Abstract

In the pursuit of sustainable economic development, fostering new-quality productivity (NQP) is both an inherent requirement and a strategic priority for advancing a green economy, while digital transformation has emerged as a pivotal driver in reconciling economic growth with environmental protection. Grounded in the Dual-Factor Theory of Productivity, this study empirically examines the impact of digital transformation on corporate NQP, with a focus on its heterogeneous effects, using panel data from China’s A-share listed firms (2013–2022). We further investigate the mediating role of green innovation—encompassing both technological and managerial dimensions—and the moderating effect of digital financial inclusion (DFI). The results show that digital transformation significantly enhances NQP, a finding robust to multiple endogeneity tests and alternative model specifications. Mechanism analysis indicates that digitalization fosters NQP by promoting green technological and managerial innovations, while DFI amplifies this effect. Heterogeneity analysis reveals stronger impacts in state-owned enterprises, non-manufacturing sectors, firms in developed regions, and highly competitive industries. These findings advance theoretical understanding of dynamic control mechanisms in environmental economics, provide empirical evidence on how digital transformation drives sustainable productivity through green innovation, and offer actionable insights for policymakers and firms seeking to align economic growth with environmental sustainability.

1. Introduction

Since the financial crisis, global economic growth has shown a persistent downward trend [1,2]. How to sustain economic growth has become a universal challenge for nations worldwide and a focal topic across disciplines [3,4]. As policy practices evolve, there is growing recognition of the importance of incorporating technological innovation and total factor productivity into economic development frameworks, with increasing emphasis on the quality of economic growth. In recent years, new-quality productivity (NQP) has garnered significant attention, with its development being regarded as an effective pathway to achieve qualitative leaps in economic development. Conceptually, NQP represents a form of productivity characterized by qualitative transformations in labor forces, means of production, and their optimal combinations, with total factor productivity improvement as its core indicator. It serves as a hallmark of high-quality development grounded in productivity practices and the new technological revolution [5,6]. However, the existing literature, although rich in conceptual definitions and macro-policy discussions, often remains at a descriptive or correlational level, with limited critical examination of methodological limitations or empirical biases. For example, while Pan et al. [7] emphasize the role of the digital economy, and Wang et al. [8] focus on carbon emission reduction, most studies treat these as parallel drivers without clarifying their relative explanatory power or interaction effects. Moreover, climate policy uncertainty has been examined [9], but often through aggregated national-level data, which may mask micro-level heterogeneity and firm-level behavioral dynamics [10,11].

The accelerated iteration and evolution of digital technologies, particularly big data, cloud computing, and blockchain, have positioned digitalization as an effective solution for enhancing economic growth momentum and sustainable development worldwide [12,13,14]. Concurrently, corporate digital transformation has gained increasing emphasis from shareholders and managers [15,16]. Taking China as an example, Accenture’s 2022 Report on the Digital Transformation Index of Chinese Enterprises reveals that the average digital transformation score of Chinese firms surged from 38 in 2015 to 52 in 2022. This empirical evidence demonstrates that even in developing economies like China, corporate digital transformation practices have become increasingly widespread, with continuous breakthroughs in effectiveness. Existing literature has extensively examined the micro-level consequences of corporate digital transformation, demonstrating its significant value in technological innovation [17], organizational restructuring [18], investment efficiency [19], and sustainable performance [20]. Nevertheless, most empirical studies adopt either single-industry samples or short cross-sectional datasets, which restrict the ability to capture temporal dynamics and heterogeneous effects across regions, ownership structures, or competition intensity. Methodologically, the reliance on simple OLS or panel regressions without robust endogeneity controls raises concerns about causal inference, particularly when examining complex constructs like NQP [21,22]. This creates a research gap for studies employing richer panel data, multi-dimensional measurement frameworks, and quasi-natural experimental designs. Despite the broadening impact of digital transformation on firms, few studies have evaluated its economic effects from the perspective of NQP. Given that NQP serves as a critical indicator of corporate excellence, establishing the intrinsic relationship between digital transformation and NQP carries substantial theoretical and practical significance. This study addresses this gap by not only estimating the direct effect of digital transformation on NQP, but also unpacking the underlying mechanisms (green innovation), boundary conditions (digital financial inclusion), and heterogeneous impacts across ownership types, industry competition levels, and regional development stages. In doing so, it provides a more nuanced understanding of whether the influence of digitalization is primarily driven by innovation capacity enhancement, market connectivity, cost efficiency, or other firm-level capabilities.

Theoretically, corporate digital transformation exerts significant influence on new-quality productivity through three fundamental mechanisms. Primarily, the implementation of digital transformation strategies enables enterprises to reconfigure products, organizational structures, and business models, thereby enhancing production efficiency and productivity levels to generate greater value [20,23]. A compelling illustration is Inspur Group’s adoption of the Joint Design-Manufacturing (JDM) model, which through intensive collaboration with customers and partners achieved a 3–10 fold improvement in R&D efficiency, reduced new product development cycles from 1.5 years to 9 months, and enabled prototype delivery within just 3 months, thereby consolidating its technological leadership in both domestic internet infrastructure and global server markets. Concurrently, digital transformation strengthens enterprise-stakeholder connectivity and enhances market responsiveness, facilitating accelerated product iteration and upgrading [24]. Moreover, digital technologies empower enterprises to achieve green transition through pollution reduction and environmental performance improvement, consequently boosting green total factor productivity and advancing new-quality productivity development. Drawing upon empirical evidence from China, this study addresses three pivotal research questions: Does corporate digital transformation effectively enable new-quality productivity development? Through which specific channels does this effect materialize if confirmed? And do heterogeneous effects exist across regions, industries, and enterprise characteristics?

This study selects China as its research context for three compelling reasons. First, as a representative emerging market economy, China has prioritized digital transformation through its national “Digital China” strategy. The government has substantially invested in digital infrastructure, creating favorable conditions for corporate digital transformation [25]. By May 2024, China had deployed 3.837 million 5G base stations, accounting for over 60% of the global total, while its fixed broadband networks achieved rapid upgrades from 10 Mbps to 100 Mbps and then to gigabit speeds. These developments provide an ideal setting to examine digital transformation’s effects while offering valuable insights for other digitalizing economies. Second, mirroring global trends, China’s economic growth has slowed significantly in recent years [25,26,27,28]. In response, policymakers have introduced the novel concept of new-quality productive forces, emphasizing total factor productivity growth and technological innovation as pathways to high-quality development. As the world’s largest developing economy, China’s approach to cultivating new-quality productive forces offers valuable policy lessons for other developing nations facing growth momentum challenges.

This study establishes the causal relationship between digital transformation and corporate NQP through rigorous empirical analysis of China’s non-financial A-share listed companies from 2013 to 2022, utilizing data from corporate annual reports, CNRDS, and CSMAR databases. We employ Python’s (version 3.10.12) Jieba (version 0.42.1) text segmentation tool to extract digital transformation-related keywords from annual reports, constructing a comprehensive firm-level digitalization index. The measurement of NQP is achieved through a multidimensional indicator system encompassing both labor and production tools factors, with weights determined by the entropy method. Baseline regression results demonstrate that digital transformation exerts a statistically significant positive effect on NQP enhancement. The robustness of this finding has been thoroughly verified through alternative model specifications, including reconstructed digitalization indices (Dig) and total factor productivity-based NQP measures, with all tests consistently supporting our primary conclusion.

