Abstract

In the digital economy, data has emerged a pivotal driver for optimizing resource allocation, enhancing productivity, and accelerating the transition toward environmentally sustainable development. Exploring how the marketization of data elements affects corporate green innovation is of considerable theoretical and practical significance. Using the establishment of data trading platforms in China as a quasi-natural experiment, this study constructs a multi-period difference-in-differences (DID) model based on panel data of A-share listed firms between 2009 and 2022 to investigate the impact of data element marketization on corporate green innovation. The empirical results demonstrate that the marketization of data elements significantly promotes corporate green innovation, and this conclusion remains consistent across a series of robustness checks. Further exploration of the underlying mechanisms reveals that the marketization of data elements fosters green innovation by alleviating financing constraints, improving the structure of human capital, and facilitating collaborative innovation. These mechanisms highlight the role of data markets in strengthening corporate innovation capacity while reinforcing environmental responsibility. Moreover, heterogeneity analyses indicate that the promoting effect is particularly pronounced among firms located in the eastern China, regions equipped with advanced digital infrastructure, industries with lower pollution level, and non-state-owned enterprises. By linking reforms in data governance with green development objectives, this research enriches the growing literature on digital institutional transformation and corporate environmental innovation. The findings provide new empirical evidence that the establishment of data markets constitutes an effective institutional mechanism for advancing green and low-carbon development, offering valuable policy insights for integrating digital economy progress with ecological sustainability.

1. Introduction

With the continuous upgrading of digital technologies represented by blockchain, big data, artificial intelligence, and cloud computing, the digital economy has developed rapidly [1]. The development of the digital economy is profoundly reshaping production and innovation patterns. In this transformation, data has emerged as a new type of production factor, complementing traditional production factors such as human capital, financial capital, and land resources [2]. The deep integration of data with technological innovation, industrial upgrading, and public governance is forming a new foundation for economic growth and sustainable development. As a strategic asset that enhances productivity and stimulates innovation, data also plays a central role in driving the transition toward green and low-carbon development.

However, the development of data-driven economies faces several persistent challenges. Prevailing data market mechanisms are frequently characterized by data monopolies, fragmented data silos, unclear property rights, and opaque pricing mechanisms [3]. These obstacles hinder the efficient circulation and utilization of data, thereby limiting the realization of its broader economic and social potential [3]. In response, governments worldwide have increasingly recognized the necessity of institutional reforms aimed at promoting the market-oriented governance of data resources. By establishing mechanisms for data circulation, pricing, and utilization, policymakers aim to unlock the potential of data, enhance innovation capacity, and support sustainable economic transformation. In China, the formal inclusion of data elements as a new production factor within national development strategies represents a significant step toward a more digital and sustainable economy.

At the same time, corporate green innovation has become a crucial pathway for achieving carbon neutrality and addressing global climate challenges [4]. Green innovation refers to improvements of products, processes, or services that mitigate negative environmental impacts and improve resource efficiency [5]. However, green innovation is often characterized by high uncertainty, long investment cycles, and substantial information asymmetry [6], which constrain firms’ incentives and capacity to pursue sustainable technological advancement.

The challenge of unlocking the value of data through market mechanisms is linked to the challenges of promoting green innovation. The establishment of effective data markets has the potential to address the obstacles that inhibit green innovation. By providing verified data related to green technologies, innovation trends and market opportunities, data markets can reduce the information asymmetry, thereby lowering financing constraints and mitigating uncertainty associated with green R&D. Moreover, data markets also lower transaction costs for forming green innovation partnerships and accessing specialized knowledge, facilitate knowledge sharing, and strengthen the network of green innovation. Therefore, it is necessary to connect this institutional reform with corporate green innovation behavior. The core question we address is whether and how the marketization of data elements promotes corporate green innovation.

Although a growing body of research has examined the determinants of corporate green innovation, focusing on environmental regulation [7,8], financial development [9], government subsidies [10], and executive characteristics [11], limited attention has been devoted to the role of digital institutional reforms, particularly the marketization of data elements, in shaping firms’ green technological behaviors. From the perspective of digital governance, the marketization of data elements can reshape the innovation environment by enhancing information flows, facilitating cooperative innovation, and reducing information asymmetries that impede green R&D. Therefore, exploring the influence of data element marketization on corporate green innovation is of critical importance for understanding how digital institutional transformation contributes to sustainable economic development.

In recent years, the marketization of data elements has become a strategic priority in China’s policy agenda. The Chinese government has actively advanced institutional and infrastructural reforms to promote data circulation, clarify data property rights, and build trading platforms to enable data transactions [12]. These initiatives are closely aligned with China’s national goals of peaking carbon emissions before 2030 and achieving carbon neutrality by 2060. The establishment of regional data trading platforms, beginning with pilot projects in cities such as Guiyang, Shanghai, and Shenzhen, reflects the government’s commitment to creating a regulated and efficient data market system. Against this backdrop, investigating the relationship between data element marketization and corporate green innovation is of both theoretical and practical significance for understanding how the digital economy can facilitate green and sustainable development.

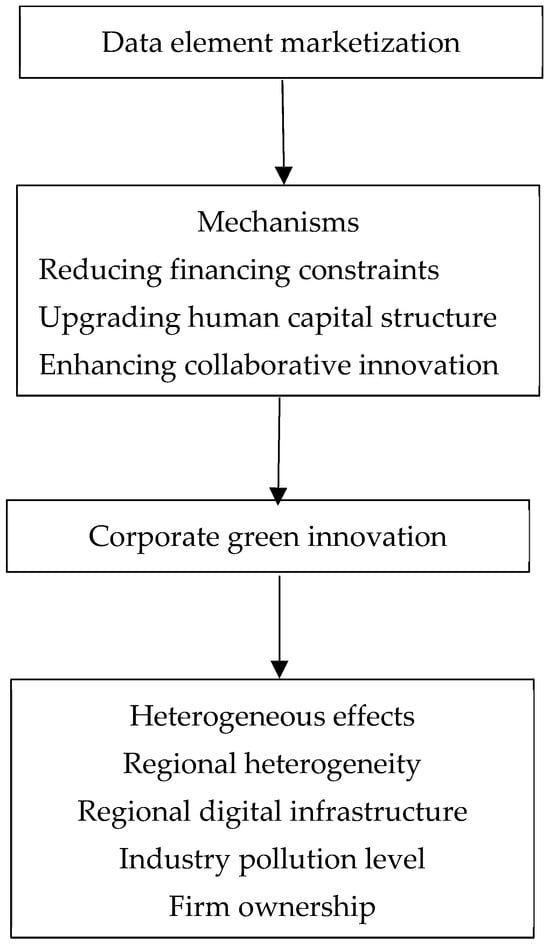

To empirically assess this relationship, this study takes advantage of the staggered establishment of data trading platforms across Chinese cities since 2014 as a quasi-natural experiment. Using panel data from A-share listed firms between 2009 and 2022, we construct a multi-period difference-in-differences (DID) model to examine the effect of data element marketization on corporate green innovation. Our analysis proceeds in three steps to provide a comprehensive understanding. First, we estimate the average treatment effect and conduct a series of robustness tests to validate the main finding. Second, we investigate the potential mechanism through which data element marketization might influence green innovation, focusing on financing constraints, human capital structure, and collaborative innovation. Third, we explore how this effect varies across different contexts. The research framework is presented in Figure 1.

