1. Introduction

Rapid urbanization, ongoing industrialization, and population expansion have significantly escalated the demand for resources, resulting in a series of severe environmental consequences such as pollution and global warming [

1]. The tension between limited environmental carrying capacity and the requirements of sustainable socio-economic development has become progressively severe, emerging as a significant bottleneck hindering high-quality growth in many countries and regions. In this context, promoting a green and low-carbon transformation of development pathways has become imperative. As a key metric, UGTFP is now widely used to assess environmental governance, green development, and the achievement of sustainable economic growth, playing an increasingly prominent role in facilitating a country’s economic recovery and green development [

2].

China has actively implemented eco-friendly growth strategies at both domestic and global levels, aiming for coordinated, balanced, and innovation-driven green development. Rich in resources and talent, with solid industry and strong growth potential, the country is well positioned for sustained and healthy economic expansion. However, traditional industries such as steel, petrochemicals, and cement continue to dominate the industrial landscape, exerting severe pressure on the atmosphere and ecosystems. This reality underscores the urgent need for industrial modernization [

3]. A well-structured and balanced industrial system is crucial for coordinating resource management, environmental protection, and economic development [

4]. At present, China’s economic development places a high priority on altering growth models, adjusting economic structures, enhancing UGTFP, and cultivating new high-quality productive forces [

5]. To achieve these goals, the government has introduced a series of policies and measures aimed at promoting energy conservation, emission reduction, and green development. However, an undeniable reality is that an idealized and fully effective environmental policy system is often difficult to achieve in practice. China’s immense territory, varied stages of regional development, and the intricate relationships between central and local governments together create a suboptimal policy landscape marked by friction and constraints [

6]. Within this context, there may exist policy implementation deviations, uneven regulatory capacities, local protectionism, and other market distortions. Under the framework of the theory of the second best, fiscal instruments such as environmental taxes or emission fees, even if not set at the theoretically optimal level, can still partially internalize environmental costs, thereby creating economic incentives for firms to reduce pollution and pursue green technological innovation [

7]. Furthermore, in the real world of suboptimal policymaking, fiscal policy does not operate as a single, idealized instrument. Instead, it fosters and encourages a green transition within a complex socioeconomic system through the strategic combination and synergy of multiple tools, such as taxes, subsidies, and expenditures [

8].

In response to escalating environmental pressures and the urgent need for a sustainable development model, the Chinese government has increasingly turned to fiscal policy as a key instrument for environmental governance. Although traditional command-and-control environmental regulations were effective to some degree, they often encountered difficulties, such as high administrative costs and regional protectionism. Against this backdrop, proactive and incentive-based policies became a crucial alternative. Pollution’s external costs, governance’s public benefits, and the shared-good nature of ecosystems make pure market solutions insufficient for environmental and climate problems. Existing research indicates that cooperation between central and local governments is essential for environmental protection and pollution management, with fiscal policy serving as a crucial instrument to sustain this coordination [

9]. Fiscal policy underpins national governance and is central to tackling pollution and climate change: it funds green growth, embeds carbon reduction into development, and drives incentives, constraints, and compensation in the push for high-quality, eco-civilized economies [

10]. Consequently, an important question arises: can fiscal policy enhance UGTFP and promote sustainable urban development, and if so, how does it facilitate such green development?

Most of the existing literature examining green development from a policy perspective has focused primarily on environmental policies aimed at pollution reduction, carbon emission mitigation, and energy conservation effects. Fiscal policy is just as vital as environmental measures in tackling climate change and pollution [

11]. In 2011, the Chinese government launched a comprehensive fiscal policy demonstration program for energy conservation and emission reduction in selected cities. The policy was designed to address two core issues: first, the disjointed nature of fiscal funds for environmental protection, and second, the insufficient motivation for local governments to embrace green development. By providing substantial central fiscal rewards, the ECERFP aimed to guide cities to integrate various funds and independently explore tailored paths for energy conservation and emission reduction, thus fostering a proactive approach to green transformation. The policy’s core mechanism was not to prescribe uniform instruments, but to provide central fiscal reward funds that empowered pilot cities to integrate and deploy their own tailored portfolios of green investments, including subsidies for energy-efficient retrofits, development of green infrastructure, and support for R&D in clean technologies. This initiative was a three-year pilot scheme, implemented in three batches and involving a total of 30 demonstration cities. The program assigned local governments as the main responsible bodies, designated cities as the implementation vehicles, and used fiscal policy integration as its primary method. As a representative case of green fiscal policy, this pilot aimed to promote urban achievement of energy conservation and emission reduction targets through a combination of incentives and constraints.

Building on this, we used the ECERFP as an entry point and empirically examined the impact of fiscal policies on UGTFP using methodologies such as SBM-DDF and multi-period DID. This research enriches the existing literature in three main respects. First, while previous studies have focused on general environmental regulations or singular fiscal subsidies, our research evaluates a comprehensive green fiscal policy package that integrates incentives and constraints at the city level, thus offering a more holistic understanding of fiscal policy’s role in green development. Second, we employ a methodologically robust combination of the SBM-DDF model, which provides a more accurate, non-radial measure of UGTFP by addressing input–output slackness, and the multi-period DID approach, which is essential for obtaining unbiased causal estimates from the policy’s staggered rollout. This combined approach allows for a more nuanced and robust assessment than previous studies. Third, our analysis provides fresh insights by not only confirming the policy’s positive impact but also by uncovering its underlying mechanisms (technological innovation and energy efficiency) and significant heterogeneity across different types of cities, thereby offering targeted policy implications.

2. Literature Review

Fostering urban green development necessitates improving production efficiency through adjustments in industrial structure, reducing emissions and saving energy will drive a greener, low-carbon and high-quality economy [

12,

13,

14]. Existing research on urban green development primarily focuses on financial mechanisms [

15], official pressures [

16], digital dividends [

17], technological innovation [

18], and inclusive digital finance [

19]. Beyond the scope of government policy, recent literature has also shed light on the micro-foundations of green development. A substantial amount of research has started to investigate the determinants of corporate environmental behavior, including corporate governance structures, executive characteristics, and investor attention [

20]. In particular, research on the identification of corporate “greenwashing” and its relationship with ESG ratings has become a focal point, revealing the complexities in assessing a firm’s true level of greenness. Concurrently, the impact of technological disruption, such as the rise of artificial intelligence and the digital economy, on corporate green innovation and efficiency has become a burgeoning field of research. These studies investigate how new technologies can empower firms to achieve intelligent and green production processes, offering new perspectives on the drivers of sustainable transformation [

21]. Regarding the measurement and evaluation of green development, academia mainly employs indicator system methods and UGTFP. The indicator system method is a structured evaluation technique that allows for the creation of an indicator framework targeted at specific goals, which in turn supports a thorough assessment [

22]. However, the limitations, subjectivity, and biases inherent in indicator selection can lead to contentious evaluation outcomes.

