Abstract

From the perspective of “dynamic supply–demand coordination,” this study evaluates the development level of China’s economic “dual circulation” across 30 provinces during 2001–2020. Employing Kernel density estimation, natural breakpoint method, and exploratory spatial–temporal data analysis (ESTDA), we provide a comprehensive examination of the spatiotemporal evolution and developmental dynamics of China’s “dual circulation” economy. Furthermore, a nested matrix linking the quantile response types of driving factors with spatiotemporal transition types is constructed to uncover the mechanisms underlying these transitions, in order to form a unified understanding of the significance of China’s implementation of the economic “dual circulation” strategy against the background of high-quality development and lay a solid theoretical foundation for the empirical measurement of China’s economic “double circulation”. The results reveal the following: (1) Despite the “dual circulation” development level of Chinese provinces steadily improving over time, a marked east-to-west gradient of regional imbalance remains; (2) The spatial correlation of the “dual circulation” development level across provinces is significant, with changing trends influenced by neighboring provinces, showing both “concentration” and “differentiation” characteristics; (3) The spatial agglomeration trend of China’s “dual circulation” economy continues to strengthen, with distinct characteristics of “high rigidity + low mobility.” The low mobility of provinces locked in low-level spatial patterns will become a key limiting factor for their overall transition; (4) The quantile response types of the driving factors for the “dual circulation” development level in each province exhibit nest ability with their spatiotemporal transition types. The driving and constraining patterns of various driving factors coexist and interact.

1. Introduction

The economic circulation model constitutes a fundamental dimension of national economic development. China’s traditional model of “external ends, large-scale imports and exports” has been identified as a primary factor contributing to the imbalance between internal and external circulation, as well as the uneven development across various spatial economic units [1]. Despite the implementation of numerous reform measures since the inception of the Reform and Opening-up policy, these efforts have predominantly concentrated on China’s engagement in “international circulation.” Consequently, the core imbalance between internal and external economic circulation remains unaddressed. As China’s economy transitions to a new normal, structural and systemic contradictions are becoming increasingly apparent, with issues of insufficiency and imbalance gaining prominence. These contradictions manifest in both domestic and international circulations. The Chinese economy is faced with the dual imperatives of deepening comprehensive reform and opening up, alongside advancing a new form of economic globalization [2]. Against this backdrop, the Fifth Plenary Session of the 19th Central Committee of the Communist Party of China proposed accelerating the establishment of a new development paradigm, wherein the domestic cycle serves as the primary focus, and the domestic and international cycles mutually reinforce each other. This approach, henceforth referred to as the “dual circulation” strategy, was further solidified as a major strategic initiative for the new developmental phase in the report to the 20th National Congress of the Communist Party. The “dual circulation” strategy seeks to ensure the seamless and efficient operation of the national economy, with the crux of this efficiency being the consideration of both supply and demand as foundational elements. Consequently, from the perspective of “dynamic supply–demand coordination,” integrating the comparative advantages of both supply and demand and maintaining coordinated efforts from both ends is instrumental in fostering a virtuous cycle within the national economy. Nevertheless, the current stage reveals a growing imbalance between domestic and international circulation in China, presenting significant challenges to advancing high-quality development and achieving modernization in the Chinese style. Therefore, a precise understanding of the underlying logic of the “dual circulation” strategy’s “dynamic balance of supply and demand,” along with a scientific assessment of the level and spatiotemporal shifts in “dual circulation” development, and an elucidation of the causes of these shifts and changes, hold both theoretical and practical significance for comprehensively promoting regional coordinated development and optimizing the spatial layout of China’s economic “dual circulation.”

Existing research has focused on aspects such as theoretical logic and connotations, practical logic and pathways, and statistical measurement of the “dual circulation” strategy. First, regarding the theoretical reasoning and connotations of China’s “dual circulation” economic strategy, the “dual circulation” strategy is underpinned by a robust theoretical framework, with Marxist political economy and the theory of the socialist market economy with Chinese characteristics serving as its foundational basis. The economic development concepts articulated by successive generations of Chinese Communist Party members offer an empirical synthesis. At the same time, the political economy of socialism with Chinese characteristics constitutes its logical inception and central theme [3]. Scholars contend that China’s “dual circulation” strategy signifies a fundamental shift from the previous model of growth driven by external demand and characterized by “two ends outside, large-scale imports and exports,” to a novel development paradigm driven by domestic demand, wherein “domestic and international circulations mutually reinforce each other.” This strategy represents a robust national initiative aimed at economic modernization and long-term stability. It is a strategic decision by the Chinese Communist Party to fully capitalize on the country’s extensive domestic market as a core strength, thereby reshaping its advantages in international cooperation and competition [4]. Internationally, China’s economic “dual circulation” strategy is recognized [5,6]. With the increasingly tense relationship between China and the United States, the domestic and international “dual circulation” strategy is China’s strategic choice of “self-reliance” [7], which aims to reshape the strong growth momentum by “unblocking the domestic and international market channels”, promote the construction of an open world economy, and solve the problem of sustainable development [8]. However, there is also a misconception that China’s efforts under the “dual cycle” strategic framework are to seek to promote the international “decoupling” plan and link the “dual cycle” strategy with the “decoupling” plan [9,10]. This error lies in only recognizing the “internal circulation as the main body” and “high-level self-reliance and self-improvement” of the “double circulation” strategy but ignoring the important connotation of “mutual promotion of double circulation” [11].

Second, regarding the practical logic and pathway of China’s “dual circulation” economy, the “dual circulation” strategy originates from China’s response to the challenges and requirements of implementing new development concepts in the current stage of development, and it embodies distinct practical logic. The evolving dynamics of China’s internal and external environments and development conditions not only form the practical foundation for transforming its development model but also serve as a critical support for reshaping its economic development pattern. Furthermore, they provide the fundamental guidelines for comprehending the practical logic underlying the “dual circulation” strategy [12]. Regarding the realization path of China’s “dual circulation” economic strategy, existing research suggests that the “dual circulation” strategy emphasizes unimpeded flows within the national economy, coordinating the comparative advantages on both the supply and demand sides. By leveraging “dynamic supply–demand coordination,” it seeks to jointly address and alleviate bottlenecks in the four major links of social reproduction. While highlighting the primary role of “domestic circulation,” it also reflects the organic unity of China’s development strategy—an approach marked by “phased, situational adjustment” and practical logic. The strategy actively leads the restructuring and reconfiguration of global supply, industrial, and value chains, accelerates the formation of an integrated domestic–international circulation, and upholds the principle of “promoting the external through the internal” to facilitate the smooth operation of both domestic and international circulations [13].

Third, there is the statistical measurement of China’s “dual circulation” economy. Existing measurement studies mainly focus on the following two paradigms: within the input–output theoretical framework, “domestic circulation” is measured by the extent of China’s economic reliance on domestic final demand, while “international circulation” is measured by the reliance on foreign final demand. Building on this framework, quantitative analyses have been conducted to examine the spatial and temporal patterns and evolutionary trends of these circulations from both supply and demand perspectives [14]. The added value is disaggregated to ascertain the proportions attributable to the “domestic cycle” and the “international cycle,” which serve as proxy variables for measurement [12,13,14,15]. While the majority of research is concentrated at the national level, there is a relative paucity of studies adopting an inter-provincial perspective. However, some scholars have extended their research to quantifying China’s “dual circulation” economy. These investigations employ the theoretical framework of econometrics to develop a measurement framework for assessing the development level of the “dual circulation” model. Wang et al. [16] constructed a “dual circulation” development level measurement system based on the two dimensions of internal cycle and external cycle, and further tested its impact on the high-quality development of China’s economy with “internal cycle” and “external cycle” as independent variables. Ding, X. and Zhang, S [17] built a multi-dimensional measurement index system of economic “dual circulation” from the four dimensions of internal and external cycle concentration, dependence intensity, competitive advantage and involution based on the perspective of trade, and comprehensively and systematically analyzed the evolution law of China’s economic “dual circulation” from 1987 to 2017. Li, R., et al. [18] constructed an evaluation index system for the new development pattern of “double circulation” from the three dimensions of domestic circulation, international circulation and the integration of domestic and foreign capital, measured the performance level of “double circulation” from 2004 to 2018, and systematically tested its spatial convergence. Liu, C., et al. [19] constructed the evaluation index system of “dual circulation” development level based on the two dimensions of “internal cycle” and “external cycle” and further analyzed its spatial evolution characteristics and driving mechanism. Based on the perspective of coupling theory, Zhao, W. & Zhang, Z. [20] constructed an evaluation index system of the dual cycle coupling coordination system from the two dimensions of internal cycle and external cycle, measured the actual level of the coupling coordination degree of “internal cycle” and “external cycle” of China’s economy, and analyzed its distribution dynamics, spatial differences and convergence. Zou, W. [21] constructed a dynamic measurement index system for the new development pattern of “double circulation” from seven dimensions, namely, the reliability of economic operation, the support of factor market, the cultivation of a unified large market, trade, investment, technology exchange and international scientific research. On this basis, the dynamic factor cluster analysis method was used to explore the influencing factors of the new development pattern of “double circulation”. Notably, representative studies have devised measurement frameworks based on the dual dimensions of “domestic circulation” and “international circulation.” Utilizing these measurements, they endeavor to elucidate spatial convergence and have undertaken preliminary exploration of the economic implications [18,19,22]. Drawing upon the theoretical frameworks of social reproduction theory, economic cycle theory, and supply–demand theory, a comprehensive measurement framework is developed from multiple perspectives. This framework is employed to elucidate the trends in its evolution, spatial correlations, spatial spillover effects, and influencing factors [17,21]. However, existing literature has not yet applied it jointly to specific research problems.

The existing literature demonstrates that previous studies have significantly advanced the understanding of China’s “dual circulation” economy. These contributions are essential for grasping the dynamics and trends associated with the “dual circulation” strategy and for facilitating its effective implementation. However, because the formulation and execution of the “dual circulation” strategy represent a long-term and complex process that is continually evolving, several critical issues require ongoing, in-depth investigation: (1) While certain scholars assert that measurement should logically incorporate both supply and demand considerations, they have not comprehensively examined the mechanism through which “dynamic supply–demand coordination” generates the foundational logic of “prioritizing the domestic cycle while fostering mutual reinforcement between domestic and international dual cycles.” (2) The measurement framework associated with the Marxist theory of social reproduction remains underdeveloped, particularly as it fails to adequately address the comprehensive scenarios of economic circulation in major countries, such as “production, distribution, circulation, and consumption.” Additionally, it does not sufficiently incorporate interpretations grounded in public sentiment and China’s unique national conditions during the 14th Five-Year Plan. (3) Many scholars have offered straightforward descriptions of spatial patterns derived from measurement results, and it is widely accepted that China’s “dual circulation” economy demonstrates distinct spatiotemporal transition characteristics. Nevertheless, there is a paucity of research on the underlying mechanisms driving these spatiotemporal transitions. (4) Most scholars focus on empirically testing the regional heterogeneity of its influencing factors, but there is a lack of empirical research on the spatiotemporal transformation mechanism of China’s “dual circulation” economy, which reduces the relevance and practical guidance of these studies.