A potential endogeneity concern is that firms with strong technological innovation capabilities, economic efficiency, and high-quality development may be more inclined to prioritize digital transformation and thus possess greater capacity for digitization. To mitigate this reverse causality issue, this study leverages the “Broadband China” pilot policy as an exogenous shock and employs a multi-period difference-in-differences (DID) approach to estimate the policy’s impact on firm-level NQP. Our findings demonstrate that the “Broadband China” policy exerted a positive effect on NQP. Furthermore, to address additional endogeneity issues such as omitted variable bias, we construct instrumental variables (IVs) and implement a two-stage least squares (2SLS) estimation. After implementing these robustness checks, the causal relationship between digital transformation and NQP is strongly supported.

In the mechanism analysis, we identify two key channels through which digital transformation enhances firm-level NQP: green technology innovation capability and green management innovation. Furthermore, employing a moderation effects model, we demonstrate that digital financial inclusion significantly amplifies the positive impact of digital transformation on NQP. Finally, cross-sectional heterogeneity tests reveal that the productivity-enhancing effects of digitization are more pronounced for state-owned enterprises (SOEs), non-manufacturing firms, firms located in developed regions, and those operating in industries with higher competition intensity.

Compared with existing studies, this paper makes three key contributions. First, this study examines how technological progress affects firms’ new-quality productivity (NQP). Recent literature has mainly focused on defining NQP and discussing its drivers [5]. Previous studies have explored various factors behind NQP, including the digital economy [7], international trade [29], and entrepreneurship [30]. However, most of these studies rely on single productivity measures, overlooking NQP’s multidimensional nature. Few provide quantitative evidence on how technological progress—especially digital technologies—shapes NQP. Additionally, many studies use short timeframes [31], making it difficult to assess long-term effects. This limited approach may lead to biased results and underestimate the role of innovation. To address these gaps, we construct a multidimensional NQP index using the entropy method and analyze ten years of firm-level panel data. Our findings help clarify the causal relationship between digital transformation and NQP, contributing to research on NQP’s key drivers.

Second, this study extends research on the microeconomic consequences of digital technologies. In the digital economy era, technologies such as artificial intelligence, blockchain, cloud computing, big data, and the Internet of Things are being widely adopted in the real economy, driving firms to seek transformative pathways [23]. However, existing studies often overlook the precision and quality of innovation outputs—particularly green innovation, which is critical for sustainable growth—and rarely distinguish between its technological and managerial forms [10,11,17]. They also neglect micro-level enabling conditions, relying instead on broad institutional indicators and overlooking the role of digital financial ecosystems. Unlike prior literature, our findings show that digital transformation significantly enhances firms’ NQP. Furthermore, we identify the mediating role of green innovation capabilities and the positive moderating effect of digital financial inclusion, thereby deepening the understanding of how digital transformation empowers the development of NQP.

Finally, our study, based on empirical data from China, confirms the important role of digital transformation in driving new-quality productivity, which is an important implication in the context of sluggish growth and increasing risks of uncertainty prevailing globally [32]. In particular, the new-quality of productivity emphasized in this paper implies the need to focus on quality and efficiency in the development process, which is a new and more futuristic concept of productivity [5], and can bring new insights and reflections for the sustained growth of the world economy.

The paper is organized as follows: The paper is structured as follows: Section 2 develops the theoretical analysis, research hypotheses, and baseline model; Section 3 reports the empirical findings, including robustness checks and endogeneity tests; Section 4 provides further analysis comprising mechanism tests, moderating effects, and heterogeneity analysis; and Section 5 concludes with research implications and policy recommendations.

2. Materials and Methods

2.1. Research Hypothesis

New-quality productivity “takes the leap of workers, labor materials, labor objects and their optimal combinations as its basic connotation” [5]. From a production function perspective, digital transformation can be conceptualized as an enabling factor that shifts the firm’s production frontier outward by altering the efficiency parameters of labor, capital, and technology [33,34]. The causal structure between Digital transformation (DCG) and New-Quality Productivity (NQP) is achieved through three mutually reinforcing channels—upgrading of human capital, deepening of physical capital and optimization of factor allocation.

First, human capital upgrading under digital shocks. Under Human Capital Theory, education, training, and skill accumulation increase the marginal productivity of labor [35]. In the presence of DCG, firms introduce advanced digital tools (e.g., AI-assisted design, cloud-based collaboration), which causes task content to shift toward higher cognitive and non-routine activities. This triggers micro-level behavioral responses: workers invest more in digital skills, managers reallocate tasks to match capabilities, and the organization increases training intensity. The result is an endogenous rise in average human capital quality, which directly enters the production function as an enhanced labor-augmenting technology parameter.

Second, physical capital deepening and reconfiguration. From the Resource-Based View, sustainable competitive advantage stems from unique, valuable, and inimitable resources [36,37]. DCG serves as a capital reconfiguration shock, allowing traditional equipment and tools to be supplemented or replaced by digital assets such as IoT devices and automated production lines. These assets expand the feasible set of production combinations, raising both the marginal product of capital and scale efficiency. Firms in turn adjust investment portfolios toward intangible digital capital, thereby shifting the production frontier outward in capital-intensive dimensions [38].

Third, factor allocation efficiency and innovation-driven complementarities. Innovation-Driven Growth Theory posits that technological change increases the efficiency with which factors are combined [5,6]. DCG reduces information frictions across departments and between firms and markets, enabling real-time resource reallocation toward high-productivity uses. At the same time, human and physical capital upgrading exhibit complementarity—digitally skilled workers can exploit advanced equipment more effectively, and new capital assets require upgraded human capital to realize full returns. This complementarity reinforces the innovation capacity of the firm, generating both process and product innovations that further expand the production frontier [39]. In sum, DCG operates as a systemic productivity shock that simultaneously enhances labor-augmenting, capital-augmenting, and total factor efficiency parameters in the firm’s production function. Therefore, this paper proposes the following research hypotheses:

Hypothesis 1.

Digital transformation is positively associated with firms’ new-quality productivity.

The core of green innovation capability lies in the creation of new value that simultaneously satisfies environmental and economic objectives [40,41]. It encompasses two interrelated dimensions: green technology innovation and green management innovation. Existing research indicates that these capabilities not only reduce environmental impact but also enhance firms’ competitiveness by improving operational efficiency and promoting sustainable growth [42].

Digital transformation (DCG) contributes to the development of green technology innovation by increasing the precision of innovation inputs and the quality of innovation outputs. Data-driven R&D investment targeting allows firms to allocate resources more effectively to high-potential green projects, avoiding redundant or low-yield investments [43,44]. Artificial intelligence–assisted patent landscaping helps identify technological gaps, while digital twins and simulation tools reduce trial-and-error costs, thereby raising the likelihood of producing high-quality green patents—characterized by higher forward citations, broader claims, and higher grant-to-application ratios—which are more strongly associated with new-quality productivity (NQP) growth than raw patent counts [45,46,47].

DCG also enables green management innovation by expanding the monitoring and scalability of sustainable practices. Real-time tracking of environmental metrics such as carbon emissions and energy consumption facilitates timely process adjustments [48]. Big data analytics allow managers to identify underperforming units and replicate best practices across organizational units, ensuring that environmental management systems (e.g., ISO14001-aligned redesign [49]) are consistently implemented and yield system-wide productivity improvements.

Furthermore, DCG strengthens collaborative innovation in both green technology and management domains. Cloud-based platforms support cross-functional and cross-institutional collaboration, while blockchain-enabled intellectual property protection encourages secure knowledge exchange and accelerates commercialization of green innovations. These interactions enhance the novelty, applicability, and diffusion speed of green innovation outcomes, thus amplifying their contribution to NQP [50]. Based on this analysis, we propose the following hypotheses:

Hypothesis 2.

Digital transformation enhances firms’ New-quality productivity (NQP) by improving green technological innovation capability.

Hypothesis 3.

Digital transformation enhances firms’ New-quality productivity (NQP) by improving green management innovation capability.

