From Digitalization to Sustainability: Does Supply Chain Digitalization Enhance Corporate Green Transformation Performance?

Abstract

1. Introduction

2. Literature Review

2.1. Practice-Based View

2.2. Supply Chain Digitization and Corporate Green Performance

2.3. Research Gap

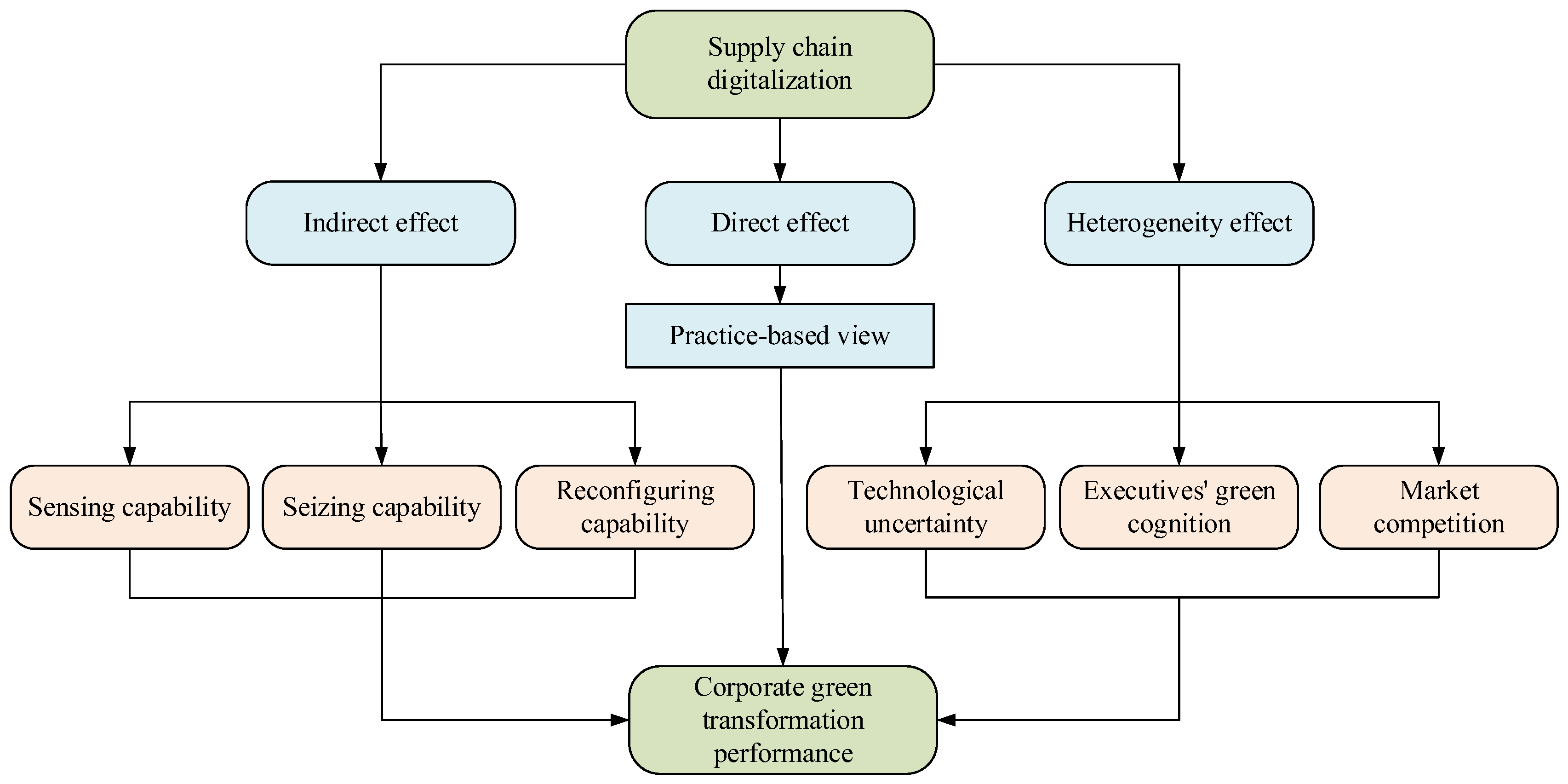

3. Hypothesis Development

3.1. The Interplay Between SCD and CGTP

3.2. The Role of Dynamic Capability

3.3. SCD and CGTP Under the Heterogeneous Conditions

4. Research Design

4.1. Sample Selection

4.2. Variable Definition

4.2.1. Explained Variable

4.2.2. Explanatory Variable

4.2.3. Control Variable

4.3. Model Specification and Estimation Method

5. Empirical Findings

5.1. Summary Statistics

5.2. Regression Results

5.3. Robustness Test

5.4. Endogeneity Test

5.5. Heterogeneity Analysis

5.6. Mechanism Test

6. Discussion

6.1. Relationship Between SCD and CGTP

6.2. Discussion on the Dynamic Capabilities

6.3. Discussion on Heterogeneity

7. Conclusions and Contributions

7.1. Conclusions

7.2. Theoretical Implications

7.3. Managerial Implications

7.4. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Han, Y.; Wei, T. Supply chain digitization and corporate carbon emissions: A chain mediation examination based on digital transformation and green innovation. J. Environ. Manag. 2025, 379, 124825. [Google Scholar] [CrossRef] [PubMed]

- Lu, H.; Pan, Y.; Fan, R.; Guan, W. Green credit policy and heavily polluting enterprises’ green transition. Int. Rev. Financ. Anal. 2025, 103, 104162. [Google Scholar] [CrossRef]

- Guo, B.; Hu, P.; Lin, J. The effect of digital infrastructure development on enterprise green transformation. Int. Rev. Financ. Anal. 2024, 92, 103085. [Google Scholar] [CrossRef]

- Wieland, A.; Creutzig, F. Taking Academic Ownership of the Supply Chain Emissions Discourse. J. Supply Chain Manag. 2025, 61, 3–13. [Google Scholar] [CrossRef]

- Wang, J.; Wu, H.; Wang, W.; Liu, Y. Effects of supply chain digitization on carbon performance of manufacturing corporations. J. Manuf. Technol. Manag. 2025; ahead of print. [Google Scholar] [CrossRef]

- Zhang, H.; He, F.; Wan, P.; Zhang, Y.; Zhu, Y. The digital path to green: Exploring the impact of supply chain digital transformation on corporate green investments. J. Clean. Prod. 2025, 526, 146656. [Google Scholar] [CrossRef]

