Abstract

The Science and Technology Finance ecosystem plays an increasingly important role in shaping the sustainable development of new quality productive forces (NQPF). This study, based on the perspective of complex systems and using a multi-period fsQCA approach, takes 31 provinces, municipalities, and autonomous regions in mainland China as cases to analyze the relationship between the Science and Technology Finance ecosystem and NQPF from 2017 to 2022. The findings are as follows: first, the antecedent configurations of NQPF are multiple, with the variables of the Science and Technology Finance ecosystem jointly matching and working together to drive its development. Second, in 2017–2018, there were three configurations: the “Bank–Enterprise” collaborative-driven type, the Bank-led type, and the Enterprise-led type; in 2019–2020, there were three configurations: the “Bank–Enterprise” collaborative-driven type, the “Bank–Enterprise–Market” collaborative-driven type, and the “Enterprise–Market” collaborative-driven type; in 2021–2022, there was one configuration, namely the Multi-Actor collaborative-driven type. Third, the development of NQPF across the three stages underwent an evolution from being dominated by core financial resources, to coordinated driving by core finance and the market, and finally to multi-stakeholder collaborative promotion. Fourth, in the configurations where high-level NQPF was not achieved, insufficiency of Enterprise Self-owned Funds (ESOF) was identified as a common problem. These findings provide theoretical references and policy implications for optimizing the Science and Technology Finance ecosystem in line with local conditions.

1. Introduction

New quality productive forces (NQPF), as the core engine of high-quality economic development, have become a current research focus. NQPF refers to high-quality, knowledge-intensive, and technology-driven productive capacities that restructure the combination of production factors through disruptive technological innovation, thereby significantly enhancing total factor productivity, promoting the development of advanced manufacturing, and upgrading traditional growth drivers. However, the development of NQPF cannot be achieved without sufficient and efficient financial support. Enterprises, as the main carriers of NQPF, are facing financial difficulties: first, the structural contradiction between high-risk R&D investment and the uncertainty of long payback periods creates significant obstacles for external financing, making corporate cash flows prone to tightening; second, the practical application of innovative achievements is challenged by uncertainties in technological pathways and insufficient protection of intellectual property rights, which further increases the risks of financial investment.

In October 2023, the Central Financial Work Conference first proposed doing a good job in five major areas of finance: science and technology finance, green finance, inclusive finance, pension finance, and digital finance. As the first of the “Five Major Articles”, science and technology finance plays a key driving role. In March 2025, the State Council issued the Guiding Opinions on Advancing the “Five Major Articles” of finance, proposing to promote the capacity building of financial services for technological innovation and to provide technology-based enterprises with full-chain and full life-cycle financial services. Science and technology finance can not only inject financial momentum into regional scientific and technological innovation through various methods such as venture capital, technology credit, and intellectual property securitization, but also effectively cope with and mitigate the risks faced in the development of NQPF by providing diversified financial instruments and optimizing the institutional environment. Internationally, different economies have developed distinct models for promoting science and technology finance and innovation. The European Union’s Horizon Europe framework emphasizes mission-oriented and sustainability-driven research to support scientific and technological innovation, while the United States’ ARPA-E program follows a high-risk, high-reward approach, focusing on disruptive energy and technology innovations. In contrast, China’s science and technology finance system has evolved into a hybrid model that combines government guidance with market mechanisms. For example, public R&D funding and bank technology loans provide macro-level support, while venture capital stimulates market-driven innovation. These policy instruments collectively create a diversified science and technology finance ecosystem, thereby promoting the development of NQPF. For this reason, finding a way to better exert the boosting role of science and technology finance in the development of NQPF requires further empirical analysis for verification. Revealing the internal mechanism between the Science and Technology Finance ecosystem and the improvement of the development level of NQPF will help provide theoretical support for local governments to formulate more targeted and regionally adaptive science and technology finance policies, thereby more effectively promoting the high-quality development of NQPF. Specifically, this study aims to address the following research questions: (1) How do the complex and nonlinear interactions among the elements of the Science and Technology Finance ecosystem affect the development of NQPF? (2) Which conditional variables serve as necessary or sufficient factors for high or non-high NQPF development in different periods? (3) How do the configurational patterns of these conditional variables exhibit stage-wise evolution across different periods?

This paper argues that the ecological elements of science and technology finance that support the development of NQPF have multidimensional and complex interconnections, while traditional regression analysis methods tend to analyze the impact of science and technology finance on NQPF from a single-factor perspective, making it difficult to examine the impact mechanism and dynamic evolution mechanism of the synergistic effects among the internal elements of science and technology finance on the development of NQPF. Therefore, the fsQCA method is used to identify the complex interaction effects between the science and technology finance ecology and the development of NQPF from a regional perspective. The possible marginal contributions of this paper are as follows: first, it breaks through the paradigm of traditional single-factor analysis and focuses on the complex linkage relationships among the components of the science and technology finance ecology. By examining the interactions among the components, it reveals the mechanisms through which they jointly promote the development of NQPF along different paths. Second, by adopting the fsQCA method, it is possible to identify and analyze different dynamic combinations of multiple conditions, which are suitable for dealing with complex and nonlinear system problems, thus compensating for the limitations of traditional regression analysis. Third, a time dimension is incorporated to explore the dynamic evolutionary characteristics of the complex causal relationship between science and technology finance and the development of NQPF, and the study period is divided into three stages to sort out the evolutionary trends and patterns of different configuration paths in each stage. Fourth, the findings reveal the key configurations driving high-level new quality productive forces, providing theoretical insights and guidance to some extent for optimizing the Science and Technology Finance ecosystem to guide ESG investments and advance the circular economy.

2. Literature Review

2.1. Research on Science and Technology Finance

Current research on science and technology finance mainly focuses on two aspects: first, the study of science and technology finance indicator systems. Zou Ke et al. [1], from the perspective of the supply side of science and technology finance, constructed a multi-level comprehensive indicator system including public science and technology finance, market science and technology finance, and seven secondary dimensions; Li Junlin and Zhou Zhiqiang [2], from the perspectives of connotation and extension, built a comprehensive indicator system from five dimensions: policy guidance, development environment, service level, product innovation, and talent reserve, discussing the spatiotemporal evolution pattern of the development of science and technology finance in China in a comprehensive manner. Second, the study of the economic consequences of science and technology finance. From a macro perspective, existing studies have found that science and technology finance can optimize resource allocation [3], improve total factor productivity [4], accelerate the upgrading of industrial structure [5], and promote high-quality economic development; from a micro perspective, existing studies have found that science and technology finance can reduce financing constraints [6], lower the level of information asymmetry [7], reduce the degree of information asymmetry [8], enhance enterprise innovation, and accelerate high-quality development of enterprises [9]. International scholars have primarily conducted their research within the framework of sustainable financial systems. For example, Scholtens (2017) pointed out that sustainable banks, as financial institutions, can provide consulting and financial intermediation services to reduce problems related to information asymmetry [10]. Moreover, they help redirect financial resources toward technologies and projects aligned with ecological and social objectives. Weber (2018), in a policy report, explored the role of the financial sector—including banks, investment funds, and venture capital—in achieving the Sustainable Development Goals (SDGs), emphasizing the importance of innovative financial forms such as sustainable investment and impact investment in promoting green technologies and low-carbon transitions [11].