UGTFP considers both desirable and undesirable outputs, merging economic and environmental benefits to pursue a win-win scenario between economic progress and environmental preservation [

23]. Many scholars currently utilize UGTFP to assess the level of green development [

24]. In terms of input indicators, the majority of existing research relies on labor, capital, and energy inputs [

25]. However, some studies have also introduced more nuanced indicators such as technological variables [

26]. Regarding the measurement methods, Data Envelopment Analysis (DEA) is the most commonly applied approach. Pittman [

27] was the first to incorporate undesirable outputs into the analytical framework. Building upon this foundation, Färe et al. [

28] further expanded the DEA model, leading to the development of the Directional Distance Function (DDF). They also proposed the Malmquist-Luenberger (ML) index, which aligns more closely with the principles of green development and has since been widely by scholars [

29,

30,

31].

It is crucial to recognize, however, that conventional directional distance functions have radial and directional limitations that do not account for the slack in input and output indicators [

32]. To overcome these limitations, Tone [

33] proposed a non-radial, non-directional SBM model that incorporates undesirable outputs. However, this model still encounters challenges in achieving radial improvements in inputs and outputs and in mitigating efficiency overestimation. Subsequently, researchers refined the measurement methods by integrating the SBM approach with directional distance functions, resulting in the SBM-DDF model based on relaxed measures [

34]. This hybrid model, SBM-DDF combines the non-radial advantages of the SBM model, which can handle input/output slacks, with the DDF model’s ability to account for undesirable outputs. It seeks to simultaneously maximize the reduction of inputs and undesirable outputs while increasing desirable outputs. This model capably resolves the problems of efficiency overestimation and the failure to proportionally modify input and output efficiencies [

35], thereby providing a more accurate representation of the relationship between inputs, outputs, and pollution emissions.

The impact of fiscal policy on urban green development has been extensively studied within the academic community. Fiscal studies mostly look at how spending, decentralization, taxes and transfers shape the green low-carbon shift [

36,

37]. Additionally, some researchers explore the green, low-carbon effects arising from policy synergies, including financial, industrial, and pricing policy [

38,

39]. Through tax adjustments, fiscal subsidies, and enhanced financing, fiscal policy facilitates urban green development. Regarding case studies on fiscal policy, research on ECERFP primarily examines the effects on carbon emission reduction [

40], pollutant emission reduction, synergies between pollution reduction and carbon mitigation [

9], energy conservation and emission reduction [

41], and the green, low-carbon transition [

42]. However, the existing literature rarely addresses the relationship between fiscal policy and UGTFP.

In conclusion, previous research has established a strong foundation for understanding urban green development through perspectives such as environmental regulation, industrial transformation, technological innovation, and financial mechanisms. Nevertheless, the nexus of fiscal policy and UGTFP has garnered scarce scholarly focus. While studies have explored the impact of specific green fiscal policies on carbon emissions or overall energy conservation, a comprehensive analysis of their effect on the holistic measure of UGTFP remains underexplored. This research void is especially important because UGTFP integrates both economic output and environmental costs, offering a more nuanced assessment of sustainable urban development. To fill this gap, the present study examines the ECERFP as a representative case of green fiscal policy and empirically evaluates its influence on UGTFP. In doing so, this research not only enriches the literature on fiscal policy and green development but also offers policy-relevant insights for achieving sustainable urban transitions. Specifically, this paper fills a critical gap by moving beyond separate analyses of environmental regulations or fiscal tools. By treating the ECERFP as a unique, integrated policy experiment and applying a rigorous SBM-DDF and multi-period DID framework, we provide a clearer, causally identified evaluation of how such comprehensive fiscal strategies directly influence UGTFP. This approach overcomes limitations in prior work, which often struggled with the endogeneity of policy placement or used less precise measures of green productivity, thereby advancing our understanding of effective green governance.

3. Policy Background and Theoretical Framework

3.1. The ECERFP in China

To address mounting environmental pressures and achieve its national targets, China’s Ministry of Finance, in conjunction with the National Development and Reform Commission (NDRC), launched the ECERFP program in 2011. This policy represents a significant shift from sector-specific or project-based support to an integrated, city-level approach driven by fiscal incentives.

