Abstract

In recent years, with the emergence of the “greenwashing” problem caused by asset divestments by enterprises, whether green mergers and acquisitions can significantly curb this greenwashing behavior is a very worthwhile research question in the context of sustainable development becoming a long-term competitive strategy for enterprises. This paper analyzes the relevant data of A-share listings in China from 2014 to 2023 and concludes that corporate green mergers and acquisitions have a certain negative impact on ESG greenwashing through three mechanisms: reducing financing constraints, enhancing social reputation, and suppressing managerial shortsightedness. And this correlational negative impact has a stronger effect due to the business relationship between the acquiring and acquired companies, the strong regulatory intensity of the environment in which the acquired company is located, and the fact that the main acquiring company is in a first-tier city. This study not only breaks the inherent cognitive shackles of “greenwashing” opportunistic behavior in green mergers and acquisitions, the opposite of corporate asset divestment, but also provides theoretical support for companies to achieve long-term sustainable development through green mergers and acquisitions.

1. Introduction

In recent years, the advancement of the “dual carbon” goals and the rise in ESG investing have drawn increasing attention from capital markets and regulators to corporate environmental responsibility. However, this trend has also brought to light the potential for “greenwashing” through strategic actions such as asset spin-offs—where companies may temporarily enhance environmental metrics by divesting high-pollution assets, rather than pursuing genuine green transformation [1]. Such opportunistic behavior not only undermines the credibility of ESG disclosures but also poses risks to long-term sustainable development. Against this backdrop, a key research question emerges: can green mergers and acquisitions, as a strategic counterpoint to asset divestiture, effectively curb corporate greenwashing tendencies? Exploring this issue is essential not only for identifying effective corporate environmental governance mechanisms, but also for understanding how firms can achieve sustainable development through substantive resource reallocation.

The existing literature has begun to explore corporate greenwashing, primarily examining its drivers and economic consequences through perspectives such as information disclosure quality [2], external institutional pressure [3], and corporate governance structure [4]. Some scholars suggest that financing needs [5] and reputation management [6] are key motivations for firms to engage in symbolic environmental actions, while others find that managerial short-termism can reinforce such opportunistic behavior [7]. However, most studies treat asset divestiture and green mergers and acquisitions (M&As) in isolation, failing to systematically examine their interrelation within corporate environmental strategy. On the one hand, research on green M&As has largely focused on its role in fostering innovation [8] or improving financial performance [9], overlooking its potential governance function in curbing greenwashing. On the other hand, studies on anti-greenwashing mechanisms still emphasize external regulation and disclosure frameworks [10], with limited attention to the role of proactive strategic investments by firms. Moreover, the existing theory has yet to fully elucidate the channels through which green M&As influence corporate environmental behavior, or how contextual factors may moderate this relationship.

To address these research gaps, this study examines the impact of green mergers and acquisitions (M&As) on corporate greenwashing using a sample of China’s A-share listed firms from 2014 to 2023. We document that green M&As have a certain negative impact on corporate ESG greenwashing, a finding that remains robust after a series of endogeneity checks and robustness tests. A further mechanism analysis reveals that green M&As operate primarily through three channels: alleviating financing constraints, enhancing social reputation, and curbing managerial short-termism—reflecting their dual governance effects in improving external resource acquisition and strengthening internal incentive alignment. Moreover, we find that the anti-greenwashing effect is more pronounced when the merging firms are related in business, when the target is located in a region with stringent environmental regulations, or when the acquirer is based in a first-tier city. These results underscore the roles of strategic synergy, institutional context, and locational factors in shaping the governance outcomes of green M&As.

This study makes three main contributions. First, by integrating green mergers and acquisitions (M&As) and corporate greenwashing into a unified analytical framework, it extends the research on greenwashing governance beyond the conventional focus on passive strategies such as asset divestiture. This shift in perspective toward proactive environmental investment offers new insights into the dynamic evolution of corporate environmental behavior. Second, by identifying the mediating roles of financing constraints, social reputation, and managerial cognition, the study sheds light on the underlying mechanisms through which green M&As influence corporate environmental decision-making, thereby addressing a gap in the literature regarding micro-level transmission pathways. Third, by revealing the moderating effects of business relatedness, environmental regulation, and geographic location, it clarifies the contextual contingencies of green M&As’ governance effectiveness, providing theoretical and practical guidance for firms to formulate differentiated green transition strategies under heterogeneous conditions.

2. Literature Review and Research Hypotheses

- (1)

- ESG Greenwashing Behavior and Corporate Green Mergers and Acquisitions

From the perspective of organizational behavior, corporate ESG greenwashing behavior can be seen as a typical phenomenon of “inconsistency between words and deeds”, where companies form a systematic gap between their environmental commitments and actual performance, which is a manifestation of strategic impression management [11]. The existing research mostly explains its motives through two aspects: institutional pressure and resource constraints. On the one hand, external pressures such as the “dual carbon” target prompt companies to obtain green financing or maintain reputation by selectively disclosing or exaggerating performance [12]. On the other hand, internal financing constraints and management shortsightedness limit the ability and willingness of companies to make long-term substantial environmental investments [13]. Although there have been extensive discussions on the causes and governance of greenwashing in the existing literature, most studies still follow a binary narrative framework of “external regulation” and “passive adjustment”, or focus on defensive strategies such as information disclosure standards and asset divestiture [14,15], without delving into whether companies can fundamentally reshape their environmental behavior motivations through forward-looking, high-commitment strategic investments.

Green mergers and acquisitions, as a strategic behavior for enterprises to actively acquire green technologies, environmental assets, or enhance environmental management capabilities, are not simply about scale expansion, but can be seen as a substantial environmental commitment with a high asset specificity and high sunk costs [16]. According to the resource-based view and signal theory, green mergers and acquisitions transmit credible signals of the company’s true transformation intention to the outside world through irreversible resource investment, thereby enhancing its legitimacy and reputation capital in the eyes of stakeholders [17]. This process deeply binds the environmental performance of the enterprise to its strategic resources, significantly increasing the reputation risk and economic cost of subsequent opportunistic behavior. Therefore, there is a fundamental difference between symbolic operations such as green mergers and acquisitions and asset divestitures: the former establishes long-term, specialized resource commitments to internally constrain the motivation space for companies to engage in greenwashing behavior.

