Abstract

This study examines the role of the supply chain finance (SCF) ecosystem as an innovative financial framework in driving the high-quality development of rural industries. Using panel data from 31 Chinese provinces (2004–2022), we employ a fixed-effects model to analyze this relationship, confirming that the SCF ecosystem has a significant promoting effect. Mechanism analysis reveals that this positive effect operates primarily through two channels: enhancing rural industrial integration and stimulating technological innovation. Furthermore, we identify significant regional heterogeneity, with the most substantial positive spillover effects observed in the Southwest and South China. These results underscore the critical importance of the SCF ecosystem in rural revitalization and provide a basis for formulating regionally tailored financial policies.

1. Introduction

The lack of financial backing is a major obstacle in the pursuit of high-quality growth for countryside industries in China. As an innovative model that interconnects and integrates diverse financial elements, the supply chain finance ecosystem not only addresses information asymmetry among participants in the rural industry chain but also serves as a golden key for unlocking solutions to this challenge. Keynes’ theory of national income determination underscores how financial supply strength is a pivotal determinant of regional economic development levels. It highlights the significant connection between financial policies and efficient countryside industry growth [1,2]. As rural industrial structures evolve and upgrade, the supply chain finance ecosystem has emerged as a potent driver of high-quality rural industrial development, concurrently triggering substantial increases in rural incomes. Despite significant progress in rural industrial development, persistent challenges remain, including inefficient resource allocation, inadequate endogenous motivation, superficial integration levels, and limited technological advancements [3]. According to the report from the 20th National Congress of the Communist Party of China, there is a need to speed up the creation of a robust agricultural sector and provide strong support for revitalizing industries, talent, culture, ecology, and organization. Ongoing modern agricultural advancements are bringing the supply chain finance ecosystem and superior rural industry advancement into closer alignment. This alignment manifests in two key dimensions: fostering collaborative progress in rural industries and significantly enhancing the intelligentization of agricultural production. This reveals a profound coupling and synergistic relationship between the two. In the contemporary era, establishing a supply chain finance ecosystem tailored to rural industries is therefore of vital strategic importance for fostering in-depth integration and ensuring enduring prosperity in the rural economy.

At present, both domestic and international researchers have made substantial progress in examining the high-quality development of rural industries, yielding notable achievements in several key areas.

- (1)

- The meaning and assessment of high-quality growth in rural industries.

The essence of high-quality rural industry development is centered around farmers, deeply optimizing the structure of agricultural products by leveraging the unique resources and current industries in rural areas, and developing a new model to effectively boost farmers’ income and promote overall rural prosperity [4]. Rural industry advancement prioritizes innovation-driven development, industrial integration, environmentally sustainable practices, and core optimization to foster diversified sector integration. This approach aims to achieve comprehensive upgrading and sustainable prosperity for rural industries within the framework of the modern economic system [5]. Measuring this high-quality development is often based on single-dimensional indicators such as industrial innovation, structure and scale [6]; diversified industrial integration [7]; sustainable industrial development [8]; and green development [9]. The current reliance on single-dimensional indicators and their corresponding systems is insufficient in capturing the multifaceted nature of this type of development, thereby failing to adequately represent its fundamental essence. It is therefore imperative to construct an extensive and well-organized set of indicators based on the scientific principles of high-quality development within rural industries. This set of indicators should enable precise evaluations of the degree of development by employing quantitative assessment techniques.

- (2)

- Determinants shaping high-quality development in rural industries.

Prior research has predominantly examined the influence of elements like the state of infrastructure [10], production factors [4], e-commerce [8], macroeconomy [11], property rights [12], digital economy [10], and resource endowment [13] on the development of rural industries. In addition, a few scholars extended their research to examine key factors such as institutional environment [14] and agricultural policies [15], conducting in-depth discussions.

Previous research has explored the core principles and evaluation methods of achieving high-quality development in rural industries, as well as the determinants influencing this process. Nonetheless, few studies have delved into the role of supply chain finance ecosystems. Building on earlier findings, this paper investigates the relationship between the “innovative financial mechanisms” within supply chain finance ecosystems and the advancement of rural industries, seeking to empirically determine whether and how these ecosystems contribute to high-quality growth. Supply chain finance is not limited to optimizing capital chains for enterprises; the widespread adoption of financial technology also plays a significant role in shaping industrial maturity and clustering. Although previous studies have thoroughly explored the “enterprise environment optimization” function of supply chain finance—such as alleviating financing constraints and improving resource allocation efficiency [16,17,18]—research on its “industry environment optimization” function, including the promotion of industrial integration and revitalization of technological ecosystems, remains scarce. Compared to existing studies, this paper’s key contributions are as follows:

- (1)

- This study adopts supply chain finance as a key perspective, constructing a symbiosis measurement model centered on “capital flow-information flow-logistics-external environment” and focusing on the supply and demand entities. Through detailed numerical analysis, it demonstrates the specific roles and practical effects of financial instruments in promoting rural industry growth. The conclusions not only enrich academic discussions in the field, but also provide theoretical support and guidance for innovative rural industrial model practice.

- (2)

- This study incorporates industrial integration and technological innovation into the research framework, elucidating the mechanisms through which supply chain finance ecosystems promote sustainable rural industry growth. Based on the characteristics of financial ecosystems, this paper creatively explores the threshold characteristics of supply chain finance’s impact on rural industries, analyzing the regional variations in these effects from the perspective of different geographical areas. It deepens our understanding of how these ecosystems support rural revitalization and provides empirical evidence of their ability to optimize the “industry environment.”