2.2. Research on the Connotation and Influencing Factors of NQPF

First, when it comes to research on the concept and connotation of NQPF, most scholars, from the perspective of its characteristics, believe that it is necessary to consider both the aspects of “new” and “quality”. The term “new” refers to the combination of three dimensions: new technology, new economy, and new business models, highlighting technological innovation and integration [12,13]; the term “quality” refers to providing stronger innovation momentum for the development of productive forces through breakthroughs in key disruptive technologies, emphasizing the driving role of technological innovation [14]. Some scholars, based on systems theory and Marxist productivity theory, consider NQPF essentially as a “factor–structure–function” system composed of interactions among productive force elements, structure, and function [15], whose basic connotation is reflected in a qualitative leap of the three major productive force elements based on optimized combination [16]. Furthermore, NQPF also possesses the attributes of being green, low-carbon, and sustainable [17]. They emphasize the harmonious coexistence between humans and nature by promoting the digitalization of production processes, the greening of production technologies, and the ecological orientation of production outputs. This fosters the continuous emergence of green and low-carbon new materials and new energy, fundamentally transforming the traditional development model of productive forces that relies on high energy consumption and high pollution, thereby advancing both the harmonious coexistence between humans and nature and the green transformation of industries. Second, the influencing factors of NQPF have been studied from multiple perspectives, including the digital economy, environmental regulation, and sustainable finance. First, the digital economy, based on data elements and information technology, accelerates the transformation of traditional industries toward higher technology levels, providing essential technological support and market demand for industrial structure optimization and upgrading, thereby promoting the development of NQPF [18,19]. Second, environmental regulation encourages local governments to increase attention to environmental quality and invest in environmental infrastructure [20], which significantly enhances NQPF development. Third, finance, as a core hub of resource allocation efficiency, can guide resources toward high-efficiency allocation through sustainable finance, promote value distribution reform, and drive enterprises’ production processes to shift from energy-intensive and wasteful “one-dimensional” modes to green and low-carbon “circular” models, thereby increasing the proportion of growth-oriented, high-tech, and clean industries in the economic structure and accelerating the formation of NQPF [21].

2.3. Science and Technology Finance and NQPF

Regarding the relationship between science and technology finance and the development of NQPF, existing research mainly focuses on two aspects: qualitative analysis and quantitative analysis. First, from a qualitative perspective, the relationship between science and technology finance and NQPF has been explored, pointing out that science and technology finance can accelerate the development of NQPF by promoting technological innovation [22], guiding industrial transformation and upgrading [23], and optimizing the innovation ecosystem [24]. Second, from a quantitative perspective, most scholars treat science and technology finance as an overall variable to study its impact and mechanism on regional NQPF, finding that science and technology finance can enhance the agglomeration level of high-tech industries [25], promote industrial structure upgrading [26], and improve innovation levels [27], thereby promoting the development of NQPF, with an overall pattern of stronger western regions and weaker eastern regions [28]. Some scholars also study from the perspective of individual variables within science and technology finance, showing that government subsidies play an important role in promoting regional NQPF [29]; VC can significantly improve regional NQPF, and the government’s attention to scientific and technological talent and the level of industrial agglomeration have positive moderating effects on this impact [30].

In summary, existing studies have conducted in-depth theoretical and empirical investigations on the relationship between science and technology finance and the development of NQPF from multiple perspectives, revealing the mechanism of their interaction and providing a basis for this study. However, there are still the following shortcomings: first, most existing studies analyze the net effect of science and technology finance on the development of NQPF from a single-factor perspective, ignoring that the development of NQPF driven by science and technology finance is a complex process involving multiple factors interacting simultaneously. Second, existing studies rarely analyze the dynamic evolution process and stage-specific characteristics of the impact of science and technology finance on NQPF from a temporal perspective, overlooking the complex changes in their relationship over time.

3. Theoretical Background

3.1. Complex Systems Perspective

The complex systems perspective posits that market actors are highly interrelated—both competing and cooperating with each other—to jointly drive the dynamic evolution of technology, thereby influencing the formation and structural transformation of the economy [31]. Within an economic system, in the face of widespread definitional ambiguity and environmental uncertainty, market actors must continuously learn and adjust their strategies to adapt to change. This process does not aim to achieve a single optimal equilibrium; instead, it explores diversified solutions and gradually evolves into a pluralistic economic ecosystem that can more precisely respond to a complex and volatile external environment. Furthermore, unlike the traditional economic assumption of diminishing returns, the complex systems perspective emphasizes that technological leadership can generate positive feedback mechanisms through network effects and economies of scale, resulting in increasing returns [32]. Under this positive feedback mechanism, small random events accumulate over time, causing the system to exhibit dynamically evolving states of multiple equilibria throughout the evolutionary process.

In addition, the complex systems perspective also suggests that innovation arises not only from the emergence of new technologies but also from the recombination of existing ones [32]. This process continuously fuels the advancement of innovation and, in turn, enhances productivity. The emergence of new technologies does not merely replace old ones but also generates new demands for emerging technologies, becoming part of the process that creates further innovations. It simultaneously drives the self-reorganization of economic, social, and institutional systems. This multi-level technological transformation exhibits the characteristics of continuous and non-disruptive “creative destruction”, thereby propelling the ongoing evolution of the economic system and sustaining productivity growth.

In summary, the competition and cooperation among market actors spontaneously drive the dynamic evolution of technology. The emergence of new technologies and the recombination of existing ones continuously promote the development of productivity, while the positive feedback mechanisms formed by technological advancement led the economic system to eventually exhibit a state of multiple dynamic equilibria. The development of productivity can thus be viewed as an emergent phenomenon within a complex system, with the continuous interaction among market participants serving as its core driving force. This theoretical perspective provides valuable insights into understanding how the Science and Technology Finance ecosystem, as part of the broader economic system, drives the development of NQPF.

3.2. Analysis Framework

Based on the perspective of complex systems, Science and Technology Finance is the key to generating technological combinations, while the differentiated measures taken by relevant market participants in Science and Technology Finance in the face of economic uncertainty play an important role in promoting the development of NQPF. Drawing on existing research [33], this paper analyzes the Science and Technology Finance Ecosystem from six dimensions: Fiscal Science and Technology Investment (FSTI), Bank Technology Loans (BTL), Enterprise Self-owned Funds (ESOF), Venture Capital (VC), Science and Technology Capital Market (STCM), and Science and Technology Insurance (STI).

3.2.1. Fiscal Science and Technology Investment (FSTI)

FSTI refers to the support provided by the government through fiscal funds for enterprises to carry out technological innovation, research and development, and technology transformation activities. As a key component planned by the Chinese government, FSTI can not only alleviate enterprise financing constraints, increase R&D intensity, and enhance enterprise innovation vitality [34], but also guide more social capital into the technology sector by sending positive signals to the financial market, promote the formation of a healthy innovation ecosystem, accelerate the industrialization of scientific and technological achievements, and thereby comprehensively improve the development level and overall competitiveness of NQPF.

3.2.2. Bank Technology Loans (BTL)

BTL refers to the loan support obtained by enterprises from banks when carrying out technological innovation, research and development, and technology transformation activities. Yu Liping and Jin Zhenzhen [35], based on panel data of China’s high-tech industries, found that BTL significantly improves the quality of innovation. BTL provides direct financial support to technology-based enterprises, optimizes the loan structure, reduces financing costs, and enables risk management to ensure the safety and effectiveness of loan funds, thereby guaranteeing the sustainability of the development of NQPF.

3.2.3. Enterprise Self-Owned Funds (ESOF)

ESOF refers to the funds accumulated by enterprises through their own operations that can be freely allocated. As internally accumulated funds, ESOF can be used for R&D and innovation to improve product quality, as well as for business expansion and increasing production capacity, thereby promoting the sustainable development of enterprises, and further enhancing the development level of NQPF. Existing studies have shown that an increase in enterprise R&D investment significantly promotes the improvement of enterprise innovation capability [36], strengthens the enterprise’s core competitiveness, and further enhances total factor productivity [37], thereby strengthening the endogenous vitality of NQPF development.

