Abstract

Within the innovation-driven development paradigm, transportation infrastructure is playing an increasingly prominent role in shaping innovative activity. This paper examines the impact of transportation infrastructure on firm innovation by exploiting the staggered expansion of China’s High-Speed Rail (HSR) network as a quasi-natural experiment. Using a difference-in-differences framework, we show that the introduction of HSR significantly increases firms’ patenting activity, and the effect remains robust across a battery of alternative specifications and checks. Mechanism analyses suggest that HSR alleviates financing constraints, facilitates the mobility of highly skilled workers, and enhances the efficiency of industry-level resource allocation, thereby fostering firm innovation. Heterogeneity analyses reveal that the effect is most pronounced among firms with stronger R&D capacity, located farther from banks, non-state-owned enterprises, and SMEs. Finally, we document that the innovation-enhancing effect of HSR translates into higher firm competitiveness and profitability, underscoring the broader economic implications of transportation infrastructure development. This study deepens understanding of the mechanisms through which transportation infrastructure shapes innovation and offers important implications for optimizing the HSR network and enhancing the efficiency of innovation resource allocation. These findings offer valuable insights into how enhancing transportation infrastructure can drive firm innovation, boost corporate competitiveness, and contribute to the coordinated and sustainable development of regional economies.

1. Introduction

Transportation infrastructure, as a fundamental channel for the movement of production factors, has increasingly become a critical driver of sustainable economic growth [1]. As an efficient and environmentally sustainable mode of transportation, High-Speed Rail (HSR) replaces traditional transport systems, significantly reducing carbon emissions and advancing both low-carbon development and the green economy’s sustainable transformation. Moreover, by reducing the time and spatial distances between cities, HSR enhances the flow of people, capital, and information, thereby promoting the sustainable development of regional economies. Among various forms of infrastructure, HSR has emerged as a strategic priority worldwide, owing to its pronounced “space–time compression” effects and strong network externalities. In the United States, the Federal government introduced Program Vision for High-Speed Rail in America in 2009, followed by the High-Speed Intercity Passenger Rail (HSIPR) Program in 2010. These initiatives sought to improve the efficiency of medium-distance and long-distance travel, ease congestion, and stimulate innovation and employment. Likewise, the European Union’s 2011 Transport White Paper Roadmap to a Single European Transport Area—Towards a competitive and resource efficient transport system set ambitious targets to complete the pan-European TEN-T core network and significantly expand HSR coverage by 2030, with the broader aim of fostering regional integration and a unified transport market. China’s investment in HSR has been even more remarkable in both scale and speed. The Medium and Long-Term Railway Network Plan (revised in 2008) established the “Four Verticals and Four Horizontals” framework of passenger-dedicated lines, which was reinforced by the Twelfth Five-Year Plan for National Railway Development in 2012. The latter emphasized near-universal coverage of the rapid railway network across major freight hubs and cities with populations above 200,000. Since then, China has continuously accelerated HSR construction to enhance accessibility and facilitate regional market integration. According to the 2024 Railway Statistical Bulletin, the country’s HSR network reached 48,000 km of operating mileage by the end of 2024, making it by far the largest in the world and providing an unparalleled empirical setting to study the economic and innovative consequences of transportation infrastructure.

Innovation is widely regarded as a primary engine of economic growth and a cornerstone of sustained high-quality development. A central question in economics, therefore, is how to effectively stimulate firms’ innovative activity [2]. Yet firms often face substantial barriers to innovation, including financing frictions, shortages of skilled human capital, and impediments to knowledge diffusion [3,4,5]. These constraints significantly dampen firms’ capacity to generate and commercialize new ideas. To address these challenges, prior research has highlighted the role of policy instruments such as government R&D subsidies [6], tax incentives [7,8,9], and industry–university–research partnerships [10]. While these interventions can ease certain external constraints, they primarily rely on institutional arrangements and fiscal support. Their effectiveness in strengthening firms’ intrinsic R&D capacity and fostering a self-sustaining innovation drive, however, remains limited. Against this backdrop, the rapid expansion of transportation infrastructure opens new avenues for easing the constraints that impede firm innovation. Enhanced connectivity improves the information environment, lowers travel costs, and broadens firms’ access to critical resources [11,12]. At the same time, modern transport networks facilitate the cross-regional mobility of capital, skilled labor, and knowledge, thereby reinforcing the channels through which innovation can take place [13,14]. A systematic evaluation of the relationship between transportation infrastructure and firm innovation is thus both timely and necessary. Such an analysis not only enriches our understanding of how large-scale infrastructure investment shapes innovative activity, but also yields important policy insights for advancing strategies of high-quality economic development.

The literature identifies two primary channels through which transportation infrastructure shapes firm innovation. The first is a cost-reduction channel: by lowering travel and coordination costs, improved connectivity enhances the efficiency of firms’ R&D activities and stimulates innovation output [15,16,17]. The second is a knowledge-spillover channel: greater mobility and accessibility facilitate the exchange and recombination of ideas, fostering collaboration among R&D personnel and ultimately strengthening firms’ innovative capacity [18,19,20]. However, while prior studies underscore the roles of reduced travel costs and enhanced knowledge flows, they devote far less attention to the potential of HSR expansion to relax firms’ external financing constraints and to improve the efficiency of industry-level resource allocation. This paper extends the existing literature by explicitly examining these additional channels and by demonstrating how the opening of HSR stimulates innovation through them. In doing so, it advances the theoretical understanding of how transportation infrastructure shapes innovative activity and broadens the conceptual scope of this research agenda.

This paper exploits the staggered expansion of China’s HSR network as a quasi-natural experiment and applies a difference-in-differences (DID) approach to assess the impact of transportation infrastructure on firm innovation. Our baseline results show that HSR openings significantly increase firms’ innovative activity. Mechanism analyses indicate that HSR relaxes financing constraints, facilitates the mobility of highly skilled labor, and enhances the efficiency of industry-level resource allocation, thereby fostering innovation. We also uncover important heterogeneity in these effects. The innovation gains from HSR are especially pronounced among firms with stronger R&D capacity, those located farther from banks, non-state-owned enterprises, and SMEs. Finally, we examine the broader consequences of HSR-induced innovation and find that it not only strengthens firm competitiveness but also translates into higher profitability.