Therefore, in order to comprehensively evaluate the impact of supply chain finance ecosystems on rural industrial development, this study utilizes rural industrial data from 31 provinces in China spanning 2004 to 2022, applying both a symbiosis measurement model and the entropy method to construct indicators and conduct empirical analysis. Our results demonstrate that supply chain finance ecosystems significantly promote the high-quality development of rural industries. Further analysis reveals that industrial integration and advancements in rural technology serve as primary mechanisms through which these ecosystems exert their influence. Regional comparative analysis indicates that the Southwest and South China regions benefit most substantially from these ecosystems. The research findings passed robustness tests, and corresponding conclusions—along with targeted recommendations—are provided.

The structure of this paper is as follows: Section 1, Introduction, elaborates on the research background, literature review, and research objectives; Section 2, Theoretical Analysis and Research Hypothesis, constructs the theoretical framework and proposes hypotheses regarding how the supply chain finance ecosystem promotes high-quality development of rural industries; Section 3, Research Design, details variable measurement, data sources, and empirical model construction; Section 4, Empirical Results and Analysis, includes benchmark regression, endogeneity tests, and robustness checks; Section 5, Impact Mechanism test and Further Analysis, explores the mediating roles of industrial integration and technological innovation, as well as spatial heterogeneity; Section 6, Discussion, provides an in-depth interpretation of the empirical findings and compares them with existing studies; Section 7, Conclusions and Significance, summarizes the research findings and proposes policy recommendations.

2. Theoretical Analysis and Research Hypothesis

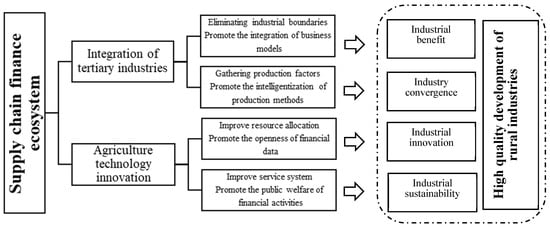

Internal growth dynamics theory posits that financial innovation serves as a key factor advancing technological progress and fostering capital accumulation, making it a key enabler of long-term economic growth [19]. By harnessing its distinctive strengths, the supply chain finance ecosystem significantly supports rural industry sustainability by optimizing industrial structures and production methods (see Figure 1).

Figure 1.

The mechanism of supply chain finance ecology on high-quality rural industry development. (Source: Drawn manually by the author).

Firstly, the supply chain finance ecosystem significantly enhances rural industry efficiency. Grounded in the unique agricultural and rural resources of various regions, this ecosystem develops tailored financial products that align with the specific needs of different segments and combinations of the agricultural industry chain [20]. These financial products effectively mobilize medium- and long-term credit funds, channeling them into rural industries in a high-efficiency, low-cost manner [21]. As capital increasingly converges toward rural infrastructure, traditional agricultural production methods gradually transition toward more efficient and intelligent practices [22], significantly improving operational efficiency and driving substantial growth in rural industry performance.

Secondly, the supply chain finance ecosystem injects strong momentum into integration [23]. Through integrating resources from both up- and downstream segments of the chain and dissolving industrial barriers, it promotes profound collaboration between agriculture and secondary and tertiary economic sectors [7]. Such collaboration not only boosts rural industries’ dynamism and market competitiveness, but also lays the foundation for their long-term growth. When the supply chain finance ecosystem is integrated into agriculture [5], it not only offers strong financial backing for agricultural value chain extension and scaling, but also unlocks the commercial potential of traditional cultural assets by facilitating resource exchange, thereby bringing dormant cultural heritage back to life in the marketplace [12].

Thirdly, the supply chain finance ecosystem empowers innovative rural industry development. The widespread application of financial technology in rural areas significantly enhances the ability to identify, monitor, warn against, and address risks in rural credit, effectively overcoming the weak financial infrastructure bottleneck in these regions [18].

Finally, the supply chain finance ecosystem is a key enabler of sustainable countryside industry development [15]. Innovative financial services have established a comprehensive agricultural service system, expanding the coverage of financial services and ensuring fairer and more reasonable pricing for rural products. This effectively prevents price manipulation and exploitation, thereby stabilizing farmers’ income sources [24].

H1:

The supply chain finance ecosystem significantly promotes the high-quality development of rural industries.

The supply chain finance ecosystem can significantly enhance the integration of the three rural industries and technological innovation, thereby profoundly impacting rural development at the industrial structure level. From the perspective of agricultural production factor allocation and technology diffusion, the injection of financial elements effectively breaks down the information barriers between rural industries, accelerating the transition from isolation, to deep integration and then to symbiotic development [25]. Driven by the wave of digital transformation, the supply chain finance ecosystem leverages the powerful functionalities of digital tools, such as big data and artificial intelligence, to improve essential financial services, including payment systems and credit evaluation. This strategy effectively reduces the spatial and temporal barriers between the primary, secondary, and tertiary sectors in rural areas, enabling the smooth integration and flow of vital resources such as technology, capital, data, and market opportunities [1]. By extending the industrial chain and refining the value chain, the scope of traditional agriculture is broadened, and its functions are diversified beyond mere production to encompass areas such as ecological conservation, cultural preservation, and recreational tourism.

Furthermore, the implementation of supply chain finance in rural sectors has significantly driven the intelligent transformation of up-, mid-, and downstream rural industries. Supported by the supply chain finance ecosystem, rural industry players can access external resources via information collaboration networks, establish high-efficiency digital and intelligent supply chains, and develop innovative technology service systems, effectively reducing the adverse effects of external uncertainties [26]. The new generation of supply chain finance technology has established a new type of service channel system that “connects online and offline, interconnects across financial institutions, and integrates finance with public domains.” This changes the allocation of rural production factors and provides strong impetus for agricultural operators on the chain to move towards intelligent transformation [27]. Based on this, this paper proposes the following two hypotheses:

H2a:

The supply chain finance ecosystem promotes high-quality rural industry development by enhancing the integration of the three rural industries.