3.2.4. Venture Capital (VC)

VC refers to investment activities that provide funding support to start-up enterprises in exchange for equity or similar rights. VC provides financial support to innovative enterprises, promotes the R&D and application of new technologies and new products, and helps optimize resource allocation and drive industrial structure adjustment and upgrading, thereby providing strong support for the development of NQPF. VC can not only alleviate the financial pressure of technology-based enterprises during their growth stage, support their expansion and development, and meet their demand for innovation capital, but also provide enterprises with value-added services in supervision and management, professional knowledge, and talent resources, thereby effectively enhancing their technological innovation capability [30], and injecting strong momentum into the development of NQPF.

3.2.5. Science and Technology Capital Market (STCM)

The STCM mainly provides financial services such as financing and investment for technology-based enterprises, characterized by both high risk and high return. Participation in the capital market makes enterprises pay more attention to long-term development and the improvement of core competitiveness, stimulates technological progress and industrial transformation and upgrading, achieves breakthrough innovation in core technologies, and contributes to the enhancement of enterprise NQPF [38]. Lin Chun et al. [39], based on listed company data, found that the openness of the capital market can significantly promote the improvement of NQPF by optimizing enterprise governance structures, increasing risk-taking capacity, and expanding financing channels, with this effect being more pronounced in high-tech enterprises.

3.2.6. Science and Technology Insurance (STI)

Technology-based enterprises face special high risks in many business activities, and STI can play a role in risk bearing to ensure the smooth operation of enterprise activities. In the context of the digital economy era, enterprises in the process of innovative R&D and production face the risk of core technology leakage, which can affect their business operations and reduce their willingness to engage in technological innovation [40]. Due to the unique risk diversification mechanism of STI, by establishing an insurance protection system, enterprises can focus on R&D, promote the improvement of total factor productivity, and accelerate the development of NQPF.

From the above theoretical analysis, all elements of science and technology finance ecology have an important impact on the development of NQPF. To further identify the impact mechanism of the interaction of different elements in the science and technology finance ecology on the development of NQPF, this paper constructs a relevant research framework, as shown in Figure 1.

Figure 1.

Research framework.

4. Research Design

4.1. Research Method

fsQCA is a qualitative comparative analysis method based on set theory and Boolean algebra, combining the characteristics of case-oriented and variable-oriented approaches, and is used to analyze complex causal relationships in small- to medium-sized samples (10–60). This study employs the fsQCA method to explore the configurational mechanisms through which the Science and Technology Finance ecosystem promotes the development of NQPF, based on two main considerations. First, as discussed above, achieving a high level of NQPF requires the coordinated influence of multiple STF elements, which aligns with the fsQCA assumption of “causal complexity”. Second, fsQCA has relatively flexible sample size requirements and integrates qualitative and quantitative approaches. Given the limitation of regional sample size, this study includes 31 cases, making fsQCA well suited to provide reliable analytical results for this finite sample. Based on this, this paper selects a small- to medium-sized sample of 31 provinces in China and adopts the multi-period fsQCA method to explore, through multi-stage comparisons, the configurational paths by which the science and technology finance ecology promotes the development of NQPF from 2017 to 2022, based on the time dimension, further revealing the research patterns of antecedent configurations.

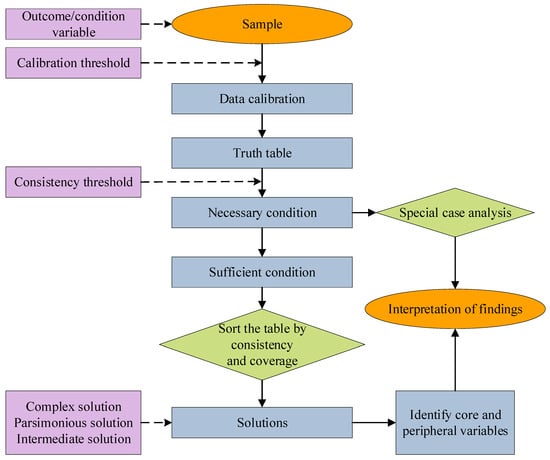

The fsQCA method first identifies the outcome and condition variables and calibrates all variables to a range between 0 and 1 based on preset thresholds to form fuzzy sets. Next, a truth table is constructed, with consistency thresholds, proportional reduction in inconsistency (PRI) thresholds, and minimum case frequencies set to identify necessary and sufficient condition relationships. Finally, the configurations are organized and interpreted based on the analysis results. The specific steps are shown in Figure 2.

Figure 2.

The steps of the fsQCA.

4.2. Data Processing

4.2.1. Measurement and Calibration

When it comes to data measurement, the first to be considered are the condition variables. For FSTI, government funding in the internal expenditure of R&D is used as the measure [41], because FSTI not only provides financial support for science and technology finance but also compensates for market failures. For BTL, since the National Bureau of Statistics has not published science and technology loan indicators since 2009, other funding in the internal expenditure of R&D is used as a proxy [42]. For ESOF, science and technology innovation enterprises usually promote R&D activities through higher R&D investment to enhance their core competitiveness; therefore, enterprise funding in the internal expenditure of R&D in each region is used as the measure [33]. For VC, due to the incompleteness of relevant yearbook statistics, from the perspective of data availability, regional venture capital investment divided by regional GDP is used as the measure [43]. For STCM, since high-tech enterprises usually have larger asset scales and higher technological levels, which reflect the role of science and technology finance in accelerating the formation of NQPF, the ratio of the market value of regional high-tech enterprises to regional GDP is used as the measure [1]. For STI, since there is no authoritative statistical data on science and technology insurance and it is difficult to obtain a depth index, the ratio of original premium income to regional GDP is used as the measure [44].

Second, speaking of the outcome variable, the basic connotation of NQPF includes the advancement of workers, objects of labor, and means of labor. Therefore, referring to the study by Ren Yuxin et al. [45], a provincial-level rating indicator system for NQPF development constructed, with three core dimensions: workers, means of labor, and objects of labor, comprising 7 secondary indicators and 17 tertiary indicators. To avoid subjective weighting and the problem of overlapping indicator selection, the entropy method is used to measure the development level of NQPF. The specific indicator construction is shown in Table 1.

Table 1.

Evaluation indicators of NQPF.

The descriptive statistical analysis results of each variable are shown in Table 2. Specifically, the minimum and maximum values of NQPF development at different stages differ greatly, indicating significant differences in the development levels of NQPF across provinces. In addition, there are also substantial differences in the indicators of the science and technology finance ecology among provinces. This provides explanatory space for subsequently exploring the impact of different configurational conditions on the development of NQPF.

Table 2.

Descriptive statistics.

Data Calibration: This paper uses fsQCA 3.0 software to convert conditional variables and outcome variables into set-theoretic expressions. Since there is no mature basis for the membership of conditional and outcome variables, the direct calibration method is adopted to transform the variables into fuzzy sets. This paper follows the calibration standards of Tao Ketao et al. [46] and Pappas I O [47], based on the actual situation of the cases, and it adopts 95%, 50%, and 5% as the calibration anchors for variable calibration. When the fuzzy set membership reaches 0.5, sample cases may be lost. Therefore, following the approach of Zhang Ming and Du Yunzhou [48], the calibrated value of 0.5 is adjusted to 0.501. The results of variable calibration are shown in Table 3.

Table 3.

Calibration results of condition and outcome variables.

4.2.2. Data Source

In July 2016, the State Council issued the “13th Five-Year Plan” for National Science and Technology Innovation, which formally proposed for the first time the improvement of the mechanism combining science and technology with finance, to strengthen capital support for technological innovation. Based on data availability, this paper takes 31 provinces in China (excluding Hong Kong, Macao, and Taiwan) as the research objects. The data cover the period 2017–2022 and are analyzed in two-year periods to explore the evolution patterns of NQPF development paths across periods. The two-year grouping is adopted to correspond to the internal stages of the Five-Year Plan periods, thereby capturing the policy-driven phase effects in technological and financial development while smoothing annual fluctuations, ensuring the robustness of the configurational analysis. Relevant data are sourced from the WIND database, the National Bureau of Statistics, China Science and Technology Statistical Yearbook, China High-Tech Industry Statistical Yearbook, and other sources.