Relative to the existing literature, this paper makes four key contributions. First, while most prior studies on transportation infrastructure and innovation rely on city-level analyses [15,19,20], we exploit firm-level tax survey data from China to assess the impact of HSR development on innovation, thereby providing more fine-grained evidence. Second, we enrich the understanding of the mechanisms at work. Whereas the existing literature has primarily focused on reduced travel costs and enhanced knowledge flows [15,19,20], we additionally highlight the roles of relaxed financing constraints and improved resource allocation efficiency, thus broadening the theoretical framework and supplying novel mechanism-based evidence. Third, this paper demonstrates that the innovation effects of HSR are heterogeneous. The impact is especially pronounced among firms with stronger R&D capacity, those located farther from banks, non-state-owned enterprises, and SMEs. These results not only deepen our understanding of the mechanisms through which HSR fosters innovation but also provide novel empirical evidence on cross-firm differences in innovative responses. Fourth, given that innovation is a key driver of firm competitiveness and performance, we further investigate whether HSR-induced innovation translates into broader business outcomes. The evidence shows that the innovation gains from HSR strengthen firm competitiveness and lead to higher profitability. Taken together, these findings advance the literature on transportation infrastructure and innovation while also offering policy-relevant lessons for countries considering large-scale infrastructure investments.

The remainder of the paper is organized as follows. Section 2 reviews the related literature and outlines the research hypotheses. Section 3 describes the data, variables, and empirical strategy. Section 4 reports the baseline results and robustness checks, and Section 5 investigates the underlying mechanisms. Section 6 explores heterogeneity across firms and industries, while Section 7 examines the effects on firm competitiveness and performance. Section 8 concludes.

2. Theoretical Analysis and Hypothesis

According to classical theories of economic growth, transportation infrastructure serves as an important exogenous determinant of regional economic development [21]. As a major form of infrastructure featuring pronounced time–space compression effects, the expansion of HSR has influenced firm innovation through several channels, including an improved financing environment, greater labor mobility, and more efficient resource allocation.

First, HSR shortens the distance between banks and firms as well as between investors and investees, thereby reducing information acquisition costs and mitigating financing asymmetries [11,22]. This improves firms’ access to credit [23], facilitates face-to-face interactions between venture capitalists and entrepreneurs, and increases the likelihood of securing venture capital [24]. Second, HSR lowers barriers to cross-regional labor mobility, encouraging the flow and concentration of highly skilled human capital [13]. This not only enhances matching efficiency but also strengthens firms’ ability to absorb and transform external knowledge. Third, HSR reduces the cost of factor mobility across regions [25], promotes regional market integration, and intensifies competition [14]. As a result, production factors shift more rapidly toward high-productivity firms, raising industry-level resource allocation efficiency [26]. Improved allocation efficiency enables these firms to attract additional capital and talent, thereby reinforcing investment in R&D and innovation. Based on this analysis, we propose the following hypothesis:

H1.

The opening of HSR fosters firm innovation.

2.1. Alleviating the Financing Constraint Mechanism

Credit-rationing theory posits that information asymmetry prevents banks from accurately assessing borrowers’ underlying credit risk, thereby giving rise to credit rationing and financing constraints [27]. Relationship-lending theory further emphasizes that greater geographic distance between banks and firms impairs banks’ ability to acquire soft information, amplifying information asymmetries [23,28]. Consequently, reducing bank–firm distance and facilitating more frequent face-to-face interactions can mitigate financing frictions and expand firms’ access to credit for innovation.

Despite the accelerating digital transformation of the financial system, with online channels substantially enhancing information transmission, service efficiency, and financial inclusion, both information economics and relationship-lending frameworks underscore that the acquisition and assessment of soft information continue to rely predominantly on in-person interactions [23,28]. Soft information refers to qualitative, context-specific knowledge about borrowers—such as entrepreneurs’ reputations, managerial competence, innovative potential, and business judgment—that cannot be fully captured or quantified through digital data or remote exchanges [29]. Hence, face-to-face interactions remains indispensable for establishing credit relationships, screening borrower quality, and building mutual trust.

The expansion of transportation infrastructure—especially the opening of HSR—has opened a new channel that facilitates face-to-face interactions and thereby eases firms’ financing constraints. On the one hand, HSR reduces information asymmetries between banks and firms by lowering travel time, increasing the frequency of face-to-face interactions, and enabling loan officers to more efficiently gather soft information on firms’ operations and managerial quality [22]. Better access to such information improves the accuracy of credit assessments, allows banks to make more informed lending decisions [30] and ultimately enhances firms’ access to external finance.

On the other hand, the opening of HSR mitigates information asymmetries between venture capitalists and firms [11], thereby increasing the likelihood of firms obtaining venture capital financing [24]. By improving cross-regional travel efficiency, HSR enables venture capitalists to conduct more frequent and convenient face-to-face meetings with potential investees [11]. Such interactions provide investors with richer soft information—ranging from managerial ability and market prospects to firms’ R&D commitments—thus alleviating the frictions that commonly hinder remote investment [31,32].The reduction in information asymmetry improves the quality of investment decisions, lowers uncertainty and risk, and stimulates venture capital activity [24]. This process ultimately eases firms’ external financing constraints and creates more favorable conditions for innovation. Based on this analysis, we propose the following hypothesis:

H2.

The opening of HSR promotes firm innovation by alleviating external financing constraints.

2.2. Enhancing the Human Capital Mechanism

Endogenous growth theory posits that the accumulation of human capital and the diffusion of knowledge are fundamental engines of technological progress and innovation [33]. Building on this view, the knowledge-spillover framework emphasizes that geographic proximity and face-to-face interactions facilitate the exchange and absorption of tacit knowledge that cannot be effectively transmitted through remote or digital channels [34]. Although digital technologies have advanced rapidly—making remote communication, virtual collaboration, and online interviews increasingly common and efficient—such modes of interaction are primarily suited to conveying standardized and codified information. In contrast, when exchanges involve trust building, creative collaboration, or the transfer of tacit and experience-based knowledge, face-to-face interactions remains essential.

Prior research underscores the distinctive role of face-to-face interactions in fostering trust, interpreting nonverbal cues, and transmitting complex tacit knowledge [35]. In the recruitment of highly skilled workers and the selection of innovation-intensive positions, face-to-face interactions enable employers to more accurately evaluate candidates’ abilities, creativity, and cultural compatibility, while facilitating the rapid formation of mutual trust and willingness to collaborate. Accordingly, as an efficient and convenient mode of interregional transport, HSR serves as a crucial mechanism for enhancing the mobility and matching efficiency of high-quality human capital.

