity of the staff (Aleknavičiūtė et al. 2016; McGuirk et al. 2015). Human capital provides absorptive capacity, which is the capacity to identify the external knowledge that reaches the company as a result of its interaction with other market actors (González et al. 2016). Cognitive barriers hinder collaborative innovations, especially in the supply chain (Skippari et al. 2017).

Companies receive market information primarily from customers and consumers. Customers provide information about their needs (Pejić Bach et al. 2015) and their experiences with the products (Gu et al. 2016). Cooperation with external market actors such as customers, suppliers, competitors, and consultants allows for an increasing flow of external knowledge to the company (Chang and Taylor 2016; Estrada et al. 2016; Kumar et al. 2017). Cooperation for innovation is a strategic action between organizations that seek reciprocal incentives and benefits (Arranz et al. 2019). The lack of cooperation has a greater impact on SMEs due to their limited human and technological resources and knowledge (Strobel and Kratzer 2017).

Madrid-Guijarro et al. (2009) found barriers to qualified human resources in Spanish SMEs. Similarly, Demirbas et al. (2011) found, in their study conducted in Turkey, that low human resource ratings negatively impact innovation, while Seenaiah and Rath (2017) found a lack of qualified labor in Indian companies. On the other hand, in a study performed in Scotland, Freel (2000), encountered that low-skilled human resources are a significant barrier to innovation. Yen et al. (2019) found that human resources is the main barrier to innovation in Vietnamese SMEs due to the low level of job qualifications. Similarly, Pellegrino (2018) found that Spanish companies had restrictions to innovate due to the qualifications of their staff and that young companies are less affected by the lack of qualified human resources than older firms.

Knowledge factors correspond to technology, impacting the company’s production processes and product improvement (Kumar et al. 2017). The lack of information on technology negatively affects innovative performance since companies do not know the technologies that can improve their processes, such as production, including the production plant and the technologies to develop the product (Kumar et al. 2017).

Stankovska et al. (2016) found that SMEs lack information about technology and, more specifically, about digital channels in the UK. This shortcoming affects companies’ innovative performance, as it prevents firms from progressing or using technology to boost their processes.

1.3. Market Factor Barriers

The lack of resources and the structure of the market are obstacles especially for new companies since this restricts them in knowledge, the required organizational skills, and the experience in the technologies used, while the structure of the market can impose restrictions in the form of competition, company size, and conditions of appropriability of innovations (D’Este et al. 2012). These factors can prevent a company from initiating innovation as well as its deceleration of its innovative process (Pellegrino 2018). Barriers due to market concentration and the risk of not satisfying demand are factors that prevent companies from participating in the development of innovations (D’Este et al. 2012).

Market barriers include markets dominated by established companies and uncertainty in demand for innovative products or services, which are barriers related to the market structure and demand that can mainly affect companies with less experience or companies that operate in saturated markets, which restricts companies to finance and develop innovations due to the difficulties in recovering the innovation investment (Pellegrino 2018).

Barrera (2017), in a study implemented in Chilean SMEs, evidenced a lack of information about the market, and García-Quevedo et al. (2016) found that the uncertainty of the demand and a low product demand alter innovation differently. Barrera (2017) found in Chile that the market is dominated by some established companies, which is an essential restriction for SMEs to develop innovation.

In general, barriers to innovation negatively affect more small companies than large firms due to the difficulties in obtaining funds and financing, the scarce qualified human resources, and the predicaments they face to obtain market information (Barrera 2017). The lack of qualified personnel and the lack of resources for innovation affect older companies more than younger businesses (Barrera 2017).

1.4. General Characteristics of the Economy and Companies of Ecuador

Ecuador is a country in South America, it is a dollarized country dependent on the export of oil and primary products (Ray and Kozameh 2012) with plans for economic growth and substitution of industrial imports through science and technology strategies knowledge-based (Purcell et al. 2017). The directory of companies for the year 2015 was made up of 843,644 companies, and of the 6275 companies that were part of the survey, the participation by sector corresponds to mining and quarrying companies 3.8%, manufacturing 25.8%, service 40%, and trade 30.4% (INEC 2016b). The main manufactures present in the sample correspond to food products, wearing apparel, rubber and plastics products, manufactured metal products, and chemical products. In the mining and quarrying sector, the companies are mainly involved in extraction of metallic ores and extraction of crude oil and natural gas. In the services sector, the companies mainly corresponds to those in building construction, food and beverage services, accommodation services, financial services, and real estate services. Finally, in the trade sector, companies are mainly car and motor trade, wholesale, and retail trade companies.

Ecuador has been selected in this study because it is a developing country and for its economic and business environment at the level of financing, knowledge, and market for the development and commercialization of innovations. At the level of investment, its R&D expenses in 2014 was 0.44% of the GDP (World Bank 2019), which is a low level of investment in R&D compared to developed countries. The educational level of the staff in the sample was is as follows: doctors PhD 0.20%, master’s degree 1.61%, specialist degree 1.45%, staff with completed higher education 19.99%, technological/technical 5.31%, and the rest of the staff with a lower level of education (INEC 2016b). The sizes of the companies in the sample are as follows: small companies 72.41%, medium-sized companies 10.23%, and large companies 17.36% (INEC 2016b). It is a market where SMEs predominate, and in the sample, 17.61% of companies were part of business groups and 6% of companies have located their headquarters outside of Ecuador (INEC 2016b).

1.5. Hypothesis

To propose the hypotheses, the definition of product innovation has been considered as new or improved goods or services of the company (OECD 2018) without distinguishing the degree of novelty of the innovation if it is new for the company or the market national or international (radical innovation). Identically, process innovation is considered as new or improved processes in the company (OECD 2018).

