Abstract

The European Sustainability Reporting Standards (ESRS), a set of standards to be used by companies to meet the requirements of the Corporate Sustainability Reporting Directive (CSRD), create a paradigm shift in sustainability reporting. Nonetheless, their implementation poses significant challenges, especially due to their complexity and extensive reporting requirements. This paper proposes a multi-tiered information architecture to assist organizations in addressing those challenges, presenting a comprehensive framework that links the ESRS regulatory requirements with the informational requirements for sustainability reporting. The architecture considers the ESRS datapoints as its foundational elements, emphasizing on systematic data collection, analysis, and reporting. Additionally, it presents a conceptual model that describes the ESRS principles, outlines the main ideas and connections, and establishes a clear foundation for the management of sustainability-related information. The model enables the practical implementation of the ESRS, as it bridges the gap between abstract standards and operational processes. The proposed framework supports digital transformation, enhances transparency, and promotes a strategic approach to sustainability reporting. The paper addresses a significant academic and conceptual gap regarding the transformation of the ESRS regulatory requirements into suggestions for information management.

1. Introduction

The orientation of the European Sustainability Reporting Standards (ESRS) is to promote harmonized ESG reporting practices to improve transparency, ensure comparability, and foster informed decision-making []. The companies that fall under CSRD must include in their annual financial reports a sustainability statement in accordance to the ESRS linking financial and non-financial reporting []. This illustrates the importance of social and environmental performance to the market and the economy and supports the green transition []. The ESRS have presented considerable challenges in their implementation. This is a topic of intense discussion among scholars, practitioners, and the companies mandated to adopt the standards during the first wave in spring of 2025 []. These challenges were also relevant for the subsequent wave of large companies that were not initially covered by the Non-Financial Reporting Directive (NFRD), but were slated to publish their sustainability statements based on the ESRS by the spring of 2026. However, the complexity of these standards prompted the European Commission, with strong advocacy from Germany and France, to consider substantial modifications []. Consequently, an omnibus proposal was introduced for discussion, which could lead to significant changes in the scope and application of the ESRS. In fact, a “stop-the-clock” measure was officially adopted, granting companies an additional two years, until 2028, to comply []. The exact requirements and the final form of the revised ESRS remain to be seen, but these developments are expected to significantly alter the regulatory landscape for sustainability reporting in the European Union. As the EU’s ambition is to put sustainability reporting on par with financial reporting, a key element for this is the digitalization of the information management and reporting procedures.

The challenges inherent in the effective implementation of the ESRS stem from a diverse array of factors, predominantly linked to the complexities of information management, demanding reporting requirements, and the novelty of the underlying concepts and approaches to sustainability management. First of all, the structure of the ESRS includes several guidelines and requirements, organized into three main categories []: cross-cutting standards (ESRS 1 and ESRS 2), topical standards that cover specific environmental (ESRS E1–E5), social (ESRS S1–S4), and governance (ESRS G1)-related sustainability topics, and sector-specific standards that address the unique sustainability impacts, risks, and opportunities that are common to all companies within a particular sector. The ESRS presents novel concepts regarding sustainability requirements and innovative approaches to sustainability management, which business managers often find unfamiliar and struggle to fully grasp.

The requirements that the ESRS bring are innovative and companies have to create new reporting processes, systems, and formats to comply with the increasing number of reporting requirements []. Notably, the ESRS include 1.144 datapoints in total []. Because of the ESRS’ new and rapid emergence, there is not enough knowledge regarding their mandates and the level of preparedness of companies in complying with ESRS mandates at such a scale []. For instance, the double materiality assessment requires companies to evaluate both impact materiality (how their activities affect the environment and society) and financial materiality (how sustainability matters affect the company’s financial position); this dual perspective necessitates sophisticated data collection, analysis, and reporting capabilities that many organizations struggle to implement effectively. Likewise, extensive value chain mapping is required, necessitating a particularly complex sustainability information collection process, both from upstream (suppliers) and downstream (customers) in the reporting organization’s value chain. The effective management of impacts, risks, and opportunities necessitates advanced management systems and processes, encompassing everything from the strategic design of initiatives and interventions to their execution, evaluation, and reporting of their outcomes to different stakeholder groups. Finally, the ESRS Disclosure Requirements necessitate the activation of over a thousand datapoints, varying in necessity (mandatory or voluntary) and in form (numerical, semi-narrative, and narrative), arranged with different levels of granularity. These complexities pose substantial challenges for managers and require a profound and thorough understanding of both the conceptual foundation and the informational prerequisites of the ESRS.

The ESRS have important differences in relation to other dominant sustainability reporting standards and guidelines. For instance, the ESRS emphasize the integration of sustainability into business models and strategies and have as a starting point the double-materiality element []. This element differentiates the ESRS from other recognized reporting standards such as GRI (Global Reporting Initiative) and SASB (Sustainability Accounting Standards Board). Especially, GRI is the most widely adopted and comprehensive sustainability reporting method and although other standards and guidelines gain momentum, most companies worldwide use them when reporting [,,]. GRI suggests a single-materiality approach (impacts the company has on environment and society) and SASB has predefined material topics for each business sector. Examining 2046 US-listed companies, researchers from Italy found that financial and sustainability materiality are motivated by different drives []. SASB gives emphasis to financial perspectives while GRI takes into consideration corporate governance mechanisms that derive from sustainable and ethical principles.

Bataleblu et al. [] highlight some additional differences between the ESRS and GRI. First, the ESRS have a geographical focus on the European Union, whereas the GRI is adopted globally. Furthermore, the ESRS are legally mandated, while the GRI remains voluntary. The ESRS were developed under the auspices of the European Union with the involvement of key institutional stakeholders, whereas the GRI was established and evolved through a multi-stakeholder process involving businesses, civil society, labor organizations, and global investors. Finally, the ESRS require the application of a double-materiality approach, whereas the GRI adopts an impact materiality perspective.

This paper proposes developing a dedicated information architecture (IA) for the ESRS to tackle this complexity. By providing a fundamental organization of information within a system [], this information architecture outlines requirements for managing sustainability matters in business organizations, while highlighting the interconnections with business management priorities related to governance, strategy, business model, value chain, and stakeholder management. An effective architecture would also need to demonstrate the impact of sustainability matters and provide stakeholders with comprehensive understanding of how they affect business performance and strategy. In general, such an architecture could bridge the gap between high-level ESRS requirements and practical implementation, providing clear guidance for information management and reporting processes.

The paper aims to fill a methodological and conceptual gap and to offer an innovative and timely contribution to the limited research area of the interconnection between sustainability and information systems. It offers a multi-layered information architecture, making regulatory requirements actionable from a systems design and information management perspective. In addition, the proposed conceptual model of the ESRS decodes a complex set of guidelines and makes it easier for researchers to further investigate the subject and for business practitioners to apply the ESRS to their organization more easily. It sets a clear theoretical and architectural baseline for interdisciplinary work combining accounting, sustainability, and information systems. At the same time, it provides practical guidance on managing sustainability data, aligning corporate governance with regulatory requirements, and implementing digital infrastructures capable of supporting ESRS-compliant reporting. It can serve as a blueprint for IT (Information Technology) designers, sustainability officers, and regulatory bodies developing digital ESG strategies. Additionally, the suggested layered model makes sustainability integration an ongoing, data-focused process rather than just a one-time compliance task.

