Master–Slave Game Pricing Strategy of Time-of-Use Electricity Price of Electricity Retailers Considering Users’ Electricity Utility and Satisfaction

Abstract

1. Introduction

1.1. Background

1.2. Literature Review

1.3. Contribution and Construction

- (1)

- The master–slave game model is introduced into the time-of-use electricity price pricing strategy, and the user response ability is mobilized in the game process to achieve a win-win situation for both parties;

- (2)

- The user benefit function is studied, and the user’s electricity utility is introduced as the user’s income, and the user’s electricity purchase cost and satisfaction cost are taken as the user’s expenditure;

- (3)

- Three different electricity price mechanisms, fixed electricity price, peak-valley time-of-use electricity price, and 24 h time-of-use electricity price, are set up to study the impact of different electricity price flexibility on the benefits of both parties under the game model;

- (4)

- Three different types of users, including residential users, industrial users and commercial users, are set up to study the impact of different user response capabilities on the benefits of both parties under the game model.

2. Analysis of Electricity Sales Company and User Benefit

2.1. User Electricity Efficiency

- (1)

- Electricity utility for users

- (2)

- Electricity satisfaction cost

- (3)

- Electricity purchasing cost

2.2. The Revenue of the Electricity Sales Company

- (1)

- Sales income

- (2)

- Electricity purchasing cost

- (3)

- User satisfaction cost

3. Construction of Pricing Strategy Model Based on Master–Slave Game

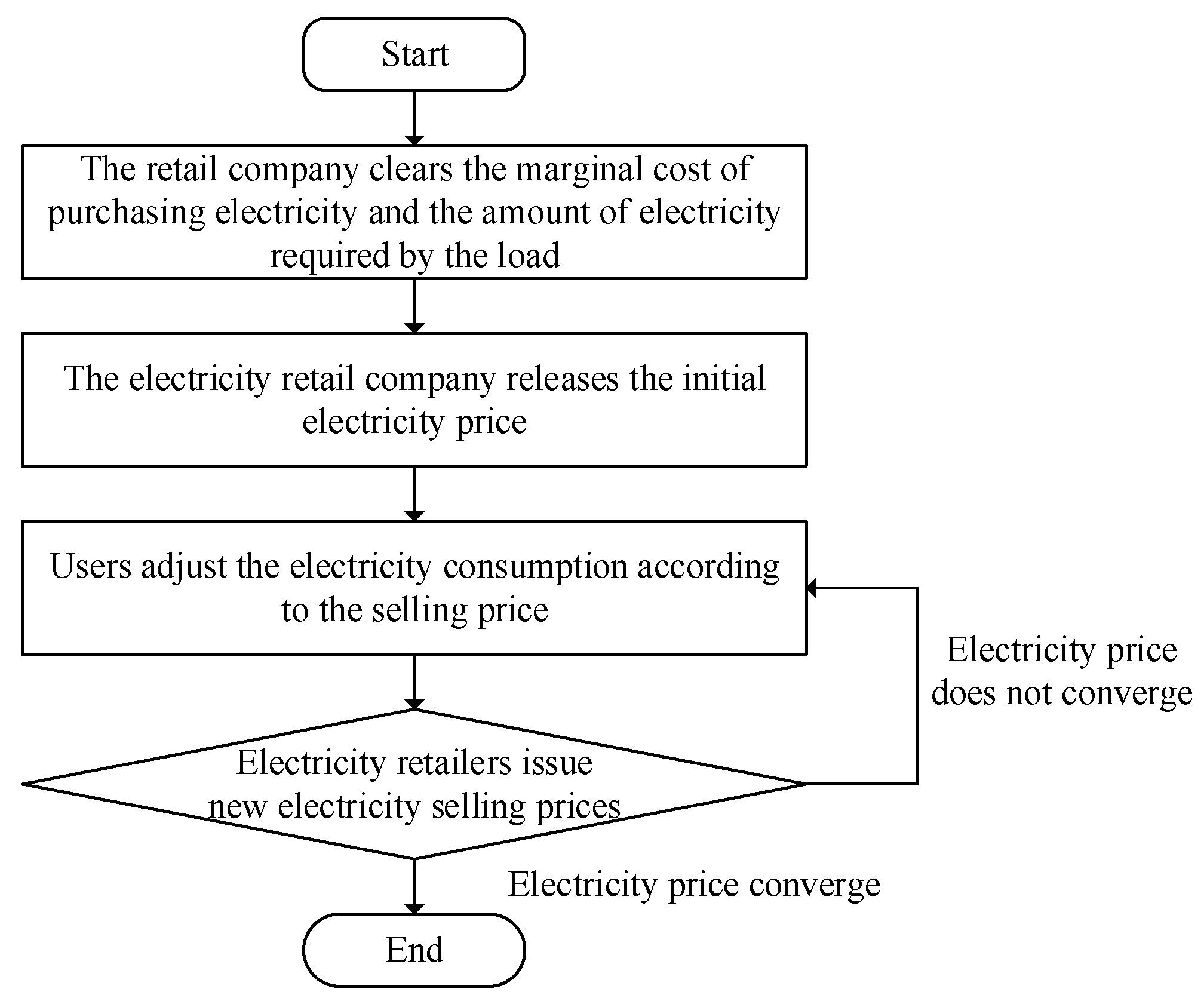

3.1. Master–Slave Game Process

- (1)

- The electricity selling company determines its electricity purchase strategy and marginal cost of electricity purchase, as well as the nominal load demand of users;

- (2)

- As the leader, the electricity selling company formulates and publishes the electricity selling price of each period, , to the user;

- (3)

- As a follower, the user responds to the electricity sales price issued by the electricity sales company, formulates the optimal electricity consumption strategy, , and feeds it back to the electricity sales company;

- (4)

- According to the user’s feedback and its own benefit function, the electricity selling company adjusts the electricity selling price, , in each period;

- (5)

- Repeat step (3) to step (5) until the two sides no longer adjust their strategies to increase efficiency, and the game is balanced.