It is considered to examine both product innovation and process invocation because the barriers to innovation can have a different impact on product and process innovation (Madrid-Guijarro et al. 2009), and to achieve product and process innovation, the company requires different knowledge and skills (Ruiz-Pava and Forero-Pineda 2018). It is considered that the size of the company can influence the relationships of the variables due to the fact that larger companies can access a greater number of qualified personnel (Díaz-Díaz and De Saá-Pérez 2014; Gu et al. 2016), and the age of the company in the business can be of influence because older companies can accumulate more knowledge (Lefebvre et al. 2015).

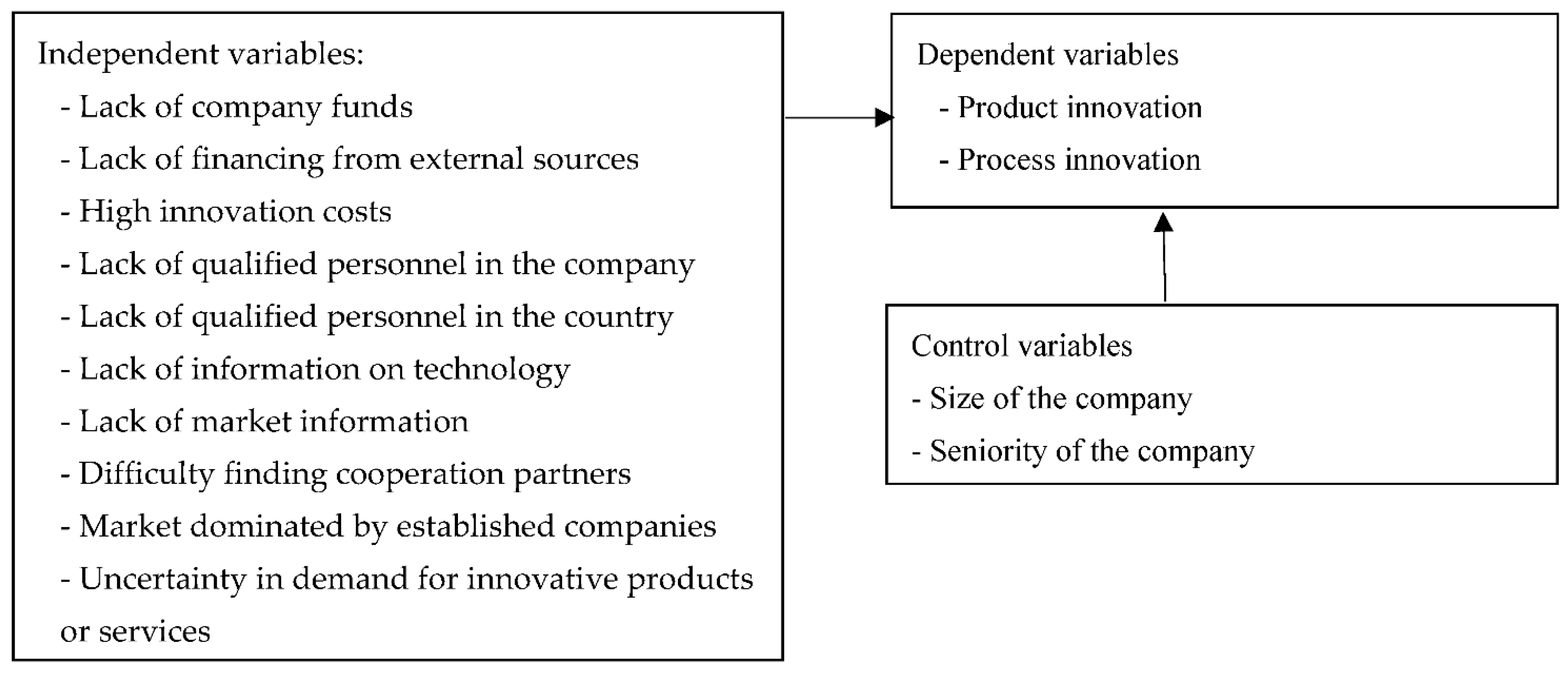

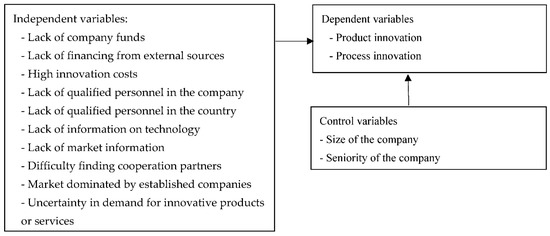

Figure 1 shows the relationship of the variables identified in the literature.

Figure 1.

Relationship of the variables.

Considered that knowledge is the main resource to achieve innovation in companies (Farooq 2018; Grant 1996), and investment in research and development (R&D) allows the company to develop skills and obtain machinery and technologies necessary to achieve innovation in developing countries since, generally in these countries, companies acquire technologies instead of developing them internally (Zanello et al. 2016). Thus, the lack of funds in the company is a limitation to financial innovation. Companies not having funds are limited in carrying out R&D and in developing innovation. Financial barriers exert a strong negative effect on companies in investing in innovation (Amara et al. 2016; Ghisetti et al. 2017). We propose the following hypothesis:

Hypothesis 1 (H1).

The lack of funds in the business is negatively related to product and process innovation in Ecuadorian companies.

Because there are risks in the return on the investment made to develop the innovations (Leiponen 2012; Leiponen and Helfat 2010), external sources of financing such as government agencies and financial institutions play an important role in financing innovation when companies have difficulties in allocating internal funds for innovation (Zhu et al. 2012). The lack of financing from external sources to the company, such as government agencies and financial institutions in a developing country, is a limitation for innovation because the company must seek internal financing and assume the economic risks of innovation. We propose the following hypothesis:

Hypothesis 2 (H2).