H2b:

The supply chain finance ecosystem promotes high-quality rural industry development by driving agricultural technological innovation.

3. Research Design

3.1. Variable Design

- (1)

- Explained Variable

High-quality development of rural industries is a multidimensional and comprehensive system that not only involves economic benefits and operational efficiency, but also environmental protection, social responsibility, and future development potential. Existing studies have mainly evaluated it by constructing a comprehensive and multi-level indicator system. Drawing on policies including the “Comprehensive Rural Revitalization Plan (2024–2027)” and the “National Rural Industrial Development Plan (2020–2025)”, this study assesses the socio-economic and environmental impacts of rural industrial development across four dimensions: industrial efficiency, integration, innovation, and sustainability.

Initially, enhanced industrial benefits serve as a direct manifestation of high-quality development. Rural industries must strive to maximize economic returns through boosting production efficiency, slashing costs, and enhancing product value. Key indicators in this regard encompass agricultural production efficiency, grain production capacity, and the degree of agricultural mechanization. Subsequently, industrial integration emerges as a crucial pathway for fostering high-quality rural industrial development. By merging agriculture with other sectors like manufacturing and services, novel economic growth poles can be established, thereby bolstering the overall industrial chain competitiveness. Key indicators include agricultural product processing and conversion rates, the degree of industrial integration, and agricultural service quality. Moreover, industrial innovation serves as the primary driver of sustainable rural industry advancement. Through innovation, rural industries can achieve upgrades and transformations, thereby enhancing their added value and market competitiveness. Specific metrics include funds allocated to agricultural, scientific and technical practices, the number of agricultural science and technology professionals, and the development level of rural e-commerce. Industrial sustainability ultimately acts as a long-term safeguard for the high-quality development of rural industries. In promoting such development, protecting the ecological environment and the rational use of resources must be fully considered in order to ensure that industrial development does not cause irreversible environmental damage. Measurement indicators include pesticide and fertilizer application intensity, agricultural plastic film use, and the level of water saving irrigation. To guarantee data accuracy and reliability, each indicator is selected based on existing research [28,29]. The data has undergone normalization, positive transformation, and reverse transformation, with weights assigned to each indicator using the entropy method and detailed quantitative measures presented in Table 1 (see Appendix A for details).

Table 1.

High-quality rural industry development evaluation criteria.

- (2)

- Explanatory Variable

The “Guiding Opinions on Financial Support for the Development of New Agricultural Business Entities” highlight the “development of a supply chain finance ecosystem” as a crucial measure. They encourage financial institutions to engage in businesses such as “accounts receivable financing, inventory financing, and order pledge financing,” aiming to help new agricultural business entities address challenges in technology, logistics, and talent acquisition [30,31]. Building upon this policy foundation, this paper constructs an evaluation indicator system for the supply chain finance ecosystem, as detailed in Table 2 (see Appendix A for details). This ecosystem is conceptualized as a balanced system comprising both the demand and supply entities of supply chain finance, as well as their external symbiotic environment. Its internal organizational structure consists of subsystems, such as capital flow, information flow, and logistics, and involves various entities including up- and downstream enterprises in the industrial chain, financial institutions, and third-party logistics providers. Shaped by factors like financial development, transportation infrastructure, and technology services, the external environment plays a vital supportive role for internal activities.

Table 2.

Supply chain finance evaluation index system.

Based on the supply chain finance Evaluation Index System, the indexes are normalized and weights obtained via entropy method. Using Fraccascia et al.’s symbiosis measure model [32], we assess the degree of financial symbiosis in our supply chain:

Firstly, let be the capital flow, information flow, logistics and external environment systems, respectively, and X be the parameter sequence of each subsystem:

In the formula, denotes the -th order parameter component of the -th subsystem, i.e., the measurement index. The order degree of the order parameter components of each subsystem is as follows:

where is the minimum and the maximum of all ordered parameter components, .

Secondly, the order degree of the order parameters of each subsystem is integrated using the arithmetic weighted method. The greater this order degree, the higher the stability of the subsystem. The formula for this is as follows:

where is the weight of each component calculated by the entropy method, and is the ordering degree of the order parameter of the first subsystem.

Finally, based on the order degree of the order parameters of each subsystem, the supply chain’s financial ecological symbiosis index S is calculated by geometric weighted integration. The formula is as follows:

where is the subsystem weight calculated using the entropy method, and is the level of financial symbiosis in the supply chain; the greater the , the higher the degree of supply chain finance development representing the region.

- (3)

- Control variables

To reduce the impact of other macroeconomic factors on the research results, this study includes regional characteristic variables as control variables. More specifically, human capital (HC) is measured by the proportion of higher education students relative to the total regional population, reflecting the region’s human capital density. The level of economic development (GDP) is represented by the per capita GDP growth rate, capturing trends in regional economic expansion. Urbanization (UB), indicating the degree of urban development, is calculated as the urban population’s share of the total population. Cultural facilities (CF) are assessed using the logarithm of the total library collections, representing the availability of cultural resources and residents’ access to cultural activities. Industrial structure (IS) is determined by the proportion of GDP derived from secondary industry, showcasing the regional economic framework’s diversity.

