Abstract

Based on a comprehensive review of previous studies about the threshold effects of financial development on the process of foreign direct investment (FDI) spillovers, the present work roundly measures the financial development from the aspects of scale, structure, and efficiency and applies a multiple threshold regression model to estimate the threshold effects of financial development on FDI spillovers, and then examines the inherent relationship between FDI spillovers effects and the financial development from the three aspects, respectively, in different regions of China, based on regional panel data from 2000 to 2014. The results revealed that there are two thresholds of financial development scale, structure and efficiency, existing in the FDI spillover processes in different regions. The FDI spillovers effects are greatest in the eastern region and are generally smallest in the western region. There is a negative correlation between FDI spillovers effects and the financial development scale or efficiency in eastern and central region. Moreover, there is positive correlation between FDI spillovers effects and the financial development structure in eastern and central region. Additionally, there is a positive correlation between FDI spillovers effects and the financial development scale, structure, or efficiency in western region. The capital, labor, and regional technology progress have positive effects on economic growth in different regions and the effects of financial development on economic growth are not unanimous in each region. Based on the empirical results, some policies on how to develop regional finances and how to introduce FDI to promote economic growth are recommended.

1. Introduction

Since 2000, a large amount of foreign direct investment (FDI) has flowed into China. According to the World Investment Report 2015, released by the United Nations Trade Development Organization, there were approximate 129 billion dollars of FDI flowing into China in 2014 [1]. China has been the largest country in terms of FDI flows in the world. The amount of actually-utilized FDI has grown rapidly, with an annual growth rate of 13.74% in China, over 2000–2014. However, the amount of actually-utilized FDI has an unbalanced distribution in different regions of China. The amount of actually-utilized FDI reached 181.5 billion dollars in the eastern region, but was only $29.2 billion in the western region in 2014 (China Statistical Yearbook, 2015) [2]. Zhang et al. [3] said that FDI can generate spillovers on economic growth through the acquisition of high technical knowledge [4,5,6,7], competing in markets [6,8,9,10], and human capital flowing freely from foreign capital sectors [11,12,13]. Cohen and Levinthal first noted that the significant positive effect of FDI spillovers on economic growth depended on “absorptive capacity” and its threshold effects [14,15]. Thereafter, the innovation degree, human capital, trade openness, infrastructure, technology gap, and financial development are regarded as the representative variables of absorptive capacity in order to examine the corresponding threshold effects on the FDI spillovers process [16,17,18,19,20]. Among these variables, financial development is revealed to play a key role in the process of FDI spillovers. Additionally, the FDI spillovers on host economy growth might crucially depend on the extent of the development of domestic financial markets [21]. China is made up of several provinces. Every province has different finance levels. Zhang et al. [22] said that the finances of the eastern region are much more developed than those of the western region in China. Therefore, we can form the hypothesis that the eastern region can gain much more FDI spillovers than the western region in China. However, how does one select appropriate indicators to measure financial development? The threshold effect of financial development is whether or not the process of FDI spillovers affecting different regions of China. If there are threshold effects of financial development on FDI spillovers, how much are the threshold values? What is the inherent relationship between the FDI spillovers effects and the financial development in different regions of China? Therefore, selecting appropriate indicators to measure the financial development and calculate the threshold effects of financial development on FDI spillovers, and finding the inherent relationship between FDI spillovers effects and the financial development in different regions of China has a certain theoretical and practical significance.

2. Literature Review

FDI spillovers firstly had been found in the research of MacDougall [23]. Since then, the FDI spillovers on economic growth has became an important topic. Sincce, Cave [24] firstly took the lead in studying the FDI spillovers empirically, lots of empirical studies have been done and published. However, there is not a unanimous conclusion recently. In the studies of Blomström and Persson, Savvides and Zachariadis, Hu and Wen, Du et al., Mao and Yang, and Liu et al., they revealed that FDI can generate positive spillovers in host counties [13,25,26,27,28,29]. Aitken and Harrison, Javorcik, Pattnayak and Thangavelu, and Suyanto and Ruhul pointed out that there are negative FDI spillovers in host counties [30,31,32,33]. Some studies believed that the FDI spillovers effects are not obvious in host counties, such as Lichtenberg, Djankov and Hoekman, and Driffield [34,35,36].

The relations between financial development and economic growth have always been a foucus topic. Goldsmith firstly did the empirical research to examine the relation between financial development and economic growth in 35 countries and concluded that the rapid economic growth are usually with a rapid growth of financial development [37]. Since then, many relevant researches have been published. However, because of the differences of analysis methods, statistical indicators and sample data, there is not a unanimous conclusion. Majority studies supported that economic growth can promote financial development, such as, Beck et al., Aghion et al., Vlachos and Waldenström, Habibullah and Eng, Christopoulos and Tsionas, Hasan and Barua, Valickova et al. [38,39,40,41,42,43,44]. Meanwhile, Boulila and Trabelsi, Kim, and Chakraborty checked the influence of financial development on economic growth and found that financial development also can promote economic growth [45,46,47]. Furthermore, some researches revealed that economic growth and financial development are causal relation to each other, such as, Shan et al., Calderón and Liu, Caporale et al. [48,49,50]. Additionally, Aghion et al. believe that financial development may bring adverse effects on economic growth [51].

Additionally, the relationship between financial market development and FDI spillovers have also been studied from different aspects. Li, Liu, Sun and Alfaro et al. pointed out that the financial market played an important role in promoting FDI spillovers, and that financial market development was conducive to FDI spillovers [52,53,54,55,56,57]. In detail, some of the studies observed the relationship over a long period of time at a single nation level. James and Ang, Gungor and Katircioglu, Rahman and Shahbz, Anwar and Cooray, and Gungor et al. found that financial development contributed to FDI spillovers in the long run [58,59,60,61,62]. In addition, some studies have also focused on the relationship on multiple national levels. Choong used a panel data of 95 developed and developing countries, from 1983 to 2006, and found strong evidence that domestic financial systems are a significant prerequisite for FDI having a positive effect on economic growth [63]. However, on multiple national levels, Alfaro et al., Niels and Lensink, and Choong et al. concentrated on comparative studies between developed and undeveloped countries regarding financial market development under the effects of FDI spillovers. They revealed that countries with well-developed financial markets usually gained significant spillovers from FDI, and that FDI generated a negative effect on countries with poor financial markets [57,64,65]. Furthermore, Li and Zeng, Su and Song, and Luo also carried out comparative studies, but focused on the different financial market development phases. They pointed out that the FDI spillovers effects increase with improvements to the financial market [66,67,68]. However, Jiang and Wang revealed that there was a limitation to financial market development with FDI spillovers processes. Only after financial market development reaches a certain minimum level do the effects increase with the improvement to financial markets [69].