On the one hand, the opening of HSR has shortened interregional distances, eliminated traditional time–space constraints, and facilitated the cross-regional mobility of highly skilled labor [13]. Specifically, the expansion of HSR allows job seekers from other regions to travel more conveniently to destination cities for interviews and recruitment events. This reduces the time costs of job search and hiring while fostering more frequent interactions between applicants and employers. By conducting interviews and evaluations in person, firms can more precisely assess candidates’ abilities and potential, thereby enhancing the efficiency of talent matching in the labor market [36].

On the other hand, the opening of HSR has substantially increased employees’ opportunities to participate in external training, industry conferences, and technical workshops [13], while markedly reducing the travel costs of interregional learning and exchange [15]. These improvements allow employees to gain easier access to frontier technologies and industry best practices, thereby enabling firms to absorb external knowledge, foster organizational learning, and facilitate technology transfer—ultimately strengthening their innovative capacity [10]. Based on this analysis, we propose the following hypothesis:

H3.

The opening of HSR promotes firm innovation by increasing the input of highly skilled talents.

2.3. Resource Allocation Efficiency Mechanism Enhancing the Resource Allocation Mechanism

Innovation competition theory posits that competitive pressure drives firms to sustain their market positions through ongoing technological innovation [37]. In parallel, resource misallocation theory argues that when capital and labor fail to flow toward high-productivity firms, aggregate efficiency declines [26]. By reducing the costs of interregional factor mobility and mitigating spatial transaction frictions, the expansion of HSR promotes the reallocation of resources from low-productivity to high-productivity sectors, thereby boosting overall industrial efficiency and invigorating firms’ innovation activity.

On the one hand, the opening of HSR reduces geographical distances and time costs, lowering the expenses associated with the cross-regional movement of labor, capital, and intermediate goods [25]. This enhances the mobility of production factors across a wider spatial area [14]. Market selection mechanisms drive productive resources toward firms with higher marginal returns, while inefficient firms progressively exit the market. Such reallocation shifts resources from low-productivity to high-productivity enterprises, thereby alleviating intra-industry resource misallocation [38].

On the other hand, the opening of HSR has significantly enhanced regional market integration, reducing spatial fragmentation and administrative barriers. This expansion broadens firms’ participation in competition and intensifies rivalry across regions [14]. Competitive selection compels low-productivity firms to upgrade technologically or exit the market, freeing resources for reallocation. High-productivity firms, in turn, strengthen their competitiveness through technological upgrading and scale expansion, drawing in greater amounts of capital and labor. As a result, industry-level resource allocation efficiency rises, and firms’ incentives to innovate are further reinforced [26]. Based on this analysis, we propose the following hypothesis:

H4.

The opening of HSR promotes firm innovation by improving the efficiency of resource allocation.

3. Research Design

3.1. Model Specification

This paper leverages the quasi-natural experiment of the opening of HSR to examine the causal relationship between HSR openings and firm innovation using a DID approach. The benchmark model is specified as follows:

Here, i denotes the firm, and t represents the year. lnApply refers to the total number of patent applications submitted by the firm. HSR is the dummy variable for the opening of HSR, while includes the control variables. represents the firm fixed effects, and denotes the year fixed effects. is the error term. The coefficient is the key parameter of interest in this study. To account for heteroscedasticity and serial correlation, standard errors are clustered at the firm level.

3.2. Variable Settings

Dependent variable: The dependent variable is the total number of patent applications filed by the firm. Following Hall et al. (2001) [39], we take the natural logarithm of (1 + total patent applications).

Independent variable: The dummy variable for HSR is defined as follows: we treat the opening of HSR as an exogenous shock, using the interaction term between treatment group cities and the policy implementation time to capture the treatment effect of HSR. If a city opened HSR in a given year or later, the value of HSR is 1; otherwise, it is 0.

Control variables: The control variables include both firm-level and city-level variables. At the firm level, these include firm size, return on assets, debt-to-asset ratio, and total asset turnover. Specifically, firm size is measured as the natural logarithm of (1 + the firm’s total output value) in the current year. Return on assets is calculated as total profit divided by average assets for the year. The debt-to-asset ratio is defined as average annual liabilities divided by average annual assets. Total asset turnover is computed as operating income divided by average assets for the year. At the city level, control variables include the urban GDP growth rate, the share of the secondary industry, and the level of urban financial development. Specifically, the urban GDP growth rate is measured as the real GDP growth rate at constant prices. The share of the secondary industry is calculated as the value added of the secondary industry to regional GDP. The urban financial development level is proxied by the ratio of the RMB deposit and loan balance of financial institutions to regional GDP.

3.3. Data

This study draws on three primary sources of data: China’s tax survey data, firm-level innovation data, and city-level data. Firm-level innovation data are obtained from the National Intellectual Property Administration, while city-level variables come from the China Urban Statistical Yearbook. The sample covers the period from 2007 to 2016.

To ensure data quality, we exclude observations with missing values in the dependent, independent, or control variables, as well as firms observed for only a single year. Continuous variables are winsorized at the 5% and 95% levels. The final dataset comprises 2,409,315 firm-year observations. Table 1 reports descriptive statistics for the main variables used in the benchmark model.

Table 1.

Descriptive statistics.

4. Empirical Results

4.1. Baseline Estimates

In the baseline regression, we estimate the impact of HSR openings on firm innovation using the DID framework, as specified in equation (1). Table 2 presents the benchmark regression results. The dependent variable in columns (1) and (2) is the total number of patent applications filed by the firm. Column (1) reports results with only firm and year fixed effects, while column (2) includes control variables in addition to the fixed effects from column (1). The HSR coefficients in both columns are positive and statistically significant at the 1% level, indicating that the opening of HSR significantly promotes patent applications by firms. We consider the results in column (2) as the benchmark results, thereby validating Hypothesis 1.

Table 2.

Baseline regression.

We use the estimates in column (2) as the benchmark to interpret the economic significance of HSR expansion on firm innovation. The coefficient of 0.002 indicates that HSR openings increase the logarithm of patent applications by about 0.2 percent. Although this effect is highly statistically significant, its economic magnitude is modest, suggesting that the innovation-promoting impact of HSR construction remains limited. This likely reflects the fact that most HSR lines were introduced between 2013 and 2016, leaving a relatively short post-treatment window. Moreover, since innovation outcomes often lag behind R&D investment, the observed effect may represent only the initial stage of accumulation and transformation, with the full impact yet to unfold.