In summary, green mergers and acquisitions are not simply a combination of assets, but a profound transformation in which companies convey credible commitments, accumulate reputation capital, and reconstruct strategic orientation. It systematically weakens the root cause of ESG greenwashing in enterprises from the perspectives of motivation and ability by alleviating external financing pressure, internalizing reputation maintenance needs, and correcting managers’ decision-making perspectives. Therefore, we hypothesize the following:

H1:

Corporate green mergers and acquisitions have a certain negative correlational impact on ESG greenwashing behavior.

- (2)

- Mechanism for the negative correlational impact ESG Greenwashing Behavior Through Corporate Green mergers and Acquisitions: Reducing Financing Constraints

The existing research generally believes that financing pressure is a key external factor driving corporate ESG greenwashing behavior [18]. When facing financing constraints, companies tend to adopt low-cost symbolic environmental disclosure to cater to the short-term preference of the capital market for green performance, in order to obtain financing convenience [19]. However, although this “inconsistency between words and deeds” strategy can bring short-term benefits, it will exacerbate information asymmetry and damage the long-term reputation and financing sustainability of the enterprise [20]. To solve this dilemma, companies need to convey credible long-term green commitments to the market.

Green mergers and acquisitions, as a strategic investment with high asset specificity and high sunk costs, can effectively play the role of this credible commitment [21]. According to the resource-based view and signal transmission theory, the irreversibility and resource specificity of green mergers and acquisitions make them a substantive signal that is difficult to imitate and embellish. This signal clearly conveys the strategic determination of enterprises to commit to green transformation to the capital market, effectively alleviating the financing frictions caused by environmental information asymmetry [22].

Specifically, green mergers and acquisitions improve the financing environment of enterprises through a dual path: firstly, they provide verifiable substantive evidence for the environmental strategy and long-term profitability of enterprises, which helps attract green investors who focus on long-term value; secondly, they enhance the compliance and reputation of enterprises in the eyes of regulatory authorities and green finance institutions, thereby expanding the access possibilities of specific financing channels such as green credit and green bonds, and potentially optimizing overall financing costs. The alleviation of financing constraints fundamentally weakens the intrinsic motivation of enterprises to “package” short-term green images to obtain financial resources and promotes their environmental behavior to return to the track of long-term value creation.

Based on the logical chain of “financing pressure–greenwashing motivation–credible commitments–constraint relief” mentioned above, this article proposes the following mechanistic hypotheses:

H2:

Corporate green mergers and acquisitions will negatively affect their ESG greenwashing behavior by reducing financing constraints.

- (3)

- Mechanism for the negative correlational impact ESG Greenwashing Behavior through Corporate Green Mergers and Acquisitions: Enhancing Social Reputation

Reputation capital is an important intangible asset for enterprises, and ESG greenwashing behavior essentially constitutes a speculative consumption of this capital—enterprises attempt to obtain reputation benefits through low-cost environmental declarations but avoid substantial investments that match them. Once this “inconsistency between words and deeds” pattern is exposed, it will trigger serious legitimacy crises and trust losses [23]. Therefore, to effectively curb greenwashing, the key is to guide companies to establish their environmental reputation on credible and costly commitments.

Green mergers and acquisitions are precisely such strategic actions that can reconstruct the foundation of a company’s reputation. According to signal theory, due to the high asset specificity and significant sunk costs of green mergers and acquisitions, they convey a strong and credible signal of the company’s true green transformation intention to the outside world, which is difficult for companies that simply pursue image engineering to imitate [24]. When a company engages in green mergers and acquisitions, it is not just acquiring assets, but is also making visible and specific investments to multiple stakeholders such as the government, investors, consumers, and the public, thereby significantly enhancing its environmental reputation and organizational legitimacy [25].

This reputation established through substantial investment will constrain the opportunistic behavior of enterprises through two mutually reinforcing mechanisms: one is the punishment mechanism. The accumulation of green reputation capital by enterprises increases the expectation that their subsequent behavior will be closely scrutinized by all parties. Any exposure of greenwashing behavior will lead to a greater reputation degradation and stakeholder sanctions, thereby significantly increasing the cost of opportunistic behavior [26]. The second is a buffering mechanism. A solid substantive reputation provides a space for understanding the short-term fluctuations or performance gaps that companies may encounter in green transformation. Stakeholders show a higher tolerance based on their trust in the company’s long-term commitment, which reduces management’s anxiety about resorting to greenwashing due to the fear of short-term evaluations [27].

Therefore, green mergers and acquisitions reshape the incentive structure for maintaining reputation by shifting corporate environmental reputation from “statement led” to “investment led”: companies actively suppress greenwashing behavior that may damage the reputation assets they have invested heavily in to protect them [28].

So, based on the theoretical path of “substantial investment–reputation capital accumulation–behavior constraint strengthening” mentioned above, this study proposes the following hypotheses on the influencing mechanism:

H3:

Corporate green mergers and acquisitions will negatively affect their ESG greenwashing behavior through mechanisms that enhance their social reputation.

- (4)

- Mechanism for the negative correlational impact ESG Greenwashing Behavior Through Corporate Green Mergers and Acquisitions: Suppressing Short-Sightedness of Managers

The short-sightedness of managers is a key cognitive factor driving companies to adopt environmental opportunistic behaviors such as ESG greenwashing [29]. Due to considerations of tenure performance and short-term market evaluation, management with a tendency towards short-sightedness often tends to avoid substantial green investments with long cycles and large investments and instead adopt low-cost, quick-acting environmental communication strategies to shape the “green” appearance [30]. The limitation of this time perspective makes it easy for corporate environmental behavior to deviate from the track of long-term sustainable development and fall into a state of decoupling between “claims” and “practices” [31].

Green mergers and acquisitions provide a strategic governance path to break through this cognitive limitation. Different from general environmental investments, green mergers and acquisitions are strategic organizational commitments with a high resource specificity, high sunk costs, and long return cycles. This characteristic enables it to reshape the decision-making framework of managers from both cognitive and institutional levels: at the cognitive level, major green M&A decisions and their subsequent integration will prompt management to deeply bind the company’s future with environmental assets, thereby internalizing long-term green value orientation in strategic cognition [32]. At the institutional level, the sustained resource investment and cross-cycle management required after mergers and acquisitions will implant long-term-oriented constraints in the organizational structure and assessment system, objectively limiting the decision-making horizon and behavioral choice set of managers [33].

