Abstract

This study develops and validates the concept of Regulatory Cultural Stewardship (RCS) as a dynamic capability that enables small and medium-sized enterprises (SMEs) to achieve sustainable AI-enabled digital transformation (AIEDT) in a volatile emerging economy. RCS empowers SMEs to harmonize regulatory compliance with cultural legitimacy, a critical nexus for fostering sustainable business practices and long-term resilience (economic viability and social legitimacy), in line with the global sustainable objectives. Using survey data from 391 Pakistani SMEs and Partial Least Squares Structural Equation Modeling (PLS-SEM), we find that four key AIEDT drivers explain 65.1% of the variance in AI innovation, with Technological Infrastructure and Policy and Ecosystem Support as dominant enablers. AI innovation fully mediates the relationship between AIEDT drivers and sustainable business performance. RCS not only enhances SME performance directly but also strengthens the AI innovation–business performance linkage as a significant moderator. Sectoral analysis reveals that services benefit most from Socio-Cultural Readiness, while manufacturing and primary sectors depend more on policy infrastructure and RCS. Significantly, RCS is validated as a distinct construct, integrating compliance and cultural alignment, rather than a subset of existing factors like policy support or cultural readiness. The study emphasizes the importance of scalable AI infrastructure, workforce upskilling, and internal cultural adaptation, while urging policymakers to stabilize AI governance frameworks to ensure a sustainable and equitable digital transition. The findings advance theory by conceptualizing RCS as a meta-capability bridging institutional voids and socio-cultural dynamics and offer practical insights for policymakers and managers seeking to implement ethically aligned and sustainable AIEDT strategies in emerging markets. At a conceptual level, RCS is ethically grounded in global AI principles, including fairness, accountability, and transparency, ensuring that cultural alignment never overrides human-centered values.

1. Introduction

Digital transformation represents a paradigm shift in how organizations operate and deliver value to their customers [,]. This study builds upon prior digital transformation literature [,] and recent AI-sustainability studies [,] to situate AI-enabled digital transformation within volatile emerging economies. By explicitly linking AI innovation and sustainability debates, it advances beyond earlier work that treated them separately. Artificial intelligence (AI) technology, being a key enabler, provides tools for optimization, personalization, and innovative solutions []. The implementation of digital transformation necessitates the integration of digital technologies across all operations, fundamentally altering processes, organizational culture, and customer interactions.

In this paradigm shift, AI plays a vital role. AI refers to systems that perceive their environment and take actions to achieve specific goals. AI has emerged as a transformative force, permeating various aspects of modern life [], as AI learns and adapts to various situations, performing tasks like pattern recognition, problem-solving, and language understanding []. However, digital transformation is increasingly dependent on the application of AI innovations (AII) that use AI technologies for organizational core functions [] to deliver improved business performance results. Consequently, AI-enabled digital transformation (AIEDT) has become a critical driver for process optimization and enhanced decision-making in a competitive business environment [].

Despite these advantages, ensuring the sustainability of AIEDT in practice is challenging. It requires strong Organizational Readiness (OR) combined with advanced Technological Infrastructure (TI) and coherent Policy and Ecosystem Support (PES) alongside broad Socio-Cultural Readiness (SCR) to harness AI Innovations []. The implementation of AI for digital transformation is largely challenging for smaller economies because of evolving AI regulatory frameworks and limited implementation capabilities [,]. Lagging OR, inadequate TI, fragmented PES, and uneven SCR collectively hinder AIEDT, particularly in small and medium enterprises (SMEs).

SMEs play a pivotal role in global economies; however, AIEDT in SMEs remains constrained by resource limitations, together with institutional gaps and cultural barriers []. Furthermore, AIEDT faces additional challenges due to global volatility arising from geopolitical tensions and rapid technological change/transformations. These instabilities heighten business risk and compliance in long-term planning for SMEs. The volatile economy of Pakistan presents a unique case for AIEDT in SMEs. SMEs in Pakistan occupy a critical yet paradoxical position in the economy. The business establishments of SMEs constitute 90% of the total number, while their GDP contribution reaches between 30 and 40%, employing 80% of non-farming workers []. The sustainable development of SMEs is not merely an economic imperative but a cornerstone of the United Nations Sustainable Development Goals (SDGs), particularly SDG 8 (Decent Work and Economic Growth) and SDG 9 (Industry, Innovation, and Infrastructure). In volatile economies like Pakistan, the failure of SMEs to digitally transform poses a direct threat to their economic sustainability, risking widespread job losses and economic instability. Consequently, understanding how to enable a sustainable AIEDT, one that is not only profitable but also resilient, socially legitimate, and ethically grounded, becomes a critical research endeavor. Such transformation is essential for achieving inclusive economic growth, fostering social welfare, and ensuring that the benefits of technological progress are broadly shared, thereby contributing directly to national and global sustainability agendas. However, AIEDT in Pakistani SMEs faces substantial barriers from political instability and regulatory ambiguity as well as widespread public resistance toward AI-based development []. Particularly, the implementation of AI innovations across multiple sectors results in minimal scalability and restricts SMEs business performance (SMEBP) development because businesses fail to utilize AI for resilience and competitiveness [,]. This study extends prior digital transformation frameworks by explicitly situating AI-enabled digital transformation within the intertwined theoretical domains of the Technology–Organization–Environment (TOE) framework, Institutional Theory, and Dynamic Capability Theory. Existing research has rarely integrated these perspectives within volatile emerging markets, leaving conceptual and empirical voids concerning how SMEs reconcile regulatory and cultural contradictions. By introducing Regulatory-Cultural Stewardship (RCS) as a bridging meta-capability, this study builds a theoretical bridge between external institutional pressures and internal adaptive governance. Hence, it situates RCS as a timely theoretical advancement grounded in extant literature while offering new contextual insight into sustainable AI transformation in volatile economies.

Small and medium-sized enterprises (SMEs) in Pakistan face chronic constraints in capital accumulation, human resource sophistication, and digital infrastructure, which inhibit their capacity to compete on scale or cost. As noted by [], and corroborated by recent Pakistan-context evidence on SME constraints and capability reliance, SMEs in emerging economies frequently depend on intangible resources (e.g., managerial capabilities, networks) to compensate for material scarcity. These intangible assets enable strategic flexibility but remain insufficient in the absence of technological augmentation. Consequently, while large enterprises exploit data-driven systems to optimize productivity, SMEs frequently depend on experiential decision-making and fragmented information channels, which limit their efficiency and international competitiveness.

Against this backdrop, AI innovation emerges as a strategic necessity rather than a discretionary technological upgrade. Through cost-efficient automation, predictive analytics, and intelligent process optimization, AI applications can substantially reduce operational redundancy, enhance supply chain visibility, and improve customer responsiveness even within resource-deficient contexts. In volatile institutional environments such as Pakistan, where regulatory instability and infrastructural uncertainty amplify business risk, AI innovation allows firms to reconfigure scarce resources into adaptive advantages. Therefore, AI innovation becomes not a luxury but a resilience strategy for resource-constrained SMEs operating under institutional volatility.

AIEDT in complex private systems can be studied through the Technology-Organization-Environment (TOE) framework, which evaluates Technological Infrastructure (TI), and Organizational Readiness (OR), and Policy and Ecosystem Support factors (PES) as key elements []. However, this traditional framework alone could not effectively address unstable institutional settings. AIEDT strategic decisions should incorporate institutional theory to pursue legitimacy by responding to government regulations (PES coercive pressures) and societal norms (SCR normative pressures) [,], thus creating a method to evaluate AIEDT by examining TI, OR, and PES elements. While PES provides essential external structures and SCR reflects social technological recognition, these constructs are inherently reactive. They describe environmental conditions but fail to equip SMEs with the proactive internal capability to navigate institutional complexity or shape cultural narratives.