3.2. Game Models’ Construction

4. Game Model Solution

- (1)

- The user’s optimal power consumption strategy

- (2)

- The optimal pricing strategy of electricity selling companies

5. Example Analysis

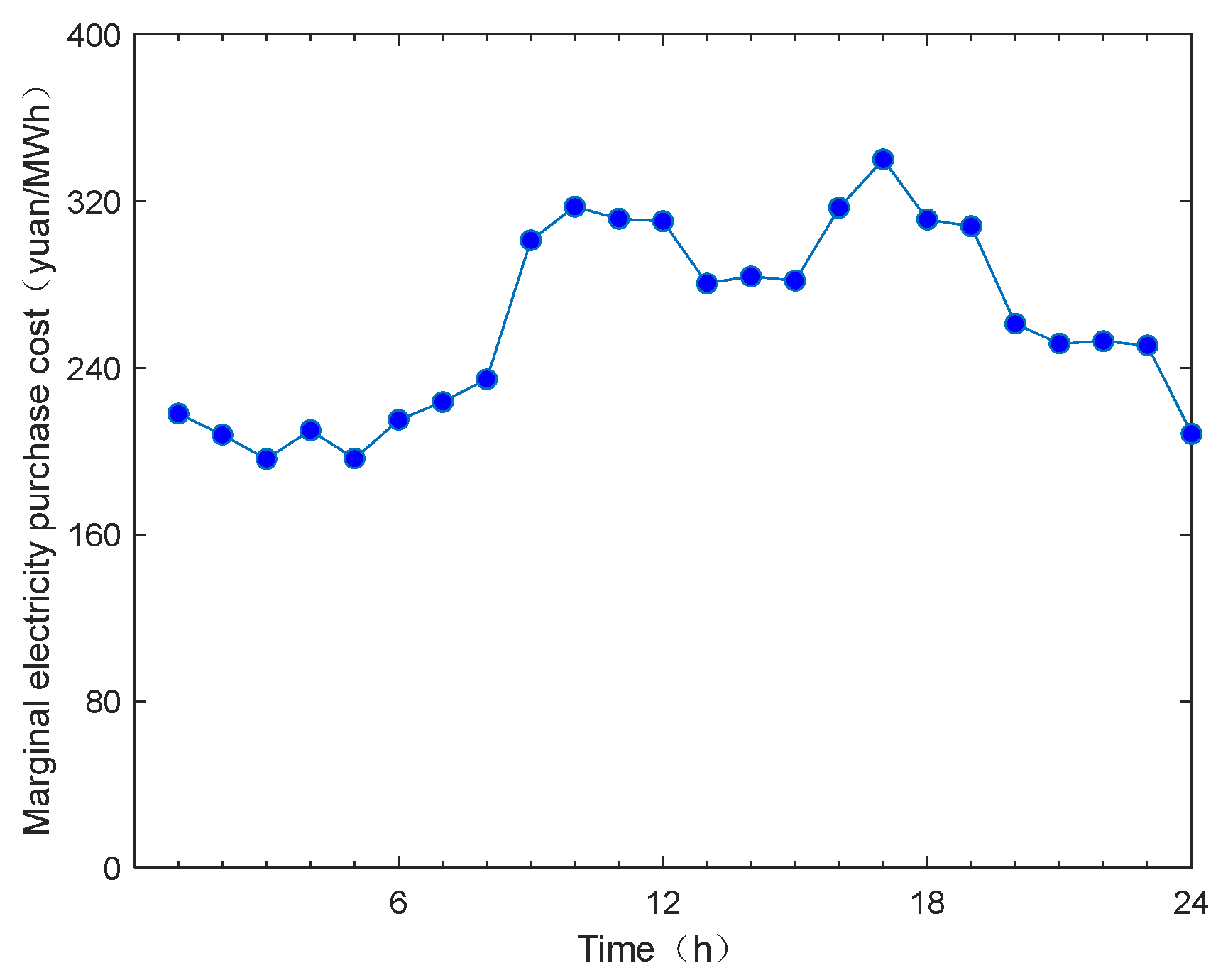

