Abstract

Public-Private Partnerships (PPPs) are essential for accelerating sustainable development as they combine public goals with private sector efficiency, leading to improved service delivery and less financial burden on governments. It is a project delivery model based on long-term contractual arrangements, where the private sector provides services, including engineering, construction, and operation of public infrastructure, taking financial risks. At the project development stage, the private sector carries out a financial risk assessment to ensure economic returns from a PPP investment and secure funding for the project. In this paper, we present a Bayesian Belief Network (BBN)-based model that can be used to assess financial risks, particularly the level of profitability in PPP projects. The proposed model was developed considering PPP projects in the healthcare sector and validated using data on PPP hospital projects in Turkiye. The findings demonstrate that the BBN model is useful for capturing the interdependencies between risks, resulting in different scenarios, and provides effective decision support for investors in PPP projects. This study contributes to the literature by offering a novel application of probabilistic risk assessment to provide a better understanding of interrelated risk factors that may result in different financial scenarios. The model can be used by the private sector to assess risk, estimate profitability, and develop risk mitigation strategies in PPP healthcare projects, which may increase project success, contributing to social, environmental, and economic sustainability.

1. Introduction

Public-Private Partnerships (PPPs) play a crucial role in advancing sustainable infrastructure investments by leveraging the strength of the private sector with public oversight and regulations. PPPs have become essential for enhancing infrastructure services, such as energy, transportation, and healthcare, to achieve sustainable development goals. These long-term agreements between public agencies and private entities utilize private sector expertise and resources to deliver public services efficiently, allocate risks to the private sector, and provide economic benefits for retaining risks [1,2]. Research indicates that PPPs are not only cost-effective but also help improve the quality and speed of service delivery compared to purely public investments [3]. However, managing the inherent risks in PPP projects remains a critical challenge, as financial, legal, and operational risks can significantly impact project success, especially in sectors like healthcare where the stakes are higher [4].

Various empirical studies have demonstrated that stakeholders can encounter problems such as cost overruns, unrealistic pricing, and misleading income projections due to poor financial risk assessment [5,6]. Poor performance at the project level, leading to delays in project completion, constitutes a major risk for achieving sustainable development goals. This study aims to develop a Bayesian Belief Network (BBN) model to assess risks in PPP hospital projects from the perspective of the contractor, considering the financial risk that may emerge due to a complex web of interrelated risk factors. The literature supports that BBNs provide a better understanding and modeling of complexity and risk interdependencies in large-scale projects, offering a significant advantage over deterministic approaches [7]. Although there have been previous applications of BBNs for risk assessment published in the literature, their practical applications have been limited, mainly due to the complexity of model development, data requirements, and lack of awareness [8]. Incorporating real-world case studies may bridge the gap between theoretical and practical knowledge, which has been one of the motivations behind this study. This study focuses on Turkiye, a country that has been using PPP to realize its healthcare investments for the last 30 years and implements strategies to foster green and smart building applications via this scheme. Data and expert opinions from the Turkish construction industry were used to develop and validate the BBN-based risk assessment model, which has the potential to improve financial projections and risk mitigation in PPP healthcare projects, fostering sustainable infrastructure development.

The paper begins with background information on PPP hospital projects and key risk factors identified in the literature, followed by the research questions and methodology used for the development of the BBN model. A case study is then presented to demonstrate the practical application of the BBN model. Finally, the findings are discussed, the implications for stakeholders are elaborated, and recommendations for future research are made.

2. Research Background

PPP projects have gained popularity due to their potential to enhance efficiency and reduce costs in public infrastructure endeavors. A key aspect of PPPs is the transfer of risk from the public sector to private entities, enabling governments to delegate substantial risks to private sector partners [9]. The complexity of PPP projects makes them more susceptible to risks than traditional project types, thereby increasing the need for effective risk management strategies [10]. Risk management of PPP projects, which involves the identification, analysis, and mitigation of financial, political, and contractual risks, has become a significant research focus, as several failure cases have been reported [10]. Improper risk allocation is identified as a primary factor leading to the failure of PPP projects [11]. In particular, the allocation of financial risks, such as changes in interest rates or currency fluctuations, has been shown to have a profound impact on project outcomes [12]. Some scholars argue that political risks, such as regulatory changes or government instability, can exacerbate the financial risks faced by private partners in PPPs, especially in developing economies [13].

Several scholars, such as [14], have highlighted that the extended duration of PPP projects, spanning 20 to 40 years or more, introduces challenges due to the reliance on long-term assumptions and forecasts. This extended timeframe increases exposure to macro-level risks, including economic downturns and technological changes, which can threaten the financial stability of the project as well as delay sustainable public services [15]. The private sector should identify, assess, and manage risks efficiently to control costs and mitigate potential financial impacts [9]. Failure to properly address these risks can lead to the financial failure of private firms involved in PPP projects [16], making it critical for private companies to thoroughly understand the risks associated with profitability estimates before proceeding with the investment [17]. The use of advanced risk assessment models that capture interrelated risk factors stemming from the project and macro levels has the potential to improve projections, risk management success, and facilitate better decision-making under uncertainty, which will be further discussed in Section 2.2. Before proceeding with the risk assessment methods, brief information on PPP hospital projects is provided in the next section.

2.1. PPP Hospital Projects Worldwide and in Turkiye

PPP hospital projects have become a widely utilized model across the globe for improving healthcare infrastructure by leveraging private sector expertise, innovation, and finance. PPP provides an effective instrument for countries aiming to upgrade their infrastructure for enhanced sustainability, climate resilience, and smartness. In the United Kingdom, the Private Finance Initiative (PFI) has played a crucial role in enabling the National Health Service (NHS) to upgrade its hospital infrastructure, offering modernized healthcare facilities and improved patient care standards. Australia’s Royal Children’s Hospital in Melbourne is often cited as an exemplary case of how PPPs can lead to the construction of world-class medical facilities, where private sector efficiency results in high standards of healthcare delivery [18]. In developing countries, such as India and several African countries, PPPs are instrumental in expanding access to medical services and enhancing the quality of care. PPP models have helped these regions bridge the gap between demand and supply in healthcare services, addressing both infrastructural deficiencies and medical service delivery, and achieving sustainable development goals [19]. The success of these projects lies in their ability to mobilize private investments, promote innovation, and ensure more efficient service delivery, which is particularly crucial in areas with resource constraints [20]. In Turkiye, the Ministry of Health (MoH) has been at the forefront of PPP hospital projects, with the primary goal of upgrading healthcare infrastructure to meet the country’s growing demand for high-quality and sustainable healthcare services. The Turkish PPP model, which involves the MoH conducting tenders and selecting investors, has led to the development of numerous modern hospitals across Turkiye. Once the tender is awarded, the winning bidder establishes a Special Purpose Vehicle (SPV) responsible for financing, designing, constructing, operating, and maintaining the hospital over a defined concession period. This model has allowed Turkiye to accelerate healthcare infrastructure development while mitigating the financial burden on public resources. Some key aspects of the PPP model [21] that should be considered for risk assessment are listed below:

- Financial Structure:

- Availability Payments (AP): Cover lease payments for design, construction, and medical equipment, made quarterly after project completion.