Therefore, green mergers and acquisitions are not simply asset transfers, but a governance mechanism that can reconstruct organizational time preferences [34]. They systematically suppress the motivation and possibility of managers adopting greenwashing behavior in pursuit of short-term performance by enhancing the importance of environmental goals in strategic ranking and establishing a matching resource commitment and process system [35].

Based on the theoretical logic of “short-sightedness of managers–opportunistic behavior–long-term strategic commitment–cognitive and institutional reconstruction” mentioned above, this study proposes the following hypotheses on the influencing mechanism:

H4:

Corporate green mergers and acquisitions will negatively affect the ESG greenwashing behavior of managers by suppressing their short-sighted mechanisms.

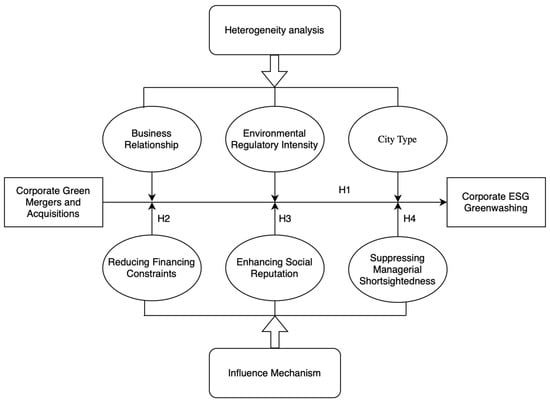

In summary, the research framework of this study is shown in Figure 1.

Figure 1.

Research framework diagram.

3. Research Design

- (1)

- Sample Selection and Data Sources

This paper takes the data of Chinese A-share listed companies from 2014 to 2023 as the initial sample. In order to ensure the effectiveness of this study, the initial research sample was screened and processed as follows: all ST (including * ST, PT) and companies with negative net assets were deleted; financial industry companies were deleted; observations with missing variables in this study were deleted. And, in order to avoid the influence of extreme values of variables, this paper applied Winsorize processing of 1% and 99% to all continuous variables. The data used in this paper, except for the indicators used to measure corporate ESG greenwashing behavior, come from the CNRDS database and Bloomberg database. Other data, unless otherwise specified, are sourced from the CSMAR database, CNRDS database, and various annual reports published by corporate officials.

- (2)

- Research Models and Variable Definitions

3.1. Research Models

To test the research Hypothesis H1 of this research, the following DID research model is established:

Model (1) is used to investigate whether green mergers and acquisitions by companies will negatively affect their ESG greenwashing behavior, where i and t represent the year t in which company i is located, and ESGgw represents the degree of ESG greenwashing behavior of the core dependent variable company; GMA×Post represents the core explanatory variable of corporate green mergers and acquisitions; Controls represents a series of control variables; FE represents fixed variables (individual enterprise and year); is a residual term.

3.2. Variable Definitions

① The dependent variable: Corporate ESG greenwashing (ESGgw) represents the relative degree to which companies disclose ESG information. Corporate ESG greenwashing (ESGgw) captures the discrepancy between a firm’s disclosed ESG commitments and its actual environmental, social, and governance performance—a phenomenon rooted in the organizational behavior literature as a form of symbolic rather than substantive action. From this perspective, it reflects strategic impression management wherein firms selectively communicate favorable ESG information while decoupling such claims from material operational practices, often in response to external institutional pressures or stakeholder expectations. The construct emphasizes observable gaps between the stated ESG targets and verified outcomes, thereby enabling an empirical validation through measures that compare the consistency of public disclosures with realized performance across comparable industry and regulatory contexts [36,37]. This paper draws on the research paradigms of Yu et al. [38], Zhang [39], and Hu et al. [40], and uses Formula (2) to measure the degree of corporate ESG “greenwashing” behavior. ESGCla represents the “words” of a company’s ESG information disclosure, while ESGPer represents the “actions” of a company’s actual ESG performance. In order to make the comparison between the ESG “words” and “actions” of enterprises meaningful, the scores in the original databases of both were standardized (both using the standard deviation of the original score minus the average score of the sample enterprises and then divided by the score of the sample enterprises).

② Core explanatory variable: Corporate Green Mergers and Acquisitions (GMA×Post): Referring to the study by Shi and Huang [25], GMA is a dummy variable for the treatment and control groups. If the company implements green mergers and acquisitions, GMA is set to 1; otherwise, it is set to 0. Post is a dummy variable for the treatment effect period. For the treatment group, if the company conducted green mergers and acquisitions during period t, the years after period t are set to 1, otherwise they are set to 0; for the control group, all posts are set to 0.

③ Control variables: To effectively avoid the omission of control variables, this paper refers to the existing research and draws on the studies of Yu et al. [38] and DasGupta [41] to control for the following variables that may affect corporate ESG “greenwashing” behavior, Dual, Shrholds5, Tstop3, Manch, Roe, Curtrt, Aslbert, At, Soe, and Age, while controlling for time and individual effects of the enterprise. The specific variable definitions are shown in Table 1.

Table 1.

Variable definition of benchmark regression.

4. Empirical Analysis

- (1)

- Descriptive Statistics

As shown in Table 2, the descriptive statistical analysis results of the main variables involved in this paper are presented. The mean of corporate ESG greenwashing (ESGgw) is 0.196, with a standard deviation of 0.327, a minimum value of −2.006, and a maximum value of 3.327. Corporate Green Mergers and Acquisitions (GMA): The mean is 0.306 and the standard deviation is 0.113, indicating that there are differences between companies, and the degree of ESG “greenwashing” varies among different companies. Therefore, this paper uses a double fixed econometric research method to study whether green mergers and acquisitions by companies will negatively affect their ESG “greenwashing” behavior, which is meaningful. The distribution characteristics of the sample in this paper are basically consistent with the existing research, and the descriptive statistical results of the other remaining control variables are also within the normal range, as shown in Table 2 for details.

Table 2.

Descriptive statistics.