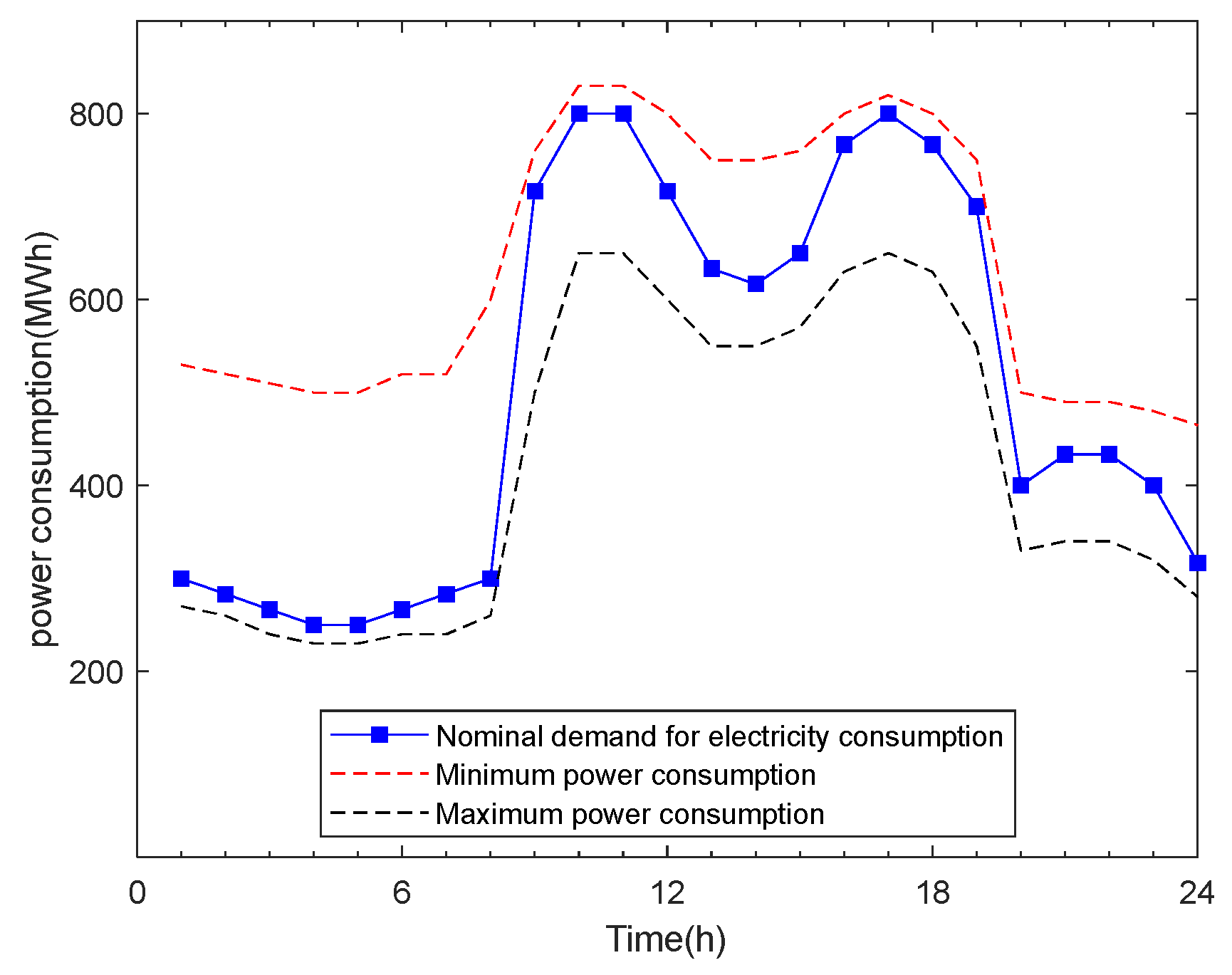

5.1. Parameter Setting

5.2. Analysis of Result

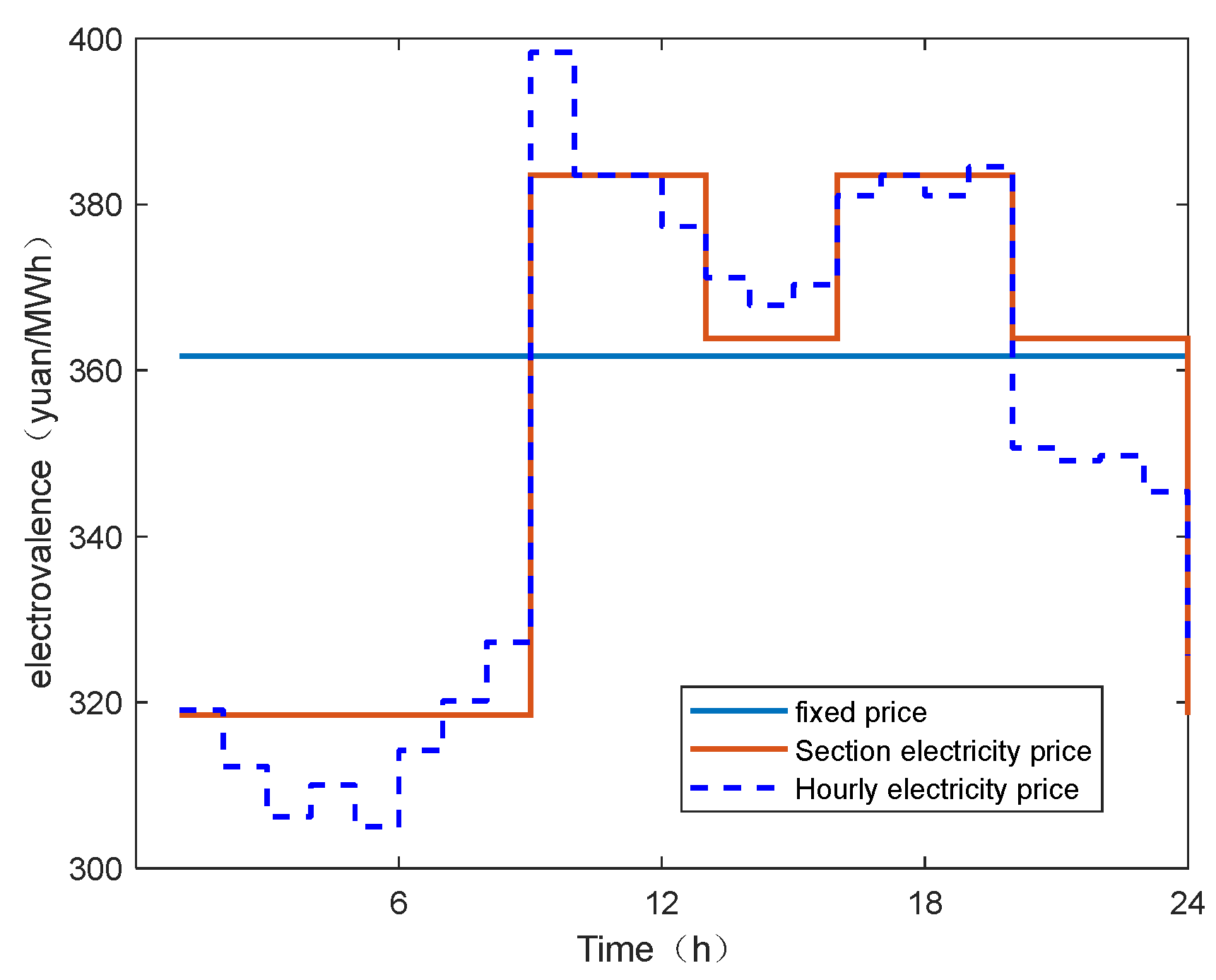

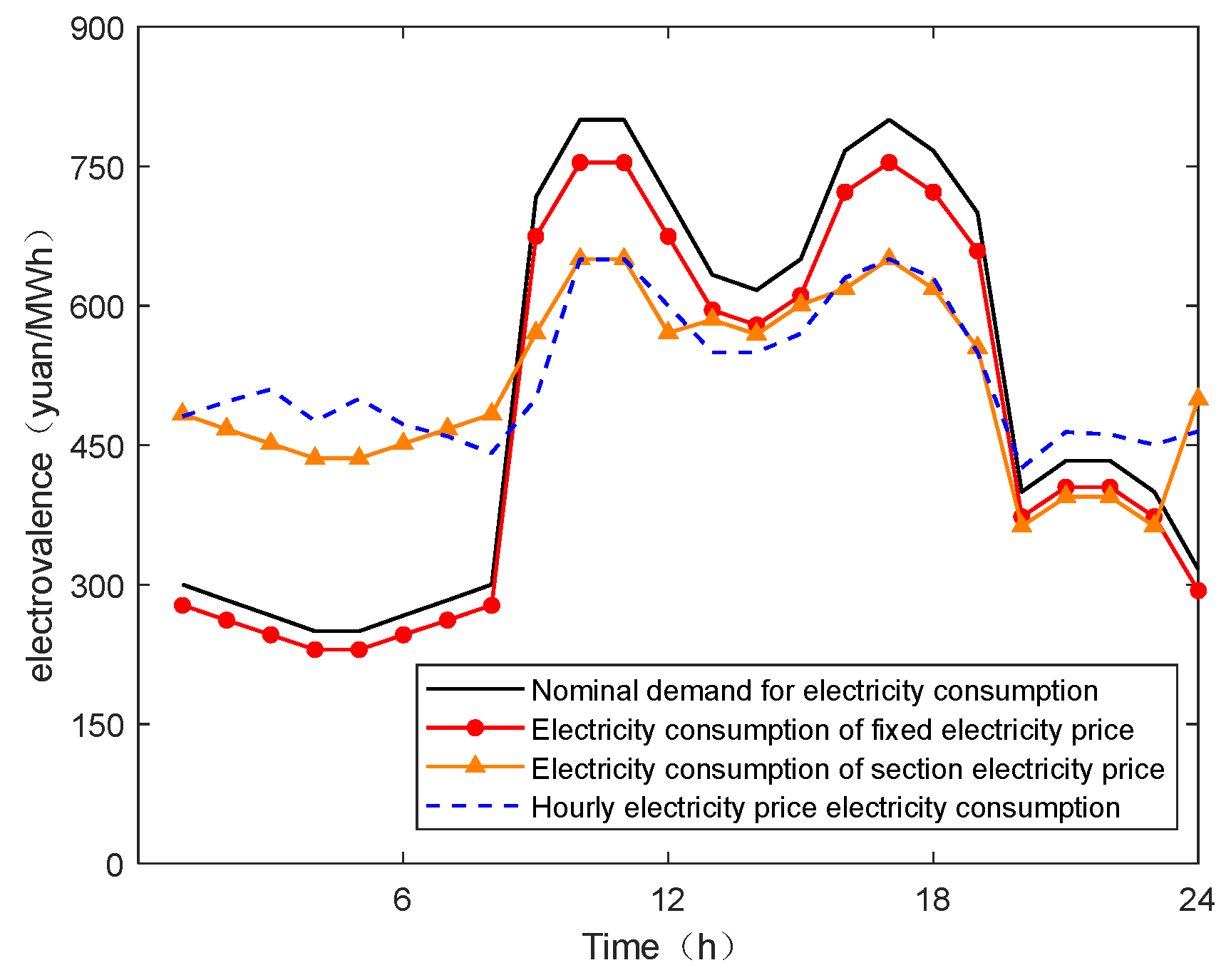

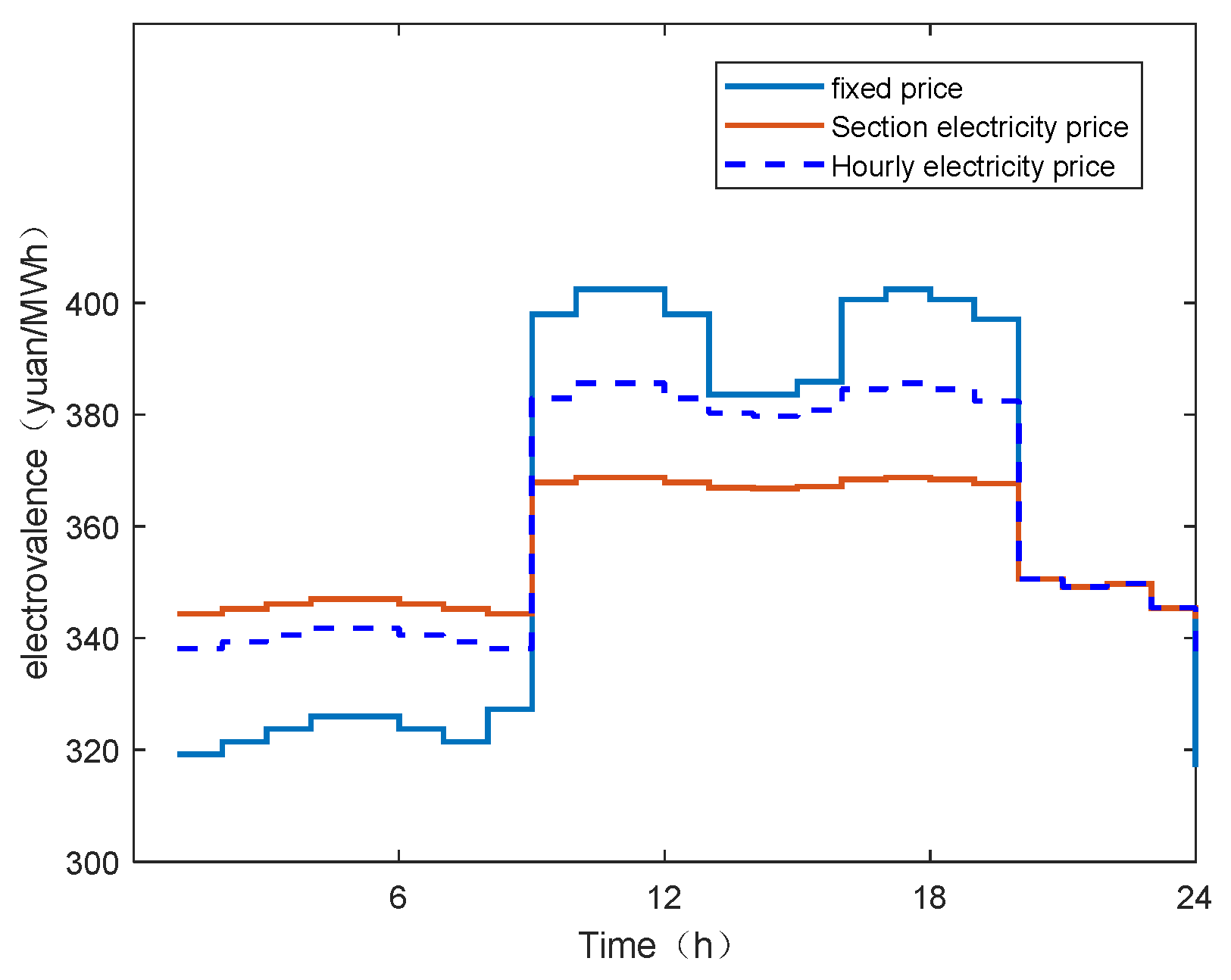