3.2. Model Construction

To mitigate the potential bias that extreme values in the data might introduce to the model estimation, we performed a Winsorization process on all continuous variables, specifically truncating values at the 1st and 99th percentiles. Furthermore, the empirical model established in this study is as follows:

In the model, the subscripts and represent the province and time (year), respectively. The variable represents the level of high-quality development of rural industries, while serves as the core explanatory variable, measuring the symbiotic supply chain finance ecosystem level in each region. summarizes all control variables to exclude the influence of other factors. In the model, denotes the dummy variables for year fixed effects, while denotes the dummy variables for province fixed effects. If the estimated coefficient is significantly positive, this indicates that the supply chain finance ecosystem positively promotes the high-quality development of rural industries, consistent with Hypothesis H1.

4. Empirical Results and Analysis

4.1. Data Sources and Descriptive Statistics Analysis

Given the unconventional policies (e.g., consumption vouchers, agricultural subsidies) implemented by the Chinese government to stimulate economic recovery after 2022, and considering data availability, this study utilizes data from 31 province-level regions in China (excluding Hong Kong, Macao, and Taiwan) spanning the period from 2004 to 2022. We focus on examining the uniqueness of supply chain finance ecosystems across different regions and their impact on the sustainable and high-quality development of rural industries. To ensure data accuracy and completeness, numerical values with different units were standardized. The data in this study were obtained from the China Statistical Yearbook, the China Rural Statistical Yearbook, provincial Statistical Yearbooks, the China Tertiary Industry Statistical Yearbook, and the CSMAR database, or were manually compiled from the above sources.

As indicated by the data in Table 3, the average degree of advanced rural industrial development in China stands at 17.1%, accompanied by a standard deviation of 6.4%. The wide gap between the highest and lowest values underscores the pronounced regional differences in rural progress. Moreover, the mean level of the supply chain finance ecosystem (SCF) is only 13.7%, suggesting a relatively underdeveloped state. This implies that there are disparities in the regional application of supply chain finance, with some areas experiencing slower development due to inadequate financial institution coverage or limited access to financial services. Other control variables do not display any significant anomalies and are thus not elaborated upon further.

Table 3.

Descriptive statistics for the main variables (n = 589).

4.2. Benchmark Regression Results

To determine the most appropriate panel data regression model for this study and identify the optimal estimation method, the Hausman test was initially conducted. The test produced a chi-square value of 35.26, accompanied by a p-value less than 0.01. This outcome led to the rejection of the null hypothesis, thereby suggesting that a fixed-effects model would be suitable for subsequent analysis. Examining the influence of the supply chain finance ecosystem on rural industries’ advancement towards high-quality development, the baseline regression results are displayed in Table 4. More specifically, columns (1) and (3) illustrate the regression outcomes without considering control variables, whereas columns (2) and (4) do incorporate them. The findings indicate that the regression coefficients are significantly positive, irrespective of the inclusion of control variables and fixed effects. This further indicates that the supply chain finance ecosystem has a significant positive effect on the high-quality development of rural industries. Moreover, the results are more robust when control variables are included. These findings suggest that the supply chain finance ecosystem helps promote balanced rural economic development. Rural industries should make rational use of financial services to facilitate capital acquisition and information flow in rural areas, thereby improving local farmers’ incomes and enhancing rural industries’ overall development quality. We can infer from this analysis that the supply chain finance ecosystem exerts a substantial positive influence on rural industries, pushing them towards high-quality development and thereby lending credence to Hypothesis H1. Some studies have found that traditional inclusive finance or microcredit has limited effects in promoting rural industries, and may even be unsustainable due to high default risks [33]. In contrast, the findings of this study highlight the core advantage of supply chain finance: by leveraging authentic trade contexts and the credit of core enterprises, it effectively reduces information asymmetry and credit risks, thus making it potentially more effective than traditional rural credit.

Table 4.

Baseline Regression.

4.3. Endogenous Analysis

Sample selection bias in this study may lead to endogeneity issues. Regions with higher levels of rural development may already have a stable financial ecosystem due to their advanced economic conditions and well-developed infrastructure. Conversely, regions with lower levels of development might encounter elevated financial development costs due to the “threshold effect”, which, in turn, leads to disparities in rural industrial quality enhancement between the two groups. In order to diminish the potential impact of endogeneity concerns on the estimation outcomes, we implemented a range of strategies to bolster research credibility.

- (1)

- Propensity Score Matching

To mitigate potential endogeneity problems arising from sample selection bias, we utilize propensity score matching (PSM) and instrumental variable (IV) approaches. Firstly, in line with the methodology of Ling et al. (2023), samples with relatively underdeveloped rural industries are chosen to create the control group, with the median value (i.e., the 50th percentile) of the sample serving as the threshold to distinguish between the treatment and control groups [30]. More specifically, groups with rural industrial development levels (hqdri) below the median of the overall sample are classified as the control group, while those above or equal to the median are categorized as the treatment group. On this basis, we implement a 1:1 nearest-neighbor matching method, drawing on the characteristics of the regions where the samples are located. The matching variables considered cover multiple dimensions, including human capital, economic development level, urbanization, cultural facilities, and industrial structure. Regression analysis was conducted on the matched sample set, and the relevant regression estimates are summarized in Table 5.

Table 5.

Endogenous analysis.

- (2)

- Instrumental Variable Method

Next, the supply chain finance ecosystem lagged by one period was used as an instrumental variable, and regression analysis was conducted using the two-stage least squares (2SLS) approach. The F-statistic from the test significantly exceeds the critical value of the Stock–Yogo weak instrumental variable test at the 10% significance level, confirming that the chosen instrumental variable is not weak. In the first-stage regression, the instrumental variable’s coefficient is significantly positive, demonstrating a strong relationship between the instrumental variable and the supply chain finance ecosystem (SCF). The under-identification test yields a p-value of 0, with detailed results presented in Table 5. The supply chain finance regression coefficient remains significantly positive in the second-stage analysis, further validating the robustness of the ecosystem’s positive effect on sustainable rural industry advancement.