The rest of the paper is organized as follows: Section 2 provides a comprehensive review of the current state of the art of information requirements for sustainability management and reporting. Section 3 details the methodology employed. Section 4 presents the proposed information architecture for the ESRS, outlining its structure and content, through a comprehensive approach that integrates considerations across governance, strategy, sustainability management, reporting requirements, and data structure and availability. To enhance understanding, the architecture is complemented by an information model in Section 5, which illustrates the key concepts within the ESRS framework and their interrelationships, thereby offering a global and in-depth understanding of the ESRS. Finally, Section 6 discusses the characteristics and anticipated benefits of the proposed architecture, along with an outline of future development stages, identified limitations, and potential shortcomings.

2. State of the Art

The role of information systems in sustainability management is an understudied academic area. Only a limited number of papers address this subject, even when considering its broader implications. The scarcity of academic studies may hinder the development of robust theoretical frameworks or practical tools to support practitioners. This opens space for conceptual models that connect ISs with sustainability performance. Effective sustainability management and the complex task of sustainability reporting needs the support of information systems that can support and enable the strategic change towards improvements of sustainability performance and integration of sustainability in business operations [].

In the recent years the interest in information systems that support sustainability management has increased, especially due to the information requirements imposed by legal obligations for sustainability reporting. A qualitative study focusing on companies based in Australia highlights the topic []. First of all, sustainability-related information systems used to function primarily as a tool to facilitate compliance, rather than enhancing sustainability performance. That study also revealed also the gap between sustainability reporting and actual progress in enhancing sustainable development and pointed out the need for innovative ESG reporting systems that will incorporate advanced technologies and science-based metrics.

A similar study recognized challenges in the gathering and managing of ESG-related data, namely the high cost of data acquisition, treatment, and validation; difficulties in data normalization; inconsistency in corporate reporting; and missing data and unavailable historical data []. These operational obstacles highlight the need for standardized systems. This also indicates that technical limitations in ISs may directly lead into governance and accountability discrepancies in ESG performance tracking.

The complex task of sustainability reporting could benefit from IT systems support to enable the strategic change towards improved sustainability performance and sustainability integration and optimization in business operations []. However, until recently, robust sustainability information systems, for instance in the form of ERP (Enterprise Resource Planning) systems, were not available in corporate practice. The main types of such systems are stand-alone customized systems, extensions of existing systems, and manual systems combined with spreadsheets []. This highlights a clear maturity gap in the IT landscape. The fragmentation of current practices suggests an opportunity for modular, scalable, and open-architecture systems that can evolve with shifting ESG requirements.

Traditional accounting standards fall short in gathering and analyzing the complex ESG information required for reporting, and this results in a growing need for informational support for sustainability management and reporting. The successful integration of sustainability into organizations’ operations can be aided by sustainability information systems that facilitate the development of multidimensional target systems, the harmonization of sustainability dimensions, and their integration into corporate processes []. A systematic literature analysis of 61 papers examined the role of information systems in the sustainable development of companies and found that synergies among information systems and other internal corporate resources improve the sustainable performance of the organization []. Another systematic literature review, which applied an automated content analysis to 106 articles, shows that information systems can be used to recognize unsustainable business practices and enhance positive change towards a more sustainable business model []. An exploratory study highlights the increasing interest of users of annual financial and non-financial reporting (i.e., integrated reporting) in ESG-related topics []. It reveals that users have significant interest in financial topics such as performance, financial statements, company profile, and value creation while demonstrating equal interest in non-financial topics. Hence, there is an apparent need for a new conceptual approach to management information systems so they can be able to address the ESG gaps in sustainability reporting through the integration of financial and non-financial indicators []. This increased stakeholder interest reinforces the case for integrated reporting platforms that can balance these dual demands.

Academic scholars generally agree that data and technology can enhance ESG business integration and aid in developing corresponding capabilities through a various means, including real-time measuring, monitoring, and reporting of ESG KPIs; improvement of ESG data quality, accuracy, and accessibility throughout the supply chain; and the promotion of green innovation [].

The issue of information requirements for the reporting and management of sustainability matters becomes more complex because there are several recognized and widely used sustainability frameworks worldwide that request different kinds of ESG information. They all have different methodological approaches, diverse time frames, and key performance indicators, and this causes variations in sustainability reporting even on broad issues []. This creates increased operational burden on corporations highlighting the need for explanation layers that enable cross-framework interpretation and compliance. Organizations invest both financial and human resources in comprehending the interconnected requirements of various standards. In addition, the standards have overlapping indicators, with small variations resulting in a significant volume of repeated work []. This raises issues of reporting fatigue and inefficiency, suggesting the potential value of automation and IS implementation.

Digital information systems enhance sustainability reporting by enabling data collection, analysis, and management which are essential parts of accurate and transparent reporting []. The digital technology may improve corporate reporting process in terms of effectiveness could bring greater transparency for all stakeholders [].

Companies face technological and informational challenges regarding what and how to report on their ESG performance and the eXtensible Business Reporting Language (XBRL) offers a solution for structuring digital data, potentially allowing companies to disclose succinct sustainability information to stakeholders and facilitating useful analysis and strategic decision-making []. XBRL may act as a key enabler of ESG digitalization. The application of XBRL increases the transparency and the credibility of sustainability reporting and aids the regulation of sustainability performance []. Another advantage of the use of XBRL is that it allows stakeholders to find the sustainability data directly from source files, reducing information asymmetry [].

One of the challenges of integrating ESG criteria when investing is the amount of resources needed to analyze and understand ESG information as well as the difficulty of obtaining and managing it []. The need for decision-support tools becomes apparent and thus ISs can reduce cognitive load and enhance transparency for both investors and stakeholders.

A critical issue in sustainability management is that companies often face difficulties in prioritizing their material impacts, and determining appropriate thresholds for those impacts while simultaneously facing considerable uncertainty in deciding how to effectively gather and disclose the relevant information []. Thus, in a plethora of international standards and a wide array of key performance indicators (KPIs), it is unclear which sustainability topics should be addressed and what specific information pertaining to these issues ought to be disclosed. This showcases the need for materiality-driven ISs that can utilize input from stakeholders and shape ESG strategy.

Digital transformation has the potential to significantly improve sustainable development and environmental performance when it includes CSR in its implementation process. One sufficient way to perform this is through Enterprise Architecture (EA), which could offer a comprehensive view of all layers of an organization []. Enterprise architecture (EA) may enhance corporate sustainability by integrating economic, social, and environmental dimensions into organizational processes []. Recognized EA frameworks, such as TOGAF (The Open Group Architecture Framework) and Zachman, may optimize ICT (Information and Communication Technology) resources, reduce costs, and enable sustainability through reuse, integration, and standardization. This requires the integration of company strategy and organizational design while fostering agility and efficiency.

Nevertheless, despite the increasing literature regarding the benefits that data and technology bring for ESG, the studies remain scattered, and this creates cognitive and conceptual difficulties in understanding the interconnection and interaction among different aspects of data and technology [].

Thus, the critical yet underexplored role of information systems (ISs) in sustainability management and reporting is becoming apparent. There is a growing interest in ISs mainly because of the increased regulatory requirements and stakeholder interest for enhanced ESG transparency. While there is increased interest in the topic, a disconnect persists between academic research and practical implementation, where the technologies in place mostly help with compliance instead of improving sustainability performance. The analysis reveals significant challenges, including high costs, data inconsistencies, and the operational burden of navigating diverse ESG frameworks. These issues highlight the need for standardized, modular, and scalable IS solutions that integrate financial and non-financial indicators, improve data quality, and enable cross-framework compliance. Digital technologies like XBRL and enterprise architectural frameworks can also help a business become more efficient and improve its sustainability. However, the scattered nature of existing studies and the lack of robust conceptual models hinder progress, suggesting an urgent need for interdisciplinary research and innovative IS designs that align with the evolving ESG requirements. It seems that ISs have the opportunity to transition from mere compliance enablers to strategic facilitators of sustainability integration and performance optimization.