5. Empirical Results Analysis

5.1. Necessary Condition Analysis

Before conducting configurational analysis of conditions, it is necessary to test the necessity of individual conditions for the outcome. Consistency is an important criterion for testing necessity; when the consistency is greater than 0.9, the condition is considered a necessary condition for the outcome. The analysis of single-condition necessity based on fsQCA is shown in Table 4. In the three stages, the consistency of single-condition variables for high/non-high NQPF development is mostly low (necessity consistency < 0.9). In the first stage of high NQPF development, none of the conditions constitute a necessary condition. In the second and third stages, ESOF is the sole necessary condition. For non-high NQPF development, in the first stage, ~BTL, ~ESOF, and ~VC are three necessary conditions. In the second stage, ~ESOF is the only necessary condition, while in the third stage, ~BTL and ~ESOF are two necessary conditions.

Table 4.

Results of necessary condition consistency analysis.

5.2. Configurational Analysis of High NQPF Development

The configurational paths for high NQPF development are analyzed, with the threshold settings as follows: considering that the research sample consists of 31 provinces, which is a small-to-medium sample, a lower frequency threshold is adopted and set to 1; in the sufficiency test, the raw consistency threshold for configurations is set at 0.8, while the PRI consistency threshold is set at 0.7.

Through fsQCA software computation, three types of solutions are obtained: complex, intermediate, and parsimonious solutions. This paper mainly relies on the intermediate solution for analysis, using the parsimonious solution to assist in distinguishing core and peripheral conditions. The configurational results of high NQPF development in each province are shown in Table 5. The results indicate that the consistency of all configurations exceeds 0.9, demonstrating the reliability of the configurational analysis results. Below, the configurations leading to high NQPF development in each stage are named and analyzed in detail.

Table 5.

Configurational analysis results of high NQPF development across three stages.

(1) Analysis of Configurational Results in 2017–2018. In 2017–2018, there were three configuration paths for high NQPF development: the “Bank–Enterprise” Collaborative Driving Type, the “Bank-led” Type, and the “Enterprise-led” Type.

Configurations A1 and A2 belong to the “Bank–Enterprise” Collaborative Driving Type, with BTL and ESOF as the core presence conditions. Configuration A1 uses FSTI as an auxiliary condition, while Configuration A2 uses both FSTI and STI as auxiliary conditions. The results indicate that by strengthening BTL and ESOF, supplemented by FSTI or STI, local NQPF development can be effectively promoted. Typical regions covered by this path include Shandong, Jiangsu, Beijing, and Shanghai. For example, in Beijing during 2017–2018, banks continuously increased credit support to technology-oriented enterprises, with the loan balance of high-tech enterprises in the Zhongguancun Demonstration Zone reaching nearly 80 billion RMB by the end of 2017, a year-on-year growth of over 15%. Meanwhile, enterprise R&D intensity remained among the highest nationwide, with enterprises accounting for more than 40% of total R&D expenditure in 2018, demonstrating the core role of BTL and ESOF in the innovation system, effectively alleviating financing constraints and supporting NQPF development.

Configuration A3 belongs to the Enterprise-led Driving Type, with ESOF as the core presence condition. BTL, VC, STCM, and STI are marginally absent, while FSTI is irrelevant. The results indicate that regardless of the level of FSTI, strengthening ESOF as the main driver, supplemented by BTL, VC, STCM, and STI, can effectively promote NQPF development. Typical regions covered by this path include Jiangxi and Liaoning. Taking Jiangxi Province as an example, in 2017–2018, the province launched the “Ke Dai Tong” program to alleviate corporate financing difficulties, with cumulative loans exceeding 1.069 billion yuan by 2018. Enterprise R&D investment showed steady growth, reaching 22.449 billion yuan in 2017, accounting for 87.8% of the province’s total R&D expenditure. In 2018, R&D investment by state-owned enterprises in the province amounted to 4.35 billion yuan, highlighting an innovation model dominated by self-financing, which has actively promoted the development of regional NQPF.

Configuration A4 belongs to the Bank-led Driving Type, with BTL as the core presence condition and STCM as an auxiliary condition. FSTI, ESOF, VC, and STI are marginally absent. This configuration indicates that BTL as the leading factor, supported by STCM, can effectively promote NQPF development. The typical coverage area is Yunnan. Taking Yunnan Province as an example, in 2017–2018, the province established a 46 million yuan “risk fund pool” and launched the “Ke Chuang Loan” program, capping interest rate increases at no more than 30%. In 2017, loans totaling over 3.98 billion yuan were issued to support 213 enterprises. By 2018, the Agricultural Bank’s technology loan balance reached 5.3 billion yuan, with an additional 1.5 billion yuan newly allocated, while leveraging regional equity markets and other auxiliary financing channels to provide strong support for enterprise innovation activities.

(2) Analysis of Configurational Results in 2019–2020. In 2019–2020, there were a total of five configurational paths for high NQPF development, which can be further classified into three types of configurations: “Bank–Enterprise” collaborative-driven type, “Bank–Enterprise–Market” collaborative-driven type, and “Enterprise–Market” collaborative-driven type.

“Bank–Enterprise” collaborative-driven type: In configurations B1 and B4, BTL and ESOF serve as the core present conditions, representing a configurational pattern in which banks and enterprises play a collaborative role. ESOF, as internally accumulated financial resources, provides a fundamental guarantee for technological R&D, while BTL offers external financial support, enhancing enterprise risk resistance and playing a foundational and protective role in supporting the development of NQPF.

Specifically, configuration B1 has FSTI as an auxiliary condition, with the STCM and STI being peripherally absent, and VC being irrelevant. Configuration B4 has FSTI and VC as auxiliary conditions, with STI being peripherally absent and the STCM being irrelevant. The results of this type of configuration indicate that by increasing investment in BTL and ESOF, combined with supplementary support from FSTI or VC, local regions can effectively promote the development of NQPF. Typical cases include Chongqing, Hunan, Zhejiang, and Jiangsu. Taking Zhejiang Province as an example, in 2019–2020, the province implemented policies such as technology-focused bank branches and the “Ke Ji Dai” (Technology Loan) program. By the end of 2019, the loan balance for technology-based enterprises had reached 568.68 billion yuan. At the same time, measures such as the super deduction for R&D expenses encouraged enterprise self-financing, resulting in tax reductions of 11.47 billion yuan from January to July 2020 and driving a 13.5% increase in corporate R&D expenditure, highlighting the effective support of bank–enterprise collaboration for the development of NQPF.

“Bank–Enterprise–Market” collaborative-driven type: In configurations B2 and B5, BTL, ESOF, and the STCM serve as the core present conditions, representing a configurational pattern in which banks, enterprises, and the market collaboratively play a role. Specifically, configuration B2, with BTL, ESOF, and the STCM as core present conditions, has STI as an auxiliary condition while VC is irrelevant. Configuration B5 has VC as an auxiliary condition while STI is irrelevant. The results of this type of configuration indicate that by strengthening BTL, increasing ESOF, and optimizing the STCM, supplemented by either STI or VC, local regions can promote the development of NQPF. Typical cases include Beijing, Shanghai, and Sichuan. Taking Sichuan Province as an example, in 2019–2020, nearly 10,000 technology enterprises received loans totaling 389.1 billion yuan, and loans to technology-related service industries increased by over 20%. Corporate R&D expenditure reached 54.74 billion yuan in 2020, a 10.0% increase. In the same year, direct financing totaled 420.66 billion yuan, and 495 technology enterprises were listed on the “Science and Technology Finance Board”, fully demonstrating the support of bank–enterprise–market collaboration for the development of regional new-type productive forces.