Research findings demonstrate that SME digital transformation requires further investigation of both institutional and socio-cultural aspects and dimensions of SMEs digital transformation []. For instance, there is limited empirical evidence on how evolving government policies and regulatory frameworks influence SMEs AI transformation in emerging economies [,]. Similarly, although organizational culture and SCR are acknowledged as enablers of digital transformation, research treats these as static antecedents rather than dynamic elements. Moreover, most empirical research on AI transformation targets large firms or stable economies [], leaving SMEs largely overlooked. These gaps point to a critical need for an integrative approach that links external institutional pressures with internal dynamic capabilities to achieve sustainable AIEDT. We propose Regulatory-Cultural Stewardship (RCS), as a dynamic firm-level capacity that actively harmonizes regulatory compliance with cultural legitimacy to ensure the long term sustainability and ethical grounding of AI initiatives. Unlike PES as external policy support and SCR as static cultural readiness [,], RCS can actively steward regulatory compliance and cultural alignment through ethical governance, stakeholder engagement, and anticipatory strategy. Therefore, this research aims to investigate the complex interrelations between AIEDT, AII, RCS, and SMEBP to fill this essential knowledge gap. Our research predicts that RCS as a dynamic capability will bridge the gap between external regulatory compliance and internal cultural unity during AIEDT for SMEs.

This study represents (1) a novel construct, RCS, and its measurement; (2) an integrative theoretical framework linking institutions, capabilities, and digital innovation; and (3) practical insights for SME managers and policymakers on leveraging AI in a way that is attuned to the regulatory and cultural ecosystem. This study integrates multiple theories with the TOE framework to explain SME digital transformation in volatile ecosystems, taking a case study of Pakistan. It bridges macro-level institutional pressures (regulatory/cultural) and micro-level organizational agility, addressing a gap in AIEDT models. Beyond addressing gaps in extant literature, this study offers distinct theoretical and practical contributions. Theoretically, RCS as a new construct reconciles institutional voids with firm-level agility. Methodologically, we validate this framework through multi-sector PLS-SEM analysis of 391 SMEs. Practically, we reveal sector-specific pathways for AIEDT in unstable environments, enabling policymakers and managers to prioritize context-sensitive interventions. Guided by Pakistan’s institutional and technological landscape, this multi-sectoral study is structured around the following three research questions (RQs):

- RQ1: How do the four AIEDT drivers (OR, TI, PES, and SCR) collectively influence AI innovations in SMEs?

- RQ2: To what extent does AI innovation mediate the relationship between AIEDT drivers and SMEBP under volatile institutional and economic conditions?

- RQ3: How does RCS, as a dynamic organizational capability, shape or strengthen the effect of AI innovation on SMEBP in culturally and regulatorily complex environments?

The remainder of this paper is structured as follows: Section 2 integrates the TOE framework, institutional theory, and dynamic capability theory to position RCS bridging institutional voids. Section 3 details the methodology and measurements, including the PLS-SEM approach and sampling strategy. Section 4 presents the empirical results. Section 5 discusses theoretical and practical implications, and Section 6 concludes the study with policy recommendations.

2. Theoretical Background and Literature Review

2.1. Theoretical Background

The Technology–Organization–Environment (TOE) framework provides a systematic approach for understanding the factors that influence technology adoption [] in organizations. Ref. [] highlights the interplay of three interdependent contexts: technological, organizational, and environmental. In the context of AI-enabled digital transformation (AIEDT) within SMEs, the TOE framework functions as a fundamental starting point, identifying essential enablers and barriers to digital transformation []. Technological Infrastructure (TI) represents the technological context that enables AI applications. Likewise, Organizational Readiness (OR) addresses the organizational context, evaluating internal capabilities, including leadership together with skilled personnel and financial resources required for AI transformation []. Additionally, the environmental context, traditionally captured in TOE as external pressures, is categorized into two dimensions: Policy and Ecosystem Support (PES) and Socio-Cultural Readiness (SCR). PES encompasses institutional elements such as government regulations, industry policies, and support mechanisms []. While it provides external support, it does not explain how firms strategically respond to or leverage this support internally.

SCR includes societal elements like digital literacy and cultural values and public acceptance of AI-enabled digital transformation []. However, SCR reflects a static state of readiness and does not account for a firm’s ability to actively shape these cultural norms during implementation. The distinctions hold particular importance in emerging economies, where institutional voids and cultural dynamics together establish the outcomes of AIEDT []. Thus, the TOE framework provides a basis for understanding AIEDT by organizing both internal and external elements that affect AI transformation. Table 1 demonstrates the specific functions of PES and SCR in relation to RCS.

Table 1.

Comparison of PES, SCR, and RCS (key constructs in institutional and cultural framework).

Institutional theory further provides more detailed information about external pressures by showing how both formal and informal institutions affect organizational behavior []. SMEs operating in unstable economies face institutional pressures that stem from both coercive forces (such as laws and regulations) and normative pressures (including societal norms and cultural values) []. The pressures force businesses to match legal standards and social expectations, which in turn determine their technological transformation approaches [,]. PES, which represents the formal regulatory environment, that consists of government policies and AI laws, and industry standards that SMEs need to follow. Moreover, SCR represents the informal, cultural context, societal attitudes toward AI, ethical norms, and the broader community’s openness to digital transformation. The dynamic nature of these institutional pressures is crucial in volatile economies where institutional frameworks may be nascent or fragmented, making it even more important for firms to navigate these external factors proactively []. However, while institutional theory identifies these external forces, it does not provide a mechanism for understanding how SMEs actively respond to or shape these pressures. This gap is addressed by introducing Regulatory-Cultural Stewardship (RCS) as a dynamic capability.

Furthermore, Dynamic Capability Theory (DCT) is particularly relevant for AIEDT, as AI technologies evolve rapidly, and SMEs must adapt their resources accordingly. DCT explores how SMEs perceive to gain competitive advantage in turbulent markets by developing the capacity to sense, seize, and reconfigure resources in response to change []. TOE factors, OR, reflect organizational agility, leadership commitment, and a skilled workforce that can integrate AI into business processes, while TI encompasses the digital infrastructure that supports AI tools and applications. The dynamic capabilities lens highlights the importance of continuous adaptation, emphasizing that SMEs must actively reconfigure their resources to exploit AI opportunities and overcome barriers. The research demonstrates SMEs with strong dynamic capabilities are better equipped to navigate rapid technological changes and institutional challenges []. DCT provides a foundation for conceptualizing RCS as a firm-level meta-capability that helps SMEs proactively align regulatory compliance and cultural adaptation with their digital transformation strategies.

The proposed construct of RCS builds on DCT by establishing itself as a superior dynamic capability that enables organizations to proactively handle both regulatory and cultural aspects of AIEDT. RCS extends beyond dynamic capabilities by enabling firms to actively govern their regulatory compliance and cultural alignment through governance mechanisms. An SME with robust RCS capabilities would implement AI technologies while simultaneously handling regulatory changes and transforming its organizational culture to support AI-based innovations. RCS, therefore, functions as a connection between external institutional forces (PES and SCR) and the internal capabilities required for successful AI transformation. Through this forward-thinking approach, SMEs can anticipate regulatory changes and cultural shifts. This strengthens their resilience to institutional ambiguity and enables a more effective pursuit of AI innovation []. By conceptualizing RCS as a dynamic capability, this framework goes beyond the passive description of external pressures (PES and SCR) and offers a mechanism for how firms actively manage these pressures. This logic resonates with findings on dynamic capabilities for navigating institutional voids [].

Stewardship theory extends this framework by focusing on ethical and relational aspects of organizational leadership. According to [], stewardship theory suggests that managers act as stewards, motivated by long-term interests rather than narrow self-interest. In the context of AIEDT, stewardship theory emphasizes the role of leadership in ensuring that AI initiatives are in line with both regulatory requirements and cultural values, thereby securing the social license to operate and long-term organizational sustainability. RCS, as a concept, embodies this stewardship-oriented approach, where firm leaders take responsibility for both ethical compliance and cultural alignment, ensuring that AI-enabled digital transformation is not only legally sound but also socially responsible and sustainable []. This approach helps build stakeholder trust, ensuring that AI-enabled digital transformation is not only technically and legally sound but also socially legitimate. This ethical orientation is particularly important in volatile economies, where regulatory uncertainty and cultural resistance to AI are prevalent. By framing leadership through the lens of stewardship, RCS integrates ethical governance with dynamic capability, providing a strategic mechanism for firms to navigate complex regulatory and cultural landscapes during AIEDT.