The preceding discussion highlights that the integration of information systems into sustainability management and reporting is a novel, as yet underexplored area in both academic research and practical application. There is a distinct lack of relevant case studies exploring the practical aspect of this topic indicating the emergence of this subject area. Accordingly, this paper proposes a theoretical framework intended to serve as a foundation for further investigation. The interest in this area has grown mainly by the evolving new regulations and legal obligations, while most organizations still rely on fragmented systems that mainly serve as compliance enablers rather than sustainability performance accelerators. The literature underscores the need for a new conceptual approach to sustainability information systems—one that integrates financial and non-financial indicators, enhances data quality and accessibility, and aligns with diverse ESG frameworks.

3. Materials and Methods

This section describes the methodological considerations necessary for the development of the information architecture for the ESRS. The approach for the development of this paper integrates principles from information architectures, enterprise architectures, and conceptual modeling.

The architecture provides a holistic view of the structure and the organization of the system under investigation []. The literature identifies two interconnected types of architecture: enterprise architecture and information architecture. The enterprise architecture provides a holistic view of an enterprise’s strategy, structure, processes, and technological resources describing how they are interrelated to achieve organizational objectives. Enterprise architecture translates the broader principles, capabilities, and goals defined in strategies into systems and processes that enable the enterprise to realize these goals []. Hence, an enterprise architecture provides the overarching organizational framework, aligning IT and business strategies []. The information architecture refers to organizing, structuring, and managing information assets that support the development and implementation of organizational strategies []. Information architecture aims to ensure that information is well-organized and seamlessly integrated within the enterprise in order to enhance decision-making, operational efficiency, and strategic planning, ultimately enabling information systems to function effectively within the broader framework of the enterprise architecture. The contemporary literature regards information architecture as a part of enterprise architecture []. However, some authors use the term “enterprise information architecture” [] to emphasize the key role of information requirements and information systems in modern organizations [].

In this paper, we are focusing on information architecture to highlight the crucial role of information requirements and information management in successfully implementing sustainability reporting according to the ESRS. As mentioned in the introductory section, the main hurdles in effectively adopting the ESRS are the complexities of managing information, the demanding reporting requirements, and the novelty of certain sustainability management concepts. We consider that information architecture can better address these requirements.

The methodology integrates the Zachman Framework and TOGAF as two well-established frameworks that have evolved over the past two decades to address challenges in information system design []. The Zachman Framework provides a structured and logical approach to categorizing and organizing descriptive representations of an enterprise IT environment [], making it particularly well-suited for structuring sustainability reporting standards. Our proposed information architecture aligns with four of its six layers: Planner (addressing defining scope and vision), Owner (capturing business concepts and requirements), Designer (representing business processes), and Enterprise (focusing on business processes, stakeholder interactions, and performance monitoring). TOGAF offers a comprehensive framework complemented by supporting tools for developing the architecture necessary for sustainability reporting implementation. Our proposed information architecture largely adopts TOGAF’s methodical approach, especially concerning architecture vision (defining scope, stakeholders, and strategic objectives), business architecture (encompassing business models and processes), information systems architecture (detailing information requirements), and governance (ensuring compliance and management). TOGAF has been employed for sustainability projects (see for example [,]).

Information architectures are typically detailed with conceptual data models that provide a basic, essential view of the key concepts in the business domain and show how these concepts relate to each other []. In general, information architectures and conceptual models are distinct yet interrelated constructs. Information architectures refer to the structural design of information environments, focusing on the organization, management, and flow of information. In contrast, conceptual models represent abstract entities and relationships within a domain. The relationship between the two is both hierarchical and complementary: information architectures often incorporate conceptual models as foundational components []. Hence, in this paper we provide an information architecture for the ESRS that is supported by underlying conceptual models. The model-driven approach separates business logic from underlying technologies [] and provides particularly relevant insights for the general requirements of the sustainability reporting standards.

We are using UML (Unified Modeling Language) class diagrams to illustrate our conceptual models. These diagrams offer a standardized, visual way to represent entities and their relationships and they are widely recognized by both technical and business professionals. Class diagrams are well-suited for the complex, interconnected nature of sustainability reporting. They can effectively capture the taxonomical structures found within sustainability metrics and reporting categories. Compared to other methods like entity–relationship diagrams, class diagrams provide richer semantic expressiveness through features such as inheritance, polymorphism, and encapsulation, and their scope extends beyond just database development. Furthermore, the behavioral modeling capabilities of class diagrams allow us to directly specify business rules and validation logic within the conceptual model. This is especially useful for sustainability reporting, which often requires precise calculation methodologies, validation rules, and compliance checking procedures.

4. Information Requirements

4.1. Datapoints

Datapoints are discrete pieces of information collected about sustainability matters that are required to be disclosed according to the ESRS Disclosure Requirement. In practice, organizations gather the raw data (e.g., measurements, counts, descriptions) and then organize it into datapoints to present in their sustainability statements. Hence, datapoints are used to transform raw data into standardized, reportable pieces of information and serve both as qualitative and measurable quantitative indicators to evaluate policies and progress in a variety of areas that are related to business sustainability.

Information on certain datapoints is disclosed regardless of materiality, as a part of the general disclosures. The disclosure of other datapoints is subject to the materiality of the related sustainability matter.

The ESRS framework structures the information to be disclosed under Disclosure Requirements (DRs) and Additional Requirements (ARs). Each requirement includes one or more distinct datapoints, which can be quantitative measurements (e.g., amount of greenhouse gas emissions) or qualitative indicators (e.g., explanation of a policy or process). This flexibility allows for both quantitative metrics and qualitative narrative elements to be systematically captured and reported, ensuring comprehensive coverage of sustainability matters, while maintaining the granularity necessary for meaningful analysis and comparison. The relationship between datapoints and disclosure requirements can be explained with a couple of examples. A disclosure requirement for the total greenhouse gas emissions for the reporting year is supported by datapoints that refer to quantitative data on emissions, explanations of measurement methods, and a description of any reduction initiative implemented. Likewise, a disclosure requirement about training employees on diversity and inclusion issues is supported by datapoints that refer to the number of employees trained, the percentage of the workforce covered, and descriptions of training programs.

The ESRS datapoint classification system organizes datapoints into three primary categories: numerical elements, semi-narrative elements, and narrative elements []. Numerical datapoints encompass quantitative types including monetary amounts, percentages, volumes, energy measurements, and other measurable quantities that form the foundation for comparable sustainability metrics across organizations. This classification ensures that quantitative sustainability data can be systematically collected, analyzed, and compared across different undertakings and reporting periods. Semi-narrative datapoints represent a critical bridge between purely quantitative and qualitative information, encompassing Boolean datapoints and enumeration datapoints that allow undertakings to select from pre-defined lists. This semi-narrative classification enriches narrative disclosures while maintaining standardization and comparability. Narrative datapoints capture qualitative information that provides context, explanation, and strategic insight to ensure that the quantitative elements of sustainability reporting are complemented by meaningful narrative explanations that help stakeholders understand the strategic context, challenges, and opportunities that underlie the numerical data.

Datapoints are structured at different levels of granularity, to ensure that each distinct piece of sustainability information can be identified, captured, and reported consistently across different organizations. This system of information requirements is designed to promote comparability across organizations while ensuring comprehensive coverage of sustainability matters through structured disclosure requirements that integrate strategy, governance, business model considerations, and materiality assessments into a cohesive reporting framework.