4.2. Parallel Trend Tests

The key assumption for using the multi-period DID model is that the treatment and control groups follow parallel trends prior to the policy intervention, i.e., the parallel trend assumption holds. To test this assumption, we have constructed the following model:

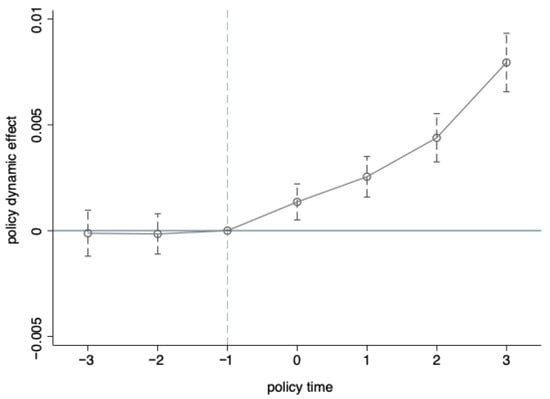

In this model, if firm i is located in a city where HSR has been introduced, and the policy has been in effect for k years, then is set to 1. The control variables used are consistent with the baseline results. The dynamic effects are presented in Figure 1.

Figure 1.

Dynamic Treatment Effects.

As shown in Figure 1, the estimated coefficients for the years prior to the opening of the HSR are not statistically significant, indicating no notable difference between the treatment and control groups. This suggests that the parallel trends assumption holds. After the policy implementation, the treatment effect coefficient shows a significant upward trend, with all estimates being statistically significant. This demonstrates that the opening of HSR has a significant positive effect on firm innovation.

4.3. Heterogeneous Treatment Effects

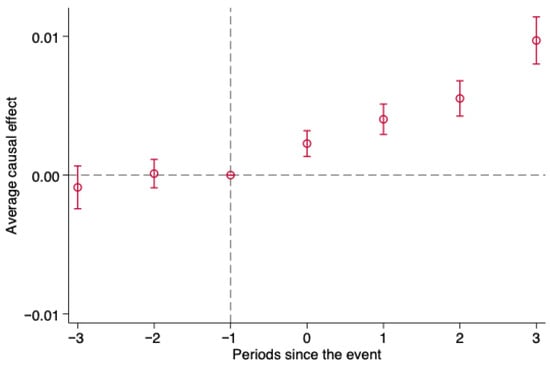

Given the staggered implementation of HSR openings, the benchmark regression employs the staggered DID method for estimation. However, this approach has certain limitations. Specifically, in a staggered DID setting, individuals with a later treatment period may serve as the control group for those with an earlier treatment period, potentially leading to heterogeneous treatment effects and biased estimates [40].

To address this issue, we adopt the interaction-weighted estimator proposed by Sun and Abraham (2021) [41] to re-estimate the model, thereby mitigating the heterogeneity in treatment effects. The corresponding results for the dynamic treatment effects are presented in Figure 2. As shown in Figure 2, the heterogeneous robust estimation results align with the benchmark dynamic effects, confirming the robustness of the benchmark findings.

Figure 2.

Estimated heterogeneous treatment effects.

4.4. PSM-DID

Given that the planning and selection of HSR lines are not entirely random, they may be influenced by factors such as economics, politics, and geography. This selection process could create systematic differences between cities with and without HSR, leading to potential endogeneity issues. To address potential selection bias from non-random assignment, we apply a Propensity Score Matching–Difference in Differences (PSM-DID) approach to more precisely identify the causal impact of HSR expansion. In the first step, propensity score matching (PSM) constructs treatment and control groups with comparable pre-treatment characteristics. In the second step, the DID framework estimates the net effect of HSR openings on firm innovation, thereby mitigating endogeneity concerns associated with sample selection. The control variables used in Model (1) serve as matching variables, and we employ 1:1, 1:2, or 1:3 nearest neighbor matching. The matching results are presented in Table 3. The coefficient remains significantly positive, confirming the robustness of our results.

Table 3.

PSM-DID results.

4.5. Instrumental Variable Method

We implement an instrumental variable (IV) estimation to ensure causal identification. Following Dong et al. (2020) [13], we use geographical slope as the instrument for HSR openings. Specifically, we calculate the altitude difference between the maximum and minimum altitudes within each 10 km × 10 km grid in each city. The average altitude difference across all grids within the city is then used to compute the geographical slope index (Slope). Since this variable is time-invariant, we generate a time-varying instrumental variable by interacting the slope variable with the year dummy variable for two-stage least squares (2SLS) estimation.

There are two main reasons for choosing geographical slope as an instrument. First, the cost and feasibility of HSR construction are closely linked to topography. Building railways in mountainous or hilly areas with steep slopes is costly and technically challenging due to the need for tunnels and bridges. In contrast, construction in areas with flatter terrain and gentler slopes is more economically feasible. Thus, HSR tends to be located in regions with smaller slopes, ensuring a strong correlation between geographical slope and the likelihood of rail openings, which meets the correlation assumption. Second, geographical slope is a natural feature formed millions of years ago and has no direct connection to contemporary enterprise innovation decisions. It influences the feasibility of railway construction and indirectly affects the location of rail lines, thereby satisfying the exogeneity assumption.

In the first stage of the IV regression, we use the interaction term between the Slope and the year dummy variable as the core instrumental variable, while controlling for all variables in model (1) to predict the likelihood of HSR opening. In the second stage, we use the predicted values from the first stage as the key explanatory variable and re-estimate model (1). The results in column (1) of Table 4 show that the coefficients of the instrumental variable are statistically significant, with an F-statistic exceeding the commonly used threshold. The results confirm a strong relationship between the instrument and the likelihood of HSR opening. The results in column (2) of Table 4 further show that the coefficient for the predicted value of HSR opening is significantly positive at the 1% level. This suggests that after addressing endogeneity, the opening of HSR continues to have a significant positive effect on firm innovation, thereby further confirming the robustness of the benchmark results.

Table 4.

Instrument variables method results.