Accordingly, the core issue addressed in this study is how to formulate fair, efficient, and locally adaptive policies for implementing the “dual circulation” strategy, so as to comprehensively advance regional coordination and spatial optimization in China’s dual-circulation economy. Achieving this goal hinges on developing scientific approaches to quantitatively assess the dual circulation system and to systematically explore its spatiotemporal evolution and underlying driving mechanisms. The potential contributions of this study are as follows: (1) In this study, a theoretical measurement system and research framework are reconstructed to elucidate the connection between the supply and demand subsystems. From the perspective of “dynamic supply–demand coordination,” this study elucidates the foundational logic of prioritizing the domestic economic cycle while fostering mutual reinforcement between domestic and international dual circulation. This approach establishes a theoretical basis for developing an evaluation index system to assess the level of “dual circulation” development. By integrating supply and demand theory with the concept of economic circulation, this study endeavors to construct an evaluation index system that acknowledges spatiotemporal transition characteristics, respects regional development features, and reflects the interactions among various elements of social reproduction. This addresses the limitations of existing research, which predominantly employs static indicators, such as “internal–external” cycles, to measure the level of “dual circulation” development and inadequately considers “dynamic supply–demand coordination.” (2) Based on geographic spatial carriers and utilizing kernel density estimation, natural breakpoint method, and ESTDA methods, this study attempts to comprehensively deconstruct the spatiotemporal evolution process and development trends of the “dual circulation” development level. This study aims to address the current deficiency of abundant static research and the lack of dynamic analysis. (3) A nested matrix was constructed to categorize the quantile response types of the driving factors influencing the development level of the “dual circulation” economy and the types of spatiotemporal transitions. This matrix illustrates the multidimensional coupling relationships between spatiotemporal transitions and various driving factors. Furthermore, it seeks to elucidate the transition mechanisms and formation processes, thereby providing empirical evidence to comprehensively advance regional coordinated development and optimize the spatial layout of China’s “dual circulation” economy.

2. Materials and Methods

2.1. Indicator System Construction

2.1.1. Theoretical Basis

According to Marxist political theory on social reproduction, the processes of production, distribution, circulation, and consumption form the national economic cycle. The central concept of the “dual circulation” strategy is “economic circulation,” which aims to achieve an “unimpeded” national economic cycle. This objective relies on the establishment of dynamic, stable, and well-organized technical, economic, and spatial connections among various sectors, industries, departments, and regions throughout all stages of social reproduction. The essence of the “dual circulation” strategy involves a shift from the traditional model, which primarily depended on international markets and resources for substantial imports and exports, to a new development paradigm that emphasizes domestic markets while integrating both domestic and international advantages. In this context, developing a measurement framework based on “economic circulation theory” not only aligns with the fundamental characteristics of economic operations but also enhances and advances the theoretical framework and evaluation model for assessing the level of “dual circulation” development.

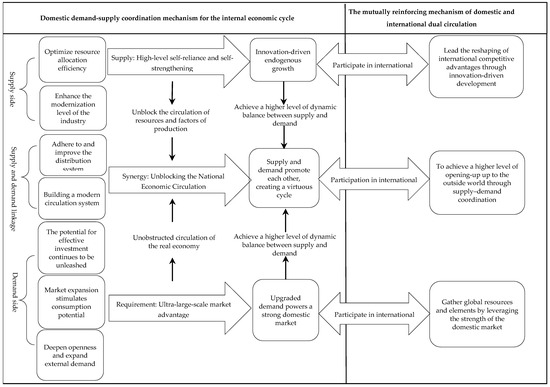

The proposal of the “dual circulation” new development paradigm stems from China’s strategic assessment of the systematic changes in internal and external development conditions and is a profound response to the evolution of development stages and the restructuring of the global landscape [23]. From a practical logic perspective, its motivation is rooted in two major dimensions: On the one hand, the internal economic structure has undergone fundamental changes. After decades of integrating into the global value chain by relying on factor cost advantages, the principal contradiction in Chinese society has transformed. The growth momentum previously dependent on external demand has significantly weakened, while the potential of the domestic demand market and the advantages of the entire industrial chain have become increasingly prominent [24]. However, economic growth is also accompanied by multiple structural imbalances between supply and demand, urban and rural areas, and regions, as well as the risk of “low-end lock-in” caused by the “bottleneck” of key core technologies, which collectively pose severe constraints on achieving high levels of “self-reliance and self-improvement” and “smooth and unimpeded” internal circulation [12,25]. On the other hand, the external environment is undergoing profound changes unseen in a century. The intertwining of anti-globalization, trade protectionism, and geopolitical conflicts has put the global industrial and supply chains under dual pressures of “fracture” and “impediment”, shaking the foundation of the traditional international circulation model with “both ends exposed” [26,27,28]. The “dual circulation” strategy emphasizes the necessity of effectively aligning supply and demand through the coordination of supply-side reforms and demand-side management. This approach seeks to strengthen the foundation of the “dual circulation” strategy from both supply and demand perspectives. The uninterrupted flow of the economic cycle aims to rectify discrepancies between production and consumption, thereby achieving a high-level dynamic equilibrium between supply and demand. From the perspective of “dynamic supply–demand coordination,” utilizing the comparative advantages of both supply and demand sides and promoting their dynamic synergy aligns with the practical logic of the “dual circulation” strategy, which merges supply-side structural reform with the initiative to expand domestic demand. Consequently, this study asserts that the essence of unimpeded economic circulation resides in the connection between supply and demand. Viewing both ends of supply and demand as the logical starting point for understanding and evaluating China’s “dual circulation” economy holds both theoretical and practical significance.

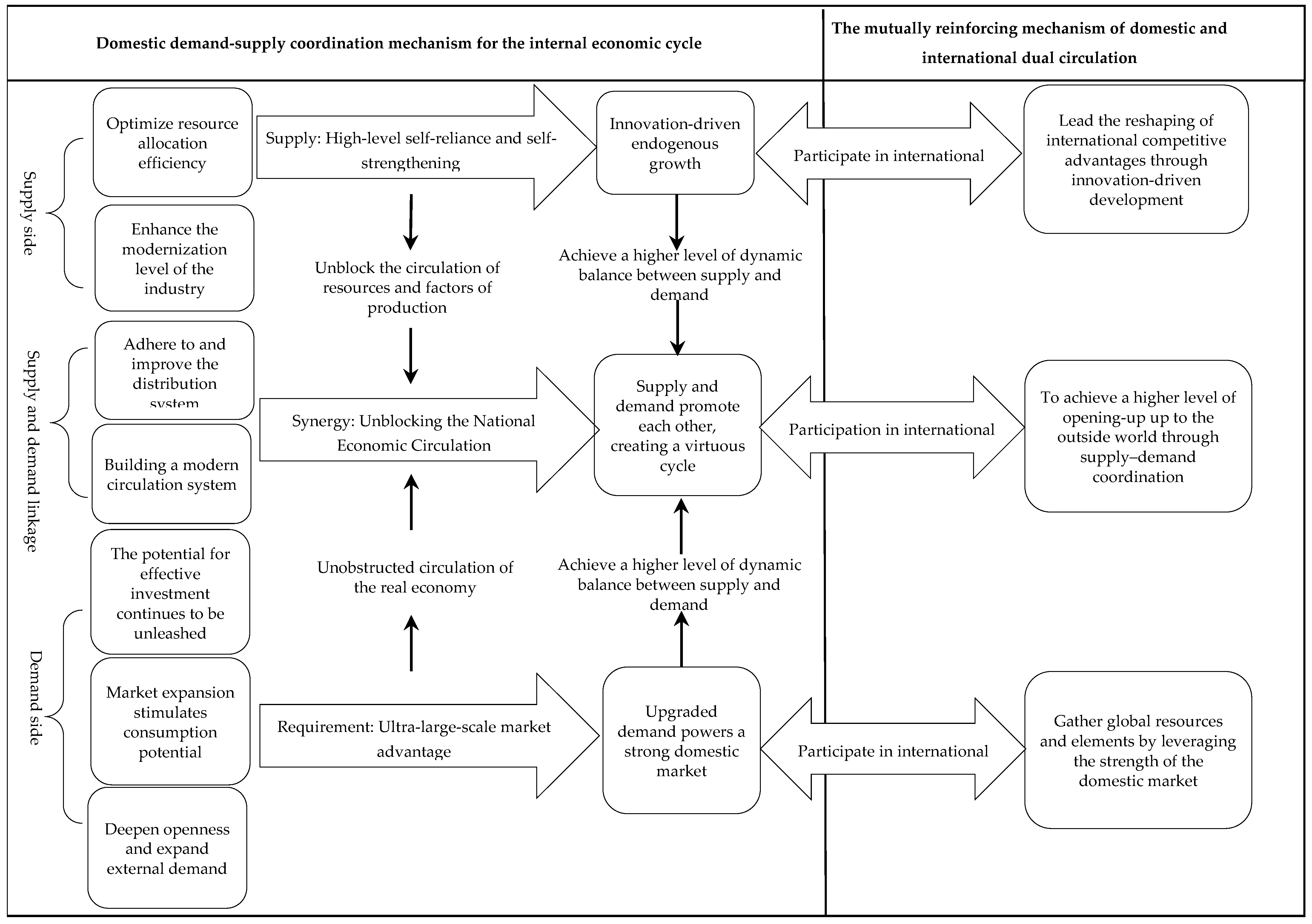

Building on the previous analysis, this paper argues that the developmental stage of China’s “dual circulation” economy should be defined from the perspectives of the supply side, the demand side, and the interaction between supply and demand, all within the framework of “dynamic supply–demand coordination.” Furthermore, by examining the obstacles and challenges in national economic circulation through the lens of social reproduction theory, a theoretical measurement framework has been established. This framework encapsulates the core logic of “prioritizing the domestic cycle, with mutual reinforcement between domestic and international dual circulation,” as depicted in Figure 1.

Figure 1.

Theoretical framework for measuring the development level of China’s “dual circulation” economy.

2.1.2. Theoretical Framework

- (1)

- Supply Side

Marx’s theory of social reproduction holds that production occupies a dominant position and is the starting point of all economic activity. “A particular mode of production determines a particular mode of consumption, distribution, exchange, and the specific relationships between these different elements [29].” In the context of social reproduction, production plays a pivotal role, as it not only dictates the overall volume of social supply but also shapes its structure. To effectively implement the “dual circulation” strategy and advance supply-side structural reforms, it is essential to prioritize the optimization of resource allocation and to facilitate industrial transformation and upgrades. There should be a strong emphasis on enhancing the foundational capabilities of industries and expediting the achievement of self-sufficiency in industrial and supply chains. This approach will ensure a seamless economic cycle characterized by robust self-reliance and strength on the supply side. Furthermore, innovation-driven development strategies must be maintained on the supply side to invigorate the intrinsic driving force behind China’s economic growth and to lead the redefinition of international competitive advantages. Thus, resources and industries serve as critical indicators for evaluating the level of supply.

Resources: The successful implementation of the “dual circulation” strategy hinges on reforming the market-based allocation of production factors, thereby unlocking the inherent potential of these factors and actively facilitating the orderly circulation of resources such as labor, capital, and technology across industries, sectors, fields, and enterprises. Regarding capital factors, it is imperative to standardize capital market regulations, enhance the capital market system, and redirect funds from speculative activities toward the real economy. Concerning labor factors, it is crucial to address income disparities, regional inequalities, and class distinctions, while also improving the systems and mechanisms that govern labor circulation between urban and rural areas, across regions, and within both domestic and international contexts. With respect to technological factors, it is essential to overcome core technological bottlenecks and eliminate institutional barriers that impede the market-based allocation and free flow of various factors. Consequently, four indicators—capital misallocation, labor misallocation, the introduction of foreign technology, and capital inflow—were employed to assess the efficiency of resource allocation.