Figure 1.

Research framework.

The significance of this study lies in three major aspects. First, it enriches the literature on the digital economy and sustainable development by introducing data element marketization as a novel institutional factor influencing green innovation. It builds on and advances institutional theory and innovation system frameworks by highlighting the role of data governance in easing financing constraints, optimizing human capital allocation, and strengthening innovation networks. Second, it extends the determinants of corporate green innovation from traditional perspectives, such as environmental regulation and financial support, to the perspective of digital governance and institutional transformation. Third, the findings provide actionable insights for policymakers seeking to design effective data market infrastructures that can simultaneously promote digital transformation and green development goals. This is especially relevant for China and other developing economies aiming to balance economic growth, digital transformation, and environmental sustainability.

The remainder of this paper is organized as follows. Section 2 includes a comprehensive review of the literature. Section 3 introduces the policy background and theoretical hypotheses. Section 4 describes the research design. Section 5 presents the empirical results. Section 6 presents the mechanism analysis. Section 7 present the heterogeneity analysis. Section 8 concludes with the research findings, policy implications, limitations, and future research directions.

2. Literature Review

2.1. The Digital Economy and the Marketization of Data Elements

The digital economy has become a central driver of global economic transformation, reshaping industrial structures, innovation models, and governance mechanisms. Digital technologies, such as artificial intelligence, blockchain, and big data analytics, facilitate the generation, storage, and utilization of vast amounts of data, thereby reshaping traditional production modes. As a result, data has been gradually recognized as a strategic production factor comparable to labor, capital, and land, due to its ability to reduce information asymmetry, improve resource allocation efficiency, and stimulate new forms of technological innovation [13,14,15]. Existing studies have shown that digitalization can enhance productivity not only through process optimization but also by enabling data-driven value creation mechanisms that foster business model innovation and technological upgrading [14,16,17,18,19,20,21].

However, the strategic importance of data simultaneously exposes institutional constraints in existing governance systems. The lack of clear data property rights, pricing standards, and trading mechanisms leads to fragmented data markets and inhibits the efficient circulation of data resources [22]. These institutional frictions have been widely discussed in global debates on data governance and digital market regulation.

In response, governments worldwide are exploring market-oriented institutional arrangements to govern data sources, that is, the establishment of market-oriented systems that enable data exchange, valuation, and utilization under transparent and secure frameworks. The development of data element markets, characterized by transparent trading platforms, standardized contracts, and well-defined property rights, is expected to unlock the potential value of data by facilitating its efficient circulation. Empirical research from international digital market reforms suggests that advanced data markets can enhance resource allocation efficiency, reduce transaction costs, and generate cross-sector innovation spillovers [23].

In the Chinese context, the concept of data elements as a new factor of production was officially recognized in the 2019 Decision on Improving the Socialist Market Economy. Since then, pilot projects for data trading platforms have been launched in cities such as Guiyang, Shanghai, and Shenzhen. These platforms provide institutional support for defining data ownership, facilitating transactions, and ensuring security and compliance in data exchange. These initiatives reflect a broader institutional transition toward a digital governance system, in which data resources are integrated into production and innovation processes under market-oriented frameworks. However, despite rapid institutional progress, empirical studies examining the economic and environmental effects of data element marketization remain limited, creating an opportunity for further investigation.

2.2. Corporate Green Innovation

Corporate green innovation represents a critical means through which firms can balance economic performance with environmental sustainability [24]. It encompasses the development of new products, services, or processes that reduce environmental impacts and improve resource efficiency. The determinants of corporate green innovation have been extensively studied and can be broadly categorized into external and internal drivers.

From the external perspective, environmental regulation has consistently been identified as a crucial influence factor of green technological innovation [25]. A large body of empirical evidence supports the Porter Hypothesis [26], highlighting that appropriately designed environmental regulation can significantly stimulate firms to engage in green technology innovation [27,28,29,30,31,32,33]. Additionally, financial development mitigates funding constraints that typically hinder green innovation activities [34], while government subsidies [10,35] and tax incentives [36,37,38] reduce innovation costs and encourage firms to engage in environmentally friendly innovation.

From the internal perspective, the organizational characteristics, such as executive characteristics [11,39,40,41], ownership structure [42,43,44], and corporate social responsibility [45], play vital roles in shaping green innovation strategies. More recently, international scholars have emphasized the enabling role of digital transformation, noting that digitalization enhances environmental monitoring, energy management, and the adoption of cleaner production practices [16,17,46]. This aligns with the emerging understanding that digital transformation can act as a catalyst for ecological modernization by creating more intelligent and responsive production systems.

Despite these comprehensive insights, a significant gap remains. The existing literature focuses on digital technology adoption at the firm level, while few examine how broader digital institutional reforms, especially the marketization of data elements, reshape firms’ green innovation behavior. This gap highlights the need to bridge the literature on digital economy institutions with that on green innovation determinants.

2.3. Marketization of Data Element and Corporate Green Innovation

The intersection between data market development and corporate green innovation represents an emerging research frontier. Theoretically, according to institutional theory and resource-based view, the marketization of data elements functions as an institutional shock that enhances firms’ ability to access and leverage critical data resources, thereby facilitating green innovation. The main influence mechanisms are as follows.

First, enhancing information transparency. Data element marketization improves the transparency and accessibility of environmental, financial, and technological information, thereby reducing uncertainty in green R&D investment decisions [22]. This can help firms better identify green technology opportunities and evaluate environmental risks. Second, optimizing resource allocation. Data element marketization facilitates the efficient allocation of digital and financial resources [46], which can mitigate financing constraints and optimize capital flow toward sustainable projects. Third, strengthening collaborative innovation. Data sharing and circulation across organizational boundaries strengthen inter-firm cooperation and knowledge spillovers, fostering green technological ecosystems [22]. Finally, promoting human capital upgrading. As data becomes a core production factor, firms are incentivized to cultivate digital literacy and innovation-oriented skills among employees, thereby enhancing their capacity for green technological breakthroughs [47].

However, empirical evidence on these mechanisms remains scarce. While recent studies have explored the relationship between digitalization and environmental performance [48], few have examined how the institutional dimension of digital governance, the formation of data markets, shapes corporate green innovation.

By connecting data element marketization to corporate green innovation, this research contributes to bridging the gap between digital economy studies and environmental economics. It emphasizes that the digital institutional transformation, manifested through data property rights, trading platforms, and circulation mechanisms, constitutes a new driver of green innovation. This perspective aligns with global efforts of integrating digital economy development with sustainable development, particularly within the context of China’s carbon neutrality goals.

Existing studies provide valuable insights into the roles of environmental regulation, financial systems, and technological capabilities in promoting green innovation. However, the impact of data element marketization as an institutional reform in the digital era remains underexplored. Therefore, this study is guided by the three research questions: (1) How does the marketization of data elements influence corporate green innovation? (2) Through what key mechanisms does the marketization of data elements influence corporate green innovation? (3) Does the impact of data element marketization on corporate green innovation exhibit heterogeneity across different types of firms?

Addressing this gap not only enriches the theoretical discourse on sustainable innovation but also offers practical implications for policymakers seeking to balance digital transformation and environmental objectives.