- (2)

- Benchmark Regression

As shown in Table 3, the results of the multivariate analysis in this paper are presented. The first column does not have a fixed year and individual enterprise, nor does it include any control variables. The regression coefficient for the degree of ESG “greenwashing” of the enterprise is −1.684, which is significant at the 1% level, and the maximum absolute value of the T-value at this time is −6.68. The second column does not have a fixed year and individual enterprise but includes all control variables. At this point, the regression coefficient for the degree of managerial corruption is −1.038, which is significant at the 1% level. The third column includes all control variables and only fixes the year. At this point, the regression coefficient for the degree of managerial corruption is −0.662, which is significant at the 1% level. The third column includes all control variables and fixes the time and individual enterprise. At this point, the regression coefficient for the degree of ESG “greenwashing” of the enterprise is −0.539 and is significant at the 1% level. Our findings confirm that green M&As will negatively affect corporate ESG greenwashing, thus validating Hypothesis H1. The relationship and significance between other control variables and corporate ESG “greenwashing” behavior are basically consistent with the existing research, as shown in Table 3.

Table 3.

Benchmark regression.

- (3)

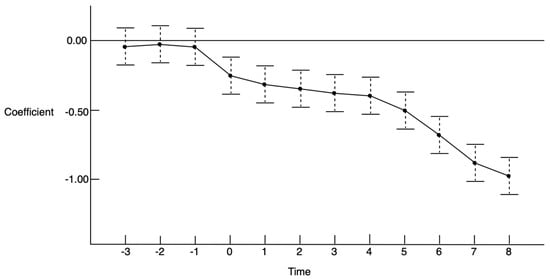

- Parallel Trend Test

The parallel trend hypothesis of this study refers to the fact that the ESG “greenwashing” behavior of companies that have undergone green mergers and acquisitions and those that have not remains largely consistent over time. If the parallel trend between the processing group and the control group of companies implementing green mergers and acquisitions is broken, it indicates that the company’s green mergers and acquisitions have a certain negative correlational impact that caused a change in the processing group trend, which proves that, compared with companies that did not implement green mergers and acquisitions during the same period, green mergers and acquisitions have affected the company’s ESG “greenwashing” behavior. As shown in Figure 2, before the occurrence of green mergers and acquisitions, the regression coefficient of the relative time dummy variable is very small and not significant, which proves that the DID model of this study has passed the parallel trend test and further proves the reliability of the conclusions of this study.

Figure 2.

Parallel trend test.

- (4)

- Robustness Tests

4.1. Placebo Test

In order to effectively verify that the suppression of ESG “greenwashing” behavior by corporate green mergers and acquisitions is not caused by random factors, this paper draws on the research methods of Roth and Sant’Anna [42]. The companies implementing green mergers and acquisitions were randomly assigned values and subjected to placebo tests. The results of the tests are shown in Column (1) of Table 4, with a coefficient of −0.002, which is not significant, proving that the negative correlational impact of ESG “greenwashing” behavior by corporate green mergers and acquisitions is not caused by random factors. The conclusions of this study are robust.

Table 4.

Robustness tests.

4.2. Alternative Variables

① Replace the measurement method of GMA: Following the approach of Zeng et al. [43], after using all the green M&A behaviors of the sample companies covered in the CNRDS database to measure the green M&As of enterprises, the GMA was ranked before regression to obtain a new variable, RankGMA. There are two advantages to using GMA rankings for analysis: firstly, it can make the analysis results more robust in non-normal distribution situations, and, secondly, it can effectively reduce the influence of outliers. Therefore, using the ranked GMA for regression analysis can effectively evaluate the sensitivity of the results and ensure that the research conclusions of this paper are valid under different conditions. The specific analysis results are shown in Column (1) of Table 4, and replacing the analysis with RankGMA still yields robust results.

② Replace the measurement method of ESGgw: Drawing on the research of Walker and Wan (2012) [44], the corporate greenwashing strategy is defined as two methods: selective disclosure (LS) and expressive operation (LE). The specific calculation method of LS is LS = 1 − (number of disclosed events/number of events to be disclosed); LE = number of symbolic disclosures/number of disclosed events. Among them, the number of disclosed matters comes from the ESG reports released by the company. The number of items to be disclosed comes from Bloomberg’s ESG rating indicators. Symbolic disclosure refers to whether a company discloses specific cases or numbers. Finally, use Formula (3) to calculate the geometric mean of the two to effectively measure ESGgw. The results of the replacement analysis are shown in Column (3) of Table 4, which are basically consistent with the baseline regression results, proving the robustness of the research conclusions.

4.3. Subsample Test

With the continuous development and penetration of ESG management concepts by Chinese enterprises, disclosing ESG-related information is a gradual process of development. Due to the significant increase in the number of companies disclosing ESG information in the selected sample in 2018, this section selected the initial sample of companies disclosing ESG information from 2018 to 2023 for relevant regression analysis. The results obtained are shown in Column (3) of Table 4, and the analysis using subsamples is still robust.

4.4. Replace Research Model

This paper fixed the year and individual enterprise in the benchmark regression analysis to control for difficult to observe variables, but, over time, differences between industries may have a certain impact on the regression results. Therefore, this section will adopt a new triple-fixed model with fixed years, individual enterprises, and industries, as shown in Equation (4). The results of robustness testing using Equation (4) are shown in Column (4) of Table 4, and the analysis using the new research model still shows robustness.

- (5)

- Endogeneity test

4.5. Instrumental Variable and Heckman Two-Step Tests

Due to the fact that the CNRDS database covers the ESG rating scores of all Chinese A-share listed companies, while the Bloomberg database only covers the ESG rating scores of some Chinese A-share companies, this paper cannot analyze the greenwashing behavior of Chinese A-share companies that are not included in the Bloomberg database, resulting in the loss of randomness in the sample selection of this study. Therefore, this paper adopts the method of the Instrumental Variable and Heckman Two-Step Tests to alleviate the endogeneity problem caused by the possible self-selection of samples. In the first stage, this study used the indicator BloomD as the dependent variable of the Probit model, which is whether it is included in the Bloomberg database, and the mean of green mergers and acquisitions by enterprises (GMA-D) as the Instrumental Variable for the Heckman Two-Step Tests. The analysis results are shown in Table 5 (1) and (2). Firstly, the IMR is not significant, indicating that, for samples that are not included in the Bloomberg database, there is no serious sample self-selection problem in the benchmark regression of this study. Secondly, after the Heckman Second-Step Test, the regression results showed no significant difference compared to the benchmark regression results in this paper, and the regression results remained robust, proving that the research hypothesis in this paper still holds true.