4.2. Datapoints and ESRS Reporting Areas

Datapoints provide information for the sustainability performance of organizations in a variety of topics that enables organizations to interpret data correctly within the context of their overall sustainability approach. With regard to strategy and governance, datapoints provide information that helps organizations to demonstrate how operational data reflects strategic priorities and governance practices, supporting transparency about their sustainability commitments. Datapoints are used as a tool for sustainability reporting. As a result of the materiality assessment process, reporting on the identified material sustainability matters is done based on selecting relevant datapoints that genuinely capture significant impacts, risks, and opportunities. Organizations are required to produce integrated reports, where narrative explanations, policies, performance metrics, and actual data seamlessly connect, enhancing clarity for stakeholders.

Taking into account that the ESRS framework structures the information to be disclosed in four distinct reporting areas, namely governance; strategy and business model; IRO (Impact, Risk, and Opportunity) management; and metrics and targets, the rest of this section elaborates on the role of datapoints and the information requirements in these four distinct reporting areas.

4.2.1. Governance

Governance-related datapoints establish the accountability framework for sustainability performance, capturing information about board oversight, management responsibility, risk management processes, and stakeholder engagement mechanisms. The topic-specific standard on governance (ESRS 2 G1 Business Conduct) [] requires information on governance matters that may be material to the company. Governance-related disclosure requirements ask the company to disclose information on the diversity and composition of its administrative, management, and supervisory bodies, their roles and responsibility in overseeing the impacts, risks, and opportunities, and their access to expertise and skills on sustainability matters (GOV-1) []. In addition, they require the company to disclose information on how the administrative, management, and supervisory bodies are informed about sustainability matters and how they address these matters (GOV-2) [], as well as whether sustainability-related performance metrics are integrated in its incentive schemes and remuneration policies (GOV-3) []. Finally, a company is required to provide information on its due diligence process regarding sustainability matters (GOV-4) [] and on its risk management and internal control processes and systems with regards to the sustainability reporting process (GOV-5) [].

The governance-related datapoints create transparency around the governance structures and processes that support effective sustainability management, enabling stakeholders to evaluate the adequacy of governance practices for addressing material sustainability matters. Τhe interconnection between governance and strategy (see Section 4.2.2) datapoints, in particular, creates a comprehensive picture of how companies approach sustainability management at the highest levels of corporate decision-making. This relationship ensures that reported sustainability information reflects genuine governance commitments and strategic priorities, providing stakeholders with insight into the depth and authenticity of corporate sustainability commitments.

4.2.2. Strategy and Business Model

Strategy refers to the way that companies set objectives and allocate resources to manage material impacts, risks, and opportunities related to a variety of environmental, social, or business issues. Strategy-related disclosure requirements demand from the company to provide information on the impact that the business strategy, the business model, and the value chain operations and relationships may have on sustainability matters (SBM-1), on the engagement with the stakeholders, and particularly how the strategy and the business model take into account the interest and views of its stakeholders (SBM-2) [], and the material impacts, risks, and opportunities that may derive from the double materiality analysis and their interaction with the strategy and the business model (SBM-3) []. Strategy-related datapoints that include both quantitative metrics and narrative explanations are used to explain how sustainability considerations are integrated into strategic decision-making processes.

The business model refers to the organizational framework and operational logic that underpin how an organization operates and creates, delivers, and captures value and how this particular operation relates to sustainability impacts. Datapoints regarding the business model aim to ensure that sustainability reporting must reflect the specific characteristics, challenges, and opportunities associated with different types of business operations. These datapoints capture information about how sustainability impacts affect the resilience, adaptability, and viability of the business model. In particular, they provide disclosures about how sustainability issues (e.g., climate change, biodiversity loss, social inequalities, etc.) may affect the business model assumptions, revenue streams, cost structures, and competitive positioning over different time horizons.

The value chain refers to the full range of activities that companies engage in to create a product or a service from its conception to its final use by the consumers []. It includes all phases, from raw material sourcing, manufacturing, distribution, sales, and after-sales services, covering both upstream (suppliers, raw materials, logistics) and downstream (distribution, customers, recycling) activities. The value chain operationalizes the organization’s strategy and business model, translating high-level plans into actual activities that generate revenues and impacts. The ESRS framework emphasizes on the upstream and downstream relationships that take place across the value chain. That implies that the interest lies in situations, dependencies, and effects that occur beyond the direct operational boundaries of the company. This value chain perspective requires datapoints that capture upstream and downstream impacts, dependencies, risks, and opportunities, ensuring that sustainability reporting provides a comprehensive view on sustainability impacts, even if they derive from the business context and are not under the direct control of the company.

4.2.3. Impact, Risk, and Opportunity Management

Impact, Risk, and Opportunity (IRO) management involves a structured approach to identifying, assessing, managing, and monitoring impacts, risks, and opportunities related to sustainability matters, ensuring they are integrated into the organization’s governance and strategic framework. Such impacts, risks, and opportunities can be positive or negative, actual or potential, short-term, medium-term, or long-term, and originate in the company or derive from its context.

Impacts refer to the effects of the company on people or the environment. Risks and opportunities arise due to environmental, social, or governance sustainability matters that may affect the company’s finances negatively or positively, respectively. Each company has to perform a double materiality analysis exercise in order to identify and prioritize its IROs.

The relationship between the materiality assessment and datapoint reporting represents one of the core aspects of the ESRS framework, with 622 datapoints being subject to materiality assessment while 161 datapoints must be reported irrespective of materiality conclusions. This dual structure ensures that certain fundamental sustainability information is always disclosed, while allowing for customization based on each undertaking’s specific context and sustainability priorities.

Datapoints that must be reported irrespective of materiality assessment include those in ESRS 2 [] and those relating to IRO-1 (Impacts, Risks, and Opportunities) in each topical standard. These mandatory datapoints establish a baseline level of sustainability disclosure that enables stakeholders to understand an undertaking’s overall approach to sustainability management, regardless of which specific sustainability matters are deemed material in any given reporting period.

The materiality-dependent datapoints allow for more detailed and specific disclosure on the sustainability matters that are most relevant to each undertaking’s business context and stakeholder priorities. This approach ensures that sustainability reporting resources are focused on the most material sustainability matters, while maintaining sufficient standardization to enable meaningful comparison across undertakings with similar business activity.

The management of impacts, risks, and opportunities is performed through the development of policies and the implementation of actions.

Policies represent formal commitments and approaches adopted for managing, namely preventing, minimizing, or remediating, actual or potential material sustainability matters, while actions are the operational steps taken to achieve those policy objectives and realize the organization’s sustainability commitments. The ESRS establish specific Minimum Disclosure Requirements (MDRs) for policies and actions which create a structured approach to reporting on sustainability management approaches and performance and ensure that sustainability reporting captures both the management approach and the performance outcomes.

Policy-related datapoints capture information about the formal commitments, procedures, and management systems that undertakings have established to address material sustainability matters. These datapoints ensure that stakeholders can understand the systematic approaches that undertakings have adopted to manage sustainability risks and opportunities, including the scope, implementation mechanisms, and effectiveness monitoring systems associated with sustainability policies.

Action datapoints create accountability for sustainability performance by requiring disclosure of specific actions taken or planned and progress made towards achieving stated objectives. The ESRS require information on any actions for managing material sustainability matters, namely the action plans to preventing, minimizing, or remediating actual or potential IROs, including the resources allocated or planned to be allocated to these action plans. These datapoints establish the foundation for performance-oriented sustainability reporting that enables stakeholders to assess whether undertakings are making meaningful progress on their sustainability commitments.