- Li, Z.; Hu, B.; Bao, Y.; Wang, Y. Supply chain digitalization, green technology innovation and corporate energy efficiency. Energy Econ. 2025, 142, 108153. [Google Scholar] [CrossRef]

- Gu, J. Did supply chain digitization contribute to corporate green energy innovation? The mediating role of asset receivable management and policy spillovers. Energy Econ. 2025, 143, 108274. [Google Scholar] [CrossRef]

- Yang, P.; Lv, Y.; Chen, J.; Shen, H.; Xu, Y. Can the digitization of supply chains promote the low-carbon transformation of enterprises? A case study of listed companies in China. Energy Econ. 2025, 143, 108212. [Google Scholar] [CrossRef]

- Wang, S.; Zhang, H. How does digital supply chain transformation determine environmental, social, and governance (ESG) performance? Mediating role of firm integration and moderating effect of organizational digital culture. Oper. Manag. Res. 2025, 18, 960–986. [Google Scholar] [CrossRef]

- Wang, S.; Zhang, R.; Yang, Y.; Chen, J.; Yang, S. Has enterprise digital transformation facilitated the carbon performance in Industry 4.0 era? Evidence from Chinese industrial enterprises. Comput. Ind. Eng. 2023, 184, 109576. [Google Scholar] [CrossRef]

- Di Vaio, A.; Zaffar, A.; Chhabra, M. Intellectual capital and human dynamic capabilities in decarbonization processes for net-zero business models: An in-depth examination through a systematic literature review. J. Intellect. Cap. 2024, 25, 23–53. [Google Scholar] [CrossRef]

- Li, L. Digital transformation and sustainable performance: The moderating role of market turbulence. Ind. Mark. Manag. 2022, 104, 28–37. [Google Scholar] [CrossRef]

- Liu, W.; Hou, J.; Cheng, Y.; Yuan, C.; Lan, R.; Chan, H.K. The potential of smart factories in reducing environmental emissions: The evidence from Chinese listed manufacturing firms. Humanit. Soc. Sci. Commun. 2024, 11, 1105. [Google Scholar] [CrossRef]

- Wang, L.; Cheng, Z. Impact of the Belt and Road initiative on enterprise green transformation. J. Clean. Prod. 2024, 468, 143043. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Chatterjee, S.; Mariani, M.; Ferraris, A. Digitalization of Supply Chain and Its Impact on Cost, Firm Performance, and Resilience: Technology Turbulence and Top Management Commitment as Moderator. IEEE Trans. Eng. Manag. 2024, 71, 10469–10484. [Google Scholar] [CrossRef]