The lack of financing from external sources is negatively related to product and process innovation in Ecuadorian companies.

Developing innovation has economic risks (Leiponen 2012; Leiponen and Helfat 2010), and when innovation is expensive, there is a probability of abandoning the innovation (García-Quevedo et al. 2018). In developing countries, companies have less propensity to develop innovation alone and not in collaboration with other companies (Zanello et al. 2016), so these companies assume all the costs of innovation. We propose the following hypothesis:

Hypothesis 3 (H3).

The high innovation costs are negatively related to product and process innovation in Ecuadorian companies.

Knowledge is the primary resource for innovation (Farooq 2018; Grant 1996). Skilled workers provide the company with human capital, which is an essential driver of innovation and provides the absorptive capacity to the company that is necessary to internalize external knowledge in the company (González et al. 2016). Human capital refers to the processes of education, training, and career plans to provide skills and abilities. It is a part of intellectual capital, known as the company’s most relevant intangible asset (Allameh 2018). Developing countries have a shortage of qualified personnel for innovation (Zanello et al. 2016). We propose the following hypothesis:

Hypothesis 4 (H4).

The lack of qualified personnel in the company is negatively related to product and process innovation in Ecuadorian companies.

Human capital is a constraint to innovation and companies perceive that unskilled personnel are a severe obstacle to business activities (Botrić and Božić 2018). Because of this, when companies do not have qualified personnel, they seek to hire them in the country. We propose the following hypothesis:

Hypothesis 5 (H5).

The lack of qualified personnel in the country is negatively related to product and process innovation in Ecuadorian companies.

The lack of information on technological advances limits the company’s knowledge of new technology’s advantages and how to acquire it. So, companies cannot take advantage of technological advances in their processes and R&D to achieve innovation. Technology is defined as the set of knowledge and techniques applied in a logical and orderly way, and knowledge is the primary resource for innovation (Farooq 2018). We propose the following hypothesis:

Hypothesis 6 (H6).

The lack of information on technology is negatively related to product and process innovation in Ecuadorian companies.

When innovation is carried out using market information, the company obtains knowledge about customer needs (Pejić Bach et al. 2015) and their experience with products (Gu et al. 2016). With market information, the company can develop the most appropriate innovation for their customer’s needs. We propose the following hypothesis:

Hypothesis 7 (H7).

The lack of information on the market is negatively related to product and process innovation in Ecuadorian companies.

Internal knowledge and external knowledge are complementary to develop innovation in the company (Rodriguez et al. 2017), so developing innovation with other players’ cooperation, such as suppliers or competitors, is important because they provide knowledge about their clients, the supply chain, and the knowledge base to develop innovation. The difficulty of finding partners to cooperate in innovation limits the company from developing innovation. We propose the following hypothesis:

Hypothesis 8 (H8).

The difficulty in finding cooperation partners is negatively related to product and process innovation in Ecuadorian companies.

Innovation is an activity that has economic risks (Leiponen 2012; Leiponen and Helfat 2010), and when established companies dominate the market, they could prevent a company that auspiciously develops product innovation from being commercially successful with the innovative product. We propose the following hypothesis:

Hypothesis 9 (H9).

The market dominated by established companies is negatively related to product and process innovation in Ecuadorian companies.

Innovation is an activity that has economic risks (Leiponen 2012; Leiponen and Helfat 2010), and the company will try to compensate with the sales of the innovative product. However, given the uncertainty of the demand for an innovative product in the market, the company may limit itself to investing and carrying out R&D, thus limiting innovation. We propose the following hypothesis:

Hypothesis 10 (H10).

The uncertainty in the demand for innovative products or services is negatively related to product and process innovation in Ecuadorian companies this research.

2. Methodology

The design selected is quantitative, cross-sectional, and non-experimental, following criteria for quantitative designs. This research follows a deductive approach as it derives from existing theories. The data used come from the 2015 Ecuadorian National Survey of Innovation Activities, which INEC developed following the Oslo manual criteria. The sample obtained for the national survey of innovation activities was 7055 companies, and once the survey was collected, the valid number of surveys was 6275 companies that belong to the mining and quarrying, manufacturing, services, and construction sectors (INEC 2016a). The sampling method was stratified by province and by economic sector, with a 10% error and a confidence level of 90% (INEC 2016a).

2.1. Measurement of the Variables

Two measures of variables were considered for innovative performance, product innovation, and process innovation. These dependent variables take the value of one if the company has carried out innovation and take the value of zero if the company has not executed innovation. The binary dependent variable as a measure of innovative performance is evidenced in the literature (Demirbas et al. 2011; Leiponen 2012).

The variable barriers to innovation in the survey appear on a 1 to 4 Likert scale, considering how they affect innovation in the company, being 1 = high, 2 = medium, 3 = low, and 4 = not experienced. A binary variable has been generated for each innovation barrier that takes the value of 1 from the scale (1 = high, 2 = medium) and takes the value of 0 from the scale (3 = low and 4 = not experienced) from the 1 to 4 scale recorded in the survey. Each variable of the barriers was converted into a binary variable (1, 0). As evidenced in the literature, the process was followed by authors to alleviate potential measurement errors that might arise from use of a Likert scale (Cohen and Malerba 2001; Laursen and Salter 2006; Leiponen and Helfat 2010).

For the variable size of the company, the number of workers was considered as a measure. This criterion has been used in the literature (Díaz-Díaz and De Saá-Pérez 2014; Gu et al. 2016; Pejić Bach et al. 2015; Robinson and Stubberud 2011). For the variable seniority of the company, the time the company has been in the business was considered a measure (Gu et al. 2016; Lefebvre et al. 2015). Table 1 presents the composition of the variables under study.