5.2.1. The Influence of Electricity Price Type

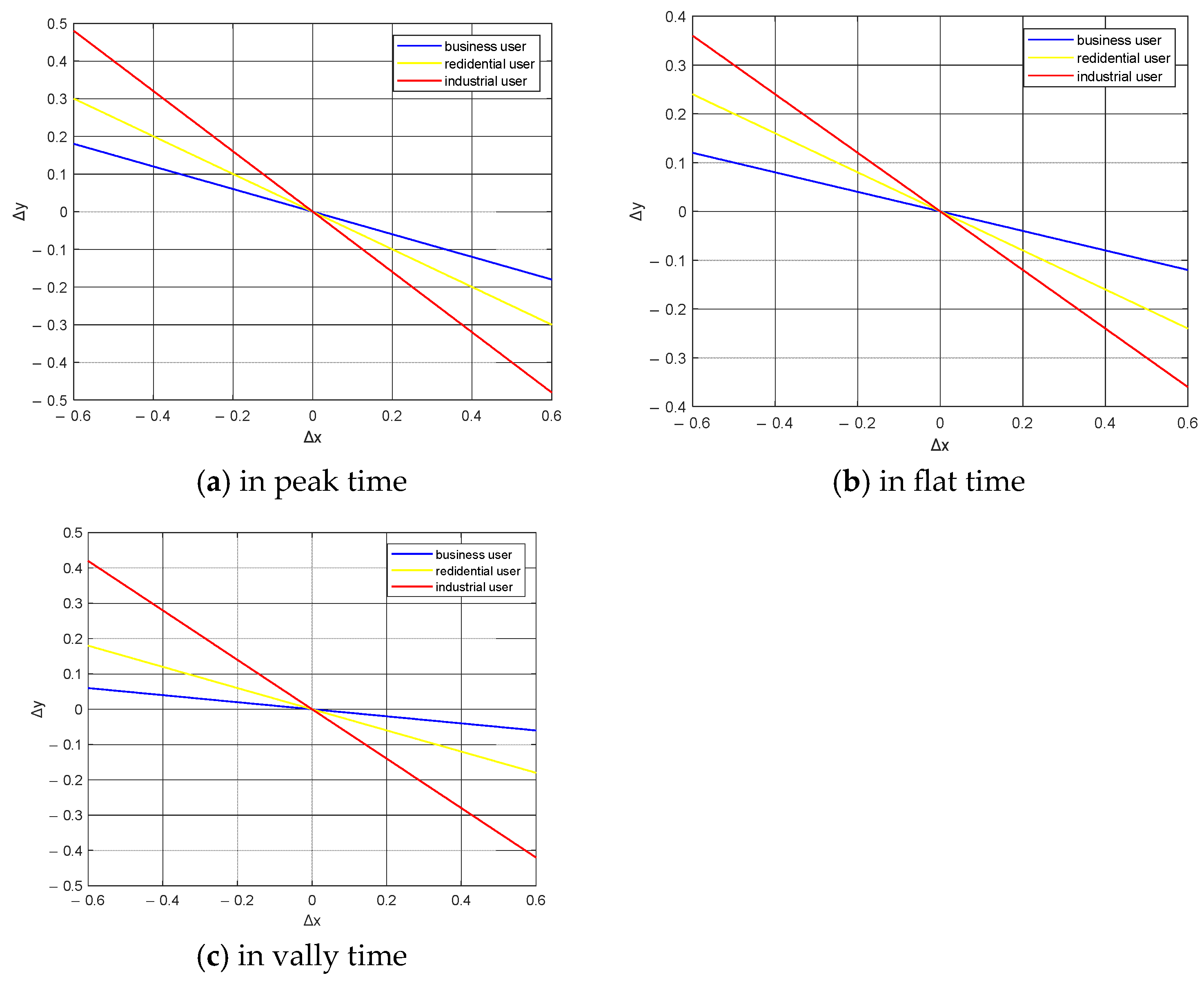

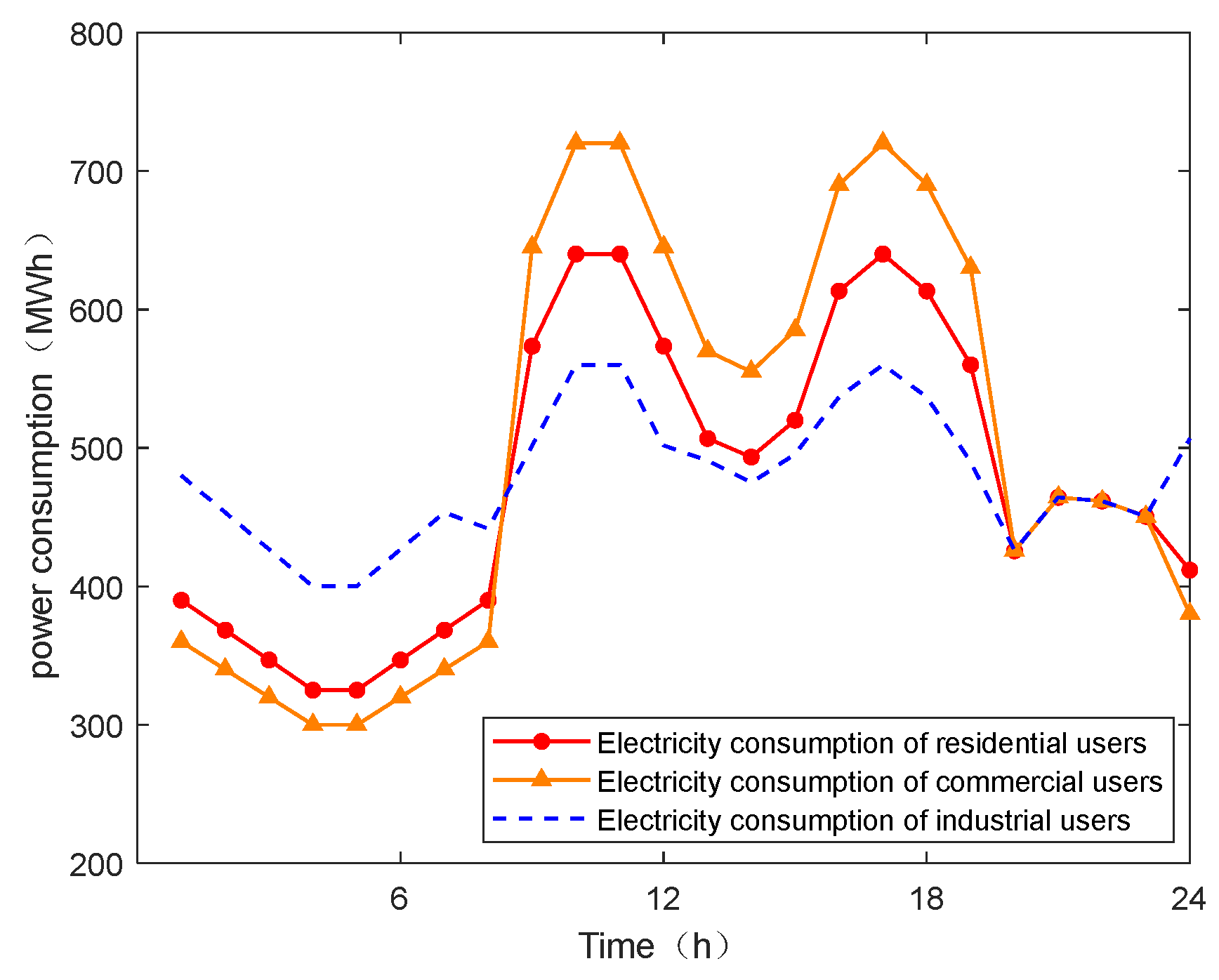

5.2.2. The Impact of User Type

6. Conclusions

- (1)

- Considering the utility and satisfaction of users, the comprehensive benefit function of electricity retailers and users is established. With the goal of maximizing the benefits of both parties, an optimization model of time-of-use electricity price pricing strategy based on master–slave game is established. The application of this model can mobilize the demand response ability of users, effectively optimize the pricing of electricity retailers and the load curve of users, and achieve a win-win situation for both parties;