- Fan, Z.; Long, R.; Shen, Z. Regional digitalization, dynamic capabilities and green innovation: Evidence from e-commerce demonstration cities in China. Econ. Model. 2024, 139, 106846. [Google Scholar] [CrossRef]

- Jiang, G.; Peng, J.; Liang, X.; Pan, J. Supply chain digitization and continuous green innovation: Evidence from China. Energy Econ. 2025, 142, 108158. [Google Scholar] [CrossRef]

- Niu, J.; Qiang, M.; Chen, M. Can the Management’s green cognition promote the Enterprise’s green Transformation? Based on the perspective of carbon emissions. Int. Rev. Econ. Financ. 2025, 102, 104290. [Google Scholar] [CrossRef]

- Xu, B.; Guo, Q.; Chen, L. The Influence of Supply Chain Digitalization on Enterprise ESG Performance: A quasi-natural experiment based on pilot policies for supply chain innovation and application. Econ. Anal. Policy 2025, 87, 1058–1072. [Google Scholar] [CrossRef]

- Wu, Y.; Wang, J.; Xia, S.; He, Q.; Zhang, Q. The Impact of Supply Chain Digitalization on Firms’ Performance: An Empirical Test of How Resource Specificity Explains the Digitalization Paradox. J. Bus. Logist. 2025, 46, e70023. [Google Scholar] [CrossRef]

- Xue, R.; Ong, T.S.; Di Vaio, A. Environmentally Sustainable Development: The Role of Supply Chain Digitalization in Firms’ Green Productivity. Sustain. Dev. 2025, 33, 7807–7825. [Google Scholar] [CrossRef]

- Bromiley, P.; Rau, D. Operations management and the resource based view: Another view. J. Oper. Manag. 2016, 41, 95–106. [Google Scholar] [CrossRef]

- Bromiley, P.; Rau, D. Towards a practice-based view of strategy. Strateg. Manag. J. 2014, 35, 1249–1256. [Google Scholar] [CrossRef]

- Bui, M.T.; Jeng, D.; Ta, H.H. Accelerating Digital Supply Chain Management Practices, Customer Development, and Firm Performance: Organizational Culture Matters. Contemp. Econ. 2024, 18, 40–66. [Google Scholar] [CrossRef]

- Li, L.; Liu, Y.; Jin, Y.; Cheng, T.C.E.; Yang, S. Leveraging supply chain digitalization for performance improvement in manufacturing and service firms: A practice-based view. Transp. Res. Part E Logist. Transp. Rev. 2025, 200, 104189. [Google Scholar] [CrossRef]

- Liu, X.; Tse, Y.K.; Wang, S.; Sun, R. Unleashing the power of supply chain learning: An empirical investigation. Int. J. Oper. Prod. Manag. 2023, 43, 1250–1276. [Google Scholar] [CrossRef]

- Chen, M.; Tan, X.; Zhu, J.; Dong, R.K. Can supply chain digital innovation policy improve the sustainable development performance of manufacturing companies? Humanit. Soc. Sci. Commun. 2025, 12, 307. [Google Scholar] [CrossRef]

- Zhao, N.; Hong, J.; Lau, K.H. Impact of supply chain digitalization on supply chain resilience and performance: A multi-mediation model. Int. J. Prod. Econ. 2023, 259, 108817. [Google Scholar] [CrossRef]

- Deng, W.; Zhang, Z.; Guo, B. Firm-level carbon risk awareness and Green transformation: A research on the motivation and consequences from government regulation and regional development perspective. Int. Rev. Financ. Anal. 2024, 91, 103026. [Google Scholar] [CrossRef]

- Xu, Y.; Yang, C.; Ge, W.; Liu, G.; Yang, X.; Ran, Q. Can industrial intelligence promote green transformation? New insights from heavily polluting listed enterprises in China. J. Clean. Prod. 2023, 421, 138550. [Google Scholar] [CrossRef]

- Wang, J.; Liu, Y.; Wang, W.; Wu, H. How does digital transformation drive green total factor productivity? Evidence from Chinese listed enterprises. J. Clean. Prod. 2023, 406, 136954. [Google Scholar] [CrossRef]

- Lin, B.; Pan, T. The impact of green credit on green transformation of heavily polluting enterprises: Reverse forcing or forward pushing? Energy Policy 2024, 184, 113901. [Google Scholar] [CrossRef]