Table 1.

Variable composition.

2.2. Econometric Model

The following econometric model is used for the research, considering two measures, product innovation, and process innovation. They will be used for innovative performance:

where:

Y1 = β0 + β1 X1 + β2 X2 + β3 X3 + β4 X4 + β5 X5 + β6 X6 + β7 X7 + β8 X8 + β9 X9 + β10 X10 + β11 X11 + β12 X12 + εi

Y2 = β0 + β1 X1 + β2 X2 + β3 X3 + β4 X4 + β5 X5 + β6 X6 + β7 X7 + β8 X8 + β9 X9 + β10 X10 + β11 X11 + β12 X12 + εi

- Dependent variables:

- Y1 = Product innovation;

- Y2 = Process innovation.

- Independent variables:

- X1 = Lack of funds in the company;

- X2 = Lack of financing from external sources;

- X3 = High innovation costs;

- X4 = Lack of qualified personnel in the company;

- X5 = Lack of qualified personnel in the country;

- X6 = Lack of information on technology;

- X7 = Lack of market information;

- X8 = Difficulty finding partners for cooperation;

- X9 = Market dominated by established companies;

- X10 = Uncertainty in demand for innovative products or services.

- Control variables:

- X11 = Company size;

- X12 = Seniority of the company.

The Bivariate Probit model was selected for processing the data. The Probit model is appropriate because the dependent variables are binary (1, 0). Using the ordinary least squares estimators (OLS) when a binary dependent variable exists is not recommended. The Bivariate Probit model is used because two dependent variables (product innovation and process innovation), which have the same group of independent variables in common and can be correlated, are processed simultaneously. There exists in the literature evidence of the use of the Bivariate Probit model to process the dependent variable product innovation and process innovation (Criscuolo et al. 2018; Gómez et al. 2016; Ruiz-Pava and Forero-Pineda 2018).

3. Results

In the development of this investigation, the reliability was verified with Cronbach’s alpha, obtaining a reliable value of 0.843. When processing the existence of endogeneity, multicollinearity, and heteroscedasticity, we verified the existence of problems. The robustness of the model was validated by using the modern econometric approach. The following considerations were taken into account: (a) In respect to strong non-multicollinearity, the VIF (variance inflation factor) test was used, yielding results of a value less than 10, ruling out multicollinearity problems; (b) the model incorporated robust standard errors to avoid heteroscedasticity problems. The Stata statistical software, which allows obtaining the Bivariate Probit regression with robust errors, was used to process data. The correlations among the variables were also analyzed, verifying that they are less than 0.8. Thus, it was determined that there is no high correlation among the independent variables.

Table 2 shows the descriptive results of the companies that reported having cost and financing innovation barriers. Table 3 shows the descriptive results of the companies identified as having barriers to knowledge factor innovation. Table 4 shows the descriptive results of the companies presenting barriers to market factor innovation. Table 5 shows the results of the Bivariate Probit regression performed with robust errors.

Table 2.

Companies with innovation barriers: Cost and financing factors (Expressed as a percentage of the total number of companies that carried out innovation activities or carried out product or process innovations).

Table 3.

Companies with innovation barriers: Knowledge factors (Expressed as a percentage of the total number of companies that carried out innovation activities or carried out product or process innovations).

Table 4.

Companies with innovation barriers: Market factors (Expressed as a percentage of the total number of companies that carried out innovation activities or carried out product or process innovations).

Table 5.

Regression Results from the Bivariate Probit.

In the following hypotheses are the innovation barriers related to the innovative performance of the company:

H1 Lack of funds in the company, positively related to product and process innovation;

H2 Lack of financing from external sources is negatively related only to process innovation;

H3 High innovation costs are positively related to product and process innovation;

H4 Lack of qualified personnel in the company is positively related to product and process innovation;

H5 Lack of qualified personnel in the country is positively related to product and process innovation;

H6 Lack of information on technology is positively related only to process innovation;

H7 Lack of market information is positively related only to product innovation;

H8 Difficulty in finding partners is negatively related only to process innovation;

H9 Market dominated by established companies is negatively related only to process innovation;

H10 is rejected for both product innovation and process innovation.

In the control variables, it is observed that the size and seniority of the company are positively related to the innovation of products and processes.

The results show that, in Ecuador, there are barriers that are positively related to the innovative performance of companies, which indicates the ability of the company to overcome the obstacles presented by the barriers (Galia and Legros 2004; Mohnen and Röller 2005; Pellegrino 2018), and they are lack of funds in the company, high innovation costs, lack of qualified personnel in the company, and lack of qualified personnel in the country related to product and process innovation. There is also lack of information on technology, which is positively related only to process innovation, and lack of market information, which is positively related only to product innovation.

The results also show that there is a group of barriers that is negatively related to innovative performance. The negative relationship of barriers with innovative performance reduces the company’s innovative potential (Galia and Legros 2004; Mohnen and Röller 2005; Pellegrino 2018), and these barriers are lack of financing from external sources, difficulty in finding partners, and markets dominated by established companies, related to process innovation.

4. Discussion

The results show empirical evidence that Ecuadorian companies have many barriers to innovation in the three types: high-cost innovation and financing barriers, knowledge factor barriers, and market barriers. This result follows Zanello et al. (2016), who mentioned that developing countries have difficulties in financing innovations, lack of qualified personnel, and difficulties in companies for cooperation for innovation.