- Service Payments (SP): Cover fees for mandatory or optional services, paid monthly. SP includes Volume-Based Services (dependent on factors like hospital occupancy) and Non-Volume Services.

- Revenue Streams:

- Generated from commercial facilities within the hospital campus, such as canteens and restaurants.

- Deductions are applied for utilization failures based on clear contract criteria.

- Financing:

- SPV secures loans covering 75–80% of the investment, with the remaining 20–25% provided as equity by the SPV.

- The MoH provides site access and the necessary urban planning data.

- Operations:

- Upon project completion, the SPV can subcontract or internally manage Engineering, Procurement, and Construction (EPC) works, as well as Operation and Maintenance (O&M) works.

- The MoH oversees the medical consumables and operations.

The PPP mechanism requires that the private sector consider the above financial and legal arrangements to make reliable cost predictions, demand projections, estimate possible deductions from the revenue streams, and consider risks during the life cycle of the project, covering all phases, including operation and tasks such as procurement that require a comprehensive risk assessment process.

2.2. Risk Assessment Methods Proposed for PPP Projects

Risk assessment is critical for all stakeholders, especially the private sector, to evaluate the financial viability of PPP projects [13]. Various studies have explored the utilization of different risk assessment methods and demonstrated their application in PPP projects in different countries. Methods based on multi-criteria ratings, such as the analytical hierarchy process (AHP) and analytic network process (ANP), and incorporating fuzzy sets to account for bias and subjectivity, are among the most widely used methods. For example, Ref. [16] developed a fuzzy synthetic assessment model to evaluate risk levels in Chinese PPP projects, Ref. [13], applied fuzzy AHP to PPP expressway projects in China, demonstrating that fuzzy AHP effectively addresses imprecision and biases in human judgment, leading to more accurate risk assessments. Ref. [22] used ANP for risk assessment in hydropower PPP investments where environmental risk factors are significant. There has also been significant progress in developing hybrid models that combine different methodologies for better modeling. For example, Ref. [23] used fuzzy ANP and interpretive structural modeling (ISM) to eliminate data inaccuracies in assessing risk in PPP projects, Ref. [24] developed a risk model using fuzzy synthetic evaluation for PPP straw-based power generation projects, which also highlighted the importance of incorporating environmental and operational risks. Another important contribution is from Ref. [25], who created a hybrid fuzzy technique integrated with the Cybernetic ANP model to define and evaluate shared risks in PPP projects. It has been argued that hybrid models offer more flexibility and accuracy in addressing the complexity of PPP projects and considering the interdependencies between risk factors. The development of dynamic risk assessment models that incorporate real-time data, allowing for continuous monitoring and adjustment, has also been proposed. For instance, Ref. [26] developed a dynamic risk assessment model using AI for PPP transportation projects and demonstrated that real-time data integration can significantly enhance the predictive accuracy of risk assessments.

BBN is an alternative risk assessment method that can be used to model interrelated risk factors leading to different scenarios and estimate probabilities. It is a probabilistic graphical model that represents a set of variables and their conditional dependencies using a directed acyclic graph. Unlike rule-based systems that describe expert knowledge, BBNs represent the knowledge domain using Bayesian probability to model relationships and dependencies [27]. BBNs are particularly effective in modeling uncertainty by incorporating data and expert knowledge. BBNs facilitate the estimation of conditional probabilities and provide a clear visualization of the relationships between different risk factors, thus enabling stakeholders to generate hypotheses and understand the marginal probability distributions of relevant variables [28].

BBNs help develop scenarios and estimate probability values that significantly aid in the decision-making process [28]. This scenario-based approach differs from multi-criteria rating methods and constitutes a reasonable alternative for accounting for interdependencies in complex projects. Even in the absence of direct evidence or observations, BBNs may allow users to interpret associations between variables or factors through their causal links, providing valuable insights for making predictions [29]. This structured approach makes BBNs especially valuable in PPP projects, where understanding and mitigating complex risk patterns is crucial for project success. Several studies have highlighted the performance of BBNs in managing risk in complex infrastructure projects due to their ability to handle interdependencies and incorporate expert judgments [30]. However, there are limited BBN-based applications in the PPP financial risk assessment domain. One of these studies [31] explored the use of BBN for evaluating risks in Urban Rail Transit PPP projects by focusing on risk likelihood, rationale, and sensitivity. In this study, we explore whether BBN can be used to estimate profitability and assess risk in PPP healthcare projects under different risk-occurrence scenarios.

3. Research Gap and Objectives

The body of literature on assessment of risk in PPP projects primarily focuses on using multi-criteria rating or hybrid methods that are deterministic and project/sector specific, such as transportation and hydropower. There is a noticeable gap in addressing the financial risks associated with PPP hospital projects, which is critical for the overall success of the PPP model in the healthcare sector. This research gap is particularly significant in developing countries such as Turkiye, where PPPs in healthcare are gaining momentum and becoming critical for sustainability and climate resilience. Current multi-criteria rating models often lack the flexibility to adapt to the dynamic nature of PPP projects and model possible scenarios, and may not fully capture the interdependencies between risk-related factors. The integration of real-world data with expert opinions remains limited, which reduces the effectiveness of these models in making accurate predictions under uncertainty [32]. There is a need for more robust and adaptable models that integrate real-world data with expert opinions to enhance the risk assessment process.

The objective of this study is to explore whether a BBN-based model can reflect risk scenarios in PPP hospital projects that affect the profitability of private sector participants. For this purpose, we developed and validated a BBN model using data and expert opinions from the Turkish construction industry. The research design is explained in the next section.