3. Policy Background and Theoretical Analysis

3.1. Policy Background of Data Trading Platforms in China

In recent years, China has undertaken a comprehensive policy transformation to promote the marketization of data elements. A pivotal milestone occurred in 2019, when the Fourth Plenary Session of the 19th Central Committee of the Communist Party of China (CPC) formally recognized data as a new factor of production, alongside labor, capital, and land. This policy shift signaled a new stage in the digital economy, reflecting the government’s determination to integrate data into the broader resource allocation system. In subsequent years, a series of national strategic documents, such as the Outline of the 14th Five-Year Plan for National Economic and Social Development and the Long-Range Objectives for 2035 and the 14th Five-Year Plan for Digital Economy Development, emphasized the need to develop data markets and to improve mechanisms for data circulation, valuation, and utilization. The goal is to transform data from an underutilized resource into a tradable production factor that stimulates innovation, enhances productivity, and supports sustainable and high-quality economic growth.

The institutional framework for China’s data trading platforms has evolved through three major phases. From 2014 to 2016, policymakers focused on building preliminary mechanisms for data exchange and promoting the integration of public and corporate data resources. China’s data trading platforms first emerged in 2014, marking a milestone in the nation’s exploration of data element marketization. The Big Data Industry Development Plan (2016–2020), issued by the Ministry of Industry and Information Technology, proposed establishing standardized data trading venues and enhancing data governance frameworks. During this phase, several pilot exchanges were introduced, laying the groundwork for subsequent institutionalization.

From 2017 to 2021, as digital transformation accelerated across industries, national policies began to emphasize the need for comprehensive frameworks governing data ownership, pricing, circulation, and trading. In 2020, the Opinions on Improving the System and Mechanism for Market-Oriented Allocation of Production Factors officially included data as a key production element to be allocated by market forces. Local governments responded by establishing regional data exchanges, such as those in Shanghai, Shenzhen, and Guiyang, to explore different models of data element marketization. These platforms began to test mechanisms for trading, settlement, and valuation, gradually forming the foundation for a national data market system.

The publication of the Opinions on Building Basic Data Systems to Better Play the Role of Data Elements in December 2022 marked a new stage in policy maturity. Commonly known as the Twenty Data Measures, this policy introduced four foundational systems, including data property rights, circulation and trading, income distribution, and governance. It provided a coherent framework to standardize market practices, protect data security, and clarify responsibilities among stakeholders. Subsequently, the Three-Year Action Plan for Data Elements (2024–2026) reinforced these goals by calling for the creation of a unified, secure, and transparent data trading environment, integrating data resources from government, firms, and society at large.

By 2024, more than 40 regional and municipal data trading platforms had been established nationwide, collectively listing tens of thousands of data products. According to China Daily reports, the market size of China’s data element economy reached approximately RMB 159 billion in 2024, reflecting rapid institutional growth and significant potential for further expansion.

While the policies underpinning data trading platforms primarily aim to advance the digital economy, they also carry important implications for green and sustainable development. Data-driven mechanisms can improve firms’ access to high-quality information on energy efficiency, emissions, and supply chain performance, enabling evidence-based environmental management. By reducing information asymmetry and transaction costs in the data market, data trading platforms can lower barriers to technological collaboration and resource optimization.

The establishment of data trading platforms represents a distinctive policy-driven institutional innovation that transforms data from a passive resource into an active driver of productivity, innovation, and sustainability. Against this institutional backdrop, this study explores how the formation of data trading platforms stimulates corporate green innovation in China. Understanding this relationship contributes to the broader discourse on how emerging data markets interact with sustainable development objectives in a digital economy context.

3.2. Theoretical Analysis

The marketization of data elements represents a new institutional arrangement in the digital economy, designed to promote the effective circulation and value realization of data as a new production factor. Data have become a critical input for technological advancement, economic coordination, and sustainability transitions. However, unlike traditional factors, data possesses distinctive characteristics of non-rivalry, non-excludability, infinite replicability, and network externalities [49], which makes its market formation inherently complex. These characteristics imply that while the use of data by one actor does not diminish its availability to others, the lack of clear ownership and valuation mechanisms can lead to inefficiencies and underutilization.

To address these challenges, governments worldwide, particularly in China, have initiated institutional reforms to establish data trading platforms that ensure the secure, standardized, and lawful flow of data resources. From an institutional economics perspective, this process can be understood as the creation of formal rules to reduce uncertainty and transaction costs. The objective is to transform data from a latent informational resource into a tradable economic asset that supports innovation, industrial upgrading, and sustainable development.

The establishment of data trading systems serves several interrelated objectives. First, it clarifies data ownership and usage rights, thus addressing one of the most fundamental barriers to data utilization, the question of who holds ownership and who ultimately gains. This aligns directly with the property rights theory, which posits that well-defined and enforceable property rights are a prerequisite for efficient exchange and investment by internalizing externalities. Second, it promotes data liquidity by creating marketplaces where firms and institutions can legally and efficiently exchange data assets. Third, it ensures data security and compliance, which are prerequisites for trust and participation in the digital economy. These institutional innovations contribute to the formation of a data-driven market environment that supports firms’ technological upgrading and sustainable transformation.

From the perspective of institutional economics, data element marketization can be understood as a process of reducing institutional transaction costs and improving the efficiency of resource allocation through market-oriented governance [50]. The institutionalization of data transactions clarifies ownership, promotes trust among market participants, and lowers barriers to data exchange. According to Coase’s theory of transaction costs, market efficiency depends on the ability of institutions to minimize the costs associated with searching for information, negotiating contracts, and enforcing exchanges [51]. When data are fragmented, unstandardized, or legally ambiguous, firms face high transaction costs in acquiring and utilizing them. The establishment of data trading platforms and property-rights systems reduces these costs by clarifying ownership, establishing standardized contracts, and providing legal recourse for disputes [52]. Moreover, institutionalization promotes mutual trust among market participants, thereby reducing perceived risks and facilitating voluntary exchange. When the friction of data transactions is lowered, data resources, along with associated knowledge and technologies, can flow more freely to their most productive and innovative uses. In this context, the marketization of data elements acts as an institutional catalyst that enhances the circulation of information and technological knowledge within and across industries [53]. Firms that participate in data markets gain improved access to external datasets, including environmental, industrial, and consumer data, that can complement internal R&D efforts [54]. This enhanced information access strengthens firms’ capacity to identify efficiency bottlenecks, optimize production processes, and pursue innovation strategies that reduce waste and emissions. Therefore, by improving the institutional environment for information exchange, data marketization indirectly contributes to green innovation.

From the perspective of innovation economics, the Schumpeterian view emphasizes that innovation arises from the recombination and diffusion of knowledge across organizational and industrial boundaries [55]. The establishment of data markets serves as a catalyst for such knowledge recombination by enabling data-driven collaboration and learning effects [22]. According to Schumpeter’s view, the essence of innovation lies in the ability to combine existing resources and information in new ways. Data trading platforms accelerate this process by lowering barriers to access and encouraging collaboration among diverse actors in the innovation ecosystem [22]. Firms can obtain external data to complement their internal capabilities, thus engaging in green innovation. This integration of diverse datasets enhances technological learning and improves innovation efficiency.

In addition, network externalities inherent in digital platforms magnify these effects. As more participants engage in data exchange, the total value and utility of the data ecosystem increase exponentially, a phenomenon known as the data network effect. Larger and more active data markets produce richer, more diverse datasets that further stimulate innovation across sectors [22]. The resulting positive feedback loop enhances technological spillovers, fosters industrial upgrading, and promotes sustainable economic growth.