“Enterprise–Market” collaborative-driven type: In configuration B3, ESOF and STCM are the core conditions, with STI as an auxiliary condition, forming an “Enterprise–Market” synergistic model. The representative case is Hebei. This configuration suggests that strengthening enterprise self-owned funds and optimizing the science and technology capital market, supplemented by enhancing science and technology insurance, can effectively promote NQPF development. Taking Hebei Province as an example, in 2019–2020, the province established the Science and Technology Innovation Board at the Hebei Equity Exchange Center, set up provincial-level industrial funds to attract social capital, and implemented insurance subsidies for first-set equipment. In 2020, corporate R&D expenditure reached 54.62 billion yuan, an increase of 11.7%; direct financing totaled 98.628 billion yuan, up 26.06%; and 1534 pieces of equipment received 170 million yuan in insurance subsidies, providing strong support for the development of new-type productive forces.

(3) Analysis of Configurational Results in 2021–2022: In 2021–2022, there were a total of three configurational paths in which the science and technology finance ecology drove the development of NQPF. Since these three paths involve different core present conditions and multiple participating actors, they are named the Multi-Actor collaborative-driven type.

In configuration C1, FSTI, ESOF, VC, and the STCM serve as the core present conditions, representing a configurational pattern in which the government, enterprises, and the market collaboratively play a role. The typical cases covered include Anhui, Guangdong, Fujian, and Shandong. The results indicate that regardless of the intensity of local BTL, if FSTI, ESOF, VC are strengthened, and the STCM is optimized, forming a government–enterprise–market collaborative driving chain, the development of NQPF in the region can be promoted. Taking Fujian Province as an example, in 2021–2022, the provincial-level science and technology budget increased by 25.7%, reaching 2.37 billion yuan. A total of 5207 enterprises received R&D subsidies, with corporate R&D expenditure accounting for 88%, and R&D super deduction totaling 3.81 billion yuan. Venture capital funds invested 393 million yuan, leveraging over 2 billion yuan in social capital. The “Ke Ji Dai” (Technology Loan) program issued cumulative loans exceeding 23.5 billion yuan, benefiting more than 3200 enterprises, fully demonstrating the effectiveness of government–enterprise–market collaboration in promoting innovation.

In configuration C2, FSTI, BTL, ESOF, and the STCM serve as the core present conditions, representing a configurational pattern in which the government, banks, enterprises, and the market collaboratively play a role. The typical cases covered include Beijing, Shanghai, Henan, and Hubei. The results indicate that regardless of the intensity of local VC, if FSTI, BTL, ESOF, and the STCM serve as core development elements, supplemented by STI, the development of NQPF in the region can be promoted. Taking Henan Province as an example, in 2021–2022, the province’s fiscal expenditure on science and technology consecutively surpassed 30 billion and 40 billion yuan, with the 2022 provincial budget reaching 11.2 billion yuan, an increase of 124.4%. The “Ke Ji Dai” (Technology Loan) program issued cumulative loans exceeding 9.7 billion yuan, benefiting more than 1800 enterprises. Corporate R&D expenditure accounted for 86.8%, with 38.537 billion yuan in super deductions for R&D expenses in 2022, and the value of technology contract transactions exceeded 100 billion yuan, fully demonstrating the effectiveness of government–bank–enterprise–market collaboration in promoting innovation.

In configuration C3, BTL, ESOF, VC, and STI serve as the core present conditions, representing a configurational pattern in which banks, enterprises, investors, and insurance institutions collaboratively play a role. The typical case covered is Chongqing. The results indicate that even if local FSTI and the STCM are peripheral absent, if BTL, ESOF, VC, and STI serve as core development elements, the development of NQPF in the region can be promoted. Taking Chongqing as an example, in 2021–2022, the city implemented policies such as the “Ke Chuang Dai” (Technology Innovation Loan) and “Ke Piao Tong” programs. In 2022, corporate R&D expenditure reached 54.91 billion yuan, accounting for 80% of the total. The angel guidance fund established 29 venture capital funds with a total scale of 22.128 billion yuan, of which 5.626 billion yuan was invested in local enterprises. The first-set equipment insurance provided over 4.2 billion yuan in risk coverage for more than forty enterprises, fully demonstrating the effectiveness of bank–enterprise–investor–insurance collaboration in promoting innovation.

5.3. Analysis of Evolutionary Characteristics of Configurational Paths

As shown in Table 5, the configurational paths leading to high NQPF development vary across different time periods, and no single condition configuration dominates the development of high NQPF in all three periods. This indicates that the development environment of NQPF is characterized by variability, uncertainty, and complexity. Regions need to adjust the investment approaches of science and technology finance ecological elements based on local resource endowments, which may also change the configuration of NQPF development and the interactions among conditions within each configuration.

Comparing the configurations across different periods, ESOF consistently spans the entire process of NQPF development, exerting a continuous impact. Specifically, during 2017–2018, BTL and ESOF were the main driving force for achieving high NQPF; during 2019–2020, BTL, ESOF, and STCM were the main driving forces; and during 2021–2022, the actors involved in the paths to achieving high NQPF became more diversified. Overall, the driving forces of high NQPF have undergone an evolution from being dominated by core financial resources, to coordinated driving by core finance and the market, and finally to multi-stakeholder collaborative promotion, exhibiting a progressively more diversified, coordinated, and systematic development pattern.

5.4. Configurational Analysis of Non-High NQPF Development

Next, we examine regions with relatively low levels of NQPF to explore which issues in the science and technology finance ecology have prevented the level of NQPF from reaching a high standard. As shown in Table 6, during 2017–2018, BTL and ESOF were the main core absent conditions; during 2019–2020, ESOF were the core absent condition; and during 2021–2022, both FSTI and ESOF were the main core absent conditions. This indicates that when core conditions such as FSTI, BTL, and ESOF are missing, the science and technology finance ecology cannot effectively promote the development of NQPF.

Table 6.

Configurational analysis results of non-high NQPF development across three stages.

Furthermore, regardless of the presence or absence of VC, the STCM, and STI, these factors mostly appear only as auxiliary conditions in the low NQPF configurations. This demonstrates that within the science and technology finance ecology, the STCM and STI are not the key constraints on improving the level of NQPF. The key limiting factors are FSTI, BTL, and ESOF, with insufficient ESOF being a common issue. Low ESOF may also interact with sustainability-related indicators—such as high CO2 emission intensity, low forest coverage, limited environmental protection spending, and a low proportion of green patents—thereby further constraining the enhancement of NQPF. When a region’s science and technology finance cannot effectively drive the development of NQPF, it indicates a lack of corresponding core conditions and highlights the need to continuously optimize the structure of the science and technology finance ecology to promote NQPF development.

5.5. Robustness Test

To verify whether there exists a subset relationship among the generated results, it is important to note that if such a subset relationship exists, the substantive interpretation of the findings will not be altered, and the previous results can be considered robust. The robustness tests were conducted as follows: (1) the raw consistency threshold was increased from 0.80 to 0.85, and the results are shown in Table 7; (2) the PRI consistency threshold was adjusted from 0.70 to 0.75, and the results are shown in Table 8; and (3) the extreme cases (Beijing and Shanghai) were excluded, and the results are shown in Table 9. (4) The calibration anchors of the variables were adjusted to 90%, 50%, and 10%, and the results are shown in Table 10. The results show that the adjusted configurational paths are subsets of the original ones, which meets the robustness criteria of fsQCA and provides further evidence for the stability and reliability of the results.