4. Research Methodology

The research methodology employed in this study is based on data collection from domain experts in multiple stages. Initially, a comprehensive literature review was conducted to identify the risk factors that may affect contractor profitability in PPP hospital projects, as explained in Section 5.1. This review established a theoretical foundation and helped identify an initial set of risk factors. Subsequently, expert opinions were gathered through semi-structured interviews to validate and refine the risk factors. The selected experts had extensive experience in PPP hospital projects, each with more than 10 years of experience. The expert knowledge elicitation sessions aimed to capture their perspectives and experiences related to the key factors affecting profitability in such projects. A summary of the experts involved is provided in Table 1.

Table 1.

Profiles of experts involved in risk identification.

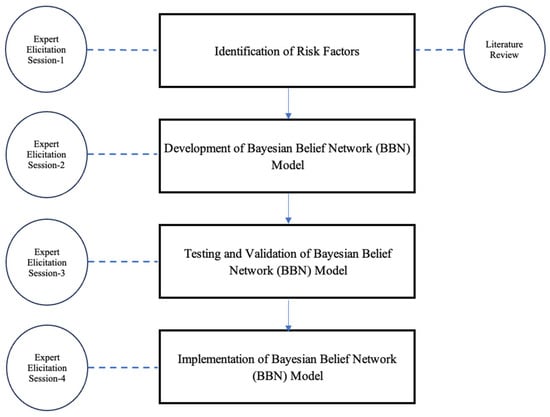

Based on the literature findings and insights from these experts, the risk factors to be used in the BBN model development and possible interrelations between the risk factors were finalized, ensuring the accuracy and comprehensiveness of the BBN model. The BBN model represents the relationships between the identified risk factors and profitability, allowing for the assessment of conditional dependencies and interactions among the factors, thus providing a structured framework for analysis and decision-making. To develop and test the validity of the BBN model, data on risk factors, states, interrelations, and conditional probabilities were collected from relevant stakeholders, the details of which will be provided in the next sections. These data were used to populate the BBN model and evaluate its performance in predicting profitability based on the identified risk factors. The findings provide insights into the relative importance and influence of each risk factor on profitability. Sensitivity analyses and validation processes were conducted to assess the robustness and reliability of the BBN model. The research design is depicted in Figure 1.

Figure 1.

The research design.

5. The BBN Model Development Process

The development process began by identifying relevant risks through extensive literature reviews and expert input (Expert Knowledge Elicitation Session-1), which were then incorporated into the GeNIe software 3.0 by Decision Systems Laboratory, Urbana, IL, USA. Experts were consulted to establish critical risk factors, their relationships, and their possible states, forming the foundation of the BBN model in the Expert Knowledge Elicitation Session-2. Since no data from completed PPP hospital projects in Turkiye were available, expert opinions were used to generate the required conditional probability tables (CPTs) and simulate the model (Expert Knowledge Elicitation Session-3). The final stage involved validating the model through sensitivity analysis, comparison studies, and expert feedback, compensating for the lack of real-world data (Expert Knowledge Elicitation Session-4).

The development of the Bayesian Belief Network (BBN) model in this study followed a structured multi-step process:

Step 1—Risk Factor Identification and Refinement.

Step 2—Software Implementation: The finalized risk factors were integrated as nodes into the GeNIe modeling software. A series of expert sessions was held to define the interdependencies among the variables, forming a directed acyclic graph structure of the BBN.

Step 3—State Definition and Quantification: Experts provided input on the possible discrete states of each node (e.g., low/high, yes/no) and determined the relationships between parent and child nodes.

Step 4—Conditional Probability Table (CPT) Creation: CPTs were populated using expert judgment derived from their previous experience and knowledge.

Step 5—Model Validation: The BBN model underwent comprehensive validation, including face, content, and nomological validity, as well as sensitivity and extreme condition tests. This ensured the reliability of the model despite the lack of empirical datasets.

The model development steps are explained in the following sections.

5.1. Identification of Factors Affecting Risk

To ensure the accuracy and relevance of the risk model, this research commenced with an extensive literature review of PPP hospital projects. This review identified a preliminary list of risk factors commonly associated with such projects, which were derived mainly from academic papers, including gray literature such as industry reports published between 2000 and 2023. Major academic databases such as Scopus, Web of Science, and Google Scholar were used. The search was performed using combinations of keywords, including “PPP hospital projects”, “contractor profitability”, “PPP risk assessment”, “Bayesian Belief Networks”, “risk factors in PPP”, “health infrastructure PPPs”, and “project finance risks”. Boolean operators (AND, OR) were applied to expand the scope of the results, where necessary. Relevant studies were selected based on their methodological rigor, relevance to healthcare PPPs, and frequency of citation. The selected literature was reviewed to extract risk factors, which were later grouped under main categories such as financial, regulatory, construction, and operational risks.

The findings from this structured review formed the initial foundation for identifying key risk variables, which were subsequently validated and refined through the expert interviews. Table 2 summarizes the factors extracted from the literature that can be used to model risk-occurrence scenarios in the BBN model.

Table 2.

Risk-related factors.

Table 2 formed the basis of expert elicitation sessions that were conducted to explore the significance of these factors in affecting the profitability of contractors involved in PPP hospital projects. To finalize the factors to be used in the BBN, a panel of experts renowned for their expertise in PPP hospital projects (as given in Table 1) was convened for a dedicated session. Interviews were conducted either in person or online, depending on the availability of participants (Expert Knowledge Elicitation Session-1). In the first round, experts were asked open-ended questions regarding the profitability of PPP hospital projects, the factors influencing it, and real-world examples from their own experiences. In the second session, a comprehensive list of risk factors gathered from the literature was presented to the experts. Through open discussion, the experts were asked to evaluate the practical relevance and significance of each factor. Risk items considered too generic, redundant, or irrelevant to contractor profitability in the Turkish PPP hospital context were either merged under broader headings or removed entirely. This expert-driven prioritization process enabled the refinement of the longlist into a final set of 27 key risk factors grouped under relevant thematic categories. These discussions took approximately 3 h. The states of these risk factors, representing different conditions, were determined based on expert opinions. The states of each factor (e.g., “High Inflation”, and “Low Delay in Construction”) used in the BBN model were determined through subjective assessments, rather than using a fixed scale. The states and evaluations are context-dependent, particularly based on conditions in Turkiye, which have high inflation rates and unstable economic conditions. For example, the term “High Inflation” was defined by experts as an inflation rate exceeding 25% per year, based on their professional experience and project-budgeting practices. Similarly, “Low Inflation” was interpreted as inflation rates below 15%, and “Medium” as between 15% and 25%. These ranges are consistent with the macroeconomic trends observed in Turkiye over the past decade and with the thresholds generally used in the PPP contract price adjustment formula. Other factors, such as “Frequent Contractual Changes” or “Major Design Changes” were also qualitatively assessed by the experts. These state definitions were cross-validated by multiple experts to ensure conceptual alignment and reduce subjectivity. However, it should be noted that they represent the PPP investment climate in Turkiye and may not be applicable to other types of projects, markets, and countries.