4.4. Robustness Analysis

To ensure the reliability of the findings analyzed previously, we performed a series of robustness checks, which involved substituting the dependent and independent variables, as well as downsizing the sample. The regressions were subsequently recalculated using these modified samples.

- (1)

- Replacing the Measurement of the Explanatory Variable

In the initial regression model, the study employed the supply chain finance ecosystem symbiosis level, derived from secondary indicators, as the explanatory variable. To reduce the potential influence of measurement errors on the findings, the secondary indicator measurement approach was revised (Table 6), and a new symbiosis level (nSCF) for the supply chain finance ecosystem was computed using the symbiosis degree model. The regression outcomes align with the conclusions drawn from the earlier benchmark model.

Table 6.

Explanatory variable change measurement method.

- (2)

- Replacing Dependent Variable Measurement

In the previous regressions, we measured the high-quality development of rural industries from four dimensions: industrial benefits, integration, innovation, and sustainability. Given the variety of indicators selected for constructing a high-quality growth index for countryside industries in the existing literature, we changed the calculation methods for some indicators in order to reduce the impact of measurement error (Table 7). The regression results for the new measure (nhqdri) remain consistent with previous findings.

Table 7.

Explained variable change measurement method.

5. Impact Mechanism Test and Further Analysis

5.1. Mechanism Test Based on Industrial Integration and Technological Innovation

Based on the previous analysis, we concluded that the supply chain finance ecosystem significantly promotes high-quality countryside industry growth. Here, we introduce two mediating variables—the degree of rural industry integration and agricultural technological innovation—to further explore how the supply chain finance ecosystem affects rural development. More specifically, we use an indicator system for the integration of rural primary, secondary, and tertiary economic sectors to measure the degree in each province. On the other hand, we use the total number of valid agricultural invention patents to measure agricultural technological innovation. To analyze the impact mechanism of the supply chain finance ecosystem on the high-quality development of rural industries, we set up the following mediation effect model:

The mediating variables are denoted here, specifically the integration level of the three industries (MIX) and agricultural technological innovation (AT), while the definitions of other variables remain unchanged from earlier sections. Columns (1) and (2) of Table 8 present the mediating effect test results for the integration of the three industries (MIX). Column (1) reveals that the supply chain finance ecosystem significantly enhances industry integration. In column (2), the coefficients for the supply chain finance ecosystem (SCF) and the integration level (MIX) are both significantly positive at the 1% level, indicating that the ecosystem fosters sustainable rural enhancement by driving industrial integration, thereby validating Hypothesis H2a. Columns (3) and (4) of Table 8 display the mediating effect test results for agricultural technological innovation (AT). The regression coefficients for both the supply chain finance ecosystem (SCF) and agricultural technological innovation (AT) are significantly positive, suggesting that the ecosystem supports sustainable rural growth by advancing agricultural technological innovation, thus confirming Hypothesis H2b. In conclusion, the supply chain finance ecosystem effectively facilitates the coupling of rural primary, secondary, and tertiary industries and enhances agricultural technological innovation, thereby strengthening the foundation for sustainable rural industry development. This is consistent with a substantial body of research concluding that rural industrial integration and technological innovation are fundamental pathways to rural revitalization [7,12,14], with financial support being key to breaking down industrial barriers. The contribution of this paper lies in specifying and empirically demonstrating that the “supply chain finance ecosystem” serves as an efficient organizational form of finance that drives this integration, providing a more precise perspective than general calls to “increase financial support”.

Table 8.

Intermediary mechanism test.

5.2. Spatial Heterogeneity Test Based on Different Geographical Divisions

To further investigate the variations in the impact of the supply chain finance ecosystem on sustainable rural industry advancement, this study builds on the benchmark regression model by incorporating the dual dimensions of geographical and economic zoning and performing a comparative analysis of the sample data. By combining regional geographical characteristics and economic development levels, this paper aims to reveal the heterogeneity of the supply chain finance ecosystem’s mechanism of action under different regional backgrounds, providing more targeted policy references and a theoretical basis for promoting the high-quality development of rural industries in a location-specific manner. More specifically, according to geographical location, the samples of the 31 provinces are divided into seven administrative geographical regions: North China, Northeast China, Northwest China, Central China, East China, South China, and Southwest China. As shown in Table 9, the regression coefficients of the supply chain finance ecosystem are significantly positive in most cases, with particularly evident positive impacts in the Southwest and South China regions. This finding indicates that the development of the supply chain finance ecosystem has played a significant role in promoting the high-quality development of rural industries in China, further supporting the conclusions of previous research. According to an analysis of China’s regional economic map in 2023, the country’s economy shows a new characteristic of “fast in the east and west, slow in the central region.” The slow fiscal revenue growth rate in the central region is mainly due to the impact of economic uncertainties, structural tax reduction and fee reduction policies [30]. These factors may indirectly lead to an unobvious industrial optimization effect of the part of the supply chain finance ecosystem in Central China. In contrast, the Northwest region may suffer from a relatively single industrial structure and insufficient infrastructure construction, which may have a negative impact on the effective construction and operation of the supply chain finance ecosystem. The negative correlation observed in Northeast China may stem from deep-seated structural contradictions: credit resources may continue to habitually flow into traditional large state-owned enterprises or sectors with overcapacity, failing to effectively penetrate rural industries [34].

Table 9.

Spatial heterogeneity test.