To clarify the conceptual novelty of Regulatory Cultural Stewardship (RCS) and to demonstrate its theoretical distinction from related constructs that have appeared under different labels, a comparative synthesis is provided in Table 2 below. This table positions RCS within, yet beyond, the domains of institutional responsiveness, cultural alignment, ethical governance, and institutional stewardship. It shows how RCS transforms these largely reactive or compliance-oriented orientations into a proactive, dynamic-capability framework that simultaneously integrates institutional, cultural, and ethical logics. Moreover, stakeholder proximity—relational, value-based, and territorial—supports the cultural arm of stewardship [].

Table 2.

Comparative positioning of RCS and related constructs.

This aligns with stewardship as an alternative to control-fixated governance []. Collectively, these comparisons underscore that RCS is not a re-labeling of existing constructs but a higher-order dynamic capability that synthesizes the adaptive, cultural, and ethical dimensions of organizational behavior. By embedding stewardship logic into institutional theory, RCS advances from reactive conformity to proactive harmonization, as emphasized by Andrews & Luiz (2025) and Torfing & Bentzen (2020) [,]. This interpretation aligns with the argument of Andrews & Luiz (2025) [], who demonstrate that firms operating in institutionally weak contexts deploy dynamic capabilities not merely to fill structural voids but to actively reshape the institutional landscape. Extending this logic, RCS embeds ethical and cultural stewardship mechanisms within the dynamic-capability framework, fostering long-term legitimacy rather than short-term regulatory compliance.

The relational and territorial proximity perspective of Attanasio et al. (2025) [] reinforces this argument by showing that proximity-based stakeholder engagement enhances mutual understanding and trust across institutional boundaries. In this sense, RCS’s cultural stewardship dimension operates through value-based proximity and contextual empathy, strengthening the relational networks that underpin sustainable AIEDT in SMEs.

The combination of the TOE framework with institutional, dynamic capability, and stewardship theory creates a strong base for understanding AIEDT in SMEs, especially in volatile institutional environments. It aids in identifying key enablers and pressures, but institutional theory extends this understanding by showing how external forces drive AIEDT while requiring both regulatory compliance and cultural alignment. According to Gao et al. (2025) [], DCT shows how SMEs can use their internal capabilities of OR and TI to capture AI opportunities and adjust to changing circumstances. Stewardship theory demonstrates that leadership plays a crucial role in leading SMEs through regulatory and cultural complexities. Together, these theories form an integrative framework: TOE and institutional perspectives explain the drivers and pressures of AIEDT, while dynamic capabilities and stewardship perspectives show how SMEs can proactively navigate and shape their institutional and cultural context through RCS.

Moreover, Torfing & Bentzen (2020) [] argue that stewardship theory provides a viable alternative to control-oriented performance management systems by emphasizing trust, intrinsic motivation, and collective purpose. This insight supports our conceptualization of RCS as an ethically guided, trust-centric governance capability that prioritizes responsibility and transparency over bureaucratic control—particularly critical in volatile regulatory environments.

This study addresses a critical gap in digital transformation literature by extending the TOE framework through Regulatory-Cultural Stewardship (RCS) [,]. While prior research treats institutional pressures (PES and SCR) as static environmental factors [], we conceptualize RCS as a dynamic capability enabling SMEs to proactively navigate regulatory and cultural complexities [,]. This shift from passive adaptation to active engagement is particularly vital in volatile, resource-constrained contexts, such as Pakistan, where institutional voids exacerbate barriers to AI integration []. By embedding RCS within the TOE-institutional nexus, our framework advances theoretical understanding of SME resilience and offers practical pathways for leveraging AI amid instability [].

This theoretical background sets the stage for understanding the complex interplay between external institutional pressures, internal capabilities, and strategic leadership in driving AIEDT []. The introduction of RCS as a dynamic organizational capability connects institutional theory’s external pressure analysis to DCT’s internal adaptation framework. By integrating these theories, it comprehends a model that not only explains how SMEs can navigate institutional voids but also how they can proactively shape their regulatory and cultural context to achieve sustainable AI-driven transformation.

While RCS has been defined as a proactive governance capability enabling firms to align regulatory compliance with socio-cultural expectations, it is equally important to ensure that such alignment does not conflict with universal human-centered values. To reinforce the ethical legitimacy of the construct, RCS is explicitly anchored in global AI–ethics frameworks, including the [] AI Principles, []. Recommendation on the Ethics of Artificial Intelligence, and []. Regulation on Artificial Intelligence (EU AI Act).

Accordingly, RCS is redefined as “the firm’s dynamic capability to anticipate and harmonize regulatory and cultural environments through ethically responsible governance consistent with global AI principles, thereby ensuring the sustainability and legitimacy of its AI-driven digital transformation.” This refinement underscores that RCS operates as a two-tier capability: (i) strategic stewardship, encompassing regulatory compliance and cultural legitimacy and (ii) ethical stewardship, ensuring fairness, transparency, inclusiveness, and accountability in AI adoption/AI-enabled digital transformation environment.

This dual framing prevents cultural alignment from deteriorating into relativism and guarantees that stewardship is grounded in global ethical principles, directly contributing to the social sustainability of technological change. We further acknowledge that, without ethical reflexivity, RCS could be misused to justify adaptation to discriminatory or exclusionary norms. Thus, RCS is repositioned as a human-centered governance capability that harmonizes institutional and cultural environments while safeguarding fairness, inclusion, and human rights in AIEDT.

2.2. Literature Review

2.2.1. AI-Enabled Digital Transformation in SMEs

The AI-enabled digital transformation (AIEDT) refers to the strategic integration of AI into firms’ business processes and models. Research indicates that effective use of advanced digital technologies can markedly improve firm performance: for example, AI-driven automation and analytics can enhance productivity, reduce operating costs, and enable the creation of new products and services []. The integration of AI unlocks new levels of efficiency, innovation, and competitiveness []. However, successful AI-enabled digital transformation requires a holistic approach considering Technological Infrastructure alongside data management and talent acquisition and cultural and change management elements []. For example, Schwaeke et al. (2025) [] categorize AIEDT influences into eight clusters (e.g., technological compatibility, infrastructure readiness, organizational culture, regulation, competition, etc.) that align with the TOE dimensions, confirming our broad view of AIEDT drivers.

The study of AI-enabled transformation in SMEs in European countries by [] explores the interplay between digital capabilities, innovation capabilities, and business environmental support. Globally, SMEs exhibit significantly lower AI adoption rates than larger firms, primarily due to resource constraints, financial barriers, capability gaps, and data quality deficiencies []. This gap is particularly pronounced in developing economies, where infrastructural and institutional voids exacerbate existing challenges. The digital divide between advanced and emerging economies continues to widen, as SMEs in lower economies contend with acute internal operational hurdles and external environmental barriers. In many such contexts, unreliable electricity and internet access directly impede the deployment of AI-driven solutions. Arroyabe et al. (2024) [] find that even in European SMEs, digital capabilities and external support interplay to drive AI adoption. In developing economies, these challenges are exacerbated by infrastructural voids, such as unreliable electricity and limited internet penetration (e.g., around one-third of Pakistani SMEs lack broadband connectivity), which hinder AI deployment.

Apart from infrastructures, contextual research reveals different barriers and opportunities for AIEDT. European SMEs face regulatory complexities; African SMEs grapple with implementation costs; while South Asian enterprises confront sustainability concerns and cultural barriers alongside resource constraints []. These multifaceted barriers—structural, cultural, and economic—reduce adoption rates. As evidenced in Saudi Arabia’s SME sector, overcoming them requires ecosystem-level interventions [,]. Although, AI brings potential transformative advantages for SMEs, its deployment faces multiple context-specific obstacles that require analytical comparison and customized policies. Therefore, theoretical frameworks for AIEDT analysis need to expand their focus from technology and organization to include regulation and environment, especially for volatile ecosystems.