Some researches have also concentrated on the threshold effects of financial development on FDI spillovers. There was a threshold effect of financial development on FDI spillovers processes [70]. Li et al. did empirical research in high technology industries and found that there was obviously a threshold effect of financial development in terms of FDI spillovers [71]. Financial development is a bond between FDI spillovers and economic growth, and its efficiency would directly affect FDI spillovers. However, the number of thresholds is uncertain. Choong et al., Wang and Woog, Azman-Saini, and Yao and Shi believed that there was only one threshold. Only after the financial development exceeded the minimum level could FDI generate positive spillovers on economic growth [72,73,74,75]. Some studies revealed that there were two threshold values. Tang and Luo used provincial panel data from 1986 to 2010 to perform empirical research, and pointed out that there were double the amount of threshold effects of financial development on FDI spillovers [76]. Wu et al. also found double the amount of threshold effects of financial development, and showed that, with the constant improvement of financial level, the effects of FDI spillovers increased gradually [77]. Zhang et al. also used provincial panel data from 2002 to 2010 and found similar results [22].

Exiting studies generally selected one or two indicators in order to measure financial development; this is not comprehensive. Additionally, most studies were based on the grouping test method and the interaction term method to research threshold effects. However, the grouping test method can barely objectively determine the standard of grouping samples. Therefore, it is impossible to estimate the specific threshold values from mathematical statistics and it is also impossible to perform significant tests for the regression results of different groups. Although the interaction term model method can estimate specific threshold values, it is difficult to objectively set the interaction terms, and it is impossible to verify the correctness of the threshold estimators. Furthermore, majority studies focused on the threshold effects of financial development on FDI spillovers. However, They are rare to explore the inherent relationship between FDI spillovers and financial development in difference regions of China.

This paper focuses on the following three aspects: First, financial development refers to finance changes of scale and quality over a certain period of time, and include the scale, structure and efficiency. In China, different regions might have different financial developments, and it is not appropriate to take one or two indicators to measure financial development. Therefore, in this paper, we devised three indicators to comprehensively measure financial development. Second, the Hansen threshold regression model can make up for the disadvantages of the two aforementioned methods [78,79]; it can, not only estimate the threshold values, but also test the significance of the threshold values. We apply regional panel data from China during the period of 2000 to 2014 in order to research the threshold effects of financial development and the FDI spilloverseffects, by means of the extension Cobb-Douglas production function and themultiple-threshold regression model. Third, previous research generally focused on the national level, but this paper focuses on the regional level of China. We divide China into three regions, according to economy and financial development level.

3. Model and Data

3.1. Framework and Model

Among the literature regarding FDI spillovers, the mostly used model is based on the Cobb-Douglas production function, or its expanded forms, which can estimate the effects of FDI spillovers on output. We also apply this model in our research, which is:

where the variables Yit, Ait, Kit and Lit represent the output, comprehensive technical level, capital stock and labor stock, respectively; and where the subscripts i and t represent the province and year, respectively. Additionally, supposing that the comprehensive technical level (Ait) can be separated into three parts, including regional technology progress (R&Dit), FDI spillovers (FDIit) and regional financial development level (FINit). The equation is supposed as follows:

Replacing the comprehensive technical level Ait with Equation (2) in Equation (1), and taking natural logarithm on both sides of Equation (1), we can acquire the expanded empirical model:

μi is the individual effect by province reflecting the influence of regional factors on output. εit is a random disturbance, and it contains the information excluding the main variables. It follows a normal distribution with zero mean and finite variance. The positive coefficients, η, θ, κ, α and β, mean that each explanatory variable has positive effects on output and vice versa. As noted above, financial development (FINit) which is measured from the scale (FGRit), structure (FSRit) and efficiency (LSRit) of financial development is taken as the threshold variable in this study. In order to avoid any bias from an artificially setting threshold, we adopt the threshold regression model of Hansen [69] which can determine the threshold effect based on the characteristics of the data themselves, and replace the term of Ln(FDIit) with the interaction term of Ln(FDIit) I(·) in Equation (3) to determine the impacts, which are the threshold effects of financial development upon the process of FDI spillovers on output. The estimating model is:

I(·) is an indicator function which has two values of zero and one. The FDI spillovers effects are reflected by the coefficients of the interaction term and the estimated value is θ. The threshold effects indicate that the FDI spillovers effects are different under different ranges of financial development. For example, when financial development surpasses a critical value, the sign or the magnitude of FDI spillovers effects change significantly. Furthermore, whether we adopt a multiple threshold model or a single threshold model depends on the number of thresholds. The following is a single threshold model. The multiple-threshold model can be extended accordingly. The formula of the single threshold model is:

In the Equation (5), λ is the estimated threshold value.

3.2. The Principle of Estimating and Testing the Thresholds

There are two main issues of threshold estimate needing to be focused on. One is to estimate the threshold values and regression coefficients of explanatory variables. The other is to test the significance of threshold estimators and confidence interval.

We use the common method of deducting the group average from every observation in order to estimate the coefficients of explanatory variables. Then, given threshold value λ, we use the ordinary least square (OLS) method to estimate the coefficients of explanatory variables. We can obtain the corresponding sum of squared errors () after the coefficients of variables are estimated. As for the single threshold model, when the threshold model is tested with all possible values of financial development, the threshold estimators should yield the smallest sum of squared errors. That is:

In this article, we apply Hansen’s [78] grid search method to solve the issue of squared errors and their minimization. Once the threshold value is determined, the coefficients of explanatory variables can be obtained.

Thereafter, we should do two analysis tests. One is the level of significant of the threshold effects; and the other is whether the threshold estimators are equal to the actual values. The null hypothesis of the first test can be represented by the linear constraint:

The Lagrange Multiplier (LM) test statistic is:

where S0 is the sum of squared errors after the coefficients of explanatory variables estimate under the null hypothesis. The is the corresponding variance of the residuals under the alternative hypothesis. The threshold value λ is uncertain under the null hypothesis, and hence the statistic F1 follows a non-standard distribution. Hansen [79] advises that a bootstrap technique should be applied to simulate its gradual distribution in order to estimate the corresponding p-values.