Table 7.

Results of increasing the raw consistency threshold.

Table 8.

Results of increasing the PRI consistency threshold.

Table 9.

Results of excluding the extreme cases.

Table 10.

Results of changing the calibration anchors of variables.

6. Conclusions and Implications

6.1. Research Conclusions

- (1)

- The six elements of the science and technology finance ecology have an important impact on the development of NQPF. Specifically, FSTI plays a foundational and guiding role in promoting NQPF; BTL provide medium- and long-term credit support to enterprises; ESOF serves as the internal driving force for continuous innovation; VC accelerates the marketization of technological achievements; the STCM provides liquidity and valuation mechanisms for the large-scale diffusion of technological achievements; and STI provides protection for high-risk activities during the innovation process. It should be noted that the development of NQPF is not driven by a single factor alone but is the result of the synergistic interaction of internal elements within the science and technology finance ecology.

- (2)

- By comparing the different stages of the study, it was found that in 2017–2018 there were three configuration paths for high new quality productive forces, namely the “Bank–Enterprise” collaborative-driven type, the Bank-led type, and the Enterprise-led type. During 2019–2020, there were five configurations, which can be further classified into three configurational patterns: the “Bank–Enterprise” collaborative-driven type, the “Bank–Enterprise–Market” collaborative-driven type, and the “Enterprise–Market” collaborative-driven type. During 2021–2022, there were three configurations, summarized into a single pattern: the Multi-Actor collaborative-driven type. The different developmental paths across periods reflect that local regions can develop NQPF in a complex and variable manner, independent of the endowment of science and technology finance resources.

- (3)

- The configurations for achieving high NQPF vary greatly across different time periods, and no dominant configurational paths for high NQPF were found across the three periods. Comparing the configurations at each stage, ESOF is basically present throughout the entire process of NQPF development, exerting a continuous influence. Overall, the driving forces of high NQPF have undergone an evolution from being dominated by core financial resources, to coordinated driving by core finance and the market, and finally to multi-stakeholder collaborative promotion, exhibiting a progressively more diversified, coordinated, and systematic development pattern. This phase-based evolutionary process not only maintains the optimization of element combinations but also consistently follows the strategic mainline guided by the government, while the effectiveness of the market mechanism shows a gradient improvement, jointly constructing an evolutionary paradigm for high NQPF development. In the configurational results of non-high NQPF development across the three stages, insufficient ESOF emerged as a common problem.

China’s experience in promoting high NQPF highlights the critical role of government guidance, market coordination, and ESOF in fostering multi-stakeholder collaboration. Similar mechanisms can be observed in other developing economies. In India, digital finance initiatives such as the Unified Payments Interface (UPI) enhance financial access for enterprises, particularly SMEs, reflecting a logic like China’s “Bank–Enterprise” collaborative-driven path, although regional disparities in financial infrastructure limit balanced development. In Brazil, national green credit policies channel resources into renewable energy and sustainable agriculture, aligning with the green-oriented configurations identified in this study. These comparisons indicate that while the specific institutional contexts differ, the underlying mechanisms of financial resources, market coordination, and multi-stakeholder collaboration provide some degree of reference value for fostering high-quality productive forces across diverse settings.

6.2. Managerial Implications

First, the government should continue to play a strategic guiding role by promoting differentiated policies and resource allocation to foster balanced high-level NQPF development across regions; facilitate multi-actor collaboration among banks, enterprises, and markets by providing policy incentives, innovation funds, and tax benefits; and optimize regional development layouts to support potential areas in enhancing core productive factors. Financial institutions should strengthen financing support for high-tech enterprises by offering customized financial products; promote collaborative innovation financing mechanisms, such as joint investment funds and supply chain finance; and dynamically adjust financial resource allocation according to NQPF development stages to improve fund utilization efficiency. Enterprises should enhance internal R&D capabilities and technological innovation, cultivate core competitiveness, actively participate in multi-actor collaboration, leverage resources from banks, government, and markets to drive innovation and capacity upgrades, and achieve a multi-actor collaborative financial ecosystem.

Second, financial institutions and the government should optimize resource allocation according to different development stages, forming a collaborative mechanism among finance, enterprises, and markets to improve the efficiency of the Science and Technology Finance system; investors can prioritize support for enterprises with strong ESG performance based on the core driving factors of high NQPF to achieve both economic returns and sustainable development objectives; enterprises can reference key configuration patterns in technology innovation, resource allocation, and production process design to strengthen green innovation and circular utilization capabilities; policymakers can promote the deep integration of Science and Technology Finance, ESG investment, and the circular economy through innovative fiscal subsidies, green credit support, and cross-departmental coordination mechanisms, thereby supporting high-quality and sustainable economic development.

6.3. Limitations and Prospects

First, the sample in this study is primarily based on provincial-level data from China, which may limit the granularity and regional applicability of the findings. Future research could extend the analysis to prefecture-level data to better capture inter-regional heterogeneity and the micro-level characteristics of high NQPF development. Second, this study employs the fsQCA method to identify the key configuration paths driving high NQPF, but a single method may not fully reveal the complexity of causal relationships. Future studies could combine fsQCA with other quantitative methods to explore the antecedent conditions influencing the development of NQPF and their underlying mechanisms in greater depth. Finally, the empirical analysis mainly relies on data and cases from China, and cross-country comparisons are provided only as illustrative discussion without systematic quantitative validation. Subsequent research could expand the sample to include India, Brazil, and other developing countries, using systematic data and empirical methods to test the applicability of Chinese experiences and identify sustainable development pathways under different institutional and market environments. At the same time, further research could explore the direct impact of the Science and Technology Finance ecosystem on sustainable development, incorporating environmental indicators such as carbon emissions for quantitative analysis.

Author Contributions

Conceptualization, J.Z. and Y.W.; Methodology, J.Z. and Y.W.; Software, Y.W.; Validation, Y.W.; Data curation, Y.W.; Writing—original draft, J.Z. and Y.W.; Writing—review & editing, J.Z.; Supervision, J.Z.; Project administration, J.Z.; Funding acquisition, J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Shanxi Province Philosophy and Social Science Planning Project grant number 2024QH046(YB) and 2024YB100.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Dataset available on request from the authors.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Zou, K.; Liu, X.; Ni, Q.; Zhang, G. China’s Science and Technology Finance Development Index: Synergistic Promotion, Regional Differentiation, and Development Adapted to Local Conditions. J. Financ. Econ. Res. 2025, 40, 3–23. [Google Scholar]

- Li, J.; Zhou, Z. China’s Regional Science and Technology Finance Development Level Measurement: Index Compilation and Spatial Characteristics. Sci. Technol. Manag. Res. 2024, 44, 56–66. Available online: https://kns.cnki.net/kcms2/article/abstract?v=Y4WXQ1XfpS6fLeD2n6uQalfB-ayWrQdwaeXwZnBTvDeIyGAT2aM9_kD7rfEvrt1SpXQli9PLmLoawOYYb2FAPktlywe8m_eCHkqO5OQzMVQyTC-xaV4o2FIEJh8BpZF-RfMWtQFqP2Mtbn5Aa2_OJbiZDoaYByY5CfArgWYj6tB63Q5MvosQQg==&uniplatform=NZKPT&language=CHS (accessed on 14 October 2025).