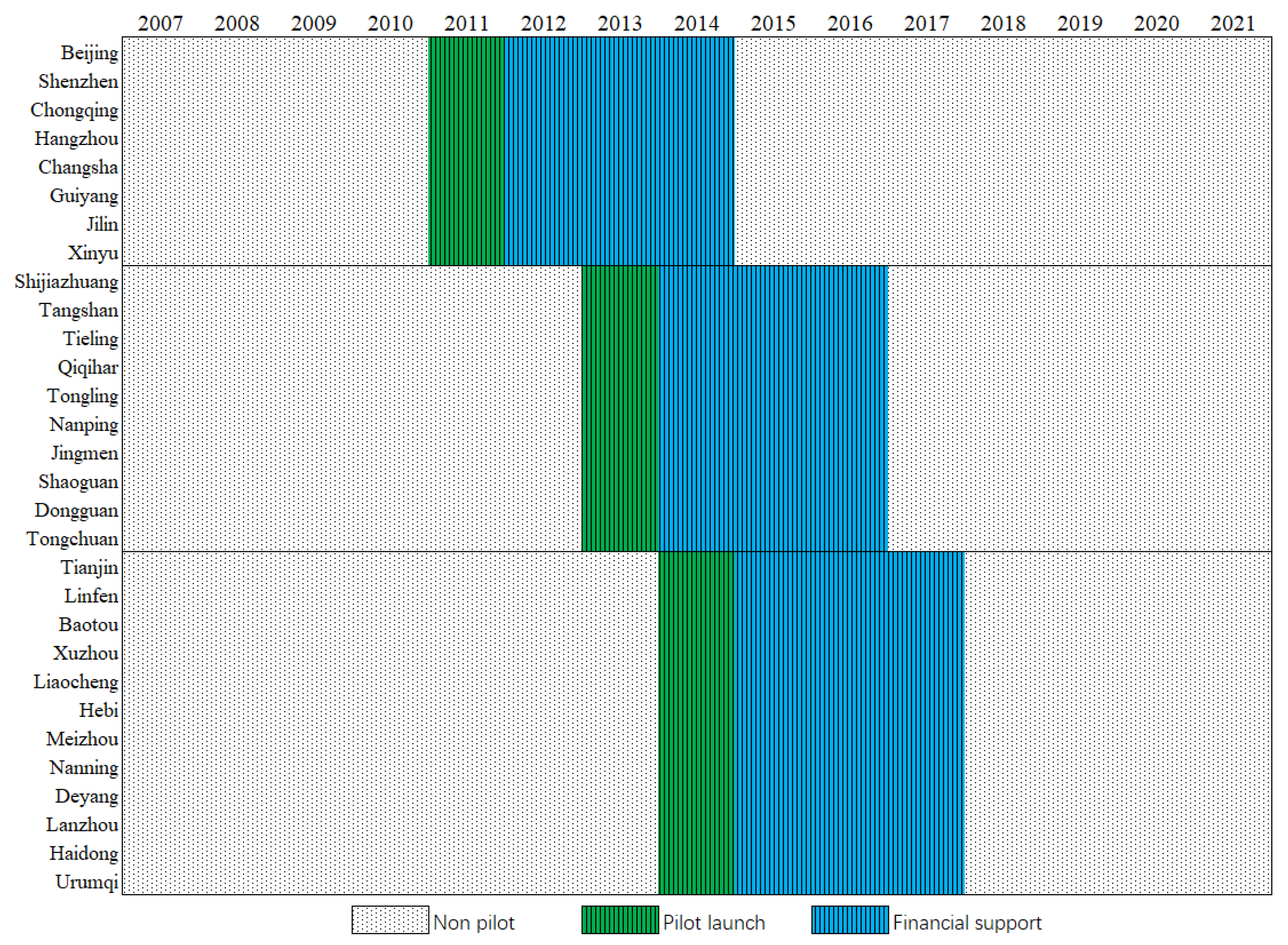

The core objective of the ECERFP was to leverage central government funds to achieve ambitious energy-saving and pollution-reduction goals. The policy was rolled out in three batches (2011, 2013, and 2014), ultimately including 30 cities (

Figure 1). Selected cities would receive substantial reward funds from the central government for three consecutive years based on their performance in meeting predefined targets. The key features of the policy include:

Integrated Fiscal Support: Unlike fragmented subsidies, the ECERFP provided a block grant to demonstration cities. This allowed local governments to strategically allocate funds across various areas, including industrial upgrading, green buildings, clean transportation, and pollution control infrastructure, thereby fostering a holistic green transformation.

Performance-Based Incentives: The allocation of funds was tied to the achievement of specific, measurable targets for energy efficiency improvement and reductions in key pollutants (like SO2, COD). This performance-based mechanism created strong incentives for local officials to prioritize green development.

Local Government as the Primary Actor: The policy designated cities as the main implementation carriers, empowering them to design and execute tailored action plans that fit their local industrial structure and environmental challenges. This decentralized approach aimed to improve policy effectiveness and encourage local innovation in governance.

The ECERFP is not a single fiscal instrument but a policy package. It combines direct financial rewards with the implicit requirement for cities to mobilize their own fiscal resources and enact complementary local policies, such as stricter environmental standards, tax incentives for green industries, and public investment in green technologies.

3.2. Theoretical Analysis and Conceptual Framework

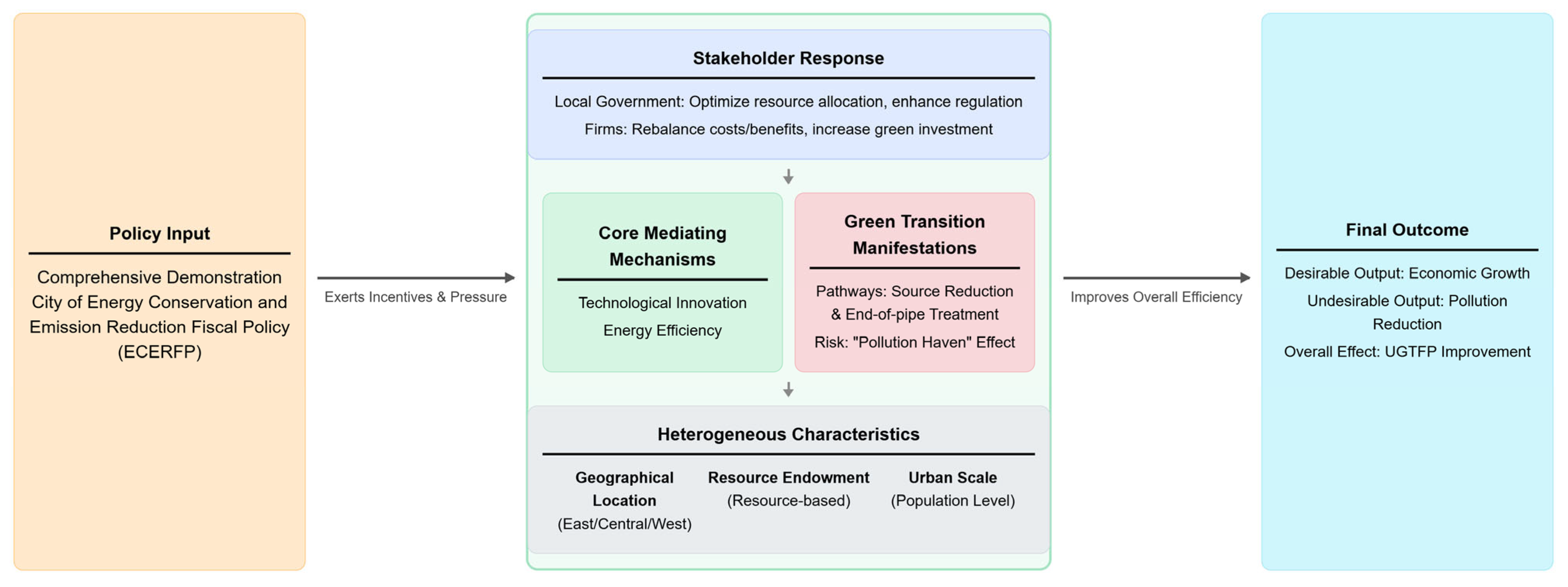

The impact of the ECERFP on UGTFP is a systematic process. It begins with the policy input, which triggers behavioral adjustments in key stakeholders, activates core mediating mechanisms, and ultimately leads to an improvement in UGTFP. The effectiveness of this entire causal chain, however, is contingent upon the specific characteristics of each city.

Figure 2 provides a conceptual framework that illustrates this multi-stage theoretical mechanism.

First, the ECERFP serves as the primary Policy Input, acting as an external shock that exerts both incentives and pressure on the pilot cities. The policy’s core instrument, performance-based fiscal incentives, provides local governments with crucial financial resources, alleviating the capital constraints often associated with green transformation.

Second, these external stimuli elicit a Stakeholder Response from two key actors: local governments and firms. Local governments are motivated to optimize the allocation of fiscal resources towards green projects and to enhance local environmental regulations to meet performance targets. In response, firms face a rebalanced cost–benefit calculation; stricter regulations increase the cost of polluting, while government subsidies and a supportive policy environment lower the cost of green investment. This dual influence guides their behavior towards adopting cleaner technologies and production processes.