6. Discussion

The empirical findings of this study align with the resource-based perspective, as well as with prior research. Similar to supply chain finance models in countries such as India, which focus on alleviating credit constraints for smallholders under contract farming, this research confirms its fundamental role in optimizing resource allocation [35]. However, unlike models in other developing countries, which are predominantly privately led and focus on single segments [36], China’s policy-driven, full-chain financial ecosystem uniquely emphasizes synergy among core enterprises and multiple actors, extending support from production to processing, branding, and services. This characteristic may explain how the coupled challenges of “financing difficulties” and “short industrial chains” are more systematically resolved in rural areas.

The mechanisms of the financial ecosystem can be further elucidated: Firstly, interest alignment and information sharing within symbiotic relationships reduce transaction costs, consistent with the relevant economics. Secondly, by embedding dynamic capabilities, the ecosystem effectively mitigates the inherent vulnerabilities and market uncertainties facing rural industries [37]. This dual mechanism of “cost reduction” and “capacity enhancement” explains why traditional inclusive finance often fails due to information asymmetry and high risks, while a transaction-based supply chain finance ecosystem proves more effective [38].

This study has several limitations. Its reliance on macro- and industry-level data limits the generalizability of findings to micro-level entities such as enterprises and households. Although instrumental variable approaches alleviate endogeneity concerns, bidirectional causality warrants more robust identification strategies. Furthermore, while the measure of rural integration is representative, future studies could incorporate more diverse sectoral indicators.

The theoretical implications of this research lie in the integration of financial geography and symbiosis theory to reveal how a “relationship”-based financial ecosystem complements traditional “asset”-based credit models. Practically speaking, policymakers should prioritize the following synergistic strategies: (1) encouraging core enterprises to build open, shared digital platforms to strengthen the ecosystem’s data foundation; (2) designing differentiated financial products tailored to regional industrial heterogeneity; and (3) leveraging policy funds to galvanize private capital in jointly modernizing rural supply chains.

7. Conclusions and Significance

As an innovative financial framework, the supply chain finance ecosystem optimizes fund allocation within the industrial chain through financial instruments, thereby providing precise resource allocation support for key areas and identifying priority development directions for the rural economy. This model has played a crucial role in consolidating poverty alleviation achievements, promoting rural industrial revitalization, and achieving comprehensive rural development. Research indicates that the supply chain finance ecosystem has a significant positive impact on high-quality countryside industry growth. Mechanism analysis shows that the ecosystem mainly promotes this development through two channels: industrial integration and technological innovation. Particularly in the rural areas of Southwest and South China, the supply chain finance ecosystem can fully capitalize on its financial strengths to catalyze rapid advancement. Based on the above analysis, this paper proposes the following policy insights:

Firstly, achieving high-quality growth in countryside industries relies heavily on stable financial support and robust policy guarantees. Rural industry growth and financial ecosystem enhancement are mutually reinforcing, with the continuous optimization of the latter providing a constant source of momentum for rural industries. In the face of macroeconomic fluctuations, the government should enhance the industrial chain’s stability and security through fiscal incentives and policy guidance, deepen structural reforms on the supply side, and foster stable rural industry progress. The government can establish supply chain finance service platforms to facilitate information sharing and technological transformation, reduce financing risks, and encourage rural industries to actively participate in cluster development.

Secondly, localized supply chain finance ecosystem development requires the collaborative efforts of multiple stakeholders. Rural industries should establish close strategic partnerships with financial institutions, technology service providers, and logistics companies to leverage the complementary advantages of financial resources in different regions. For areas with relatively weak financial infrastructure, the government should further increase policy support and resource investment, improve the rural credit system and property rights trading mechanism, and accelerate the integration and sharing of agricultural data resources to create a better ecological environment for formulating differentiated financial policies.

Thirdly, the innovative application of financial technology serves as the core driving force behind supply chain finance ecosystem development. Rural industries should actively utilize advanced technologies like big data and blockchain to comprehensively refine its operational mechanisms. They should also innovate in product and service systems to better adapt to rapid market changes and increasingly intense industrial competition.

Author Contributions

Conceptualization, F.L.; methodology, J.H.; formal analysis, J.L.; data curation, J.H.; writing—original draft preparation, F.L. and S.Y.; writing—review and editing, J.L.; visualization, S.Y.; funding acquisition, F.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Foundation of China, under grant number” 23BGL268”, and the Jiangxi Province social science Fund general project, under grant number “23YJ08”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Data sources for the indicator system of explanatory and dependent variables.

Table A1.

Data sources for the indicator system of explanatory and dependent variables.

| Index Layer | Method for Constructing Indicators Before Changes | Data Resources |

|---|---|---|

| Agricultural production efficiency | Total production value of agriculture, forestry, livestock, and fisheries divided by the number of agricultural workers | Manual compilation based on the China Statistical Yearbook |

| Grain production capacity | Grain production/grain production area | Manual compilation based on the China Statistical Yearbook |

| Agricultural mechanization level | Total power of agricultural machinery/number of agricultural labor forces | Manual compilation based on the China Statistical Yearbook |

| Conversion rate of agricultural product processing | Revenue from agricultural products divided by the total value of agricultural output | Manual compilation based on the China Rural Statistical Yearbook |

| Industrial convergence level | Contribution of secondary and tertiary industries/contribution of primary industry | Manual compilation based on the CSMAR database |

| Agricultural service level | The total output value of agriculture, forestry, animal husbandry, and fishery services divided by the total output value of agriculture, forestry, animal husbandry, and fishery | Manual compilation based on the CSMAR database |