- Ge, W.; Xu, Y.; Razzaq, A.; Liu, G.; Su, X.; Yang, X.; Ran, Q. What drives the green transformation of enterprises? A case of carbon emissions trading pilot policy in China. Environ. Sci. Pollut. Res. 2023, 30, 56743–56758. [Google Scholar] [CrossRef] [PubMed]

- Li, H.; Zhu, X.; Chen, J.; Jiang, F. Environmental regulations, environmental governance efficiency and the green transformation of China’s iron and steel enterprises. Ecol. Econ. 2019, 165, 106397. [Google Scholar] [CrossRef]

- Bian, Z.; Luo, M. Digital transformation’s impact on upstream green technology innovation: A supply chain perspective. Appl. Econ. 2025, 1–18. [Google Scholar] [CrossRef]

- An, S.; Gu, Y.; Pan, L.; Yu, Y. Supply chain digitalization and firms’ green innovation: Evidence from a pilot program. Econ. Anal. Policy 2024, 84, 828–846. [Google Scholar] [CrossRef]

- Kong, T.; Feng, T. Linking digital transformation with supply chain intelligence integration and carbon performance: Does business model innovation matter? Bus. Process. Manag. J. 2025, 31, 1274–1305. [Google Scholar] [CrossRef]

- Shen, Y.; Tian, Z.; Chen, X.; Wang, H.; Song, M. Unpacking the green potential: How does supply chain digitalization affect corporate carbon emissions?—Evidence from supply chain innovation and application pilots in China. J. Environ. Manag. 2025, 374, 124147. [Google Scholar] [CrossRef]

- Liu, W.; Lee, P.T.W.; Zhou, L.; Li, K.W.; Nguyen, T.V. Guest editorial: Smart supply chain management to achieve carbon neutrality: Risk, challenges and opportunities. Ind. Manag. Data Syst. 2023, 123, 2425–2434. [Google Scholar] [CrossRef]

- Wu, W.; Zhang, Y. Artificial intelligence innovation and environmental performance: Unraveling the complex roles of application and method innovation across enterprise sizes. Technol. Forecast. Soc. Chang. 2025, 218, 124211. [Google Scholar] [CrossRef]

- Feng, Q.; Li, M.; Hu, X.; Deng, F. Digital infrastructure expansion and carbon intensity of small enterprises: Evidence from China. J. Environ. Manag. 2024, 366, 121742. [Google Scholar] [CrossRef]

- Qi, Y.; Hou, K.; Zhang, M.; Pu, T.; Guo, H. Digitalization and financial performance: A supply chain perspective. Inf. Manag. 2025, 62, 104199. [Google Scholar] [CrossRef]

- Gupta, A.; Singh, R.K.; Kamal, M.M. Blockchain technology adoption for secured and carbon neutral logistics operations: Barrier intensity index framework. Ann. Oper. Res. 2024. [Google Scholar] [CrossRef]

- Luo, S.; Xiong, Z.; Liu, J. How does supply chain digitization affect green innovation? Evidence from a quasi-natural experiment in China. Energy Econ. 2024, 136, 107745. [Google Scholar] [CrossRef]

- Zhou, X.; Zhu, Q.; Xu, Z. The role of contractual and relational governance for the success of digital traceability: Evidence from Chinese food producers. Int. J. Prod. Econ. 2023, 255, 108659. [Google Scholar] [CrossRef]

- Yuan, S.; Pan, X. The effects of digital technology application and supply chain management on corporate circular economy: A dynamic capability view. J. Environ. Manag. 2023, 341, 118082. [Google Scholar] [CrossRef]

- Ma, J.; Li, Q.; Zhao, Q.; Liou, J.; Li, C. From bytes to green: The impact of supply chain digitization on corporate green innovation. Energy Econ. 2024, 139, 107942. [Google Scholar] [CrossRef]

- Li, Y.; Hu, Y.; Li, L.; Zheng, J.; Yin, Y.; Fu, S. Drivers and outcomes of circular economy implementation: Evidence from China. Ind. Manag. Data Syst. 2023, 123, 1178–1197. [Google Scholar] [CrossRef]

- Sheng, H.; Feng, T.; Liu, L. The influence of digital transformation on low-carbon operations management practices and performance: Does CEO ambivalence matter? Int. J. Prod. Res. 2023, 61, 6215–6229. [Google Scholar] [CrossRef]

- Chen, L.; Dai, Y.; Ren, F.; Dong, X. Data-driven digital capabilities enable servitization strategy—From service supporting the product to service supporting the client. Technol. Forecast. Soc. Chang. 2023, 197, 122901. [Google Scholar] [CrossRef]