The positive relationship of the barriers to innovation with innovative performance indicates the ability of the company to overcome the obstacles presented by the barriers (Galia and Legros 2004; Mohnen and Röller 2005; Pellegrino 2018) or that companies have achieved innovation despite the existence of barriers. On the contrary, the negative relationship of barriers with innovative performance reduces the company’s innovative potential (Galia and Legros 2004; Mohnen and Röller 2005; Pellegrino 2018).

Regarding barriers to innovation, the positive relationship that exists between the lack of funds in the company and the high-cost innovation with the innovative performance indicates that the company, despite the reduction in its innovative potential due to these financial barriers, overcomes the obstacles presented by the barriers (Galia and Legros 2004; Mohnen and Röller 2005; Pellegrino 2018). Analyzing the results, it is found that the control variables size and seniority of the company are related to the innovative performance of the company. This is explained because large companies develop the ability to combine internal and external financing, which is crucial to invest in innovation (Nylund et al. 2019); large companies have greater possibilities to increase innovative performance because they have more resources and can accumulate knowledge in greater quantity (Díaz-Díaz and De Saá-Pérez 2014; Gu et al. 2016); and because innovation is achieved mainly by combining several knowledge bodies that include internally acquired knowledge through R&D and external knowledge of information sources (Criscuolo et al. 2018; Laursen and Salter 2006). Although financial barriers restrict R&D and knowledge acquisition, companies acquire the necessary knowledge to innovate. The negative relationship of the lack of funding sources from external sources with innovative performance restricts their investment in innovation and the innovative potential of companies (Amara et al. 2016; Ghisetti et al. 2017).

These financial barriers found in Ecuadorian companies are similar to those identified in other countries as reported by Madrid-Guijarro et al. (2009) in Spanish SMEs, Zhu et al. (2012) in China, Seenaiah and Rath (2017) in India, and Hvolkova et al. (2019) in Slovakia. The results identified that the lack of internal and external financing restricts the company from investing in research and development (R&D). The positive relationship between high innovation cost barriers and innovative performance found in Ecuadorian companies is similar to the results discovered by Demirbas et al. (2011) in Turkey and Barrera (2017) in Chile. These researchers identified high innovation costs as an important barrier to innovation development, consistent with Zanello et al. (2016) companies in developing countries prefer to acquire technology than to develop it internally due to the costs involved and its appropriability. Funding barriers and high innovation costs are the most critical barriers that companies face (Barrera 2017), even more so considering that innovation activity involves risks (Leiponen 2012; Leiponen and Helfat 2010).

Regarding knowledge factor barriers, the lack of qualified personnel limits Ecuadorian companies in human capital and the absorptive capacity that the company has to absorp the external knowledge. The lack of qualified personnel restricts the company in its innovative capacity and, along with financial barriers, is the most important barriers to innovation in Ecuadorian companies.

The positive relationship of the barriers of lack of qualified personnel in the company and the country with the innovative performance found in Ecuadorian companies is similar to results found by other researchers: Madrid-Guijarro et al. (2009), who examined Spanish SMEs; Demirbas et al. (2011) in their study in Turkey; Freel (2000), who examined industrial companies in Scotland; Pellegrino (2018) in Spanish companies; and Yen et al. (2019), who examined Vietnamese companies, found that human resources at a low level of job qualification is the main barrier to innovation that these companies have.

Regarding market factor barriers, the positive relationship between the barrier of lack of market information and product innovation found in Ecuadorian companies is similar to Barrera (2017), who evidenced Chile’s SMEs’ lack of information on the market regarding information that comes from customers or consumers and information about suppliers.

Innovation comes from the knowledge that a company acquires from its R&D activities. Interaction with other market players (Farooq 2018) and the lack of information from customers prevents knowledge from experience with products and consumers’ needs (Pejić Bach et al. 2015), as well as on customers’ emotions regarding products (Christensen et al. 2017), which is important information for product development and innovation success.

The positive relationship of the barrier to lack of information on technology with the innovation of processes found in Ecuadorian companies concurs with Stankovska et al. (2016), they found, in UK SMEs, that the lack of information on technology affects the company’s innovative performance. Technology, especially that used in production plants and the technology that comes from suppliers, is an important source of information (Kumar et al. 2017). When this barrier exists, companies find their innovative potential restricted.

The negative relationship of the barrier of difficulty in finding partners for the process of innovation in Ecuadorian companies causes the firms to decrease their innovative potential because the company is limited in external knowledge that can be used for innovation (Galia and Legros 2004; Mohnen and Röller 2005; Pellegrino 2018). This result parallels the one obtained by Barrera (2017) in Chile, where it is difficult for SMEs to find partners for innovation.

The negative relationship between the barrier market dominated by established companies and the innovation process in Ecuadorian companies causes businesses to decrease their innovative potential due to restrictions in commercializing innovations (Galia and Legros 2004; Mohnen and Röller 2005; Pellegrino 2018). This result is similar to those obtained by Barrera (2017) in Chile, who found that the industry concentration dominated by established companies is an important restriction for SMEs to develop innovation.

Regarding the control variables, both the size and seniority of the company are positively related to the innovation of products and processes. This relationship implies that larger companies can have more knowledge to create innovation due to having more personnel and resources. The same happens with older companies that can compile more knowledge for innovation.

These results on the barriers to innovation in Ecuadorian companies contribute to understand the innovation process because companies in developing countries generally have low innovative potential. The empirical evidence of the barriers contributes to understanding their impact on the innovation process.

5. Conclusions

The main barriers to product and process innovation found in this research on Ecuadorian companies are lack of funds in the company, high costs of innovation, lack of qualified personnel in the company, and lack of qualified personnel in the country. Product innovation, in addition, is affected by the barrier generated by the lack of market information and process innovation. Furthermore, it is affected by the lack of external sources of financing, the lack of information on technology, and the market dominated by established companies.