4.2.4. Metrics and Targets

Targets and metrics are used to assess the company’s performance in relation to its material sustainability matters. The effectiveness of policies and actions (see above) related to each material sustainability matter is assessed through targets. Targets are specific, measurable objectives that derive from policies and/or actions. They define the desired future state or performance level (e.g., reduce injuries by 20% by 2030), often using current metrics as a baseline or reference point. The setting of targets depends on the datapoints and the resulting metrics to establish realistic, verifiable goals.

Metrics are structured, standardized indicators derived from datapoints that quantify impacts, risks, or management effectiveness in a way that facilitates comparison over time or across organizations. The metrics datapoints provide the quantitative foundation for tracking and reporting progress, ensuring that sustainability performance can be measured, monitored, and compared over time. For example, the percentage of workforce covered by safety policies is an aggregated metric based on collected datapoints about policy implementation.

Disclosure requirements on targets and metrics are used to assess the company’s performance in managing its material sustainability matters. The company is required to disclose any targets it has set regarding the management of each one of its material sustainability matters and any progress towards meeting them. Minimum Disclosure Requirements (MDRs) set the baseline (minimum) requirements for when a company is disclosing information on the metrics and targets it uses regarding each of its material sustainability matters.

5. Information Architecture for the European Sustainability Reporting Standards

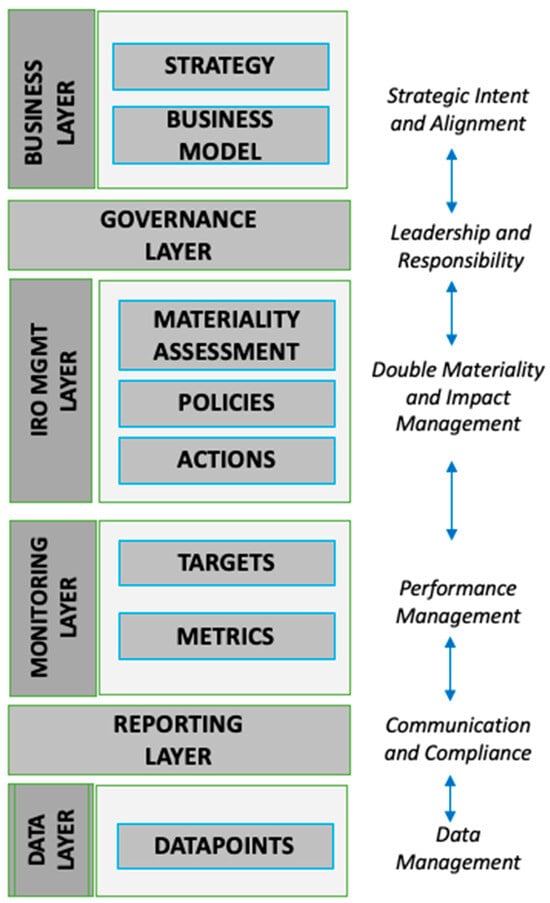

In this section we provide an information architecture that translates ESRS information mandates into a coherent information management framework that is aligned with the management and reporting principles of European sustainability regulation. The proposed architecture is based on the foundational role of datapoints in collecting and managing information for the comprehensive coverage of sustainability considerations. Datapoints are used for the systematic integration of information for business strategy, governance, sustainability impact management, performance monitoring, and reporting. These areas form the basic layers of the proposed information architecture for the ESRS, which is depicted in Figure 1.

Figure 1.

Information architecture for the ESRS.

5.1. The Business Layer

The Business layer represents the foundational strategic context within which sustainability initiatives operate and create value. This layer encompasses three interconnected components that collectively define how an organization approaches sustainability within its strategy and core business operations. The strategy component addresses how the undertaking’s strategic direction integrates with material sustainability impacts, risks, and opportunities, essentially answering how the organization positions itself to address sustainability challenges while pursuing business objectives. The business model component focuses on the fundamental value creation mechanisms and operational approaches that characterize the organization’s approach to sustainability integration. This includes examining how sustainability considerations influence product development, service delivery, customer relationships, and revenue generation mechanisms. The value chain component extends the analysis beyond organizational boundaries to encompass upstream and downstream activities that contribute to the organization’s sustainability efforts.

These three components work interactively to provide a comprehensive understanding of how sustainability considerations are embedded within core business activities. The strategy component provides directional guidance, the business model component translates strategic intent into operational reality, and the value chain component ensures comprehensive coverage of sustainability impacts across all business relationships and activities.

In practical terms, a reporting company can satisfy the requirements of this layer by information included into the company’s business plan. Regarding information related to the business model’s resilience to climate change, a climate transition plan or a scenario analysis report about climate change resilience could be useful, if there are any. Value chain maps, stakeholder maps, supplier codes of conduct, sustainability certifications, and financial statements for the anticipated financial effects could also be of use in this respect.

5.2. Governance Layer

The Governance layer serves as the corporate leadership and responsibility framework that ensures systematic management of sustainability matters across the organization. This layer encompasses the governance processes, controls, and procedures that organizations implement to monitor, manage, and oversee sustainability matters. The governance structure establishes accountability mechanisms, decision-making frameworks, and oversight processes that guide sustainability strategy implementation and performance monitoring. The governance layer also encompasses stakeholder engagement mechanisms that ensure appropriate consideration of diverse perspectives in sustainability decision-making processes.

The governance framework establishes the institutional foundation for all other layers of the architecture. Within this layer, board-level mechanisms define strategic direction and ensure appropriate resource allocation for sustainability initiatives, management structures translate board-level guidance into operational frameworks, while control systems ensure consistent implementation of sustainability policies and procedures. This layer ensures that sustainability considerations receive appropriate attention and resources, while maintaining alignment with the overall organizational objectives.

Access to this information for each reporting company can be obtained from its Articles of Association, its organizational chart, Board of Directors meeting minutes showing oversight of sustainability matters, its sustainability or ESG policy, sustainability committee charters, information on internal control and risk management systems, risk assessments, and details of any sustainability-related remuneration schemes.

5.3. Impact, Risk, and Opportunity Management Layer

The Impact, Risk, and Opportunity management layer constitutes the analytical core of the sustainability reporting framework, where organizations conduct comprehensive assessments of their sustainability-related impacts and develop appropriate response strategies. This layer integrates materiality assessment processes with policy development and action implementation to ensure systematic addressing of identified sustainability challenges and opportunities.

The materiality assessment within this layer follows the double-materiality principle established by the ESRS, examining both how the organization affects people and the environment (impact materiality) and how sustainability issues create financial risks and opportunities for the organization (financial materiality). Policy development processes translate materiality assessment outcomes into systematic organizational responses. These policies establish frameworks for addressing identified impacts, managing risks, and capitalizing on opportunities, while ensuring alignment with strategic objectives and organizational priorities. Action implementation mechanisms ensure that policies translate into concrete activities that produce measurable outcomes and drive continuous improvement in sustainability performance.

The integration of policies and actions within this layer ensures coherent organizational responses to identified sustainability challenges. Policies provide guidance and frameworks, while actions deliver tangible results that address specific impacts, risks, and opportunities. This combination ensures that materiality assessment outcomes are used to shape improved organizational practices.

An organization effort to collect relevant data related to this layer can be supported by its materiality assessment methodology, including its use of data sources, stakeholder engagement, and threshold definitions. Surveys and other stakeholder consultation records can show how stakeholder engagement has informed the IRO identification. Regarding environmental IROs, climate scenario reports, risk assessments, environmental impact assessments (EIAs), and life cycle analysis (LCA) studies could also be used to inform the IRO inventory. Action plans and sustainability or ESG policies can provide valuable insights on how sustainability IROs are managed.

