China’s Carbon Emissions Trading Market: Current Situation, Impact Assessment, Challenges, and Suggestions

Abstract

1. Introduction

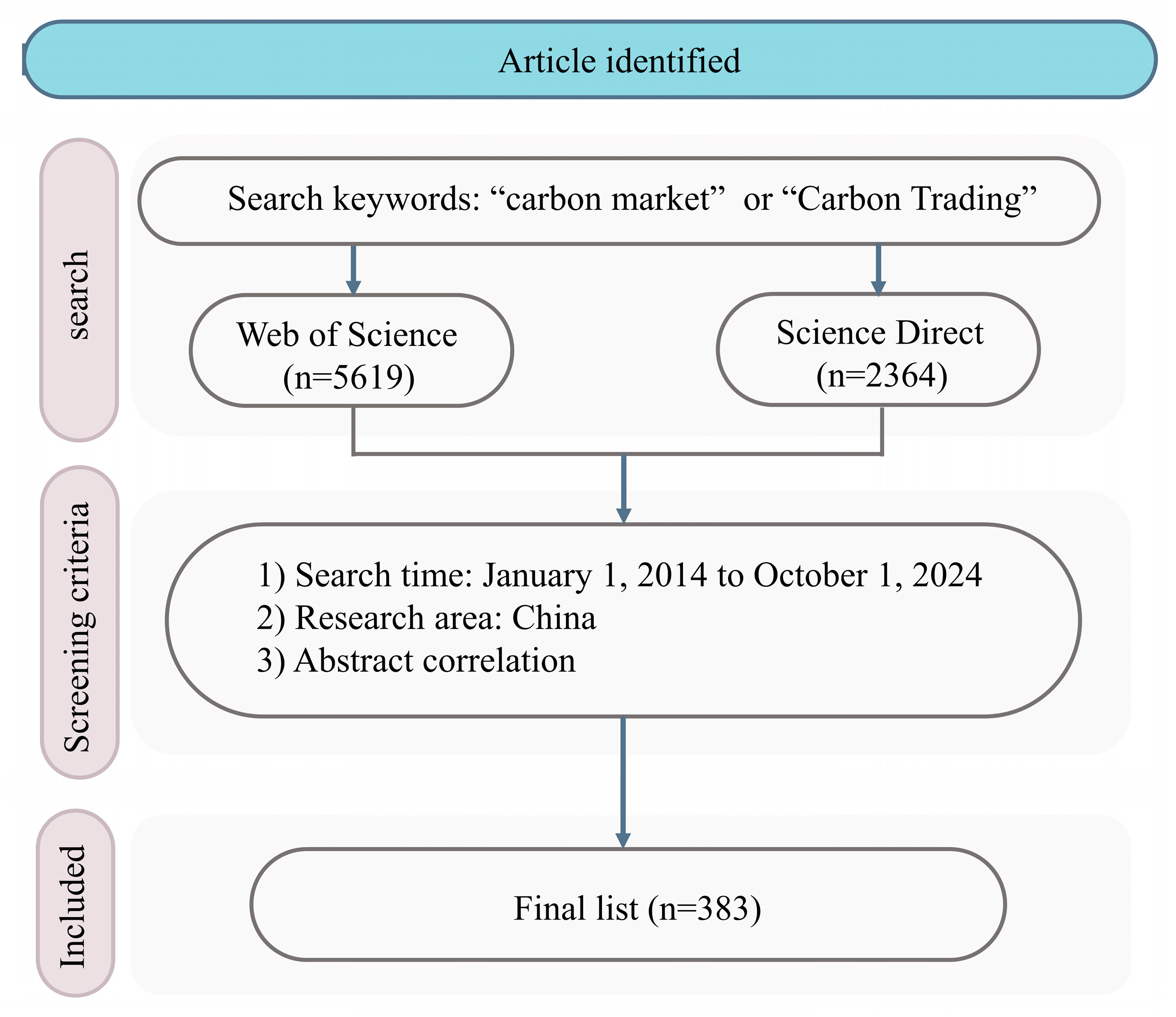

2. Methods

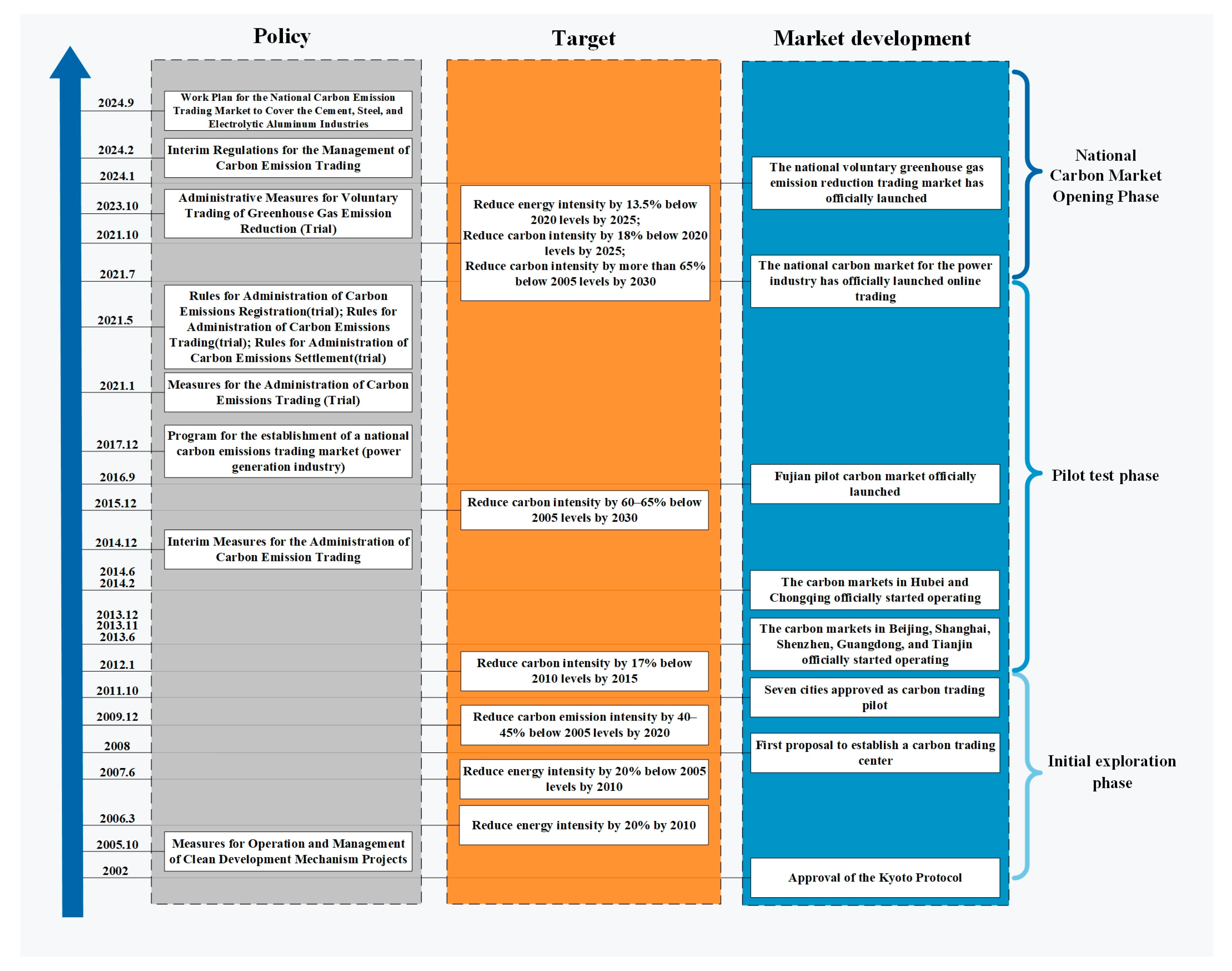

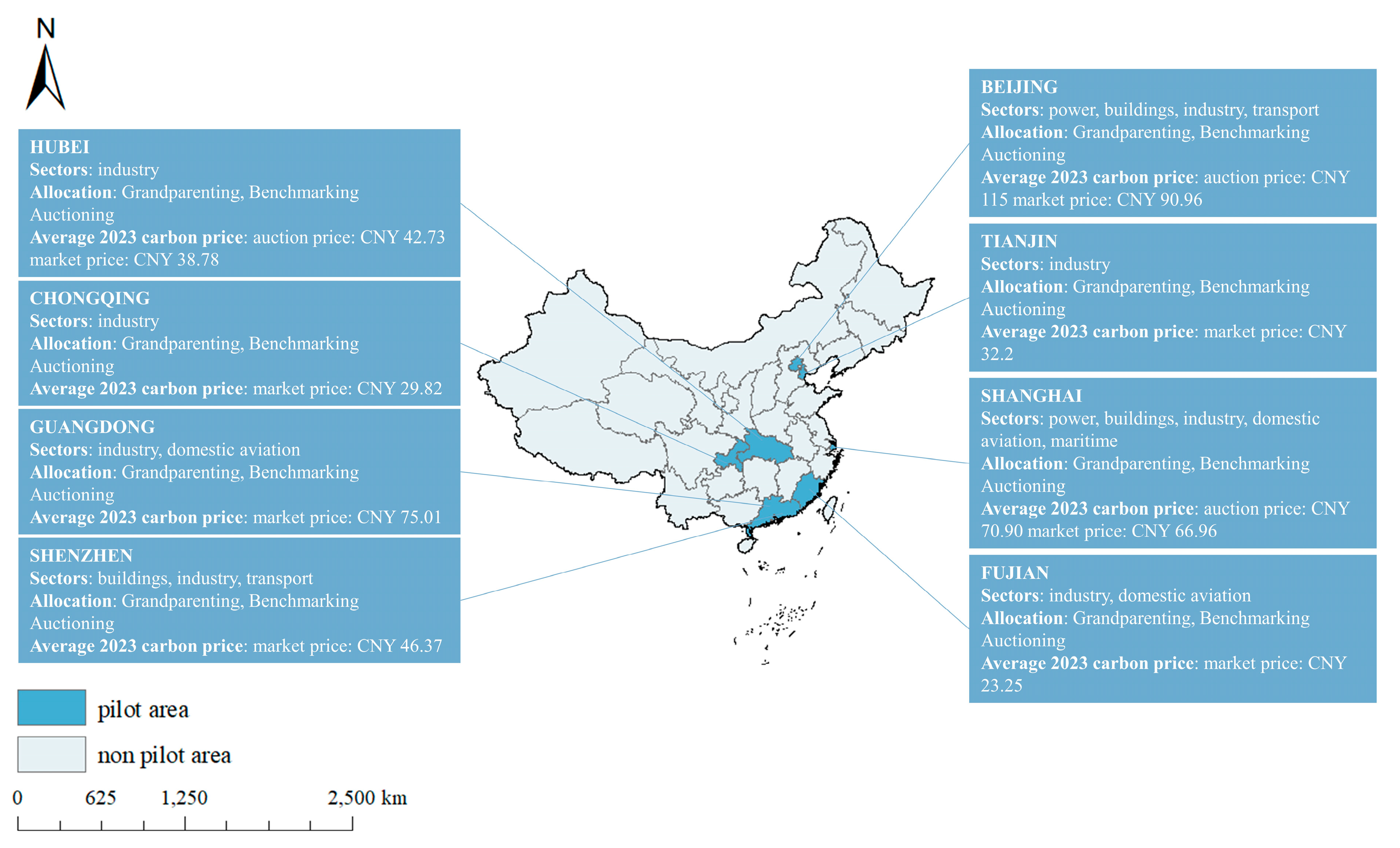

3. Development and Current Situation of the CETM

3.1. Development of the CETM

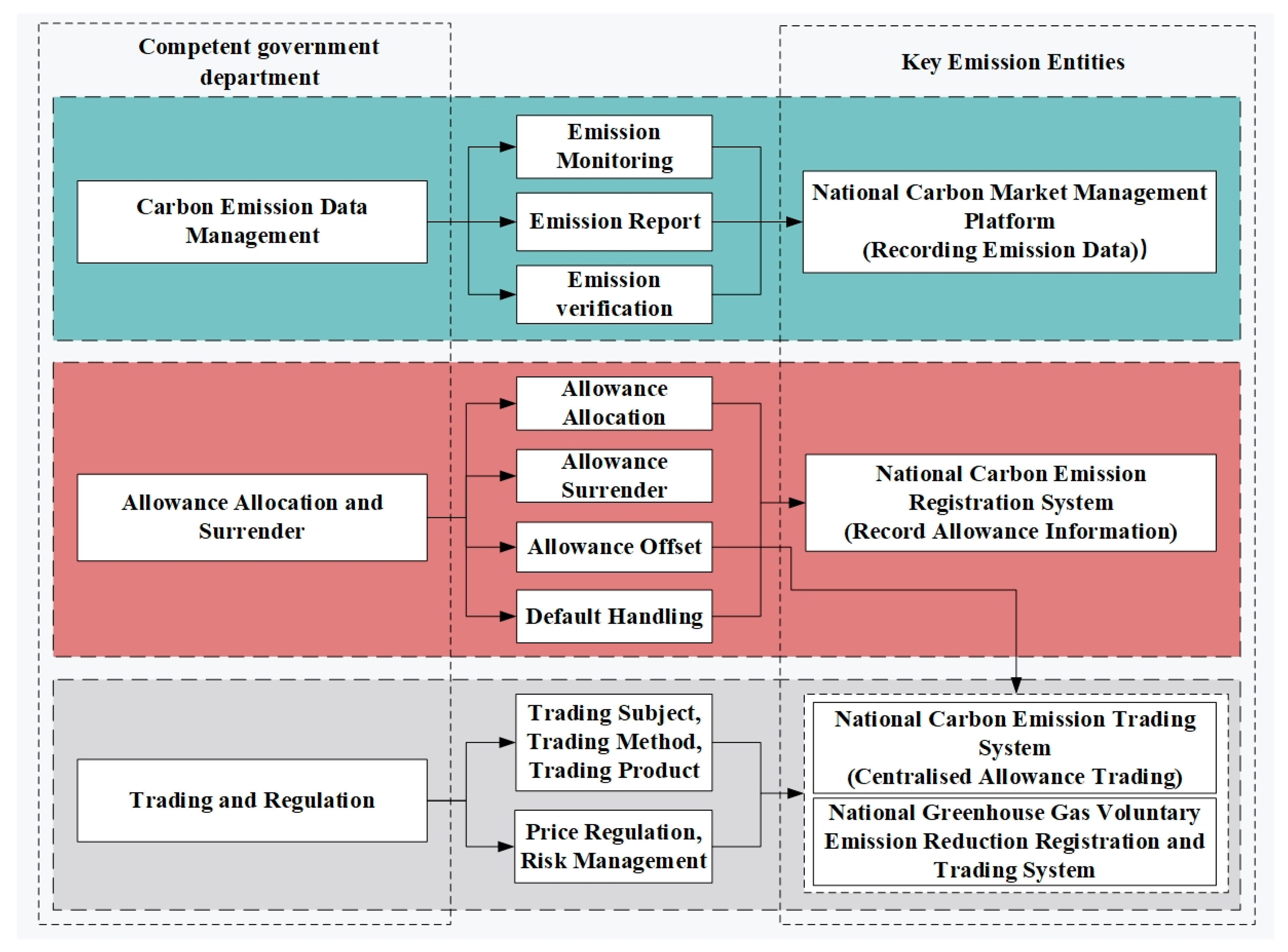

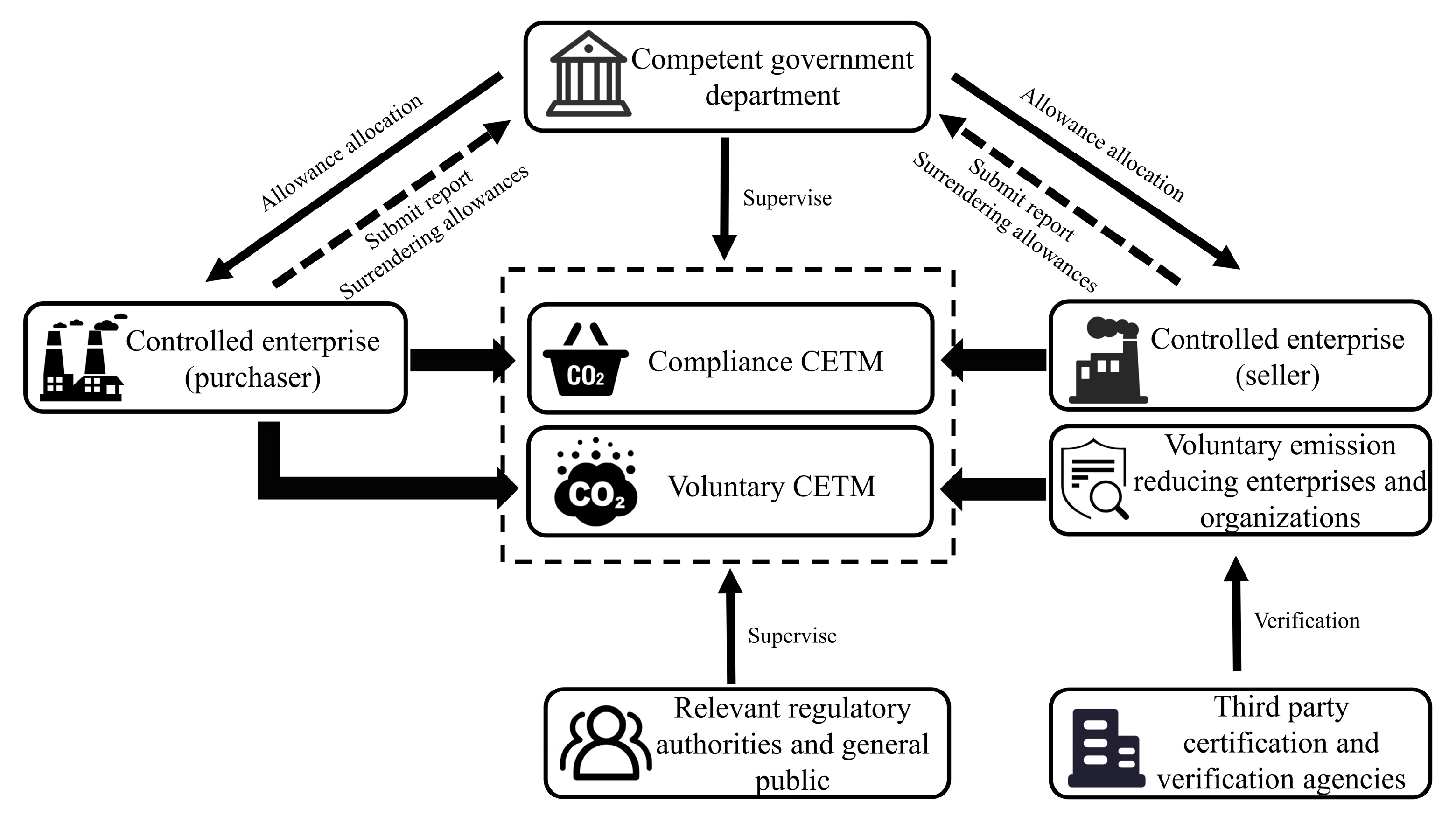

3.2. Current Situation of the CETM

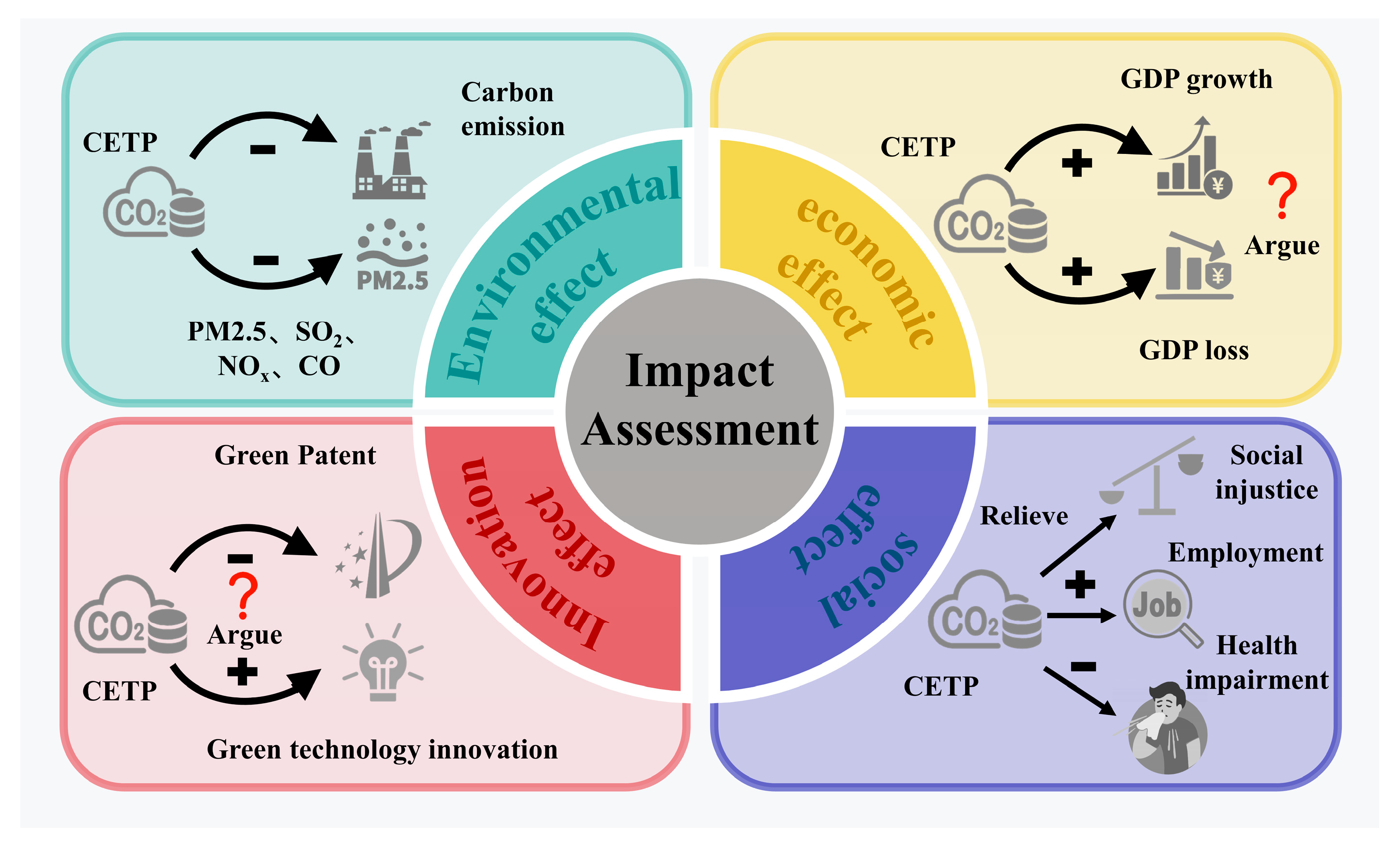

4. Recent Research on CETM Impact Assessment