Table 5.

Endogeneity tests.

5. Mechanism Analysis

- (1)

- Analysis of Mechanisms for Reducing Corporate Financing Constraints

First, external financing pressure serves as a key driver of corporate ESG greenwashing, as firms under high financial constraints often resort to low-cost, symbolic actions to appeal to short-term market evaluations and secure much-needed capital. Second, green M&As, characterized by high asset specificity and substantial resource commitments, convey a credible signal of a firm’s dedication to long-term green transition. This substantive investment helps mitigate information asymmetry and enhance the firm’s legitimacy and attractiveness to green financiers, such as providers of green credit and ESG-focused investment funds, thereby alleviating financing constraints. Third, the easing of external financing pressures reduces the marginal incentive for firms to engage in greenwashing as a means of financial packaging, reorienting their environmental conduct toward substantive, long-term strategic goals. To test whether green M&As mitigate ESG greenwashing by alleviating financing constraints, we employ the SA index to measure such constraints and specify Model (5) for mediation analysis. As shown in Column (1) of Table 6, green M&As are significantly negatively associated with the level of financing constraints, consistent with our theoretical reasoning. This result supports the proposed mechanism that green M&As will affect ESG greenwashing by easing financing constraints and validates Hypothesis H2.

Table 6.

Mechanism inspection analysis.

- (2)

- Analysis of Mechanisms for Enhancing Corporate Social Reputation

First, the essence of corporate ESG greenwashing lies in the deliberate creation of a strategic gap between environmental commitments and substantive actions; such opportunistic behavior, when unsupported by substantial investment, readily triggers reputational damage. Second, green mergers and acquisitions (M&As), as highly visible strategic commitments, transmit credible signals of environmental responsibility to stakeholders through irreversible resource investments, thereby functioning as a critical mechanism for constructing a green organizational identity and accumulating reputational capital. Third, grounded in cognitive consistency theory, once a firm establishes a distinct environmental identity via green M&As, any subsequent greenwashing induces significant cognitive dissonance; this identity verification pressure generates a potent self-regulatory force that compels the firm to maintain behavioral consistency to safeguard its reputational capital. Consequently, this study measures social reputation pressure (SRP) by whether a sample firm is concurrently audited by all Big Four accounting firms. The regression results from Model (6), presented in Column (2) of Table 6, indicate a significant positive relationship between green M&As and the level of social reputation pressure, which aligns with the theoretical reasoning and supports the mechanism whereby green M&As will affect ESG greenwashing through enhancing corporate social reputation, thus validating Hypothesis H3.

- (3)

- Analysis of Mechanisms to Suppress Short-sightedness of Enterprise Managers

First, managerial myopia drives firms towards cost-efficient ESG greenwashing to pursue short-term performance. Second, as a long-term strategic investment, green mergers and acquisitions (M&As) reshape managers’ temporal perspectives by forming organizational commitments that inherently incorporate long-term value orientation. Third, the resource investments and integration demands following such mergers establish a long-term-oriented incentive mechanism at the institutional level, systematically correcting myopic managerial behavior. Accordingly, this study uses the shareholding ratio of the controlling shareholder to measure the level of short-termism among managers (SLSM). The regression results from Model (7), reported in Column (3) of Table 6, show a significant negative correlation between green M&As and managerial short-termism, consistent with the theoretical analysis. This supports the mechanism whereby green M&As will affect ESG greenwashing by reducing managerial myopia, thus validating Hypothesis H4.

6. Further Research

- (1)

- Heterogeneity Analysis Based on Whether there is a Business Relationship Between the Two Companies in Green M&As

Examining whether there is a business relationship between the two parties involved in the merger and acquisition can effectively test the boundary of the role of green mergers and acquisitions in suppressing greenwashing effects, as business relationships significantly enhance the substantive restructuring ability of green mergers and acquisitions on corporate environmental strategies by strengthening technological collaboration and resource integration depth. Therefore, this study grouped green M&A transactions based on whether there is a business relationship between the two parties. Those with a business relationship are referred to as RT, while those without a relationship are referred to as NRT. According to the analysis results in Table 7 (1) and (2), it can be seen that, when there is a business relationship between the two parties in a green M&A transaction, the green M&A of the enterprise will negatively inhibit the enterprise from engaging in ESG “greenwashing”, and it is significant at the 1% level. However, in the group where there is no business relationship between the two parties in the green M&A transaction, there is no significant result, and it has also passed the detection of intergroup coefficient differences. The possible reason for this heterogeneous result is that green mergers and acquisitions with business connections can embed environmental governance more deeply into the enterprise’s main business value chain through core technology collaboration and operational process integration, thereby enhancing the substantive nature of green transformation. Mergers and acquisitions that do not have business connections often lack this deep integration and are easily seen as isolated strategic investments, making it difficult to fundamentally reshape corporate environmental behavior.

Table 7.

Heterogeneity analysis.

- (2)

- Heterogeneity Analysis of Environmental Regulatory Intensity of Acquired Companies in Green M&As

Examining the environmental regulatory intensity of the region where the acquired enterprise is located can effectively identify the boundary role of the institutional environment in suppressing the greenwashing effect of green mergers and acquisitions, since strict external regulation strengthens environmental compliance constraints and increases the cost of violations, ensuring the transformation of green mergers and acquisitions from strategic symbolism to substantive governance. Therefore, this study grouped the acquired companies in green M&A transactions according to the different levels of environmental regulatory intensity in their locations. Companies in locations that explicitly require environmental information disclosure are referred to as HC, while those in locations that do not explicitly require environmental information disclosure are referred to as LC. According to the analysis results in Table 7 (3) and (4), it can be seen that, when the environmental regulatory intensity of the acquired company in green M&A transactions is strong, green M&As will negatively inhibit the company’s ESG “greenwashing” behavior, and it is significant at the 1% level. However, there is no significant result in the group where the environmental regulatory intensity of the acquired company in green M&A transactions is weak, and it also passes the detection of intergroup coefficient differences. This heterogeneity result reveals that strict environmental regulation strengthens the governance effect of green mergers and acquisitions through a dual mechanism: on the one hand, higher compliance requirements and enforcement efforts in regions with strong environmental regulation significantly increase the expected cost of corporate environmental violations. On the other hand, such regions often have a more complete system of environmental information transparency, which collectively encourages companies to internalize the environmental resources obtained through green mergers and acquisitions into long-term governance capabilities, rather than short-term public relations tools.