Table 3 illustrates the final list of risk factors and states used in the BBN model.

Table 3.

The risk factors and states used in the BBN model.

5.2. Model Structuring

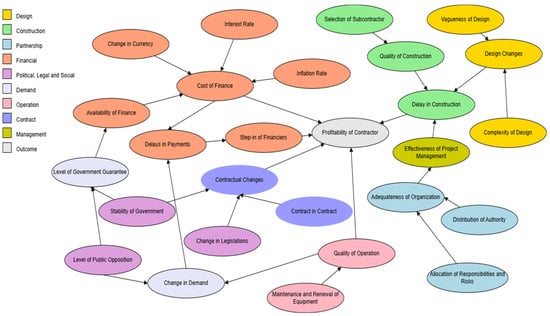

In BBN, nodes represent critical risk factors affecting profitability in PPP hospital projects during the investment planning (project appraisal) phase, and these nodes are interconnected by arcs that define the relationships between the factors. Expert Elicitation Session-2, which used the findings from the previous session, provided useful information for finalizing the model structure. For instance, during this session, various questions were posed to explore the interrelations between factors, such as “How do government guarantees influence the availability of financing for PPP hospital projects?” Figure 2 illustrates the main structure of the BBN model.

Figure 2.

The structure of the BBN model.

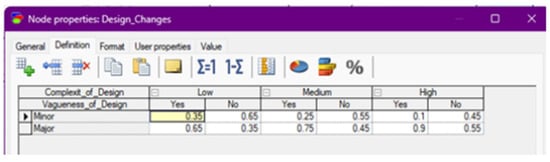

Once the model structure was finalized, the next crucial step involved assigning conditional probabilities to nodes. These probabilities reflect the dependencies between variables, indicating how the state of one node influences the others. Given the lack of data from completed PPP hospital projects in Turkiye, expert assessments were used to estimate these probabilities. Experts were asked to evaluate the likelihood of specific outcomes under various parent node conditions using verbal probability categories such as low, medium, and high. A predefined probability mapping system was used to translate these subjective judgments into quantifiable inputs. Verbal terms were associated with specific numerical intervals (e.g., Low = 10–20%, Medium = 20–30%, High = 30–45%), and the midpoint values (15%, 25%, 37.5%) were used for calculations. After each expert developed their CPTs individually, a group session was held to compare and reconcile the differences. The Delphi method was used to harmonize diverging views. In this process, the experts reviewed each other’s estimates anonymously, discussed discrepancies, and iterated their inputs until a consensus was reached. A consensus threshold of ±5% was used to define acceptable agreement across expert inputs for each conditional probability entry. If any probability estimates diverged beyond this threshold, further clarification was requested, and a final revision was made through facilitated discussion. In the rare cases where disagreements persisted, the mean value of the proposed estimates was used. The finalized CPTs were then incorporated into the corresponding nodes within the GeNIe software to enable structured analysis and decision-making. An example of a CPT for “design changes” (Screenshot from GeNIe) is provided in Figure 3 as an illustrative example of how the likelihood of outcomes can vary based on different input factors. An example of the input data used to construct the CPTs is also provided in Table 4 for the “delay in construction” factor.

Figure 3.

CPT for “Design”.

Table 4.

An example of conditional probabilities for “Delay in Construction”.

6. Testing and Validation

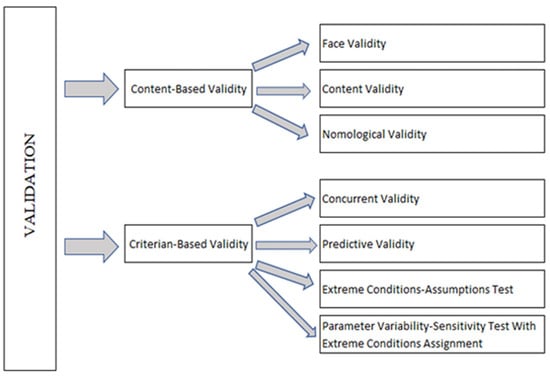

While it is commonly believed that model validity can be confirmed solely by testing its fit against a dataset, the concept of validity extends far beyond this simple approach [44]. Due to the lack of actual data on projects, expert opinions play a crucial role in the validation process for the BBN model. The proposed framework for validating the BBN model, as illustrated in Figure 4, uses content-based and criterion-based validation techniques. These methods are employed to ensure the model’s reliability, accuracy, and credibility, especially in the absence of empirical data.

Figure 4.

Validation framework for the BBN model.

6.1. Content-Based Validation

Content-based validity assesses how accurately the BBN model reflects the relevant subject matter that forms the basis of its findings [45]. This validation process includes three key tests: content validity, face validity, and nomological validity. These tests ensure that the variables in the model are sufficient, correctly establish relationships, and comprehensively represent the problem. The results indicate that the model content is adequate for representing the real system and covers a broad domain.

The face validity test is a subjective evaluation of how well the model structure replicates real-world scenarios [46]. In Expert Elicitation Session-3, the experts were asked to assess whether the model’s nodes, labels, and connections accurately depict the factors influencing contractor profitability in PPP hospital projects. They also evaluated whether the network’s discretization reflects expert knowledge and whether the relationships between variables are realistic. At the conclusion of the face validity test, experts were asked to respond to a series of questions, which were adapted from the work of [44]:

- Does the model structure (the number of nodes, node labels, and arcs between them) represent BBN Hospital Projects Contractors’ Profitability appropriately?