Prior studies, as shown in Table 3, have largely treated factors like policy support (PES) and Cultural Readiness (SCR) as exogenous conditions or static readiness measures, without explaining how firms can proactively cope with institutional volatility. By conceptualizing RCS as a dynamic organizational capability, our framework extends beyond those traditional constructs to capture the active harmonization of regulatory compliance and cultural consonance in digital transformation. Thus, RCS emerges from this multi-theory integration as a theoretically necessary construct that enables SMEs to bridge institutional voids and cultural barriers during AIEDT. It is not merely a repackaging of PES or SCR, but rather a meta-capability that combines compliance and stewardship to ensure AI-driven innovation is both technologically effective and institutionally sustainable in volatile environments. This integrated perspective lays the groundwork for our research model, which links the TOE factors (OR, TI, PES, SCR), AI innovation, and SME performance, with RCS playing a pivotal moderating and direct role in ensuring successful outcomes even amid environmental turbulence.

Table 3.

Research gap matrix of recent results.

This synthesis demonstrates extensive reliance on and extension of recent literature from 2021 to 2025, ensuring temporal relevance. To reinforce theoretical alignment, additional recent works on digital transformation governance [,,] and ethical AI stewardship [,,] are incorporated, collectively broadening both the empirical base and conceptual legitimacy of this research.

2.2.2. Hypothesis Development

Organizational Readiness (OR)

AIEDT implementation by SMEs requires Organizational Readiness as their essential foundational element. The OR for digital transformation includes both innovative support systems, financial flexibility, and strategic digital integration approaches. SMEs with dynamic aptitudes demonstrate better potential to adopt AI tools and modify their internal processes. This perspective aligns directly with DCT, which focuses on how firms detect opportunities and seize them by restructuring their operations for AI integration []. The adoption of AIEDT becomes more likely when organizations provide sufficient resources and structured training programs and managerial support because these elements decrease the perceived complexity (effort expectancy) of AI implementation [].

Empirical evidence underscores this theoretical foundation; recent research on Pakistani SMEs [,] highlights the critical role of leadership commitment and agile decision-making, revealing that SMEs with robust training programs and financial flexibility exhibited significantly higher AI integration rates, illustrating how OR operationalizes dynamic capabilities.

Top management support is particularly pivotal within OR, as it enables the allocation of necessary resources, fosters employee motivation, and actively resolves implementation barriers [,]. Beyond leadership, a successful AIEDT model fundamentally depends on human capital readiness, possessing trained and adaptable employees, and sufficient financial preparedness. When internal processes, resources (human and financial), and strategic alignment converge, the acceptance and effective adoption of new technologies are significantly enhanced. This was demonstrably evident in the context of Pakistani retail SMEs, where such internal alignment facilitated rapid e-commerce adoption during the volatile COVID-19 pandemic [], suggesting similar dynamics apply to AIEDT. Therefore, we propose the following:

H1:

Organizational Readiness (AIEDT_OR) positively affects AI Innovations (AII) in SMEs.

Technological Infrastructure (TI)

Technological Infrastructure having robust hardware, software, reliable connectivity, ample data storage constitutes the basic foundation for AI initiatives. The absence of modern, scalable IT infrastructure presents a significant barrier to deploying advanced AI solutions, whereas its presence facilitates the straightforward testing, integration, and deployment of AI applications [,,]. Institutional theory adds dimension to it, highlighting coercive pressures, such as the need to comply with evolving global IT standards or meet supply chain partner requirements, which can compel SMEs to modernize infrastructure despite inherent resource constraints [].

Developing economies encounter severe difficulties in Technological Infrastructure. Research studies have consistently shown that limited infrastructure presents a primary barrier for technology adoption in these geographical areas. [] indicate that unstable internet connections together with broader infrastructure problems in emerging markets create significant barriers for AI technology adoption. According to []. SMEs in Indonesia that had more developed ICT infrastructure showed higher probabilities of adopting eco-innovations. The adoption of cloud computing by Bangladeshi SMEs increased substantially among businesses with better IT infrastructure []. Pakistan demonstrates this issue through its 4G telecom infrastructure advancement, which leaves behind significant rural disparities []. Collectively, these findings underscore that robust TI is a prerequisite for the adoption of advanced innovations, including AI. The outdated data systems of SMEs prevent them from adopting AI-driven analytics as a result. We propose the following hypothesis:

H2:

Technological Infrastructure (AIEDT_TI) positively affects AI Innovations in SMEs.

Policy and Ecosystem Support (PES)

While PES encompasses institutional conditions such as government incentives and innovation platforms, it does not represent how firms internally navigate or influence these forces. That role is captured by RCS, which describes a firm’s internal capability to respond to and align with such institutional dynamics. According to [], a well-aligned policy ecosystem where institutional incentives match organizational capabilities serves as an effective driver of SME innovation.

Theoretical perspectives explain influential functions of PES. Institutional theory explains how PES emerges from firms following new AI regulations or data standards as well as competitive forces or customer requirements, which drive businesses to implement AI to preserve their legitimacy. The institutional forces direct SME behavior either by forcing or encouraging them to adopt AIEDT. According to Dynamic Capability Theory, a strong PES enables SMEs to identify AI subsidies and market trends by allocating resources effectively. The firm’s environment requires PES as a critical enabler, which enhances its internal capabilities for AI innovation. The importance of PES in practice becomes evident through empirical research. Different studies show that government support functions as a key factor that drives SMEs to adopt AIEDT, demonstrated in Saudi Arabia []. Market dynamics, reflecting mimetic pressures, consistently push SMEs towards innovation, as seen in customer demands for high-tech solutions and competitive necessity in India [].

However, the effectiveness of PES is contingent on its design and implementation. The Pakistani context exemplifies both potential and challenge. Initiatives like National Incubation Centers, tech startup funding programs, and task forces preparing for Industry 4.0 represent positive steps towards building a supportive ecosystem []. IT clusters have demonstrably enhanced digital innovation capabilities for participating SMEs. Yet, significant barriers persist, particularly for underdeveloped SMEs. These include bureaucratic hurdles, inconsistent policy implementation, and a lack of sufficiently accessible supportive measures, which have traditionally burdened small businesses and limited them in growing within the volatile ecosystem []. This underscores that a conducive policy environment and vibrant innovation ecosystem are important for enhancing SMEs’ willingness and capacity to adopt AI. Therefore, we propose the following:

H3:

Policy and Ecosystem Support (AIDET_PES) positively affects AI Innovations (AII).

Socio-Cultural Readiness (SCR)

It is pertinent to note that SCR represents a state of cultural readiness rather than a dynamic capability. In contrast, RCS reflects how firms cultivate, align with, and strategically manage cultural norms during digital transformation. However, SCR consists of organizational culture and workforce values alongside digital literacy levels and organizational change acceptance and technological trust [], is another human and cultural dimension essential for AIEDT within SMEs. The way people and organizations perceive and adopt AI innovations depends directly on SCR.

Theoretical frameworks illuminate the impact of SCR in organizations. The institutional theory explains how normative pressures in SCR influence organizational behavior toward AI adoption through professional and societal expectations []. Cultural factors profoundly shape these perceptions. Societies with high uncertainty avoidance tend to resist both automation and disruptive technologies such as AI, according to Hofstede’s cultural dimensions [].

Studies demonstrate that socio-cultural elements play a crucial role in the decision-making process. Educational programs combined with exposure lead to better AI attitudes owing to improved users’ perceptions of AI usability and effectiveness in educational environments []. Consequently, acceptance of technology by different population groups heavily depends on cultural compatibility and social standards []. Particularly within SMEs, normative pressures and stakeholder influences play critical roles. The decision-making processes of family-run SMEs face challenges because of their familial structures and traditions, creating complex social dynamics that hinder AI adoption []. The Pakistani context demonstrates substantial SCR challenges because of its high uncertainty avoidance and limited public AI understanding and technological distrust, which primarily affect traditional SME sectors, including textiles. Therefore, such cultural factors likely impact AIEDT; hence we hypothesize the following:

H4:

Socio-Cultural Readiness (AIEDT_SCR) positively influences AI innovations (AII).