According to information asymmetry theory, asymmetric information among market participants can lead to market inefficiency and heightened operational risks. Digital Financial Inclusion (DFI) mitigates resource misallocation by leveraging precise data analytics, cloud platforms, and intelligent risk-control systems, thereby enhancing information transparency and financing efficiency while addressing the limitations of traditional financial services [51]. From a cost perspective, DFI reduces the financial barriers that often hinder firms’ digital transformation. By providing alternative credit channels based on big-data risk assessment, DFI eases financing constraints for small and medium-sized enterprises (SMEs) and innovation-driven projects [52]. This expanded access to credit stimulates investment in R&D, human capital upgrading, and process optimization, all of which directly contribute to new-quality productivity (NQP). Moreover, lower financing costs reduce the intermediation bias and scale dependence inherent in traditional financial models, accelerating technological progress and industrial upgrading. From an efficiency perspective, DFI enhances inclusiveness by enabling a wider range of firms—especially those in rural and underdeveloped regions—to participate in the digital economy through digital payment systems and online supply-chain financing. This inclusiveness broadens the base of innovation contributors and accelerates the diffusion of productivity-enhancing practices. Furthermore, DFI optimizes financial resource allocation by improving information matching between investors and borrowers [53], enabling higher resource utilization efficiency, fostering total factor productivity growth, and supporting high-quality development. By easing financing constraints, stimulating innovation investment, and enhancing inclusiveness, DFI creates favorable conditions for firms to fully leverage the productivity gains of DCG. Based on this theoretical framework, we propose the following hypothesis:

Hypothesis 4.

Digital financial inclusion positively moderates the impact of digital transformation on firms’ New-quality productivity (NQP).

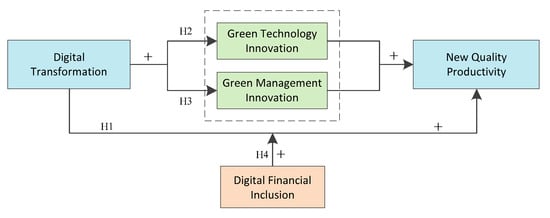

The logical diagram of the theoretical analysis is presented in Figure 1.

Figure 1.

Logic diagram of theoretical analysis.

In summary, this section integrates insights from information asymmetry theory, human capital theory, resource-based view, and innovation-driven development theory to construct a comprehensive analytical framework linking digital transformation to new-quality productivity. The framework posits a direct positive effect of digital transformation on NQP (H1), the mediating roles of green technology innovation and green management innovation (H2, H3), and the moderating role of digital financial inclusion (H4). Together, these hypotheses capture both the internal mechanisms and contextual conditions that shape the productivity impact of digital transformation. This theoretical architecture not only enriches the literature on digital economy and productivity upgrading, but also provides a structured basis for the empirical testing in the following section, where the proposed relationships will be quantitatively validated using firm-level data.

2.2. Variable

Since the 18th National Congress of the Communist Party of China, the Central Committee has prioritized the development of the digital economy and technological innovation as a national strategy, emphasizing the deep integration of informatization and industrialization. This strategic focus has accelerated China’s transition into a “fast track” of digital transformation. Accordingly, this study selected China’s A-share listed companies from 2013 to 2022 as the initial research sample and applied the following data filters: (1) Excluded of financial sector firms; (2) Removed of ST, *ST, and delisted companies during the sample period; (3) Retained only of firms with complete data for at least five consecutive years. To mitigate the influence of outliers, all continuous variables were winsorized at the 1st and 99th percentiles. The data were sourced from the CNRDS and CSMAR databases.

2.2.1. Explained Variable

New-quality productivity (NQP). Drawing on the methodologies of Liu and He [5] and Wang and Li [47], this study constructed a multidimensional indicator system integrating both labor and production tools, grounded in the two-factor theory of productivity. The weights of individual NQP indicators were determined using the entropy method. The selected indicators were presented in Table 1.

Table 1.

New-quality productivity indicators.

2.2.2. Explanatory Variable

Digital transformation (DCG). Following the approaches of Fang, Nie and Shen [24], Li et al. [54], and Teng et al. [55], this study first collated annual reports of all A-share listed enterprises and categorized digital transformation into five dimensions: artificial intelligence (AI), blockchain, big data, cloud computing, and digital technology applications. A digital-related lexicon was constructed for word-frequency analysis. Subsequently, Python’s Jieba segmentation tool was employed to extract keywords related to digital transformation from each firm’s annual report. Finally, the word frequencies across the five dimensions were aggregated to build a firm-level digital transformation index. To mitigate the pronounced right-skewness of the data, a logarithmic transformation was applied after adding 1 to the raw values.

2.2.3. Mediating Variable

Green innovation capability. First, according to the classification of the China National Intellectual Property Administration (CNIPA), green patents can be categorized into green invention patents and green utility model patents. While both patent applications and grants reflect a firm’s innovation activity, granted patents are a more reliable measure of innovation capability, as some firms may prioritize quantity over quality. Following Li et al. [56] and Li, et al. [57], we used the logarithm of the total number of granted green invention patents and green utility model patents (plus 1) as the proxy variable for green technological innovation (Gt). Second, drawing on Clarkson et al. [58] and Liu et al. [59], we measured green management innovation (Gm) based on disclosures in the CSMAR database, including: Environmental management systems, Environmental education and training, Special environmental initiatives, ISO 14001 certification status, and ISO 9001 [60] certification status. The total score across these five dimensions (plus 1) was logarithmically transformed to serve as the proxy variable for Gm.

2.2.4. Moderating Variable

Digital Financial Inclusion (DFI). Following the approaches of Hu, Fang and DiGiovanni [52], Liu et al. [61], and Wang et al. [62], this study employed the Peking University Digital Financial Inclusion Index (released in April 2021 by the Institute of Digital Finance at Peking University) as a proxy for regional digital financial inclusion development. Since this index is a provincial-level panel dataset, we matched it with firms based on their registered cities and corresponding years to construct a firm-level panel. To ensure comparability across variables with differing scales, the digital financial inclusion index was uniformly scaled down by a factor of 100.

2.2.5. Control Variables

To comprehensively analyze the impact of digital transformation on new-quality productivity (NQP), we incorporated a set of control variables based on prior literature [24,55,63,64,65]. The selected controls included the following: ① Leverage (Lev): Total liabilities divided by total assets. ② Firm growth (Growth): Year-on-year growth rate of total operating revenue. ③ Proportion of independent directors (Indep): Number of independent directors divided by total board members. ④ CEO duality (Dual): Dummy variable equal to 1 if the CEO also serves as the board chair, and 0 otherwise. ⑤ Ownership concentration (SC): Combined shareholding ratio of the top 10 shareholders. ⑥ Firm age (Age): Logarithm of the current year plus 1 minus the founding year. ⑦ Management shareholding (Mshare): Shares held by directors, supervisors, and executives divided by total outstanding shares. ⑧ Board size (Board): Logarithm of the number of board members plus 1. As shown in Table 2.

Table 2.

Control variable construction.

2.3. Modeling

To examine the direct impact of digital transformation on firms’ new-quality productivity (NQP), we specified the following econometric model (Equation (1)):

In the model, denotes new-quality productivity of firm i in year t, while represents the digital transformation level of firm i in year t − 1. The term encompasses a set of control variables, with , , , and capturing time, firm, industry, and city fixed effects, respectively. stands for the random disturbance term. To account for the temporal lag between digital transformation implementation and its impact on NQP, we applied a one-period lag to the core explanatory variable. This specification addressed both the inherent time required for digital transformation effects to materialize in productivity outcomes, and potential reverse causality concerns that could bias estimation results.