- (2)

- Compared with the fixed price package, the average electricity price of the users is reduced by 5.4 yuan and 8.09 yuan, respectively, by using the time-of-use price package including the peak-to-valley section electricity price and the 24 electricity price. The electricity sales revenue of the company increased by 16.58 million yuan and 17.25 million yuan, respectively, and the peak-valley difference in user load decreased by 236.58 MWh and 315.39 MWh, respectively. It shows that under the game model, the benefits of both sides are affected by the flexibility of electricity price, and the benefits of power selling companies and users are better under the hourly price;

- (3)

- The demand response effect of users is related to the flexibility of users’ electricity consumption. Compared with the response effect of commercial users, the average electricity price of residents and industrial users is reduced by 2.1 yuan and 5.94 yuan, respectively, after participating in the game. The electricity sales revenue of the company increased by 7.02 million yuan and 12.07 million yuan, respectively, and the peak-valley difference in user load decreased by 104.79 MWh and 283.14 MWh, respectively. It shows that industrial users have the highest flexibility in electricity consumption, and the benefit improvement effect is the best after participating in the game.

7. Future Work

- (1)

- The uncertainty of renewable energy is incorporated into the master–slave game model to study its impact on the optimization strategy of time-of-use electricity price;

- (2)

- The collaborative pricing strategy of multi-regional electricity market is studied, and the optimization mechanism of cross-regional electricity trading is explored.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, S. Success Criteria and Driving Forces of Power System Reform—Discussion Based on Article 9. Energy 2015, 92–96. [Google Scholar]

- Yu, X. Research on the Optimization Model of Electricity Purchase and Sale Transaction of Electricity Selling Companies in the Electricity Market Environment; North China Electric Power University: Beijing, China, 2018. [Google Scholar]

- Yuan, H.; Dong, X.; Liu, Q.; Jin, L.; Zhang, W.; Yang, Z. Design of power retail side market framework under the unified national power market system. Grid Technol. 2022, 46, 4852–4862. [Google Scholar] [CrossRef]

- Tan, X.; Chen, Y.; Li, Y.; Jing, J.; Jiang, N.; Wang, Z.; Shen, Y. Research on time-of-use price optimization considering load development and user behavior. China Electr. Power 2018, 51, 136–144. [Google Scholar] [CrossRef]

- Jerzy, A.; Józef, L.; Agnieszka, W. Seasonal variability of price elasticity of demand of households using zonal tariffs and its impact on hourly load of the power system. Energy 2020, 196, 117175. [Google Scholar] [CrossRef]

- Alsokhiry, F.; Siano, P.; Annuk, A.; Mohamed, M.A. A Novel Time-of-Use Pricing Based Energy Management System for Smart Home Appliances: Cost-Effective Method. Sustainability 2022, 14, 14556. [Google Scholar] [CrossRef]

- Liang, G.; Wang, Y.; Sun, B.; Zhang, Z. An optimization method for the distributed collaborative operation of multilateral entities considering dynamic time-of-use electricity price in active distribution network. Energies 2024, 17, 359. [Google Scholar] [CrossRef]

- Nikzad, M.; Samimi, A. Integration of optimal time-of-use pricing in stochastic programming for energy and reserve management in smart micro-grids. Iran. J. Sci. Technol. Trans. Electr. Eng. 2020, 44, 1449–1466. [Google Scholar] [CrossRef]

- Fraija, A.; Agbossou, K.; Henao, N.; Kelouwani, S.; Fournier, M.; Hosseini, S.S. A discount-based time-of-use electricity pricing strategy for demand response with minimum information using reinforcement learning. IEEE Access 2022, 10, 54018–54028. [Google Scholar] [CrossRef]

- Zhang, G.; Yan, Y.; Zhang, K.; Li, P.; Li, M.; He, Q.; Chao, H. Time-of-use pricing model considering wind power uncertainty. CSEE J. Power Energy Syst. 2020, 8, 1039–1047. [Google Scholar] [CrossRef]

- Cao, J.; He, Y.; Zhou, J.; He, L.; Long, C.; Wang, Y. Research on dynamic time-of-use price optimization of different time scales based on demand side response. J. Electr. Power Sci. Technol. 2024, 39, 242–250+268. [Google Scholar] [CrossRef]

- Yang, J.; Zhao, J.; Wen, F.; Dong, Z. A model of customizing electricity retail prices based on load profile clustering analysis. IEEE Trans. Smart Grid 2019, 10, 3374–3386. [Google Scholar] [CrossRef]

- Lu, E.; Bie, P.; Wang, H.; Chen, Q.; Li, W.; Gu, W. Power system automation. Autom. Electr. Power Syst. 2020, 44, 177–184. [Google Scholar] [CrossRef]

- Kong, Q.; Fu, Q.; Lin, T.; Zhang, Y. Peak-valley time-of-use electricity price optimization model based on cost-benefit analysis. Power Syst. Prot. Control 2018, 46, 60–67. [Google Scholar] [CrossRef]

- Wang, L.; Zhang, L.; Zhang, F.; Jin, D. Decision-making and risk assessment of electricity purchase and sale business. Power Syst. Autom. 2018, 47–54, 143. [Google Scholar] [CrossRef]

- Nojavan, S.; Zare, K.; Mohammadi-Ivatloo, B. Application of fuel cell and electrolyzer as hydrogen energy storage system in energy management of electricity energy retailer in the presence of the renewable energy sources and plug-in electric vehicles. Energy Convers. Manag. 2017, 136, 404–417. [Google Scholar] [CrossRef]