4.6. Robustness Tests

4.6.1. Excluding the Influence of Other Policies

Previous studies have demonstrated that innovation-driven policies, technological advances, and the development of information technology can also stimulate firm innovation [42,43,44]. If not accounted for, these factors may introduce omitted variable bias. To address this, we control for the effects of innovation policy support and technological changes by including National High-tech Zones, National Independent Innovation Demonstration Zones, and Broadband China Pilot Policies in the benchmark regression. These results are presented in columns (1)–(3) of Table 5. We also include indicators of regional digital development, such as broadband and fixed-line telephone penetration rates at the urban level, to control for the impact of digital infrastructure on innovation. These results are presented in columns (4) and (5) of Table 5. The HSR coefficients remain significantly positive, indicating that the results are robust even after controlling for the effects of other policies. This reinforces the finding that the opening of HSR continues to significantly promote firm innovation, even when accounting for other policy influences.

Table 5.

Results after excluding other policies effects.

4.6.2. Other Robustness Tests

To further test the robustness of the benchmark results, we conduct several additional checks. First, we use R&D investment as an alternative measure of innovation and re-estimate the regression. Second, we apply a Poisson pseudo-maximum likelihood (PPML) estimator with firm fixed effects to address the presence of zero-inflated patent observations and heteroskedasticity. Third, we include urban fixed effects to account for unobservable regional factors that do not vary over time. Fourth, standard errors are two-way clustered at the city and year levels to control for spatial correlation across cities and contemporaneous shocks over time. Fifth, to address possible time lags in the policy effect, we exclude cities that opened HSR in 2016, ensuring the policy has had sufficient time to take effect. Sixth, recognizing that provincial capitals may have unique advantages in resource access and infrastructure, we exclude these cities to avoid potential bias in the estimates. The results of these robustness tests are reported in Table 6. In all cases, the estimated HSR coefficients remain significantly positive, confirming the robustness of our findings.

Table 6.

Other robustness test.

4.6.3. Placebo Tests

As an additional robustness check, we implement a placebo test based on the approach of Ferrara et al. (2012) [45]. In this test, the opening times of HSR and the cities are randomly assigned, and multiple DID regressions are performed. The process is repeated 1000 times to generate the regression coefficients and plot the kernel density.

As shown in Figure 3, the placebo test coefficients follow a normal distribution with a mean of zero. Moreover, there is a significant difference between the benchmark regression coefficient and those obtained under random policy shocks. This suggests that the benchmark results are not driven by random fluctuations or unobservable factors, reinforcing the robustness of our findings.

Figure 3.

Results of placebo tests. Notes: The dashed line indicates the actual estimated effect, while the distribution represents the placebo estimates from the simulated samples.

5. Mechanism Analysis

As shown in Section 4.1, the HSR has significantly fostered firm innovation. This section explores the mechanisms through which HSR impacts firm innovation. As hypothesized in Section 2, HSR promotes firm innovation by easing financing constraints, facilitating the influx of highly skilled talent, and enhancing resource allocation efficiency.

5.1. Financing Constraint Mitigation Mechanism

To assess the impact of HSR openings on external financing constraints, we replace the dependent variable with a measure of external financing constraints (EFC). Specifically, we define this indicator as 1 minus the ratio of the difference between year-end current assets and year-end current liabilities to year-end total assets. A higher value of this indicator reflects greater difficulty for the firm in obtaining external financing, indicating stronger financing constraints. The estimation results are displayed in column (1) of Table 7. The HSR coefficient is significantly negative, suggesting that the opening of HSR significantly reduced the EFC index, thereby alleviating firms’ external financing constraints. This supports Hypothesis 2.

Table 7.

Mechanism analysis.

5.2. High-Skilled Talent Mechanism

To examine whether the opening of HSR affects firms’ investment in high-skilled talent, we replace the dependent variable with the firm’s average salary. The average salary serves as a proxy for the firm’s investment in highly skilled talent, with higher salaries indicating a greater concentration of skilled workers. This variable is expressed as the natural logarithm of (1 + average salary). The estimation results are displayed in column (2) of Table 7. The HSR coefficient is significantly positive at the 1% level, suggesting that the opening of HSR has notably increased firms’ investment in high-skilled talent. This confirms Hypothesis 3.

5.3. Resource Allocation Efficiency Mechanism

To investigate the effect of HSR openings on resource allocation efficiency, we replace the dependent variable with industry resource allocation efficiency. Following Liu et al. (2021) [46], we use industry distortion as a proxy for resource allocation efficiency. Specifically, greater industry distortion indicates lower efficiency in resource allocation. This variable is expressed as the natural logarithm of (1 + industry distortion). The estimation results are displayed in column (3) of Table 7. The HSR coefficient is significantly negative at the 1% level, suggesting that the opening of HSR has notably reduced industry distortions, thereby enhancing resource allocation efficiency. This supports Hypothesis 4.

6. Heterogeneity Analysis

The previous analysis shows that the opening of HSR significantly reduces financing constraints, attracts highly skilled talent, and improves resource allocation efficiency, thereby promoting firm innovation. This section investigates the heterogeneous effects of HSR openings on firm innovation across four dimensions: R&D capabilities, external financing constraints, ownership structure, and enterprise size.

6.1. Enterprise R&D Capabilities

Previous research indicates that highly skilled human capital plays a crucial role in internal R&D within firms. Internal R&D depends not only on the professional skills and creativity of R&D personnel but also on their ability to absorb, transform, and apply external knowledge [47]. As a result, firms with superior R&D capability can attract and retain a greater share of human capital, which in turn strengthens their innovative capacity. The previous analysis suggests that HSR openings lead firms to invest more in highly skilled human capital. Therefore, we hypothesize that the effect of HSR on enhancing innovation capabilities is more pronounced in firms with superior internal R&D capabilities.

We measure internal R&D using their expenditures on developing new products, technologies, and processes, and interact HSR with RD to capture heterogeneous effects across firms with different levels of R&D intensity. The estimation results are displayed in column (1) of Table 8. The coefficient on HSR × RD is positive and significant at the 1% level, indicating that the innovation-enhancing impact of HSR expansion strengthens with greater firm R&D capability. This evidence further supports the view that HSR promotes innovation by fostering the accumulation of highly skilled human capital within firms.

Table 8.

Heterogeneity test.

6.2. External Financing Constraints for Enterprises

Existing research demonstrates that the distance between banks and firms significantly influences bank credit decisions. A shorter distance allows banks to more easily gather soft information about firms, reducing information asymmetry and improving credit access [23]. In contrast, firms located farther from banks face greater information asymmetry, making it more challenging to secure bank credit, thereby increasing their financing constraints. The previous analysis indicates that the opening of HSR alleviates external financing constraints. Thus, we hypothesize that HSR openings have a more pronounced effect on alleviating financing constraints for firms located farther from banks, thereby boosting their innovation potential.