4.1. Environmental Effects

4.2. Economic Effects

4.3. Innovation Effects

4.4. Social Effects

5. Challenges

5.1. Green Paradox

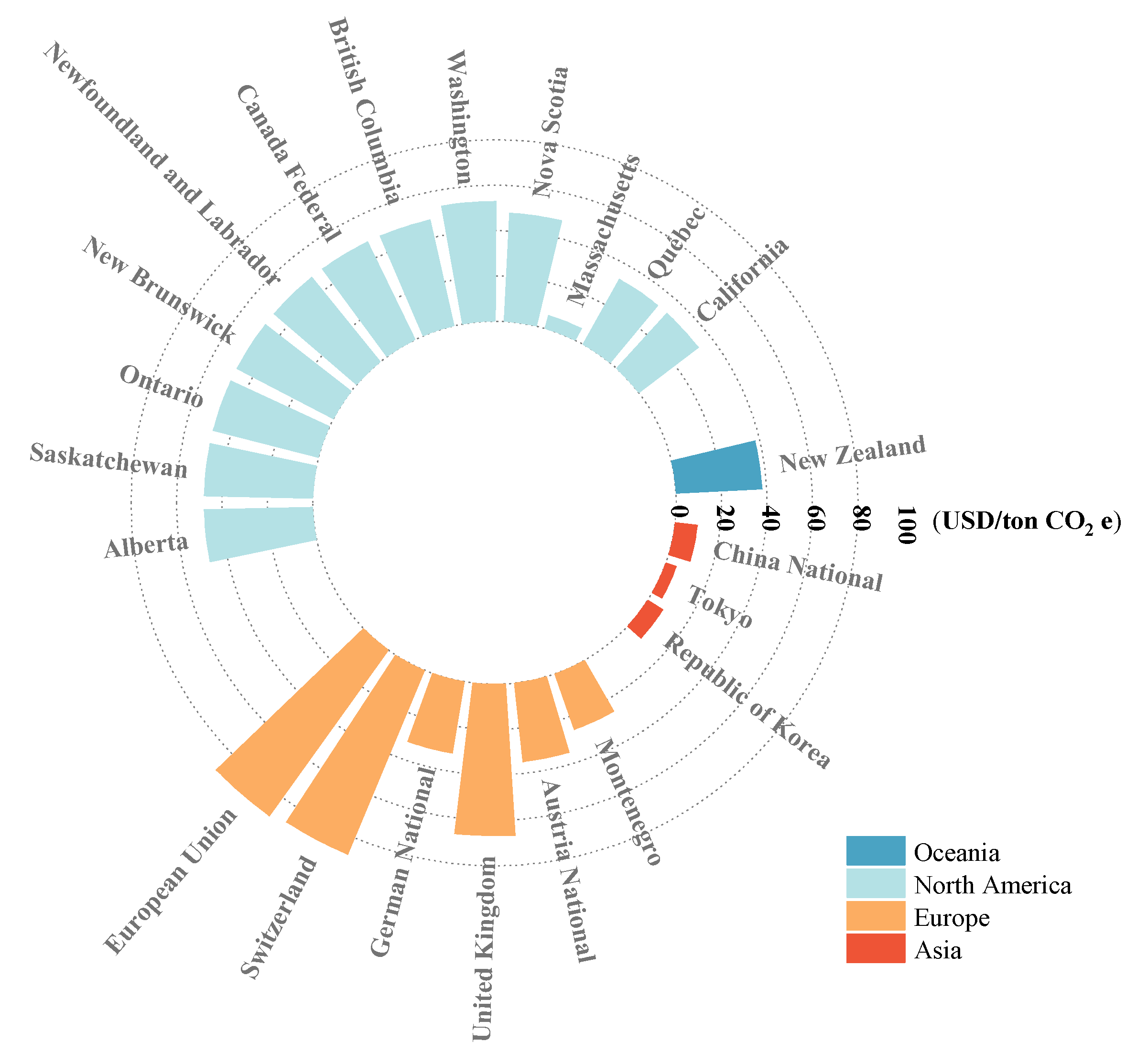

5.2. Low Carbon Prices

5.3. Cap Setting and Quota Allocation

5.4. Coverage

5.5. MRV System, Legal System, and Regulatory System

6. Suggestions for Optimising the CETM

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| CCER | Certified carbon emission reduction |

| CDM | Clean development mechanism |

| CETM | Carbon emissions trading market |

| CETP | Carbon emissions trading policy |

| CGSP | Carbon Generalised System of Preferences |

| ETS | Emissions trading system |

| GDP | Gross domestic product |

| GHG | Greenhouse gas |

| GTFP | Green total factor productivity |

| MEE | The Ministry of Ecology and Environment |

| MRV | Monitoring, reporting, and verification |

| NDRC | National Development and Reform Commission |

References

- Liu, X.; Zhou, X.; Zhu, B.; He, K.; Wang, P. Measuring the maturity of carbon market in China: An entropy-based TOPSIS approach. J. Clean. Prod. 2019, 229, 94–103. [Google Scholar] [CrossRef]