When applied to the environmental domain, these mechanisms acquire strategic importance. Green innovation is inherently data-intensive. Firms require accurate, timely, and multidimensional information to monitor emissions, manage resources, and evaluate sustainability performance. Marketized data flows enable firms to identify pollution hotspots, optimize energy use, and evaluate the carbon footprint of their products throughout their life cycle. Through data-driven environmental management, firms can transition from reactive compliance to proactive sustainability strategies, thereby strengthening their competitive advantage while contributing to national and global sustainability goals.

In summary, the marketization of data elements enhances both the institutional environment and the innovation capacity necessary for corporate green transformation. By improving the efficiency of data exchange, reducing transaction costs, and stimulating cross-boundary knowledge recombination, the marketization of data elements enables firms to innovate more effectively and sustainably. The resulting synergies between institutional reform and technological advancement contribute to cleaner production, resource efficiency, and long-term competitiveness.

Therefore, this study proposes the following hypothesis:

Hypothesis 1 (H1).

The marketization of data elements significantly promotes corporate green innovation.

While the above hypothesis outlines the core theoretical relationships, we acknowledge that several contextual factors at the level of region, industry and firm may moderate or confound these relationships. To provide a more nuanced understanding, these potential boundary conditions will be explicitly examined in the subsequent heterogeneity analysis section.

Based on the above theoretical analysis, this study proposes three mechanisms: alleviating financing constraints, optimizing human capital structure, and enhancing collaborative innovation. The methodological rationale for selecting these three mechanisms is that they represent the most direct and theoretically grounded pathways through which the core functions of data element marketization, including information asymmetry and transaction cost reduction, address the most critical and well-documented barriers to corporate green innovations. The following sections detail this logic for each mechanism.

3.2.1. Financing Constraints

Corporate green innovation requires substantial financial support due to significant capital investments, long payback periods, and high risks [4]. However, many firms face significant financing constraints due to information asymmetry and limited collateral. These financial constraints hinder firms’ willingness and ability to undertake green innovation projects [9], thus limiting the diffusion of environmentally friendly technologies and the overall transition toward low-carbon development.

The marketization of data elements introduces a novel institutional mechanism to reduce financing constraints. Through the establishment of data trading platforms and the standardization of data assets, information related to firms’ operations, environmental performance and innovation activities becomes more transparent and traceable. This improved data accessibility enhances financial institutions’ ability to evaluate corporate creditworthiness and innovation potential more accurately, effectively mitigating information asymmetry between lenders and borrowers [56]. Thus, investors and banks can better differentiate between high-quality and low-quality projects, leading to lower risk premiums and improved capital allocation efficiency.

Moreover, as big data analytics and artificial intelligence become increasingly integrated into financial risk assessment models, the development of a data-driven market system can further optimize credit decision-making. By enabling dynamic monitoring of firms’ environmental and operational data, financial institutions can establish more adaptive and precise risk management frameworks [57]. This process not only reduces the perceived risks of financing green projects but also fosters a favorable environment for sustainable investment and technological upgrading. In this regard, the marketization of data elements acts as a catalyst that aligns financial incentives with green innovation objectives, thereby reinforcing the financial foundation of corporate sustainability transitions.

Therefore, this study proposes the following hypothesis:

Hypothesis 2 (H2).

The marketization of data elements promotes corporate green innovation by alleviating financing constraints.

3.2.2. Human Capital

Human capital, defined as the knowledge, skills, and abilities embodied in individuals, is a key driver of technological innovation [47]. Its role is particularly critical in the context of green innovation, which requires specialized expertise to solve complex environmental problems. The marketization of data elements fundamentally transforms the structure and dynamics of corporate human capital. Data element marketization creates a powerful skill-biased technological change. As data becomes an essential production factor, the demand for data-competent professionals increases. This incentivizes firms to reallocate resources to recruit and train employees with high level of skill and education to meet the evolving requirements of a data-driven economy [58]. The integration of data into production and management processes encourages knowledge sharing and the formation of data-driven decision-making cultures, which enhance the efficiency of green R&D activities. Furthermore, this upgraded human capital directly enhances the firm’s absorptive capacity. Employees equipped with both digital and environmental knowledge are better positioned to leverage the vast external information made accessible through data markets [47]. They can more effectively identify relevant technological opportunities, and recombine external knowledge with internal expertise [59]. This process of knowledge recombination is the essence of innovation. Moreover, a more data competent workforce promotes organizational resilience, adaptability, and responsiveness to environmental regulations and market shifts, thereby establishing a sustainable competitive advantage in the green economy.

Accordingly, this study proposes the following hypothesis:

Hypothesis 3 (H3).

The marketization of data elements promotes corporate green innovation by upgrading the human capital structure.

3.2.3. Collaborative Innovation

Corporate green innovation, which involves the integration of environmental protection and technological progress, is inherently complex and knowledge-intensive, often requiring cooperation among firms, research institutions, governments, and other stakeholders [25]. However, traditional collaboration mechanisms face barriers such as information asymmetry, data fragmentation, and high transaction costs of identifying and coordinating with suitable partners. The marketization of data elements establishes an institutional framework that directly addresses these barriers. By creating standardized data trading rules and interoperable data infrastructures, it mitigates the risks and frictions associated with knowledge exchange. High coordination costs can deter collaboration. Data markets function as a governance mechanism that reduces the costs of partner search, contracting, and monitoring, thereby facilitating cooperation [22]. In addition, this institutional arrangement is a key enabler of open innovation by providing formal channels for firms to efficiently access and share high-quality data and knowledge resources. Through the development of transparent and regulated data markets, firms can more readily obtain high-quality external data, access diverse scientific and technological resources, and engage in structured knowledge sharing [60]. Data markets also enhance the firms’ absorptive capacity to enable more effective knowledge recombination across firm boundaries. Firms can integrate external datasets with their internal R&D, leading to solutions for sustainability challenges. Furthermore, the network effects inherent in digital platforms amplify this process. As more participants join the data ecosystem, the diversity and value of the knowledge pool increase, creating a positive feedback loop for innovation. This data-driven collaborative environment allows firms to integrate complementary capabilities, thereby accelerating the development and diffusion of green technologies [48].

Therefore, this study proposes the following hypothesis:

Hypothesis 4 (H4).

The marketization of data elements promotes corporate green innovation by enhancing collaborative innovation.

4. Research Design

4.1. Sample Selection and Data Sources

This study selects A-share listed firms in China from 2009 to 2022 as the primary research sample. The sample period is selected to ensure data continuity and capture the evolution of the data element marketization process. Observations prior to 2009 are excluded to mitigate the interference of the 2008 global financial crisis and subsequent government stimulus policies, which could introduce systematic distortions in corporate investment and innovation behavior. The sample is further screened according to the following criteria: (1) firms designated as ST, *ST, or PT during the sample period are removed due to abnormal financial conditions that may bias the analysis; (2) observations with missing values for key variables are excluded to ensure the reliability of empirical estimation; and (3) financial industry firms are eliminated because their balance sheet structures and regulatory environments are significantly different from those of non-financial firms. To mitigate the impact of outliers, all continuous variables are subjected to winsorization at the 1% and 99% levels. After these screening and preprocessing steps, the final dataset consists of 39,612 firm-year observations. This comprehensive and rigorously processed panel dataset offers strong support for analyzing the influence of data element marketization on corporate green innovation.