To measure the distance between banks and firms, we first gather the addresses of bank branches for each year from the financial license information query system of the China Banking and Insurance Regulatory Commission. Using internet maps and geocoding API technology, we extract the longitude and latitude coordinates for all bank branches. Similarly, we apply the same method to convert firm addresses into geographic coordinates. Based on the approach by Bellucci et al. (2013) [48], we calculate the geographical distance between each firm and all bank branches, selecting the shortest distance as the firm’s distance from the nearest bank. We then examine how the impact of HSR on innovation varies with the geographic distance between firms and banks by interacting HSR with bank–firm distance. The estimation results are displayed in column (2) of Table 8. The coefficient on HSR × Distance is positive and statistically significant at the 1% level, indicating that the innovation-enhancing effect of HSR expansion intensifies as the distance between banks and firms increases. This evidence further supports the mechanism that HSR fosters firm innovation by mitigating external financing constraints.

6.3. The Ownership Structure of the Enterprises

Existing research highlights ownership discrimination in China’s credit market, where non-state-owned enterprises (NOSOEs) face greater external financing constraints than state-owned enterprises (SOEs) [49]. The previous analysis suggests that the opening of HSR alleviates financing constraints. Therefore, we hypothesize that the opening of HSR will have a more significant impact on alleviating financing constraints for NOSOEs, thereby enhancing their innovation capacity.

In this study, we match tax enterprise survey data with industrial and commercial enterprise registration data based on firm names. Enterprises classified as wholly state-owned, state-controlled, or other state-owned categories are defined as SOEs, while all other firms are considered NOSOEs. We define a dummy variable NOSOEs that equals one for NOSOEs and zero otherwise. We then examine how the impact of HSR on innovation varies with ownership type by interacting HSR with the NOSOEs indicator. The estimation results are displayed in column (3) of Table 8. The coefficient on HSR × NOSOEs is positive and highly significant at the 1% level, indicating that the innovation-enhancing impact of HSR is markedly stronger for NOSOEs than for their SOEs. This finding provides further evidence that HSR expansion fosters firm innovation by alleviating external financing constraints.

6.4. Enterprise Size

Prior studies emphasize that firm size is a key determinant of both financing constraints and innovation activities. Small and medium-sized enterprises (SMEs), in particular, tend to face more binding external financing frictions than large firms [50], constraining their ability to sustain innovation when funding is limited. As shown earlier, HSR expansion eases firms’ external financing constraints. Accordingly, we expect the mitigating effect of HSR on financing constraints—and its subsequent innovation-enhancing impact—to be more pronounced for SMEs.

According to the official classification of the National Bureau of Statistics of China (NBS), firms are categorized into SMEs and other enterprises. Specifically, firms with 300–1000 employees and revenue with RMB 20–400 million as medium-sized; those with 20–300 employees and revenue with RMB 3–20 million as small. We construct a dummy variable SMEs that equals one for small and medium-sized enterprises and zero otherwise. We then examine how the impact of HSR on innovation varies with firm size by interacting HSR with the SME indicator. The estimation results are displayed in column (4) of Table 8. The coefficient on HSR × SMEs is positive and highly significant at the 1% level, indicating that the innovation-enhancing effect of HSR expansion is significantly stronger among SMEs than other firms.

7. Further Analysis

Existing research emphasizes that innovation is a key driver of firm growth and market competitiveness [51,52,53]. By achieving breakthroughs in technology, products, or services, firms can gain a competitive edge and improve their business performance. This section examines whether the innovation-enhancing effect of HSR has impacted firms’ market competitiveness and business performance. The empirical specification is constructed as follows:

In the model, lny denotes firm performance, and all other variables are defined as in the baseline specification. Specifically, captures the direct effect of HSR expansion on firm performance, while represents the indirect effect transmitted through firm innovation. The coefficient is the main focus of this analysis.

Table 9 reports the regression results. Column (1) presents the baseline estimates, and columns (2)–(4) display the mediation results. We use the Herfindahl–Hirschman Index (HHI) as a proxy for market competition, defined as the sum of squared market shares based on firms’ operating revenues within each industry. A higher HHI denotes greater concentration and lower competition intensity. As shown in column (2), the coefficient on the innovation interaction term is positive and significant at the 1% level, suggesting that the innovation-enhancing effect of HSR expansion strengthens firms’ market competitiveness. We then use operating revenue and net profit margin as indicators of firm performance. The results, reported in columns (3)–(4), show that the coefficients on lnApply × HSR remain positive and statistically significant, indicating that the innovation improvements induced by HSR expansion substantially increase firms’ revenue and enhance their profitability.

Table 9.

Further analysis.

8. Conclusions and Policy Implications

8.1. Conclusions

As an efficient and environmentally sustainable mode of transportation, HSR reduces the time and spatial distances between cities, thereby enhancing the flow of people, capital, and information, which in turn promotes the sustainable development of regional economies. Innovation is a core driver of sustainable economic growth, and examining HSR’s impact on innovation provides deeper insights into its pivotal role in fostering long-term, sustainable economic development. This paper examines the impact and mechanisms of HSR openings on firm innovation using survey data from Chinese tax enterprises between 2007 and 2016. Additionally, it explores the effects of HSR on firm competitiveness and business performance. The findings indicate that: First, HSR openings significantly increase patent applications by firms, with this result robust across various tests. Second, mechanism tests show that easing financing constraints, increasing the supply of highly skilled talent, and improving resource allocation efficiency are the key channels through which HSR enhances firm innovation. Third, heterogeneity analysis reveals that the innovation-enhancing effect of HSR is particularly strong in firms with stronger internal R&D capabilities, those farther from banks, non-state-owned enterprises and SMEs. Finally, further analysis shows that the innovation-driven effect of HSR not only significantly boosts firm competitiveness but also improves profitability.

8.2. Policy Implications

Based on these findings, we offer the following policy recommendations. First, continue expanding the HSR network and other transportation infrastructure, particularly in the central and western regions and underdeveloped areas. This expansion will promote regional economic integration. Second, establish a comprehensive system to support financial services and talent mobility, encouraging the expansion of financial institutions into underserved areas and enhancing cross-regional talent development and exchange. These efforts will amplify the institutional benefits of high-speed rail, facilitating firms’ access to external financing and skilled labor, thereby laying the groundwork for the efficient integration and optimal allocation of regional innovation resources.