- Appiah, L.O. Does proactive boundary—Spanning search drive green innovation? Exploring the significance of green dynamic capabilities and analytics capabilities. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 2589–2599. [Google Scholar] [CrossRef]

- Fan, W.; Wu, X.; He, Q. Digitalization drives green transformation of supply chains: A two-stage evolutionary game analysis. Ann. Oper. Res. 2024. [Google Scholar] [CrossRef]

- Chevrollier, N.; van Lieshout, J.W.F.C.; Argyrou, A.; Amelink, J. Carbon emission reduction: Understanding the micro-foundations of dynamic capabilities in companies with a strategic orientation for sustainability performance. Bus. Strateg. Environ. 2024, 33, 968–984. [Google Scholar] [CrossRef]

- Dubey, R.; Bryde, D.J.; Blome, C.; Dwivedi, Y.K.; Childe, S.J.; Foropon, C. Alliances and digital transformation are crucial for benefiting from dynamic supply chain capabilities during times of crisis: A multi-method study. Int. J. Prod. Econ. 2024, 269, 109166. [Google Scholar] [CrossRef]

- Li, Q.; Zhang, H.; Liu, K.; Zhang, Z.J.; Jasimuddin, S.M. Linkage between digital supply chain, supply chain innovation and supply chain dynamic capabilities: An empirical study. Int. J. Logist. Manag. 2024, 35, 1200–1223. [Google Scholar] [CrossRef]

- Sullivan, Y.; Fosso Wamba, S. Artificial intelligence and adaptive response to market changes: A strategy to enhance firm performance and innovation. J. Bus. Res. 2024, 174, 114500. [Google Scholar] [CrossRef]

- Yin, Q.; Wang, Y.; Song, D.; Lai, F.; Collins, B.; Guo, H. The impact of digitalization on operational risk: An organizational information processing perspective. Int. J. Prod. Econ. 2024, 276, 109369. [Google Scholar] [CrossRef]

- Nie, S.; Cao, X.; Li, Z.; Liu, M.; Zhang, Y. Supply chain digitization in the net-zero era: The impact of digital technology, renewable energy, and infrastructure. Energy Econ. 2025, 144, 108403. [Google Scholar] [CrossRef]

- Cheng, W.; Li, Q.; Wu, Q.; Ye, F.; Jiang, Y. Digital capability and green innovation: The perspective of green supply chain collaboration and top management’s environmental awareness. Heliyon 2024, 10, e32290. [Google Scholar] [CrossRef] [PubMed]

- Deng, M.; Tang, H.; Luo, W. Can the green experience of CEO improve ESG performance in heavy polluting companies? Evidence from China. Manag. Decis. Econ. 2024, 45, 2373–2392. [Google Scholar] [CrossRef]

- Hao, X.; Miao, E.; Wen, S.; Wu, H.; Xue, Y. Executive Green Cognition on Corporate Greenwashing Behavior: Evidence From A-Share Listed Companies in China. Bus. Strateg. Environ. 2025, 34, 2012–2034. [Google Scholar] [CrossRef]

- Zhang, B.; Yu, L.; Sun, C. How does urban environmental legislation guide the green transition of enterprises? Based on the perspective of enterprises’ green total factor productivity. Energy Econ. 2022, 110, 106032. [Google Scholar] [CrossRef]

- Gao, D.; Zhou, X.; Mo, X.; Liu, X. Unlocking sustainable growth: Exploring the catalytic role of green finance in firms’ green total factor productivity. Environ. Sci. Pollut. Res. 2024, 31, 14762–14774. [Google Scholar] [CrossRef]

- Wu, J.; Xia, Q.; Li, Z. Green innovation and enterprise green total factor productivity at a micro level: A perspective of technical distance. J. Clean. Prod. 2022, 344, 131070. [Google Scholar] [CrossRef]

- Ding, X.; Xu, Z.; Petrovskaya, M.V.; Wu, K.; Ye, L.; Sun, Y.; Makarov, V.M. Exploring the impact mechanism of executives’ environmental attention on corporate green transformation: Evidence from the textual analysis of Chinese companies’ management discussion and analysis. Environ. Sci. Pollut. Res. 2023, 30, 76640–76659. [Google Scholar] [CrossRef] [PubMed]

- Lin, B.; Sun, A.; Xie, Y. Digital transformation and green total factor productivity of heavy pollution enterprises: Impact, mechanism and spillover effect. J. Environ. Manag. 2025, 373, 123619. [Google Scholar] [CrossRef]