Industry: The contemporary industrial system serves as the foundation for implementing the “dual circulation” strategy. As a central component of the modern economic framework, the industrial system facilitates the provision of goods and services. In this new stage of development, the production process aims to optimize the supply structure through innovation-driven methodologies, which encompass the circulation of industrial chains and directly influence the integration of supply and demand. It is essential to address bottlenecks within and across various segments of the industrial structure to enable efficient coordination throughout the entire industry chain, including upstream and downstream activities, as well as production, supply, and sales. This requires further improvements in the rationalization and advancement of the industrial structure, the establishment of a modern, independently controllable industrial system, and the rectification of weaknesses within the industry chain to promote its growth. Consequently, four indicators—industrial structure rationalization, industrial structure advancement, the proportion of output value among the three sectors, and foreign trade upgrading—were utilized to assess the level of industrial development.

- (2)

- Demand Side

In May 2020, the Standing Committee of the Political Bureau of the CPC Central Committee underscored the importance of “leveraging domestic demand potential to better connect domestic and international markets.” The successful implementation of the “dual circulation” strategy hinges on fully harnessing China’s vast market advantages to foster self-sustaining cycles in production, distribution, circulation, and consumption. From the perspective of final demand, the national economy is propelled by consumption, investment, and exports. In macroeconomic terms, total demand is classified as follows: monetary expenditures on consumer goods are referred to as “consumption,” expenditures for acquiring factors of production are labeled “investment,” and expenditures by foreign entities on purchases are designated as “exports.” As China’s domestic demand market matures, the focus of the national economic cycle is progressively shifting from international circulation to a dual-circulation model that integrates both domestic and international channels. This dual approach is regarded as the primary driving force behind the sustainable development of China’s economy, emphasizing the need to leverage the substantial scale of the domestic market on the demand side to strengthen the domestic market while attracting global resources and production factors. Consequently, the demand level was assessed using three indicators: investment, consumption, and openness (exports).

Investment: The Proposals of the Central Committee of the Communist Party of China for Formulating the 14th Five-Year Plan for National Economic and Social Development and the Long-Range Objectives Through the Year 2035 (hereinafter referred to as the “Proposals”) underscore the significance of “unblocking domestic economic circulation, promoting both domestic and international dual circulation, comprehensively boosting consumption, and expanding investment opportunities.” Implementing the “dual circulation” strategy necessitates the full harnessing of investment’s pivotal role, unlocking the potential for effective investment, and adhering to the strategic direction of supply-side structural reforms. The objective is to cultivate effective investment that aligns with the demands of consumption transformation, optimizing the supply structure and enhancing supply quality through such investments, while also improving the adaptability of the supply system to domestic demand. Consequently, four indicators are employed to gauge the level of investment: the fixed asset investment index, the productive investment index, the proportion of outbound direct investment, and the number of foreign-invested enterprises.

Consumption: The “Proposals” highlight the necessity of “strengthening the fundamental role of consumption in economic development,” while the Third Plenary Session of the 20th CPC Central Committee underscores the significance of “improving and expanding long-term mechanisms to boost consumption.” It is evident that consumption serves as both the endpoint and starting point, as well as the objective and driving force of economic activity. Enhancing consumption has emerged as a new engine for facilitating economic flow. The execution of the “dual circulation” strategy should fully leverage the stimulating effect of consumption to unlock domestic demand potential and promote seamless economic circulation. It is crucial to optimize the structure of accumulation and consumption, establish a higher-level dynamic equilibrium between the two, and prioritize the enhancement of consumption quality. By adopting these measures, we can more effectively utilize the fundamental role of consumption in driving economic growth, accelerate the establishment of a new consumption ecosystem, deepen institutional mechanisms for market expansion, and further stimulate consumption potential. Consequently, the level of consumption is represented by four indicators: the consumption contribution rate, consumption upgrading, outbound international tourism rate, and per capita international tourism income.

Open: The report from the 20th National Congress of the Communist Party of China underscored the necessity to “steadfastly expand opening-up and focus on overcoming deep-rooted institutional and structural barriers.” The successful implementation of the “dual circulation” strategy hinges on achieving a higher level of openness to connect domestic and international markets and resources, thereby facilitating the seamless flow of both domestic and international circulation. The “Proposals” stress the importance of “breaking industry monopolies and local protectionism to create a virtuous cycle in the national economy.” They advocate for coordinated advancements in both external openness and internal reforms, cautioning that an exclusive focus on external openness would be misguided. Deepening openness necessitates not only a comprehensive elevation of the level of engagement with the outside world and the establishment of an all-encompassing, multi-level, and diversified framework for open cooperation to enhance external demand, but also an active effort to reduce regional economic disparities, dismantle administrative barriers between regions, accelerate the development of a unified national market, and address the limitations posed by insufficient and uneven economic growth. Consequently, four indicators—degree of marketization, market segmentation, import dependence, and export dependence—were employed to gauge the level of openness.

- (3)

- Supply and Demand Coordination

Marx provided a profound explanation of the dialectical relationship between supply and demand, pointing out that “production not only produces objects for the subject, but also produces the subject for the object [30,31,32].” “No production means no consumption, but without consumption, there is also no production, because if that were the case, production would have no purpose” [29]. It is evident that the relationship between production and consumption is paramount. The smooth flow of the economic cycle fundamentally depends on resolving the contradictions between production and consumption and achieving a high-level dynamic balance between supply and demand. Economic development issues, including the “dual circulation” strategy, must not be understood from the one-sided perspective of either supply or demand alone, nor should the two aspects of supply and demand be separated from each other. The implementation of the “dual circulation” strategy aims to achieve a smooth and unobstructed flow of the national economy. The fundamental aspect of this smooth flow lies in taking both supply and demand as the logical starting points and adhering to a coordinated effort from both ends based on a perspective of “dynamic supply–demand synergy.” This not only helps establish a virtuous cycle for the national economy but also contributes to a higher level of openness to the outside world. Therefore, two indicators, distribution and circulation, are used to measure the level of the supply–demand linkage.

Allocation: The report from the 20th National Congress of the Communist Party of China underscores that “the distribution system is a fundamental mechanism for promoting common prosperity.” Upholding the socialist income distribution system and establishing an improved income distribution framework that balances efficiency with fairness are essential prerequisites for addressing the populace’s increasing demands for a better quality of life. These elements are also critical for ensuring the effective operation of the national economy. As a vital intermediary connecting production and consumption, distribution significantly influences the expansion of consumption and the seamless circulation of the economy. The implementation of the “dual circulation” strategy should prioritize the reform and enhancement of existing income and wealth distribution patterns, while maintaining a distribution system that harmonizes efficiency and fairness. This approach serves as a crucial leverage point to unlock domestic demand and invigorate the endogenous dynamics of economic circulation. Consequently, four indicators—fiscal transfer payment rate, distribution fairness, income distribution relations, and trade balance—were selected to assess the fairness of distribution.

Circulation: Marx believed that circulation is the key factor determining whether the economic cycle can proceed smoothly, serving as the medium for social reproduction [29]. It can act in reverse on production, driving the transformation of production methods and influencing consumption, thus promoting an effective connection between production and consumption and enabling the “daring leap” from product to commodity [29]. The smooth operation of all links in the national economic cycle and social reproduction relies on the effective functioning of market mechanisms. The production stage represents the supply side, and the consumption stage represents the demand side. Therefore, to successfully realize the value of total social products in market circulation, it is essential to firmly grasp this key link of circulation and give full play to its role as a bridge and bond between production and consumption. Accordingly, four indicators are used to reflect the level of circulation: the contribution of logistics industry development, road network density, online circulation convenience, and foreign trade circulation efficiency.

2.2. Indicator System Construction for the Development Level of the “Dual Circulation” Strategy

This study upholds the principles of objectivity, scientific rigor, and feasibility while addressing the comprehensiveness and hierarchical structure of the indicator system. Grounded in Marxist political economy theory and following the foundational logic of “taking the domestic cycle as the mainstay and promoting mutual reinforcement between the domestic and international dual cycles,” it establishes a measurement framework for assessing the development level of the “dual circulation” model. This framework emphasizes the interplay between the supply and demand sides, illustrating the coordinated linkage between these two subsystems. Additionally, by incorporating the theory of social reproduction, the supply side is represented by the production stage, which includes both the prerequisites of production (resources) and the production process itself (industry) within the supply subsystem. Conversely, the demand side is characterized by the consumption stage, which integrates the components of final demand—investment, consumption, and openness (exports)—into the demand subsystem. The connection between production and consumption signifies the supply–demand interaction, with the “distribution and circulation” aspects of social reproduction encompassed within the supply–demand linkage subsystem. The comprehensive evaluation index system for the level of “dual circulation” development is presented in Table 1. A summary of the specific metadata is presented in Appendix A, Table A1.

Table 1.

Evaluation index system for the development level of the “dual circulation” strategy.

2.3. Methods

2.3.1. Entropy Weight Method-TOPSIS Combined Weight Model

To address the limitations of subjective weighting methods and principal component analysis in determining indicator weights, this study draws on the approach of Wei, M and Li, S [31] by adopting an entropy weight–TOPSIS integrated model to evaluate the “dual circulation” development level across 30 Chinese provinces (It should be noted that due to significant data omissions for Tibet, it has been excluded from the sample. In addition, the research sample in this paper does not include Hong Kong, Macao, or Taiwan. Ultimately, the study focuses on 30 provinces.), aiming to address the critical prerequisite of scientifically assessing the “dual circulation” system and to provide a solid quantitative foundation for the entire study. This combined model effectively minimizes subjective bias, enhances the objectivity of the results, and systematically captures inter-indicator correlations and their relative importance, thereby enabling a more comprehensive and accurate assessment of provincial development performance. The specific procedures are as follows:

(1) Entropy weight method for calculating weights

Step 1: Matrix Construction

Let represent the value of the -th indicator in the -th year (, 2, … n; , 2, … m)

Step 2: Data Standardization

To further eliminate evaluation errors caused by differences in indicator units, the data are standardized by applying the following treatments to positive and negative indicators within the indicator system:

The following equation for positive indicators:

The following equation for positive indicators:

Step 3: Calculation of Indicator Proportions

Let represent the proportion of the value of the -th indicator in the -th year to this indicator:

Step 4: Calculation of Information Entropy, the entropy value (e) was used to express the decision information for each indicator, where the value of ranged from 0 to 1

Step 5: Calculate the weight of the indicators, represents the coefficient of difference for the -th indicator :

(2) TOPSIS method

Step 1: The weighted standardized decision matrix can be obtained from the standardized matrix and the weights of each indicator

Step 2: Calculate positive and negative ideal solutions

Step 3: Calculate the Euclidean distance between each indicator and the positive and negative ideal solutions

Step 4: Calculate the comprehensive evaluation value

2.3.2. Kernel Density Estimation Method

To further clarify the changing trend, extensibility, and polarization trend of the absolute difference in the development level of China’s “dual circulation” economy, this study employs kernel density estimation to clarify its dynamic evolution characteristics in time and space. The specific formula is as follows:

where f(x) denotes the estimated density at point x; is the i-th sample observation; x represents the evaluation point at which the density is estimated; h is the bandwidth parameter controlling the smoothness of the estimation; and K(⋅) is the kernel function.