AI Innovations (AII) and SMEs Business Performance

AI innovations, encompassing machine learning, predictive analytics, and intelligent automation, function as transformative drivers of firms’ performance. This impact is fundamentally rooted in Dynamic Capability Theory []. Especially for SMEs, they empower them to sense market shifts and operational inefficiencies more acutely, seize opportunities through optimized processes and enhanced decision-making agility, and reconfigure resources to achieve sustained competitive advantage. Furthermore, the TOE framework positions AII not merely as a technological input, but as the critical outcome arising from the synergistic interplay of its core contexts: robust TI, strong OR, and conducive PES []. AII, therefore, represents the realized capability of translating these enabling factors into performance-enhancing applications.

Empirical research consistently demonstrates the positive performance impact of AII in SMEs globally. Strategic deployments yield significant gains; i.e., AI-driven supply chain optimization reduces stockouts by 25–40% through superior demand forecasting [], while AI-powered customer engagement tools boost sales conversion rates by 15–30% in retail []. Textile SMEs utilize AI-powered quality control, reducing defects by up to 50%, while dynamic pricing tools empower small retailers to compete effectively [].

In Pakistan’s emerging economy, AII can address critical systemic challenges. AI-enabled credit scoring models leveraging non-traditional data are expanding financing access to more than 60% of previously underserved SMEs, tackling financial exclusion []. The State Bank of Pakistan recognizes this potential, highlighting that AI integration, e.g., enhanced fraud detection, coupled with scalable infrastructure, could elevate SME productivity by 20–30% []. Evidence indicates that AII’s success hinges on human capital alignment with agile workflows []. Firms that achieve this alignment report substantial gains in operational efficiency, innovative capacity, and overall resilience in volatile environments. Therefore, we hypothesize the following:

H5:

AI Innovations (AII) positively affect SMEs’ Business Performance (SMEBP).

Regulatory-Cultural Stewardship (RCS): Concept and Theoretical Gaps

While SCR and PES are recognized antecedents to AII, their conceptual scope is insufficient for ensuring the sustained institutional alignment essential for translating AI initiatives into enduring SME business performance within volatile ecosystems. SCR captures an organization’s static internal fit with technological change [] but fails to account for the firm’s active, ongoing engagement with evolving external norms, societal expectations, and regulatory frameworks during AI implementation and scaling. PES represents crucial exogenous enablers like government incentives and infrastructure [], yet neglects the firm’s agentic capacity to strategically internalize, govern, and co-evolve with these external forces []. This gap is particularly acute in contexts characterized by regulatory fragmentation, shifting ethical landscapes, and resource constraints [,,], where fragmented policies amplify uncertainty and stifle innovation potential.

Addressing this gap necessitates an internalized, dynamic capability that transcends SCR’s passive “readiness” and PES’s external dependency. Such a capability must enable firms to proactively anticipate and navigate regulatory ambiguities; cultivate cultural legitimacy through stakeholder alignment and workforce trust in AI ethics []; and embed robust ethical governance as AI scales [,]. Without this proactive stewardship of the institutional interface, SMEs face significant risks of compliance failure, reputational damage, and stalled transformation [], outcomes that can occur despite high initial SCR or available PES.

The theoretical imperative for this capability is anchored in the integration of institutional theory and stewardship theory. Institutional theory highlights the dual pressures of regulative elements (laws and policies) and normative-cultural elements (values and norms) that organizations must navigate []. Stewardship theory positions firms as responsible entities capable of aligning organizational goals with broader societal values, fostering trust and sustainable performance []. Research underscores that successful AIEDT requires not only clear regulatory incentives and coherent compliance frameworks [,] but also a learning oriented culture that diffuses innovation [,,]. Conversely, mismatches between regulatory clarity and cultural adaptability hinder transformation, highlighting the need for integrated stewardship [,].

We therefore formalize the novel construct of RCS as an organization’s capacity and commitment to proactively manage regulatory compliance and cultural alignment throughout technological and digital innovation. RCS acts as a meta-capability, resolving institutional misalignment by integrating regulatory acumen, cultural adaptiveness, and ethical governance. It provides the crucial conceptual home for the active, ongoing management of institutional forces that extant constructs treat as static antecedents or exogenous conditions [].

Thus, we hypothesize the following:

H6:

Regulatory-cultural stewardship (RCS) positively moderates the relationship between AI Innovations (AII) and SMEs business performance (SMEBP).

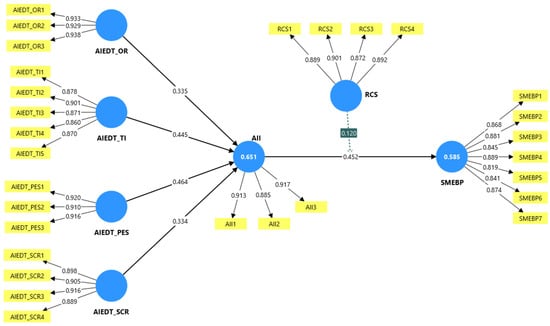

The relationships and hypotheses of the conceptual model are presented in Figure 1.

Figure 1.

Conceptual model. Source(s): Created by authors.

3. Methodology and Measurement

The research design follows a sequential deductive logic: (1) conceptualization of Regulatory Cultural Stewardship (RCS) through integrative literature synthesis, (2) formulation of six hypotheses aligning with the proposed conceptual model (Figure 1), and (3) empirical testing using survey-based quantitative methods via Partial Least Squares Structural Equation Modeling (PLS-SEM). The design ensures theoretical–empirical alignment, enabling robust hypothesis verification and model validation across multi-sector SME data.

3.1. Data Collection and Sampling

This study employs a quantitative survey design to test the proposed model among SMEs. The target population consists of registered SMEs operating in Pakistan, covering key sectors such as primary (agriculture and livestock), services, and manufacturing. Aligning with the official Pakistani definition (SMEDA), an SME was defined as a business employing up to 250 personnel.

A stratified random sampling technique was applied to ensure the sample represented variations in firm age, size (5–250 employees), and industry sector. The stratification proportions were designed to mirror the distribution of Pakistan’s SME sector: manufacturing (32%), services (46%), primary (22%). The questionnaire was distributed to 600 SMEs in major cities (Lahore, Karachi, Faisalabad, Islamabad, Rawalpindi, Peshawar, Quetta, and Multan) using both offline and online channels (email, online surveys, and social networks). This multi-sector approach facilitates a comparison of AI-adoption dynamics between compliance-intensive manufacturing and knowledge-intensive services.

The unit of analysis was the SME, with data provided by owners or senior managers as key informants, a well-established practice in organizational research [,]. From the 600 distributed questionnaires, 391 valid responses were obtained. The response rate and sample composition were checked against official SME demographics and found to be satisfactory (with no evidence of non-response bias). Non-response bias was examined by comparing early and late respondents on key variables, and no significant differences were found.

The demographic and firmographic profile of the final sample (n = 391) is presented in Table 4. The sample is predominantly represented by senior respondents (80% aged 41–60) from male-led (68%), urban-based (70%) firms. Furthermore, the data shows a diverse representation across firm ages, sizes, and industry sectors, closely aligning with the intended stratification.

Table 4.

Demographics and firmographics.

3.2. Data Analysis Methodology

Partial Least Squares Structural Equation Modeling (PLS-SEM) was used on Smart PLS with bootstrap resampling (5000 subsamples) to evaluate the measurement and structural models. PLS-SEM was chosen due to its suitability for prediction-oriented research and ability to handle complex models with formative constructs and smaller samples. It also makes minimal assumptions about data distribution, which is advantageous given the exploratory nature of the new RCS construct []. To account for firm- and manager-level heterogeneity, firm geographical location, age, size, and industry sectors were included as control variables. The Variance Inflation Factors (VIF) for all controls were below 3, confirming the absence of multicollinearity. These control variables were partialled out during the bootstrapping procedure to minimize omitted-variable bias. Finally, we evaluated the model’s out-of-sample predictive ability using the PLSpredict procedure with k-fold cross-validation and the cross-validated predictive ability test (CVPAT), and we conducted endogeneity diagnostics (full collinearity VIF and a Gaussian copula approach) to ensure that no omitted-variable bias or endogeneity affected the structural results. Furthermore, to strengthen the model’s explanatory credibility, predictive validity and endogeneity diagnostics were applied. Specifically, the PLSpredict and Cross-Validated Predictive Ability Test (CVPAT) procedures were implemented through SmartPLS 4.0 predictive modules. These tests provide a robust, out-of-sample validation of the model’s predictive performance, ensuring that results are not merely sample-specific but hold generalizability to similar SME contexts. Additionally, Gaussian copula tests were complemented with full collinearity VIF diagnostics to capture both measurement-level and structural endogeneity. This dual diagnostic approach minimizes potential bias, confirming that the observed structural relationships represent substantive causal linkages rather than spurious correlations.