The second null hypothesis is as follows:

Its corresponding likelihood ratio test statistic is as follows:

The distribution of the statistic LR1 is also non-standard. However, Hansen [79] provides an inequation for calculating the area of rejection. When , the null hypothesis would be rejected, where is the level of significance [80].

As mentioned above, the coefficients of explanatory variables estimate and hypothesis test methods is only for the existence of one threshold. However, there may be more than one threshold. Next, we express how to estimate the coefficients of variables for a double threshold model briefly, and a multi-threshold model can be extended based on the single threshold model [80]. The double threshold model is as follows:

We follow the principle for the sequential estimate strategy provided by Hansen [78,79]. Firstly, we estimate through the method for a single threshold model. Secondly, we apply the grid search method to estimate the second threshold value in order to minimize . Finally, we should re-estimate the first threshold value through the second threshold value, and gain a modified first threshold value. Because the hypothesis tests for the double threshold model are similar to those for a single threshold model which are mentioned above, and we are not describe here [80].

In the study of Anwar and Lan; Nowak-Lehmann et al., they predominantly concerned with potential endogeneity of the main variable FDI [81,82]. There is a consensus about the endogeneity relationship between output and FDI in China. As indicated by Ubeda and Pérez-Hernández; Girma, on the one hand, the presence of FDI may be attracted to regions of China with high economic growth. On the other hand, regions of China with low economic growth may also be attractive for FDI, which may explain negative effects associated with the FDI. This would directly affect the estimated coefficients [83,84]. Finally, we should take the Durbin-Wu-Hausman test for endogeneity in order to avoid the endogeneity that results from the presence of FDI. The null hypothesis is that the explanatory variables are exogenous variables. If the hypothesis is rejected, suggesting that the explanatory variables are endogenous variables in the estimate model and the OLS estimates might be biased and inconsistent and hence OLS is not an appropriate estimation technique. If the hypothesis is accepted, suggesting that the explanatory variables are exogenous variables in the estimate model and the OLS estimates is reasonable.

3.3. Data and Variables

Considering the available data, this paper selected provincial panel data of China (Tibet was excluded because of a lack of data) from 2000 to 2014. The data are from the “China Statistical Yearbook”, “China Financial Statistics Yearbook”, “China Statistical Yearbook on Science and Technology”, National Database, and Wind Database. The variables in this paper are shown in Table 1.

Table 1.

The description and explanation of all variables.

The original data of Yit, Kit, FDIit and R&Dit contained the price impacts by years; thus, they did not accurately reflect the actual fluctuation. Therefore, Yit is deflated by the GDP deflator and Kit is deflated by the price index of investment in fixed assets. FDIit and R&Dit are mostly used for projects related to fixed assets. They are also deflated by the price index of investments in fixed assets. According to the level and the speed of economic development, the National Bureau of Statistics divides the 30 provinces of China into three regions. The eastern region includes Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; the central region includes Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan; and the western region includes Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang. The main variables statistical descriptions of the different regions are shown in Table 2.

Table 2.

The statistical descriptions of the main variables by region.

We take a correlation analysis in order to examine whether there is multi-collinearity among the independent variables based on the cross section data of the panel data. The correlation matrix of dependent and independent variables is as follows.

From Table 3, the correlation coefficients among the independent variables are small generally. It implies that there is not multi-collinearity among the independent variables. Therefore, the empirical model is reasonable.

Table 3.

The correlation matrix of dependent and independent variables.

According to the theory of modern econometrics, the econometric models should be established on the basis of stationarity series. Otherwise, there may be a “spurious regression” which leads to the credibility of estimators reducing greatly. Therefore, we should do the stationarity test of the variables before taking threshold regression. After stationary test, we find that each variable’s logarithmic form is stationarity series. The results are shown in Table 4.

Table 4.

The stationarity test of each variable.

4. Empirical Analyses

4.1. Test and Estimate Threshold Values

As mentioned above, the threshold values of financial development are tested and estimated from three aspects, in different regions of China. We adopt the multiple-threshold regression model and apply the OLS method in STATA 12.0, allowing for zero, one, two, and three thresholds in the eastern, central, and western regions, respectively. The F-value of LM testing and the bootstrap p-values are shown in Table 5.

Table 5.

The results of the test for threshold effects.

From Table 5, the test is for the null threshold with an F-value of 25.052 when we take financial development scale as the threshold variable in the eastern region. However, the critical value is 25.475 at a 5% significance level. The F-value is bigger than the critical value; therefore, it is rejected with a bootstrap p-value of 0.017 [86]. Sequentially, the test is for a single threshold with an F-value of 35.575, and the critical value is 4.558 at a 5% significance level. The F-value is larger than the critical value; therefore, it is rejected with a bootstrap p-value of 0.000 [86]. Finally, the test is for the double threshold, with an F-value of 0.000, and is not statistically significant, with a bootstrap p-value of 0.603 at a 5% significance level. Therefore, we have strong evidence to conclude that the financial development scale has a double-threshold effect on FDI spillover processes in the eastern region. Then, we perform the same test for the central and western regions, and find that there are also two thresholds in the central and western regions. Furthermore, we take the structure and efficiency of financial development as a threshold variable to do the same test, respectively, and find that there is also a double-threshold effect in each region.

After that, we use regional panel data of China, including eight variables, during the period of 2000 to 2014, and apply the aforementioned double threshold regression model to estimate the threshold estimators. Table 6 shows the estimators. All estimators fall in the corresponding 95% confidence interval and the second threshold estimator is generally greater than the first threshold estimator.

Table 6.

The threshold estimators and confidence intervals.

4.2. Regression Results

After confirming the existence of the two threshold values, the scale, structure, and efficiency of financial development is divided into three ranges, respectively, and the corresponding threshold effects on FDI spillovers are estimated in different regions. Then the inherent relationship between FDI spillovers effects and the financial development are determined in different regions. The regression results are shown in Table 7.

Table 7.

The regression results of the financial development threshold effects on foreign direct investment (FDI) spillovers.

From Table 7, we find that the within R-sq values are over 0.6 in each regression. This means that each regression line fits the observed values well. The F-statistics test is with a p-value of 0.000 in each regression. This implies that the overall regression equations have a significant linear relationship. The F-statistics test is for no fixed effects with a p-value of 0.000 in each regression. This means that the fixed-effect model should be selected in each regression; the Hansen’s multiple-threshold regression model is also a fixed-effect model. Therefore, we can conclude that the regression results we gained are reasonable at a statistical level. The p-values of the Durbin-Wu-Hausman test are over 0.1, it means that the null hypothesis is accepted and the explanatory variable FDI is exogenous variable. The OLS estimate is reasonable.