- Is the network discretized into sets that represent the expert knowledge at each node?

- Do the model structure and variables adequately represent the actual system?

- Are the relationships between the variables in the model realistic and reasonable?

- Does the model take into account all variables and system-affecting factors?

- Does the model output provide meaningful and useful information for decision-making in the relevant domain?

- Are the probabilities and conditional dependencies in the model reasonable?

This test confirmed that the model’s structure and outputs provide meaningful and useful information for decision-making in the relevant domain.

Nomological validity assesses the BBN model’s applicability within a broader theoretical framework [44]. This test verifies that the relationships and predictions within the model align with established theoretical concepts. The finalized risk factors, categorized appropriately through expert discussions in the session, were validated to represent PPP hospital projects effectively, confirming the model’s broader applicability.

The content validity test compares the variables in the BBN model with those recognized as significant in real-world systems [46]. It checks whether the model includes all the necessary nodes and relationships to fully comprehend the problem. During the session, the experts thoroughly reviewed and refined the risk factors, their states, and the relationships between them, ensuring that the model accurately represents the studied issue. The test confirmed that the model’s elements are detailed enough to effectively represent the problem being analyzed.

6.2. Criterion-Based Validation

Criterion-based validation evaluates how well the model’s predictions align with external variables, ensuring that the model accurately reflects the real-world criteria it is designed to represent [46]. This validation process includes several key tests: concurrent validity, extreme conditions assumptions test, parameter variability-sensitivity test, and predictive validity test. The results of these tests indicate that the model meets the general criteria for accuracy. This validation is also addressed during Expert Elicitation Session-3. The concurrent validity test examines the extent to which the model or its components correspond to another model that is theoretically similar [46]. In Session-3, it was confirmed that the risk factors used in the model are applicable across various types of PPP projects.

The extreme conditions assumptions test assesses the consistency of the probabilities assigned within the model under extreme conditions by comparing the model’s logic to real-world scenarios. Experts defined extreme conditions, and the model outputs were found to be reasonable when compared to these real-world scenarios. For instance, when the state of “Step in of Financiers” was set to “Yes”, the model predicted that the probability of “Low Profitability of Contractor” would exceed 50%, which was confirmed by a 54.4% probability output. Similarly, for other extreme conditions like “Vagueness of Design” and “Level of Government Guarantee”, the model provided outputs of 75.3% and 71.4%, respectively, aligning with expectations, as shown in Table 5.

Table 5.

Assumption control factors and model outputs.

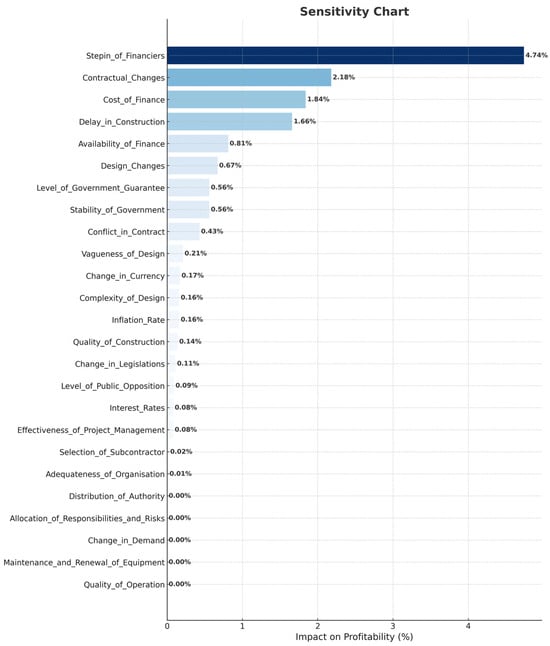

A sensitivity analysis was performed to assess how changes in the model’s input parameters affected its outputs, measuring the model’s sensitivity to variations in key variables. This test involved calculating the expected profitability of the contractor under various extreme conditions, categorized into low (10–20%), medium (20–30%), and high (30–45%) profitability scenarios. The test provided a range of possible outcomes for different risk factors, such as the best- and worst-case scenarios for factors like government stability, changes in legislation, subcontractor selection, and construction delays. The analysis was visualized using a tornado graph, highlighting the most sensitive risk factors, such as “Step in of Financiers”, “Contractual Changes”, and “Cost of Finance”, which had the most significant impact on profitability predictions. A tornado graph is presented in Figure 5.

Figure 5.

The tornado graph.

The predictive validity test aimed to assess the accuracy of the BBN model in forecasting outcomes in different hypothetical scenarios. In Session-3, experts developed several cases with specific inputs and compared the model’s predictions to their expectations.

Case-1:

- Inputs: Step-in of Financiers (Yes), Frequent Changes in Legislation, High Delays in Construction.

- Expectation: A significant increase in “Low Profitability” was expected, though not surpassing 60–65%, with a corresponding decrease in “High Profitability”.

- Model Output: Low Profitability: 57.8%, Medium Profitability: 28.4%, and High Profitability: 13.8%

Case-2:

- Inputs: High Inflation Rate, High Interest Rates, High Delays in Construction, Frequent Changes in Legislation.

- Expectation: A moderate rise in “Low Profitability” due to these risks, although the impact was expected to be less severe due to contractual safeguards.

- Model Output: Low Profitability: 36.1%, Medium Profitability: 34.7%, and High Profitability: 29.2%.

Case-3:

- Inputs: Low Cost of Finance, Infrequent Contractual Changes, High Effectiveness of Project Management.

- Expectation: This favorable scenario was anticipated to boost “High Profitability” to around 45–50%, although achieving more than 50% would be difficult.

- Model Output: Low Profitability: 27.6%, Medium Profitability: 31.6%, and High Profitability: 40.8%.

Overall, the BBN model’s predictions aligned well with expert expectations, validating its ability to accurately assess profitability under varying conditions. It should be stated that if historical data or actual levels of profitability in projects are available, validations could be carried out using this data to minimize the subjectivity of the validation process.

7. Application of the BBN Model to a Case

A practical application of the BBN model was carried out on an ongoing PPP hospital project in Turkiye, with an estimated investment cost of approximately 400 million euros. This hospital, with a capacity of around 1600 beds, represents a significant healthcare infrastructure project under the PPP framework. The objective of this case study was to illustrate the real-world applicability and effectiveness of the BBN model in evaluating contractor profitability within such a large-scale infrastructure project. The selected hospital project, now in its fifth year of operation, exemplifies the PPP model’s collaborative approach to delivering essential healthcare services.