3.3. Measurements

All constructs were measured using multi-item scales adapted from prior literature (with minor wording adjustments for context). Responses were recorded on five-point Likert scales (1 = “strongly disagree” to 5 = “strongly agree”). The following are the details of the construction of the survey, including the measures, sources, and items in which AIEDT was disaggregated into four components: OR, TI, PES, and SCR.

- i.

- Organizational Readiness (AIEDT_OR): We measured the internal capacity for AIEDT, including top management support, availability of skilled personnel/training, and sufficient budget/strategy [,,].

- ii.

- Technological Infrastructure (AIEDT_TI): We assessed the adequacy of hardware/software/networks, internet reliability, digital data management/security, cloud/scalable infrastructure adoption, and technical support access for AI [,].

- iii.

- Policy & Ecosystem Support (AIEDT_PES): We evaluated external enablers like government incentives/support, a supportive regulatory environment, and customer/competitive pressures driving AIEDT [,,,].

- iv.

- Socio-Cultural Readiness (AIEDT_SCR): We focused on internal human factors: an innovation-encouraging culture, employee receptiveness to AI, existing AI skills/training, knowledge sharing, and adaptability to change [,].

- v.

- AI Innovations (AIEDT_AII): We captured the firm’s development of AI-enhanced products/services, process innovation via AI, investment in AI R&D/experimentation, scaling pilots, and collaboration for AI innovation [,,,,].

- vi.

- Regulatory-Cultural Stewardship (RCS): We emphasized regulatory compliance (data/AI laws), ethical AI practices (fairness, transparency), data privacy/security, employee ethics training, AI system monitoring, and transparent communication for trust [,,].

- vii.

- SME’s Business Performance (SMEBP): We measured outcomes attributed to AI: operational efficiency, financial gains (revenue/cost), competitive strength, innovation success, customer outcomes, growth metrics, and customer satisfaction [,,,,].

We ensured content validity through a two-stage process: first, expert panel review; second, a pilot test with 14 managers leading to refined wording. After validating the measurement model, we tested the structural paths in the PLS-SEM model. Path coefficients were estimated, and their significance was assessed via bootstrapping. The moderating effect of RCS was examined by creating an interaction term and observing its influence on the AI–performance link. Overall model fit and predictive power were evaluated, providing a robust test of the hypothesized relationships.

3.4. Common Method Bias (CMB)

To mitigate common method bias, we used psychological separation of predictor and criterion variables in the survey design and assured respondents of anonymity. We also conducted Harman’s single-factor test, which showed no single factor explaining the majority of variance, and all full collinearity VIFs were below the 5 threshold, suggesting that common method variance is unlikely to confound the results.

4. Empirical Results

4.1. Measurement Model

Reliability: It was confirmed at both item and construct levels. All indicator loadings exceeded 0.8 (Table 5), demonstrating strong item reliability. Construct reliability was further supported by Cronbach’s alpha values, all surpassing the 0.7 threshold [].

Table 5.

The items’ loadings (λ) and the constructs’ Cronbach’s α coefficients and AVEs.

Convergent validity: It was established as the Average Variance Extracted (AVE) for all constructs exceeded the recommended 0.5 benchmark [], confirming that items adequately captured their respective constructs.

Content validity: It was ensured through a two-stage process. First, the constructs (AIEDT drivers, AII, RCS) and survey items, grounded in extensive literature, were reviewed and refined by seven academic experts. Second, clarity and contextual relevance were validated by 14 Pakistani SME CEOs/managers.

Discriminant validity: It was established through the Fornell-Larcker criterion and Heterotrait-Monotrait (HTMT) ratio analysis. All HTMT ratios (Table 6) fell significantly below the conservative 0.85 threshold, with the highest observed value being 0.749 (between AII and SMEBP). The Fornell-Larcker criterion (Table 7) confirmed discriminant validity, as the square root of the AVE for each construct exceeded all corresponding inter-construct correlations; for instance, AII’s AVE square root (0.905) surpassed its highest correlation (0.688 with SMEBP), while SMEBP’s AVE square root (0.860) likewise exceeded all its correlations []. Collectively, these results empirically confirm that each latent construct in the measurement model is distinct from the others.

Table 6.

Heterotrait–monotrait ratio (HTMT)-Matrix.

Table 7.

Fornell–Larcker criterion.

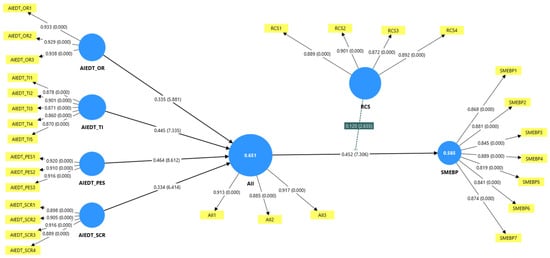

4.2. Structured Model

Following confirmation of the measurement model’s reliability and validity, the hypothesized structural relationships were assessed, as shown in Figure 2. The model demonstrates strong explanatory power, accounting for 65.1% of the variance in AI innovation (AII) (R2 = 0.651) and 58.5% of the variance in SMEs business performance (SMEBP) (R2 = 0.585). Hypothesis testing (Table 8) confirms all paths are statistically significant (p < 0.01) and directionally positive. Notably, H2 (TI→AII) and H3 (PES→AII) exhibit the strongest effects on AII, while H5 (AII→SMEBP) and H6 (RCS→SMEBP) are essential for performance outcomes, validating the model’s theoretical foundations and practical relevance. Effect size analysis (f2) substantiates these findings: TI→AII (f2 = 0.567) and PES→AII (f2 = 0.605) show large effects; OR→AII, SCR→AII, and AII→SMEBP (all f2 ≈ 0.313) demonstrate moderate effects; and RCS→SMEBP (f2 = 0.224) is smaller. The moderation effect of RCS on the AII-SMEBP relationship is small but significant (path coefficient = 0.120, f2 = 0.048), indicating its role as a performance enhancer rather than a primary amplifier.

Figure 2.

Measurement model—PLS SEM. Source(s): Created by authors.

Table 8.

Hypothesis testing.

Model fit indices confirm acceptability (Table 9): SRMR (0.051) meets the ≤0.08 threshold, and NFI (0.856) approaches the 0.90 benchmark [,] and the model met the SRMR criterion comfortably. Combined with high explanatory power (R2 = 0.651 for AII, 0.585 for SMEBP) and significant structural paths, the good model fit indices support the model’s validity. Additionally, the PLS predict results showed positive Q2 values (above 0), indicating that the model has meaningful predictive relevance. Finally, bootstrap-mediated analysis (5000 samples; Figure 3) confirms AII fully mediates the relationship between AIEDT drivers and SMEBP. These results substantiate the robustness of the model estimates. Collectively, the results provide statistically robust and theoretically meaningful insights into AIEDT’s performance implications for SMEs. Based on the results, the H1 to H6 were all accepted.

Table 9.

Model fit and quality.

Figure 3.

Structural model—bootstrapping. Source(s): Created by authors.

Predictive Relevance and Model Validity

To comprehensively assess the model’s predictive power and validity, we employed advanced predictive analytics, including PLS predict and cross-validated predictive ability tests (CVPAT). As shown in Table 10, the Q2 predict values demonstrate substantial predictive relevance: AII (Q2 = 0.625) and SMEBP (Q2 = 0.528). Following Hair et al. (2019) [], Q2 values greater than 0.25, 0.50, and 0.75 indicate small, medium, and large predictive relevance, respectively. Thus, our model exhibits large predictive relevance for AII and medium-to-large predictive relevance for SMEBP.