3. Results

3.1. Descriptive Statistics

Table 3 reveals that for several key variables, the median values are lower than the means, indicating right-skewed distributions. This suggests that while a small proportion of firms exhibited high levels of digital transformation (DCG) and new-quality productivity (NQP), the majority performed below the average, reflecting significant heterogeneity in both digital adoption and productivity outcomes. Such skewness implies that productivity gains from digital transformation were unevenly distributed across firms, with potential implications for competitiveness and sustainable growth. Moreover, preliminary correlation analysis showed a positive association between DCG and NQP, indicating that firms with more advanced digital transformation tended to achieve higher productivity levels. This observation is consistent with the theoretical framework, which posits that digital transformation can enhance productivity through innovation and efficiency improvements. This statistical characterization is consistent with the study of Wang, Qiao, Zhu, Di and Zhang [6].

Table 3.

Descriptive statistics.

However, correlation does not imply causation, and the observed relationship may be confounded by other firm-level characteristics such as size, industry, and governance. Therefore, in the subsequent regression analysis, we examined whether digital transformation exerted a significant causal effect on NQP, and whether this effect operated through the mediating mechanisms of green innovation and was moderated by digital financial inclusion, as hypothesized in Section 2.

3.2. Baseline Regression

To empirically test Hypothesis 1, namely, that digital transformation is positively associated with firms’ new-quality productivity, we first reported the results of the core test of the “digital transformation-firms’ new-quality productivity” relationship. The results of the benchmark regressions are shown in Table 4, with Column (1) showing the results of the direct regression between the explanatory variables and the explained variables; Columns (2) and (3) showing the results of the regressions controlling for fixed effects and the inclusion of the control variables, respectively; and Column (4) showing the results of the regressions controlling for the time and industry fixed effects as well as the inclusion of all the control variables.

Table 4.

Benchmark regression results.

The regression results showed that the coefficient of DCG was positive and statistically significant at the 1% level, indicating that firms with higher levels of digital transformation tended to achieve higher NQP. Economically, a one-standard-deviation increase in DCG was associated with a 1.97% increase in NQP, suggesting a substantial effect magnitude [66,67]. This result supported the theoretical expectation that digital technologies enhance production efficiency and innovation capacity, thereby improving productivity. Furthermore, the adjusted R2 increased from Model (1) to Model (3) as additional control variables were included, rising from 0.02 to 0.818. This improvement in explanatory power suggested that the inclusion of firm- and industry-specific characteristics captured additional variance in NQP, strengthening the robustness of the estimated DCG effect.

This finding strongly aligns with the theoretical foundations presented in Section 2.1, particularly the resource-based view [36,37] and the production function perspective [33,34]. It did so by leveraging digital technologies as unique and valuable resources to systematically upgrade human capital, reconfigure physical assets, and optimize the combination of production factors. This outward shift in the production frontier, driven by qualitative leaps in inputs, encapsulated the essential connotation of NQP [5]. Taken together, these results all provided consistent evidence for Hypothesis 1: digital transformation exerted a direct positive effect on new-quality productivity. These baseline findings set the stage for subsequent analyses that incorporated mediating and moderating mechanisms.

3.3. Robustness Tests

To enhance the robustness of our empirical findings, we conducted the following sensitivity analyses.

3.3.1. Alternative Measures of Core Variables

First, we replaced the dependent variable. Following Teng, Du and Lin [55], we adopted total factor productivity (TFP) as an alternative proxy for New-quality productivity (NQP). Given that the Levinsohn-Petrin (LP) method effectively addresses endogenous sample selection biases inherent in traditional productivity measurements—unlike the Olley-Pakes (OP) and Ackerberg-Caves-Frazer (ACF) approaches—we employed LP-estimated TFP as our revised NQP measure. Column (1) of Table 5 presents these regression results. Second, we reconstructed the digital transformation index. Drawing on Fang, Nie and Shen [24] and Huang and Gao [68], we: ① Conducted textual analysis of annual reports to identify high-frequency terms related to digital development, compiling a firm-level digital lexicon; ② Quantified disclosure intensity across four dimensions—digital technology applications, internet-based business models, smart manufacturing, and modern information systems—by counting keyword occurrences; ③ Standardized the term-frequency data and applied entropy weighting to derive a composite digital transformation index (Dig). Column (2) of Table 5 reports the results using this refined measure.

Table 5.

Replacing Core Variables and Excluding Macroeconomic Factors.

As shown in Table 5, the regression coefficients for these two Columns remain positive and statistically significant at the 1% level, demonstrating the robustness of the baseline results. Specifically, in Column (1), when replacing the dependent variable with TFP_LP, the coefficient of L.DCG was 0.055 and remained highly significant, indicating that the positive relationship between digital transformation and productivity is not dependent on the specific measure of NQP. In Column (2), after substituting the reconstructed digital transformation index (L.Dig), the coefficient was 0.064 and also significant at the 1% level, confirming robustness to alternative measures of digital transformation.

3.3.2. Mitigating Macroeconomic Confounders

To further isolate firm-level effects from macroeconomic fluctuations, we augmented Equation (1) with regional economic controls following established protocols [67,69], including gross regional product (GDP), research and development (R&D) intensity (RD), and informatization level (IL), to Equation (1). The regression results are shown in Column (3) in Table 5.

In Column (3), even after adding macroeconomic control variables, the coefficient of L.DCG increased to 0.107 and remained significant, suggesting that macro-level factors did not weaken the observed relationship. The stability in sign, magnitude, and significance across models provided strong empirical support for the robustness of our conclusions.

3.3.3. Excluding Provincial Capitals

In China, provincial capital cities have greater economic specificity, in order to reduce the impact of the above cities on the results of the study, this paper conducted regression after excluding the sample enterprises in provincial capital cities. Column (1) of Table 6 shows the regression results of this method. Excluding the outlier cities reduced the sample size from 27,260 observations to 12,517 observations, but the coefficient on L.DCG remained positive (0.033) and statistically significant at the 5% level. This suggested that the baseline findings are not driven by potential biases in the capital city data.

Table 6.

Other Robustness Tests.

3.3.4. Addressing Extraordinary Years

In the time series of the sample data in this paper, there were three important international and domestic shocks: first, the State Council issued the Action Outline for Promoting the Development of Big Data in 2015, in which various industries and regions paid more attention to digitization; second, the Chinese stock market crash event in 2015 had a major impact on the financial market, which in turn would be passed on to the enterprise level, and had a certain impact on the process of digital transformation of enterprises; Third, the outbreak of the first China-US trade war occurred in 2018. Considering the impact of these exogenous shocks on the process of enterprise digital transformation, therefore, this paper referred to the approach of Huang and Gao [68], and conducted a robustness test on the empirical results after excluding the samples of enterprises in 2015 and 2018, and Column (2) of Table 6 demonstrates the regression results of this method. In Column (2), after excluding years associated with major market disruptions (2015 stock market crash and 2018 policy adjustments), the sample size decreased to 15,555 observations, and the coefficient of L.DCG remained positive (0.107) and significant at the 1% level, with a magnitude similar to the baseline estimate. The stability in sign, significance, and magnitude across both robustness checks confirmed that the positive effect of digital transformation on NQP is not sensitive to the exclusion of specific cities or years.

3.3.5. Digital Transformation Sub-Dimensions

Building on the previous robustness test based on the macro level, this section further refined the analysis to the micro level by subdividing the digital transformation of firms into two dimensions, i.e., the “underlying technology application (uta)” and the “practical application of technology (pat).” This micro perspective helped to identify the intensity of the role of different digitalization segments in driving the new-quality of productivity, thus validating the refined causal mechanism proposed in the theoretical framework. This analysis was closely aligned with the main line of the previous paper and helped to further justify the core conclusion that digital transformation drives new-quality productivity through diversified operational paths.