- Wen, H.; Hu, K.; Nghiem, X.; Acheampong, A.O. Urban climate adaptability and green total-factor productivity: Evidence from double dual machine learning and differences-in-differences techniques. J. Environ. Manag. 2024, 350, 119588. [Google Scholar] [CrossRef]

- Chernozhukov, V.; Chetverikov, D.; Demirer, M.; Duflo, E.; Hansen, C.; Newey, W.; Robins, J. Double/debiased machine learning for treatment and structural parameters. Econ. J. 2018, 21, C1–C68. [Google Scholar] [CrossRef]

- Shi, X.; Geng, S. Double-edged sword? Heterogeneous effects of digital technology on environmental regulation-driven green transformation. J. Environ. Manag. 2025, 389, 125960. [Google Scholar] [CrossRef] [PubMed]

- Huang, Y.; Mu, W. Strategy adaptation under external uncertainty: Examining speed-based competitions. Manag. Decis. 2025, 63, 1703–1721. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, L.; Yu, F. A study on the impact of corporate executives’ green perceptions on carbon disclosure. Int. Rev. Econ. Financ. 2025, 103, 104406. [Google Scholar] [CrossRef]

- Deng, X.J.; Yuan, M.Q.; Luo, C.Y. Corporate digital transformation, market competition, and the environmental performance—Microevidence from Chinese manufacturing. Bus. Strateg. Environ. 2024, 33, 3279–3298. [Google Scholar] [CrossRef]

- Li, J.; Lu, Y.; Song, H.; Xie, H. Long-term impact of trade liberalization on human capital formation. J. Comp. Econ. 2019, 47, 946–961. [Google Scholar] [CrossRef]

- Kindermann, B.; Beutel, S.; Garcia De Lomana, G.; Strese, S.; Bendig, D.; Brettel, M. Digital orientation: Conceptualization and operationalization of a new strategic orientation. Eur. Manag. J. 2021, 39, 645–657. [Google Scholar] [CrossRef]

- Yang, G.; Nie, Y.; Li, H.; Wang, H. Digital transformation and low-carbon technology innovation in manufacturing firms: The mediating role of dynamic capabilities. Int. J. Prod. Econ. 2023, 263, 108969. [Google Scholar] [CrossRef]

- Luo, T.; Qu, J.; Cheng, S. Digital transformation, dynamic capability and total factor productivity of manufacturing enterprises. Ind. Manag. Data Syst. 2025, 125, 921–944. [Google Scholar] [CrossRef]

- Jan, A.M.; Salameh, A.A.; Rahman, H.U.; Alasiri, M.M. Can blockchain technologies enhance environmental sustainable development goals performance in manufacturing firms? Potential mediation of green supply chain management practices. Bus. Strateg. Environ. 2024, 33, 2004–2019. [Google Scholar] [CrossRef]

- Silva, G.M.; Patrucco, A.S.; Gomes, P.J. Advancing green supply chains through downstream digitalization: An information processing theory perspective. J. Purch. Supply Manag. 2025; in press. [Google Scholar] [CrossRef]

- Gao, W.; Wen, S.; Li, H.; Lyu, X. Executives’ carbon cognition and corporate carbon performance: The mediating role of corporate low-carbon actions and the moderating role of firm size. Heliyon 2024, 10, e23959. [Google Scholar] [CrossRef] [PubMed]

- Jiang, Y.; Hu, Y.; Asante, D.; Mintah Ampaw, E.; Asante, B. The Effects of Executives’ low-carbon cognition on corporate low-carbon performance: A study of managerial discretion in China. J. Clean. Prod. 2022, 357, 132015. [Google Scholar] [CrossRef]

- Tu, Z.; Cao, Y.; Goh, M.; Wang, Y. Executive green cognition and corporate ESG performance. Financ. Res. Lett. 2024, 69, 106271. [Google Scholar] [CrossRef]

- Wang, M.; Prajogo, D. The effect of supply chain digitalisation on a firm’s performance. Ind. Manag. Data Syst. 2024, 124, 1725–1745. [Google Scholar] [CrossRef]

- Yu, W.; Chavez, R.; Liu, Q.; Cadden, T. Examining the Effects of Digital Supply Chain Practices on Supply Chain Viability and Operational Performance: A Practice-Based View. IEEE Trans. Eng. Manag. 2024, 71, 10413–10426. [Google Scholar] [CrossRef]

- Jia, F.; Du, K.; Chen, L.; Lim, M.K.; Cheng, Y. The Side Effects of Corporate Digitalization on Corporate Social Responsibility: A Fraud Triangle Perspective. Br. J. Manag. 2025, 36, 1360–1373. [Google Scholar] [CrossRef]