5.4. Monitoring Layer

The Monitoring layer encompasses the systematic tracking of sustainability performance towards certain objectives. This layer integrates target-setting processes with metrics development and performance monitoring to ensure continuous improvement in sustainability outcomes. Target-setting processes within this layer establish specific, measurable objectives that guide organizational sustainability efforts. These targets reflect materiality assessment outcomes and align with policy commitments and regulatory requirements. Metrics development processes identify and define the specific indicators that organizations use to measure progress towards established targets. These metrics encompass both quantitative measures that provide objective performance data and qualitative indicators that capture important sustainability considerations that resist numerical quantification.

Performance monitoring processes encompass data collection, analysis, and interpretation activities that generate insights into organizational performance. Effective monitoring processes provide timely feedback that enables adaptive management and continuous improvement in sustainability performance.

To achieve effective monitoring with meaningful comparisons to previous performance, the company can refer to its previous sustainability disclosures. For information relating to any targets set to manage sustainability-related IROs, an organization can consult its sustainability report, ESG target records, Science Based Targets initiative commitments, any sustainability-related action plans, including a climate change transition plan and ESG policies. Studies such as the Environmental Impact Assessment and risk assessments may also include information on environmental targets.

5.5. Reporting Layer

The Reporting layer transforms organizational sustainability information into structured statements and reports that address stakeholder information needs and meet the regulatory disclosure requirements. This layer encompasses the preparation of sustainability statements, development of specific disclosure requirements responses, and provision of additional reporting that enhances stakeholder understanding of organizational sustainability performance.

Sustainability statements follow ESRS structural requirements for the systematic disclosure of material sustainability information. These statements integrate information from all other architectural layers to present coherent narratives about organizational sustainability performance, challenges, and opportunities. Disclosure Requirements (DRs) represent specific information elements that organizations must provide to satisfy ESRS compliance obligations. These requirements encompass both mandatory disclosures that all organizations must provide and conditional disclosures that depend on materiality assessment outcomes. In addition, Application Requirements (ARs) provide explanatory information, methodological details, and contextual factors that enhance understanding and ensure that sustainability disclosures provide meaningful insights for the stakeholders. The overall disclosure requirements framework ensures systematic coverage of material sustainability topics, while maintaining comparability across organizations and reporting periods.

5.6. Datapoints

Datapoints constitute the fundamental building blocks of the entire information architecture. The datapoint framework ensures systematic capture and organization of sustainability information.

The technical implementation of datapoints follows XBRL taxonomy standards that enable machine-readable sustainability reporting. This facilitates automated data processing, enhances comparability across organizations, and supports regulatory oversight, while reducing the administrative burden of sustainability reporting. The digital framework ensures that sustainability information can be efficiently collected, analyzed, and disseminated across multiple stakeholder audiences.

5.7. Architectural Relationships and Information Flow Dynamics

The six-layer architecture operates through systematic information flows that ensure coherent integration of sustainability considerations across all organizational activities. Datapoints provide foundational information that populates all other layers, while each subsequent layer adds analytical depth and contextual understanding that enhances the value and usability of sustainability information.

The Business layer establishes the strategic context within which all other layers operate. Strategy, business model, and value chain considerations influence governance design, shape double materiality assessment outcomes, guide target-setting processes, and determine reporting that reflect genuine business priorities.

The Governance layer provides oversight and control mechanisms that guide activities within all other layers. Governance structures influence strategic decision-making, establish double materiality assessment frameworks, authorize policy development, approve targets and metrics, and oversee reporting processes. This layer ensures the systematic management of sustainability considerations, while maintaining accountability for outcomes and performance.

The Impact, Risk, and Opportunity management layer translates strategic intent and governance guidance into systematic analysis and response frameworks. Materiality assessment outcomes inform target-setting processes, while policy and action frameworks guide implementation activities that generate the datapoints captured in sustainability reporting. This layer ensures that organizational sustainability efforts address genuine impacts, risks, and opportunities rather than superficial concerns.

The Monitoring layer ensures that sustainability efforts produce measurable outcomes and provides feedback mechanisms that enable continuous improvement across all other architectural layers. Performance data informs strategic decisions, enables policy optimization, and populates sustainability reports.

The Reporting layer synthesizes information from all other layers to produce comprehensive sustainability reports. Reporting processes integrate strategic context, governance frameworks, materiality outcomes, policy responses, and performance data to present coherent narratives about organizational sustainability performance and prospects.

6. Conceptual Model for the European Sustainability Reporting Standards

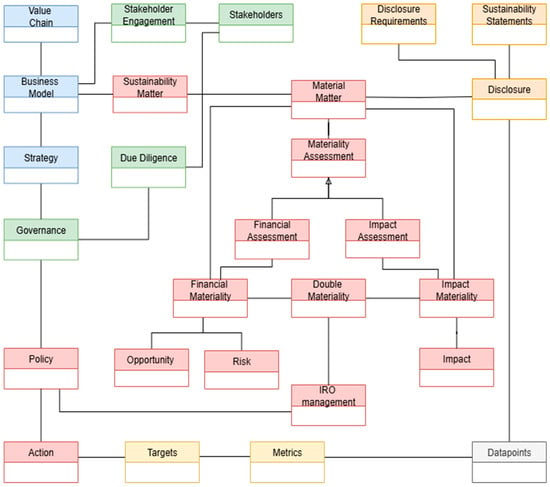

This section delineates a conceptual model for the ESRS. The model articulates how the ESRS’ foundational principles, from overarching strategic imperatives to precise implementation mandates and measurement mechanisms, interconnect to form a comprehensive framework for sustainability disclosure. It further elucidates the relationships between these core ESRS concepts and the requisite information content that is essential for their effective operationalization. Therefore, the model offers a comprehensive yet concise depiction of the conceptual structure of the ESRS that enhances understanding and fosters deeper insights into the practical execution of the ESRS.

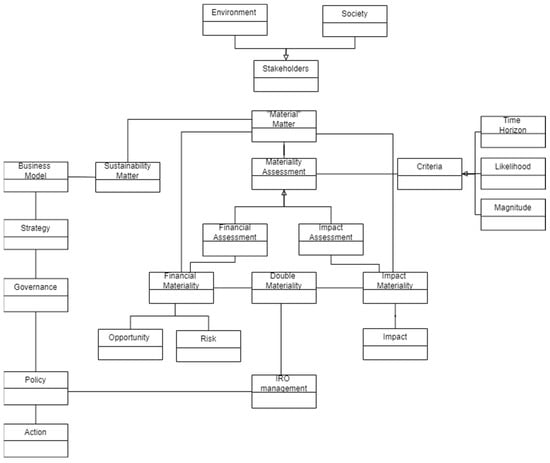

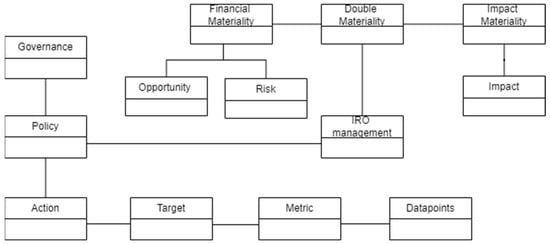

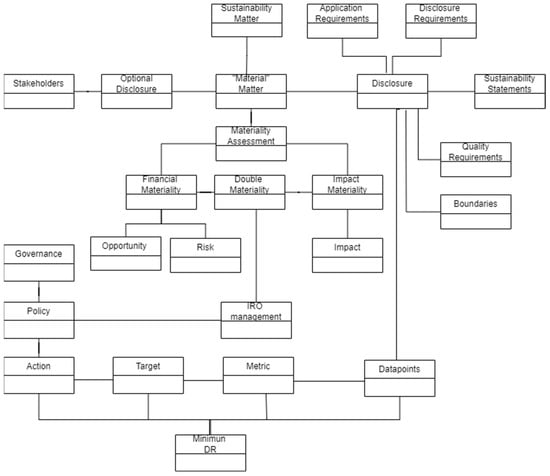

The model builds upon the information architecture for the ESRS introduced in the preceding section, further elaborating on its structure by integrating key concepts and their interrelationships. Initially, we present the comprehensive conceptual model for the ESRS (Figure 2) which contains all fundamental concepts, but deliberately omits peripheral concepts and details for reasons of clarity. To provide a more in-depth perspective, however, we introduce subsequently distinct views of the conceptual model (Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7), each corresponding to one of the five layers within the ESRS information architecture.