Column (3) of Table 6 reports the results for the “underlying technology application” dimension. The coefficient for L.uta was 0.114 and significant at the 1% level, indicating that foundational technology adoption—such as cloud computing, AI, and blockchain—exerted a strong and robust positive influence on NQP. Column (4) focuses on the “practical use of technology” dimension, where L.pat had a coefficient of 0.027, significant at the 5% level, suggesting that the translation of technological capabilities into operational practices also contributed positively, albeit with a smaller magnitude. The higher coefficient for underlying technology application implied that the technological infrastructure and capability layer formed the primary driver of productivity gains, while the practical application layer played a complementary role. This aligned with our theoretical argument that digital transformation enhances NQP through both capability building and operational embedding, with the former generating stronger initial productivity effects. The consistency in coefficient signs and statistical significance across both dimensions further reinforced the robustness of our main findings.

3.3.6. Extending the Observation Window

This paper extended the temporal analysis window of the impact of digital transformation on firms’ new-quality productivity (NQP). Specifically, the core explanatory variable (DCG) was lagged by two to three periods, while the dependent variable (NQP) was replaced with its lead terms (two to three periods ahead) for cross-comparison. As shown in Table 7, whether using lagged DCG or lead NQP, the estimated effect of digital transformation on NQP remained highly significantly positive, and this facilitation did not exhibit noticeable attenuation as the time window was extended.

Table 7.

Extended observation window.

3.3.7. Changing the Standard Error of Clustering

While our baseline regression controls for firm-level clustering, we recognized that productivity dynamics may exhibit interdependencies across industries, regions, and interconnected firms. To enhance the robustness of our findings, we conducted additional analyses by varying the clustering levels of standard errors. From the regression results in Table 8, all were significantly positive at the 1% level after changing to industry clustering, region clustering, industry × region clustering, and individual clustering. The results remained consistent across these seven robustness checks, confirming that our core findings are not sensitive to clustering assumptions. This provided further empirical support for Hypothesis H1 regarding digital transformation’s positive impact on New-quality productivity (NQP).

Table 8.

Change clustering standard errors.

3.4. Endogeneity Tests

3.4.1. Instrumental Variables Approach

Although our core finding regarding digital transformation’s (DCG) significant positive impact on new-quality productivity (NQP) had demonstrated robustness through various tests, potential endogeneity concerns arising from omitted variables remained theoretically plausible. To address this critical identification challenge, we employed an instrumental variables (IV) approach following established econometric literature [70,71]. Our instrument (IV1) was constructed as the cubic term of the deviation between firm-level DCG and its annual industry mean, capturing nonlinear variation in digital transformation adoption while satisfying exclusion restrictions. The comprehensive diagnostic tests presented in Table 9 validated our IV strategy: the Kleibergen–Paap LM statistic (p ≈ 0) decisively rejected instrument underidentification at the 1% significance level, while the Wald F-statistic comfortably exceeded the Stock-Yogo weak instrument critical value at the 10% threshold. The first-stage results (Column (1)) confirmed the instrument’s strong predictive power for endogenous DCG, and the second-stage estimates (Column (2)) robustly reaffirmed DCG’s productivity-enhancing effect, with coefficients maintaining both statistical significance and economic magnitude consistent with our baseline findings. This rigorous IV analysis not only corroborated our central conclusion but also effectively mitigated potential biases from unobserved confounding factors, thereby strengthening the causal interpretation of digital transformation’s role in fostering new-quality productivity development.

Table 9.

Instrumental Variable Test.

3.4.2. Difference-in-Differences Approach

While all regressions inherently adopt a lagged treatment of core explanatory variables to mitigate reverse causality and employ instrumental variable methods to address omitted variable bias, potential endogeneity concerns may persist. In accordance with the Notice of the State Council on Issuing the “Broadband China” Strategy and Implementation Plan, the Ministry of Industry and Information Technology (MIIT) and the National Development and Reform Commission (NDRC) designated 120 cities (or city clusters) across three batches (2014, 2015, and 2016) as “Broadband China” demonstration zones. This policy initiative aimed to accelerate digital infrastructure development, thereby promoting nationwide economic digitization and informatization—creating an exogenous shock that facilitated corporate digital transformation. Following Hong et al. [72] and He et al. [73], we leveraged the “Broadband China” pilot policy as a quasi-natural experiment for robustness checks. Firms located in pilot cities were assigned to the treatment group, while those in non-pilot cities served as the control group. Combined with the characteristics of “Broadband China” demonstration sites set up in batches, the two variables Treat and Post were set, if the location of the listed company was selected for the pilot list, Treat was assigned to 1, otherwise it was 0; the year the listed company’s location was selected for the pilot list and the following years, Post was assigned to 1, otherwise it was 0.The interaction term between Treat and Post (denoted as DID) served as the key explanatory variable, representing the dynamic treatment effect of the “Broadband China” policy. We then estimated the following multi-period difference-in-differences (DID) model to examine how digital transformation affects firm-level new-quality productivity (NQP) (see Equation (2)):

Here, represents the dummy variable for designating a “Broadband China” demonstration zone, where firms in regions selected as demonstration zones are assigned a value of 1 from the designated year onward, and 0 otherwise. denotes a set of control variables, while and capture time and industry fixed effects, respectively. is the random disturbance term. The coefficient a reflects the policy effect of establishing “Broadband China” demonstration zones. A significantly positive a indicates that digital transformation significantly enhances firms’ new-quality productivity (NQP). Table 10 presents the regression results of the exogenous shock test. Column (1) reports the baseline regression without control variables or fixed effects, showing a significantly positive DID coefficient of 0.510 at the 1% level. Columns (2) and (3) sequentially introduce fixed effects and control variables, with the key explanatory variable remaining significantly positive at the 1% level. Column (4) further incorporates both time and industry fixed effects alongside control variables, yielding a DID coefficient of 0.254 (significant at 1%). These endogeneity test results robustly supported our core hypothesis that digital transformation drives NQP development in firms, confirming the reliability of our earlier findings.

Table 10.

Difference-in-Differences (DID) Method.

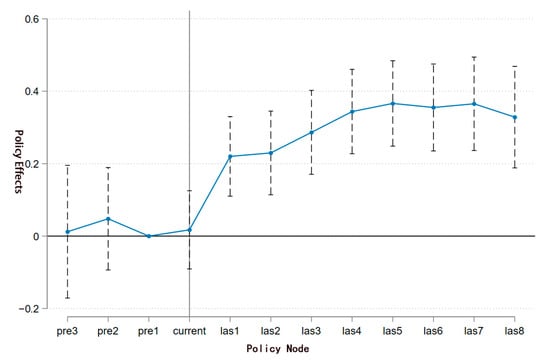

Following the approach of Huang and Gao [68], this study employed an event study methodology to examine the parallel trends assumption. Since counterfactual outcomes are unobservable, an indirect test involves comparing the difference-in-differences (DID) coefficients before the exogenous event. If the pre-event DID coefficients are close to zero and statistically insignificant, it suggests that the treatment and control groups followed similar trends prior to the intervention. Specifically, we set 2014 as the current year (when the policy took effect), with the three preceding years coded as pre1–pre3 and the subsequent eight years as las1–las8 in dummy variables. The year immediately before the policy (pre1) served as the baseline period. To mitigate multicollinearity, the parallel trends test results are presented in Figure 2.

Figure 2.

Parallel trend charts.

The results demonstrated that the interaction term coefficients before the implementation of the “Broadband China” policy were not statistically different from zero, indicating that our findings satisfied the parallel trends assumption. Following the policy implementation, all coefficients were significantly positive, suggesting that digital transformation enhanced the development of new-quality productivity (NQP) in enterprises.