Third, the behavioral adjustments of these stakeholders activate the Core Mediating Mechanisms and lead to tangible Green Transition Manifestations. This stage represents the central transmission pathway from policy to outcome.

Core Mediating Mechanisms: The policy’s influence is primarily channeled through two pathways empirically tested in this study. The Technological Innovation channel is activated as fiscal support and market demand for green solutions stimulate R&D activities, leading to an increase in patent output. The Energy Efficiency channel is activated as cities upgrade their industrial structure and firms adopt energy-saving technologies, resulting in a lower energy intensity per unit of GDP.

Green Transition Manifestations: These mechanisms are reflected in concrete actions. Cities pursue green transformation through two main pathways: Source Reduction, by decreasing overall energy consumption, and End-of-pipe Treatment, by improving pollution removal rates. However, this process is not without risks. The heightened regulatory standards in pilot cities may also trigger a “Pollution Haven” Effect, a potential negative consequence where pollution-intensive industries relocate to areas with laxer regulations.

Finally, the combined effect of these mechanisms and transition pathways leads to the Final Outcome: an improvement in UGTFP. This is achieved by increasing desirable outputs (i.e., economic growth) while simultaneously reducing undesirable outputs (i.e., pollution), thereby enhancing overall efficiency. The effectiveness of this entire process, however, is not uniform. It is shaped by the Heterogeneous Characteristics of the cities, including their Geographical Location, Resource Endowment, and Urban Scale, which explains the varying policy impacts observed across different urban contexts.

4. Research Design

4.1. Model Specification and Model Approach

Utilizing a Difference-in-Differences (DID) method to structure a quasi-natural experiment is a particularly effective strategy for policy evaluation. This approach isolates the net policy effects by comparing the outcomes between a treatment and a control group both prior to and following the policy’s introduction. Building on this, this study analyzes the ECERFP as a quasi-natural experiment to accurately assess the impact of fiscal policy on UGTFP.

Traditional DID models are applicable only to single-batch policy analyses. Given that the ECERFP was implemented across several batches, a multi-period DID model offers a more suitable framework, enabling the evaluation of policy effects across different implementation waves. While recent econometric literature has highlighted potential biases in traditional two-way fixed-effects (TWFE) DID estimators under heterogeneous treatment timing [

43,

44], we address this concern in our robustness checks. Specifically, we employ the Goodman-Bacon decomposition to diagnose the sources of variation in our estimates, thereby ensuring the credibility of our findings. Accordingly, this study employs a multi-period DID model to assess how UGTFP differs between pilot cities and non-pilot cities.

Drawing on existing research, the baseline model is specified as follows:

In the equation, represents the dependent variable, namely UGTFP. denotes the group dummy variable, which takes the value of 1 for cities in the experimental (pilot) group and 0 otherwise. is the policy shock dummy variable, taking the value of 1 for period after the policy implementation and 0 otherwise. The estimated coefficient of the interaction term is the primary focus of this study. A positive indicates that fiscal policy has promoted an increase in UGTFP; a negative suggests that fiscal policy has inhibited UGTFP growth; and implies that fiscal policy has no significant effect on UGTFP. signifies a set of control variables. and represent individual (city) and time fixed effects, respectively, while is the random error term.

4.2. Variables Specification

Dependent variable: UGTFP. UGTFP serves as a key indicator for assessing regional economic growth, resource utilization, and environmental protection, and the cultivation of new productivity. In recent years, it has gained increasing recognition as a comprehensive measure of green development. Data Envelopment Analysis (DEA) is widely used due to its straightforward computation and its ability to minimize estimation bias caused by unrealized assumptions. More importantly, DEA allows for the simultaneous inclusion of multiple inputs and outputs. Traditional DEA relies on radial and production-oriented approaches, which can lead to overestimation of efficiency values. The non-radial, non-oriented Slack-Based Measure (SBM) addresses some of the limitations but still cannot fully resolve the issue of efficiency overestimation. To overcome these challenges, this study employes the latest SBM-DDF method, which effectively mitigates the above issues. The specific model is outlined as follows:

In the equation, represents the inputs of each decision-making unit within , denotes types of desired outputs, and signifies types of undesired outputs. corresponds to the input-output data for region i over time, denotes the direction vector, and represents the slack variable associated with the input-output on the frontier surface. is interpreted as the intensity vector, with the sum of its elements equal to 1, indicating the assumption of Variable Returns to Scale (VRS).

Based on the intrinsic logic of UGTFP, the input variables selected in this study are capital stock, labor, and energy. The capital stock is calculated using the perpetual inventory method, based on the depreciation rate, with 2000 as the base year. Labor is measured by the total number of employed persons within the region, while energy consumption is proxied by the total electricity consumption. We use this proxy due to the consistent availability of data at the prefecture-level city level for our study period. However, we acknowledge this measure does not fully capture total energy use, as it excludes the direct combustion of other primary energy sources like coal and natural gas, which are significant components of China’s energy mix. This data constraint, common in related literature, should be considered when interpreting the UGTFP results, as it may lead to an underestimation of total energy inputs for some industrial cities. The expected output is the regional GDP, adjusted to year 2000 prices using a chain-type index. The undesired (non-expected) output is represented by industrial “three wastes”. Specifically, industrial sulfur dioxide emissions are used as the baseline undesired output in the main regression analysis, whereas industrial wastewater emissions and industrial smoke and dust emissions are employed in robustness checks.

Core explanatory variable: ECERFP. Since 2011, China has implemented a fiscal policy. The policy’s objective is to strengthen the integration of fiscal funds and fiscal policies while enabling participating cities to benefit from central fiscal reward funds. This policy is implemented at the urban level and has been rolled out in three batches to date, with each batch supported by central fiscal reward funds for a duration of three years. Currently, a total of 30 cities has been designated as demonstration cities under this program. The ECERFP is a comprehensive fiscal policy package that employs a combination of instruments. These primarily include direct central fiscal reward funds and subsidies provided to pilot cities. In the dataset, a city is coded as 1 if it is selected in the current year or has already been designated as a demonstration city and is receiving central fiscal reward funds; otherwise, it is coded as 0.

Control variables: This study selects six control variables: urban population size (UPS), Openness to the outside world (OP), level of urbanization (UR), industrial structure (IST), Scientific and technological development (STL), and educational attainment (EL). These variables are chosen to account for various socioeconomic and developmental factors that could also influence UGTFP (

Table 1), thereby minimizing omitted variable bias. Larger populations can both drive economic growth and increase resource consumption and pollution, making it an important control for scale effects [

45]. Higher openness to the outside world can introduce advanced green technologies but may also attract pollution-intensive industries, thus its impact needs to be controlled for. Urbanization is closely linked to industrial concentration, infrastructure development, and environmental pressure [

46]. A shift towards tertiary industry typically indicates a more advanced and less pollution-intensive economic structure [

46]. Technological progress is a key driver of green innovation and efficiency improvements [

45]. Higher educational attainment is associated with a more skilled workforce, greater environmental awareness, and improved capacity for technological adoption and innovation [

47].