- (3)

- Heterogeneity Analysis Based on the City Type of the Main Acquiring Enterprise in Green M&As

Focusing on the differences in the types of cities where the main acquiring enterprises are located can effectively reveal how the institutional pressure and resource endowment carried by location factors regulate the governance effectiveness of green mergers and acquisitions. This is because the stricter regulatory environment, more complete information transparency, and denser green element resources in first-tier cities collectively constitute the key contextual conditions for promoting enterprises to transform green mergers and acquisitions into substantive environmental governance. Therefore, in this study, buyer companies involved in green M&A transactions that are located in first-tier cities will be referred to as FC, while those in non-first-tier cities will be referred to as NFC. According to the analysis results in Table 7 (5) and (6), it can be seen that, when the buyer of green M&A transactions is located in a first-tier city, green M&As will negatively inhibit the company’s ESG “greenwashing” behavior, and it is significant at the 1% level. However, when the buyer of green M&A transactions is located in a non-first-tier city group, there is no significant result, and it has also passed the detection of intergroup coefficient differences. This heterogeneity is due to the fact that first-tier cities have stricter institutional environments and more complete factor markets compared to non-first-tier cities. On the one hand, first-tier cities have stronger regulatory enforcement, media attention, and public supervision, significantly increasing the potential cost of corporate environmental violations. On the other hand, its developed green technology market and professional talent reserve provide the necessary support for enterprises to effectively integrate green resources, jointly ensuring the transformation of green mergers and acquisitions from investment behavior to governance effectiveness.

7. Conclusions and Discussion

- (1)

- Research Conclusion and Theoretical Inspiration

This study indicates that corporate green mergers and acquisitions have a certain negative impact on their ESG greenwashing behavior, and this governance effect is mainly achieved through three mechanisms: alleviating financing constraints, accumulating social reputation capital, and correcting managerial shortsightedness. And after a series of robustness and endogeneity tests, the research results of this paper still hold true. Further research has found that green mergers and acquisitions have a more significant impact effect on greenwashing behavior when there is a business relationship between the acquiring parties, the acquired party is located in a strong environmental regulatory area, or the main acquiring enterprise is located in a first-tier city. This reveals the key boundary conditions of strategic synergy, institutional environment, and location factors. The theoretical inspiration of this study is that it reveals the governance function of green mergers and acquisitions in suppressing corporate environmental opportunistic behavior from the perspective of corporate governance, breaking through the limitations of the traditional literature that simply regards them as strategic expansions or compliance responses and deepening the understanding of corporate strategic environmental motivations. By constructing and validating a “mechanism context”-integrated analysis framework, this study not only clarifies the internal mechanism of how green mergers and acquisitions affect greenwashing behavior through three paths, alleviating financing constraints, accumulating reputation capital, and correcting managerial shortsightedness, but also identifies key boundary conditions such as business collaboration, institutional pressure, and geographical location, providing a more refined theoretical lens for subsequent research. The conclusion provides a theoretical basis for enterprises to promote green transformation through a substantial investment in the Chinese context and also provides regulatory insights for identifying and preventing new greenwashing risks through asset restructuring.

- (2)

- Practical Insights

At the practical level of enterprises, the findings of this study suggest that managers can pay more attention to strategic synergy and institutional context adaptation when planning green mergers and acquisitions. Prioritizing the selection of green targets closely related to the main business can help embed environmental commitments into the core value chain through technological integration. At the same time, carefully evaluating the environmental regulatory strength of the location where the target of the merger and acquisition is located can help identify and utilize external institutional pressures to strengthen internal governance. For enterprises located in strong regulatory environments or first-tier cities, green mergers and acquisitions may be more likely to play a potential role in alleviating financing constraints and accumulating reputation. Therefore, companies can view green mergers and acquisitions as a substantive investment that is aligned with long-term environmental strategies, systematically considering their business connections, location, and institutional environment in decision-making in order to more robustly guide resource allocation and support sustainable transformation.

Based on the findings of this study, government departments can pay attention to the correlation and context of green M&A-related support policies with corporate environmental behavior when improving them. Policy design can consider guiding enterprises to focus on the strategic synergy of mergers and acquisitions and providing moderate procedural convenience for projects with a high business relevance and meeting substantive transformation characteristics. At the same time, it is possible to explore the construction of differentiated environmental regulations and supporting incentive systems. For example, in regions with strong environmental supervision or first-tier cities, the requirements for tracking and disclosing environmental information integrated after mergers and acquisitions can be strengthened so as to more effectively exert the constraint and guidance role of the external institutional environment. In addition, financial institutions can be encouraged to refer to the substantive characteristics of corporate green mergers and acquisitions, develop more targeted financing tools, and indirectly support them in improving environmental performance through long-term investment.

For investors and other stakeholders, the findings of this study suggest that, when evaluating a company’s environmental commitments, the essence and context of its green M&A behavior can be examined more cautiously. This means that, when analyzing the environmental performance of a company, investors can not only focus on whether it has conducted green mergers and acquisitions, but can also evaluate whether the merger has formed a strategic synergy with its main business, whether it has occurred in areas with strong environmental regulations, and whether the company itself is in a location where it can more effectively acquire and integrate green resources. These contextual features, together with merger and acquisition behaviors, constitute a relevant dimension for observing the substantive nature of the corporate environment. Creditors and other market participants can also refer to this type of information and consider the environmental improvements achieved through collaborative mergers and acquisitions when designing financing or evaluation terms in order to incentivize them to allocate strategic resources more sustainably to substantive green activities in a market-oriented manner.