This study provides empirical evidence, which is scarce in developing countries, on how barriers impact innovation. This research contributes to close the knowledge gap and understand the impact of these barriers on innovation in Ecuadorian companies. The results of this paper are of importance to the academy since the lack of qualified personnel in innovative companies shows the need to design and direct the offer of education and training, especially to the fields of innovative companies, so that firms can develop their innovative potential.

The results also contribute with evidence that high innovation costs, lack of funding and financing for innovation, and lack of qualified personnel are the most critical barriers to innovation. Other barriers found in this research, such as the lack of market and technology information, are also present in the literature. The results of this research differ from those found in the literature in that, in previous studies, especially those carried out in developing countries, companies have few barriers to innovation. In contrast, in Ecuador, many barriers are observed that affect innovation development, and a higher percentage of innovative companies are affected.

The research has practical implications because its results can serve as a basis for forming public policies. Business managers and administrators can improve the innovative performance of their companies by minimizing the impact of the main barriers to innovation in businesses.

One of the limitations of this research is the temporality with which the study was carried out. So, it is recommended to implement studies in other developing countries. In addition, given that the impacts on innovation are seen over time, new longitudinal studies can provide data to endorse this research’s results.

Author Contributions

Conceptualization, O.C.-F.; Data curation, O.C.-F. and M.C.-F.; Formal analysis, O.C.-F. and M.C.-F.; Investigation, O.C.-F. and M.C.-F.; Methodology, O.C.-F.; Project administration, O.C.-F.; Resources, O.C.-F., M.C.-F. and W.C.-F.; Software, O.C.-F.; Supervision, O.C.-F.; Validation, O.C.-F.; Visualization, O.C.-F. and M.C.-F.; Writing—original draft, O.C.-F., M.C.-F. and W.C.-F.; Writing—review & editing, O.C.-F., M.C.-F. and W.C.-F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adeyeye, David, Abiodun Egbetokun, Jacob Opele, Omolayo Oluwatope, and Maruf Sanni. 2018. How barriers influence firms’ search strategies and innovative performance. International Journal of Innovation Management 22: 1850011. [Google Scholar] [CrossRef]

- Aleknavičiūtė, Rasa, Viktorija Skvarciany, and Simona Survilaitė. 2016. The Role of Human Capital for National Innovation Capability in Eu Countries. Economics and Culture 13: 114–25. [Google Scholar] [CrossRef]

- Allameh, Sayyed Mohsen. 2018. Antecedents and consequences of intellectual capital. Journal of Intellectual Capital 19: 858–74. [Google Scholar] [CrossRef]

- Amara, Nabil, Pablo D’Este, Réjean Landry, and David Doloreux. 2016. Impacts of obstacles on innovation patterns in KIBS firms. Journal of Business Research 69: 4065–73. [Google Scholar] [CrossRef]

- Arranz, Nieves, Marta F. Arroyabe, and Juan Carlos Fernandez De Arroyabe. 2019. Obstacles of innovation and institutional support in the cooperation agreements. European Journal of Innovation Management 23: 696–712. [Google Scholar] [CrossRef]

- Barrera, Gustavo. 2017. Relevance of external information and collaboration in Chilean SMEs: Perception of barriers to innovation and intention to innovate. Revista Espacios 38: 14. Available online: https://www.revistaespacios.com/a17v38n21/a17v38n21p14.pdf (accessed on 26 January 2022).

- Botrić, Valerija, and Ljiljana Božić. 2018. Human Capital as Barrier to Innovation: Post-Transition Experience. International Journal of Innovation and Technology Management 15: 1850033. [Google Scholar] [CrossRef]

- Chang, Woojung, and Steven A. Taylor. 2016. The Effectiveness of Customer Participation in New Product Development: A Meta-Analysis. Journal of Marketing 80: 47–64. [Google Scholar] [CrossRef]

- Chesbrough, Henry, and Marcel Bogers. 2014. Explicating Open Innovation: Clarifying an Emerging Paradigm for Understanding Innovation. In New Frontiers in Open Innovation. Edited by Henry Chesbrough, Wim Vanhaverbeke and Joel West. Oxford: Oxford University Press, pp. 3–28. [Google Scholar]

- Christensen, Poul Rind, Kristin Munksgaard, and Anne Louise Bang. 2017. The wicked problems of supplier-driven innovation. Journal of Business & Industrial Marketing 32: 836–47. [Google Scholar] [CrossRef]

- Cohen, Wesley M., and Franco Malerba. 2001. Is the Tendency to Variation a Chief Cause of Progress? Industrial and Corporate Change 10: 587–608. [Google Scholar] [CrossRef]

- Criscuolo, Paola, Keld Laursen, Toke Reichstein, and Ammon Salter. 2018. Winning combinations: Search strategies and innovativeness in the UK. Industry and Innovation 25: 115–43. [Google Scholar] [CrossRef]

- D’Este, Pablo, Simona Iammarino, Maria Savona, and Nick von Tunzelmann. 2012. What hampers innovation? Revealed barriers versus deterring barriers. Research Policy 41: 482–88. [Google Scholar] [CrossRef]

- Das, Patrick, Robert Verburg, Alexander Verbraeck, and Lodewijk Bonebakker. 2018. Barriers to innovation within large financial services firms. European Journal of Innovation Management 21: 96–112. [Google Scholar] [CrossRef]

- Demirbas, Dilek, Javed G. Hussain, and Harry Matlay. 2011. Owner-managers’ perceptions of barriers to innovation: Empirical evidence from Turkish SMEs. Journal of Small Business and Enterprise Development 18: 764–80. [Google Scholar] [CrossRef]