- Amiri-Pebdani, S.; Alinaghian, M.; Safarzadeh, S. Time-Of-Use pricing in an energy sustainable supply chain with government interventions: A game theory approach. Energy 2022, 255, 124380. [Google Scholar] [CrossRef]

- Mahmood, R. Pricing and competition for generative ai. Adv. Neural Inf. Process. Syst. 2024, 37, 75727–75748. [Google Scholar]

- Yang, P.; Tang, G.; Nehorai, A. A game-theoretic approach for optimal time-of-use electricitypricing. IEEE Trans. Power Syst. 2013, 28, 884–892. [Google Scholar] [CrossRef]

- Hu, P.; Ai, X.; Zhang, S.; Pan, X. Research on master-slave game modeling and simulation of time-of-use electricity price based on demand response. Grid Technol. 2020, 2, 585–592. [Google Scholar] [CrossRef]

- Pan, H.; Gao, H.; Yang, Y.; Ma, W.; Zhao, Y.; Liu, J. Multi-retail package design and multi-level market power purchase strategy based on master-slave game. Chin. J. Electr. Eng. 2022, 42, 4785–4800. [Google Scholar] [CrossRef]

- Zhou, Z.; Zhang, L.; Tu, W.; Yuan, Z.; Gou, X. Research on the marketing strategy of electricity selling companies for users’ interruptible load-based on game theory to depict the interaction between electricity selling companies and users. Price Theory Pract. 2020, 133–136+179. [Google Scholar] [CrossRef]

- Xue, W.; Zhao, X.; Li, Y.; Mu, Y.; Tan, H.; Jia, Y.; Wang, X.; Zhao, H.; Zhao, Y. Research on the optimal design of seasonal time-of-use tariff based on the price elasticity of electricity demand. Energies 2023, 16, 1625. [Google Scholar] [CrossRef]

- Yang, J.; Zhang, G.; Ma, K. Demand response based on Stackelberg game in smart grid. In Proceedings of the 32nd Chinese Control Conference, Xi’an, China, 26–28 July 2013. [Google Scholar]

- Liu, X.; Gao, B.; Li, Y. A review of the application of game theory on the power demand side. Grid Technol. 2018, 8, 2704–2711. [Google Scholar] [CrossRef]

- Yu, M.; Hong, S.H. A Real-Time Demand-Response Algorithm for Smart Grids: A Stackelberg Game Approach. IEEE Trans. Smart Grid 2017, 7, 879–888. [Google Scholar] [CrossRef]

- Jia, L.; Tong, L. Dynamic Pricing and Distributed Energy Management for Demand Response. IEEE Trans. Smart Grid 2017, 7, 1128–1136. [Google Scholar] [CrossRef]

| Peak Period | Flat Period | Vally Period | |

|---|---|---|---|

| time division | 9:00–12:00, 16:00–19:00 | 13:00–15:00, 20:00–23:00 | 0:00–8:00 |

| Electricity Price Type | Total Electricity Consumption/ (MWh) | Average Electricity Price/ (Yuan/MWh) | Proceeds of Electricity Selling Companies/ (Million Yuan) | Peak-to-Valley Difference/ (MWh) |

|---|---|---|---|---|

| Fixed electricity price | 11,381.31 | 361.67 | 92.28 | 523.81 |

| Peak-valley TOU electricity price | 12,327.40 | 356.27 | 108.86 | 287.23 |

| 24 h TOU electricity price | 12,634.07 | 353.58 | 109.53 | 208.42 |

| User Type | Maximum Power Consumption | Minimum Power Consumption |

|---|---|---|

| residential user | 130% | 80% |

| business customer | 120% | 90% |

| industrial user | 160% | 70% |

| User Type | Total Electricity Consumption/ (MWh) | Average Electricity Price/ (Yuan/MWh) | Proceeds of Electricity Selling Companies/ (Million Yuan) | Peak-to-Valley Difference/ (MWh) |

|---|---|---|---|---|

| residential user | 11,498.15 | 363.26 | 107.13 | 315.02 |

| business customer | 11,446.95 | 365.36 | 100.11 | 419.81 |

| industrial user | 11,991.95 | 359.42 | 112.19 | 136.67 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Zhang, W.; Hu, G.; Xu, B.; Cui, X.; Liu, X.; Zhao, J. Master–Slave Game Pricing Strategy of Time-of-Use Electricity Price of Electricity Retailers Considering Users’ Electricity Utility and Satisfaction. Sustainability 2025, 17, 3020. https://doi.org/10.3390/su17073020

Liu J, Zhang W, Hu G, Xu B, Cui X, Liu X, Zhao J. Master–Slave Game Pricing Strategy of Time-of-Use Electricity Price of Electricity Retailers Considering Users’ Electricity Utility and Satisfaction. Sustainability. 2025; 17(7):3020. https://doi.org/10.3390/su17073020

Chicago/Turabian StyleLiu, Jiangping, Wei Zhang, Guang Hu, Bolun Xu, Xue Cui, Xue Liu, and Jun Zhao. 2025. "Master–Slave Game Pricing Strategy of Time-of-Use Electricity Price of Electricity Retailers Considering Users’ Electricity Utility and Satisfaction" Sustainability 17, no. 7: 3020. https://doi.org/10.3390/su17073020

APA StyleLiu, J., Zhang, W., Hu, G., Xu, B., Cui, X., Liu, X., & Zhao, J. (2025). Master–Slave Game Pricing Strategy of Time-of-Use Electricity Price of Electricity Retailers Considering Users’ Electricity Utility and Satisfaction. Sustainability, 17(7), 3020. https://doi.org/10.3390/su17073020