- Wang, S.; Gu, S. Research on the Impact of Science and Technology Finance on China’s High-Quality Economic Development: Theoretical Analysis and Empirical Testing. Economist 2021, 81–91. [Google Scholar] [CrossRef]

- Zhang, T.; Jiang, F. Science and Technology Finance, Technological Innovation, and High-Quality Economic Development. Stat. Decis. 2023, 39, 142–146. [Google Scholar] [CrossRef]

- Zhang, C.; Wang, M. Research on the Impact of Science and Technology Finance on Urban Industrial Structure Upgrading: A Quasi-Natural Experiment Based on the “Pilot Policy to Promote the Integration of Science, Technology, and Finance”. Explor. Econ. Issues 2023, 73–86. Available online: https://kns.cnki.net/kcms2/article/abstract?v=Y4WXQ1XfpS4K9BGU5AJ8tl6BIbspQgpQChLnHgFx_r4xH_MmCrrfrWc6ifgBiGQxVuvmkv7uF1Gr-bm4Zu9gpvjG0qivncp2pX1ocyOst5j-VIxgsju4T2D5FK_tBui5AXNOsvKVDar1Q_mELJBXySQOkSUHK4M0MJGHX_Se0iynhs8eV_OX_g==&uniplatform=NZKPT&language=CHS (accessed on 14 October 2025).

- Lin, Q.; Mao, S. Science and Technology Finance and Enterprise Innovation: Does Fiscal Funding Play a Guiding Role? Stud. Sci. Sci. 2024, 42, 2445–2453. [Google Scholar] [CrossRef]

- Tan, Y.; Xiao, S.; Jiang, L. Science and Technology Finance, Patient Capital, and Innovation in Technology-Based SMEs. J. Xiamen Univ. (Philos. Soc. Sci. Ed.) 2025, 75, 70–84. Available online: https://kns.cnki.net/kcms2/article/abstract?v=Y4WXQ1XfpS5r6sjuPeEVG_UH4pq8yRLTuDf6_-8NSLl81sOoWE78SMLLAbat6ZGkxT8DbrJ6Kkv-0k3OFyn46lBrqh8yfSa4HIpKA-q-o-Ne1MRB4lTGVQlqGG6qO-tYkQjBbx8ianDWIy5SfE5b4Pob5113yAd3DJkuE14U1C0adhm-vtSdiw==&uniplatform=NZKPT&language=CHS (accessed on 14 October 2025).

- Xiang, Y.; Zhong, R.; Zheng, Q. How the Integration of Science, Technology, and Finance Affects the Quality of Enterprise Technological Innovation: Evidence from the “Pilot Policy to Promote the Integration of Science, Technology, and Finance”. Financ. Econ. 2024, 135–148. Available online: https://kns.cnki.net/kcms2/article/abstract?v=Y4WXQ1XfpS5kITt7cBXqcNmB01TbD_R-zyOGgxXLfZGvbTLp-wz13w4jEPfbWYURCzhf_YbXE8eYCjwjQ-O62lEKMf1Cegc577zCksuJhrtcvD5Fw27ecAosylyZL5z3aMUvUN2Aoch1OXGNkZwKUaAOLpmTaDMjpMRqSqqGdnb8yYWlHW2BgQ==&uniplatform=NZKPT&language=CHS (accessed on 14 October 2025).

- Zhang, L.; Ding, J. Science and Technology Finance Policies and the High-Quality Development of Technology-Based SMEs. Stat. Decis. 2023, 39, 147–151. [Google Scholar] [CrossRef]

- Scholtens, B. Why Finance Should Care about Ecology. Trends Ecol. Evol. 2017, 32, 500–505. [Google Scholar] [CrossRef]

- Weber, O. The Financial Sector and the SDGs: Interconnections and Future Directions; Edward Elgar Publishing: Cheltenham, UK, 2018. [Google Scholar] [CrossRef]

- Zhou, W.; Xu, L. The Core Essentials of the Political Economy of New-Type Productivity. Econ. Dyn. 2024, 3–12. Available online: https://kns.cnki.net/kcms2/article/abstract?v=Y4WXQ1XfpS7sTuOp82flCB4ObxhntEnye5LKJUCSv5GhFbdKF69-TVux6tcc69D-rGAoyGaqk1WF9d2CdcW2WBaiB5pPLtPjhcJUgPT4om7Sfm5o9SPLxTeX6lWlFpK1n3JC4Bg1ON40yqOFdgNByKHX2LBood7nWJ60jW6R0qZP0eAVix0hDA==&uniplatform=NZKPT&language=CHS (accessed on 14 October 2025).

- Jia, R.; Dou, H. New-Type Productivity: Connotation, Major Significance, and Development Priorities. J. Beijing Adm. Coll. 2024, 31–42. [Google Scholar] [CrossRef]

- Zhang, L.; Pu, Q. Connotation, Theoretical Innovation, and Value Implications of New-Type Productivity. J. Chongqing Univ. (Soc. Sci. Ed.) 2023, 29, 137–148. [Google Scholar]

- Huang, Q.; Sheng, F. Industrial Policy for Developing Future Industries from the Perspective of New-Type Productivity: Connotation, Functions, and Innovation. J. Party Sch. CPC Cent. Comm. (Natl. Acad. Gov.) 2024, 28, 27–38. [Google Scholar] [CrossRef]

- Hu, Y.; Fang, T. Further Discussion on the Connotation, Characteristics, and Formation Path of New-Type Productivity: From the Perspective of Marx’s Theory of Productive Forces. J. Zhejiang Gongshang Univ. 2024, 39–51. [Google Scholar] [CrossRef]

- Wang, J.; Wang, H.; Sun, R. Measurement and Evaluation of the Level of New Quality Productive Forces in Chinese Cities and Its Spatiotemporal Pattern. Econ. Geogr. 2025, 45, 67–78. [Google Scholar] [CrossRef]

- Duan, Y.; Zhao, Y.; Dong, X. How the Digital Economy Empowers New-Type Productivity: An Empirical Study Based on Provincial Panel Data. Explor. Econ. Issues 2025, 1–15. Available online: https://kns.cnki.net/kcms2/article/abstract?v=Y4WXQ1XfpS4UyM7VZTqEVXWfGdXrYWnt8RcW09S2oWEy770bsQt8vadLNFiS4_1CyTgGgCmwQvjxl4aJKnW_yE7xgjfkYjovkZrLmRYwZPCIOSJC6AFRJPXTG2I85I9MVlJu9iZJl1OF3Ub-bMWdGrcatDP5EzhLR2n7x5qLiqmjdDPtli6-IQ==&uniplatform=NZKPT&language=CHS (accessed on 14 October 2025).

- Wang, Z.; Ji, F. Digital Economy Empowering the Development of New-Type Productivity: Mechanism Analysis and Spatial Spillover. Mod. Financ. Econ. (J. Tianjin Univ. Financ. Econ.) 2025, 45, 25–46. [Google Scholar] [CrossRef]

- Li, B.; Li, J.; Huang, S.; Dong, J. Study on the Impact of Environmental Regulation on New-Type Productivity: An Empirical Analysis Based on Provincial Panel Data. China Environ. Sci. 2025, 1–19. [Google Scholar] [CrossRef]

- Wang, Y.; Li, Y.; Wu, Z. Theoretical Mechanism of Sustainable Finance Supporting the Development of New Quality Productive Forces. Contemp. Econ. Sci. 2025, 1–16. [Google Scholar]

- Liu, J.; Zhu, W. Research on the Empowered Development of New-Type Productivity under the Background of a “Financial Power”. Zhongzhou Acad. J. 2024, 47–54. Available online: https://kns.cnki.net/kcms2/article/abstract?v=Y4WXQ1XfpS5jds1LWiS5fKJa5RFrLRCvLAQQLyee9AujWQEm_Oon5RqN_JOqn-JSE_Sa4R8yMYJtx8iT_vjOgaoN9yDJO7MX8qiJVXwalt-NYucNFDphP9bA1aWjRR0lpCJaZmAURz0ljOYk2xcwIxAvJmch3AqIdfG_ADuImuSiKMdZaKC0Hg==&uniplatform=NZKPT&language=CHS (accessed on 14 October 2025).