2.3.3. ESTDA

To identify the spatiotemporal differentiation characteristics of China’s “dual circulation” economy and to clarify its trend toward balanced development, this study employs an ESTDA to reveal the dynamic evolution patterns of its spatial–temporal interactions. The specific formulas are as follows:

(1) Moran Index

Drawing on existing research [46], this study uses the global Moran’s I to verify the spatial clustering degree of the “dual circulation” development level among Chinese provinces. When this index falls within the range of (0, 1], it indicates a positive spatial correlation in the “dual circulation” development level across provinces; when it is within [−1, 0), it indicates a negative spatial correlation. Specifically, the closer the index is to 1, the stronger the positive spatial correlation; the closer it is to −1, the stronger the negative spatial correlation; and the closer it is to 0, the less relevant the “dual circulation” development is to the provinces. The specific formula is as follows:

In the formula: I denotes the Global Moran’s I; represents the average “dual circulation” development level across all provinces in China, where i = 1, 2,…, 30, and j = 1, 2,…, 30; is the spatial weight matrix; and denote the measured values of the “dual circulation” development level for province i and province j in period t, respectively; n indicates the total number of provinces (in this study, n = 30).

Local spatial autocorrelation can be used to measure the spatial agglomeration characteristics of China’s “dual circulation” in local regions, and to describe the heterogeneity and instability of these local areas [46]. By constructing a Local Moran’s I scatter plot, the interactions between the “dual circulation” development levels of various provinces can be clearly revealed. Provinces and their neighboring areas located in the first quadrant (HH type) and third quadrant (LL type) exhibit spatial clustering characteristics, meaning that if a province is at a high (or low) level, its surrounding provinces are also at a high (or low) level. Conversely, provinces in the second quadrant (LH type) and fourth quadrant (HL type) and their neighboring provinces show spatial differentiation, indicating that when a province is at a low (or high) level, its neighboring provinces are at a high (or low) level. The specific formula is as follows:

In the formula: represents the spatial weight matrix. and are the standardized observations, where denotes a row-standardized, asymmetric weight matrix transformed through standardization.

(2) LISA spatiotemporal transition method

The LISA spatiotemporal transition approach captures local spatial dependencies among study units [46,47], this study classifies transitions into four types based on changes in “dual circulation” development levels: Type I, where the observed province transitions while neighbors remain stable; Type II, where neighbors transition while the observed province remains stable; Type III, where both the observed province and its neighbors transition; and Type IV, where both remain stable. The formula is expressed as follows:

In the formula, represents the number of provinces with a transition type of “self-stability neighborhood stability” in the development level of “dual circulation” during the research period t; N is the total number of provinces studied, which is 30 in this article. →[0, 1]; the larger the value, the better the spatial stability of the “dual cycle” development level, and the greater the resistance to transition.

2.4. Data Source

The original data for the evaluation indicators and their driving factors selected in this study were obtained from the China Statistical Yearbook and provincial statistical bulletins, the China Foreign Economic and Trade Statistical Yearbook, the China Economic and Social Big Data Research Platform(CNKI, Beijing, China), the China Customs Statistics Database(General Administration of Customs of China, Beijing, China), and the CSMAR(GuoTaiAn Co., Shenzhen, China) and Wind databases(Wind Info Co., Shanghai, China), among others. In cases where data are missing, interpolation or analogy methods are used to supplement the gaps.

3. Analysis of the Spatiotemporal Evolution Characteristics of China’s “Dual Circulation” Economy

3.1. Dynamic Evolution Analysis of China’s “Dual Circulation” Economy

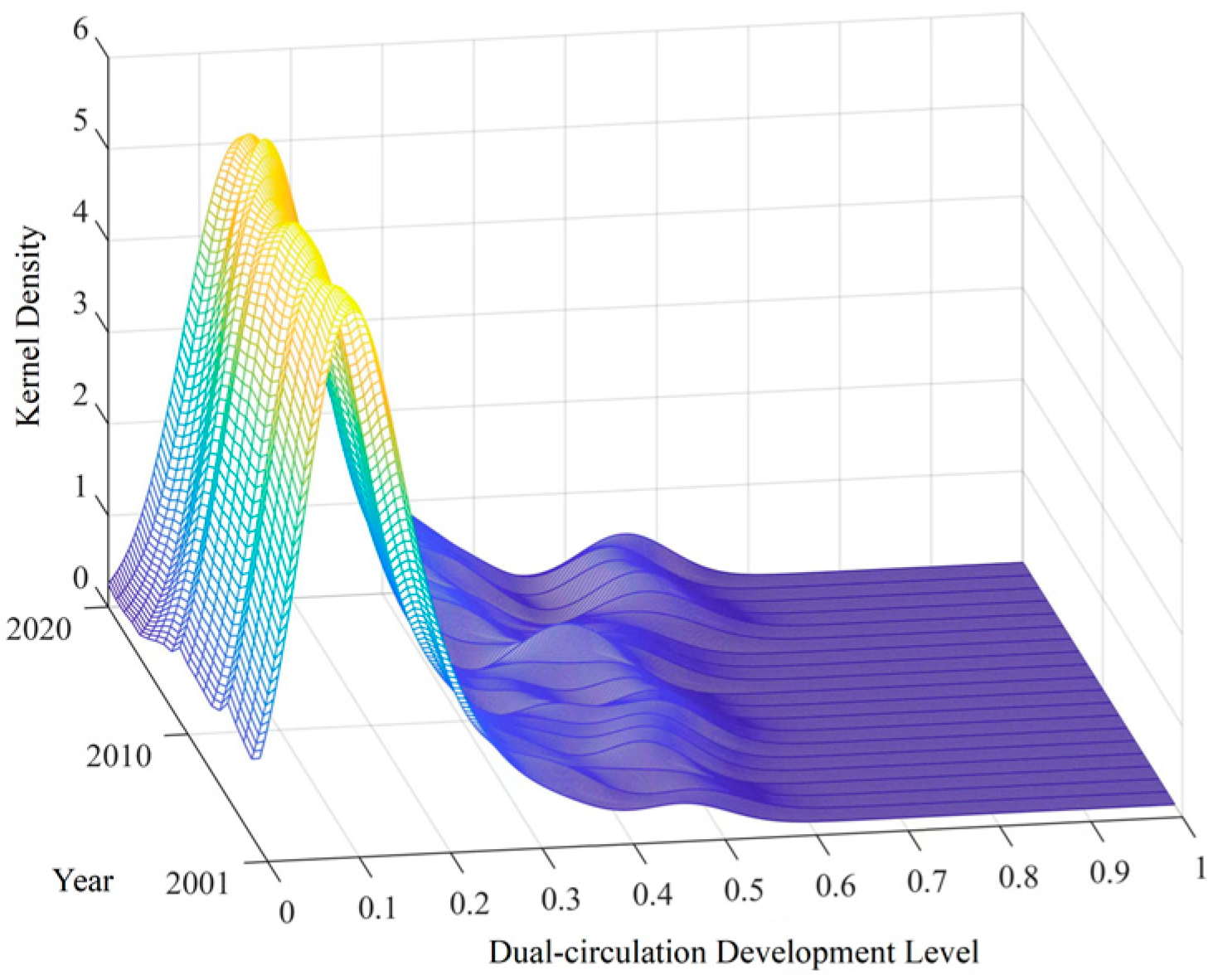

To intuitively analyze the spatiotemporal distribution characteristics of the “dual circulation” development level, this paper employs the Kernel density estimation method to portray the overall distribution pattern of China’s economic “dual circulation,” and, through regional comparisons, grasps the dynamic evolution of China’s economic “dual circulation.”

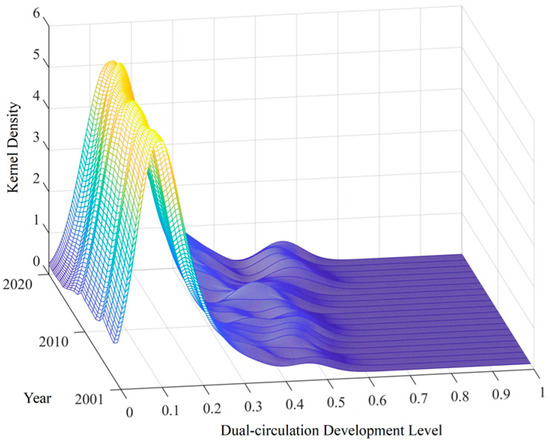

3.1.1. National Level

As shown in Figure 2, the main peak exhibited a slight rightward shift in terms of peak movement. This indicates that during the study period, although the overall trend of China’s “dual circulation” economy was upward, its growth was relatively slow. In terms of peak height and width, the peak height gradually increased, whereas the width narrowed. From 2001 to 2020, side peaks appeared, and the distance between the main peak and side peaks showed a widening trend. The left tail gradually converged, whereas the right tail significantly expanded. This indicates that the development level of the “dual circulation” among provinces is gradually stabilizing, but a few provinces (such as Guangdong, Shanghai, and Beijing) remain in a leading position. As for the number of main peaks, China’s economic “dual circulation” has always been in a single-peak state, indicating that there has been no polarization among provinces in terms of “dual circulation.” Overall, the trend shows steady growth, but the growth rate is not high. Differences between provinces still exist, but the gap is narrowing.

Figure 2.

Dynamic evolution of the “dual circulation” development level at the national level.