After that, we observe that, by comparing the three regions, the coefficients are greatest in the eastern region and are smallest in the western region, at each range of the scale, structure and efficiency of financial development, and the coefficients of the central region are in the middle generally. This reveals that FDI spillovers effects are greatest in the eastern region, smallest in the western region, and the FDI spillovers effects are in the middle in the central region, at each range of the scale, structure and efficiency of financial development. Then we could observe that the coefficients of interaction items gradually decrease when the financial development scale or the efficiency passes the first and second thresholds, in sequence, in eastern region. However, when the financial development structure passes the first and second thresholds, in sequence, the coefficients increase at first and then tend to decrease slightly in eastern region. This implies that the FDI spillover effects decrease with the increase of the financial development scale or efficiency and the FDI spillovers effects increase with the increase of the financial development structure in eastern region. Additionally, we could observe that the coefficients of interaction items gradually decrease when the financial development scale passed the first and second thresholds, in sequence, in central regions. However, when the financial development structure and efficiency passes the first and second thresholds in sequence, the coefficients decrease at first and then tended to increase. This means that the FDI spillovers effects decrease with the increase of the financial development scale. The FDI spillover effects decrease slightly at first, with the increase of financial development structure or the efficiency; however, when it increases continually and exceeds the second threshold, the effects restore to prior levels in central region. At last, we also find that the coefficients of interaction items gradually increase when the financial development scale, the structure or the efficiency passes the first and second thresholds, in sequence, in western region. The coefficients are negative, except that when the financial development scale or the efficiency passes the second thresholds, the coefficients increase and tend to positive. This implies that the FDI spillovers effects increase with the increase of the financial development scale, the structure or the efficiency. But, only when the financial development scale or the efficiency passes the second thresholds, the FDI spillovers effects are positive in western region.

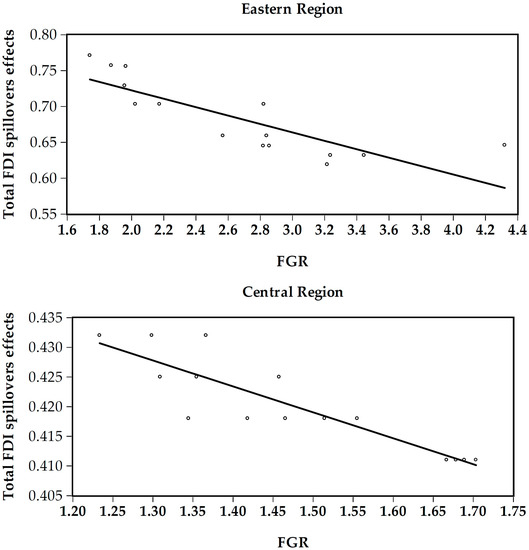

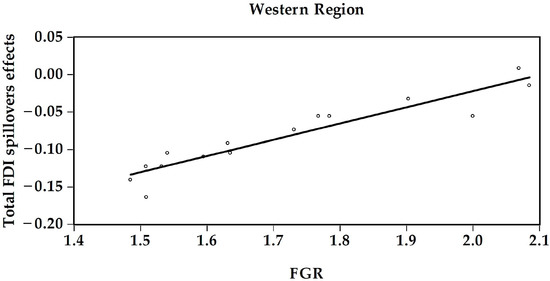

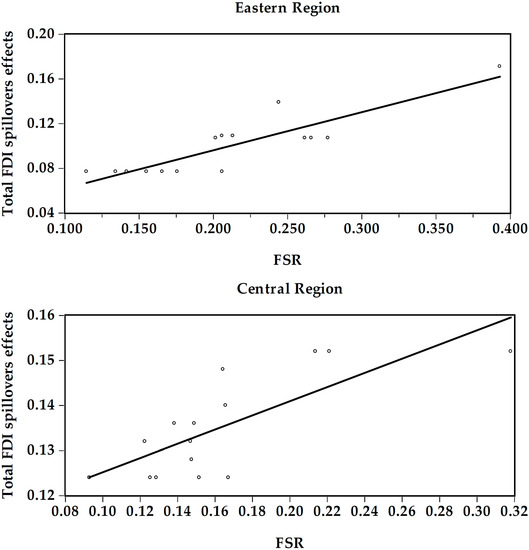

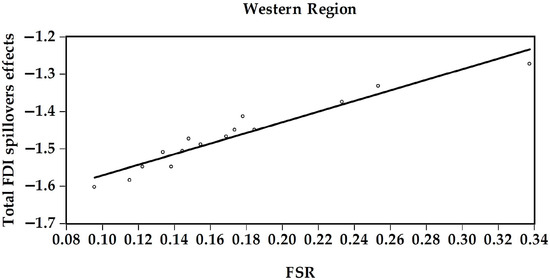

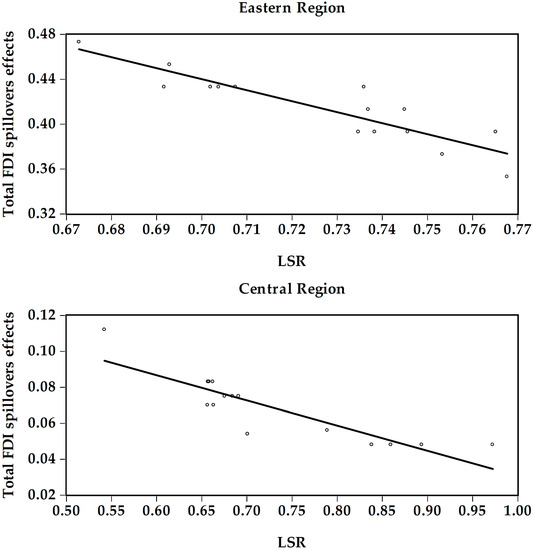

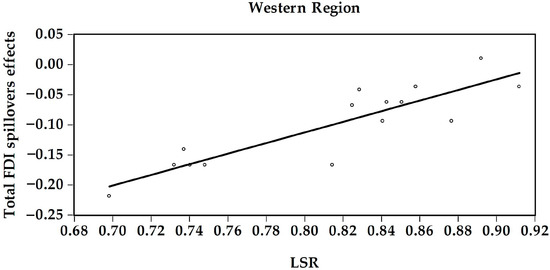

In order to reveal the inherent relationship between the FDI spillovers effects and the financial development in different regions, we calculate the total FDI spillovers effects and present them, with the average scales, structures, and efficiencies of financial development, in different regions, the relationship are shown in Figure A1, Figure A2 and Figure A3 which are listed in the part of Appendix A.