- (3)

- Research Limitations and Prospects

There are still some limitations to this study that need further exploration. Firstly, this study uses a pre-and-post comparative DID analysis to verify the potential correlation between green mergers and acquisitions and corporate ESG greenwashing behavior. Even after passing a series of robustness and endogeneity tests, there may still be a series of endogeneity issues when measuring, selecting, and analyzing the corresponding mechanisms and time effects of potentially correlated variables. In future research, we can consider using the dynamic interleaved event impact DID research method for further “quasi experimental” studies to enrich and improve the conclusions of this study. Secondly, this study is based on relevant data from Chinese A-share companies. In the future, it may be considered to use relevant information from global companies engaged in green mergers and acquisitions to further enhance the universality of the conclusions of this study. Thirdly, the measurement of corporate ESG green indicators in this study depends on the differences between different rating agencies. In the future, big language models can be introduced to conduct in-depth analyses of ESG texts published by enterprises in order to obtain specific indicators that are more in line with the green nature of enterprise ESG, and further improve the effectiveness of the conclusions of this study.

Author Contributions

H.S. and Z.W.; methodology, Z.D.; software, H.S.; validation, H.S., Z.W. and Z.D.; formal analysis, Z.W.; investigation, Z.W.; resources, H.S.; data curation, H.S.; writing—original draft preparation, H.S.; writing—review and editing, Z.W.; visualization, Z.W.; supervision, Z.D.; project administration, Z.D.; funding acquisition, Z.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by [The Key Project of the National Social Science Fund of China] grant number [24AGL030] And The APC was funded by [Hongjun Sun].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Duchin, R.; Gao, J.E.; Xu, Q.P. Sustainability or Greenwashing: Evidence from the Asset Market for Industrial Pollution. J. Financ. 2025, 80, 699–754. [Google Scholar] [CrossRef]

- Wang, H.; Shen, H. Self-Restraint or External Supervision: Green Bond Issuance and Greenwashing. Res. Int. Bus. Financ. 2024, 70, 102402. [Google Scholar] [CrossRef]

- Zhang, Z.B.; Zheng, X.R.; Lv, Q.T.; Meng, X.H. How Institutional Pressures Influence Corporate Greenwashing Strategies: Moderating Effects of Campaign-Style Environmental Enforcement. J. Environ. Manag. 2025, 373, 123914. [Google Scholar] [CrossRef]

- Frendy; Oshika, T.; Koike, M. Environmental Greenwashing in Japan: The Roles of Corporate Governance and Assurance. Meditari Account. Res. 2024, 32, 266–295. [Google Scholar] [CrossRef]

- Wang, W.J.; Sun, Z.Y.; Dong, Y.T.; Zhang, L.Y. Cost of Debt Financing, Stock Returns, and Corporate Strategic ESG Disclosure: Evidence from China. Bus. Ethics Environ. Responsib. 2025, 34, 1787–1812. [Google Scholar] [CrossRef]

- Pinheiro, A.B.; Ramanho, A.L.D.S.; Carraro, W.B.W.H. Road to Glory or Highway to Hell? Uncovering the Consequences of Corporate Greenwashing in Latin America. Manag. Res. Rev. 2025, 48, 1257–1271. [Google Scholar] [CrossRef]

- Zhao, J.Y.; Wang, X.H. Managerial Myopia, Technological Innovation, And Greenwashing: Moderating Roles of Financing Constraints and Environmental Uncertainty. Technol. Forecast. Soc. Change 2025, 218, 124210. [Google Scholar] [CrossRef]

- Han, Z.J.; Wang, Y.W.; Pang, J. Does Environmental Regulation Promote Green Merger and Acquisition? Evidence from the Implementation of China’S Newly Revised Environmental Protection Law. Front. Environ. Sci. 2022, 10, 42260. [Google Scholar] [CrossRef]

- Sun, Z.Y.; Sun, X.; Wang, L.H.; Wang, W. Substantive Transformation or Strategic Response? The Impact of A Negative Social Responsibility Performance Gap on Green Merger and Acquisition of Heavily Polluting Firms. J. Environ. Plan. Manag. 2025, 68, 1238–1262. [Google Scholar] [CrossRef]

- Cheng, Z.H.; Yan, X.Q. Environmental Management System Certification and Corporate ESG Greenwashing. Energy Econ. 2025, 149, 108800. [Google Scholar] [CrossRef]

- Kim, J.; Lee, Y.K.Y. Association Between Earnings Announcement Behaviors and ESG Performances. Sustainability 2023, 15, 7733. [Google Scholar] [CrossRef]

- Peng, Q.; Xie, Y. ESG Greenwashing and Corporate Debt Financing Costs. Financ. Res. Lett. 2024, 69, 106012. [Google Scholar] [CrossRef]

- Zhong, M.; Zhu, Y.F.; Li, R.Q.; Liu, Z.Y. ESG Greenwashing and Retail Investor Criticisms. Res. Int. Bus. Financ. 2025, 79, 103034. [Google Scholar] [CrossRef]

- Chai, H.R.; Cheng, Z.H.; Wu, W.X. Is ESG Performance A Protective Umbrella for ESG Violations? Int. Rev. Financ. Anal. 2025, 98, 103858. [Google Scholar] [CrossRef]

- Liao, Z.J.; Xu, L.J.; Zhang, M.N. Government Green Procurement, Technology Mergers and Acquisitions, And Semiconductor Firms’ Environmental Innovation: The Moderating Effect of Executive Compensation Incentives. Int. J. Prod. Econ. 2024, 273, 109285. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, Z.Y.; Sheng, A.Q.; Zhang, L.Y.; Kan, Y.W. Can Green Technology Mergers and Acquisitions Enhance Sustainable Development? Evidence from ESG Ratings. Sustain. Dev. 2024, 32, 6072–6087. [Google Scholar] [CrossRef]

- Yu, L.; Lv, H.X.; Fung, A.; Feng, K.Y. CEO Turnover Shock and Green Innovation: Evidence from China. Int. Rev. Econ. Financ. 2024, 92, 894–908. [Google Scholar] [CrossRef]

- Hu, J.; Fang, Q.; Wu, H.Y. Environmental Tax and Highly Polluting Firms’ Green Transformation: Evidence from Green Mergers and Acquisitions. Energy Econ. 2023, 127, 107046. [Google Scholar] [CrossRef]