- Yang, Z.; Zhan, J. Examining the multiple impacts of renewable energy development on redefined energy security in China: A panel quantile regression approach. Renew. Energy 2024, 221, 119778. [Google Scholar] [CrossRef]

- Lu, H.; Cheng, Z.; Yao, Z.; Xue, A. Impacts of pilot carbon emission trading policies on urban environmental pollution: Evidence from China. J. Environ. Manag. 2024, 359, 121016. [Google Scholar] [CrossRef] [PubMed]

- Li, K.; Luo, Z.; Hong, L.; Wen, J.; Fang, L. The role of China’s carbon emission trading system in economic decarbonization: Evidence from Chinese prefecture-level cities. Heliyon 2024, 10, e23799. [Google Scholar] [CrossRef]

- Chang, X.; Wu, Z.; Wang, J.; Zhang, X.; Zhou, M.; Yu, T.; Wang, Y. The coupling effect of carbon emission trading and tradable green certificates under electricity marketization in China. Renew. Sustain. Energy Rev. 2023, 187, 113750. [Google Scholar] [CrossRef]

- Crippa, M.; Guizzardi, D.; Pagani, F.; Banja, M.; Muntean, M.; Schaaf, E.; Monforti-Ferrario, F.; Becker, W.; Quadrelli, R.; Risquez Martin, A.; et al. GHG Emissions of all World Countries. 2024. Available online: https://data.europa.eu/doi/10.2760/4002897 (accessed on 23 June 2025).

- Yang, X.; Jiang, P.; Pan, Y. Does China’s carbon emission trading policy have an employment double dividend and a porter effect? Energy Policy 2020, 142, 111492. [Google Scholar] [CrossRef]

- Zhan, J.; Wang, C.; Wang, H.; Zhang, F.; Li, Z. Pathways to achieve carbon emission peak and carbon neutrality by 2060: A case study in the Beijing-Tianjin-Hebei region, China. Renew. Sustain. Energy Rev. 2024, 189, 113955. [Google Scholar] [CrossRef]

- Liu, J.; Xu, F.; Lv, Y. How an emission trading system affects carbon emissions? Evidence from the urban agglomeration in the Middle Reaches of the Yangtze River, China. Ecol. Indic. 2024, 160, 111865. [Google Scholar] [CrossRef]

- Zhong, J.; Zhang, J.; Fu, M. Does the carbon emissions trading pilot policy have a demonstrated impact on advancing low-carbon technology? Evidence from a case study in Beijing, China. Land 2024, 13, 1276. [Google Scholar] [CrossRef]

- ICAP. Emissions Trading Worldwide: Status Report 2024. 2024. Available online: https://icapcarbonaction.com/en/publications/emissions-trading-worldwide-2024-icap-status-report (accessed on 19 December 2024).

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef]

- Yang, S.; Jahanger, A.; Hu, J.; Awan, A. Impact of China’s carbon emissions trading scheme on firm-level pollution abatement and employment: Evidence from a national panel dataset. Energy Econ. 2024, 136, 107744. [Google Scholar] [CrossRef]

- Zhao, L.; Li, Z.; Cheng, L. The impact of China’s carbon emissions trading policy on corporate investment expenditures: Evidence from carbon-intensive industries. J. Environ. Manag. 2024, 366, 121743. [Google Scholar] [CrossRef] [PubMed]

- Yu, D.; Li, J. Evaluating the employment effect of China’s carbon emission trading policy: Based on the perspective of spatial spillover. J. Clean. Prod. 2021, 292, 126052. [Google Scholar] [CrossRef]

- Peng, X.; Jian, W.; Chen, Y.; Ali, S.; Xie, Q. Does the carbon emission trading pilot policy promote green innovation cooperation? Evidence from a quasi-natural experiment in China. Financ. Innov. 2024, 10, 14. [Google Scholar] [CrossRef]

- Yu, H.; Jiang, Y.; Zhang, Z.; Shang, W.; Han, C.; Zhao, Y. The impact of carbon emission trading policy on firms’ green innovation in China. Financ. Innov. 2022, 8, 55. [Google Scholar] [CrossRef]

- Zhao, X.; Jiang, G.; Nie, D.; Chen, H. How to improve the market efficiency of carbon trading: A perspective of China. Renew. Sustain. Energy Rev. 2016, 59, 1229–1245. [Google Scholar] [CrossRef]

- Shi, B.; Li, N.; Gao, Q.; Li, G. Market incentives, carbon quota allocation and carbon emission reduction: Evidence from China’s carbon trading pilot policy. J. Environ. Manag. 2022, 319, 115650. [Google Scholar] [CrossRef]

- State Council. 12th Five-Year Greenhouse Gas Emissions Control Work Program. 2011. Available online: https://www.gov.cn/gongbao/content/2012/content_2049995.htm (accessed on 19 December 2024).

- Guo, B.; Feng, Y.; Hu, F. Have carbon emission trading pilot policy improved urban innovation capacity? Evidence from a quasi-natural experiment in China. Environ. Sci. Pollut. Res. 2024, 31, 10119–10132. [Google Scholar] [CrossRef]

- Li, G.; Niu, M. How does the carbon trading scheme promote the decarbonization of China’s power sector? J. Environ. Plann. Manag. 2024, 68, 1969–1996. [Google Scholar] [CrossRef]

- Yu, Y.; Zhang, X.; Liu, Y.; Zhou, T. Carbon emission trading, carbon efficiency, and the Porter hypothesis: Plant-level evidence from China. Energy 2024, 308, 132870. [Google Scholar] [CrossRef]

- MEE. Responding to Climate Change: China’s Policies and Actions. 2024. Available online: https://www.mee.gov.cn/ywgz/ydqhbh/wsqtkz/202411/t20241106_1093618.shtml (accessed on 19 December 2024).

- MEE. National Carbon Market Information Network. 2024. Available online: https://www.cets.org.cn/ (accessed on 19 December 2024).

- MEE. Report on the First Compliance Cycle of the National Carbon Emission Trading Market. 2023. Available online: https://www.mee.gov.cn/ywgz/ydqhbh/wsqtkz/202301/t20230101_1009228.shtml (accessed on 15 July 2025).

- MEE. Progress Report of China’s National Carbon Market. 2024. Available online: https://www.mee.gov.cn/ywdt/xwfb/202407/t20240722_1082192.shtml (accessed on 19 December 2024).

- MEE. Report on the First Performance Cycle of the National Carbon Emission Trading Market. 2022. Available online: https://www.mee.gov.cn/ywgz/ydqhbh/wsqtkz/ (accessed on 19 December 2024).

- MEE. Total Allowances and Allocation Plan for the National Carbon Emission Trading Power GENERATION industry in 2023 and 2024. 2024. Available online: https://www.gov.cn/zhengce/zhengceku/202410/content_6981938.htm (accessed on 19 December 2024).

- Blanton, A.; Mohan, M.; Galgamuwa, G.A.P.; Watt, M.S.; Montenegro, J.F.; Mills, F.; Carlsen, S.C.H.; Velasquez-Camacho, L.; Bomfim, B.; Pons, J.; et al. The status of forest carbon markets in Latin America. J. Environ. Manag. 2024, 352, 119921. [Google Scholar] [CrossRef] [PubMed]

- MEE. Administrative Measures for Voluntary Trading of Greenhouse Gas Emission Reduction (Trial). 2023. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk02/202310/t20231020_1043694.html (accessed on 19 December 2024).

- MEE. Methodology of Voluntary Greenhouse Gas Emission Reduction Projects. 2023. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk06/202310/t20231024_1043877.html (accessed on 19 December 2024).

- Department of Ecology and Environment of Zhejiang Province. Management Measures for Greenhouse Gas Emission Verification of Key Enterprises (Institutions) in Zhejiang Province (Trial). 2020. Available online: http://sthjt.zj.gov.cn/art/2020/7/31/art_1229116580_1553561.html (accessed on 19 December 2024).

- Guangxi Zhuang Autonomous Region People’s Government. Implementation Plan for Pilot Development and Trading of Forestry Carbon Sequestration in Guangxi. 2023. Available online: http://gxggzy.gxzf.gov.cn/jyfw_zcfg/zcfg_gycq/zcfg_gycq_zzq/t18992580.shtml (accessed on 19 December 2024).

- Heilongjiang Forestry and Grassland Bureau. Management Measures for Trading of Forestry Carbon Sequestration Projects in Heilongjiang Province (Trial). 2024. Available online: https://www.hlj.gov.cn/hljzqc/c100117/202406/c00_31744555.shtml (accessed on 19 December 2024).