3.1.2. Regional Level

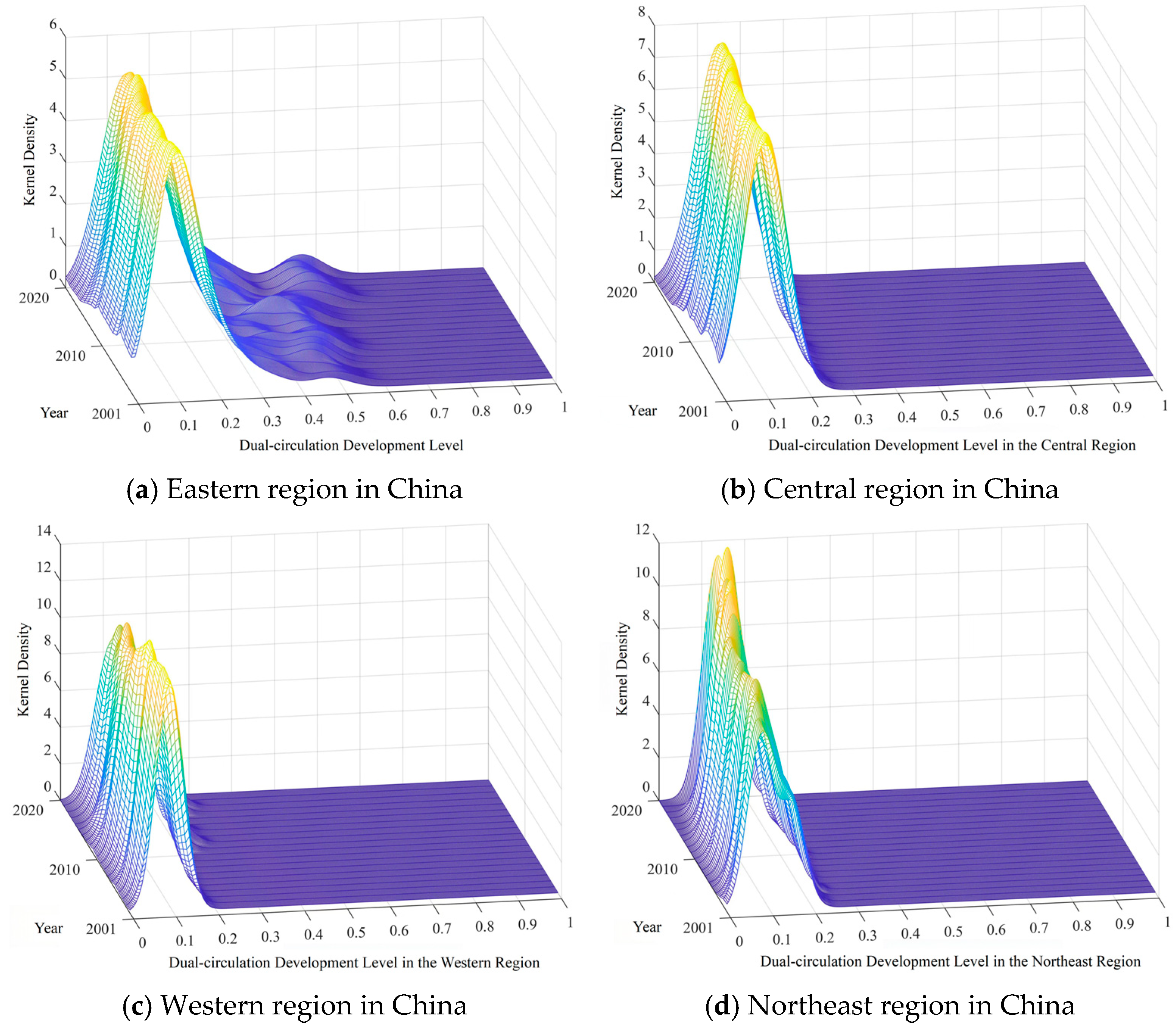

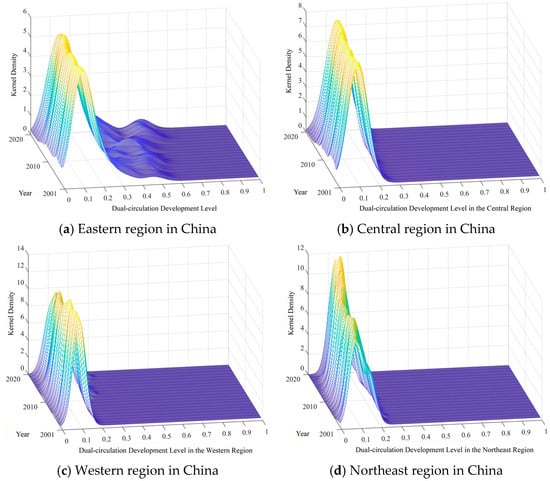

Overall, as illustrated in Figure 3, the primary peaks of the “dual circulation” development levels across the four major regions have notably shifted to the right, showing an upward trend in the overall “dual circulation” development levels in these regions. Concurrently, the main peaks in all four regions demonstrate, to varying extents, a pattern of “rising from low to high and narrowing from wide to narrow,” with the peaks becoming increasingly steep and exhibiting only one main peak. This suggests that the absolute disparities in the “dual circulation” development levels of China’s economy are generally diminishing, with no evidence of polarization. Specifically:

Figure 3.

Dynamic evolution of the “dual circulation” development level in the four major regions.

Figure 3a shows that the distribution curve of the “dual circulation” development level in the eastern region is shifting to the right and its peak is rising, indicating a continuous overall improvement in the region. The shape of the main peak did not change significantly, although a secondary peak appeared during the period. The distance between the main and secondary peaks gradually increased, while the width of the secondary peak expanded, but its height decreased. This indicates that the absolute difference in the overall level within the eastern region has narrowed, but intra-regional differences remain significant, with a tendency toward regional polarization. Figure 3b shows that the main peak of the distribution curve for the “dual circulation” development level in the central region tends to shift to the right, indicating an overall rise in the region’s development level. The main peak gradually became higher and narrower and increasingly steep, and the distribution curve consistently exhibited a right tail with expanding extensibility. No side peaks were observed, and only a single main peak was observed. This suggests that absolute disparities in overall development levels across the central region are narrowing, with no signs of polarization. Figure 3c shows that the distribution curve of the “dual circulation” development level in the western region is unimodal and shifts to the right. The peak demonstrates a trend of “rising–falling–rising,” but overall, it continues to rise, becoming narrower and steeper. This indicates a general improvement in the overall level in the western region, a reduction in absolute differences, and no signs of polarization in the western region. There was a temporary decline in the peak height, which then returned to normal, suggesting that in certain years, there were signs of increasing differences in the “dual circulation” development level. Figure 3d shows that the distribution curves of the “dual circulation” development level in the Northeast and Central regions exhibit similar characteristics, with a more pronounced upward trend in the peak values. During the study period, there is only one main peak, which shows a rightward shift, indicating an overall upward trend in the development level of the Northeast region, with no sign of polarization. The peak becomes narrower and higher, with an extended right tail, reflecting a gradual reduction in absolute differences within the Northeast region.

3.2. Analysis of the Evolutionary Trends of China’s “Dual Circulation” Economy

To more intuitively display the evolution of the “dual circulation” development levels across 30 provinces in China for the years 2005, 2010, 2015, and 2020, this study divides the “dual circulation” development levels for each year within the sample period into five categories, using the same range intervals to present them. The value ranges are (0.235, 0.574], (0.122, 0.235], (0.098, 0.122], (0.088, 0.098], and (0.001, 0.088], corresponding to high, upper–middle, middle, lower–middle, and low levels of China’s economic “dual circulation” development, respectively.

In 2005, Shanghai and three other provinces were at a high level, Zhejiang and four other provinces were at an upper–middle level, Sichuan and five other provinces were at a middle level, Yunnan and six other provinces were at a lower–middle level, and Xinjiang and seven other provinces were at a low level. In 2010, Zhejiang was added to the provinces at a high level, bringing the total to five provinces. Chongqing, Hainan, and Anhui were added to the upper–middle level, bringing the total to seven provinces. Among the remaining provinces, only Xinjiang, Qinghai, Ningxia, and Guizhou—four in total—were still at a low level, while the other fourteen provinces had all moved into the middle or lower–middle level. In 2015, Tianjin was newly added to the high-level category, bringing the number of provinces at this stage to six. A total of 23 provinces reached the middle–high and middle levels, but Qinghai and Inner Mongolia remained at the middle–low level of development. By 2020, the number of provinces at the high level was still 6, and 17 provinces had reached the middle–high level, although a few provinces remained at relatively low levels. China’s “dual-circulation” economy is advancing toward a higher level, and the “dual-circulation” development levels of each province are growing at varying speeds; however, there is still room for improvement in development levels (Table 2).

Table 2.

Spatial distribution and evolution trends of the development level of China’s “dual circulation” economy.

In terms of average annual growth rate, the mean is only 2.000%, with rates ranging from [0.385% to 5.302%], indicating slow growth and significant differences between provinces. Regionally, the eastern region leads the national average and performs notably well, while other regions generally lag behind the national average, with the western region lagging the most.

In terms of spatial distribution, China’s economic “dual circulation” presents a gradient pattern that decreases progressively from the east to the west. Regionally, the eastern area, leveraging multiple advantages such as its geographical location, level of economic development, and talent accumulation, has gradually established an underlying foundation of “supply–demand synergy and coordinated production and sales,” holding a leading position in both its starting point and level of maturity. The western region is at a disadvantage in external circulation and coupled with low technological levels and severe brain drain, it remains in a backward position. In addition, as the eastern coastal provinces—with higher levels of “dual circulation” development—expand outward in terms of supply, demand, and supply–demand linkage, this expansion has also extended to inland areas, steadily enhancing the overall level of China’s “dual circulation” economic development. Among the provinces, Beijing, Shanghai, Guangdong, Tianjin, Zhejiang, and Jiangsu have maintained a leading position for a long time and are showing a trend of radiating toward other regions, driving inland provinces to expand outward. As an important intersection of the domestic and international “dual circulation” strategy, Hainan leverages policy advantages such as offshore duty-free policies and the construction of the Hainan Free Trade Port. Backed by the vast and mature domestic market and bordering the emerging markets of Southeast Asia, and relying on the convenient and accessible South China Sea shipping routes, the implementation of the “dual circulation” strategy has been highly effective. In contrast, with the overall development level in inland areas lagging behind, Chongqing is striving to establish itself as a pivotal hub for the “dual circulation” strategy under the new economic norm. The city seeks to enhance its key position along the Belt and Road Initiative and the Yangtze River Economic Belt, using the development of an “inland highland of openness” as a lever to reshape its advantages in cooperation and competition in the region. Thanks to its high-quality industrial structure and an advanced, multilayered, and healthy super-circulatory development system, Chongqing demonstrates impressive performance in the “dual circulation” development.