4.3. Data Sources

This study utilizes panel data from 279 prefecture-level cities in China. Due to data limitations, certain regions, including Hong Kong, Macau, and Taiwan, are excluded from the analysis. The primary data sources include the China City Statistical Yearbook, the China Environmental Statistical Yearbook, the EPS database, and various government bulletins. Information on demonstration cities for the ECERFP was manually compiled and organized by the authors from government websites.

5. Empirical Results and Analysis

5.1. Benchmark Regression Analysis

Table 2 reports the baseline regression results of the impact of ECERFP on UGTFP. Columns (1)–(3) present the estimations without incorporating control variables. The results show that, regardless of whether individual fixed effects, time fixed effects, or both are included, the estimated coefficient of the interaction term

remains highly significant and positive, indicating a robust positive correlation between ECERFP and UGTFP. After incorporating the full set of control variables, the estimated coefficient of

is 0.0388 and remains significant at the 1% level, suggesting that the implementation of ECERFP has effectively promoted the improvement of UGTFP, thereby confirming the policy’s role in advancing green development.

The ECERFP implemented by the central government provides incentive funds to selected regions, thereby stimulating greater investments in green industries and environmental protection projects, which in turn fosters the development of green industries. Concurrently, demonstration regions adjust their tax policies to encourage energy-efficient, low-carbon, and environmentally friendly behaviors, while discouraging high-energy consumption and high-pollution activities. Together, these measures enhance UGTFP. On the one hand, fiscal incentives increase subsidies for green industries. On the other hand, regulatory measures restrict the polluting behaviors of energy-intensive enterprises. This dual mechanism effectively promotes urban green transformation, nurtures new drivers of productivity, and improves overall factor productivity. This finding aligns with previous studies that demonstrate the effectiveness of green fiscal policies in promoting pollution reduction and energy efficiency [

6].

From the perspective of control variables, the results reveal several significant correlations with UGTFP. UPS is positively associated with UGTFP (0.1046, at the 1% level), suggesting that larger cities tend to exhibit higher green productivity, possibly due to economies of scale and resource agglomeration effects. In contrast, OP, UR, and IST show negative and significant correlations with UGTFP in our model. Notably, the STL is strongly and positively correlated with UGTFP (0.8447, at the 1% level), as is EL (0.3764, at the 5% level). This indicates that cities with higher investment in science, technology, and education are more likely to achieve higher UGTFP. The ECERFP strengthens support for energy conservation and emission reduction initiatives by providing substantial funding for relevant technological research and development. This, in turn, attracts top scientific talent and accelerates technological innovation. Meanwhile, the ECERFP promotes the growth of energy conservation and environmental protection industry, encourages the formation of industrial clusters with high-tech enterprises, and facilitates inter-enterprise communication, collaboration, and technological diffusion. Furthermore, the ECERFP increases investment in education, guiding institutions to adjust their talent cultivation strategies. By enhancing societal awareness of environmental protection and energy issues, it helps to cultivate a culture that values knowledge and continuous learning.

Under the impetus of the ECERFP, pilot regions such as Linfen—traditionally an energy-intensive city in Shanxi Province—have actively promoted the development of new energy transportation system centered on clean and renewable energy sources, with a particular focus on energy-efficient and environmentally friendly new energy vehicles. Once heavily reliant on coal and other high-pollution industries, Linfen’s transition illustrates how fiscal policy can redirect local economic structures toward green innovation and sustainable growth. At the same time, the rapid growth of the new energy industry has increased the demand for highly skilled professionals, prompting local educational systems to adjust training programs and invest in cultivating expertise aligned with green, low-carbon industries.

In summary, the baseline regression results demonstrate that the ECERFP has a significant and positive effect on UGTFP. This relationship holds consistently across different model specifications, including with or without control variables. The findings suggest that fiscal policy effectively promotes green transformation through both technological innovation and the development of specialized talent.