Third, implement differentiated policy tools and targeted support. For firms with weaker R&D capabilities and greater distances from banks, policies such as R&D subsidies, industry-academia partnerships, and strategic allocation of financial resources should be introduced to reduce innovation barriers and lower financing costs. For non-state-owned enterprises and highly competitive industries, the credit environment should be optimized, taxes reduced, and innovation funds established to alleviate external constraints and foster long-term innovation.

Finally, efforts should be made to promote the transformation and dissemination of innovation outcomes. The government can facilitate the creation of platforms for showcasing and trading innovation results in cities along the high-speed rail routes, guide the accelerated industrialization of research, and support firms in upgrading to high value-added and emerging industries. Simultaneously, stronger coordination among industrial, regional, and technological policies should be prioritized to foster a mutually reinforcing relationship between transportation infrastructure and industrial innovation, maximizing the economic dividends generated by HSR.

8.3. Limitations and Suggestions for Future Research

Despite our best efforts, several limitations remain, which also open avenues for further inquiry. (1) Innovation measurement: We measure innovative output by patent counts, which capture the breadth of innovation but not its quality or economic value. Future research should incorporate richer indicators—such as forward citations—to evaluate how HSR openings affect the quality of innovation more comprehensively. (2) Time window: Our sample covers 2007–2016, corresponding to the backbone construction phase of China’s HSR network. The findings therefore primarily reflect early-stage impacts as regions transitioned from no HSR to initial access. Since 2017, the network has entered a stage of densification and maturation, during which both mechanisms and effect magnitudes may have shifted (e.g., nonlinear amplification or diminishing marginal returns). Extending the analysis to later years would allow future research to capture medium- and long-term dynamics and to assess heterogeneity across HSR network centrality and market accessibility.

Author Contributions

Conceptualization, X.Z.; methodology, X.Z.; software, X.Z.; validation, X.Z. and T.C.; formal analysis, X.Z. and T.C.; investigation, X.Z.; resources, X.Z.; data curation, X.Z.; writing—original draft preparation, X.Z.; writing—review and editing, X.Z. and T.C.; visualization, X.Z. and T.C.; supervision, X.Z. and T.C.; project administration, X.Z. and T.C.; funding acquisition, X.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Banerjee, A.; Duflo, E.; Qian, N. On the Road: Access to Transportation Infrastructure and Economic Growth in China. J. Dev. Econ. 2020, 145, 102442. [Google Scholar] [CrossRef]

- Acemoglu, D.; Akcigit, U.; Alp, H.; Bloom, N.; Kerr, W. Innovation, Reallocation, and Growth. Am. Econ. Rev. 2018, 108, 3450–3491. [Google Scholar] [CrossRef]

- Hall, B.H.; Lerner, J. The Financing of R&D and Innovation. In Handbook of the Economics of Innovation; Elsevier: Amsterdam, The Netherlands, 2010; Volume 1, pp. 609–639. ISBN 978-0-444-51995-5. [Google Scholar]

- Kerr, W.R.; Nanda, R. Financing Innovation. Annu. Rev. Financ. Econ. 2015, 7, 445–462. [Google Scholar] [CrossRef]

- Mao, Y.; Wang, J.J. Access to Finance and Technological Innovation: Evidence from Pre-Civil War America. J. Financ. Quant. Anal. 2023, 58, 1973–2023. [Google Scholar] [CrossRef]

- Cao, L.; Jiang, H.; Li, G.; Zhu, L. Haste Makes Waste? Quantity-Based Subsidies under Heterogeneous Innovations. J. Monet. Econ. 2024, 142, 103517. [Google Scholar] [CrossRef]

- Akcigit, U.; Grigsby, J.; Nicholas, T.; Stantcheva, S. Taxation and Innovation in the Twentieth Century. Q. J. Econ. 2021, 137, 329–385. [Google Scholar] [CrossRef]

- Atanassov, J.; Liu, X. Can Corporate Income Tax Cuts Stimulate Innovation? J. Financ. Quant. Anal. 2020, 55, 1415–1465. [Google Scholar] [CrossRef]

- Chen, Z.; Liu, Z.; Suárez Serrato, J.C.; Xu, D.Y. Notching R&D Investment with Corporate Income Tax Cuts in China. Am. Econ. Rev. 2021, 111, 2065–2100. [Google Scholar] [CrossRef]

- Hsu, D.H.; Hsu, P.-H.; Zhou, K.; Zhou, T. Industry-University Collaboration and Commercializing Chinese Corporate Innovation. Manag. Sci. 2024, 71, 5351–5375. [Google Scholar] [CrossRef]

- Chen, D.; Ma, Y.; Martin, X.; Michaely, R. On the Fast Track: Information Acquisition Costs and Information Production. J. Financ. Econ. 2022, 143, 794–823. [Google Scholar] [CrossRef]

- Herpfer, C.; Mjøs, A.; Schmidt, C. The Causal Impact of Distance on Bank Lending. Manag. Sci. 2023, 69, 723–740. [Google Scholar] [CrossRef]

- Dong, X.; Zheng, S.; Kahn, M.E. The Role of Transportation Speed in Facilitating High Skilled Teamwork across Cities. J. Urban Econ. 2020, 115, 103212. [Google Scholar] [CrossRef]

- Wu, M.; Yu, L.; Zhang, J. Road Expansion, Allocative Efficiency, and pro-Competitive Effect of Transport Infrastructure: Evidence from China. J. Dev. Econ. 2023, 162, 103050. [Google Scholar] [CrossRef]

- Berger, T.; Prawitz, E. Collaboration and Connectivity: Historical Evidence from Patent Records. J. Urban Econ. 2024, 139, 103629. [Google Scholar] [CrossRef]

- Kang, M.; Li, Y.; Zhao, Z.; Song, M.; Yi, J. Travel Costs and Inter-City Collaborative Innovation: Evidence of High-Speed Railway in China. Struct. Change Econ. Dyn. 2023, 65, 286–302. [Google Scholar] [CrossRef]

- Lin, Y. Travel Costs and Urban Specialization Patterns: Evidence from China’s High Speed Railway System. J. Urban Econ. 2017, 98, 98–123. [Google Scholar] [CrossRef]

- Agrawal, A.; Galasso, A.; Oettl, A. Roads and Innovation. Rev. Econ. Stat. 2017, 99, 417–434. [Google Scholar] [CrossRef]