- Shenyang Municipal People’s Government. Management Measures for Carbon Emission Trading in Shenyang City. 2021. Available online: https://www.shenyang.gov.cn/zwgk/zcwj/zfwj/szfbgtwj1/202112/t20211201_1699044.html (accessed on 19 December 2024).

- Jilin Provincial Department of Ecology and Environment. Jilin Province Carbon Market Performance Risk Prevention and Control Work Plan. 2024. Available online: https://xxgk.jl.gov.cn/zcbm/fgw_98007/xxgkmlqy/202409/t20240925_8979008.html (accessed on 19 December 2024).

- Cui, J.; Wang, C.; Zhang, J.; Zheng, Y. The effectiveness of China’s regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. USA 2021, 118, e2109912118. [Google Scholar] [CrossRef] [PubMed]

- Lin, B.; Huang, C. Analysis of emission reduction effects of carbon trading: Market mechanism or government intervention? Sustain. Prod. Consum. 2022, 33, 28–37. [Google Scholar] [CrossRef]

- Xuan, D.; Ma, X.; Shang, Y. Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Dong, Z.; Wang, H.; Wang, S.; Wang, L. The validity of carbon emission trading policies: Evidence from a quasi-natural experiment in China. Adv. Clim. Change Res. 2020, 11, 102–109. [Google Scholar] [CrossRef]

- Chen, S.; Shi, A.; Wang, X. Carbon emission curbing effects and influencing mechanisms of China’s Emission Trading Scheme: The mediating roles of technique effect, composition effect and allocation effect. J. Clean. Prod. 2020, 264, 121700. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. What will China’s carbon emission trading market affect with only electricity sector involvement? A CGE based study. Energy Econ. 2019, 78, 301–311. [Google Scholar] [CrossRef]

- Wu, R.; Tan, Z.; Lin, B. Does carbon emission trading scheme really improve the CO2 emission efficiency? Evidence from China’s iron and steel industry. Energy 2023, 277, 127743. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, S.; Luo, T.; Gao, J. The effect of emission trading policy on carbon emission reduction: Evidence from an integrated study of pilot regions in China. J. Clean. Prod. 2020, 265, 121843. [Google Scholar] [CrossRef]

- Tan, R.; Lin, B. The long term effects of carbon trading markets in China: Evidence from energy intensive industries. Sci. Total Environ. 2022, 806, 150311. [Google Scholar] [CrossRef]

- Peng, H.; Qi, S.; Cui, J. The environmental and economic effects of the carbon emissions trading scheme in China: The role of alternative allowance allocation. Sustain. Prod. Consum. 2021, 28, 105–115. [Google Scholar] [CrossRef]

- Liu, Q.; Yin, Y. Strategies for Emission Reduction in Construction: The Role of China’s Carbon Trading Market. J. Knowl. Econ. 2024. [CrossRef]

- Gao, Y.; Li, M.; Xue, J.; Liu, Y. Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ. 2020, 90, 104872. [Google Scholar] [CrossRef]

- Yang, Z.; Yuan, Y.; Zhang, Q. Carbon Emission Trading Scheme, Carbon Emissions Reduction and Spatial Spillover Effects: Quasi-Experimental Evidence From China. Front. Environ. Sci. 2022, 9, 824298. [Google Scholar] [CrossRef]

- Cheng, X.; Yu, Z.; Gao, J.; Liu, Y.; Jiang, S. Governance effects of pollution reduction and carbon mitigation of carbon emission trading policy in China. Environ. Res. 2024, 252, 119074. [Google Scholar] [CrossRef]

- Liu, J.; Woodward, R.T.; Zhang, Y. Has carbon emissions trading reduced PM2.5 in China? Environ. Sci. Technol. 2021, 55, 6631–6643. [Google Scholar] [CrossRef]

- Almond, D.; Zhang, S. Carbon-trading pilot programs in China and local air quality. Aea Pap. Proc. 2021, 111, 391–395. [Google Scholar] [CrossRef]

- Weng, Z.; Liu, T.; Wu, Y.; Cheng, C. Air quality improvement effect and future contributions of carbon trading pilot programs in China. Energy Policy 2022, 170, 113264. [Google Scholar] [CrossRef]

- Xian, B.; Wang, Y.; Xu, Y.; Wang, J.; Li, X. Assessment of the co-benefits of China’s carbon trading policy on carbon emissions reduction and air pollution control in multiple sectors. Econ. Anal. Policy 2024, 81, 1322–1335. [Google Scholar] [CrossRef]

- Sun, Y.; Liao, W. Resource-exhausted city transition to continue industrial development. China Econ. Rev. 2021, 67, 101623. [Google Scholar] [CrossRef]

- Fu, X. Impacts of the pilot policy for carbon emissions trading on pollution reduction in China. J. Clean. Prod. 2024, 468, 142878. [Google Scholar] [CrossRef]

- Yan, Y.; Zhang, X.; Zhang, J.; Li, K. Emissions trading system (ETS) implementation and its collaborative governance effects on air pollution: The China story. Energy Policy 2020, 138, 111282. [Google Scholar] [CrossRef]

- Shao, S.; Cheng, S.; Jia, R. Can low carbon policies achieve collaborative governance of air pollution? Evidence from China’s carbon emissions trading scheme pilot policy. Environ. Impact Assess. Rev. 2023, 103, 107286. [Google Scholar] [CrossRef]

- Zhu, J.; Li, X.; Fan, Y.; Shi, H.; Zhao, L. Effect of carbon market on air pollution: Firm-level evidence in China. Resour. Conserv. Recycl. 2022, 182, 106321. [Google Scholar] [CrossRef]

- Cai, B.; Bo, X.; Zhang, L.; Boyce, J.K.; Zhang, Y.; Lei, Y. Gearing carbon trading towards environmental co-benefits in China: Measurement model and policy implications. Global Environ. Change 2016, 39, 275–284. [Google Scholar] [CrossRef]

- Hübler, M.; Voigt, S.; Löschel, A. Designing an emissions trading scheme for China—An up-to-date climate policy assessment. Energy Policy 2014, 75, 57–72. [Google Scholar] [CrossRef]

- Tang, L.; Wu, J.; Yu, L.; Bao, Q. Carbon emissions trading scheme exploration in China: A multi-agent-based model. Energy Policy 2015, 81, 152–169. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Change 2021, 168, 120744. [Google Scholar] [CrossRef]

- Fan, D.; Chen, S. No pain, no gain? Simulation of carbon reduction potential and socioeconomic effects of voluntary carbon trading in China during 2021–2060. Appl. Energy 2024, 375, 124195. [Google Scholar] [CrossRef]

- Shanxi Provincial People’s Government. Carbon Inclusive Mechanism—“Three Jin Green Life.” 2022. Available online: https://www.jcgov.gov.cn/dtxx/sxyw/202209/t20220925_1672179.shtml (accessed on 19 December 2024).

- Zhang, W.; Li, J.; Li, G.; Guo, S. Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 2020, 196, 117117. [Google Scholar] [CrossRef]

- Zhang, Y.; Liang, T.; Jin, Y.; Shen, B. The impact of carbon trading on economic output and carbon emissions reduction in China’s industrial sectors. Appl. Energy 2020, 260, 114290. [Google Scholar] [CrossRef]

- Wang, P.; Dai, H.; Ren, S.; Zhao, D.; Masui, T. Achieving Copenhagen target through carbon emission trading: Economic impacts assessment in Guangdong Province of China. Energy 2015, 79, 212–227. [Google Scholar] [CrossRef]

- Wu, R.; Dai, H.; Geng, Y.; Xie, Y.; Masui, T.; Tian, X. Achieving China’s INDC through carbon cap-and-trade: Insights from Shanghai. Appl. Energy 2016, 184, 1114–1122. [Google Scholar] [CrossRef]

- Xian, Y.; Li, N.; Zhao, M. Market potential and the industrial sectors inclusion sequence in China’s national carbon emission trading: From the perspective of maximizing gains. J. Clean. Prod. 2024, 435, 140511. [Google Scholar] [CrossRef]

- Huang, H.; Roland-Holst, D.; Springer, C.; Lin, J.; Cai, W.; Wang, C. Emissions trading systems and social equity: A CGE assessment for China. Appl. Energy 2019, 235, 1254–1265. [Google Scholar] [CrossRef]

- Jing, Z.; Liu, Z.; Wang, T.; Zhang, X. The impact of environmental regulation on green TFP: A quasi-natural experiment based on China’s carbon emissions trading pilot policy. Energy 2024, 306, 132357. [Google Scholar] [CrossRef]

- Zeng, S.; Fu, Q.; Haleem, F.; Shen, Y.; Peng, W.; Ji, M.; Gong, Y.; Xu, Y. China’s carbon trading pilot policy, economic stability, and high-quality economic development. Humanit. Soc. Sci. Commun. 2024, 11, 1107. [Google Scholar] [CrossRef]

- Li, W.; Zhang, Y.; Lu, C. The impact on electric power industry under the implementation of national carbon trading market in China: A dynamic CGE analysis. J. Clean. Prod. 2018, 200, 511–523. [Google Scholar] [CrossRef]

- Gao, M. The impacts of carbon trading policy on China’s low-carbon economy based on county-level perspectives. Energy Policy 2023, 175, 113494. [Google Scholar] [CrossRef]