5.2. Parallel Trend Test

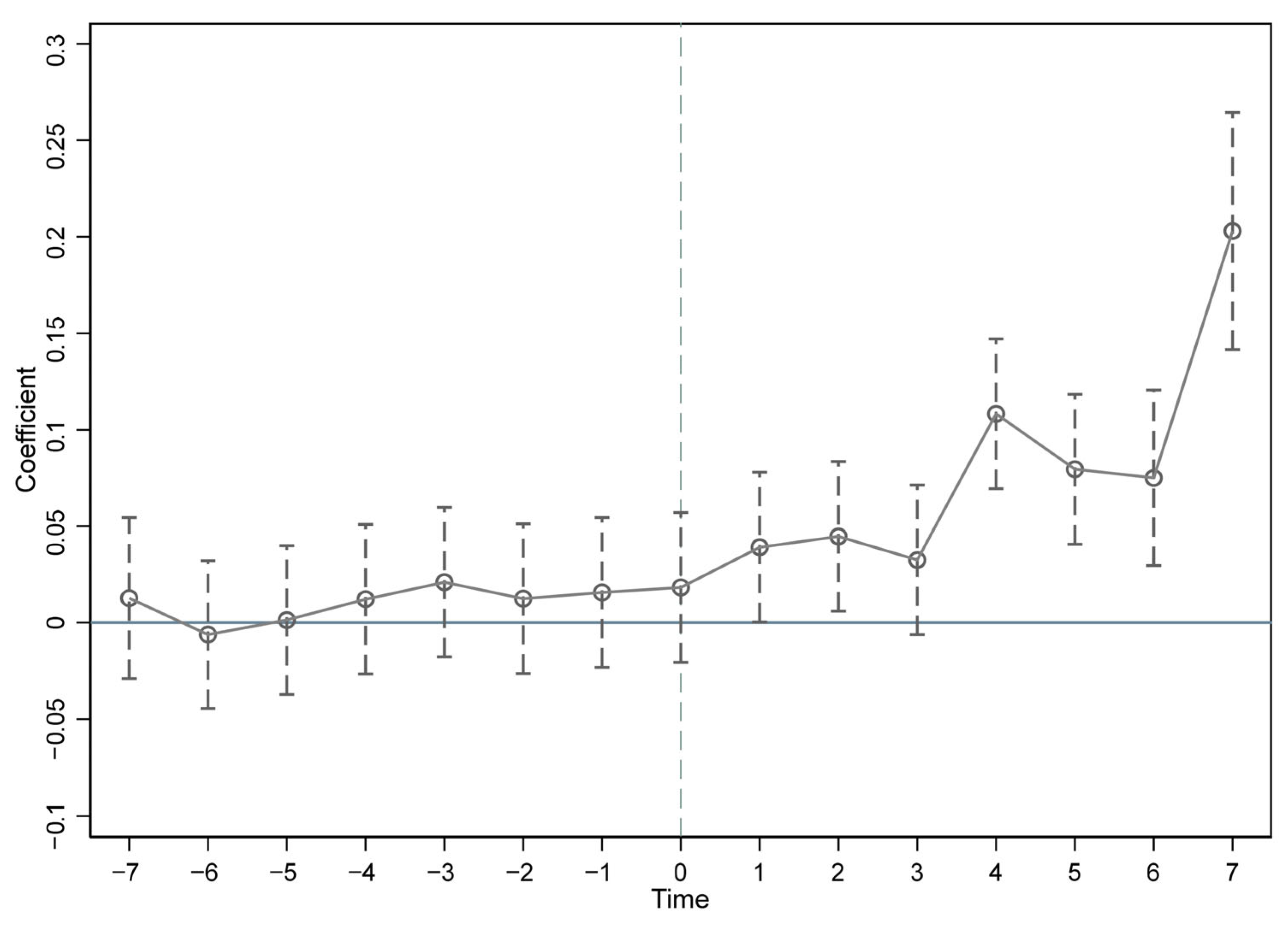

The DID method produces valid estimates by mitigating potential endogeneity. This assumption requires that the experimental and control group samples exhibit similar temporal trends in the outcome variable prior to the policy implementation, without significant divergences. To verify this assumption, this study implements an event study methodology, which allows us to test whether pilot regions and non-pilot regions exhibit comparable trends in UGTFP.

Specifically, Formula (1) (

Section 3.1., Page 6) is expanded into Formula (3) at above, where

represents a series of dummy variables, while the remaining variables remain consistent with the baseline regression equation. Here, m = 0 indicates the year of ECERFP implementation; m < 0 denotes the m-th year prior to ECERFP implementation, and m > 0 signifies the m-th year after ECERFP implementation. For the experimental group,

takes the value of 1 during the m-th year before or after ECERFP implementation, and 0 otherwise.

The dashed lines above and below the scatter points represent the 95% confidence interval. As illustrated in

Figure 3, the coefficients for the pre-implementation period are largely insignificant within the 95% confidence interval, suggesting similar pre-policy UGTFP trends in both groups. Conversely, the coefficients for the post-implementation period are strongly significant, thereby validating the parallel trends assumption.

5.3. Robustness Test

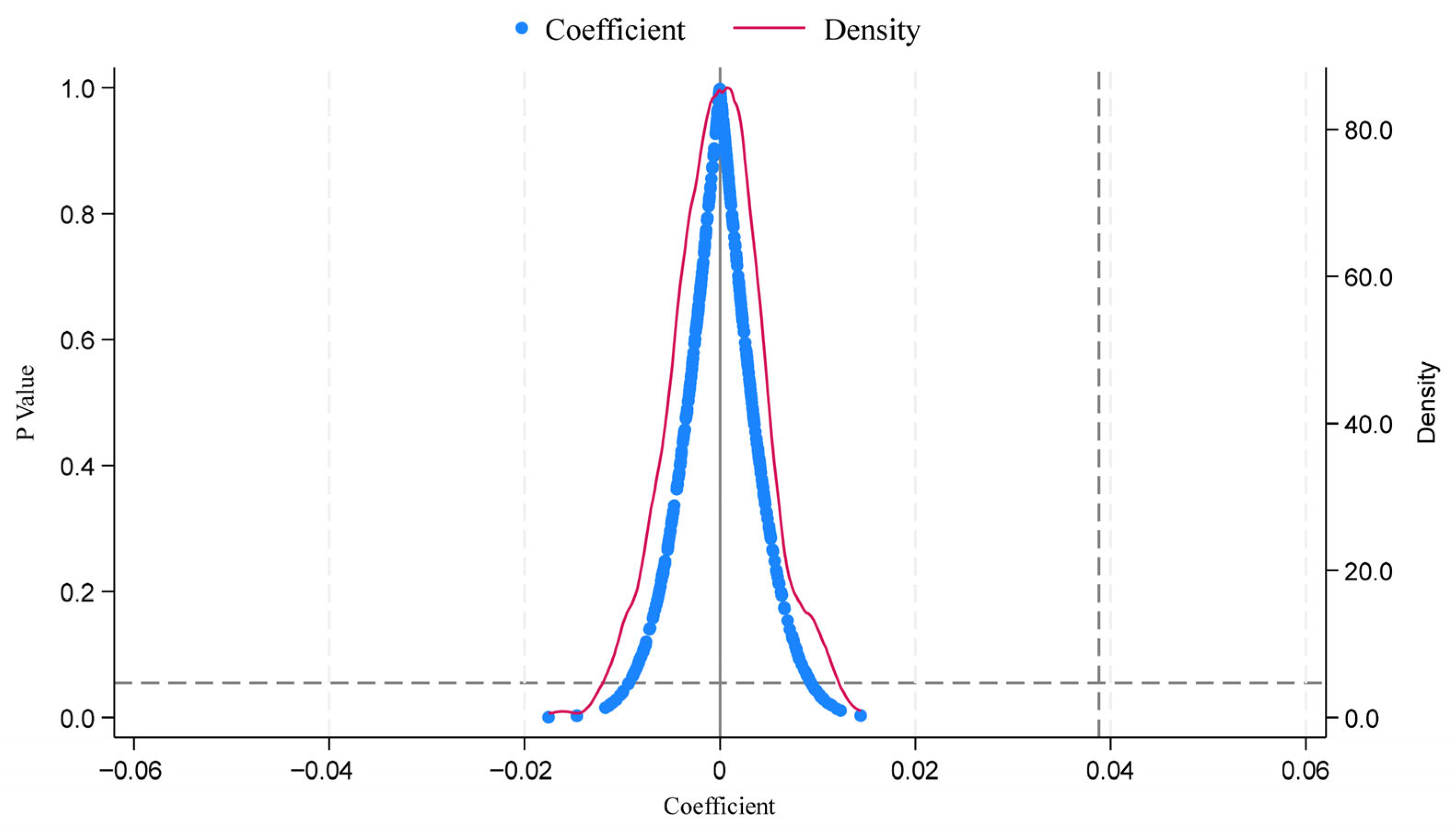

5.3.1. Placebo Test

To ensure that the estimated results are not driven by anticipated effects, a placebo test was conducted. Among the 279 cities in the sample, a subset of cities was randomly assigned a “treatment group”, while the remaining regions served as the control group. This random assignment was repeated 500 times to construct virtual treatment groups, and baseline regressions were re-estimated for each iteration.

Figure 4 presents the placebo test results. As illustrated, the estimated coefficients of

are centered around zero, with a mean value close to zero. This outcome indicates that the ECERFP does not generate a significant treatment effect under random sampling simulations. Therefore, the baseline regression results are unlikely to be biased and are not driven by a placebo effect.