From Figure A1, Figure A2 and Figure A3, the horizontal axis in each chart represents the average scales, structures, or efficiencies of financial development by year, and the vertical axis in each chart represents the total FDI spillovers effects, which are calculated according to the coefficients of interaction term at each range of the scales, structures or efficiencies of financial development and the corresponding number of provinces by year, respectively. From Figure A1, Figure A2 and Figure A3, we can observe that there is a negative correlation between the total FDI spillovers effects and the financial development scales in eastern and central regions. There is positive correlation between the total FDI spillovers effects and the financial development structures in eastern and central regions. There is also a negative correlation between the total FDI spillovers effects and financial development efficiencies in eastern and central regions. Namely, when the financial development scales or efficiencies increase or structures decrease, the total FDI spillover effects decrease in eastern and central regions, and vice versa. There is a positive correlation between the total FDI spillover effects and the financial development scales, structures or efficiencies in western region. Namely, when the financial development scales or structures or efficiencies increase, the total FDI spillover effects increase in western region, and vice versa.

Taking other explanatory variables into consideration, we find that the coefficients of variables K, L and R&D are positive in each region nearly. However, the coefficients of threshold variable financial development are not unanimous in each region. This implies that the capital, labor and regional technology progress can generate positive effects on economic growth in each region. The coefficient of variable K is greater than that of the coefficient of variable L in the eastern region, but is smaller in the central and western regions. This means that the effects of capital are greater than the effects of labor on economic growth in the eastern region, but are smaller in the central and western regions. The financial development has significant positive effects on economic growth in eastern region, has significant negative effects on economic growth in western region and has not significant effects on economic growth in central region which verifies the previous results.

4.3. Discussion of the Results

As mentioned in the literature review, Zhang et al. pointed out that the effects of FDI spillovers on developed regions are greater than those of underdeveloped regions [22]. Our present study has verified the result that the FDI spillover effects are greatest in the eastern region and are smallest in the western region, and the effect on the central region are in the middle generally.

The total FDI spillovers effects have a same trend with the financial development structure changes, but have an opposite trend with the financial development scale and efficiency changes in eastern and central region. The total FDI spillovers effects have a same trend with the financial development scale, structure and efficiency changes in western region. The financial development scale increase means that the total financial assets are increasing. Additionally, the sum of the deposit balance of all financial institutions, the stock price and the premium income is increasing. However, the increase of total financial assets mainly depends on the deposit balance of all financial institutions in each region. When the deposit balance of all financial institutions increases, the loan balance of all financial institutions will also increase under unchanged conditions. Additionally, the increasing speed of the loan balance of all financial institutions is quicker than that of the deposit balance of all increasing financial institutions. The financial development efficiency also increases; therefore, a large financial development scale usually has high financial development efficiency.

The financial development scale and the financial development efficiency, increasing together, implies that domestic enterprises can gain greater funds from financial institutions than before, in order to support their own technological innovations, to train their employees’ skills, and to develop their own management, which can narrow the gap between domestic enterprises and foreign capital enterprise. Domestic enterprises become more efficient and will not gain much more spillover from FDI; therefore, the FDI spillovers effects tend to decrease with the financial development scales or efficiencies increasing. However, comparing with the other regions, the finances of the western region is undeveloped, and the FDI spillovers effects are negative overall. Therefore, the western region should develop its own finance, including scales and efficiencies, to gain much more FDI spillovers effects and the FDI spillover effects tend to increase with the financial development scales or efficiencies increasing.

However, the proportion of the sum of the stock prices and the premium incomes to the increasing total financial assets means that the financial development structure is improving. The increasing financial development structures can help a region to attract much more direct foreign investment. Sino-foreign joint ventures are also called equity joint ventures, which occupy a large proportion of foreign-funded enterprises in absorbing FDI, which can easily spread advanced technology, skilled workers, and advanced management to domestic sectors, leading to abundant spillovers on economic growth of each region. Therefore, the FDI spillover effects tend to increase with the increase of financial development structure.

Economic growth needs a certain amount of capital and labor input; they are the basic elements of economic growth. Technological progress is helpful in improving economic growth. Only the improvement of technology can continue to promote economic growth; therefore, technical progress can promote economic growth to some degree. Comparing the three regions, there are many capital and technology-intensive industries in the eastern region, and labor intensive industries in the central and western regions. Therefore, the effects of capital on the economic growth in the eastern region are greater than in the other regions, and the effects of labor on the economic growth in the central and western regions are greater than in the eastern region. Additionally, the finances level is highest in the eastern region and is lowest in the western region, and the finances level of the central region is in the middle generally. Therefore, the financial development can promote the economic growth in eastern region and hinder the economic growth in the western region. There is no obvious relation between financial development and economic growth in the central region.

5. Conclusions and Policy Recommendations

In this paper, we propose a multiple threshold model to estimate the threshold effect of financial development on FDI spillovers, and then inspect the inherent relationship between the financial development and the FDI spillovers effects by using regional panel data from China during the period of 2000 to 2014. We measure financial development from three aspects: Scale, structure and efficiency. The empirical results show that there is a double-threshold effect in terms of each aspect of financial development that exist in FDI spillovers processes in different regions. Three main conclusions are drawn.

The first is that the FDI spillovers effects are greatest in the eastern region, and are smallest in the western region. Additionally, the FDI spillovers effects are in the middle in the central region. The second is that there is a negative correlation between the FDI spillovers effects and the financial development scale or efficiency in eastern and central region. Moreover, there is positive correlation between the FDI spillovers effects and the financial development structure in eastern and central region. Additionally, there is a positive correlation between the FDI spillovers effects and the financial development scale, structure, or efficiency in western region. The third is that capital, labor and regional technology progress have positive effects on economic growth and the effects of financial development on economic growth are not unanimous in each region.

Based on these conclusions, there are three policy implications that can be recommended.

First, considering that the eastern region occupies a large proportion of FDI and gains much more spillovers from FDI than the other regions; therefore, the governments, especially in the central and western regions, should make corresponding policies to attract FDI.