- Wen, Y.; Hu, P.; Li, J.; Liu, Q.; Shi, L.; Ewing, J.; Ma, Z. Does China’s carbon emissions trading scheme really work? A case study of the hubei pilot. J. Clean. Prod. 2020, 277, 124151. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Stavins, R.N. Dynamic incentives of environmental regulations: The effects of alternative policy instruments on technology diffusion. J. Environ. Econ. Manag. 1995, 29, S43–S63. [Google Scholar] [CrossRef]

- Liu, J.; Liu, X. Effects of carbon emission trading schemes on green technological innovation by industrial enterprises: Evidence from a quasi-natural experiment in China. J. Innov. Knowl. 2023, 8, 100410. [Google Scholar] [CrossRef]

- Wang, C.; Wang, L.; Wang, W.; Xiong, Y.; Du, C. Does carbon emission trading policy promote the corporate technological innovation? Empirical evidence from China’s high-carbon industries. J. Clean. Prod. 2023, 411, 137286. [Google Scholar] [CrossRef]

- Jia, L.; Zhang, X.; Wang, X.; Chen, X.; Xu, X.; Song, M. Impact of carbon emission trading system on green technology innovation of energy enterprises in China. J. Environ. Manag. 2024, 360, 121229. [Google Scholar] [CrossRef] [PubMed]

- Liu, M.; Li, Y. Environmental regulation and green innovation: Evidence from China’s carbon emissions trading policy. Financ. Res. Lett. 2022, 48, 103051. [Google Scholar] [CrossRef]

- Liu, M.; Shan, Y.; Li, Y. Study on the effect of carbon trading regulation on green innovation and heterogeneity analysis from China. Energy Policy 2022, 171, 113290. [Google Scholar] [CrossRef]

- Bai, Y.; Wang, C.; Zeng, M.; Chen, Y.; Wen, H.; Nie, P. Does carbon trading mechanism improve the efficiency of green innovation? Evidence from China. Energy Strategy Rev. 2023, 49, 101170. [Google Scholar] [CrossRef]

- Zhang, H.; Sun, X.; Ahmad, M.; Wang, X. Heterogeneous impacts of carbon emission trading on green innovation: Firm-level in China. Energy Environ. 2023, 35, 3504–3529. [Google Scholar] [CrossRef]

- Wang, X.; Liu, C.; Wen, Z.; Long, R.; He, L. Identifying and analyzing the regional heterogeneity in green innovation effect from China’s pilot carbon emissions trading scheme through a quasi-natural experiment. Comput. Ind. Eng. 2022, 174, 108757. [Google Scholar] [CrossRef]

- Liu, Z.; Sun, H. Assessing the impact of emissions trading scheme on low-carbon technological innovation: Evidence from China. Environ. Impact Assess. Rev. 2021, 89, 106589. [Google Scholar] [CrossRef]

- Zhang, W.; Li, G.; Guo, F. Does carbon emissions trading promote green technology innovation in China? Appl. Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

- Shi, B.; Feng, C.; Qiu, M.; Ekeland, A. Innovation suppression and migration effect: The unintentional consequences of environmental regulation. China Econ. Rev. 2018, 49, 1–23. [Google Scholar] [CrossRef]

- Zhao, X.; Shang, Y.; Ma, X.; Xia, P.; Shahzad, U. Does carbon trading lead to green technology innovation: Recent evidence from chinese companies in resource-based industries. IEEE Trans. Eng. Manag. 2024, 71, 2506–2523. [Google Scholar] [CrossRef]

- Lai, J.; Chen, Y. Innovation spillover effect of the pilot carbon emission trading policy in China. Heliyon 2023, 9, e20062. [Google Scholar] [CrossRef] [PubMed]

- Zhu, J.; Fan, Y.; Deng, X.; Xue, L. Low-carbon innovation induced by emissions trading in China. Nat. Commun. 2019, 10, 4088. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, S.; Shao, X.; He, Y. Policy spillover effect and action mechanism for environmental rights trading on green innovation: Evidence from China’s carbon emissions trading policy. Renew. Sustain. Energy Rev. 2022, 153, 111779. [Google Scholar] [CrossRef]

- Zhang, Z.; Zhang, F.; Ma, C. Does carbon emission trading scheme inhibit corporate executives’ pursuit of excess compensation? Evidence from a quasi-natural experiment in China. Energy Econ. 2024, 139, 107870. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, N.; Wang, S.; Wen, M.; Chen, Z. Will carbon trading reduce spatial inequality? A spatial analysis of 200 cities in China. J. Environ. Manag. 2023, 325, 116402. [Google Scholar] [CrossRef]

- Cong, J.; Xu, T.; Zhang, W.; Liang, D.; Zhao, Y. Creation or crowding out? A “two-eight split” phenomenon in the employment effects of the carbon trading policy in China. J. Clean. Prod. 2023, 415, 137722. [Google Scholar] [CrossRef]

- Hao, Y.; Li, Y.; Shen, Z. Does carbon emission trading contribute to reducing infectious diseases? Evidence from China. Growth Change 2023, 54, 74–100. [Google Scholar] [CrossRef]

- Jia, Z.; Lin, B. Rethinking the choice of carbon tax and carbon trading in China. Technol. Forecast. Soc. Change 2020, 159, 120187. [Google Scholar] [CrossRef]

- Zhang, H.; Zhang, B. The unintended impact of carbon trading of China’s power sector. Energy Policy 2020, 147, 111876. [Google Scholar] [CrossRef]

- Bai, J.; Ma, W.; Wang, Y.; Jiang, J. Political incentives in market-based environmental regulation: Evidence from China’s carbon emissions trading scheme. Heliyon 2024, 10, e25730. [Google Scholar] [CrossRef]

- Ge, X.; Li, Y.; Yang, H. The green paradox of time dimension: From pilot to national carbon emission trading system in China. Environ. Impact Assess. Rev. 2024, 109, 107642. [Google Scholar] [CrossRef]

- Tavares, A.R.; Robaina, M. Drivers of the Green Paradox in Europe: An empirical application. Environ. Sci. Pollut. Res. 2023, 30, 42791–42812. [Google Scholar] [CrossRef] [PubMed]

- Zhou, B.; Zhang, C.; Wang, Q.; Zhou, D. Does emission trading lead to carbon leakage in China? Direction and channel identifications. Renew. Sustain. Energy Rev. 2020, 132, 110090. [Google Scholar] [CrossRef]

- Jiang, J.; Ye, B.; Zeng, Z.; Yang, X.; Sun, Z.; Shao, S.; Feng, K.; Tan, X. Carbon abatement and leakage in China’s regional carbon emission trading. Environ. Sci. Technol. 2024, 58, 17661–17673. [Google Scholar] [CrossRef]

- Feng, H.; Tang, B.; Hu, Y.; Li, C.; Wang, H. Dynamic optimisation of carbon allowance considering inter-provincial energy resources trade for emissions reduction: Case of China southern power grid. J. Clean. Prod. 2024, 471, 143318. [Google Scholar] [CrossRef]

- Pan, X.; Yu, L. Do China’s pilot emissions trading schemes lead to domestic carbon leakage? Perspective from the firm relocation. Energy Econ. 2024, 132, 107334. [Google Scholar] [CrossRef]

- Dai, S.; Qian, Y.; He, W.; Wang, C.; Shi, T. The spatial spillover effect of China’s carbon emissions trading policy on industrial carbon intensity: Evidence from a spatial difference-in-difference method. Struct. Change Econ. Dyn. 2022, 63, 139–149. [Google Scholar] [CrossRef]

- Zhao, Z.; Li, Y.; Su, X. Beggar-thy-neighbor: Carbon leakage within china’s pilot emissions trading schemes. Sustain. Prod. Consum. 2024, 47, 208–221. [Google Scholar] [CrossRef]

- Zhu, J.; Ge, Z.; Wang, J.; Li, X.; Wang, C. Evaluating regional carbon emissions trading in China: Effects, pathways, co-benefits, spillovers, and prospects. Clim. Policy 2022, 22, 918–934. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. What are the main factors affecting carbon price in Emission Trading Scheme? A case study in China. Sci. Total Environ. 2019, 654, 525–534. [Google Scholar] [CrossRef] [PubMed]

- Zeng, S.; Fu, Q.; Yang, D.; Tian, Y.; Yu, Y. The Influencing Factors of the Carbon Trading Price: A Case of China against a “Double Carbon” Background. Sustainability 2023, 15, 2203. [Google Scholar] [CrossRef]

- Ding, L.; Zhang, R.; Zhao, X. Forecasting carbon price in China unified carbon market using a novel hybrid method with three-stage algorithm and long short-term memory neural networks. Energy 2024, 288, 129761. [Google Scholar] [CrossRef]

- Wang, N.; Guo, Z.; Shang, D.; Li, K. Carbon trading price forecasting in digitalization social change era using an explainable machine learning approach: The case of China as emerging country evidence. Technol. Forecast. Soc. Change 2024, 200, 123178. [Google Scholar] [CrossRef]

- Lu, H.; Ma, X.; Huang, K.; Azimi, M. Carbon trading volume and price forecasting in China using multiple machine learning models. J. Clean. Prod. 2020, 249, 119386. [Google Scholar] [CrossRef]