Green innovation data are obtained from the China Research Data Service Platform (CNRDS), which provides standardized and widely acknowledged indicators for corporate green patents. Financial indicators and corporate governance data at the firm level come from the China Stock Market and Accounting Research (CSMAR) database, a widely utilized authoritative source in empirical studies on Chinese listed firms. Additionally, information on the establishment and development timeline of local data trading platforms is manually collected from official government portals and policy announcements to ensure accuracy and completeness.

4.2. Variable Definition

4.2.1. Dependent Variable: Corporate Green Innovation (lngre)

Corporate green innovation denotes firms’ innovation activities that promote energy conservation, emission reduction, low-carbon production, and ecological sustainability. Such innovation aims to achieve a coordinated balance between environmental protection and economic performance, thereby supporting long-term sustainable development. Referring to previous research [61], this study measures corporate green innovation by using the number of green patents granted to firms. Green patents are widely regarded as a credible indicator of substantive innovation outcomes with environmental attributes. To mitigate the influence of potential outliers and potential heteroscedasticity, and make the distribution of variables more aligned with the normality assumption of linear models, thereby aligning the data distribution more closely with the assumptions of ordinary least squares regression, the natural logarithm of one plus the number of granted green patents is employed. This transformation provides a robust and continuous measure of corporate green innovation intensity.

4.2.2. Independent Variable: Marketization of Data Elements (did)

To capture the degree of data element marketization, this study exploits the staggered establishment of regional data trading platforms in China as a quasi-natural experiment. These platforms represent institutional milestones in the construction of digital factor markets, facilitating standardized data exchange and strengthening data resource allocation efficiency. Accordingly, a dummy variable is constructed, taking the value of 1 for firms located in regions that have established data trading platforms in a given year and each subsequent year, and 0 otherwise.

4.2.3. Control Variables

To alleviate potential omitted-variable bias and more accurately identify the effect of data element marketization on green innovation, this study incorporates a set of commonly used control variables in empirical analyses. These controls account for firm characteristics that may influence innovation decisions and performance. Specially, the control variables include: (1) firm size (Size), measured by the natural logarithm of the firm’s total assets; (2) return on assets (ROA), measured by the ratio of net profit to total assets; (3) Tobin’s Q value (TobinQ), measured by the ratio of total market capitalization to total assets; (4) financial leverage (Lev), measured by the ratio of total liabilities to total assets; (5) firm age (FirmAge), measured by the natural logarithm of the number of years since the firm’s establishment.

The detailed definitions and descriptions of all variables are reported in Table 1.

Table 1.

Variable definition.

4.3. Model Specification

To empirically investigate the effect of data element marketization on corporate green innovation, this study employs a staggered difference-in-differences (DID) model. The staggered DID approach allows us to exploit temporal and regional heterogeneity in the establishment of data trading platforms across China, thereby providing a quasi-natural experimental setting to identify the causal impact of data element marketization. The model is specified as follows:

where i denotes the firm and t represents the year. The dependent variable, , measures the level of corporate green innovation, proxied by the logarithmic transformation of green patent grants. The independent variable, , captures the implementation of data element marketization policies by taking the value of 1 for firms located in regions that have established official data trading platforms, and 0 otherwise. The coefficient reflects the average treatment effect of data element marketization on corporate green innovation. represents a cluster of control variables to mitigate omitted variable bias and account for observable heterogeneity in firm characteristics. Firm fixed effect, , is included to control for unobservable, time-invariant firm characteristics, while year fixed effects, , is also included. denotes the idiosyncratic error term. This model design enables us to rigorously evaluate whether the development of data trading platforms, representing a key component of China’s data element marketization, substantively promotes corporate green innovation.

5. Empirical Analysis

5.1. Descriptive Statistics

Table 2 displays the descriptive statistics of the primary variables. As shown, the mean value of corporate green innovation () is 0.314, with a standard deviation of 0.687, a maximum of 3.296, and a minimum of 0. This distribution indicates notable variation in green innovation performance among Chinese listed firms, suggesting that while some firms actively engage in green technological development and patenting, others exhibit relatively limited innovation efforts. The mean value of the independent variable () is 0.294, implying that approximately 29.4% of observations are associated with regions that have established data trading platforms during the sample period. This proportion suggests a gradual but notable expansion of data element marketization initiatives across China between 2009 and 2022. The variation in exposure to data trading platforms across regions and years provides the empirical foundation for applying a staggered difference-in-differences (DID) approach.

Table 2.

Descriptive statistics of variables.

5.2. Baseline Regression Results

The baseline estimation results evaluating the effect of data element marketization on corporate green innovation are shown in Table 3. Column (1) presents the results from the regression model excluding control variables, while Column (2) presents the results after incorporating the full set of control variables.

Table 3.

Baseline regression results.

In Column (1), the did coefficient is 0.032 and is statistically significant at the 5% level. The results suggest that firms located in regions where data trading platforms have been established tend to exhibit a higher level of green innovation than those in regions without such platforms. The positive and significant coefficient provides preliminary evidence that the marketization of data elements fosters corporate green innovation. Column (2) shows the regression results after including control variables. In Column (2), the did coefficient is 0.030 and still statistically significant. The results suggest that data element marketization substantially enhances firms’ incentives to pursue environmentally oriented technological innovation. This improvement may be attributed to improving data accessibility, reducing information asymmetry, facilitating efficient resource allocation, and strengthening firms’ capacity for digital-driven environmental management and innovation.

Regardless of the inclusion of control variables, the did coefficients remained positive and statistically significant, reinforcing the reliability of the estimated relationship. These findings consistently demonstrate that the establishment of data trading platforms, representing the institutionalization of data element marketization, plays a crucial role in promoting corporate green innovation. H1 is strongly supported by the empirical evidence.

5.3. Robustness Tests

5.3.1. Parallel Trend Test

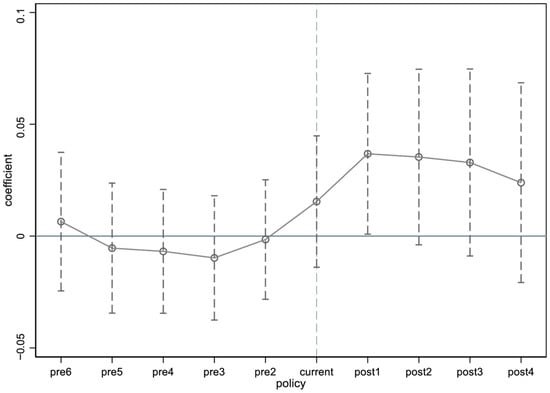

A fundamental assumption of the DID method is the parallel trend assumption, which holds that the treatment and control groups would have exhibited similar trends before the implementation of the policy. To validate this assumption, this study conducts an event study analysis using a six-year window before and a four-year window after the establishment of regional data trading platforms. This design allows for the dynamic examination of how corporate green innovation behavior evolved around the timing of policy implementation. The model is designed as follows:

Specifically, the model includes a series of interaction terms between year dummies and the treatment indicator to estimate the time-varying effects of data element marketization. The estimated coefficients and their confidence intervals are plotted in Figure 2. As shown, the coefficients of the pre-policy interaction terms are statistically insignificant and fluctuate closely around zero, indicating that before the establishment of data trading platforms, there were no systematic differences in the green innovation trends between the treatment and control groups. This finding supports the validity of the parallel trend assumption and confirms that the subsequent observed effects can be plausibly attributed to the policy shock rather than pre-existing differences. In contrast, the post-policy coefficients become positive and statistically significant, suggesting that corporate green innovation increased markedly after the launch of data trading platforms. The evidence offers compelling support for the reliability of the DID estimation and confirms that the positive effect of data element marketization on green innovation is not attributable to pre-policy trajectories.