- Liao, Y.T.; Marquez, R.; Cheng, Z.; Li, Y.L. Can ESG Performance Sustainably Reduce Corporate Financing Constraints Based on Sustainability Value Proposition? Sustainability 2025, 17, 7758. [Google Scholar] [CrossRef]

- Yang, Y.; Chi, Y. Path Selection for Enterprises’ Green Transition: Green Innovation and Green Mergers and Acquisitions. J. Clean. Prod. 2023, 412, 137397. [Google Scholar] [CrossRef]

- Li, J.J. Can Technology-Driven Cross-Border Mergers and Acquisitions Promote Green Innovation in Emerging Market Firms? Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 27954–27976. [Google Scholar] [CrossRef]

- Yi, Z.M.; Liu, H.Y.; Wang, Y.L.; Chen, J.Y. How Does Green Finance Policy Affect Firms’ Pro-Environmental Mergers and Acquisitions? Account. Financ. 2024, 64, 4723–4728. [Google Scholar] [CrossRef]

- Mao, Z.H.; Wang, S.Y.; Lin, Y.E. ESG, ESG Rating Divergence and Earnings Management: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 3328–3347. [Google Scholar] [CrossRef]

- Yoshida, K.; Iino, Y.; Eba, F.; Xie, J.; Managi, S. Do Climate Change Risks and Corporate Governance Encourage Green M&A? J. Environ. Manag. 2025, 393, 127123. [Google Scholar] [CrossRef] [PubMed]

- Shi, P.H.; Huang, Q.H. Green Mergers and Acquisitions and Corporate Environmental Responsibility: Substantial Transformation or Strategic Arbitrage? Econ. Anal. Policy 2024, 83, 1023–1040. [Google Scholar] [CrossRef]

- Boone, A.; Uysal, V.B. Reputational Concerns in the Market for Corporate Control. J. Corp. Financ. 2020, 61, 101399. [Google Scholar] [CrossRef]

- Ma, R.C.; Pan, X.D.; Suardi, S. Green M&A Dilemma: Unravelling the Impact on High Polluting Enterprises’ Performance. Financ. Res. Lett. 2024, 70, 106292. [Google Scholar]

- Lu, J. Can the Green Merger and Acquisition Strategy Improve the Environmental Protection Investment of Listed Company? Environ. Impact Assess. Rev. 2021, 86, 106470. [Google Scholar] [CrossRef]

- Zhang, J.W.; Li, Y.; Xu, H.W.; Ding, Y. Can ESG Ratings Mitigate Managerial Myopia? Evidence from Chinese Listed Companies. Int. Rev. Financ. Anal. 2023, 90, 102878. [Google Scholar] [CrossRef]

- Appiah, L.O.; Essuman, D. How Do Firms Develop and Financially Benefit from Green Product Innovation in A Developing Country? Roles of Innovation Orientation and Green Marketing Innovation. Bus. Strategy Environ. 2024, 33, 7241–7252. [Google Scholar] [CrossRef]

- Wen, T.Q.; Wang, Y. The Mirage of Sustainable Development: The Impact of ISO 14001 Certification on Corporate Greenwashing. Bus. Strategy Dev. 2025, 8, e70112. [Google Scholar] [CrossRef]

- Niemczyk, J.; Sus, A.; Borowski, K.; Jasinski, B.; Jasinska, K. The Dominant Motives of Mergers and Acquisitions in the Energy Sector in Western Europe from the Perspective of Green Economy. Energies 2022, 15, 1065. [Google Scholar] [CrossRef]

- Chen, X.M.; Liang, X.; Wu, H. Cross-Border Mergers and Acquisitions and CSR Performance: Evidence from China. J. Bus. Ethics 2022, 183, 255–288. [Google Scholar] [CrossRef]

- Ding, Y.B.; Li, J.; Tian, Y.Q. The Short and Long-Term Effects of Cross-Border M&A Network on Chinese Enterprises’ Green Innovation. Econ. Model. 2024, 134, 106704. [Google Scholar]

- Shahiduzzaman, M.; Mudalige, P.; Al Farooque, O.; Alauddin, M. The Effect of Corporate Environmental Performance (CEP) of an Acquirer on Post-Merger Firm Value: Evidence from the US Market. Int. J. Financ. Stud. 2025, 13, 125. [Google Scholar] [CrossRef]

- Liu, Y.; Li, W.; Wang, L.X.; Meng, Q.K. Why Greenwashing Occurs and What Happens Afterwards? A Systematic Literature Review and Future Research Agenda. Environ. Sci. Pollut. Res. 2023, 30, 102–116. [Google Scholar] [CrossRef]

- Jia, H.; Liu, J.Y. The Impact of Environmental Protection Tax Towards Corporate ESG Greenwashing. Sustainability 2025, 17, 9559. [Google Scholar] [CrossRef]

- Yu, E.P.Y.; Van Luu, B.; Chen, C.H. Greenwashing in Environmental, Social and Governance Disclosures. Res. Int. Bus. Financ. 2020, 52, 101192. [Google Scholar] [CrossRef]

- Zhang, D.Y. Environmental regulation and firm product quality improvement: How does the greenwashing response? Int. Rev. Financ. Anal. 2022, 80, 102058. [Google Scholar] [CrossRef]

- Hu, P.; Li, X.M.; Li, N.; Wang, Y.Y.; Wang, D.D. Peeking into Corporate Greenwashing through the Readability of ESG Disclosures. Sustainability 2024, 16, 2571. [Google Scholar] [CrossRef]

- DasGupta, R. Financial performance shortfall, ESG controversies, and ESG Performance: Evidence from firms around the world. Financ. Res. Lett. 2022, 46, 102487. [Google Scholar] [CrossRef]

- Roth, J.; Sant’Anna, P. What’s Trending in Difference-in-Differences? A Synthesis of the Recent Econometrics Literature. J. Econom. 2023, 2, 2218–2244. [Google Scholar] [CrossRef]

- Zeng, Y.; Lee, E.; Zhang, J. Value relevance of alleged corporate bribery expenditures implied by accounting information. J. Account. Public Policy 2016, 35, 592–608. [Google Scholar] [CrossRef]

- Walker, K.; Wan, F. The Harm of Symbolic Actions and Green-Washing: Corporate Actions and Communications on Environmental Performance and Their Financial Implications. J. Bus. Ethics 2012, 2, 227–242. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).