- Long, C.X.; Yi, W. Information Effects of High-Speed Rail: Evidence from Patent Citations in China. China Econ. Rev. 2024, 84, 102115. [Google Scholar] [CrossRef]

- Wang, J.; Cai, S. The Construction of High-Speed Railway and Urban Innovation Capacity: Based on the Perspective of Knowledge Spillover. China Econ. Rev. 2020, 63, 101539. [Google Scholar] [CrossRef]

- Aschauer, D.A. Is Public Expenditure Productive? J. Monet. Econ. 1989, 23, 177–200. [Google Scholar] [CrossRef]

- Geng, C.; Li, D.; Sun, J.; Yuan, C. Functional Distance and Bank Loan Pricing: Evidence from the Opening of High-Speed Railway in China. J. Bank. Financ. 2023, 149, 106810. [Google Scholar] [CrossRef]

- Agarwal, S.; Hauswald, R. Distance and Private Information in Lending. Rev. Financ. Stud. 2010, 23, 2757–2788. [Google Scholar] [CrossRef]

- Bernstein, S.; Giroud, X.; Townsend, R.R. The Impact of Venture Capital Monitoring. J. Financ. 2016, 71, 1591–1622. [Google Scholar] [CrossRef]

- Gibbons, S.; Machin, S. Valuing Rail Access Using Transport Innovations. J. Urban Econ. 2005, 57, 148–169. [Google Scholar] [CrossRef]

- Hsieh, C.-T.; Klenow, P.J. Misallocation and Manufacturing TFP in China and India. Q. J. Econ. 2009, 124, 1403–1448. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Petersen, M.A.; Rajan, R.G. Does Distance Still Matter? The Information Revolution in Small Business Lending. J. Financ. 2002, 57, 2533–2570. [Google Scholar] [CrossRef]

- Liberti, J.M.; Petersen, M.A. Information: Hard and Soft. Rev. Corp. Financ. Stud. 2019, 8, 1–41. [Google Scholar] [CrossRef]

- Levine, R.; Lin, C.; Peng, Q.; Xie, W. Communication within Banking Organizations and Small Business Lending. Rev. Financ. Stud. 2020, 33, 5750–5783. [Google Scholar] [CrossRef]

- Chen, H.; Qu, Y.; Shen, T.; Wang, Q.; Xu, D.X. The Geography of Information Acquisition. J. Financ. Quant. Anal. 2022, 57, 2251–2285. [Google Scholar] [CrossRef]

- Giroud, X. Proximity and Investment: Evidence from Plant-Level Data. Q. J. Econ. 2013, 128, 861–915. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous Technological Change. J. Political Econ. 1990, 98, 71–102. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Feldman, M.P. R&D Spillovers and the Geography of Innovation and Production. Am. Econ. Rev. 1996, 86, 630–640. [Google Scholar]

- Storper, M.; Venables, A.J. Buzz: Face-to-Face Contact and the Urban Economy. J. Econ. Geogr. 2004, 4, 351–370. [Google Scholar] [CrossRef]

- Faber, B. Trade Integration, Market Size, and Industrialization: Evidence from China’s National Trunk Highway System. Rev. Econ. Stud. 2014, 81, 1046–1070. [Google Scholar] [CrossRef]

- Arrow, K. Economic Welfare and the Allocation of Resources for Invention. In The Rate and Direction of Inventive Activity: Economic and Social Factors; Princeton University Press: Princeton, NJ, USA, 1962; pp. 609–626. [Google Scholar]

- Wu, G.L.; Feng, Q.; Wang, Z. A structural estimation of the return to infrastructure investment in China. J. Dev. Econ. 2021, 152, 102672. [Google Scholar] [CrossRef]

- Hall, B.H.; Jaffe, A.B.; Trajtenberg, M. The NBER Patent Citation Data File: Lessons, Insights and Methodological Tools 2001. The MIT Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Goodman-Bacon, A. Difference-in-Differences with Variation in Treatment Timing. J. Econom. 2021, 225, 254–277. [Google Scholar] [CrossRef]

- Sun, L.; Abraham, S. Estimating Dynamic Treatment Effects in Event Studies with Heterogeneous Treatment Effects. J. Econom. 2021, 225, 175–199. [Google Scholar] [CrossRef]

- Gómez, J.; Salazar, I.; Vargas, P. Does Information Technology Improve Open Innovation Performance? An Examination of Manufacturers in Spain. Inf. Syst. Res. 2017, 28, 661–675. [Google Scholar] [CrossRef]

- Tian, X.; Xu, J. Do Place-Based Policies Promote Local Innovation and Entrepreneurship? Rev. Financ. 2022, 26, 595–635. [Google Scholar] [CrossRef]

- Yang, M.; Zheng, S.; Zhou, L. Broadband Internet and Enterprise Innovation. China Econ. Rev. 2022, 74, 101802. [Google Scholar] [CrossRef]

- Ferrara, E.L.; Chong, A.; Duryea, S. Soap Operas and Fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 2012, 4, 1–31. [Google Scholar] [CrossRef]

- Liu, C.; Wang, W.; Wu, Q.; Zhang, H. Highway Networks and Allocative Efficiency: Firm-Level Evidence from China. J. Transp. Econ. Policy JTEP 2021, 55, 283–307. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Bellucci, A.; Borisov, A.; Zazzaro, A. Do Banks Price Discriminate Spatially? Evidence from Small Business Lending in Local Credit Markets. J. Bank. Financ. 2013, 37, 4183–4197. [Google Scholar] [CrossRef]

- Brandt, L.; Li, H. Bank Discrimination in Transition Economies: Ideology, Information, or Incentives? J. Comp. Econ. 2003, 31, 387–413. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Maksimovic, V. Financial and Legal Constraints to Growth: Does Firm Size Matter? J. Financ. 2005, 60, 137–177. [Google Scholar] [CrossRef]

- De Bettignies, J.-E.; Liu, H.F.; Robinson, D.T.; Gainullin, B. Competition and Innovation in Markets for Technology. Manag. Sci. 2023, 69, 4753–4773. [Google Scholar] [CrossRef]

- Aghion, P.; Cai, J.; Dewatripont, M.; Du, L.; Harrison, A.; Legros, P. Industrial Policy and Competition. Am. Econ. J. Macroecon. 2015, 7, 1–32. [Google Scholar] [CrossRef]

- Akcigit, U.; Kerr, W.R. Growth through Heterogeneous Innovations. J. Political Econ. 2018, 126, 1374–1443. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).