Figure 2.

Parallel trend test.

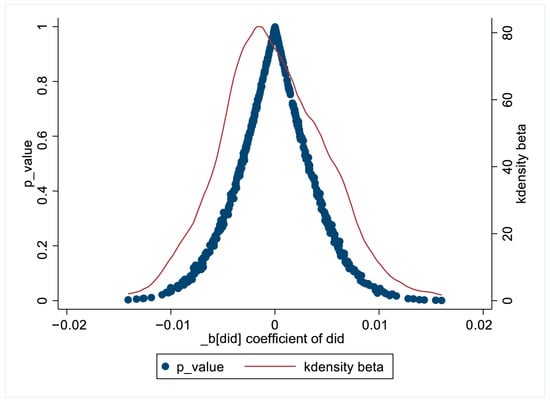

5.3.2. Placebo Test

To further verify the robustness of the baseline estimation results and mitigate the estimation error resulting from omitted variables, a placebo test is conducted. The primary objective of this test is to assess whether the positive association between data element marketization and corporate green innovation could arise purely by chance. We employ a random grouping method in which all firms in the sample are randomly reassigned to the treatment group, irrespective of the actual timing or location of data trading platform establishment. This randomization process is repeated 500 times, and for each iteration, the baseline regression model is re-estimated to obtain a distribution of placebo coefficients for the treatment variable. This resampling strategy effectively simulates a scenario where the policy intervention is randomly assigned, thus serving as a falsification test of the causal inference. As shown in Figure 3, the estimated coefficients obtained from the randomly constructed placebo regressions are distributed approximately normally and cluster around zero, and most of the simulated effects are statistically insignificant. This outcome confirms that when the treatment is randomly assigned, no systematic relationship between the pseudo-policy and corporate green innovation is observed. The absence of any spurious policy effect further strengthens the credibility of our core findings. Therefore, the placebo test results provide strong evidence that the positive impact identified in the baseline analysis is not attributable to random noise or unobserved confounders, but rather reflects the causal influence of data element marketization in fostering corporate green innovation.

Figure 3.

Placebo test.

5.3.3. PSM-DID

The baseline regression may confront endogeneity issues such as sample selection bias. Firms located in regions that have established data trading platforms may systematically differ from those in non-treated regions in terms of innovation capacity, which may distort the estimation results. To address this concern and enhance the robustness of causal identification, this study adopts a PSM-DID approach. The PSM–DID framework allows us to construct a more balanced comparison between the treatment and control group based on observable characteristics prior to the policy implementation. Specifically, firms are matched through nearest neighbor matching method without replacement, where the propensity score is calculated. This matching step enhances the similarity between treated and untreated firms in terms of observable features, thereby limiting bias originating from heterogeneous samples.

After generating the matched dataset, the DID model is re-estimated to evaluate the impact of the policy. The results are shown in Table 4, indicating the estimated coefficient of did remains positive and statistically significant, even after controlling for potential selection bias through matching. The PSM–DID results align with those of the baseline analysis, confirming that the observed positive relationship is robust and stable across different estimation strategies. These results reinforce the conclusion that the marketization of data elements effectively stimulates corporate green innovation, validating the reliability of the empirical evidence.

Table 4.

PSM-DID and exclude interference of public data openness.

5.3.4. Exclude Interference of Public Data Openness

To address the concern that the promotion of public data openness during the sample period might confound our results, we incorporate a dummy variable (pubdata) into the baseline model. As reported in column (2) of Table 4, the coefficient of did remains positive and statistically significant at the 10% level. This finding reinforces our baseline conclusions that data element marketization has a positive impact on corporate green innovation.

5.3.5. Lagged Variables

The effect of data element marketization on corporate green innovation may not occur instantaneously. Firms often require time to internalize digital infrastructure improvements, reallocate resources, and adjust their innovation strategies in response to newly established data trading mechanisms. To account for this possibility, this study re-estimates the baseline model by introducing a one-period lag of the dependent variable, representing delayed responses in green innovation activities. The model is as follows:

The regression results are presented in Table 5. Consistent with the baseline findings, the coefficient of did remains positive and statistically significant after the inclusion of the lagged dependent variable. This indicates that the promotion effect of data element marketization on corporate green innovation persists over time, rather than being confined to the immediate post-policy period. The observed lagged effect may stem from the gradual diffusion of data-related resources, the learning and adaptation process within enterprises, and the time required for R&D investment to materialize into green patents. Overall, the findings further reinforce the robustness and temporal stability of the main conclusions, confirming that data element marketization plays a persistent role in stimulating environmentally oriented innovation within firms.

Table 5.

Lagged variables.

5.3.6. Excluding Samples from Special Period

To further ensure the robustness of the empirical results, this study accounts for the potential confounding impact of major external shocks during the sample period. The COVID-19 pandemic that emerged in 2020 had a profound influence on China’s economic activity and firms’ innovation behavior. The pandemic and subsequent policy responses may have introduced exceptional fluctuations in firms’ R&D investment, environmental management, and patent application activities, thereby potentially biasing the estimation of policy effects. To mitigate this concern, all firm-year observations after 2020 are excluded from the sample, and the baseline regression is re-estimated using the pre-pandemic data only. The results are shown in Table 6, indicating that the did coefficient continues to be significantly positive at the 5% level. This indicates that even after excluding the COVID-19 period, the marketization of data elements continues to exert a significant and positive effect on corporate green innovation. The consistency of these findings with the main regression results demonstrates that the positive association between data element marketization and green innovation is not attributable to short-term shocks. This robustness analysis thus enhances the validity of the core conclusions.

Table 6.

Excluding samples from special period.

5.3.7. Instrumental Estimates

To mitigate potential endogeneity issues, this study employs an instrumental variable strategy. Specifically, the number of fixed telephone lines and post offices per million people in 1984 is used as an instrument variable. The variable is interacted with the lagged number of national Internet users to construct an instrument that reflects differences in the degree of data element marketization across cities.

Column (1) of Table 7 presents the first-stage estimation. The coefficient of IV is significantly positive at the 5% level, indicating strong relevance between the IV and data element marketization, thereby meeting the relevance criterion for valid instrumental variables. Column (2) reports the second-stage estimation results, showing that the coefficient for did remains positive and statistically significant. This finding suggests that data element marketization still promotes corporate green innovation after addressing endogeneity, further reinforcing the robustness of the baseline findings.

Table 7.

Instrumental estimates.

6. Mechanism Analysis

Baseline and robustness tests confirm that data-element marketization significantly stimulates corporate green innovation. Understanding the underlying mechanisms driving this effect is essential for identifying how digital institutional reforms translate into environmental and innovation outcomes. Drawing on the theoretical analysis above, the study examines three potential transmission channels: alleviation of financing constraints, optimization of the human capital structure, and enhancement of collaborative innovation. The model is designed as follows:

The empirical results corresponding to the mechanism analysis are presented in Table 8.