| Funds for agricultural science and technology activities | Internal expenditure of R&D funds × share of agriculture, forestry, animal husbandry, and fishery in the region’s GDP | Manual compilation based on the Provincial Statistical Yearbooks |

| Number of personnel engaged in agricultural science and technology activities | The number of R&D personnel × the contribution of agriculture, forestry, animal husbandry, and fishery to the region’s total GDP | Manual compilation based on the Provincial Statistical Yearbooks |

| Rural e-commerce level | Proportion of Taobao villages | Manual compilation based on the CSMAR database |

| The level of pesticide and chemical fertilizer application | Application number of pesticides and chemical fertilizers/grain production area | Manual compilation based on the China Rural Statistical Yearbook |

| Strength of agricultural plastic film | Use of agricultural plastic film/grain production area by region | Manual compilation based on the China Rural Statistical Yearbook |

| Water saving irrigation level | Water saving irrigation cultivated land area/cultivated land area | Manual compilation based on the China Rural Statistical Yearbook |

| The level of financial services | The balance of various RMB loans of financial institutions | Provincial Statistical Yearbooks |

| Management level of accounts receivable | NET accounts receivable of industrial enterprises above designated size· | Provincial Statistical Yearbooks |

| Inventory management scale | The inventory size of industrial enterprises above the designated size | Provincial Statistical Yearbooks |

| Degree of Internet development | Internet penetration | China Statistical Yearbook |

| Information transfer level | Information technology services revenue/GDP | Manual compilation based on the China Tertiary Industry Statistical Yearbook |

| Transportation of goods | Road freight volume | China Rural Statistical Yearbook |

| Turnover of freight transport | Highway cargo turnover | China Rural Statistical Yearbook |

| Express delivery service support | Number of express posts | China Rural Statistical Yearbook |

| Development level of supply chain finance | The number of regional supply chain financial enterprises | Provincial Statistical Yearbooks |

| The degree of traffic development | Urban Road area/total urban area | Manual compilation based on the Provincial Statistical Yearbooks |

| Service level of science and technology | Urban employees in scientific research/technical services | Manual compilation based on the Provincial Statistical Yearbooks |

References

- Ahmad, M.; Khan, Z.; Anser, M.K. Do rural-urban migration and industrial agglomeration mitigate the environmental degradation across China’s regional development levels? Sustain. Prod. Consum. 2021, 27, 679–697. [Google Scholar] [CrossRef]

- Philip, L.; Cottrill, C.; Farrington, J.; Williams, F.; Ashmore, F. The digital divide: Patterns, policy and scenarios for connecting the ‘final few’in rural communities across Great Britain. J. Rural Stud. 2017, 54, 386–398. [Google Scholar] [CrossRef]

- Cowie, P.; Townsend, L.; Salemink, K. Smart rural futures: Will rural areas be left behind in the 4th industrial revolution? J. Rural Stud. 2020, 79, 169–176. [Google Scholar] [CrossRef]

- Unay-Gailhard, İ.; Bojnec, Š. The impact of green economy measures on rural employment: Green jobs in farms. J. Clean. Prod. 2019, 208, 541–551. [Google Scholar] [CrossRef]

- Wang, G.; Li, X.; Gao, Y.; Zeng, C.; Wang, B.; Li, X.; Li, X. How does land consolidation drive rural industrial development? Qualitative and quantitative analysis of 32 land consolidation cases in China. Land Use Policy 2023, 130, 106664. [Google Scholar] [CrossRef]

- Burström, T.; Parida, V.; Lahti, T. AI-enabled business-model innovation and transformation in industrial ecosystems: A framework, model and outline for further research. J. Bus. Res. 2021, 127, 85–95. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, T.; Jia, F. Industry convergence as a strategy for achieving sustainable development of agricultural complex: The case of Sandun-Lanli in China. Bus. Strategy Environ. 2020, 29, 2679–2694. [Google Scholar] [CrossRef]

- Tang, W.; Zhu, J. Informality and rural industry: Rethinking the impacts of E-commerce on rural development in China. J. Rural Stud. 2020, 75, 20–29. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Rehman, S.U.; Zafar, A.U. Adoption of green innovation technology to accelerate sustainable development among manufacturing industry. J. Innov. Knowl. 2022, 7, 100231. [Google Scholar] [CrossRef]

- Tiwasing, P.; Clark, B.; Gkartzios, M. How can rural businesses thrive in the digital economy? A UK perspective. Heliyon 2022, 8, e10745. [Google Scholar] [CrossRef]

- Alon, T.; Kim, M.; Lagakos, D. Macroeconomic effects of COVID-19 across the world income distribution. IMF Econ. Rev. 2022, 71, 99. [Google Scholar] [CrossRef]

- Getie, A.M.; Birhanu, T.A.; Dadi, T.T. Rural cadastral implementation and its effect on women’s landholding use rights in Amhara region, Ethiopia. Land Use Policy 2023, 127, 106556. [Google Scholar] [CrossRef]

- Kong, R.; Castella, J.C. Farmers’ resource endowment and risk management affect agricultural practices and innovation capacity in the Northwestern uplands of Cambodia. Agric. Syst. 2021, 190, 103067. [Google Scholar] [CrossRef]

- Xiong, Z.; Huang, Y.; Yang, L. Rural revitalization in China: Measurement indicators, regional differences and dynamic evolution. Heliyon 2024, 10, e29880. [Google Scholar] [CrossRef] [PubMed]

- Domínguez, A.G.; Roig-Tierno, N.; Chaparro-Banegas, N.; García-Álvarez-Coque, J.-M. Natural language processing of social network data for the evaluation of agricultural and rural policies. J. Rural Stud. 2024, 109, 103341. [Google Scholar] [CrossRef]