5.3.2. Goodman-Bacon Decomposition Test

Following the placebo test, which confirmed that the results are not driven by spurious effects, the Goodman-Bacon decomposition is further applied to examine the structure of the DID estimates. This study employs the Goodman-Bacon decomposition to identify potential bias in the baseline regression of the multi-period DID model arising from different weighting schemes. In simple terms, this decomposition helps verify whether our main result is driven by robust comparisons (e.g., treated cities versus never-treated cities) or potentially biased comparisons (e.g., comparing early-treated cities with late-treated cities, where the latter act as a “bad control” group). Furthermore, the analysis examines the extent to which such bias may influence the final estimation.

We decompose the multi-period DID estimator into three pairwise comparisons: (1) treatment group vs. never-treated group, (2) earlier-treated group vs. later-treated group (with the latter serving as the control), and (3) later-treated group vs. earlier-treated group (with the latter serving as the control). Among these, the first two comparisons represent relatively well-matched comparisons and thus provide more reliable estimates. In contrast, the third comparison may involve treatment effects that are not fully homogeneous, which may introduce bias into the estimation results. If the weight assigned to the third comparison is disproportionally large, it may significantly distort the overall results.

The overall DID regression outcomes are largely driven by the “Treatment vs. Never Treated” comparison, accounting for approximately 98.2% of the total weight (

Table 3). By contrast, the third comparison, “Later Group Treatment vs. Earlier Group Control,” contributes only about 1.2%, exerting a negligible influence on the baseline regression results. Furthermore,

Figure 5 illustrates the relationship between the Goodman-Bacon decomposition group tests and their corresponding weights, where the vertical axis represents the individual DID estimates and the horizontal axis indicates the true estimated outcomes of the model. The analysis confirms that the DID regression results primarily originate from the comparison between the treatment group and the never-treated group, thereby reinforcing the robustness and reliability.

5.3.3. PSM-DID

To further mitigate potential estimation errors, this study employs the Propensity Score Matching Difference-in-Differences (PSM-DID) method to examine the validity of common supporting hypotheses. As shown in Column (1) of

Table 4, the regression results based on the PSM-DID analysis remain consistently significant and positive, confirming that the DID model employed in this study is robust. These findings strengthen confidence in the causal interpretation of the ECERFP’s effects.

5.3.4. Additional Robustness Tests

- (1)

Replacement of the Dependent Variable

In the baseline regression, sulfur dioxide emissions are used as the undesirable output in calculating UGTFP. To test the robustness of the results, we replace the dependent variable by employing wastewater emissions and particulate matter emissions as alternative undesirable outputs to recompute UGTFP. The results remain significant at the 1% level, indicating that changing the measurement of dependent variable does not affect the robustness of the regression findings.

- (2)

Exclusion of Special Samples

Municipalities directly under the central government and provincial capital cities enjoy significant advantages and benefits in economic development, population scale, and policy support, which may bias the regression results. To address this, these special samples were excluded. As shown in column (1) of

Table 5, the regression coefficient of

remains positive at 0.0202 and significant at the 5% level, confirming the robustness.

- (3)

Controlling for Concurrent Policies

During the ECERFP period, China also initiated several other policies. In July 2010, the NDRC launched pilot projects for low-carbon provinces and cities. Subsequently, the second and third batches of national low-carbon city pilot projects were introduced in 2012 and 2017. Additionally, in October 2021, carbon emission trading pilot programs were approved by the NDRC in seven provinces and municipalities aiming to reduce carbon emissions through market mechanisms. Furthermore, various provincial-level regulations or industry-specific mandates (e.g., for the steel or cement sectors) were active during this period. While it is challenging to quantify and control for every such policy due to data limitations, our use of city and time fixed effects helps mitigate potential confounding effects. City fixed effects absorb time-invariant, city-specific characteristics (e.g., being a historical industrial base), while time fixed effects capture national-level shocks or policy trends affecting all cities simultaneously. To eliminate the influence of the most prominent national-level policies on the ECERFP, this study incorporates carbon emission trading policy and low-carbon pilot policy into the baseline regression model and conducted separate regressions. The results indicate that the baseline regression results remain robust.

5.4. Heterogeneity Analysis

5.4.1. Geographical Location

China’s vast territory encompasses significant disparities, which may influence the effectiveness of fiscal policy implementation. According to the classification principles established by the National Bureau of Statistics of China, we divide the regions into Eastern, Central, and Western areas to investigate the impact of the ECERFP on UGTFP under regional heterogeneity. The results presented in columns (1)–(3) of

Table 6 indicate that the ECERFP significantly enhances the UGTFP in the Central and Western regions, while its effect in the Eastern region is not statistically significant.

The ECERFP primarily supports local efforts through dedicated fiscal funding. The Eastern region, with its relatively strong economic foundation and already high UGTFP, is less responsive to short-term fiscal interventions. The Central and Western regions, which face more constraints and exhibit relatively lagging urban green development, benefit substantially from robust fiscal support. Such funding helps alleviate regional fiscal pressures, facilitates industrial upgrading, improves ecological governance, and ultimately enhances UGTFP. This regional disparity is consistent with findings in other studies, which suggest that environmental policies tend to have a more pronounced impact in less developed regions where the initial environmental quality is poorer and the marginal benefits of improvement are higher [

48].

A comparison of the results in columns (2) and (3) of

Table 6 reveals that the enhancement effect of the ECERFP on UGTFP is stronger in the Western region than in the Central region. This can be explained from two perspectives. On the one hand, fiscal resources in the Western region are generally more constrained compared to those in the Central region. On the other hand, the Central region’s economic development has long been dominated by secondary industries, resulting in relatively high industrial pollution and substantial pressures for industrial transformation. Consequently, fiscal funding in the Central region may not directly or effectively promote green development. In contrast, the Western region has recently focused on developing clean industries such as photovoltaics and wind power, which has led a more noticeable improvement in UGTFP.

5.4.2. Resource Endowment

Cities in China differ significantly in their resource endowments. We categorize cities nationwide into two types: resource-based cities and non-resource-based cities. The results presented in columns (4) and (5) of

Table 6 indicate that the regression coefficients of the ECERFP on the UGTFP are positive and statistically significant at the 1% level for both city types. This suggests that fiscal policies aimed at energy conservation and emission reduction significantly enhance UGTFP, with a more pronounced effect in resource-based cities. Resource-based cities typically rely heavily on resource extraction, with economic development primarily driven by resource-intensive industries, resulting in considerable pollution. The provision of dedicated fiscal funds supports local resource transformation, strengthens environmental governance, and promotes improvement in UGTFP.