3.3. Analysis of the Spatiotemporal Trends of China’s “Dual Circulation” Economy

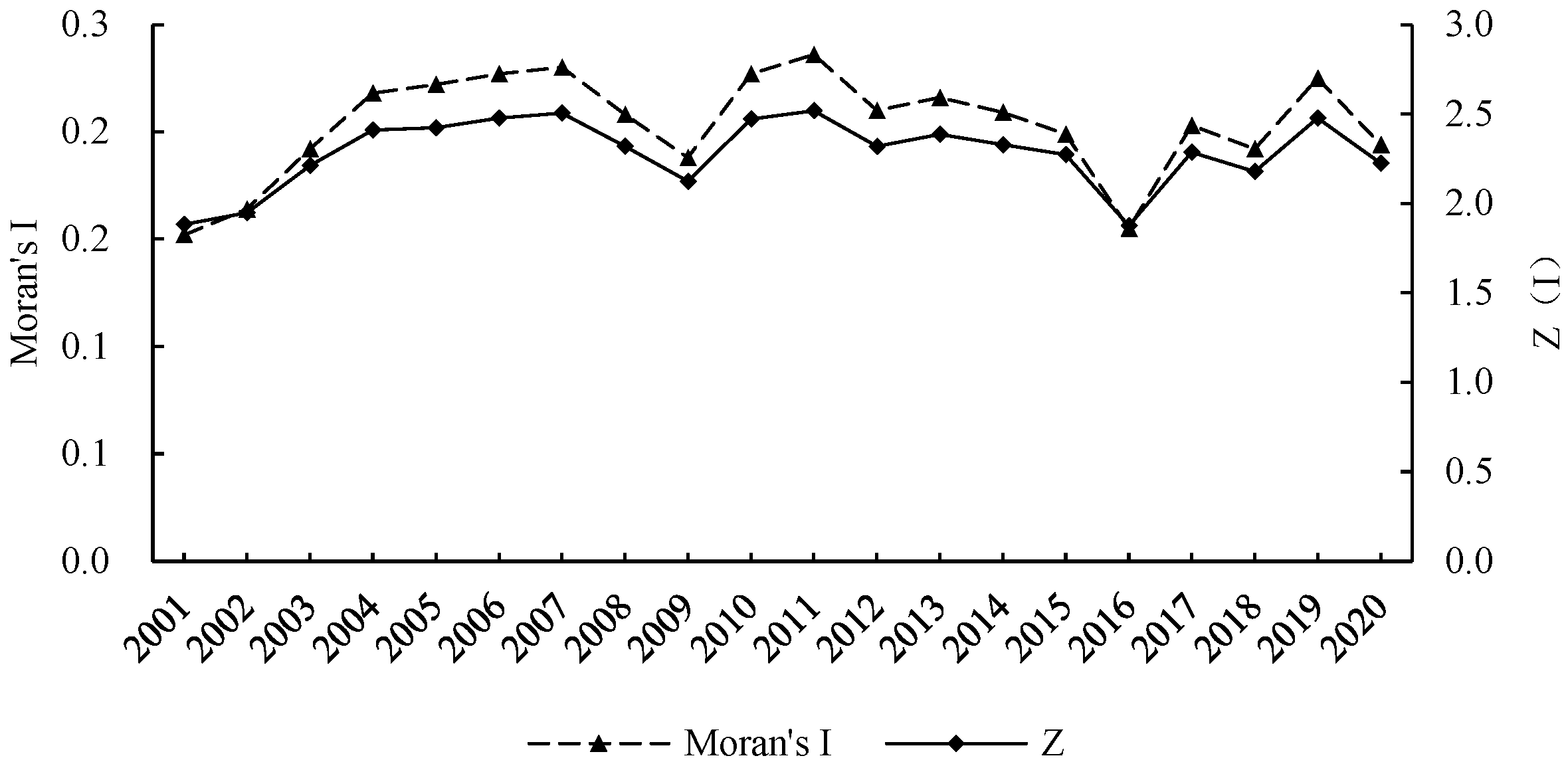

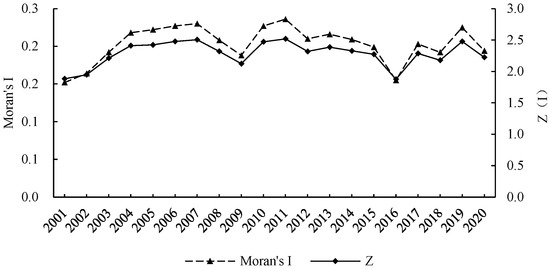

3.3.1. Global Spatial Autocorrelation Analysis

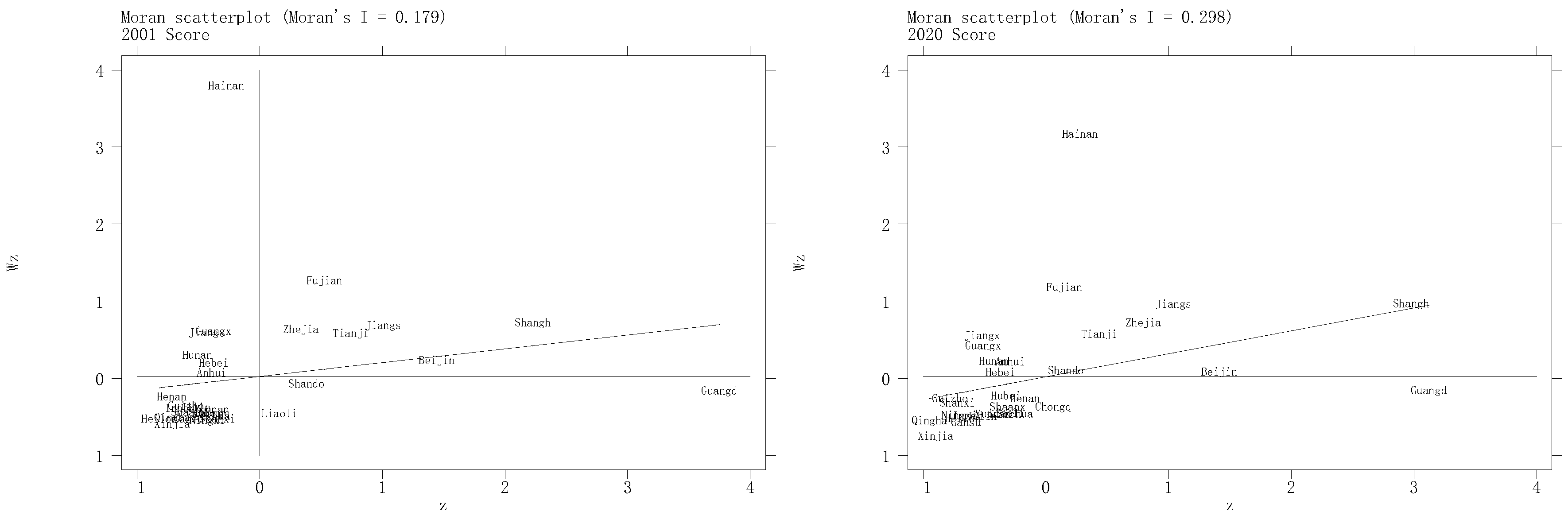

In view of this, this study employs Stata 17.0 software to conduct a global spatial autocorrelation analysis of the spatial panel data on the “dual circulation” of the economy during the study period (Figure 4). The results show that the Global Moran’s I of China’s economic “dual circulation” consistently remains positive and passes the 5% significance test, indicating that its spatial distribution is not completely random. There is a clear mutual influence and spatial correlation in the economic “dual circulation” among provinces that are geographically adjacent.

Figure 4.

Statistical results of global spatial autocorrelation Moran’s I and Z(I) from 2001 to 2020.

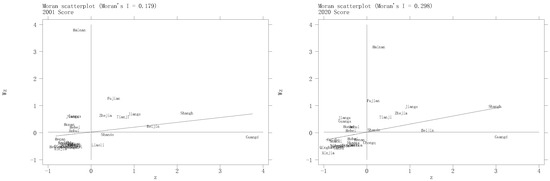

3.3.2. Local Spatial Autocorrelation Analysis

In view of this, to explore the spatiotemporal evolution characteristics (the clustering or differentiation of the same attribute) of the “dual circulation” economy in the observed provinces and their neighboring provinces, this paper plots the Local Moran’s I scatterplot (Figure 5) and correspondingly lists the quadrant tables for 2001 and 2020 (Table 3). The first (H-H) and third (L-L) quadrants represent spatial agglomeration and a positive correlation in their spatial distribution, and the second (H-L) and fourth (L-H) quadrants represent spatial differentiation and a negative correlation in their spatial distribution. As shown in Figure 5, the spatial correlation of China’s “dual circulation” economy is significant, presenting spatiotemporal evolution characteristics where both “clustering” and “differentiation” coexist.

Figure 5.

Moran scatter plots of the development level of China’s “dual circulation” economy (2001, 2020).

Table 3.

Distribution of local Moran’s I in different quadrants across provinces.

3.4. Types of Spatiotemporal Transitions in China’s “Dual Circulation” Economy

To reveal the spatiotemporal transformation patterns of the “dual circulation” economy in various provinces, this study further describes the changes in the number of provinces with different types of spatial differentiation over different periods (Table 4). There are four types. The first type (I) of spatiotemporal transformation refers to the situation where the observed province itself shifts to a neighboring quadrant over time (i.e., only the province itself transforms), including H-H→L-H (Hainan), L-L→H-L (Chongqing), and H-L→L-L (Liaoning) transformations. The second type (II) of spatiotemporal transition is characterized by the observed province itself shifting over time to a non-adjacent quadrant (i.e., only the neighboring provinces of the observed province undergo transition), including H-L→H-H (Shandong). The third (III) type of spatiotemporal transition refers to situations where the observed province remains in the same quadrant over time, but there are significant differences in the “dual circulation” development level between the observed province and its neighboring provinces, meaning that either the observed province has a lower development level while its neighbors are higher, or vice versa (i.e., both the observed province and its neighbors undergo transition). The fourth (IV) type of spatiotemporal transition is where the observed province remains in the same quadrant over time, and both the observed province and its neighboring provinces have either consistently high or low “dual circulation” development levels (i.e., both the province itself and its neighbors remain stable), including H-H→H-H (Fujian and five other provinces), L-H→L-H (Jiangxi and five other provinces), L-L→L-L (Henan and fourteen other provinces), and H-L→H-L (Guangdong), indicating that most provinces in China face significant pressure in “dual circulation” development. Clearly, the number of provinces observed in the fourth type of spatiotemporal transition is relatively large, whereas those in the first, second, and third types are fewer. This shows that during the spatiotemporal evolution of the economic “dual circulation” from 2001 to 2020, a large proportion of provinces exhibited stable high (or low) “dual circulation” development levels. The fourth (IV) type of spatiotemporal transition covers 26 provinces: 7 provinces have high “dual circulation” development levels, while 19 provinces have low levels, accounting for approximately 87% of the observed provinces. This further indicates a gradually increasing trend in spatial clustering and significant stability. In addition, four provinces fell into the first and second types of spatiotemporal transition, accounting for approximately 13% of the observed provinces. Therefore, policy efforts should focus on provinces with stable high “dual circulation” development levels, such as Fujian, Zhejiang, Tianjin, Jiangsu, Beijing, Shanghai, and Guangdong, while also paying attention to provinces such as Hainan, Chongqing, Liaoning, and Shandong that exhibit spatiotemporal transition characteristics.

Table 4.

Spatiotemporal transition matrix of each province (2001, 2020).

4. Quantile Regression Analysis of the Influencing Factors of China’s “Dual Circulation” Economy

What is the driving mechanism behind the above phenomena of temporal and spatial differences, dynamic evolution and evolution trends? What are the key factors leading to regional disparity? This constitutes the core task of the driver analysis in this section.

4.1. Quantile Regression Model

Drawing on existing research [48], the reason for using a quantile regression model to describe the conditional distribution of the driving factors behind the development level of the “dual circulation” system is that it does not require strict assumptions, and its results are strongly nested with different types of spatiotemporal transitions [46], which can reveal the mechanisms by which various driving factors influence its spatiotemporal transitions. The specific formula is as follows

Suppose the probability distribution of random variable Y is:

The τ quantile of Y is defined as the minimum Y value satisfying ≥ τ:

The τ quantile of is calculated by the objective function of minimizing the absolute value of the weighted error ξ as:

In the formula, {} function represents the value of ξ when the functional takes the minimum value, τ(⋅) is the check function, τ∫(y − ξ)dF(y) represents the total absolute error with the weight of τ in the region of y > ξ, (1 − τ)∫|y − ξ|dF(y) represents the absolute error with the weight of 1 − τ in the region of y > ξ sum.

4.2. Variable Selection

Dependent variable: “Dual Circulation” development level (DEC), calculated based on the previously constructed indicator system.