- Huang, Z.; Zhang, W. Forecasting carbon prices in China’s pilot carbon market: A multi-source information approach with conditional generative adversarial networks. J. Environ. Manag. 2024, 359, 120967. [Google Scholar] [CrossRef]

- Shi, H.; Wei, A.; Xu, X.; Zhu, Y.; Hu, H.; Tang, S. A CNN-LSTM based deep learning model with high accuracy and robustness for carbon price forecasting: A case of Shenzhen’s carbon market in China. J. Environ. Manag. 2024, 352, 120131. [Google Scholar] [CrossRef]

- Li, W.; Lu, C. The research on setting a unified interval of carbon price benchmark in the national carbon trading market of China. Appl. Energy 2015, 155, 728–739. [Google Scholar] [CrossRef]

- Tang, L.; Wu, J.; Yu, L.; Bao, Q. Carbon allowance auction design of China’s emissions trading scheme: A multi-agent-based approach. Energy Policy 2017, 102, 30–40. [Google Scholar] [CrossRef]

- Liu, J.; Huang, Y.; Chang, C. Leverage analysis of carbon market price fluctuation in China. J. Clean. Prod. 2020, 245, 118557. [Google Scholar] [CrossRef]

- Su, X.; Chen, M. Can carbon emissions trading systems mitigate carbon distortion? Evidence from China. J. Clean. Prod. 2024, 468, 143071. [Google Scholar] [CrossRef]

- Xu, S.; Xu, Q. Impacts of carbon emissions allowance limitations on carbon price with power generation rights trading in China. J. Clean. Prod. 2024, 470, 143312. [Google Scholar] [CrossRef]

- Li, G.; Niu, M.; Xiao, J.; Wu, J.; Li, J. The rebound effect of decarbonization in China’s power sector under the carbon trading scheme. Energy Policy 2023, 177, 113543. [Google Scholar] [CrossRef]

- Cui, J.; Zhang, J.; Zheng, Y. Carbon Pricing Induces Innovation: Evidence from China’s Regional Carbon Market Pilots. Aea Pap. Proc. 2018, 108, 453–457. [Google Scholar] [CrossRef]

- Lin, S.; Wang, B.; Wu, W.; Qi, S. The potential influence of the carbon market on clean technology innovation in China. Clim. Policy 2018, 18, 71–89. [Google Scholar] [CrossRef]

- Lv, M.; Bai, M. Evaluation of China’s carbon emission trading policy from corporate innovation. Financ. Res. Lett. 2021, 39, 101565. [Google Scholar] [CrossRef]

- Wu, Q.; Wang, Y. How does carbon emission price stimulate enterprises’ total factor productivity? Insights from China’s emission trading scheme pilots. Energy Econ. 2022, 109, 105990. [Google Scholar] [CrossRef]

- Cong, J.; Pei, Y.; Xu, T.; Zhao, Y.; Ren, L.; Schwarz, P.; Zhang, M.; Song, J.; Zhang, W.; Yang, J. How does the carbon market impact the economy-energy-environment system in resource-based regions of China? Empirical evidence from shanxi province. J. Clean. Prod. 2022, 376, 134218. [Google Scholar] [CrossRef]

- Munnings, C.; Morgenstern, R.D.; Wang, Z.; Liu, X. Assessing the design of three carbon trading pilot programs in China. Energy Policy 2016, 96, 688–699. [Google Scholar] [CrossRef]

- Yi, Z.; Wong, G.; Cannon, C.H.; Xu, J.; Beckschäfer, P.; Swetnam, R.D. Can carbon-trading schemes help to protect China’s most diverse forest ecosystems? A case study from Xishuangbanna, Yunnan. Land Use Policy 2014, 38, 646–656. [Google Scholar] [CrossRef]

- Ke, S.; Zhang, Z.; Wang, Y. China’s forest carbon sinks and mitigation potential from carbon sequestration trading perspective. Ecol. Indic. 2023, 148, 110054. [Google Scholar] [CrossRef]

- Jiang, J.; Xie, D.; Ye, B.; Shen, B.; Chen, Z. Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Appl. Energy 2016, 178, 902-17-NaN. [Google Scholar] [CrossRef]

- Tian, H.; Whalley, J. Level Versus Equivalent Intensity Carbon Mitigation Commitments; National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar] [CrossRef]

- Pang, T.; Duan, M. Cap setting and allowance allocation in China’s emissions trading pilot programmes: Special issues and innovative solutions. Clim. Policy 2016, 16, 815–835. [Google Scholar] [CrossRef]

- Jin, Y.; Liu, X.; Chen, X.; Dai, H. Allowance allocation matters in China’s carbon emissions trading system. Energy Econ. 2020, 92, 105012. [Google Scholar] [CrossRef]

- Wang, K.; Zhang, X.; Wei, Y.; Yu, S. Regional allocation of CO2 emissions allowance over provinces in China by 2020. Energy Policy 2013, 54, 214–229. [Google Scholar] [CrossRef]

- Yu, S.; Wei, Y.; Wang, K. Provincial allocation of carbon emission reduction targets in China: An approach based on improved fuzzy cluster and Shapley value decomposition. Energy Policy 2014, 66, 630–644. [Google Scholar] [CrossRef]

- Qin, Q.; Liu, Y.; Li, X.; Li, H. A multi-criteria decision analysis model for carbon emission quota allocation in China’s east coastal areas: Efficiency and equity. J. Clean. Prod. 2017, 168, 410–419. [Google Scholar] [CrossRef]

- Yi, W.; Zou, L.; Guo, J.; Wang, K.; Wei, Y.-M. How can China reach its CO2 intensity reduction targets by 2020? A regional allocation based on equity and development. Energy Policy 2011, 39, 2407–2415. [Google Scholar] [CrossRef]

- Zhang, N.; Wang, S. Can China’s regional carbon market pilots improve power plants’ energy efficiency? Energy Econ. 2024, 129, 107262. [Google Scholar] [CrossRef]

- ICAP. Allocation: How Emissions Allowances Are Distributed. 2023. Available online: https://icapcarbonaction.com/en/publications/allocation-how-emissions-allowances-are-distributed-brief-5 (accessed on 19 December 2024).

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef]

- RGGI. The Regional Greenhouse Gas lnitiative. 2009. Available online: https://www.rggi.org/ (accessed on 15 July 2025).

- EU. Emissions Trading System (EU ETS): Auctioning of Allowances. 2005. Available online: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/auctioning-allowances_en (accessed on 15 July 2025).

- Leining, C.; Rontard, B. Future options for industrial free allocation in the NZ ETS. J. Environ. Plann. Manag. 2021. [Google Scholar] [CrossRef]

- Jiang, N.; Sharp, B.; Sheng, M. New Zealand’s emissions trading scheme. N. Z. Econ. Pap. 2009, 43, 69–79. [Google Scholar] [CrossRef]

- Santikarn, M. Is it feasible to link the European union emissions trading system with the Californian cap-and-trade programme? Hertie Sch. 2014. Available online: https://creativecommons.org/licenses/by-nc-sa/3.0/de (accessed on 19 December 2024).

- Rontard, B.; Hernández, H.R. Political construction of carbon pricing: Experience from New Zealand emissions trading scheme. Environ. Dev. 2022, 43, 100727. [Google Scholar] [CrossRef]

- Cheng, Z.; Yu, X. China’s carbon emissions trading system and energy directed technical change. Environ. Impact Assess. Rev. 2024, 105, 107417. [Google Scholar] [CrossRef]

- Chi, Y.; Zhao, H.; Hu, Y.; Yuan, Y.; Pang, Y. The impact of allocation methods on carbon emission trading under electricity marketization reform in China: A system dynamics analysis. Energy 2022, 259, 125034. [Google Scholar] [CrossRef]

- Liu, L.; Chen, C.; Zhao, Y.; Zhao, E. China’s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Dai, H.; Xie, Y.; Liu, J.; Masui, T. Aligning renewable energy targets with carbon emissions trading to achieve China’s INDCs: A general equilibrium assessment. Renew. Sustain. Energy Rev. 2018, 82, 4121–4131. [Google Scholar] [CrossRef]

- Wang, K.; Wang, Z.; Xian, Y.; Shi, X.; Yu, J.; Feng, K.; Hubacek, K.; Wei, Y.-M. Optimizing the rolling out plan of China’s carbon market. iScience 2023, 26, 105823. [Google Scholar] [CrossRef] [PubMed]

- Wu, J.; Xia, Y.; Voigt, S. Impacts of strategic behavior in regional coalitions under the sectoral expansion of the carbon market in China. Sustain. Sci. 2022, 17, 1767–1779. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Does the different sectoral coverage matter? An analysis of China’s carbon trading market. Energy Policy 2020, 137, 111164. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Why do we suggest small sectoral coverage in China’s carbon trading market? J. Clean. Prod. 2020, 257, 120557. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y.; Jia, Z. Impact of carbon allowance allocation on power industry in China’s carbon trading market: Computable general equilibrium based analysis. Appl. Energy 2018, 229, 814–827. [Google Scholar] [CrossRef]

- MEE. The National Carbon Emission Trading Market Covers the Work Plan of Cement, Steel and Electrolytic Aluminum Industries. 2024. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk06/202409/t20240909_1085452.html (accessed on 19 December 2024).