Table 10.

Construct Q2 predict RMSE MAE predictive relevance.

Furthermore, the CVPAT results (Table 11) confirm that our PLS-SEM model significantly outperforms the indicator average benchmark (p < 0.001 for both constructs), providing strong evidence of the model’s superior out-of-sample predictive power.

Table 11.

Cross-validated predictive ability test (CVPAT) results.

The effect sizes (f2) further substantiate the practical significance of our findings. Following Cohen’s (1988) [] guidelines, where f2 ≥ 0.02, ≥ 0.15, and ≥ 0.35 represent small, medium, and large effects, respectively, our results show the following: large effects of TI (f2 = 0.567) and PES (f2 = 0.605) on AII; medium effects of OR (f2 = 0.313), SCR (f2 = 0.313) on AII, and AII on SMEBP (f2 = 0.309); and a moderate effect of RCS’s direct role (f2 = 0.224) and a small effect of its moderating role (f2 = 0.048).

We implemented comprehensive procedures to address potential endogeneity concerns. First, full collinearity tests, following Kock (2015) [], showed that all VIF values were below 3.3, indicating no significant common method bias. Second, we applied the Gaussian copula [] approach, with non-significant copula terms for key structural paths (p > 0.05), suggesting endogeneity is not a critical concern. Third, the strong predictive performance (Q2 > 0.50) provides additional confidence that omitted variable bias does not substantially distort our results. Together, these diagnostics confirm that the model exhibits strong predictive validity, large substantive effect sizes, and minimal endogeneity bias, thereby ensuring the robustness and reliability of the structural estimates. Collectively, these procedures confirm that the model’s estimations are statistically reliable and theoretically stable. The significant negative loss difference (p < 0.001) in the CVPAT analysis empirically demonstrates that the PLS-SEM model outperforms the naïve indicator-average benchmark, reinforcing its superior predictive relevance. Moreover, the combined evidence from Q2 values (>0.50) and f2 effect sizes (>0.15) indicates a high level of both explanatory and practical significance. The integration of predictive and endogeneity diagnostics thus enhances the overall methodological robustness and ensures replicable findings for future SME-level digital transformation research.

Our model demonstrates exceptional predictive relevance with Q2 values of 0.625 and 0.528 (well above the 0.50 threshold for large predictive power), and our PLS-SEM significantly outperforms naive benchmarks (p < 0.001). All hypotheses are strongly supported with robust effect sizes. The collective evidence provides compelling validation of the model’s reliability and predictive generalizability.

4.3. Summary of Key Results and Sectoral Analysis

This study empirically validates the transformative impact of AI-enabled digital transformation drivers on the sustainable business performance of SMEs through the mediating role of AI innovation, while highlighting the influence of RCS. The PLS-SEM analysis of 391 Pakistani SMEs reveals that the four AIEDT drivers collectively explain a substantial 65.1% of the variance in AI innovations. Among these, PES (β = 0.464, p < 0.001) and TI (β = 0.445, p < 0.001) emerge as the most potent enablers, underscoring the foundational necessity of stable governance frameworks and robust digital foundations for successful AI integration. Notably, AI innovation fully mediates the relationship between AIEDT drivers and SMEs business performance, exerting a strong direct effect (β = 0.452, p < 0.001) and accounting for 58.5% of SMEBP variance. This confirms AII’s pivotal role in translating digital transformation investments into tangible gains in productivity, competitiveness, and resilience within volatile ecosystems. Similarly, OR and SCR underscore the importance of leadership commitment and workforce adaptability, as highlighted in []’s study on Pakistani SMEs. The strong effect of SCR (β = 0.334, p < 0.001) demonstrates that SMEs with innovation-friendly cultures can overcome resistance more effectively, fostering a socially sustainable environment for technological adoption that mitigates employee displacement and anxiety, than those who solely depend on policy incentives. This result highlights prior studies that focused on resource scarcity []; it suggests that even SMEs with limited resources can achieve performance gains if external support (PES) and internal culture (SCR) enable effective AI innovation. The large Q2 values (0.625 for AII and 0.528 for SMEBP) and substantial f2 statistics reinforce the statistical credibility of these findings. According to Hair et al. (2019) [] and Cohen (1988) [], these results indicate that the proposed model not only explains but also accurately predicts unseen data, thereby strengthening its theoretical generalizability and practical reliability in policy and managerial contexts.

The direct positive effect of RCS on SMEBP is substantial (β = 0.385, p < 0.001), corresponding to a moderate effect size, whereas RCS’s moderating influence on the AII–SMEBP link is statistically significant but modest (β = 0.120, p < 0.01, small effect). In volatile settings like Pakistan, RCS may enable baseline compliance before amplifying AI’s returns []. This result highlights that RCS serves as a stabilizing governance capability that first ensures compliance and cultural coherence before amplifying AI’s performance outcomes in Pakistan’s context. The direct relationship between RCS and SMEBP supports Ayinaddis’ (2025) [] argument that AIEDT necessitates both regulatory clarity and ethical compliance. The specific result matches institutional theory and supports findings of Alam et al. (2024) [] regarding bureaucratic obstacles in Pakistan, which demonstrate the problems of a scattered regulatory system and cultural resistance. RCS functions as both an accelerator and a protector, a dynamic governance capability that connects institutional needs with flexible organizational practices, enabling SMEs to meet regulations while pursuing agility.

We conducted a multi-group analysis (PLS-SEM) to examine sectoral differences. The analysis of sectoral heterogeneity in Table 12 demonstrates the specific implementation of AIEDT within Pakistan’s framework, summarizes the path coefficients and t-values for each sector, and notes significant differences. It presents significant heterogeneity in how AIEDT drivers influence outcomes across manufacturing, service, and primary sectors. Service-oriented SMEs showed the most significant benefits from their internal capabilities, with OR and SCR exerting the greatest impact on their AI adoption and performance. These findings align with the characteristics of their agile organizational structures and knowledge-based operations []. On the other hand, manufacturing and primary sector SMEs show their heightened dependence on external enablers, with RCS applying significant influence on their performance [,]. This reflects their export requirements and compliance-intensive environment for performance improvement. PES and TI demonstrate strong effects across all business sectors, highlighting them as basic elements that enable AI innovation regardless of context []. The small but significant impact demonstrated by RCS on services indicates a possible mismatch between established governance systems and the cultural elements that influence digital performance in this sector []. This finding emphasizes that tailored strategies addressing sector-specific needs are important for maximizing the benefits of AIEDT in SMEs.

Table 12.

Differences analysis between industry sectors.

The above section presents the empirical findings; the following section interprets these results in light of prior studies and theoretical frameworks.

5. Discussion and Implications

Our findings provide robust empirical insights into the drivers and outcomes of sustainable AIEDT in Pakistani SMEs. The discussion that follows interprets these results by comparing them with prior literature, elucidating the theoretical contributions, and drawing out the key implications.