5.4.3. Urban Scale

With ongoing urbanization, city sizes in China are evolving rapidly, leading to significant differences in R&D, industrial structure upgrading, resource aggregation and utilization, and pollution concentration and treatment. We categorize the cities in this study based on resident population size (POP) into five categories: (1) megacities (POP ≥ 10 million), (2) large cities (POP ≥ 5 million and < 10 million), (3) Type I large cities (POP ≥ 3 million and < 5 million), (4) Type II large cities (POP ≥ 1 million and < 3 million), and (5) small and medium-sized cities (POP < 1 million). The examination results of the ECERFP’s impact on UGTFP under urban scale categories are presented in

Table 7, highlighting how fiscal policy effects vary with city size.

As shown in

Table 7, the ECERFP has a significantly positive effect on UGTFP in megacities, large cities, and Type I large cities, while its impact on smaller cities is not significant. This indicates that when urban population exceeds 3 million, ECERFP can significantly promote UGTFP. As cities reach a certain scale, aggregation economic effects become more pronounced, and with the support of dedicated fiscal funding, various factor resources are mobilized to improve energy efficiency, thereby promoting urban green development. A comparison of the results in columns (1)–(3) reveals that the ECERFP has the strongest promoting effect on Type I large cities, indicating that ECERFP is particularly effective in cities with populations between 3 and 5 million. This finding is consistent with the results of Luo et al. [

49]. Beyond this optimal scale, however, congestion effects may emerge, increasing in the consumption of various factors and exacerbating pollution emissions. Therefore, a moderate urban scale appears to be most conducive to the improvement of UGTFP.

Overall, the heterogeneity analysis indicates that the ECERFP’s effectiveness in enhancing UGTFP varies across regions, resource endowments, and urban scales, with the policy exerting the strongest impact in Central and Western regions, resource-based cities, and moderately large cities. These insights highlight the importance of considering local conditions in policy design and implementation and set the stage for exploring the underlying mechanisms through which fiscal policy promotes urban green development.

7. Conclusions and Policy Implications

7.1. Conclusions

This study investigates the impact of China’s ECERFP on UGTFP across 279 cities. It uses the ECERFP as a quasi-natural experiment and employs methodologies such as SBM-DDF and multi-period DID to empirically examine its impact on UGTFP. The research findings are as follows:

- (1)

Overall Effectiveness: The implementation of the ECERFP significantly promotes the enhancement of UGTFP. This result remains robust across multiple robustness tests, including parallel trend analysis, placebo tests, and Goodman–Bacon decomposition.

- (2)

Regional Heterogeneity: The pilot policy significantly improves UGTFP in the Central and Western regions, while its impact on the Eastern region is not significant. Similarly, the policy enhances the UGTFP in both resource-based and non-resource-based cities, with a stronger effect observed in resource-based cities.

- (3)

Urban Scale: The ECERFP has a significantly positive effect on the UGTFP of megacities, large cities, and Type I large cities, while its impact on smaller cities is not significant. Specifically, the policy’s promotional effect becomes more pronounced in cities with populations exceeding three million, suggesting that moderate to large urban scales are more conducive to the improvement of UGTFP.

- (4)

Mechanism Analysis: The pilot policy enhances UGTFP through increased technological innovation and more efficient energy utilization, thereby advancing urban green development. In terms of energy consumption control and pollution management, the pilot policy reduces overall urban energy consumption, achieving energy savings and source reduction. Concurrently, it improves the removal rates of sulfur dioxide and particulate matter, strengthening end-of-pipe treatment.

- (5)

Environmental Regulation and Pollution Transfer: The implementation of ECERFP significantly reduces pollution emissions in regions with stronger environmental regulation (ER), while its impact in weaker-ER regions is not significant. This pattern indicates potential pollution transfer from high-ER areas to low-ER areas, consistent with the “pollution haven” hypothesis.

7.2. Policy Implications

The policy recommendations are as follows.

First, implement spatially differentiated fiscal strategies based on regional heterogeneity. Our results show the ECERFP is most effective in the Central and Western regions. Therefore, for these regions, fiscal policy should prioritize direct financial support for upgrading green infrastructure, adopting mature energy-saving technologies, and strengthening environmental governance capacity to address their foundational weaknesses. In contrast, for the economically advanced Eastern region, where the policy effect was insignificant, future fiscal interventions should pivot from broad subsidies to more sophisticated instruments. This includes fostering green financial markets, offering tax incentives for cutting-edge R&D, and establishing carbon trading platforms to leverage the region’s innovation potential.

Second, design tailored fiscal support for cities with different resource endowments. The policy’s stronger impact on resource-based cities highlights a critical opportunity. For these cities, fiscal funds should be strategically earmarked not only for end-of-pipe pollution control but also for facilitating long-term economic diversification. This could involve creating special funds to support the growth of alternative industries, financing retraining programs for workers from declining resource sectors, and incentivizing investment in renewable energy to break the dependency on traditional industrial structures.

Third, optimize policy design according to urban scale to maximize efficiency. Our finding that the policy is most effective in Type I large cities (3–5 million population) suggests that an “optimal scale” for such interventions exists. Policymakers should leverage this insight by encouraging these moderately large cities to use fiscal support to build on their agglomeration economies, transforming them into regional hubs for green innovation and technology diffusion. For megacities, where congestion effects may diminish policy effectiveness, fiscal tools should focus on mitigating urban diseases, such as subsidizing green public transportation and circular economy initiatives. For smaller cities, where the policy impact was not significant, support should be directed toward developing niche green industries that align with local advantages, rather than pursuing capital-intensive, large-scale projects.

Finally, strengthen inter-regional regulatory coordination to prevent pollution transfer. The evidence supporting the “pollution haven” hypothesis calls for a more coordinated governance approach. The central government should establish a unified environmental standards framework and a cross-regional compensation mechanism. This would reduce the incentive for enterprises to relocate based on regulatory arbitrage and ensure that fiscal policies for green development in one area do not inadvertently lead to environmental degradation in another, promoting balanced and sustainable development nationwide.

7.3. Limitations and Future Research Directions

Despite offering meaningful insights, this study has certain limitations. First, due to data availability constraints, this study employs a binary variable to represent the ECERFP. This approach does not capture the heterogeneity in the intensity, scale, or specific timing of fiscal support across different pilot cities. Future research could provide more nuanced insights by collecting detailed financial data to construct a continuous measure of policy intensity. Second, our analysis relies on electricity consumption as a proxy for total energy use and SO2 as the primary indicator for undesirable output. Although robustness checks with other pollutants were conducted, future studies could incorporate a more comprehensive set of energy inputs and environmental outputs to enhance the accuracy of the UGTFP measurement. Finally, while we controlled for major concurrent environmental policies, it is challenging to isolate the effects of every specific provincial or industry-level mandate. As industrial relocation and regulatory enforcement often exhibit significant heterogeneity at the sub-provincial level, future research employing more granular, city-level data on environmental regulation could offer a more nuanced understanding of pollution transfer dynamics.