- United Nations. Kyoto Protocol to the United Nations Framework Convention on Climate Change. 1998. Available online: https://unfccc.int/zh/kyoto_protocol (accessed on 19 December 2024).

- European Commission. EU Emissions Trading System (EU ETS). 2005. Available online: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets_en (accessed on 19 December 2024).

- ICAP. Korea Emissions Trading Scheme. 2015. Available online: https://icapcarbonaction.com/en/ets/korea-emissions-trading-scheme (accessed on 19 December 2024).

- Ministry for the Environment. New Zealand Emissions Trading Scheme. 2008. Available online: https://environment.govt.nz/what-government-is-doing/areas-of-work/climate-change/ets/ (accessed on 19 December 2024).

- Ritchie, H.; Rosado, P.; Roser, M. Greenhouse Gas Emissions, Our World Data. 2024. Available online: https://ourworldindata.org/greenhouse-gas-emissions (accessed on 10 November 2024).

- Dietrich, K.; Mert, E. MRV in Practice Experience in Turkey with Designing and Implementing a System for Monitoring, Reporting and Verification of Ghg Emissions; Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH: Bonn, Germany, 2017; Available online: https://www.giz.de/en/downloads/MRV_in_Practice_Booklet_2017.pdf (accessed on 19 December 2024).

- Deng, Z.; Li, D.; Pang, T.; Duan, M. Effectiveness of pilot carbon emissions trading systems in China. Clim. Policy 2018, 18, 992–1011. [Google Scholar] [CrossRef]

- Jiang, X. The rise of carbon emissions trading in China: A panacea for climate change? Clim. Dev. 2014, 6, 111–121. [Google Scholar] [CrossRef]

- Tang, R.; Guo, W.; Oudenes, M.; Li, P.; Wang, J.; Tang, J.; Wang, L.; Wang, H. Key challenges for the establishment of the monitoring, reporting and verification (MRV) system in China’s national carbon emissions trading market. Clim. Policy 2018, 18, 106–121. [Google Scholar] [CrossRef]

- Wang, P.; Liu, L.; Tan, X.; Liu, Z. Key challenges for China’s carbon emissions trading program. WIREs Clim. Change 2019, 10, e599. [Google Scholar] [CrossRef]

- MEE. Notice on Doing a Good Job in Greenhouse Gas Emission Reporting and Verification for Some Key Industry Enterprises in 2023–2025. 2023. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk06/202310/t20231018_1043427.html (accessed on 19 December 2024).

- NDRC. Notice on Issuing the Second Batch of Greenhouse Gas Emission Accounting Methods and Reporting Guidelines for Four Industry Enterprises (Trial). 2015. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/201502/t20150209_963759.html (accessed on 19 December 2024).

- NDRC. Notice on Issuing the Third Batch of Greenhouse Gas Accounting Methods and Reporting Guidelines for 10 Industry Enterprises (Trial). 2015. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/201511/t20151111_963496.html (accessed on 19 December 2024).

- NDRC. Notice on Issuing the First Batch of 10 Industry Enterprises’ Greenhouse Gas Emission Accounting Methods and Reporting Guidelines (Trial). 2013. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/201311/t20131101_963960.html (accessed on 19 December 2024).

- State Council. Interim Regulations on the Administration of Carbon Emission Trading. 2024. Available online: https://www.mee.gov.cn/zcwj/gwywj/202402/t20240205_1065850.shtml (accessed on 19 December 2024).

- Yang, J.; Luo, P. Review on international comparison of carbon financial market. Green Financ. 2020, 2, 55–74. [Google Scholar] [CrossRef]

- Qian, H.; Ma, R.; Wu, L. Market-based solution in China to finance the clean from the dirty. Fundam. Res. 2024, 4, 324–333. [Google Scholar] [CrossRef] [PubMed]

- Cao, Y.; Kang, Z.; Bai, J.; Cui, Y.; Chang, I.-S.; Wu, J. How to build an efficient blue carbon trading market in China?—A study based on evolutionary game theory. J. Clean. Prod. 2022, 367, 132867. [Google Scholar] [CrossRef]

- Liu, Y.; Tan, B. Consignment auctions revisited. Econom. Lett. 2021, 203, 109847. [Google Scholar] [CrossRef]

- Long, X.; Goulder, L.H. Carbon emission trading systems: A review of systems across the globe and a close look at China’s national approach. China Econ. J. 2023, 16, 203–216. [Google Scholar] [CrossRef]

- Fang, G.; Tian, L.; Liu, M.; Fu, M.; Sun, M. How to optimize the development of carbon trading in China—Enlightenment from evolution rules of the EU carbon price. Appl. Energy 2018, 211, 1039–1049. [Google Scholar] [CrossRef]

- Zhou, D.; Lu, Z.; Qiu, Y. Do carbon emission trading schemes enhance enterprise green innovation efficiency? Evidence from China’s listed firms. J. Clean. Prod. 2023, 414, 137668. [Google Scholar] [CrossRef]

- Xiong, L.; Shen, B.; Qi, S.; Price, L.; Ye, B. The allowance mechanism of China’s carbon trading pilots: A comparative analysis with schemes in EU and California. Appl. Energy 2017, 185, 1849–1859. [Google Scholar] [CrossRef]

| Legal | Structure | Policy |

|---|---|---|

| Interim Regulations for the Management of Carbon Emission Trading | Allowance allocation and surrender | December 2020: 2019–2020 Implementation Plan for National Carbon Emissions Trading Total Allowance Setting and Allocation (Power Generation Industry) |

| December 2020: List of Key Emission Entities to be Included in the National Carbon Emissions Trading Allowances Administration for 2019–2020 | ||

| October 2021: Notice on Allowances Surrender for National Carbon Emissions Trading First Compliance Cycle | ||

| March 2023: Notice on Allowances Allocation of National Carbon Emissions Trading for 2021 and 2022 | ||

| July 2023: Notice on Allowance Surrender of the National Carbon Emissions Trading Market for 2021 and 2022 | ||

| October 2024: Notice on Allowances Allocation and Surrender of National Carbon Emissions Trading for Power Generation Industry in 2023 and 2024 | ||

| Monitoring, reporting, and verification | March 2021: Notice on Strengthening Management of Enterprise Greenhouse Gas Emissions Reporting | |

| March 2022: Notice on Management of Enterprise Greenhouse Gas Emissions Reporting for 2022 | ||

| December 2022: Guidelines for Enterprise Greenhouse Gas Emission Accounting and Reporting-Power Generation Industry | ||

| December 2022: Guidelines for Enterprise Greenhouse Gas emission Verification-Power Generation Industry | ||

| February 2023: Notice on Strengthening Management of Enterprise Greenhouse Gas Emission Reporting in the Power Generation Industry for 2023–2025 | ||

| September 2024: Guidelines for Enterprise Greenhouse Gas Emission Accounting and Reporting | ||

| October 2024: Work Plan for Improving the Carbon Emission Statistical Accounting System | ||

| Registration, trading, and settlement | May 2021: The Rules for Administration of Carbon Emissions Registration (trial) | |

| May 2021: The Rules for Administration of Carbon Emissions Trading (trial) | ||

| May 2021: The Rules for Administration of Carbon Emissions Settlement (trial) | ||

| Administrative Measures for Voluntary Trading of Greenhouse Gas Emission Reduction (Trial) | Design and implementation | November 2023: Guidelines for Voluntary Greenhouse Gas Emission Reduction Project Design and Implementation |

| Registration and enrolment | November 2023: Rules for Voluntary Greenhouse Gas Emission Reduction Registration (Trial) | |

| Verification and trading | November 2023: Rules for Voluntary Greenhouse Gas Emission Reduction Trading and Settlement (Trial) | |

| December 2023: Implementation Rules for Validation of Voluntary Greenhouse Gas Emission Reduction Projects and Verification of Emission Reductions |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Q.; Zhan, J.; Zhang, H.; Cao, Y.; Yang, Z.; Wu, Q.; Otho, A.R. China’s Carbon Emissions Trading Market: Current Situation, Impact Assessment, Challenges, and Suggestions. Land 2025, 14, 1582. https://doi.org/10.3390/land14081582

Wang Q, Zhan J, Zhang H, Cao Y, Yang Z, Wu Q, Otho AR. China’s Carbon Emissions Trading Market: Current Situation, Impact Assessment, Challenges, and Suggestions. Land. 2025; 14(8):1582. https://doi.org/10.3390/land14081582

Chicago/Turabian StyleWang, Qidi, Jinyan Zhan, Hailin Zhang, Yuhan Cao, Zheng Yang, Quanlong Wu, and Ali Raza Otho. 2025. "China’s Carbon Emissions Trading Market: Current Situation, Impact Assessment, Challenges, and Suggestions" Land 14, no. 8: 1582. https://doi.org/10.3390/land14081582

APA StyleWang, Q., Zhan, J., Zhang, H., Cao, Y., Yang, Z., Wu, Q., & Otho, A. R. (2025). China’s Carbon Emissions Trading Market: Current Situation, Impact Assessment, Challenges, and Suggestions. Land, 14(8), 1582. https://doi.org/10.3390/land14081582