Second, financial development is helpful for economic growth. However, the FDI spillovers effects have a negative correlation with the financial development scale and financial development efficiency in eastern and central regions. Therefore, we should not blindly pursue the significant positive effects of FDI spillovers, or it may have negative effects on the regional financial development scale and efficiency in eastern and central regions. However, the FDI spillovers effects have a positive correlation with the financial development scale and financial development efficiency in western region. Therefore, we should develop the finances in western region. Meanwhile, the FDI spillovers effects have a positive correlation with the financial development structure. Therefore, we should expand the stock market and the insurance market in order to improve the financial development structure. The increase financial development structure will help a region to gain more FDI spillovers to promote economic growth.

Finally, the effects of the capital, labor and the regional technology progress have positive effects on economic growth. Therefore, governments should increase capital and labor inputs. Additionally, governments should also provide more funds to support domestic sectors to improve their own technical levels. Meanwhile, the higher finance level is helpful the economic growth, therefore, the government, especially in the central and western regions, should make corresponding policies to develop the finances.

Acknowledgments

The authors express their sincere thanks for the support from the Fundamental Research Funds for the Central Universities, under Grant No. 53200859697, and the Key Laboratory of Carrying Capacity Assessment for Resource and Environment, and the Ministry of Land and Resources (Chinese Academy of Land and Resource Economics, China University of Geosciences Beijing) under Grant No. CCA2016.05.

Author Contributions

Huifang Liu conceived and designed the research and methodology; Hui Wang and Huifang Liu collected and compiled all the data and literature; Hui Wang finished the experiments and calculation; Huifang Liu analyzed the results and put forward the policies; Hui Wang revised the manuscripts and approved the manuscript; Huifang Liu is responsible for future questions from readers as the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Figure A1.

The relationship between the total FDI spillovers effects and the scale of financial development in different regions.

Figure A2.

The relationship between the total FDI spillovers effects and the structures of financial development in different regions.

Figure A3.

The relationship between the total FDI spillovers effects and the efficiencies of financial development in different regions.

References

- United Nations Conference on Trade and Development. Available online: http://unctad.org/en/Pages/MeetingDetails.aspx?meetingid=743 (accessed on 24 June 2015).

- National Bureau of Statistics of the People’s Republic of China. Available online: http://www.stats.gov.cn/tjsj/ndsj/2015/indexch.htm (accessed on 17 October 2015). (In Chinese)

- Zhang, J.H.; Ouyang, Y.W. Foreign direct investment, the spillover effect and economic growth—A case of Guangdong province. China Econ. 2003, 2, 647–666. (In Chinese) [Google Scholar]

- Findlay, R. Relative backwardness, direct foreign investment, and the transfer of technology: A simple dynamic model. Q. J. Econ. 1978, 92, 1–16. [Google Scholar] [CrossRef]

- Koizumi, T.; Kopecky, K.J. Foreign direct investment, technology transfer and domestic employment effects. J. Int. Econ. 1980, 10, 1–20. [Google Scholar] [CrossRef]

- Kokko, A. Technology, market characteristics, and spillovers. J. Dev. Econ. 1994, 43, 279–293. [Google Scholar] [CrossRef]

- Colombo, M.G.; Mosconi, R. Complementarity and cumulative learning effects in the early diffusion of multiple technologies. J. Ind. Econ. 1995, 43, 13–48. [Google Scholar] [CrossRef]

- Caves, R.E. International corporations: The industrial economics of foreign investment. Economica 1971, 38, 1–27. [Google Scholar] [CrossRef]

- Wang, J.Y.; Blomström, M. Foreign investment and technology transfer: A simple model. Eur. Econ. Rev. 1992, 36, 137–155. [Google Scholar] [CrossRef]

- Dasb, S. Externalities and technology transfer through multinational corporations: A theoretical analysis. J. Int. Econ. 1987, 22, 171–182. [Google Scholar]

- Görg, H.; Strobl, E. Multinational companies and productivity spillovers: A meta-analysis. Econ. J. 2001, 111, 723–739. [Google Scholar] [CrossRef]

- Jiang, D.C.; Xia, L.K. The Empirical Study of the Function of FDI on Innovation in China’s High-Tech Industries. World Econ. 2005, 8, 3–10. (In Chinese) [Google Scholar]

- Savvides, A.; Zachariadis, M. International technology diffusion and the growth of TFP in the manufacturing sector of developing economies. Rev. Dev. Econ. 2005, 9, 482–501. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 39–67. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Innovation and Learning: The Two Faces of R&D. Econ. J. 1989, 99, 569–596. [Google Scholar]

- Borensztein, E.; Gregorio, J.D.; Lee, J.W. How does foreign direct investment affect economic growth? Nber Work. Pap. 1995, 45, 115–135. [Google Scholar] [CrossRef]

- Haskel, J.E.; Slaughter, M.J. Does Inward Foreign Direct Investment Boost the Productivity of Domestic Firms? Rev. Econ. Stat. 2007, 89, 482–496. [Google Scholar] [CrossRef]

- Qi, J.H.; Wei, Q.G.; Ju, L. FDI, Financial Market and Economic Growth: Regional Differences and threshold Effect. Rev. Ind. Econ. 2009, 8, 91–106. (In Chinese) [Google Scholar]

- Li, M.; Liu, S.C. The regional differences and the threshold effect of the OFDI: The regression analysis based on the threshold of the Chinese provincial panel data. Manag. World 2012, 1, 21–32. (In Chinese) [Google Scholar]

- Yong, K.L.; Liu, Y. The Contribution of Inward FDI to Chinese Regional Innovation: The Moderating Effect of Absorptive Capacity on Knowledge Spillover. Eur. J. Int. Manag. 2016, 3, 284–313. [Google Scholar]

- Alfaro, L.; Chanda, A.; Kalemli-Ozcan, S.; Sayek, S. FDI and economic growth: The role of local financial markets. SSRN Electron. J. 2003, 64, 89–112. [Google Scholar]

- Zhang, L.; Ran, G.H.; Chen, Q. Regional financial strength, FDI spillover and the real economy Growth: A research based on the panel threshold model. Econ. Sci. 2014, 6, 76–89. (In Chinese) [Google Scholar]

- Macodougall, G.D.A. The benefits and costs and costs of private investment from abroad: A theoretical approach. Oxf. Bull. Econ. Stat. 1960, 36, 13–35. [Google Scholar] [CrossRef]