4. Mechanistic and Heterogeneity Analysis

4.1. Mechanism Analysis

4.1.1. Mediation Effect Analysis

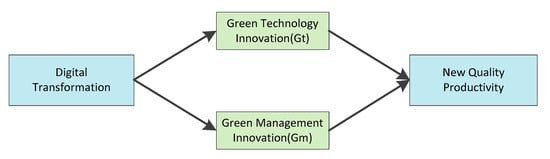

From a theoretical perspective, digital transformation can enhance firms’ new-quality productivity (NQP) by fostering capabilities in green technology innovation (Gt) and green management innovation (Gm). The former refers to the application of digital technologies—such as AI, IoT, and blockchain—to improve the quality, efficiency, and novelty of green products or processes, while the latter concerns the integration of digital tools into organizational and managerial systems to optimize green practices, governance, and decision-making. These two mechanisms are complementary rather than sequential: green technology innovation provides the technical foundation for sustainability-oriented productivity gains, whereas green management innovation ensures their systematic implementation and diffusion. This dual-path structure aligns with our earlier theoretical framework in Section II, where both Gt and Gm were hypothesized to independently mediate the DCG–NQP relationship (As shown in Figure 3).

Figure 3.

Mediation effect path diagram.

Digital transformation enhances enterprises’ new-quality productivity level by strengthening both green technology innovation capability and green management innovation capability. To empirically test Hypothesis 2 and 3, referring to the study of Zhao et al. [74], this paper adopted the two-stage regression method to obtain the estimation results of the transmission mechanism of digital transformation on the development of firms’ new-quality productivity. The basic principle of the two-stage regression method is similar to that of the instrumental variables method, which can overcome the unfavorable interference of confounding variables in identifying causal mediating effects. The specific operational steps were as follows: the first stage was regressed from M (mechanism variable) to X (independent variable) and the predicted value of M was obtained, and the model was set up as shown in Equation (3). We used Equation (3) to test the effect of digital transformation on green technology innovation capacity and green management innovation capacity. The second stage was regressed by the dependent variable of Y on the predicted value of M (Mhat), and the model was set up as shown in Equation (4). In this paper, according to the regression results of Equation (3), the predicted value of the corresponding mechanism variables was obtained, and then the predicted value of each mechanism variable was regressed on the new-quality productivity. This approach ensured that the mediators were purged of endogeneity arising from simultaneity or omitted variables.

where is the mediating variable green innovation capacity, and Gm and Gt are used as the mediating variables in the regression, representing green technology innovation capacity and green management innovation capacity, respectively. Mhat represents the predicted value of each mechanism variable, and the meaning of the rest of the variables is the same as Equation (1).

The results presented in Columns (1) and (2) of Table 11 provided robust empirical support for Hypothesis 2, confirming that digital transformation (DCG) enhanced New-Quality Productivity (NQP) by improving green technological innovation capability (Gt). In Column (1), the mediating variable in model (3) was green technology innovation (Gt), and the coefficient before digital transformation (DCG) was significantly positive at the 1% level, indicating that digital transformation substantially enhanced firms’ green technology innovation capability. In Column (2), the coefficient before the predicted value of Gt in model (4) remained significantly positive at the 1% level, confirming that green technology innovation partially mediated the effect of digital transformation on new-quality productivity (NQP). This mediating effect aligns with the data-driven innovation theory discussed in the theoretical analysis [43,44]. Digital transformation, through tools such as AI and digital twins, raises the precision of R&D targeting and improves the output quality of green innovation [45,46]. The resulting high-quality green patents—characterized by greater novelty and applicability—enhanced productivity by simultaneously raising efficiency and environmental sustainability. Thus, the findings illustrated a key indirect channel: DCG not only raised NQP directly but also did so indirectly by fostering green technological breakthroughs that harmonize efficiency and environmental goals, thereby supporting sustainable development strategies and strengthening long-term competitiveness [53,75]. Therefore, Hypothesis 2 is supported.

Table 11.

Mechanism test results.

The results in Columns (3) and (4) of Table 11 validated Hypothesis 3, demonstrating that green management innovation (Gm) served as a distinct mediating pathway between digital transformation (DCG) and New-Quality Productivity (NQP). In Column (3), when Gm was used as the mediating variable in model (3), the coefficient before DCG was significantly positive at the 5% level, indicating that DCG improved firms’ ability to innovate in management systems, operational standards, and governance practices that integrate green principles. Unlike Gt, which focuses on technological artifacts, Gm emphasizes organizational processes—such as optimizing resource allocation, implementing digitalized compliance monitoring, and integrating sustainability metrics into decision-making. In Column (4), the coefficient before the predicted value of Gm in model (4) remained significantly positive at the 5% level, confirming that green management innovation partially mediated the DCG–NQP link. This finding was elucidated by Organizational Capability Theory and sustainable management research [58,59]. In contrast to green technological innovation, green management innovation entails advancements in organizational structures and processes. Digital transformation empowers this by enabling sophisticated environmental management systems (e.g., real-time emissions tracking, ISO 14001) and enhancing green training and stakeholder engagement. These managerial improvements systematically increased productivity by reducing resource waste, standardizing operations, and ingraining sustainable practices firm-wide. This suggested that DCG enhanced NQP not only via technical improvements but also by reshaping firms’ managerial logic and operational culture toward sustainable practices [75]. Therefore, Hypothesis 3 is supported.

This path relied more on behavioral and institutional adjustments than on technological breakthroughs compared to H2, and the complementarity of Gt and Gm suggested that digital transformation had the strongest productivity-enhancing effect when the two types of green innovations, technological and managerial, were pursued in parallel.

4.1.2. Moderating Effect Analysis

In order to effectively test the moderating effect of digital financial inclusion in the process of digital transformation affecting the new-quality productivity of enterprises, digital financial inclusion was introduced into the model and Equation (5) was constructed to test it.

where refers to the moderator variable digital financial inclusion, subscript p denotes province, variable is the cross-multiplier of digital transformation and digital financial inclusion, the coefficient was significant, which indicated that the moderating effect of by was statistically significant, and was positive, characterizing that the moderating variable enhanced the effect of digital transformation on new-quality productivity.

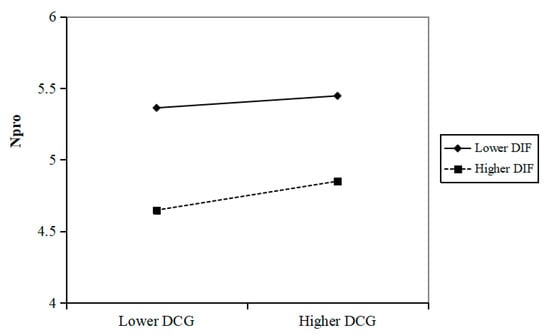

The results presented in Table 12 provided robust support for Hypothesis 4, confirming the positive moderating role of DFI in the relationship between DCG and NQP. In Column (1), the coefficient of DFI was significantly negative (−0.313, p < 0.05), suggesting that, in isolation, higher levels of digital financial inclusion were associated with a reduction in NQP. A possible explanation is that in the early stages of development, digital finance may lead to financial misallocation or a “crowding-out effect” on innovation investment, especially for firms with low digital capabilities, resulting in financing being channelled towards short-term or low-productivity uses. However, the interaction term DCG × DFI was significantly positive (0.129, p < 0.01), indicating that when digital transformation and digital financial inclusion were jointly advanced, their combination had a synergistic effect on enhancing NQP. It enabled these firms to unleash their digital transformation potential, preventing capital shortages from stifling their progress. This finding aligned with information asymmetry theory, the resource-based view and the theory of technology–finance complementarity, whereby digital transformation enhances firms’ absorptive capacity and information-processing efficiency, enabling them to better utilise the financing channels provided by digital financial inclusion. In other words, while DFI alone may not guarantee productivity gains, its integration with digital transformation can overcome information asymmetry, improve capital allocation efficiency, and channel resources toward green and innovative activities, thus amplifying the productivity-enhancing effect of DCG [52,61,62]. The moderating effect is shown in Figure 4.