- Zhang, Y.; Lu, M. Cultivating the “Patience” of Government-Guided Funds from the Perspective of New-Type Productivity: Evaluation System and Interest Balance. Secur. Mark. Her. 2025, 53–64. [Google Scholar]

- Zhang, X.; Huang, Z. Science and Technology Finance Empowering the Development of New-Type Productivity: Theoretical Framework, Practical Challenges, and Policy Recommendations. Huxiang Forum 2024, 37, 53–66. [Google Scholar] [CrossRef]

- Hu, H.; Li, Z.; Liang, Z.; Liu, Y. Science and Technology Finance, High-Tech Industry Agglomeration, and New-Type Productivity. Financ. Econ. Rev. (J. Zhejiang Univ. Financ. Econ.) 2025, 51–63. [Google Scholar] [CrossRef]

- Zou, K.; Liu, X.; Li, X. Study on the Generation Effects and Mechanisms of New-Type Productivity in the Development of Science and Technology Finance. J. Financ. Econ. Res. 2024, 39, 3–18. [Google Scholar]

- Li, Y.; Cai, X. Does Science and Technology Finance Promote the Development of Industrial New-Type Productivity? Financ. Theory Pract. 2024, 45, 10–18. [Google Scholar] [CrossRef]

- Wu, Y.; Meng, X. Science and Technology Finance Empowering New-Type Productivity: Spatial Effects and Heterogeneity Testing. Stat. Decis. 2024, 40, 31–36. [Google Scholar] [CrossRef]

- Xiang, X.; Ai, G.; Wang, Z. Study on the Impact of Government Innovation Subsidies on Enterprise New-Type Productivity. Technol. Econ. 2025, 44, 51–65. Available online: https://kns.cnki.net/kcms2/article/abstract?v=Y4WXQ1XfpS6gi22tbhlQSbuoneAM3Il_VAulXspjHkxodxns67u6zk00HmlNVw30DBJs3_lQS4ttVPDS8O-hDVwfq51H593nAfZiacoNhFdefUjWTW1sM2UFqQzARWcCUQYGj0W4QmI4zQauvl83f5wsDGnuDIkosd90rgsvG3cb7TDyB9jTKw==&uniplatform=NZKPT&language=CHS (accessed on 14 October 2025).

- Hao, H.; Zhang, X.; Tian, Y. Venture Capital Empowering the Development of New-Type Productivity: Theoretical Analysis and Empirical Evidence. Southwest Financ. 2025, 67–79. [Google Scholar]

- Du, Y.; Liu, Q.; Chen, K.; Xiao, R.; Li, S. Business Environment Ecology, Total Factor Productivity, and Multiple Modes of Urban High-Quality Development: A Configurational Analysis Based on the Complex Systems Perspective. Manag. World 2022, 38, 127–145. [Google Scholar] [CrossRef]

- Arthur, W.B. Foundations of complexity economics. Nat. Rev. Phys. 2021, 3, 136–145. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, Q. Dynamic Comprehensive Evaluation of Regional Science and Technology Finance Ecosystems. Stud. Sci. Sci. 2018, 36, 1963–1974. [Google Scholar] [CrossRef]

- Chen, L.; Liu, J.; Liu, H. Fiscal Science and Technology Investment Intensity and Enterprise Innovation Output: Mechanisms and Heterogeneity. West. Forum 2023, 33, 64–80. [Google Scholar]

- Yu, L.; Jin, Z. Study on the Impact Mechanisms and Effects of Bank Technology Loans on Innovation Quality. J. Univ. Electron. Sci. Technol. China (Soc. Sci. Ed.) 2024, 26, 31–43. [Google Scholar] [CrossRef]

- Cui, T.; Ding, X.; Xu, X.; Liu, X. R&D Intensity and Breakthrough Innovation in Startups: Contingent Effects of Venture Capital Characteristics and Entrepreneurial Failure Experience. Manag. Rev. 2025, 1–17. [Google Scholar] [CrossRef]

- Lu, C.; Wang, C.; Jiang, C. Government Subsidies, Innovation Investment, and Total Factor Productivity of Manufacturing Enterprises. Econ. Manag. Rev. 2023, 39, 50–61. [Google Scholar] [CrossRef]

- Sun, Y.; Zhang, W.; Lin, C. Theoretical Logic, Practical Challenges, and Implementation Paths of Supply Chain Finance Empowering New-Type Productivity. J. Liaoning Univ. (Philos. Soc. Sci. Ed.) 2024, 52, 20–30. [Google Scholar] [CrossRef]

- Lin, C.; Hu, S.; Sun, Y. Capital Market Opening Promotes the Enhancement of Enterprise New-Type Productivity: Evidence from the “Stock Connect” Quasi-Natural Experiment. Shanghai Econ. Res. 2024, 30–41. [Google Scholar] [CrossRef]

- Pan, G.; Guo, B.; Hou, G. Multiple Paths for New-Type Productivity Empowering Digital Rural Construction: A Dynamic QCA Analysis Based on Provincial Panel Data. East China Econ. Manag. 2025, 39, 106–116. [Google Scholar] [CrossRef]

- Du, B.; Lian, Y. Configurational Pathways for Science and Technology Finance Driving Innovation Capability Enhancement: FsQCA Analysis Based on 30 Inland Provinces in China. Stud. Sci. Manag. 2023, 41, 135–142. [Google Scholar] [CrossRef]

- Guo, J.; Lu, Y. Does Science and Technology Finance Contribute to the Improvement of Enterprise Innovation Efficiency?—Also Discussing the Moderating Effect of Enterprise Digital Transformation. South. Financ. 2022, 50–63. [Google Scholar]

- Li, Z.; Dong, S. Science and Technology Finance, Technology Transfer, and the Upgrading of the Manufacturing Value Chain. Sci. Technol. Prog. Policy 2024, 41, 38–48. [Google Scholar]

- Gu, Y.; Wang, Z.; Guo, T.; Chen, H. Configurational Effects of Science and Technology Finance Investment on Innovation Performance in High-Tech Industries: Based on Fuzzy-Set Qualitative Comparative Analysis (fsQCA). Sci. Technol. Prog. Policy 2023, 40, 60–68. [Google Scholar]

- Ren, Y.; Wu, Y.; Wu, Z. Financial Agglomeration, Industry–University–Research Collaboration, and New-Type Productivity. Financ. Theory Pract. 2024, 45, 27–34. [Google Scholar] [CrossRef]

- Tao, K.; Zhang, S.; Zhao, Y. What Determines the Performance of Government Public Health Governance?—A Study of Linkage Effects Based on the QCA Method. Manag. World 2021, 37, 128–138+156+10. [Google Scholar] [CrossRef]

- Pappas, I.O.; Woodside, A.G. Fuzzy-set Qualitative Comparative Analysis (fsQCA): Guidelines for research practice in Information Systems and marketing. Int. J. Inf. Manag. 2021, 58, 102310. [Google Scholar] [CrossRef]

- Zhang, M.; Du, Y. Application of QCA Method in Organization and Management Research: Positioning, Strategies, and Directions. J. Manag. 2019, 16, 1312–1323. Available online: https://kns.cnki.net/kcms2/article/abstract?v=Y4WXQ1XfpS7UzQkz8L--8N6-ZhkZ1Y5O1dN_TFnza68SsGFdBCPI0WsiRxrXyFVlZZ7oaROSFU6XnOEjlzh2MNPz1msFmxPWusxUSnJf-jgzNSLdWS9hje_0rn2aNreFP8IWe_eyPvkcUdDFDowuT3E0y1H3e0oBWsaDIlbw_-J8DI405_QS6Q==&uniplatform=NZKPT&language=CHS (accessed on 14 October 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).