The initial step in implementing the BBN model involved identifying key risk factors that could potentially impact the project’s success. These factors were carefully evaluated in Expert Elicitation Session-4, where one of the experts was directly involved in the project. Table 6 outlines the current state of each risk factor in the project. As a result of the discussions, experts anticipated that there is a higher chance that a project will have a high level of profitability when compared to a low-level scenario. The assigned values for high, medium, and low profitability scenarios were 45%, 35%, and 20%, respectively.

Table 6.

The risk information regarding the case project.

The identified risk factors and their states, as listed in Table 6, were subsequently integrated into the BBN model using the GeNIe software. The risk factors and their states were input into the model as evidence, enabling the BBN to simulate various scenarios and predict their impact on contractor profitability. When the BBN model was run, it resulted in three scenarios with 27.50%, 31.32%, and 41.18% probabilities for low, medium, and high levels of profitability.

To better interpret whether these findings effectively represent experts’ initial estimates, a weighted average was calculated using a 1–3 subjective rating scale, where low-, medium-, and high-profitability scenarios were assigned the values of 1, 2, and 3, respectively. According to the experts’ expectations, the expected profitability score was around 2.25, showing a tendency toward medium-to-high profitability:

- Expected Profitability Score (Expert judgment) = (1 × 0.20) + (2 × 0.35) + (3 × 0.45) = 2.25

When the model outputs were integrated to calculate a weighted average using the same scale, the calculated profitability score was approximately 2.14.

- Expected Profitability Score (BBN model) = (1 × 0.275) + (2 × 0.3132) + (3 × 0.4118) = 2.1368

The BBN model’s expected profitability score of 2.14 is remarkably close to the experts’ anticipated score of 2.25. This close alignment demonstrates the model’s accuracy for the case project, showing its effectiveness in capturing the complex interactions of various risk factors that influence contractor profitability. The BBN model enables project stakeholders to proactively identify risks, generate realistic scenarios, and make informed decisions considering the level of risk and expected profitability in PPP hospital projects.

The BBN model demonstrated several significant benefits in this case application. It provides a robust framework for risk assessment by effectively capturing the complexities and interdependencies of various risk factors specific to the PPP hospital project. Moreover, the model’s probabilistic approach enabled more realistic performance predictions, allowing stakeholders to anticipate potential challenges and opportunities. For instance, in a ‘what-if’ scenario where the model was tested with inputs such as the Step-in of Financiers, frequent changes in legislation, and high delays in construction, the output indicated a 57.8% probability of low profitability, and only 13.8% for high profitability. This insight closely aligns with expert expectations. This exercise provided decision-makers with a clear indication of the need for proactive measures, such as enhancing contract monitoring, implementing contractual safeguards, and devising strategies to minimize the impact of delays. By changing the input values and monitoring the expected change in profitability scenarios, the BBN model can guide project teams on risk mitigation actions, thereby supporting more informed decision-making and contributing to the overall success of the project.

However, the implementation of the BBN model highlights some challenges. One of the primary challenges was the availability and accuracy of the data, as obtaining comprehensive and reliable data for all relevant risk factors proved to be difficult. As the number of factors and states increases, it becomes difficult for experts to assign probabilities, resulting in the necessity of keeping the model simple, which may be oversimplistic if numerous possible states of a risk factor are considered. Moreover, the process of assigning probabilities to different nodes within the model involved a degree of subjectivity, which introduced potential bias and uncertainty. Despite these challenges, the overall benefits of using the BBN model in this context are significant, making it a valuable tool for enhancing decision-making and risk management in PPP hospital projects.

In essence, this case study illustrates the practical application of the BBN model in a real PPP hospital project, demonstrating its effectiveness in assessing contractor profitability and understanding complex risk-occurrence scenarios. The model’s ability to integrate expert knowledge, simulate various scenarios, and provide realistic predictions makes it an indispensable tool for stakeholders involved in healthcare projects. While challenges such as data limitations and model complexity must be addressed, the advantages of using the BBN model clearly outweigh these difficulties, offering a comprehensive approach to risk management and decision-making in PPP hospital projects.

8. Conclusions

The motivation for this research was to develop a risk assessment model that can accommodate the complexities and uncertainties regarding financial outcomes that may significantly affect the success of PPP healthcare projects. BBN was identified as a reasonable risk assessment method because it can be used to generate alternative scenarios by considering interrelated factors and estimating the probability of alternative scenarios. Another advantage of BBN is the integration of expert knowledge into model development and the visual representation of the model, which facilitates the communication of information input and model outputs. By identifying critical risk-related factors and their interrelations, as well as conditional probabilities by expert judgment, the BBN model was constructed using the GeNIe software. The BBN model identified key risk factors, such as “Step-in of Financiers”, “Contractual Changes”, and “Delays in Construction”, which significantly impact profitability, were identified as high-risk factors in other studies [22,42]. The model was validated using a case project. The findings demonstrate that it has the potential to enhance risk-based decision-making by reflecting the impact of several factors on profitability scenarios and how probabilities may change with changing conditions.

From a theoretical perspective, this research introduces a novel application of a BBN-based model for risk assessment in PPP hospital projects, enriching the literature on financial risk assessment in PPP investments. The model development and validation methodology depicted in this paper can be used by other researchers to develop BBNs for different purposes. In practical terms, the model can aid contractors in identifying and mitigating risks in healthcare projects. Its applicability has the potential to extend beyond the studied hospital projects to other PPP ventures and potentially to other countries with similar PPP mechanisms. Private and public sector participants can utilize BBNs to explore scenarios that may lead to deviations from expected costs and benefits, including social, environmental, and economic sustainability targets.

However, the study’s reliance on a limited number of experts increases subjectivity and limits generalizability. Although a very experienced group of experts with differing managerial roles in PPP projects was involved in this study and a Delphi process was employed during knowledge elicitation sessions to minimize bias, the findings of this study cannot be generalized. The BBN application depicted in this study is an example of how experts can use BBN to understand risk factors and assess financial risk in projects, where the developed BBN model is specific to PPP projects in Turkiye and depends on the subjective judgment of experts rather than actual project data. This demonstrates how BBNs can be developed using expert knowledge, where statistical data are also limited in practice. Our findings demonstrate that the complexity of the BBN model, especially in terms of data entry and software limitations, may pose challenges that can be partially mitigated with well-designed model development and validation processes.