Figure 2.

Conceptual model for the ESRS.

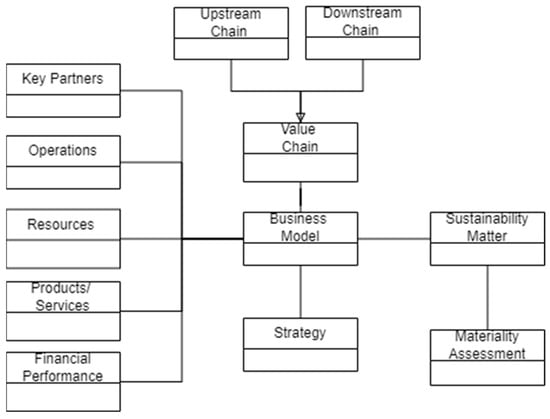

Figure 3.

Conceptual model for strategy, business model, and value chain.

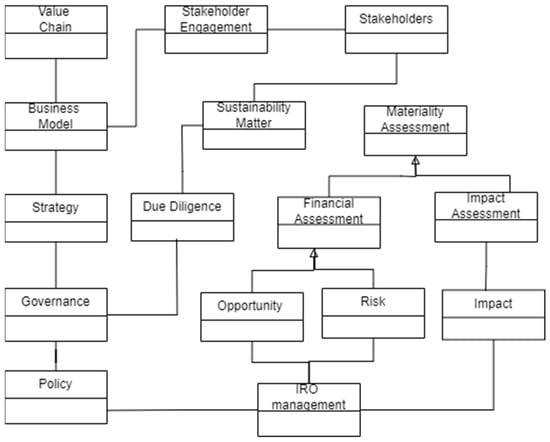

Figure 4.

Conceptual model for governance.

Figure 5.

Impact, risk, and opportunity management.

Figure 6.

Monitoring.

Figure 7.

Reporting.

The model builds upon the information architecture for the ESRS introduced in the previous section, further elaborating on its structure by integrating key concepts and their interrelationships. Initially, we present the overall conceptual model for the ESRS (Figure 2) which corresponds to the information architecture for the ESRS (in Figure 1). This model contains all the fundamental concepts of the information architecture for the ESRS, but intentionally excludes other peripheral concepts and details, given the size limits, to maintain clarity. To provide a more in-depth perspective, we subsequently introduce particular views of the conceptual model (in Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7), each corresponding to one of the five layers within the ESRS information architecture. These particular models include additional concepts that are not present in the overall model and may provide different views, according to the particular focus of each layer.

The conceptual models are presented as UML class diagram, as described in Section 3. To make the diagrams accessible even to readers unfamiliar with the UML notation, we include only classes and their relationships, omitting additional details, such as association names, directions, and multiplicities. Hence, the model depicts only the relationship between the key concepts, without specializing on the details of these relationships. We use only the generalization relationship of UML class diagrams as a necessary special type or relationship, that represents inheritance between two concepts—where one is a specialized ”subtype” (sub-concept) of the other. This is depicted with an arrow pointing to the more general (parent) concept.

To enhance the clarity of the overall conceptual model for the ESRS, we apply color coding to the concepts. Specifically, blue represents concepts related to the business layer, green to the governance layer, red to the IRO management layer, orange to the monitoring layer, yellow to the reporting layer, and grey to the datapoints layer. It is important to note that certain concepts may be relevant to multiple layers. For example, stakeholders play a role in both the business model and strategy, as well as in governance. It is colored green to reflect its central role exists within the governance layer. Note also that the particular models (Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7) incorporate not only the core concepts but also related concepts, in order to illustrate how the layers interconnect and how their respective concepts are intertwined.

6.1. Strategic and Business Model Alignment

The ESRS framework emphasizes the integration of sustainability considerations into core business functions through several interconnected concepts. The term ”sustainability matters” interrelates business and sustainability considerations and aligns business operations and sustainability reporting. “Sustainability matters” refers to specific environmental, social, and governance issues (e.g., issues related to climate change, labor conditions, business ethics, etc.) that can significantly impact, positively or negatively, the competitive position of the company or the relationship with its partners and stakeholders. Sustainability matters arise according to the ways that companies operationalize their business model and interact with partners across the value chain.

The business model describes what the business does and how it operates to create, deliver, and capture value. A company’s choices in products/services, operations, resources, relationships with key partners, and financial priorities within its business model determine its sustainability matters. In fact, the relationship between the business model and sustainability matters is two-way: the business model shapes the company’s activities and resources, influencing which sustainability matters are relevant; conversely, identified sustainability matters can reshape the business model by highlighting risks or opportunities that necessitate operational or strategic adjustments.

The value chain details the business relationships required for producing and delivering products or services within the framework of the business model. The concept of the value chain in the ESRS refers to upstream and downstream activities and interactions with suppliers, customers, and other partners. Hence, this notion expands the domain of sustainability matters, as they take place also in activities that are beyond the direct control and responsibility of the company.

Strategy guides the design and evolution of the business model, while the business model is the mechanism, or a blueprint, through which the strategy is implemented. The ESRS require companies to demonstrate how their strategic approach and business operations integrate with material sustainability matters.

6.2. Governance, Oversight, and Accountability

Governance refers to the systems, processes, and practices through which an organization is directed and controlled. It is related to business strategy, as governance aims to ensure that the strategy considers environmental and social impacts and aligns with the organization’s values, stakeholders’ interests, legal requirements, and ethical standards, providing, hence, strategic direction. Governance is also related to IRO management, as it affects the policies and the subsequent processes, controls, and procedures used to monitor, manage, and oversee sustainability impacts, risks, and opportunities.

Some sustainability matters may lie outside the organization’s direct control, making due diligence and stakeholder engagement essential as guiding principles for governance and sustainability management. Due diligence is a proactive and systematic process by which an undertaking systematically identifies, assesses, and addresses its actual or potential negative impacts on the environment and people. Due diligence is linked directly to stakeholders as affected parties of the business model. Stakeholder engagement refers to the interaction with stakeholders to understand and assess sustainability matters that are material.

Note that the model provides a simplified representation of the overall conceptual framework. It illustrates the relationship between governance and policy, and from there, its connection to the concepts within the IRO management layer. However, to preserve clarity and brevity, the full structure of concepts within the IRO management layer is not reproduced.

6.3. Impact, Risk, and Opportunity Management

The foundation of the ESRS framework rests on materiality assessment, as the process through which sustainability matters are identified, i.e., they are considered as being material, meaning they can produce “material effects” that influence the company’s competitive advantage, ability to create value over time or financial performance. The materiality assessment involves analyzing impacts, risks, and opportunities over different time horizons (short, medium, long-term) and according to their likelihood to induce material effects and the potential magnitude of those material effects.