- Díaz-Díaz, Nieves L., and Petra De Saá-Pérez. 2014. The interaction between external and internal knowledge sources: An open innovation view. Journal of Knowledge Management 18: 430–46. [Google Scholar] [CrossRef]

- Estrada, Isabel, Dries Faems, and Pedro de Faria. 2016. Coopetition and product innovation performance: The role of internal knowledge sharing mechanisms and formal knowledge protection mechanisms. Industrial Marketing Management 53: 56–65. [Google Scholar] [CrossRef]

- Farooq, Rayees. 2018. Developing a conceptual framework of knowledge management. International Journal of Innovation Science 11: 139–60. [Google Scholar] [CrossRef]

- Freel, Mark Stephen. 2000. Barriers to Product Innovation in Small Manufacturing Firms. International Small Business Journal: Researching Entrepreneurship 18: 60–80. [Google Scholar] [CrossRef]

- Galia, Fabrice, and Diègo Legros. 2004. Complementarities between obstacles to innovation: Evidence from France. Research Policy 33: 1185–99. [Google Scholar] [CrossRef]

- García-Quevedo, Jose, Agustí Segarra-Blasco, and Mercedes Teruel. 2018. Financial constraints and the failure of innovation projects. Technological Forecasting and Social Change 127: 127–40. [Google Scholar] [CrossRef]

- García-Quevedo, José, Gabriele Pellegrino, and Maria Savona. 2016. Reviving demand-pull perspectives: The effect of demand uncertainty and stagnancy on R&D strategy. Cambridge Journal of Economics 41: 1087–122. [Google Scholar] [CrossRef]

- Ghisetti, Claudia, Susanna Mancinelli, Massimiliano Mazzanti, and Mariangela Zoli. 2017. Financial barriers and environmental innovations: Evidence from EU manufacturing firms. Climate Policy 17: S131–S147. [Google Scholar] [CrossRef]

- Gómez, Jaime, Idana Salazar, and Pilar Vargas. 2016. Sources of Information as Determinants of Product and Process Innovation. PLoS ONE 11: e0152743. [Google Scholar] [CrossRef] [PubMed]

- González, Xulia, Daniel Miles-Touya, and Consuelo Pazó. 2016. R&D, worker training and innovation: Firm-level evidence. Industry and Innovation 23: 694–712. [Google Scholar] [CrossRef]

- Grant, Robert M. 1996. Toward a knowledge-based theory of the firm. Strategic Management Journal 17: 109–22. [Google Scholar] [CrossRef]

- Gu, Qinxuan, Wan Jiang, and Greg G. Wang. 2016. Effects of external and internal sources on innovation performance in Chinese high-tech SMEs: A resource-based perspective. Journal of Engineering and Technology Management 40: 76–86. [Google Scholar] [CrossRef]

- Hottenrott, Hanna, and Bettina Peters. 2012. Innovative Capability and Financing Constraints for Innovation: More Money, More Innovation? The Review of Economics and Statistics 94: 1126–42. [Google Scholar] [CrossRef]

- Hvolkova, Lenka, Ladislav Klement, Vladimira Klementova, and Marcela Kovalova. 2019. Barriers Hindering Innovations in Small and Medium-Sized Enterprises. Journal of Competitiveness 11: 51–67. [Google Scholar] [CrossRef]

- INEC. 2016a. National Survey of Innovation Activities: 2012–2014. Metodología. Available online: http://www.ecuadorencifras.gob.ec/documentos/web-inec/Estadisticas_Economicas/Ciencia_Tecnologia-ACTI/2012-2014/Innovacion/MetodologIa%20INN%202015.pdf (accessed on 26 January 2022).

- INEC. 2016b. Presentation of the Main Innovation Results. Available online: http://www.ecuadorencifras.gob.ec/encuesta-nacional-de-actividades-de-ciencia-tecnologia-e-innovacion-acti/ (accessed on 26 January 2022).

- Kim, Moon Koo, and Jong Hyun Park. 2018. Factors influencing innovation capability of small and medium-sized enterprises in Korean manufacturing sector: Facilitators, barriers and moderators. International Journal of Technology Management 76: 214. [Google Scholar] [CrossRef]

- Kumar, Manoj, Jyoti Raman, and Priya Raman. 2017. A model of the supplier involvement in the product innovation. Yugoslav Journal of Operations Research 27: 61–89. [Google Scholar] [CrossRef]

- Laursen, Keld, and Ammon Salter. 2006. Open for innovation: The role of openness in explaining innovation performance among U.K. manufacturing firms. Strategic Management Journal 27: 131–50. [Google Scholar] [CrossRef]

- Lefebvre, Virginie Marie, Hans De Steur, and Xavier Gellynck. 2015. External sources for innovation in food SMEs. British Food Journal 117: 412–30. [Google Scholar] [CrossRef]

- Leiponen, Aija. 2012. The benefits of R&D and breadth in innovation strategies: A comparison of Finnish service and manufacturing firms. Industrial and Corporate Change 21: 1255–81. [Google Scholar] [CrossRef]

- Leiponen, Aija, and Constance E. Helfat. 2010. Innovation objectives, knowledge sources, and the benefits of breadth. Strategic Management Journal 31: 224–36. [Google Scholar] [CrossRef]

- Madrid-Guijarro, Antonia, Domingo Garcia, and Howard Van Auken. 2009. Barriers to Innovation among Spanish Manufacturing SMEs. Journal of Small Business Management 47: 465–88. [Google Scholar] [CrossRef]

- McGuirk, Helen, Helena Lenihan, and Mark Hart. 2015. Measuring the impact of innovative human capital on small firms’ propensity to innovate. Research Policy 44: 965–76. [Google Scholar] [CrossRef]