Explanatory variables: (1) Level of economic development (GDP). The level of “dual circulation” development is closely related to the level of economic development [21]. The higher the level of regional economic development, the greater the region’s ability to attract investment, talent, and high-quality resources, the more complete its economic growth conditions and resources, and the higher the quality and efficiency of the national economic cycle. In this study, the natural logarithm of per capita GDP was used as a representation. (2) The level of financial development (FIN). Financial development empowers industrial upgrading and economic structural optimization, stimulates endogenous economic growth, unleashes the effects of economies of scale and scope, and promotes the coordinated development of domestic and international circulation. Drawing on existing research [49], it is represented by the proportion of outstanding bank loans to GDP. (3) Income Gap (IG). Income distribution is crucial for economic development and social stability. Narrowing the income gap is not only an essential requirement for achieving common prosperity in the process of Chinese-style modernization but also an inherent part of the “dual circulation” strategy. An excessive income gap has become a key factor restricting the overall improvement of the nation’s consumption capacity. Drawing on existing research [50], the Theil index was used as a measure. (4) Information Flow (IF). As a key “catalyst” for smooth economic circulation, efficient information flow can not only accelerate the dissemination and sharing of knowledge and technology, but also reduce the cost of acquiring information, improve the efficiency of governance-related information spillovers, and promote the deep integration of logistics, business, information, and capital flows. Drawing on existing research [51], this study used the postal and telecommunications business volume indicators of each province. (5) Infrastructure Construction (IC). As hardware support for implementing the “dual circulation” strategy, infrastructure not only directly contributes as an input factor to the production function to increase output, but also accelerates the circulation of factors, goods, and capital, thereby expediting dynamic coordination between supply and demand. Drawing on existing research [52], we used four indicators including per capita road area. (6) Human Capital Level (HC). As a vital foundation for innovation-driven development, human capital influences every link in the national economic cycle through technological innovation and technology spillovers. It drives supply-side structural reform, promotes the dynamic alignment of supply and demand, and thereby enhances the level of “dual circulation” development. Drawing on existing research [53], the average years of education per capita in each region was used as an indicator. (7) Level of the Rule of Law (LOL). Laws are an important safeguard for the healthy development of the national economy. In implementing the “dual circulation” strategy, it is not only necessary to focus on the economic aspect but also to pay attention to the legal and rule-of-law dimensions, thereby strengthening the legal guarantees of the “dual circulation” strategy. Drawing on existing research [54], the development of market intermediary organizations and the legal institutional environment index, as characterized by Fan Gang, are adopted. (8) Technological Innovation Level (INN). Technological innovation is the internal driving force of the economic “dual circulation.” The “dual circulation” strategy aims to foster a safer, more controllable, and highly resilient independent innovation ecosystem and promote better integration between domestic and international markets. Drawing on existing research [55], the natural logarithm of the number of domestic invention patent applications accepted in each province was used as an indicator. (9) Regional Resource Endowment (RRE). The “dual circulation” strategy is a strategic adjustment made in response to changes in China’s resource endowment in international competition. It is a modernization strategy driven by innovation to ensure smooth economic circulation and aims to systematically build a secure, controllable, resilient, and robust economic system. Drawing on existing research [19], the number of employees in mining industry urban units was used as an indicator. (10) Degree of Capital Market Development (DCMD). The real economy is the foundation for implementing the “dual circulation” strategy, and the capital market is important for the healthy development of the real economy. The effective implementation of the “dual circulation” strategy cannot be separated from the sound development of the capital market. Cultivating a resilient and mature Chinese capital market helps to give full play to the central role of the capital market in the process of implementing the “dual circulation” strategy. Drawing on existing research [56], the degree of development of factor markets is represented by the Factor Market Development Index from Fan Gang’s Marketization Index. (11) Demand Structure (DS). Firmly focusing on the strategic foundation of expanding domestic demand and accelerating the optimization of the demand structure are key drivers for strengthening the domestic economic cycle. Simultaneously, better tapping into the potential of domestic demand, optimizing its structure, and continuously building an ultra-large-scale domestic market are crucial advantages for implementing the “dual circulation” strategy. Drawing on existing research [57], the ratio of total retail sales of consumer goods to regional GDP was used as an indicator. Multicollinearity was assessed using the Variance Inflation Factor (VIF), with a mean value of 5.81, indicating no severe multicollinearity.

4.3. Quantile Regression Results

As shown in Table 5, the regression coefficient of GDP is significantly negative at the 0.2 to 0.8 low and high quantiles, indicating that it has a constraining effect on the development level of the “dual circulation.” The regression coefficient of FIN is significantly negative at the 0.5, 0.7, and 0.9 high quantiles, indicating a constraining effect on the “dual circulation” development level. The regression coefficient of IG is significantly negative at the 0.2 to 0.8 low and high quantiles, also indicating a constraining effect on the “dual circulation” development level. The regression coefficient of IF is significantly positive at the 0.1 to 0.8 low and high quantiles, suggesting that it has a driving effect on the development level of the “dual circulation.” The regression coefficient of IC is significantly negative only at the 0.1 to 0.2 low quantiles, indicating that it constrains the development level of the “dual circulation.” The regression coefficient of HC is significantly positive at the 0.3 to 0.9 low and high quantiles, showing a driving effect on the “dual circulation” development level. The regression coefficient of LOL is significantly positive at the 0.3, 0.4, 0.5, and 0.7 quantiles, indicating a driving effect on the “dual circulation” development level. The regression coefficient of INN is significantly positive at all quantiles from 0.1 to 0.9, reflecting a driving effect on the “dual circulation” development level. The regression coefficient of RRE is significantly negative at all quantiles from 0.1 to 0.9, indicating a constraining effect on the level of “dual circulation” development. The regression coefficient of DCMD is significantly positive only at the 0.6, 0.7, and 0.9 high quantiles, showing a driving effect on the development level of the “dual circulation.” The regression coefficient of DS is significantly positive only at the 0.9 high quantile, suggesting a driving effect on the development level of “dual circulation.”

Table 5.

Quantile regression of the driving factors of dual circulation.