- Caves, R.E. Multinational firms, competition, and productivity in host-country markets. Economic 1974, 41, 176–193. [Google Scholar] [CrossRef]

- Blomström, M.; Persson, H. Foreign investment and spillover efficiency in an underdeveloped economy: Evidence from the Mexican manufacturing industry. World Dev. 1983, 11, 493–501. [Google Scholar] [CrossRef]

- Hu, X.J.; Wen, L.Q. Empirical research on technology spillover effects of FDI to domestic firms of auto industry in China. J. Hunan Univ. 2009, 3, 60–64. (In Chinese) [Google Scholar]

- Du, L.; Harrison, A.; Jefferson, G.H. Testing for horizontal and vertical foreign investment spillovers in China, 1998–2007. J. Asian Econ. 2012, 23, 234–243. [Google Scholar] [CrossRef]

- Mao, Z.X.; Yang, Y. FDI spillovers in the Chines hotel industry: The role of geographic regions, star-rating classifications, ownership types, and foreign capital origins. Tour. Manag. 2016, 54, 1–12. [Google Scholar] [CrossRef]

- Liu, W.S.; Agbola, F.W.; Dzator, J.A. The impact of FDI spillover effects on total factor productivity in the Chinese electronic industry: A panel data analysis. J. Asia Pac. Econ. 2016, 2, 217–234. [Google Scholar] [CrossRef]

- Aitken, B.J.; Harrison, A.E. Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. Am. Econ. Rev. 1999, 89, 605–618. [Google Scholar] [CrossRef]

- Javorcik, B.S. Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am. Econ. Rev. 2004, 94, 605–627. [Google Scholar] [CrossRef]

- Pattnayak, S.S.; Thangavelu, S.M. Linkages and technology spillovers in the presence of foreign firms. J. Econ. Stud. 2011, 38, 275–286. [Google Scholar] [CrossRef]

- Suyanto; Ruhul, S. Foreign direct investment spillovers and technical efficiency in the Indonesian pharmaceutical sector: Firm level evidence. Appl. Econ. 2013, 45, 383–395. [Google Scholar]

- Lichtenberg, F.R. International R&D spillovers: A re-examination. Anal. Chem. 1996, 55, 245–246. [Google Scholar]

- Djankov, S.; Hoekman, B. Foreign investment and productivity growth in Czech enterprises. World Bank Econ. Rev. 2000, 14, 49–64. [Google Scholar] [CrossRef]

- Driffield, N. The impact on domestic productivity of inward investment in the UK. Manch. Sch. 2001, 69, 103–119. [Google Scholar] [CrossRef]

- Goldsmith, R.W. Financial structure and development. Stud. Comp. Econ. 1969, 70, 31–45. [Google Scholar]

- Beck, T.H.L.; Levine, R.; Loayza, N.V. Financial intermediary development and growth: Causes and causality. J. Monet. Econ. 2000, 46. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P.; Mayerfoulkes, D. The effect of financial development on convergence: Theory and evidence. Q. J. Econ. 2004, 120, 173–222. [Google Scholar]

- Vlachos, J.; Waldenström, D. International financial liberalization and industry growth. Int. J. Financ. Econ. 2005, 10, 263–284. [Google Scholar] [CrossRef]

- Habibullah, M.S.; Eng, Y.K. Does financial development cause economic growth? A panel data dynamic analysis for the Asian developing countries. J. Asia Pac. Econ. 2006, 11, 377–393. [Google Scholar] [CrossRef]

- Christopoulos, D.K.; Tsionas, E.G. Financial development and economic growth: Evidence from panel unit root and cointegration tests. Res. Financ. Econ. Issues 2007, 73, 55–74. [Google Scholar] [CrossRef]

- Hasan, R.; Barua, S. Financial development and economic growth: Evidence from a panel study on south Asian countries. Asian Econ. Financ. Rev. 2015, 10, 1159–1173. [Google Scholar]

- Valickova, P.; Havranek, T.; Horvath, R. Financial development and economic growth: A meta-analysis. J. Econ. Surv. 2015, 3, 506–526. [Google Scholar] [CrossRef]

- Boulila, G.; Trabelsi, M. Financial development and long-run growth: Evidence from Tunisia: 1962–1997. Sav. Dev. 2004, 28, 289–314. [Google Scholar]

- Kim, Y.C. Does financial development precede growth? Robinson and Lucas might be right. Appl. Econ. Lett. 2007, 14, 15–19. [Google Scholar]

- Chakraborty, I. Does financial development cause economic growth? The case of India. South Asia Econ. J. 2008, 9, 109–139. [Google Scholar] [CrossRef]

- Shan, J.Z.; Morris, A.G.; Fiona, S. Financial development and economic growth: An egg-and-chicken problem? Rev. Int. Econ. 2001, 5, 514. [Google Scholar] [CrossRef]

- Calderón, C.; Liu, L. The direction of causality between financial development and economic growth. J. Dev. Econ. 2003, 72, 321–334. [Google Scholar] [CrossRef]

- Caporale, G.M.; Rault, C.; Sova, A.D.; Sova, R. Financial development and economic growth: Evidence from 10 new European Union members. Int. J. Financ. Econ. 2015, 1, 48–60. [Google Scholar] [CrossRef]

- Aghion, P.; Bacchetta, P.; Banerjee, A. Financial development and the instability of open economies. J. Monet. Econ. 2004, 51, 1077–1106. [Google Scholar] [CrossRef]

- Li, J.W. Foreign direct investment and economic growth: The role of the financial markets. Contemp. Financ. Econ. 2007, 1, 27–30. (In Chinese) [Google Scholar]

- Liu, S.J. FDI and economic growth: Research based on the financial market absorption capacity. Shanghai Financ. 2007, 5, 9–12. (In Chinese) [Google Scholar]

- Sun, L.J. Financial Development, FDI and Economic Growth. J. Quant. Tech. Econ. 2008, 25, 3–14. (In Chinese) [Google Scholar]

- Alfaro, L.; Chanda, A.; Kalemli-Ozcan, S.; Sayek, S. Does foreign direct investment promote growth? Exploring the role of financial markets on linkages. J. Dev. Econ. 2006, 91, 242–256. [Google Scholar] [CrossRef]

- Chen, Y.; Feng, D. The association among the regional level of financial development, the spillover effects of FDI and economic growth in the Pearl River. J. Reg. Financ. Res. 2015, 1, 17–21. (In Chinese) [Google Scholar]