5.1. Interpretation and Comparison with Prior Studies

The empirical findings affirm the centrality of the Technology–Organization–Environment (TOE) framework in explaining AI-enabled digital transformation (AIEDT) in SMEs, as all four drivers, i.e., Organizational Readiness [OR], Technological Infrastructure (TI), Policy and Ecosystem Support (PES), and Socio-Cultural Readiness (SCR), exerted significant positive effects on AI innovation (AII). This aligns with recent literature emphasizing the necessity of both internal capabilities and external institutional enablers for digital transformation in resource-constrained firms [,]. A comparable study by Ul Haq et al., 2025 [] on Bangladeshi SMEs corroborates these findings, demonstrating that Technological Infrastructure and Organizational Readiness remain the strongest predictors of AI adoption in resource-scarce contexts. Their TOE–RBV model, like the present study, identifies the mediating role of AI innovation and highlights the moderating influence of resource constraints on SME performance. The parallel between Pakistan and Bangladesh suggests that both South-Asian economies face structurally similar institutional voids—weak regulatory coordination, fragmented digital infrastructure, and cultural resistance to automation—yet Bangladesh’s more stable SME policy environment yields comparatively higher diffusion of AI technologies. This cross-national consistency reinforces the robustness of the present study’s framework and underlines the regional relevance of the Regulatory-Cultural Stewardship (RCS) construct as a governance capability for volatile emerging economies. In particular, the strong influence of PES and TI mirrors findings in emerging economies, where infrastructural reliability and regulatory clarity are prerequisites for innovation []. The sectoral divergence, services benefiting more from SCR while manufacturing and primary sectors rely on PES, further refines prior models, suggesting industry-specific patterns in digital readiness that have been largely underexplored. These empirical insights are consistent with earlier digital transformation studies but also reveal notable divergences. Unlike prior studies that integrate results and discussion, this section focuses on interpretation and theoretical synthesis. The differences between this study’s findings and previous evidence illustrate how institutional volatility and regulatory ambiguity reshape the determinants of AI innovation. While similar studies in Bangladesh or Saudi Arabia emphasize infrastructural readiness, the present findings underscore that in Pakistan’s uncertain environment, Regulatory-Cultural Stewardship (RCS) operates as a stabilizing governance mechanism—ensuring compliance and cultural cohesion before amplifying AI’s performance outcomes. This distinction provides new theoretical and contextual nuance to the AI transformation literature.

Our model confirms that AII fully mediates the relationship between AIEDT enablers and SME business performance, highlighting innovation as the operative mechanism translating digital readiness into performance gains. This insight is coherent with Dynamic Capability Theory, where firms must not only possess resources but also reconfigure them into adaptive innovations to capture value in volatile environments [,]. The mediation pathway underscores a critical nuance often omitted in earlier research that organizational and ecosystem inputs only yield business benefits when operationalized through AI innovations. This finding addresses calls for more granular, process-based models of digital transformation, particularly in emerging markets where contextual barriers inhibit linear resource-to-performance conversions.

The most distinctive contribution lies in the conceptualization and empirical validation of Regulatory-Cultural Stewardship (RCS) as a firm-level dynamic capability. Unlike prior studies treating institutional and cultural factors as static, exogenous conditions [], RCS is shown to be an internal capability allowing SMEs to proactively align regulatory compliance with cultural expectations. This extends institutional and stewardship theories by illustrating how firms can co-create legitimacy and ethical alignment while pursuing innovation, especially in unstable institutional environments such as Pakistan. The significant, albeit modest, moderating role of RCS in enhancing the AII–performance link parallels findings in strategic orientation and governance literature [,], indicating that internal governance capabilities can amplify the returns of technological investments.

The overall coherence between theoretical propositions and empirical outcomes reinforces the conceptual validity of RCS. While PES and TI confirm established enablers [,], RCS introduces a governance dimension that moderates the performance link, adding explanatory depth absent in earlier TOE-based models. The balance between external policy support and internal cultural alignment indicates that institutional harmony, not infrastructural dominance, determines sustainable transformation under volatility. These findings collectively render the argument both empirically consistent and theoretically compelling. Hence, the discussion presents a balanced interpretation that situates RCS as a unifying governance mechanism bridging compliance, culture, and performance under institutional volatility.

5.2. Theoretical Contributions

Theoretically, this study contributes to the following four interrelated domains: (i) it extends the TOE framework by integrating institutional, dynamic-capability, and stewardship logics; (ii) it validates RCS as a distinct meta-capability bridging regulatory and cultural dimensions; (iii) it empirically links predictive-validity diagnostics to theoretical robustness, confirming that model stability accompanies conceptual advancement; and (iv) it refines understanding of dynamic capabilities in unstable institutional environments.

The notable contributions of this research establish AI-driven innovation as a mediator. Unlike prior studies framing AII as a direct outcome [], the results (R2 = 0.651 for AII) confirm that AII is a transformative mechanism converting AIEDT investments into performance gains. This mediation effect (β = 0.452, p < 0.001) aligns with []’s dynamic capability framework, where AI innovations act as “orchestration mechanisms” for SMEs to exploit volatile markets.

The introduction of RCS addresses a gap in both TOE and institutional theory by adding a firm-level dynamic capability that accounts for proactive regulatory and cultural alignment. This extends institutional theory beyond passive conformity, illustrating how SMEs can become agents shaping their compliance and cultural narrative. The study proposes RCS as an essential moderator in enhancing the relationship between AI innovations and SME business performance. The political instability of Pakistan, where regulatory uncertainty and socio-cultural resistance to new technologies are common, RCS enables SMEs to navigate these challenges and achieve successful AI integration []. The moderating role of RCS (β = 0.120, p < 0.01), though modest, introduces a boundary condition for AI’s impact. This echoes [] stewardship theory, suggesting that SMEs balancing compliance (e.g., data privacy laws) and cultural adaptability (e.g., ethical AI norms) achieve higher performance resilience.

Importantly, the integration of predictive and validity diagnostics reinforces the theoretical credibility of these contributions. The strong Q2 (>0.50) and f2 (>0.30) statistics validate the model’s explanatory strength within the TOE–Institutional–Stewardship nexus. The demonstrated absence of endogeneity (via Gaussian copula and full collinearity tests) confirms that the structural paths reflect true theoretical relationships rather than model artifacts. Thus, the theoretical advancement achieved through RCS as a meta-capability is supported by rigorous empirical validation, ensuring that these contributions are both conceptually sound and empirically defensible.

In light of the supported hypotheses and validated model, this study offers three interrelated contributions that advance both theory and practice as follows:

- Theoretical Contribution: Regulatory Cultural Stewardship (RCS) is introduced and validated as a distinct dynamic capability that bridges the institutional and cultural domains of the TOE framework. By integrating stewardship theory and institutional theory, RCS extends the theoretical understanding of how SMEs harmonize external regulatory pressures with internal adaptive agility.

- Methodological Contribution: The study empirically operationalizes RCS through a rigorously validated multi-item scale and a predictive PLS-SEM model demonstrating high internal consistency (Cronbach’s α > 0.88), convergent validity (AVE > 0.79), and substantial out-of-sample predictive power (e.g., Q2 > 0.50 for key endogenous constructs). This methodological advancement provides a reliable measurement tool for future studies examining governance-based dynamic capabilities.

- Practical Contribution: The findings yield a context-sensitive governance roadmap for SME managers and policymakers. By aligning AI-driven digital transformation with both regulatory compliance and cultural legitimacy, the study provides differentiated strategic guidance for manufacturing and service-sector SMEs seeking responsible AI integration under volatile institutional environments.

5.3. Practical and Policy Implications

Practically, the findings underscore several actionable implications for policymakers and SME leaders in volatile economies. This study offers valuable findings for policymakers, and industry associations of SMEs, navigating AIEDT within volatile economies like Pakistan with the goal of achieving sustainable and inclusive growth. Primarily, SMEs need to prioritize establishing strong TI and engaging with supportive PES frameworks, as these are basic enablers for AI innovation [,]. Investments in OR through committed leadership and SCR by promoting adaptable, innovation-friendly cultures are equally crucial for overcoming resistance and enabling AIEDT [,]. Critically, since AI innovation fully mediates the impact of AIEDT drivers on performance, SMEs must actively translate these foundational investments into concrete AI applications.

Policymakers and regulators should consolidate fragmented regulations and reduce bureaucracy, recognizing that a robust RCS capability is a fundamental prerequisite for AIEDT success, directly enhancing SME performance [,]. Such actions are fundamental to creating an enabling environment for sustainable industrialization (SDG 9) and fostering sustained, inclusive economic growth (SDG 8). However, as RCS primarily enables adoption rather than strongly amplifying AI’s performance impact, policymakers must extend efforts beyond regulation. This includes developing accessible digital infrastructure (supporting TI and PES), offering capability-building incentives, and, crucially, tailoring support to sectoral needs: fostering agility in service SMEs and aiding compliance for manufacturing/primary sector SMEs [,]. The organizations should build internal teams or roles focused on compliance and ethical AI governance (what we term RCS), as this study shows such stewardship directly enhances performance.