Looking forward, further research can compare the performance of the BBN model with other risk assessment methods, such as multi-criteria decision-making methods, including AHP and ANP, and Monte Carlo Simulation for a probabilistic assessment. The method that performs better in an application depends on the availability of data and the expectations of decision-makers from this assessment. For example, compared to the Monte Carlo Simulation, BBN requires less input data but provides only a limited number of scenarios (three scenarios in this application) rather than a probability distribution of the output, which is preferred in this application. Future research may consider comparing the performance of alternative risk assessment methods for different user expectations and scenarios. In future studies, statistical data can be used for BBN model development, sensitivity testing, and predictive validity analyses, together with expert judgments, to provide better insights into the estimation of profitability in PPPs and may have higher accuracy and reliability. Due to the unavailability of data and dependence on expert ratings, the number of risk factors and their states were optimized considering the time and effort required for evaluations. In future studies, researchers may consider revising the risk factors and increasing the number of states to develop a more comprehensive and realistic BBN model.

In conclusion, the research findings demonstrate that BBN-based models have the potential to offer valuable insights into risk-occurrence scenarios in complex projects, such as PPP healthcare projects. Ultimately, risk-based approaches and realistic estimating methods may contribute to the sustainable development of healthcare infrastructure through better decisions and effective public-private partnerships.

Author Contributions

Conceptualization, A.A., I.D., and M.T.B.; methodology, A.A.; software application, A.A.; validation, A.A.; formal analysis, A.A.; data curation, A.A.; writing—original draft preparation, A.A.; writing—review and editing, I.D. and M.T.B.; visualization, A.A.; supervision, I.D. and M.T.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

This manuscript is from the MSc study carried out in METU and accepted by the METU Graduate School of Natural and Applied Sciences. Committee Name: METU GSNAS, Approval Code: 11511/105426, Approval Date: 29 August 2023.

Informed Consent Statement

Written informed consent has been obtained from the experts participated in this study.

Data Availability Statement

Data are available upon request from the authors.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Pârvu, D.; Voicu-Olteanu, C. Advantages and limitations of public-private partnerships and the possibility of using them in Romania. Transylv. Rev. Adm. Sci. 2009, 5, 189–198. [Google Scholar]

- Hwang, B.; Zhao, X.; Gay, M.J.S. Public-private partnership projects in Singapore: Factors, critical risks, and preferred risk allocation. Built Environ. Proj. Asset Manag. 2013, 3, 98–111. [Google Scholar] [CrossRef]

- Marin, P. Public-Private Partnerships for Urban Water Utilities: A Review of Experiences in Developing Countries; World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Delmon, J. Private Sector Investment in Infrastructure: Project Finance, PPP Projects and Risk; Kluwer Law International and World Bank: London, UK, 2009. [Google Scholar]

- Kumaraswamy, M.; Zhang, X. Governmental Role in BOT-Led Infrastructure Development. Int. J. Proj. Manag. 2001, 19, 195–205. [Google Scholar] [CrossRef]

- Hodge, G.; Greve, C. What can public administration scholars learn from the economics controversies in public-private partnerships? Asia Pac. J. Public Adm. 2021, 43, 219–235. [Google Scholar] [CrossRef]

- Jin, X.-H.; Doloi, H. Interpreting risk allocation mechanism in Public-Private Partnership projects: An empirical study in a transaction cost economics perspective. Constr. Manag. Econ. 2008, 26, 707–721. [Google Scholar] [CrossRef]

- Zhang, J.; Yue, H.; Wu, X.; Chen, W. A brief review of Bayesian belief network. In Proceedings of the 2019 Chinese Control and Decision Conference (CCDC), Nanchang, China, 3–5 June 2019; pp. 3910–3914. [Google Scholar]

- Bracey, N.; Moldovan, S. Public-Private Partnerships: Risks to the Public and Private Sector. In Proceedings of the 6th Global Conference on Business and Economics, Boston, MA, USA, 15–17 October 2006. [Google Scholar]

- Cheung, E.; Chan, A.P.C. Risk factors of Public-Private Partnership projects in China: Comparison between the water, power, and transportation sectors. J. Urban Plan. Dev. 2011, 137, 409–415. [Google Scholar] [CrossRef]

- Marques, R.C.; Berg, S.V. Risks, contracts, and private-sector participation in infrastructure. J. Constr. Eng. Manag. 2011, 137, 925–932. [Google Scholar] [CrossRef]

- Ng, A.; Loosemore, M. Risk allocation in the private provision of public infrastructure. Int. J. Proj. Manag. 2007, 25, 66–76. [Google Scholar] [CrossRef]

- Li, J.; Zou, P.X.W. Fuzzy AHP-based risk assessment methodology for PPP projects. J. Constr. Eng. Manag. 2011, 137, 1205–1209. [Google Scholar] [CrossRef]

- Badran, Y. Risk Analysis and Contract Management for Public-Private Partnership Projects in Egypt. Master’s Thesis, The American University in Cairo, AUC Knowledge Fountain, Cairo, Egypt, 2013. [Google Scholar]

- Hodge, G.A.; Greve, C.; Boardman, A.E. (Eds.) International Handbook on Public-Private Partnerships; Edward Elgar Publishing: Cheltenham, UK, 2010. [Google Scholar]

- Xu, Y.; Yeung, J.F.; Chan, A.P.; Chan, D.W.; Wang, S.Q. Developing a risk assessment model for PPP projects in China—A fuzzy synthetic evaluation approach. Int. J. Proj. Manag. 2010, 28, 560–572. [Google Scholar] [CrossRef]

- Hardcastle, C.; Edwards, P.J.; Akintoye, A.; Li, B. Critical Success Factors for PPP/PFI Projects in the UK Construction Industry: A Factor Analysis Approach; The School of the Built and Natural Environment: Glasgow, UK, 2002; pp. 1–9. [Google Scholar]

- Burger, P.; Hawkesworth, I. How to attain value for money: Comparing PPP and traditional infrastructure public procurement. OECD J. Budg. 2011, 11, 91–146. [Google Scholar]