Table 8.

Mechanism analysis.

6.1. Financing Constraints

Financing constraints represent a major obstacle to firms’ engagement in green innovation, as environmentally friendly technologies typically involve high uncertainty, long payback periods, and substantial sunk costs. Limited access to external financing restricts firms’ capacity to invest in such innovation projects. The marketization of data elements serves as a crucial mechanism for reducing information asymmetry between firms and financial institutions by promoting data standardization, data transparency, and data sharing. Through enhanced data circulation and improved credit evaluation mechanisms, data trading platforms contribute to more efficient capital allocation and strengthen institutional trust within financial markets.

As presented in Column (1) of Table 8, the did coefficient on financing constraints is −0.002 and statistically significant at the 5% level. This negative relationship indicates that regions with established data trading platforms experience a notable reduction in firms’ financing frictions. The result suggests that the marketization of data elements reduces financing constraints, which facilitates firms’ ability to sustain long-term investments in green research and development. These findings support H2. The development of data trading platforms improves financial accessibility and creates a more favorable environment for sustained investment in environmentally friendly technological innovation.

6.2. Human Capital Structure

Human capital constitutes a fundamental driver of firms’ innovative activities. The accumulation and optimization of skilled human resources directly influence a firm’s capacity to generate, absorb, and utilize new knowledge. Within the context of digital transformation, the marketization of data elements facilitates the flow, integration, and effective utilization of data resources, thereby creating a heightened demand for high-quality. As firms adapt to the evolving digital environment, they are incentivized to adjust their human capital structure by recruiting and retaining employees with advanced skill sets, supporting green innovation.

Table 8 presents the results. The did coefficient in Column (2) is 0.356 and statistically significant at the 5% level, suggesting that the establishment of data trading platforms significantly increases the number of high-skilled employees within firms. The did coefficient in Column (3) is 0.577 and statistically significant at the 1% level, further confirming that data element marketization contributes to a more knowledge-intensive workforce. H3 is supported. These findings imply that the marketization of data elements not only enhances information accessibility but also reshapes firms’ human capital structure toward higher skill intensity and educational attainment. This upgrading of human capital provides essential knowledge and technical support for green innovation. In particular, a workforce with stronger digital and environmental competencies can more effectively integrate data-driven insights into eco-friendly product design, process optimization, and clean technology development. The empirical evidence indicates that an important channel through which data element marketization promotes corporate green innovation is the optimization of the human capital structure within firms, thereby strengthening firms’ internal innovation capabilities and knowledge foundations.

6.3. Collaborative Innovation

Green innovation often requires collaboration between various sectors. Collaboration enables firms to share technological resources, exchange specialized knowledge, and jointly address the complexities of green technological development. However, effective collaboration depends critically on the effective information flows across organizational boundaries. The marketization of data elements creates an institutional framework that facilitates the legal circulation, standardized pricing, and efficient utilization of data resources. By establishing secure and transparent mechanisms for data transactions, these platforms help mitigate information asymmetry and enhance the interoperability of digital systems across firms and industries. This improved data connectivity expands opportunities for cooperation and enables the formation of innovation networks. As data flows more freely between sectors, firms can engage in joint R&D projects, share environmental technologies, and leverage complementary expertise to pursue green innovation goals.

As presented in Column (4) of Table 8, the coefficient of did for collaborative green innovation is 0.026 and statistically significant at the 5% level. This result suggests that firms located in regions with established data trading platforms are significantly more likely to engage in collaborative green innovation compared to those in regions without such platforms. The evidence suggests that the marketization of data elements fosters collaboration by promoting data sharing and knowledge diffusion across sectors. Through these collaborative channels, firms can better integrate external technological resources, enhance innovation efficiency, and accelerate the development of green technologies. Thus, data element marketization serves not only as an economic reform but also as a catalyst for collaborative green innovation, reinforcing its importance in advancing green transformation.

7. Heterogeneity Analysis

This study further investigates whether the positive effects of data element marketization differ across regions, industries and firms.

7.1. Regional Heterogeneity

The effect of data element marketization on corporate green innovation may vary across regions. The eastern region typically enjoys a higher degree of marketization and a better innovation ecosystem. Therefore, firms can more effectively integrate external data, collaborate with research institutions, and transform digital resources into green innovation. However, the central and western regions encounter limitations, such as lower marketization levels and insufficient innovation inputs. Insufficient data accessibility, talent shortages, and institutional inefficiencies limit the capacity of firms in these regions to benefit from data element marketization. As a result, even if data element policies are implemented, their marginal effect on promoting corporate green innovation may be weaker.

Table 9 presents the results of the regional heterogeneity analysis. Column (1) reveals that the coefficient of did for the eastern region is positive and statistically significant at the 5% level, suggesting that the marketization of data elements significantly enhances corporate green innovation in economically developed regions. In contrast, the coefficients of did in Column (2) and Column (3) for the central and western regions are statistically insignificant. This suggests that data element marketization does not generate a significant promoting effect on green innovation in these areas. These results align with the preceding discussion and underscore pronounced regional differences in the extent to which data element marketization enhances green innovation.

Table 9.

Regional heterogeneity.

7.2. Regional Digital Infrastructure

The effectiveness of data element marketization in promoting corporate green innovation may vary with the level of regional digital infrastructure, as it influences the efficiency and cost of data transmission, processing, and utilization. Digital infrastructure, such as broadband networks, forms the physical and technological foundation for the flow of data resources. Regions equipped with well-developed digital infrastructure can facilitate faster, more secure, and lower-cost data exchange, thereby enhancing the marginal benefits of data element marketization [23]. The improved connectivity and interoperability of data networks promote the exchange of information within and across regional boundaries, enabling firms to access diverse data sources and to apply data-driven insights in their green innovation processes. This not only supports optimal resource allocation but also fosters a more efficient diffusion of green technologies and knowledge. In contrast, in regions where digital infrastructure is poorly developed, data transmission inefficiencies, high transaction costs, and limited data accessibility significantly hinder the potential benefits of marketization. As a result, the impact of data elements in driving green innovation is considerably weakened.

Based on the level of digital infrastructure of regions firms are located in, this study classifies the sample into groups with well-developed and poorly developed digital infrastructure to assess how the effects of data element marketization on corporate green innovation vary across different levels of digital readiness. The hypothesis is that the positive impact of data element marketization on corporate green innovation will be stronger in regions with more advanced digital infrastructure. The regression results are shown in Table 10 and provide empirical support for this expectation. In Column (1), the coefficient of did for regions with relatively weak digital infrastructure is positive but statistically insignificant, suggesting a limited policy effect. However, in Column (2), the did coefficient is positive and statistically significant at the 5% level, suggesting that data element marketization significantly enhances corporate green innovation in regions characterized by more advanced digital infrastructure. These findings highlight the complementary relationship between digital infrastructure development and data element marketization. Enhancing the digital foundation of regional economies can amplify the effectiveness of data market reforms, accelerate information flow, and strengthen the role of data as a strategic production factor in promoting sustainable technological transformation. From a policy perspective, governments should put more emphasis on strengthening digital infrastructure, especially in less developed regions, to reduce the digital divide and ensure that the benefits of data-driven green innovation are equitably distributed across regions.

Table 10.