Table 12.

Moderating effects test results and robustness.

Figure 4.

Moderating effect diagram.

In this paper, we adopted the secondary indicators of the digital financial inclusion index to replace the digital financial inclusion index to implement robustness tests on the moderating effect of digital financial inclusion on the role of digital transformation in promoting new-quality productivity enhancement, including the breadth of digital financial coverage (Cover), the depth of digital financial use (Use), and the degree of digitization of financial inclusion (Dif), and Columns (3) to (5) of Table 12 report the specific results. Across all specifications, the interaction terms remained significantly positive (0.124, 0.092, and 0.158, respectively), while the standalone effects of these DFI dimensions remained negative, reaffirming that the productivity benefits of DFI were conditional on a sufficient level of digital transformation within firms. These results underscored that digital financial inclusion, when combined with enterprise digital transformation, could act as a catalytic driver of new-quality productive forces.

4.2. Analysis of Heterogeneity

Although the previous paper discussed in some detail the impact of digital transformation on firms’ new-quality productivity and its mechanism of action, it mainly focused on the overall level and did not take into account the impact of heterogeneity, such as the characteristics of firms’ ownership. Therefore, this paper further developed the heterogeneity test around the nature of enterprise ownership, the degree of regional economic differences, the degree of industry competition, etc., and the results are shown in Table 13 and Table 14.

Table 13.

Heterogeneity analysis: degree of economic differentiation, degree of industry competition.

Table 14.

Heterogeneity analysis: firm ownership, industry characteristics.

Heterogeneity of economic differences. Economically developed regions attract scientific and technological talents and capital due to the “siphon effect”, which provides human and material support for the development of digital infrastructure and digital technology innovation and research and development [76]. In addition, developed regions have a first-mover advantage in promoting the integration of digital technology and the real economy, and digital technology as a production factor combines with traditional factors of production to increase total factor productivity, so that developed regions show greater potential and vitality in the development of new-quality productivity than less developed regions [67]. To examine economic heterogeneity in the impact of the degree of digital transformation on firms’ new-quality productivity level, we divided the sample into two subsamples based on median GDP: developed regions and less developed regions. The regression results based on regional heterogeneity, presented in Columns (1) and (2) of Table 13, demonstrated that digital transformation exerted a stronger positive effect on the new-quality productivity level of firms in developed regions. This finding confirms the presence of economic differentiation heterogeneity among firms.

Heterogeneity in the degree of industry competition. In this paper, we utilized the business receipts of individual enterprises to calculate their market share (HHI index). The smaller the value, the more competitive the market is. According to the average value of HHI index, the sample was divided into two groups: high-competition and low-competition environments. The regression results are shown in Columns (3) and (4) of Table 13, which indicated that firms in high-competitive environments were more effective in improving new-quality productivity in digital transformation. From the perspective of industry competition, enterprises in highly competitive industries have greater difficulty in obtaining competitive advantages and smaller profit margins, while the application of digital technology can prompt enterprises to strengthen innovation and improve the competitiveness of their products, and thus the fierce market competition will increase the effect of enterprises’ use of digital technology to promote the development of new-quality productivity [77]. Compared to firms in low-competitive industries, firms in highly competitive industries have stronger incentives to use digital technologies and thus efficiently utilize limited resources to promote new-quality productivity [78].

Ownership heterogeneity. State-owned enterprises (SOEs) benefit from the government’s policy inclination and support, undertake national political and social goals, and respond more positively to the national strategic development plan. These characteristics make SOEs actively invest in digital technology and smart manufacturing, and emphasize talent training and technological innovation, thus effectively promoting the development of new-quality productivity [79]. In contrast, non-SOEs usually face more competitive market pressures and need to invest more resources in direct business development and cost control [80]. To examine the heterogeneous effects of digital transformation on the new-quality productivity level of firms with different ownership types, we divided the sample into two subsamples: state-owned enterprises (SOEs) and non-SOEs. The regression results based on ownership heterogeneity are presented in Columns (1) and (2) of Table 14. The results showed that the baseline hypothesis was verified in both SOEs and non-SOEs, but the effect of digital transformation on the new-quality productivity of SOEs was more significant, and this result confirmed the heterogeneity analysis on the nature of firm ownership.

Industry Heterogeneity. The regression results based on industry heterogeneity are shown in Columns (3) and (4) of Table 14. The results showed that non-manufacturing firms were more effective in enhancing new-quality productivity in digital transformation. The possible reason for this was that non-manufacturing firms are usually more flexible than manufacturing firms in terms of their business model, which relies mainly on data, information, and customer relationships rather than physical production processes, and thus are able to adapt quickly when digital technologies are introduced [81]. In addition, digital transformation in non-manufacturing firms usually focuses mainly on software and services, which require relatively low investment and carry less risk, and therefore were easier to implement and more likely to see productivity gains quickly, whereas digital transformation in manufacturing usually involves the renewal of hardware equipment and the intelligent modification of factories, which tends to require higher capital investment and is accompanied by a higher risk of implementation.

5. Conclusions

This section synthesizes key findings on how digital transformation drives new-quality productivity through dual pathways of green innovation. It positions these findings within the existing literature to demonstrate both convergence with established theories and novel contributions to the field. Building on empirical evidence, we derive policy implications for advancing sustainable digitalization and green growth. The section concludes by addressing methodological limitations and proposing future research directions to investigate alternative mechanisms and contextual factors.

5.1. Deliberations

As the global economy enters a new phase of structural transition, countries are facing varying degrees of growth slowdown. In this context, the concept of New-Quality Productivity (NQP) has gained increasing prominence as a driver of sustainable development, demonstrating significant value for economic, ecological, and social progress [2,5,6]. The empirical findings of this study demonstrate that digital transformation serves as a critical driver of NQP, operating through the dual channels of green innovation and amplified by digital financial inclusion. To systematically elucidate the theoretical implications of these findings, this section situates our conclusions within the existing literature, clarifying their alignment with and extension of prior research.

Our core finding—that digital transformation significantly enhances NQP—reinforces the established consensus in existing research while providing micro-level evidence. Consistent with Pan, Xie, Wang and Ma [7], our study confirms that digital technologies enhance productivity by optimizing information flows and factor allocation. Similarly, our results align with Li and Tian [11], who demonstrated that digitalization promotes green innovation, which subsequently improves productivity—thereby validating the synergistic relationship between digital transformation and environmental innovation. Furthermore, our finding that digital financial inclusion (DFI) positively moderates the digital transformation–NQP relationship corroborates Hu, Fang and DiGiovanni [52], who established that digital finance alleviates financing constraints and facilitates the translation of innovation potential into realized performance. This further supports the view that digital finance serves as a key enabler of technological diffusion and sustainable productivity growth.

Despite these alignments, our study introduces critical distinctions that refine existing understanding. First, while prior studies typically treat productivity as a monolithic construct measured by total factor productivity [33], we conceptualize NQP as a multidimensional construct grounded in the Dual-Factor Theory. This approach captures qualitative improvements in labor and production tools that are essential for sustainable development but often obscured in conventional productivity measures. Second, unlike studies that treat green innovation as an aggregate construct [11], we disentangle its dual dimensions—green technological innovation and green managerial innovation—revealing distinct yet complementary mediation pathways. This granular analysis demonstrates how digital transformation simultaneously reshapes technological systems and managerial practices to generate sustainable productivity gains. Third, we establish that DFI’s positive effect is conditional on firms’ digital transformation level, suggesting a synergistic relationship wherein external digital finance yields maximum benefits only when firms possess sufficient internal digital capabilities to effectively absorb and deploy resources—a nuance overlooked in earlier work [61]. Finally, our heterogeneity analysis reveals that the productivity-enhancing effects of digital transformation are more pronounced in state-owned enterprises, non-manufacturing sectors, and firms in developed regions, indicating that institutional context, industry characteristics, and regional development jointly shape the realization of digital dividends.