- Li, X.Y. Study on the relationship between financial development and FDI. Sci. Econ. Soc. 2016, 1, 55–59. (In Chinese) [Google Scholar]

- Ang, J.B. Financial development and the FDI growth nexus: The Malaysian experience. Appl. Econ. 2009, 41, 1595–1601. [Google Scholar] [CrossRef]

- Gungor, H.; Katircioglu, S.T. Financial development, FDI and real income growth in Turkey: An empirical investigation from bounds tests and causality analysis. Actual Probl. Econ. 2010, 12, 215–225. [Google Scholar]

- Cheng, L.W.; Yuan, M.C. Study of Nonlinear Effects of Institutional Quality and Financial Development on Transnational Capital. In Proceedings of the 7th International Conference on Financial Risk and Corporate Finance Management, Las Vegas, NV, USA, 18–20 August 2015. [Google Scholar]

- Rahman, M.M.; Shahbaz, M. Foreign Direct Investment-Economic Growth Link: The Role of Domestic Financial Sector Development in Bangladesh. Acad. Taiwan Bus. Manag. Rev. 2011, 7, 104–112. [Google Scholar]

- Anwar, S.; Cooray, A. Financial development, political rights, civil liberties and economic growth: Evidence from South Asia. Econ. Model. 2012, 29, 974–981. [Google Scholar] [CrossRef]

- Güngör, H.; Katircioglu, S.T.; Mercan, M. Revisiting the nexus between financial development, FDI, and growth: New evidence from second generation econometric procedures in the Turkish context. Acta Oecon. 2014, 64, 73–89. [Google Scholar] [CrossRef]

- Choong, C.K. Does domestic financial development enhance the linkages between foreign direct investment and economic growth? Empir. Econ. 2012, 42, 819–834. [Google Scholar] [CrossRef]

- Niels, H.; Lensink, R. Foreign direct investment, financial development and economic growth. J. Dev. Stud. 2003, 40, 142–163. [Google Scholar]

- Choong, C.K.; Yusop, Z.; Soo, S.C. Foreign Direct Investment, Economic Growth, and Financial Sector Development. J. Southeast Asian Econ. 2004, 21, 278–289. [Google Scholar]

- Li, J.C.; Zeng, H. The Relationship between FDI Spillover and Economic Growth: A Study Based on the Financial Market Development with Panel Data of Chinese Provinces. Stat. Res. 2009, 26, 30–37. [Google Scholar]

- Su, N.; Song, L.S. The influence of financial development on FDI technology spillover effect. J. Zhongnan Univ. Econ. Law 2012, 4, 54–61. (In Chinese) [Google Scholar]

- Luo, J. Threshold of financial development, FDI and regional economic growth. World Econ. Study 2016, 4, 107–118. (In Chinese) [Google Scholar]

- Jiang, X.L.; Wang, Y. The impact of financial development on FDI spillovers—Analysis based on the perspective of human capital flow. Financ. Trade Econ. 2011, 5, 65–70. (In Chinese) [Google Scholar]

- Li, B.; Li, Q.; Qi, Y. An Analysis of the Threshold Effects of the FDI Technology Spillover on the Technological Progress in the High-tech Industry. Int. Bus. 2016, 3, 74–84. (In Chinese) [Google Scholar]

- Choong, C.K.; Yusop, Z.; Law, S.H. Private Capital flows to developing countries: The role of the domestic financial sector. J. Asia Pac. Econ. 2010, 15, 509–529. [Google Scholar] [CrossRef]

- Wang, M.; Wong, M.C.S. Foreign Direct Investment and Economic Growth: The Growth Accounting Perspective. Econ. Inq. 2009, 47, 701–710. [Google Scholar] [CrossRef]

- Azman-Saini, W.N.W.; Law, S.H.; Ahmad, A.H. FDI and economic growth: New evidence on the role of financial markets. Econ. Lett. 2010, 107, 211–213. [Google Scholar] [CrossRef]

- Yao, Y.J.; Shi, W.L. FDI and TFP growth: The test of financial development threshold effect. J. Financ. Dev. Res. 2013, 2, 16–20. (In Chinese) [Google Scholar]

- Tan, L.Z.; Luo, L. Financial development and the FDI technology spillover effect: Linear or nonlinear? Jilin Univ. J. Soc. Sci. Ed. 2013, 3, 49–57. (In Chinese) [Google Scholar]

- Wu, C.; Wang, D.X.; Li, C. Financial Deepening, FDI Spillovers and Regional TFP—Empirical Analysis Based on Provincial Panel Threshold Model. J. Shanghai Financ. Univ. 2013, 4, 10–22. (In Chinese) [Google Scholar]

- Hansen, B.E. Sample Splitting and Threshold Estimation. Econometrica 2000, 68, 575–603. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econ. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Huang, L.Y.; Liu, X.M.; Xu, L. Regional innovation and spillover effects of foreign direct investment in China: A threshold approach. Reg. Stud. 2012, 5, 583–596. [Google Scholar] [CrossRef]

- Anwar, S.; Lan, P.N. Is foreign direct investment productive? A case study of the regions of Vietnam. J. Bus. Res. 2014, 67, 1376–1387. [Google Scholar] [CrossRef]

- Nowak-Lehmann, F.; Dreher, A.; Herzer, D.; Klasen, S.; Martínez-Zarzoso, I. Does foreign aid really raise per capita income? A time series perspective. Can. J. Econ. Rev. Can. D'écon. 2012, 45, 288–313. [Google Scholar] [CrossRef]

- Ubeda, F.; Pérez-Hernández, F. Absorptive capacity and geographical distance two mediating factors of FDI spillovers: A threshold regression analysis for Spanish firms. J. Ind. Compet. Trade 2017, 17, 1–28. [Google Scholar] [CrossRef]

- Girma, S. Absorptive capacity and productivity spillovers from FDI: A threshold regression analysis. Oxf. Bull. Econ. Stat. 2005, 67, 281–306. [Google Scholar] [CrossRef]

- Zhang, J.; Wu, G.Y.; Zhang, J.P. The Estimation of China’s provincial capital stock: 1952–2000. Econ. Res. J. 2004, 10, 35–44. [Google Scholar]

- Wang, H.; Liu, H.F.; Cao, Z.Y.; Wang, B.W. FDI technology spillover and threshold effect of the technology gap: Regional differences in the Chinese industrial sector. SpringerPlus 2016, 1, 323–334. [Google Scholar] [CrossRef] [PubMed]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).