Regional digital infrastructure.

7.3. Industry Pollution Level

The marketization of data elements serves as a key driver of green innovation, thereby facilitating energy conservation, emissions mitigation, pollution control, and the transition toward cleaner production. The promoting effect of data element marketization may vary across industries with different pollution levels. Given the distinct environmental responsibilities and innovation incentives faced by firms in different sectors, it is important to explore whether the impact of data element marketization on corporate green innovation differs between heavily polluted and non-heavily polluted industries. Based on the Management List of Environmental Protection Verification Industries of Listed Companies issued by the Ministry of Environmental Protection, this study classifies firms into heavily and non-heavily polluting industries and performs a grouped regression to analyze the heterogeneous impacts of data element marketization.

The results are shown in Table 11 and reveal heterogeneity across industry types. In Column (1), the did coefficient is positive and statistically significant at the 5% level, indicating that the marketization of data elements significantly stimulates the green innovation among firms in non-heavily polluting industries. The coefficient of did in Column (2) is statistically insignificant, suggesting that data element marketization does not exert a notable influence on firms in heavily polluting industries. A plausible explanation is that firms in non-heavily polluting industries face less stringent regulations and greater flexibility in allocating obtained resources from data market participation. These firms may be more capable of leveraging data-driven information flows to optimize production processes, enhance technological efficiency, and invest in green innovation initiatives. However, firms in heavily polluted industries may allocate more resources toward compliance with mandatory pollution control measures rather than proactive green R&D, thereby diminishing the observable policy effect. The results suggest that the impact of data element marketization on green innovation is more significant in industries with lower pollution levels, where firms can more flexibly integrate digital resources into innovation strategies. From a policy perspective, this implies that in order to achieve balanced green transformation across sectors, additional institutional and financial support may be needed to help firms in heavily polluted industries convert data resources into effective green innovation outcomes.

Table 11.

Industry pollution level.

7.4. Firm Ownership

Considering China’s institutional background and economic structure, the effect of data element marketization on corporate green innovation may differ according to the nature of firm ownership. The ownership structure determines not only the firms’ access to resources and policy support but also their governance flexibility, innovation incentives, and responsiveness to market mechanisms. Based on firms’ ownership characteristics, we categorized the sample into state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs), and then performed a comparative analysis to examine the heterogeneity of effects across these ownership types.

Table 12 presents the empirical results. The estimated coefficient of did in Column (1) is positive and significant at the 5% level, suggesting that the marketization of data elements significantly stimulates the green innovation in non-SOEs. However, the coefficient of did in Column (2) is statistically insignificant. The results demonstrate that the green innovation enhancement impact of data element marketization mainly exists in non-SOEs. This disparity can be explained by differences in resource constraints and behavioral motivations between ownership types. Non-SOEs often operate in markets with stronger competitive pressures and tend to face tighter financial and technological constraints. As a result, they are more likely to actively utilize emerging data market mechanisms to acquire external data resources, reduce information asymmetry, and improve innovation efficiency. The flexibility of decision-making and stronger market sensitivity of non-SOEs also enable them to more effectively integrate data-driven insights into sustainable product design and process optimization. SOEs often enjoy relatively stable access to traditional resources such as capital and policy support, which may reduce their incentive to participate in data market transactions or to innovate under market pressure. Additionally, bureaucratic management structures may hinder their responsiveness to new digital market opportunities, thereby limiting the potential benefits derived from data element marketization. These findings indicate that the positive impact of data element marketization is significant in non-SOEs, reflecting the greater adaptability and innovation dynamism of market-oriented firms. From a policy perspective, to fully realize the environmental and innovation benefits of data element marketization, it is essential to encourage SOEs to deepen their engagement in the data market, strengthen digital governance capabilities, and adopt more flexible innovation incentive mechanisms.

Table 12.

Firm ownership.

8. Conclusions and Policy Implications

8.1. Conclusions

Promoting corporate green innovation is an important micro-level pathway toward achieving sustainable development. Using a panel dataset of A-share listed firms from 2009 to 2022, this paper employs the establishment of data trading platforms as a quasi-natural experiment to empirically examine how the data element marketization affects corporate green innovation.

The main conclusions are as follows: (1) The marketization of data elements significantly promotes corporate green innovation, and this conclusion remains robust under a series of robustness tests. (2) The mechanism analysis indicates that data element marketization promotes green innovation mainly by reducing financing constraints, optimizing the human capital structure, and enhancing collaborative innovation. (3) The heterogeneity analysis further reveals that the positive effect of data element marketization on corporate green innovation is significant among firms in the eastern region, the regions with well-developed digital infrastructure, non-heavily polluted industries and non-SOEs. These findings suggest that both institutional context and firm characteristics play vital roles in shaping the effectiveness of data market reforms.

8.2. Policy Implications

This study demonstrates that data element marketization serves as a critical pathway for stimulating corporate green innovation, thereby facilitating the transition to high-quality economic development. The research thus offers empirical evidence and practical implications for achieving sustainable and low-carbon development. The empirical findings offer meaningful guidance for both policymakers and firm managers to leverage data markets in advancing green innovation.

8.2.1. Implications for Policymakers

First, governments should advance the institutionalization and governance of data markets. Considering the pivotal role that the marketization of data elements exerts in stimulating green innovation, policymakers should establish clearer data property rights and security standards to facilitate data circulation, develop unified and transparent data trading platforms to reduce transaction costs and information asymmetry, and strengthen cross-departmental data sharing mechanisms to enhance data accessibility for firms.

Second, tailored support should be provided to reinforce the identified mechanisms. Since the mechanism analysis shows that data element marketization promotes green innovation by easing financing constraints, upgrading human capital, and fostering collaborative innovation, we recommend introducing green credit incentives and data-backed financing tools to ease financial constraints for firms engaging in data transactions, designing skill-upgrading programs and digital talent recruitment policies to help firms internalize data-driven innovation ability, and fostering data collaboration platforms, especially in regions with poor digital infrastructure.

8.2.2. Implications for Managers

Firms should actively engage in data markets and align corporate strategy with green transition goals. Firms should recognize data as a strategic production factor and actively engage in data market transactions to expand innovation resources and partnerships, integrate green innovation objectives into data utilization, leveraging big data analytics for cleaner production. At the same time, firms should enhance internal data governance and talent development to better utilize external data resources.

8.3. Limitation and Future Research

Although this study offers meaningful insights, it still presents limitations that should be recognized and further explored in future investigations.

First, this study relies solely on Chinese A-share listed firms as its sample, which may restrict the generalizability of its conclusions to unlisted firms or firms operating under different institutional environments. Listed firms generally possess stronger innovation capabilities, better access to capital, and more standardized governance structures, which may cause the effects of data element marketization on green innovation to diverge from smaller or privately owned firms. Future research could include unlisted firms, SMEs, or multi-country samples to improve generalizability.

Second, the evaluation of green innovation performance is largely based on information extracted from patent records, which does not capture non-patented innovations or actual environmental outcomes. Future research could incorporate green product revenues or carbon emission metrics.

Third, this study focuses primarily on data trading platforms as a key digital policy tool. However, other dimensions of digitalization, including artificial intelligence and big data analytics, are closely interrelated with the development and operation of data markets. Future research could examine interactions with other digital transformations or differentiate between types of data transactions, such as personal and industrial data, and their varying impacts on sustainability performance.