- Zhou, H.; Wang, Q.; Li, L.; Teo, T.S.H.; Yang, S. Supply chain digitalization and performance improvement: A moderated mediation model. Supply Chain. Manag. 2023, 28, 993–1008. [Google Scholar] [CrossRef]

- Zhang, T.; Zhao, X.; Xi, Y. Greening the chain: How digital transformation of supply chains drives corporate innovation in China’s A-share market. Int. Rev. Financ. Anal. 2025, 103, 104224. [Google Scholar] [CrossRef]

| Variable | Metrics | Abbreviation | Measurement |

|---|---|---|---|

| Dependent variable | Corporate green transformation performance | CGTP | Corporate green total factor productivity |

| Independent variable | Supply chain digitalization | SCD | ) |

| Control variable | Firm size | SIZE | Ln (Total assets) |

| Asset liability ratio | LEV | Total liabilities/Total assets | |

| Financial performance | ROA | Net profit/Total assets at beginning of period | |

| Tobin’s Q value | TOBINQ | Market value of the company/Cost of asset replacement | |

| Cash holdings | CASH | Net Cash Flow from Operating Activities/Total assets | |

| Fixed asset ratio | FIXED | Fixed assets/Total assets | |

| Growth ability | GROWTH | Operating revenue growth rate | |

| Listing age | AGE | Ln (2021—Company’s listing year) | |

| Management shareholding ratio | MSHARE | Proportion of total shares owned by directors and supervisors | |

| Industry concentration degree | HHI | Summed quadratic values of individual enterprises’ market proportions | |

| Economic development level | EDV | Natural logarithm of GDP per capita | |

| Industrial structure | INS | Service sector to manufacturing sector ratio |

| Variable | N | Mean | SD | Min | Max | VIF |

|---|---|---|---|---|---|---|

| CGTP | 16,634 | 0.999 | 0.016 | 0.918 | 1.082 | — |

| SCD | 16,634 | 0.340 | 0.474 | 0.000 | 1.000 | 1.147 |

| SIZE | 16,634 | 22.240 | 1.249 | 19.910 | 26.480 | 1.916 |

| LEV | 16,634 | 0.404 | 0.193 | 0.046 | 0.901 | 1.689 |

| ROA | 16,634 | 0.042 | 0.068 | −0.363 | 0.250 | 1.687 |

| TOBINQ | 16,634 | 2.182 | 1.389 | 0.818 | 11.420 | 1.270 |

| CASH | 16,634 | 0.050 | 0.063 | −0.150 | 0.252 | 1.362 |

| FIXED | 16,634 | 0.199 | 0.140 | 0.004 | 0.689 | 1.154 |

| GROWTH | 16,634 | 0.170 | 0.328 | −0.552 | 2.499 | 1.154 |

| AGE | 16,634 | 2.108 | 0.758 | 0.693 | 3.367 | 1.526 |

| MSHARE | 16,634 | 0.158 | 0.293 | 0.000 | 20.170 | 1.180 |

| HHI | 16,634 | −0.798 | 0.245 | −1.020 | −0.216 | 1.075 |

| INS | 16,634 | 1.136 | 0.523 | 0.284 | 3.397 | 1.090 |

| EDV | 16,634 | 10.890 | 0.509 | 9.275 | 12.100 | 1.026 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CGTP | CGTP | CGTP | CGTP | |

| θ0 | 0.0024 *** (0.0007) | 0.0049 *** (0.0007) | 0.0023 *** (0.0007) | 0.0045 *** (0.0006) |

| Control | Yes | Yes | Yes | Yes |

| Control2 | No | No | Yes | Yes |

| Firms/Year FE | Yes | Yes | Yes | Yes |

| N | 16,634 | 16,634 | 16,634 | 16,634 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| CGTP | CGTP | CGTP | CGTP | CGTP | CGTP | |

| θ0 | 0.0139 *** (0.0052) | 0.0023 *** (0.0007) | 0.0012 *** (0.0004) | 0.0051 *** (0.0003) | 0.0019 *** (0.0004) | 0.0025 *** (0.0005) |

| DML model | RF | RF | GBDT | SVM | Lasso | NN |

| Control/Control2 | Yes | Yes | Yes | Yes | Yes | Yes |

| Firms/Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 16,634 | 16,634 | 16,634 | 16,634 | 16,634 | 16,634 |

| Variable | Treatment Group | Control Group | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Count | Mean | Sd | Min | Max | Count | Mean | Sd | Min | Max | |