- Patil, N.A.; Tharun, D.; Laishram, B. Infrastructure development through PPPs in India: Criteria for sustainability assessment. J. Environ. Plan. Manag. 2016, 59, 708–729. [Google Scholar] [CrossRef]

- Roehrich, J.; Lewis, M.; George, G. Are public-private partnerships a healthy option? A systematic literature review. Soc. Sci. Med. 2014, 113, 110–119. [Google Scholar] [CrossRef]

- ADB; EBRD; IDB; IsDB; WBG. The APMG Public-Private Partnership (PPP) Certification Guide; World Bank Group: Washington, DC, USA, 2016. [Google Scholar]

- Akcay, E.C. An analytic network process-based risk assessment model for PPP hydropower investments. J. Civ. Eng. Manag. 2021, 27, 268–277. [Google Scholar] [CrossRef]

- Li, Y.; Wang, X. Using fuzzy analytic network process and ISM methods for risk assessment of public-private partnership: A China perspective. J. Civ. Eng. Manag. 2019, 25, 168–183. [Google Scholar] [CrossRef]

- Wu, Y.; Li, L.; Xu, R.; Chen, K.; Hu, Y.; Lin, X. Risk assessment in straw-based power generation public-private partnership projects in China: A fuzzy synthetic evaluation analysis. J. Clean. Prod. 2017, 161, 977–990. [Google Scholar] [CrossRef]

- Valipour, A.; Yahaya, N.; Md Noor, N.; Mardani, A.; Antucheviciene, J. A new hybrid fuzzy cybernetic analytic network process model to identify shared risks in PPP projects. Int. J. Strateg. Prop. Manag. 2016, 20, 409–426. [Google Scholar] [CrossRef]

- Javed, A.A.; Lam, P.T.I.; Chan, A.P.C. Change negotiation in public-private partnership projects through output specifications: An experimental approach based on game theory. Constr. Manag. Econ. 2014, 32, 323–348. [Google Scholar] [CrossRef]

- Jensen, F.V. An Introduction to Bayesian Networks; UCL Press: London, UK, 1996. [Google Scholar]

- Zhang, L.; Hou, Y. Bayesian Belief Network Analysis for Chinese Off-Site Manufacturing Risk. Buildings 2025, 15, 1138. [Google Scholar] [CrossRef]

- Krieg, M.L. A Tutorial on Bayesian Belief Networks; Department of Defence Defence Science & Technology Organisation DSTO: Canberra, Australia, 2002. [Google Scholar]

- Khakzad, N.; Khan, F.; Amyotte, P. Quantitative risk analysis of offshore drilling operations: A Bayesian approach. Saf. Sci. 2013, 57, 108–117. [Google Scholar] [CrossRef]

- Liu, Z.; Jiao, Y.; Li, A.; Liu, X. Risk assessment of urban rail transit PPP project construction based on Bayesian network. Sustainability 2021, 13, 11507. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.Q.; Chan, A.P.C.; Lam, P.T.I. Preferred risk allocation in China’s public-private partnership (PPP) projects. Int. J. Proj. Manag. 2010, 28, 482–492. [Google Scholar] [CrossRef]

- Li, B.; Akintoye, A. Risks and Risk Treatments in Public-Private Partnership Projects; University of Northumbria, Association of Researchers in Construction Management: Glasgow, UK, 2002; pp. 403–417. [Google Scholar]

- Li, B.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. Critical success factors for PPP/PFI projects in the UK construction industry. Constr. Manag. Econ. 2005, 23, 459–471. [Google Scholar] [CrossRef]

- Almarri, K.; Boussabaine, H. The influence of critical success factors on value for money viability analysis in PPP projects. Proj. Manag. J. 2017, 48, 93–106. [Google Scholar] [CrossRef]

- Abdel Rashid, I.; El-Mikawi, M.; Baha, H.E.-D.M. Factors affecting the calculations of Return on Investment (ROI) in Public-Private Partnerships (PPP) projects In Egypt. ARCHive-SR 2019, 2, 332–345. [Google Scholar] [CrossRef]

- Chen, Z.; Zhao, Y.; Zhou, X.; Zhang, L. Investigating critical factors that encourage private partners to participate in sports and leisure characteristic town public-private partnerships: Evidence from China. Sustainability 2020, 12, 3212. [Google Scholar] [CrossRef]

- Kim, K.; Kim, J.; Yook, D. Analysis of features affecting the contracted rate of return of Korean PPP projects. Sustainability 2021, 13, 3311. [Google Scholar] [CrossRef]

- Demirel, H.C.; Leendertse, W.; Volker, L. Mechanisms for protecting returns on private investments in public infrastructure projects. Int. J. Proj. Manag. 2022, 40, 155–166. [Google Scholar] [CrossRef]

- Global Infrastructure Hub. (12 July 2019). Hospital PPP Risk Allocation Matrix. PPP Risk Allocation Tool. Available online: https://ppp-risk.gihub.org/risk-allocation-matrix/social/hospital/ (accessed on 3 December 2022).

- Lewis, M.K. Risk Management in Public Private Partnerships. Center for Globalization and Europeneanization of the Economy (CeGE) Discussion Paper 12. Georg-August-Universitat-Gottingen, Germany, 2001. Available online: https://www.econstor.eu/bitstream/10419/31983/1/346217636.pdf (accessed on 14 May 2025).

- Rasheed, N.; Shahzad, W.; Khalfan, M.; Rotimi, J.O.B. Risk identification, assessment, and allocation in PPP projects: A systematic review. Buildings 2022, 12, 1109. [Google Scholar] [CrossRef]

- Oyedele, L.O. Avoiding performance failure payment deductions in PFI/PPP projects: Model of critical success factors. J. Perform. Constr. Facil. 2013, 27, 283–294. [Google Scholar] [CrossRef]

- Pitchforth, J.; Mengersen, K. A proposed validation framework for expert elicited Bayesian networks. Expert Syst. Appl. 2013, 40, 162–167. [Google Scholar] [CrossRef]

- Messick, S. Validity of Test Interpretation and Use. In Educational Testing Service Research Report Series; Princeton University: Princeton, NJ, USA, 1990; pp. 1487–1495. [Google Scholar]

- Fu, S.; Zhang, D.; Montewka, J.; Yan, X.; Zio, E. Towards a probabilistic model for predicting ship besetting in ice in Arctic waters. Reliab. Eng. Syst. Saf. 2016, 155, 124–136. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).