- Ali, Z.; Gongbing, B.; Mehreen, A. Does supply chain finance improve SMEs performance? The moderating role of trade digitization. Bus. Process. Manag. J. 2020, 26, 150–167. [Google Scholar] [CrossRef]

- Lekkakos, S.D.; Serrano, A. Supply chain finance for small and medium sized enterprises: The case of reverse factoring. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 4. [Google Scholar] [CrossRef]

- Salemink, K.; Strijker, D.; Bosworth, G. Rural development in the digital age: A systematic literature review on unequal ICT availability, adoption, and use in rural areas. J. Rural Stud. 2017, 54, 360–371. [Google Scholar] [CrossRef]

- Khraisha, T.; Arthur, K. Can we have a general theory of financial innovation processes? A conceptual review. Financ. Innov. 2018, 4, 4. [Google Scholar] [CrossRef]

- Guo, J.; Chen, L.; Kang, X. Digital inclusive finance and agricultural green development in China: A panel analysis. Financ. Res. Lett. 2024, 69, 106173. [Google Scholar] [CrossRef]

- Janssens, W.; Pradhan, M.; de Groot, R. The short-term economic effects of COVID-19 on low-income households in rural Kenya: An analysis using weekly financial household data. World Dev. 2021, 138, 105280. [Google Scholar] [CrossRef]

- Fuseini, M.N. Rural infrastructure and livelihoods enhancement: The case of community-based rural development program in Ghana. Heliyon 2024, 10, e33659. [Google Scholar] [CrossRef] [PubMed]

- Kim, N.; Lee, H.; Kim, W. Dynamic patterns of industry convergence: Evidence from a large amount of unstructured data. Res. Policy 2015, 44, 1734–1748. [Google Scholar] [CrossRef]

- Levi, R.; Rajan, M.; Singhvi, S.; Zheng, Y. The impact of unifying agricultural wholesale markets on prices and farmers’ profitability. Proc. Natl. Acad. Sci. USA 2020, 117, 2366–2371. [Google Scholar] [CrossRef] [PubMed]

- Zhan, L.; Wang, S.; Xie, S.; Zhang, Q.; Qu, Y. Spatial path to achieve urban-rural integration development− analytical framework for coupling the linkage and coordination of urban-rural system functions. Habitat Int. 2023, 142, 102953. [Google Scholar] [CrossRef]

- Moretto, A.; Caniato, F. Can Supply Chain Finance help mitigate the financial disruption brought by COVID-19? J. Purch. Supply Manag. 2021, 27, 100713. [Google Scholar] [CrossRef]

- Malik, P.K.; Singh, R.; Gehlot, A.; Akram, S.V.; Das, P.K. Village 4.0: Digitalization of village with smart internet of things technologies. Comput. Ind. Eng. 2022, 165, 107938. [Google Scholar] [CrossRef]

- Ma, Q.; Shi, F. New urbanization and high-quality urban and rural development: Based on the interactive coupling analysis of industrial green transformation. Ecol. Indic. 2023, 156, 111044. [Google Scholar] [CrossRef]

- Liu, Y.; He, Z. Synergistic industrial agglomeration, new quality productive forces and high-quality development of the manufacturing industry. Int. Rev. Econ. Financ. 2024, 94, 103373. [Google Scholar] [CrossRef]

- Ling, R.; Li, B.; Pan, A.; Wang, H. Supply Chain Finance and Corporate Debt Term Selection. Econ. Res. 2023, 58, 93–113. (In Chinese) [Google Scholar]

- Zhang, T.; Jia, F.; Chen, L.; Blome, C.; Ball, P. From platformization to ecosystem: How do third-party supply chain finance platforms develop an ecosystem? An inter-organizational network perspective. Int. J. Prod. Econ. 2025, 281, 109521. [Google Scholar] [CrossRef]

- Fraccascia, L.; Giannoccaro, I.; Albino, V. Ecosystem indicators for measuring industrial symbiosis. Ecol. Econ. 2021, 183, 106944. [Google Scholar] [CrossRef]

- Moreira-Dantas, I.R.; Martínez-Zarzoso, I.; Henning, C.; Dos Santos, M.S. Rural credit acquisition for family farming in Brazil: Evidence from the Legal Amazon. J. Rural Stud. 2023, 101, 103041. [Google Scholar] [CrossRef]

- Zhao, S.; Wang, H.; Li, W. Allocation of Credit Resources and “Borrow to Lend” Activities: Evidence from Chinese-Listed Companies. Front. Psychol. 2022, 13, 856056. [Google Scholar] [CrossRef] [PubMed]

- Bhatia, M.S.; Chaudhuri, A.; Kayikci, Y.; Treiblmaier, H. Implementation of blockchain-enabled supply chain finance solutions in the agricultural commodity supply chain: A transaction cost economics perspective. Prod. Plan. Control 2024, 35, 1353–1367. [Google Scholar] [CrossRef]

- Kshetri, N. Blockchain and sustainable supply chain management in developing countries. Int. J. Inf. Manag. 2021, 60, 102376. [Google Scholar] [CrossRef]

- Aisaiti, G.; Liu, L.; Xie, J.; Yang, J. An empirical analysis of rural farmers’ financing intention of inclusive finance in China: The moderating role of digital finance and social enterprise embeddedness. Ind. Manag. Data Syst. 2019, 119, 1535–1563. [Google Scholar] [CrossRef]

- Choi, T.Y.; Hofmann, E.; Templar, S. The supply chain financing ecosystem: Early responses during the COVID-19 crisis. J. Purch. Supply Manag. 2023, 29, 100836. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).