By delineating these theoretical consonances and distinctions, our study not only validates core propositions in the digital transformation literature but also advances a more nuanced framework for understanding NQP emergence in the sustainable digitalization era.

5.2. Key Findings

This study focuses on the Chinese market and, based on empirical data from Chinese A-share listed companies from 2013 to 2022, systematically reveals the impact of digital transformation on enterprises’ new productive forces and its underlying mechanisms. The main conclusions are as follows.

Firstly, digital transformation significantly improves the new-quality productivity level of enterprises, which is still supported under mitigating endogeneity and has withstood many robustness tests. In doing so, we establish an intrinsic link between digital technology and productivity and contribute to economic growth theory. Second, we identify two plausible mechanisms of action; i.e., digital transformation improves firms’ new-quality productivity level mainly by promoting firms’ green technological innovation and green management innovation, deepening the understanding of the way in which digital technology works to improve productivity. In addition, digital inclusive finance plays a positive moderating role in the relationship between digital transformation and firms’ new-quality productivity. Finally, the results of the cross-sectional analysis show that the impact of digital transformation on firms’ new-quality productivity exhibits an asymmetric impact effect; specifically, firms in state-owned, non-manufacturing, and developed regions as well as those with a high degree of competition in the industry are more affected.

5.3. Practical Applications

Based on key research findings, this study aims to translate empirical research into concrete strategies for advancing sustainable development. First, policymakers should adopt integrated planning to construct a supportive ecosystem for digital–green synergistic development. The robust connection between digital transformation and new-quality productivity necessitates a comprehensive policy framework that extends beyond digital infrastructure to deeply align digitalization with green transition goals. This requires designing composite policy instruments—such as innovation subsidies, tax incentives, and green finance guidelines—to incentivize firms in achieving verifiable environmental benefits through digital technologies. Concurrently, cultivating talent with dual expertise in digital and green domains through education reform and vocational training is critical to bridge skill gaps and provide human capital support for new-quality productivity. Furthermore, asymmetric regulation should be implemented in less-developed regions by adopting differentiated digital transformation support policies, assisting vulnerable firms in overcoming initial barriers and preventing the expansion of “productivity divides.”

Second, corporate managers should strategically reinvest digital dividends into green innovation to amplify productivity returns by directing digital outcomes toward environmental performance enhancement. Specifically, firms should pursue integrated investment by channeling digital budgets into green R&D projects, such as utilizing data analytics for energy management or applying artificial intelligence to optimize resource circulation in a circular economy. Environmental performance indicators—including the carbon footprint and resource productivity—should be incorporated into management systems and decision-making processes to ensure the effective implementation of green management innovation. Additionally, fostering an eco-innovation culture by encouraging employee participation in environmental initiatives and establishing internal innovation incubators focused on addressing sustainability challenges through digital means is essential.

Finally, leveraging the positive moderating role of digital financial inclusion, financial institutions should develop tailored financial products and services to support the digital–green transition. This includes innovating customized financial instruments such as “digital transformation dedicated credit,” “green supply chain finance,” and “sustainability-linked loans” to precisely meet the needs of SMEs in digital and green upgrading while utilizing big data and artificial intelligence for dynamic risk assessment. Simultaneously, collaborative efforts with technology firms and policymakers are needed to build a robust financial ecosystem by improving digital payment systems and credit infrastructure to reduce transaction costs and expand financing channels for sustainable projects.

5.4. Limitations and Future Prospects

This study acknowledges several limitations that warrant consideration and suggest productive avenues for future research. The most critical limitation lies in the measurement of digital transformation. Our firm-level digital transformation index, constructed through textual analysis of keyword frequency in annual reports, primarily captures discursive emphasis rather than actual technology adoption or integration. This methodological approach may introduce measurement bias, as firms could strategically overstate their digital engagement for signaling purposes, while others implementing substantive digital upgrades might underreport their efforts. We therefore explicitly frame our findings as reflecting the relationship between reported digital transformation and new-quality productivity, rather than establishing causal effects from fully implemented digital technologies.

Second, while this study elucidates the positive impacts of digital financial inclusion (DFI) on the relationship between digital transformation and new-quality productivity, it also acknowledges its potential countervailing effects and negative implications. Digital transformation may incur transition costs, intensify internal organizational resistance, and lead to labor displacement in the short to medium term due to automation and skill mismatches [82]. Similarly, the rapid expansion of DFI could introduce challenges such as algorithmic discrimination, data privacy concerns, and over-indebtedness risks, particularly in contexts where regulatory frameworks are underdeveloped [83]. These limitations do not invalidate our core findings but underscore the necessity of implementing complementary policies—such as robust social safety nets and digital ethics guidelines—to mitigate risks.

Future research should prioritize developing comprehensive measurement frameworks that integrate discursive indicators with objective metrics—such as IT investment from financial statements, software implementation rates, and digital infrastructure—to more accurately capture the scope and depth of digital transformation. Furthermore, researchers need to systematically investigate the contextual factors and governance mechanisms that may mitigate the potential negative impacts of digital transformation and digital financial inclusion across different institutional environments, including transition costs, skill mismatches, and algorithmic risks.

Author Contributions

Conceptualization, K.W. and L.T.; methodology, K.W.; software, K.W.; validation, L.T., K.W. and H.Z.; formal analysis, K.W.; investigation, L.T.; resources, L.T.; data curation, K.W.; writing—original draft preparation, K.W.; writing—review and editing, H.Z.; visualization, K.W.; supervision, L.T.; project administration, L.T.; funding acquisition, L.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research has received funding from the National Social Science Fund project (22XTQ008).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

References

- Bischof, J.; Laux, C.; Leuz, C. Accounting for financial stability: Bank disclosure and loss recognition in the financial crisis. J. Financ. Econ. 2021, 141, 1188–1217. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Martinez Peria, M.S.; Tressel, T. The global financial crisis and the capital structure of firms: Was the impact more severe among SMEs and non-listed firms? J. Corp. Financ. 2020, 60, 101514. [Google Scholar] [CrossRef]

- Arkolakis, C.; Ramondo, N.; Rodríguez-Clare, A.; Yeaple, S. Innovation and Production in the Global Economy. Am. Econ. Rev. 2018, 108, 2128–2173. [Google Scholar] [CrossRef]

- Bjørnskov, C.; Foss, N. How Strategic Entrepreneurship and The Institutional Context Drive Economic Growth. Strateg. Entrep. J. 2013, 7, 50–69. [Google Scholar] [CrossRef]

- Liu, Y.; He, Z. Synergistic industrial agglomeration, new quality productive forces and high-quality development of the manufacturing industry. Int. Rev. Econ. Financ. 2024, 94, 103373. [Google Scholar] [CrossRef]

- Wang, J.; Qiao, L.; Zhu, G.; Di, K.; Zhang, X. Research on the driving factors and impact mechanisms of green new quality productive forces in high-tech retail enterprises under China’s Dual Carbon Goals. J. Retail. Consum. Serv. 2024, 82, 104092. [Google Scholar] [CrossRef]

- Pan, W.; Xie, T.; Wang, Z.; Ma, L. Digital economy: An innovation driver for total factor productivity. J. Bus. Res. 2022, 139, 303–311. [Google Scholar] [CrossRef]