| CGTP | 9658 | 1.000 | 0.017 | 0.918 | 1.082 | 6976 | 0.998 | 0.015 | 0.918 | 1.068 |

| SIZE | 9658 | 22.282 | 1.295 | 19.914 | 26.477 | 6976 | 22.174 | 1.180 | 19.914 | 26.477 |

| Lev | 9658 | 0.409 | 0.195 | 0.046 | 0.901 | 6976 | 0.398 | 0.190 | 0.046 | 0.901 |

| ROA | 9658 | 0.041 | 0.068 | −0.363 | 0.250 | 6976 | 0.043 | 0.069 | −0.363 | 0.250 |

| TobinQ | 9658 | 2.203 | 1.407 | 0.818 | 11.422 | 6976 | 2.154 | 1.362 | 0.818 | 11.422 |

| CASH | 9658 | 0.047 | 0.063 | −0.150 | 0.252 | 6976 | 0.054 | 0.064 | −0.150 | 0.252 |

| FIXED | 9658 | 0.178 | 0.137 | 0.004 | 0.689 | 6976 | 0.228 | 0.140 | 0.004 | 0.689 |

| GROWTH | 9658 | 0.172 | 0.333 | −0.552 | 2.499 | 6976 | 0.166 | 0.320 | −0.552 | 2.499 |

| AGE | 9658 | 2.092 | 0.764 | 0.693 | 3.367 | 6976 | 2.130 | 0.748 | 0.693 | 3.367 |

| MSHARE | 9658 | 0.165 | 0.345 | 0.000 | 20.171 | 6976 | 0.149 | 0.199 | 0.000 | 1.692 |

| HHI | 9658 | −0.792 | 0.249 | −1.020 | −0.216 | 6976 | −0.806 | 0.240 | −1.020 | −0.216 |

| INS | 9658 | 1.193 | 0.581 | 0.284 | 3.397 | 6976 | 1.056 | 0.416 | 0.284 | 3.397 |

| EDV | 9658 | 10.865 | 0.493 | 9.275 | 12.076 | 6976 | 10.915 | 0.529 | 9.275 | 12.101 |

| Variable | (1) | (2) |

|---|---|---|

| CGTP | CGTP | |

| θ0 | 0.0013 *** (0.0005) | 0.0143 * (0.0074) |

| Control/Control2 | Yes | Yes |

| Firms/Year FE | Yes | Yes |

| N | 16,617 | 15,884 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Low TU | High TU | Low EGC | High EGC | Low MC | High MC | |

| θ0 | 0.0011 (0.0007) | 0.0021 ** (0.0008) | 0.0011 (0.0009) | 0.0022 *** (0.0009) | 0.0022 ** (0.0008) | −0.0006 (0.0007) |

| Control/Control2 | Yes | Yes | Yes | Yes | Yes | Yes |

| Firms/Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 7814 | 8820 | 9815 | 6819 | 8258 | 8376 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Sensing | CGTP | Seizing | CGTP | Reconfiguring | CGTP | |

| SCD | 0.1894 *** (0.0236) | 0.0206 *** (0.0065) | 0.0608 * (0.0364) | |||

| SCD × Sensing | 0.0004 *** (0.0001) | |||||

| SCD × Seizing | 0.0020 * (0.0012) | |||||

| SCD × Reconfiguring | 0.0001 ** (0.0000) | |||||

| Control/Control2 | Yes | Yes | Yes | Yes | Yes | Yes |

| Firms/Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 16,634 | 16,634 | 13,961 | 13,961 | 13,411 | 13,411 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, T.; Feng, M.; Wu, H.; Shen, Y. From Digitalization to Sustainability: Does Supply Chain Digitalization Enhance Corporate Green Transformation Performance? Sustainability 2025, 17, 10159. https://doi.org/10.3390/su172210159

Wang T, Feng M, Wu H, Shen Y. From Digitalization to Sustainability: Does Supply Chain Digitalization Enhance Corporate Green Transformation Performance? Sustainability. 2025; 17(22):10159. https://doi.org/10.3390/su172210159

Chicago/Turabian StyleWang, Tao, Mengying Feng, Hui Wu, and Yang Shen. 2025. "From Digitalization to Sustainability: Does Supply Chain Digitalization Enhance Corporate Green Transformation Performance?" Sustainability 17, no. 22: 10159. https://doi.org/10.3390/su172210159

APA StyleWang, T., Feng, M., Wu, H., & Shen, Y. (2025). From Digitalization to Sustainability: Does Supply Chain Digitalization Enhance Corporate Green Transformation Performance? Sustainability, 17(22), 10159. https://doi.org/10.3390/su172210159