- Mohnen, Pierre, and Lars-Hendrik Röller. 2005. Complementarities in innovation policy. European Economic Review 49: 1431–50. [Google Scholar] [CrossRef]

- Nylund, Petra A., Nuria Arimany-Serrat, Xavier Ferras-Hernandez, Eric Viardot, Henry Boateng, and Alexander Brem. 2019. Internal and external financing of innovation. European Journal of Innovation Management 23: 200–13. [Google Scholar] [CrossRef]

- OECD. 2018. Oslo Manual: Guidelines for Collecting, Reporting and Using Data on Innovation, 4th ed. Paris: OECD Publishing. Luxembourg: Eurostat. [Google Scholar]

- Pejić Bach, Mirjana, Andjelko Lojpur, Sanja Pekovic, and Tatjana Stanovčić. 2015. The Influence Of Different Information Sources On Innovation Performance: Evidence From France, The Netherlands And Croatia. South East European Journal of Economics and Business 10: 89–101. [Google Scholar] [CrossRef]

- Pellegrino, Gabriele. 2018. Barriers to innovation in young and mature firms. Journal of Evolutionary Economics 28: 181–206. [Google Scholar] [CrossRef]

- Pellegrino, Gabriele, and Maria Savona. 2017. No money, no honey? Financial versus knowledge and demand constraints on innovation. Research Policy 46: 510–21. [Google Scholar] [CrossRef]

- Penrose, Edith Tilton. 1959. The Theory of the Growth of the Firm. New York: Sharpe. [Google Scholar]

- Purcell, Thomas F., Nora Fernández, and Estefania Martinez. 2017. Rents, knowledge and neo-structuralism: Transforming the productive matrix in Ecuador. Third World Quarterly 38: 918–38. [Google Scholar] [CrossRef]

- Ray, Rebecca, and Sara Kozameh. 2012. Ecuador’s Economy Since 2007. Washington, DC: Center for Economic and Policy Research. Available online: https://www.cepr.net/documents/publications/ecuador-2012-05.pdf (accessed on 26 January 2022).

- Robinson, Sherry, and Hans Anton Stubberud. 2011. Sources of information and cooperation for innovation in Norway. Journal of International Business Research 10: 91. [Google Scholar]

- Rodriguez, Mercedes, David Doloreux, and Richard Shearmur. 2017. Variety in external knowledge sourcing and innovation novelty: Evidence from the KIBS sector in Spain. Technovation 68: 35–43. [Google Scholar] [CrossRef]

- Romer, Paul M. 1994. The Origins of Endogenous Growth. Journal of Economic Perspectives 8: 3–22. Available online: http://www.jstor.org/stable/2138148 (accessed on 26 January 2022). [CrossRef]

- Ruiz-Pava, Guillermo, and Clemente Forero-Pineda. 2018. Internal and external search strategies of innovative firms: The role of the target market. Journal of Knowledge Management 24: 495–518. [Google Scholar] [CrossRef]

- Schumpeter, Joseph. 1934. Rconomic Development Theory. Cambridge: Harvard University. [Google Scholar]

- Seenaiah, Kale, and Badri Narayan Rath. 2017. Obstacles to innovation in selected Indian manufacturing firms. International Journal of Technological Learning, Innovation and Development 9: 379. [Google Scholar] [CrossRef]

- Skippari, Mika, Mikko Laukkanen, and Jari Salo. 2017. Cognitive barriers to collaborative innovation generation in supply chain relationships. Industrial Marketing Management 62: 108–17. [Google Scholar] [CrossRef]

- Stankovska, Ivana, Saso Josimovski, and Chris Edwards. 2016. Digital channels diminish SME barriers: The case of the UK. Economic Research-Ekonomska Istraživanja 29: 217–32. [Google Scholar] [CrossRef]

- Strobel, Natalia, and Jan Kratzer. 2017. Obstacles to Innovation for SMES: Evidence from Germany. International Journal of Innovation Management 21: 1750030. [Google Scholar] [CrossRef]

- Thomä, Jörg. 2017. DUI mode learning and barriers to innovation—A case from Germany. Research Policy 46: 1327–39. [Google Scholar] [CrossRef]

- Wernerfelt, Birger. 1984. A resource-based view of the firm. Strategic Management Journal 5: 171–80. [Google Scholar] [CrossRef]

- Wilches-Ocampo, Ana C., Julia C. Naranjo-Valencia, and Gregorio Calderon-Hernandez. 2020. How the perception of obstacles to innovation affects innovation results: Evidence in a developing country. International Journal of Business Innovation and Research 22: 281. [Google Scholar] [CrossRef]

- World Bank. 2019. Expenditure on Research and Development (% of GDP). Available online: https://datos.bancomundial.org/indicador/GB.XPD.RSDV.GD.ZS (accessed on 26 January 2022).

- Yen, Tran Thi Bach, Le Binh Minh, and Tran Thu Huong. 2019. Analyzing the Barriers to Innovation Development in Emerging Economies: Vietnamese Small and Medium Enterprises (SMEs) as an Empirical Case. Asian Economic and Financial Review 9: 64–77. [Google Scholar] [CrossRef]

- Zanello, Giacomo, Xiaolan Fu, Pierre Mohnen, and Marc Ventresca. 2016. The creation and diffusion of innovation in developing countries: A systematic literature review. Journal of Economic Surveys 30: 884–912. [Google Scholar] [CrossRef]

- Zhu, Yanmei, Xinhua Wittmann, and Mike W. Peng. 2012. Institution-based barriers to innovation in SMEs in China. Asia Pacific Journal of Management 29: 1131–42. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).