5. Analysis of the Spatiotemporal Evolution and Leapfrogging Mechanism of China’s “Dual Circulation” Economy

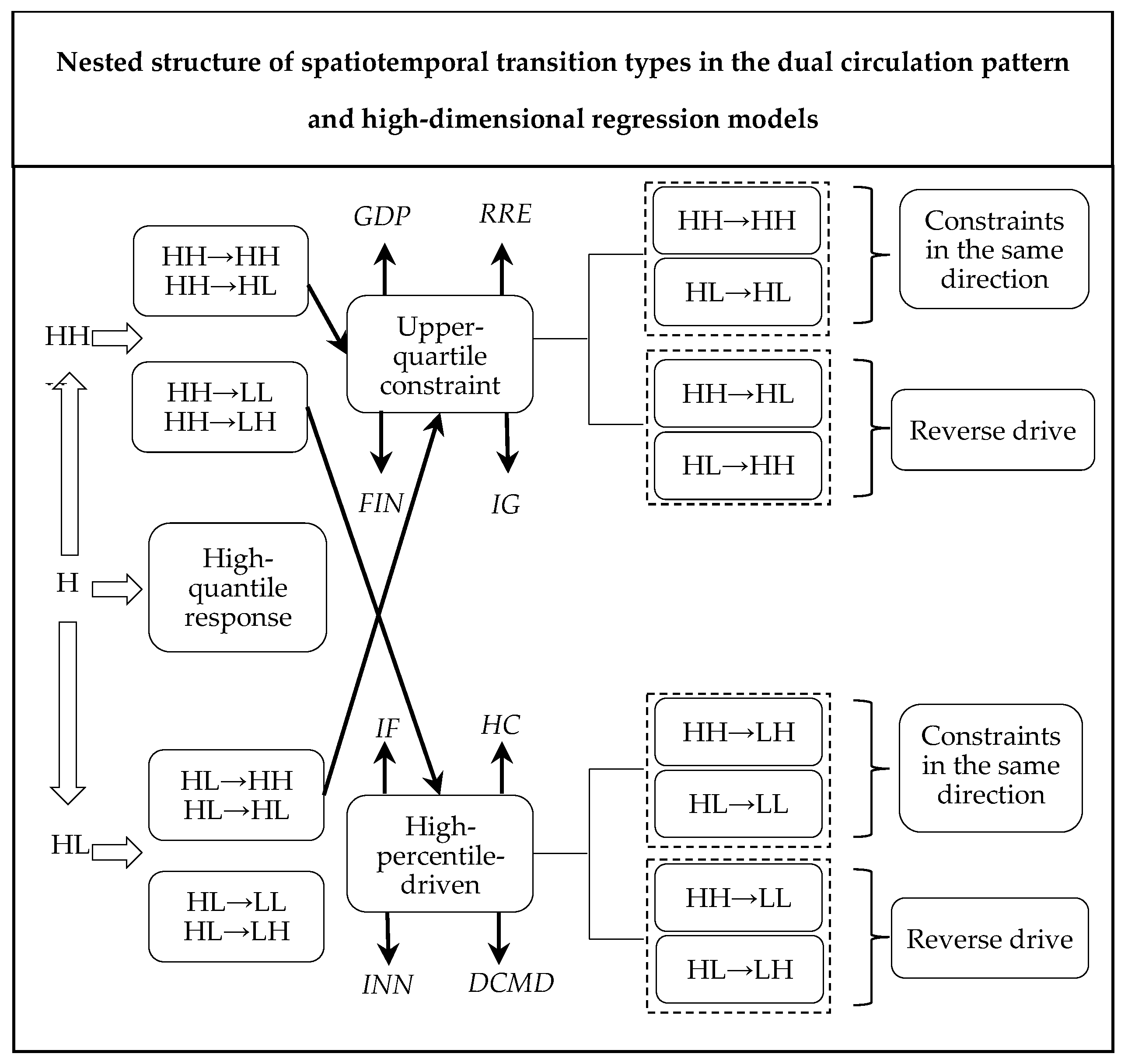

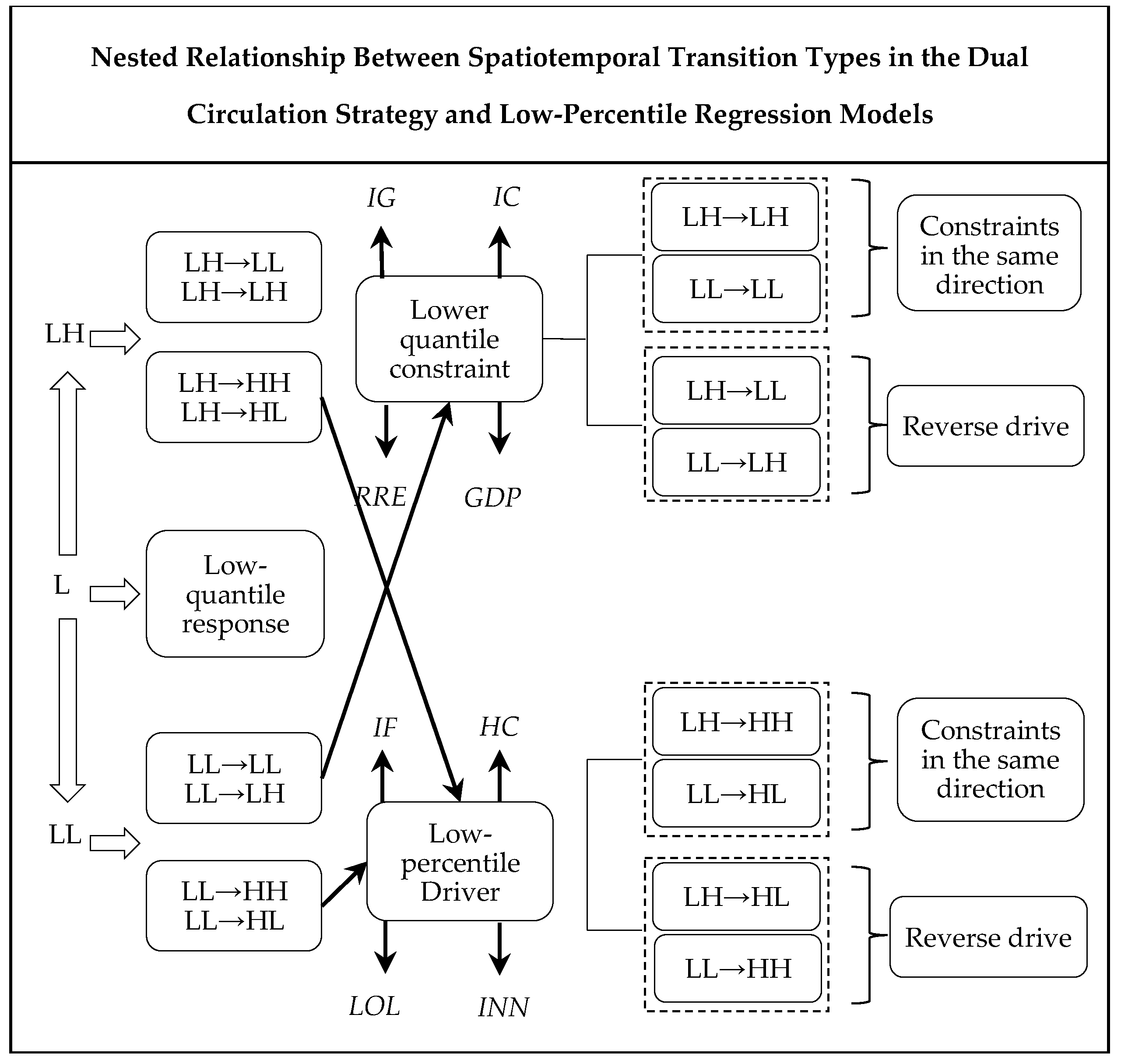

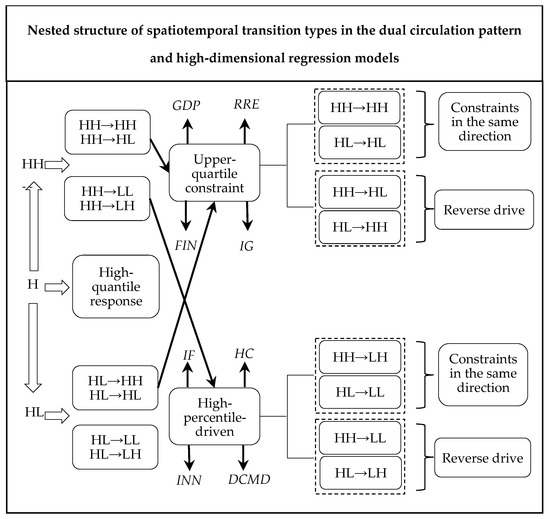

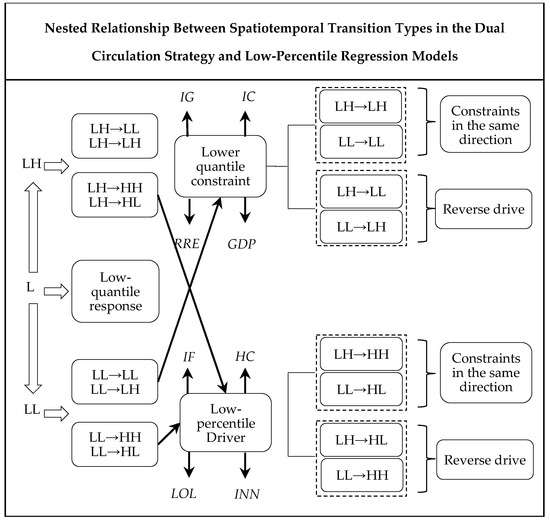

The results of the quantile regression help illustrate the mechanisms by which various driving factors influence the spatiotemporal transformation of China’s “dual circulation” economy. Moreover, there is a strong degree of interrelationship between the quantile response types of each driving factor and the types of spatiotemporal transformation [46]. In view of this, drawing on existing research [46], this study adopts a nested approach combining quantile regression and spatiotemporal transition types to reveal the multidimensional factor coupling driving the mechanisms behind its spatiotemporal transitions.

5.1. The Nesting of Spatiotemporal Transitions and Quantile Regression Results

As shown in Table 6 and Figure 6, in the high quantile constraint model, the level of GDP, FIN, IG, and RRE exert a constraining effect on the leap in the development level of the dual circulation strategy. In this model, the region maintains high-level stability by enhancing economic and financial development, narrowing income disparities, and leveraging its regional resource endowments. This approach helps Fujian, Zhejiang, Tianjin, Jiangsu, Beijing, and Shanghai (HHt→HHt+1), Guangdong (HLt→HLt+1), and Shandong (HLt→HHt+1) sustain their high-level status while constraining their transition to lower levels. In the high-quantile-driven model, IF, HC, INN, and DCMD constrain high-level stability in regions such as Liaoning (HLt→LLt+1). Among these factors, human capital and technological innovation levels exert a relatively greater influence, while information flow and capital market development have comparatively less impact.

Table 6.

Nested results of spatiotemporal transition and quantile regression (2001, 2020).

Figure 6.

Nesting of spatiotemporal transition types and a high-quantile regression model.

As shown in Table 6 and Figure 7, in the low-quantile constraint model, the level of GDP, IG, IC, and RRE constrain the advancement of the “dual circulation” development level. Under this model, the economic development level, income disparity, infrastructure construction, and regional resource endowment limit the leap from low-level to higher-level for provinces such as Jiangxi, Guangxi, Hunan, Hebei, Anhui (LHt→LHt+1), and Henan, Shaanxi, Hubei, Shanxi, Guizhou, Sichuan, Yunnan, Jilin, Heilongjiang, Gansu, Xinjiang, Inner Mongolia, Ningxia, and Qinghai (LLt→LLt+1). In the low-quantile driving model, IF, HC, LOL, and INN drive provinces with lower levels, such as Hainan (LHt→HHt+1) and Chongqing (LLt→HLt+1), to leap to a higher-level state.

Figure 7.

Nesting of spatiotemporal transition types and low quantile regression models.

5.2. The Development Level of the “Dual Circulation” Strategy Fosters Coordinated Regional Development

5.2.1. Promote the Stable Development of High-Level Regions in the “Dual Circulation” Strategy

Table 7, Table 8, Table 9 and Table 10 were obtained from Table 6 and Figure 6 and Figure 7. The optimization measures for maintaining stable high-level “dual circulation” development in the eight provinces are as follows: (1) GDP, FIN, IG, and RRE act as constraints on Shandong (HL→HH) in maintaining stable high-level development. Therefore, transforming Shandong’s “speed-driven” economic growth model, addressing the three major mismatches in the financial sector, narrowing the income gap, and making reasonable use of and leveraging regional resource endowments are conducive to maintaining regional high-level stability. (2) The levels of GDP, FIN, IG, and RRE exert constraining effects on maintaining a high and stable level in provinces such as Fujian, Zhejiang, Tianjin, Jiangsu, Beijing, and Shanghai (HH→HH). In view of this, efforts should be made to accelerate the transformation of the region’s economic development model, vigorously develop digital finance to enhance the quality and efficiency of financial services for the real economy, intensify reforms of the income distribution system, encourage resource-rich areas to implement industrial restructuring, and promote the shift of industries toward high value-added, technology-intensive, and environmentally friendly sectors. (3) The levels of GDP, FIN, IG, and RRE all constrain Guangdong (HL→HL) from maintaining a high-level stability. In view of this, strengthening economic restructuring, addressing the three major mismatches in the financial sector, boosting consumption, unleashing the potential of domestic demand to narrow the income gap, formulating and implementing cross-regional coordinated development plans, enhancing cooperation and coordination between regions, and promoting complementary development between regions with weaker and richer resource endowments will all be conducive to maintaining Guangdong’s high level of stability, as shown in Table 7.

Table 7.

Regions promoting the stable development of the high-level “dual circulation”.

5.2.2. Constraints on Changes in High-Level Regional Development Under the “Dual Circulation” Strategy

For Liaoning, where the level of high “dual circulation” development fluctuates, the specific constraints are as follows: IF, HC, INN, and DCMD, all of which hinder the province’s ability to maintain a high and stable level. In view of this, Liaoning should focus on promoting the synergistic effects of other factors to reduce the constraining impact of the four factors mentioned above on maintaining high and stable development. For example, further improving the quality of economic development, accelerating the development of digital finance, increasing investment in new types of infrastructure, and optimizing the industrial structure to enhance the efficiency of regional resource endowments. These measures would strengthen the multidimensional coupling and synergistic effects among information flow, human capital level, technological innovation level, and capital market development, thereby reducing their restrictive impact on Liaoning’s sustained high performance. The goal is to prevent high-performing provinces from shifting to lower levels and to achieve mutual promotion and coordinated development between internal and external economic cycles, as shown in Table 8.

Table 8.

Regions limiting changes in the level of high “dual circulation” development.

Table 8.

Regions limiting changes in the level of high “dual circulation” development.

| Province Name | Types of Spatiotemporal Transitions | Factors Driving Changes in the Region |

|---|---|---|

| Liaoning | Local region transition—Adjacent region transition (HL→LL) | IF, HC, INN, and DCMD |

5.2.3. Break Through the Constraints of Low-Level Regions Locked in by the “Dual Circulation” Development Model

For the 19 provinces locked into a low-level “dual circulation” development model, the specific measures are as follows: (1) GDP, IG, IC, and RRE are driving factors in the low-level lock-in of provinces such as Jiangxi, Guangxi, Hunan, Hebei, and Anhui. Therefore, Jiangxi, Guangxi, Hunan, Hebei, and Anhui should shift from input-driven growth to efficiency-driven economic development, narrow income gaps to promote social equity, increase investment in new infrastructure to improve regional connectivity, and optimize the development and utilization of regional resource endowments to break through their current low-level lock-in states. (2) GDP, IG, IC, and RRE are driving factors behind the low-level lock-in observed in provinces such as Henan, Shaanxi, Hubei, Shanxi, Guizhou, Sichuan, Yunnan, Jilin, Heilongjiang, Gansu, Xinjiang, Inner Mongolia, Ningxia, and Qinghai. Therefore, to break free from this low-level lock-in, it is essential to improve the quality of economic development, shift from a “speed-oriented” growth model, focus on increasing the added value of industrial chains, raise the income levels of low-income groups, unleash consumption potential, promote domestic demand growth, avoid excessive investment, emphasize the quality and efficiency of infrastructure, advance the intelligent and green development of infrastructure, tap into and integrate regional resources, promote the development of characteristic industries, and transform resource advantages into economic advantages, as shown in Table 9.

Table 9.

Regions locked into a low “dual circulation” development level.

Table 9.

Regions locked into a low “dual circulation” development level.

| Province Name | Types of Spatiotemporal Transitions | Factors Driving Regional Lock-In |

|---|---|---|

| Jiangxi, Guangxi, Hunan, Hebei, Anhui | Stability in this region—Stability in the adjacent areas (LH→LH) | GDP, IG, IC, and RRE |

| Henan, Shaanxi, Hubei, Shanxi, Guizhou, Sichuan, Yunnan, Jilin, Heilongjiang, Gansu, Xinjiang, Inner Mongolia, Ningxia, Qinghai | Stability in this region—Stability in the adjacent areas (LL→LL) | GDP, IG, IC, and RRE |

5.2.4. Encouraging Low-Level Regions to Leapfrog in the Development of the “Dual Circulation” Strategy