There are two types of materiality assessment: impact materiality assessment and financial materiality assessment. Impact materiality assessment refers to evaluating how the company’s operations or relationships are related to sustainability matters that (may) affect the environment and the society, positively or negatively. Financial materiality assessment (specifically, “assessment of financial materiality”, as mentioned in ESRS 1) refers to determining whether a Sustainability Matter may have a significant financial effect on the company, meaning that it influences its financial position, performance, or cash flows. Financial materiality assessment recognizes risks and opportunities. Risks are sustainability matters that are considered material because they may adversely affect the organization’s financial position and performance. Opportunities are sustainability matters that are considered material because that may have potential positive impacts or benefits that could enhance the organization’s financial performance.

The foundation of the ESRS framework rests on the notion of double materiality that consists of two dimensions of what is considered material information: impact materiality and financial materiality. Impact materiality focuses on material impacts of an organization’s activities and relationships that may affect people and the environment. Financial materiality assesses how ESG-related risks or opportunities affect the organization’s financial performance, position, or development. Hence, double materiality aligns corporate disclosures with both societal expectations and financial decision-making and requires companies to consider both how sustainability matters affect the environment and the society (impact materiality) and how they affect the company’s financial performance (financial materiality).

IRO management, as a particular concept, follows the materiality assessment and applies to the sustainability matters that the company identifies as material (impacts, risks, and opportunities) through the process of double materiality assessment.

Once identified, the organization implements policies and actions to address these impacts, risks, and opportunities. Policies represent formal commitments and approaches adopted to manage material sustainability matters, while actions are the operational steps taken to achieve those standards and realize the organization’s sustainability commitments.

6.4. Monitoring

The organization tracks the effectiveness of the actions taken to address impacts, risks, and opportunities with the development of targets and metrics. Targets are specific, measurable goals set by the organization to achieve desired outcomes within a certain timeframe. Metrics are quantitative or qualitative indicators used to measure specific aspects of an organization’s performance related to sustainability matters. Each metric typically consists of one or more datapoints that provide the actual data used to measure the performance. Datapoints are the building blocks of metrics, the specific discrete pieces of information that make up a metric. There is a close relationship between targets and metrics: targets establish what the organization intends to achieve, and metrics are used to monitor progress toward reaching those goals.

6.5. Reporting

The materiality assessment determines which sustainability matters require disclosure (i.e., the ones that are found to be material). The ESRS involve various types of disclosure mechanisms. Disclosure requirements specify the information that companies must provide in their Sustainability Statements. Sustainability Statements represent the primary output of the ESRS framework, containing all required disclosures organized according to standardized principles. They must demonstrate information quality characteristics (relevance, faithful representation, comparability, verifiability, and understandability). Time horizon considerations ensure that companies address both short-term and long-term sustainability implications in their reporting. The concept of boundaries defines the scope of reporting, determining which entities, activities, and business relationships must be included in sustainability disclosures.

Application Requirements (ARs) provide explanatory information, methodological details, and contextual factors that enhance understanding and ensure that sustainability disclosures provide meaningful insights for the stakeholders.

Minimum Disclosure Requirements (MDRs) establish baseline reporting obligations that apply regardless of materiality assessments. These include the MDR for Policies (MDR-P), MDR for Actions (MDR-A), MDR for Metrics (MDR-M), and MDR for Targets (MDR-T). Optional disclosures allow companies to provide additional information, beyond mandatory requirements, when relevant to stakeholder needs. Additional Reporting provisions permit companies to report under other sustainability frameworks, alongside ESRS requirements.

7. Discussion

The main purpose of the information architecture and the conceptual model for the ESRS lies integrating abstract reporting standards into operational practices with clear interconnections, addressing the issue of systemic integration of the ESRS elements, which is one of the major difficulties in the successful implementation of the standards.

In particular, the Business layer addresses some of the ESRS’ most challenging requirements, regarding the connection between sustainability matters and strategic decision making and business model considerations, as well as the extensive reporting of the value chain activities. By making value chain considerations a foundational element, the architecture allows organizations to systematically identify and engage with material sustainability impacts, both in their business model and across their value chain. In practical terms, this is tantamount to information found in a company’s strategic business plan, climate transition plan, climate scenario analysis, value chain and stakeholder maps, supplier codes of conduct, and sustainability certifications.

The Governance layer provides critical support by highlighting governance disclosure requirements and mechanisms for oversight, IRO management, implementation, and control. The distinction between this layer and strategic and operational business components demonstrates the dual role of governance as a source of corporate leadership on the one hand and sustainability responsibility and oversight on the other hand. Information related to the Governance layer is included in an organization’s founding documents, organizational structure, minutes from the Board of Directors meetings demonstrating oversight of sustainability matters, sustainability, or ESG policies, charters of sustainability-related committee charters, risk assessments, internal auditing documents, and information on sustainability-linked remuneration schemes.

The IRO management layer delineates a structured process for ongoing materiality assessment. It highlights the double materiality principle that addresses both its impact materiality and its financial materiality aspects. The integration of policy development and action implementation creates closed-loop processes that align with the ESRS’ requirement for continuous materiality assessment. The explicit connection between materiality outcomes and policy development addresses the common failure of businesses to convert assessment results into operational changes. To manage the IROs identified through the double materiality assessment an organization often needs to refer back to climate scenario reports, risk assessments, environmental impact assessments, and life cycle analysis studies. In addition, the interrelated “materiality–policy–action–monitoring” cycle which is clearly described in the architecture highlights the need for continuous assessment processes and can provide insights for their standardization.

By considering datapoints as key architectural elements, rather than just reporting outputs, the model can assist organizations in building digital capabilities and addressing reporting compliance. In addition, it can provide support for companies’ digital readiness, through the development of machine-readable reporting requirements (e.g., by relating to the XBRL taxonomy of datapoints that provides technical aspects for their structure).

The information architecture and the conceptual model can enable ESRS implementation, as they enhance understanding of the key concepts by elucidating fundamental requirements, clarifying conceptual structures, and describing key relationships. However, while they provide a solid conceptual foundation for ESRS implementation, they do not aim to resolve all implementation challenges, particularly the practical difficulties faced by companies. The primary limitations of the research are outlined below.

While the paper defines key concepts and interconnections between them, it does not engage in detailed data modeling or establishes technical specifications for information requirements. These issues will be addressed by particular implementation of information systems that companies will develop in order to implement the ESRS. Likewise, the paper does not examine the specific locations of data sources necessary for the development of datapoints, or the mechanisms though which they can be integrated. In addition, the architecture does not sufficiently address the challenges that integrating new sustainability reporting systems into existing enterprise resource planning (ERP) platforms poses. The value chain component successfully identifies necessary data flows; however, obtaining and verifying data collected from suppliers and customers still remains a challenge.

Organizations often struggle to align board-level governance with operational monitoring systems and frontline business functions. The architecture sensibly separates the Governance, Business, and Monitoring layers; however, it does not describe strategies and mechanisms for the integration of these layers in everyday business practices.

Data quality poses a significant challenge in the implementation of the ESRS, as the vast majority of companies struggle to identify the correct datapoints and ensure accurate, consistent, and meaningful sustainability disclosures. The ESRS demand detailed and structured data that many organizations have not historically collected. One of the top challenges here is the fragmented nature of data sources, which are often dispersed across departments such as HR, finance, and operations, as well as across internal and external systems. Effective collaboration, both within organizations and across the supply chain, is a critical success factor for ESRS compliance. Adapting existing ERP systems to meet ESRS requirements is essential. Additionally, emerging technologies, particularly AI and IoT, can play a key role in streamlining data collection and analysis.